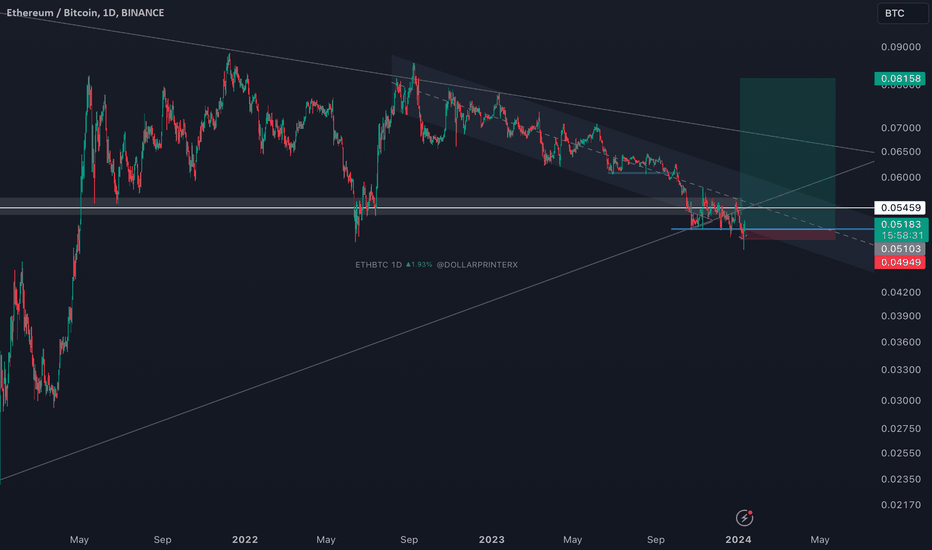

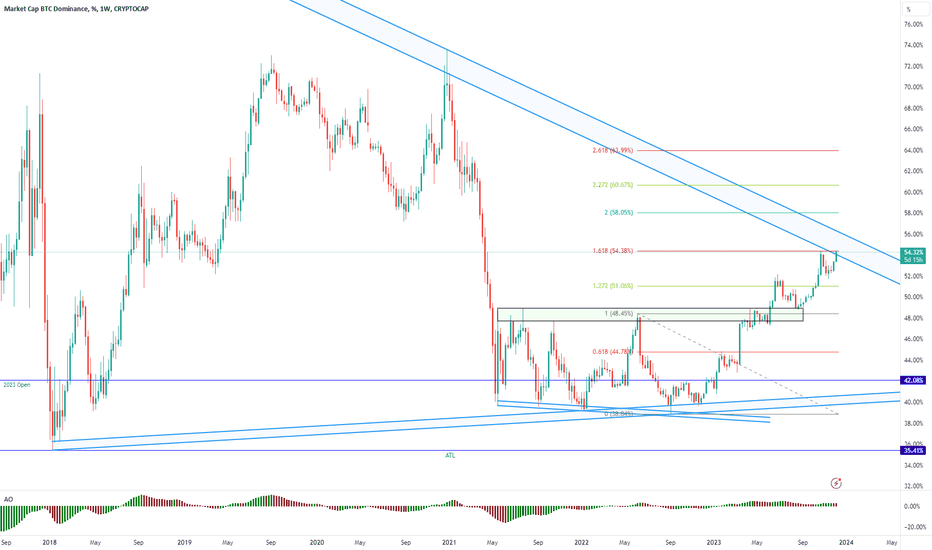

ETHBTC LongI think ETHBTC has bottomed, if not will bottom this month.

that in turn means that BTC.D has topped

which means alts will have more legroom.

Can go on binance and long the ETHBTC Perp in futures.. best average entry is .0513 with daily SSL (soft stop loss) on .04949

Could be more than a couple years until we see ETHBTC or BTC.D at these levels.

