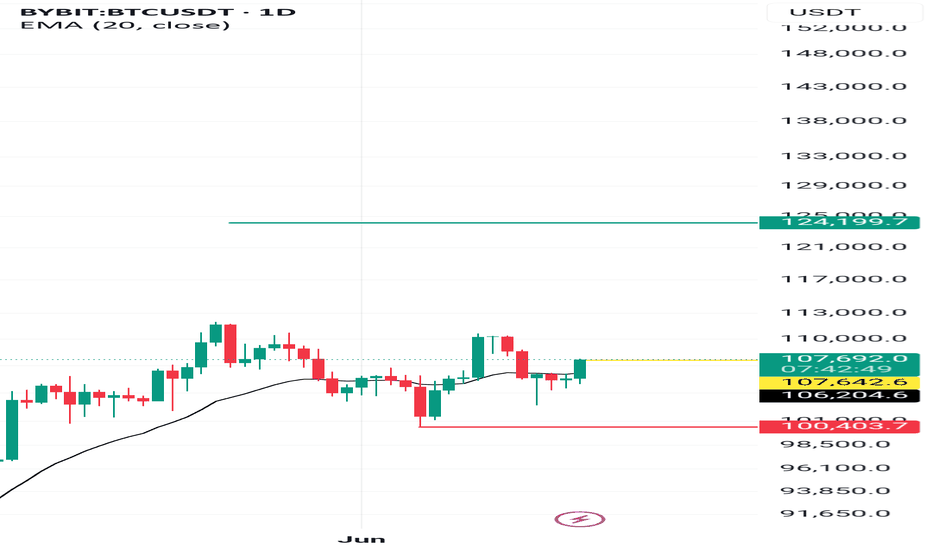

Need to wait for the key turning point.The Bitcoin market has currently broken below the key support level of 100,300, confirming a downward trend reversal. A daily-level recovery rally is now underway, and the 4-hour wave structure has not yet concluded. First, the downside target is seen at 95,000 to 98,000. Next week, the key turning point at 92,000 will likely determine the low of a rebound. Although this rebound low is not the ultimate bottom, it will trigger a relatively strong rebound after formation.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

buy@95000-95500

TP:97500-98000

Btcusdtanalysis

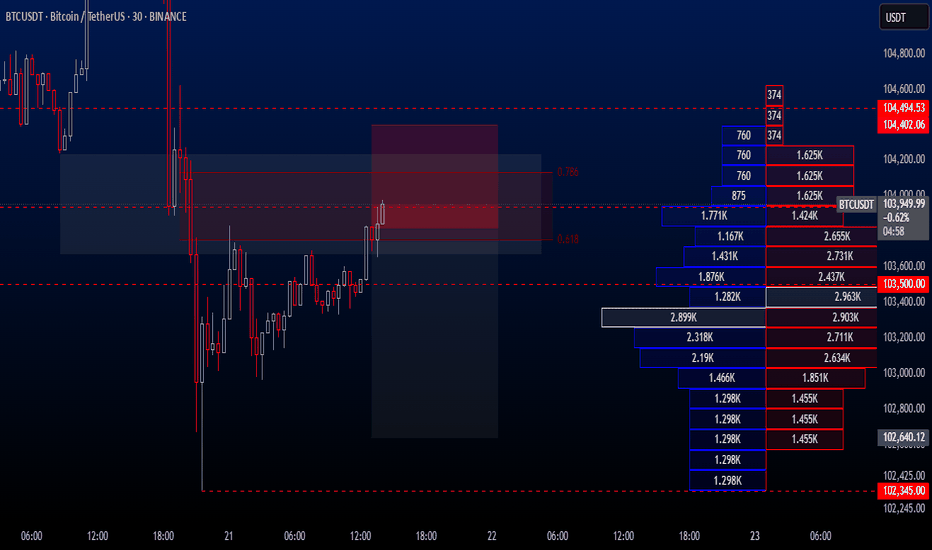

BTCUSDTHello traders. Wishing each of you a great weekend ahead!

Even though it's the weekend, I’ve spotted a sell opportunity on the BTCUSDT pair and decided to share it with you. However, we should also keep in mind that weekend markets tend to have lower volume. That said, I will still proceed with this trade based on my own risk parameters and trading strategy.

🔍 Trade Details

✔️ Timeframe: 30-Minute

✔️ Risk-to-Reward Ratio: 1:2

✔️ Trade Direction: Sell

✔️ Entry Price: 103815.32

✔️ Take Profit: 102640.12

✔️ Stop Loss: 104402.06

🕒 If the trade does not continue with strong momentum, I will keep the position open only until 23:00 today. Otherwise, I will close it either in profit or at a loss depending on the price action.

