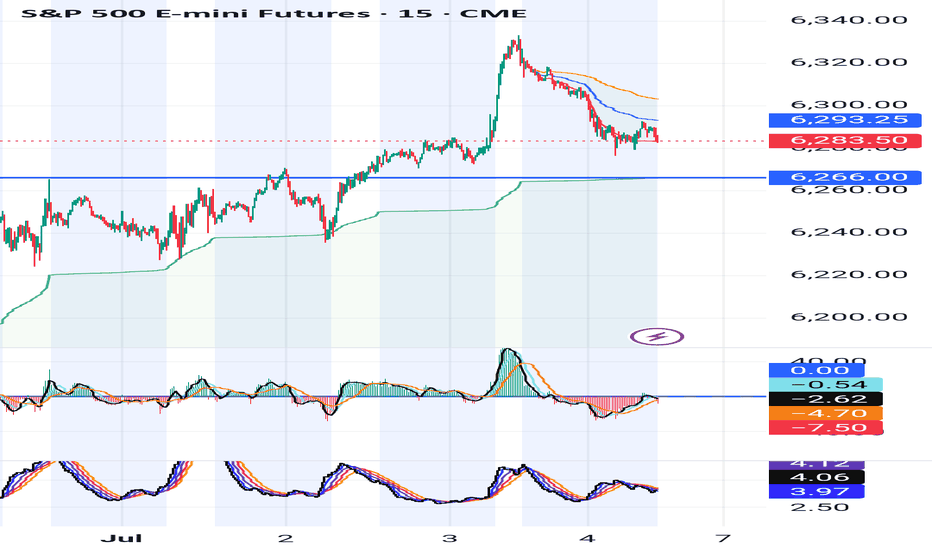

ES, SPY, SPX will be testing key support on Sunday After a welcome rally into new highs for the s&p, there appears to be a critical crossroad forming. Using the ES continuous contract I have placed 2 anchored VWAP's. The first being anchored to the last higher low on Thursday, June 19. And the the second, being anchored to this last Thursdays high on July 3rd.

For this post we will call the anchor from June 19 - VWAP1. And for the July 3rd anchor - VWAP2

VWAP1 r1 has acted as a key support line since the higher low was set. Successfully bouncing and holding support several times.

As we headed lower on this Thursdays July 3rd session, we remained between the center and r1 of VWAP2 indicating strong selling pressure for the day. With it being a shortened trading day with less liquidity however, I have less concern over the days price action. The forming crossroads and the upcoming Sundays open will be more telling for where we likely head this week.

The blue Horizontal Line at 6266 is placed directly on VWAP1s r1 (green line) which has acted as support. If we trade into this level on the Sunday open, it's a clear signal the sellers are still in control. If however, price can consolidate at that level (6266) and form structure, a breakout of the structure would be evidence of sellers backing off and buyers stepping in creating a good buying opportunity for the week.

Another possible scenario, if we first manage to trade up into s1 of VWAP2 (orange line) around the 6300 level, I will be looking for a short scalp down to the r1 of VWAP1 at 6266. From here it would be prudent to sit and wait for more confirmation on if this is a reversal, or just another pullback in the uptrend.

These are my two trade setups and ideas for Sunday's open. Hope this analysis helps. Happy trading 🤙💰📈

