Btcusdanalysis

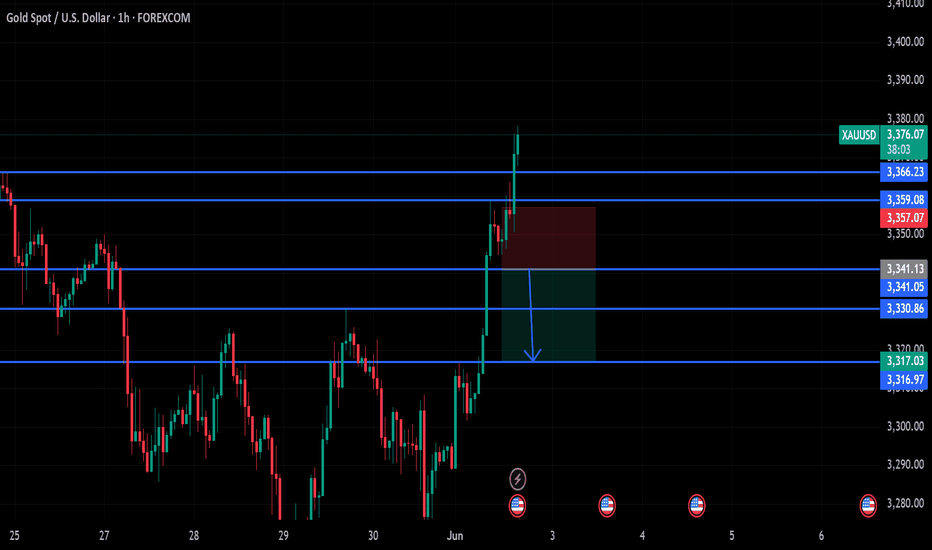

BTC/USDT – Retest in Play After Breakdown!Bitcoin broke below its 4H ascending trendline and is now showing signs of a retest at the broken trendline zone.

It tried to break the immediate resistance of $105,100 but couldn't sustain it.

📉 Breakdown confirmed

Key Levels:

Resistance: $105,968 | $108,941

Support: $101,539 | $97,205

Bearish Target remains near $97K if rejection holds

Watch how the price reacts here — rejection could lead to further downside. A break back above $105K may invalidate the move.

#Bitcoin #BTCUSDT #CryptoTrading #TechnicalAnalysis #TrendlineBreak #Retest #BearishSetup #PriceAction

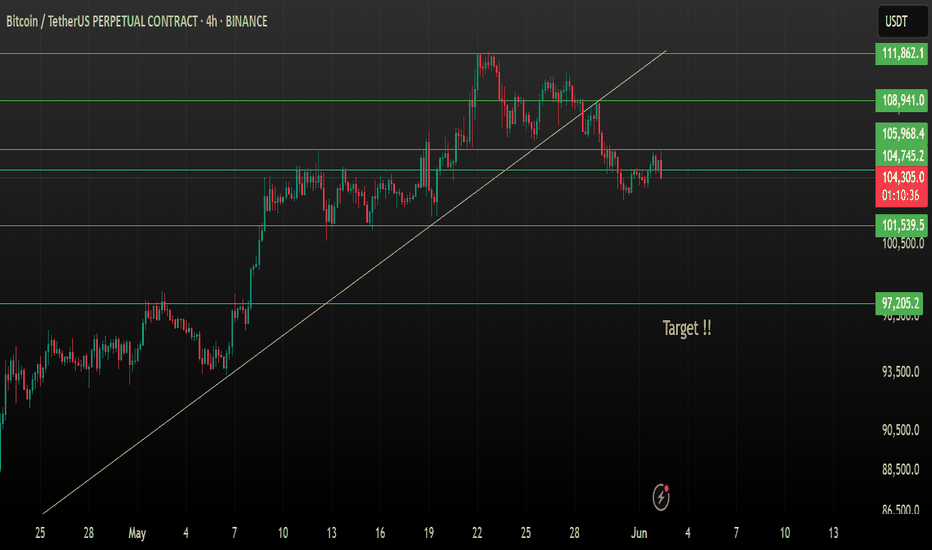

BTCUSD Breakdown Incoming? 4H Chart Flags Key Bearish Entry🔵 Entry Point (Sell Limit / Market Entry)

• Around $104,600 – $104,700

This area aligns with the retest of the descending trend line and a weak resistance zone. Price is reacting negatively after hitting this level.

🟥 Stop Loss

• $107,060

Placed just above the weak resistance. This protects the trade in case price breaks structure and invalidates the bearish setup.

🟩 Take Profit Targets

1. TP1: $101,818 (Support 1)

o First major support zone; price has bounced here previously.

2. TP2: $98,020 (Support 2)

o Deeper support and more aggressive target. Aligned with previous wick lows.

🔺 Chart Observations

• Trend Line: Still intact and respected. Price rejected it on the latest retest.

• Structure: Lower highs and lower lows show bearish momentum.

• Volume/Volatility: Tapering candles around resistance indicate weakening bullish attempts.

• Risk-to-Reward

o TP1 R:R ≈ 1.3:1

o TP2 R:R ≈ 2.5:1+

⚠️ Scalper Note

If you’re trading this as a scalp, consider securing partial profits at TP1 and moving SL to breakeven to protect gains. Volatility around macro events or news (like the red event icons near June 3–5) could trigger wicks.

Would you like me to add RSI, MACD, or EMA confluence to strengthen the setup further?

