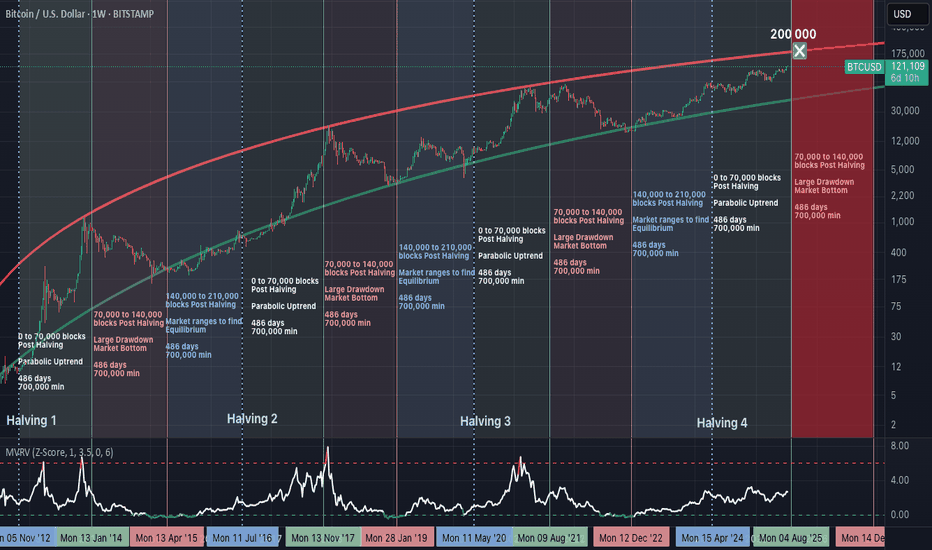

Bitcoin’s 486-Day Halving Blueprint: The $200,000 Blowoff?Summary

Bitcoin’s price consistently follows a 3-phase structure after each halving, with ~486 days per phase. If history repeats, we are nearing the end of the parabolic phase, with a potential peak around $200,000, before entering a structured drawdown.

Halving Cycles: The Real Clock Behind Bitcoin

Bitcoin’s monetary policy is pre-programmed.

A halving occurs approximately every 210,000 blocks (~4 years), and market behaviour after each halving follows this repeating pattern:

Phase 1: Parabolic Rally (0 to 70,000 blocks post-halving).

Phase 2: Major Drawdown (70,000 to 140,000 blocks).

Phase 3: Equilibrium Phase (140,000 to 210,000 blocks).

Each phase lasts approximately 486 days, and this structure has repeated reliably since 2012.

Phase 1: The Parabolic Rally (Current Phase)

We are currently in the growth segment of the cycle:

Price rising rapidly.

Miner profitability at highs.

Hashrate and network security increasing.

MVRV Z-Score steadily climbing, but not yet overextended.

Roughly 700,000 BTC are mined during this period, creating a supply shock as issuance is halved while demand accelerates.

Phase 2: The Drawdown (Expected Next)

Historically begins between block 70,000 to 140,000 post-halving.

Market peaks and begins to correct.

Miner margins compress.

Hashrate may plateau or decline.

Forced selling and miner capitulation drive volatility.

Price retraces significantly from the peak.

This phase resets the market and eliminates unsustainable excess.

Phase 3: The Equilibrium Phase

Occurs between block 140,000 to 210,000 post-halving.

Price enters consolidation.

Realized value and market price converge.

Ideal accumulation period for long-term investors.

Network fundamentals stabilize ahead of the next halving.

This phase is critical in building the base for the next cycle.

MVRV Z-Score: Market Thermometer

The chart includes the MVRV Z-Score, a key metric showing how far price deviates from realized value:

Readings above 6.0 have consistently marked cycle tops.

Readings near or below 0 have marked major bottoms.

Current value is around 2.67 — indicating a rising trend, but not overheated.

This metric reflects market-wide profitability and speculative pressure.

Why $200,000 Is in Sight

The projected resistance curve on the chart suggests that:

$200,000 aligns with the top of the long-term parabolic channel.

It corresponds with the expected end of the parabolic phase (Q1–Q2 2026).

It fits prior extension patterns following each halving.

It is a strong psychological target, likely to trigger heavy profit-taking.

This price level is not arbitrary—it is derived from the same structure that defined previous peaks.

What Comes After

If the historical cycle structure remains intact:

The peak should occur before mid-2026.

A deep correction phase follows, likely into 2027.

True bottoms tend to occur as miner capitulation concludes and difficulty adjusts downward.

This is where conviction and preparation matter most.

Final Thoughts

Bitcoin cycles are not random. They are structured around block height, issuance, and miner economics.

Every cycle since 2012 has followed this 486-day framework, divided across parabola, crash, and reset. This model has outperformed calendar-based predictions and technical narratives.

Disclaimer

This content is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Past performance is not indicative of future results. Always do your own research and consult with a qualified financial advisor before making investment decisions. The author holds no responsibility for any losses incurred as a result of using the information presented herein.

