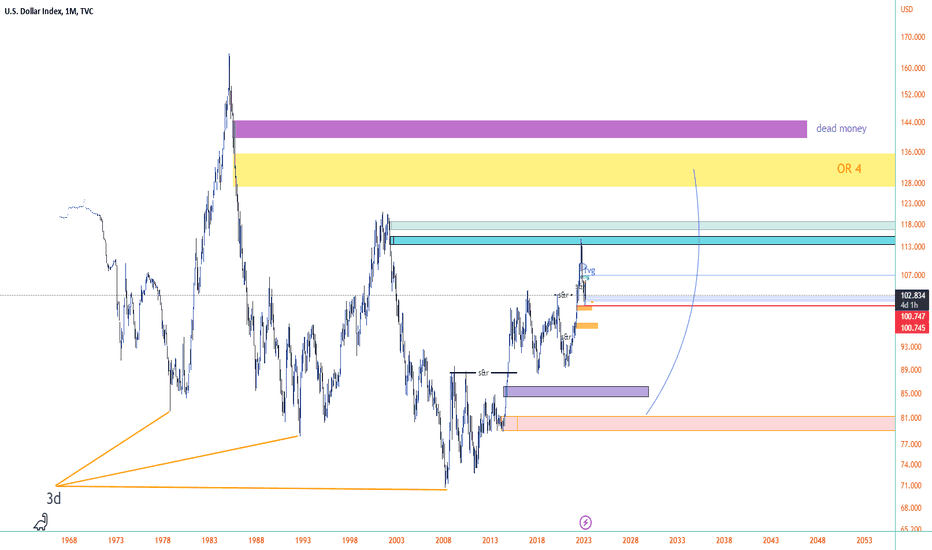

DXY - Silent, Structure in Compression, Destiny in Expansion. ⊣

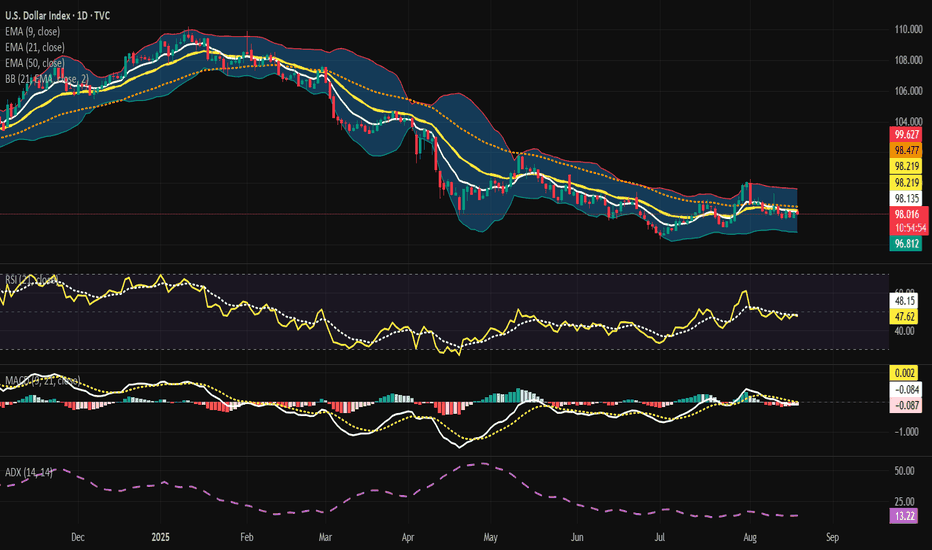

⟁ DXY / U.S. Dollar Currency Index - TVC - (CHART: 1D) - (Aug 19, 2025).

◇ Analysis Price: 98.035.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

✴️ Note: The DXY (TVC) does not provide native volume data; therefore, flow-based indicators (OBV, MFI) are substituted by ADX (14) to quantify trend strength.

▦ EMA9 - $98.139:

∴ The current price ($98.035) is positioned below the EMA9 - ($98.139), affirming short-term pressure from sellers;

∴ The slope of the EMA9 is flat to slightly downward, indicating the loss of bullish traction in the most immediate timeframe;

∴ The EMA9 is located beneath both the EMA21 and the EMA50, confirming the presence of a “bearish stacking” alignment.