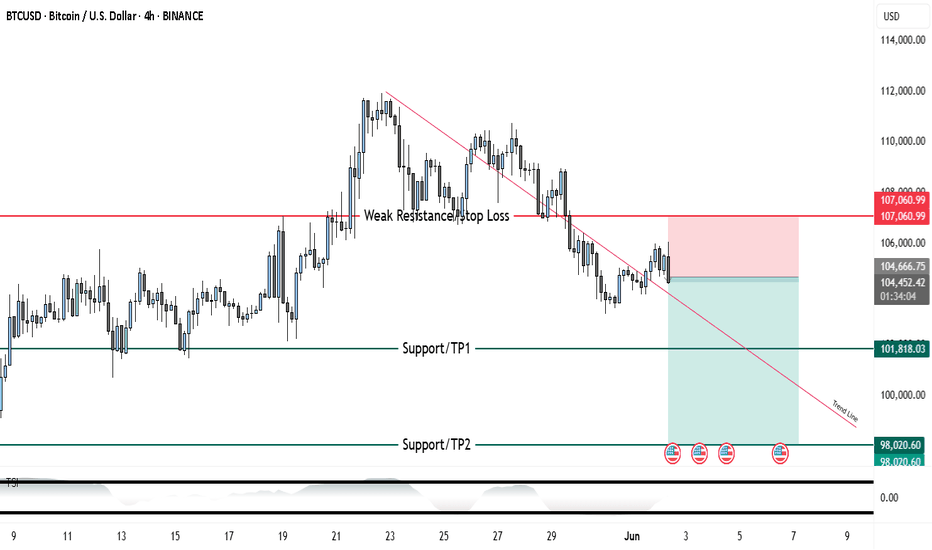

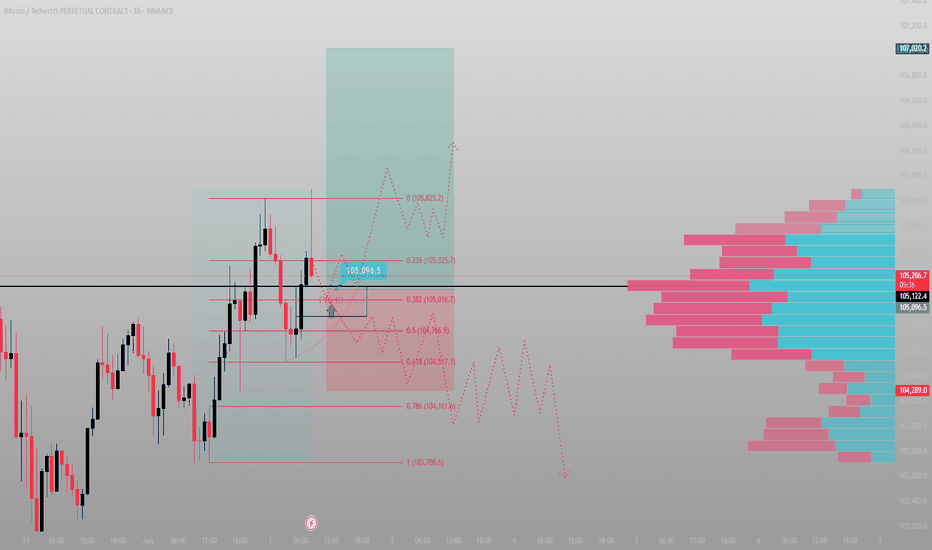

BTC didn’t dump — it tapped.BTC reached into the 1H FVG and wicked just above the OB at 104,204 — delivering premium liquidity and then reversing.

Most are staring at red candles, but the real story is the reaction zone:

Price tagged the 0.618 level (104,559) with precision and reversed with displacement.

Now what?

We're mid-delivery. If BTC can reclaim 104,800–105,000 (mid OB/FVG confluence), a strong move into 105,865 is likely — potentially sweeping for external liquidity near 106k.

Execution Plan:

Entry: 104,600–104,700 range

SL: 104,200 or beneath 103,752 swing

TP1: 105,365

TP2: 106,000+

Key invalidation: clean break below 104,200 with volume

Bias: Bullish while above 104,200

Why: Fair Value Gap fill + OB + 0.618 convergence + responsive wick

This wasn’t a sell-off.

This was a setup.

Most called rejection. I called reaccumulation — mid-trade.This wasn’t luck. It was structure.

BTC tapped directly into the 1H Fair Value Gap at 105,016 — precisely the overlap with 0.382 fib and the volume imbalance from the prior impulse. Price didn’t just react. It delivered confirmation. Fast.

Entry was clean, risk tight — and the invalidation was defined. Below 104,517, I’m out. No emotion. Just system.

I’m now watching the 105,325–105,825 pocket. That’s where the thin volume zone transitions back into resistance — and where trapped shorts begin to feel the heat.

If price breaks and holds above 105,900, expect a swift drive into 106.7–107.0 before further consolidation.

Execution clarity:

✅ Entry: FVG 1H — 105,016

🎯 TP1: 105,825

🔒 Stop: 104,517

🔓 R:R = 2.38, no drawdown, full intent

Most wait for confirmation.

I act at the point of imbalance — not after it’s obvious.

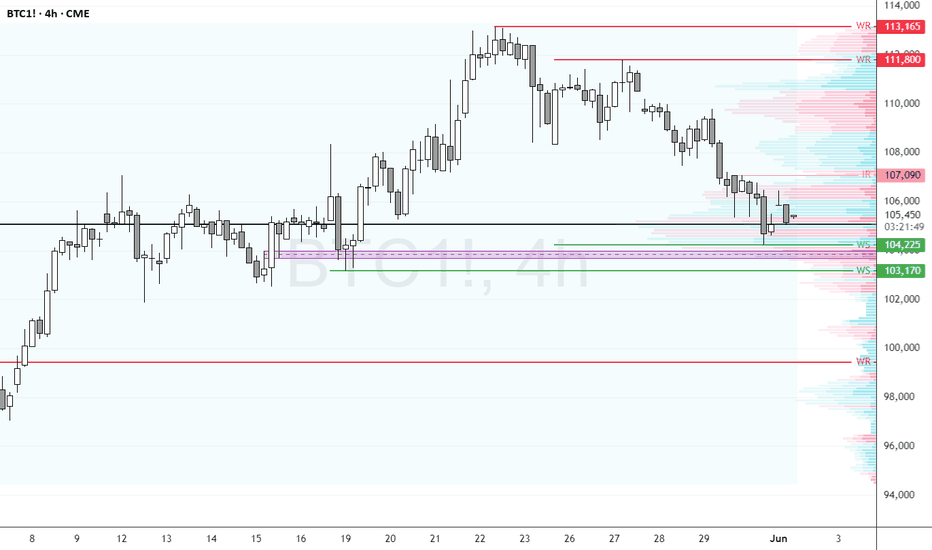

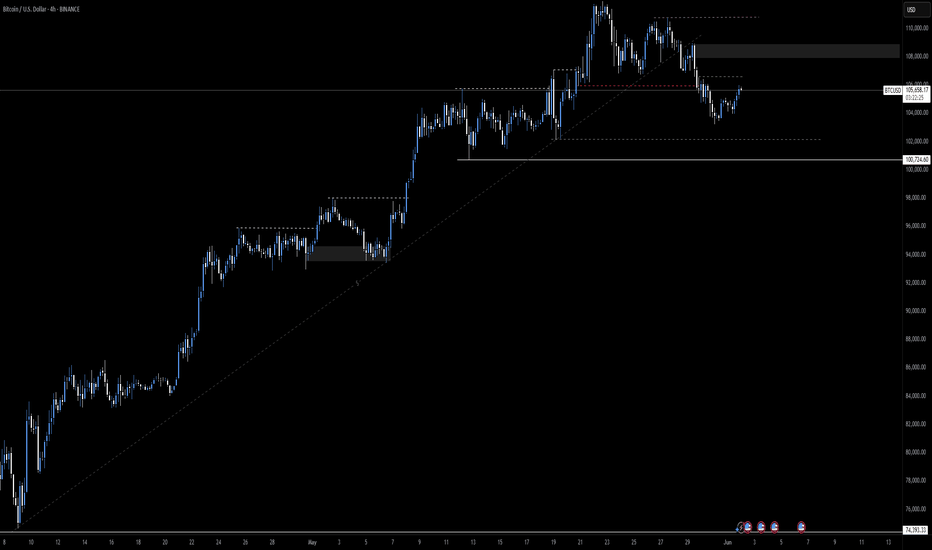

BTC Faces Critical Resistance—Breakout or Further Decline?FenzoFx—Bitcoin continues its bearish trend after hitting its 2025 all-time high at 113,165. BTC/USD is currently trading near $105,400, a high-volume area where price could either bounce or break lower.

The key resistance level rests at $103,170, supported by a bullish Fair Value Gap. If price holds above this zone, Bitcoin could rise toward $107,090.

However, a close below $103,170 would invalidate the bullish outlook, with the next bearish target at $99,435.