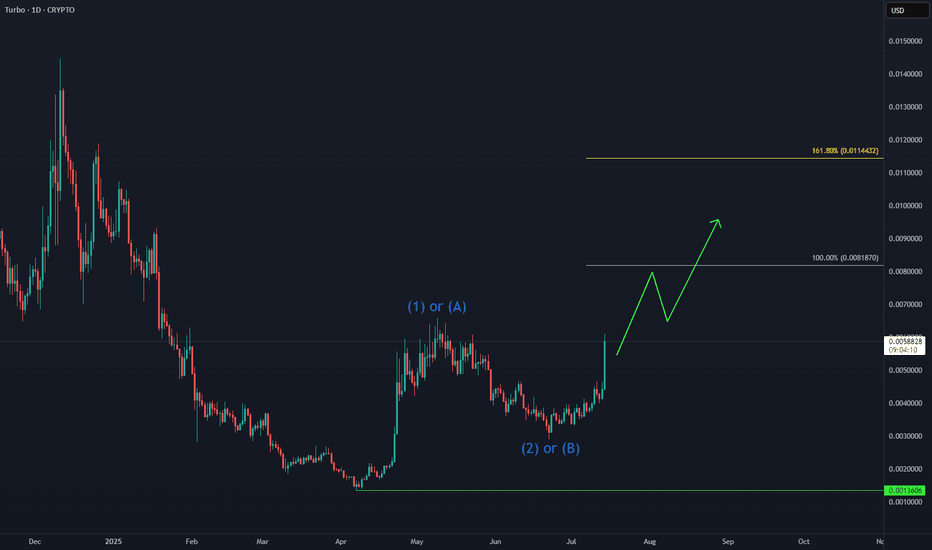

Bullishpattern

TURBO: Next Leg Higher in Progress📈 CRYPTO:TURBOUSD is building momentum after holding key support levels, with Elliott Wave projections pointing toward the equal legs target zone at $0.008–$0.011. The recent bullish structure suggests continuation, especially following its Binance US listing and strong community backing.

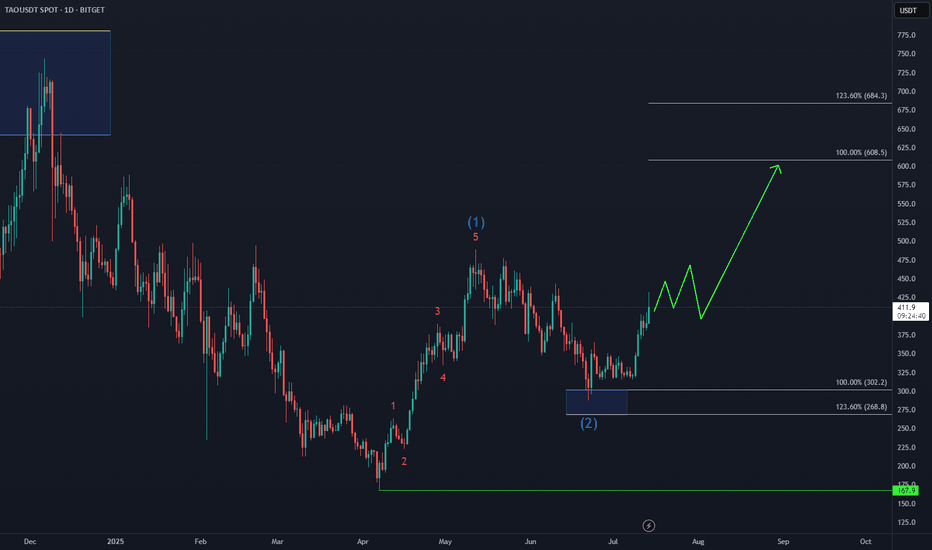

Bittensor TAO Eyes Next Upside Target📈 BINANCE:TAOUSD attracted strong demand in the Blue Box buying zone at $302–$214, triggering the next bullish leg.

Elliott Wave projections now point toward a move into the $608–$684 target area, supported by impulsive structure and rising momentum.

As long as price holds above the recent low, the bullish sequence remains intact.

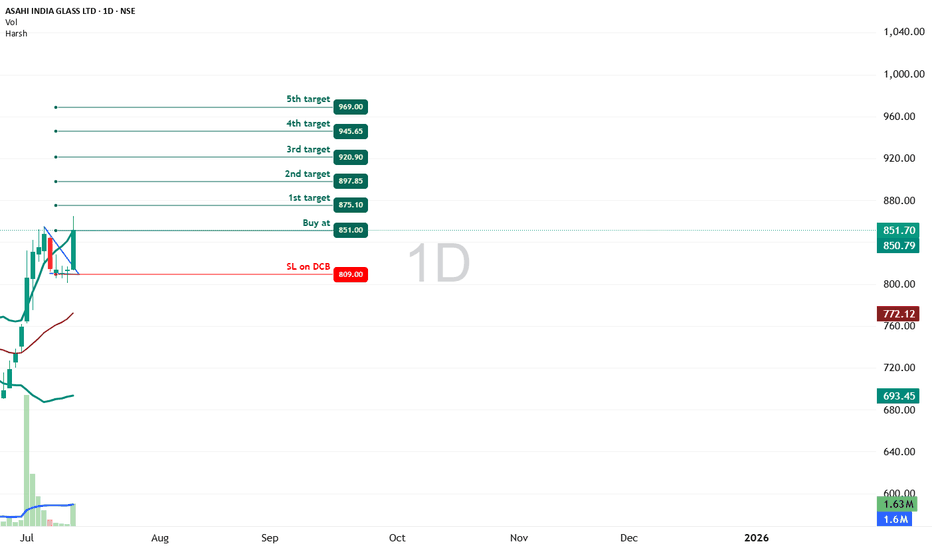

ASAHI INDIA GLASS- Bullish Flag & Pole Breakout (Daily T/F)Trade Setup

📌 Stock: ASAHI INDIA GLASS ( NSE:ASAHIINDIA )