🔔 Disclaimer: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

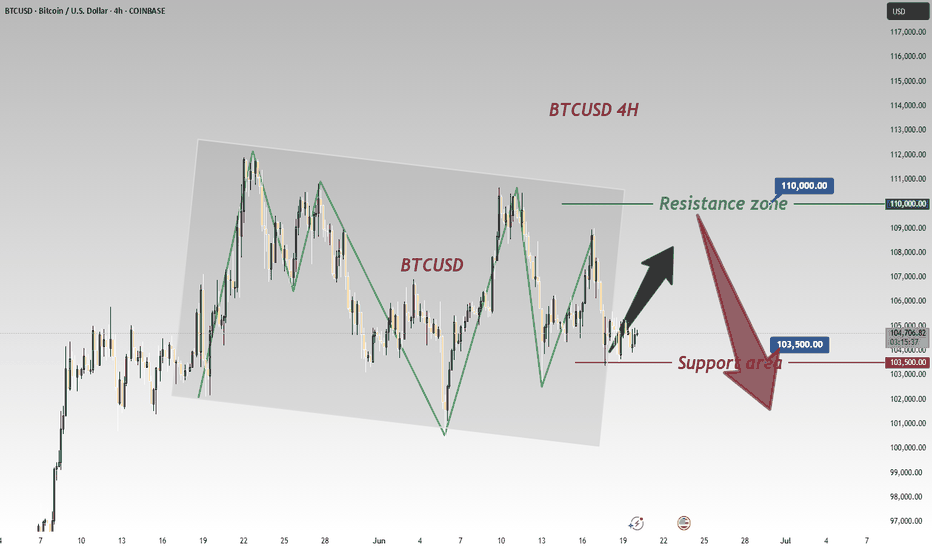

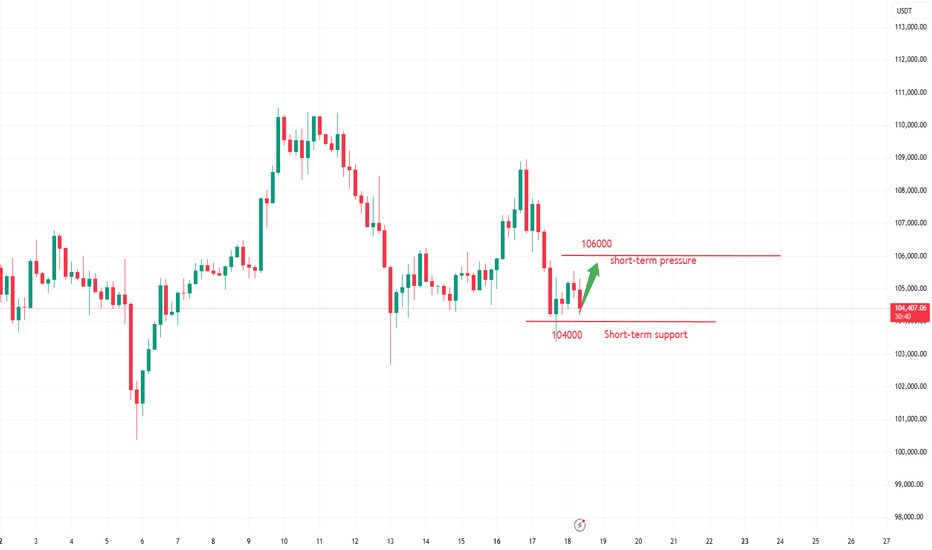

BTC Consolidates 104000-105000: Bearish Breakdown Looming?BTC Technical Update: Bitcoin has been consolidating within the 104000-105000 range for an extended period, with the overall trend showing a downward bias. With the overall trend tilting bearish, traders should watch for a break below 103500 to confirm the next leg down. 📉

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Sell@ 105000 - 104500

🚀 TP 102500 - 101500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Future market trend predictionIn the short term, the price trend of Bitcoin is full of uncertainties. On the one hand, if the global macroeconomic environment continues to deteriorate, with slower economic growth and increased inflationary pressures, it may prompt more investors to seek safe-haven assets. As an asset with certain safe-haven properties, Bitcoin may attract some capital inflows, providing support for its price. However, if regulatory policies are further tightened in the short term, especially if more stringent restrictive measures are introduced in countries and regions where Bitcoin trading is active, then the price of Bitcoin may face significant downward pressure.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

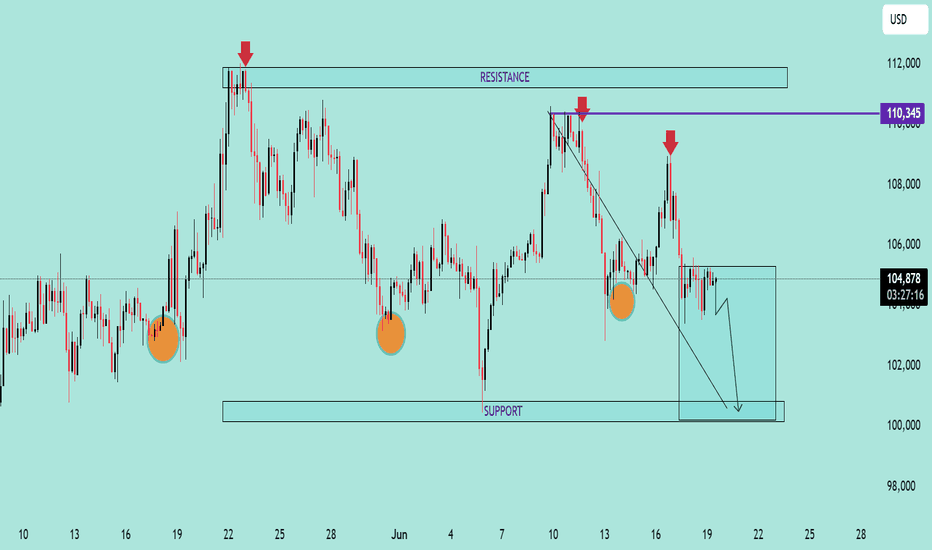

BTC/USD Bearish Outlook AnalysisBTC/USD Bearish Outlook Analysis 📉🧠

📊 Technical Overview:

The BTC/USD chart is showing signs of a bearish structure formation, suggesting increased downside momentum in the short term.

🔻 Resistance Zone:

Clear resistance is identified near $110,345, marked by multiple price rejections (🔴 red arrows).

Price failed to break above this zone several times, indicating strong selling pressure.

🔸 Support Zone:

Strong support lies near the $100,000 psychological level.

Price has respected this zone multiple times (🟠 orange circles), indicating buyer interest.

📉 Current Price Action:

A descending trendline breakout attempt failed and price is now consolidating just below $105,000.

Price is forming a bearish flag/consolidation structure after recent rejection.

A breakdown from the current box range is likely to push BTC toward the support zone at $100,000.

📉 Bearish Scenario:

If BTC breaks below $104,000, expect continuation towards $100,000.

A daily candle close below support could signal further downside.

📈 Invalidation:

Bullish invalidation occurs if BTC reclaims and closes above $108,000, with volume, retesting resistance at $110,345.

🧭 Summary:

BTC/USD is exhibiting a lower highs structure within a descending channel. Unless it breaks above the resistance zone, the bias remains bearish with a high probability of retesting support.

Bitcoin's Latest Market AnalysisThe recent escalation of the situation in the Middle East has triggered a surge in risk - aversion sentiment across global financial markets. As a risk - on asset, Bitcoin has faced certain selling pressure in a market environment dominated by risk - off sentiment.

From a technical chart perspective, Bitcoin has made multiple attempts to break through the key resistance range of $108,800 - $110,000 in the recent period, but has encountered significant selling pressure each time. On the other hand, the area between $105,000 - $103,000 forms an important support zone. When the price drops to this area, it attracts some bargain - hunting capital inflows, which provides a certain degree of support for the price.

The price of Bitcoin is expected to fluctuate within a relatively narrow range. If it can hold the key support level of $105,000 and the bulls can regain strength, the price is likely to rebound to the range of $106,000 - $108,000. However, if the $105,000 support level is effectively breached, it may trigger additional selling pressure, potentially driving the price down further to $103,000. In extreme cases, if market panic sentiment spreads further, it may test the psychological threshold of $100,000.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Bitcoin - The Elevated Cycle and the Silence Before Powell.⊢

⟁ BTC/USD – Bitstamp – (CHART: 1M) – (June 18, 2025).

⟐ Analysis Price: $104,044.00

⊢

⨀ I. Temporal Axis – Strategic Interval – (1M):

▦ EMA90 – ($39,909.00):

∴ Rising steadily, serving as long-cycle structural support since 2020;

∴ Price remains well above this average, with no signs of downward pressure;

∴ The positive slope confirms ongoing bullish macro structure.

✴️ Conclusion: EMA90 holds the foundational base of the long-term uptrend with ample buffer.

⊢

▦ SMA50 – ($48,924.00):

∴ Key axis of mid-to-long-term structure, validated by multiple touches during 2022–2023;

∴ Current price distance suggests technical room for retracement;

∴ Still rising with no sign of flattening or decay.

✴️ Conclusion: SMA50 confirms trend integrity, though overextension calls for caution.