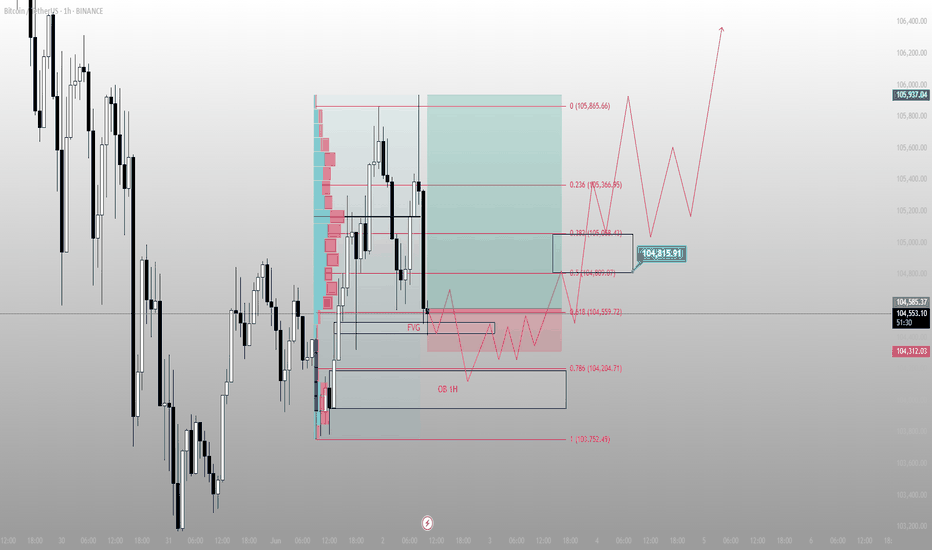

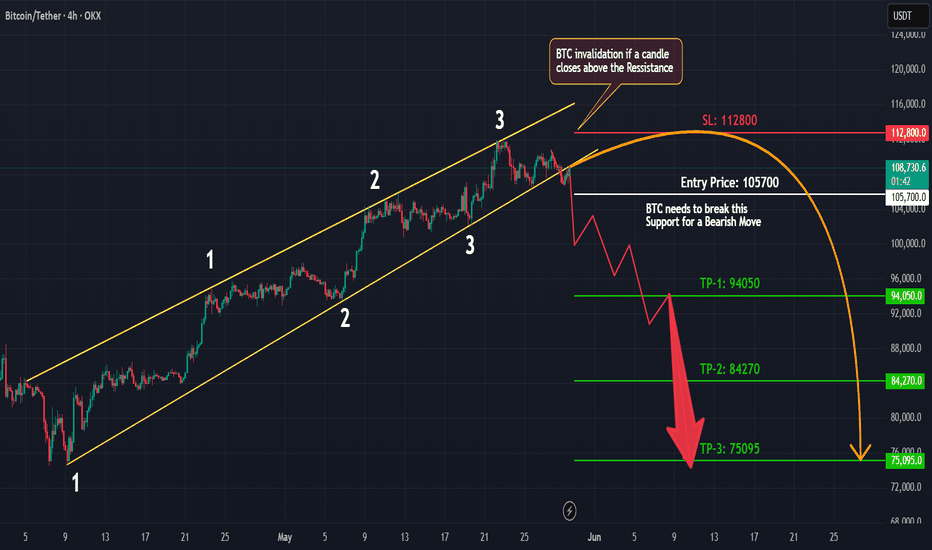

BTC Trendline Breakdown? Bearish Setup Brewing!📉 #Bitcoin has recently broken its key trendline after making a new All-Time High (ATH). This could be the first major sign of a trend reversal. Here’s what we’re seeing:

🔹 Trendline Broken: The uptrend has been broken — a significant technical signal.

🔹 Retesting the Break: Price is currently retesting the broken trendline, a classic move before continuation.

🔹 Triple Touch Confirmation: The trendline was respected with 3 clear touches during the uptrend — increasing the validity of this break.

🔹 Support Still Holding: We’re watching a major support level below — a break here would confirm bearish momentum.

🚨 Strategy Plan:

If the support level breaks and #BTC retests it as resistance, we’re planning a short position with strict risk management. Patience is key — wait for confirmation before entering!

🛡️ Risk Management First. Always.

Don't rush into a trade — wait for a clean breakdown and retest for a high-probability entry.

📊 What do you think? Is #BTC ready to reverse, or will the bulls defend the trend?

👇 Drop your thoughts in the comments.

❤️ Like this idea if it helped you.

✅ Follow for more #BTC setups and real-time updates!

#BTCUSD #Bitcoin #CryptoTrading #TrendlineBreak #ShortSetup #TechnicalAnalysis #BearishReversal #PriceAction #TradingStrategy

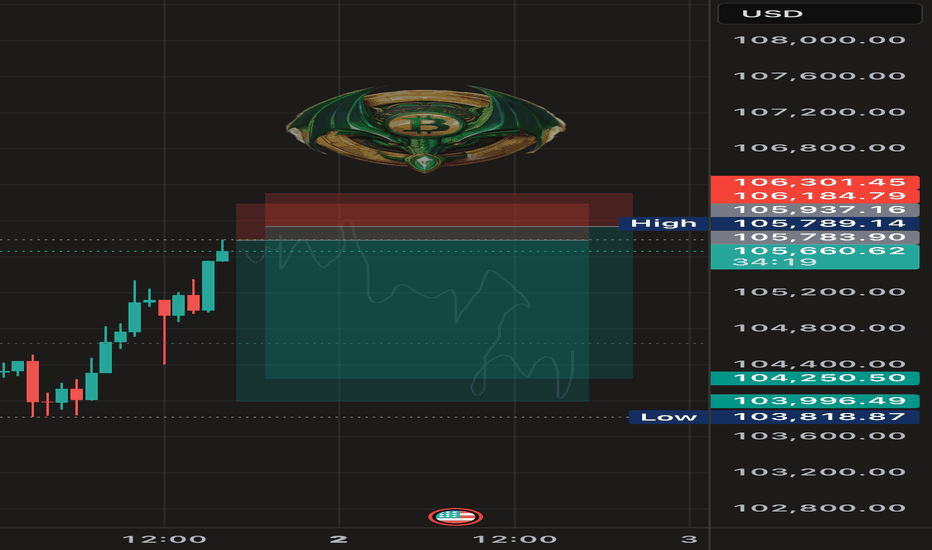

BTC SHORT TP:104,100 01-06-2025🚨 SHORT

Entry zone: 105,600 – 105,800

Target zone: 104,000 – 104,300

RR: 4.4

Timeframe: 1H – 2H

Estimated duration: 20 to 24 hours

We’re in a Sunday distribution + manipulation zone. There might still be a small final push to the upside, but the setup shows signs of exhaustion. Use a tight stop or adapt it to your risk profile.

If the move doesn’t happen within the estimated time, this setup is invalid.

We don’t use indicators, we’re not out here drawing lines or cute little shapes — I just give you a clean trade.

#BTC #Short #PriceAction

Bitcoin (BTC) Market Analysis1. Previous Analysis Validation

Our previous week's analysis played out perfectly, aligning well with the market movement.

2. Current Market Sentiment

The market remains bearish overall. However, we are seeing a short-term price pump, likely due to late short positions entering the market. This is resulting in a price move to trigger short liquidations. The recent 4H swing highs are acting as key stop-loss zones.

3. Imbalance & Rebalancing

The price is moving upward toward a daily imbalance area (highlighted in orange). We expect the market to rebalance in this zone, potentially leading to a price rejection and continuation of the downward trend.

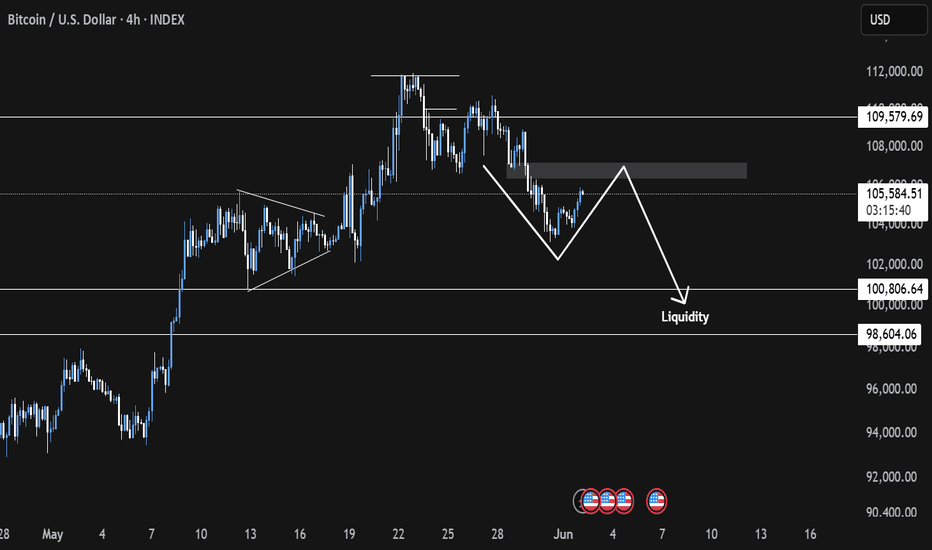

4. Liquidity Zone

Our primary liquidity zone lies between \$100K and \$98K. We anticipate this area to be a key region for price reaction.

