Bitcoin Structure in Stillness, Power in Silence, Just Control?⊣

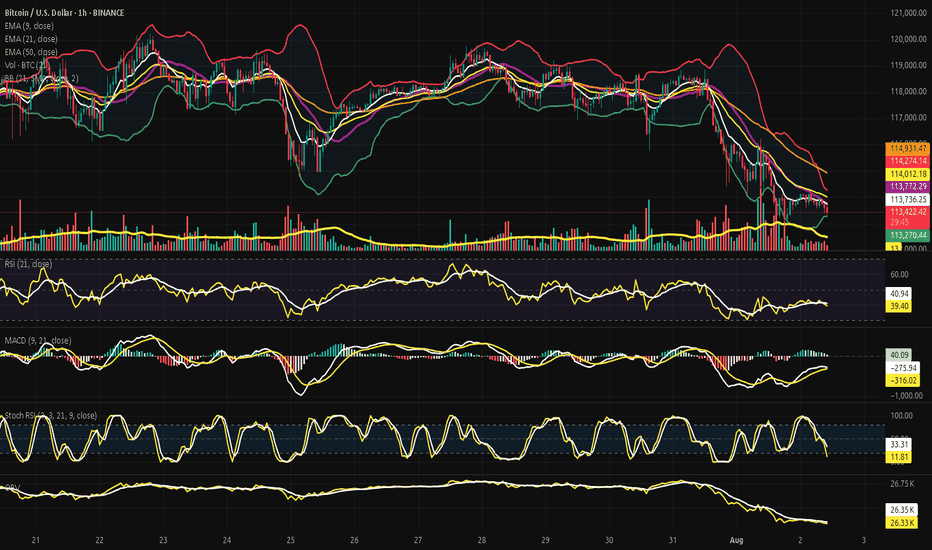

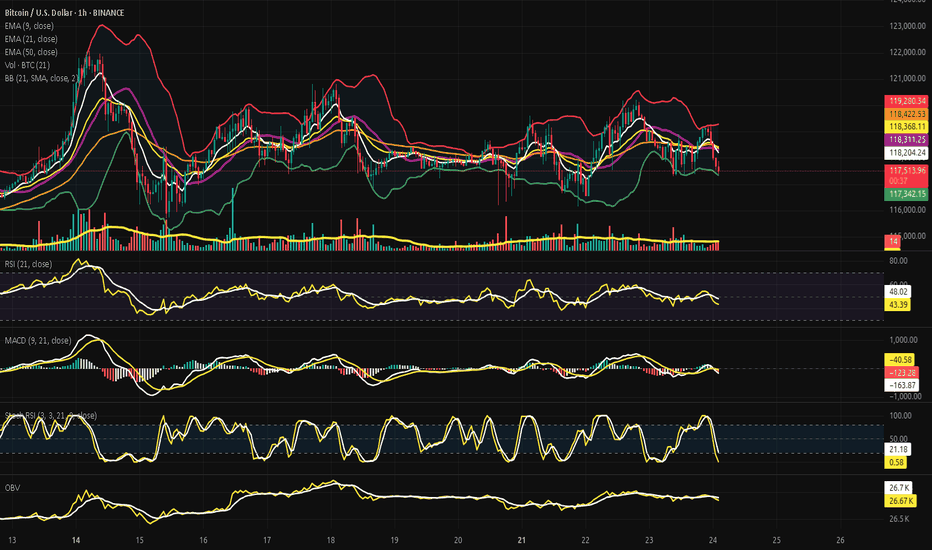

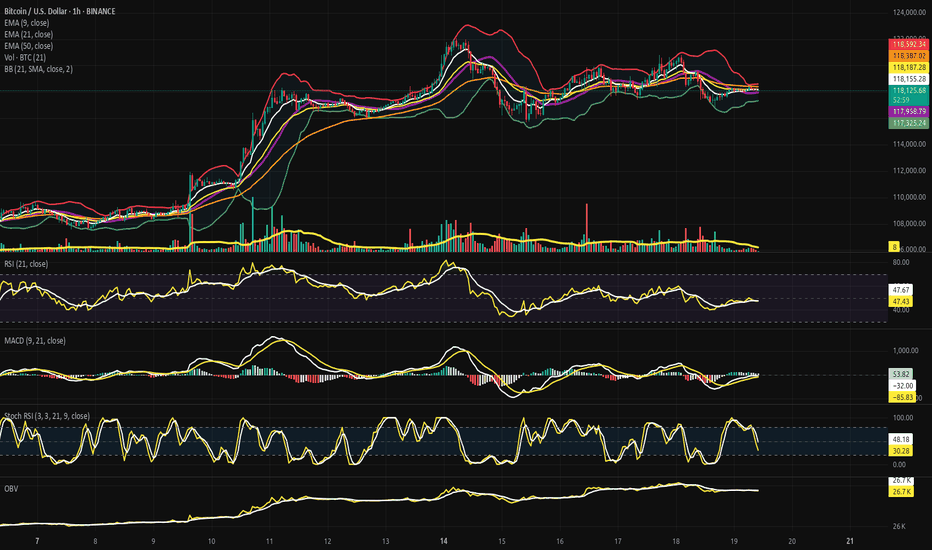

⟁ BTC/USD - BINANCE - (CHART: H1) - (Aug 02, 2025).

◇ Analysis Price: $113,869.77.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1H):

▦ EMA9 - ($113,889.32):

∴ The price is trading just below the EMA9, which acts as immediate reactive resistance;

∴ The short-term slope remains negative, with no breakout signal;

∴ Buyers are unable to push the price above this threshold, indicating technical weakness.

✴️ Conclusion: Momentum remains capped; the EMA9 has not been reclaimed.

⊢

▦ EMA21 - ($113,896.52):

∴ The EMA21 stands as a tactical compression line in this range;

∴ The close proximity of EMA9 and EMA21 forms a technical knot - indecision zone;

∴ Past rejections in this region reinforce it as a powerful barrier.

✴️ Conclusion: Mid-range resistance holds; continuation is blocked unless breached with volume.

⊢

▦ EMA50 - ($114,128.22):

∴ EMA50 defines the current macro resistance on the 1H chart;

∴ The price has yet to test this level directly after the last drop;

∴ For structural recovery, this line must be broken cleanly with follow-through.

✴️ Conclusion: Primary obstacle on the path to reversal - decisive zone.

⊢

▦ BB (21 + EMA9) - Status: Compression:

∴ Bands are tightening around the price, signaling low volatility;

∴ Price action is contained within the central channel;

∴ Indicates upcoming volatility spike - direction still unknown.

✴️ Conclusion: Volatility compression is active; no directional bias confirmed.

⊢

▦ Volume + EMA21 - (3.84 BTC):

∴ Trading volume remains below the EMA21 period average;

∴ No surge of bullish commitment visible;

∴ Momentum lacks conviction without participation.

✴️ Conclusion: Absence of volume undermines the strength of any move.

⊢

▦ RSI (21, 9) - (42.37):

∴ RSI hovers in the lower neutral band - weak momentum;

∴ Slight upward curve suggests a modest rebound;

∴ No divergence or strength signal confirmed.

✴️ Conclusion: Minor relief rally underway - structurally weak.

⊢

▦ MACD (9, 21, 9) - (MACD: -238.89 / Signal: -340.58):

∴ Bullish crossover confirmed, histogram positive;

∴ Both lines remain in bearish territory - (below zero);

∴ Trend momentum is building but not strong enough to reverse.

✴️ Conclusion: Technical rebound in play - not a structural shift.

⊢

▦ Stoch RSI (3, 3, 21, 9) - (%K: 58.90 / %D: 52.70):

∴ Positive crossover established and advancing in neutral-upper zone;

∴ No overbought signal;

∴ Possibility of further upside if confirmed with price action.

✴️ Conclusion: Oscillator supports continuation - contingent on volume.

⊢

▦ OBV (21, BB2) - (26.35K):

∴ OBV remains flat, indicating market indecision;

∴ No divergence with price movement;

∴ No fresh buying pressure detected.

✴️ Conclusion: Neutral volume behavior - flow not favoring bulls.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The 1H chart of (BTC/USD) reveals a battlefield sealed in compression and anticipation.

The price is locked beneath converging exponential resistances (EMA9, EMA21, EMA50), forming a triple entrenchment zone. None have been broken - each rejection reinforces the stronghold;

∴ The Bollinger Bands constrict like a ritual binding. Volatility is silent - too silent - awaiting the spark. Yet no participant steps forward with force; volume remains suppressed, showing that neither side has declared war;

∴ Momentum oscillators (RSI, Stoch RSI) hint at an upward drift, but these are echoes, not proclamations;

∴ The MACD crossover is not a trumpet - it is a murmur in the underworld, below the zero line, concealed from the living trend;

∴ The OBV confirms it: no one is entering the field with conviction. This is not a battlefield - it is a waiting room;

✴️ And yet, amidst this silence, the Code speaks:

∴ If the zone between ($114.1K and $114.6K) is breached with volume and confirmation, this will mark the first true structural challenge to the prevailing descent. If it fails - the repique folds into another trap, devoured by gravity.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + EMA9 - (All Exchanges) - (6.2K BTC):

∴ The total Bitcoin flowing into centralized exchanges remains subdued, with no signs of aggressive sell-side pressure;

∴ The EMA9 confirms a flat, low-intensity behavior, distinct from capitulation spikes;

∴ The absence of major inflows during price compression implies a strategic wait state.

✴️ Conclusion: No incoming threat detected - institutions are not preparing to sell.

⊢

▦ Exchange Netflow Total + EMA9 - (All Exchanges) - (-644.5 BTC):

∴ Netflow remains negative, indicating Bitcoin is being withdrawn from exchanges rather than deposited;

∴ A negative netflow during a price downtrend reflects silent accumulation behavior or rotation into cold storage;

∴ The EMA9 shows a consistent drainage pattern, not episodic outflow.

✴️ Conclusion: This confirms defensive posture by large holders - supporting the technical compression.

⊢

▦ Spent Output Profit Ratio - (SOPR) + EMA9 - (1.003):

∴ The SOPR hovers just above 1.0, suggesting coins moved on-chain are being sold at or near cost basis;

∴ No signs of aggressive profit-taking or panic selling - rather, equilibrium behavior;

∴ The 9-period EMA confirms stability in this zone.

✴️ Conclusion: Market psychology is suspended - no one is winning or losing.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ All on-chain signals reflect preparation without declaration;

∴ No pressure enters, and no blood leaves;

∴ The field is not empty - it is coiled;

∴ Withdrawals - (Netflow) - suggest protective accumulation;

∴ Low Inflow signals no new panic supply;

∴ SOPR near 1.0 says: (We're all waiting - and none are ahead);

∴ The technical compression in price is not betrayed by the chain;

∴ The silence is consistent;

∴ But silence is not peace - it is a veil.

✴️ Conclusion: If volume does not breach $114.6K - all remains a ghost echo beneath resistance.

If broken - the coil unwinds.

⊢

⧉ III. Contextvs Macro-Geopoliticvs - Interflux Economicvs - (Aug 02, 2025):

⟁ All movements of the market's breath are influenced not only by price, nor volume, but by the tides beyond the chart. Here begins the reading of the outer realm:

▦ EVENTVM I - (Wall Street Silent Accumulation) - (U.Today + Coindesk):

∴ Institutional actors are actively acquiring BTC and ETH through stealth operations - not OTC spikes, but ETF inflows and treasury balance shifts;

∴ Tom Lee (Bitmine/Fundstrat) confirms: Wall Street is not waiting for clarity, it is accumulating in silence;

∴ SEC’s Project Crypto and “in-kind” ETF mechanisms further reduce friction for institutional entry.

✴️ Conclusion: Price stagnation conceals power transfer - retail hesitates while funds consolidate control.

⊢

▦ EVENTVM II - (SEC’s “Project Crypto” Activation):

∴ Regulatory framing under “Project Crypto” unfolds in phases: transparency, compliance infrastructure, and institutional bridges;

∴ Despite its regulatory mask, the program facilitates liquidity channels into crypto markets;

∴ Legalized ETF's now serve as strategic vacuum points for Bitcoin supply.

✴️ Conclusion: What appears as regulation is in fact an alignment mechanism - structure over rebellion.

⊢

▦ EVENTVM III - (July ETF Flows (US) - $12.8B Inflow):

∴ U.S.-based crypto ETF's report record-breaking $12.8 billion inflows in July alone;

∴ Largest flows tracked in BlackRock, Fidelity, and VanEck vehicles - no signs of reversal;

∴ These flows occurred during price weakness, not during breakout - a signature of accumulation.

✴️ Conclusion: The public hesitates while custodians act - the veil of weakness conceals a new floor.

⊢

🜎 Strategic Interpretation - Macro Context:

∴ The charts compress. The flows retract;

∴ But the outer forces converge - Wall Street is no longer watching. It is acquiring;

∴ Through structure, silence, regulation, and engineering of access;

∴ This is no longer the market of peer-to-peer rebellion;

∴ This is the codification of power into institutional hands;

✴️ Conclusion: Price may appear static - but ownership is shifting.

