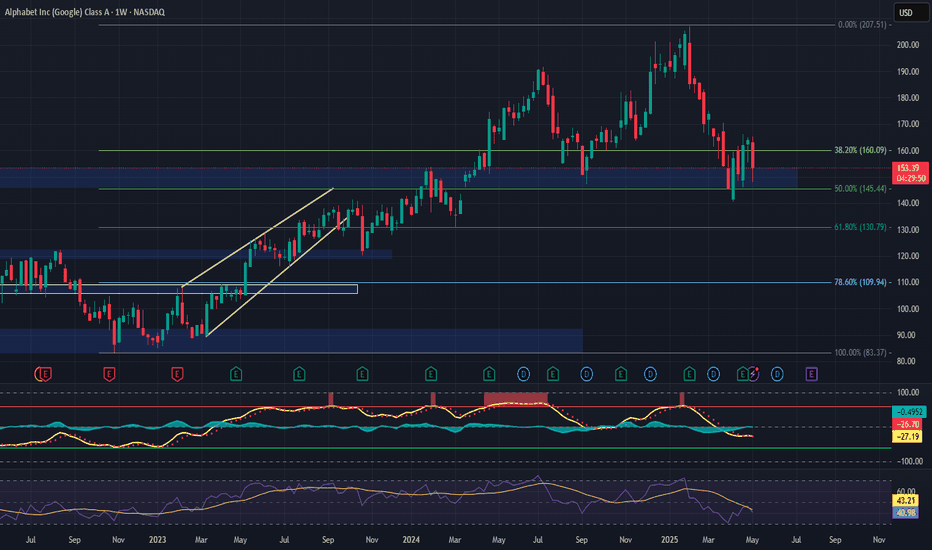

GOOGL (Alphabet Inc.) – Medium-Term Position Trade SetupNASDAQ:GOOGL is showing strength as it revisits its previous all-time high, now aligning with the 50% Fibonacci retracement of the current wave. The price action suggests a bullish flip of resistance into support at the $153 zone, with clear signs of buyer defense—offering a compelling medium-term opportunity.

🔹 Entry Zone:

Around $153 (support zone)

🎯 Take Profit Targets:

🥇 $200

🥈 $230

🛑 Stop Loss:

Weekly close below $130

Bullish Patterns

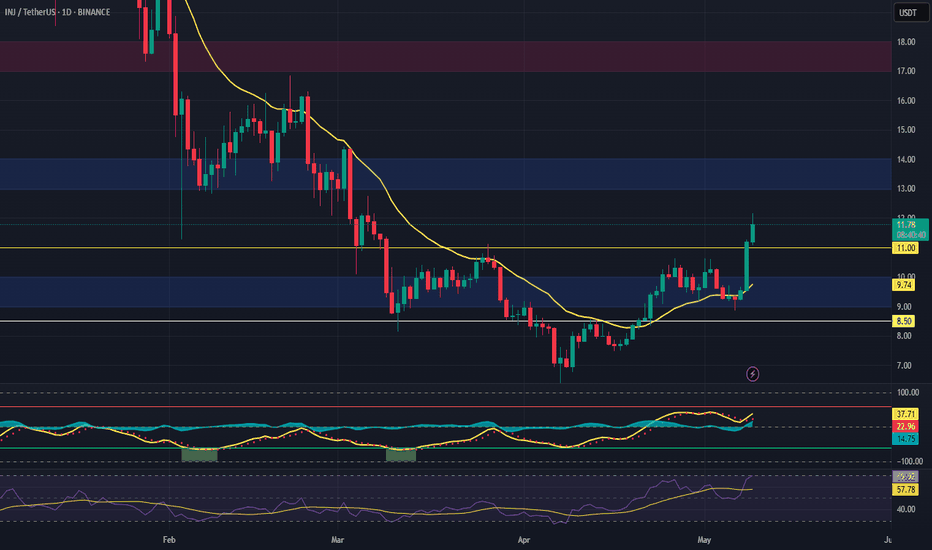

INJ - Long Trade Setup (Medium-Term Reversal Opportunity)INJ (Injective) has completed a deep liquidity sweep and is now reclaiming key technical levels, including the 21-day EMA and a critical horizontal support zone around $11. This sets the stage for a potential medium-term move higher if the structure confirms.