BTC TO $74KPrice took off a strong bullish momentum from 74,500. Now buyers are beginning to show signs of weakness after a mitigation block triggered a market shift and we can finally see sellers stepping back into the market. If 108,000 holds as resistance, we will get a new trend and momentum to the downside to 75,000

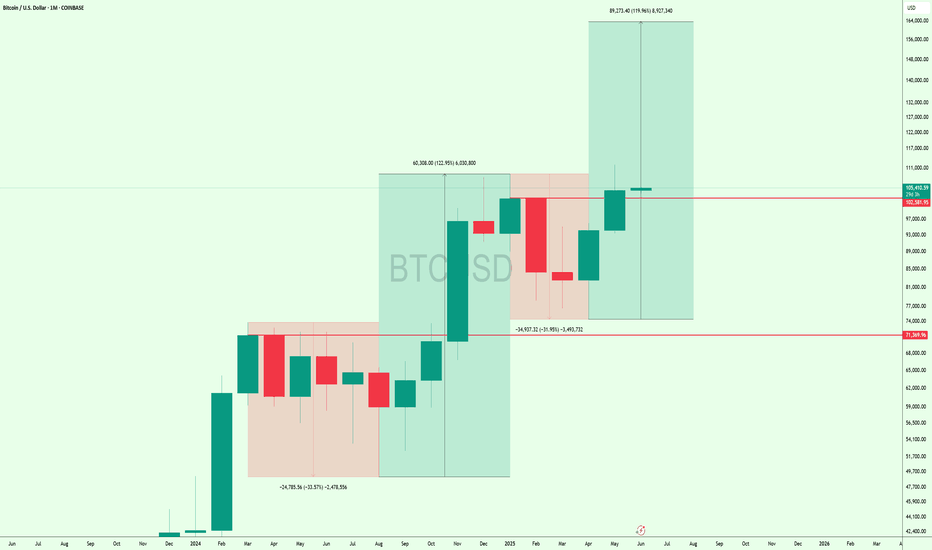

This Is Not a Top – It’s the Beginning of the Mega Bull RunThis is the monthly #Bitcoin chart, and honestly, how can anyone be bearish here?

CRYPTOCAP:BTC just bounced after a -31.95% correction and is now holding strong above the $101K breakout zone.

Last time, a similar setup led to a 122% pump... and this time, we could be looking at a move toward $160K that's 120% upside from here.

We’re likely entering the biggest bull market ever.

Get ready. 🚀

Unmasking the "Intrinsic Value" Debate Between Gold vs BTCFool's Gold? Unmasking the "Intrinsic Value" Debate Between Gold and Bitcoin

The assertion is a familiar one, a well-worn cudgel in the ongoing debate between traditional assets and their digital counterparts: "Gold has intrinsic value that Bitcoin doesn't." This statement often serves as the bedrock for arguments championing the yellow metal's timeless appeal while dismissing cryptocurrency as mere speculative froth. But what if this foundational claim, this appeal to gold's inherent, undeniable worth, is built on shakier ground than its proponents believe? What if the very notion of "intrinsic value" as applied to these assets is a misunderstanding, a convenient narrative rather than an objective truth?

This exploration will journey into the heart of this debate, dissecting the concept of intrinsic value and examining how it truly applies – or doesn't – to both gold and Bitcoin. We will scrutinize gold's much-vaunted industrial utility against the backdrop of its vast above-ground stocks and its overwhelming monetary premium. We will consider whether value is indeed an inherent property of an object or a subjective judgment made by individuals. Ultimately, by challenging long-held assumptions, we aim to illuminate the real sources of value for both the ancient metal and the modern digital asset, moving beyond simplistic labels to a more nuanced understanding.

1. The Elusive Nature of "Intrinsic Value"

Before we can meaningfully discuss whether gold or Bitcoin possesses intrinsic value, we must grapple with the term itself. In the realm of corporate finance, "intrinsic value" refers to the fundamental worth of a company, derived from an analysis of its assets, earnings potential, cash flows, and overall financial health. It's an attempt to ascertain what a stock should be worth, independent of its fluctuating market price. This is the world of discounted cash flow models and balance sheet scrutiny.

However, this definition struggles when applied to commodities or currencies. Gold, like Bitcoin, does not generate cash flows. It doesn't pay dividends or have earnings reports. As one observer noted, gold and Bitcoin are commodities that have a spot price; their "value" is essentially what someone is willing to pay for them at a given moment. Companies, by contrast, can have an intrinsic value tied to the future economic benefits they are expected to produce for their owners.

So, when advocates claim gold has intrinsic value, they are often pointing to something else entirely. Usually, this encompasses its tangible, physical nature – you can hold it, feel its weight. It also refers to its historical use as money and a store of value over millennia. And crucially, it implies a baseline worth derived from its utility in practical applications, particularly in industry. One might even argue, as some have, that there is simply "no such thing as intrinsic value" in an absolute sense; value is not a property embedded within an object but is assigned to it by human beings.

2. Gold's Industrial Utility: A Gilded Facade?

The argument that gold's industrial use underpins its intrinsic value is perhaps the most frequently cited. "But it's used in microchips!" is a common, almost reflexive, defense. And it's true: gold's excellent conductivity, resistance to corrosion, and malleability make it a valuable component in high-end electronics, dentistry, aerospace, and certain medical applications. But the critical question is not whether gold has industrial uses, but how much these uses contribute to its overall market price.

Consider the data for a recent year, say 2024. Global industrial gold consumption was approximately 330 tonnes. However, a staggering 90% of this demand, around 297 tonnes, was met by recycling existing gold scrap, a process that can cost as little as tens of dollars per ounce. This leaves a mere 33 tonnes of new gold required from mining to satisfy the entirety of industrial needs not covered by recycling.

Now, compare this to the annual mine production. In that same year, about 3,700 tonnes of gold were newly extracted from the earth. This means that less than 1% (33 tonnes out of 3,700 tonnes) of all newly mined gold was actually needed for industrial purposes. The vast majority, over 99%, went elsewhere – primarily into jewelry, bars, and coins, all forms of value storage.

The disparity becomes even more dramatic when we consider the total above-ground stock of gold held for these value-storage purposes. This figure stands at roughly 184,000 tonnes. If, hypothetically, gold were to suddenly lose its allure as jewelry and its status as a monetary asset, and this colossal hoard were redirected to meet industrial needs (the 33 tonnes per year not covered by recycling), we would have enough gold to last for approximately 5,600 years at current industrial consumption rates. And this is without digging a single new ounce out of the ground. Much of this 184,000-tonne supply could potentially be acquired at prices far closer to the low cost of recycling than the current market price of newly mined gold.

As one commenter aptly put it, if gold's value was solely based on industrial demand, it "would be nearly worthless" compared to its current valuation. While gold does possess certain unique properties that make it useful, these applications are a drop in the ocean when explaining its price. The idea that its utility in microchips or dental fillings provides a significant "floor" for its value is, upon closer inspection, largely a myth.

3. The Towering Monetary Premium: Where Gold's Value Truly Lies

If industrial use accounts for such a tiny fraction of gold's demand and price, what explains the rest? The answer is its "monetary premium." This is the portion of an asset's price that exceeds its direct use-value as a commodity. For gold, this premium is immense, built over centuries of human history and cultural adoption.

