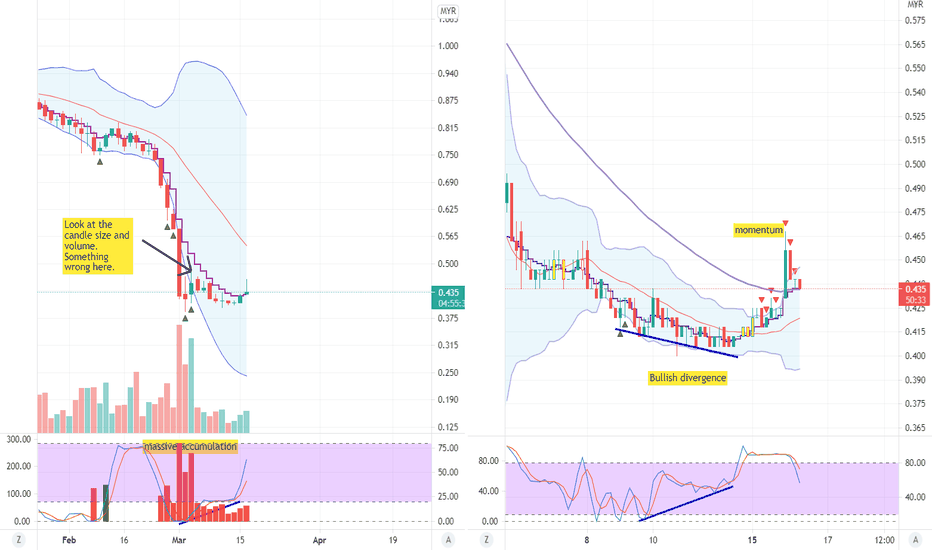

LKL Massive Accumulation by Bank!!LKL has dropped a lot since most of the supply for Covid-19 was sufficient.

People forget about this and jerung2 takes a chance to accumulate their shares little buy little like no one knows. We see massive accumulation happen at the current price level.

An early sign of the trend we see in 1H TF where price decrease but the stochastic increase. This indicates buying pressure is high causing Bullish Divergence .

Today 16 Mac 2021, buyers show their strength by bringing the price close outside BB+EMA50 indicate the sign of strength (SOS)

When the best time to enter?

1. After bullish divergence confirmation (dah terlepas)

2. After MidBB close above EMA50.

3. When MidBB above EMA50 and price retest midBB with oversold stochastic. This is the best chance to enter.

Cutloss? If price closes below starting divergence.

TP? when you feel enough... But for me... I will close when the price when Daily TF closes below EMA6.