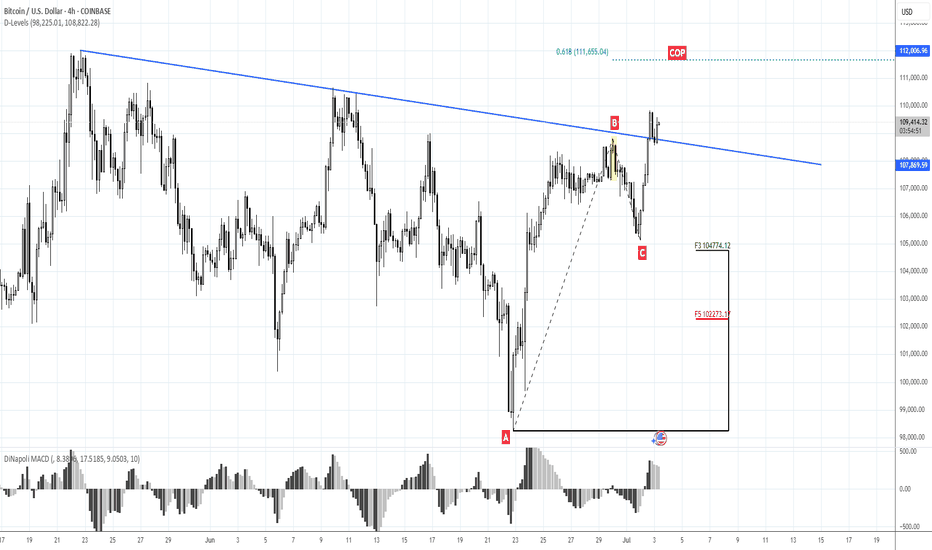

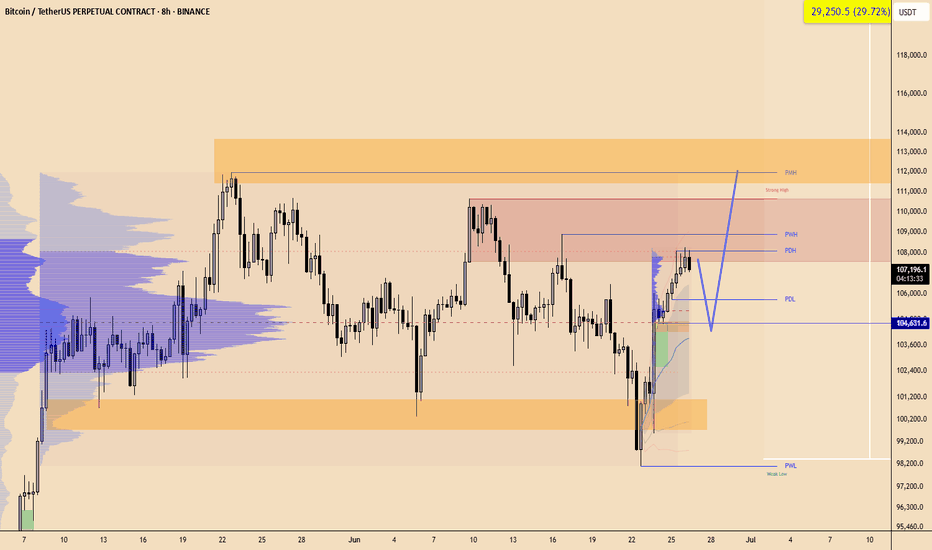

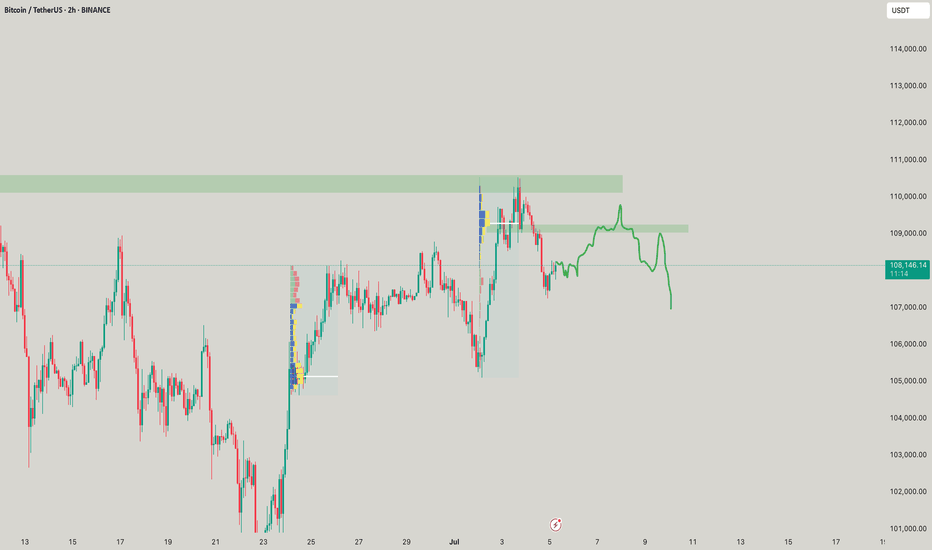

BTC-M

111.65 against 105KMorning folks,

So we've got great entry with our H&S but it is early to relax. To avoid long explanations - BTC has to stay above 105K lows to keep current tendency valid. So, if you still plan to buy BTC here - you do not need to watch for too deep standing Fib levels.

If BTC will still drop below 105K, we could get extended downside action to 100K and maybe even deeper.

Nearest upside target with our current plan is 111.65K.

BITCOIN ANALYSIS - What's Next for for BTC?🎯 KEY LEVELS DECODED

🛡️ FORTRESS SUPPORT: $102,800 - $103,200

_____________________________

NEUTRAL STRATEGY:

Buy Zone: $102,800 - $102,600

Sell Zone: $110,000 - $112,000

Stop Loss: $100,500 (range breakdown)

Target: Opposite end of range

Position Size: 3-5% of portfolio

_____________________________

🎢 SCENARIO : (Probability: 35%)

If BTC consolidates between $102K-$108K :

Range-bound trading for 2-3 weeks

Accumulation phase before next major move

Key levels: Buy $102K, Sell $110K

_________________________

🛡️ RISK MANAGEMENT 🚨 DISCLAIMER 🛡️ DYOR

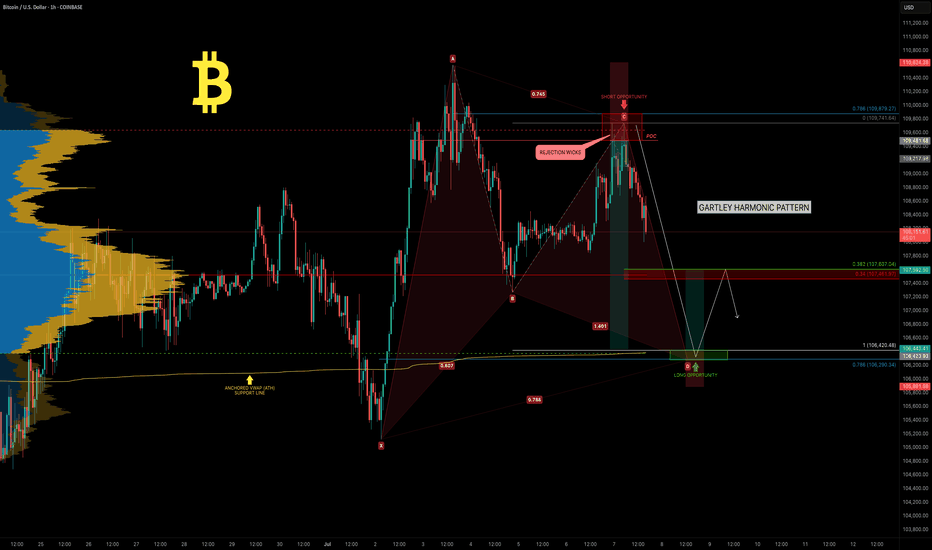

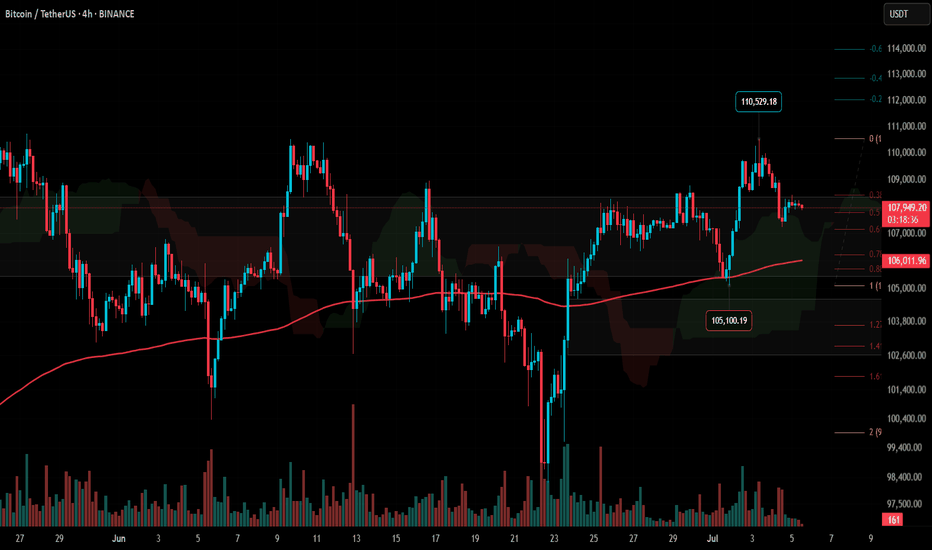

BTC — Weekend Pump Fades.. All Eyes on the Gartley Reversal ZoneBitcoin has been consolidating in a tight range between $110K and $105K over the past two weeks. This weekend’s attempted breakout stalled out quickly! BTC was rejected at the Point of Control (POC) of the previous range and came close to the 0.786 retracement of the recent drop.

🧠 Reminder: Weekend pumps are notorious for being unreliable, especially without strong volume.

Now, the charts point toward something much more structured — a potential Gartley harmonic pattern forming, with multiple levels of confluence suggesting the next key decision zone is just around the corner.

🧩 Gartley Completion Zone: $106,290–$106,400

This price zone is loaded with confluence:

✅ 0.786 Fib retracement of the XA leg sits at $106,290

✅ 1.0 trend-based Fib extension of the BC leg is at $106,370

✅ Anchored VWAP from all-time high aligns precisely at $106,370

✅ VAL (Value Area Low) sits at the same level

✅ Imbalance (Fair Value Gap) from earlier price inefficiency lies in this exact region

All of this stacks up into a high-probability reaction zone.

