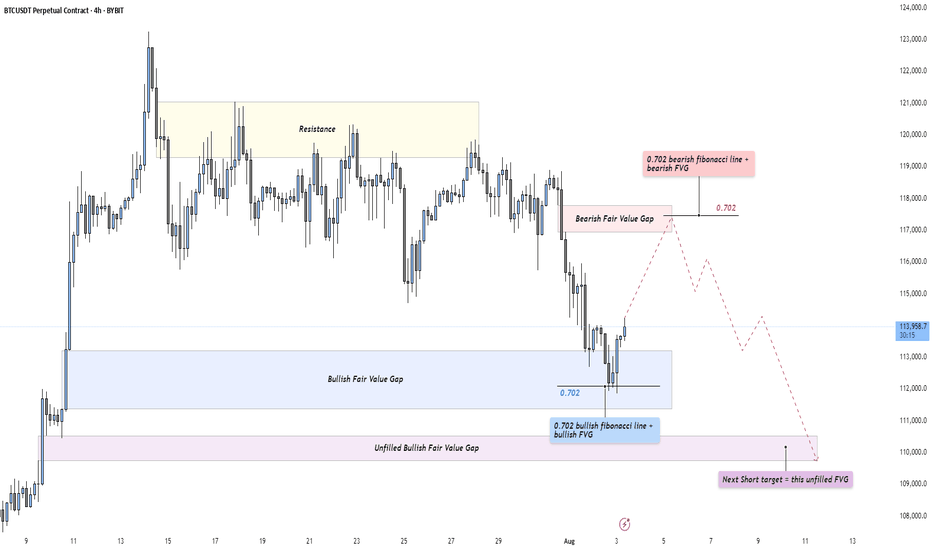

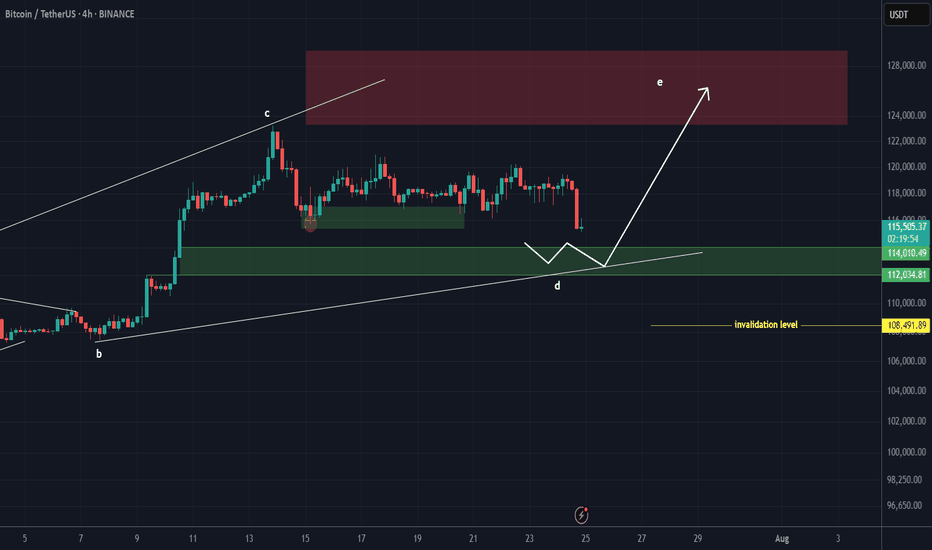

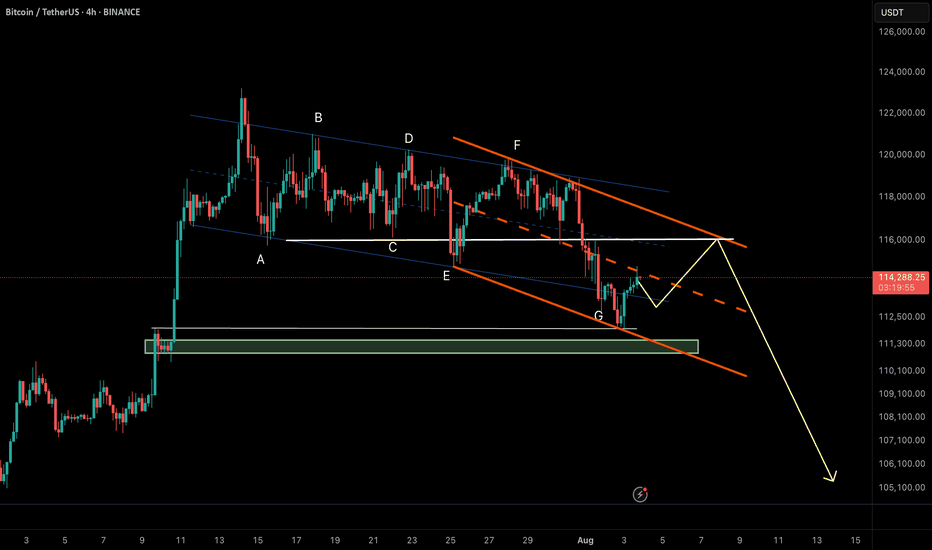

BTC - Short Setup at 0.702 Fibonacci & Fair Value GapMarket Context

Bitcoin recently rejected from a major resistance area and has since been retracing downward, finding temporary support inside a bullish Fair Value Gap. The market is currently in a corrective phase, with buyers attempting to defend lower levels while sellers look for optimal positions to reload shorts. This environment shows a classic tug-of-war between these two forces as price moves between supply and demand zones.

Consolidation and Current Phase

Although the prior consolidation has been broken, the current price action can still be described as corrective, with intraday structure forming lower highs. The bullish Fair Value Gap beneath price has been respected so far, creating a temporary base. However, the path remains complex, as the market has unfilled imbalances both above and below.

Bearish Retest Scenario

One key scenario involves a retracement toward the bearish Fair Value Gap near 117K, which also aligns with the 0.702 Fibonacci retracement level. This confluence makes it a high-probability area for sellers to step in again. A rejection from that zone would likely resume the downtrend, with the next logical target being the deeper unfilled bullish Fair Value Gap around 110K. This zone acts as a magnet for price due to the inefficiency left behind during the last rally.

Bullish Defense Scenario

For bulls to regain control, the current Fair Value Gap at 114K must hold, followed by a strong move that invalidates the lower-high structure. Such a move would need to break above the 117K bearish FVG with conviction. Only then could momentum shift back to the upside, opening the door for another challenge of the higher resistance zones.

Final Words

Patience and precision are key when dealing with setups like this. Let the market come to your level — and react with intent.

If you found this breakdown helpful, a like is much appreciated! Let me know in the comments what you think or if you’re watching the same zones.

Btc-e

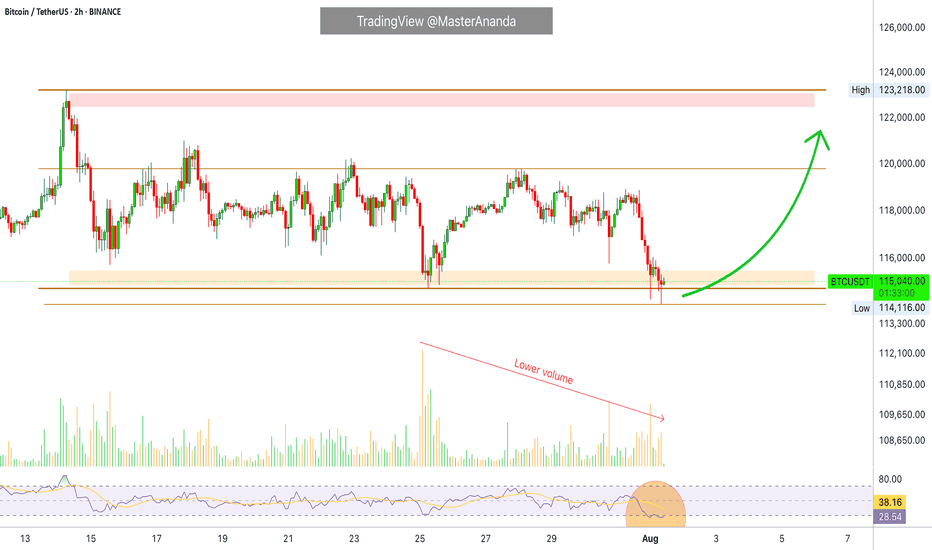

Bitcoin Hits $40,000, It Will Recover —Name Your AltcoinSorry, there is a typo there on the title, I meant to say: Bitcoin hits $114,000, soon to recover.