🔹 Entry Zone:

Around $11

🎯 Take Profit Targets:

🥇 $13 – $14

🥈 $17 – $18

🛑 Stop Loss:

Daily close below $8.50

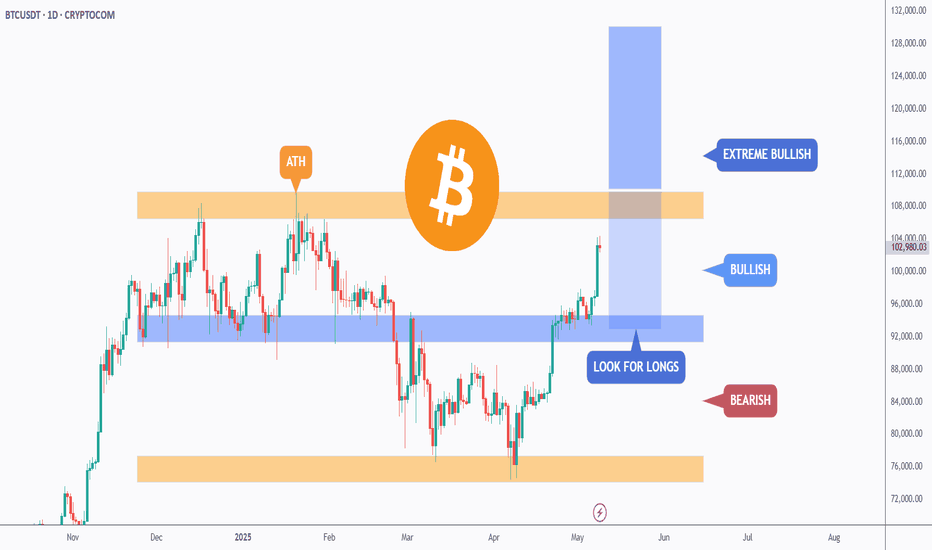

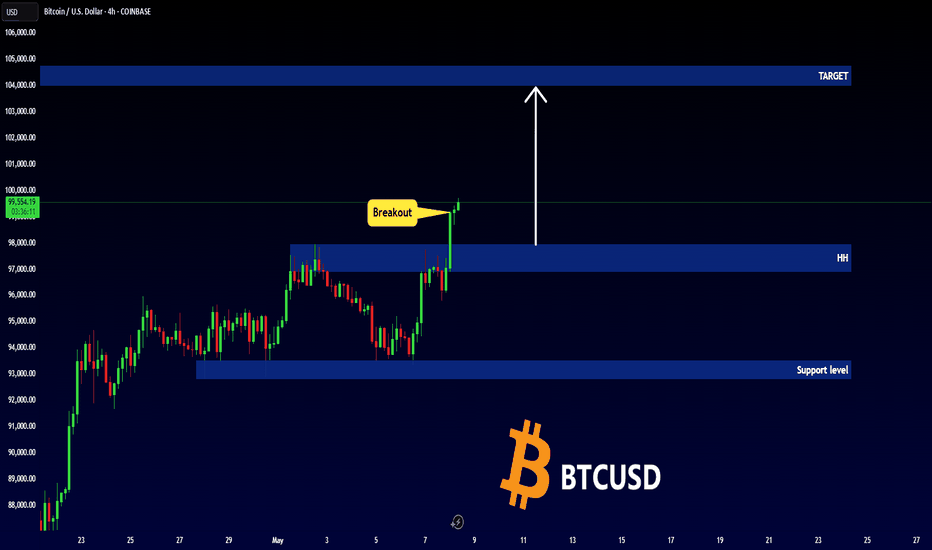

BTC - From Bullish to Extreme Bullish...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

🏢 BTC Building Blocks:

📈 Bullish:

BTC is currently trading within the second floor, between $92,000 and the previous all-time high (ATH) at $109,000.

As BTC retests the $96,000 demand zone, we’ll be looking for trend-following long setups!

📈 Extreme Bullish:

For the momentum to shift from Bullish to Extreme Bullish and enter the price discovery phase, a break above the previous ATH around $109,000 is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

SONIC | (Previously Fantom) | HUGE BULLISH PatternFTM has now officially been replaced on most exchange and is now trading as Sonic.

At first we saw an initial drop, typical "sell the news" actions, but now there is a bullish pattern forming in the 4h timeframe.

SONIC is bullish because:

✅ Upwards trendline trading

✅ Higher Lows

✅ Bullish chart pattern: W-Bottom

_______________

BYBIT:SONICUSDT

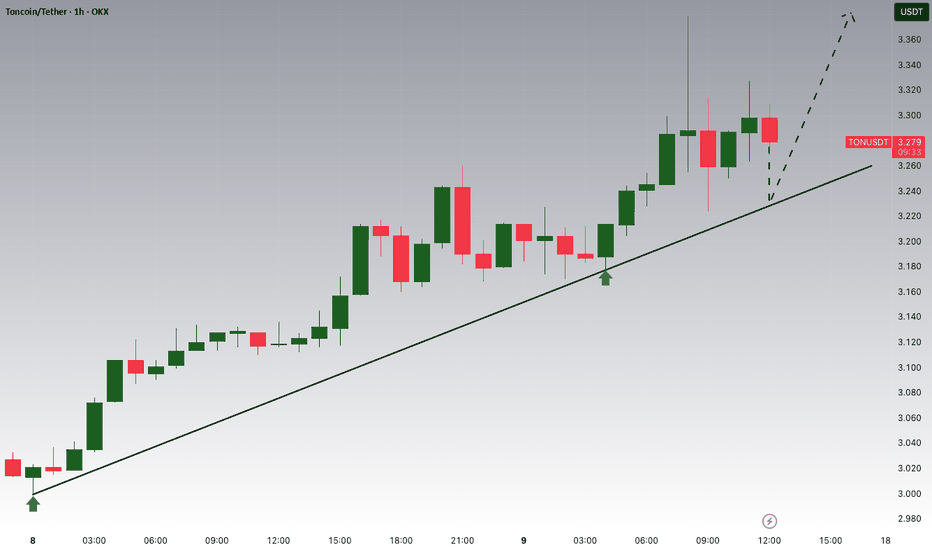

TONUSDT Built a Fresh Up Trend!!!Hey Traders, in today's trading session we are monitoring TONUSDT for a buying opportunity around 3.20 zone, TONUSDT is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 3.20 support and resistance area.

Trade safe, Joe.

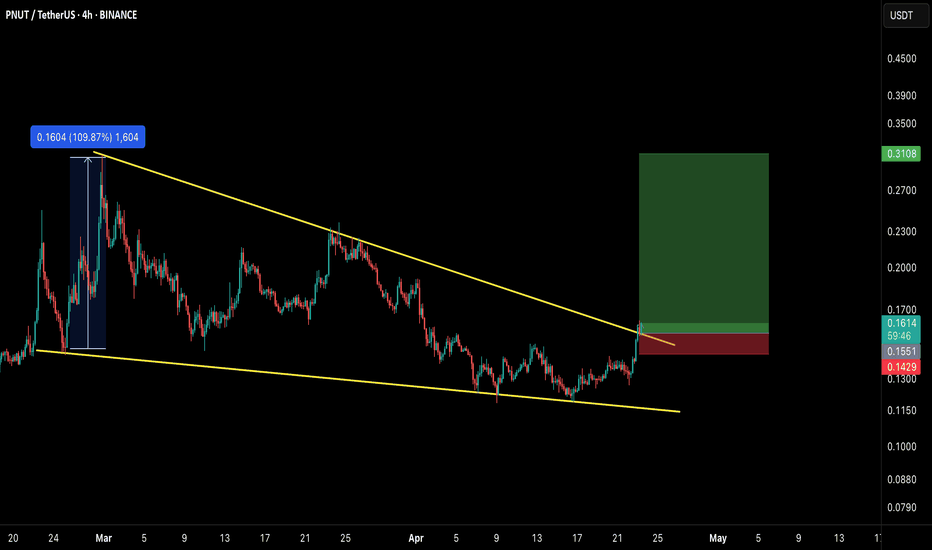

PNUT/USDT: FALLING WEDGE BREAKOUT ALERT!!🚀 PNUT Breakout Alert – 100%+ Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver! 💹💯

PNUT has officially broken out of a falling wedge structure — a bullish reversal pattern we've been eyeing for weeks! After weeks of consolidation and pressure along the wedge resistance, the price has now made a clean breakout with increasing volume.

🔹 Last time it broke out from this zone, we witnessed a massive 109% move.

🔹 Currently, it’s showing a similar breakout structure with room for a big upside move.

🔵 Entry Zone: $0.158–$0.162

🎯 Targets:

• Target 1: $0.21

• Target 2: $0.27

• Target 3: $0.31+

🛑 Stop-loss: $0.142

📊 Leverage: 3x–5x (low to moderate risk)

⚠️ As always, manage your risk and don’t chase pumps. Setup looks strong as long as the breakout holds and we don’t see a fakeout candle back inside the wedge.

📍Let me know what you think — will PNUT fly again?