✴️ Conclusion: The micro-trend remains subdued under short-term resistance. The immediate ceiling is defined at ~98.14, and failure to close above reinforces continuous seller control.

⊢

▦ EMA21 - $98.221:

∴ The price remains below the EMA21, which represents tactical control by sellers in the intermediate horizon;

∴ The fact that EMA9 < EMA21 demonstrates that rebound attempts will likely fail beneath 98.22;

∴ The EMA21 is in direct confluence with the Bollinger Band midline, magnifying the importance of 98.22 as a structural pivot.

✴️ Conclusion: The 98.22 zone is the primary tactical battleground; daily closure above would reduce immediate bearish pressure and open short-term relief potential.

⊢

▦ EMA50 - $98.477:

∴ The price resides below EMA50, and EMA21 is positioned below EMA50, both confirming the persistence of a downward-leaning intermediate trend;

∴ The EMA50 itself is sloping gently downward, acting as a supply zone between $98.45 / $98.50;

∴ Rejections have occurred repeatedly below the $98.5 region, validating this level as the medium-term structural ceiling.

✴️ Conclusion: The $98.45 / $98.50 range is the second barrier; only a sustained close above this threshold neutralizes the existing bearish framework.

⊢

▦ BB (21, 2) - $96.815 / $98.221 / $99.628:

∴ Current price oscillates around the midline ($98.22) but is positioned slightly below, keeping price action inside the lower quadrant of the bands;

∴ Bandwidth is approximately 2.81 points (~2.9% of the midline), which signals suppressed volatility and relative compression;

∴ The upper band at $99.63 and the lower band at $96.82 establish the immediate operational box.

✴️ Conclusion: A compression regime dominates; the probability of false breakouts increases as long as ADX remains below threshold levels.

⊢

▦ RSI (21, 9) - RSI 47.75 / Signal 48.17:

∴ The RSI remains below the neutral 50 line, maintaining a neutral-to-bearish bias;

∴ RSI is positioned beneath its signal line, reinforcing waning momentum;

∴ No oversold or overbought extremes are present, leaving ample room for mean-reversion moves in either direction;

∴ The RSI lost its bullish inclination after the early-August peak, revealing that bullish momentum has dissipated.

✴️ Conclusion: Relative strength is fragile and biased downward; pressure persists, though without signs of exhaustion.

⊢

▦ MACD (9, 21, 9) - MACD Line: −0.085 | Signal: −0.082 | Spread ≈ −0.003:

∴ Both MACD line and Signal line remain below zero, sustaining the negative macro momentum regime;

∴ The spread between MACD and Signal line is marginally negative (−0.003), illustrating momentum compression and indecision;

∴ The histogram bars are shallow, suggesting the likelihood of sideways “chop” until a decisive expansion occurs;

∴ No evidence yet of either bullish or bearish acceleration; instead, momentum is locked in equilibrium.

✴️ Conclusion: Residual bearish momentum persists, but without traction. A valid directional impulse requires expansion of the spread.

⊢

▦ ADX (14) - 13.22:

∴ ADX at 13.22 is significantly below the 20 threshold, confirming a non-trending market;

∴ Under low volatility and low ADX conditions, breakouts tend to fail or reverse, producing whipsaw environments;

∴ Without ADX expansion, directional signals from EMAs, RSI, or MACD lack confirmation.

✴️ Conclusion: The trend is weak; consolidation dominates. Breakouts require ADX above 20 for validation.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The structural configuration of the moving averages (Price < EMA9 < EMA21 < EMA50) defines a layered bearish stacking, emphasizing that control remains under sellers until the price successfully reclaims successive thresholds;

∴ The triple resistance crown ($98.14 / $98.22 / $98.50) represents the immediate fortress overhead. Until pierced, rallies remain corrective rather than structural;

∴ The Bollinger Band compression in combination with ADX = 13.22 reflects a regime of latent instability: volatility is contracted, energy is being stored, and the market is poised for a sharp directional move once equilibrium breaks;

∴ Mapping of levels:

Support zones: $97.94 (recent intraday floor) -> $96.82 (lower Bollinger band);

Resistance zones: $98.22 (BB midline + EMA21 pivot) -> $98.45 / $98.50 (EMA50 zone) -> $99.63 (BB upper).