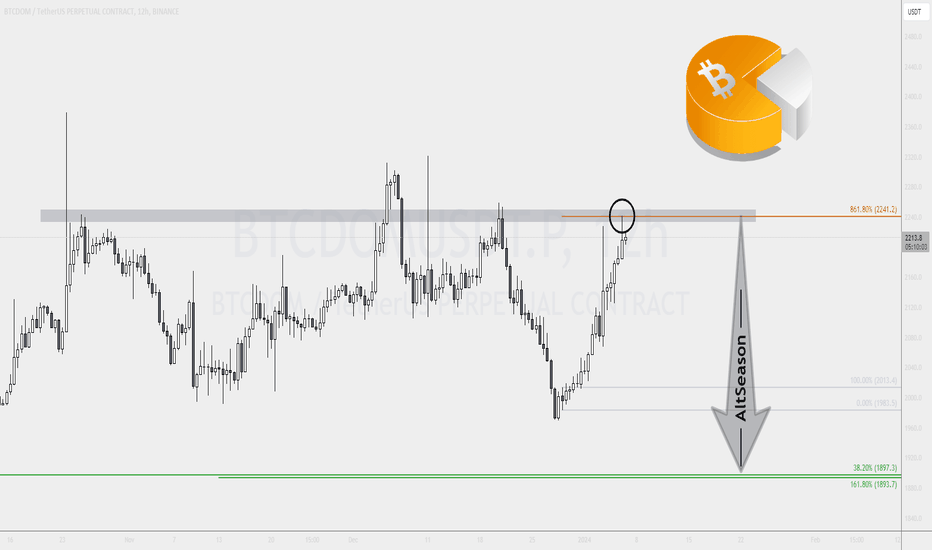

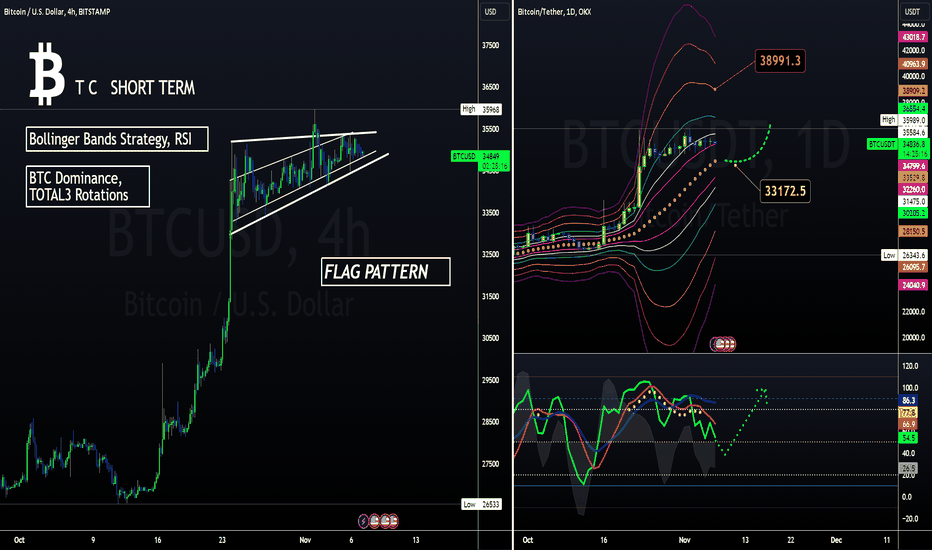

Btcd

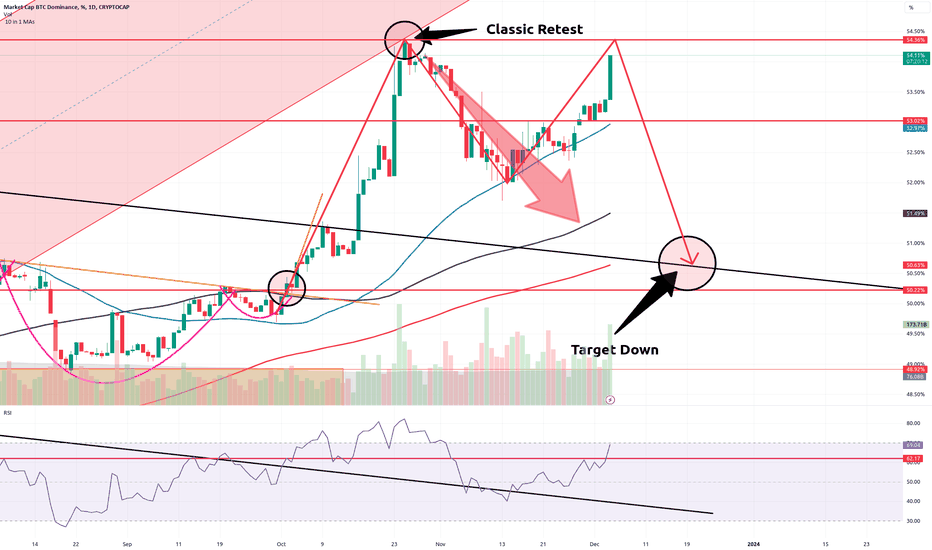

📈BTC.D analysis, ready to pullback📉CRYPTOCAP:BTC.D

Hello Traders, please check out my previous ideas.

As indicated in the chart, Bitcoin Dominance can return to the yellow range, near the pitchfork midline.

BTC.D can reach Bollinger-midline then starts its downward trend.

✌💥If you are satisfied with my analytical content, please share my ideas💥✌

✍🐱👤Otherwise, make sure you leave comments and let me know what you think.🐱👤✍

🤑🍾Thank you for your support. I hope you will gain profit by following my analyses.🍾🤑

CrazyS✌

BTC.D up, ALTS downBTC.D is made a retest but failed to create a lower low, instead given a break and close above of the Resistance Area. Alts were dumping aggressively right now, as #BTC make short-term aggressive moves, and money started flowing into it. Dominance Reached towards the Resistance area of 54.5%. Still, there's index reached area, so alts will react and might jump a little bit.

You Really Think that the Altcoin Season is Over?The way it looks is that Bitcoin Dominance yet again approached and rejected our Fibonacci resistance. If that resistance holds, we do expect a strong, yet potentially short altcoin season.

But remember, not all coins will produce super gains, only a very small portion of them. In our private channel we have shared those that we believe could be those "gems"

BTCD - Triple Bottom - TIME TO SWITCH ALTS TO BITCOINThe Triple Bottom has emerged in BTC.D. A Triple Bottom is a reversal pattern so I would suggest if you are holding Alts, turn it to BTC.

What is Triple bottom?

The triple bottom is formed after a period of a downtrend and is formed after the price movement of the stock went lower three times, but found support each time around the same level.

After the third bounce off of the support level and then a break through the resistance level, the trend reverses and the stock moves higher.

If you find any value in this idea, give it a thumbs up!

Ehsan.F

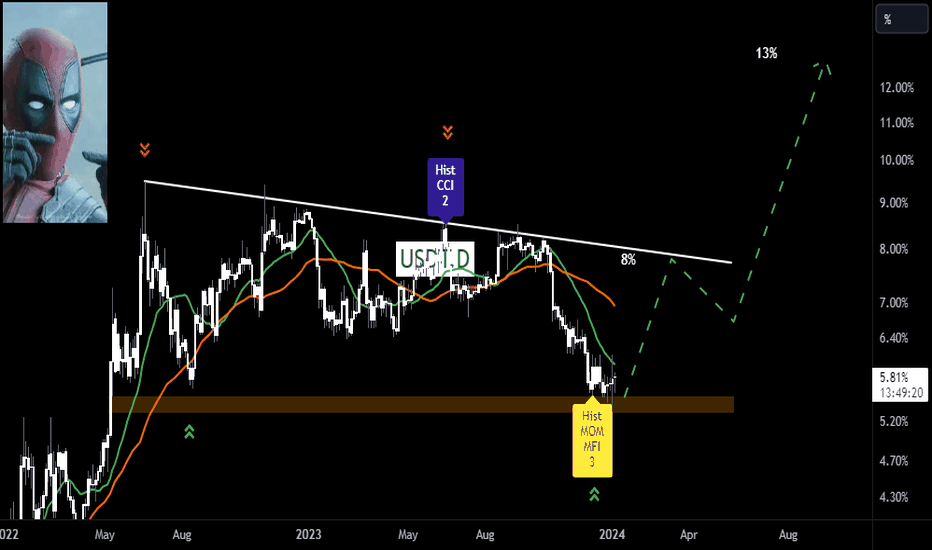

📈USDT.D is close to a bullish scenario📉CRYPTOCAP:USDT.D

GEMINI:USDTUSD

Hello dear traders. Let's make it simple.

