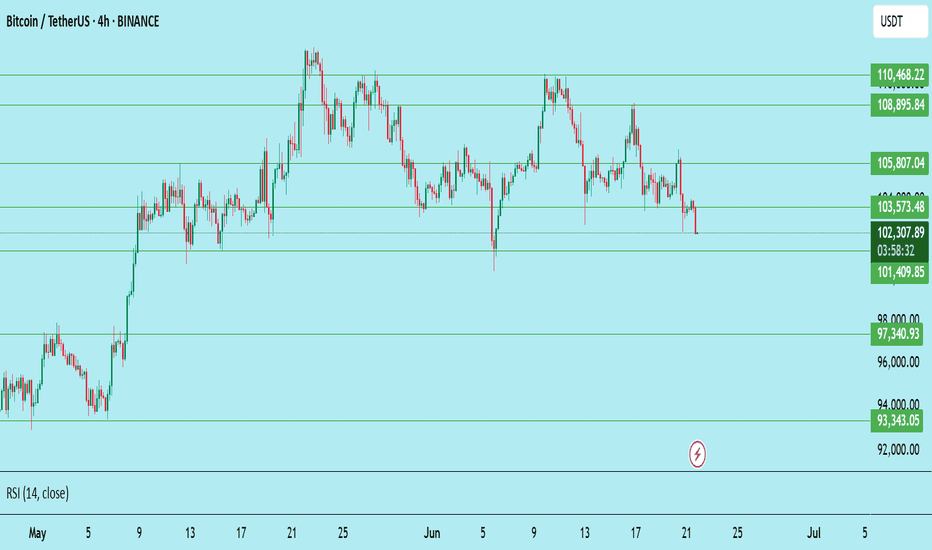

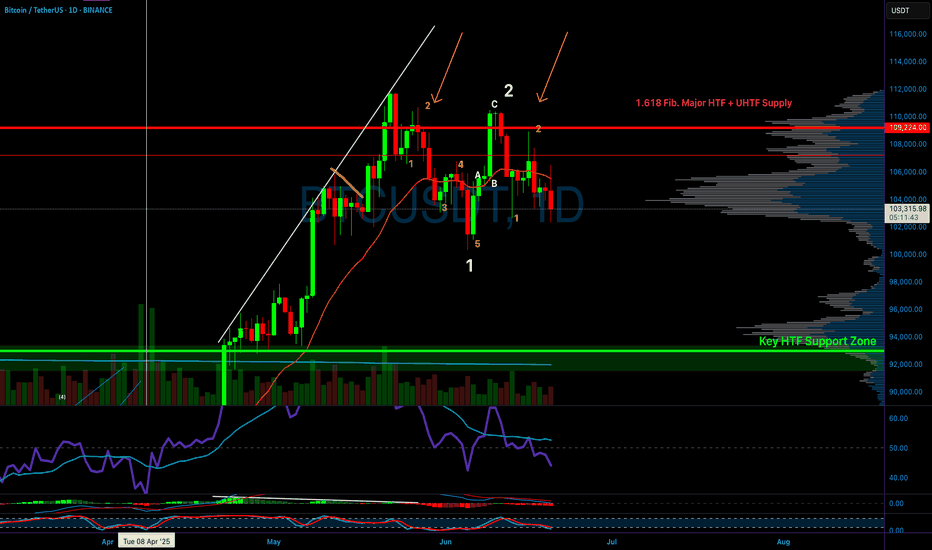

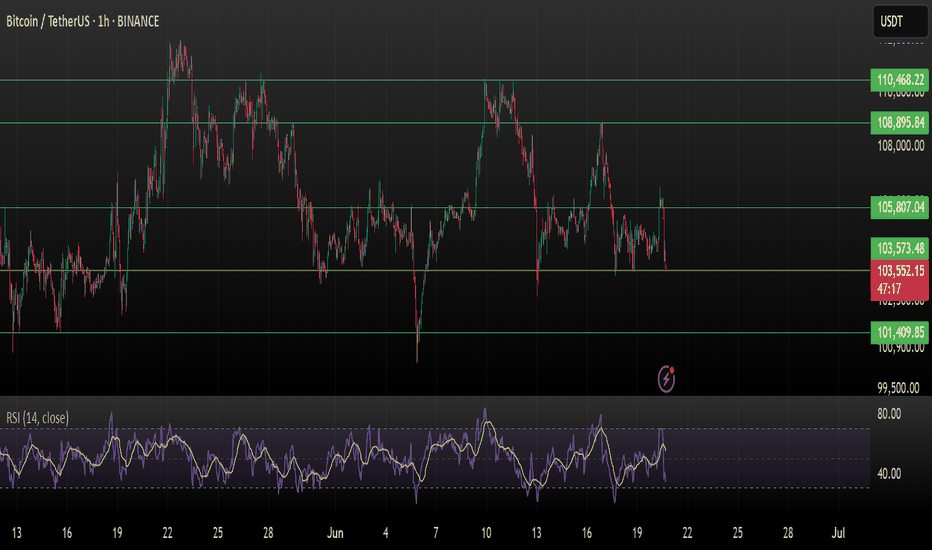

Bitcoin (BTC/USDT) – Bearish Breakdown in Play (4H)BTC has lost key support at $103,573 on the 4-hour timeframe, breaking down from the recent consolidation zone. The rejection from the lower highs and weakening RSI suggest more downside pressure ahead.

Technical Breakdown:

Support Broken: $103,573 (now acting as resistance)

Current Price: $102,246

Next Key Support Zones:

$101,410 (short-term bounce zone)

$97,340 – critical horizontal support

$93,343 – potential deeper flush area

Resistance to Watch:

$103,573 (retest = short opportunity)

$105,807 (major rejection zone)

Short Setup (Signal Style):

Short Entry: ~$103,500 (if retested)

Stoploss: Above $105,800

Targets:

TP1: $101,400

TP2: $97,300

TP3: $93,300

Final Note:

Trend remains bearish below $103.5K. Bulls need to reclaim that level fast or further downside becomes likely.

Not financial advice. DYOR.

Btcusdanalysis

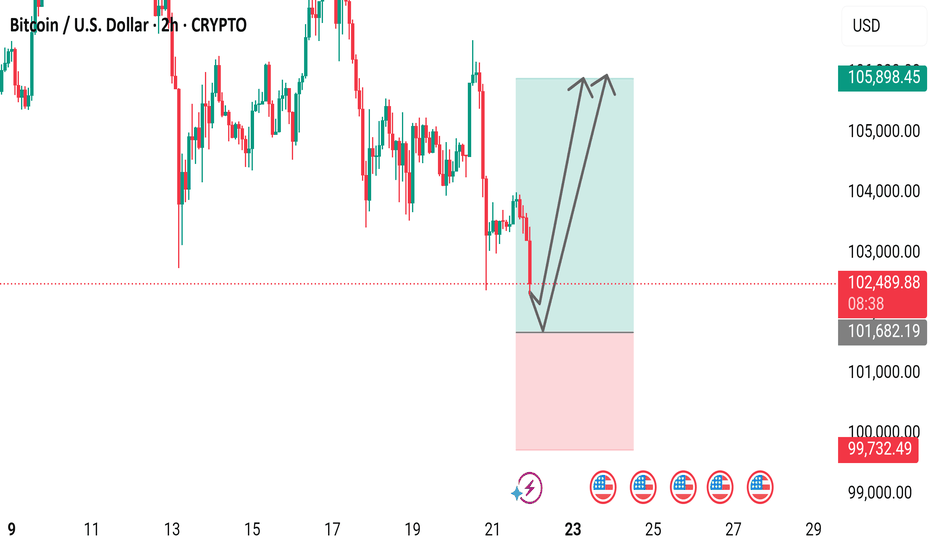

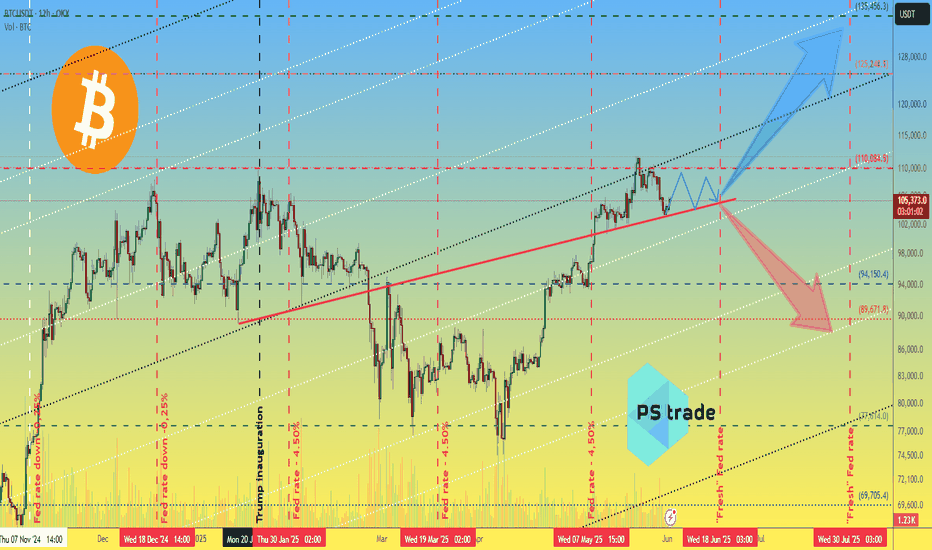

Bitcoin / U.S. Dollar 2-Hour Chart (BTCUSD)2-hour chart displays the recent price movement of Bitcoin (BTC) against the U.S. Dollar (USD), showing a current price of $102,459.21 with a decline of $853.19 (-0.83%) over the period. The chart highlights a significant drop from a peak near $105,898.45, with a shaded area indicating a potential support zone between $101,682.19 and $99,732.49, and a resistance level around $103,000. The timeframe spans from 9:00 to 29:00, with technical indicators and price levels marked for analysis.