📌 Trend: Strong Bullish Momentum

📌 Risk-Reward Ratio: 1:3 (Favorable)

🎯 Entry Zone: ₹851.00 (Breakout Confirmation)

🛑 Stop Loss: ₹809.00 (Daily Closing Basis) (-5 % Risk)

🎯 Target Levels:

₹875.10

₹897.85

₹920.90

₹945.65

₹969.00.00 (Final Target)

Technical Rationale

✅ Bullish Flag & Pole Breakout - Classic bullish pattern confirming uptrend continuation

✅ Strong Momentum - Daily RSI > 60, Weekly RSI >60 Monthly rsi >60

✅ Volume Confirmation - Breakout volume 121.30K vs previous day's 1.63M

✅ Multi-Timeframe Alignment - Daily and weekly charts showing strength

Key Observations

• The breakout comes with significantly higher volume, validating strength

• Well-defined pattern with clear price & volume breakout

• Conservative stop loss at recent swing low

Trade Management Strategy

• Consider partial profit booking at each target level

• Move stop loss to breakeven after Target 1 is achieved

• Trail stop loss to protect profits as price progresses

Disclaimer ⚠️

This analysis is strictly for educational purposes and should not be construed as financial advice. Trading in equities involves substantial risk of capital loss. Past performance is not indicative of future results. Always conduct your own research, consider your risk appetite, and consult a financial advisor before making any investment decisions. The author assumes no responsibility for any trading outcomes based on this information.

What do you think? Are you watching NSE:ASAHIINDIA for this breakout opportunity? Share your views in the comments!

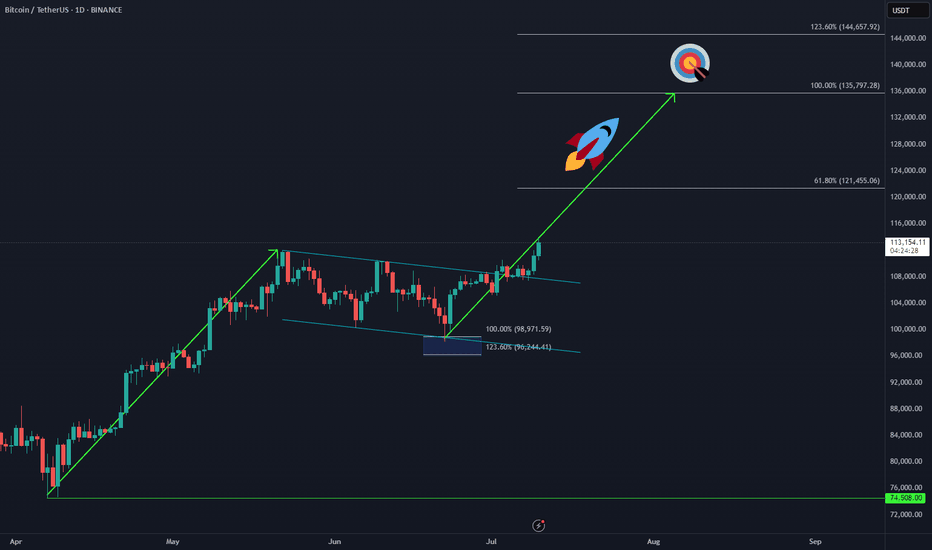

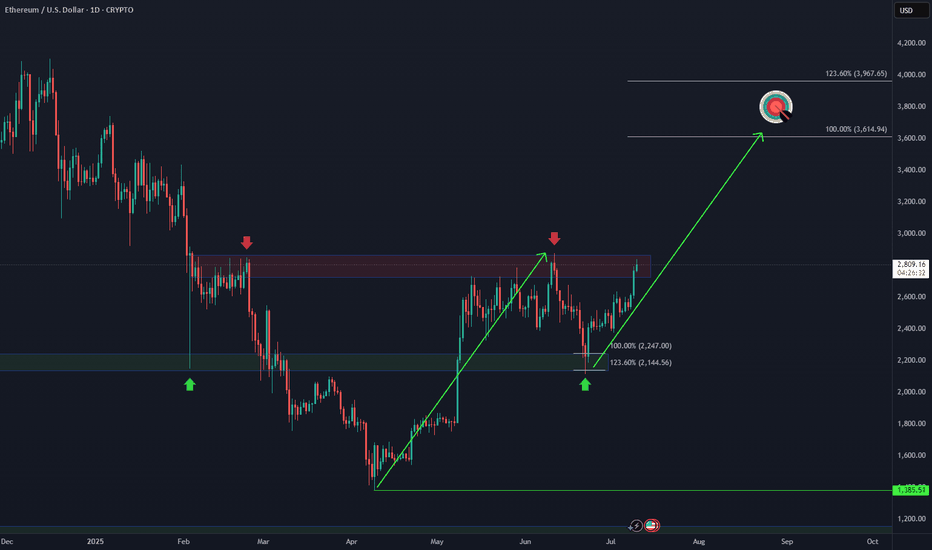

Bitcoin Makes New ATH – Next Sequence in Play 🚀 CRYPTO:BTCUSD has officially broken into new all-time highs, confirming the next bullish sequence is underway.