USDT.D is close to its stable support level. If there is more outflow from cryptocurrencies, the dominance of USDT.D will increase. At the same time, there are divergences in the price level that can lead to the possibility of a bullish scenario.

✌💥If you are satisfied with my analytical content, please share my ideas💥✌

✍🐱👤Otherwise, make sure you leave comments and let me know what you think.🐱👤✍

🍾Thank you for your support. I hope you will gain profit by following my analyses.🍾

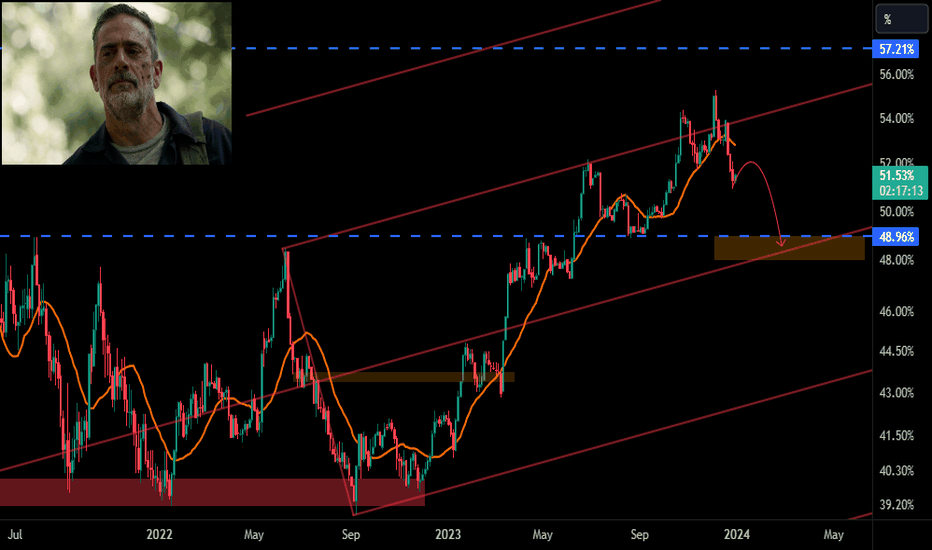

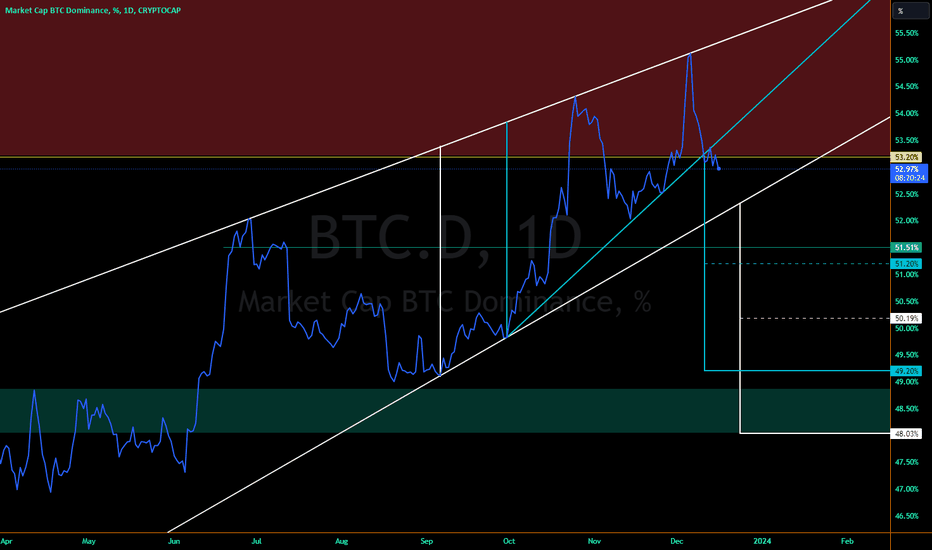

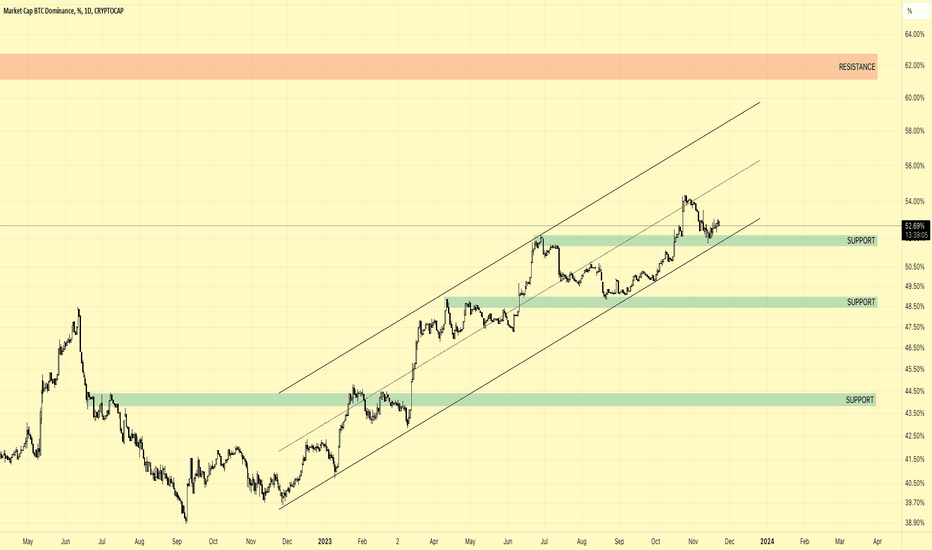

Possible Move Down to Daily SupportBitcoin Dominance may move down to daily support around ~48-49%.

Confluence:

It has failed to remain above 53.2%, which is the bottom of a resistance area

Not pictured: it has also lost the 50 day SMA and is presently pushing on the 50 day EMA

It has formed a smaller rising wedge as it moved into resistance and broke down from the bottom of that wedge (light blue diagonal) targeting ~49% for its 1x measured move down.

