Btctrend

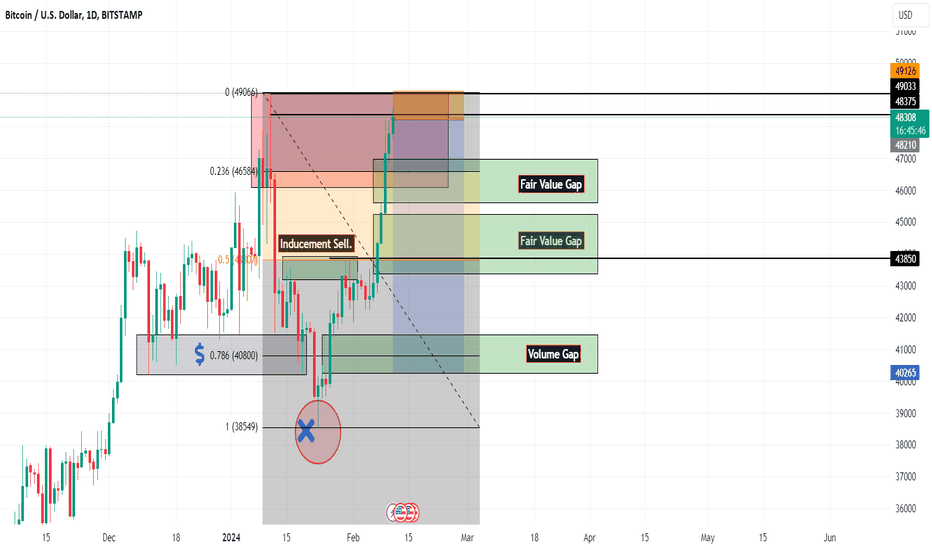

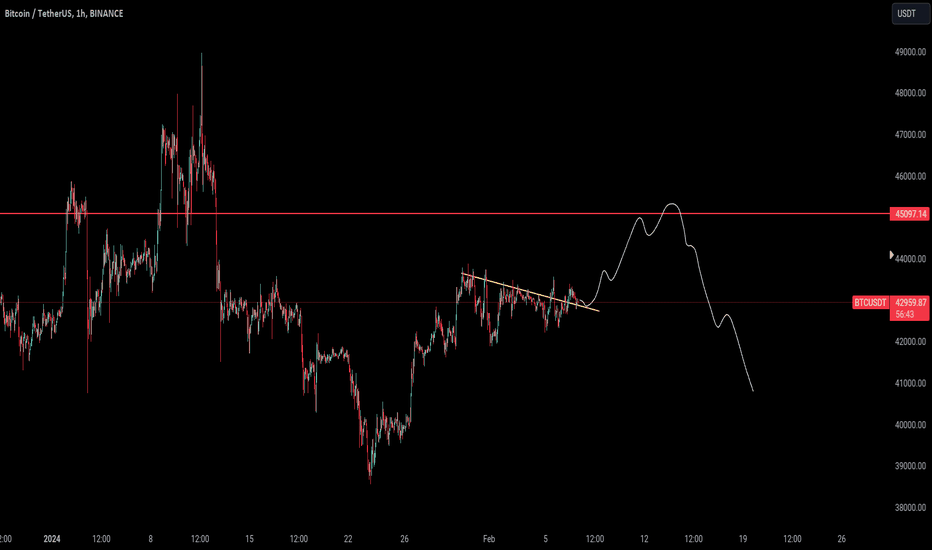

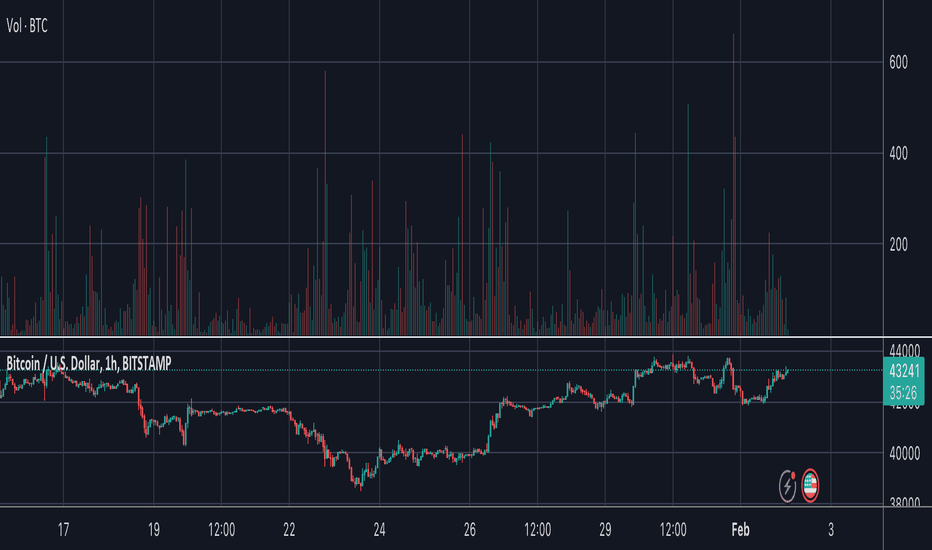

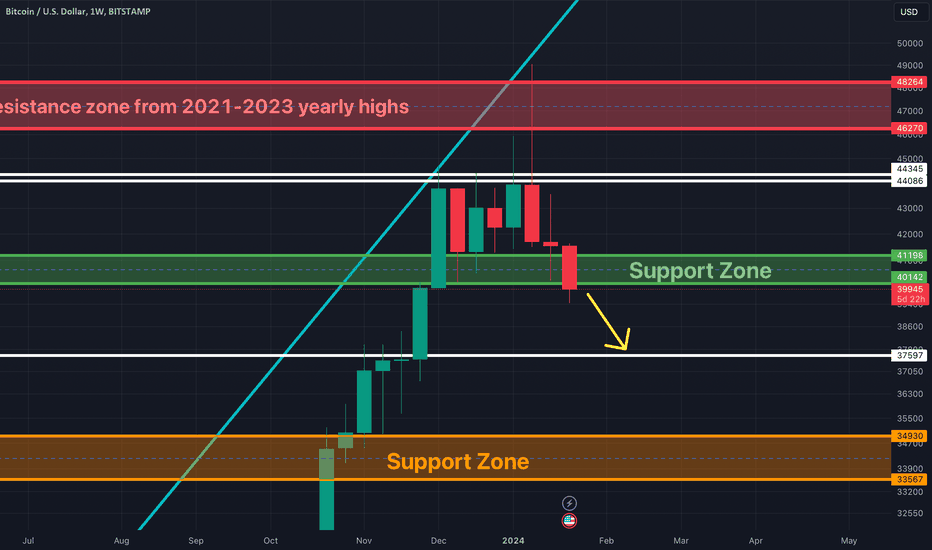

Are you ready to Short Bitcoin Yet? {11/02/2024}Educational Analysis says BITCOIN BTCUSD may go short selling for some time according to my technical.

Broker - Bitstamp

This is not an entry signal. I have no concerns with your profit and loss from this analysis.

Because from past week bitcoin has just pumping up to collect Sell Stop hunt from retail traders.

I think it's high time for bitcoin to go short!.

Let's see what this pair brings to the table in the future for us.

Please check the Comment section on how it turned out for this trade.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