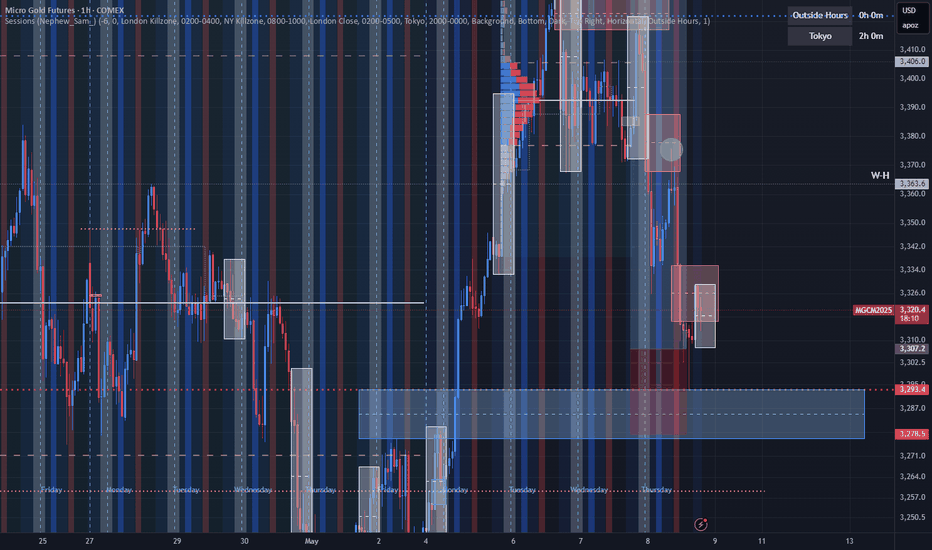

Retrace Complete...but we need 1 more Sweep on Gold!This pullback is what I waited for and it took all week for it to happen. Not sure if I will get the bullish move today being that it is Friday. But if they hit the level I'm looking for I will try at least once. Keeping expectations low since its the end of the week. but things are shaping out for us to have a STRONG bullish week next week.

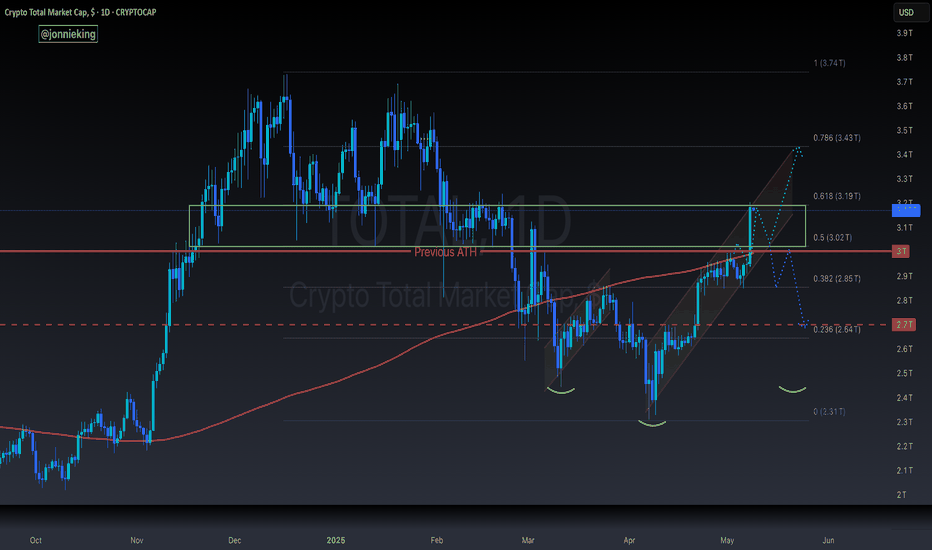

$TOTAL Crypto Market Cap - Banana Zone or Bull Trap!?Massive day for CRYPTOCAP:TOTAL Crypto Market Cap with 9% move UP, breaking above the 200DMA and last cycle’s ATH.

Got rejected at the .618 Fib ~$3.19T, so work still needs to be done to confirm this region.

Expect a retest at $3T to decide if the market goes to $3.2T or back down to $2.85T

As I've been saying this past month, this is either the biggest bull trap all cycle, or it's the start of the PARABOLA 🍌