Bursamalaysia

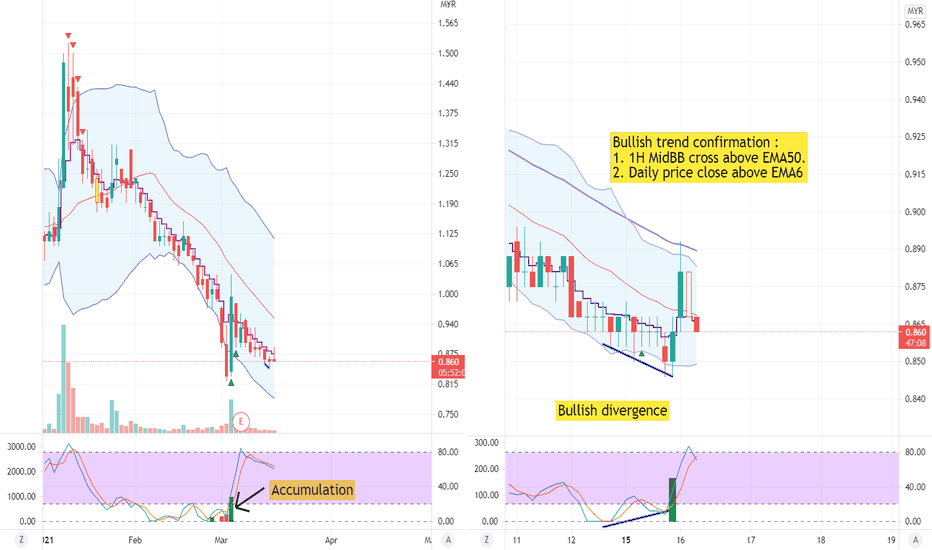

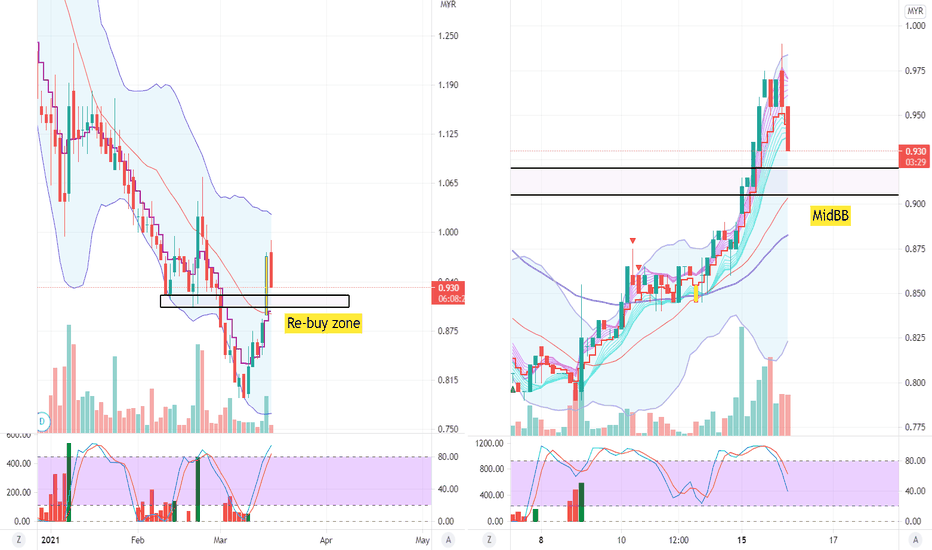

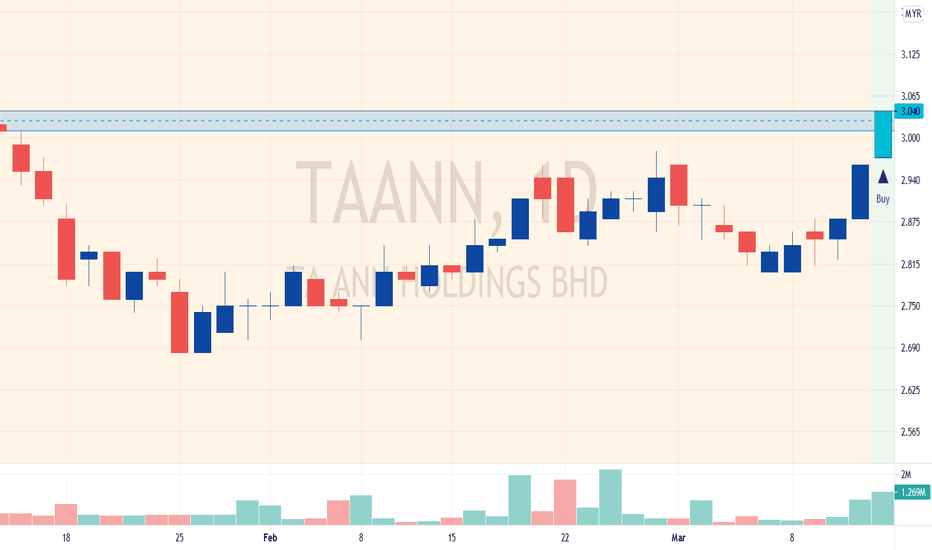

PRLEXUS Re-entry BUY chancesAfter multiple times accumulation period, price break MidBB Daily TF indicate strong buyers.

1H TF shows uptrend movement with MidBB cross above EMA50.