There is a larger rising wedge (white diagonals) that will see a confirmed breakdown if the smaller one above hits its ~49% target, and its initial target is bottom of daily support @ ~48%

How this could be invalidated:

A reclaim of the 50 day SMA (not pictured).

Get back above the 53.2% level and continue pushing through resistance.

Move back above the smaller rising wedge's bottom and get above the shared top from both rising wedges

Here's a look at the chart above, but with the 50/200 day SMAs and EMAs:

Thanks ahead for reading and sharing your thoughts!

- dudebruh

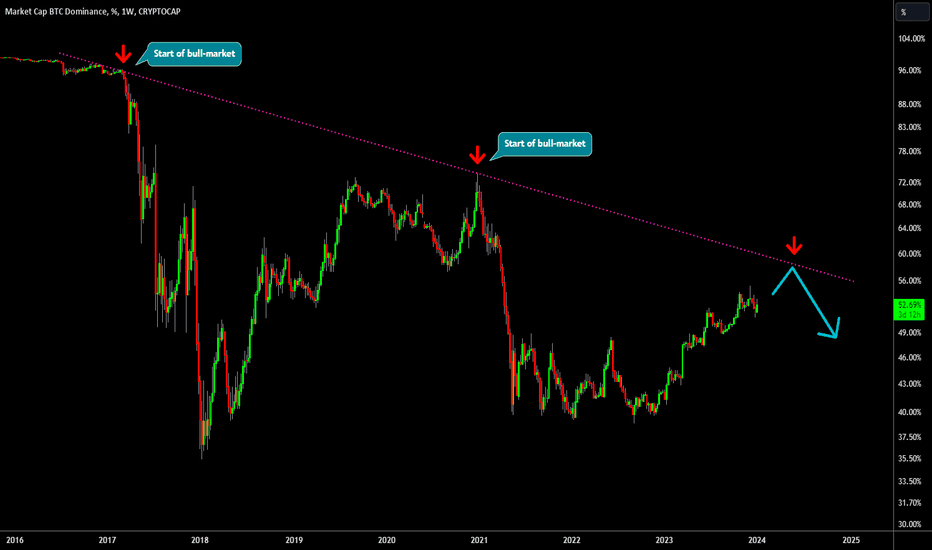

🔥 Predict The Next Crypto Bull-Market: Save This Chart! 🚨In this analysis we're going to take a closer look at the Bitcoin dominance, also known as BTC.D.

As seen on the chart, the BTC.D appears to be trending downwards over a long period. However, the most recent peaks (red arrows) in the BTC.D value have coincided with the start of the bull-markets.

Assuming that the Bitcoin Dominance will keep on going up, there's a very decent probability that the next Crypto Bull-Market will start once the purple resistance line is hit. Just be patient!

Keep an eye on this chart, since it might signal the start of the next bull-run.

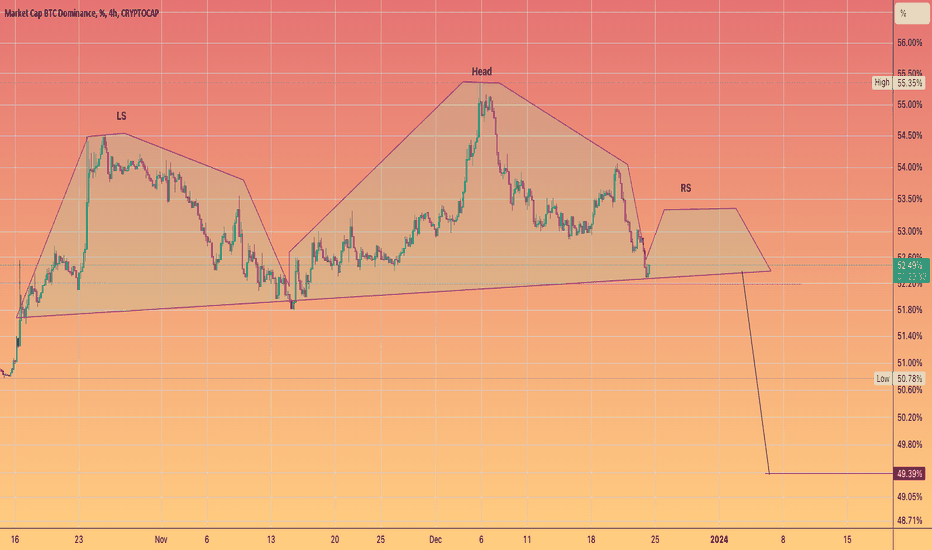

BITCOIN DOMINANCE to drop back under 50% #BTC.DNice head and shoulder's on the dominance chart

Maxi's are not your friend

Saylor was calling for 80% dominance just a very short while ago.

And yet here we are heading back below 50

Wouldn't be surprised to see massive money rotate into #ETH on the news of the ETF approval.

Merry Christmas and Happy Holidays.