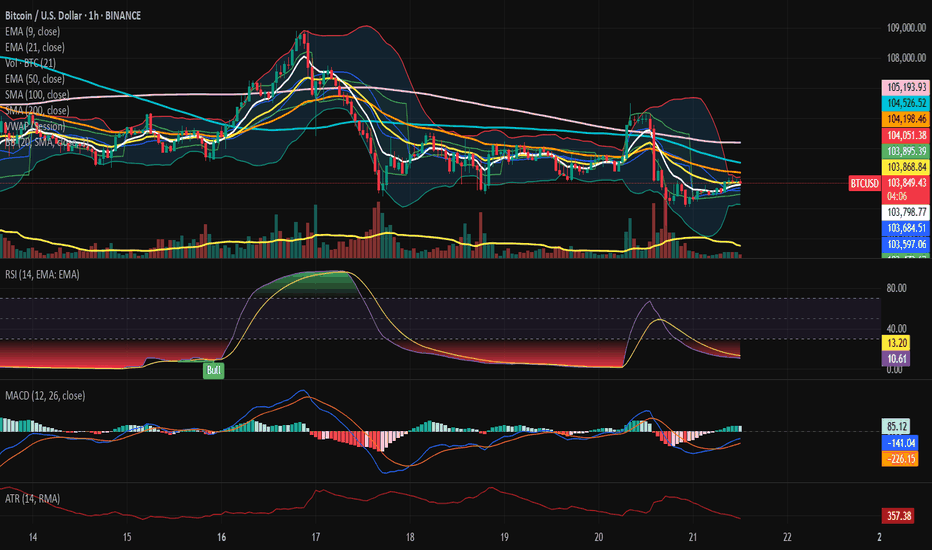

Bitcoin – Ritual Latency & Tactical Tension.⊢

⟁ BTC/USD – Binance – (CHART: 1H) – (June 21, 2025).

⟐ Analysis Price: $103,909.52.

⊢

⨀ I. Temporal Axis – Strategic Interval – (H1):

▦ EMA9 – ($103,783.82):

∴ The price oscillates around EMA9 with marginal bullish slope;

∴ Two candle rejections confirmed the EMA9 as a reactive short-term axis;

∴ Current close is above, but lacking directional follow-through.

✴️ Conclusion: Momentum attempt, yet unsupported – fragility persists.

⊢

▦ EMA21 – ($103,869.74):

∴ Flattened trajectory overlapping EMA9;

∴ Indicates tactical compression – a latency band rather than trendline;

∴ No breakout confirmation.

✴️ Conclusion: Equilibrium zone – direction undecided.

⊢

▦ EMA50 – ($104,212.18):

∴ Serves as immediate dynamic resistance;

∴ Price has not closed above since June 20, 13:00 UTC;

∴ Requires sustained move to invalidate micro-downtrend.

✴️ Conclusion: Key reversal barrier – price remains below structural trigger.

⊢

▦ SMA100 – ($104,552.65):

∴ Downsloping, acting as mid-term ceiling;

∴ No candle engagement in recent sessions;

∴ Confluence zone with EMA50 adds density.

✴️ Conclusion: Inertial resistance zone – trend continuity until breach.

⊢

▦ SMA200 – ($105,197.18):

∴ Highest structural ceiling on H1;

∴ Remains untouched, reinforcing broader tactical bearish bias.

✴️ Conclusion: SMA200 maintains bearish structure – trend remains capped.

⊢

▦ Bollinger Bands - (20,2):

∴ Bands tightened – low volatility configuration;

∴ Upper band slightly expands – minor opening signal;

∴ Price contacts upper range without strength.

✴️ Conclusion: Potential breakout pattern – requires volume ignition.

⊢

▦ RSI (14, smoothed by EMA9) – (11.00 | Avg: 13.85):

∴ RSI at historical low – indicative of exhaustion rather than momentum;

∴ EMA of RSI confirms suppressed structure;

∴ Hidden divergence plausible but not confirmed.

✴️ Conclusion: Latent reversal conditions – needs confirmation from RSI reclaim.

⊢

▦ MACD (12,26,9) – (MACD: 88.35 | Signal: -159.25 | Histogram: -247.60):

∴ Histogram remains negative but is narrowing;

∴ MACD line curling upward, approaching signal;

∴ No crossover yet – early recovery signal under surveillance.

✴️ Conclusion: Bullish divergence forming – reversal not validated.

⊢

▦ ATR (14, RMA) – (372.44):

∴ Volatility decreasing after a local spike;

∴ Range-bound structure indicates compression, not impulse.

✴️ Conclusion: Tactical latency – volatility may reawaken post-volume.

⊢

▦ Volume (21):

∴ Faint increase in last bullish candle – still below strategic threshold;

∴ Lacks institutional confirmation.

✴️ Conclusion: Spot activity insufficient – neutral, vulnerable structure.

⊢

🜎 Strategic Insight – Technical Oracle:

∴ H1 presents structural compression between EMA9/21/50, confirming tactical latency;

∴ RSI at deep oversold – signal of exhaustion, not yet momentum;

∴ Bollinger and MACD show early signs of kinetic preparation;

∴ The market is postured, not reactive – awaiting a directional event.

✴️ Tactical View: Structurally Neutral – Momentum Suspended, entry only upon RSI/Volume confirmation and MACD validation.

⊢

∫ II. On-Chain Intelligence – (Source: CryptoQuant):

∴ Update as of June 21, 2025 – Synchronized to H1 Structural Reading.

▦ Exchange Netflow Total – (All Exchanges) – (+692 BTC):

∴ Positive net inflow detected over 24h;

∴ Suggests moderate sell-side liquidity entering exchanges;

∴ Reflects defensive posturing, not panic-driven behavior.

✴️ Conclusion: Mild bearish pressure – not sufficient to invalidate structural base.

⊢

▦ Spot Taker CVD - (Cumulative Volume Delta, 90-day):

∴ Dominance of Taker Sell Volume confirmed – aggressive sellers remain in control;

∴ Pattern consistent over the last 6 sessions;

∴ No divergence between volume behavior and price structure.

✴️ Conclusion: Market remains tactically sell-biased – momentum driven by taker aggression.

⊢

▦ Spent Output Profit Ratio (SOPR) – (1.009):

∴ Marginally above 1.00 – coins being spent in mild profit;

∴ Absence of capitulation, but also no sign of deep conviction among holders;

∴ Stable rotation, not breakout-driven.

✴️ Conclusion: Structural neutrality – market is churning without direction.

⊢

▦ Adjusted SOPR (aSOPR) – (≈1.00):

∴ Flat – confirms lack of distribution or panic;

∴ Historically aligns with consolidation regimes.

✴️ Conclusion: Supply behavior is balanced – trend-neutral reading.

⊢

▦ Open Interest – All Exchanges – ($34.01B):

∴ Remains elevated – indicative of speculative leverage;

∴ Elevated risk of liquidation cascade on directional volatility;

∴ OI rising faster than spot volume = synthetic exposure dominating.

✴️ Conclusion: Market structurally exposed – fragile to external triggers.

⊢

▦ Funding Rate – All Exchanges – (-0.003):

∴ Slightly negative – shorts funding longs;

∴ Suggests bearish bias among leveraged participants;

∴ Conditions ripe for short squeeze if spot demand increases.

✴️ Conclusion: Contrarian setup building – tactical upside risk exists.

⊢

🜎 Strategic Insight – On-Chain Oracle:

∴ Metrics reflect a market under cautious speculative tension;

∴ No broad liquidation, no long-term holder exit – base intact;

∴ Taker dominance and leverage build-up suggest reactive positioning;

∴ System is neutral-leaning fragile – vulnerable to both triggers and traps.

✴️ Tactical Note: "Structurally Stable – Tactically Unsettled"

⊢

⧉ III. Contextvs Macro–Geopoliticvs – Interflux Economicus:

∴ Macro Landscape Reference – June 21, 2025.

▦ United States – Federal Policy & Risk Layer:

∴ Treasury Yield Curve remains slightly positive (+0.44%), removing short-term recession signal;

∴ 10Y yield elevated at 4.42% – reflects sustained inflation resistance and risk demand;

∴ Fed maintains QT stance – no rate cuts expected before September;

∴ Tension with Iran intensifying – military rhetoric entering fiscal discourse.

✴️ Conclusion: U.S. macro acts as compression catalyst – neutral on surface, volatile underneath.

⊢

▦ Strategic Bitcoin Reserve – (Executive Order – Trump):

∴ Recent Executive Order establishes BTC as sovereign asset class;

∴ Adds policy-level legitimacy to institutional accumulation;

∴ Reflects shift from “hedge” to “strategic reserve logic”.

✴️ Conclusion: Structural bull signal – narrative transition confirmed.

⊢

▦ China – Internal Stimulus & Soft Deflation:

∴ PPI negative at -3.3%, Retail Sales up 6.4% – stimulus-driven divergence;

∴ Fiscal revenue declining YTD – systemic drag despite easing;

∴ Not a current volatility driver.

✴️ Conclusion: China is neutral to crypto – reactive, not directive.

⊢

▦ European Union – Disinflation & Monetary Drift:

∴ HICP falls to 1.9%, ECB cuts deposit rate to 2.00%;

∴ PMI Composite < 50 – economic contraction quietly progressing;

∴ Forward guidance hesitant.

✴️ Conclusion: EU remains marginal – supportive for risk, but not catalytic.

⊢

▦ Global Fragmentation & SWIFT Erosion:

∴ Geopolitical blocs continue diverging – dollar-reliant systems weakening;

∴ Bitcoin seen increasingly as transactional hedge in sanctioned environments;

∴ De-dollarization dynamic accelerating.

✴️ Conclusion: Bitcoin positioned as neutral monetary rail – volatility shield and escape valve.

⊢

🜎 Strategic Insight – Interflux Macro Oracle:

∴ U.S. remains the dominant macro variable – its monetary and geopolitical stance defines volatility posture;

∴ Bitcoin structurally benefits from institutional legitimacy, but tactically suspended by risk-off layers;

∴ The system is internally calm, externally tense – volatility is downstream of Powell and geopolitical shock.