🎓 Educational Insight: How to Trade a Gartley Harmonic

The Gartley pattern is one of the most powerful harmonic setups — a structured form of retracement and extension that captures exhaustion before reversals. Here's how it works:

🔹 XA: Impulse leg

🔹 AB: Retracement of 61.8% of XA

🔹 BC: Retraces 38.2%–88.6% of AB

🔹 CD: Extends to 78.6% retracement of XA and aligns with a 1.0–1.272 Fib extension of BC

🟢 Point D is the entry zone — your reversal opportunity.

📉 Stop-loss sits just below invalidation (Point X).

💰 Targets usually lie at 0.382 and 0.618 of the CD leg.

🔎 Why It Works: It traps late traders and captures price exhaustion at natural Fibonacci ratios. Combined with other tools — like VWAP, liquidity zones, and order flow — it becomes a high-conviction strategy. These patterns are most effective on higher timeframes like 4H or daily.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

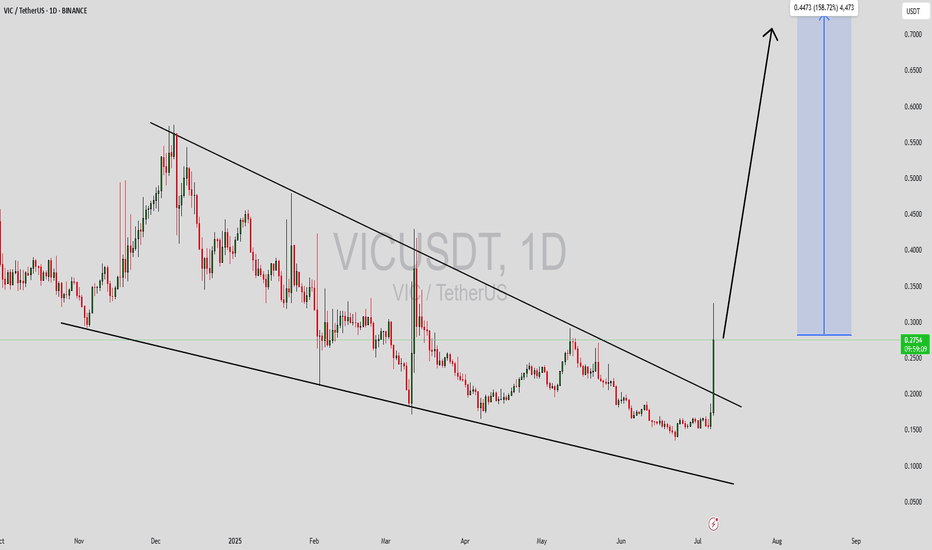

VICUSDT Forming Falling WedgeVICUSDT is displaying a classic falling wedge breakout pattern, which is often seen as one of the most reliable bullish reversal signals in technical analysis. This pattern suggests that the downtrend may be losing steam and a significant trend reversal could be underway. With a well-formed falling wedge and a strong breakout confirmation, VIC is now positioned to potentially deliver impressive gains in the range of 90% to 100%+, capturing the attention of traders looking for high-potential altcoins.

Recent spikes in trading volume further validate the strength of this breakout move. Higher volume during a breakout often indicates that both retail traders and larger investors are stepping in, adding conviction to the trend reversal. This strong volume profile could drive sustained upward momentum, making VICUSDT a crypto pair worth monitoring closely over the coming weeks.

The fundamentals surrounding VIC’s project are also contributing to growing investor interest. As the crypto space evolves, innovative projects with real-world use cases and active development teams tend to attract capital faster. VIC appears to be aligning with these factors, offering a compelling combination of solid technicals and supportive market sentiment.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

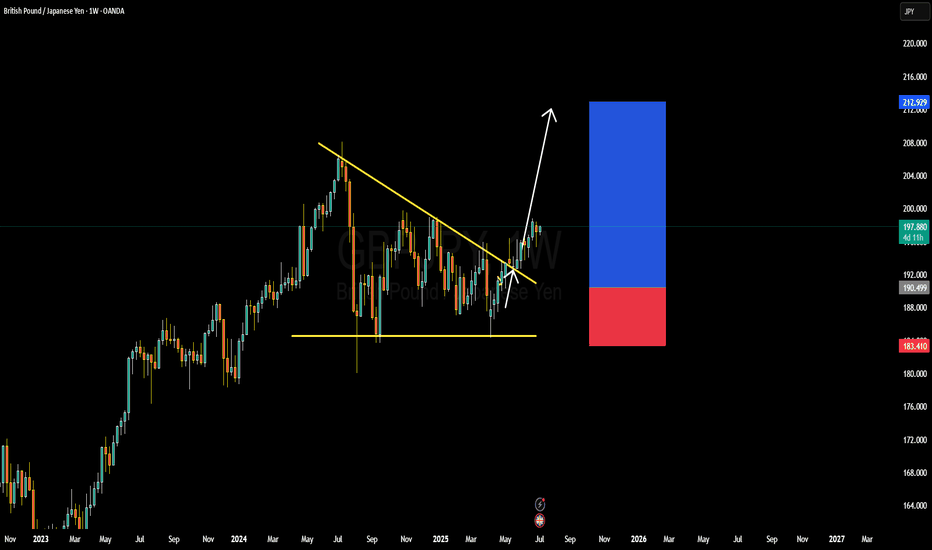

GBPJPY BULLISH OR BEARIS DETAILED ANALYSISGBPJPY has successfully broken out of a long-term falling wedge on the weekly chart, and the bullish momentum is unfolding as expected. Price has rallied from 190.00 to the current 197.00 level, delivering solid profits from the breakout zone. This continuation setup is extremely strong, with the market respecting the wedge breakout structure and forming higher highs. As long as we hold above the 190.00 support, the bullish bias remains fully intact, with 205.00 as the next key upside target.

Fundamentally, the British pound remains well-supported due to the Bank of England’s hawkish stance. Despite softer inflation data, the BoE has signaled a cautious approach to rate cuts compared to other central banks, maintaining underlying GBP strength. On the other side, the Japanese yen continues to weaken as the Bank of Japan sticks with its ultra-loose monetary policy. Yen weakness is further fueled by rising US and UK bond yields, widening the yield differential and attracting carry trades into GBPJPY.

Technically, the breakout is unfolding with textbook precision. Price has cleared descending resistance, retested it, and is now building a new leg higher. The volume profile is supporting this bullish breakout, and market structure is confirming further upside. The 200.00 psychological level may act as a minor resistance, but once cleared, 205.00 is well within range and aligns with major Fibonacci extensions.

GBPJPY is also benefiting from increased volatility in risk-on sentiment, as equity markets remain firm and bond yields rise globally. Traders are favoring high-yielding currencies like GBP while shorting low-yielders like JPY. With the fundamentals and technicals now strongly aligned, this trade is well-positioned to deliver continued profits toward 205.00 and beyond.