Gold's journey as money began thousands of years ago. Its inherent characteristics – it doesn't rust or tarnish (durability), it's relatively rare (scarcity), it's easily recognizable and has a pleasing aesthetic (acceptability), it can be melted and reformed (divisibility and fungibility), and it's dense (portability of value) – made it a superior choice for a medium of exchange and store of value in pre-industrial societies. This long history has ingrained gold into the collective human consciousness as something inherently valuable. There's a certain "magical power," as one person described it, to the shiny yellow metal, a testament to its enduring legacy.

This historical precedent and the deep-seated belief in its enduring worth are what sustain gold's monetary premium. Central banks hold it in their reserves. Individuals purchase it in the form of jewelry (which, in many cultures, serves as a primary store of family wealth) and invest in bars and coins, not primarily for its practical applications, but because they trust it will preserve purchasing power or be desired by others in the future. This shared belief, this social consensus, is the bedrock of gold's value far more than its limited industrial applications. Some estimate this monetary premium to be as high as 90% of its total price, with the remaining 10% attributable to its use in jewelry and industry.

4. The Shifting Sands of Perceived Value

The notion that value is intrinsic and immutable is challenged by history itself. Value, as many economists and observers contend, is not an inherent property of an object but is determined by human perception and utility, which can and do change over time.

Consider aluminum. There was a time when aluminum was exceedingly rare and difficult to extract, making it more precious than gold. The capstone of the Washington Monument, completed in the late 19th century, was made of aluminum to signify its value and the technological prowess of the era. Today, thanks to advancements in refining processes, aluminum is abundant and inexpensive. We use it to wrap sandwiches, a far cry from its days as a "precious" metal adorning national monuments.

Similarly, Tyrian purple dye, derived from sea snails, was once so costly and labor-intensive to produce that its use was reserved for royalty and the highest echelons of society. It symbolized power and status. The invention of synthetic dyes in the 19th century made purple accessible to everyone, and the immense value once attached to the natural version evaporated.

These examples powerfully illustrate that what society deems valuable is not fixed. It is contingent on factors like scarcity (natural or artificial), the current state of technology, cultural significance, and collective human agreement. If gold's value is predominantly a monetary premium built on historical consensus and aesthetic appeal, then it too is subject to these shifting sands of human perception. The humorous desire to one day wrap sandwiches in gold foil, should it lose its monetary status, underscores this potential for radical revaluation.

5. Bitcoin's Utility: Solving Problems of the Digital Age

If gold's claim to "intrinsic value" through industrial use is tenuous, and its primary value stems from a historically constructed monetary premium, how does Bitcoin compare? Critics often dismiss Bitcoin as having no utility beyond speculation, a digital tulip mania. However, this perspective often overlooks the specific problems Bitcoin was designed to address and the unique properties it offers in the 21st century.

Bitcoin emerged in the wake of the 2008 financial crisis as a "peer-to-peer electronic cash system," aiming to provide an alternative to the traditional financial system. Its utility lies in its ability to offer:

• Decentralization: No single entity, corporation, or government controls the Bitcoin network. It operates on a distributed ledger (the blockchain) maintained by thousands of computers worldwide. This makes it resistant to control or shutdown by any central authority.

• Permissionless Access: Anyone with an internet connection can participate in the Bitcoin network – send, receive, and store value – without needing permission from a bank or government.

• Censorship Resistance: Once transactions are confirmed and added to the blockchain, they are extremely difficult to alter or reverse. This makes it a powerful tool for individuals in environments where financial censorship is a concern.

• Provable Scarcity: The Bitcoin protocol dictates that there will only ever be a maximum of 21 million bitcoins. This hard cap on supply is a fundamental aspect of its design, making it a verifiably scarce digital asset. This contrasts with gold, where new supply is continuously mined each year, estimated by some to be around 1.5-2% of the existing above-ground stock, arguably diluting its value over time.

• Portability and Divisibility: Bitcoin is incredibly portable. Vast sums can be "carried" on a tiny device or even memorized as a seed phrase, and transferred across the globe in minutes for relatively low fees. It is also highly divisible, down to one hundred millionth of a bitcoin (a "satoshi"), facilitating transactions of various sizes.

• Verifiability: The authenticity and transaction history of every bitcoin can be publicly verified on the blockchain, eliminating the need for trust in intermediaries for this purpose.

• Durability: As a digital asset secured by a vast, decentralized network, Bitcoin is highly durable as long as the network itself remains operational and secure.

A crucial real-world utility, highlighted by observers, is Bitcoin's ability to bypass capital controls. For individuals in countries with restrictive financial regimes, Bitcoin offers a means to transact and move value across borders with a degree of freedom not possible through traditional channels. This is not a speculative feature; it is a tangible benefit solving a real problem for many.

While the number of people using Bitcoin worldwide is still relatively small compared to users of traditional financial systems, its adoption is growing. Like any transformative technology, its utility is being discovered and leveraged by an expanding user base. Its "intrinsic value," if we are to use that term, lies in its capacity to fulfill these unique functions.

6. Gold vs. Bitcoin: A Clash of Properties

When we compare gold and Bitcoin based on properties often associated with a store of value or monetary good, distinct profiles emerge:

• Tangibility: Gold is physical; you can touch it. This offers a psychological comfort that some find reassuring. Bitcoin is digital; its existence is as code and ledger entries. Its "possession" is through control of cryptographic private keys.

• Industrial Utility: Gold has limited industrial uses that account for a tiny fraction of its price. Bitcoin's "industrial utility" is the operation of its network as a global system for value transfer and verification.

• Scarcity: Gold is naturally scarce, but its total earthly and cosmic abundance is unknown, and new supply is constantly mined. Bitcoin has absolute, programmable scarcity with a fixed supply cap.

• Portability: Moving large amounts of gold is cumbersome, expensive, and risky. Bitcoin is exceptionally portable.

• Divisibility: Gold can be physically divided, but it's not a seamless process. Bitcoin is easily and precisely divisible.

• Verifiability: Authenticating gold requires specialized knowledge and tools; it can be faked. Bitcoin transactions and holdings are verifiable with mathematical certainty on its public ledger.

• Durability: Gold is physically very durable. Bitcoin, as a digital protocol, is durable as long as its decentralized network is maintained and secured.

• Historical Precedent: Gold boasts millennia of use. Bitcoin is a little over a decade old, a mere infant by comparison.

• Censorship/Seizure Resistance: Physical gold can be, and has been, confiscated. Self-custodied Bitcoin, with properly secured private keys, is highly resistant to censorship and seizure.

This comparison reveals that while gold's strengths lie in its long history and physical presence, Bitcoin excels in areas like absolute scarcity, portability, divisibility, verifiability, and censorship resistance – attributes that are arguably increasingly valuable in an increasingly digital and interconnected global landscape.

7. The "Next Person" Fallacy and the Foundation of Value

A common critique leveled at both gold (for its monetary premium) and Bitcoin is that their value depends solely on "the next person being willing to buy it." In a sense, this is true for any asset that isn't consumed directly or doesn't produce cash flows. The value of a collectible, a piece of art, or indeed a monetary good, is ultimately what someone else is prepared to exchange for it.

However, this doesn't mean their value is arbitrary or baseless. The willingness of the "next person" to buy is predicated on a shared understanding or belief in the asset's desirable properties and its potential to retain or increase its value. For gold, this belief is built on thousands of years of tradition and its perceived enduring qualities. For Bitcoin, this belief is growing based on its unique technological attributes, its potential to solve modern financial problems, and its emerging network effects. The more people who recognize and utilize these properties, the stronger the shared belief, and thus the more robust its value becomes.