Re-entry BUY chances at the Support area 0.920

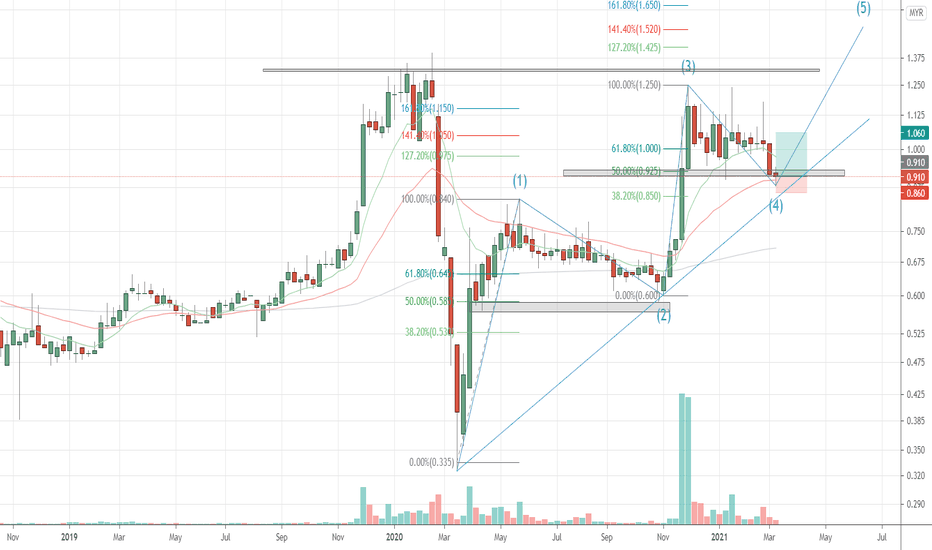

RUBEREX Daily Bullish DivergenceBullish Divergence appears in Daily TF.

Bank accumulation appears to be significant.

Trend confirmation when 1H TF MidBB (SMA20) cross EMA50.

Entry when price test MidBB in 1H TF

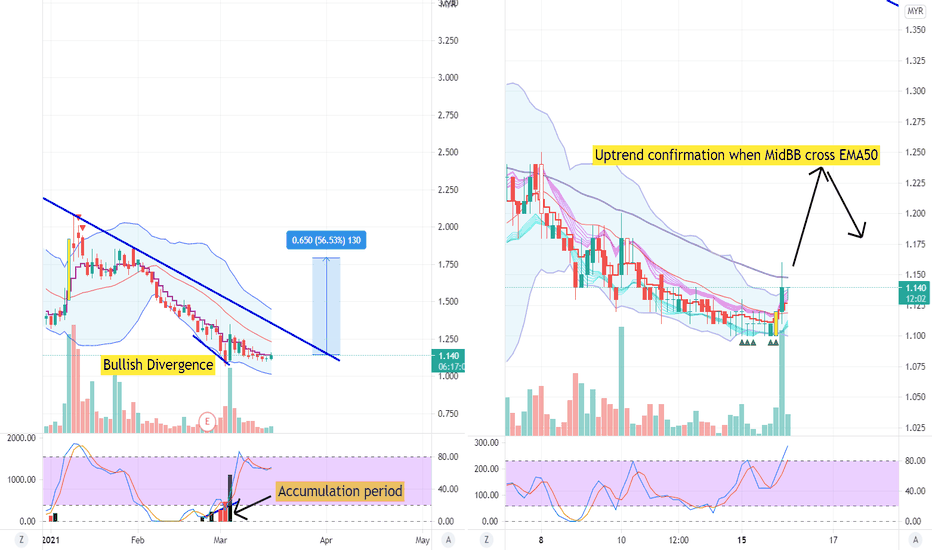

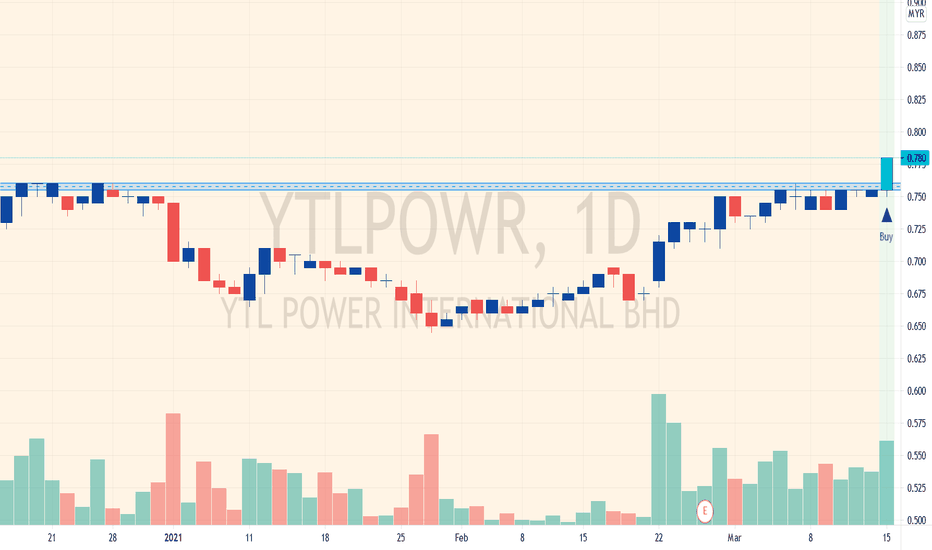

YTLPOWR 6742 Bursa MalaysiaThe study is based upon Volume Price Spread Analysis and Momentum

YTLPOWR has shown both Breakout and Momentum.