⊢

𓂀 Stoic-Structural Interpretation:

∴ The chart does not lie. The data does not beg. The market does not care. Bitcoin remains trapped beneath resistance - not by force, but by inaction, by lack of intention, by silent contest;

∴ On-chain signals whisper: no one is selling in panic, no one is buying in euphoria;

∴ The macro realm reveals: the hands of power are moving beneath regulation, using silence as shield;

∴ Thus we see a paradox - the technical shell compresses, the on-chain bloodstream circulates without fever, the macro structure redefines.

⚖️ The Stoic mind recognizes this not as chaos, but as necessary stillness.

∴ The Arcane practitioner does not chase a move - he maps the pressure points and waits;

∴ He acts only when the veil thins;

∴ To act prematurely is to violate the structure;

∴ To wait blindly is to betray the will;

∴ The Stoic Arcane path demands this: know the boundary, seal the insight, then act - once - with clarity;

∴ At ($114.6K) the veil may part. If it does not - the silence continues.

⊢

✦ Structure Bearish.

▦ This is a bearish containment, not a breakdown.

∴ The market is not collapsing - it is being held below by absence of volume, of intention, of structural reversal;

∴ The EMA's are stacked above like iron gates;

∴ The price has failed to break $114.6K - the veil remains intact;

∴ On-chain data confirms neutrality, not optimism;

∴ Macro signals suggest accumulation by institutions - but not defense for the public.

⊢

🜎 Therefore:

∴ Technically Bearish - (structure not yet reversed);

∴ Tactically Neutral to Bearish - (fragile repique);

∴ Strategically in Transition Phase - (institutions buying beneath silence).

✴️ Conclusion: Until ($114.6K) is broken with conviction, the structure remains bearishly biased - wrapped in stillness.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

Btcusdbinance

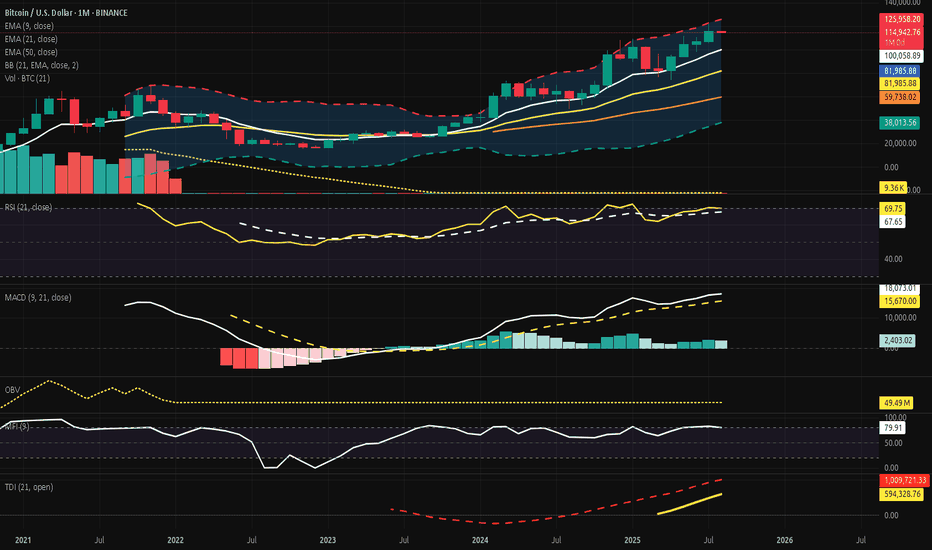

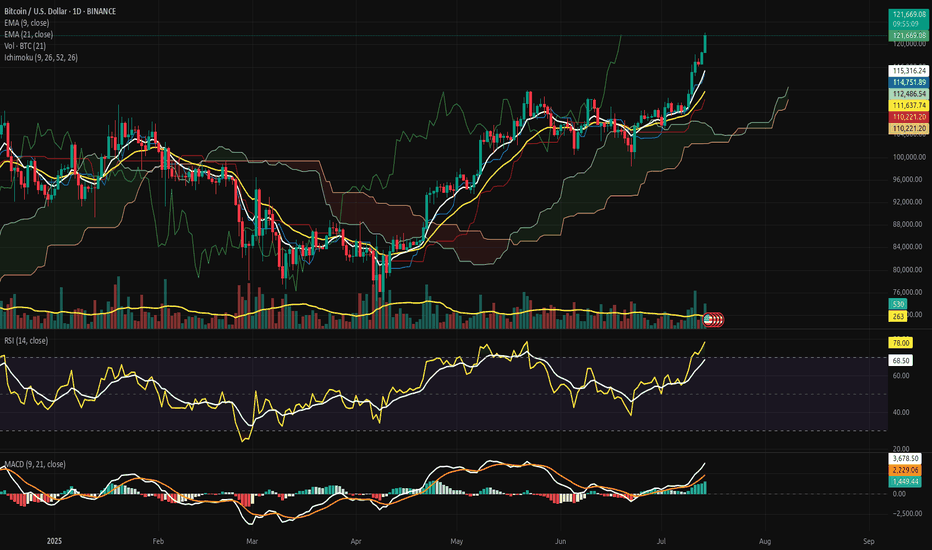

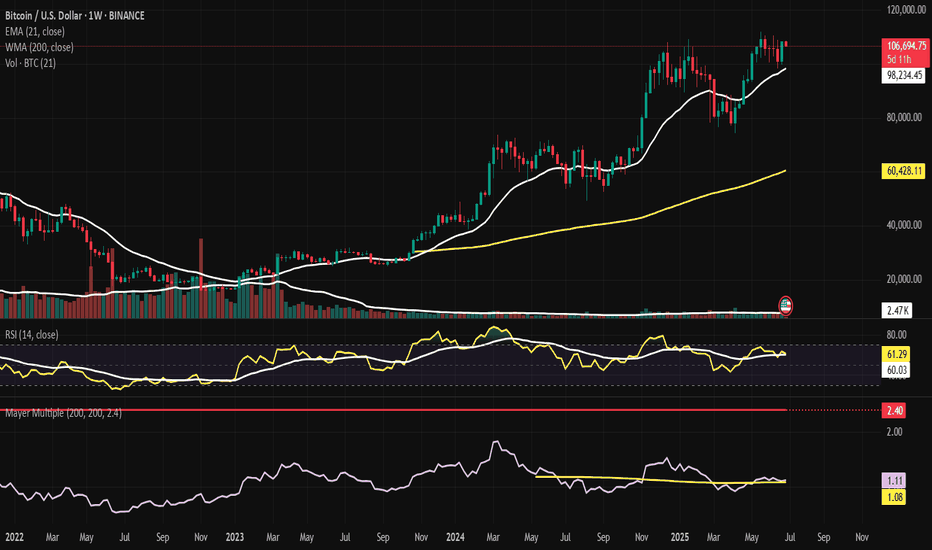

Bitcoin Monthly - Structure Intact, Tension Rising?⊣

⟁ BTC/USD - BINANCE - (CHART: 1M) - (Aug 01, 2025).

◇ Analysis Price: $114,994.73.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1M):

▦ EMA9 - ($100,069.29):

∴ Price holds 14.93% above this dynamic threshold, indicating momentum continuation but also positioning within an overheated range;

∴ The EMA9 structure is firmly ascending, representing the spine of the short-term bullish wave;

∴ July’s candle remains fully above the EMA without testing it - no wick beneath the line-marking dominance of buyers without internal correction.

✴️ Conclusion: The EMA9 governs the tempo of the current trend and stands untouched. Elevated, but structurally intact.

⊢

▦ EMA21 - ($81,990.60):

∴ A core support vector in the macrostructure, now 28.73% below price, suggesting strong bullish detachment from equilibrium;

∴ The line maintains a smooth, upward slope, echoing the recovery arc since late 2022’s structural low;

∴ Its alignment with the Bollinger Basis and Realized Cap forms a triad of reinforced technical stability.

✴️ Conclusion: EMA21 anchors the mid-term uptrend and guards the sanctum of continuation. No breach, no threat.

⊢

▦ EMA50 - ($47,983.10):

∴ Deep beneath price, resting at 58.27% below the current level - a relic of past cycles, yet still relevant as ancestral support;

∴ The EMA50 has curved upward subtly, signaling the final stage of long-term bear cycle recovery;

∴ Price has not interacted with this zone since late 2023, preserving its status as last-resort structural bedrock.

✴️ Conclusion: EMA50 serves as the sacred foundation of the macro trend - distant, but silently upholding the higher order.

⊢

▦ BB (21, 2) - ($81,990.60, $124,871.91, $39,109.29):

∴ The Basis of the bands aligns precisely with the EMA21, confirming equilibrium at ($81,990.60) - the mid-guardian of the macro cycle;

∴ The Upper Band is currently intersecting the candle body at ($124,871.91), marking an imminent volatility ceiling that may trigger either breakout or rejection;

∴ The Lower Band rests at ($39,109.29), far beneath the trend structure, now serving as a shadow chamber rather than an active field of probability.

✴️ Conclusion: The BB channels have opened widely, signaling expansion. With price nearing the upper rim, the phase is volatile but directional. The core remains intact through the EMA21 basis.

⊢

▦ Volume + EMA21 - (37.62B, 29.71B):

∴ Monthly volume for July reached $37.62 Billion, standing above the EMA21 of volume at $29.71 Billion, indicating an active expansion phase in market participation;

∴ This is the third consecutive monthly close above the EMA21, forming a sequence of rising activity that mirrors the price climb - suggesting healthy conviction behind the movement;

∴ The volume body also aligns with bullish momentum confirmation, as it occurs within an ascending slope of the EMA21, avoiding false divergence or exhaustion patterns.

✴️ Conclusion: Volume expansion supports the current trend. The flow is consistent, not speculative.

⊢

▦ RSI (21, 9) - (69.79, 64.71):

∴ The RSI main line stands at (69.79), nearing the classical overbought threshold but not breaching it, reflecting a strong yet controlled uptrend;

∴ The signal line (9-period smoothing) trails at (64.71), confirming positive pressure without showing divergence - both curves remain aligned and ascending;

∴ There is no crossover, no rejection, and no curvature breakdown - suggesting momentum still leans bullish, but the zone is tightening.

✴️ Conclusion: RSI reveals active strength under equilibrium control. Nearing the gates of exhaustion, but no conflict yet.

⊢

▦ MACD (9, 21, 9) - (4,172.31 / 3,423.95 / +748.36):

∴ The MACD Line remains well above the Signal Line, holding a spread of (+748.36), confirming an active momentum cycle;

∴ Both lines are above the zero axis, reinforcing a long-standing bullish wave with consistent inertia since late 2023;

∴ The Histogram is positive, though it shrinks slightly from previous months, suggesting a potential slowing of force - not a reversal, but a breath.

✴️ Conclusion: The MACD still flows in favor of the bulls. The pulse continues, yet shows first signs of contraction. Momentum remains, but vigilance awakens.

⊢

▦ OBV (21, BB2) - (10.27M / 9.82M / 11.19M / 8.45M):

∴ The OBV line rests at (10.27M), positioned above the Basis (EMA21 at 9.82M), indicating a net accumulation bias over the mid-term;

∴ It remains within the upper half of the Bollinger channel, but beneath the upper band, currently at (11.19M), suggesting accumulation without climax;

∴ The bands are widening, signaling expanding participation and heightened flow volatility - yet without destabilization.

✴️ Conclusion: OBV confirms active, steady inflow. Accumulation sustains the structure. Flow is present, but not yet euphoric.

⊢

▦ MFI (EMA9) - (79.90 / 74.63):

∴ The MFI registers at (79.90), resting near the upper saturation zone, traditionally viewed as overbought - but no rejection candle has occurred;

∴ The 9-period EMA smoothing line at (74.63) trails cleanly beneath, reinforcing directional alignment without divergence;

∴ This spread between the MFI and its smoothing curve affirms a persistent inflow dominance, though now nearing exhaustion thresholds.

✴️ Conclusion: The MFI reveals an environment of strong capital influx. Though high, it is not yet reversal-bound. Compression may precede contraction.

⊢

▦ TDI + EMA21 - (69.79 / 64.71 / / 62.00):

∴ The RSI Line (TDI core) sits at (69.79), nearing the volatility band’s upper arc, denoting strong upward rhythm but with limited expansion room;

∴ The Signal Line at 64.71 lags slightly, confirming the trend with no divergence or curvature weakness;

∴ The Volatility Bands (±10 around Signal) contain price action cleanly - upper band at (74.60), lower at (58.83) - showing moderate but controlled pressure;

∴ The EMA21 overlay at (62.00) forms the base layer, maintaining upward inclination and reinforcing long-term trend security.

✴️ Conclusion: The TDI remains bullish, harmonized, and stable. Momentum leads, volatility permits. No rejection yet, but expansion space is finite.

