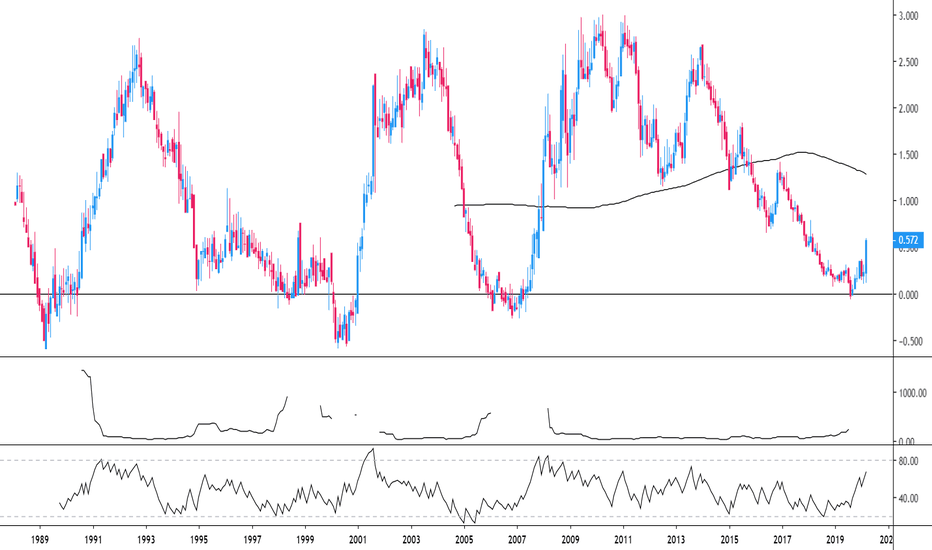

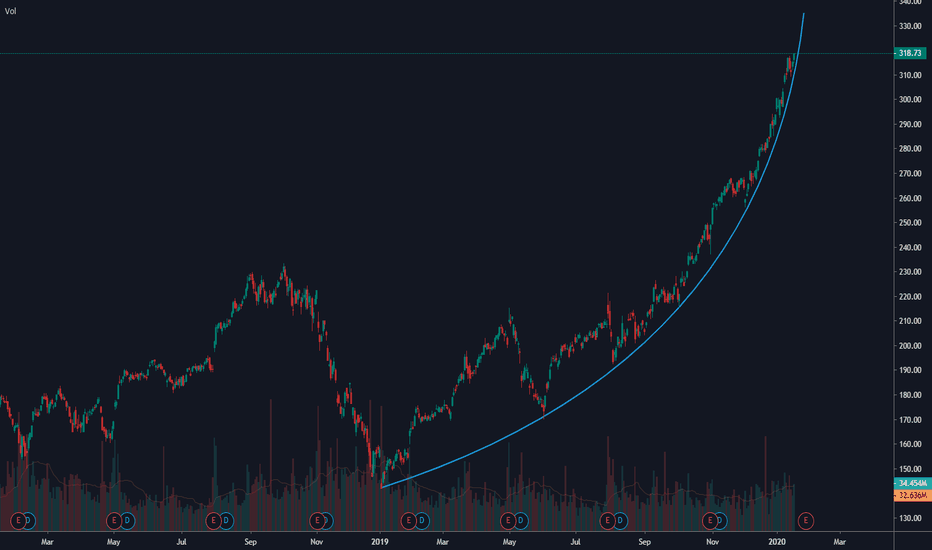

S&P RSI Bear DivergenceThe current situation on S&P500 graph reminds the Dot-Com Bubble

RSI maximums going down, while the price maximums going up.

Taking into account the current situation with coronacrisis, mass defaults in the US in the next few months, relatively high unemployment in the next few years, growing savings among households, and low CAPEX among companies, the rise of S&P seems like a big bubble.