BTC BITCOIN Technical Analysis and Trade Idea#Bitcoin Technical Analysis

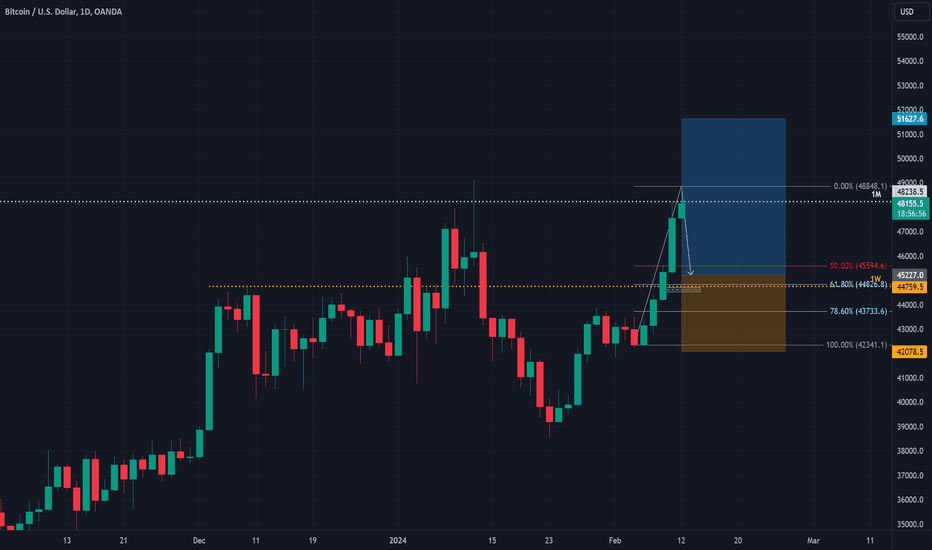

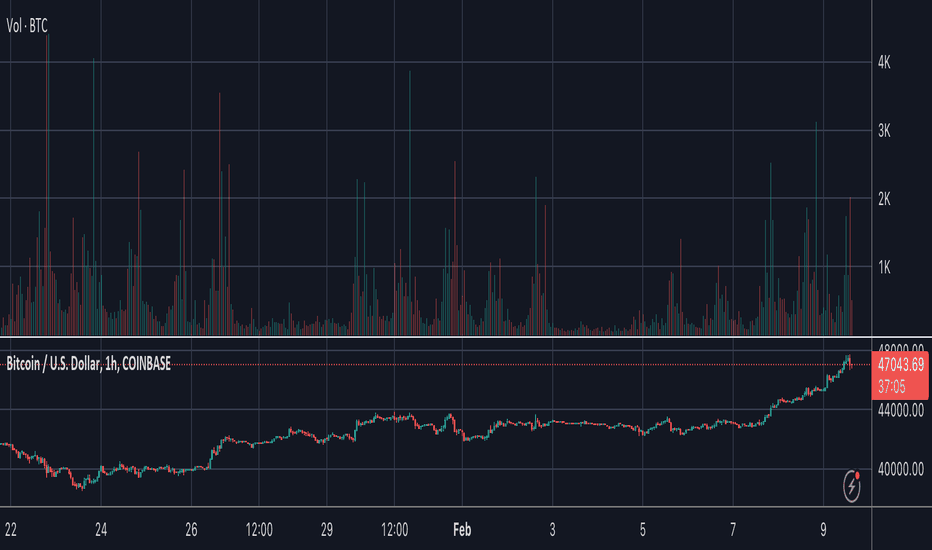

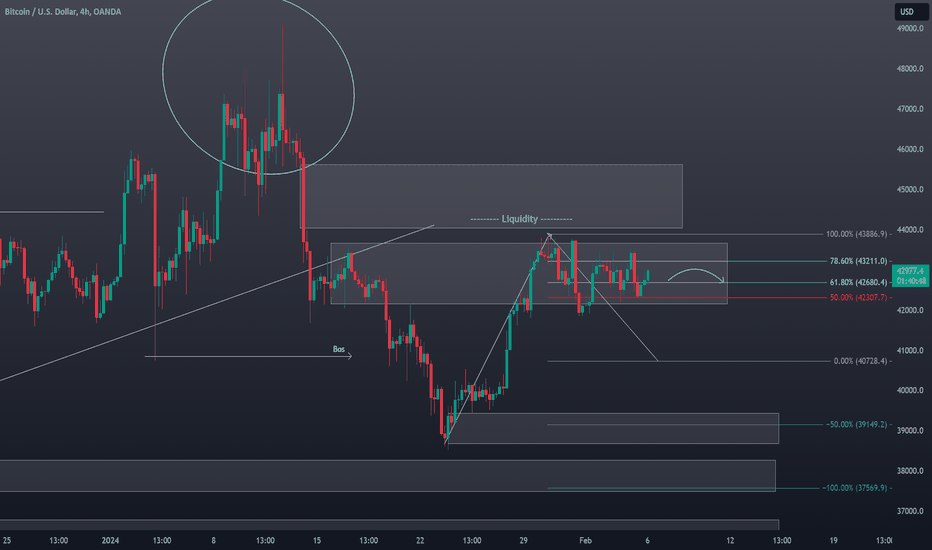

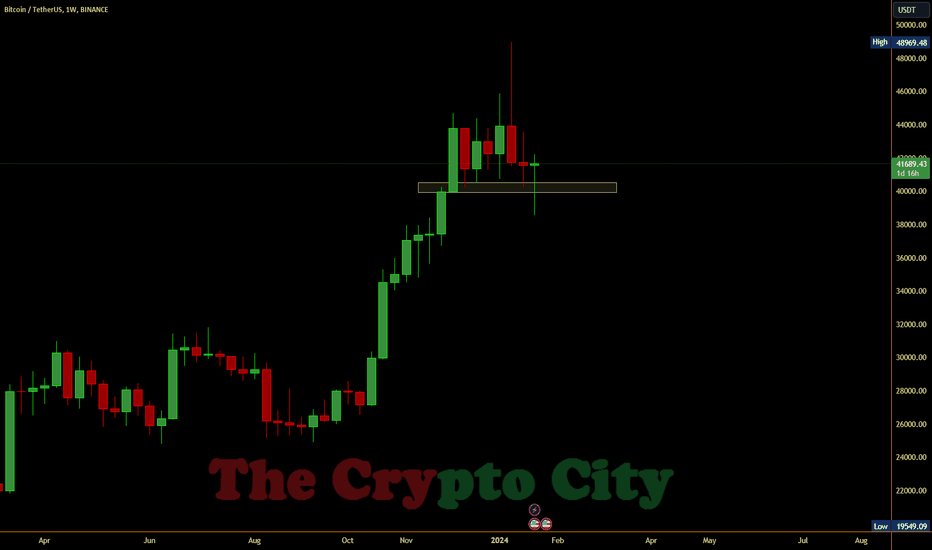

⚫ Key Market Observation: Bitcoin #BTC has reached a significant resistance level on the monthly timeframe. Historical price action demonstrates consistent rejection at this level.

⚫ Anticipated Market Behavior: Given BTC's overextended state and recent strong bullish momentum, a retracement is likely.