⊢

🜎 Strategic Insight - Technical Oracle:

𓂀 The monthly structure reveals a state of controlled elevation within a structurally sound uptrend, yet with rising compression near upper bounds. The convergence of indicators outlines a field that is both fortified and tense;

∴ EMA9, EMA21, and EMA50 remain fully aligned and ascending - the Exponential Trinity forms a resilient foundation, untouched by regression;

∴ Bollinger Bands (21) have widened, and price now hovers near the Upper Band, suggesting that the volatility channel is at maximal stretch; further price advance may trigger short-term exhaust or rejection;

∴ Volume + EMA21 confirms that market participation has expanded meaningfully across three consecutive months - a sign of conviction rather than speculation;

∴ RSI (21, 9) and MFI (EMA9) hover in elevated zones, signaling latent overextension, yet without immediate signs of breakdown - still ruled by strength, not fear;

∴ MACD (9, 21, 9) retains bullish momentum, though its histogram begins to contract slightly, marking a potential early shift in impulse rhythm;

∴ OBV confirms accumulation without climax, and the TDI shows synchrony, yet the volatility band ceiling is near - a gateway, or a wall.

✴️ Synthesis Technical: The structure is strong, but stretched, all trend anchors remain intact, and no macro-reversal signal is present. However, the cluster of elevated oscillators and narrowed volatility envelopes warns:

∴ The next impulse will define the phase - either breakout beyond resistance ($125K+) or pullback to base zones near EMA21 (~$82K).

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Realized Cap - UTXO Age Bands - ($437.6B):

∴ Capital density remains clustered in the 3m / 12m range, signifying strong mid-term holders anchoring price memory beneath $90K;

∴ The realized cap has risen steadily, confirming new capital commitment and reinforcing the EMA50 region as the “Arcane Bedrock”;

∴ No abrupt aging shift - holders have not fled, nor distributed heavily.

✴️ Conclusion: The realized cost base is lifting upward; Structure is strong beneath price.

⊢

▦ Whale to Exchange Transactions (Binance) - (Rising):

∴ Transfer spikes occurred in mid and late July, echoing pressure near technical ceilings;

∴ Whale flow to exchanges signals potential supply reloads, though no persistent distribution trend is confirmed;

∴ Activity suggests readiness, not execution - threat held in silence.

✴️ Conclusion: Whales signal tension, not aggression; Movement is tactical.

⊢

▦ MVRV Ratio + EMA9 - (2.257 / 2.039):

∴ The MVRV ratio holds above 2.0, implying price trades at over twice the realized cost basis - historically a zone of caution;

∴ No divergence from the EMA9; both slope upward - valuation expansion continues, but no climax;

∴ Price remains above the line of equilibrium, but not in parabolic distortion.

✴️ Conclusion: MVRV confirms overvaluation, but not detachment; Risk is elevated, but contained.

⊢

▦ Exchange Net Position Change (BTC) - (–35,871 BTC):

∴ Net outflows persist, with 35,871 BTC withdrawn in the last monthly cycle;

∴ This behavior aligns with strategic cold storage accumulation, reducing circulating pressure;

∴ On-chain confirms technical's: price rises on supply contraction, not mere speculation.

✴️ Conclusion: Bitcoin leaves the field; Supply retracts as price ascends; Structure reinforced.

⊢

🜎 Strategic Insight - On-Chain Oracle:

𓂀 The on-chain field reveals a fortified structure of conviction beneath the surface of price. Flow, cost basis, and behavior of dominant agents all signal a phase of controlled strength, though shadowed by rising valuation pressure;

∴ The Realized Cap ascends in harmony with price - an uncommon convergence. It suggests that new capital is not merely speculating, but embedding itself into the very structure of the network. The UTXO Age Bands reveal no panic rotation - holders remain;

∴ Whale Transactions to Exchanges rise in key moments, particularly around technical compression points. They do not yet dominate the flow, but stand ready - guardians or destroyers, in silence;

∴ The MVRV Ratio, though elevated, does not deviate violently. It warns, but does not collapse. It reflects a price above cost, but not a mania;

∴ The Net Exchange Position continues its descent. Bitcoin leaves the field; Supply contracts; This is not exit liquidity; This is strategic withdrawal.

✴️ Synthesis Technical: The network breathes in accumulation, not inflation; The participants anchoring this cycle are deliberate; On-chain structures confirm that value is migrating into dormancy, not into exits. The risk is not in structure collapse, but in overvaluation compression - a tightening halo around price.

⊢

⧉ III. Contextvs Macro-Geopoliticvs - Interflux Economicvs - (Jul 31, 2025 - Post-FOMC Strategic Decoding):

▦ FOMC Decision - (July 31, 2025):

∴ The Federal Reserve held its benchmark interest rate steady at (5.50%), marking the fourth consecutive pause - a clear stance of vigilant hold;

∴ The tone was neutral-hawkish, acknowledging progress on inflation while leaving the door open for future hikes if data demands;

∴ No mention of cuts. The Fed maintains narrative control - a message to both markets and sovereigns: we're not done yet.

▦ Jerome Powell’s Address:

∴ Powell reiterated the “data-dependent” framework, but expressed concern over sticky inflation in services and housing;

∴ He praised the resilience of the labor market, signaling no urgency to ease policy;

∴ His delivery was measured, ambiguous by design, injecting uncertainty - fuel for volatility, not clarity.

▦ Market Response - (Traditional Finance):

∴ The DXY (Dollar Index) swung sharply, but closed neutral, reflecting indecision over the Fed’s path;

∴ The S&P500 and Nasdaq attempted intraday rallies but reversed lower - a reaction to Powell not being “dovish enough”;

∴ Gold and Silver caught bids - hedges moved in, not out.

▦ Bitcoin (BTC/USD) Response:

∴ Bitcoin spiked on initial Fed release, tagging the upper Bollinger Band (1M) before retreating slightly - not a rejection, but a breath;

∴ No capital flight occurred. The response was measured and strategic, not speculative;

∴ On H4, Bitcoin touched the EMA200, reinforcing it as a post-FOMC decision point.

✴️ Macro Synthesis: The Fed sheathed the blade but did not lower the shield; Powell’s message: discipline remains. Markets flinched but did not panic; Bitcoin stood firm. This was not a moment of collapse - this was a moment of calibration.

⊢

⌘ Codicillus Silentii - Strategic Note:

𓂀 Let this note be written in the margin of all oracles, beneath the seals and above the motion: This is a cycle governed not by noise, but by intent restrained; The silence between macro movements, the calm in on-chain flows, and the geometry of structure all speak one truth:

The system is waiting;

There is no breakdown;

There is no climax;

There is only a tightening coil - one that neither confirms euphoria nor accepts rejection.

∴ Bitcoin holds above its sacred averages;

∴ The on-chain breath is slow, but pure;

∴ The macro field is firm, yet not soft.

⟁ The next force will not be a whisper - it will be a break or a roar.

✴️ Let no position be based in hope;

✴️ Let no assumption ignore volatility’s patience;

✴️ Let silence guide the strategy, not emotion.

⊢

𓂀 Stoic-Structural Interpretation:

∴ In the mirror of the arcane chart and the silence of on-chain flow, the Stoic lens reveals not merely price action - but the nature of motion itself;

∴ All movement is governed by tension and release, control and surrender. This cycle is no different;

∴ The trend holds, but does not rise arrogantly. It is disciplined;

∴ Capital flows, but not chaotically - it retreats where needed and commits only in strength;

∴ The macro world tempts chaos, but Bitcoin walks with its own gravity - unmoved unless chosen;

∴ Indicators show power without delusion, and pressure without collapse.

This is not a time for euphoria;

This is not a time for panic;

This is a time to observe structure, act with clarity, and remain unshaken.

✴️ The Stoic sees the signal beneath the storm:

Structure is intact;

Trend is valid;

Valuation is tense;

Strategy must remain cold.

⟁ Therefore, the Stoic does not chase candles; He waits for break of structure, or confirmation of continuation; No action is better than misguided motion.

⊢

✦ Structure: Bullish - (Controlled Phase).

∴ All key exponential moving averages - EMA9, EMA21, and EMA50 - remain aligned and ascending, with no curvature breakdown or crossover threat;

∴ Momentum indicators (MACD, RSI, TDI) are positive and synchronized, with no bearish divergence or rejection confirmed;

∴ Price holds above the EMA9 and remains well above the Bollinger Basis, signaling ongoing trend dominance;

∴ Volume exceeds its 21-month moving average, reflecting conviction, not hollow motion.

⟁ However:

∴ The structure is technically stretched - several oscillators approach saturation thresholds, signaling compression, not collapse;

∴ This is a bullish structure, but under strategic tension, not euphoria.

✴️ Final Judgment: Bullish Structure, currently in a compressed expansion state, preparing for either breakout continuation or technical correction - but showing no signs of structural reversal.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