∴ Trigger mechanics (Daily):

Bullish relief scenario: A daily close above $98.22 exposes a test of $98.45 / $98.50. A confirmed structural shift requires closure above $98.50 with simultaneous ADX rising above 20, projecting extension toward $98.80 -> $99.63;

Bearish continuation scenario: A breakdown below $97.94 expands the downside toward $96.82. Acceleration requires concurrent Bollinger Band expansion + ADX increase, validating momentum.

∴ Cross-asset implication (BTC/USD): A DXY trapped beneath $98.50 with ADX under 18 provides tactical relief for risk assets - (Bitcoin, equities). Conversely, a reclaim above $98.50 coupled with rising ADX would exert renewed pressure on Bitcoin and global risk sentiment.

✴️ Conclusion:

∴ The DXY is operating in a compression regime with light bearish bias, encased beneath the triple-layered resistance of $98.22 and $98.50;

∴ Until the index secures a daily close above $98.50 supported by a strengthening ADX, the prevailing outlook remains range-to-down, targeting $97.94 and potentially $96.82;

∴ Should the crown of resistance be pierced with confirmed directional strength, the Dollar Index would advance toward $98.80 / $99.63, transitioning the macro background toward “risk-off” and imposing significant headwinds on Bitcoin and correlated assets.

⊢

𓂀 Stoic-Structural Interpretation - DXY (1D, Aug 19, 2025):

∴ The Dollar Index remains imprisoned beneath its triple crown of resistance ($98.14 -> $98.22 -> $98.50). Each layer functions not as mere numbers, but as thresholds of control - the fortress where sellers guard the path forward;

∴ Momentum structures (RSI at $47.75, MACD compressed below zero, ADX at $13.22) whisper of weak conviction, a battlefield where neither camp advances decisively. Volatility compresses, energy coils. The silence of the bands is not peace; it is the breath before release.

∴ Supports lie at $97.94 and $96.82 - the fragile floor where weakness exposes the Index to further descent. Resistances culminate in the $99.63 upper band - the bastion to be conquered should strength return.

✴️ Philosophical Seal: Like the Stoic who tests virtue in adversity, the DXY now tests resolve in compression. Its stillness is deceptive - for beneath equilibrium, forces accumulate. The wise trader, like the Stoic, does not chase the noise of indecision; he prepares, unmoved, for the inevitable expansion.

⊢

✦ Structure - DXY (1D, Aug 19, 2025):

∴ Bearish Stacking Alignment: Price $98.035 resides below EMA9 $98.139, which is below EMA21 $98.221, both beneath EMA50 $98.477. The moving averages align in descending order, sealing short-, mid-, and intermediate-term control under sellers;

∴ Compression Regime: Bollinger Bands narrowed to $96.815 / $99.628, with midline at $98.221. Volatility is contracted, reflecting equilibrium. The silence before expansion governs this phase;

∴ Momentum Exhaustion: RSI at 47.75 and MACD line at −0.085 with signal −0.082 indicate weakening drive, locked in indecision. ADX 13.22 confirms absence of a dominant directional force.

∴ Critical Thresholds:

• Support: $97.94 -> $96.82;

• Resistance: $98.22 -> $98.45–$98.50 -> $99.63;

These levels form the sacred geometry of the Dollar’s battlefield.

✴️ Structural Seal: The DXY is architected in a descending yet compressed formation - a fortress of resistance above, fragile floors below. Until ADX rises and one side seizes momentum, the Index drifts in suspended balance, storing potential for decisive rupture.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