Bubble

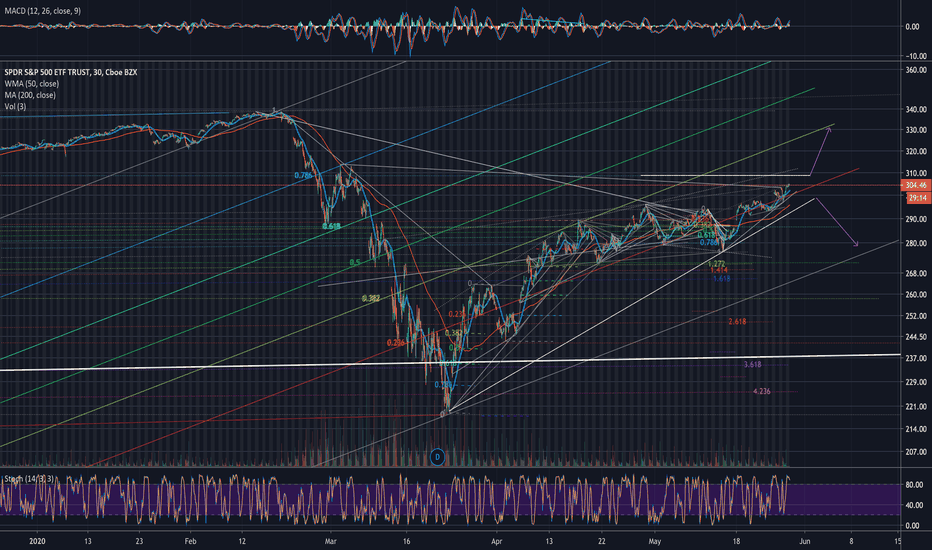

As agreement sets in, argument ensues.We are approaching agreement on the red .236 line of the fib channel.

We are also reaching an agreement between the long time support and the .786 fib retracement level of the Covid decline. When either of these fail, we will see the nature of this market.

Was may 14th the second bottom? Will or next argument be the yellow .382 of the fib channel as we approach the all time high?

-OR-

Will we dribble down the the long term support and fall through it to the bottom of the fib channel / the green .5 of the Covid retracement; Another pin to bust bubble bursts beneath us?

It is notable that our nation was on a whole quite reckless with social distancing and protective measures while celebrating over memorial day weekend. We should expect a spectacular COVID spike within the next 10 days. That will be my measure to judge the seriousness of the epidemic and the end of bear market rally.

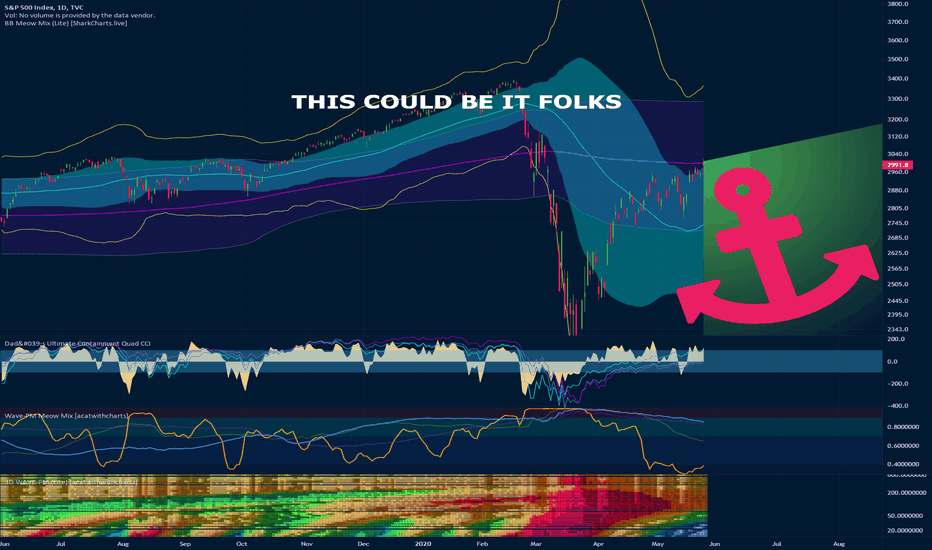

THIS COULD BE THE 100X OF THE YEAR. SPX, NDX, VIX, USD, ANALYSISSPX has been ranging at the D 200 SMA today and depending on which way it breaks, I'd expect moves to start in a lot of other asset classes too NDX has been selling off all day, by contrast, and because so much market cap has gotten concentrated in the top 5 stocks, they account for ~45% of NDX and ~20% of SPX.

So there's a lot of inherent correlation just from that.

This is probably the best spot that exists on the chart right now for equities to finally roll over.

The run over the past 2 months has been the sharpest rise in SPX history.

Which is insane.

P/E for SPX is right about at the 2000 peak. By other metrics, we're the most expensive since 1929.

Regardless of measure else we're significantly more expensive than the Feb top.

This move is widely attributed to a massive new interest in retail trading accounts since the crash, which is like textbook.

It's certainly the same exact thing that happened in 2018 in crypto after the initial pop, the argument for going any higher basically amounts to "bubble is not over yet."

My assumption at this point is that a crash back down would be pretty violent and I'm assuming that because of how absurdly overextended we are.

NDX is nearly back at ATH. Like, what?

Between Feb and now 20-30% unemployment happened, forward earnings tanked hard, and a bunch of obvious large risks are on the table that weren't before. At some point fundamentals do actually start mattering. This may be the most disconnected from them that we may see in our lifetimes given just how extreme the rift is.

We're staring down numbers that haven't been seen since the 1930s, and most people with a memory of the 1930s are dead, but IMO if we reject the 200 SMA here and dump - a very realistic scenario for the last 2 hours of the cash session where volume spikes back to open levels, the goose is cooked and it will be so obvious to big money that we're going lower that we'll go lower fast in the next few sessions.