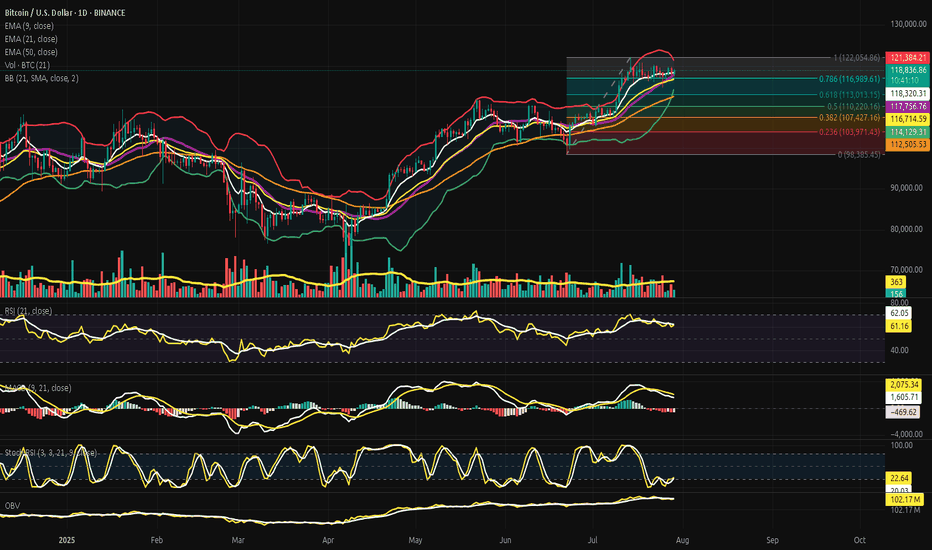

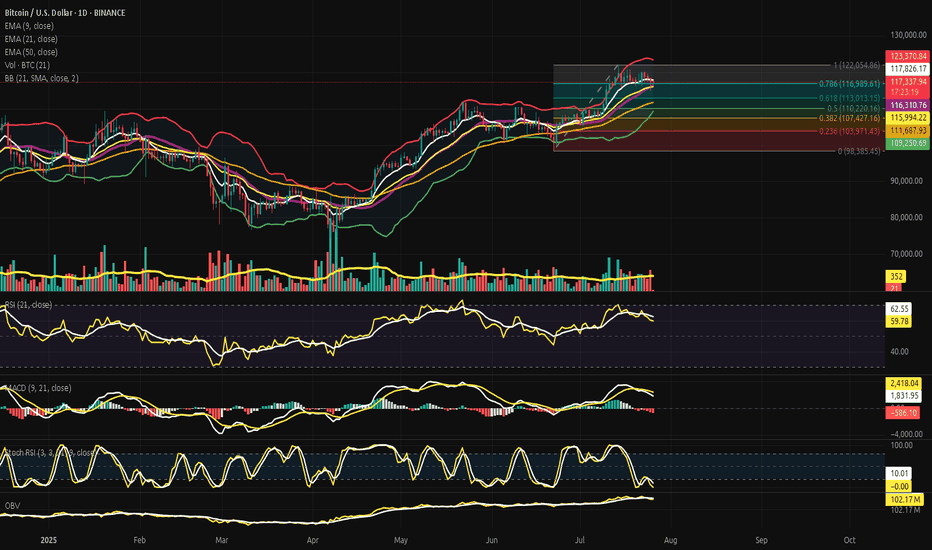

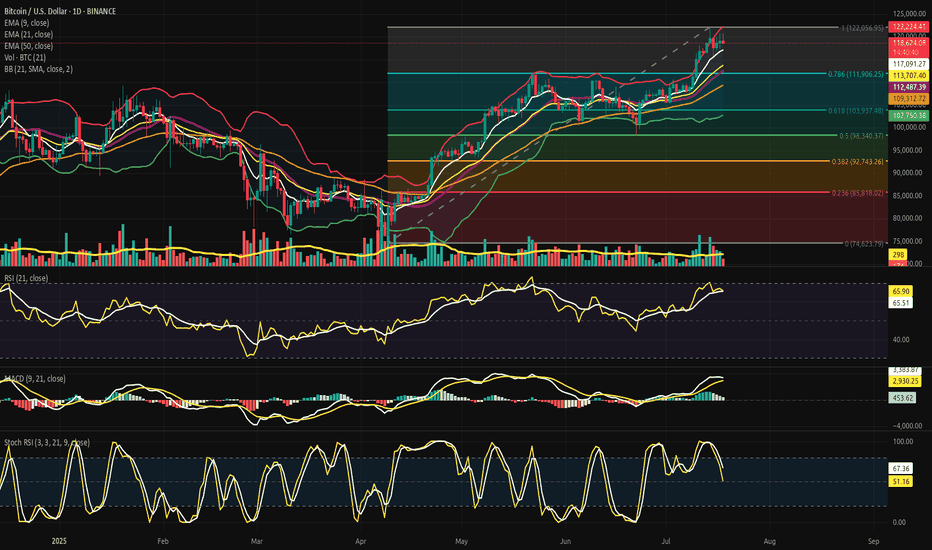

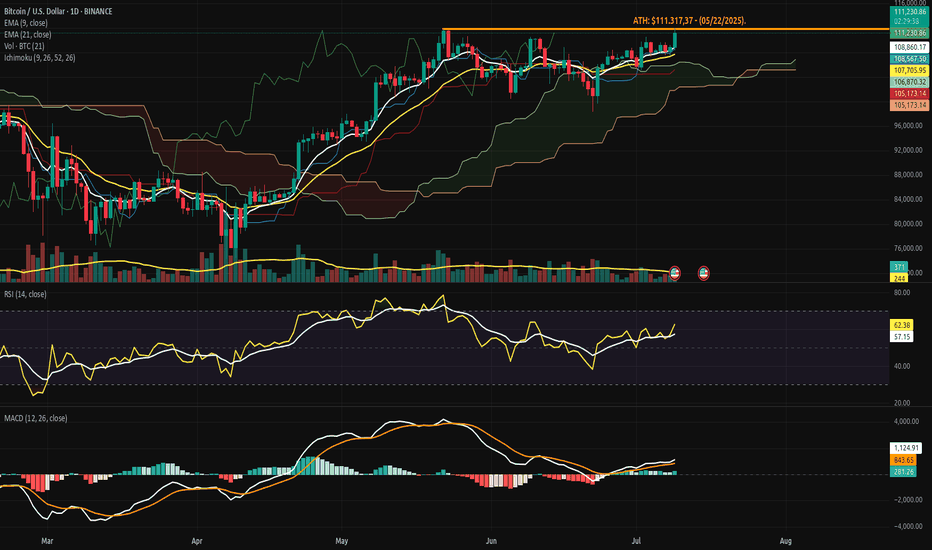

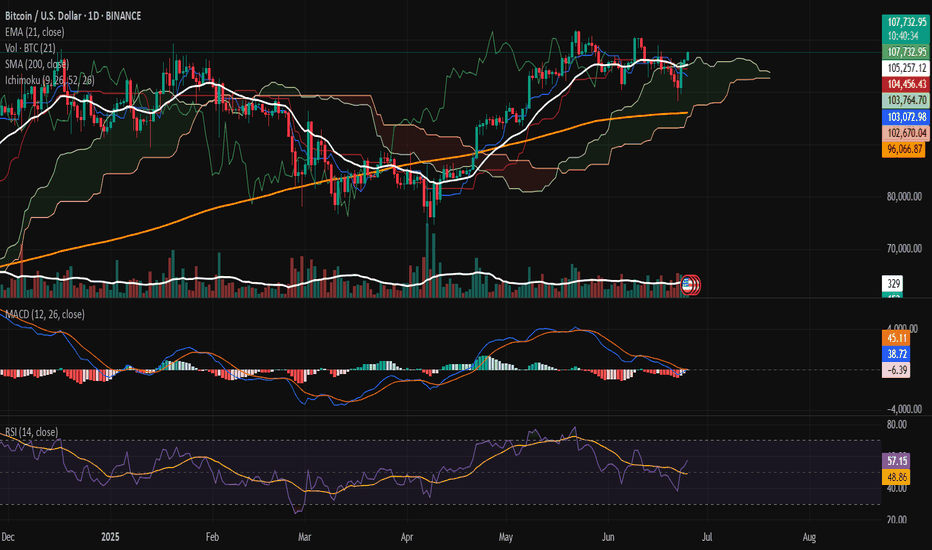

Bitcoin - Structural Ascendancy under Silent Momentum.⊣

⟁ BTC/USD - BINANCE - (CHART: 1D) - (Jul 29, 2025).

◇ Analysis Price: $118,996.40.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - (Exponential Moving Average 9) - ($118,352.22):

∴ This short-term exponential blade reflects immediate price sensitivity, showing reactive balance across recent closes;

∴ Price currently floats above this threshold, indicating micro-support for the bulls - a soft floor in the fog of uncertainty;

∴ The EMA9 line curves gently upward, though not sharply - signaling lingering momentum, but without fury.

✴️ Conclusion: EMA9 acts as a dynamic support amid deceleration; a watchful line between calm consolidation and renewed ascent.

⊢

▦ EMA21 - (Exponential Moving Average 21) - ($116,729.10):

∴ This mid-range trend beacon provides clearer directional context - its upward slope holds the spell of continuity;

∴ Price rests safely above this median force, confirming bullish alignment;

∴ However, the arc begins to curve with less conviction, a signal that the current push is softening.

✴️ Conclusion: EMA21 maintains bullish structure but foretells potential slowing; if momentum dims further, this level may serve as magnet for retracement.

⊢

▦ EMA50 - (Exponential Moving Average 50) - ($112,511.79):

∴ The long-arm average projects the memory of the trend - the deep root under the recent canopy;

∴ Price is far above this line, a sign of strong prior conviction from bulls;

∴ Its firm inclination remains intact, yet price distance signals risk of gravitational return should upper momentum fracture.

✴️ Conclusion: EMA50 preserves bullish foundation, but may become a zone of rebalancing if the rally loses vitality.

⊢

▦ BB (21) - (Bollinger Bands + SMA21) - ($117,764.35):

∴ The Bands, ever sensitive to volatility’s breath, expand wide - a sign of elevated tension and price exploration;

∴ Price nears the upper band ($121,401.48), a common altar for speculative saturation and potential rejections;

∴ The median band (SMA) acts as equilibrium, now beneath the price - suggesting deviation from balance.

✴️ Conclusion: BB21 signals a volatile climax zone; price at the upper band often faces a verdict - continuation by force, or descent by default.

⊢

▦ Volume + MA21 - (Last - 148 vs Average - 363):

∴ Volume flows now with diminished voice - the current bar echoes only 148 units against a historical pulse of 363;

∴ Such silence beneath a rising price may betray a hollow rally - or a pause before engagement;

∴ Absence of participation often precedes reversal or sudden liquidity spikes.

✴️ Conclusion: Subdued volume undermines the bullish signal - lack of validation breeds caution in forward projection.

⊢

▦ RSI - (Relative Strength Index 21) - (61.41):

∴ RSI remains in neutral-high territory, not overbought, but clearly tilted toward bullish control;

∴ Momentum persists but shows signs of plateau - recent movement flattens after steady ascent;

∴ Without new strength, RSI may drift toward the median.

✴️ Conclusion: RSI shows bullish favor, but the fire beneath the trend cools; next candles will determine if it's pause or fade.

⊢

▦ MACD - (9, 21) - (Histogram: –455.70):

∴ MACD line at 2,078.82 vs Signal line at 1,623.12 suggests bullish dominance in structure;

∴ Yet the negative histogram tells a story of fading acceleration - as if the charge slows though direction holds;

∴ This divergence signals decay beneath strength, an omen of indecision.

✴️ Conclusion: MACD is structurally bullish, but its weakening impulse demands attention - the momentum candle dims.

⊢

▦ StochRSI - (3, 3, 21, 9) - (%K: 20.46 / %D: 23.93):

∴ The indicator rests near the lower bounds (sub-25) - a territory of emotional exhaustion and tactical reversion;

∴ A cross upward from these levels often ignites short-term rally pulses;

∴ No confirmed crossover yet - but proximity speaks of potential awakening.

✴️ Conclusion: StochRSI breathes in the lowlands, poised to reverse if kinetic force is summoned.

⊢

▦ OBV - (On Balance Volume) - (102.17M):

∴ The OBV remains elevated, suggesting previous bullish runs were volume-supported, not hollow;

∴ However, flatness in recent OBV progression warns that fresh volume is not accompanying the current price hold;

∴ It whispers of consolidation, or worse - divergence.

✴️ Conclusion: OBV confirms the history of strength, but offers no new blood to feed the advance.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The battlefield holds its shape - the banners of bullish trend still wave, upheld by structural support from EMA's and historical OBV flow. But the wind... it stills.

∴ Volume fades, momentum indicators lose their incline, and oscillators rest on edges. This is a moment of price levitation - elevated without lift. The form remains, but the force hesitates.

∴ The Arcane Pattern whispers:

Should volume return and MACD reignite, $121K may be pierced with clarity;

If silence deepens, however, the bands will contract, and price may descend toward EMA21 or even test EMA50.

∴ The Vortex of Pause has formed. From here, either ignition... or gravity.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish - Strategically Cautious:

∴ Price remains securely above all major (EMA's 9/21/50) on the daily chart, preserving directional integrity;

∴ Bollinger Bands expanded near upper thresholds, signaling climax zone - yet not rupture;

∴ Momentum indicators (MACD, RSI) maintain bullish structure, but histogram weakness and RSI flattening warn of interior softening;

∴ Stoch RSI in low-band suggests reversal potential, but has yet to trigger.

✴️ Conclusion: Market structure supports continuation, but momentum exhaustion and low volume raise caution flags. Bulls hold the field - but must call the wind.

⊢

▦ Tactical Range Outlook:

∴ Upper Limit: $122,054 - Fibonacci 1.0 and previous cycle top;

∴ Short-Term Support: $118,352 - EMA9 + 0.618 Fib confluence;

∴ Median Guard: $116,729 - EMA21 + 0.382 Fib;

∴ Sacred Support: $112,511 - EMA50 base + structural floor;

∴ Final Bastion: $103,971 - 0.236 Fib retrace (macro turn pivot).

✴️ Conclusion: Bullish path remains sealed while price resides above EMA50 and above $103K. Breach of that zone could awaken deeper volatility structures.

⊢

◩ Codicillus Silentii - Strategic Note:

∴ Price stands at the edge of Fibonacci climax, just below the mythic $122K - a known threshold of reaction;

∴ Volume whispers, not commands - the force of momentum now rests on belief, not confirmation;

∴ The convergence of structure without influx invites caution. This is the realm not of action, but of observation.

✴️ Final Seal: Beware the illusion of calm. A structure may stand in silence, but silence precedes collapse as often as continuation. The Sacred Frame is intact - but shall remain sacred only through vigilance.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

