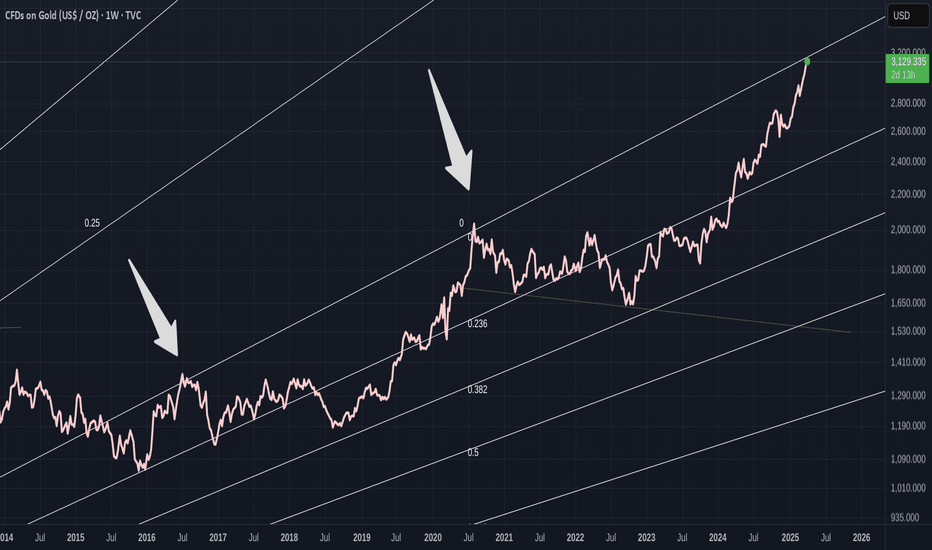

GOLD - on resistance- Could Bitcoin resume its Gains Over GoldAs you can see, GOLD has come to a point where it has been rejected twice previously.

And on each of the previous occasions, PA ended up back on the lower trend line., taking around 2 years to do so on each occasions

GOLD MOVES SO SLOW - mostly due to its HUGE market cap..... But thats another story

Has the recent rise of Gold come to a line of defeat ?

The Daily chart here shows how PA is stalling at this moment in time

Each push is getting Shorter. PA is tired.

PA is Getting OVERBOUGHT on many time frames. It needs a break

The thing is, Mr Trump will later today introduce the "liberation Tariffs"

The expectation is of FEAR as reprisals and reduced markets could cause issues in the USA , including reversing the Drop in inflation.

If the Tariffs backfire, the $ will Drop..and people will look to safe haves

Traditionally GOLD. Maybe Gold can break through its old nemesis of rejection.

But PA Is TIRED

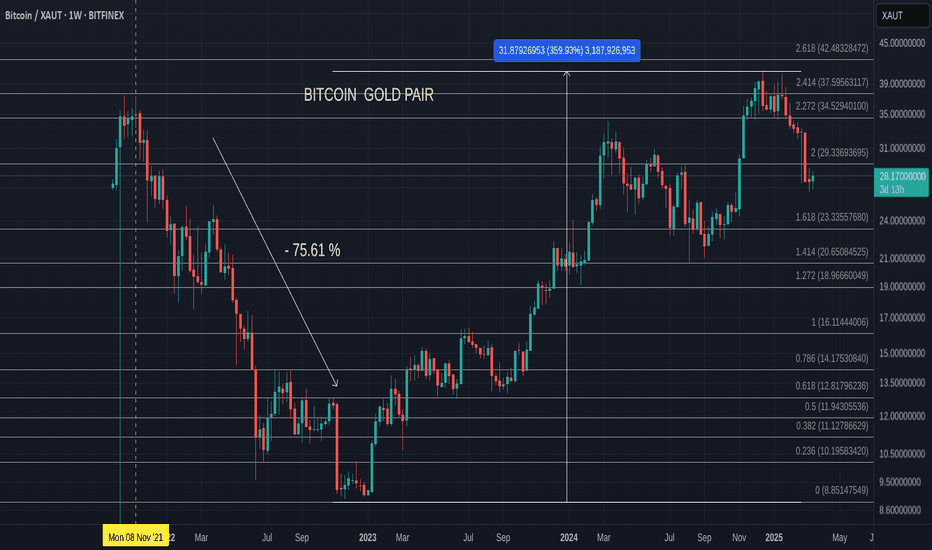

BITCOIN has been under pressure recently, following posting a new ATH and this has taken a toll on the BTC XAUT trading pair while Gold has risen.

We can see how PA dropped and has in fact, fallen below the lower line of support.

But it needs to be understood is that RSI and MACD are now in very positive positions to make a push higher.

Gold is tired

In the Near Future, we may well see the tables turn in Bitcoins Favour again

But Me Trumps, today, May actually upset that idea.