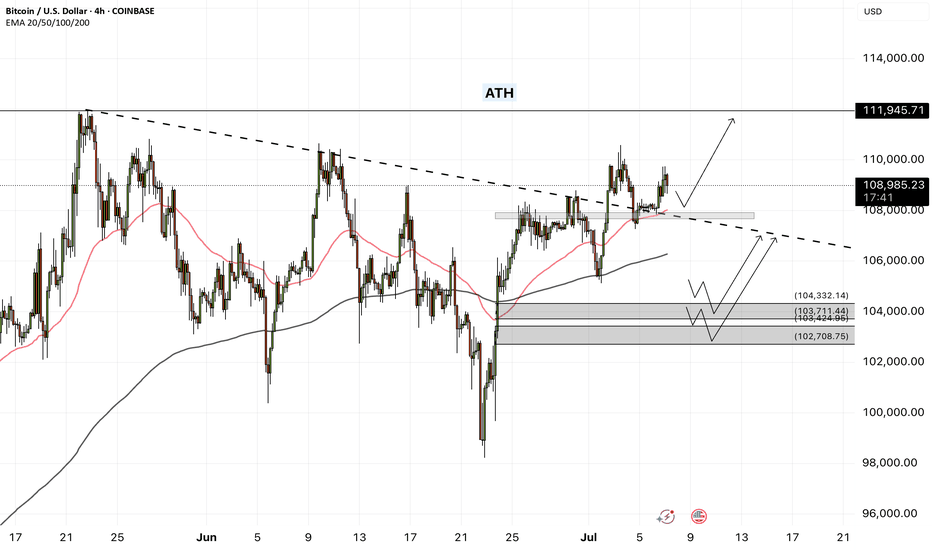

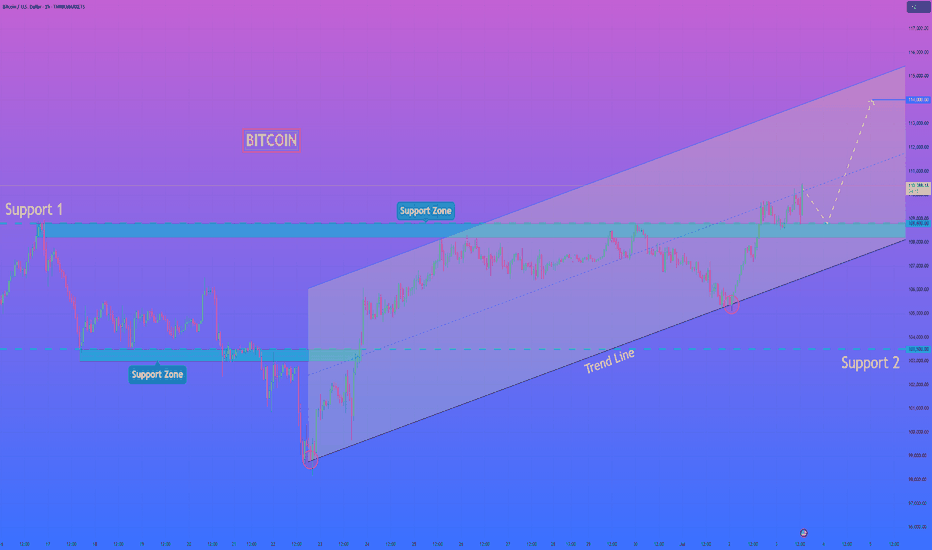

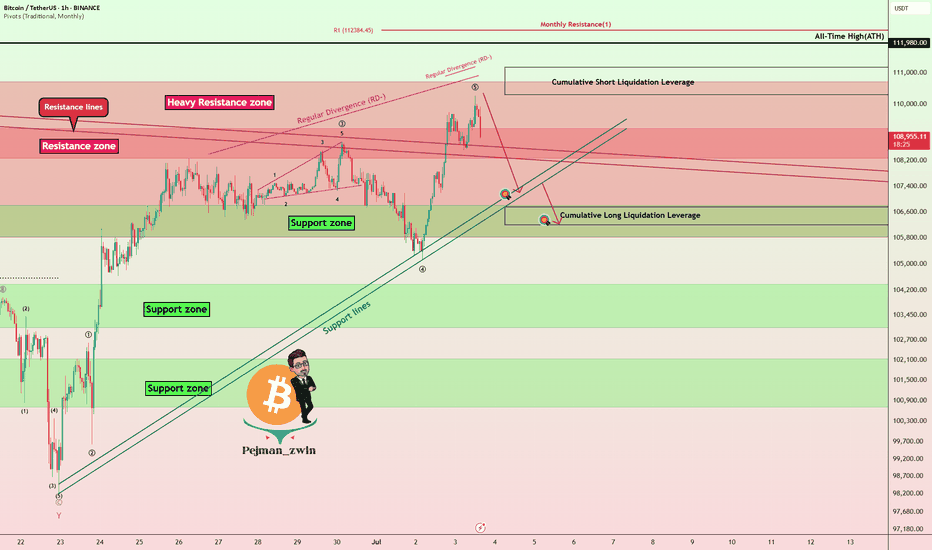

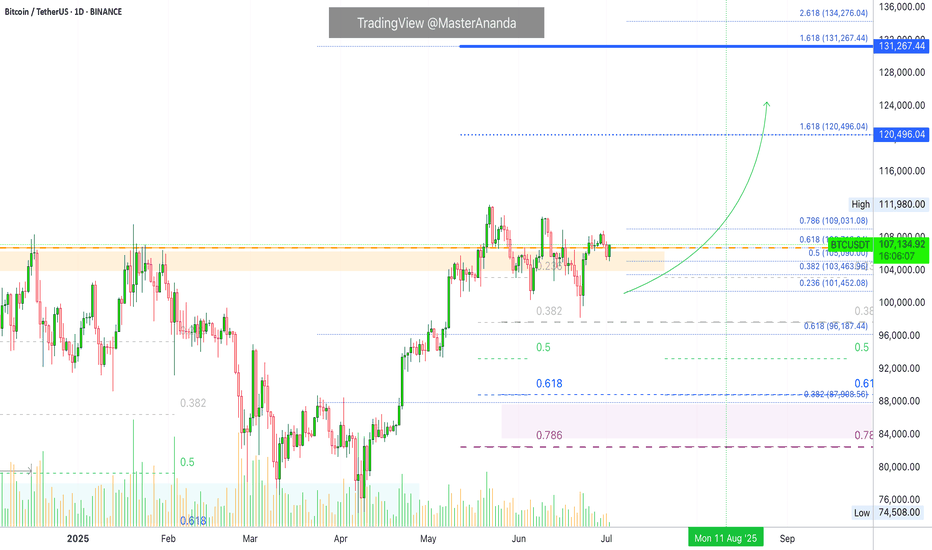

Bitcoin - Will Bitcoin record a new ATH?!Bitcoin is above the EMA50 and EMA200 on the four-hour timeframe and is in its medium-term ascending channel. Maintaining the specified support area will lead to the continuation of Bitcoin’s upward path and recording a new ATH. If it is corrected, we can look for Bitcoin buying positions from the specified demand zones.

It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and compliance with capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand area.