As you can see from our trading range, Bitcoin just went beyond the lower boundary and hit a new low, the lowest since 10-July but there is good news. There isn't room for prices to move much lower, this is part of the consolidation phase.

The first low happened 25-July and notice the high (bear) volume. The second low happens today and we have lower volume compared to 25-July, but Bitcoin hit a lower low. This reveals that the bearish move is already weak and losing force. It also reveals the fact that Bitcoin is about to recover.

Also notice the RSI, 2H. It hit oversold recently and went the lowest in a long while. Reversals tend to happen when the RSI becomes oversold.

Bitcoin is testing the lower boundary of the trading range, when this happens, the action reverses and moves back up. Prepare to see Bitcoin back above $120,000. It is normal and it will happen... But it is wise to give the market a few days. 5-August was bad last year. It gets bad but it also marks the bottom. Once the bottom is hit, growth long-term.

— Name Your Altcoin

Leave a comment with the altcoins you are holding now and I will do an analysis for you. The altcoins will also recover and we are witnessing just a small retrace. Hold strong as this is the most important part. We will have a very strong new bullish wave develop within days.

As Bitcoin moves to test support, it will reverse to test resistance next. Which one is your top altcoins choice?

Thank you for reading.

Namaste.

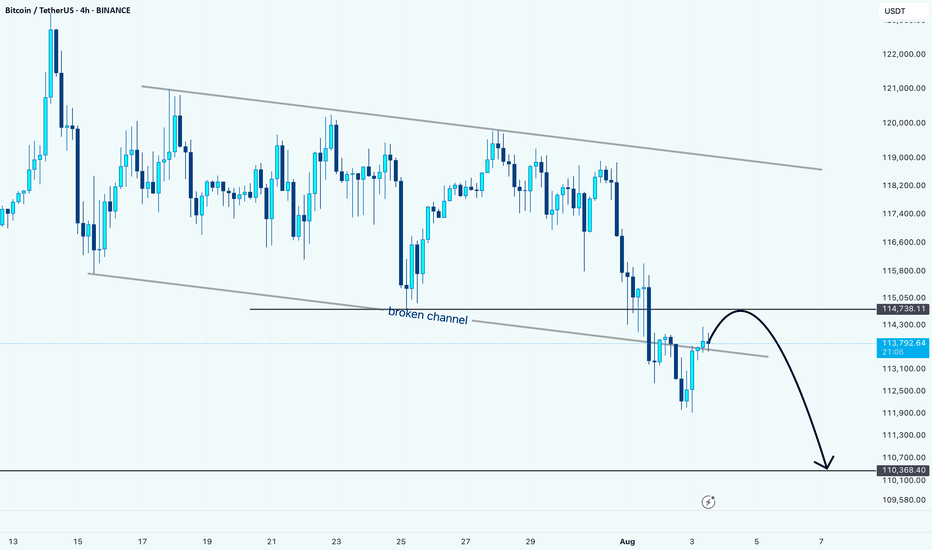

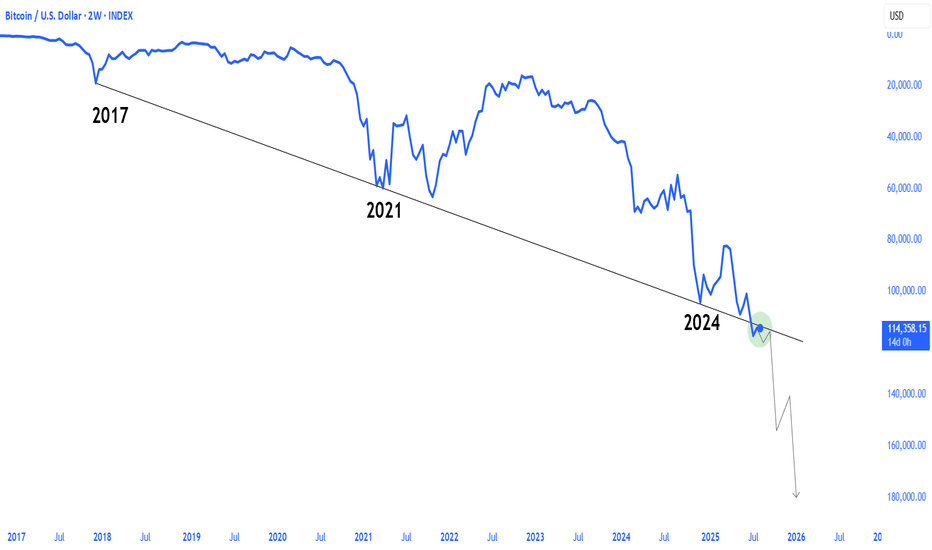

BTC Breaks Down: Retest Could Lead to More LossesHello guys!

Bitcoin has officially broken below the descending channel it was stuck in for weeks. Right now, price is pulling back to retest the broken channel, which is now acting as resistance around the 114,700 zone.

What I'm watching:

Broken channel = bearish signal

Retest zone around 114,700

Downside target near 110,400

So far, it looks like a clean setup for further downside, unless bulls manage to reclaim that broken trendline. Until then, the pressure remains to the downside.

Let’s see how price reacts here... Rejection = short opportunity.