We just have to wait and see how sentiment is towards Risk assets later today , after the announcement of these Tariffs.

But, in the Longer term, once the dust settles, I do see Bitcoin taking over again and continuing its rise to greatness.....

ENJOY

Time Will tell

BTCXAUT

The best investment since Nov 2021 - GOLD or BITCOIN ? - FACTSThe Main Chart is the chart from BITFINEX that trades Bitcoin to Gold DIRECTLY

I look to this often and find it a MUST See to compare the two assets.

This is Not done to try and make BTC like GOLD but that they are both investments with returns,

It is as simple as that

But which one has the higher return ?

I have taken the November 2021 Bitcoin ATH as the Datum point. a Worse case scenario for Bitcoin.

Bitcoin Directly to Gold.

As you can see on the main chart. If you had sold your Gold into Bitcoin and Just Held since Nov 2021, you are currently at a slight loss. Less ounces of Gold to one Bitcoin.

It is as simple as that. But PA has fallen from Above the buy price recently.

But to also mention, if you had bought Bitcoin with your Gold at the Bottom in Jan 2023, that is a 360% Rise in Value DIRECTLY OVER GOLD as opposed to the -75% Losses from ATH to Low.

Nothing else does that

Lets look at a comparison Via 100 USD investments into each asset

GOLD USD CFD

Let us say we invested 100 usd in Nov 2021 at the Bitcoin ATH that year.

Since then, there has been a 62.71 % increase in price; from your buy price, if you simply just held your investment.

This gives you 162.71 usd currently

PA had risen 12% from that date but then dropped 22% to the low. From the Low, PA has risen 89 % and if you had Traded your investment, selling high, buying Low, you would now have 211.68 usd currently

Now to Bitcoin - again, 100 usd invested at the ATH in Nov 2021

100 invested in Nov 2021 currently has a 24.68 % increase from Buy price. if you just HODL, off the 2021 ATH and so you would have 124.68 currently

From that ATH point, we saw a Loss as PA dropped 77.2% to the Low but then Rose up 596% from the Low.

If you traded , Depending on when you sold your bad 100 investment , the gains are different But lets say, you sold what was left of your 100 at the slight rise in PA in March 2022 - that was a loss of 28.5%, leaving you 71.5 usd

Wait till the Low in Jan 203 and then continue Buy Low, Sell high, you currently have 743 usd , having sold the top at 109K and waiting for the next Low

So, in summery, from 100 usd investment in Nov 2021 BTC ATH

GOLD

HODL 162.71 - Traded 211.68

BITCOIN

HODL 124.68 - Traded 743.34

The ONLY REAL Loss currently is with the BTC GOLD pair, where BTC is -20% currently off Buy price, having fallen from HIGHER than Buy price recently,.

However, PA is on the lower trend line, as you can see in the chart, and the expectation is for a Strong Bounce over the next few weeks..This will set BTC off towards that magical 50 ounces of Gold per Bitcoin.

But it has to be said, the journey if you held Bitcoin having sold out from Gold has been painful.

Tthat pain is about to end, very possibly forever.

Trading is not for everyone and Hitting the perfect High or Low point is almost impossible.

But the Gains are there in Bitcoin against Gold if you even do basic trading.

And, inmy opinion, if you have gold....SERIOUSLY think abot Bitcoin now.

Gold is OVERBOUGHT on many timeframes....

Bitcoin is not...................

Bitcoin Gold Direct Trading Pair - VERY IMPORTANT TO WATCH THISBitcoin Gold trading pair

PA heading towards 2.272 Fib extension line.

This has been Support since Nov 2024 and is now a firm line of Support at 34.52 Ounces of Gold per Bitcoin

Also about to hit 100 Daily SMA )( SMA ). This may also provide support just above the Fib line

Since December, we have been seeing a Rise in Gold prices as demand escalates due to various Macro reasons around the world.

Bitcoin has held a steady range while trading against Gold.

Now, I am Watching this close.

If BTC looses this line of Support and begins Loosing out to Gold because Gold continues to Rise, signals a Shift of Sentiment for BTC

The traditional Store of Value Wins against the New Kid on the block as a safe haven

Macro uncertainty driving money flow.

We now have Trump imposing Higher Tariffs Oon international trade and THIS alone is driving Massive uncertainty and so Stocks are falling and that money needs to go somewhere.

It has been GOLD since January this year, Rising to a New ATH

At the same Time, Bitcoin has effectively ranged just below the current ATH

GOLD has the momentum right now and is taking the prize

And THIS is why this chart is so important.

BITCOIN MUST NOT LOOSE THIS SUPPORT

DXT $ is also rising, maybe with the static interest rate and possibility of a Rise later in the year if inflation continues to rise.

Extreme Caution right now