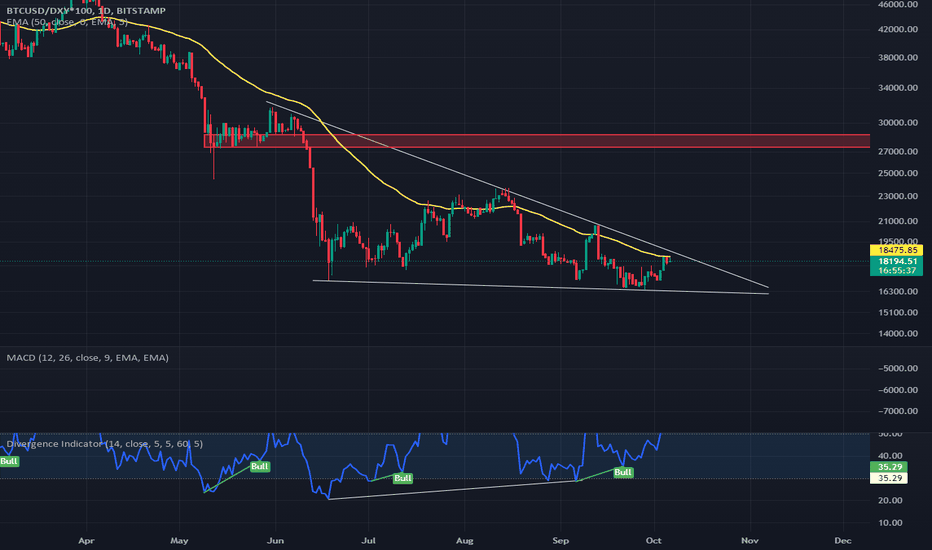

Btcdxy

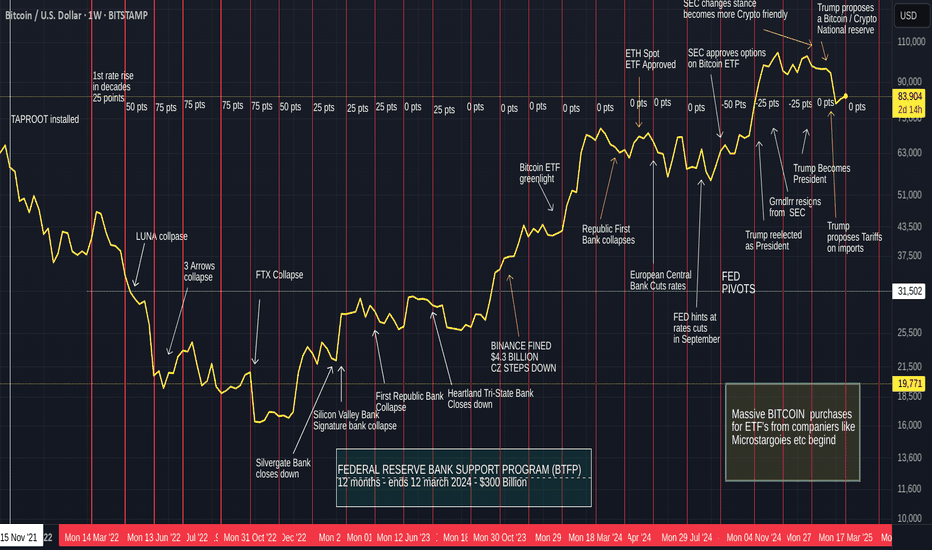

Bitcoin, interest rate effects, Macro events since 2021 - UPDATEThere is one very simple takeaway for me from this chart and that is simply that raises and Lowering of interest rates had Very little Effect on Bitcoin

It is more the effect it had on other organisations and the sentiment that followed Bitcoin and the traders.

For instance, From Jan 2023, when we saw Bitcoin begin its recovery, interest rates continued to rise.....and had NO effect on the Bitcoin recovery

And I think this continues to this day.

After the First push higher by Bitcoin in 2023, PA went into a Long range...in this time, interest rates began remaining at a static level. Bitcoin did not rise because of this.

When BTC was ready, it made a push higher again, interest rates were static and remained so while BTC entered another long range in 2024

It could be said that BTC PA rose once Rates were reduced but PA leveled out again even while the next rates decision was to reduce.

Bitcoin has its own agenda, it is NOT dependant on the USA to control its choices

On Each range, the MACD on the weekly timef rames was OVERBOUGHT.

And it is currently resetting having been overbought again.

This s NOTHING to do with interest rates.