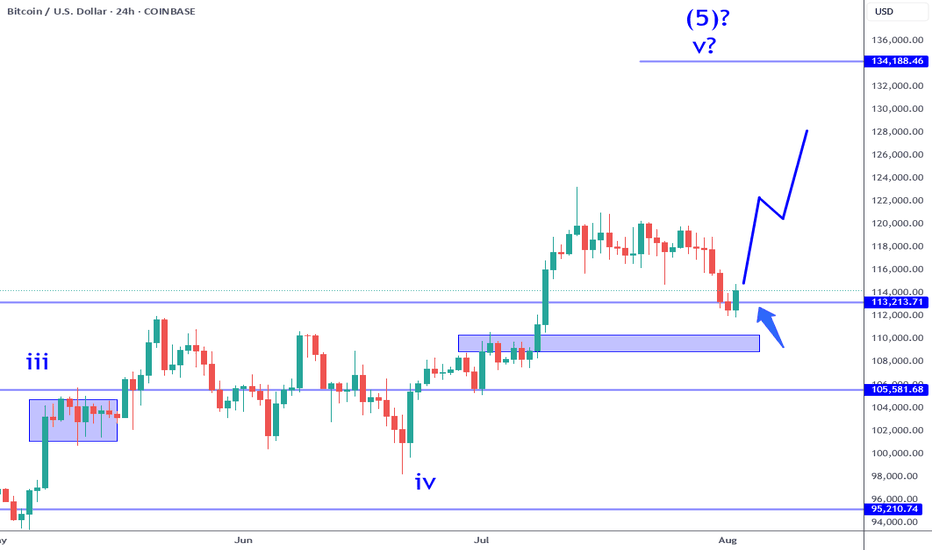

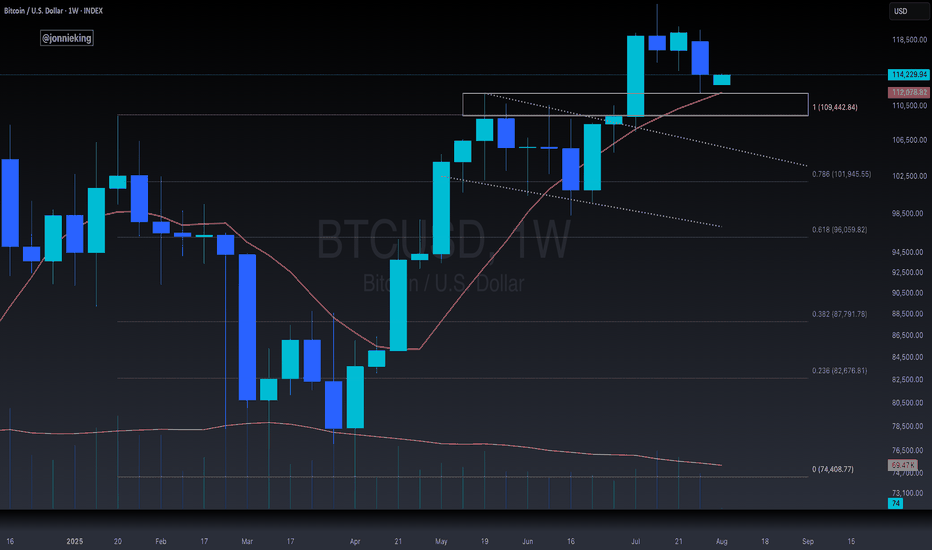

Bitcoin: 113K Support Bounce Buy Signal.Bitcoin has retraced thanks mostly to "unexpected" revisions to labor market statistics. While this move has many making outrageous forecasts, price has simply retraced to the 113K support levels and has generated a swing trade long signal (break of 114K). IF the momentum stays intact, it is within reason to anticipate a test of the low 120K's while a more aggressive expectations would be a break out into the 130K's. Keep in mind if 123K is broken, even by a small amount, that would confirm the current movement as the wave 5 of 5 which means it becomes the most vulnerable to a broader correction.

This NFP report and BLS situation is the perfect example of a catalyst that NO ONE in the financial "expert" space saw coming. Even Chairman Powell on Wednesday was pointing out how stable employment growth has been and emphasized the importance of this statistic for their rate decisions. Which means the Federal Reserve is making decisions based on totally inaccurate data. Which also means the entire market has been priced completely wrong for months. My point is, "official" information that you may be basing your investments on can be totally inaccurate and can be revealed out of nowhere. This risk alone puts every investor at the mercy of the market and why it is so important to recognize the limitations of ANY market information through the lens of RISK management.

I have been writing about a potential bullish range breakout beyond 120K for a test of the 130s OR if the range support breaks instead, to watch for a test of the key support at 113K. There is NO way to know which way the market will choose in advance, it all depends on the outcomes of specific events which act as catalysts for one scenario or the other.

This is why being knowledgeable about wave counts and other forecasting techniques can be very helpful in terms of gauging risk and potential. And based on this, AS LONG AS the 108K area is NOT overlapped, the current price structure is still within the boundaries of a bullish sub wave 4. This is why I am still short term bullish on Bitcoin and why I believe the current buy signal has potential to test at least the low 120's in the coming weeks. IF the 108K area is broken instead, that reduce the chances of a short term bullish break out, and may be the proof that the broader Wave 5 structure is complete.

The risk at this point can be measure from the 112K low area and nearest profit objective 118K which offers an attractive reward/risk. Measure everything from RISK first, and always be prepared to be wrong. If the market pays, consider it a gift.

Thank you for considering my analysis and perspective.

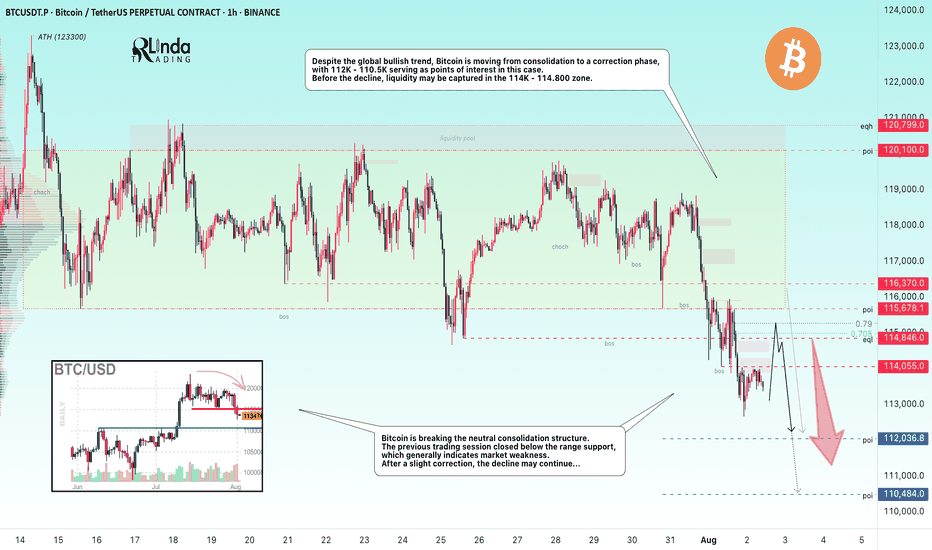

BITCOIN → From consolidation to distribution. Market weaknessBINANCE:BTCUSDT.P is moving from consolidation to a correction phase. The price broke through the support zone of 114.5–115.5, closing within the Friday trading session in the sell zone...

Previous idea from July 22: BITCOIN → Consolidation and compression to 116K. Correction?

The fundamental background is shifting to neutral, the hype has temporarily ended, and there are no bullish drivers yet. And for the health of the market, a correction is needed. Bitcoin is breaking the neutral consolidation structure. The previous trading session closed below the support range, which generally indicates market weakness. Despite the global bullish trend, Bitcoin is moving from consolidation to a correction phase, with 112K - 110.5K serving as points of interest in this case. Before the fall, liquidity may be captured in the 114K - 114.800 zone.

Resistance levels: 114.05, 114.85, 115.67

Support levels: 112.03, 110.48

After a strong movement, the market may enter a correction or local consolidation, during which it may test the specified resistance zones before continuing its downward movement to the zone of interest and liquidity at 112 - 110.5.

Best regards, R. Linda!

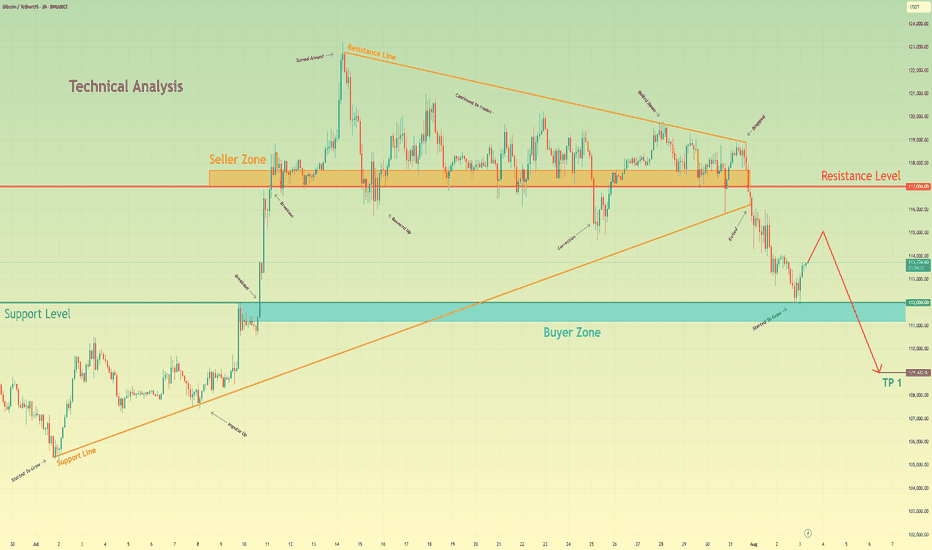

Bitcoin can continue to decline and break support levelHello traders, I want share with you my opinion about Bitcoin. Following an earlier upward trend, bitcoin entered a prolonged phase of consolidation, forming a large upward pennant where price action was tightly contested between the seller zone near 117000 and an ascending support line. This period of balance, however, has recently resolved to the downside with a significant change in market structure. A decisive breakdown has occurred, with the price breaking below the pennant's long-standing support line, signaling that sellers have ultimately gained control. Currently, after the initial drop, the asset is undergoing a minor upward correction, which appears to be a classic retest of the broken structure from below. The primary working hypothesis is a brief scenario that anticipates this corrective rally will fail upon encountering resistance from the broken trendline. A confirmed rejection from this area would validate the bearish breakdown and likely initiate the next major impulsive leg downwards. The first objective for this move is the buyer zone around the 112000 support level, but given the significance of the pattern breakdown, a continuation of the fall is expected. Therefore, the ultimate target price for this scenario is placed at the 109,000 level, representing a logical measured move target following the resolution of the large consolidation pattern. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