Close: 0.78

EP: 0.76 - 0.795

SL: 0.68

TP: 0.87/0.96

Disclaimer: This study does not constitutes Buy/Sell per say. Please consult your financial advisor before making any trading/investing decision

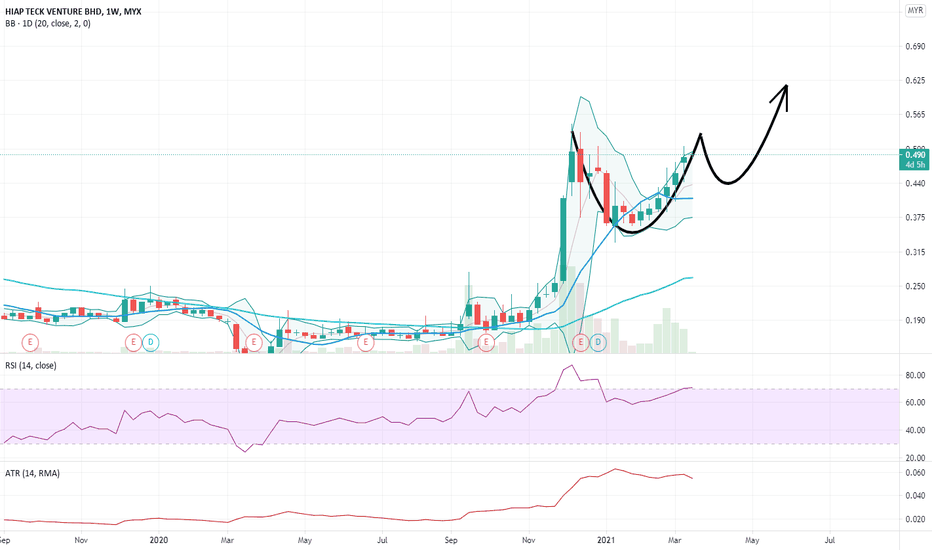

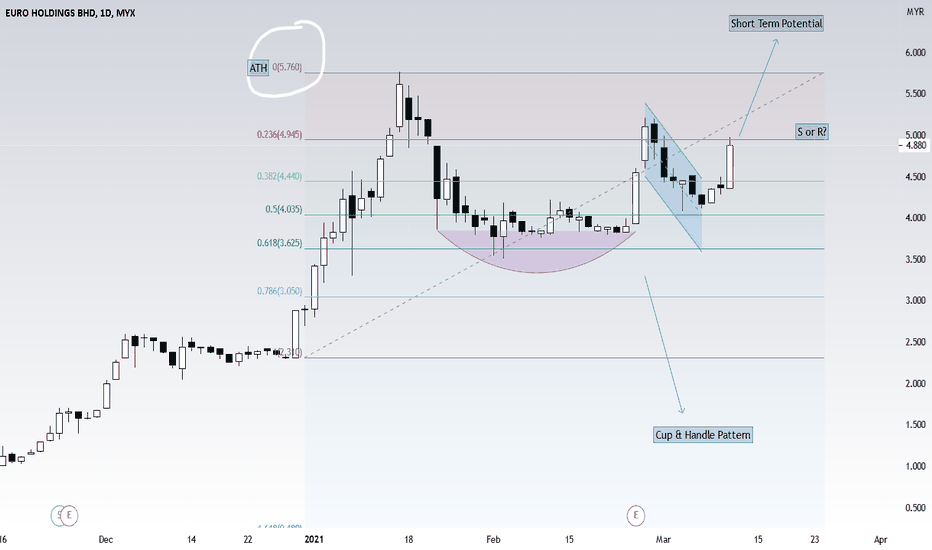

Possible Cup and Handle Forming My first time posting here as a beginner trader! Testing my ideas to see ifI see a potential cup and handle forming here, at the time of posting the cup section is coming to an end over the next couple weeks. Then if a handle forms, can go long after the breakout from the dip. Any feedback welcome as I am still learning technical analysis and gaining experience.