Treasury futures are generally around pivots for continuation up or to mean revert down. Everything is set up for a large move one way or the other. I think the only thing that would truly surprise me at this level is more VIX crush.

The ultimate safe haven is USD and USD equivalents that can be used as collateral which is to say treasuries.

Margin calls are denominated in dollars, not gold. When things are darkest, institutions take their profits on gold to get more liquid. This happened in 2008, happened briefly in the Feb-March dump.

For better or worse, as the global reserve currency USD is what people need worldwide when things dump in 2020.

So, the money supply hole the Fed is trying to print into is far larger than just in the US. This appears to be why DXY melted up in March. Institutions abroad needed dollars and had to sell other currencies into it.

The position I currently have which I'm most excited about are moonshot June Eurodollar calls

I think if a dump plays out treasuries melt up, interest rates go negative, and it happens about as fast as Feb (which took 2 weeks to move interest rates down 1.2 points)

but it's a very high R:R bet to take and it probably needs to be right less than 1 in 10 times. Arguably it's as high as a 1:100 R:R scenario.

TL;DR: a lot of things are at pivots and SPX is at the D 200 - a very strong move on a lot of things is very likely once SPX decides which way to go.

This was written by my co analyst acatwithcharts. He made the indicators used here! If you have any questions for us, links below.

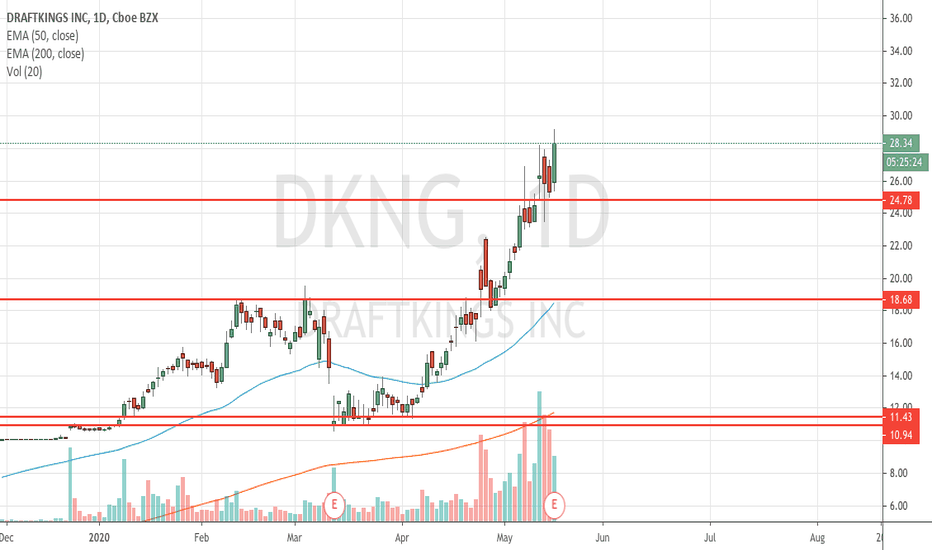

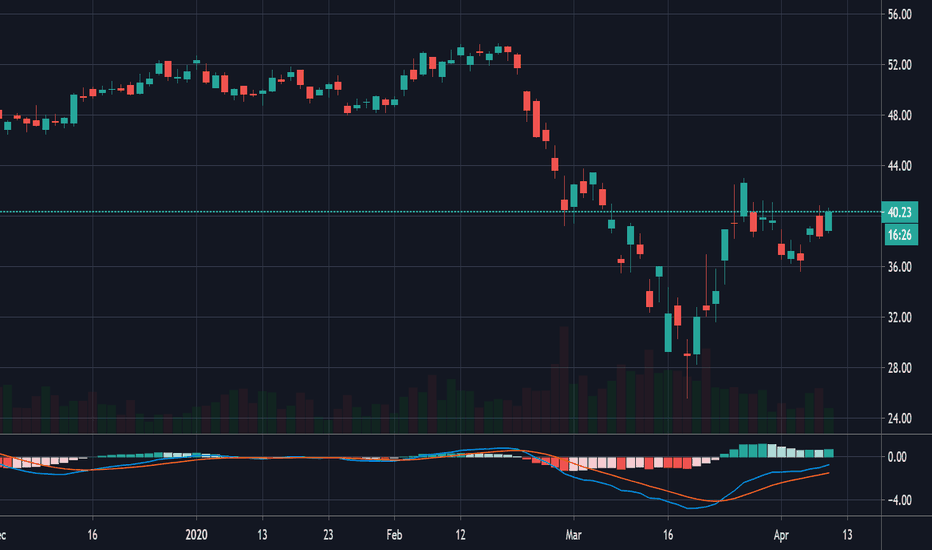

Draft Kings BubbleIN MY OPINION

The coronavirus has sparked a lot of interest in people with (extra money) stimulus checks/unemployment and (extra time) unemployed. When things go back to "normal" and people go back to their regularly scheduled days they will forget about gambling with draft kings but not all of them. I think there will be a solid price range that it will hang around... Right now the most resistance I've seen is around 18.68 and 11.43 for support. Of course price action isn't the only thing to factor in what a company is worth..