⚫ Optimal Entry Strategy: Target a potential buy entry near the 61.8% Fibonacci retracement level.

⚫ Trade Setup: Seek a daily timeframe price swing aligning with the 61.8% Fibonacci retracement. Place a stop-loss order below the previous swing low.

⚫ Risk Management: Maintain a minimum risk-reward ratio of 1:2.

Important Disclaimer: This analysis is intended for educational purposes and does not constitute financial advice.

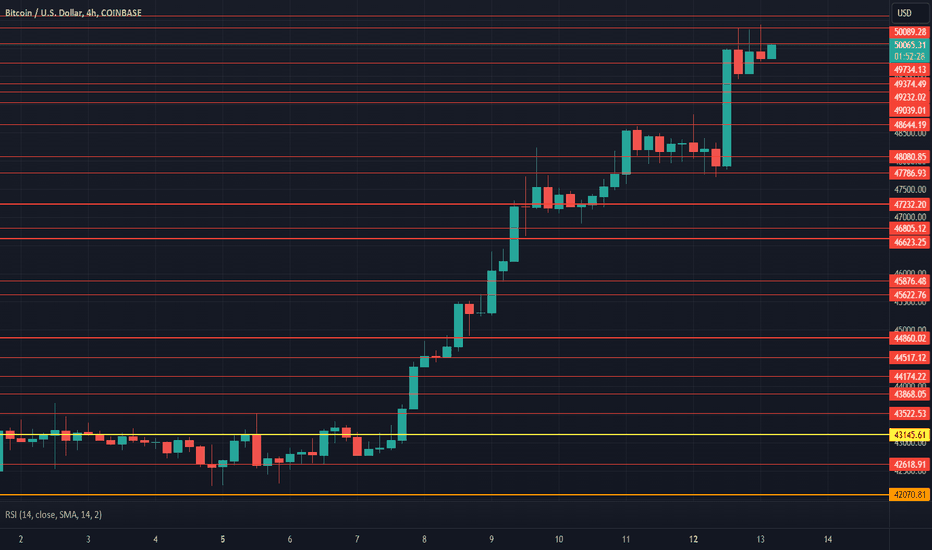