In recent days, Bitcoin has been stabilizing in a price range of around $107,000, with the market simultaneously witnessing a combination of short-term volatility and massive accumulation by institutional investors. A close examination of Bitcoin’s fundamental parameters shows that the market has entered a different phase than in the past; one that is no longer driven solely by momentary excitement, and that structured capital flows and on-chain data have formed its main axis. At the forefront of this trend are Bitcoin spot investment funds (Bitcoin ETFs), which reached their highest level of capital inflows in June. Total net inflows of these funds reached more than $4.5 billion last month, and on some days even approached more than $1 billion. Funds such as BlackRock’s IBIT and Fidelity’s FBTC now have billions of dollars in assets under management, a clear sign of increasing institutional participation in the Bitcoin market. These institutional investors are accumulating Bitcoin not with a short-term view, but with a long-term view and through legal means, which has reduced selling pressure and increased market stability.

On the other hand, the data from Anchin clearly shows that the market is in a steady accumulation trend. The amount of old Bitcoins held for more than 8 years experienced a significant growth of 5% in the second quarter of 2025. This statistic shows that long-term investors are not only reluctant to sell, but are still accumulating their assets. Also, the MVRV ratio, which indicates the relative profit or loss of the market, has decreased from 2.29 to 2.20, indicating mild and controlled profit taking by some investors, rather than widespread selling pressure or general panic. This rational behavior is a sign of market maturity and investors’ intelligence in managing short-term profits.

On-chain activity data also shows a similar trend. The average daily active addresses have reached around 1.02 million, indicating a decrease in market inflammation while maintaining overall dynamism. Other indicators such as Liveliness and Whale Accumulation also confirm that the amount of old transaction traffic has decreased and whales are mainly accumulating, not supplying. This trend is very valuable, especially in a market that has been far from explosive growth. From a macro perspective, the Bitcoin market is clearly in a consolidation and accumulation phase, but this consolidation is based on much stronger foundations than in previous periods. Institutional capital inflows via ETFs have reached over $50 billion, providing a strong foundation for continued growth. Also, some very old wallets that have been inactive for nearly 14 years have recently woken up and moved around $2 billion worth of Bitcoin. Although this could be a sign of potential supply, the market has not yet seen a significant negative reaction to it in the current market conditions and the market remains cautious.

Analysts believe that Bitcoin is in the third phase of its bullish cycle after the halving, which could bring gains of more than 120%. Some forecasts suggest a price range of $200,000-250,000 by the end of this year; however, the realization of such levels is subject to stable macroeconomic data, ETF performance and the absence of severe geopolitical shocks.

Finally, it can be said that the Bitcoin market has now reached a maturity where even periods of consolidation tend to strengthen its fundamentals rather than weaken the market. High-powered institutional investors are entering, whales continue to accumulate instead of selling, and long-term investors also see a bright outlook for the coming months. In this phase, price levels of $125,000 to $140,000 are likely by the end of the summer if the current trend continues, while in the event of severe economic or political pressures, key support for Bitcoin will be in the $95,000 to $100,000 range. Overall, Bitcoin is moving slowly but steadily towards higher targets, with stronger support than at any time in its history.

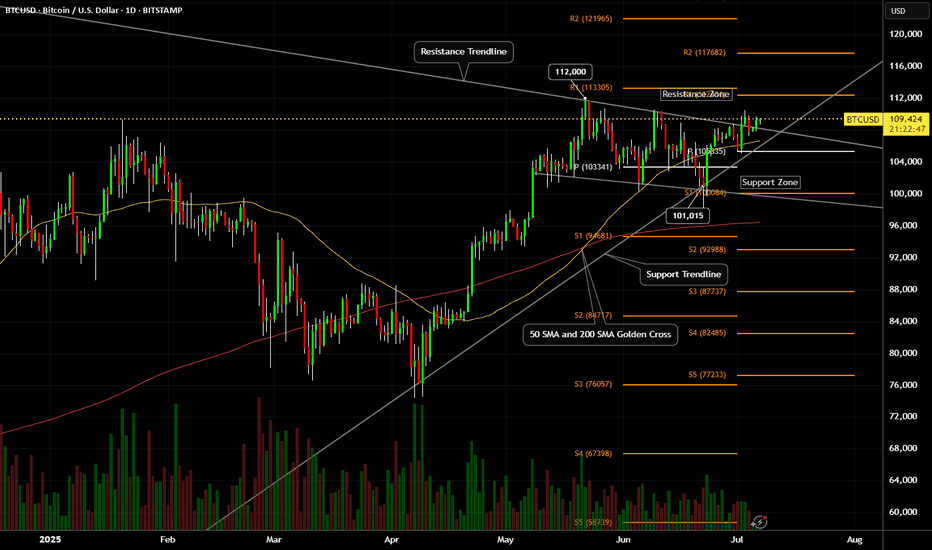

Bitcoin (BTCUSD) - Daily Price Uptrend, Resistance Breakout TestBitcoin (BTCUSD) has been in a recent Daily price Uptrend, rallying up from the $100,000 price support level.

A SMA Golden Cross printed on May 21st, 2025.

Bitcoin price is attempting a resistance zone test and has yet to breakout and hold above the $111,000 to $112,000 price zone.

Resistance levels: $110,000 , $112,000 , $117,000 , $121,000.

Support levels: $108,000 , $107,000 , $105,000 , $104,000 , $100,000.

Recent crypto industry, government legislation news, and institutional crypto purchases have helped to keep Bitcoin price above $100,000 support.

Stock market correlation volatility could also affect the crypto market and prices for the next 30 to 45 days.

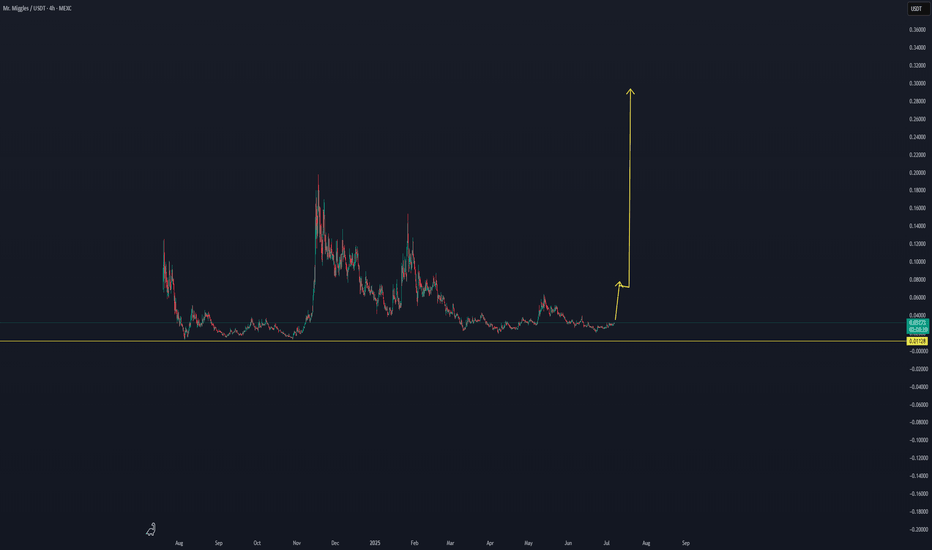

MIGGLES/USDT THE BREAK RETURN TO THE MOONMIGGLES/USDT THE BREAK RETURN TO THE MOON

We are following with live data on this coin for the next volume trend, which can have a break in the coming time.