⊢

▦ Ichimoku (Kumo & Lines) – (85,434 | 68,378 | 104,044 | 76,906 | 63,740):

∴ Price remains well above the Kumo cloud – full bullish confirmation;

∴ Tenkan and Kijun are aligned in bullish configuration, widely spread;

∴ Future cloud projects bullish momentum continuation.

✴️ Conclusion: Complete Ichimoku structure signals dominant cycle strength.

⊢

▦ MACD (12,26,9) – (2,344 | 16,426 | 14,083):

∴ MACD line remains above the signal, maintaining a monthly buy signal;

∴ Histogram shows mild expansion, but slower than previous bull cycles;

∴ Momentum is positive but decelerating.

✴️ Conclusion: Momentum remains intact, but peak cycle force may have passed.

⊢

▦ RSI (14) – (68.82 | MA: 67.35):

∴ RSI approaching overbought threshold, hovering near 70;

∴ Momentum is firm but shows resistance to further extension;

∴ Historical comparison to 2020 suggests possible ignition or exhaustion point.

✴️ Conclusion: RSI signals potential tension zone - breakout or reversal ahead.

⊢

▦ VPT (14,8) – (100):

∴ Volume Price Trend has plateaued at its max threshold;

∴ Lack of new highs despite price advance suggests fading directional volume;

∴ Often a signal of accumulation slowdown or redistribution.

✴️ Conclusion: Buyer strength may be waning beneath the surface.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ Market structure remains bullish across all core indicators;

∴ Overextension from key moving averages and flattening momentum call for tactical caution;

∴ Any macroeconomic pressure could trigger a local top, without compromising the broader trend.

⊢

∫ II. On-Chain Intelligence – (Source: CryptoQuant):

▦ Realized Price & LTH – ($47,000):

∴ Market price is well above the realized price baseline;

∴ Indicates majority of holders are in profit — structurally bullish;

∴ However, this also creates a risk of profit-taking if confidence drops.

✴️ Conclusion: Strong support floor, but latent pressure exists.

⊢

▦ SOPR - (Spent Output Profit Ratio) – (1.013):

∴ Above 1 means active profit-taking;

∴ Downward slope shows this is starting to cool;

∴ Critical to monitor for a break below 1 - would shift dynamic.

✴️ Conclusion: Still healthy, but at the edge of distribution risk.

⊢

▦ NUPL – (Net Unrealized Profit/Loss) - (0.554):

∴ Unrealized profit remains dominant;

∴ Readings above 0.5 historically precede consolidation or pullbacks;

∴ Still distant from euphoric tops, but entering alert zone.

✴️ Conclusion: Market still in profit expansion phase - but under surveillance.

⊢

▦ MVRV - (STH vs LTH) – (STH: 1.0 | LTH: 3.1 | Global: 2.2):

∴ STH neutral, LTH moderately elevated but not excessive;

∴ Market is mature, but not overheated;

∴ Still in a zone that supports further upside with restraint.

✴️ Conclusion: Healthy balance between holders - no imminent top confirmed.

⊢

▦ CME Futures Open Interest:

∴ Sharp rise in open interest across expiry horizons;

∴ Sign of speculative leverage building;

∴ Historically correlates with volatile price action post-FOMC or macro events.

✴️ Conclusion: Liquidity pressure is rising - extreme caution warranted.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ On-chain structure mirrors technical signals - strong trend, but cautious undertone;

∴ No major signs of reversal, but profit saturation could act as gravity if macro shocks occur;

∴ Market is exposed, not exhausted.

⊢

⧉ III. Contextvs Macro–Geopoliticvs – Interflux Economicus:

▦ Fed Chair Powell (Upcoming):

∴ Powell speaks today (June 18); core expectation is rate hold;

∴ Market bracing for hawkish tone: fewer projected cuts and emphasis on inflation resilience;

∴ Historically, Bitcoin has reacted with -2% to -5% dips to hawkish FOMC tone.

✴️ Conclusion: Macro tension peak. Powell’s tone may dictate the next 30-day candle.

⊢

⚜️ 𝟙⟠ Magister Arcanvm – Vox Primordialis!

⚖️ Wisdom begins in silence. Precision unfolds in strategy.

⊢

⊢

⌘ Codicillus Silentii – Strategic Note:

∴ The technicals are strong, the on-chain base is stable, and the macro setup is explosive;

∴ This is a tension point, not a resolution point - silence before decision;

∴ Precision now is not found in action, but in observation.

⊢

⌘ Market Status:

✴️ Position: " Cautiously Bullish. "

✴️ Tactical Mode: Observation Priority – No immediate entry without Powell clarity.