The upside projection now opens toward the $135K–$144K zone, aligning with long-term Fibonacci extensions and cycle projections.

📌 As always, it won’t be a straight line—expect step-by-step progress, with consolidations and pullbacks along the way. But the structure remains bullish, and the path is unfolding.

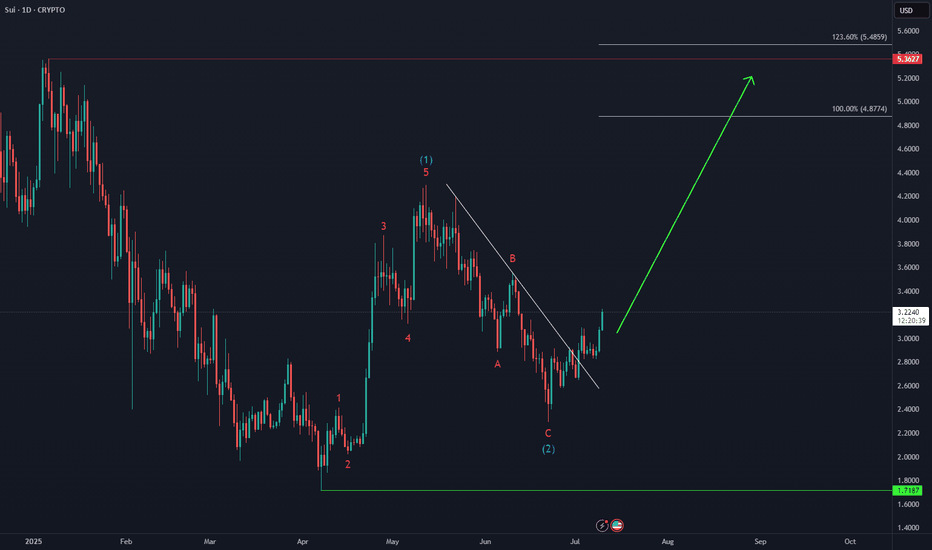

SUI Next Upside Target🚀 After holding above the April low and completing a 3-wave pullback in wave (2), CRYPTO:SUIUSD is now advancing in a potential wave (3).

Momentum is building, and the next upside target lies in the equal legs zone at $4.80 – $5.40, which could eventually lead to a new all-time high.

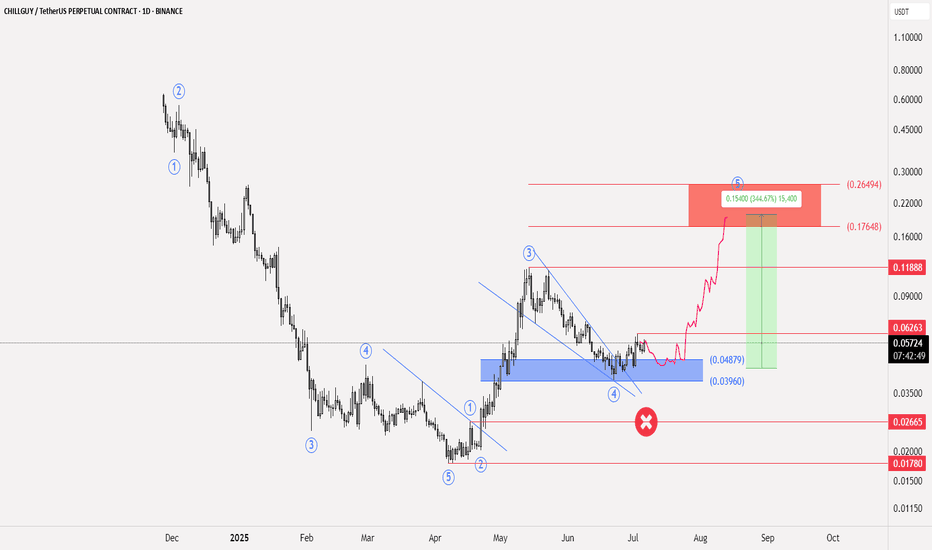

CHILLGUY trading Idea🟢 Bullish Signs

📝 Coin $CHILLGUY

✅ Entry Points: At the current price of 0.05742, consolidation is within the range of 0.04879 - 0.0396

🔴 Stop Loss is at 0.02665

💹 Potential Targets: The first target is 0.1188, and if the currency enters with an impulse wave, the target will be 0.17648, reaching 0.26494.

📊 The profit-to-loss ratio is 9:1

📝 This idea was built on Elliott Wave analysis, especially after the rebound from 0.01780 and the support range between 0.04879 and 0.03960. This is an indication that a wave 4 has been formed, especially if the price action remains above 0.02665, Wave 1 Peak

❤️ Good luck to everyone - don't enter any currency before studying your risk tolerance.