MACRO events do have an impact though and we need to pay attention this this

But over all, Bitcoin is GOOD, BULLISH and getting ready for its next push

Have a Nice day now

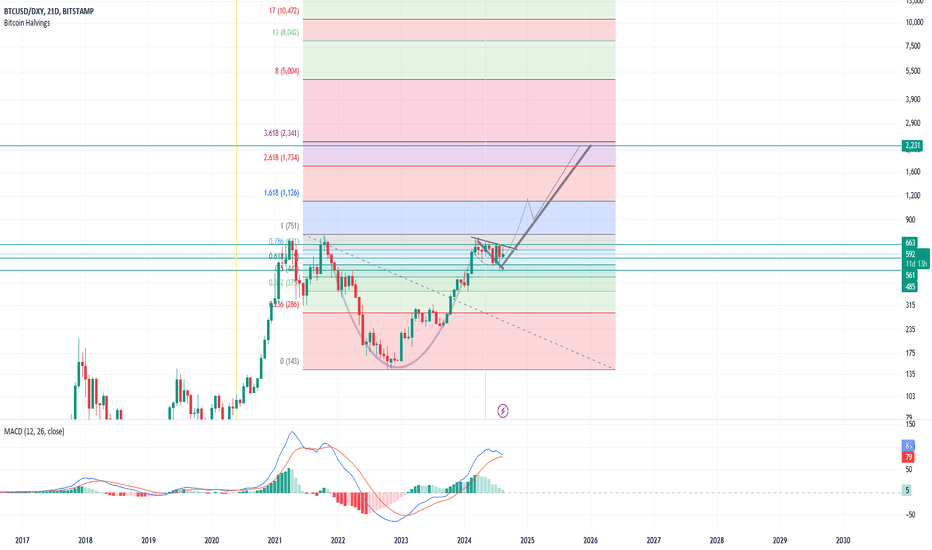

BTC-DXYI checked the BTC to DXY chart

It should be said, is it time for high-risk markets to enter their secondary bull market and once again all the people of the world stare at themselves with their champs, especially in the altcoins sector?

I say yes, the next few will prove that the beginning of this process is taking shape...

BTC minus the inflation a clear overview of bitcoinWell if we take out the USD inflation from bitcoin we will get clear view of the chart.

in that case bitcoin is looking very bullish.

we can see massive bullish divergence on daily / weekly chart.

i am basically dividing the bitcoin price by dollar index and then multiplying by 100.

this chart looks more cleaner than bitcoin / usd chart. since the inflation is minus so we can see clear chart. i believe bitcoin is going to breakout of that pattern and we will se atleast 27k this month.

