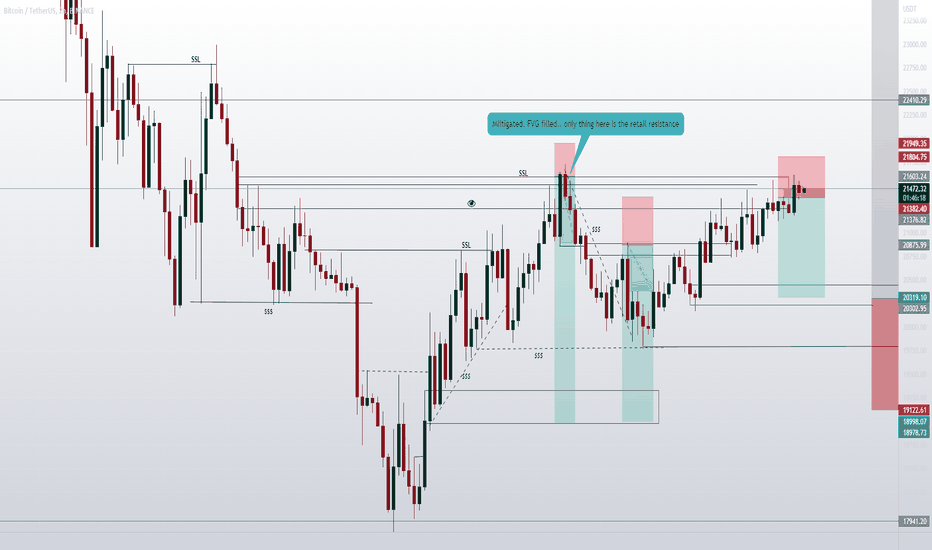

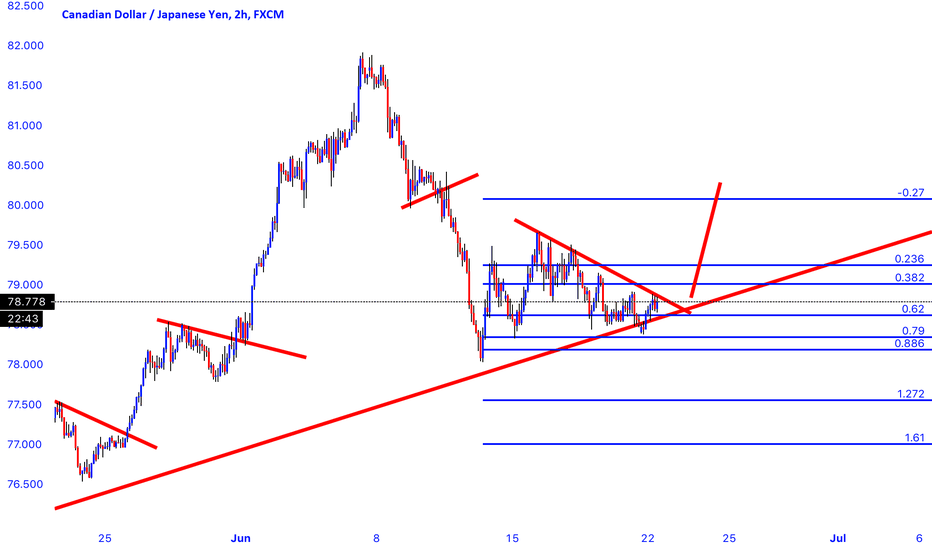

BTC SHORT TP:-100,000 21-06-2025What if this is the one that nukes it all? 😮💨

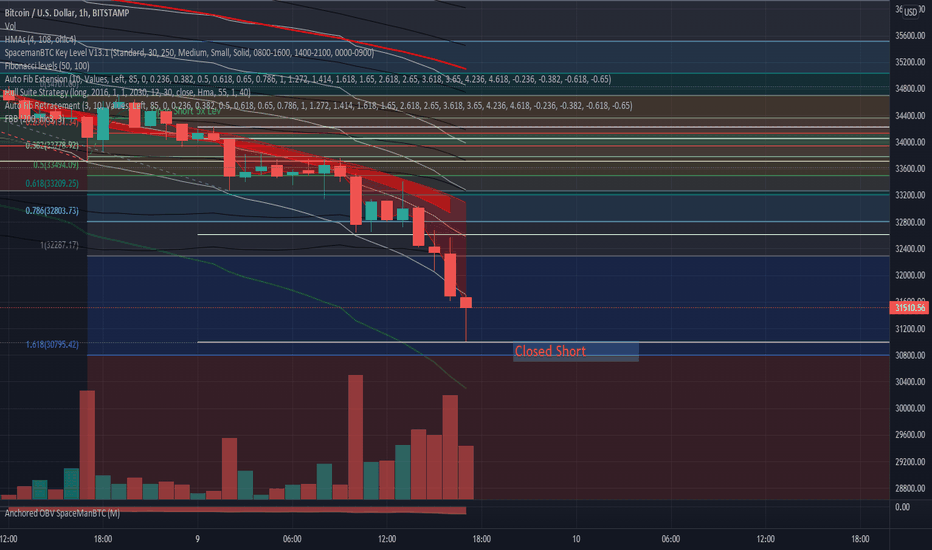

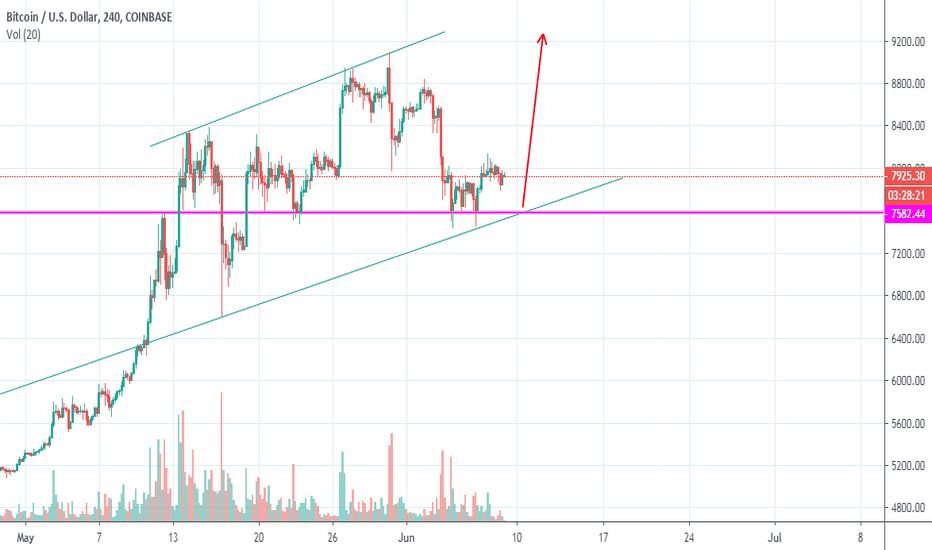

I’m entering a short between 102,500 and 103,600, aiming for a target around 99,500 – 100,200, with an average RR of 4.

This is based on the 4H timeframe, and should play out in the next 48 to 60 hours.

The structure still favors bearish continuation. If BTC breaks through the 100k level, we might be staring at a black swan scenario.

Manage your stop according to your risk plan and stay tuned for updates.

We don’t use indicators, we’re not out here drawing lines or cute little shapes — I just give you a clean trade.

If the move doesn’t happen within the estimated time, the trade is invalid.