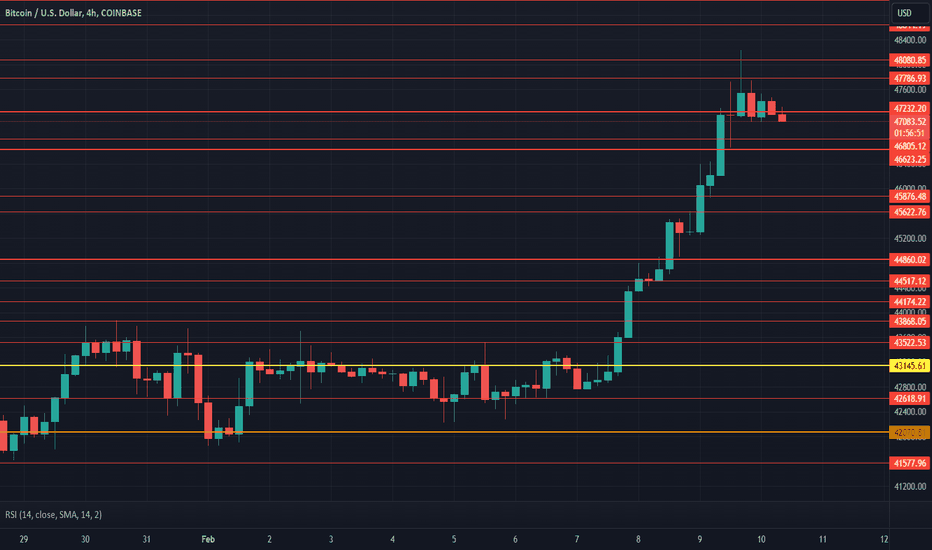

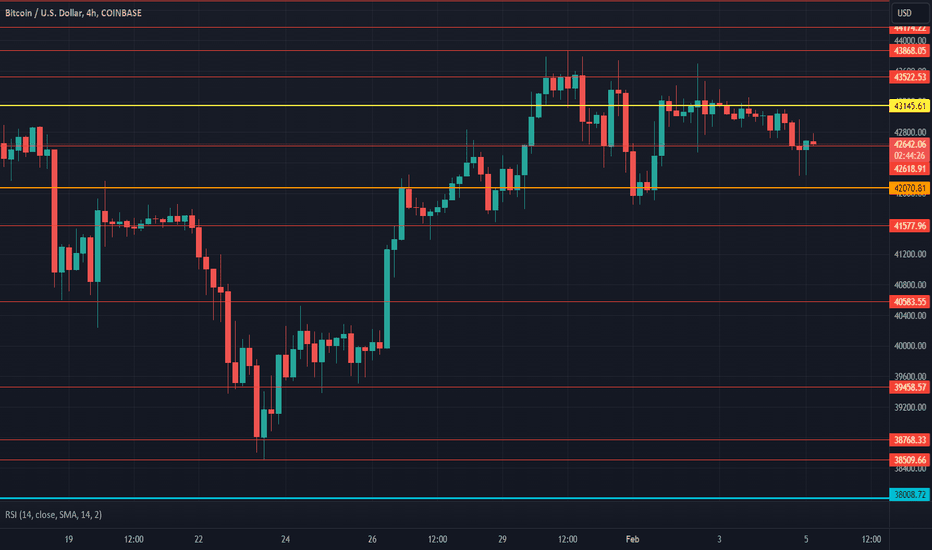

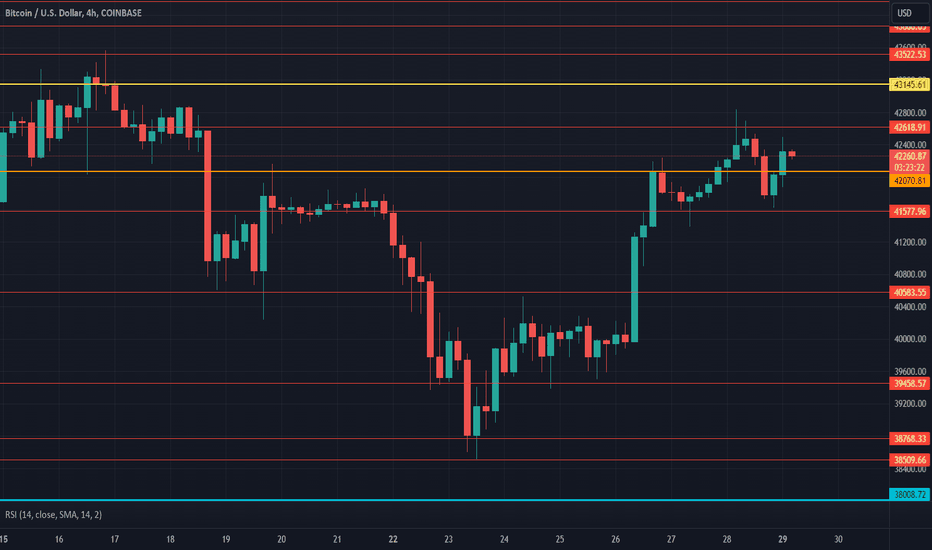

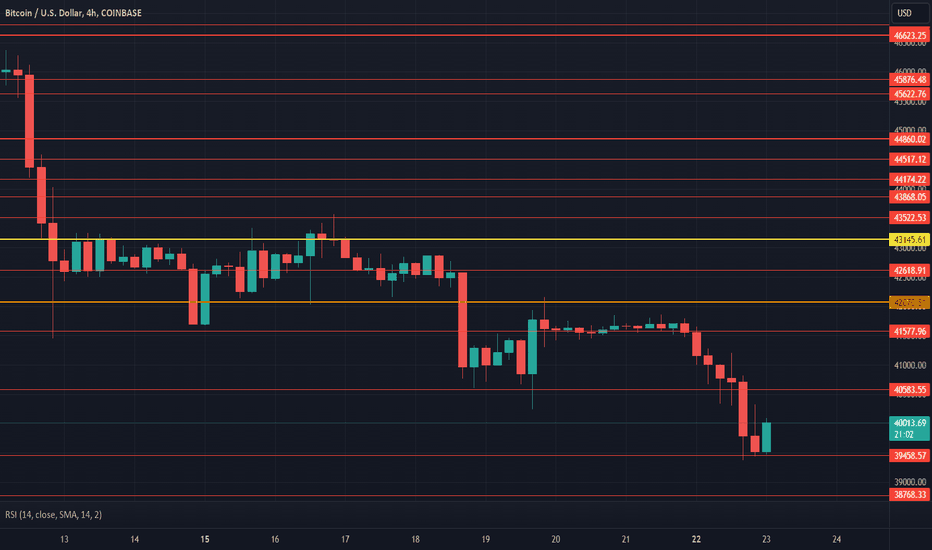

$BTC Daily UpdateCRYPTOCAP:BTC #BTC $44,860 resistance testing. Amazing break from $43,145 key resistance, RSI on 1D looking good, next resistance area to watch at $45,622-$45,876, $44,860 support crucial to hold as this will help reattempt at $47,232 key resistance. $44,174 current support yet to be tested