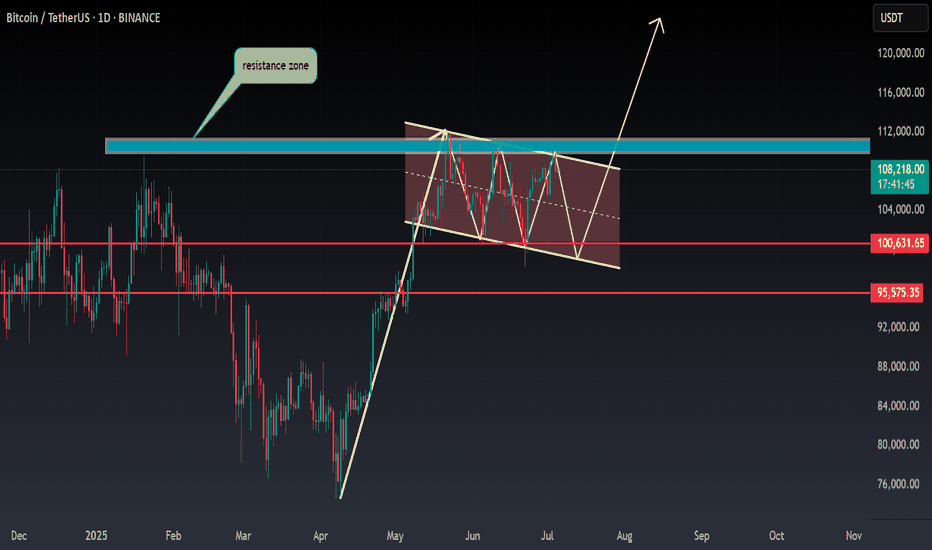

BTC ANALYSIS🌸#BTC Analysis : Bullish Trend 🚀🚀

🚀As we can see that there is a formation of Flag & Pole Pattern in #BTC in daily time frame. Right now we can see that #BTC again retest from the resistance zone and we can see a bounce back from its support zone 💪

🔖 Current Price: $1,08,050

⏳ Target Price: $1,20,000

⁉️ What to do?

- We can trade according to the #BTC chart and make some profits. Keep your eyes on chart price action, observe trading volume. Always observe market sentiments and update yourself everyday.🔰🔰

#BTC #Cryptocurrency #Breakout #TechnicalAnalysis #DYOR

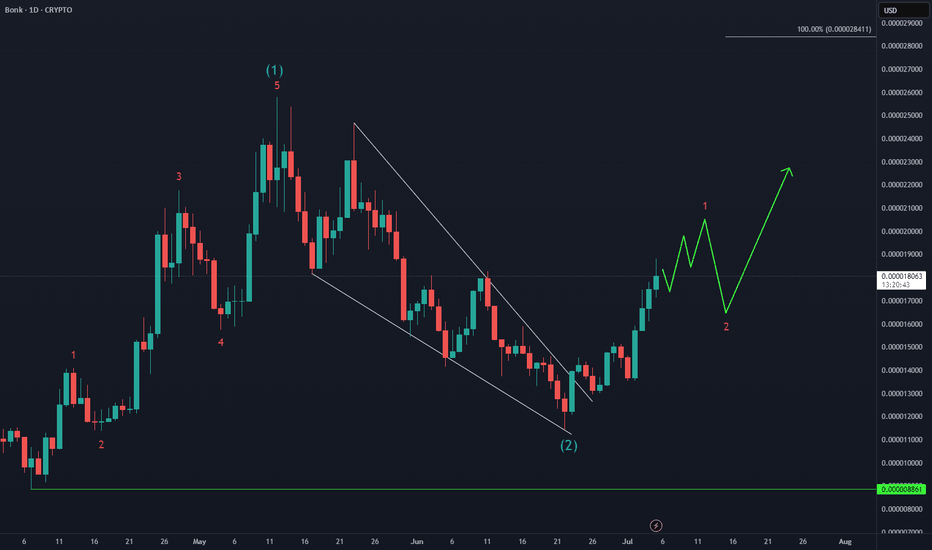

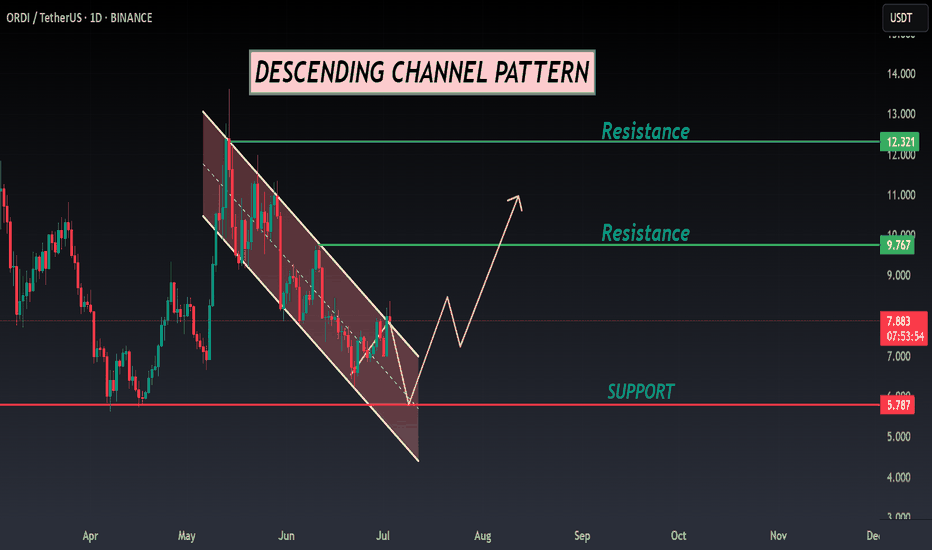

ORDI ANALYSIS📊 #ORDI Analysis

✅There is a formation of Descending Channel Pattern in daily time frame.

After a breakout of the pattern we would see a bullish momentum and can Target for $9.5 in few weeks🧐

👀Current Price: $7.890

🎯 Target Price : $9.500

⚡️What to do ?