8. The Cost of Production and the Illusion of a Price Floor

Some argue that gold's price cannot fall below its cost of extraction, suggesting this provides a natural price floor. While it's true that miners would cease operations if the price fell below their production costs for a sustained period, this argument largely ignores the colossal 184,000 tonnes of gold already above ground and held primarily for monetary or aesthetic purposes. If this massive hoard were to lose its monetary premium and be dumped onto the market, the price could plummet dramatically, far below current mining costs, until it reached a level where industrial demand (or perhaps a new, much lower equilibrium for aesthetic use) could absorb it. Much of this existing stock could be made available at recycling costs, which are significantly lower than mining costs. The "cost of production" floor applies primarily to newly added supply, not to the revaluation of existing, hoarded stock.

Conclusion: Beyond Intrinsic – Value in Utility and Belief

The debate over whether gold has "intrinsic value" that Bitcoin lacks often misses the mark by clinging to a nebulous and misapplied concept. If "intrinsic value" refers to a baseline worth derived from non-monetary, practical utility, then gold's claim is surprisingly weak. Its industrial applications are minimal compared to its price, which is overwhelmingly a monetary premium built on centuries of human belief, cultural acceptance, and its historical role as money.

Value, ultimately, is not an inherent property magically residing within an object. It is a subjective judgment made by individuals, a reflection of an asset's perceived utility and the collective belief in its future desirability. Gold has served humanity well as a store of value due to a set of physical properties that were optimal for pre-digital eras. Bitcoin, a product of the digital age, offers a different set of properties – provable scarcity, decentralization, censorship resistance, and unparalleled portability – that address the challenges and opportunities of our modern world.

Neither gold's sheen nor Bitcoin's bits possess a mystical "intrinsic value" independent of human perception and use. Gold's value is rooted in its long history and the enduring human affinity for its beauty and permanence. Bitcoin's burgeoning value is rooted in its innovative technology and its potential to offer a new paradigm for money and value transfer. Both are valuable because, and only because, people believe them to be. The critical difference lies in the reasons for that belief and the problems each asset is perceived to solve. As the world continues to evolve, so too will our understanding and assignment of value.

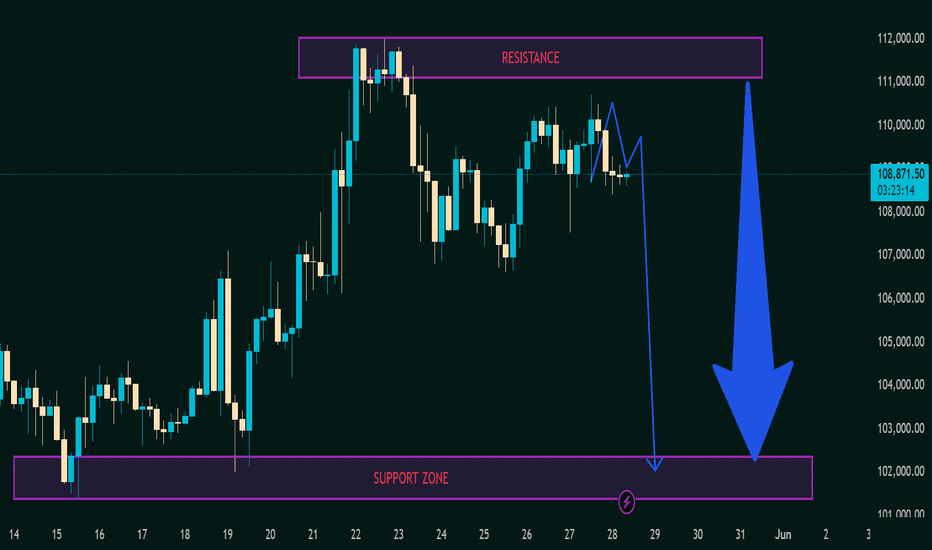

BTCUSDT Price Analysis – Potential Drop Incoming! 🔲 Chart Zones

🟥 Resistance Zone (~111,000–112,000):

Price has touched this zone multiple times and failed to break higher – this is a strong resistance area. 🚫📈

🟪 Support Zone (~101,000–102,000):

A historically strong demand area where price previously bounced up. 💪📉

🔍 Current Price Behavior

📊 Price Level: Around 108,666.66

🔄 The chart shows lower highs forming, indicating weakening bullish momentum.

📉 Bearish projection drawn (blue zigzag line) suggests a potential double top forming below resistance.

📉 What’s Expected?

🔵 Big Drop Alert! ⬇️

If the price fails to break above and gets rejected again, the chart predicts a sharp move down toward the support zone.

🎯 Target Area: ~101,000–102,000 (Support zone)

📌 Summary

🧱 Resistance holding strong

💤 Momentum slowing down

⚠️ Bearish move likely

🏹 Targeting support zone for potential bounce

⚠️ Trading Tip 🧠

Watch for confirmation before entering trades! A break below the recent lows could trigger a short opportunity, while a bounce near support could offer a buy setup. 🛑📈

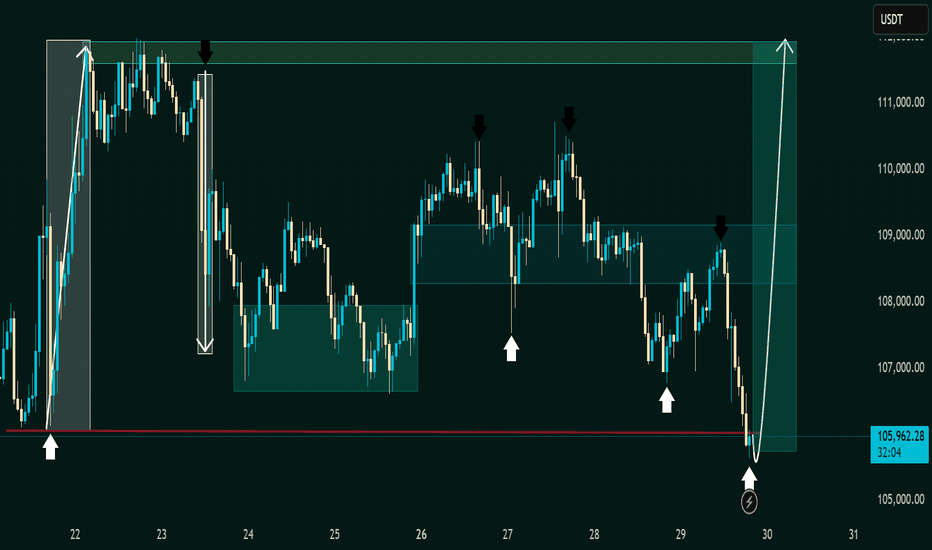

BTC/USDT – Bitcoin 1 hour timeframe 📊 Technical Overview

🟢 Support Zone:

📌 Around $105,700

🛡 Marked by multiple bounces (white arrows), this zone shows strong buyer interest.

🔁 Historically acts as a springboard for upside moves 📈.

🔴 Resistance Zone:

📌 Range: $109,000 – $111,500

🚫 Every approach has triggered a sharp sell-off (black arrows), confirming this zone as significant supply.