At this moment, this coin is showing signs of an increase. When it gets confirmed, we will follow it with live updates.

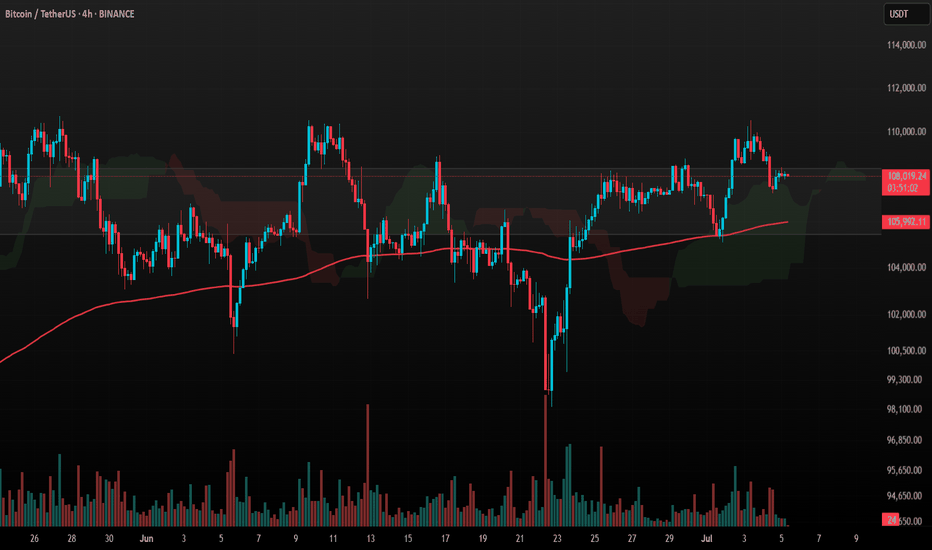

#BTC Update #3 – July 5, 2025🟠 #BTC Update #3 – July 5, 2025

Bitcoin is currently in a corrective phase following its latest impulsive move. To confirm that the correction is complete, I’d need to see a fresh impulsive leg. Until then, price may continue to pull back .

Looking at the liquidation heatmap, I’m seeing stacked liquidity between $107,100 and $106,500 . Based on that, I wouldn’t be surprised to see BTC wick down toward $106,000, sweep that zone, and potentially initiate a long-biased impulsive bounce.

If that bounce materializes, my first target is the $110,000 region . It’s also worth noting that Bitcoin is currently sitting inside a supply zone, which could add short-term resistance before any breakout.

HelenP. I Bitcoin may correct to support level and continue growHi folks today I'm prepared for you Bitcoin analytics. If we look at the chart, the price has formed a clean upward channel after bouncing from the strong support zone at 103500 - 103000 points. This movement marked the beginning of a new bullish phase. Price continued to rise step by step, confirming the structure with higher highs and higher lows. After reaching above 110000 points, it made a minor pullback but still trades above Support 1 - 108800 points. This zone, 108800 - 108200 points, aligns well with the midline of the channel and may serve as a strong area for buyers to re-enter. The price is currently trading around 110382 points and is still respecting the channel structure. As long as BTCUSD stays above the support zone and inside the ascending channel, I expect a potential continuation toward the upper boundary. My current goal is 114000 points - near the resistance line of this bullish channel. Given the strong trendline support, clean reaction at each correction, and buyer activity on lows, I remain bullish and anticipate further growth. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

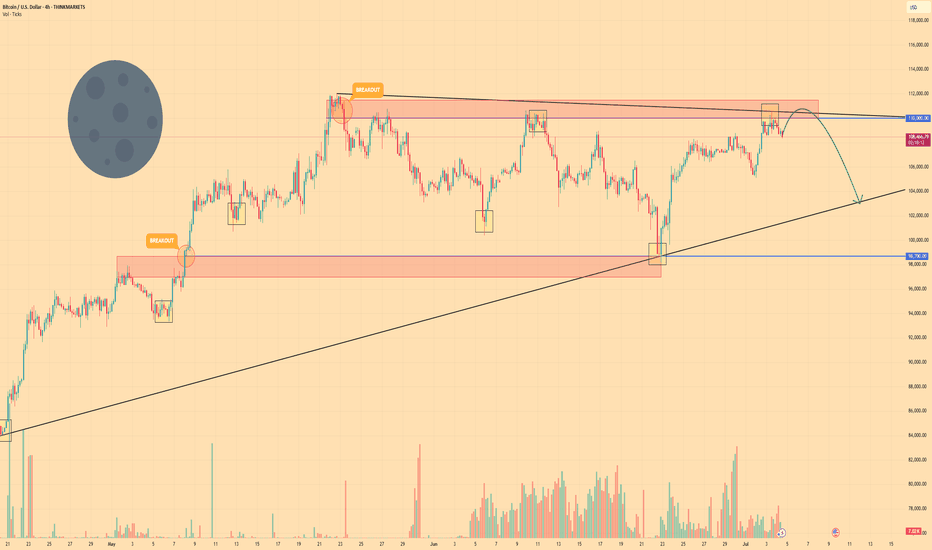

BITCOIN - Price can drop from resistance area to $103000Hi guys, this is my overview for BTCUSD, feel free to check it and write your feedback in comments👊

Some days ago, price entered a pennant pattern, where it at once made an upward impulse from support line.

Then the price reached $98700 level and soon broke it, after a small correction, and then continued to move up.

Later BTC rose to the resistance line of the pennant, but soon turned around and started to decline, breaking $110000 level.

Price little corrected and then tried to bounce back and failed, after which it fell to $98700 level and then started to grow.

In a short time, BTC rose to a $110000 resistance level and tried to break it again, but recently turned around and started to fall.

Now, I expect that BTC can grow to the resistance area and then drop to $103000 support line of the pennant.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

#BTC Update #2 – July 5, 2025🟠 #BTC Update #2 – July 5, 2025

I still see $112,000 as Bitcoin’s next major target. That said, the $110,000 zone continues to offer strong resistance, and price hasn’t managed to break through it with conviction yet.

If BTC can’t clear $110K with momentum, I expect a potential pullback. For now, I consider price action to be stuck in a decision zone. Without a clean breakout above $110K, I wouldn’t be surprised to see a deeper correction before any meaningful upside continues.