TR 331. PPHB Weekly starting to make an uptrend EMA 10 > EMA 30 > EMA 200. Now in Wave 4 and expected to make the reversal on 0.5 Fibo level. Seems like forming cup and handle pattern.

2. Reversal pattern formed at D1 (engulfing), price action slightly above EMA 200.

3. Isaham revenue and profit in uptrend, trailing PE 6.3, WAFV RM1.94.

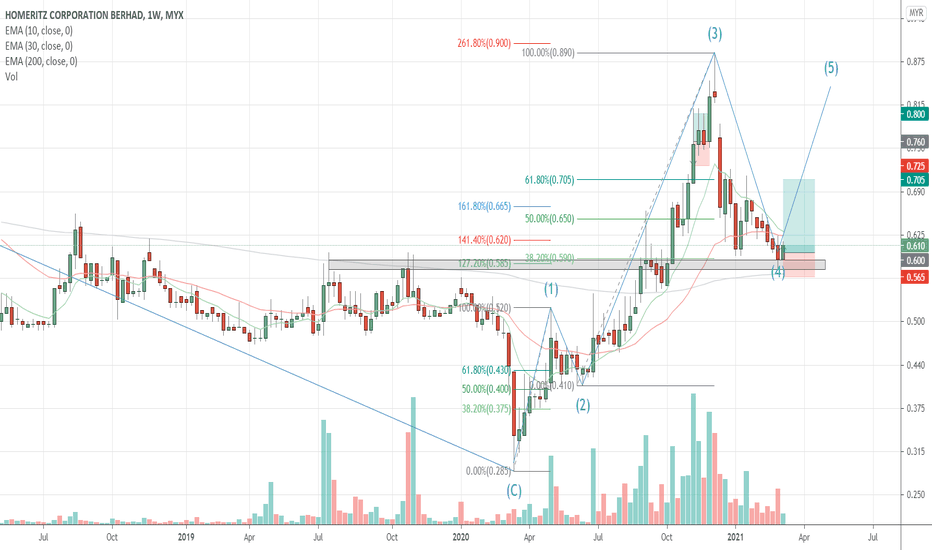

TR 321. Homeriz weekly starting to make an uptrend EMA 10 > EMA 30 > EMA 200. Now in Wave 4 and expected to make the reversal on 0.382 Fibo level (Wave 2 at 0.618).