🔄 Price Action & Pattern Insights

📉 Bearish Swings from Resistance:

Several high-wick candles followed by strong rejections ⛔

Downward arrows suggest a distribution phase near the top range

📈 Bullish Reversal Signals:

Price sharply rebounds from support 💥

V-shaped recovery setup in motion with a clean reaction from the demand zone ✅

Arrow projection hints at a potential full range recovery 🌈

📦 Box Range Formation:

Market has been consolidating in horizontal zones

Each zone acts as a base for accumulation or distribution 🧭

🎯 Trade Idea & Forecast

📍 Current Price: $105,793.35

📈 Projected Move: Upside rally toward $111,000+

🧠 Rationale:

Bounce from a major support zone

Prior similar price actions led to parabolic rises 🚀

No lower lows made – signs of a bottom forming 🪙

📌 Action Plan

✅ Long Setup:

Entry: Above $106,000

Target: $109,000 – $111,500

Stop Loss: Below $105,000

📉 Risk/Reward: Favorable (~1:3)

🚫 Bearish Alternative:

Breakdown below $105,000 with volume ❗

Target: $103,000 (next liquidity zone)

📎 Conclusion: Ready for a Bullish Comeback?

Bitcoin (BTC/USDT) is showing signs of a textbook bullish reversal 📘 after defending a key demand level 💪. If the current momentum holds, we could see a swift move back to the top of the range. Ideal for short-term buyers looking to ride the intraday wave 🌊.

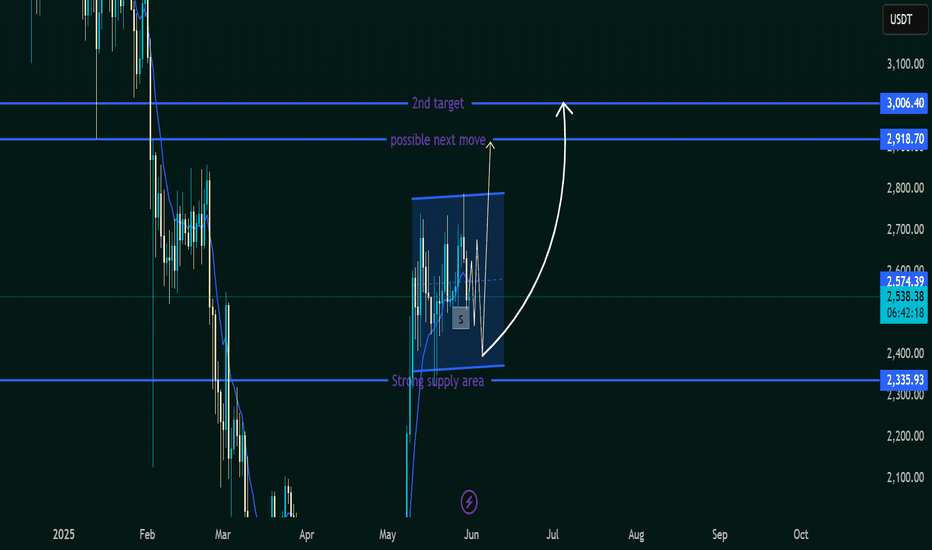

ETHUSDT Breakout Watch: Bullish Momentum Brewing🧠 Chart Analysis Summary:

This chart suggests a bullish continuation is likely for ETHUSDT based on the current market structure and visual cues:

🔍 Key Observations:

Current Price Zone:

Trading around $2,574, inside a consolidation range (highlighted blue box).

Strong Supply Area Identified:

Around $2,335.93 (marked in purple) – acted as a solid demand/support zone fueling the current move.

Breakout Box:

The price is forming a rectangle pattern, indicating accumulation or consolidation before a breakout.

Bullish Projection Arrows:

Two projected paths show:

Minor dip toward the supply area followed by a bullish breakout 🚀.

Immediate breakout from the box towards resistance levels.

🎯 Target Levels:

First Target: 🟣 $2,918.70 – “possible next move”

Second Target: 🎯 $3,006.40 – strong resistance zone

🧩 Conclusion:

This setup suggests ETH may be preparing for a breakout from the consolidation zone. If bulls maintain control, we could see a rally towards $2,918 - $3,006 in the coming weeks.

Risk Tip: Watch for a fakeout if price dips below the consolidation range — especially near the $2,335 area.

🧠 Trading Tip:

Use volume confirmation and candle closes above the box to validate the breakout! 📊

ACAUSDT forming a falling WedgeACAUSDT is currently displaying a strong falling wedge pattern—a historically bullish reversal structure that typically precedes sharp breakouts. After a prolonged downtrend, the price has formed lower highs and lower lows within a narrowing channel, suggesting decreasing selling momentum. The recent price action bouncing off the wedge's lower boundary, combined with a solid spike in volume, indicates a potential bottom formation and growing buyer interest.

Acala (ACA), known for its role in the Polkadot ecosystem as a decentralized finance hub, continues to show fundamental promise. With DeFi narratives heating up again and more liquidity flowing back into the Polkadot parachain ecosystem, ACA is regaining the attention of crypto investors and traders alike. Technical and fundamental convergence here is strong—making it a potential high-reward candidate for short- to mid-term bullish plays.

If this breakout confirms with strength above the wedge resistance, the projected price move could reach up to 90% to 100%+ based on measured move theory. Such breakouts often accelerate quickly due to short covering and renewed speculative interest. This is supported by rising trading volume and increased chatter among crypto communities, pointing toward renewed bullish momentum for ACAUSDT.

From a risk-reward perspective, the current zone near the wedge support offers an attractive entry for swing traders aiming to capitalize on the upcoming breakout. With multiple confluences lining up technically and fundamentally, this setup is one worth watching very closely.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

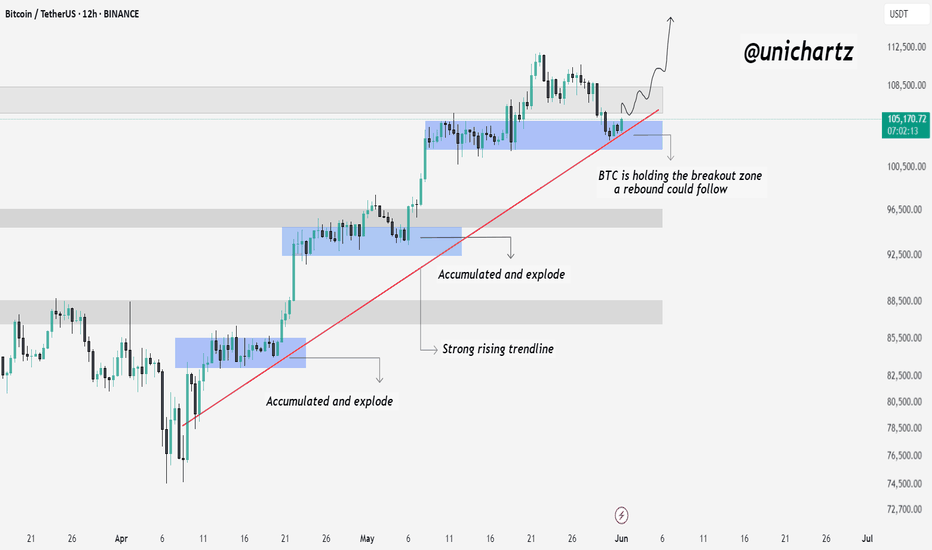

Bitcoin Retests Breakout Zone – Will It Bounce Again?Hello traders, here is the Quick CRYPTOCAP:BTC update

Bitcoin is currently holding right at the previous breakout zone, which also aligns with the rising trendline and previous accumulation area.

This zone has acted as a strong launchpad in the past — where BTC accumulated and exploded higher. If buyers defend this level again, we could see another rebound play out from here.

As long as BTC holds this structure, the bullish trend remains intact.