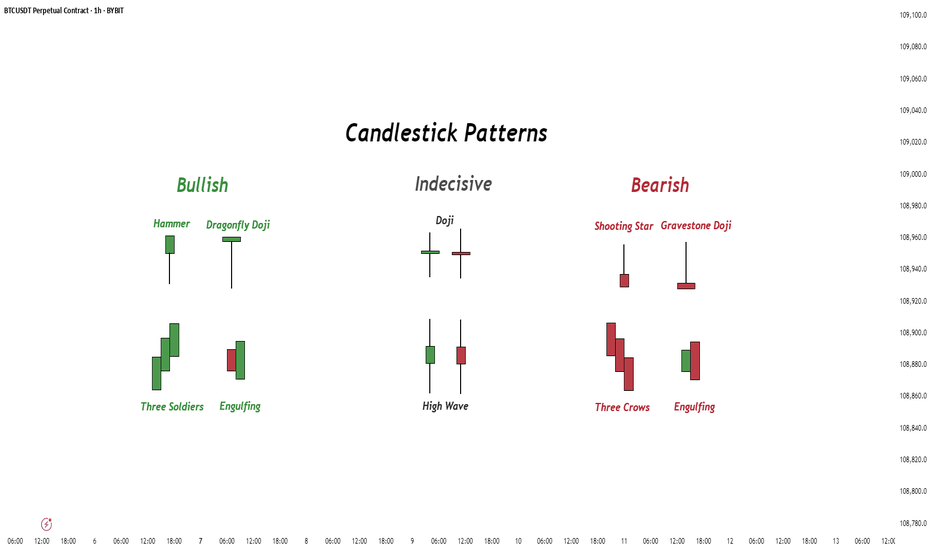

Candlestick Patterns - How to read them like a ProOverview

Candlestick charts serve as a cornerstone in technical analysis, presenting price activity in a visually digestible format. By examining how prices move over a given timeframe, traders gain key insights into potential market direction, sentiment shifts, and trend strength.

Mastering candlestick interpretation is essential for identifying bullish or bearish sentiment, as well as for spotting possible trend reversals or continuations. Still, candlesticks alone don’t paint the full picture—using them without broader context increases the risk of false signals.

---

What You'll Learn

What are candlestick charts?

Common bearish candlestick patterns

Common bullish candlestick patterns

How to apply candlestick analysis in trading

---

What is a Candlestick Chart?

A candlestick provides a snapshot of an asset’s price behavior during a specific time interval, whether it's one minute, one hour, or one day. This format allows traders to quickly assess how the price has moved within that period.

Each candle reveals four price points:

* Open – the price at the beginning of the interval

* Close – the price at the end of the interval

* High – the highest price reached

* Low – the lowest price during that time

Anatomy of a Candlestick:

* Body: The thick section between the open and close. A green (or white) body means the close was higher than the open (bullish), while red (or black) means the opposite (bearish).

* Wicks (or Shadows): Thin lines extending from the body to indicate the high and low.

* Upper wick: Marks the highest traded price

* Lower wick: Marks the lowest traded price

---

Bearish Candlestick Patterns

Understanding bearish candlestick patterns helps traders identify moments when buying momentum might be running out—setting the stage for a potential downward shift.

Evening Star

A three-candle formation that signals a shift from buying pressure to selling dominance. It starts with a strong bullish candle, followed by a small-bodied candle of indecision, and concludes with a large bearish candle that cuts deep into the first. This pattern often appears at the end of an uptrend.

Bearish Engulfing

This setup includes a small bullish candle followed by a large bearish candle that completely swallows the previous one. It indicates that sellers have seized control, potentially marking the beginning of a downward trend.

Shooting Star

With a small real body near the low and a long upper wick, this pattern reflects strong early buying that is ultimately rejected by the close—suggesting fading bullish momentum.

Gravestone Doji

This candle opens, closes, and hits its low all around the same price, leaving a long upper wick. It suggests that bulls pushed higher during the session but were overpowered by bears by the close.

Three Crows

Three consecutive bearish candles, all approximately the same size. These indicate that a sell off is coming soon.

---

Bullish Candlestick Patterns

Bullish patterns can alert traders to possible reversals after a downtrend or strengthen conviction during an uptrend.

Morning Star

This three-candle formation marks a potential turning point from bearish to bullish. It begins with a strong bearish candle, followed by a smaller candle showing indecision, and ends with a large bullish candle breaking upward—signaling buying strength is returning.

Bullish Engulfing

This two-candle pattern begins with a bearish candle, then a larger bullish candle that completely envelops the previous body. It reflects a sharp transition in sentiment, suggesting renewed buying pressure.

Dragonfly Doji

A single candle where the open, close, and high are all very close, with a long lower wick. It shows sellers pushed prices lower but buyers stepped in and brought them back up—an early sign of possible reversal.

Hammer

A classic bullish reversal signal that features a small real body near the top and a long lower shadow. It indicates a battle where sellers initially dominated, but buyers managed to close near the open price.

Three soldiers

Three consecutive bullish candles, all approximately the same size. These indicate that a big buy is coming soon.

---

Trading with Candlestick Patterns

Candlestick patterns become more meaningful when they align with major chart areas—such as previous support or resistance, trendlines, or retracement zones. A bullish signal at a support level can hint that the downward pressure is fading, while a bearish pattern at resistance may warn of an upcoming decline.

To increase the reliability of your trades, combine candlestick patterns with other forms of technical analysis:

* Support & Resistance Zones: These are price levels where the market has historically reacted. Candlestick patterns forming near these zones have stronger potential implications.

* Fibonacci Levels : These help identify likely retracement areas. When a candlestick pattern forms near a key Fibonacci level like 61.8%, it adds strength to a potential reversal setup.

* Liquidity Areas: Clusters of orders (buy or sell) tend to create strong reactions. When patterns appear in these zones, they often precede more decisive moves.

* Technical Indicators : RSI, MACD, Moving Averages, and Stochastic RSI can provide confirmation. For instance, a bullish reversal pattern that appears when RSI is oversold strengthens the signal.

💡 Tip: Don’t rush into trades based on one candlestick alone. Always wait for the next candle or price confirmation (e.g., a break of a previous high/low) to validate your signal.

---

Thanks for Reading!

✨ If you found this helpful, show some love by liking or commenting!

🔔 Don’t forget to follow for more technical breakdowns and trading insights coming soon!

MArket scan shows PRIME CAN RETURN BACKMarket scan shows PRIME CAN RETURN to higher levels.

soon, more data on this update

The first smart money whales have taken the step.. lets see what can happen next with new updates below.

We can't see the future what can happen, but we can follow the data.

as long there is more whales entering this coin, we can expect an interesting return.

Bitcoin Roadmap => Short-termBitcoin ( BINANCE:BTCUSDT ) is moving above a Heavy Resistance zone($110,720-$105,820) , Cumulative Short Liquidation Leverage($110,300-$111,177) and is approaching All-Time High(ATH) .

Do you think Bitcoin will create a new All-Time High(ATH) in this rally?

In terms of Elliott Wave theory , Bitcoin's rise over the last two days appears to have been in the form of wave 5 .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect Bitcoin to start declining in the coming hours. Targets are marked on the chart.