BRIEFING Week #31 : S&P ATH may have been a TrapHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

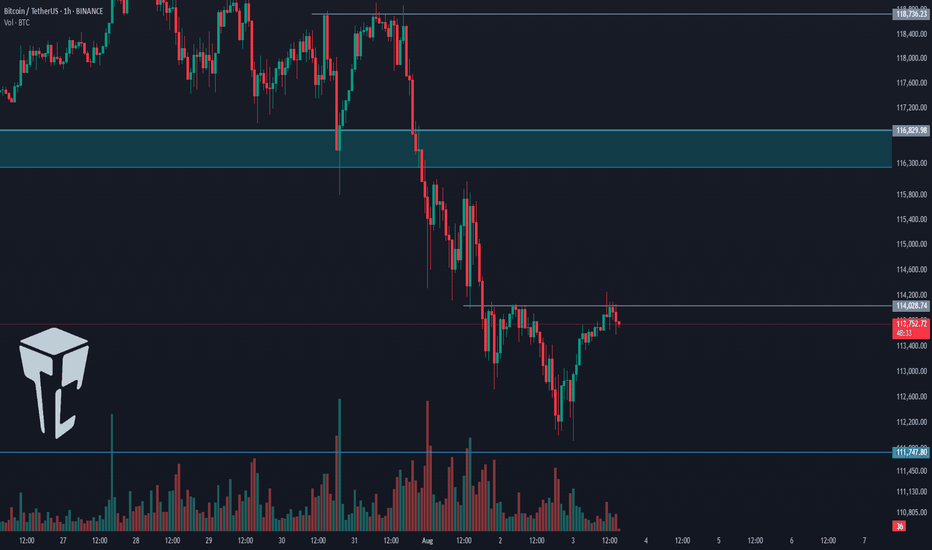

TradeCityPro | Bitcoin Daily Analysis #143👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis. Today, the weekly candle will close and the market will return to its normal condition starting tomorrow. It’s very important to have a solid analysis today so we can make profits in the upcoming week.

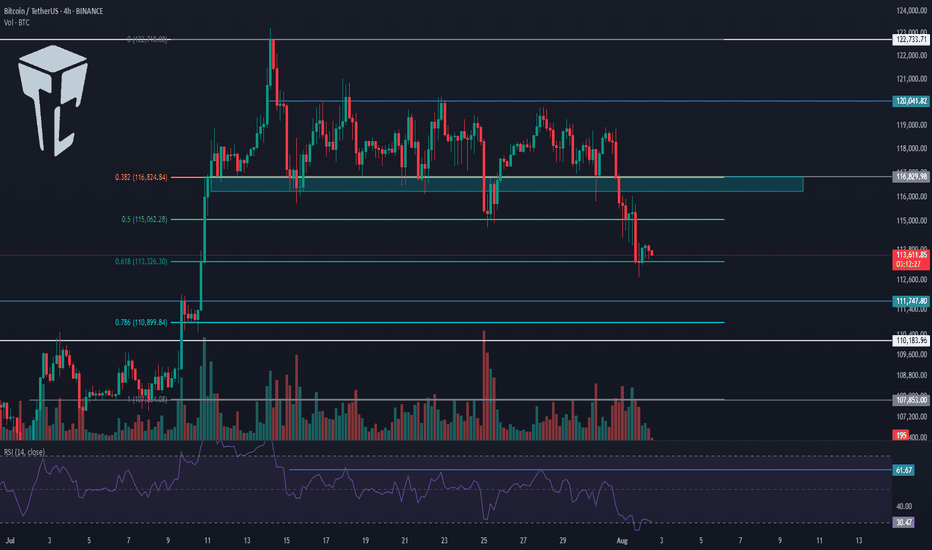

⏳ 4-Hour Timeframe

Yesterday, Bitcoin had another short drop and wicked down to around the 111747 zone, but then returned above the 0.618 Fibonacci level.

💥 Even from this timeframe, it’s clear that a long trigger has formed on lower timeframes, and it seems like a V-pattern is being formed, which we’ll analyze in the lower timeframes.

📊 If the market activates the long trigger today, I’ll try to enter so I don’t miss out in case a bullish move starts with the new weekly candle and I can have an open position.

✔️ The RSI oscillator also entered the oversold zone yesterday and exited it. Since Bitcoin is still above the 110000 zone, I still view the trend as bullish. So this double bottom that formed on the RSI is a very good sign for bullish momentum in the market.

⏳ 1-Hour Timeframe

In the 1-Hour timeframe, we had a short trigger at the 114560 zone in the previous analysis, which was activated and the price moved down. I had mentioned in that analysis that I wouldn’t open a short position with this trigger, and I didn’t.

🔽 Now the position of that trigger has shifted and moved to the 114028 zone. Today I’m watching the market closely, and if the price moves up toward this trigger with increasing volume, I’ll open a long position if 114028 breaks.

🔍 This is one of those positions where you can use either a small or large stop loss. If you go with a larger stop, you can ride the next bullish leg that may push the price back toward the 120000 zone. But if you go with a smaller stop, it becomes a short-term trade that will be closed with smaller risk-to-reward ratios.

📈 Personally, I prefer to go with a larger stop loss so that if Bitcoin starts another bullish leg, I can have a well-positioned entry. (Just make sure to practice proper risk management — I personally won’t risk more than 0.25% on this position since the main momentum hasn’t entered yet.)

💫 As for short positions, I won’t provide any triggers for now because I’m not opening shorts myself, and if you open one, I won’t be able to guide you on what to do with it.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

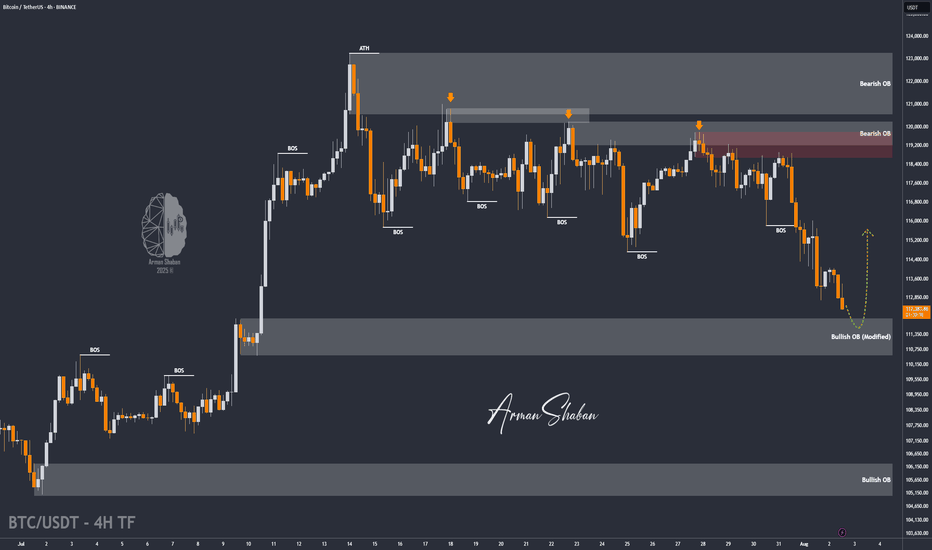

BTC New Upodate (4H)This analysis is an update of the analysis you see in the "Related publications" section

We previously stated that Bitcoin lacks the strength to move upward, and we expect the price to soon reach the green zone (114K-112K).