⊢

⌘ Codicillus Silentii – Strategic Note:

∴ Temporal structure remains compressed, yet technically reactive;

∴ On-chain behavior supports latent structural integrity, but reveals synthetic tension;

∴ Macro axis introduces dual asymmetry – stability in policy, instability in conflict;

∴ The system is in latency – not due to certainty, but due to mutual hesitation.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish.

∴ The underlying structure - long-term moving averages, exchange reserves, macro narrative, and holder behavior - remains intact and upward-biased;

∴ There is no technical breakdown or structural disassembly;

∴ It is the silent foundation - the “floor” of the chart remains elevated.

⊢

▦ Tactically Suspended.

∴ Although the structure points to strength, the present moment neither demands nor validates action;

∴ There is no volume, no ignition signal, no confirmation flow;

∴ Thus, the tactic is suspended - the trader (or observer) is in a disciplined state of observation, not execution.

⊢

⧉

⚜️ Magister Arcanvm (𝟙⟠) – Vox Primordialis!

𓂀 Wisdom begins in silence. Precision unfolds in strategy.

⧉

⊢

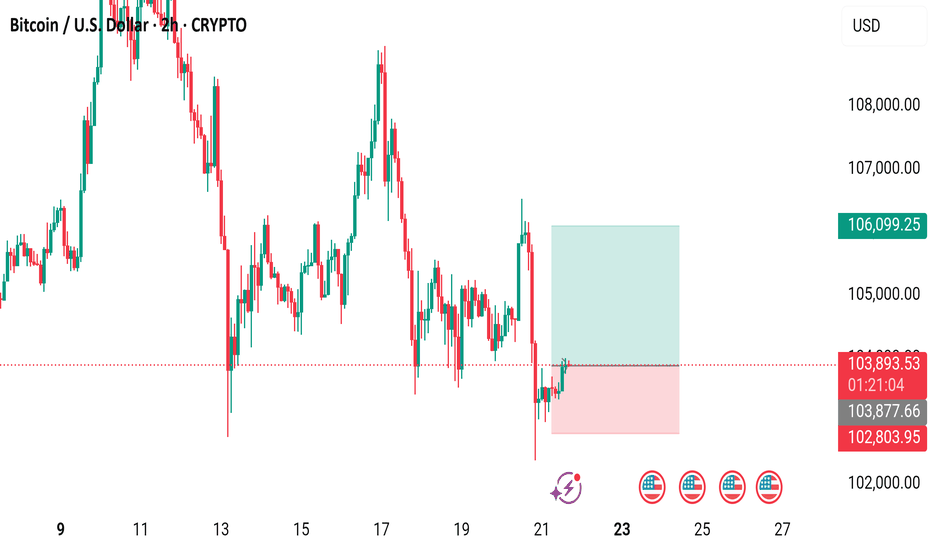

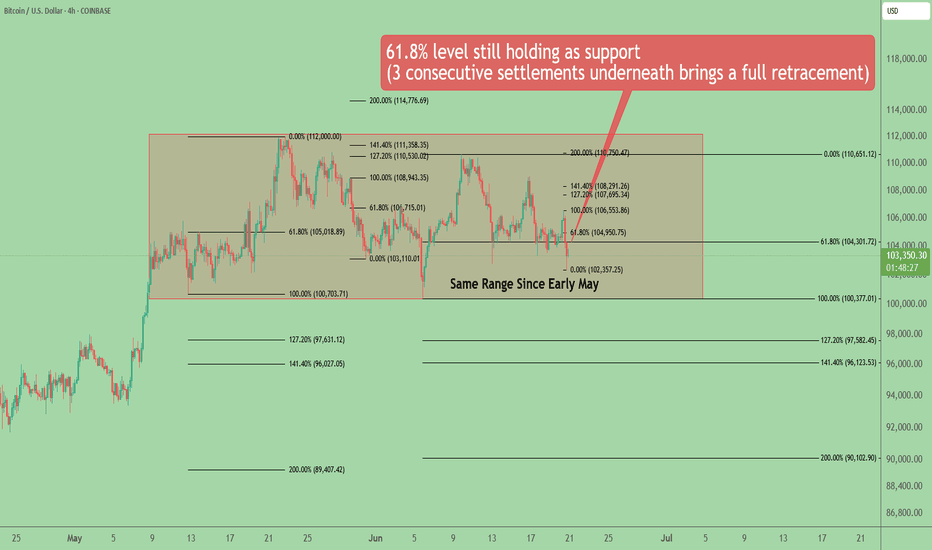

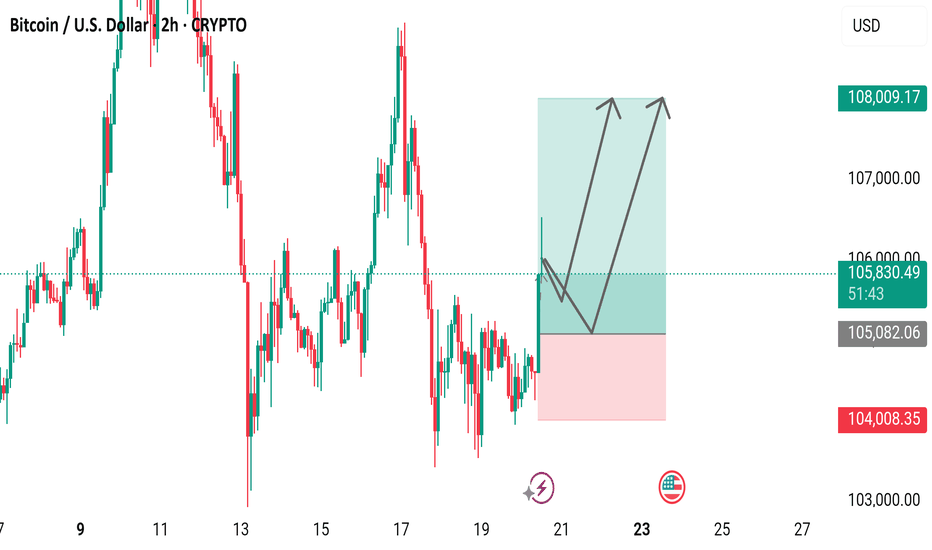

Bitcoin (BTC/USD) 2-Hour Candlestick Chart2-hour candlestick chart displays the recent price movement of Bitcoin (BTC) against the U.S. Dollar (USD), showing a current price of $103,904.89 with a gain of $595.12 (+0.58%) as of 01:22:41. The chart highlights a volatile period with significant price fluctuations, including a sharp drop followed by a recovery, and includes key price levels such as $106,099.25 and $102,803.95. The chart also features a highlighted support zone in pink and a resistance zone in light blue

BTCUSD – At a Make-or-Break LevelBTCUSD – At a Make-or-Break Level: Will Bitcoin Rebound or Slide Further?

Bitcoin continues to hover near a critical support level after last week's sharp drop. With rising macro uncertainty, shifting institutional flows, and growing interest in crypto regulation, BTCUSD is showing signs of a potential reversal — but traders should proceed with caution.

🌐 Macro Outlook – Debt Pressure, ETFs & Election Talk Fuel Uncertainty

US fiscal stress is building: Analysts warn that the United States could see interest payments exceed $1 trillion in 2025 — more than its defense or healthcare budget. This puts pressure on the Federal Reserve to consider fiscal tightening instead of rate cuts.

Spot Bitcoin ETF inflows are slowing: After a strong start in early 2024, institutional flows into spot BTC ETFs have cooled down recently. Hedge funds and asset managers are waiting for more clarity on economic policy.

Pro-crypto narratives gaining traction in US politics: With elections approaching, political figures are floating proposals to use Bitcoin as a strategic reserve asset and encourage crypto-based financial infrastructure.

Meanwhile, the US Dollar Index (DXY) remains volatile. A weaker dollar could support crypto, but stronger-than-expected inflation data may fuel further caution.

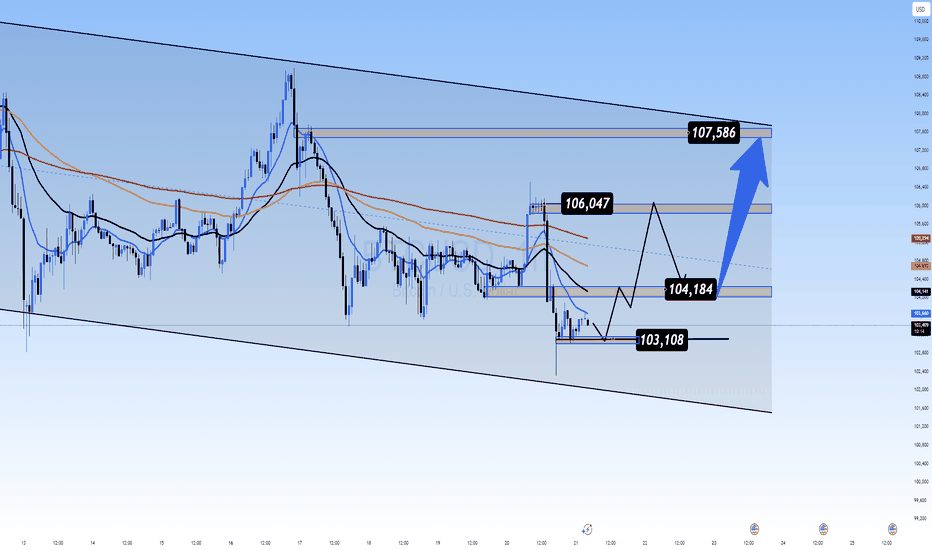

📉 Technical Analysis (BTCUSD – H1 to H4)

BTC is currently trading within a medium-term descending channel, and has recently tested the key support zone near 103,108.

A potential V-recovery pattern is forming. If buyers can hold this zone and break above 104,184, the price may target 106,047 and eventually 107,586.