2. Reversal pattern formed at H4 (hammer then break with bullish bar), price action slightly below EMA 200.

3. Isaham revenue and profit in uptrend, trailing PE 11, WAFV RM0.905

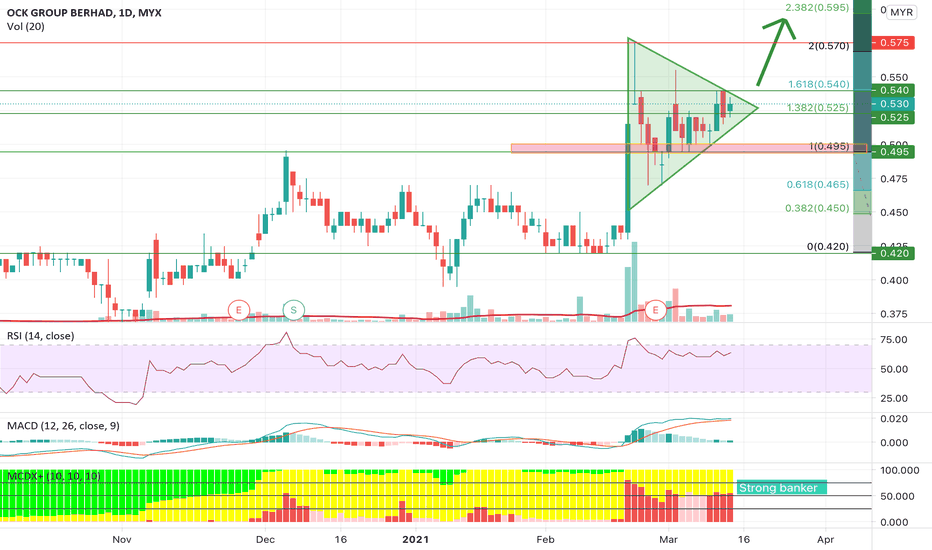

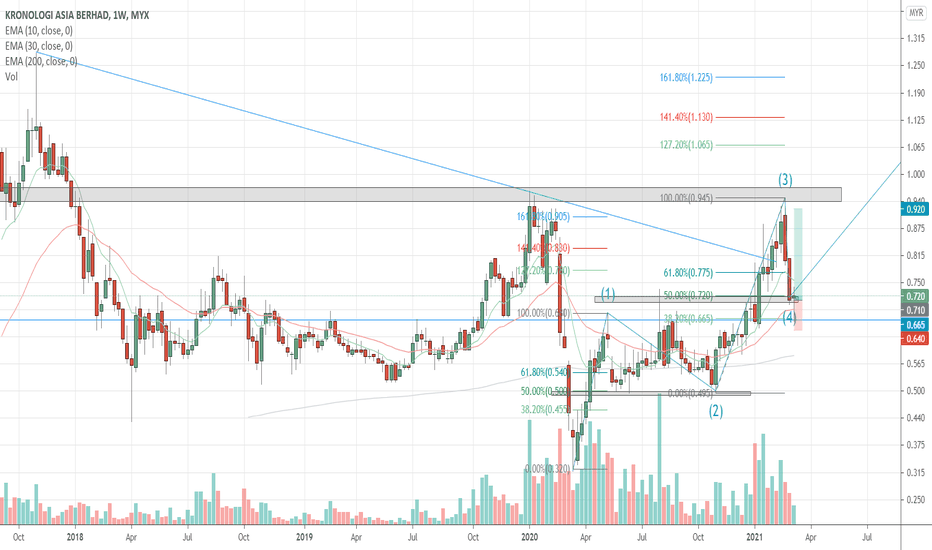

TR 311. Krono weekly start to make an uptrend with the downtrendline broken and EMA 10 > EMA 30 > EMA 200. Now in Wave 4.

2. Reversal candle formed (hammer then bullish candle) at 0.5 Fibonacci level. Also RBS. Previous reversal on Wave 2 is also at 0.5 level.

3. Isaham Revenue and profit indicator in an uptrend, PE 0, WAFV 0.

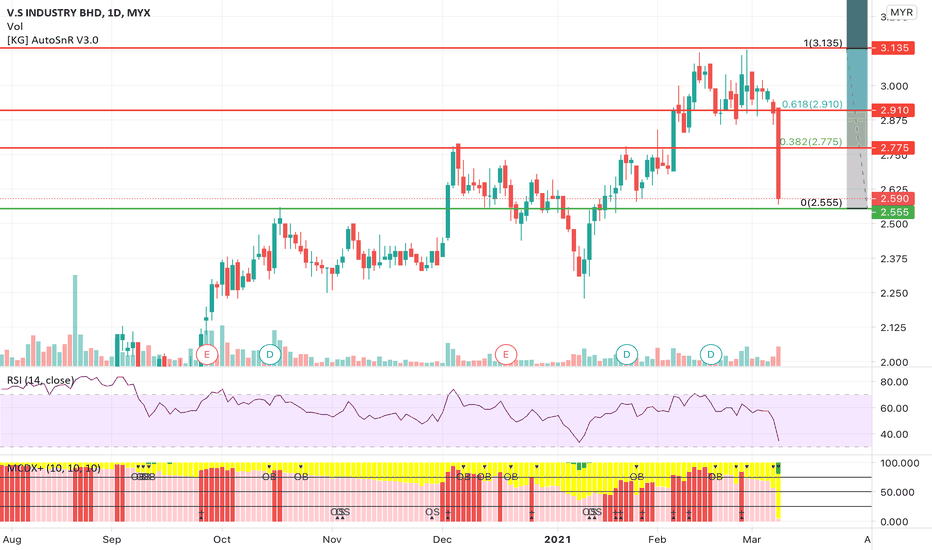

VS Monitor for Due Technical ReboundEMS stocks VS, SKPRES, ATAIMS are the hardest hit in the major tech stocks retracement. VS had the worst single day drop as the banker chips dropped just to mere 5%.