The price is now dropping toward this zone, which is the rebuy area.

The process of reaching the green zone has been and still is somewhat time-consuming, and during this time, it may repeatedly mislead beginners.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

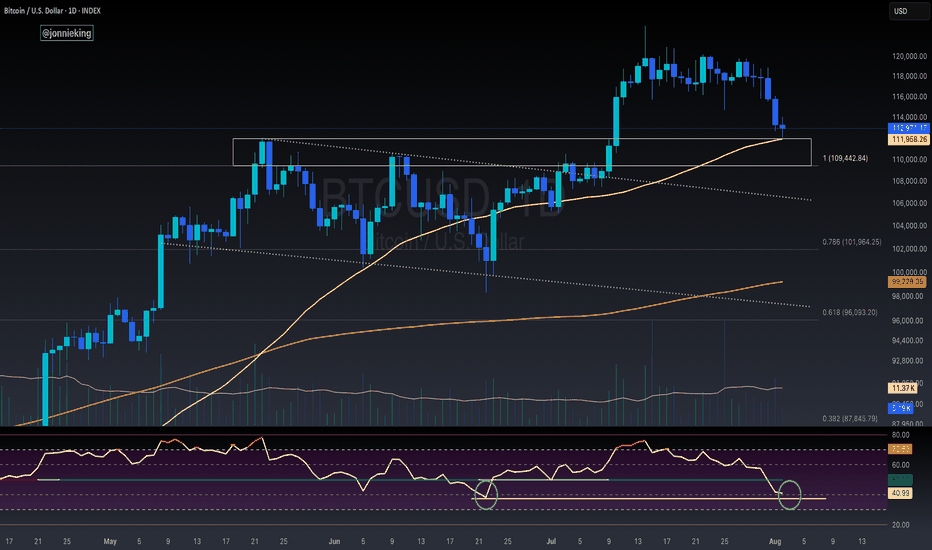

TradeCityPro | Bitcoin Daily Analysis #142👋 Welcome to TradeCity Pro!

Let's get into the Bitcoin analysis. Yesterday, Bitcoin continued its correction and we need to see what is going to happen in the market today.

📅 Daily Timeframe

First, let’s take a look at the higher timeframe. On the daily chart, that curved upward trendline we had was broken by yesterday's candle, and the breakout candle had high volume.

✔️ For now, I don’t consider this trendline as broken and I’m waiting to get confirmation of the break.

🔍 Currently, the price is in a correction phase, and this correction is quite natural since the price had very low volatility for a long time and was stuck below the 120000 zone.

💥 But no trend reversal has occurred yet. In my opinion, as long as the price is above the 110000 zone, the trend is bullish, and I will consider the trend reversal confirmed only if a lower high and a lower low below 110000 are formed.

⏳ 4-Hour Timeframe

Yesterday, the corrective movement of the price continued, and after a pause at the 0.5 Fibonacci level, another bearish leg formed down to the 0.618 zone.

🔔 The RSI oscillator also entered the oversold area and then exited it again. I believe there’s a high possibility that until the end of the week, Bitcoin will range in these areas and the probability of a bullish or bearish move is much lower.

🔽 However, if the 0.618 Fibonacci level breaks, the price can move to lower areas like the 111000 zone. I think the likelihood of this happening in the future is high because that zone is a strong PRZ, and at the same time, it counts as a pullback to the 110000 zone.

📈 In the bullish scenario, if the price is supported from this area and starts to move upward, since we currently have no highs below the 116000 zone, we need to wait until the first bullish leg is formed and then enter on the second leg after the new high is broken.

⚡️ For now, I’m not opening any short or long positions. I prefer the price to form more structure so I can make a more comfortable decision.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

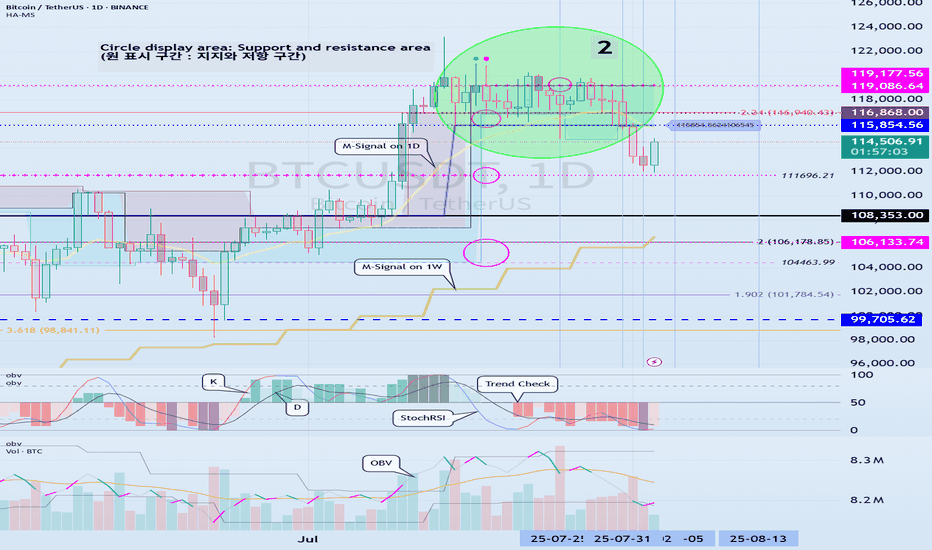

The key is whether it can rise above 115854.56

Hello, traders!

Follow us to get the latest information quickly.

Have a great day.

-------------------------------------

(BTCUSDT 1W chart)

The key is whether it can rise above the newly created DOM (60) indicator point of 119086.64.

If this fails and the price declines, we need to check for support near the previous all-time high (ATH) of 108,353.0.

Since the M-Signal indicator on the 1W chart is rising near 108,353.0, this area is expected to serve as important support and resistance.

-

(1D chart)

This period of volatility is expected to continue until August 6th.

Therefore, the key question is whether the price can rise above 115,854.56 and maintain its upward momentum.

If not, further declines are likely.

-

To rise above 115,856.56,

- The StochRSI indicator must rise within the oversold zone and remain above K > D.

- The On-Bottom Volume indicator must continue its upward trend with OBV > OBVEMA. - The TC (Trend Check) indicator should maintain an upward trend. (If possible, it's best to rise above the 0 point.)

If the above conditions are met and the price rises above 115854.56, it is expected to attempt to rise above 119177.56.

This period of volatility is a significant period of volatility.

Therefore, if the price falls below the HA-High ~ DOM(60) range and encounters resistance during this period, you should prepare for further declines.

-

The basic trading strategy is to buy in the DOM(-60) ~ HA-Low range and sell in the HA-High ~ DOM(60) range.

However, if the price rises in the HA-High ~ DOM(60) range, a stepwise upward trend is likely, while a decline in the DOM(-60) ~ HA-Low range is likely to result in a stepwise downward trend.

Therefore, a split trading strategy is recommended as the basic trading strategy.

When executing a trade, appropriate profit taking secures the liquidity of your investment, giving you the opportunity to seize new opportunities.

To achieve this, you should consider your intended investment horizon before initiating the trade and divide the trade accordingly.

-

The HA-Low indicator on the 1D chart is currently at 89294.25.

Therefore, I believe the market believes it's in a position to take profit.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain in more detail when the bear market begins.