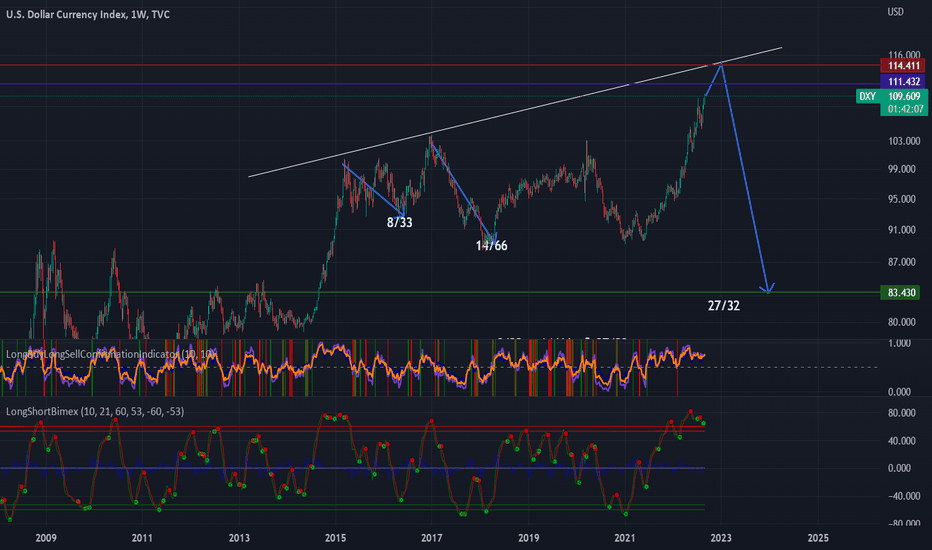

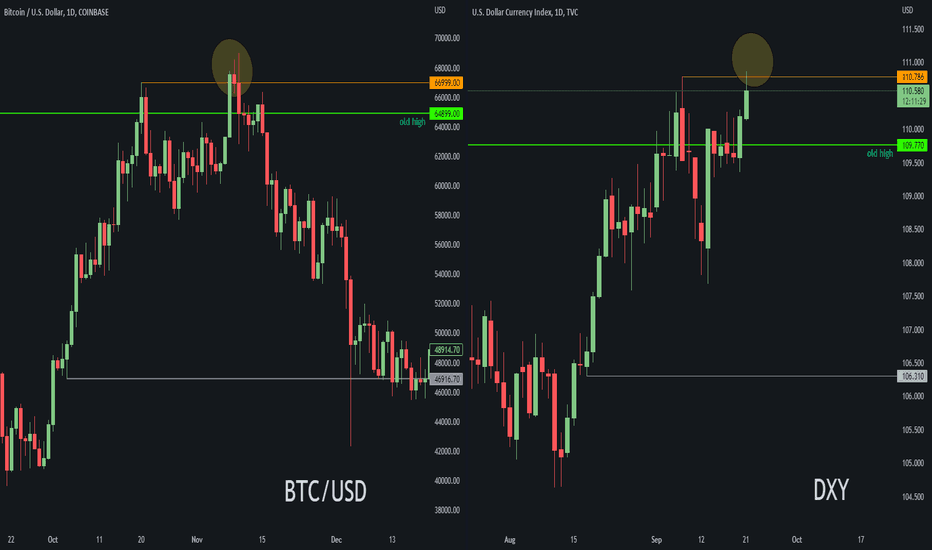

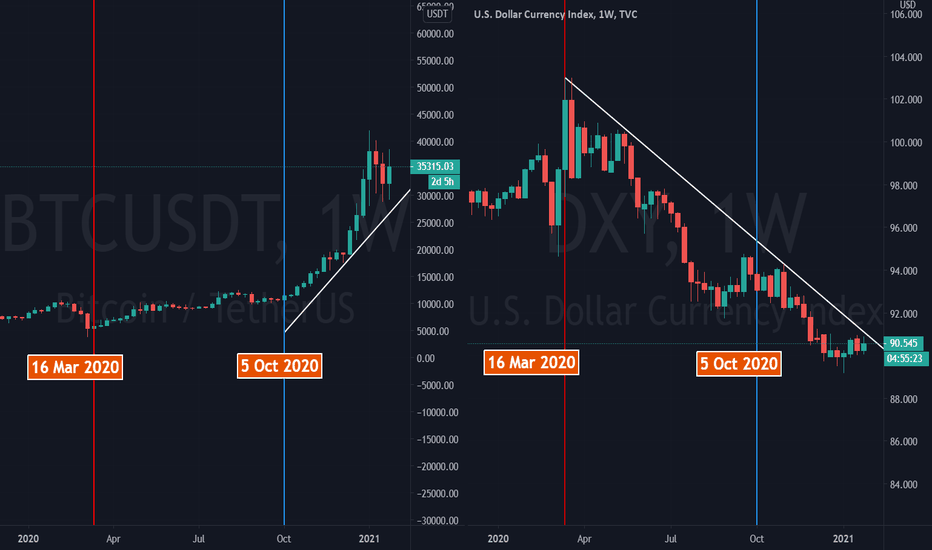

BITCOIN VS DOLLAR INDEX CLASSIC BULL TRAP IS COMINGBITCOIN AND DXY are inversely correlated.

If DXY does that what I'm referring to then I expect a classic bull trap and a beautiful bear trap in crypto market.

I'm expect a very nice rally in coming month.

Lets not forget the key is managing your risk.

I'm still bullish.