I will be looking to short this once momentum slows down.

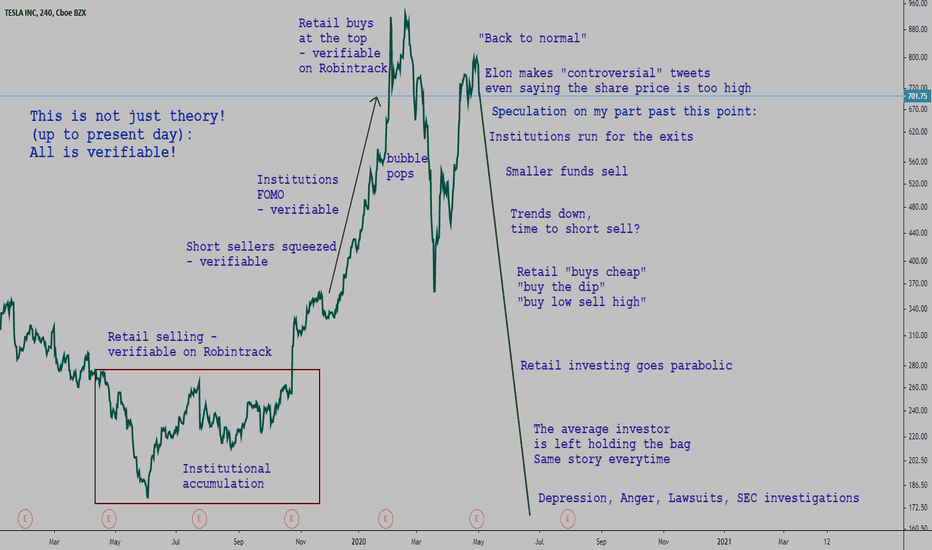

[Edutertainment] MUH BAGS: Tesla bagholder quotesWhy even bother analysing companies? I'm really starting to think looking at investors psychology and the noise around a company is all we need.

The time has finally come. Tesla has finally reached the euphoria turned denial phase, the baggy phase. I'm really starting to want to short now even with high short interest. I have no access to options and less leverage than FX & Futures (thanks for protecting me against the risk of making money). I'll have to look into it. If I have to lock my capital to make less returns than usually then what's the point.

Still, I am interested in this, and I keep learning, one day I'm sure I'll be more diversified and will be trading stocks.

We are in the typical not sure how to call it, the typical cycle phase thing.

Next step is retail investors "buying cheap". The institutional FOMO buying bubble has popped, and I don't expect a drawn out distribution like 2017-2018 because institutions do not baghold like retail.

Witness how media & Hollywood that were praising him and had a big role to play in the success of the stock, are going to do a 180 and hate on him and work to destroy the share price and turn EM into a public enemy.

So we are now closer to the typical process which is described in the textbooks with back to normal, institutional selling followed by retail bagholding.

Can go fast can not. Considering using a stop loss and a time stop.

Here are a few quotes that we see in these situations:

Long one but really good, and very typical:

Dumb money at its finest.

Ok that's enough.

I'll leave the final word to Elon, the "anti science conspiracy nut":

"What I find most surprising is that CNN still exists" - Elon Musk

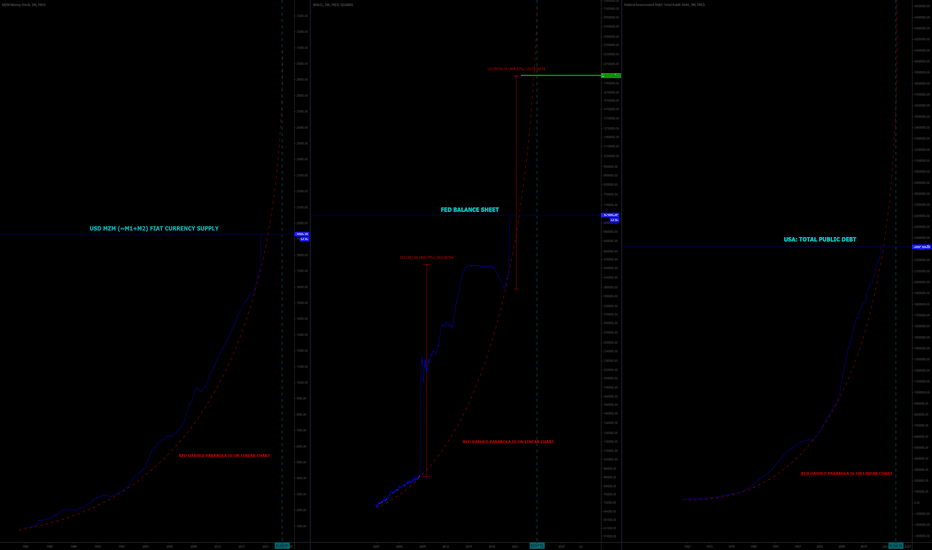

End game: USD currency fiat supply, Fed BS, US Public Debt RED DASHED PARABOLA IS ON LINEAR CHART. I will publish Log charts next.