------------------------------------------------------

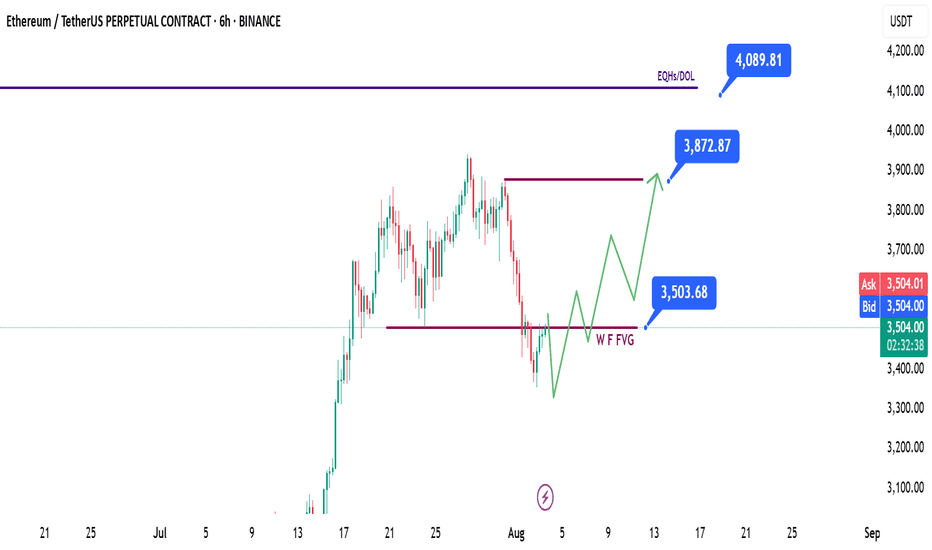

ETH | Ethereum - Weekly Recap & Gameplan - 03/08/25📈 Market Context:

Traders are currently anticipating a potential 0.25% rate cut at the September FOMC meeting, which continues to support the broader bullish outlook.

While the market pulled back following weaker-than-expected Non-Farm Payroll data, overall sentiment remains optimistic.

Greed has cooled off into a more neutral stance. Historically, August often brings some consolidation or pullbacks — but the structural bias for crypto market remains bullish.

🧾 Weekly Recap:

ETH started the retracement movement after building a bullish trend over the past couple of weeks.

It’s mainly being affected by Bitcoin's bearishness, so we’re closely following BTC’s price action.

ETH has tapped into the Weekly Fair Value Gap, which is a key level for me.

We may see a bounce from here.

📌 Technical Outlook & Game Plan:

I expect to see another low on ETH before we go up — as I’m also anticipating one more leg down on Bitcoin.

So I’ll wait for a final bearish expansion and a trap for late sellers before positioning for longs.

After that, I want to see price closing above the purple line at $3500.

🎯 Setup Trigger:

A candle close above the $3500 level will be my signal to look for long setups.

📋 Trade Management:

Stoploss: Below the swing low that breaks above $3500

Take Profit: Targeting $3870, but will trail and lock in aggressively in case of deeper downside expansion.

💬 Like, follow, and comment if this breakdown supports your trading! More setups and market insights coming soon — stay connected!

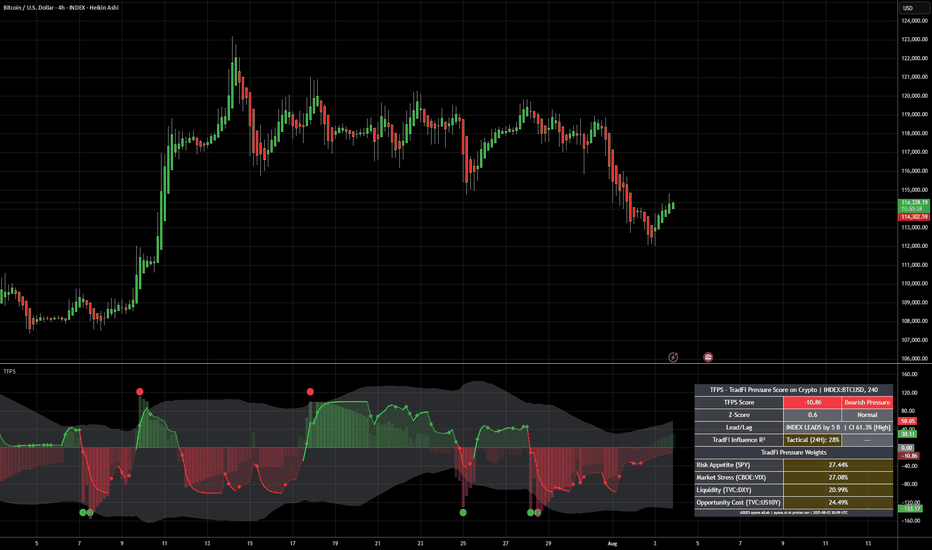

[ayana] Crypto Weather AI - 2nd test - do you like this?TFPS - TradFi Pressure Score on Crypto | INDEX:BTCUSD, 4H

Market Context Timestamp: 2025-08-03 21:50:47 UTC

TradFi Market Status: Closed

Reason (if closed): Weekend

Additional Notes: US futures are also closed. The dashboard reflects market sentiment from Friday's close.

TFPS Analysis: 2025-08-03

CORE RECOMMENDATION & NARRATIVE

The current market narrative is characterized by a shift in leadership: while TradFi markets exert slight bearish pressure, the movement is driven by internal crypto factors. The weak R² signal and the Lead/Lag indicator, which suggests the crypto asset is leading TradFi markets, point to a phase of internal crypto dynamics.

The Story: The TradFi environment shows a balanced bearish bias, with no single component dominating. However, the index (BTCUSD) is leading TradFi markets by 2 bars on the 4H chart. The TradFi correlation to price (R²) is weak at 20%, indicating that internal crypto catalysts are driving the price movement.

The Implication: This is a 'crypto-first' environment. The focus should shift from TradFi macro indicators to on-chain data and crypto-specific news. The TFPS is currently serving as a lagging indicator, confirming crypto action retroactively.

Primary Observation Signal: INDEX LEADS. The leadership of the crypto asset is the key signal. The strength and direction of the next crypto move are not predicted by TradFi but must be derived from internal crypto data.

### DATA SNAPSHOT & DECODING

| Metric | Dashboard Value | Interpretation (Based on TFPS v63 Logic) |

| :--- | :--- | :--- |

| TFPS Score | -12.66 | Bearish pressure originating from TradFi markets. |

| Z-Score | 0.53 | Normal. The current score is not statistically extreme ($$\lvert z \rvert < 2.0$$). An immediate mean reversion is not expected. |

| Lead/Lag | INDEX LEADS by 2 B CI 60.65% | The BTCUSD index is leading TradFi markets by 2 bars on the 4H chart. The high correlation confidence (> 0.50) makes this a very reliable signal. |

| TradFi Influence R² | Tactical (24H): 20% | Weak correlation. Only 20% of the price movement can be tactically explained by the TFPS. The market is currently driven mainly by internal crypto factors. |

| Top Weight: SPY | 27.98% | Non-dominant, but largest weighting factor. Represents market risk appetite. |

| Second Weight: VIX | 27.59% | Non-dominant, but second largest weighting factor. Represents market stress and fear. |

ACTIONABLE STEPS (LOW-EFFORT / HIGH-IMPACT)

🚀 MONITOR THIS FIRST: Focus on the price action of the BTCUSD chart itself. Since the INDEX LEADS signal is active, traditional TradFi charts (SPY, DXY, VIX) are currently lagging indicators. Look for chart formations, volume anomalies, or key support/resistance levels in the crypto market.

⏱️ ANTICIPATE MOVES: The INDEX LEADS indicator gives you a potential window of up to 8 hours (2 bars on the 4H chart) to observe TradFi markets after the Monday open. If the BTCUSD price rises or falls significantly before the US markets open, there is a high probability that the TradFi indices will follow.

🔍 VALIDATE THE THESIS: The weak tactical R² value of 20% confirms that TradFi correlation is low at the moment. Therefore, your trading decisions at this time should be based on approximately 80% crypto-internal data (on-chain, liquidity, news) and only 20% on macro data. If the R² value rises above 40% again, shift your focus back to TradFi.