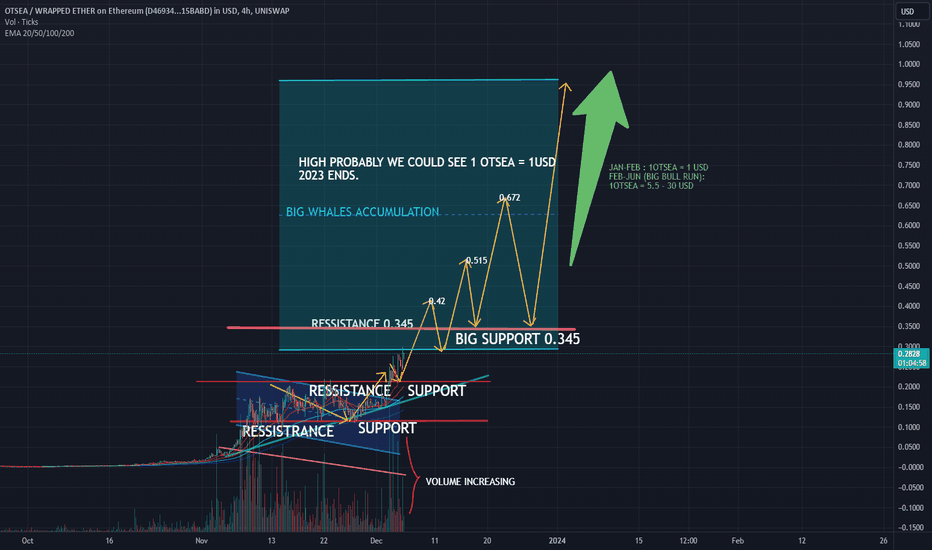

OTSEA: Microcap That Could Make You a MillionaireWhile BTC.D continues to rise towards 65%, microcap tokens maintain their dominance, marking the beginning of the pre-bull run, which means you can invest in almost any microcap and make money. Those of us who have been in this for more than 4 years know it. But look at this token: OTSEA, which, even in its beta state and with only 5000 holders and OTSEA IS ONLY ON ITS BETA, the team is really strong and with big potential, OTSEA has grown exponentially and is still expected to grow by the end of this year to: 1 OTSEA = 1 USD. Therefore, I recommend getting in now. The fall of BTC.D from 65% to 20% will be an increase for microcaps to enter the top 100, and OTSEA has the potential to go into the top 70. This bull run will be much bigger than the last, don't miss this opportunity. In a few months, you will see OTSEA above 5 dollars and will have wished to be one of those who got in early.

Bitcoin Dominance to Double-Top?Traders,

Previously, you'll remember I noted where I thought we arrive on the BTC.D chart. What I did not expect is a break back above 53% resistance. Now, with Bitcoin breaking all kinds of levels, prices, and expectations, market focus is zoned in at Bitcoin. At some point though, I do expect that focus to shift back into the altcoin space and more altcoin pumping should ensue. So, I am wondering whether BTC.D double-tops here before collapsing? I certainly know that this remains the highest probability at the moment and it is also why I am so heavily vested in altcoin trades currently.

Stewdamus

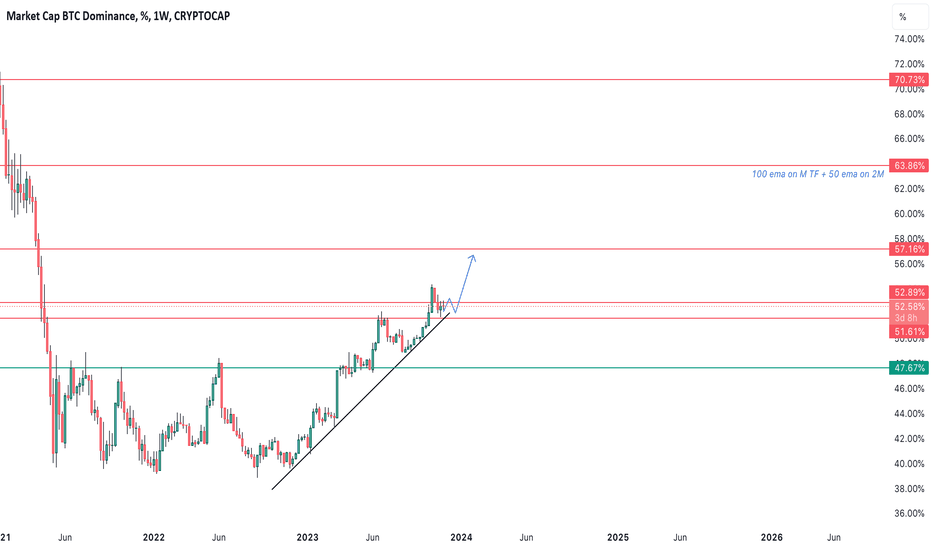

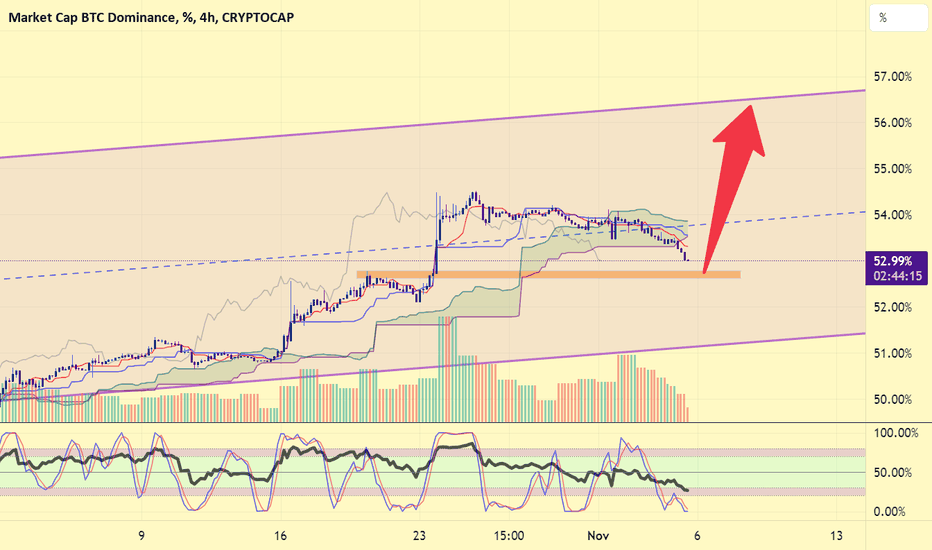

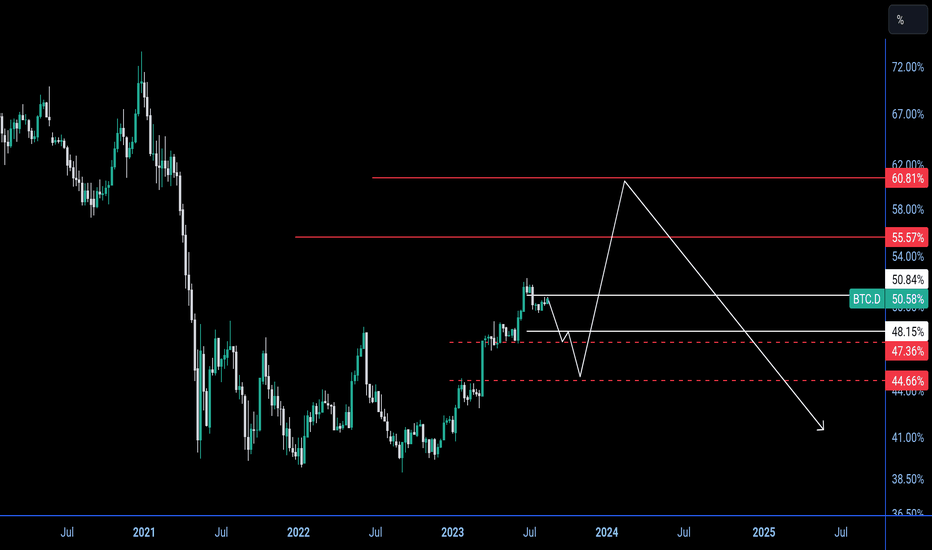

BTC DCurrently BTC D found a support on ***51.61%***, where there is also Weekly 200 ema.