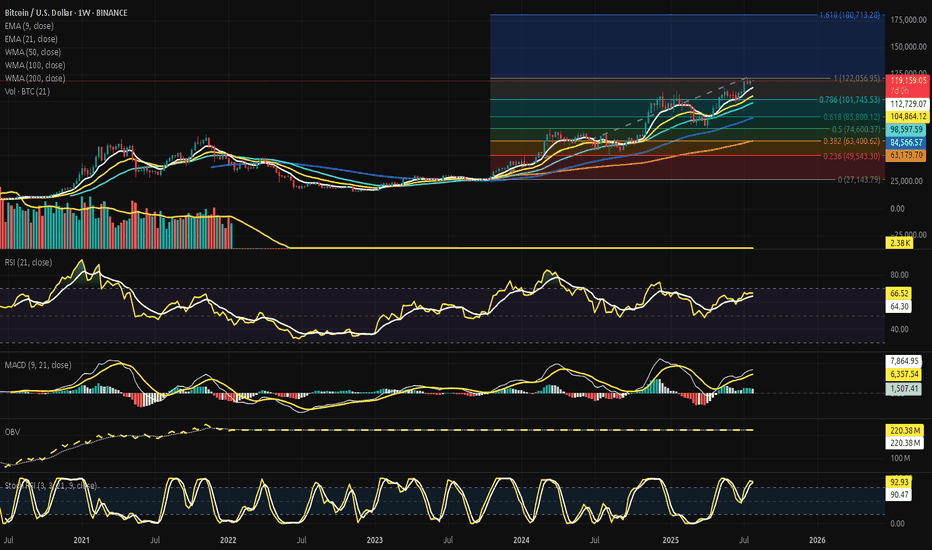

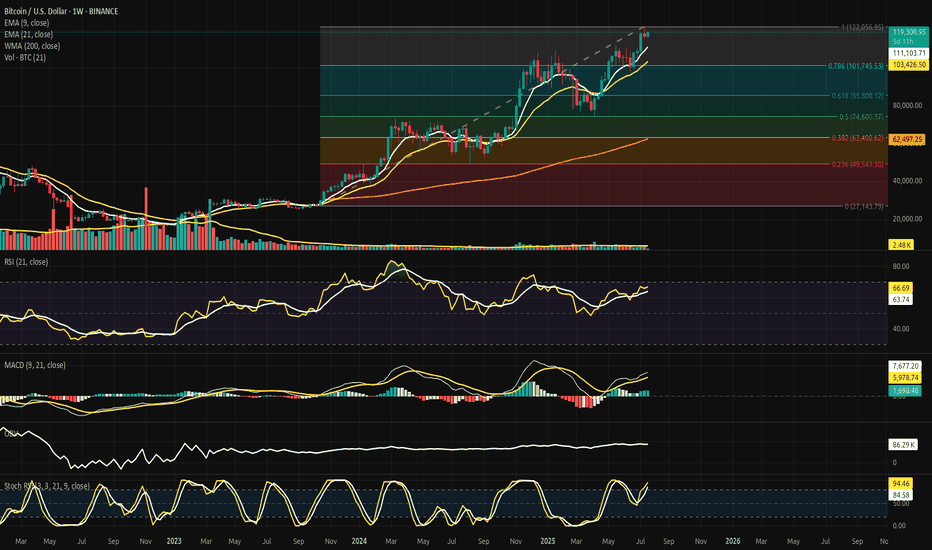

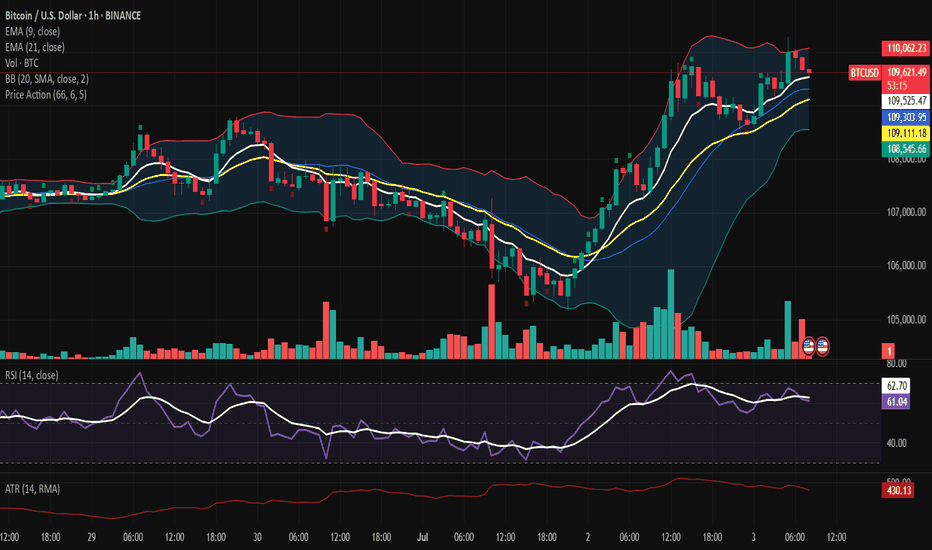

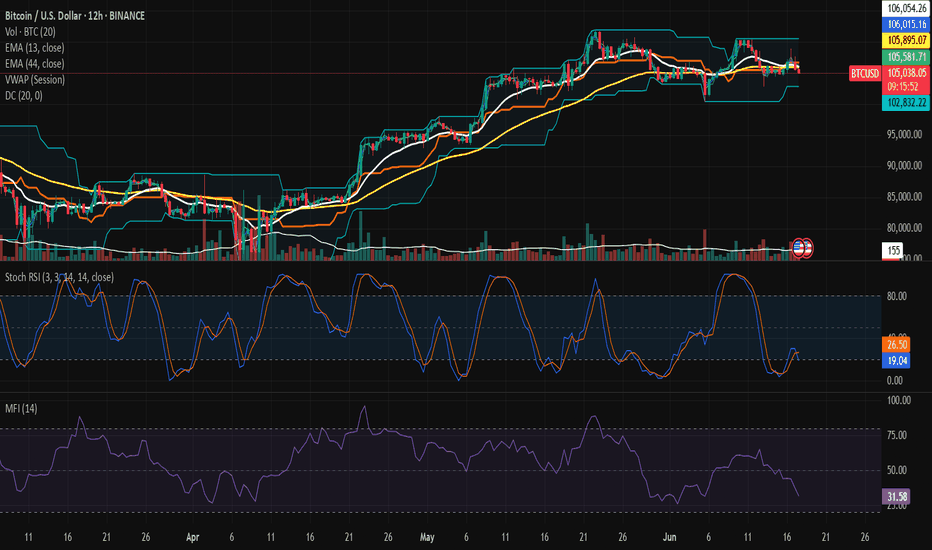

Bitcoin Weekly Seal at the Threshold 122K - No Gaps, No Retreat.⊣

⟁ BTC/USD - BINANCE - (CHART: 1W) - (Jul 27, 2025).

◇ Analysis Price: $119.374,00.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1W):

▦ EMA9 - ($112.771,21):

∴ The weekly close remains above the EMA9, preserving short-term bullish structure;

∴ The EMA9 continues rising at a consistent slope, reflecting sustained upward momentum;

∴ A retracement to this level would represent the first defensive support on a tactical pullback.

✴️ Conclusion: EMA9 acts as a dynamic short-range support and trend continuation marker.

⊢

▦ EMA21 - ($104.883,22):

∴ Price remains notably above the EMA21, confirming structural strength in medium-term trend;

∴ The EMA21 was previously retested during consolidation in Q2 2025;

∴ A weekly close below it would indicate a structural loss of momentum.

✴️ Conclusion: EMA21 confirms medium-term bullish bias as long as preserved.

⊢

▦ WMA50 - ($98.605,81):

∴ WMA50 serves as a major cyclical support and remains untouched since early 2024;

∴ The gap between price and WMA50 indicates strong extension, yet risk of mean reversion rises;

∴ This level aligns with a prior demand zone around ($95K–$100K).

✴️ Conclusion: WMA50 is a latent demand zone - strategic if market reverts from exhaustion.

⊢

▦ WMA100 - ($84.570,72):

∴ This weighted average aligns with the 0.382 Fibonacci level;

∴ A long-term correction toward this band would reflect the depth of macro pullbacks in previous cycles;

∴ Currently distant from price action, but structurally significant if macro volatility increases.

✴️ Conclusion: WMA100 anchors mid-cycle recalibrations and aligns with retracement symmetry.

⊢

▦ WMA200 - ($63.181,79):

∴ The 200-week WMA remains far below price and untouched since early 2023;

∴ This is the ultimate structural support in secular bull cycles;

∴ If revisited, it signals macro-level capitulation or black swan scenario.

✴️ Conclusion: WMA200 holds the foundational line of long-term structural integrity.

⊢

▦ Fibonacci Retracement - (Range from 0 = $27.143,79 to 1 = $122.056,95):

∴ 0.000 = $27.143,79 - Genesis base from Apr 2025 cycle;

∴ 0.236 = $49.543,30 - Psychological line of control in late 2023;

∴ 0.382 = $63.400,62 - Aligned with long-term moving averages;

∴ 0.500 = $74.600,37 - Symmetry pivot of current macro-leg;

∴ 0.618 = $85.800,12 - Golden pocket lower bound;

∴ 0.786 = $101.745,53 - Golden pocket upper edge and structural resistance pre-breakout;

∴ 1.000 = $122.056,95 - Current cycle high (resistance zone);

∴ 1.618 = $180.713,28 - Projected extension target for parabolic continuation.

✴️ Conclusion: Key retracement zones for tactical reactions lie at (0.786 - $101.7K) and (0.618 - $85.8K); upside breakout target confirmed at (1.618 - $180K).

⊢

▦ Volume + EMA21 - (Last: 2.38K BTC):

∴ Volume is stable and slightly rising compared to prior weekly sessions;

∴ No high-volume sell candles indicate panic or exit;

∴ EMA21 on volume shows baseline liquidity remains active.

✴️ Conclusion: Healthy volume confirms orderly continuation rather than climax or exhaustion.

⊢

⨀ II. Momentum & Pressure Indicators:

▦ RSI (21) + EMA9 - (66.71 / 64.34):

∴ RSI approaches the 70-level but remains below overbought territory;

∴ EMA of RSI confirms rising internal strength;

∴ No divergence is observed - internal price energy remains aligned with upward momentum.

✴️ Conclusion: RSI signals strong but not overheated momentum - bulls still in control.

⊢

▦ MACD (9, 21) - (MACD: 7,887.99 | Signal: 6,362.06 | Histogram: +1,525.93):

∴ MACD histogram remains green, showing continuation of bullish trend;

∴ The spread between MACD and Signal is positive and expanding again;

∴ No bearish crossover threat imminent at current slope.

✴️ Conclusion: MACD structure reinforces bullish pressure - trend still intact.

⊢

▦ OBV + EMA9 - (OBV: 220.38M):

∴ OBV remains in an uptrend, supporting price action;

∴ EMA overlay shows no divergence or flattening;

∴ Volume accumulation remains healthy, confirming underlying conviction.

✴️ Conclusion: OBV supports continuation - no signs of distribution.

⊢

▦ Stochastic RSI (3,3,21,9) - (%K: 93.68 / %D: 90.72):

∴ Both %K and %D lines are in the overbought zone (>90);

∴ Crossovers are still bullish but nearing potential exhaustion zone;

∴ Caution warranted for short-term momentum correction.

✴️ Conclusion: Overbought levels reached - watch for tactical slowing, though no reversal confirmed.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The weekly chart exhibits a structurally intact bull trend, confirmed by the alignment and spacing of EMA's and WMA's across all horizons (short, mid, long);

∴ Fibonacci retracement levels delineate critical reaction zones, with (0.786 - $101.745,53) and (0.618 - $85.800,12) serving as dominant retrace supports in the event of a tactical correction;

∴ The presence of a projected (1.618 extension at $180.713,28) offers a sacred path forward should price breach and sustain above the current high of $122K.

∴ Momentum oscillators (RSI and MACD) continue their upward thrust without divergence, but the Stochastic RSI warns of temporal exhaustion - a typical hallmark before consolidation or rotation;

∴ Volume structure is stable and non-climactic, suggesting continuation rather than blow-off;

∴ No sign of distribution via OBV - accumulation remains intact.

✴️ Conclusion: The market remains within the upper chamber of the Fibonacci spiral. Tactical cooling is possible due to overextension in the momentum field, but no structural damage is observed. A controlled retrace into the golden pocket would be both acceptable and ritualistically symmetrical. The path to $180K remains open, but guarded.

⊣

⟁ BTC/USD - CME Futures BTC1! - (CHART: 1D) - (Jul 27, 2025):

◇ Current Price: $120.785.

◇ Chart Link:

⊣

▦ CME Futures GAP - Observation & Ritual Closure:

∴ The current chart shows a clustered consolidation near $120K–$121K with no immediate upper gap visible;

∴ The last prominent CME Gap was filled during the late June run-up and early July vertical move;

∴ No new gap formed during the weekend-to-weekday open for the last 3 sessions - continuity is intact.

✴️ Conclusion: There is no unfilled CME Gap between the current price and previous sessions. All recent discontinuities appear ritually sealed. Attention now turns to potential downside gaps from rapid bullish impulse moves around ($104K–$108K), which could remain structurally unfilled - unless tactically challenged during correction.

⊢

🜎 Strategic Insight - CME Oracle:

∴ The lack of open CME Gaps suggests a clean technical field - no magnet effect pulling price backward in the short term;

∴ The compression near $121K may precede either an explosive breakout toward the Fibonacci extension ($122K / $130K+), or serve as a false plateau before a tactical flush;

∴ Absence of gaps also removes "gap fill" traders from immediate relevance, allowing price to move freely based on liquidity and macro flows.

✴️ Conclusion: The CME chart confirms no active gravitational pull downward - the battlefield is neutral and favorably clean for bullish continuation, pending macro and liquidity alignment.

⊢

∫ III. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + 9EMA - (All Exchanges):

∴ Exchange inflows remain significantly suppressed, with no spikes above 75K BTC since Q4 2023, despite the price nearing $120K;

∴ The 9EMA of inflows is stable and near local lows, showing no abnormal movement toward exchanges;

∴ Historically, spikes in inflow coincide with distribution, fear, or profit-taking, none of which are currently present on a structural level.

✴️ Conclusion: The on-chain exchange inflow behavior confirms low distribution pressure at current highs. The lack of elevated Bitcoin deposits into exchanges indicates conviction among holders and the absence of a mass selloff attempt, even near critical Fibonacci resistance.

⊢

🜎 Strategic Insight – On-Chain Oracle:

∴ While price consolidates near its cyclical high, exchange inflows remain muted, echoing behavior observed during earlier phases of strong market conviction (e.g., late 2020);

∴ This suggests the market is not preparing for heavy liquidation;

∴ The silence of inflows reinforces the tactical hypothesis that current price action is organic and not panic-driven, preserving the ritual path toward ($122K/$180K).

⊢

⧉ IV. Contextvs Macro-Geopoliticvs - Interflux Economicvs:

▦ US-EU Trade Accord: 1(5% Unified Tariff Across All Sectors):

∴ The United States and the European Union have reached a comprehensive trade agreement, averting escalation: a 15% unified tariff will apply across most EU exports to the US, down from a threatened 30%;

∴ Exceptionally high 50% tariffs remain on steel and aluminum, while some industries such as automotive, semiconductors, and pharmaceuticals will be capped at 15%;

∴ Zero-tariff exemptions have been granted to strategic sectors, including aerospace, select chemicals, semiconductor equipment, agricultural products, and critical raw materials;

∴ In return, the EU has committed to invest $600 billion in US infrastructure and tech, and to purchase $750 billion worth of US energy and defense products over three years.