#Bitcoin #BTC #CryptoTrading #TechnicalAnalysis #MarketAnalysis #TradFi #AITrading #TFPS #MarketNarrative

$BTC Weekly Close Keeps Bullish StructureCRYPTOCAP:BTC looking hopeful closing the Week just above previous ATH POI and above the SMA9.

PA needs to stay above this to keep bullish momentum.

the CME Gap was filled, which was the main objective on this correction.

Let’s see how the market reacts on judgement day tomorrow 🤓

$BTC One Last Flush Before the Next Leg Up!Technical Analysis really is a beautiful thing.

As mentioned, price heading down to ~$111k.

Had a small bounce off the 50DMA at $112k.

Hopefully PA doesn’t range for too long in the previous ATH POI. That will really take steam out of the bull’s engine.

I’m expecting one last flush to push the RSI a bit lower before we can continue the trend back up.

As always in a bull market, BTFD!

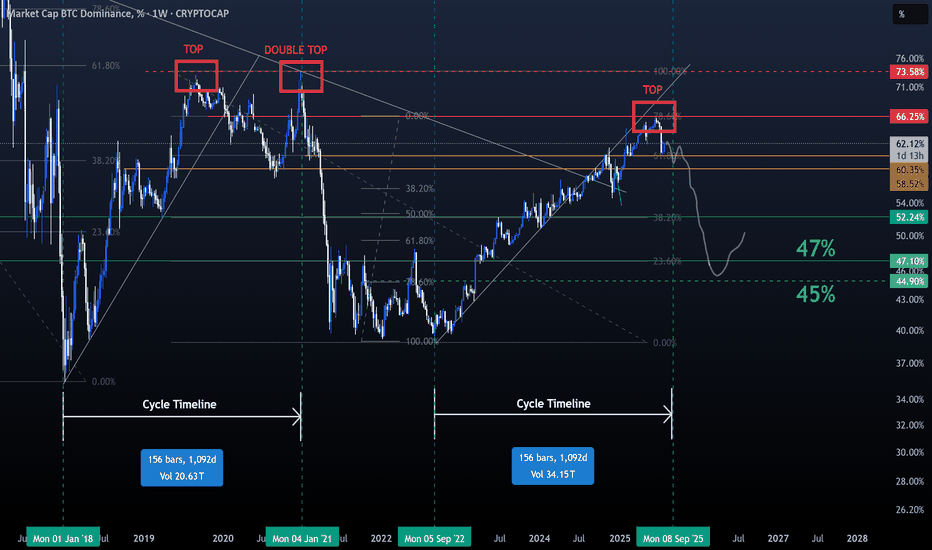

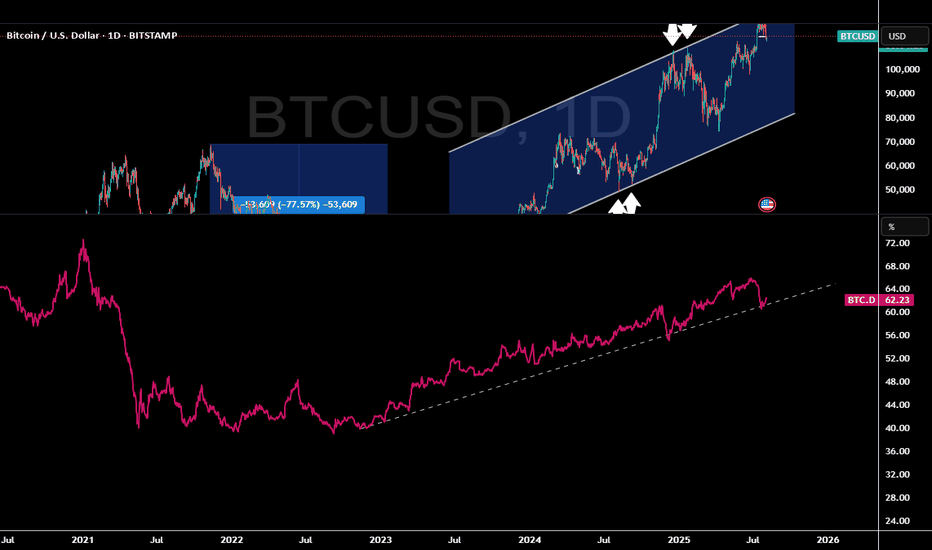

BTC DOMINANCE UPDATE- So, all elements are annotated throughout the graphic, like always.

- Timeline.

- Older Top Dom (2021) (red doted line).

- New Top Dom (2025) (red line).

- Some supports ( Orange Line ).

- Some Bottoms ( Green Lines ).

- Most important in chart : Fibonnacci Retracements.

- After this chart, I’ll drop links to my older BTC dominance posts.

- Not much to say, just look at the chart :

- In 2021, BTC.D formed a double top because Bitcoin spiked twice and hit two all-time highs.

- That doesn’t mean BTC.D will behave the same way in 2025. I don't expect another double top, but who knows.

- We could see a retracement down to the 45–47% range. That would likely signal the start of a new bear market.

- For now, i don’t see the end of the bull run yet. I’m mostly waiting for a strong BTC push in price, a fast dip in BTC Dominance, and the kickoff of Altseason.

— it’s going to be wild and fast! Just my personal opinion.

Stay Safe !

Happy Tr4Ding !

BTC/USDT | Bitcoin Eyes Rebound from $110K Support Zone! (READ)By analyzing the Bitcoin chart on the 4-hour timeframe, we can see that after reaching a new high at $123,218, the price began to pull back and has now corrected down to around $112,500. I expect the current volatility to ease soon. The next critical support zone lies between $110,500–$112,000 — watch price action closely here, as BTC could bounce from this area and push back toward $116,000+. Other key demand zones are located at $109,000, $107,900, and the $105,000–$106,000 range.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

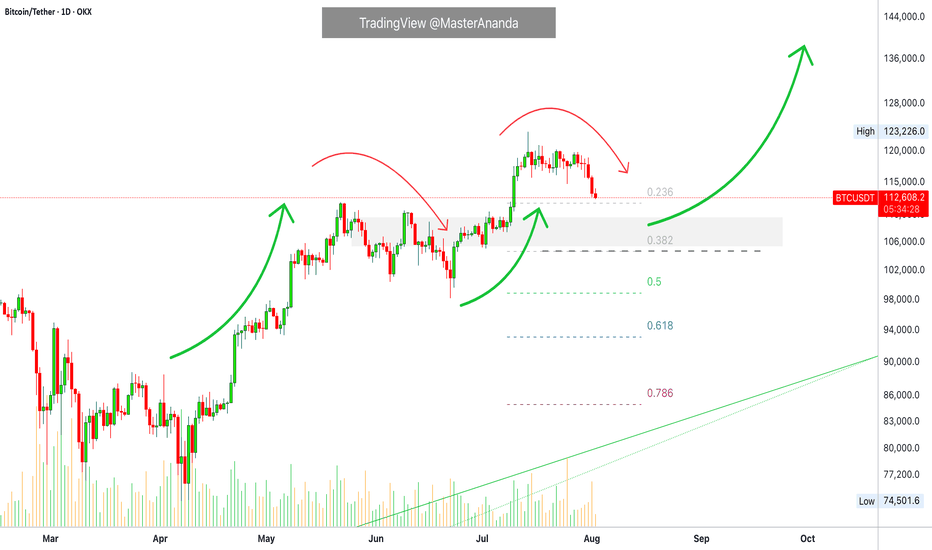

Bitcoin Enters Correction Mode?Bitcoin is already trading at support in the form of the previous all-time high and EMA55. Bitcoin is down more than 8% since its 14-July all-time high. We can see that a correction is already in, a retrace. This retrace we consider part of the normal workings of the market, price fluctuations which invariably always show up. The end result is a higher high, a rising wave, higher prices on the long haul.

Support is strong at current prices but even stronger is the support zone right above $100,000. As long as Bitcoin trades above $100,000, we will continue with a strong bullish outlook. If Bitcoin manages to move and close below $100,000 monthly or weekly, we will consider the short-term, the mid-term and update our map if necessary. For now, the bulls are still in control.