⊢

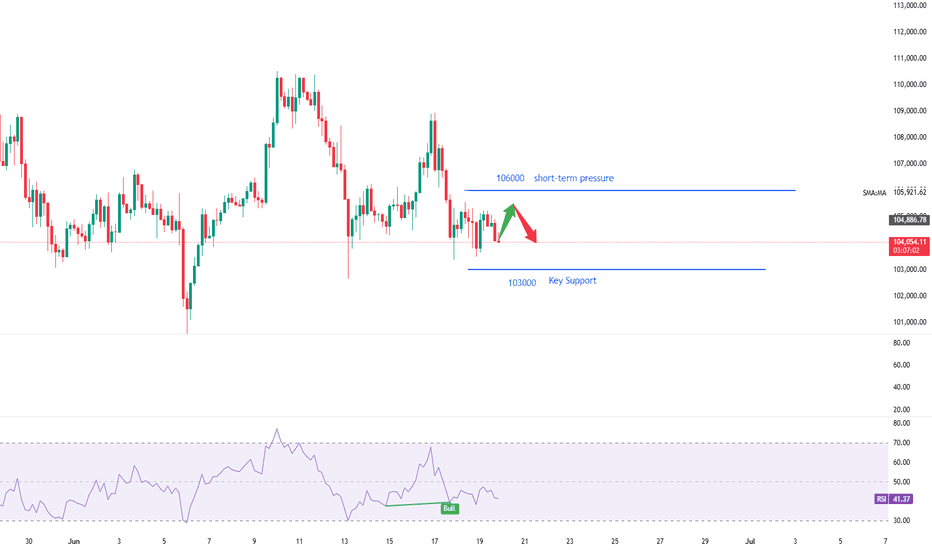

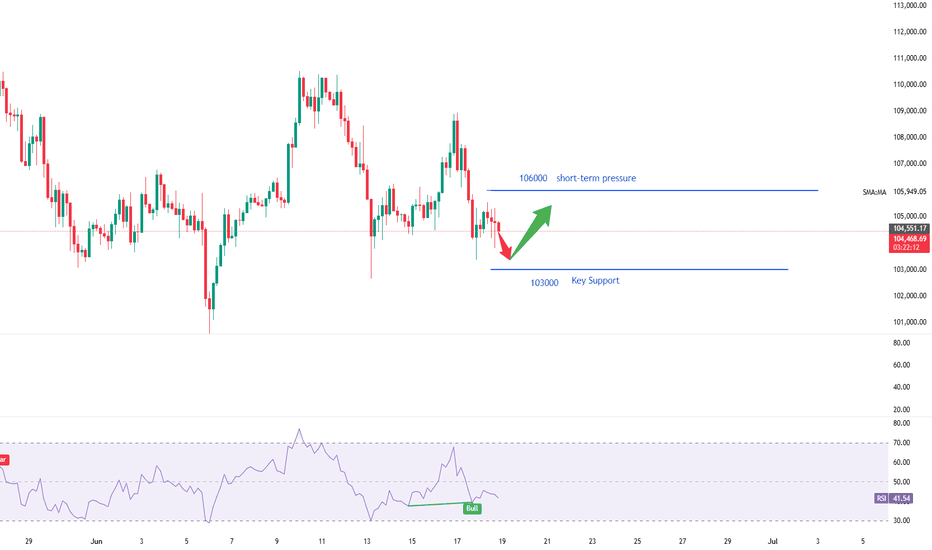

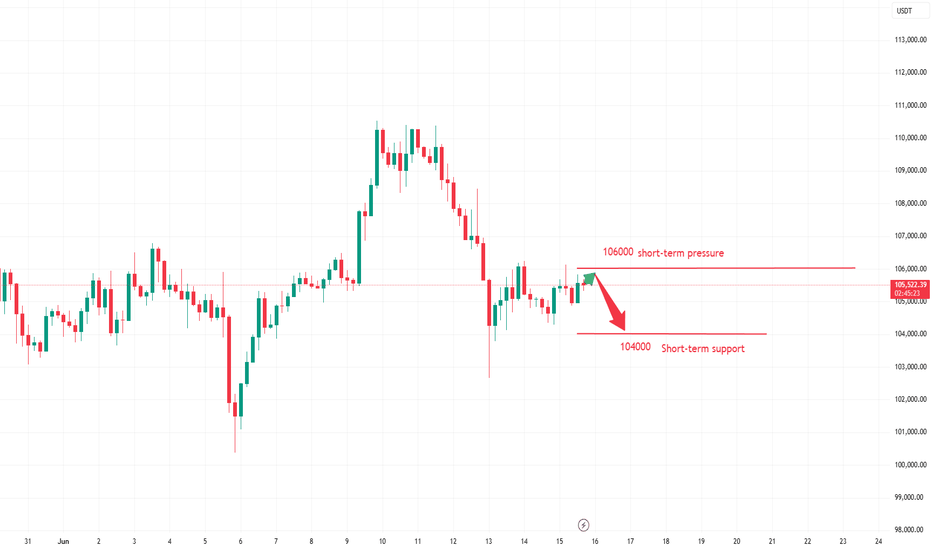

Technical Analysis of Bitcoin

From a market analysis perspective, the daily chart of the large cycle has closed with consecutive declines, the price is below the moving averages, and the indicator is in a death cross, indicating a bearish trend. However, it is necessary to be wary of the stimulation from the news and data caused by the current unstable national situation. In operation, risk control should be paid attention to, and the moving average pressure level near 106,000 on the daily chart should be focused on.

In the hourly chart of the short cycle, the decline continued in the European session after the morning decline yesterday, the U.S. session broke the low of the previous day, and the price rebounded and corrected at the support in the early morning. Currently, it is still in a corrective trend. Today, focus on the high pressure level in the 106,000 area, as well as the impact of the strength of the European session and the unemployment benefit data in the evening on the trend.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

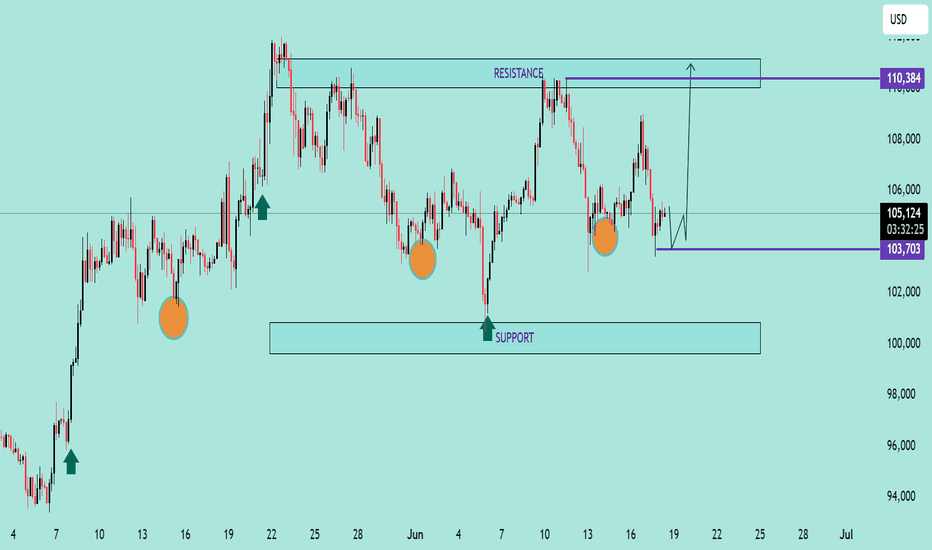

BTC/USD Potential Bullish ReversalBTC/USD Potential Bullish Reversal 🟢📈

🔍 Technical Overview:

The chart shows a potential bullish reversal pattern forming near a key support zone. Price action has consistently bounced from the support range between $100,000 – $103,700, marked by multiple higher lows (🟠 orange circles), suggesting strong buyer interest.

📌 Key Levels:

Support Zone: $100,000 – $103,700 🛡️

Immediate Resistance: $110,384 🔼

Current Price: $105,202 💰

📊 Pattern Observed:

The price structure shows a possible inverted head and shoulders pattern forming, with the right shoulder currently developing. If this structure completes and breaks the $106,000–$107,000 neckline region, we can expect a bullish breakout toward the resistance target of $110,384 or higher.

📈 Bullish Confirmation:

Bullish rejection from support area ✅

Clean structure with repeated higher lows 📈

Potential breakout arrow suggests move toward the top resistance zone

⚠️ Watch For:

Price must hold above $103,700 to maintain bullish bias

Break below this level may invalidate bullish setup and retest the broader support zone near $100,000

📌 Conclusion:

BTC/USD is setting up for a potential upside breakout if the neckline is broken. Traders should monitor for bullish confirmation before entering long positions.