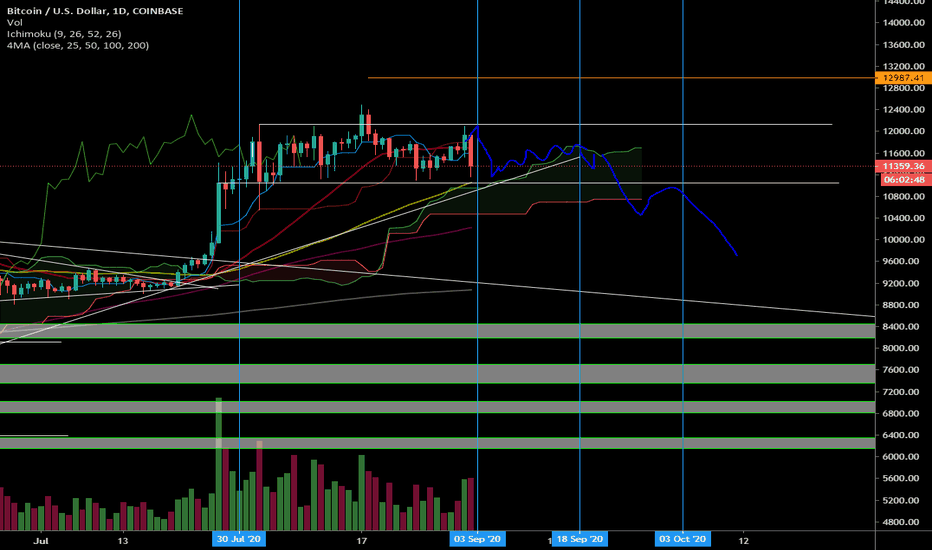

Btvusd

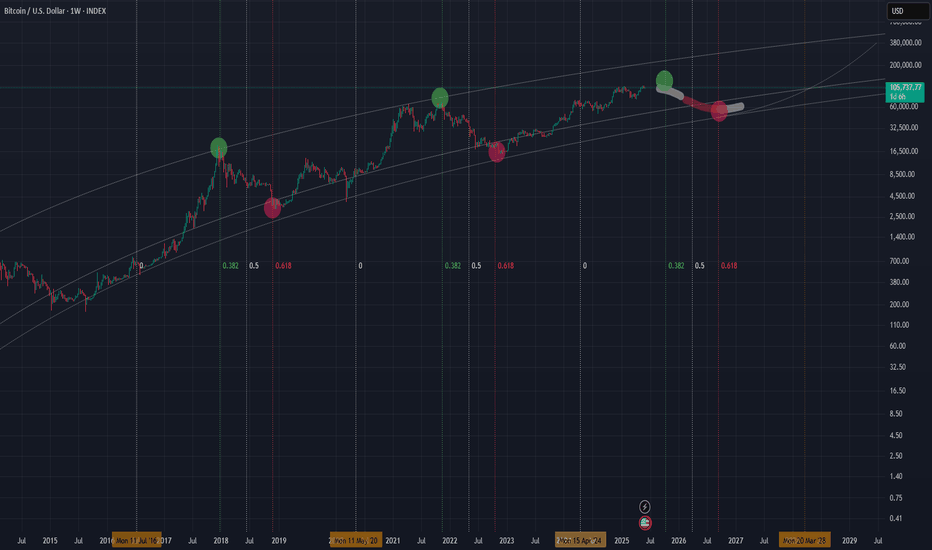

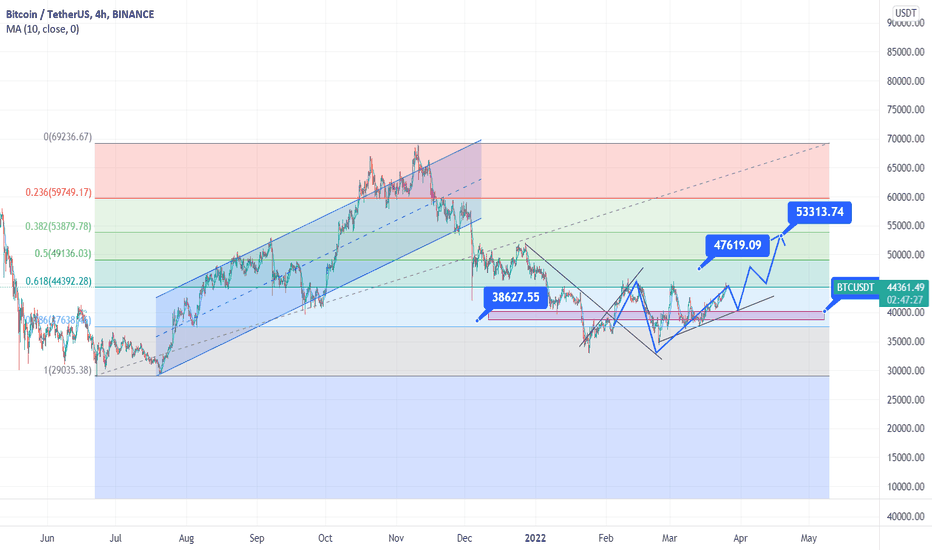

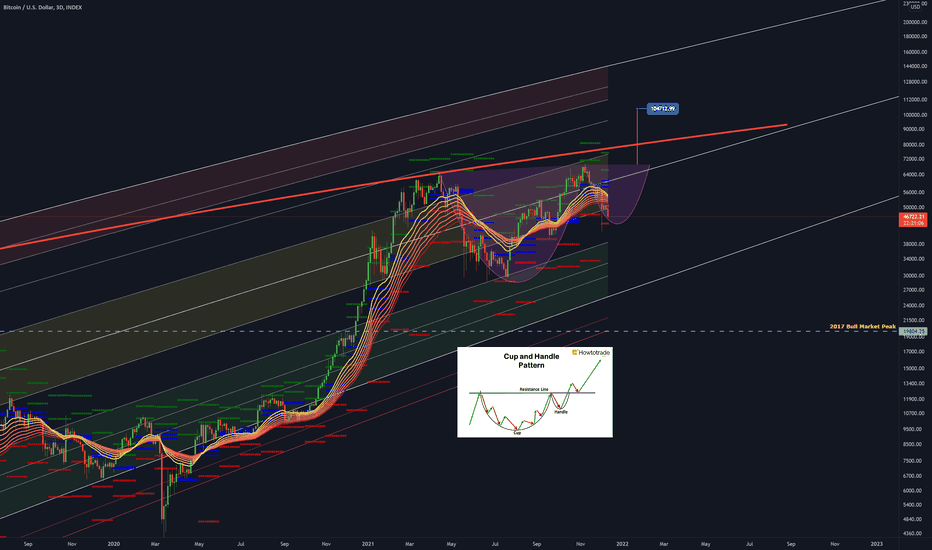

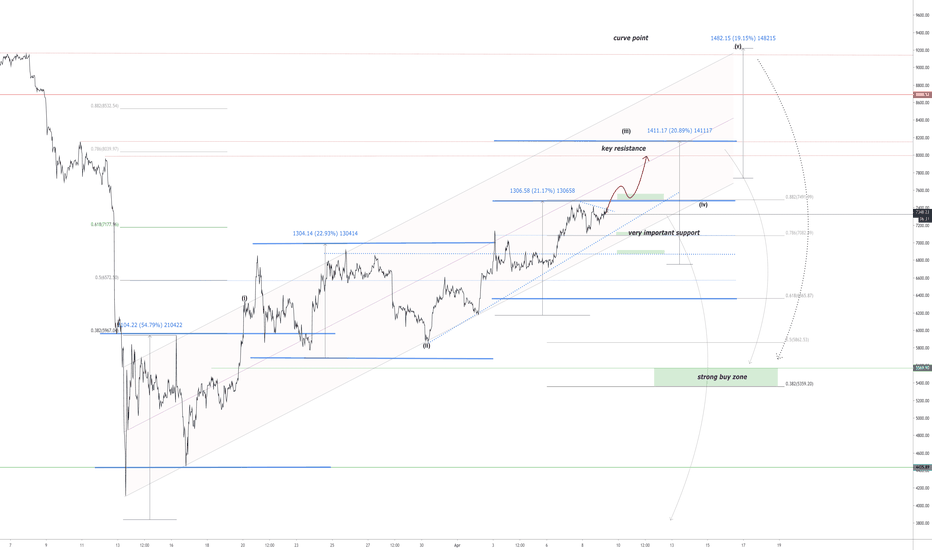

Trend Base Fib Time suggesting getting out before October 2025!I have been warning you that time is running and a few months left before things start cooling off. This tool is trend base fib time , measured from one halving till the next one. I assumed halving in 2028 at some point in march so this result in a target of October to be the month matching with the 0.382 when peaks use to be found. The 0.618 would be the one for catching the bottoms around Sep 2026. Secure some gains and buy back at next bear market lows close to 40k. Cheers