These charts show end of 2023 something has to happen. I suspect that we will see a new structure/change to USD as the reserve currency and the next 30-40 year evolution of reserve currency as uncovered by Mike Malone in hidden secrets of Money.

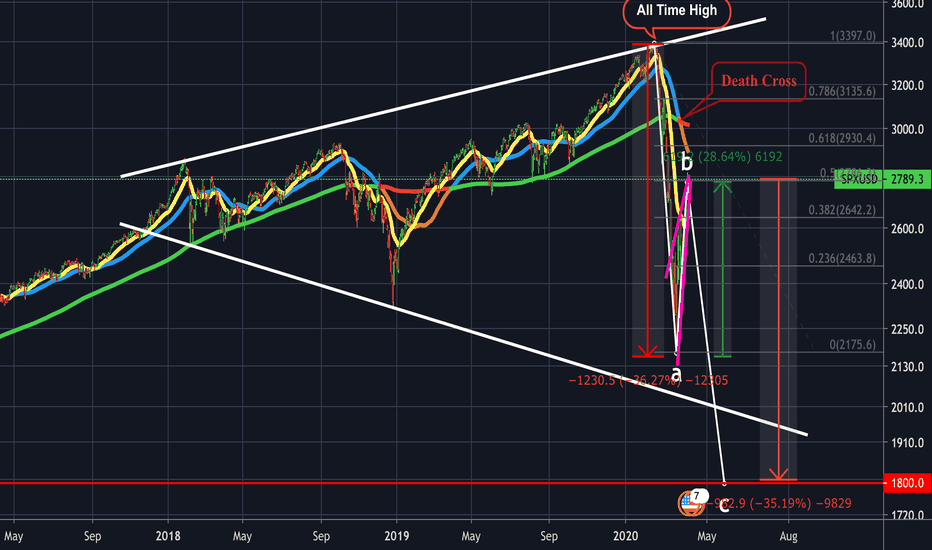

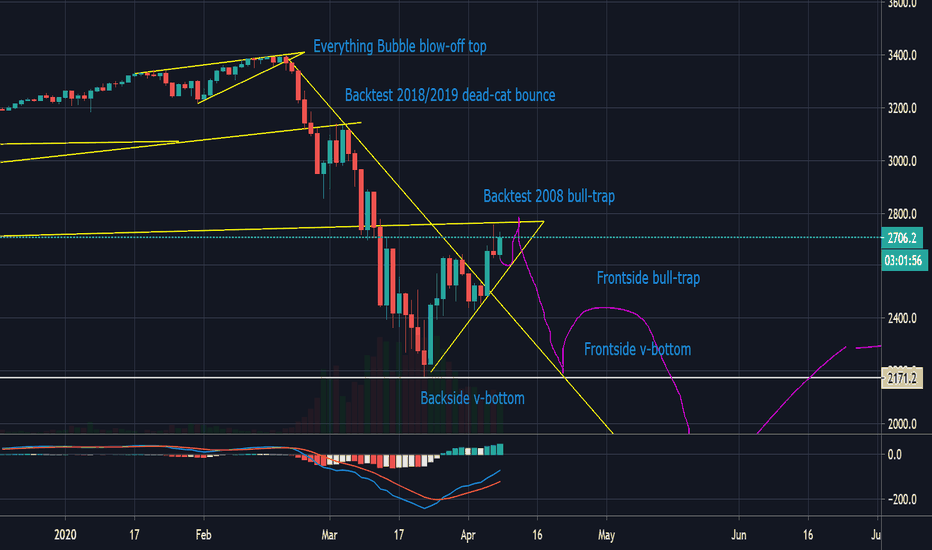

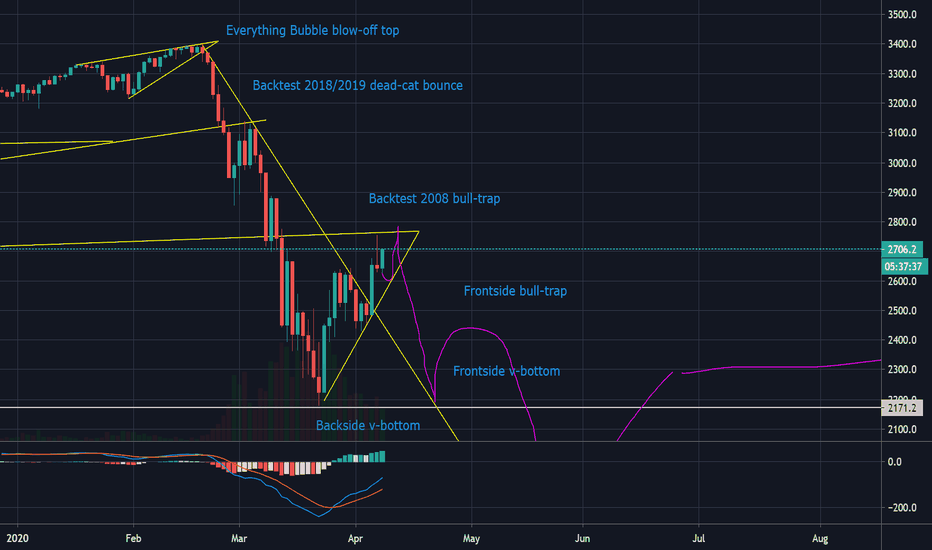

SPX Bubble Where do we begin, well here it goes:

We are in a Bear Market

1. All time high bubble has popped with a fastest one month drop of 36% in history,exceeding the pace of declines even during the Great Depression.

2. Megaphone pattern is playing out from 2018-2020 high and lows

3. Elliott Wave corrective ABC with leg B looks to be completed with 2800 level rejection, leg C is about to start which will take SPX a lot lower towards retesting resent lows around 2180

4. Leg B created a bearish bounce of approx. 25% with a rising wedge clearly defined.

Every bear market has these wild bounces and this one is no different.

5. Current price rejection is sitting at .50 Fibonacci level.

6. There is a Death Cross on a daily with 50dma crossing 200

6. Drop to 2200 for leg C is a start to retest the resent lows with 1800 in the picture.

Dell has an awful balance sheetDell has been on the down for a year, now they are really going down. And they are still doing stock buy-backs. The stock is way too high. Dell will be the main stock dragging down the XLK ETF for the next two weeks, and the next two months. They could get in serious debt trouble here.

Dell is my number one short position with out-of-the-money put options into June.