🔔 Strategy Suggestion:

Buy Zone: $103,700 – $104,500 (on bullish confirmation) 🛒

Target Zone: $110,000 – $111,000 🎯

Stop-Loss: Below $103,000 🛑

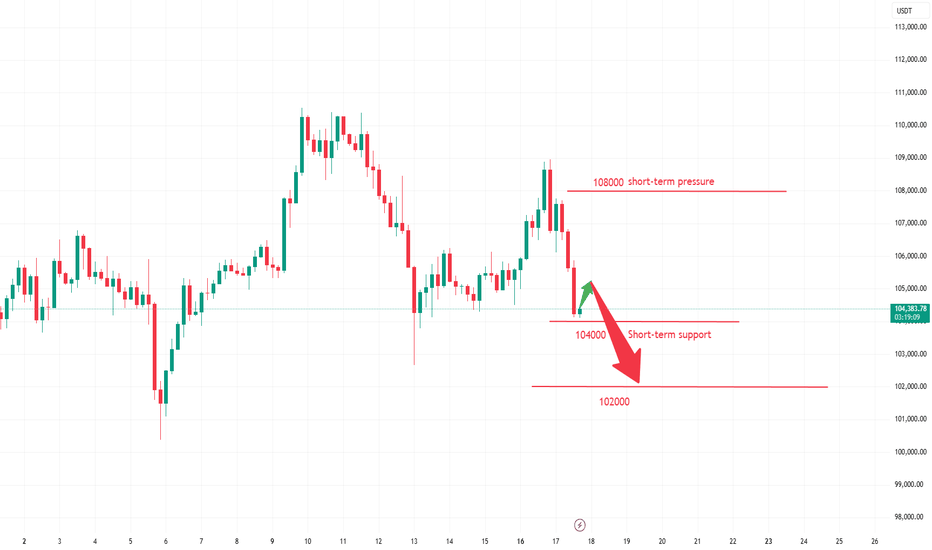

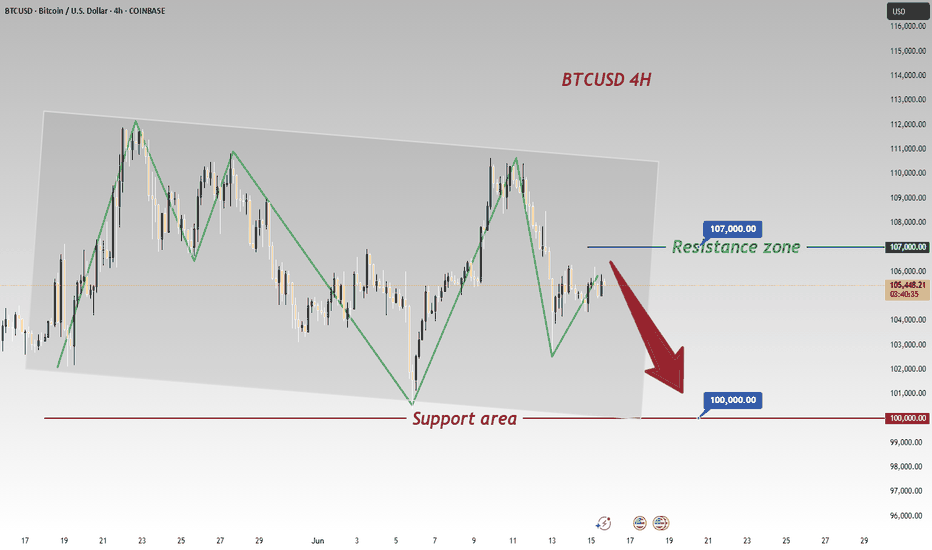

Test the crucial round-number threshold of $100,000.Affected by sudden news factors, the Bitcoin market has seen sharp fluctuations. The price started a significant downward trend from the $108,900 level and has dropped to around $104,000 as of now. This decline has caused Bitcoin to break through multiple key support levels.

On the daily timeframe, the originally important support range of $106,000 - $107,000 was easily breached, with market bearish forces gaining absolute dominance. Bitcoin is facing significant downward risks and is highly likely to continue falling to test the crucial psychological level of $100,000.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@104000-104500

TP:102000-1025000

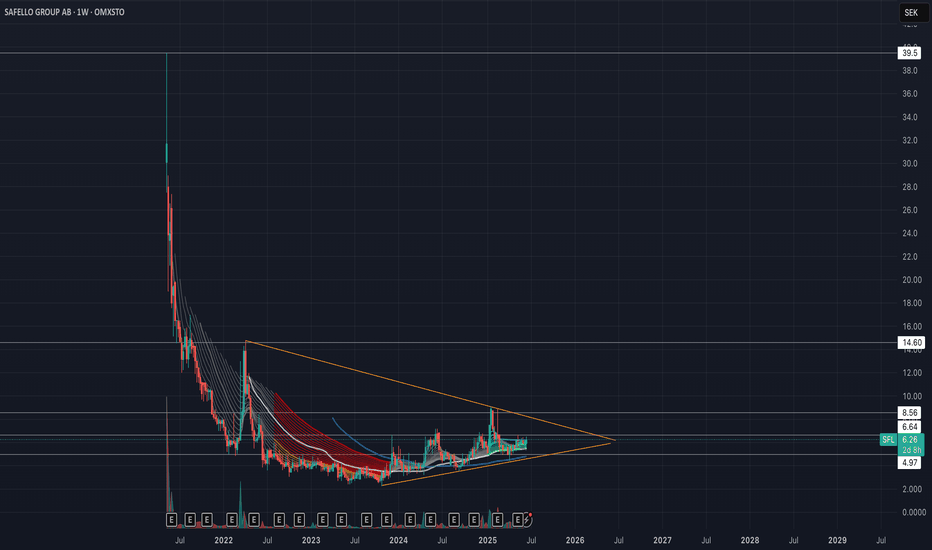

Safello Group AB - Bullish Outlook - Small Cap Crypto Firm Safello is starting to show signs of a breakout from its weekly triangle. If Bitcoin or altcoins start to show life, I believe this stock could outperform most crypto stocks. The company is constantly innovating its offerings and is regulated under Swedish law.

I have been DCA’ing into this stock for quite a while now and will continue to do so until the consolidation is over.

Current market cap is about 10 Million USD.

Nothing here should be considered financial advice. Always do your own research and make your own decisions.