👀Keep an eye on #ORDI price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#ORDI #Cryptocurrency #Breakout #TechnicalAnalysis #DYOR

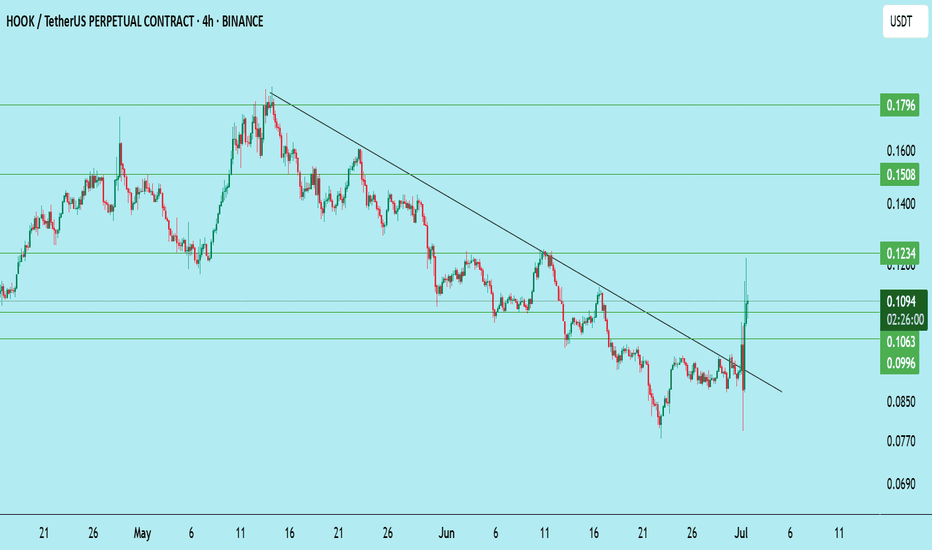

HOOK/USDT – Bullish BreakoutHOOK has successfully broken out of a long-term descending trendline on the 4H chart, signaling a potential trend reversal to the upside. The breakout is backed by strong volume and price action above key resistance.

Analysis:

After weeks of lower highs, HOOK has flipped the structure by breaking the trendline and reclaiming horizontal resistance.

Price is now holding firmly above the breakout level, indicating bullish strength.

Key Levels to Watch:

Support Zones:

$0.1063 – Retest of trendline breakout (ideal entry zone)

$0.0996 – Previous structure base and strong horizontal support

Stoploss:

Below $0.0990 (invalidate breakout setup)

Resistance/Targets:

$0.1234 – First upside target (short-term)

$0.1508 – Major horizontal resistance from May

$0.1796 – Final upside target if momentum continues

Strategy:

As long as price holds above $0.1063, bias remains bullish. A healthy pullback toward support may provide a better entry opportunity for those waiting on confirmation.

Breakout traders may ride the momentum up to $0.1234+

DYOR | Not Financial Advice

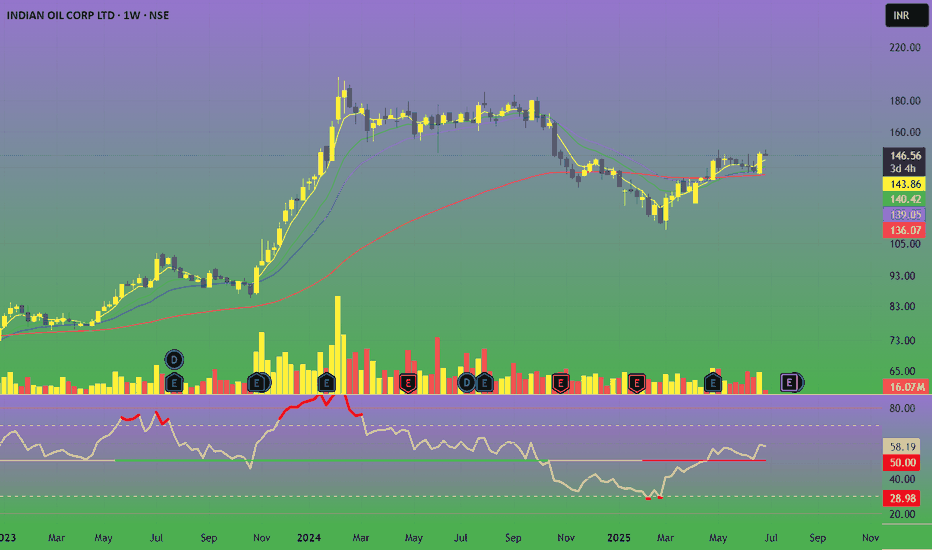

Buy IOC short term target 155, 165 & Medium Term tgt 185, 250 Indian Oil Corporation does business in the entire hydrocarbon value chain - from Refining, Pipeline transportation and marketing of Petroleum products to R&D, Exploration & production, marketing of natural gas and petrochemicals. It has the leadership position in the Oil refining & petroleum marketing sector of India.

The company aims to strengthen EV mobility infrastructure by setting up charging points and battery-swapping facilities at its fuel stations. It has also signed a binding term sheet with Panasonic Group to form a JV for manufacturing cells in India.

The company’s R&D is focused on emerging fields such as nanotechnology, Solar, Bioenergy, Hydrogen, etc. It has an effective patent portfolio of 1636. It spent Rs 946 Cr in FY24 on R&D.

The company’s R&D is focused on emerging fields such as nanotechnology, Solar, Bioenergy, Hydrogen, etc. It has an effective patent portfolio of 1636. It spent Rs 946 Cr in FY24 on R&D.

Market Cap ₹ 2,07,370 Cr.

Annual Sales - ₹ 758,106 Cr

Dividend Yield - 8.20 %

Stock P/E - 17.0

Industry PE - 29.2

Debt to equity - 0.82

ROCE - 7.37 %

EPS - ₹ 9.63

Fundamentally, this big company is trading at a very low valuation. The Crude Oil price is expected this year to be on lowest, so we can expect good profit margin and this company is into green energy business so it should have PE multiple of that business as well. We Expect growth in EPS by 30% to 12.5 And re-rating of PE multiple to 20 so that give the share price to ₹ 250 which gives return of 70.88% from current price level of 146.30.

Technically, this is very bullish on weekly, daily timeframe. Price is trading above all short term, medium term averages. It has formed a bullish candlestick pattern on daily and weekly chart, so we expect immediate strong upside to 155, 165 and eventually 185 level and investment target of 250 levels.

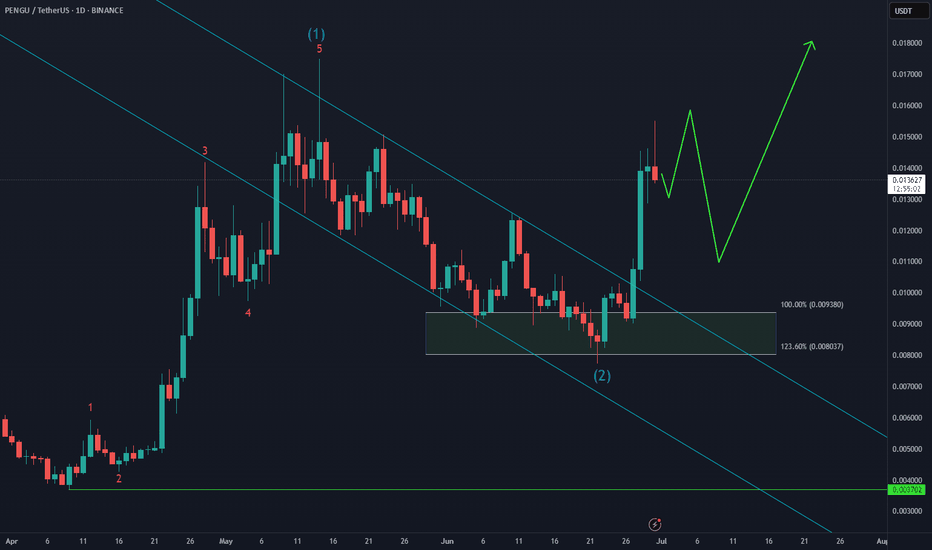

Pudgy Penguins PENGU Bullish Reversal Taking Shape🐧 Pudgy Penguins BINANCE:PENGUUSDT has bounced twice from the $0.009–$0.008 buying zone, showing resilience despite the choppy structure. As long as the June low holds, the setup favors a higher low formation next month, potentially setting the stage for the next impulsive leg higher.

Momentum is building — now it’s about follow-through and confirmation.

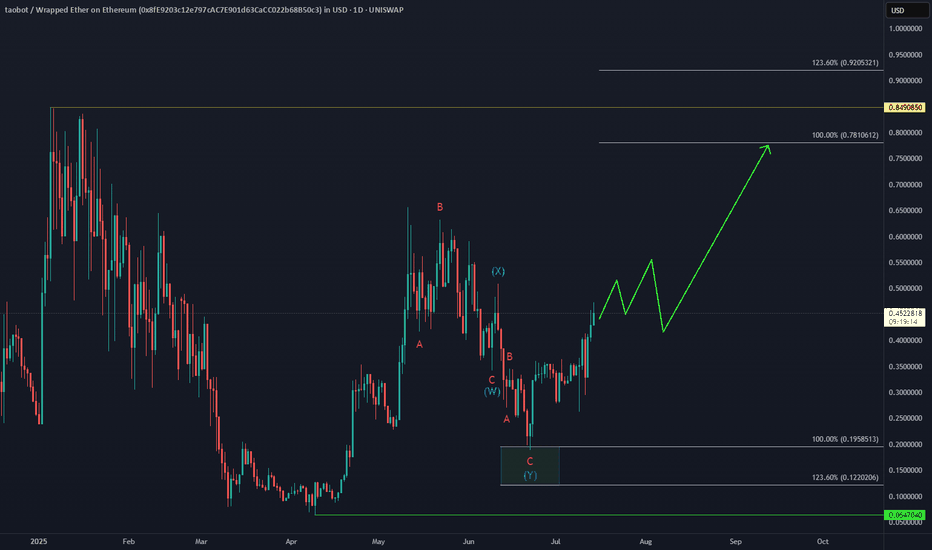

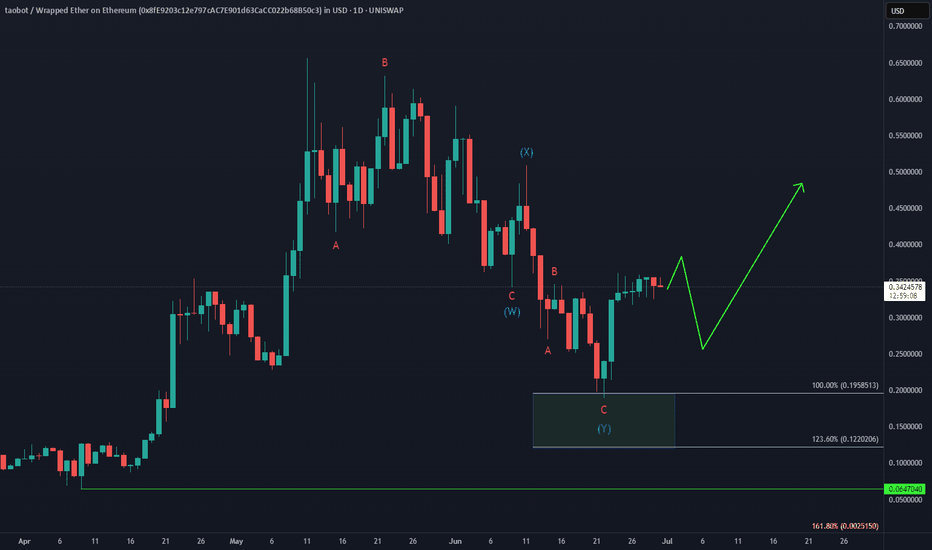

TAOBOT Bullish ReversalWill UNISWAP:TAOBOTWETH_8FE920.USD outperform BINANCE:TAOUSD ?

After the failed early June bounce, price completed a double correction into the $0.195–$0.12 equal legs zone, triggering a sharp 90% reaction higher.

As long as $0.19 holds, the setup favors continuation to the upside, with a break above the May peak in focus.

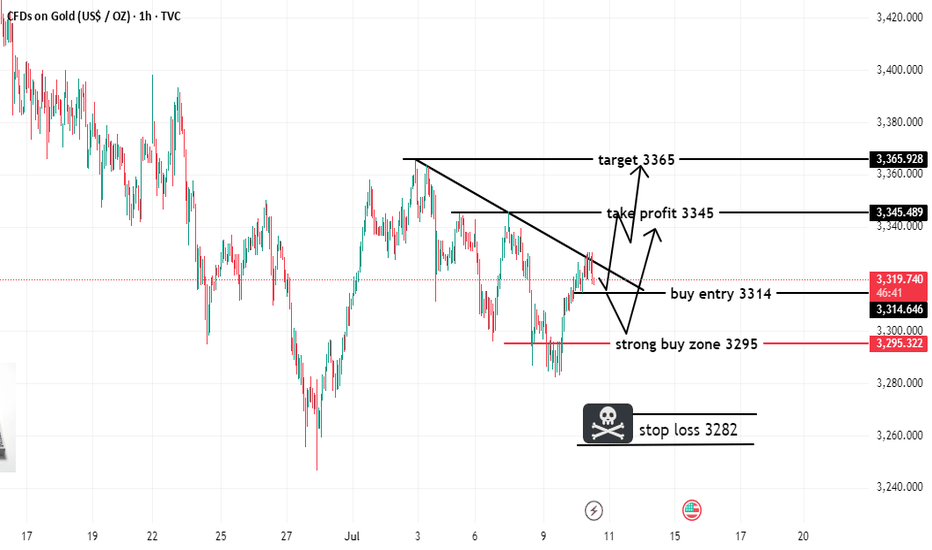

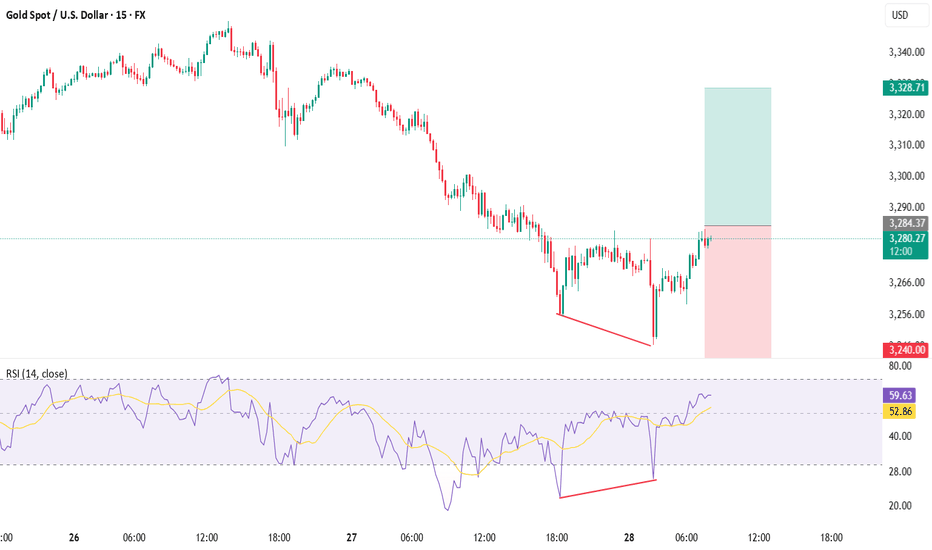

XAUUSD📉 The Setup: Bullish Divergence on XAUUSD (15m/30m)

Buy only on Breakout

🔍 Observation:

On the 30-minute timeframe, price made a lower low while the RSI indicator printed a higher low — classic sign of bullish divergence 🔄.

💡 Translation: Bears are losing steam! Bulls may be preparing to charge in! 🐂⚡

📊 Trade Plan – Long Entry