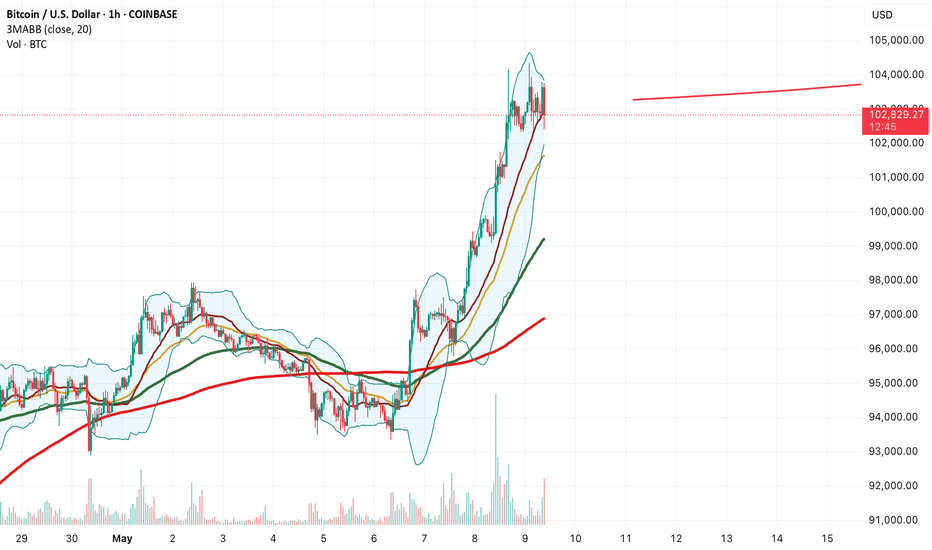

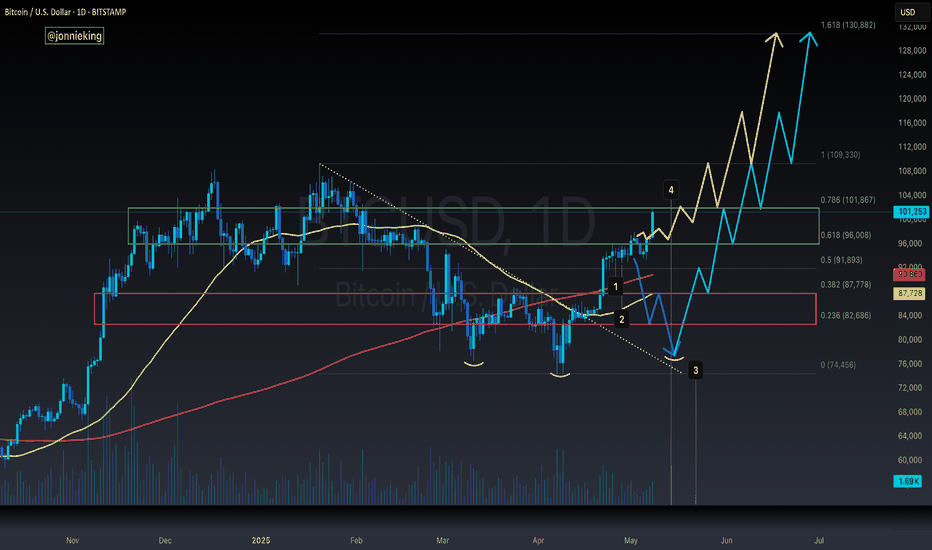

$BTC Trump Pump $100k Target HitTRUMP PUMP IS BACK 🔥

$100k target hit ✅

Another massive rip for CRYPTOCAP:BTC closing within the golden zone 🏆

Need some consistent PA in here or a rip and close above the .786 fib.

200DMA (now sitting at $90,861) is still my base case as mentioned in my original analysis several weeks ago.

IF this is the start of the PARABOLA, and you have some dry powder, a retest of ATH ~109k and then correction to .786 ~$101k would be your entry, with a SL just below the .618 ~$93k

Exciting to watch either way it goes!

This is why you always prepare for both scenarios 🤓

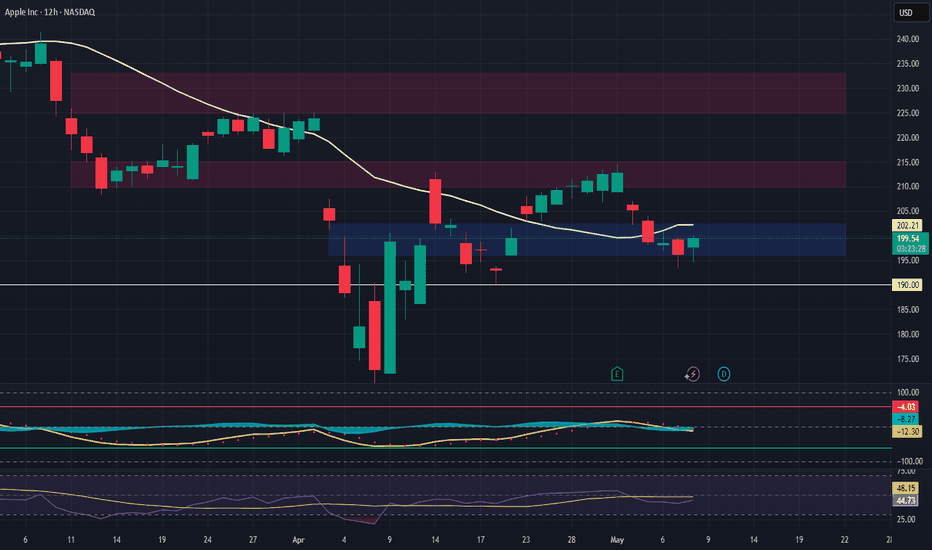

AAPL – Long Trade Setup (Support-Based Reversal Opportunity)Apple (AAPL) is pulling back toward a key support zone between $197–$198, aligning with both previous structural support and potential demand zone behavior. This setup offers a favorable risk-to-reward profile for a swing long entry.

🔹 Entry Zone:

$197 – $198

🎯 Take Profit Targets:

🥇 $210 – $215

🥈 $225 – $233

🛑 Stop Loss:

Just below $190

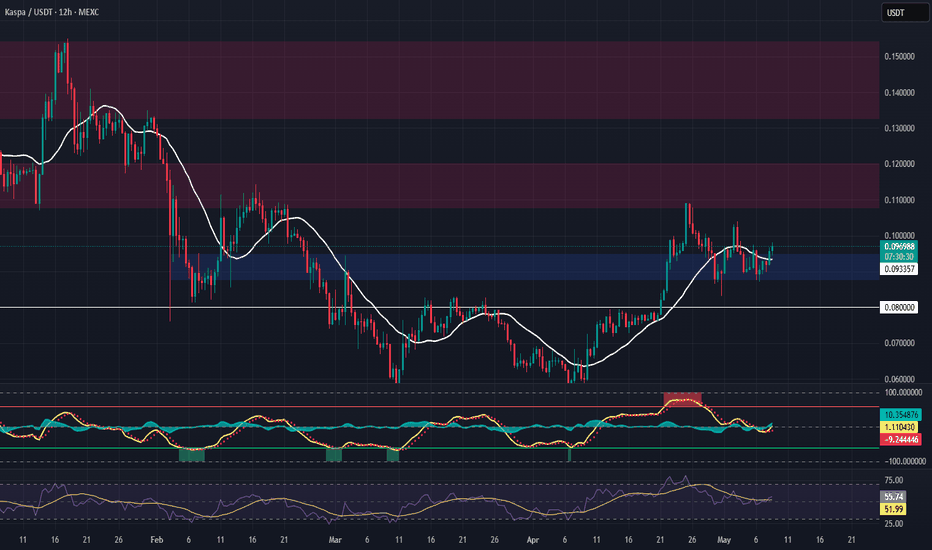

KAS – Long Spot Trade Setup (Structural Recovery in Play)KAS is beginning to show early signs of reversal, reclaiming the 20-day SMA after forming a double bottom near the $0.087 zone. This signals a potential shift in momentum and offers a favorable risk-reward opportunity.

🔹 Entry Zone:

$0.087 – $0.094

🎯 Take Profit Targets:

🥇 $0.108 – $0.120

🥈 $0.133 – $0.154

🛑 Stop Loss:

Just below $0.080

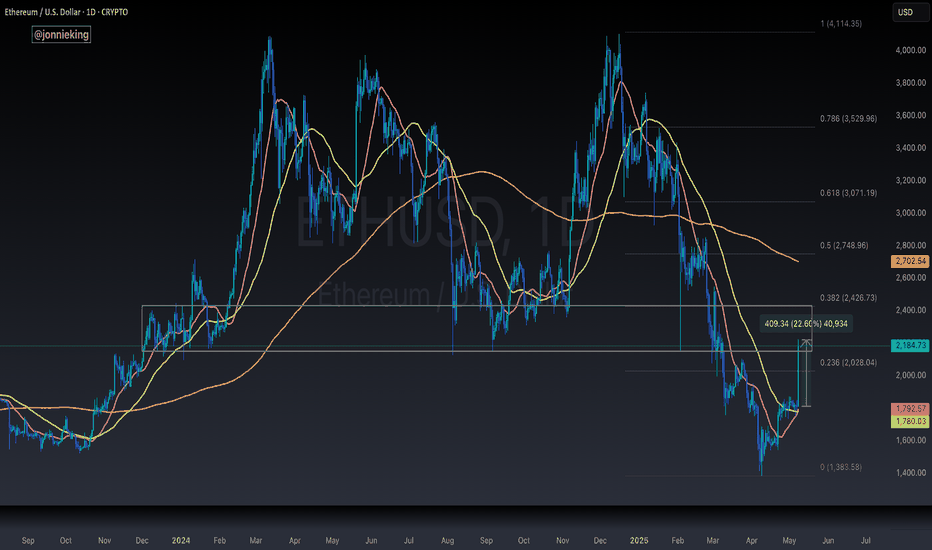

ETH - Is $3,000 next?Today marked a significant milestone for Ethereum as it successfully rolled out its much-anticipated Pectra upgrade. The update, which introduces a number of technical enhancements aimed at improving scalability, security, and developer experience, has already had a noticeable impact on market sentiment. In the hours following the upgrade, Ethereum (ETH) surged more than 13%, breaking through key resistance levels and igniting fresh bullish momentum.

From a technical standpoint, ETH is currently breaking out of a descending wedge pattern, a structure often seen as a bullish reversal signal. The price action has decisively pushed through the wedge’s upper boundary, signaling a potential end to the recent downtrend. Additionally, ETH is now testing a significant resistance zone, often referred to as the "resistance box," which has historically served as a key battleground between bulls and bears.

Should Ethereum manage to secure a clean breakout above this resistance area with strong volume. The next major upside target lies around the $3,000 level, a psychologically and technically important price point. This move could mark the beginning of a larger bullish cycle if market conditions remain favorable and momentum continues to build.

With the broader crypto market showing signs of recovery and Ethereum's fundamentals strengthening post-upgrade, traders and investors alike will be closely watching to see whether ETH can sustain its breakout and confirm this bullish trend.