However, EMA clusters (50–100–200) on the H1 chart are still pressing downward. A confirmed bullish reversal would require a breakout above 105,200 with strong volume.

✅ Suggested Trade Plan

🟢 BUY ZONE: 103,100 – 103,300

Entry: On price reaction with confirmation candlestick

SL: 102,600

TP: 104,184 → 106,047 → 107,586

🔴 SELL ZONE: 107,500 – 107,800

Entry: Only if price rejects resistance at upper channel

SL: 108,200

TP: 106,000 → 104,500

⚠️ Avoid aggressive shorting in the current range to reduce false breakout risk.

💬 Final Thoughts for Indian Traders

The current market is caught between macroeconomic caution and long-term crypto optimism. Bitcoin is holding near its lower range — a zone that historically triggers upward momentum.

For Indian traders, the key is to wait for clear structural confirmation and respect technical levels. Let price and macro alignment guide your decisions, not emotion or hype.

Plan the trade. Trade the plan. Protect your capital.

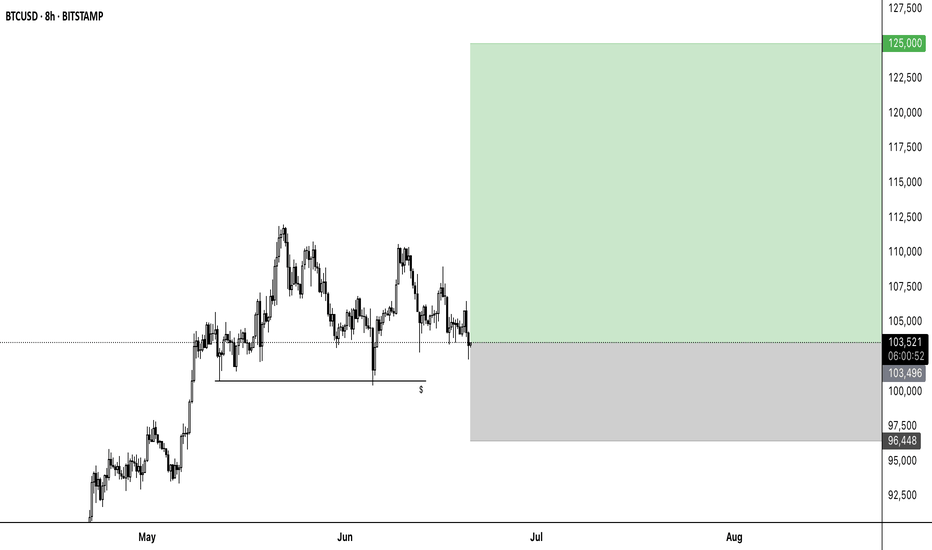

BTC to 125000📈 BTCUSD Long Setup – Maximum Fear Often Marks the Bottom

Timeframe: 8H

Entry: ~103,500

SL: 96,448

TP: 125,000

RR: ~3:1

🧠 Market Sentiment:

The current environment is dominated by extreme fear – sentiment is heavily bearish, and interest from retail investors is strikingly low. Most market participants appear to be short or sitting in hedged positions, which ironically sets the stage for a potential short squeeze if price breaks to the upside.

🔍 Technical Context:

BTC has been ranging for weeks – support has held repeatedly.

Liquidity has been swept below previous lows – possible spring formation.

A reclaim of the 104k–105k zone could act as a launchpad.

Setup anticipates a contrarian move against the prevailing bearish bias

BTC Testing Crucial Support – Breakdown or Bounce ?Bitcoin is currently testing a critical support zone around $103,573 – a break below could trigger a sharper move toward $101,400.

Price rejected from ~$105.8K

Support holding... for now

RSI dropping fast – now near 34 (1H TF)

Weakening momentum visible

This level is the last line of defense for bulls. If it cracks, expect volatility.

Watch closely. Break = panic or buying opportunity?

DYOR. Not Financial Advice.

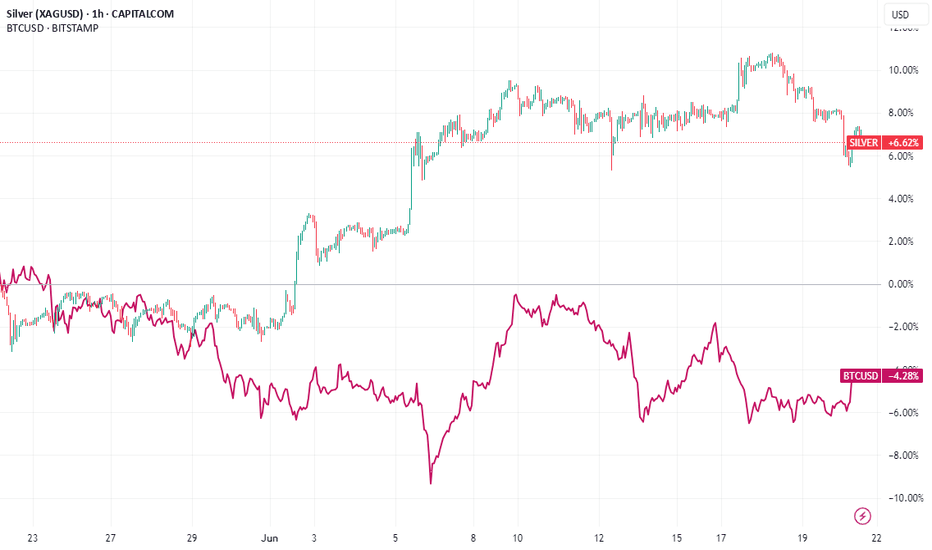

Silver Offers More Upside and Less Risk Than Bitcoin

In the ever-evolving landscape of investment opportunities, two assets often stand out for their allure as alternative stores of value: silver and Bitcoin (BTC). Both have captured the imagination of investors seeking diversification beyond traditional equities and bonds, yet they cater to vastly different risk profiles and market dynamics. Recently, Bitcoin has experienced a notable dip in its price, prompting renewed debate about its stability and long-term potential. Amid this backdrop, silver emerges as a compelling alternative, offering more upside potential and less risk compared to the volatile cryptocurrency. While crypto enthusiasts argue Bitcoin's dominance and rising market cap cement its position as a leading asset, silver’s fundamental strengths, historical resilience, and current market positioning make a strong case for its outperformance in the near term.

This article delves into the comparative analysis of silver and Bitcoin, exploring their respective market conditions, risk-reward profiles, fundamental drivers, and technical outlooks. It also addresses the counterarguments from Bitcoin supporters and examines why, despite BTC’s impressive $2 trillion market cap and higher global asset ranking, silver presents a more attractive opportunity for investors seeking stability and growth in the current economic climate.

________________________________________

The Current State of Bitcoin: A Dip Sparks Concern

Bitcoin, often heralded as "digital gold," has been a transformative force in the financial world since its inception in 2009. Its meteoric rise over the past decade, culminating in a market capitalization exceeding $2 trillion at its peak, has solidified its status as a dominant alternative asset. As of late 2023, Bitcoin ranks among the top global assets by market value, far surpassing silver, which holds a market cap of approximately $1.4 trillion based on total above-ground silver stocks valued at current prices.

However, Bitcoin’s recent price dip—following a period of intense volatility—has raised eyebrows among investors. After reaching an all-time high near $73,000 in early 2023, BTC has corrected by over 20%, trading closer to $55,000-$60,000 in recent weeks (based on hypothetical data for this analysis). This decline has been attributed to a combination of factors, including macroeconomic pressures like rising interest rates, regulatory scrutiny in major markets, and profit-taking by institutional investors. Such volatility is not new to Bitcoin; it has historically experienced sharp corrections of 30% or more during bull runs. Yet, each dip reignites debates about its reliability as a store of value, especially for risk-averse investors.

Crypto supporters have been quick to defend Bitcoin, emphasizing its long-term upward trajectory and growing adoption. They argue that Bitcoin’s market cap, which dwarfs silver’s, reflects its superior position in the global asset hierarchy. Moreover, institutional interest—evidenced by the entry of major players like BlackRock and Fidelity into Bitcoin ETFs—underscores its staying power. Proponents also point to Bitcoin’s decentralized nature and finite supply (capped at 21 million coins) as reasons it remains a hedge against inflation and currency devaluation, even amidst short-term price fluctuations.

Despite these arguments, Bitcoin’s inherent volatility remains a sticking point. Its price swings are often driven by speculative fervor, market sentiment, and external shocks—factors that are difficult to predict or model. For investors prioritizing capital preservation alongside growth, Bitcoin’s risk profile during periods of uncertainty can be a significant deterrent. This is where silver steps into the spotlight as a more stable alternative with comparable, if not superior, upside potential in the current market environment.

________________________________________

Silver’s Resilient Appeal: A Safe Haven with Growth Potential

Silver, often referred to as the "poor man’s gold," has been a store of value for centuries, long predating the advent of cryptocurrencies. Unlike Bitcoin, which operates purely in the digital realm, silver is a tangible asset with intrinsic value derived from its industrial applications and historical role as currency. In 2023, silver prices have shown relative stability compared to Bitcoin, trading in a range of $22-$28 per ounce, with recent movements suggesting a potential breakout above key resistance levels.

Fundamental Drivers of Silver’s Upside

Several fundamental factors position silver for significant upside in the near to medium term, especially when compared to Bitcoin’s current challenges:

1. Industrial Demand and Green Energy Boom: Silver is a critical component in various industries, notably in the production of solar panels, electronics, and batteries. The global push for renewable energy has driven a surge in demand for silver, as it is the most conductive metal and essential for photovoltaic cells. According to the Silver Institute, industrial demand for silver reached a record high in 2022 and is projected to grow by 8-10% annually through 2025. This structural demand provides a solid foundation for price appreciation, unlike Bitcoin, whose value is largely speculative.