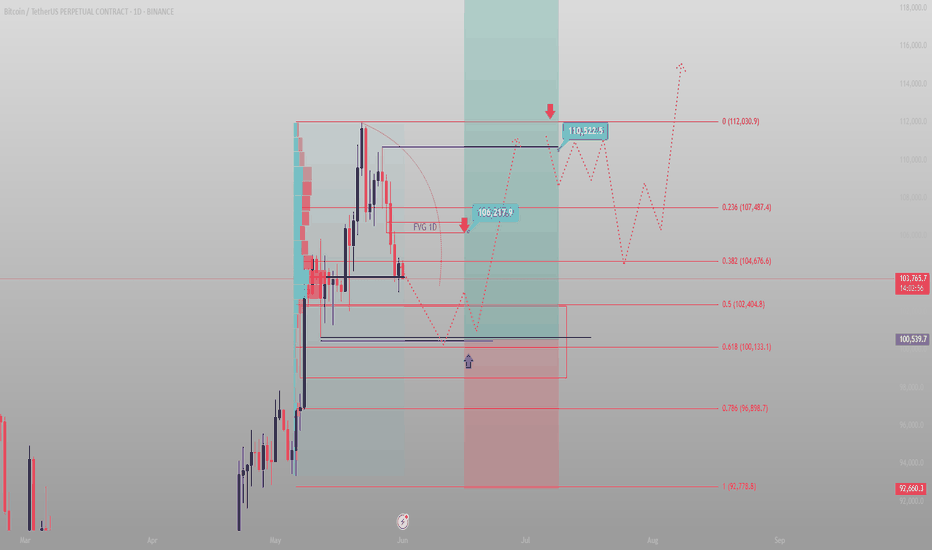

BTC isn’t bearish. It’s just collecting fuelPrice didn’t fail — it paused.

BTC retraced into the 0.382–0.5 zone after rejecting from the local high, and what looks like weakness to most is actually compression — perfectly staged above a clean 1D OB and nested FVG.

Below the current level sits the real opportunity: the imbalance between 102.4K–100.1K, backed by a 1D demand zone and high-volume support. If Smart Money wants to rebalance before the next leg, that’s where they’ll do it.

The path is simple:

Sweep into the 100.5K–102.4K zone

React off the OB

Expand to rebalance the FVG at 106.2K

Displace toward the next draw: 110.5K (final inefficiency + liquidity shelf)

Only a close below 96.9K changes the macro intent.

Execution mindset:

🔑 Optimal long: 100.5K–102.4K (OB/FVG zone)

🎯 Target 1: 106.2K

🎯 Target 2: 110.5K

❌ Invalidation: Full body close below 96.9K — structure must reset

Most traders chase the move.

I wait where Smart Money needs to act.

I’m not reacting. I’m positioned.

Daily BTC/USD Analysis - Smart Money PerspectivePrice recently swept liquidity above the previous weekly high, indicating a classic liquidity grab. After this move, we observed a market structure shift (MSS) to the downside, followed by a break and a mitigation of a bearish imbalance (BAG).

Currently, price is reacting from a small fair value gap (FVG), but this is likely just a retracement. I'm expecting the market to drop further and target the larger FVG zone that aligns on both the weekly and daily timeframes (highlighted in blue). This zone also aligns with a potential POI (point of interest) for smart money accumulation.

📌 Short-term bias: Bearish

🎯 Target: 99,000–97,000 zone

🔍 Watch for rejection at current FVG or possible internal liquidity grab before the drop.

Smart money is likely to seek deeper liquidity before any meaningful bullish continuation. Stay patient and let price come to the premium zone.

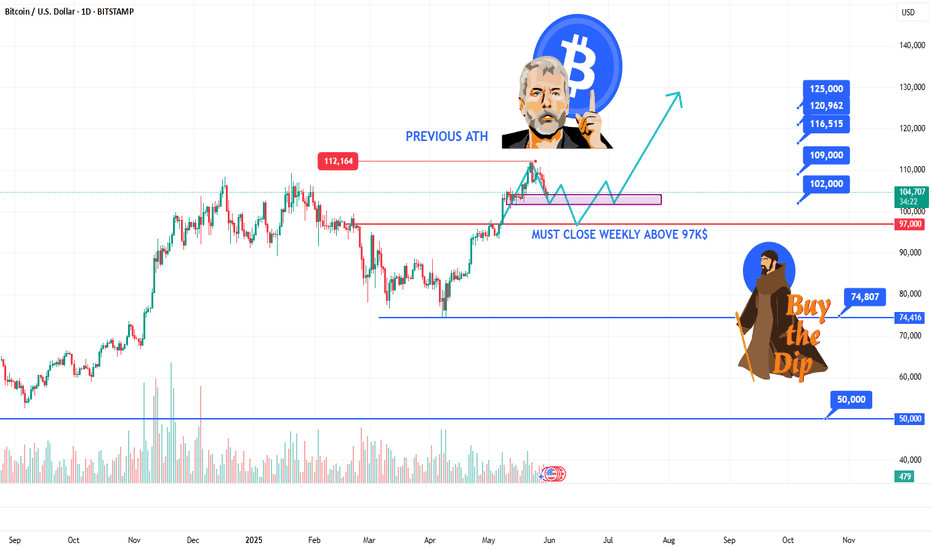

BITCOIN STILL BULLISH ABOVE 97K$HELLO TRADERS

As i can see Bitcion is just created a new ATH 112K$ and now is retracing to downside after a overbought condtions on RSI i am expected a new ATH till design levels if BTC Hold above 97K zone its just a trade idea share your thoughts with us in comments it help many other traders we love ur comments and support Stay Tuned for more updates

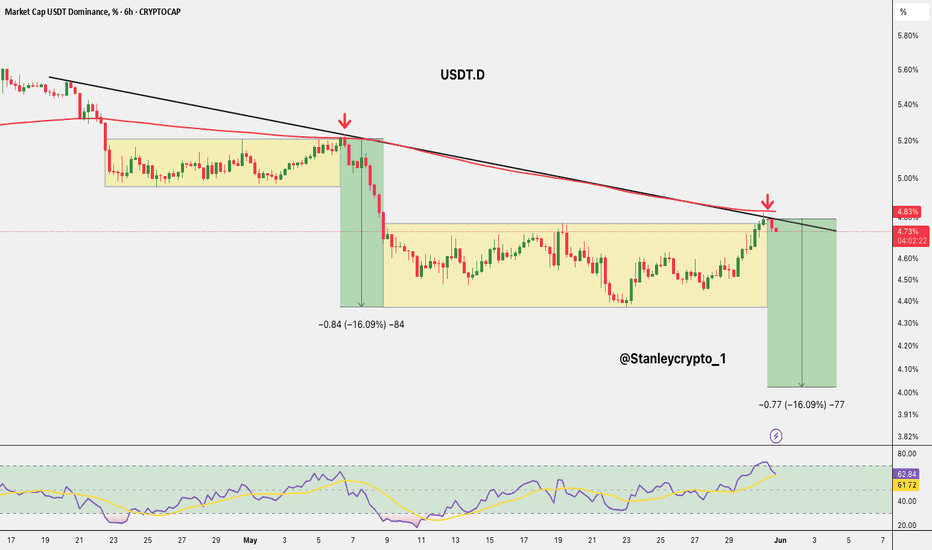

$USDT.D Rejeccted Again Altseason SignalCRYPTOCAP:USDT.D Rejected Again Altseason Signal

USDT Dominance is showing a clear rejection from the descending trendline and 200 MA, similar to the previous 16% drop.

The RSI is turning down from the overbought zone, signalling potential downside.

If this move plays out, we could see USDT.D fall toward the 4.0% zone, which is bullish for Altcoins.

DYRO, NFA

BTCUSD BREAK SUPPORT LEVEL AND WENT TO DOWN TRENDHere I Created This BTCUSD Chart Analysis

Pair : BTCUSD (BITCOIN)

Timeframe: 1 - Hour

Pattern: Breakout

Momentum: Bearish / Sell

Entry Limit : Sell 106200

Resistance zone : 106600

Target Will Be : 104000

Disclaimer : This signal is based on personal analysis for learning purposes. Trade at your own risk and always use proper risk management.