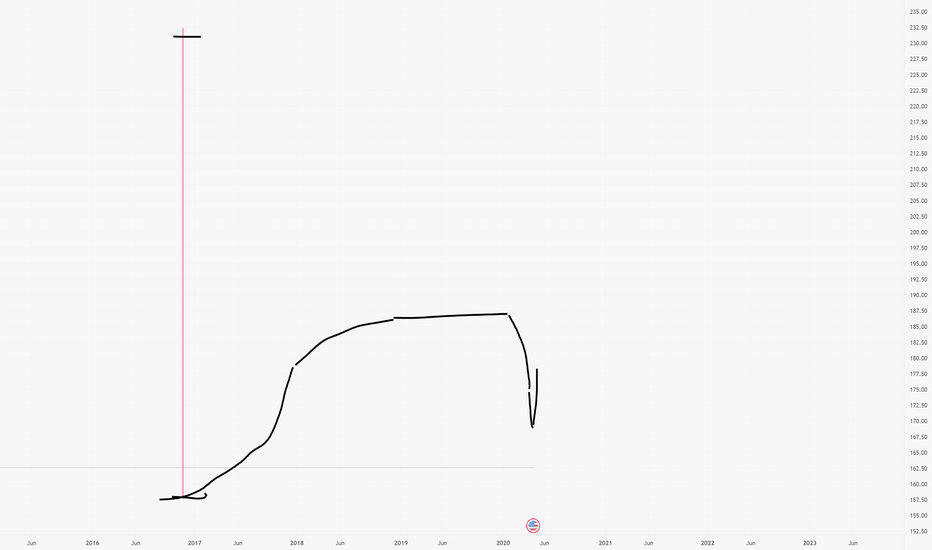

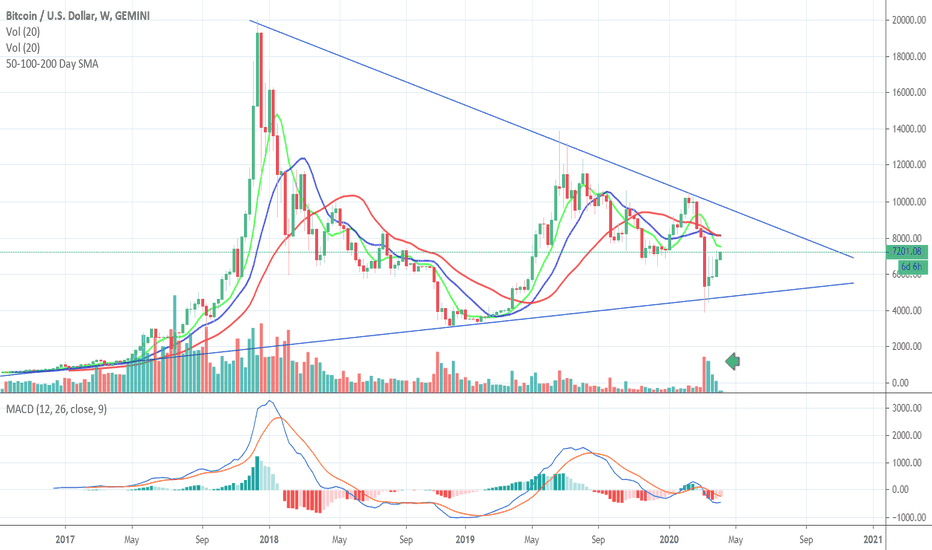

Massive Triangle (for personal use) I want to see how this goes down - in a way it is Bitcoin's big make or break moment. A break below practically signifies the end of the Bitcoin price bubble, and a break upwards may confirm that we are indeed a new cyclical uptrend. It's any sides game right now, but I am noting the huge uptick in volume.

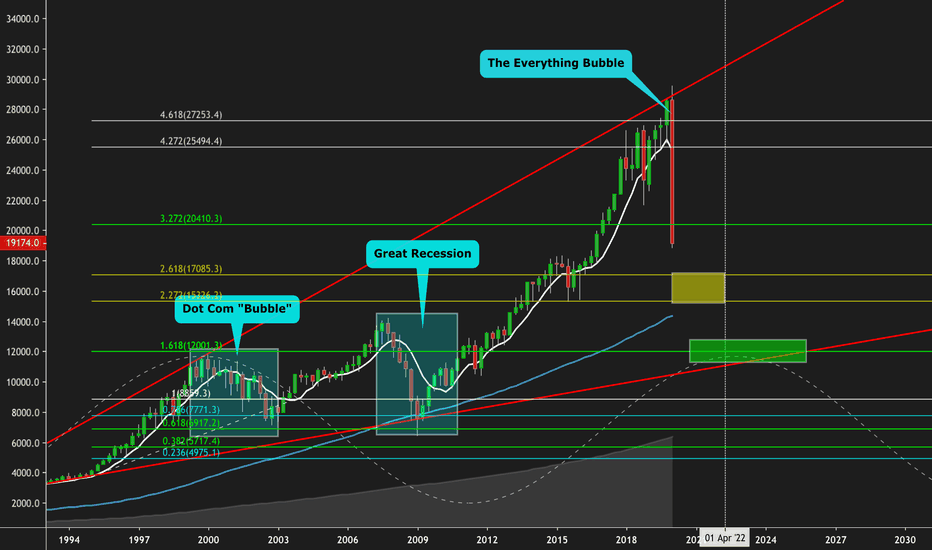

Did The Everything Bubble Just Pop??Inside a month we have nearly liquidated more assets than what was lost during the entire .Com bubble!

There is a chance to catch within a few months around 16-17k - however - the market won't fully be recovered and healthy again until we do a full reset all the way down around 12,000.

If that indeed happens then by the time its all said and done Wall Street would have lost more money than the .Com Bubble and Great Recession combined!

But hey at least the charts show that 2029-2031 should be booming again!

