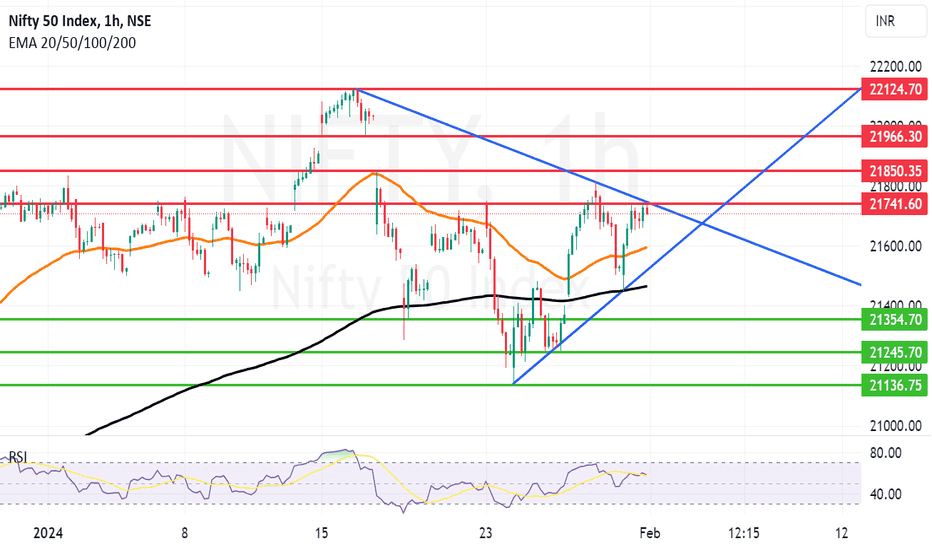

Again Nifty facing important Trendline resistance. 2024 first month has seen volatile, erratic, sudden tide to ebb and ebb to tide behaviour of Nifty which is at it's unpredictable best. The zone starting from 21741 to 21839 is having many resistances both small and big in addition to the trendline resistance. if Nifty is able to close above 21850 further journey towards 21966 and 22124+ is possible. Supports for Nifty are available at 21593 and 21464. If we get a closing below 21464 the Nifty may fall further to 21354, 21245 or 21136 levels. Usually budget days are marked with high volatility. Adding fuel to fire is the US FED meeting tonight. Do not take many / any high risk decisions tomorrow.