Expecting the same that it will consolidate between ***51.61 - 52.89%*** with possible uptrend continuation.

High probably that after reaching the upper % at around **57.16 - 60%,** the dominance will reject.

This bullish scenario invalidates only if it loses the **51.61%** support, in this case it may come lower to **47.67%**

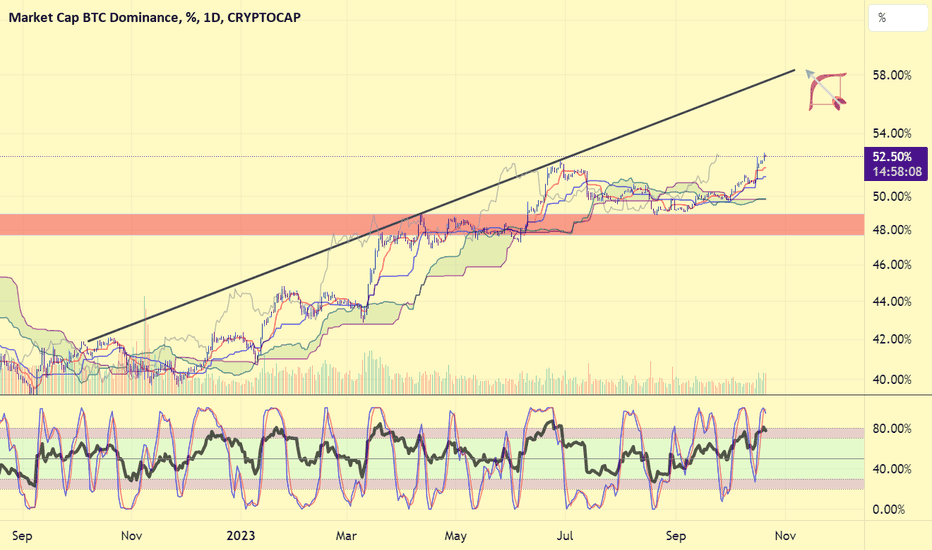

Altcoin Surge Ahead: Bitcoin Dominance Trend Analysis🔅The Bitcoin Dominance chart is presenting signals of a potential trend reversal or, at the very least, a substantial pullback. The repeated failure to breach the supply zone on two consecutive occasions highlights the resilience of altcoins against Bitcoin.

🔅The current hold within the supply zone indicates a pivotal moment where the long-anticipated altcoin season might begin or continue its ascent. This juncture could offer compelling buying opportunities for various altcoins, both in the short and long term.

🔅Further updates and insights on these potential opportunities will be shared in our VIP channel.

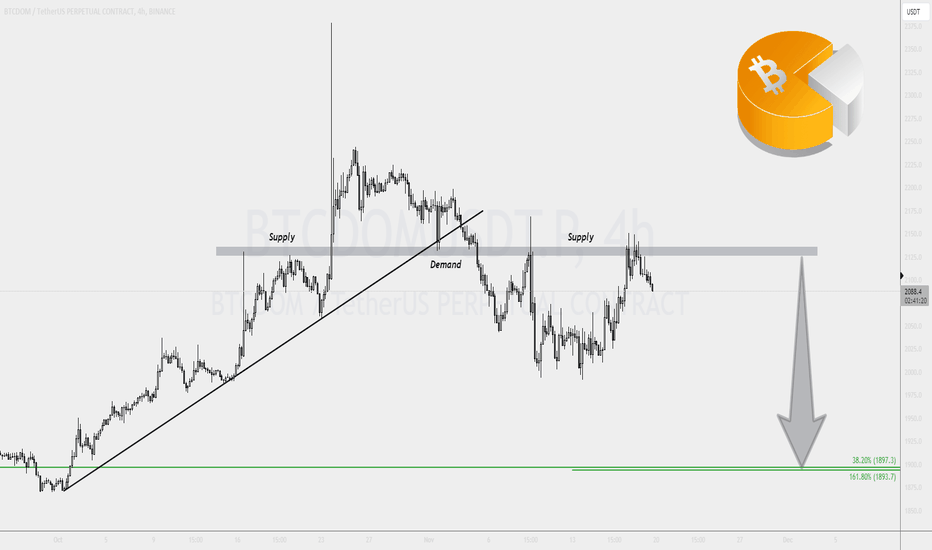

XRP Bull trap, ALTS PullbackHi Traders, Investors and Speculators of Charts📈📉

A bull trap is "false" signal that shows a bearish trend (such as the lower highs in XRP) has reversed and is now heading upwards, when in fact, it will continue to decline. Often a large wick towards the upside is observed, shaking out traders favoring the obvious move (shorting).

It's important to note that for the first time, the TOTAL3 chart is about to close a red candle ALONG with Bitcoin Dominance:

This indicates that the entire crypto environment is being drained of liquidity, and corrections will follow.

Again, I wish there were more options... I'm choosing "short" to label my outlook even though I would not trade with leverage on XRP. The bulltrap and the TOTAL3 chart indicates we're heading lower, and so my bias for the short term is testing next immediate support zones.

If you found this content helpful, please remember to hit like and subscribe and never miss a moment in the markets.

_______________________

📢Follow us here on TradingView for daily updates📢

👍Hit like & Follow 👍

We thank you for your support !