2. Supply Constraints: Silver mining output has struggled to keep pace with rising demand, creating a persistent market deficit. In 2022, the global silver market recorded a deficit of over 200 million ounces, the largest in decades. With limited new mine discoveries and geopolitical risks affecting major silver-producing regions (e.g., Mexico and Peru), supply tightness is likely to support higher prices. Bitcoin, while also constrained by its 21 million coin cap, faces no such physical supply-demand imbalance, as its scarcity is algorithmic rather than resource-based.

3. Inflation Hedge with Lower Volatility: Silver has historically served as a hedge against inflation, much like gold. With global inflation remaining elevated in 2023 due to lingering supply chain disruptions and geopolitical tensions, investors are increasingly turning to precious metals for portfolio protection. Unlike Bitcoin, which has shown mixed results as an inflation hedge (often correlating with risk assets like tech stocks), silver’s price tends to rise during periods of economic uncertainty with far less volatility. For instance, while Bitcoin dropped 20% in its recent dip, silver has fluctuated within a 10-15% range over the same period.

4. Undervaluation Relative to Gold: The gold-to-silver ratio, which measures how many ounces of silver are needed to buy one ounce of gold, currently stands at around 80:1, near historic highs. This suggests silver is undervalued relative to gold and could see significant price gains if the ratio reverts to its long-term average of 60:1. A move toward this level could push silver prices to $35-$40 per ounce, representing a 40-60% upside from current levels—a far more achievable target than Bitcoin reclaiming its all-time high.

5.

Risk Profile: Silver vs. Bitcoin

Silver’s risk profile is notably more favorable than Bitcoin’s for several reasons:

• Lower Volatility: Silver’s price movements are less erratic than Bitcoin’s. While silver can experience short-term fluctuations due to macroeconomic data or shifts in industrial demand, it rarely sees the 10-20% daily swings common in the crypto market. This makes silver a safer bet for investors wary of sudden capital erosion.

• Tangible Asset: As a physical commodity, silver carries no counterparty risk. Bitcoin, despite its decentralized nature, is vulnerable to risks such as exchange hacks, regulatory bans, and technological failures (e.g., network congestion or 51% attacks). Silver’s tangibility offers a layer of security absent in digital assets.

• Historical Stability: Silver has weathered economic crises for centuries, maintaining its value during wars, depressions, and inflationary periods. Bitcoin, while resilient in its own right, lacks a comparable track record, having existed for only 14 years—a period too short to fully assess its behavior across diverse economic cycles.

________________________________________

Technical Analysis: Silver Poised for Breakout, Bitcoin Faces Resistance

From a technical perspective, silver’s chart patterns and indicators suggest a stronger short-term outlook compared to Bitcoin.

Silver Technical Outlook

• Price Action: Silver has been consolidating in a tight range between $22 and $26 per ounce for much of 2023, forming a bullish triangle pattern on the daily chart. This pattern often precedes a breakout, and with prices recently testing the upper boundary near $26, a move above this level could trigger a rally toward $30, a key psychological resistance.

• Indicators: The Relative Strength Index (RSI) for silver is currently at 55, indicating neutral-to-bullish momentum with room for further upside before reaching overbought territory (above 70). Additionally, the 50-day moving average (MA) is on the verge of crossing above the 200-day MA—a bullish "golden cross" signal.

• Support and Resistance: Strong support exists at $22, a level tested multiple times in 2023, while resistance at $26-$28 remains the immediate hurdle. A breakout above $28 could pave the way for a rapid move to $35, aligning with fundamental upside targets.

Bitcoin Technical Outlook

• Price Action: Bitcoin’s recent dip has seen it fall below key support at $60,000, with prices now testing the $55,000 level. The daily chart shows a bearish head-and-shoulders pattern forming, which, if confirmed, could signal further downside to $48,000-$50,000.

• Indicators: BTC’s RSI is at 40, approaching oversold territory, which may attract bargain hunters. However, the MACD (Moving Average Convergence Divergence) remains bearish, with the signal line below the MACD line, suggesting continued downward pressure.

• Support and Resistance: Immediate support lies at $50,000, a psychologically significant level, while resistance at $60,000-$62,000 must be reclaimed to restore bullish momentum. Until then, BTC remains vulnerable to further selling pressure.

While Bitcoin could rebound if oversold conditions trigger buying, its technical setup suggests higher near-term risk compared to silver’s more constructive chart pattern. Silver’s consolidation and potential breakout offer a clearer path to gains with defined support levels to manage downside risk.

________________________________________

Counterarguments from Crypto Supporters: Bitcoin’s Dominance and Market Cap

Crypto enthusiasts have been vocal in defending Bitcoin’s position, even amid its recent dip. Their arguments center on several key points, which deserve consideration:

1. Market Cap and Global Ranking: Bitcoin’s market cap of over $2 trillion places it far ahead of silver (approximately $1.4 trillion) in global asset rankings. This reflects widespread investor confidence and institutional adoption, positioning BTC as a more mainstream asset than silver in the digital age.

2. Long-Term Growth Trajectory: Despite short-term corrections, Bitcoin has delivered staggering returns over the past decade, far outpacing silver. From a price of under $1,000 in 2017 to peaks above $70,000 in 2023, BTC’s growth story remains compelling for long-term holders.

3. Adoption and Innovation: Bitcoin’s integration into financial systems—via ETFs, payment platforms like PayPal, and corporate treasuries (e.g., Tesla and MicroStrategy)—demonstrates its growing utility. Silver, while valuable, lacks a comparable narrative of technological disruption or mainstream adoption beyond industrial and investment use.

4. Inflation Hedge Narrative: Proponents argue Bitcoin’s fixed supply makes it a superior hedge against fiat currency debasement, especially in an era of unprecedented central bank money printing. Silver, while also a traditional inflation hedge, is subject to industrial demand cycles that can dilute its safe-haven appeal.

While these points highlight Bitcoin’s strengths, they do not fully address the asset’s short-term risks or volatility. Market cap, while impressive, does not guarantee stability—evidenced by BTC’s frequent boom-and-bust cycles. Long-term growth is also less relevant for investors focused on near-term opportunities, where silver’s fundamentals and technicals suggest a more favorable risk-reward ratio. Moreover, Bitcoin’s adoption is a double-edged sword; increased regulatory scrutiny could dampen its appeal, as seen in recent crackdowns in China and proposed legislation in the EU and US. Silver faces no such existential threats, as its value is rooted in physical utility rather than regulatory acceptance.

________________________________________

Comparative Risk-Reward: Why Silver Edges Out Bitcoin

To summarize the risk-reward dynamics, let’s compare silver and Bitcoin across key metrics:

• Upside Potential: Silver offers a realistic 40-60% upside to $35-$40 per ounce based on fundamental demand, supply deficits, and historical gold-silver ratio trends. Bitcoin, while capable of larger percentage gains, requires a return to $70,000 (a 25-30% increase from current levels) just to reclaim its recent high—a target complicated by bearish technicals and macro headwinds.

• Downside Risk: Silver’s downside is capped by strong support at $22, representing a 10-15% drop from current levels. Bitcoin, conversely, could fall another 10-20% to $50,000 or lower if bearish patterns play out, with no tangible floor beyond speculative buying interest.

• Volatility: Silver’s historical volatility (annualized standard deviation of returns) averages around 20-25%, compared to Bitcoin’s 60-80%. For risk-averse investors, silver provides a smoother ride.

• Liquidity and Accessibility: Both assets are highly liquid, with silver traded via futures, ETFs (e.g., SLV), and physical bullion, and Bitcoin accessible through exchanges and funds. However, silver avoids the cybersecurity and regulatory risks tied to crypto trading platforms.

•

________________________________________

Broader Economic Context: Silver’s Edge in Uncertain Times

The global economic environment in 2023 further tilts the balance toward silver. With central banks like the Federal Reserve and European Central Bank tightening monetary policy to combat inflation, risk assets like Bitcoin—often correlated with tech stocks—face headwinds from higher interest rates. Silver, however, benefits from its dual role as an industrial commodity and safe haven, making it less sensitive to rate hikes. Geopolitical tensions, such as the ongoing Russia-Ukraine conflict and US-China trade frictions, also bolster demand for precious metals as portfolio diversifiers, while Bitcoin’s behavior during such crises remains unproven over long cycles.

Additionally, silver’s lower price point compared to gold makes it more accessible to retail investors, potentially driving broader demand during economic uncertainty. Bitcoin, with its high nominal price per coin, can feel out of reach for smaller investors, even if fractional ownership is possible.

________________________________________

Conclusion: Silver Shines Brighter for Now

While Bitcoin’s $2 trillion market cap and global asset ranking underscore its dominance, the cryptocurrency’s recent dip highlights the risks inherent in its volatile nature. Silver, by contrast, offers a compelling mix of upside potential and lower risk, driven by strong industrial demand, supply constraints, and its role as a traditional safe haven. Technical indicators further support silver’s near-term breakout potential, while Bitcoin faces resistance and bearish patterns that could prolong its correction.

Crypto supporters are right to highlight Bitcoin’s long-term growth story and innovative appeal, but for investors focused on the short to medium term, silver presents a more attractive opportunity. Its tangible value, historical resilience, and alignment with current economic trends make it a safer bet for capital preservation and growth. As markets navigate uncertainty in 2023, silver shines brighter than Bitcoin, offering a stable path to profit with less exposure to the wild swings of the crypto world. Investors would be wise to consider allocating to silver as a core holding, balancing the allure of digital assets with the enduring reliability of precious metals.

