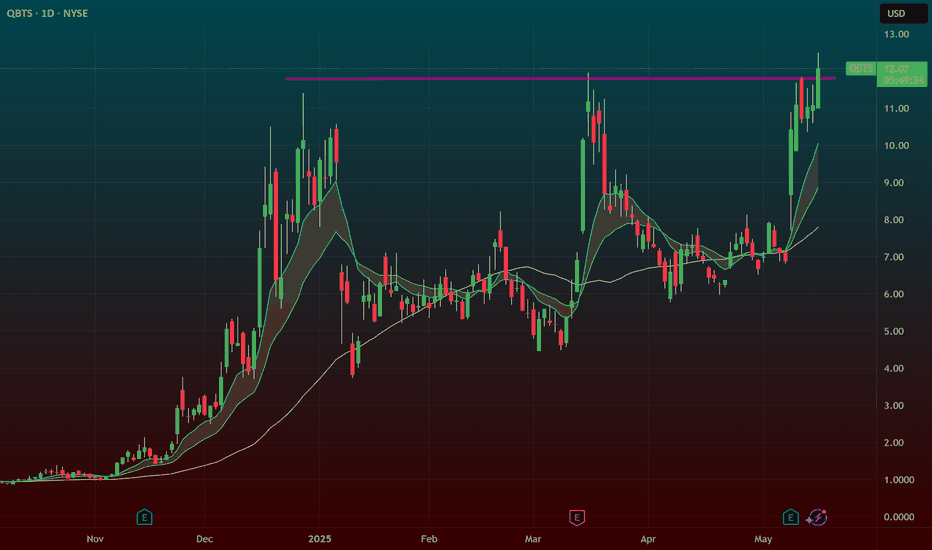

QBTS Flat top Breakout setupAfter qbts earnings report we have a little flag building under this 12.25-12.40 zone along with a bigger flat top breakout in the works.

This stock has the volume and the price break along with sector momentum.

Playing this with calls on the 12 strike for next week around .9 stop under 9ema on the daily chart on the equity. Think this one has some legs

QQQ down today but quantum is looking good liking ionq also potentially

Bullsonwallstreet

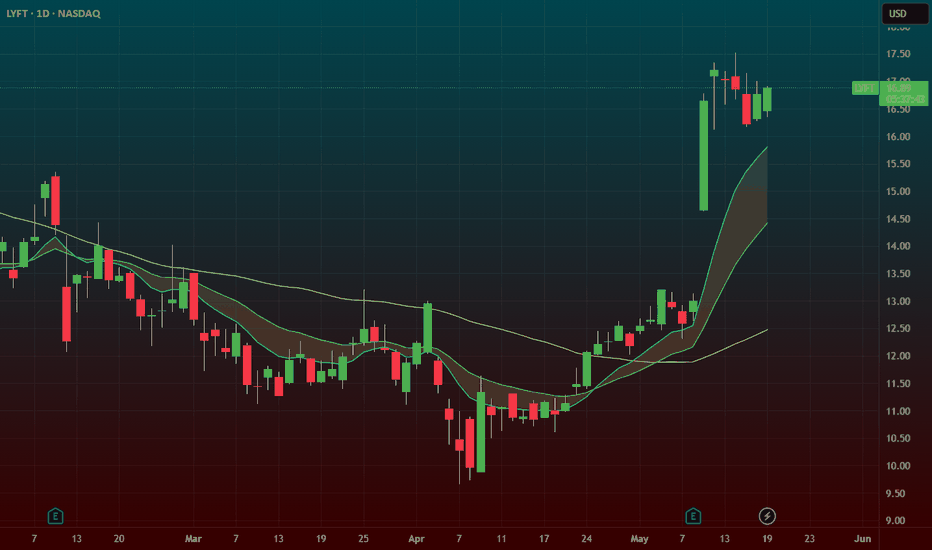

LYFT – High Tight Flag Setup Post Earnings BreakoutNASDAQ:LYFT – High Tight Flag Breakout Setup Post Earnings

LYFT has exploded on earnings and is now setting up a textbook high tight flag — one of my favorite continuation patterns.

🔹 Earnings Surge → Flag Formation

NASDAQ:LYFT followed a similar path to NYSE:HIMS , which ran to the 16s after earnings.

Since the earnings pop, it has spent 6 days consolidating above the 9 EMA — strong bullish sign.

Today, it opened down $0.50, but buyers stepped in immediately, defending support.

🔹 High Tight Flag Setup

This is a classic high tight flag — strong initial move followed by tight sideways consolidation.

The longer it stays in this tight range, the stronger the breakout can be.

🔹 My Trading Plan:

1️⃣ Starter Position: Considering a starter position here, just above the 9 EMA, to catch the early move.

2️⃣ Confirmation Add: Full size on a clean breakout over the $17 level.

3️⃣ Stop Loss: Tight stop just below the 9 EMA — risk defined, reward potential is high.

🔹 Why This Setup is Compelling:

Strong earnings run + tight flag = perfect continuation setup.

Similar setup worked on NYSE:HIMS — earnings pop followed by a massive run.

Buyers stepping in at the first sign of weakness shows bullish strength.

⚠️ Risk Management: Start small, add on confirmation — always respect your stops.

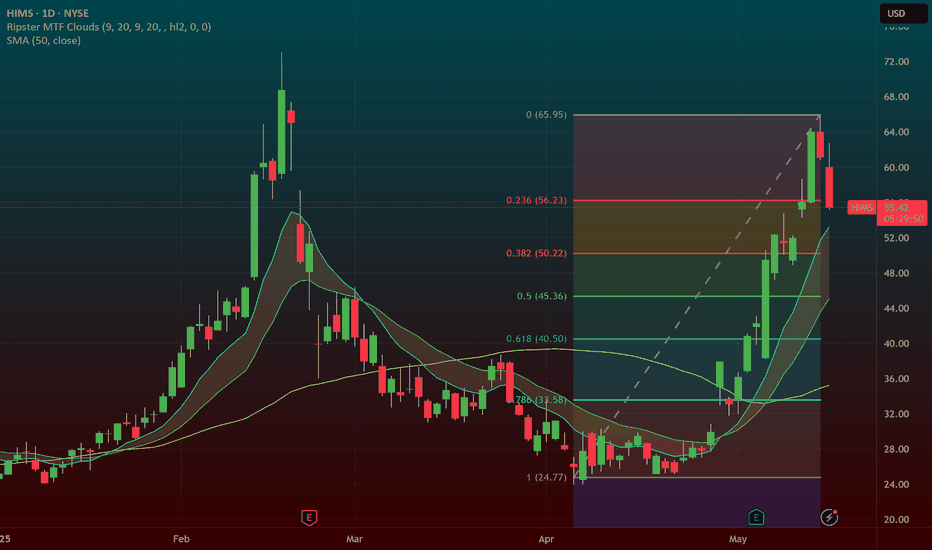

HIMS – Pullback Opportunity After Massive RunHIMS has been one of the hottest stocks in the market recently, with a massive run fueled by strong earnings. But now we’re seeing the first meaningful pullback — and this could be a golden opportunity:

🔹 Earnings Gap Reversal (Bullish Signal)

Despite an earnings gap down, buyers stepped in aggressively, pushing the stock higher.

This is a classic earnings gap down reversal — a strong sign of demand.

🔹 First Pullback Opportunity

Historically, the first pullback after a major run tends to get bought.

I’m watching two key levels for a potential buy:

The shaded zone between the 9 EMA and 20 EMA (dynamic support).

The 0.38 - 0.50 Fibonacci retracement for added confirmation.

🔹 My Trading Plan:

1️⃣ Initial Entry: Starter position in the shaded EMA zone (9 EMA - 20 EMA).

2️⃣ Confirmation Add: If price bounces off the Fib zone (0.38 - 0.50) with strength.

3️⃣ Stop Loss: Below the 20 EMA for any initial position — keeping risk tight.

🔹 Why This Setup is Compelling:

Strong run + earnings reversal shows real buyer interest.

First pullback after a big run is typically a strong buying opportunity.

The dual confluence of EMAs + Fibonacci enhances this setup.

⚠️ Risk Management: Tight stop below 20 EMA — always control risk.

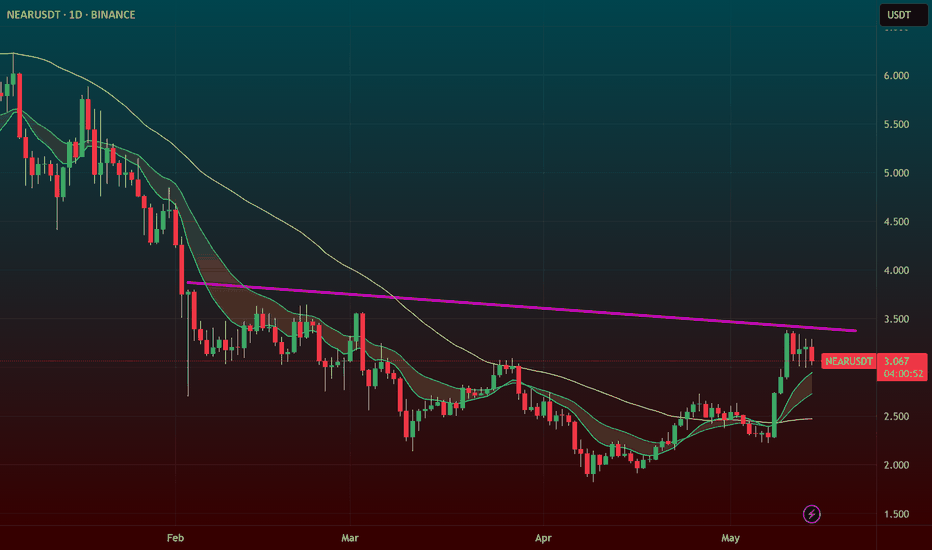

NEAR – Base Breakout Setup at $3.37: Is Altcoin Season Here?NEAR Protocol ( CRYPTOCAP:NEAR ) is setting up for a potential breakout, and it’s not just a technical play — the market narrative is shifting:

🔹 Base Breakout at $3.37

Price is pressing against the $3.37 resistance, a clear base breakout level.

Volume is increasing, signaling accumulation.

Strong support just below at $3.20 keeps risk tight.

🔹 Altcoin Season Potential

Bitcoin dominance is starting to decline — a classic early sign of an altcoin run.

Ethereum ( CRYPTOCAP:ETH ) has already gone on a massive run — could NEAR and other altcoins be next?

In previous cycles, declining BTC dominance often triggers massive runs in altcoins.

🔹 My Trading Plan:

1️⃣ Initial Entry: Starter position at $3.37 breakout, adding on strength.

2️⃣ Anticipatory Entry: Dips into $3.20 support with a tight stop below.

3️⃣ Stop Loss: Below $3.20 for any initial position — keeping risk defined.

🔹 Why This Setup is Compelling:

Clear base breakout with altcoin narrative tailwinds.

Bitcoin dominance declining is a key macro signal.

Ethereum’s strength adds confidence to the altcoin trade.

RKLB Gap Down Earnings Reversal Play + Flag BreakoutTwo powerful setups are in play here, and both are primed for action:

🔹 Setup 1: Earnings Gap Down Reversal (Kicker Candle)

Post-earnings flush, buyers stepped in hard — this has been a relentless pattern in this market.

Even on earnings misses, buyers are aggressive. We saw the same setup work beautifully on NASDAQ:TEM and NYSE:HIMS recently.

This is a kicker candle setup — strong reversal signal after a gap down flush.

🔹 Setup 2: Flag Breakout at $23.50

Price is coiling into a tight flag, with a breakout level at $23.50.

Risk is defined, with stops at $22, keeping the trade tight.

🔹 My Trading Plan:

1️⃣ Initial Position: Buying May 30th $25 Calls today.

2️⃣ Risk Management: Stop at $22 for the calls and underlying stock.

3️⃣ Add Size: On a clean breakout over $23.50.

🔹 Why This Setup is Hot:

The earnings gap down reversal has been a killer setup in this market — buyers are dominating.

Dual setup means two chances to win: Reversal + Flag Breakout.

Tight risk, with a clear invalidation at $22.

⚠️ Risk Management: Tight stop at $22 — this is a LOW-risk, high-reward setup.

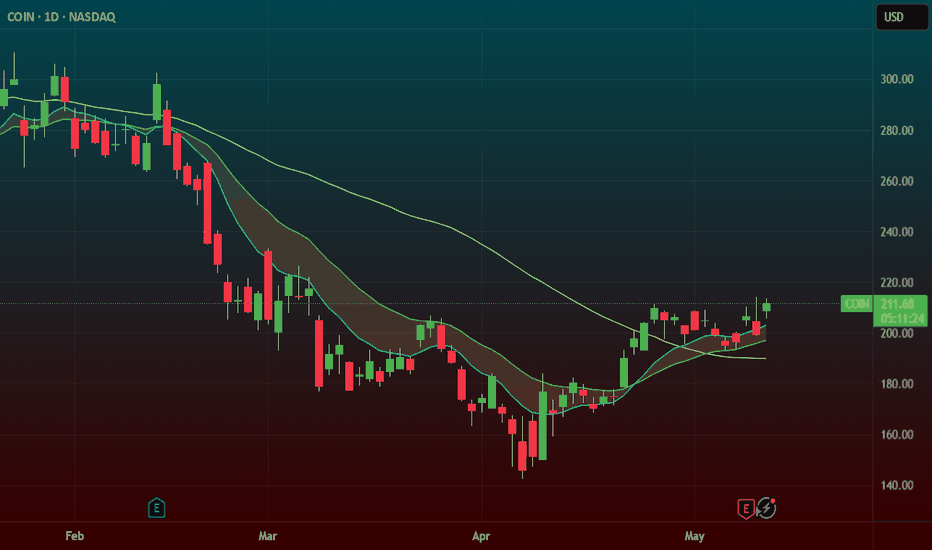

COIN – Base Breakout + Earnings Gap Reversal SetupNASDAQ:COIN – Base Breakout + Earnings Gap Reversal

NASDAQ:COIN – Base Breakout + Earnings Gap Reversal Setup

Coinbase ( NASDAQ:COIN ) is setting up for a powerful move, and I’m watching two key catalysts driving this setup:

🔹 Earnings Gap Down Reversal (Primary Setup)

Despite a sharp gap down post-earnings, buyers stepped in fast, pushing price back up.

This is a classic earnings gap down reversal — a bullish signal of aggressive buying strength.

🔹 Base Breakout Pattern

NASDAQ:COIN has formed a solid base, with a breakout zone around $212 - $214.

Bitcoin ( CRYPTOCAP:BTC ) is ripping to $104,000, and NASDAQ:MSTR has been trending for a month — bullish sector sentiment could fuel NASDAQ:COIN ’s breakout.

🔹 My Trading Plan:

1️⃣ Anticipatory Entry: Looking to build a position near $212 - $214, the breakout zone.

2️⃣ Confirmation Entry: If NASDAQ:COIN breaks and holds above $214 with volume, I’ll size up.

3️⃣ Stop Loss: Placing stops just below yesterday’s low to control risk.

🔹 Why I Love This Setup:

Dual setup = Base Breakout + Earnings Gap Reversal — powerful combo.

Sector strength (BTC & MSTR) adds confidence.

Tight risk with a clear invalidation level (yesterday’s low).

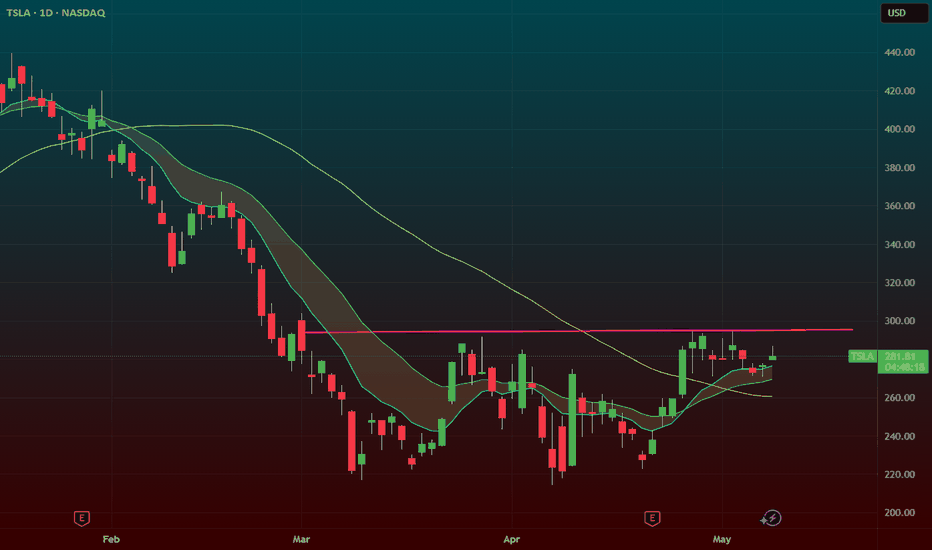

$TSLA – Base Breakout Setup with Dual Entry StrategyTesla ( NASDAQ:TSLA ) is coiling up, forming a classic base breakout setup with a dual approach for traders who want precision:

🔹 Support Zone Entry (280-285)

Shaded area = the zone between the 9 EMA (blue) and 20 EMA (yellow) — a key dynamic support area.

I'm taking a starter position here with a stop just below yesterday's low for tight risk control.

🔹 Breakout Confirmation (Above 295)

Full size only if we see a clean breakout above $295, confirming momentum.

This is where I’ll add size, looking for a strong continuation.

🔹 Execution Plan

Starter position: Shares and options at support zone ($280-$285).

Full position: Add at breakout ($295) with a mix of shares and options.

Risk: Tight stop below yesterday's low for the starter position.

⚠️ Risk Management: Always respect your stops — discipline over hope.

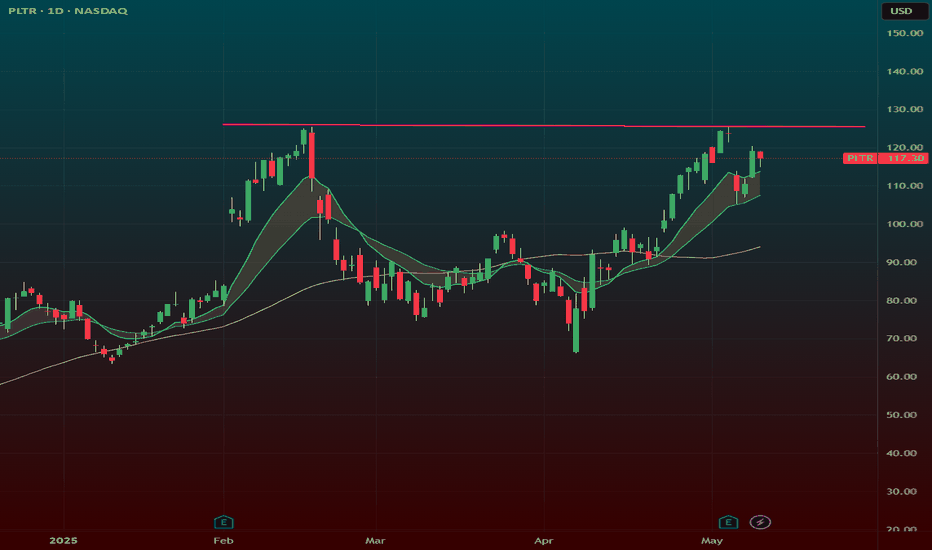

PLTR – Flat Top Breakout + Earnings Gap ReversalNASDAQ:PLTR – Flat Top Breakout with Earnings Gap Reversal

Palantir ( NASDAQ:PLTR ) is setting up for a potential explosive move, combining two of my favorite setups:

🔹 Flat Top Breakout (ATH Setup)

Price is pressing against the $126 resistance, a clear flat top breakout level.

A clean move above this triggers a breakout to new all-time highs (ATH).

🔹 Earnings Gap Down Reversal (Bullish Signal)

Recently, PLTR gapped down on earnings — but bulls stepped in fast, pushing it back up.

This is a classic gap down reversal setup, a strong signal of bullish momentum.

We saw the same setup play out on NYSE:SPOT , which reversed after earnings and broke out to ATH.

🔹 My Trading Plan:

1️⃣ Anticipatory Entry: Looking to buy dips into the shaded cloud zone (dynamic support).

2️⃣ Breakout Confirmation: Add size on a clean breakout above $126.

3️⃣ Stop Loss: Tight stop below the cloud zone to protect capital.

🔹 Why I Love This Setup:

Gap reversals signal aggressive buying even after bad news — a sign of a strong market.

Flat top breakouts tend to have explosive follow-through, especially with earnings momentum.

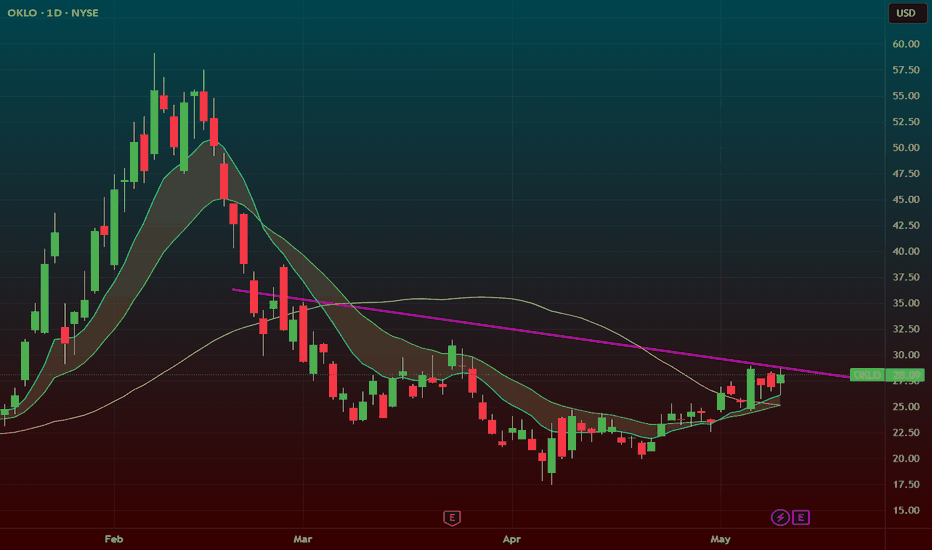

OKLO – Base Breakout Setup with a Twist: The Inside Candle CombOKLO is shaping up for a powerful move, and this setup has my attention for a dual-play approach:

🔹 Base Breakout Setup (Primary Entry)

Already in from the initial base breakout around $25, which I shared last week.

Momentum kicked in with that strong May 6th thrust.

🔹 Three Inside Candles (Power Setup)

Since that momentum spike, we've seen 3 consecutive inside candles — a textbook signal of price compression.

Price is hugging the 9 EMA (support zone), a bullish indicator of strength.

🔹 My Trading Plan:

1️⃣ Starter Position: Already in from $25.

2️⃣ Add Position: On a clean breakout above the high of the inside candle range.

3️⃣ Stop Loss: Tight stop below the 9 EMA — keeps risk tight while capturing the breakout.

🔹 Why This Setup is Special:

Inside candles indicate a tug-of-war between buyers and sellers, but with price holding strong above 9 EMA, the bulls have the edge.

Breakout + inside candle combo = explosive potential.

⚠️ Risk Management: Discipline over FOMO — tight stop, but aggressive on breakout.

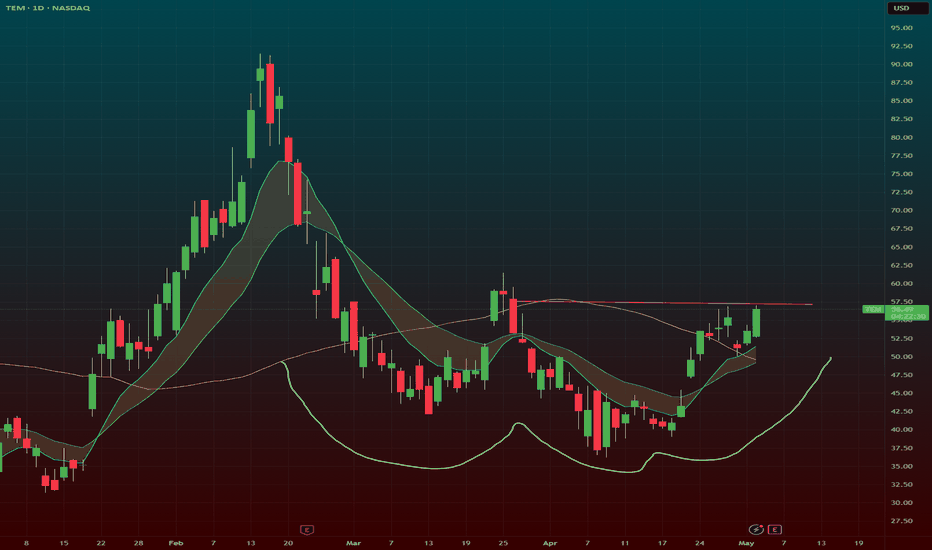

TEM W pattern + base breakout setupMany of the beaten down tech stocks and ai stocks have this same look. Big basing patterns with a W bottom where clear ranges are being formed for a break of the lid.

Thinking entry here in the 56 range with a stop under todays low shoud get a good entry for the breakout here. NASDAQ:TEM

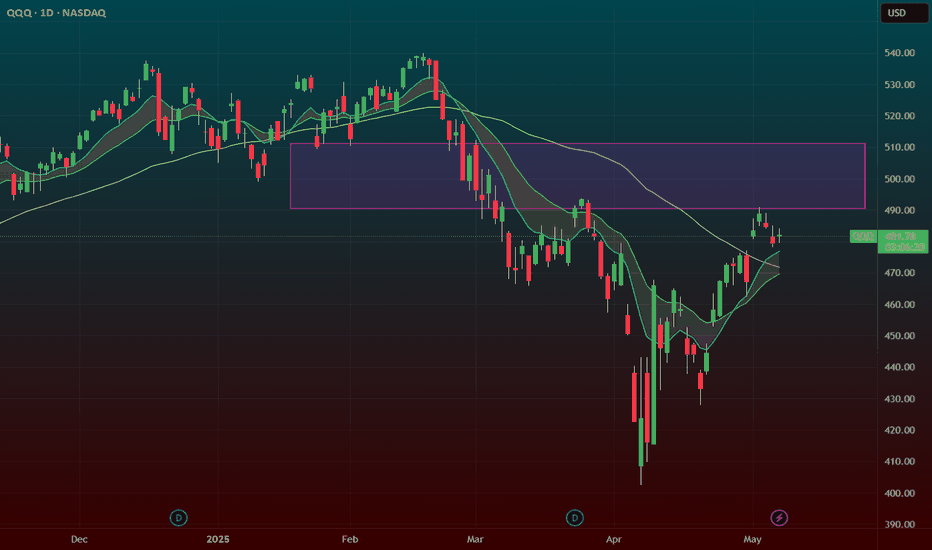

FED DAY IS HERE! $qqq at MAJOR resistance. Today will be a tellQQQ is stuck under the 200sma and a supply zone. WE have used up a lot of the tarriff deals news flow. The market will be looking to uncle Jerome for direction. If he comes in dovish and says the inflation is tempered we could push through into the suction zone.

If he comes in hot and says the tariff war heating up inflation we could get a big pause on the rally. with the QQQ under so much supply this is a logical spot for Powell to dump on the market.

We have the 9ema under if we break under it will trigger a short for me. if we stay above its a leave alone unless we remount the 200sma on the daily chart.

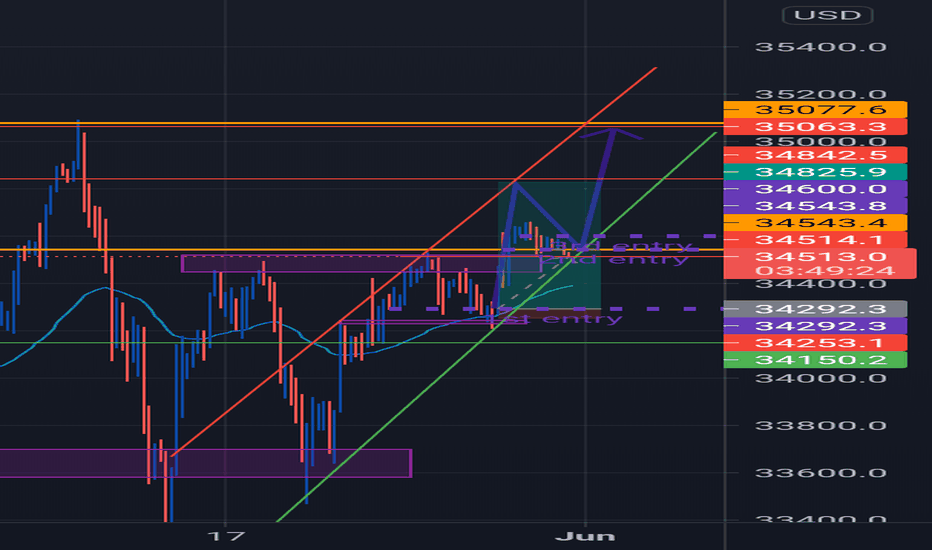

Long term uptrend for US30After large drop in the last 2 months of US30 there is now big opportunities for several long positions as the market aims to break the previous high it failed pass.

There is also a major double bottom on the weekly time frame confirming the formation of a W structure.

As the market raises to complete the W chart pattern it forms bullish flag pole patterns along the way giving us multiple opportunities to enter the market at every retractment.

For the bears to take control of this market a head and shoulders formation needs to take place with the right shoulder being a break and retest of the trend line.

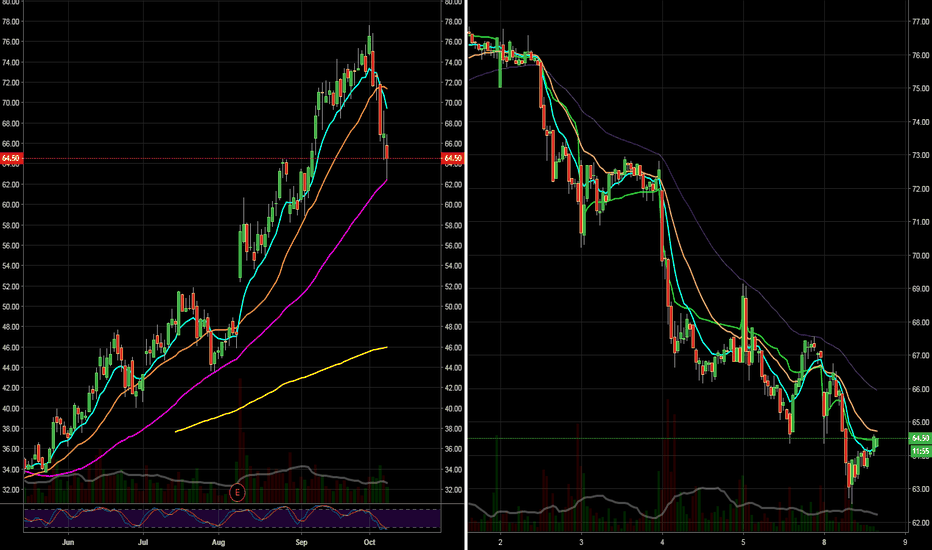

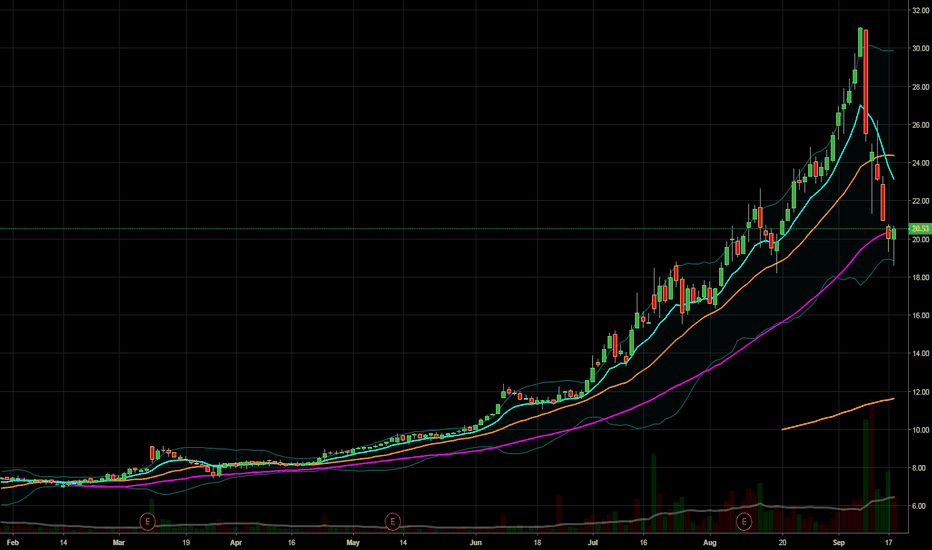

MOMO stocks on Supports . ROKU 50sma bounce playRoku has been a market leader for all of 2018. after a bit multi day pullback here we are testing the 50sma for the first time in a couple months. This has been a key bounce spot on this name.

The $qqq and $iwm are oversold now we could very well bounce into the close. I am long a few of these for a daytrade. Will turn to swing trade if it can close green and market can ramp up here this could be a nice multi day entry. The close is key!

Concerns for the trade are the $qqq conditions. the tape is weak and $tvix is elevated intraday if $tvix can stay under vwap that will give us the push we need to ramp.

Earnings Breakout SwingMule is a recent earnings winner. after its big gap up day it has been resting in a tight range. even with the recent market fluctuations this has not had any movement to the downside. Think this can be a swing trade with a stop under its recent range for a multi day hold