Peace & Love -

BK

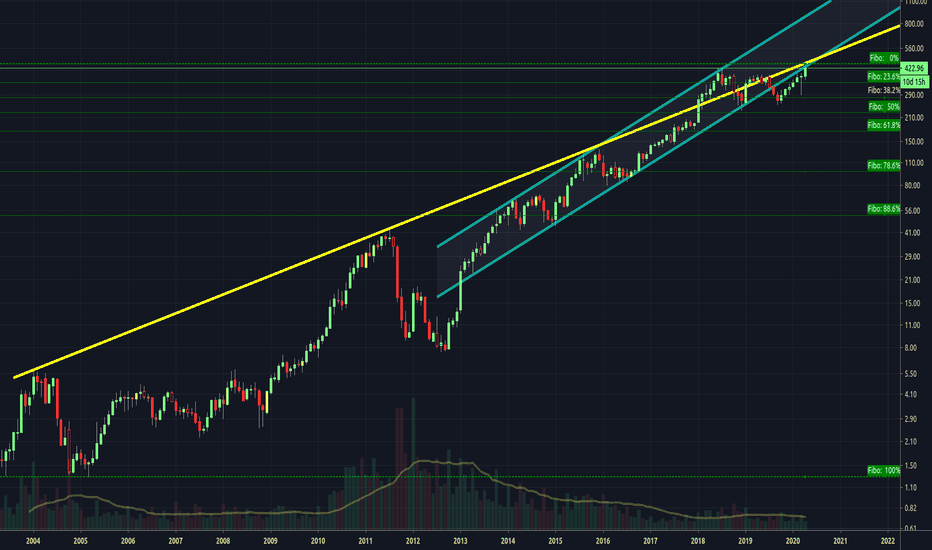

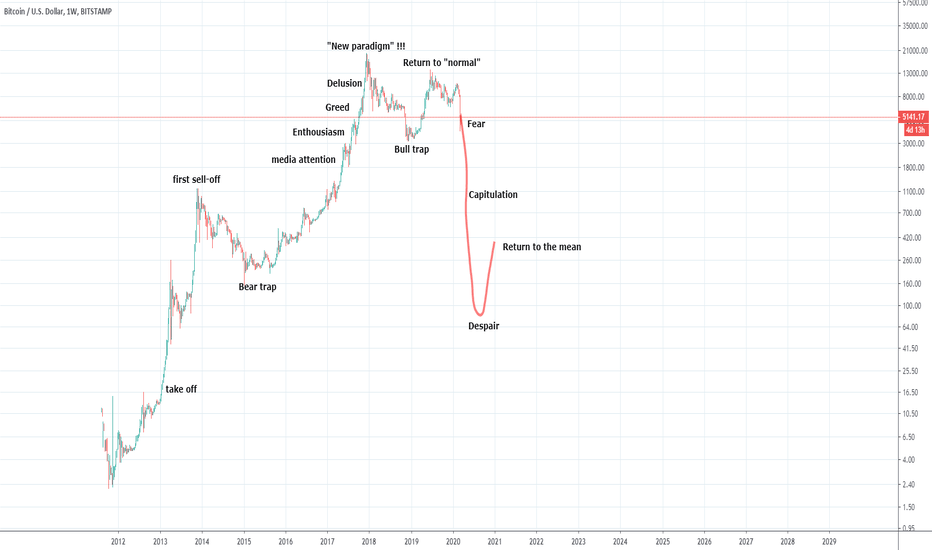

The end of Bitcoin Speculative BubbleThis obviously isn't a technical analysis, but an example of what a blow-off would look like if it is indeed what we are going to experience (and i strongly believe we are).

We know that bitcoin is a speculative bubble, we know what a speculative bubble blow-off look like, we know that a bubble that takes 10 years to appear can blow-off in just a few months.

Take care of your money and most importantly of yourself and your family, don't stay in a sinking boat because of anger, fear or greed, take whatever loss/profit you made and get out of the biggest ponzi scheme ever created before it's too late ;)

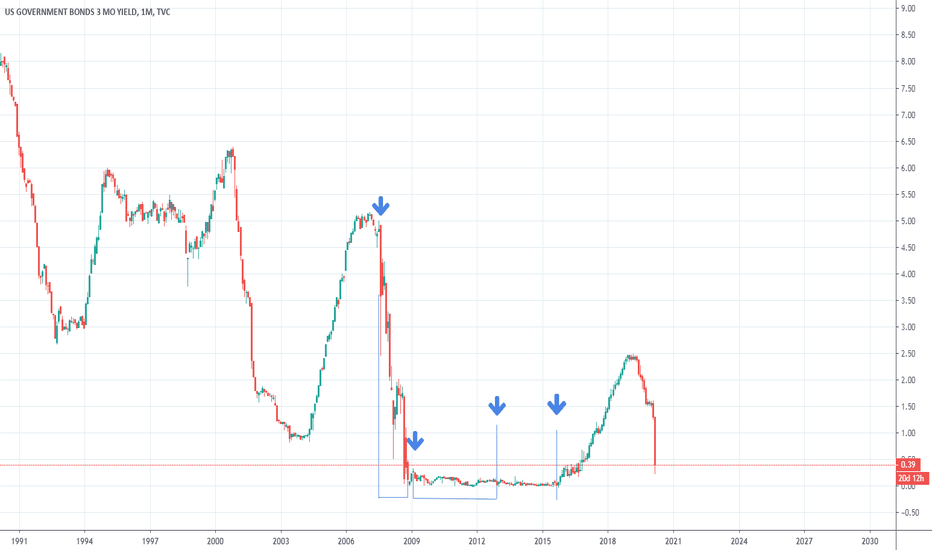

YIELD CURVE IS NOT WELL UNDERSTOOD!BOND MARKETS SAVANTS CLAIM THAT THE DEEPER THE YIELD-CURVE INVERSION, THE DEEPER THE RECESSION!

HOWEVER, VISIBLE INVERSIONS HAVE BEEN INCREASINGLY SHALLOW WHILE FOLLOWING RECESSIONS HAVE BEEN INCREASINGLY SEVERE, CULMINATING IN THE 2008 GLOBAL FINANCIAL CRISIS!

BY THIS LOGIC, WILL THIS RECESSION BE MORE SEVERE THAN 2008?