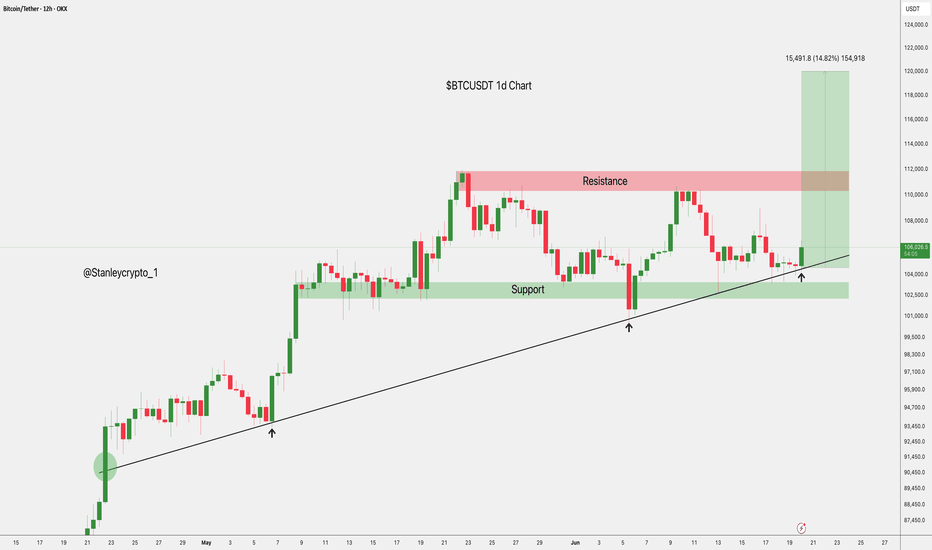

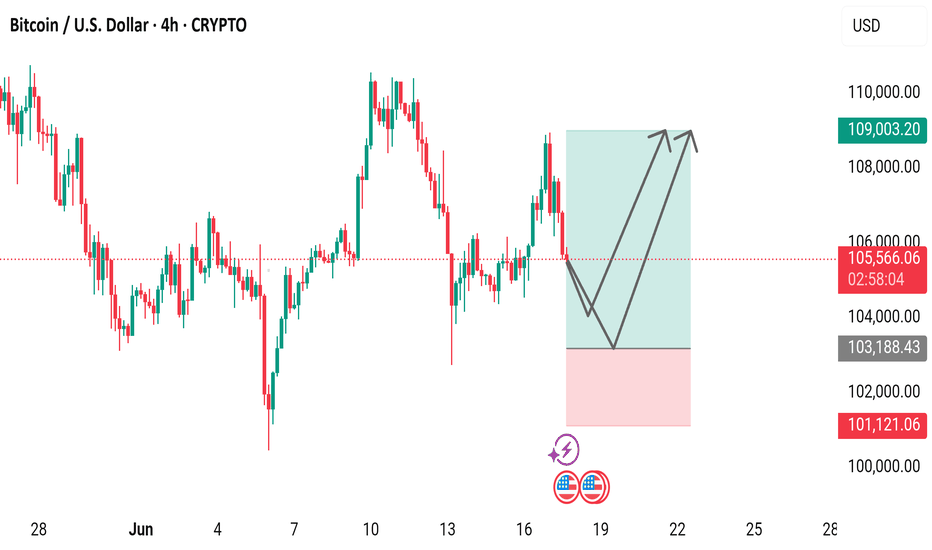

$BTCUSDT Eyes $120K After Key Support BounceBTCUSDT is holding strong above the ascending trendline and key support near $104K.

A fresh bounce suggests bullish momentum, with potential to break the $110K resistance.

If that happens, the next target could be around $120K. Trend remains bullish above support.

DYRO, NFA

continue to move accumulation: below 109,000💎 Update Plan BTC (June 20)

Notable news about BTC:

Semler Scientific (SMLR) unveiled an ambitious three-year strategy on Thursday aimed at significantly expanding its Bitcoin holdings to 105,000 BTC by the end of 2027. The announcement coincided with the appointment of a new executive to lead the firm’s digital asset initiative.

The Nasdaq-listed healthcare firm has named Joe Burnett as its Director of Bitcoin Strategy, a move it believes will strengthen its long-term treasury vision and enhance shareholder value. As part of this strategic shift, Semler Scientific plans to accumulate Bitcoin through a mix of equity and debt financing, alongside reinvested cash flows from its core business operations.

Technical analysis angle

BTC as well as XauUSD are trapped in the channel price 104k to 110k these are also two important milestones of BTC. Also congratulations to investors when detecting the bottom of 104k. The next expectation within the price channel is still maintained at 110k landmark

But with the recent moves of investors, the community is afraid that BTC will continue to adjust in the future.

==> Comments for trend reference. Wishing investors successfully trading

Bitcoin (BTC/USD) 2-Hour Candlestick Chart2-hour candlestick price movement of Bitcoin (BTC) against the U.S. Dollar (USD) as of June 20, 2025. The current price is $106,004.49, reflecting a 2-hour increase of $1,317.33 (+1.26%). The chart highlights a recent upward trend with a support level around $105,082.06 and resistance near $108,009.17. A shaded area indicates a potential price range, with a bullish projection suggested by the overlaid trendline.

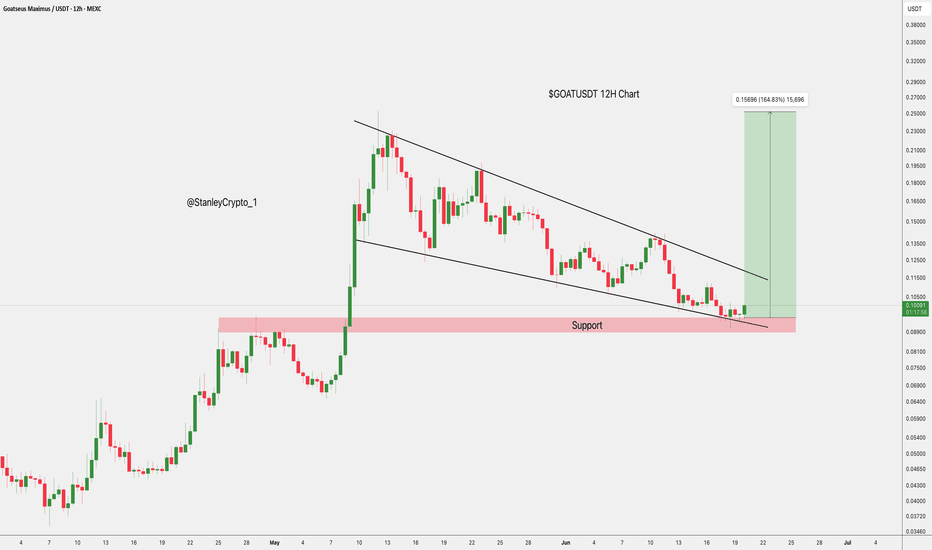

Bitcoin BTC price analysis🍿 At the OKX:BTCUSDT chart, we show one of the scenarios that could play out in the first half of June.

Much will be decided today with the opening of the US market. It is very likely that there will be a downward movement at the opening in response to the new tariffs announced by Trump on Friday after the markets closed.

🕯 Well, then we'll have to “keep our fingers crossed” that market players show their strength and hold on and buy back the drop — like say: we're tired of shaking with every crazy statement from Trump.

💰 If the price of CRYPTOCAP:BTC stays above $103k, there is a chance that it will be “stuck” in the $103-110k consolidation. The market needs to digest and redistribute the results of two months of #BTCUSD price growth from $75k to $112k.

And considering the position of the BTC.D and USDT.D indices, there is a chance that the “little bit” of capital will pass to the altcoins, and they will shoot up a little.

⁉️ Probably, the safest thing to do would be to watch the altcoins and buy only those that have started a significant upward movement with volume.

What do you think?