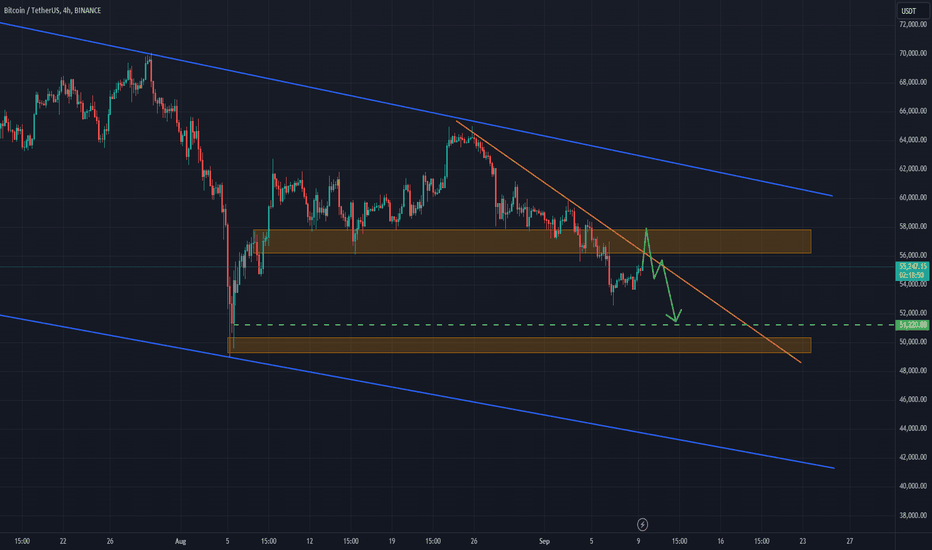

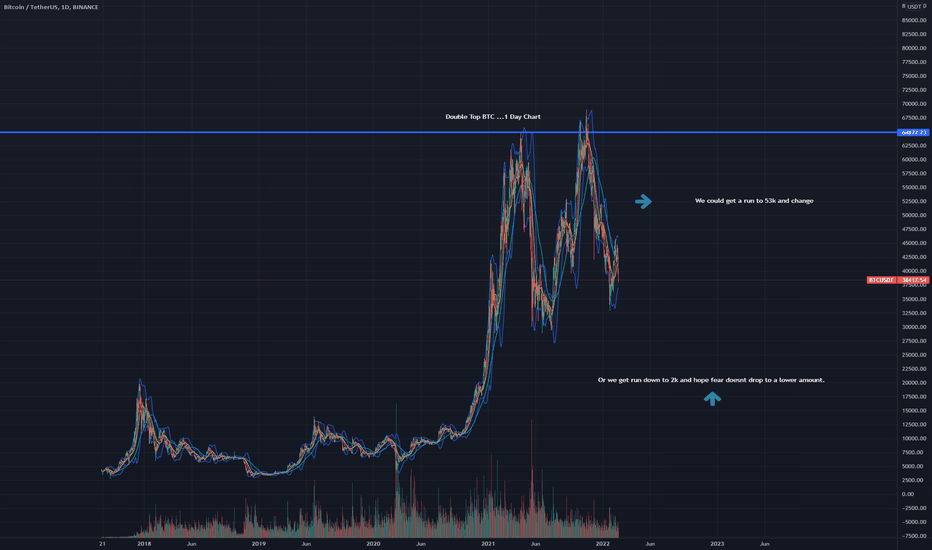

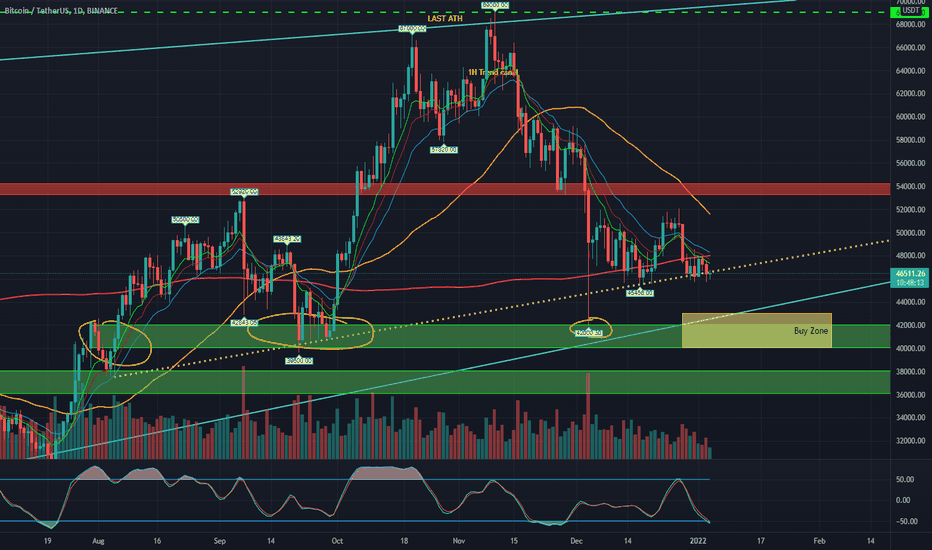

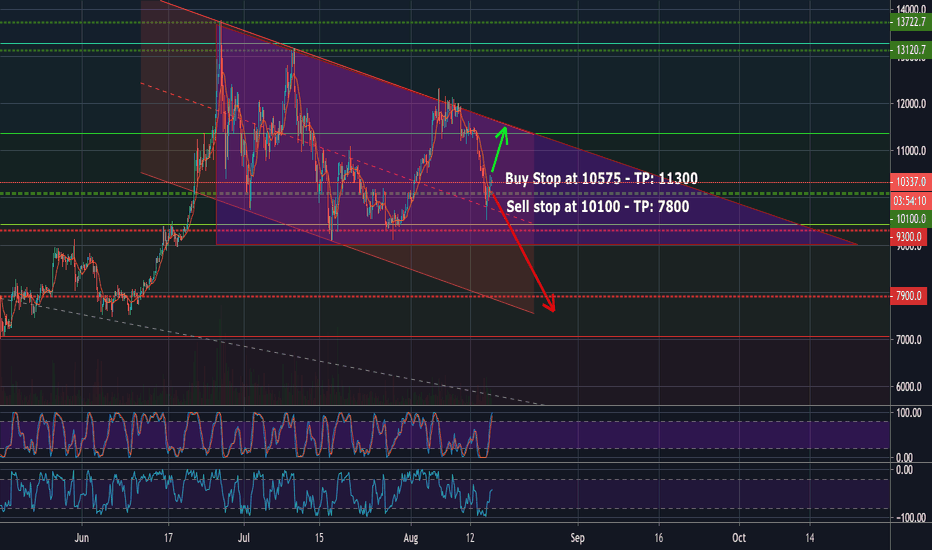

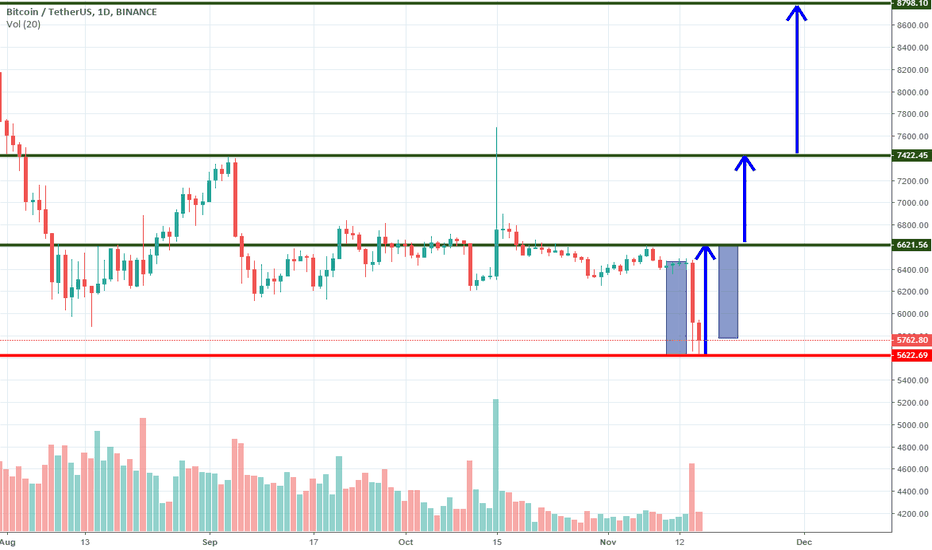

Bitcoin facing decline amid Bearish pressureBTCUSDT continues its downward trend, with a noticeable lack of buying pressure since late August. The price action has been characterized by consistent lower lows and lower closes. Even on the daily chart, we see this pattern persisting, despite a recent false breakout below the July low, with the price hovering near that level again. Historically, September tends to be a difficult month for Bitcoin, often resulting in negative performance. This pattern suggests that the price could drop further, potentially breaking below the 50,000 mark and aiming for the support zone between 48,000 and 45,000. If the price reaches this zone, a strong rebound could occur, potentially sparking a new bullish trend. The target is the support level at 51,220.00

Bitcoin Unveiled: Deciphering Cryptocurrency DynamicsIn the world of digital finance, Bitcoin stands as a beacon of innovation and speculation. Recent shifts in the cryptocurrency market have brought Bitcoin into sharp focus, captivating the attention of investors and analysts alike. From regulatory developments to technological advancements, various factors influence Bitcoin's price movements and market sentiment. As the landscape of digital assets evolves, Bitcoin's resilience and volatility continue to shape its journey through the realm of global finance. Observers diligently analyze these trends, seeking to unravel the complexities of this pioneering cryptocurrency.