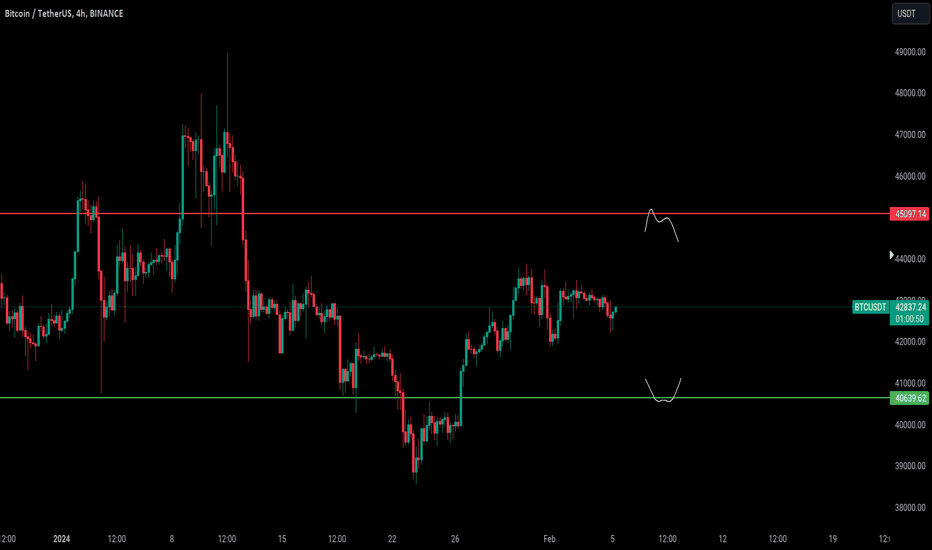

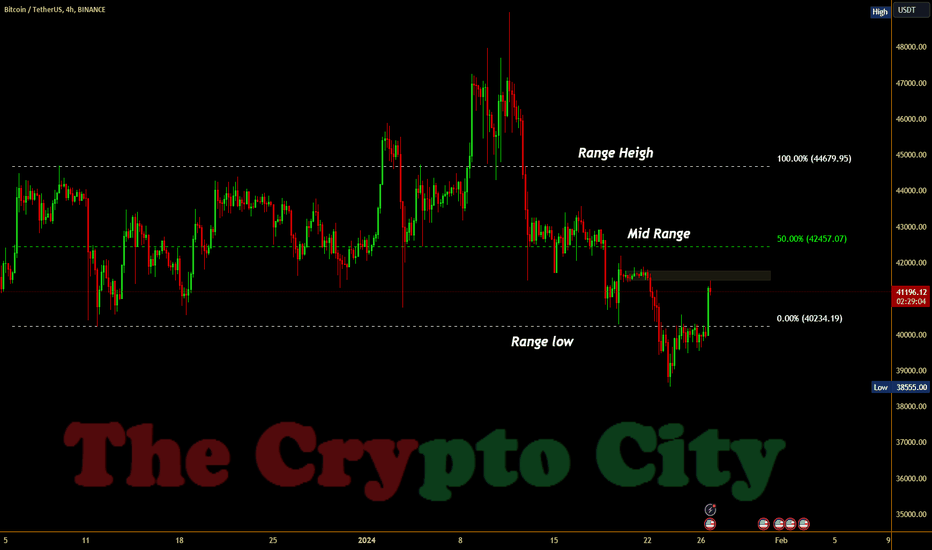

BTC Possible next movesFirst of all, this is not a long ideas. I am not entering long, actually i am 100% out from BTC. I am waiting to enter short at the red line, and i think we will see soon a pump till that zone. Bitcoin is ranging from some days and small investor are starting to loose their patience. I expect a strong upside moves, reaching 45k, then a quick and strong drop till $40.800.

BTC BITCOIN Technical Analysis and Trade IdeaRecently, Bitcoin has experienced a period of consolidation within a specific price range, punctuated by occasional spikes that have targeted liquidity. In the video, we analyze the daily time frame to gain insight into the broader context. We examine the market's trend, structure, and price action, exploring a potential trade opportunity. It's important to note that the information provided is for educational purposes only and should not be interpreted as financial advice.

BTC Weekly planPlan for this week on BTC. I will wait one of my two orders to get triggered: short limit at $45.000 or buy limit at $40.500. I think we will trigger the buy limit first, and in this scenario i think it will be just a scalp trade. If we trigger the short limit first, i will hold this trade for long term targeting $37.000