-------------------------------

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

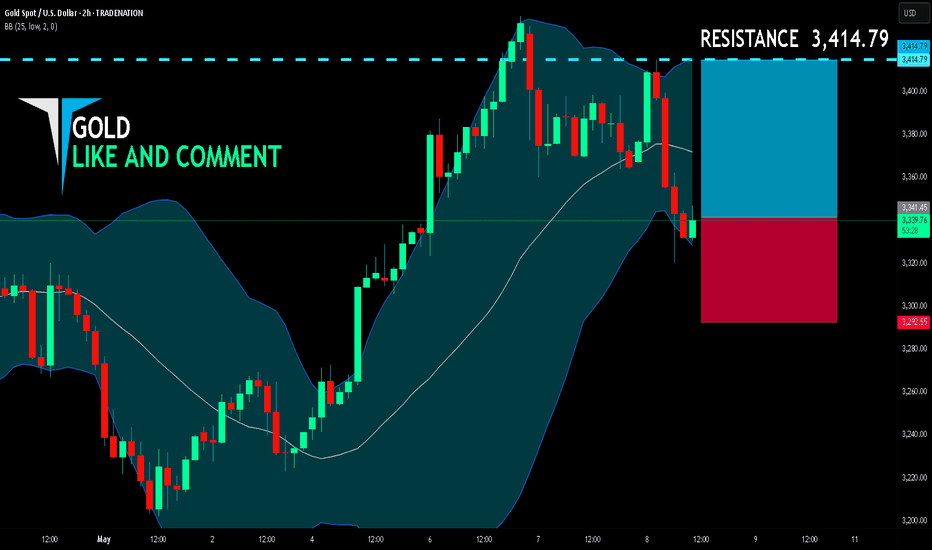

GOLD BEST PLACE TO BUY FROM|LONG

GOLD SIGNAL

Trade Direction: long

Entry Level: 3,341.45

Target Level: 3,414.79

Stop Loss: 3,292.55

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

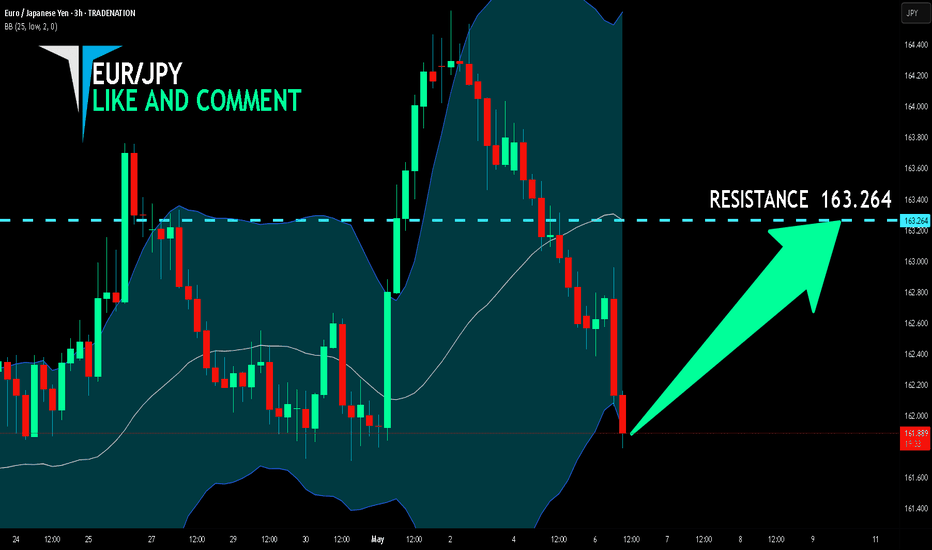

EUR/JPY LONG FROM SUPPORT

Hello, Friends!

EUR/JPY is making a bearish pullback on the 3H TF and is nearing the support line below while we are generally bullish biased on the pair due to our previous 1W candle analysis, thus making a trend-following long a good option for us with the target being the 163.264 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BANK / USDT Long Trade Setup – Big Breakout Watch!🚀 BANK Breakout Alert – 100%+ Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver! 💹💯

BSE:BANK has broken out of a massive symmetrical triangle on the 1H chart — signaling a potential continuation move after a long consolidation! ⚡📈

📌 Entry Zone: $0.0372 – $0.0390 (current breakout area)

🎯 Targets:

• Target 1 → $0.0450

• Target 2 → $0.0520

• Target 3 → $0.0600

Target 4 → $0.0720

Target 5 → $0.0820

🛡 Stop Loss (SL): $0.0350 (below breakout support)

🔑 Why this setup matters:

✅ Clean breakout after long consolidation

✅ Strong bullish volume on breakout

✅ Previous breakout gave +114% move!

⚠️ Always manage your risk — breakouts can retest!

💬 What’s your target on BSE:BANK ? Drop your thoughts below! 👇👇👇

SUI – Long Trade Setup After Trend ReversalSUI has broken out of its downtrend, hitting all prior upside targets and now pulling back toward a key support area and the 200-day EMA, potentially forming a higher low—an ideal spot for re-entry.