OMXSTO:SFL

CRYPTOCAP:OTHERS

CRYPTOCAP:TOTAL

COINBASE:BTCUSD

NASDAQ:COIN

COINBASE:ETHUSD

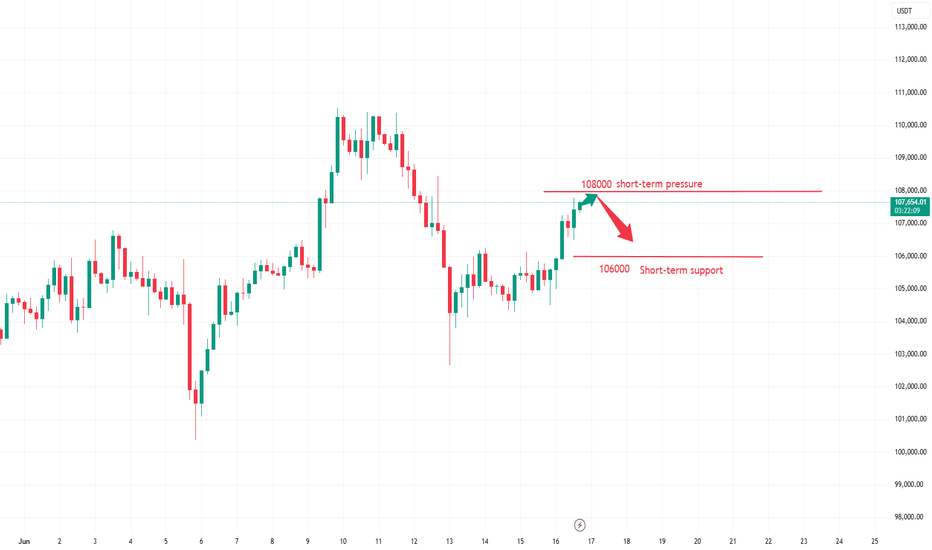

Bitcoin Market Analysis and Future Trend ForecastThe Bitcoin market has once again become the focus of investors. The price of Bitcoin has shown a significant upward trend, successfully breaking through the key resistance level of $106,000 per coin with an intraday increase of over 2%, demonstrating the strong vitality of the market. This price movement not only reflects the warming of positive sentiment in the cryptocurrency market but also indicates the gradual recovery of investor confidence, which has become the core driving force behind Bitcoin's current rally.

Currently, the Bitcoin price is at a critical juncture. From a daily chart perspective, after reaching an intraday high of $107,265, Bitcoin failed to effectively break through the key resistance level of $108,000 and has since retracted to fluctuate around $106,940. On the 4-hour timeframe, the MACD indicator shows that the histogram remains in positive territory, but the rate of increase has slowed, suggesting a short-term weakening of bullish momentum. Meanwhile, the RSI indicator stands at around 65, approaching the overbought zone, indicating that the market faces short-term correction pressure.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@107500-108000

TP:106000-106500

Analysis of Next Week's Market TrendsBitcoin is trading in a narrow range, with an intraday volatility of only 1.7% and trading volume shrinking by 18%, indicating market wait-and-see sentiment after key geopolitical events.

After the Israel-Iran conflict triggered $1 billion in liquidations, market panic has eased. Israel's preemptive strike on Iran on the 13th caused Bitcoin to flash crash to $102,000, but by the 15th, the market had partially digested the risks. The Fear & Greed Index stabilized at 60 (greed zone), showing that funds did not massively flee to safe havens.

Bitcoin is in a critical accumulation phase on the eve of a breakthrough. The digestion of geopolitical risks and institutional buying constitute supporting forces, but short-term attention should be paid to the risk of breakdown in the triangular pattern. It is recommended to strictly guard the defense level of $104,200 and the breakthrough point of $106,300.

Humans need to breathe, and perfect trading is like breathing—maintaining flexibility without needing to trade every market swing. The secret to profitable trading lies in implementing simple rules: repeating simple tasks consistently and enforcing them strictly over the long term.

Trading Strategy:

sell@105900-106000

TP:104000-1045000

Middle East Tensions Drive Capital Shift: BTC May Test 100K SupCurrently, we can clearly see that BTC is in a downward trend 🔻. Due to the tense situation in the Middle East 😰, a large amount of capital has flowed into gold and crude oil markets. BTCUSD is likely to continue its downward movement on Monday ⬇️. Let's focus on the support level at 100,000. If it breaks below 100,000, it may continue to decline ⚠️.

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Sell@ 106500 - 105500

🚀 TP 102000 - 101000

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

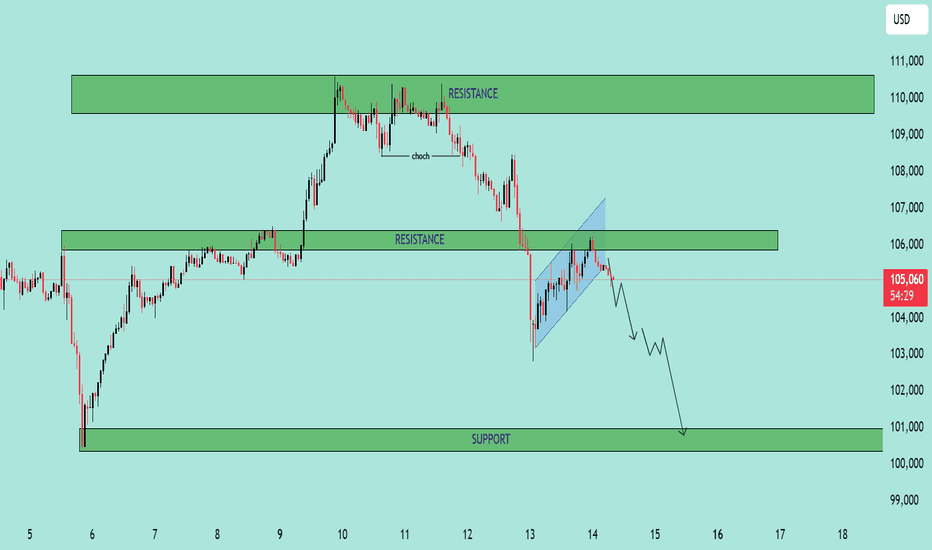

BTC/USD – Bearish Continuation from Rising Channel BTC/USD – Bearish Continuation from Rising Channel 🚨🧱

This chart indicates a bearish market structure with the following key technical features:

🔍 Chart Analysis:

Change of Character (CHoCH) 🔄

A shift from bullish to bearish was confirmed by a strong breakdown after the CHoCH marked at the top.

This breakdown invalidated previous bullish structure.

Bearish Flag Formation 📉📐

After the impulsive drop, price formed a bearish flag (rising channel), suggesting a potential continuation move to the downside.

Resistance Rejection 🚫

Price is currently testing and rejecting the 105,800–106,500 resistance zone, previously a support turned resistance.

The rejection from this level adds further bearish confluence.

Downside Projection ⬇️📍

If the pattern plays out, the projected move shows a potential drop toward the major support zone at 100,000–101,000.

📌 Key Levels:

Resistance Zones:

105,800–106,500 🧱

109,500–111,000 🧱

Support Zone:

100,000–101,000 💚

🧠 Conclusion:

The chart suggests that BTC/USD is in a bearish continuation phase, with strong rejection from key resistance and a confirmed breakdown from a bearish flag. Traders should watch for confirmation of continuation below 104,500 to target the 100k support level. Risk management is crucial near volatile zones.