✴️ Conclusion: The trade pact imposes moderate cost adjustments for key industries but restores transatlantic stability. Although friction remains in sensitive sectors, the agreement prevents global trade disorder and enhances strategic economic visibility.

⊢

🜎 Strategic Insight - Macro Oracle:

∴ The accord mitigates systemic trade risk and clears geopolitical uncertainty, which would otherwise impair market confidence in risk-on assets;

∴ Predictable tariffs (15%/50%) reduce abrupt inflationary shocks, enhancing macroeconomic forecasting and central bank policy latitude;

∴ Massive EU commitments in energy and defense inject transatlantic liquidity and strengthen demand for US dollar-based assets;

∴ While European manufacturers face pressure, the global system benefits from lower volatility and restored economic symmetry;

∴ This opens room for speculative and structural capital to flow more confidently into high-volatility instruments, including crypto assets.

✴️ Conclusion: The macro backdrop reinforces the sacred bullish path - a re-alignment of order in the West, combined with non-disruptive trade stabilization, lays the groundwork for continuation of liquidity-driven risk flows. Bitcoin stands to benefit as a speculative vessel in a structurally stable yet monetarily dynamic environment.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish - Tactically Watchful:

∴ Price remains above all critical EMA's and WMA's on the 1W chart;

∴ Fibonacci structure is intact, with the $122K high acting as ritual resistance and the (0.786 / 0.618 zone ($101K / $85K) as sacred fallback;

∴ Momentum indicators (MACD, RSI) sustain positive bias with no divergences;

∴ CME Futures show no unfilled gaps - the field is clean, allowing strategic extension.

✴️ Conclusion: The macrostructure supports continuation higher into the sacred extension zone ($130K–$180K), with short-term vigilance warranted due to overbought Stoch RSI and reduced volume velocity.

⊢

▦ Tactical Range Caution:

∴ Upper Limit: $122.056 - Cycle high and Fibonacci 1.0;

∴ Mid Guard: $112.770 - EMA9;

∴ Structural Support: ($101,745 - 0.786) Fib retrace;

∴ Golden Anchor: ($85.800 - 0.618) Fib retrace.

✴️ Conclusion: As long as price remains above $101K, the bullish code remains sealed. Breach of $85K would unlock deeper structural reassessment.

⊢

◩ Codicillus Silentii - Strategic Note:

∴ The week closes at the threshold of the Fibonacci (1.0 mark - $122.056), beneath a ceiling forged by time and belief;

∴ All technical layers are aligned, yet the silence in the inflow, the clean CME field, and macro equilibrium whisper a rarer truth - no storm is seen, but no wind is promised;

∴ This is the zone of the Watcher - where action becomes hesitation, and hesitation becomes discipline.

✴️ Strategic Note & Final Seal: Do not confuse absence of danger with presence of opportunity. A vertical structure with no threat below can still falter from within. This is a time not to act, but to remain unshaken.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

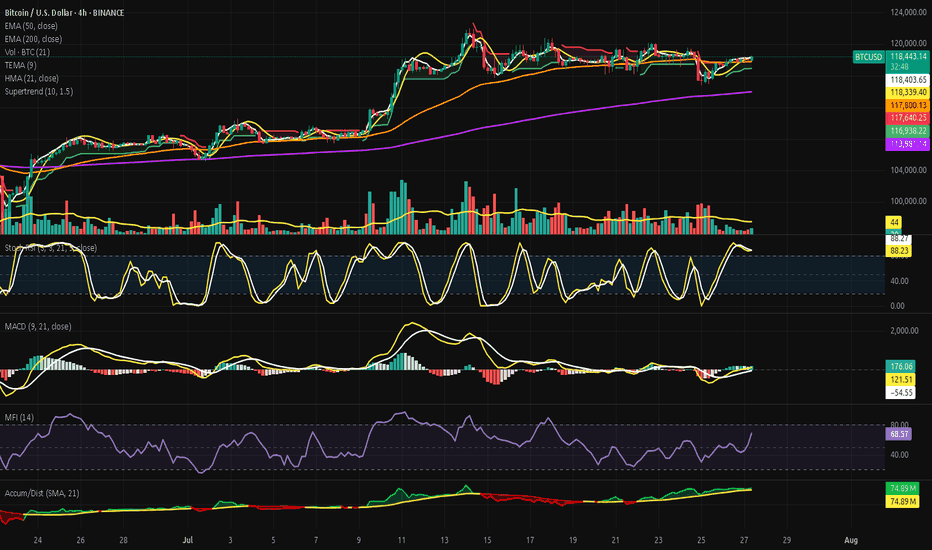

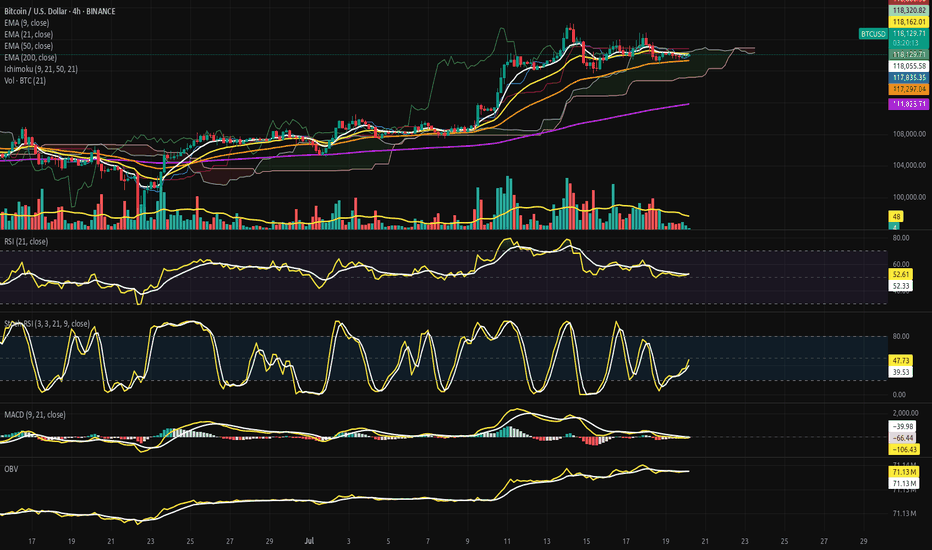

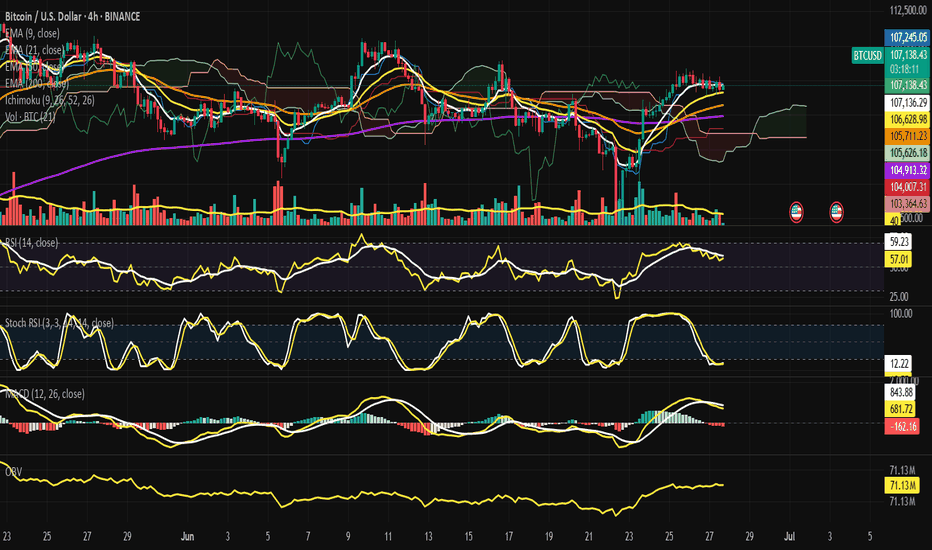

Bitcoin - Strategic Coil Within the Arcane Band.⊢

⟁ BTC/USD - BINANCE - (CHART: 4H) - (July 27, 2025).

◇ Analysis Price: $118.309,59.

⊣

⨀ I. Temporal Axis - Strategic Interval - (4H):

▦ TEMA9 - ($118.338,48):

∴ Price is currently below TEMA9, indicating near-term resistance;

∴ Curve is upward-sloping but flattening, suggesting fading acceleration;

∴ Acts as reactive signal line; minor rejection occurred on contact.

✴️ Conclusion: Momentum fading as price struggles to hold above dynamic resistance.

⊢

▦ HMA21 - ($118.324,83):

∴ Smooth curvature maintaining upward bias;

∴ Close proximity to TEMA9 shows compressed volatility regime;

∴ Price interacting with HMA without definitive breakout.

✴️ Conclusion: Tactical direction remains constructive, but confirmation is lacking.

⊢

▦ EMA50 - ($117.794,89):

∴ Strong medium-term support; price remains above it with clear respect;

∴ Acts as lower bound of the current compression channel;

∴ No bearish cross detected with TEMA or HMA.

✴️ Conclusion: Mid-term bullish support structure intact.

⊢

▦ EMA200 - ($113.979,81):

∴ Structure well below active price; rising and stable;

∴ Indicates long-term bullish posture is unbroken;

∴ No signs of major breakdown or transition to bear structure.

✴️ Conclusion: Structural uptrend remains unthreatened.

⊢

▦ SuperTrend Arcanvm - (ATR 10, 1.5 - $117.640,25):

∴ Price trades above the SuperTrend line, indicating continuation zone;

∴ Support zone lifted slightly, confirming minor trend maintenance;

∴ No signal reversal or close below since last shift.

✴️ Conclusion: Tactical upward bias protected by volatility-based support.

⊢

⨀ II. Momentum & Pressure Indicators:

▦ Stochastic RSI (3,3,21,9) - (%K: 88.23 / %D: 88.27):

∴ Deep into overbought zone; potential reversal region;

∴ Minor negative crossover forming (%K < %D);

∴ Pattern shows repeated false breaks from high zone.

✴️ Conclusion: Overextended with local fatigue building.

⊢

▦ MACD (9,21,9)- (Line: 164.40 / Signal: 106.94 / Histogram: +57.47):

∴ Bullish crossover confirmed and holding; histogram positive;

∴ Increasing MACD separation suggests underlying momentum;

∴ No divergence yet; consistent short-term upside energy.

✴️ Conclusion: Momentum favors bulls but remains immature.

⊢

▦ MFI (14) - (68.20):

∴ Trending toward overbought zone without breach;

∴ Steady increase reflects sustained volume-backed inflows;

∴ Not yet extreme; still has energy potential to fuel move.

✴️ Conclusion: Volume pressure supports bullish case with room left.

⊢

▦ Accumulation/Distribution + HMA21 - (74.89M):

∴ Line remains stable above short-term base; no outflow signals;

∴ Slight incline observed, confirming ongoing accumulation;

∴ No divergence with price; consistent flow.

✴️ Conclusion: Capital positioning remains supportive of continuation.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The current 4H structure on BTC/USD exhibits a compressed upward bias where dynamic resistance (TEMA + HMA) is being tested persistently but without explosive breakout;

∴ Momentum indicators (MACD, MFI) confirm early-stage bullish pressure, while structural supports (EMA50, SuperTrend) remain intact and responsive;

∴ However, Stoch RSI is saturated, suggesting that any continuation would likely require a cooling cycle or shallow retracement before sustainable thrust;

∴ This configuration aligns with a “Pre-Break Range Staging” - a technical limbo where buyers are present but cautious, and sellers are absorbed without significant follow-through.

✴️ Strategic Focus: Watch for confirmation above ($118.600) with volume expansion and MACD histogram follow-through, or a soft retest toward ($117.640/117.800) as reloading zone.

∴ Logic sealed. Tactical silence until resolution.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish - (Tactically Fragile Continuation):

∴ The long-term structure (EMA 200 rising, unbroken) confirms a preserved bullish frame;

∴ Mid-term support (EMA 50 + SuperTrend) is active and functioning as a technical base;

∴ However, price struggles to sustain above dynamic resistance (TEMA/HMA), and Stoch RSI signals short-term exhaustion.

✴️ Conclusion: The structure is upward, but the current tactical zone is sensitive. Any bullish continuation demands confirmation and discipline - no chasing.

⊢

▦ Tactical Range Caution:

∴ Support Zone - (Defensive): $117,640 / $117,800;

∴ Resistance Ceiling - (Breakout Trigger): $118,600;

∴ Tactical Neutral Band: $118,000 / $118,300.

✴️ Conclusion: No trade zone expands if compression persists. Breakout or breakdown must be decisive and accompanied by volume/momentum synchrony.

⊢

◩ Codicillus Silentii - Strategic Note:

∴ In moments of compressed structure near resistance, the market does not reveal itself through price - but through how it refuses to move. Silence becomes signal;

∴ What is observed here is not a lack of momentum - but deliberate withholding of directional intent;

∴ The system is balanced between emergent buy pressure (MACD, MFI, Accum/Dist) and short-term saturation (Stoch RSI), forming a strategic standoff:

No major actors are retreating, but none are charging forward either.

The candle bodies shrink while oscillators extend - a classic sign of non-confirmed bullish bias.