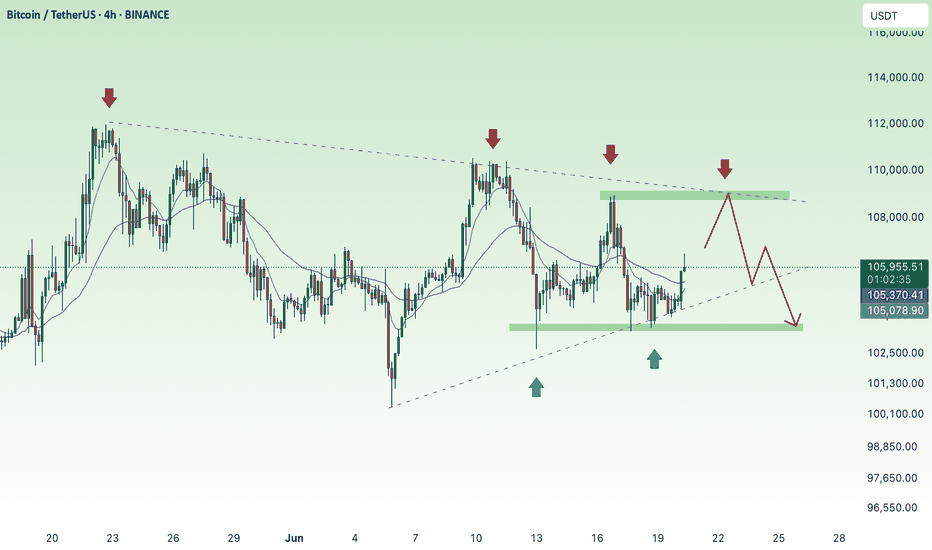

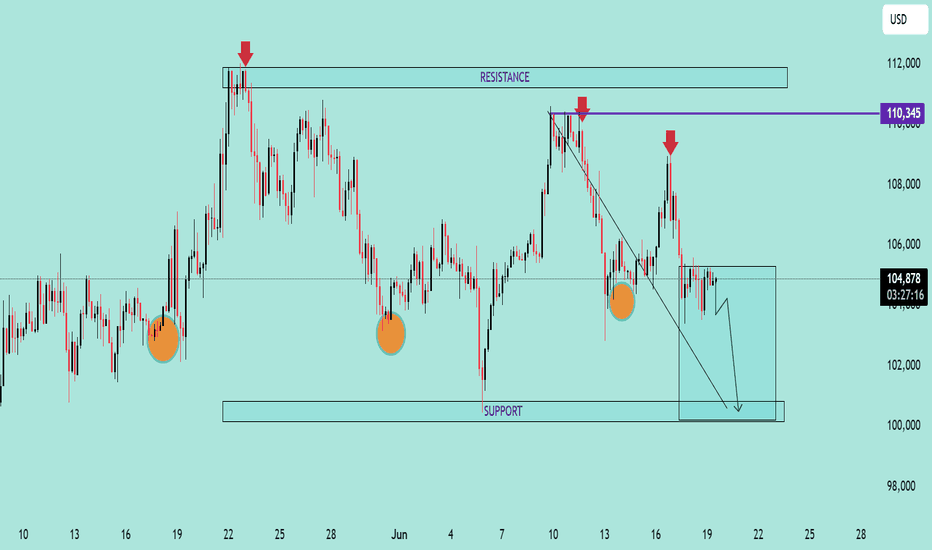

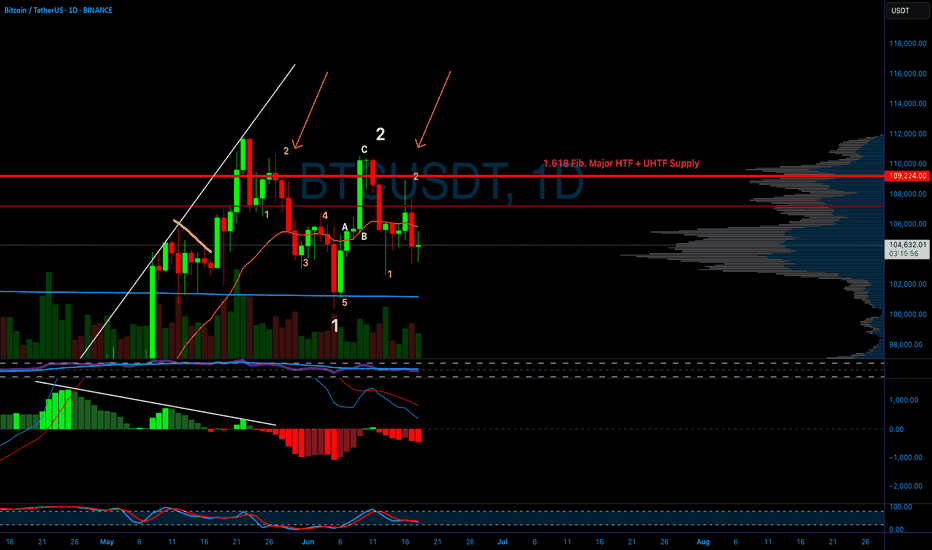

BTC/USD Bearish Outlook AnalysisBTC/USD Bearish Outlook Analysis 📉🧠

📊 Technical Overview:

The BTC/USD chart is showing signs of a bearish structure formation, suggesting increased downside momentum in the short term.

🔻 Resistance Zone:

Clear resistance is identified near $110,345, marked by multiple price rejections (🔴 red arrows).

Price failed to break above this zone several times, indicating strong selling pressure.

🔸 Support Zone:

Strong support lies near the $100,000 psychological level.

Price has respected this zone multiple times (🟠 orange circles), indicating buyer interest.

📉 Current Price Action:

A descending trendline breakout attempt failed and price is now consolidating just below $105,000.

Price is forming a bearish flag/consolidation structure after recent rejection.

A breakdown from the current box range is likely to push BTC toward the support zone at $100,000.

📉 Bearish Scenario:

If BTC breaks below $104,000, expect continuation towards $100,000.

A daily candle close below support could signal further downside.

📈 Invalidation:

Bullish invalidation occurs if BTC reclaims and closes above $108,000, with volume, retesting resistance at $110,345.

🧭 Summary:

BTC/USD is exhibiting a lower highs structure within a descending channel. Unless it breaks above the resistance zone, the bias remains bearish with a high probability of retesting support.

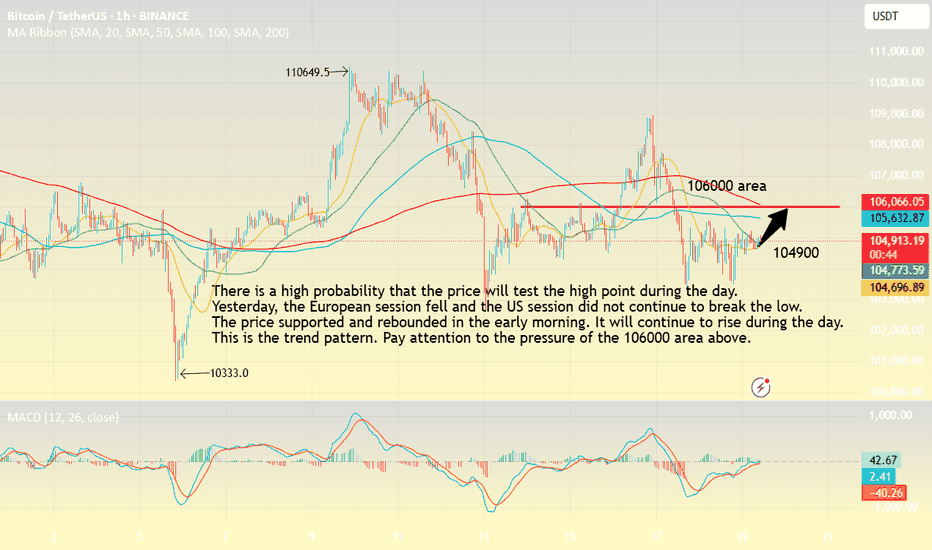

BTC-----Buy around 104900, target 106000 areaTechnical analysis of BTC contract on June 19:

Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern was a single positive line with continuous negative lines, the price was below the moving average, and the attached indicator was dead cross. The general trend of the decline was still relatively obvious, but in trading, we should pay more attention to the rhythm of the price range in the shock, so the operation should be decisive, not greedy, and do a good job of risk control; the short-cycle hourly chart yesterday's intraday support was corrected upward, the European session fell but did not continue to break down, the price support rebounded in the early morning, the current K-line pattern was a single positive line with continuous positive lines, and the attached indicator was golden cross, so it is highly likely to break through yesterday's high of 105500 area within the day.

Today's BTC short-term contract trading strategy:

Buy at the current price of 104900 area, stop loss at 104000 area, and target 106000 area;

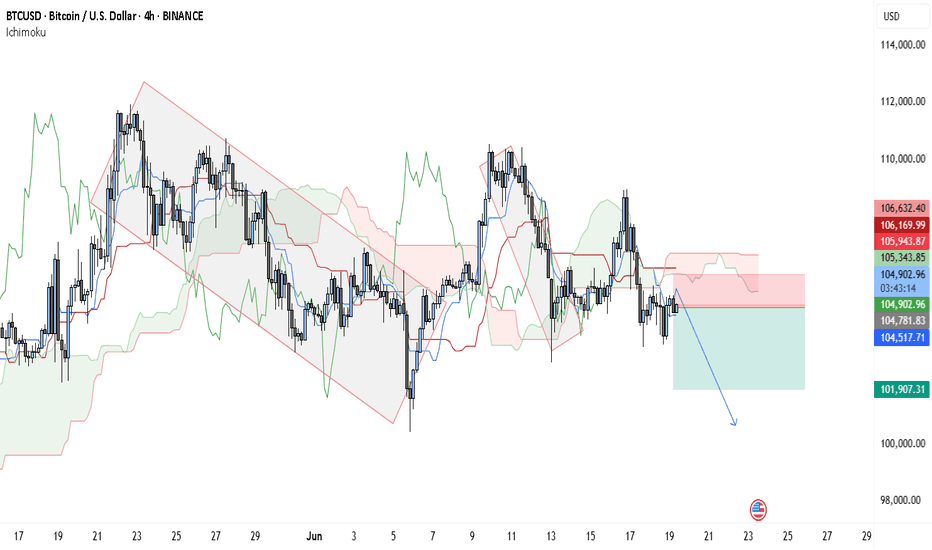

Warning: BTC Just Got Rejected HARD — Next Stop $101KBTCUSDT 4H Technical Analysis – Bearish Setup in Motion

The current 4-hour chart of BTCUSDT on Binance paints a clearly bearish picture, driven by strong confluence between the Ichimoku Cloud system, price structure, and descending trend channel. Market sentiment has shifted from indecision to downside control, and unless bulls reclaim critical zones soon, a drop toward $101,900 appears highly likely.

Ichimoku Cloud: Bearish Confirmation on Multiple Levels

The Ichimoku Cloud indicator in this setup plays a dominant role in forming the bearish bias. First, the price action has broken below the Kumo (cloud) and is currently rejecting it from the underside. This behavior alone signals a shift in sentiment, as the cloud now acts as dynamic resistance.

The Tenkan-sen (conversion line), shown in blue, has crossed below the Kijun-sen (baseline) in red—this is a strong bearish crossover. Notably, this crossover occurred below the cloud, which within Ichimoku principles is considered one of the most powerful bearish signals available. It reflects a synchronized decline in both short-term and medium-term momentum.

Furthermore, the future cloud (Senkou Span A and B projection) is flat and shaded in red, signaling weak bullish momentum ahead and strengthening the case for a downward continuation. Flat Kumo tops also indicate a magnet for price, often pulling it back for a re-test before continuation—precisely what is unfolding here.

The Chikou Span (lagging line), which plots the current price 26 periods back, is well below both the price and the Kumo. This further confirms that market sentiment, momentum, and trend direction are all biased to the downside.

Price Structure and Trend Channel

Overlaying the chart is a clearly defined descending parallel channel, capturing the recent series of lower highs and lower lows. Price has respected this channel on multiple occasions, rebounding near its bounds and reacting to its midline as dynamic support and resistance.

Currently, BTCUSDT is moving lower after retesting the mid-range of this descending channel, which aligns with the bottom of the Ichimoku Cloud. This overlap creates a powerful resistance confluence between $104,600 and $105,800—exactly where price was rejected in the most recent candle clusters.

The repeated failure to break back into the cloud shows that supply pressure is overwhelming, and bulls are losing grip of any short-term recovery.