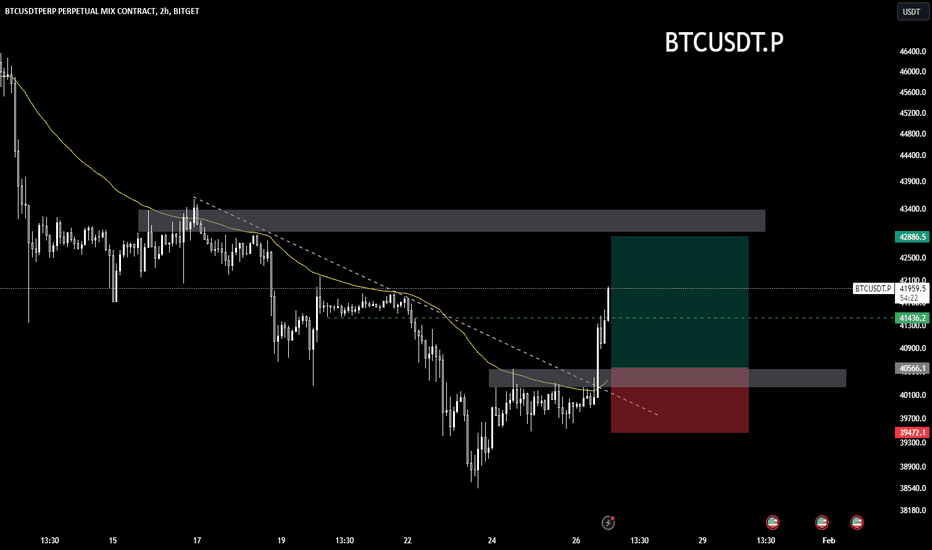

Trade in break trendline📊Analysis by AhmadArz:

this chart in bear trend for mid-term but getting open short-term long.

🔍Entry: 40566

🛑Stop Loss: 39472

🎯Take Profit: 41436 - 42886

🔗"Uncover new opportunities in the world of cryptocurrencies with AhmadArz.

💡Join us on TradingView and expand your investment knowledge with our five years of experience in financial markets."

🚀Please boost and💬 comment to share your thoughts with us!

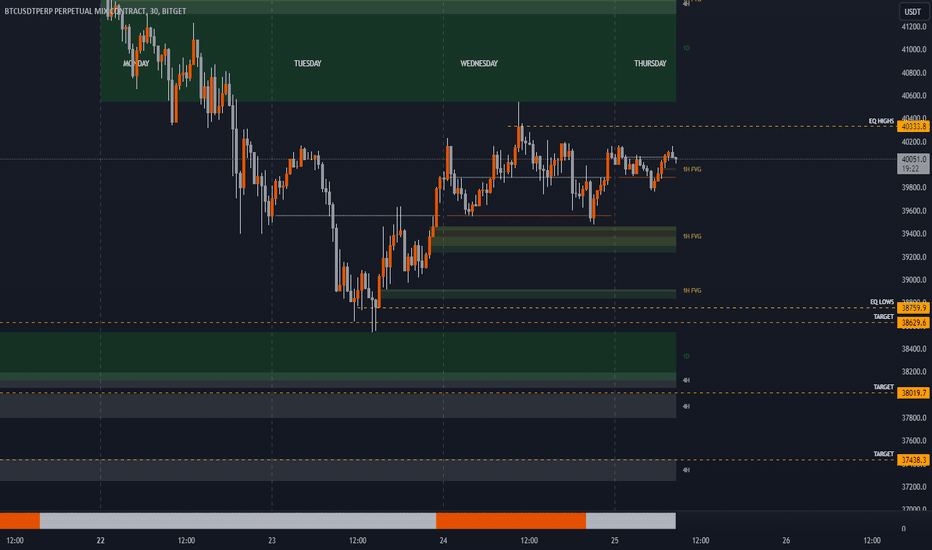

BTC - 25/01/24 - Could we test low than 38500?CRYPTOCAP:BTC #BTC

Bitcoin has left EQ Highs and EQ Lows which ever one gets hit first at the minute it's the high they are aiming for unless the orderflow changes the lows will be next!

We need to defend the low we made if it's broken then BTC could come down to around 37438 area to clear out these FVGs!

There is tons of liquidity around $42,000 now so I do expect it to be taken out at some point as well!