When Bitcoin peaked 22-May it went sideways for an entire month. From a peak of $112,000 it hit a low of $100,000. Now we have a peak around $123,000 and prices can easily swing around in this wide range.

After a few weeks, or several months, exactly as it happened last time, Bitcoin will go up. So you can expect retraces and corrections, but this is only short-term long-term we grow.

Namaste.

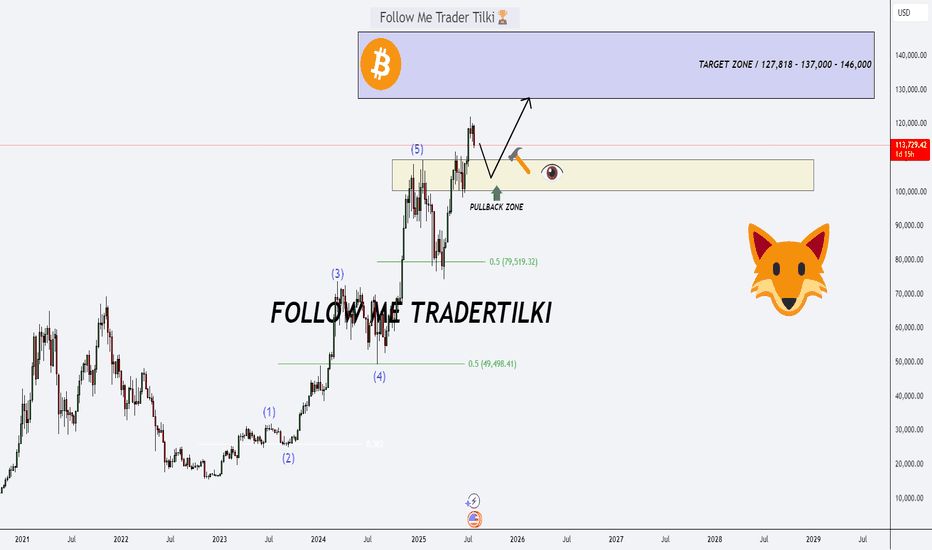

Bitcoin’s Game Has Changed: Fresh Support Zone, Targets Sky-HighHey Dear Friends,

Until recently, Bitcoin had been stuck in a range between 112,331 and 105,344 for quite some time. But that range has now been clearly broken. So, what does this mean? This zone, which used to act as resistance, is now expected to flip and act as support.

According to my weekly trading model, the long-term target levels I’m tracking for Bitcoin are: 127,818 – 137,000 – 146,000.

Since this is a weekly setup, it might take a while for these targets to play out. Even if we see pullbacks to the 112K, 105K, or even 100K levels, I expect to see strong buying pressure from that zone.

I’ll keep sharing regular updates as this setup develops.

To everyone who’s been supporting and appreciating my work—thank you, truly. Your encouragement means the world to me and keeps me motivated to keep showing up. Much love to all of you—I’m grateful we’re in this journey together.

NeoWave Alert: BTC G-Wave Sets Up a Brutal Drop After $116K PumpAs anticipated in our previous NeoWave analysis, the market appears to be deep within Wave G of a Contracting Diametric structure (A–G), originating from the March 2025 high.

⸻

🔻 Key Developments:

• After rejecting from $119,000–119,500 (Wave F resistance), price dipped to $112,000, breaking below the previous channel’s lower bound, and now appears to be forming a steeper descending channel.

• This new channel’s resistance has shifted lower to $116,000, becoming a potential bull trap zone.

• The bounce from $112K is likely a liquidity sweep, preparing for one final upside to $116K, followed by aggressive distribution.

⸻

💡 Trading Thesis:

We’re likely seeing a trap-style rally within Wave G, aiming to:

• Attract liquidity up to $116K

• Induce late longs before initiating a more violent selloff toward $105K or lower

⸻

🔍 Smart Money Confluence (SMC / ICT)

• 🟥 Confirmed bearish structure on 1H (Lower Highs + BOS)

• 🟨 Liquidity above $120K already swept during Wave F

• 📉 Order blocks around 119.5K rejected

• 🔻 Price currently trades above $114K, but trapped inside a sharper descending range

• 🧲 Unfilled FVGs between $113K–$110K may serve as magnets

⸻

🧠 Wave G Structure (Diametric)

• Possibly unfolding as a Zigzag or Complex Combination

• Channel boundary now capped at $116K

• Wave G likely targets a breakdown below Wave E ($113K) and toward $105K

⸻

📌 Primary Scenario:

• Final push to $116K → strong rejection expected

• Bearish continuation targeting $110K → $105K

🧯 Invalidations:

• Clean breakout & daily close above $120.5K invalidates this diametric structure

• Watch for triangle or flat morphing if structure shifts

⸻

⚠️ Risk Management:

• $116K = key distribution zone

• Watch closely for rejection and breakdown confirmation

• Shorts valid below $114K with tight invalidation above $117K

⸻

📌 Conclusion:

Bitcoin is nearing the climax of a multi-month complex correction. The current setup favors a liquidity trap toward $116K, followed by continuation of Wave G toward major demand zones. Smart money bias remains bearish below $117K.

⸻

💬 Drop your alternate wave counts or SMC confirmations in the comments!

Bitcoin Dominance & The Fall of AltcoinsBitcoin has sold off sharply in recent session.

Allowing alt coins to capture small percentages of bitcoins liquidity which resulted in epic bullish moves.

Now that Bitcoin is retesting a major moving average (50 MA) we might see BTC recapture some of that crypto dominance.

Other alt coins are well off of their 50 day moving average making them a riskier buy.

When BTC dominance starts to take leadership we often see alt coins and the total market cap sell off.

Bitcoin dominance is hitting a multi year trendline and looks poised to capture some of the alt liquidity.

We still think BTC can sell off and go lower, but on a relative basis it should hold up better than other alt coins & Ethereum.

There are some key nuances that are building and shaping up for a very similar topping formation that occurred in 2021.

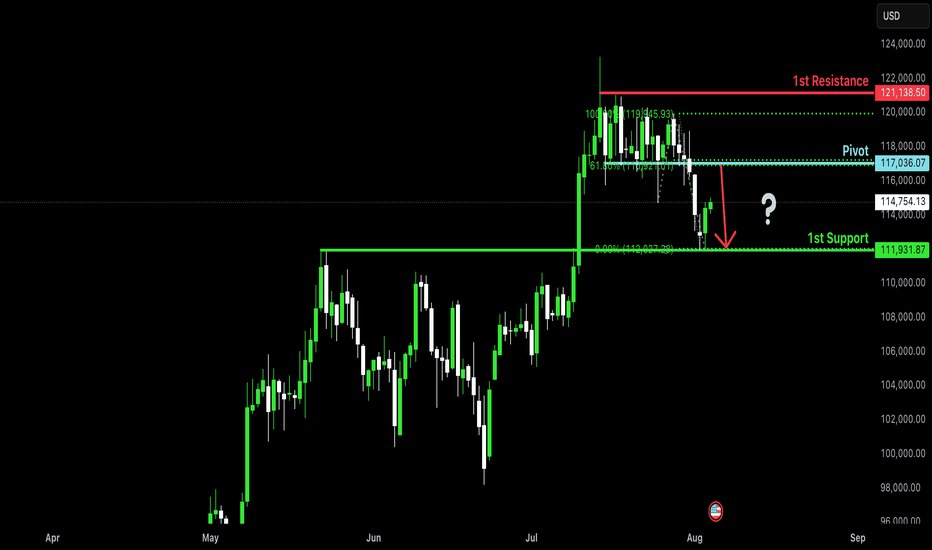

Bearish reversal?The Bitcoin (BTC/USD) is rising towards the pivot and could reverse to the 1st support.

Pivot: 117,036.07

1st Support: 111,931.87

1st Resistance: 121,138.50

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.