Cumulative Long Liquidation Leverage: $106,750-$106,202

Note: Stop Loss(SL)= $111,223

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

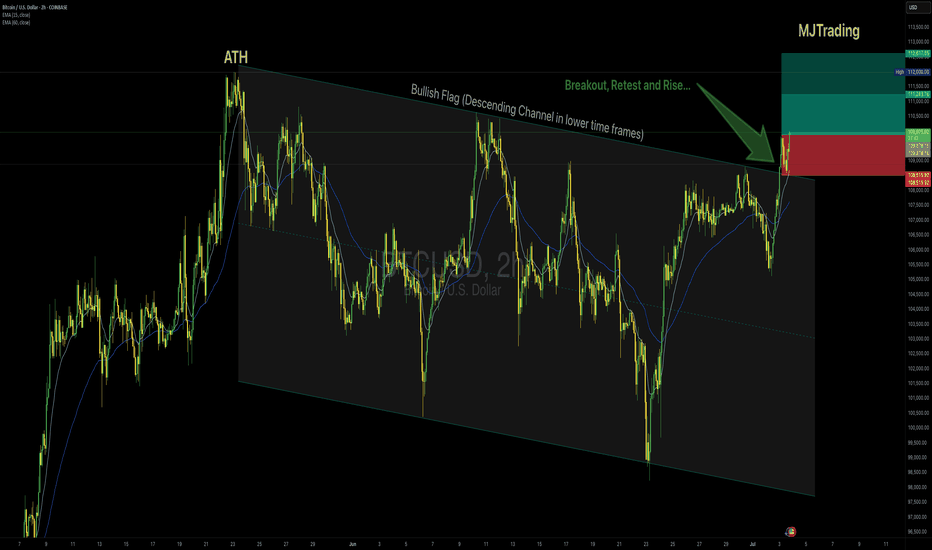

BTCUSD – Long Setup (2H Chart)👆👆🚀🚀Boost it if you like it (Thanks)🚀🚀👆👆

Idea:

Bitcoin is breaking out above the descending Flag after testing the upper boundary multiple times, showing bullish momentum confirmed by price holding above the 15 EMA and 50 EMA. The breakout aligns with strong impulse candles and sustained buying pressure.

Entry:

✅ Buy near $110,000

Stop Loss:

🔴 Below $108,500, under the breakout structure to protect against a false breakout.

Take Profit:

🟢 Tp1 $111,245

🟢 Tp2 $112,600

Rationale:

Clear breakout of the channel top resistance.

Bullish EMAs crossover with sustained slope.

Strong impulse move suggesting continuation.

Risk Management:

Position size accordingly, max risk 1–2% capital per trade.

#Bitcoin #BTCUSD #CryptoTrading #Breakout #LongSignal #TradingView #TechnicalAnalysis

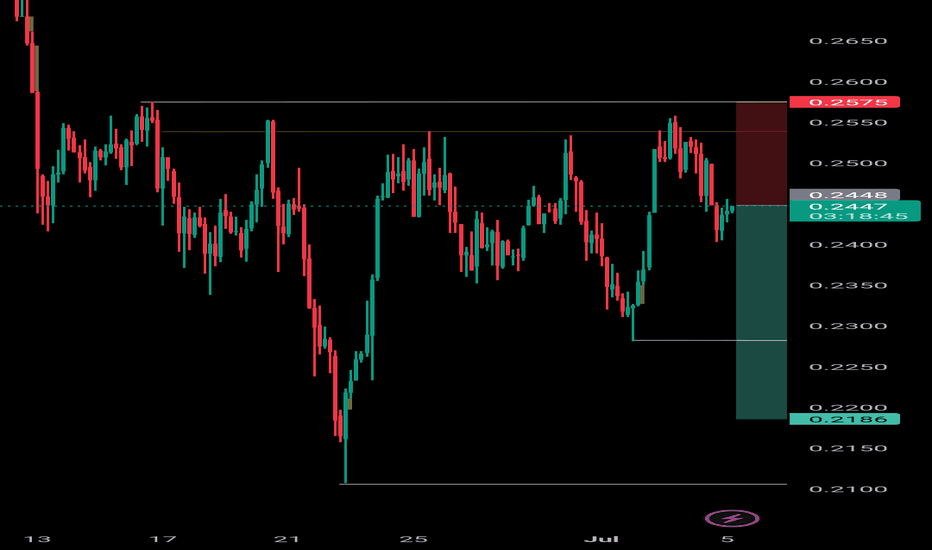

STORJ/ USDT - SHORT SET-UP 📊 Key Technical Insights

1. Price Structure

Price recently rejected near 0.2550–0.2575 zone (supply/resistance).

Lower highs forming, indicating bearish market structure.

Current price (~0.2444) is just under minor resistance, which may confirm the start of a new leg down.

2. Risk-Reward Ratio

Risk: ~0.0131 (from 0.2444 to 0.2575)

Reward: ~0.0258 (from 0.2444 to 0.2186)

RRR: ~1:2 — Good risk-to-reward ratio.

3. Support Zones

Minor support: 0.2330–0.2300 area — could act as TP1.

Major support (TP2): 0.2186 — aligns with historical price reaction.

4. Candlestick Behavior

Rejection wicks seen near the 0.2550 zone, confirming supply presence.

Recent candles show selling pressure dominating.

---

📉 Trade Plan Summary

Component Level

Sell Entry ~0.2444

Stop Loss 0.2575

TP1 ~0.2300

TP2 (Main) 0.2186

Trend Bearish

---

✅ Confluences Supporting the Short Setup

Double/triple top formation around 0.2570.

Lower highs and bearish market structure.

Price rejected strongly from resistance zone.

Clean support zones below offer logical targets.

---

🚨 Caution

If price breaks and closes above 0.2575 with strength, the bearish setup becomes invalid.

Watch for fakeouts or consolidation between 0.2400–0.2500.

BTC short setup As previous weekly went good on BTC, a nice bounce from the area on swing setup. Now wait for the liquidity grab from 107.8k then take short, that whiteline is important to break and sustain for btc to continue it's Bullish trend. Longer sl is just to avoid wick damage closing matter here. Good luck, book at least 50% on 105.2k rest hold the position, and take long from mentioned zone.

Bitcoin Recovers Above 105,000, Extremely Bullish +AltcoinsBitcoin produced only two days red, a bear-trap, and is now trading daily back above $107,000, an extremely bullish development.

Good morning my fellow Cryptocurrency trader, I hope you are having wonderful day.

The altcoins market bull market is confirmed and what Bitcoin is currently doing gives further strength to the bullish case and bias. It will be only a matter of days before the entire altcoins market turns strongly bullish with major momentum.

The range is still valid though, $100,000 - $110,000. But this time around the upper-boundary is likely to break and the last ATH tested, a new all-time high is even possible and also highly probable which is what will propelled the altcoins to hit multi-year highs and some even new all-time highs. Many pairs will move ahead.

With each passing day, the Cryptocurrency market will continue to heat up. We can expect growth long-term.

The 2025 bullish cycle started with the 7-April market low. The start of the third wave started 22-June and should go for 2-3 months. Then we will have a correction, the fourth wave followed by one final jump, the fifth wave.

We can expect growth now and all through late 2025. The entire period will be bullish. Only when the marketwide correction comes there will be a pause but many pairs will grow even at this point.

Choose wisely. Low risk vs high potential for reward.

Aim high. Focus on the long-term.

Thanks a lot for your continued support.

Namaste.