CryptoCheck

BINANCE:XRPUSDT CRYPTOCAP:BTC.D CRYPTOCAP:TOTAL3

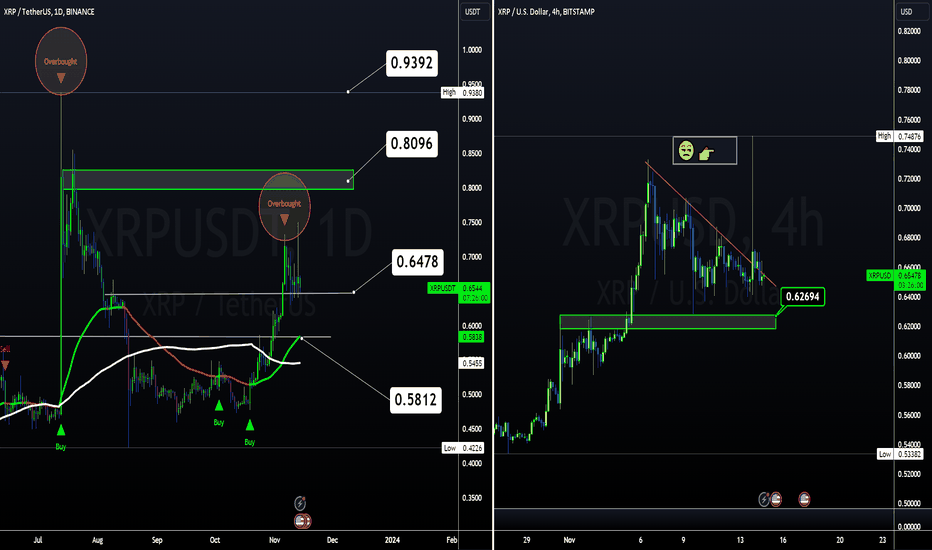

BTC - MUST WATCH For Short Term TradersHi Traders, Investors and Speculators of Charts📈📉

As you know, we're trading in the opening moments of a new bullish cycle.

As we gradually make our way up towards a new ATH over the next few months, technical indicator tools will be crucial to help catch those perfect swing-trades.

Today's analysis is an absolute MUST watch for beginners- to intermediate-level traders. The important concepts in this video are all about why you can't watch the BTC chart alone, and which other charts you need to watch together with BTC as well as which indicators are great for short term trades, and how to use them TOGETHER.

Again, I'm "forced" to label this post as long but like I said yesterday, I wish there were some other options. I'm ultimately labeling it as "long" because we are in a bull market and corrections are just opportunities for swing trades. Shorting in a bull market is risky business and I am all about risk management in setups.

If you found this content helpful, please remember to hit like and subscribe so you never miss a moment in the markets.

_______________________

📢Follow us here on TradingView for daily updates📢

👍Hit like & Follow 👍

We thank you for your support !

CryptoCheck

CRYPTOCAP:TOTAL3 CRYPTOCAP:BTC.D BINANCE:BTCUSDT BITSTAMP:BTCUSD

#btcd #bitcoin dominance preparing a new leap? Beware!..#crypto market is greedy nowadays. But when everyone is greedy, take extra caution.

Money flowed into #altcoins , while #btc price is moving sideways and naturally #btcdom indice is slightly corrected. But BTC.D is about reach the support region and it' s probable that it may bounce there.

If bounces hard, that will surely take money from altcoins if there' s no money inflow to the crypto exchanges from outer globe. (While btc price goes up)

If there' ll be dump on btc, altcoins may have a blood bath.

NOT FINANCIAL ADVICE.

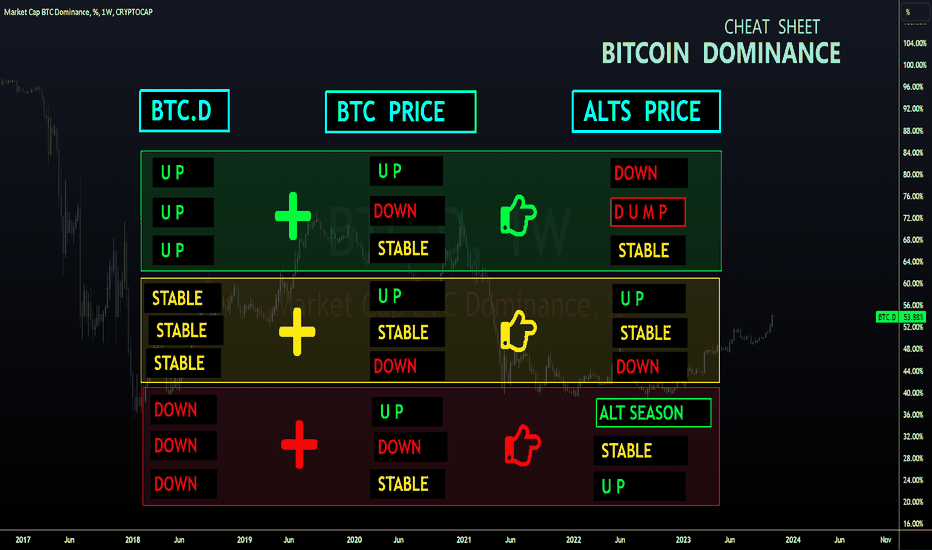

Bitcoin Dominance Cheat SheetHi Traders, Investors and Speculators of Charts📈📉

Bitcoin dominance and the rotations between BTC and altcoins can be confusing. Enjoy this easy-to-understand guide to BTC.D , and why it is important to watch alongside with the bitcoin chart.

👇👇👇

BTC dominance is calculated by dividing the market cap of BTC by the total market cap of all cryptocurrencies. If the TOTAL market cap is 1.5 trillion and the market cap of alts increases, then BTC dominance will go down unless the market cap of BTC also increases.

But to really understand the rotation of money between BTC and alts, you'll need a clear understanding of how how market caps all fit together.

Imagine a pie where each slice represents a different cryptocurrency. The pie here indicates the total cryptocurrency market cap of both Bitcoin and altcoins, which can increase or decrease at any given time. In other words the TOTAL chart.

- If BTC market cap increases but altcoin market cap shrinks (relative), the pie stays the same size.