Emotional traders will chase; initiated ones will wait for the candle that breaks the silence, not the one that whispers hope.

✴️ Final Seal: The stoic operator does not react to pressure - he reacts to structure.

Tactical inaction is a move; Watching is positioning; Discipline is participation.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

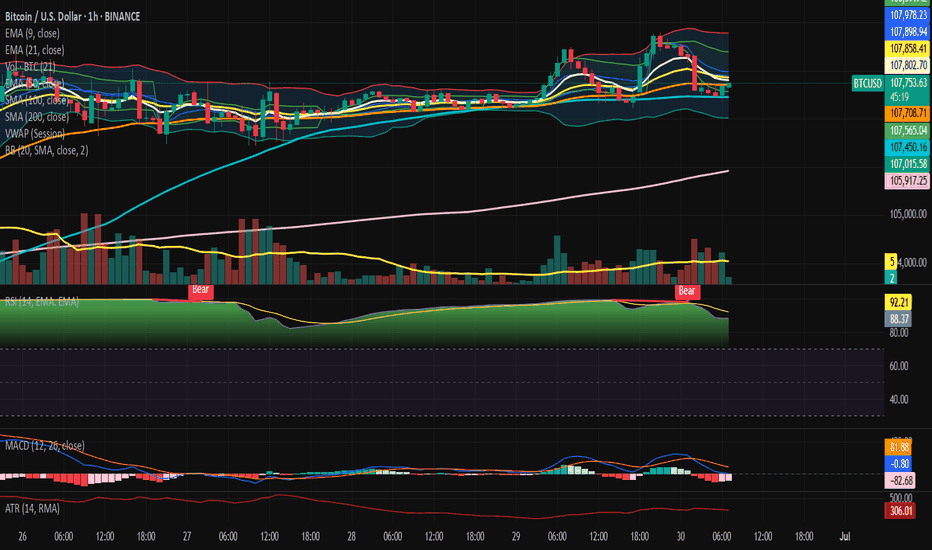

Bitcoin Beneath the Arc of Silence - Structural Faith, Tactical?⊢

⟁ BTC/USD - BINANCE - (CHART: 1D) - (July 26, 2025).

◇ Analysis Price: $117,421.02.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - ($117,842.79):

∴ The EMA9)is currently positioned at $117,842.79, slightly above the price ($117,421.02), acting as immediate dynamic resistance;

∴ Price has closed below EMA9 for multiple sessions, indicating a fading short-term momentum arc;

∴ The slope of the EMA9 is flattening, signaling an inflection zone rather than active thrust.

✴️ Conclusion: The short-term control line has been lost tactically; a sign of momentum exhaustion but not structural breakdown.

⊢

▦ EMA21 - ($116,001.77):

∴ EMA21 stands at $116,001.77, serving as an intermediate-range support below current price;

∴ The slope remains positive, providing a second-layer bullish structure after the loss of EMA9;

∴ Price has not tested EMA21 since early July - proximity implies possible gravitational pull.

✴️ Conclusion: EMA21 is the next defense line in a suspended structure, acting as the center of tactical compression.

⊢

▦ EMA50 - ($111,691.19):

∴ EMA50 sits at $111,691.19, aligned closely with the (0.236 Fibonacci) and historical cluster zone;

∴ Price has remained well above this level for over 30 sessions;

∴ The slope is clearly positive, marking macro structural support.

✴️ Conclusion: EMA50 represents the last reliable arc before macro invalidation. Its integrity maintains the long-term bullish thesis.

⊢

▦ Fibonacci Retracement:

∴ Retracement is correctly anchored: 1.0 = $122,054.86 (ATH) / 0.0 = $98,385.45 - (June 22 low);

∴ Price currently oscillates within the 0.618–0.5 zone ($113k–$110k), the classical golden pocket;

∴ The golden pocket aligns closely with EMA21 and the Bollinger mean, forming a triple confluence zone.

✴️ Conclusion: Price is inside the Fibonacci heart of reaccumulation - ideal for breakout setups or breakdown invalidation.

⊢

▦ Bollinger Bands (21, 2.0):

∴ The upper band is at $123,377.19, while the middle band rests at $116,314.72;

∴ Price is between the middle and upper bands, consolidating after rejection from the upper line;

∴ The bands are narrowing, indicating a volatility contraction cycle.

✴️ Conclusion: Bollinger geometry confirms volatility suppression, aligning with RSI and MACD flattening - a signal of impending release.

⊢

▦ RSI (21) + EMA9:

∴ RSI is at (59.99), slightly under its EMA9 - (62.59), showing momentum erosion without collapse;

∴ The RSI has declined from the high 70s in late June, signaling tactical cooling;

∴ Remaining above 50 preserves structural bullish bias.

✴️ Conclusion: RSI is in tactical descent, but not structurally bearish - neutral-to-bullish compression.

⊢

▦ MACD (9,21):

∴ MACD line is below signal line, currently at (1,841.01) vs (2,419.86), confirming a bearish cross;

∴ Histogram prints red for several sessions, with fading amplitude;

∴ Despite the crossover, MACD remains in positive territory, indicating soft correction, not trend reversal.

✴️ Conclusion: MACD confirms a tactical retracement, aligned with RSI weakness, yet within bullish context.

⊢

▦ Stochastic RSI (3, 3, 21, 9):

∴ Current value is 0.00, denoting extreme oversold conditions;

∴ Multiple sessions have closed at this level without relief;

∴ Historically, flatlines at 0.00 often precede upward jolts.

✴️ Conclusion: Stoch RSI indicates exhaustion of momentum - potential for rebound or failed bounce.

⊢

▦ Volume + EMA21:

∴ Volume on current sessions is below the 21-period EMA, confirming absence of strong sell-side dominance;

∴ No abnormal spikes or climaxes are visible - neither panic nor breakout yet;

∴ Volume profile aligns with Bollinger contraction.

✴️ Conclusion: Quiet volume supports the thesis of controlled tactical consolidation, not distribution.

⊢

▦ OBV + EMA9:

∴ OBV stands at 102.17M, flatlined with EMA9;

∴ No divergence detected relative to price;

∴ Momentum of accumulation remains static but not deteriorating.

✴️ Conclusion: OBV is in neutral stance, neither confirming breakout nor selloff - favors tactical patience.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ Bitcoin is suspended in a compressed volatility range beneath its local high, resting upon layered support zones defined by EMA21, Bollinger median, and the Fibonacci golden pocket (0.618–0.5);

∴ Momentum indicators (RSI, MACD, Stoch RSI) are all in tactical decline, yet no structure has been broken - price still floats above all macro EMA's (21, 50) with OBV unshaken;

∴ The short-term weakness is absorbed within a higher-order structural integrity, suggesting latent potential awaiting a fundamental catalyst.

✴️ Conclusion: The oracle observes a coiled market, technically restrained but not structurally broken - an archetype of Strategic Suspension Beneath the Arc of Silence.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Netflow Total + 9EMA - (All Exchanges):

∴ The current netflow is (-864.6 BTC), remaining firmly below its EMA9 baseline;

∴ The 9-day moving average of netflows is flat-to-negative, signaling persistent withdrawal pressure from exchanges;

∴ Sustained negative netflows in conjunction with a stable price floor indicate non-speculative cold storage behavior.

✴️ Conclusion: Netflow structure is bearish for exchanges, but bullish for long-term price, as BTC flows into private custody.

⊢

▦ Miner to Exchange Flow + 9EMA - (All Miners):

∴ Current flow from miners hovers near 1.2K BTC/day, well below the EMA9 which trends above 3K;

∴ The flow has not pierced its EMA9 in recent weeks, despite BTC testing local highs - a strong non-distribution signal;

∴ The divergence between low miner outflows and high price resilience confirms supply-side discipline.

✴️ Conclusion: Miner flows remain suppressed beneath EMA9 - a structurally bullish posture amid local consolidation.

⊢

▦ Funding Rate + 9EMA - (All Exchanges):

∴ The funding rate is (+0.012), sitting above its EMA9, indicating a minor long bias across derivatives markets;

∴ There is no spike or deviation suggesting leveraged imbalance - the slope of the EMA9 remains shallow;

∴ Funding above EMA9, with RSI and MACD fading, implies a passively bullish positioning without euphoria.

✴️ Conclusion: Funding is technically constructive, aligned with healthy sentiment - not overheated, nor bearish.

⊢

▦ Spent Output Profit Ratio - (SOPR) + 9EMA - (Adjusted):

∴ The SOPR stands at 1.016, maintaining a position above its 9-day EMA;

∴ No dip below 1.0 has occurred in recent sessions, showing that BTC is being transacted in profit;

∴ EMA(9) acts as a median around 1.0 - a psychological pivot between profit realization and capitulation.

✴️ Conclusion: SOPR above EMA9 confirms a healthy trend, with profits being realized in harmony - not desperation.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ All four on-chain pillars - Exchange Netflow, Miner Flow, Funding, SOPR - operate in favor of structural continuation, with none indicating exhaustion or distribution;

∴ The alignment of each indicator above or below EMA9 in the appropriate direction (accumulation vs euphoria) forms a cohesive bullish framework;

∴ The lack of pressure from miners, and the smooth funding environment, give room for technical consolidation to mature without triggering panic.

✴️ Conclusion: The oracle discerns a hidden current of strength, buried beneath the tactical mist. Structural forces remain aligned with continuation - though the flame is dimmed, it is not extinguished.

⊢

⧉ III. Contextvs Macro-Geopoliticvs - (July 25, 2025):

▦ 10:00 AM - Core Capital Goods Orders - (Durable Goods excl. Defense & Aircraft):

∴ The index, a proxy for business investment, contracted by (-0.7%) in June - the sharpest monthly decline of the year;

∴ This marks a decisive loss of momentum in private-sector expansion;

∴ While shipments rose slightly (+0.4%), the delta is attributed to inflation, not demand.

✴️ Conclusion: The business sector shows signs of hesitation, reinforcing the case for policy accommodation.

⊢

▦ 14:30 PM - Trump's Visit to the Federal Reserve - (Rare Executive Intervention):

∴ President Trump visited Powell directly, urging him to cut interest rates to "save the American engine";

∴ Powell responded with a carefully chosen phrase: “The country is doing really well” - read by markets as passive affirmation;

∴ This act marks a rare intrusion into Fed independence, adding political volatility to monetary policy expectations.

✴️ Conclusion: The Fed is now politically cornered, caught between inflation resilience and political coercion.

⊢

▦ 16:00 PM - Market Response & Euphoria Spike:

∴ U.S. indices - S&P 500, Nasdaq, Dow Jones - all reached all-time highs on the back of Powell's phrase and Trump’s pressure;

∴ Approximately 80% of S&P companies beat earnings expectations, providing fuel to the narrative;

∴ Market interpreted silence as assent, reactivating the “Fed put” theory.

✴️ Conclusion: Markets responded as if Powell had already signaled rate cuts, despite no formal commitment.

⊢

▦ 18:00 PM - Rate Cut Probability Assessment - (CME/FedWatch):

∴ Probability of a rate cut in September rose to (61.8%), precisely echoing the Fibonacci retracement now governing Bitcoin price;

∴ This alignment signals macro-on-chain-temporal resonance;

∴ Powell reiterates data dependency - no promises, but full optionality.

✴️ Conclusion: The macro veil is thin - policy pivot is anticipated, but not yet manifest. Tactical patience is vital.

⊢

🜎 Strategic Insight - Macro Oracle:

∴ Economic data weakens subtly;

∴ Political pressure intensifies;

∴ Market euphoria resurfaces on whispers, not substance.

∴ The silence of Powell is being interpreted, not spoken - a dangerous act of collective projection.

✴️ Conclusion: The Fed speaks in veils - and markets trade in illusions. The macro climate is now psychologically unstable, but not yet structurally broken.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish - Tactically Suspended:

∴ Price action remains well supported above all macro EMA's (21, 50), the OBV is intact, and no distribution signals are present;

∴ Momentum indicators (RSI, MACD, Stoch RSI) confirm a tactical cooldown, not collapse;

∴ On-chain fundamentals (Netflows, Miner Behavior, SOPR, Funding) remain constructively aligned.

✴️ Conclusion: Structurally, the market preserves a bullish foundation, while tactically locked in volatility suppression and directional indecision.

⊢

▦ Tactical Range Caution:

∴ Resistance: $123,377.19 (Upper BB), then $126,000 (local expansion);

∴ Pivot: $117,800 (EMA9) / $116,000 (EMA21);

∴ Support: $113,013.15 (Fibonacci 0.618), $111,691.19 (EMA50), then $107,400 (macro reversal threshold).

✴️ Conclusion: Tactical range is compressed within a ($116K-$123K) gate. Below $111K triggers macro risk.

⊢

◩ Codicillus Silentii - Strategic Note:

∴ In the breath between policy and projection, the markets chant futures yet unspoken.

BTC rests not in fear, nor in hope - but in silence.