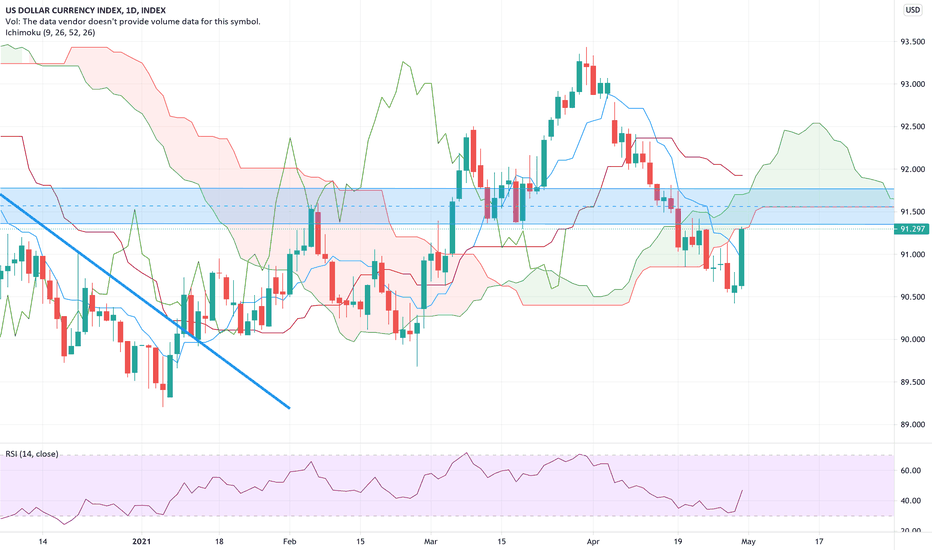

DXY recovers / BTC downHi guys,

As per my previous theory, we can see that while DXY is making a recovery, BTC's price is "consolidating" in the 55.000$ area. When DXY will break up into the Ichimoku cloud I expect BTC to go and visit the 42.000$ area. This should happen in the next 3-4 weeks.

Trade safely guys, not financial advice.

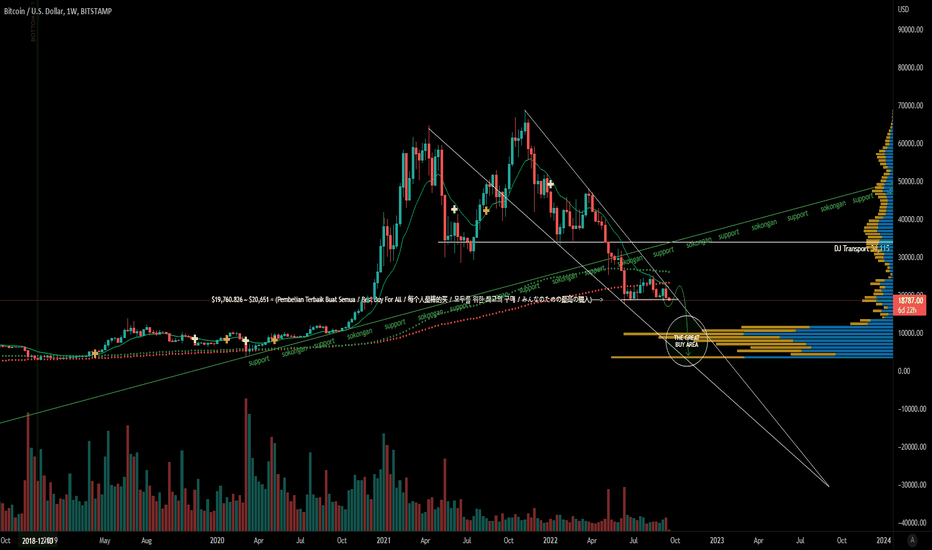

💎₿TC: The Only Reason Still Bitcoin Will Dump Hard.Hello Dear Traders,

Last 3 days are Extremely volatile and uncertain. Greed and FOMO is on the Peak. Anything is happening in stocks and crypto.

Today i would like to show u one last possibility tht bitcoin will dump hard in upcoming weeks.

as u can see in chart on march 2020 BTC dumped hard to -50% in a day, and tested 3500$ zone. why it happened?? we know all bcoz of covid panic sell off bt just look at DXY chart in march 2020 world markets and btc was dumping and DXY pumped hard.

after cool off , in april 2020 DXY started dumping and btc and stock market started to rise.

in aug-sept 2020 btc was stable and range bound, reason was DXY was showing strength. again in oct 2020 dxy started dumping, and btc started pumping from 10k.

the current situation is identical , dxy found strong demand and in upcoming weeks DXY is going to rise upside.

once dxy started rising, btc started dumping from 42k area. on weekly time frame BTC is already very bearish bt today bcoz of elon musk BTC suddenly pumped.

not only btc is weakening bt all other currencies like EURO,JPY,AUD are showing correction.

if in upcoming days btc and dxy starts pumping, then this year will be exceptional, and soon btc will test 50k.

Please Share ur views on this in comment section.