- If BTC market cap increase and altcoin market cap increases, the pie size increase and so forth.

If BTC dominance is at 40%, it means that the BTC slice of the pie chart is 40% of the total size of the pie. The remaining 60% of the pie is made up of all other cryptocurrencies (altcoins).

A pie chart from March 2023:

Now, imagine a new bullish cycle starts across the crypto markets. This causes the market capitalization of both altcoins and Bitcoin to increase. If the market capitalization of BTC also increases, but at a slower rate than the market capitalization of altcoins, then BTC dominance will remain stable even though BTC Price increases AND altcoins prices increase. This is because the BTC slice of the pie is still 40% of the total size of the pie, even though the pie has grown larger.

In other words, the pie has gotten bigger, but the size of the BTC slice has remained the same relative to the rest of the pie.

Here is another way to think about it:

Total market cap: $1.5 trillion

BTC market cap: $900 billion

Alt market cap: $600 billion

BTC dominance: 60%

Now, let's say that the alt market cap increases by $200 billion and the BTC market cap increases by $100 billion. The total market cap would now be $1.8 trillion and the BTC market cap would be $1 trillion. BTC dominance would still be 60%, even though the price of BTC increased because the overall pie has gotten bigger.

Here is an example of how the BTC dominance falls, but BTC price increases:

Total market cap: $1.5 trillion

BTC market cap: $900 billion

Alt market cap: $600 billion

BTC dominance: 60%

Now, let's say that the alt market cap increases by $200 billion, but the BTC market cap only increases by $100 billion. The total market cap would now be $1.8 trillion and the alt market cap would be $800 billion. BTC dominance would now be 50%, even though the price of BTC has increased.

As a summary:

UP: BTC d ominance is increasing, meaning that BTC is outperforming altcoins.

STABLE: BTC d ominance is remaining relatively unchanged. This could indicate price movement on either Bitcoin or Alts .

DOWN: BTC d ominance is decreasing, meaning that altcoins are outperforming BTC .

We see an increase of market capitalization on the TOTAL chart:

_______________________

📢Follow us here on TradingView for daily updates📢

👍Hit like & Follow 👍

We thank you for your support !

CryptoCheck

CRYPTOCAP:BTC.D CRYPTOCAP:TOTAL

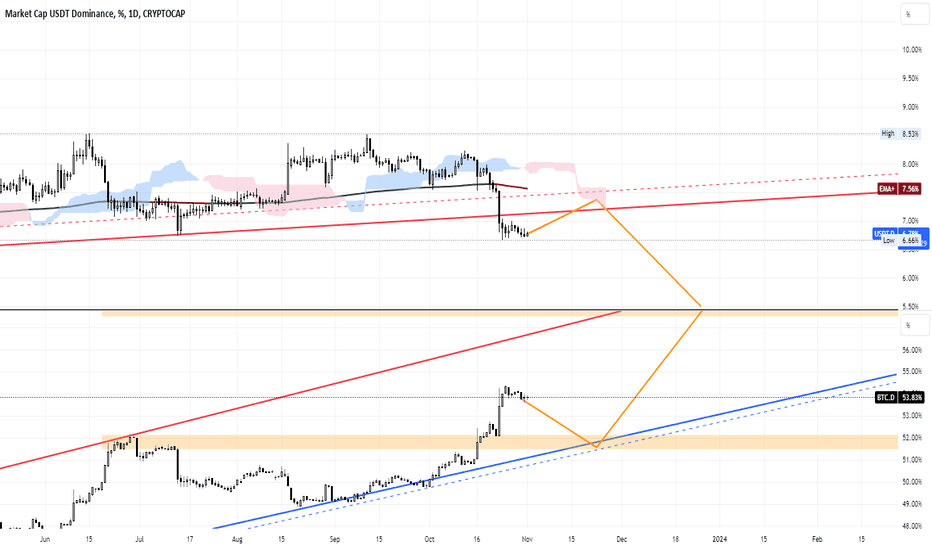

BTD.D & USDT.D -----> What's Happening?As I said before, I will say again that the market will always give you another chance to buy and there seem to be signs for this second chance.

Possible scenario for me:

Pullback to the broken levels of dominance by Tether and Bitcoin in the coming days and try to collect liquidity from the market and stop hunting small traders like me!

Then the return of dominance and the price of Bitcoin to the upward trend of the past .

and activating stop losses of positions in the opposite direction and possible shorts again!

What do you Guys Think about Btc.d and Usdt.d?

Does This Give Alts a Chance to Shine?Dominance is performing nearly perfectly with only a few surprises along the way. I wasn't quite sure dominance wanted to test the underside of that channel you see in red. That channel started in November of last year. We broke to the downside in August of this year and never really retested. Well, here we are today. We have retested the underside of the channel and can now expect BTC.D to continue its drop. The big question is will alts drop with Bitcoin as they have mostly been accustomed to doing in this bear market or will this finally be a time in which we can witness some divergence? The chart is showing the latter as a strong possibility however, be careful with your picks. Small cap/high risk alts should for the most part, not enter the equation here yet. The divergence will probably most notably be witness in larger cap alts like Ethereum and XRP. Maybe a few mid-cap alts as well.

This is not fin advice.

Stewdamus.

BITCOIN DOMINANCE analysis ⏰Expecting altseason after completing 55-60% pump 📌 then dump in CRYPTOCAP:BTC.D

Sign alts season started 📌

55-60% is accumulation of ALTS

Meanwhile white 🤍 line rejection 50.5% below 📍 lead to complete 40-45%

Then upside 🚀 move 😉 BITSTAMP:BTCUSD + $BTCD both ALTS dump and consideration

If any chance of weekend candle close above white 🤍 line 😂 no mid term bullish direct 55-60%

But I hope present market move bullish untill October later correction get started 📌

After halving we will see complete ALTS season 🚀 just accumulate pls know ur coin entry zones

If weekend candle close below 📍 last red line 📌 no bullish on dominance sign of already accumulation completed we are in ALTS season but have less chances but let's start watch 👀

Just DYOR , give boost 🚀 i will update post ⁉️ 🧐 every crucial move and month / weekend close

So u get updated 📌

So boosting Post give u an update my post when I updated 📌