🔹 Entry Zone:

Around $2.80

🎯 Take Profit Targets:

🥇 $3.40 – $3.60

🥈 $4.00 – $4.20

🥉 $5.00 – $5.20

🛑 Stop Loss:

Daily close below $2.20

📌 Strategy Notes:

Look for bullish confirmation (e.g., wick rejections, bullish engulfing candle) near $2.80

Structure remains intact as long as price holds above $2.20

EMA retests often precede strong continuation if trend strength remains

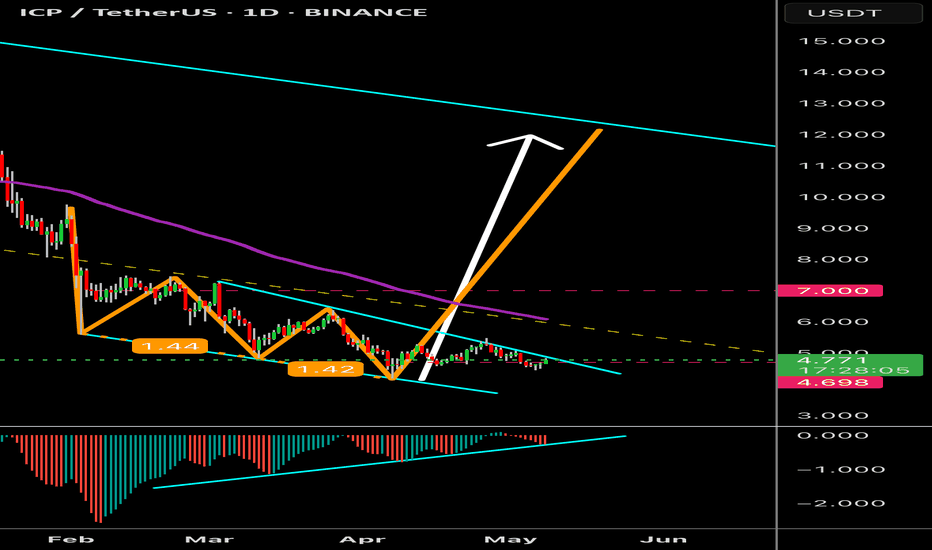

ADA (Cardano) – Long Spot Trade Setup at SupportCardano has pulled back to a key support zone around $0.66, providing a potential entry opportunity for a long spot position as the broader structure attempts to hold.

🔹 Entry Zone:

$0.66

🎯 Take Profit Targets:

🥇 $0.80 – $0.84

🥈 $0.98 – $1.02

🛑 Stop Loss:

Just below $0.59 (to protect against deeper breakdowns)

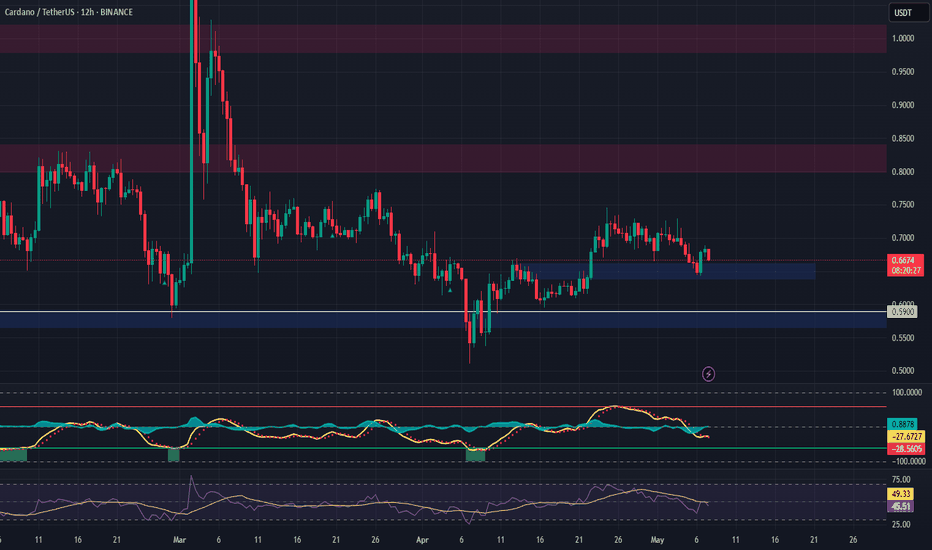

POPCAT Breakout Alert – Fresh Rally Incoming?🚀 POPCAT Breakout Alert – 60% Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver! 💹💯

POPCAT has just broken out cleanly from its ascending triangle pattern on the 4H timeframe 🔥. This follows a strong consolidation phase after its last explosive move of 61% gains—and it’s looking primed for a fresh leg up! 📈

Key Levels:

💥 Entry: $0.416 and add more in dip

🎯 Targets:

1️⃣ $0.48

2️⃣ $0.55

3️⃣ $0.61+

🛡 Stop-loss: Below $0.378

Why I Like This Setup:

✅ Clear breakout from a textbook pattern

✅ Strong volume pickup

✅ Previous breakout history shows solid momentum

Keep your eyes on this one 👀—momentum could build fast! Let’s ride the trend 🚀