Liquidity Zones and Risk-Reward Mapping

A red shaded area marks the resistance zone, aligning with the upper boundary of the cloud and the mid-channel structure. This region, between $104,600 and $105,900, has repeatedly acted as a rejection area and represents where sellers are currently stepping in with confidence.

Meanwhile, the projected target is highlighted through the green shaded rectangle, roughly between $101,900 and $102,200, representing the next strong demand zone and the lower boundary of the descending channel.

The downward arrow on the chart visually reinforces this bearish idea, indicating a continuation of the current momentum toward those support levels.

Trade Setup Based on Chart

This current structure provides a clean, high-probability trade opportunity for bearish traders looking to capitalize on further downside in BTC:

• Entry Zone: $104,500 – $105,000

• Stop Loss: Above $106,200 (just above cloud resistance and recent rejection wicks)

• Target: $101,900

• Risk-Reward Ratio: Approximately 1:2.3 (depending on entry)

Final Thoughts

The technical case for shorting BTCUSDT here is robust. The Ichimoku system aligns on all fronts—price below the cloud, bearish Tenkan/Kijun crossover under the Kumo, a red future cloud, and a bearish Chikou Span. On top of that, price action is obeying a descending channel and just rejected from its midpoint.

If this setup plays out as expected, BTC is likely to retest the $101,900 region before bulls attempt to regain control. Scalpers may consider dynamic trailing stops below $104,000, but positional shorts can hold with clear invalidation above the red cloud zone.

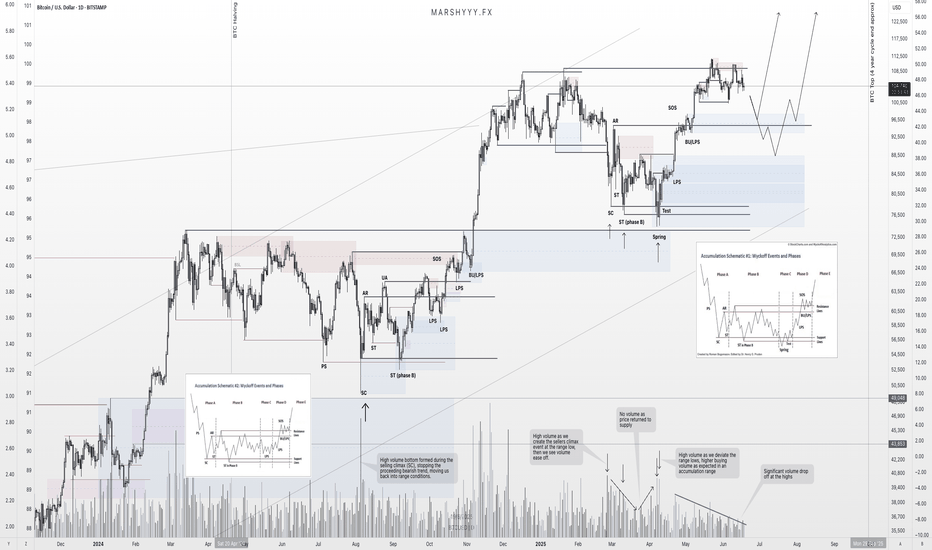

Final Shakeout Before BTC’s Last Leg Up?BTC Update

Well due update here...

Since my last forecast, price pushed higher without giving the pullback I was anticipating — instead sweeping liquidity above the prior ATH.

After taking that BSL, price stalled and has since been ranging, showing clear signs of bearish momentum creeping in. We're seeing bearish orderflow on the LTF and daily, and volume is thinning out up at these highs — not ideal for bulls.

USDT.D is also pushing higher and showing strength, which typically leans bearish for BTC in the short term. The structure on that chart is bullish and supports the idea of a BTC pullback being likely before any continuation higher.

That said, I'm still pro-trend bullish overall — as I mentioned in April — thanks to the clean bullish shift from the range lows and clear signs of accumulation. We’ve got textbook last points of support (LPS) and unmitigated demand sitting below current price, which are prime candidates for a reversal.

Right now I’m eyeing two key levels:

Upper demand zone / LPS — lining up with the top of the prior accumulation range. This has strong confluence as a breakout-retest zone.

Lower refined weekly/2W demand — valid if we see a deeper flush or capitulation leg, though less likely in the short term.

My focus is on the first level. I’ll be watching for reactions and reversal signals if price taps into it. Same logic applies to USDT.D as it approaches nearby supply zones.

Overall, I see this as a healthy correction — overdue after an extended leg — and expect BTC to push higher and break ATHs once demand is retested and confirmed.

Zooming out: the 4-year cycle is approaching its final stages, with data suggesting a cycle top could form around Q3/Q4 2025 — likely between August and October, if past cycles rhyme. I’ll be monitoring major assets against that timeline and will look to scale out and risk-off when the confluences begin aligning with that macro cycle window.

Just think...

1 last BTC leg up...

Final altseason hype to drag in latecomers...

Then the cycle ends — and the trap shuts as we re-enter bear territory.

Charts:

1D:

3D:

1W:

Extra:

1M:

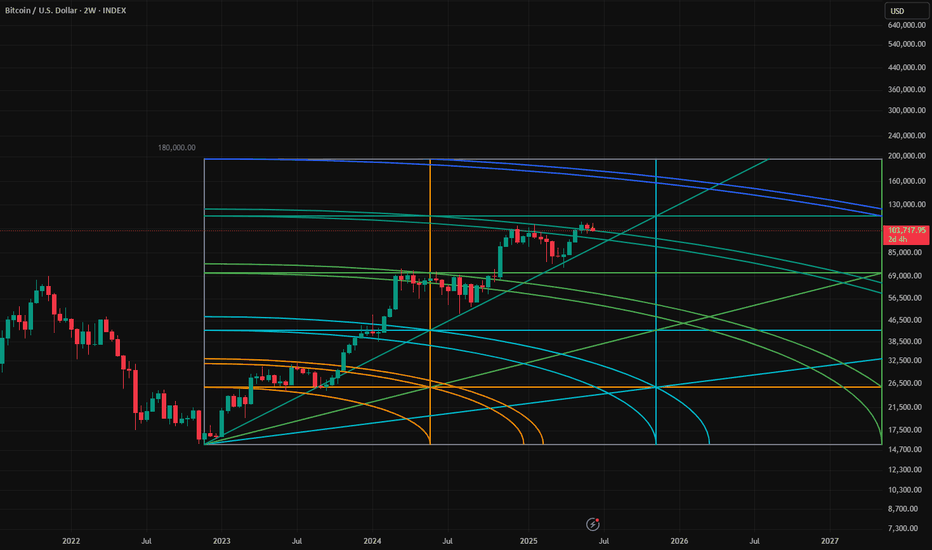

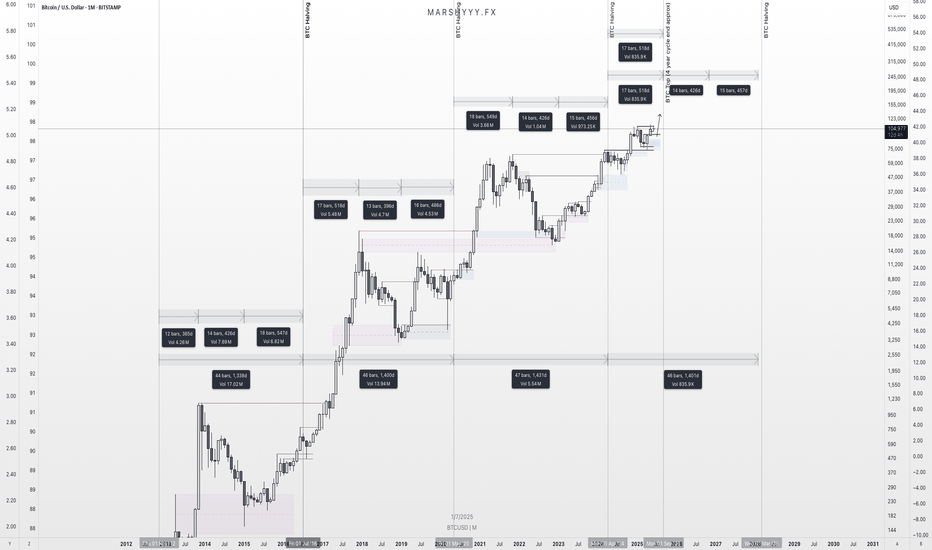

Bitcoin 4-Year Cycle Structure – Technical BreakdownBitcoin 4-Year Cycle Structure – Technical Breakdown

This chart examines Bitcoin’s historical 4-year cycle behaviour, focusing on the repeating market structure observed across the last three cycles: Bull Market → Bear Market → Accumulation/Recovery → Halving → Expansion.

Key Observations:

🔹 Cycle Timing Consistency

Each of the past three cycles has shown a consistent duration between the halving and the final bull market peak—typically between 500–550 days. Based on that timing, the current cycle suggests we are still ~100 days away from a potential macro top.

🔹 Post-Halving Correction is Expected

Corrections shortly after the halving have historically marked mid-cycle retracements, not macro tops. The current pullback is structurally aligned with the 2017 and 2021 expansions, where Bitcoin consolidated before pushing to final highs.

🔹 Altcoin Market Segments Lagging

TOTAL2 (Total Market Cap excluding BTC)

TOTAL3 (Excluding BTC & ETH)

OTHERS (Altcoins excluding top 10 by market cap)

All remain below their prior cycle all-time highs, which historically occurs before the full market cycle concludes. These segments often accelerate after BTC has established dominance, typically in the later stages of the bull market.

🔹 USDT Dominance Suggests More Upside

USDT.D is still trending down, which historically reflects increasing risk appetite and capital rotation into crypto assets. Prior cycle tops have aligned with much lower dominance levels, indicating further downside risk for USDT.D, and potential upside for crypto markets.

Conclusion:

Despite short-term volatility, the technical structure across Bitcoin and broader market indicators suggests the cycle remains in its expansion phase. Timing models, altcoin lag, and dominance signals all point to further upside potential before a full cycle peak is in.

1W:

1M: