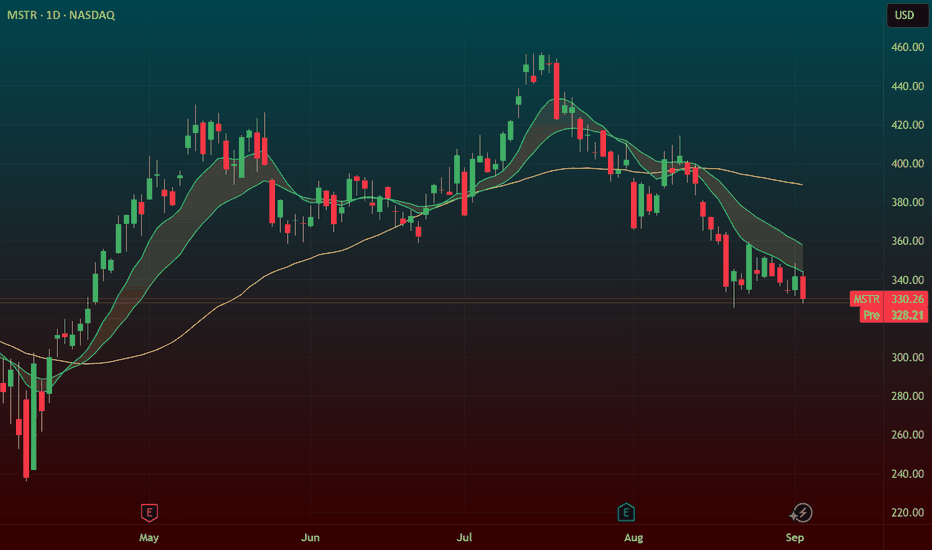

$MSTR – Bear Flag Breakdown SetupNASDAQ:MSTR – Bear Flag Triggering Despite Crypto Strength

MicroStrategy ( NASDAQ:MSTR ) has been drifting lower even as crypto has ripped the last few months — a clear sign of relative weakness. Every rally attempt has been faded, and now the chart is setting up a clean bear flag breakdown.

🔹 The Setup:

Price is pressing the $326 trigger level on a bear flag structure.

A breakdown here opens the door to $300 for the first cover zone.

Weak price action despite a strong sector = bearish divergence.

🔹 Market Context:

The NASDAQ:QQQ is flashing distribution signals — failed breakouts in momentum names and heavy selling under the surface.

If indexes continue to weaken, NASDAQ:MSTR could accelerate to the downside as speculative money comes out.

🔹 My Trade Plan:

1️⃣ Entry: Short on breakdown through $326.

2️⃣ Target: First covers into $300.

3️⃣ Stop: Above the flag highs — no need to fight if it reverses.

Why I Like This Setup:

Relative weakness vs. crypto = red flag for bulls.

Bear flag structure + clear trigger + defined target.

Broader market weakness adds conviction.

Bullsonwallstreet

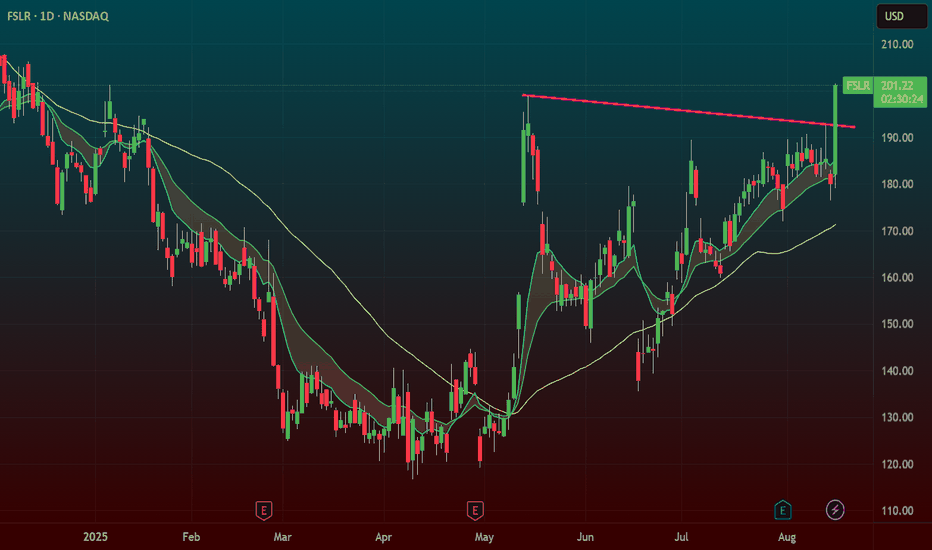

$FSLR – Big Breakout Over $200 on Solar Sector CatalystNASDAQ:FSLR – Solar Sector Breakout on Major U.S. Supply Chain News

First Solar ( NASDAQ:FSLR ) is ripping through the $200 breakout level today, fueled by a powerful sector-wide catalyst.

🔹 The News Driving It:

Solar stocks are catching a major bid after T1 Energy (NYSE: TE) announced a strategic supply agreement with Corning to produce fully American-made solar panels.

This strengthens investor confidence in the U.S. domestic solar supply chain — a narrative Wall Street loves right now.

🔹 The Technicals:

NASDAQ:FSLR has cleared $200 resistance with strength and volume.

The chart has been coiling for weeks — this breakout is resolving a larger base.

Sector momentum + breakout structure = high probability for continuation.

🔹 My Trade Plan:

1️⃣ Entry: Breakout over $200 with strong volume confirmation.

2️⃣ Stop: Just below the breakout level to protect gains if it reverses.

3️⃣ Target: Riding sector momentum — trailing stop strategy for potential extension.

Why I Like This Setup:

Clean technical breakout aligning perfectly with a macro & sector catalyst.

NASDAQ:FSLR is a leader in the solar space — when the sector runs, leaders often outperform.

Volume today confirms institutional interest.

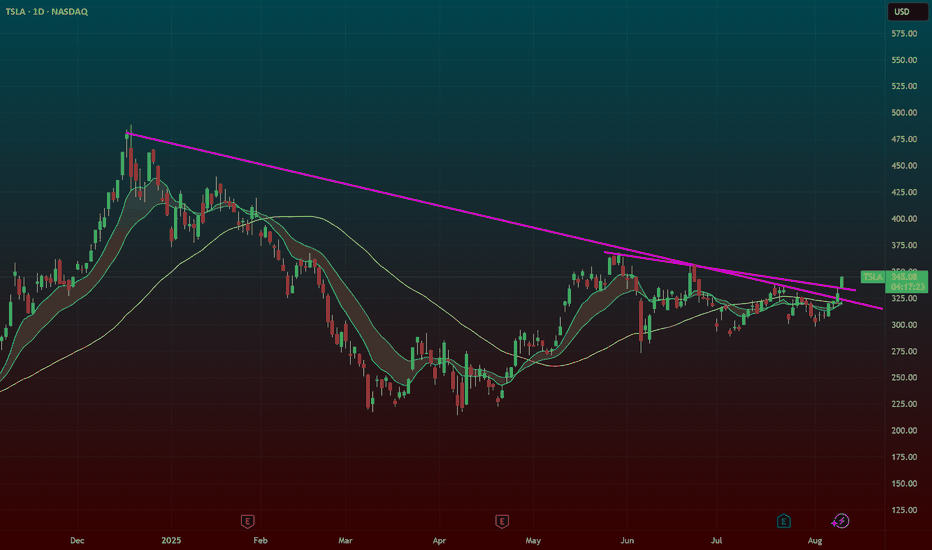

$TSLA – Wedge Breakout with Rotation PotentialNASDAQ:TSLA – Breaking Out of a Big Wedge After Earnings Reversal

Tesla ( NASDAQ:TSLA ) just broke its wedge pattern after a strong post-earnings recovery, and the price action says a lot about where sentiment is shifting.

🔹 Earnings Flush → Strong Absorption

Earnings reaction was ugly — big gap down and heavy selling.

Since then, NASDAQ:TSLA has been shrugging off negative news — sales data, guidance cuts, analyst downgrades — all absorbed without breaking down.

This tells me buyers are quietly accumulating.

🔹 Rotation Narrative

The rest of the Mag 7 has been ripping for months.

NASDAQ:TSLA is the laggard — and now traders are rotating into the one big name that hasn’t moved yet.

If it holds here, the upside could be sharp.

🔹 My Trade Plan:

1️⃣ Starter Long: Took an entry on the wedge trendline break.

2️⃣ Why Not Full Size Yet? This is day 4 of the move — in my playbook, that’s a starter size only.

3️⃣ Add Trigger: If we get an inside day or small dip that holds above the 9 EMA, I’ll add the rest of the position.

4️⃣ Stop: Under the wedge breakout level for now.

Why I Like This Setup:

Wedge break + rotation narrative + strong news absorption.

Market psychology turning — when a stock stops going down on bad news, it’s often about to go up.

Starter now, add on the dip = structured risk.

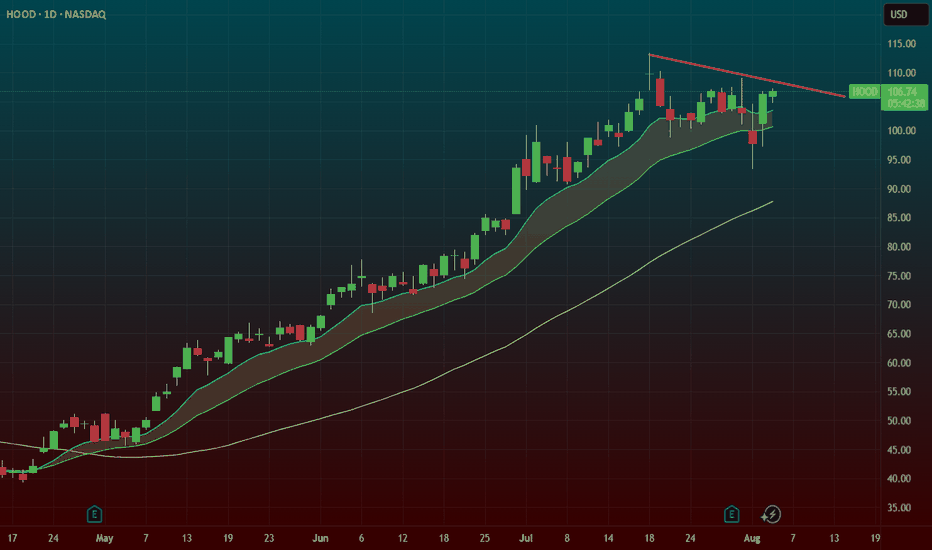

$HOOD – Flag Breakout Setup with Post-Earnings Shake & BakeNASDAQ:HOOD – Hot Momentum + Crypto Tailwind + Flag Breakout in Motion

Robinhood ( NASDAQ:HOOD ) is setting up for a momentum breakout after delivering a perfect post-earnings shake & bake — and now it’s reclaiming key levels with force.

🔹 The Setup:

After earnings, NASDAQ:HOOD flushed under $100, shaking out weak hands and triggering stop runs.

Since then, it's remounted the moving averages and is now pushing through the $107 breakout zone.

Price is flagging cleanly — compression before expansion.

🔹 Why It’s Got Juice:

Strong bounce post-earnings = real buyer interest.

Flag breakout forming with crypto sector strength ( CRYPTOCAP:BTC , CRYPTOCAP:ETH running).

NASDAQ:HOOD often rides crypto momentum — it’s a sleeper sector sympathy play.

🔹 My Trade Plan:

1️⃣ Position: Picked up $105 calls on the morning dip.

2️⃣ Add: Eyeing $110 calls with a few weeks out if we clear the flag.

3️⃣ Stop: Under today’s low or 9 EMA, depending on how it behaves into the breakout.

Why I Like It:

Shakeout + reclaim = powerful combo.

Flag structure is clean, volume is stabilizing, and crypto sector tailwinds add fuel.

When NASDAQ:HOOD runs, it runs fast — and it loves trending when sentiment flips.

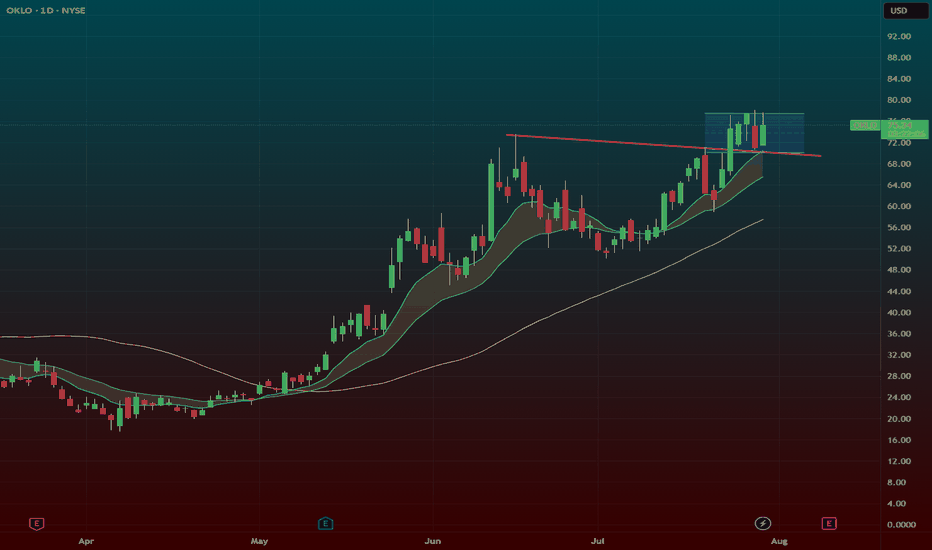

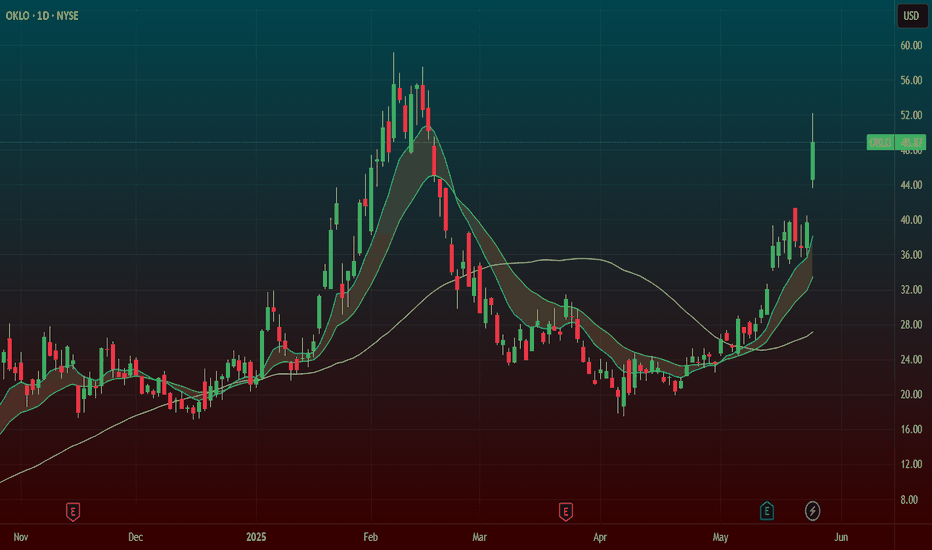

$OKLO – Back to the Moneymaker: HTF + C&H Combo at $77.50NYSE:OKLO – Back to the Moneymaker: HTF + C&H Combo at $77.50

Back to my bread and butter setup — NYSE:OKLO is setting up again, and it’s 🔥. We’ve got a high tight flag forming right above the 9 EMA, and to sweeten the deal, there’s a cup and handle structure layered in too.

🔹 The Setup:

After a strong breakout, NYSE:OKLO has spent the past week consolidating tightly above the 9 EMA.

Price action is coiled, volume has dried up — exactly what I want to see before a power move.

This is a high tight flag + cup and handle combo, one of my favorite high-probability setups.

🔹 Trigger Level:

Watching the $77.50 breakout zone — that’s the line in the sand. If you get a good intraday dip to support you can pre-empt the play i like to often scale in a half in anticipation if the market is in a runup phase

A clean push through with volume, and this can speed up fast.

🔹 My Trade Plan:

1️⃣ Entry: Either starter near 9 EMA support or confirmation on breakout over $77.50.

2️⃣ Stop: Under the 9 EMA — no reason to stay if it breaks down.

3️⃣ Target: Measured move extension if it clears $77.50 with juice.

Why I Love This Setup:

HTF + C&H = momentum fuel

This name has already proven itself — we’ve made money here before

The structure, the consolidation, and the setup are all textbook

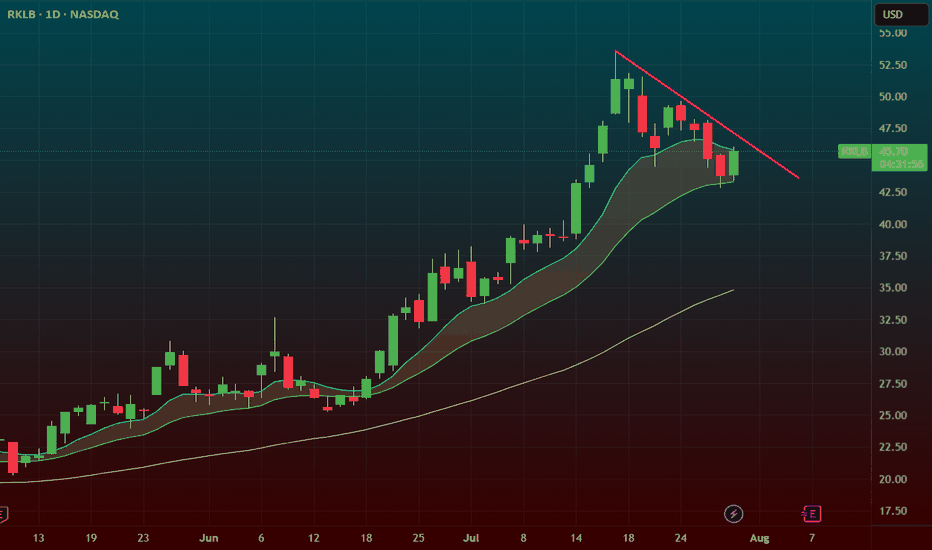

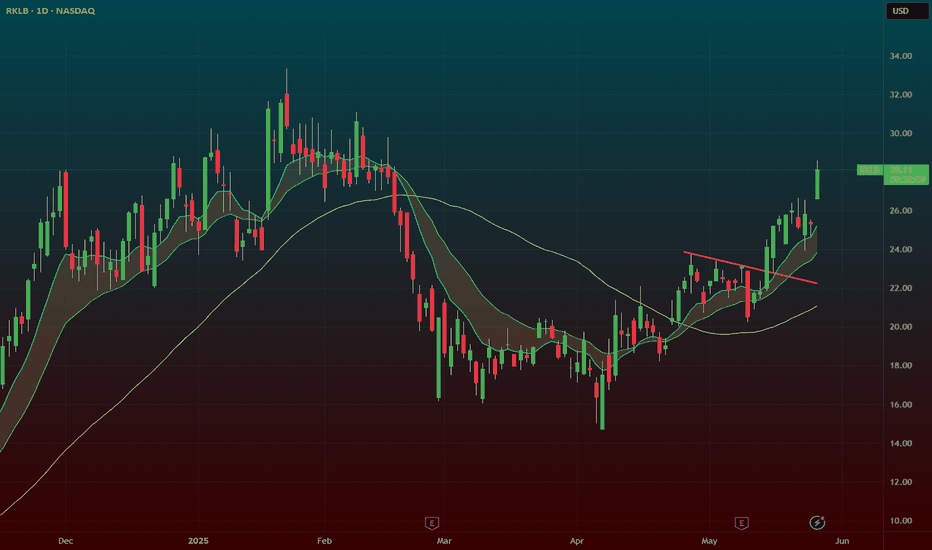

$RKLB – Momentum Pullback to 20 SMA with Trendline Break IncominRocket Lab ( NASDAQ:RKLB ) is setting up for a classic trend continuation move after a strong run. It just pulled back to the 20 SMA for the first time since breaking out over $35 — and it’s holding like a champ.

🔹 The Setup:

After peaking near $55, price pulled back in an orderly fashion on lower volume — a healthy correction.

Now we’ve got a hold at the 20 SMA, with a close back over the 9 EMA and a trendline break in progress.

This is where momentum tends to re-ignite.

🔹 Why It’s Powerful:

First 20 SMA test since the breakout = high probability bounce zone.

Lower volume on the pullback signals no panic selling.

A close over the 9 EMA + trendline = potential speed-up candle.

🔹 My Trade Plan:

1️⃣ Entry: Looking for confirmation over the 9 EMA and trendline.

2️⃣ Stop: Under the 20 SMA — tight structure, defined risk.

3️⃣ Target: Retest of highs near $55 with potential extension on breakout.

Why I Love This Chart:

NASDAQ:RKLB is a momentum name — when it moves, it moves fast.

The trend is intact, the pullback was clean, and now we have structure + volume setup.

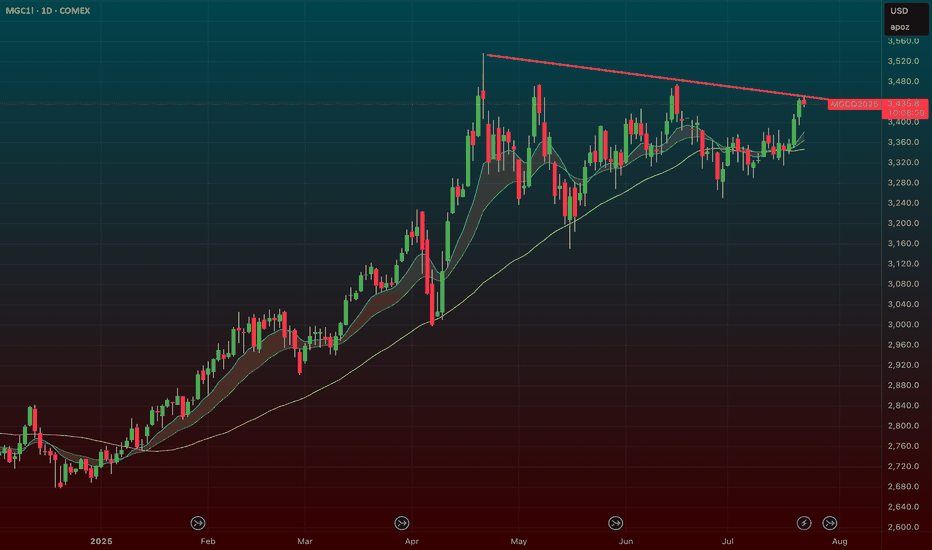

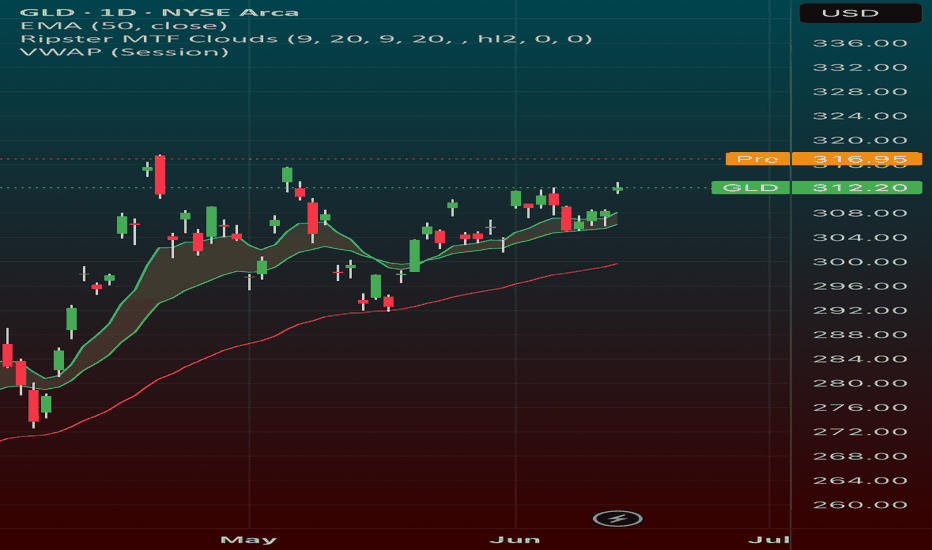

$GLD / $GC – Gold Poised for Breakout as Hard Assets FlexAMEX:GLD / SET:GC – Gold Poised for Breakout as Hard Assets Flex

Gold is setting up for a major breakout, and the broader market is finally catching on to the hard asset trade. Whether it’s inflation ticking up or the never-ending government deficit spending, the market is starting to signal something big.

🔹 Macro Tailwinds:

Inflation pressures + record deficit = a perfect storm for gold.

The dollar is under pressure — metals ( AMEX:GLD , AMEX:SLV , SET:GC ) are responding.

This theme isn’t going away anytime soon.

🔹 Technical Setup:

AMEX:GLD and SET:GC (Gold Futures) are coiled tightly just under breakout levels.

Volume is steady, and momentum is building under the surface.

A move through current resistance could send this entire trade into overdrive.

🔹 My Positioning:

1️⃣ Options: Long AMEX:GLD calls with 1-month expiration — slow mover, but clean structure.

2️⃣ Futures: Trading SET:GC contracts on the breakout side.

3️⃣ Silver Exposure: Still holding partials in AMEX:SLV — it’s following gold’s lead but with more juice.

Why I’m Focused Here:

This is not a one-day theme — hard assets are becoming a rotation trade.

If this confirms, we could see multi-week upside in precious metals.

It’s rare to get clean technicals that align this well with macro.

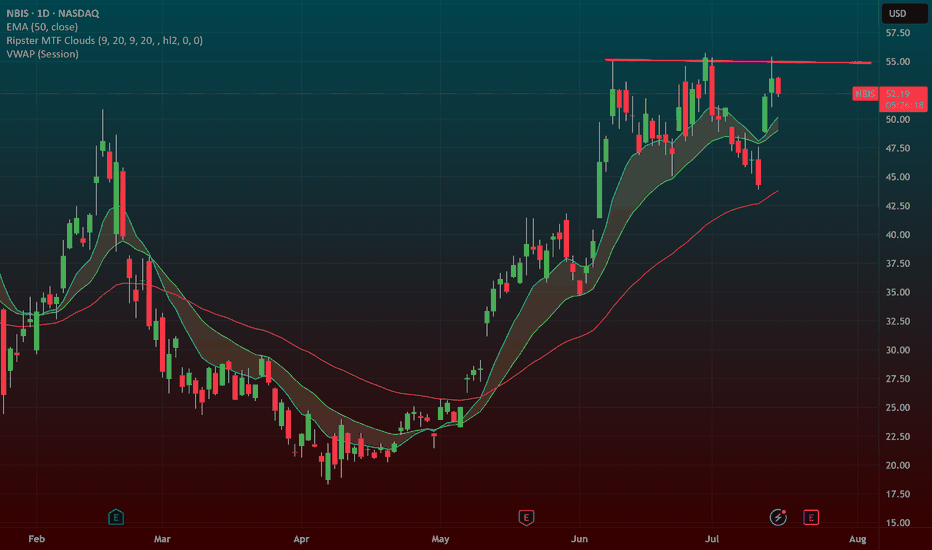

NBIS 55 BREAKOUT in the works!NBIS is an AI darling and a big momentum stock. When it goes it goes! it has been testing this 55 level for some time now.

We recently had a big GS upgrade that "woke" it up. A rest day here and another one will let the 9ema catch up to it and allow for a big breakout. If we take out this trendline at 55 ill put the stop 9ema and swing this.

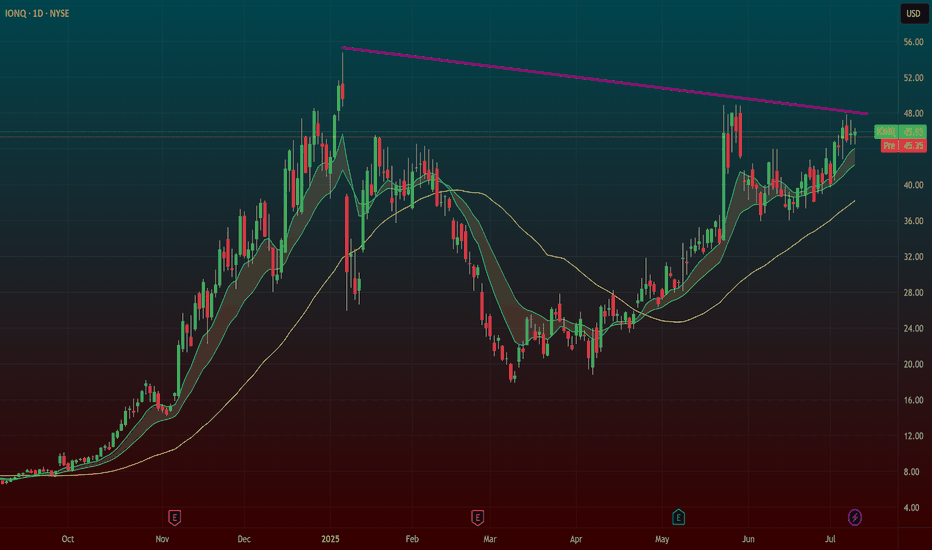

$IONQ – Breakout Watch at $48 After Months of ConsolidationNYSE:IONQ has been basing since January, quietly marinating under the $48 level — and now we’re approaching the trigger zone. Technically, it’s a great setup. But context is everything.

🔹 The Setup

Multi-month base under $48 — a breakout above that level could release serious energy.

The structure is clean, and the volume profile is tightening — signs that something is brewing.

🔹 My Concerns (Let’s Keep It Real):

Price action has been weak — this stock hasn’t traded clean lately.

Late-cycle behavior: Even A+ setups have been failing lately — breakouts aren’t sticking like they should.

Market conditions matter: I need to see risk-on confirmation from NASDAQ:QQQ , AMEX:IWM , CRYPTOCAP:BTC , and crypto names before trusting this breakout.

🔹 My Trade Plan:

1️⃣ No Anticipation Here: Only trading this on A+ intraday setup — strong volume, clean trigger through $48.

2️⃣ Risk Control: Tight stop — can’t give it room in this tape.

3️⃣ Market Check: I want to see risk-on flows:

✅ NASDAQ:QQQ strong

✅ AMEX:IWM green

✅ CRYPTOCAP:BTC & crypto names moving

✅ Speculative names showing juice

Why I’m Watching It Anyway:

Long base = stored energy

If the market flips risk-on and NYSE:IONQ catches a bid, this could move fast

But patience is key — not every setup needs to be taken

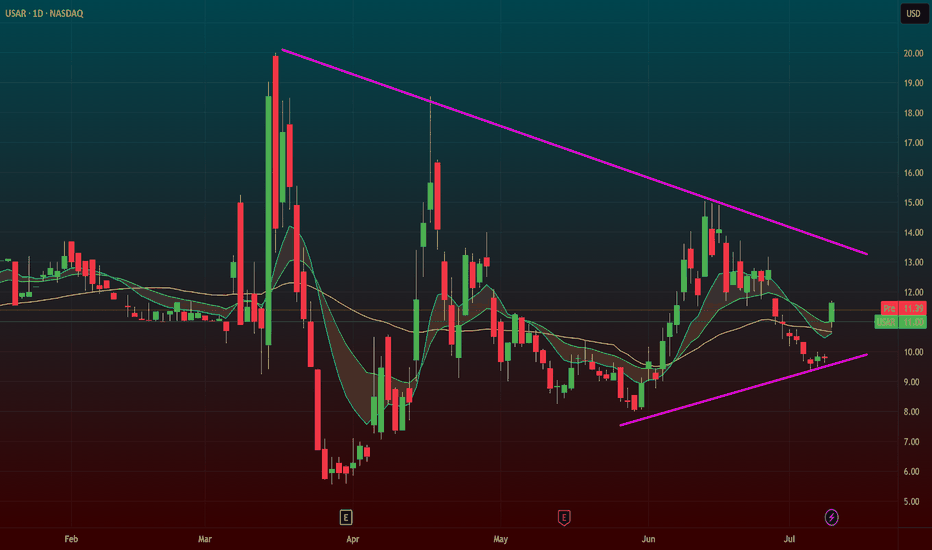

Big Deal in RARE EARTHS space with MP! USAR, TMC, CRML next!Big deal with the DOD and MP yesterday. I am looking at some other plays here in sympathy. Neither had much action yesterday USAR, TMC, CRML but if we take out yesterdays intraday highs on these I think we could play some catch up!

Lets dig into the levels im watching and the overall setups on these! Metals stocks are not always the best stocks to trade they can fart around a lot intraday vs tech stocks so be careful with your entries and make sure the volume is there!

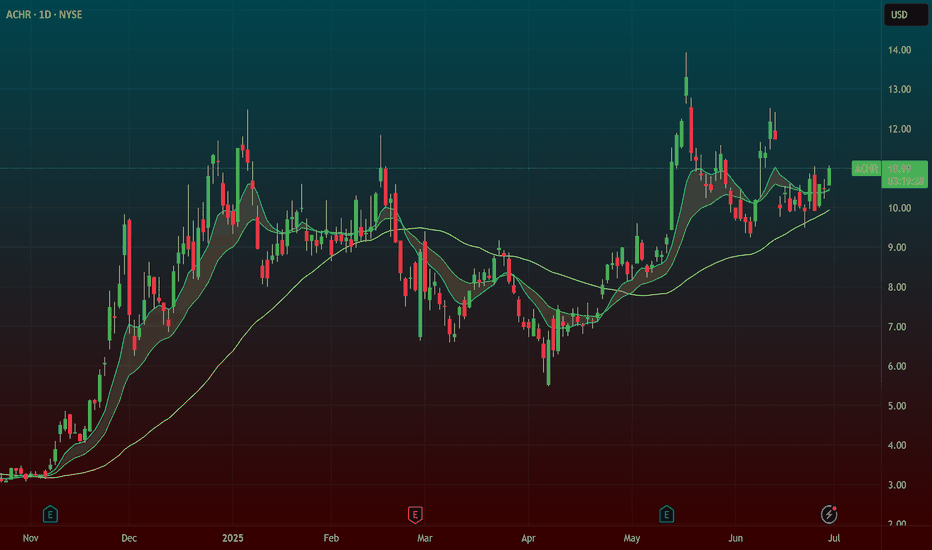

ACHR – 50 SMA Bounce with Sympathy Momentum from JOBYNYSE:ACHR – 50 SMA Pullback + Options Play Into Support

Archer Aviation ( NYSE:ACHR ) is showing signs of life right at the 50 SMA, and with competitor NYSE:JOBY ripping to new highs today on news, this could be the sympathy setup traders are looking for.

🔹 Technical Setup

After a strong run, NYSE:ACHR has pulled back in an orderly fashion, now resting on the 50-day moving average — a key support zone.

The stock is sitting on clean support, showing signs of stabilization.

🔹 Sector Tailwind from NYSE:JOBY

NYSE:JOBY is breaking out today on headlines — and NYSE:ACHR often moves in sympathy.

If momentum spills over, this could be the launchpad for NYSE:ACHR to retest prior highs.

🔹 My Trade Plan:

1️⃣ Position: Buying the August 1st $11 calls around the $0.90 area.

2️⃣ Reasoning: Strong reward-to-risk if NYSE:ACHR bounces from here.

3️⃣ Trigger: Watching for a reclaim of the short-term EMAs and increased volume as confirmation.

Why I Like This Setup:

50 SMA bounce + sympathy play = great combo.

Options are cheap, offering leverage without heavy risk.

If this breaks out again, it could move fast — this name has range.

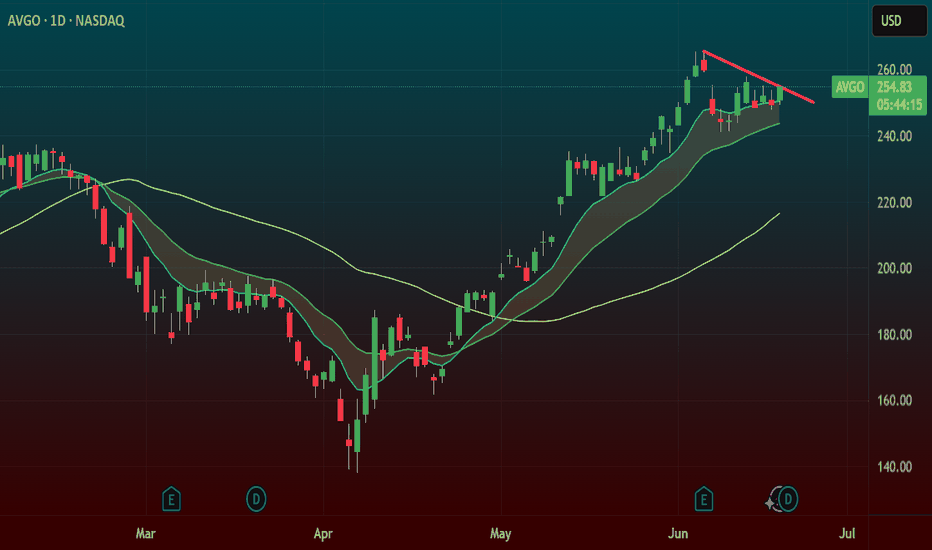

AVGO – All-Time High Breakout with Flag Pattern TriggerBroadcom ( NASDAQ:AVGO ) is breaking out of an 11-day consolidation flag, pushing through the trendline and into all-time highs — a textbook momentum setup.

🔹 Flag Pattern Breakout

After a strong run, NASDAQ:AVGO spent 11 days chopping in a tight flag just under highs.

Today, we’re seeing a clean trendline break, signaling the start of a potential fresh leg higher.

ATH breakout + flag pattern = momentum trader’s dream.

🔹 My Trade Plan:

1️⃣ Entry: Long on the flag breakout and trendline break.

2️⃣ Risk Level: Stop is down at $247, just under the consolidation base.

3️⃣ Target: Riding the trend — trailing stop strategy once price confirms above highs.

Why I Like This Setup:

Strong consolidation near highs = no weakness.

Breakout is happening with clean structure and clear volume pickup.

NASDAQ:AVGO is a leader name — when it goes, it goes.

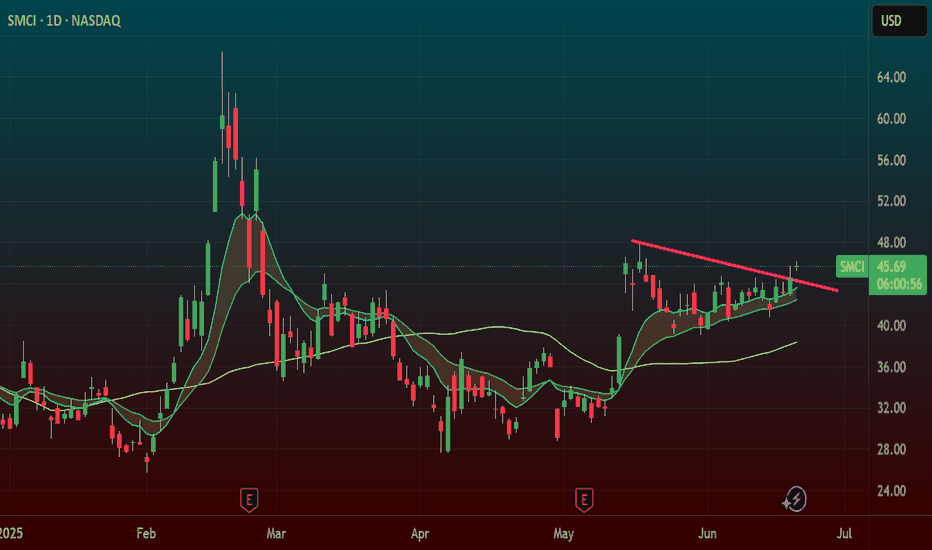

SMCI – Wedge Breakout Triggering Around 46 ZoneNASDAQ:SMCI – Wedge Breakout Watch with Intraday Setup Potential

Super Micro Computer ( NASDAQ:SMCI ) is working on a wedge breakout, and it's pressing right into the key $46 zone — the trigger area for a clean move higher.

🔹 Wedge Structure Clearing

Price has been compressing into a wedge, and it's now testing the upper trendline.

The $46 level is the key breakout point — if it clears and holds, this could unleash serious momentum.

🔹 Intraday Setup Developing

If NASDAQ:SMCI can hold this level intraday and consolidate, I’m watching for an entry signal right at or slightly above $46.

Volume confirmation will be key here — watching the tape closely.

🔹 My Trade Plan:

1️⃣ Entry: Watching for clean hold + setup at $46 zone.

2️⃣ Stop: Below yesterday’s low — keeps the trade tight and risk defined.

3️⃣ Add: If it breaks $46 with volume, I’ll build into the position.

Why I Like This Setup:

Breakout from compression = potential expansion

Clear risk level, clean structure — everything I want in a breakout trade

If it holds this level today, this could turn into a trend day.

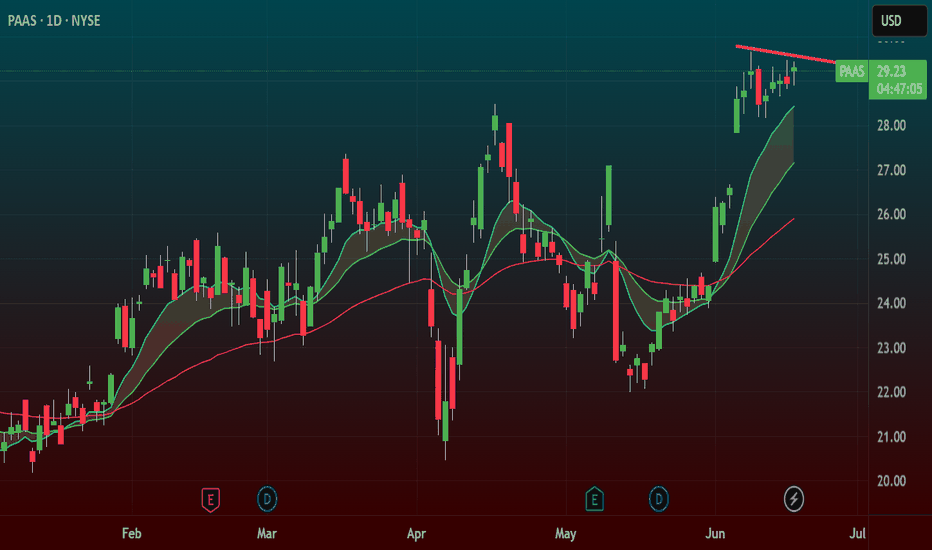

PAAS – High Tight Flag with Silver TailwindsPan American Silver ( NYSE:PAAS ) is forming a high tight flag — one of the most explosive continuation patterns — just as silver starts heating up.

🔹 High Tight Flag Formation

NYSE:PAAS ripped with momentum and is now consolidating in a tight, bullish range.

This is exactly what you want to see — shallow pullback, tight candles, and holding near highs.

🔹 Sector Momentum: Silver Heating Up

AMEX:SLV and /SI are pushing toward multi-year breakout levels.

NYSE:PAAS is riding that same energy, and any continuation in silver could ignite this setup.

My Trade Plan:

1️⃣ Starter Position: Looking to enter on strength through the top of the flag.

2️⃣ Add on Confirmation: Add size on volume surge and breakout follow-through.

3️⃣ Stop Loss: Below flag base — keeping it tight and defined.

Why I Love This Setup:

High tight flags are low-risk, high-reward when paired with macro momentum.

Silver is gaining strength — NYSE:PAAS could lead the miner group if this breaks clean.

Strong structure, clean risk, macro fuel = great setup.

GOLD poised for breakout GLD & /gcAfter going on a huge run to 317 we have spent a significant time now basing out and consolidating we’ve come down into that 300 range and tested and built up quite a bit of support

With the Iranian intentions we could kickstart the next move in gold 317 is the breakout. I am looking to play this breakout on an intra day pull back with some calls one month out for a swing Trey looking at the 320 or 325 strike price

HIMS 20SMA Trend Contiuation PULLBACK SETUP NYSE:HIMS – Momentum Reload at 20 SMA After Massive Run

NYSE:HIMS has been one of the hottest stocks in the market, and it’s giving us a textbook trend continuation pullback setup — right into the sweet spot.

🔹 Pullback to the 20 SMA

• After a huge run, NYSE:HIMS finally gave us a controlled pullback to the 20 SMA, where it based for multiple days.

• Today, it remounted the 9 EMA — a key trigger in my swing strategy for momentum re-entry.

🔹 Why This Setup Works

• Momentum names don’t stay down long — this was just a reset.

• Even with the market shaky today, NYSE:HIMS closed strong — up 8% while the rest of the tape faded.

• This setup is all about getting back into strength with low risk.

My Trade Plan:

1️⃣ Entry: Took a position on today’s remount of the 9 EMA.

2️⃣ Stop: Just under the 20 SMA — tight, well-defined risk.

3️⃣ Target: First target is a move back into the previous highs — if it breaks, we trail for continuation.

🧠 This is my bread-and-butter swing entry — clean, controlled, and full of momentum potential.

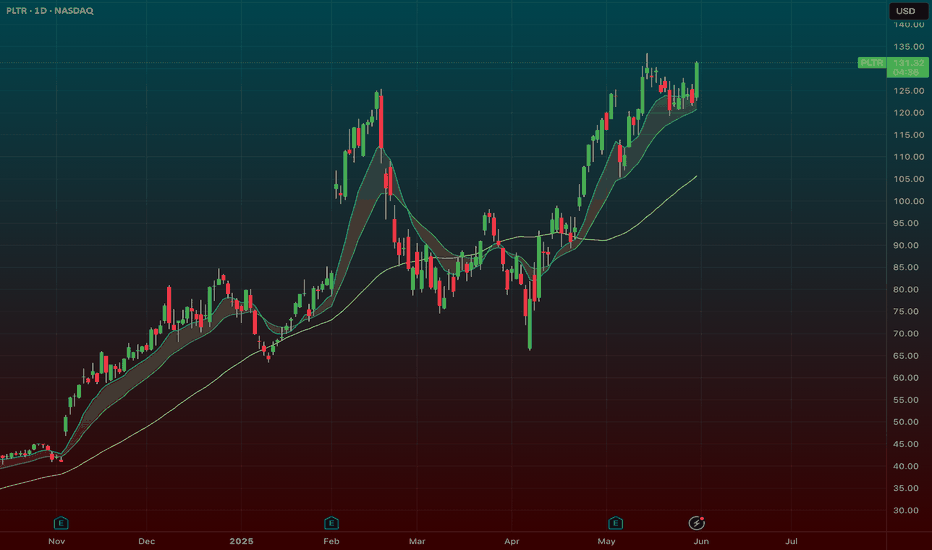

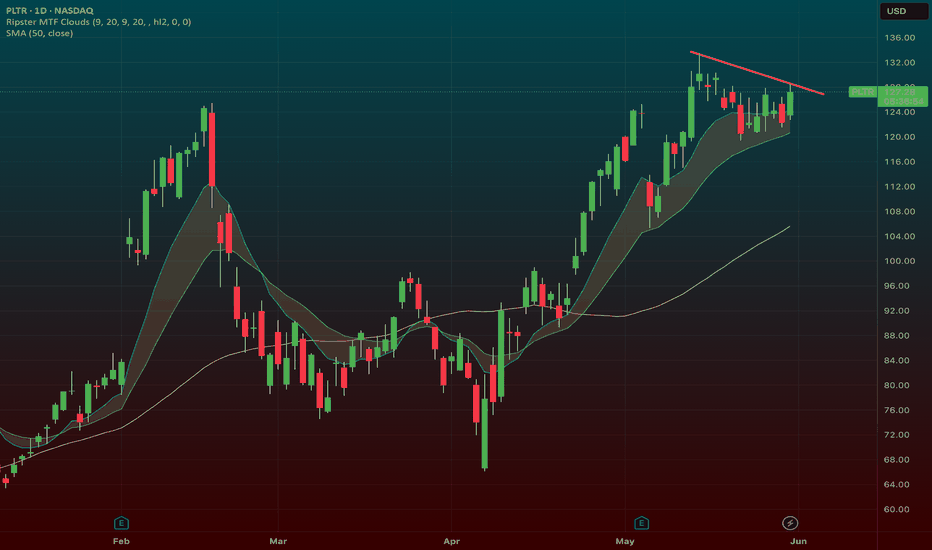

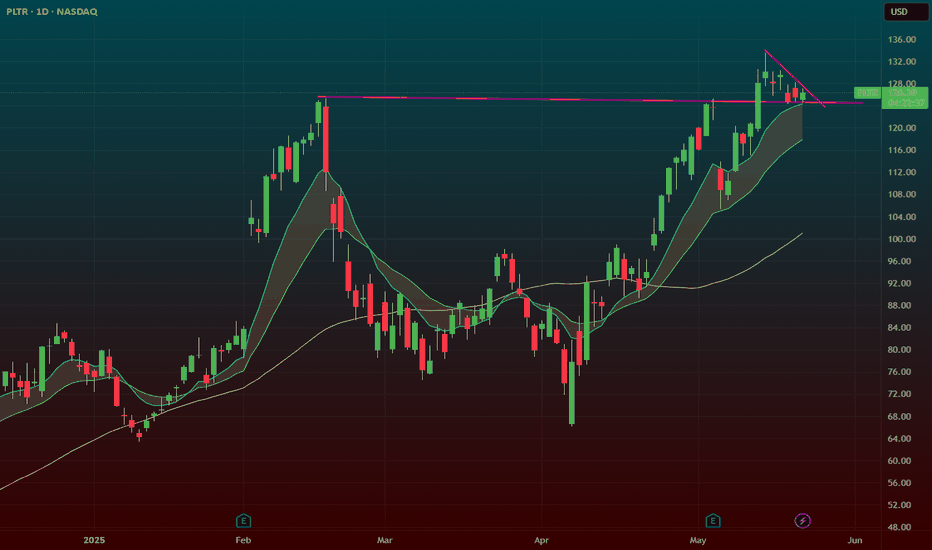

PLTR Flag Breakout Near ATHSmall catalyst today. It sold off on it at the open and quickly took out its opening range. Ive added a position here in the 126s with a stop at the low of the day.

We have a nice flag pattern. With a ton of support at the 20sma.

We have dipped now multiple times into the 9/20 zone (shaded area) and its been absorbing each time.

This is a bullish sign its had multiple times where it looked like it could sell off only to get bought up.

UBER – Momentum Pullback to 20 SMA: Classic Continuation SetupUber is giving one of my favorite swing setups — a shallow pullback into the “bone zone” (between the 9 EMA and 20 SMA) during a hot market.

🔹 Trend Continuation Play

Strong momentum stock pulling back right into the 20 SMA — not a deep retrace, just enough to reload.

In hot markets, I don’t wait for deep dips — I want tight consolidations into momentum zones.

🔹 The Bone Zone Setup

The shaded area between the 9 EMA and 20 SMA is where momentum stocks often base before the next leg up.

Price is respecting that zone perfectly — no breakdown, just controlled digestion.

🔹 Oversold Stochastics

Stochastics are in oversold territory — adds confirmation that this is a high-quality dip within a strong trend.

My Trade Plan:

1️⃣ Entry: Looking to start a swing position off the 20 SMA.

2️⃣ Add: On confirmation candle back above 9 EMA with volume.

3️⃣ Stop: Below 20 SMA lows — tight risk, strong reward if trend continues.

Why I Love This Setup:

Market’s hot — I want to ride strength, not fade it.

NYSE:UBER is a trending name with institutional accumulation.

This pattern has worked again and again in strong tape.

Update on Nuclear Stocks SMR, OKL0 + NEW IDEAS VRT, TSLA OKLO, SMR going through the roof. NNE is trailing today. Sold out most of the RKLB.

Lets go over the SPY, QQQ which are flagging now after holding support.

Liking this VRT and LTBR AND LUNR for potential swings along with HIMS!

Lets dig into the charts and see whats up!

SMR NNE OKLO – Breakout Setup Triggered by Nuclear CatalystNYSE:SMR is lighting up after Trump’s announcement on nuclear energy — and it’s not alone. NYSE:OKLO and NASDAQ:NNE are also setting up, but NYSE:SMR has one of the cleanest breakout structures on the board.

🔹 Catalyst: Trump’s nuclear energy announcement yesterday is putting serious momentum behind the sector.

🔹 Technical Setup: NYSE:SMR is building a textbook breakout formation, with $32 as the key breakout level.

🔹 Volume & sentiment are increasing — early signs that buyers are positioning.

My Trade Plan:

1️⃣ Anticipatory Entry: I’m looking to buy the first dip before the $32 breakout — getting in early with tight risk.

2️⃣ Add on Breakout: Will scale in above $32 if volume confirms.

3️⃣ Stop Loss: Just below the recent base — staying tight on risk.

Why I’m Watching This Closely:

Sector catalyst + technical setup = 🔥

Nuclear names have been under accumulation, and now they’ve got a narrative tailwind.

First dip after a big catalyst is often the best R/R opportunity.

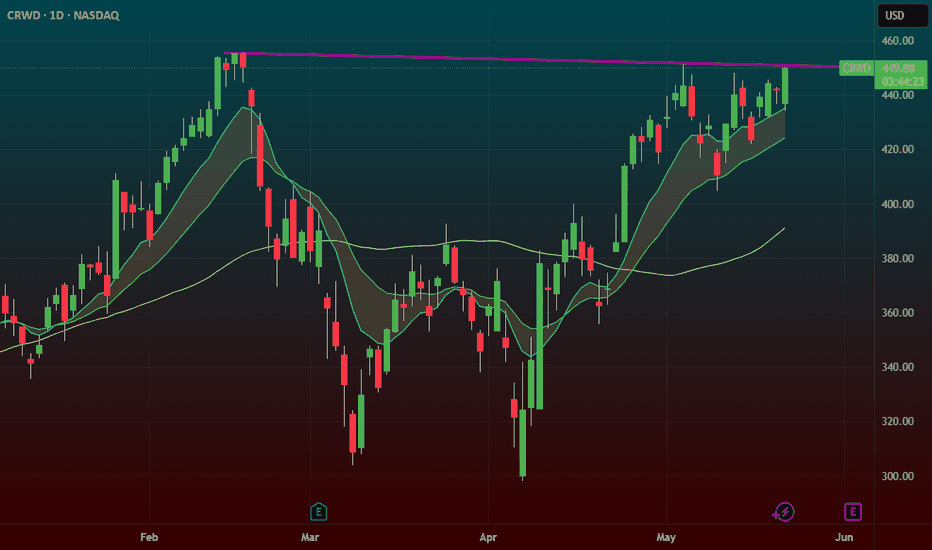

CRWD – Flat Top Breakout to All-Time HighsCrowdStrike ( NASDAQ:CRWD ) is breaking out of a flat top consolidation, pushing to new all-time highs — a clean momentum setup that’s hard to ignore.

🔹 Price has been compressing just under ATHs with multiple tests of the same level — a classic flat top breakout pattern.

🔹 Today’s breakout candle is strong, with solid volume and follow-through.

🔹 This setup is all about price acceptance at new highs — and the bulls are showing up.

My Trade Plan:

✅ Entry: On breakout through the flat top

⛔️ Stop: Just below today’s low — keep risk tight

🚀 Target: Ride momentum — trail stop as price extends

Why I like this setup:

Clean structure, strong trend, defined risk

ATH breakouts often lead to trend acceleration if supported by volume

panw had their earnings today and gapped down it still has broken loose this is a good sign

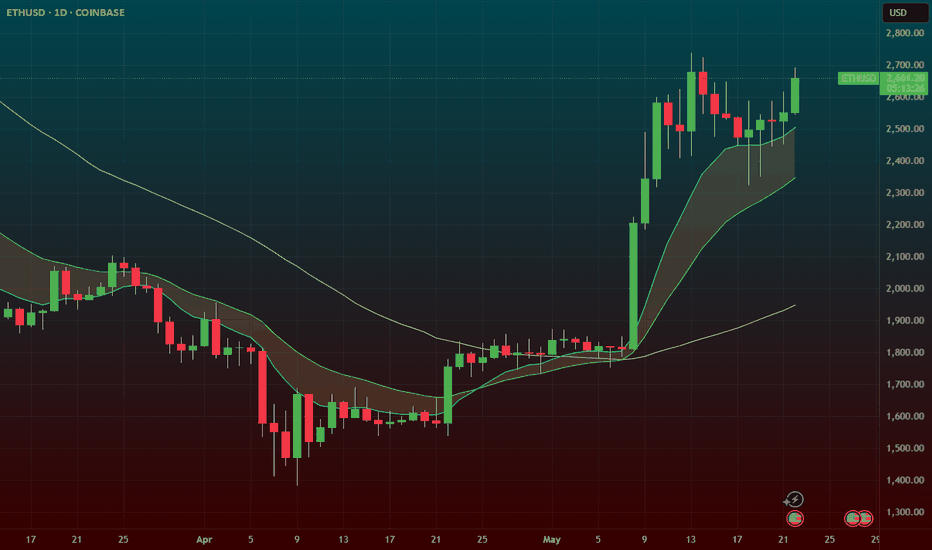

ETH (ethereum) – Massive Flag Pattern After 100% RunCRYPTOCAP:ETH – Bullish Flag After Monster Run

Ethereum ( CRYPTOCAP:ETH ) has nearly doubled since April, and now it’s cooling off — but in the best way possible: a bullish flag consolidation.

🔹 After a nearly 100% move, ETH has been consolidating tightly for two weeks — textbook flag behavior.

🔹 The trend remains strong, and this type of structure often leads to another leg higher.

🔹 Volume has tapered off during the flag — exactly what you want to see before a breakout.

Setup Overview:

Pattern: Large bull flag

Support/Risk: Defined risk to the $2500 zone

Measured Move Target: Breakout could push to $3100–$3500 based on the prior leg

Why I like this setup:

Healthy consolidation after a parabolic run

Risk/reward is favorable with structure and measured target

Potential breakout fuel from the ETH ETF narrative + BTC dominance rotation

PLTR – Flag Breakout Above All-Time HighsPalantir is printing a bullish flag pattern right above its all-time highs — this is a textbook continuation setup that often leads to explosive upside.

🔹 After a strong breakout to ATHs, NASDAQ:PLTR has been consolidating in a tight range — a healthy pause.

🔹 Flags that form above prior resistance often act as launchpads when volume comes in.

🔹 Break over the flag highs could open the door to a new leg higher.

Setup Notes:

Watching for a breakout over the flag with volume confirmation.

Tight stop under the flag base keeps risk defined.

Price action remains bullish as long as it holds above previous ATHs.

🧠 This is one of my favorite setups — strong stock, strong base, strong trend.

this is the first pull after this initial thrust. The pullback has been boring and orderly too which i think is bullish for the stock