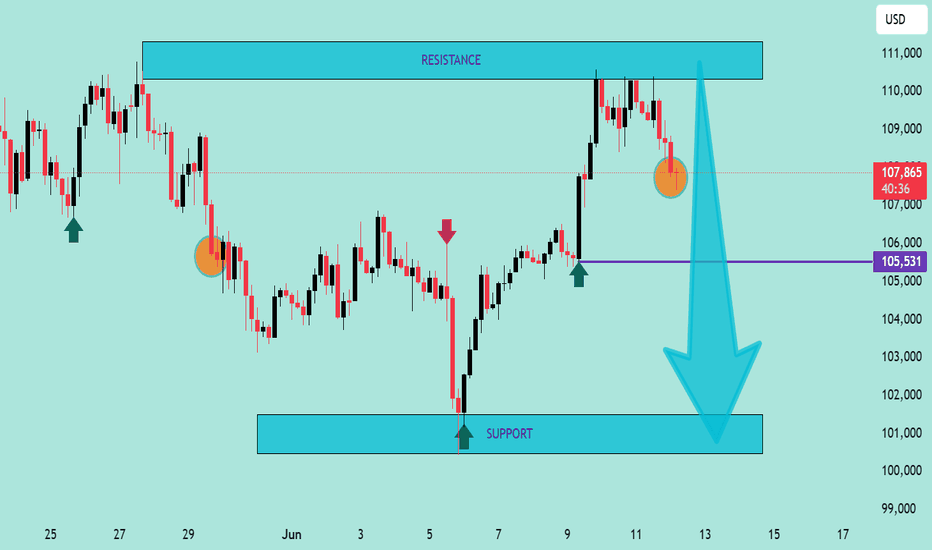

BTC/USD Technical Outlook – Potential Bearish Continuation BelowBTC/USD Technical Outlook – Potential Bearish Continuation Below Resistance 📉🧊

Chart Overview:

The chart illustrates a clear bearish rejection from a major resistance zone (⚠️ 110,000–111,000 USD), followed by the emergence of a bearish engulfing candle 🔻 marked in orange. This move suggests selling pressure has returned after a short-term bullish rally.

Key Zones & Levels:

🔵 Resistance Zone: 110,000–111,000 USD

Price was rejected from this region with a strong bearish reaction.

🟣 Mid-level Support: 105,531 USD

Currently acting as an interim level — if broken, it may lead to deeper declines.

🔵 Support Zone: 100,500–101,500 USD

This is the next strong demand area — price previously rebounded strongly from here.

Technical Signals:

✅ Double Top Structure formation at the resistance zone, indicating trend exhaustion.

❌ Bearish Engulfing Candle near resistance, confirming reversal strength.

📉 Downward Momentum Arrow suggests possible continuation toward support.

🔻 Lower Highs Formation reinforces bearish sentiment after failed breakout attempts.

Projection 🎯:

If the price closes below 105,531, a bearish continuation is likely, targeting the support zone at 101,000–100,500.

Conversely, a strong bounce above this level could delay the drop, but upside is capped below 110,000 unless a breakout occurs.

Summary:

🧭 Bias: Bearish below 105,531

📍 Targets:

Immediate: 105,531 (key level)

Bearish Target: 101,000

Invalidated if: price reclaims and closes above 110,000 with strength

📊 Trader's Note: Look for confirmation of breakdown with volume or candle close before short entry. Set tight risk management due to volatility.

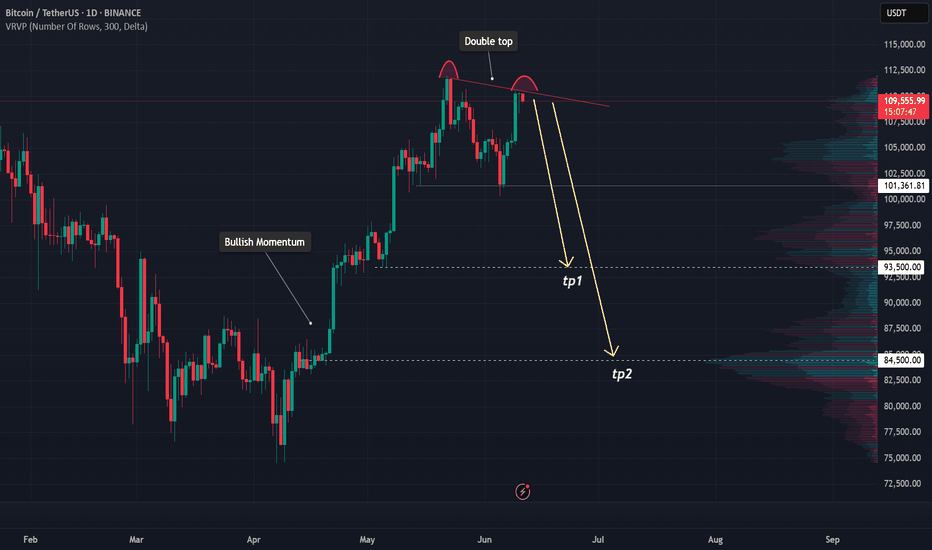

BTCUSDT – Bearish signs emerge below resistanceAfter a strong bullish run, BTCUSDT is now showing clear signs of weakness near the resistance zone around 109,600–112,000. Price action has formed a cluster of rejection candles at the top, failing to break above this key level – signaling that selling pressure is gaining control.

The current structure suggests a potential trend reversal, especially as the latest bearish candle came with rising volume, confirming selling interest from the supply zone. If the price breaks below the 101,500 support, BTC may continue dropping toward the 93,500–84,500 range – a high-liquidity area on the volume profile.

The previous bullish momentum appears to have lost strength, and this pullback may be confirming a shift after reaching its upper limit. As long as BTC remains below the 112,000 resistance, the bearish bias remains dominant.

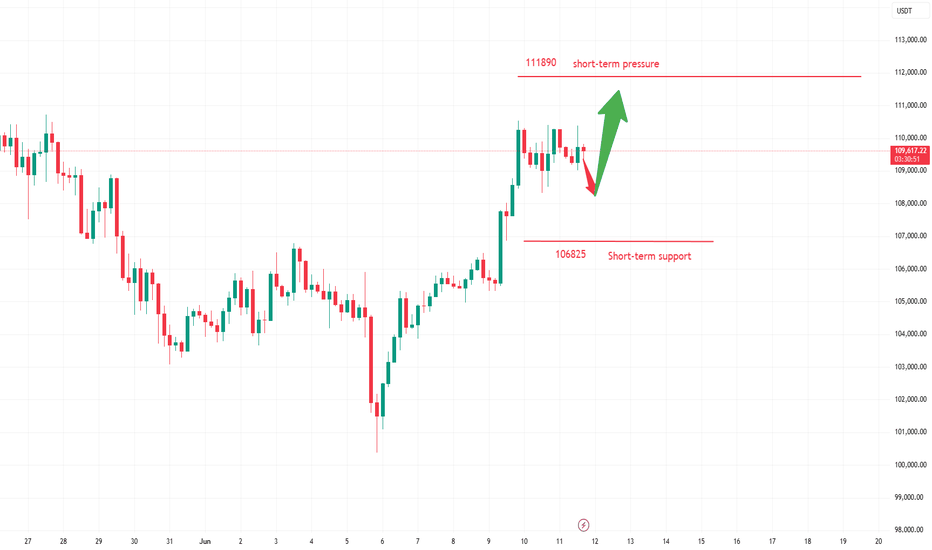

"Accumulation Phase for Breakout"Bitcoin underwent high-level consolidation on June 11, with intraday volatility ranging from $108,800 to $110,200. It failed to effectively break through the previous high of $111,980. The 24-hour global liquidations amounted to $210 million (half of the previous day), with short positions accounting for 62%, indicating that bears still dominate short-term sentiment.

