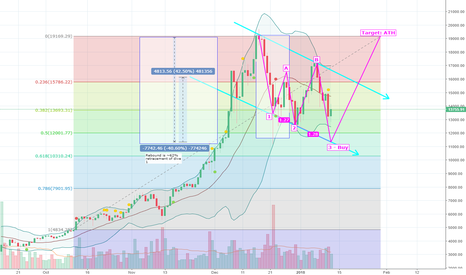

Bitcoin - Bullish Three Dive (confirmed) back to ATHHello, following bitcoins way back up from recent downtrends. Bitcoin was headed for a long correction after ATH, due to chinese and koreans it procedes faster than expected.

Still it followed the bullish three dive pattern, which will reach its goal soon enough.

Here you see the typical bullish three dive which is confirmed by following the downwards trend canal and as you can see, point A is a ~62% retracement from the first fall confirming the Bullish Three dive. Also the 1,27 diameter between , and are beeing hit!

The only rule thats not hit is that dive 3 is not as long as dive 2 since it should have hit 11k by about right now. (taking 4 day dive). Finding some support on high dives i think this rule can be neglected, but please judge for yourself!

I expect BTC to hit the fib support level of 12.000$ over the weekend and then either slow down a bit (and even fall to 11k for a short time) or go straight for following the pattern back to its recent ATH!! Best time to buy from 12000-11000.

Stoch RSI, RSI and MACD confirm still the short downtrend.