✴️ Final Seal: The arc is intact. The veil has not fallen. Patience is power.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

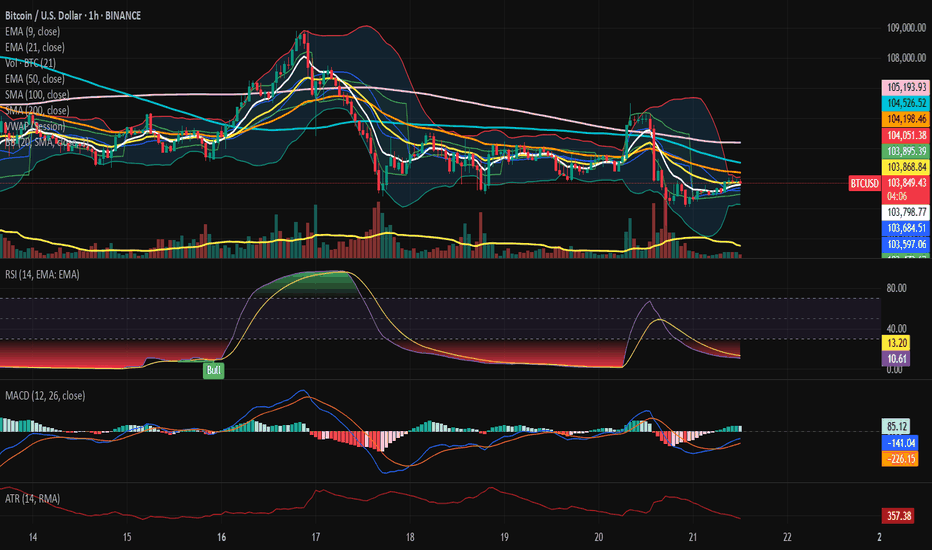

Bitcoin Awaits the Federal Voice - The Threshold of Compression.⊢

⟁ BTC/USD - BINANCE - (CHART: 1H) - (July 24, 2025).

◇ Analysis Price: $117.830,17.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1H):

▦ EMA9 - ($118.267,48):

∴ The 9-period Exponential Moving Average (EMA9) was serving as immediate microstructural support until July 23rd, when a full-bodied bearish candle broke through it with volume below average but directionally firm;

∴ Post-break, EMA9 began to flatten, then bend downward, reflecting a tactical loss of bullish momentum within the intraday range structure;

∴ Price has attempted multiple recoveries toward EMA9 but has been consistently rejected at or below it, confirming its transition into resistance status.

✴️ Conclusion: EMA9 has transitioned from a dynamic support to tactical resistance, indicating a short-term trend deterioration and weakening of upward initiative.

⊢

▦ EMA21 - ($118.396,85):

∴ The 21-period EMA functions as the median layer of microstructure and has held relatively flat for several days, suggesting a compressed momentum environment;

∴ As of the latest price action, the EMA9 has definitively crossed below EMA21 - a classic tactical signal of microtrend exhaustion, especially when paired with lateral volume and a suppressed RSI;

∴ EMA21 remains unbroken since July 21st, reinforcing its role as an anchor level for short-term rejections and as a ceiling against breakout attempts.

✴️ Conclusion: EMA21 maintains structural weight as resistance, and the confirmed cross-under by EMA9 introduces a tactical shift into intraday bearish flow.

⊢

▦ EMA50 - ($118.434,93):

∴ The 50-period EMA, long considered the “defensive perimeter” of bullish short-term structure, had been flattening with slight upward bias since July 19th;

∴ However, in the last two sessions, it has shown the first measurable downward curvature, marking the decay of medium-term intraday bullish control;

∴ Price remains significantly below the EMA50, and multiple upside attempts have failed before even reaching it, reflecting market hesitation and lack of participation.

✴️ Conclusion: EMA50 has begun its first bearish slope since July 16th, indicating an eroded tactical bias and confirming loss of momentum from the bulls' side.

⊢

▦ Bollinger Bands (21, 2) - (Upper: $119.254,34 / Lower: $117.398,28):

∴ The Bollinger Bands have narrowed continuously over the last three sessions, forming a visible compression channel - a prelude to volatility expansion;

∴ Price rejected cleanly from the upper band on July 23rd and traveled to the lower band without support, closing two candles consecutively near the lower range;

∴ The Bollinger Median is aligned with the EMA21, reinforcing its status as the core compression axis and tactical gravity point.

✴️ Conclusion: Bollinger structure suggests imminent breakout scenario; current price behavior signals bearish volatility bias unless structure is broken with strong volume.

⊢

▦ Volume + EMA 21 - (Current: 13 BTC):

∴ Volume has declined steadily throughout the last five trading sessions, as seen in the downward-sloping EMA21 overlaid on the volume histogram;

∴ Recent bearish moves occurred on lower volume compared to previous weeks, indicating low conviction and possible manipulation-prone liquidity zones;

∴ There is no expansion in volume accompanying the most recent directional candles, confirming this as a phase of tactical disinterest rather than distribution.

✴️ Conclusion: Market participants are not committing capital - the tape is flat, silent, and manipulable, increasing the risk of abrupt fakeouts or shadow breakouts.

⊢

▦ RSI (21) + EMA 9 - (Current RSI: 45.55):

∴ The Relative Strength Index has remained below the 50-neutral mark for three sessions, with a confirmed downward slope and rejection from its 9-period EMA overlay;

∴ There is no sign of divergence, bullish or bearish, suggesting that price action is neither exhausted nor ready to reverse;

∴ RSI’s current position confirms momentum is negative but controlled - an environment of inertia rather than acceleration.

✴️ Conclusion: RSI confirms tactical weakness - directional force is absent, and momentum favors sellers in a low-intensity regime.

⊢

▦ Stochastic RSI (3, 3, 21, 9) - (Current: 4.32):

∴ The Stoch RSI has fallen into extreme oversold territory after failing to sustain a double-top formation near the 80-level earlier this week;

∴ The plunge occurred with speed and depth, signaling loss of buying initiative - often a precursor to passive rebounds without follow-through;

∴ Current readings near zero indicate the potential for technical retracement, but no reversal confirmation is present without RSI and MACD alignment.

✴️ Conclusion: The oscillator signals oversold status, but the context suggests any bounce would be corrective, not impulsive - a trap for premature long entries.

⊢

▦ MACD (9, 21) - (MACD: -95.69 / Signal: -129.37):

∴ MACD histogram shows initial contraction of bearish momentum, but remains submerged below the zero-line and far from a clean crossover;

∴ MACD line is attempting to turn up, but the signal line remains significantly below it, indicating lack of consensus between short and medium-term momentum;

∴ Previous fake signals from MACD in this range suggest caution divergence is visible, but -structure is weak.

✴️ Conclusion: MACD shows early signs of momentum divergence, but without structure or volume, the setup remains fragile and unconfirmed.

⊢

▦ OBV + EMA9 - (OBV: 26.69K):

∴ On-Balance Volume has entered a horizontal band with no structural incline or decline for three consecutive days;

∴ OBV's 9-period EMA is now perfectly flat, reflecting market indecision and a symmetrical distribution of volume over time;

∴ No bullish or bearish divergence is visible, indicating that volume flow is passive and non-directional.

✴️ Conclusion: OBV confirms tactical silence in the order book - structure lacks engagement, and accumulation or distribution is absent.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ All indicators on the H1 chart converge toward a single message: tactical drift within a structurally neutral, low-volume regime;

∴ The EMA's are aligned downward, RSI is slipping without exhaustion, MACD offers unconfirmed divergence, and Stoch RSI is oversold without structure;

∴ This constellation presents a dangerous battlefield - one where silence reigns louder than signal;

∴ Breakouts are possible, but not probable without macro ignition.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Reserves + 9EMA - (All Exchanges):

∴ Bitcoin reserves on centralized exchanges have decreased from (~2.46M) to 2.41M Bitcoin over the past 30 days, but the decline halted on July 21st and entered a horizontal range;

∴ This plateau indicates a pause in the long-term outflow trend, suggesting that neither accumulation nor distribution is dominating;

∴ Exchange reserves are a key liquidity gauge, and flatlining implies equilibrium between withdrawal behavior and deposit pressure.

✴️ Conclusion: No liquidity threat from centralized exchange reserves - a neutral signal in an inert market.

⊢

▦ Funding Rate + 9EMA - (All Exchanges):

∴ The funding rate remains mildly positive across perpetual contracts, indicating a slight long bias - (+0.008);

∴ However, the rate is far from extremes that would signify either overleveraging or liquidation risk;

∴ Historical context shows that a funding rate near zero during price stagnation often precedes volatility expansion.

✴️ Conclusion: Cautious optimism present among derivatives traders, but not enough to drive trend - latent energy, directionless.

⊢

▦ Stablecoin Ratio + 9EMA - (All Exchanges):

∴ The ratio of stablecoins to Bitcoin on exchanges remains at all-time lows, signaling an environment with reduced buying power;

∴ This lack of fresh capital severely limits the capacity for breakout rallies, especially when combined with poor volume and flat OBV;

∴ No stablecoin inflows = no fuel for upward movement.

✴️ Conclusion: The market is liquidity-starved - stablecoin ratio confirms lack of bullish firepower.

⊢

▦ Realized Cap + 9EMA:

∴ Realized Cap has surpassed the $1 trillion mark for the first time, suggesting robust conviction among holders and long-term participants;

∴ This metric rises only when coins move at a profit, indicating that active participants are not capitulating but rather holding or consolidating;

∴ The Realized Cap trajectory diverges from flat spot price - an arcane sign of underlying strength.

✴️ Conclusion: Structural confidence remains intact at the macro level - price inertia belies silent conviction.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ On-chain metrics whisper stability;

∴ No excessive optimism, no panic, just a dry and frozen battlefield;

∴ Exchange reserves are flat, stablecoin ratio is weak, but Realized Cap shows unwavering belief; ∴ If the market breaks, it will be macro-induced - not on-chain triggered.

⊢

✴️ Codicillus Silentii - Strategic Note:

∴ The gatekeepers are at the threshold:

Jerome Powell’s speech: July 25;

U.S. GDP Q2 (Preliminary): July 26.

∴ Both are macro-keystones that will either ignite movement or deepen compression. The tape is silent because the world awaits signal.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Neutral - Tactically Bearish Drift.

∴ EMA's aligned downward, RSI below midline, OBV stagnant - no strength, no collapse;

∴ Bearish drift, but no conviction.

▦ Tactical Range Caution:

∴ Support: $117.400 - (lower Bollinger limit);

∴ Resistance: $118.900 - (EMA cluster + BB midline).

✴️ Final Seal: Bitcoin rests under the veil of compression. Eyes turn to Powell. Silence prepares the break.

⊢

✴️ Final Codex Interpretation:

∴ The chart speaks not in fire nor fury - but in breathless tension:

Each line, curved and silent, awaits the tremor of a greater voice;

The market is not weak - it is listening. And what it hears may not be price, but power.

∴ The candles drift beneath their own gravity:

The EMA's now form a declining constellation, dimming the tactical skies;

No reversal, no collapse - only weightless time.

∴ Volume is not a storm. It is absence:

And absence in markets is not peace - it is preparation.

∴ On-chain, conviction stands with sealed lips:

Reserves unmoved, stablecoins withdrawn, but Realized Cap ascends - as if the soul of Bitcoin advances, while the flesh waits behind.

∴ And above all - the macro sphere:

Two seals remain locked: Powell’s speech and GDP;

One whispers interest rates. The other shouts reality.

⊢

✶ This is not a trend. It is a pause in fate;

✶ This is not weakness. It is breath before the chant.

⊢

✴️ Conclusion Codex Interpretation:

∴ Bitcoin is in deliberate suspension - structurally stoic, tactically inert;

∴ A sovereign asset waiting not for buyers, but for context;

∴ The gate opens July 25th. Until then: silence reigns.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

Bitcoin at the Threshold of the Fibonacci Gate - Silent Strain.⊢

⟁ BTC/USD - BINANCE - (CHART: 1W) - (July 22, 2025).

◇ Analysis Price: $119.209,03.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1W):

▦ EMA9 - ($111.083,72):

∴ Price remains well above the EMA9, with consistent bullish spacing;

∴ The weekly candle closes with strength and full-body integrity above it;

∴ EMA9 slope continues upward, supporting ongoing momentum.

✴️ Conclusion: Short-term structure remains decisively bullish, with trend-following support intact.

⊣

▦ EMA21 - ($103.417,42):

∴ EMA21 is sharply rising and holds significant historical support;

∴ Price remains distanced, but no vertical stretch detected;

∴ Not touched since early 2024 - the bullish cycle is intact.

✴️ Conclusion: Mid-cycle momentum remains strong. No structural weakness under current trajectory.

⊣

▦ WMA200 - ($62.496,26):

∴ Remains deep below current price action - untouched since breakout phase in 2023;

∴ Its angle is now slowly tilting upward - reflecting macro regime change;

∴ Long-term holders remain in command; no gravitational pull is active.

✴️ Conclusion: WMA200 is no longer relevant for tactical reaction, but serves as a structural floor of the cycle.

⊣

▦ Fibonacci Retracement - (Top: $122.056,95 / Bottom: $27.143,79):

✴️ Top: $122.056,95 - (07/14/2025) = 1 Fibo;