The Sino-US high-level talks in London originally scheduled for June 11 have been postponed to June 15, and the details of tariff reductions remain unclear, leading to a decline in risk asset appetite. The US Dollar Index rebounded by 0.8%, suppressing Bitcoin's breakthrough momentum. Bitcoin is currently in a accumulation phase for breaking through all-time highs, with policy regularization and institutional increasing holdings forming long-term support.

Humans need to breathe, and perfect trading is like breathing—maintaining flexibility without needing to trade every market swing. The secret to profitable trading lies in implementing simple rules: repeating simple tasks consistently and enforcing them strictly over the long term.

Trading Strategy:

buy@108000-108500

TP:110500-111000

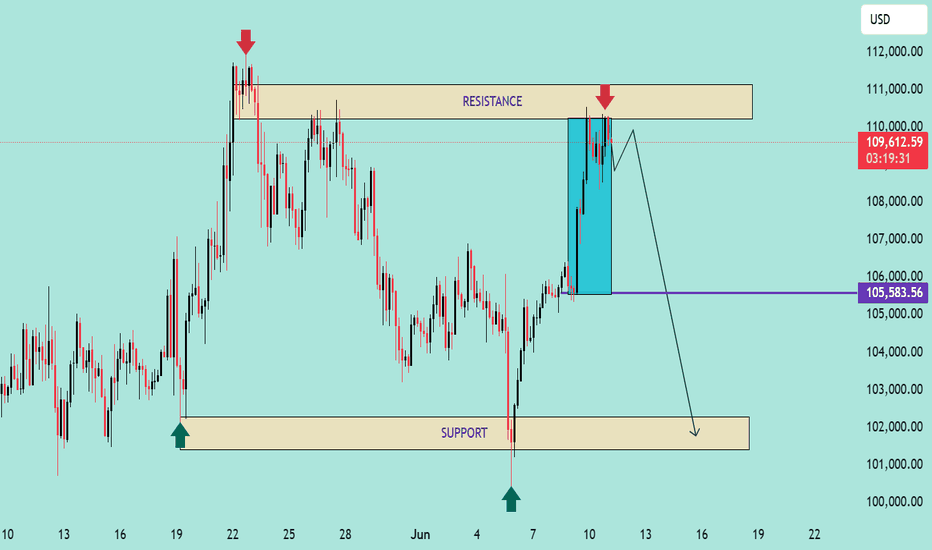

Technical Analysis – BTC/USD Technical Analysis – BTC/USD

📅 Date: June 11, 2025

🔍 Key Observations:

🔴 Resistance Zone – $110,000 to $111,800

Price has tested this resistance block twice (🔴 red arrows) and rejected both times, indicating strong selling pressure in this zone.

Rejection candles show long upper wicks, suggesting failed attempts by bulls to break above.

🟢 Support Zone – $101,800 to $103,500

This demand zone has been respected multiple times (🟢 green arrows), showing a solid base for potential bounces.

Price action previously rallied strongly after touching this level.

📦 Supply to Demand Play

Price made a sharp bullish move from support to resistance (📘 blue box shows the impulsive move).

After reaching resistance, the price is failing to break above, indicating possible exhaustion of bullish momentum.

📉 Potential Move:

🔽 Short-Term Bearish Bias

If price fails to hold current levels and breaks below the small consolidation (after blue box), we may see a drop to ~$105,583 (🔵 purple line = key level).

If that breaks, next likely destination is the support zone around $102,000 (⬇️ downward arrow path).

⚠️ Risk Notes:

🔁 Watch for any false breakouts or liquidity grabs above resistance.

📉 If bearish momentum increases below $105,583, sellers may take control in the short term.

✅ Trade Idea (Hypothetical):

Sell/Short near resistance (⚠️ confirmation needed like bearish engulfing or failed breakout)

Target 1: $105,583

Target 2: $102,000 zone

Stop-loss: Above $111,800 (invalidates setup)

📌 Summary:

BTC/USD is currently stuck between a well-defined resistance and support range. Unless bulls break above $111,800 with strong momentum, the structure favors a potential pullback toward the demand zone. ⚖️

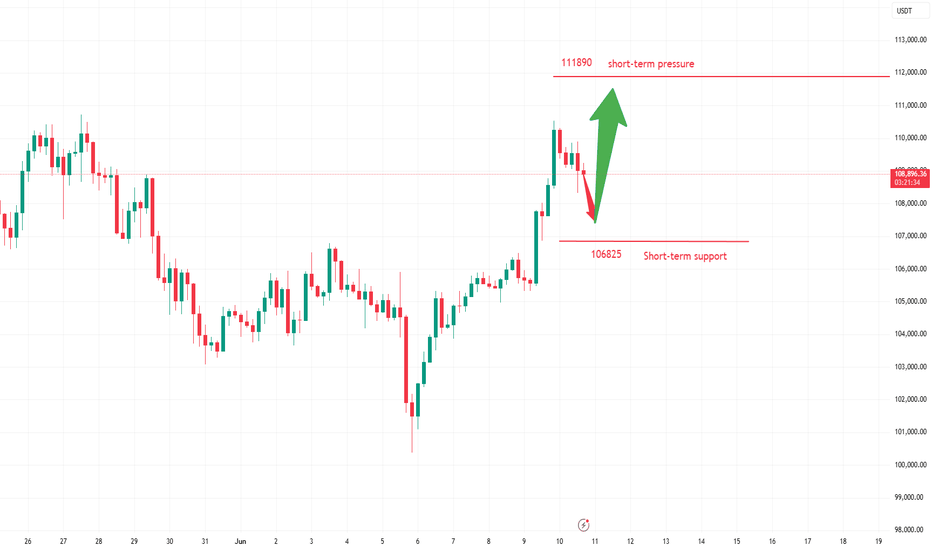

The bulls' strong momentum drives a new all-time high.hour gain stands at 4%, and the weekly increase expands to 6.7%. The total market capitalization has rebounded above $2.5 trillion. Three major positive factors have resonated: the expectation of (eased) Sino-US trade tensions, the SEC's policy shift to support on-chain innovation, and the continuous inflow of institutional capital (notably, Ethereum ETFs have seen 15 consecutive days of net inflows).

For the next 24 hours, the focus will be on the breakthrough of the all-time high at $111,980. The first resistance level is $112,500 (a dense short liquidation zone).

Humans need to breathe, and perfect trading is like breathing—maintaining flexibility without needing to trade every market swing. The secret to profitable trading lies in implementing simple rules: repeating simple tasks consistently and enforcing them strictly over the long term.

Trading Strategy:

buy@107000-107500

TP:109000-1095000