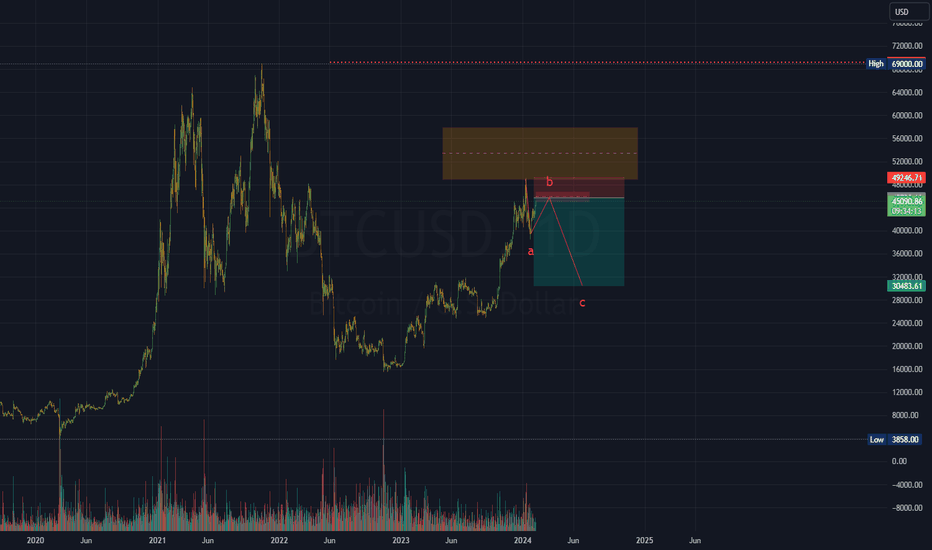

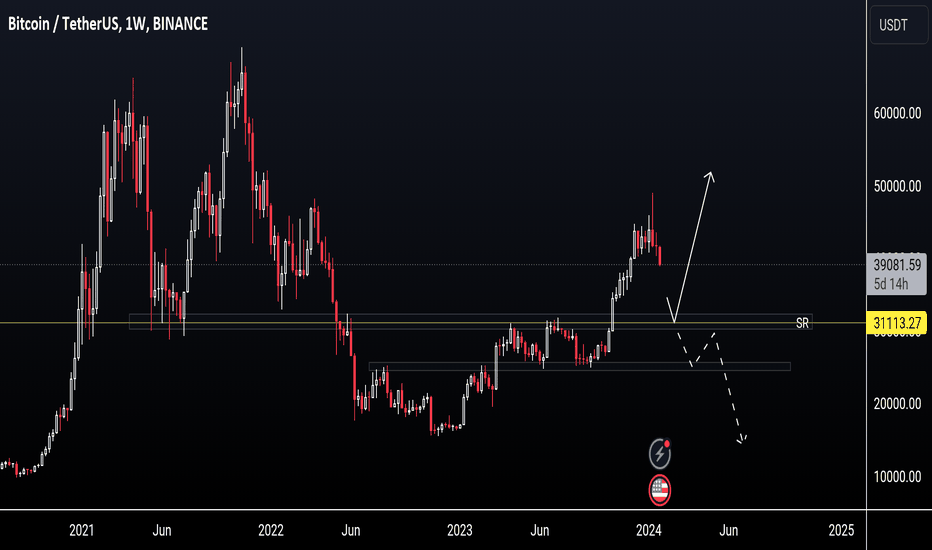

BTC will keep falling BTC has been falling over the past days, this is simply a retracement into the Weekly SR zone at 31k. Once price reaches the zone a Bullish run should be favoured since we're in a Bullish trend.

If BTC fails to hold at 31k Zone, we could have another Bearish run.

For next few days, I'd be looking for sells on the lower timeframes until 31k

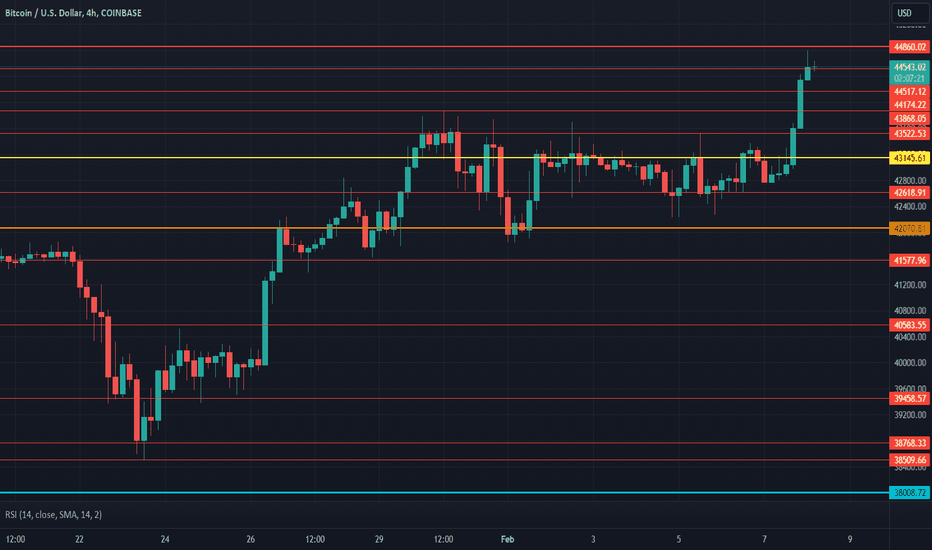

$BTC Daily updateCRYPTOCAP:BTC #BTC AMEX:GBTC outflows effecting #Bitcoin, $39,458 support came in effect, current 4h with potential bullish engulfing, Previous daily closed bearish, RSI on 4h and 1d close to oversold region, expect a reversal as AMEX:GBTC outflows cool down. $42,070 & $43,145 resistance to watch.

$BTC Lost $40k Support Level Today, Key Price Targets To MonitorCRYPTOCAP:BTC has traded sideways within a range with resistance at the white resistance zone (around $44k) and support in the green support zone around $40k. CRYPTOCAP:BTC has lost support at $40k and is at risk of a steep drop. Altcoins will get wrecked here too.

Price levels on the way down:

- The white trendline at $37.5k is the next key support level of interest.

- The orange support zone at $33.6k and $34.9k is my key support zone of interest.