Scalpers can monitor for entry as RSI shows it can rebound anytime and it closed just above the strong support of 2.555. For holders looking to enter, please stay away from techs temporarily until the theme stabilises and won’t drop further.

Support at 2.555 and resistances at 2.775, 2.910 respectively.

Disclaimer: Trade at your own risk.

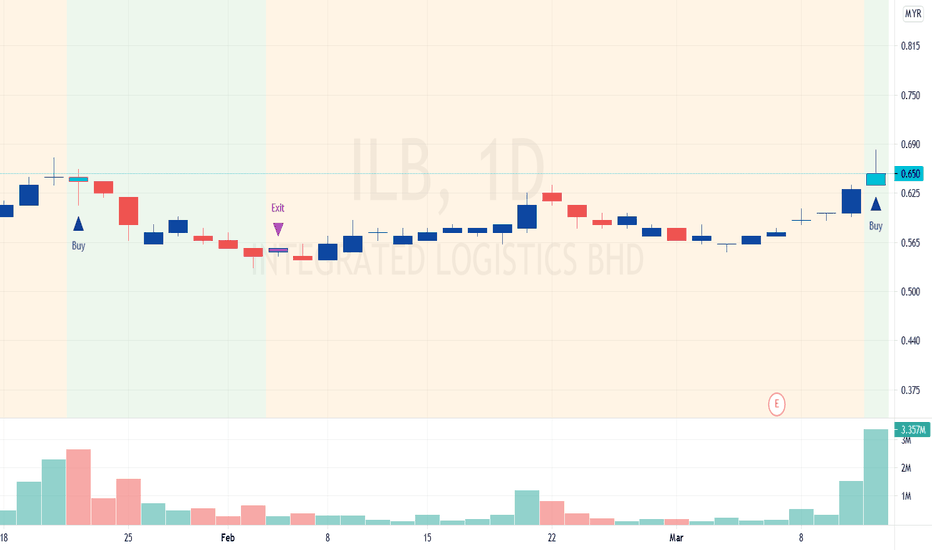

ILB 5614 Bursa Malaysia 12/3/21Looks like Momentum is setting in...

Close: 0.65

EP: 0.64 - 0.665

Sl: 0.0.57

TP: 0.74/ 0.78/Open

Disclaimer: This study does not constitutes Buy/Sell per say. Please consult your financial advisor before making any trading/investing decision.

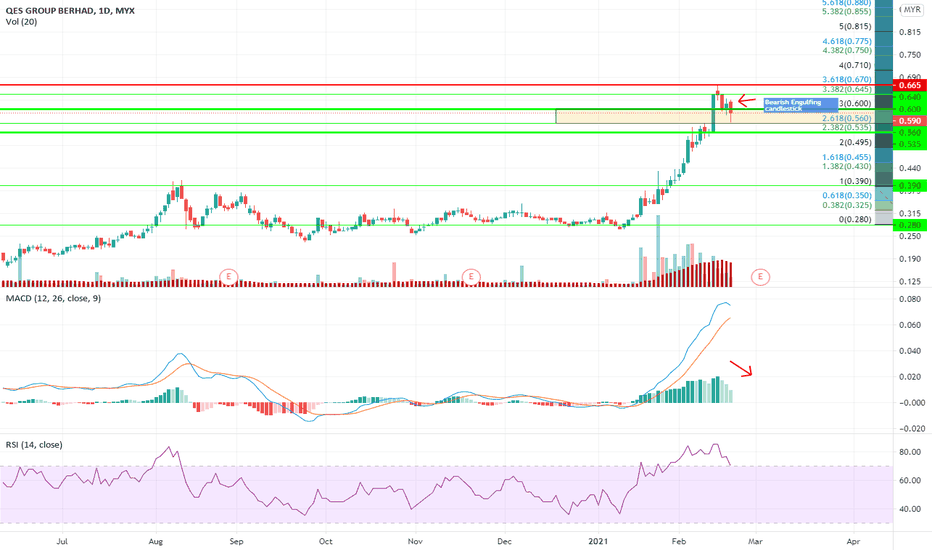

QES will further PullbackThere is possibility QES will further retrace to near 535 area, the next strong support after it closed within the current strong support zone between 600 and 560 with the slowing momentum.

The best entry price will be between 535 and 540 to take advantage of possibility the price will be pushed up just before QR for the coming week.

Disclaimer: Trade at your own risk.

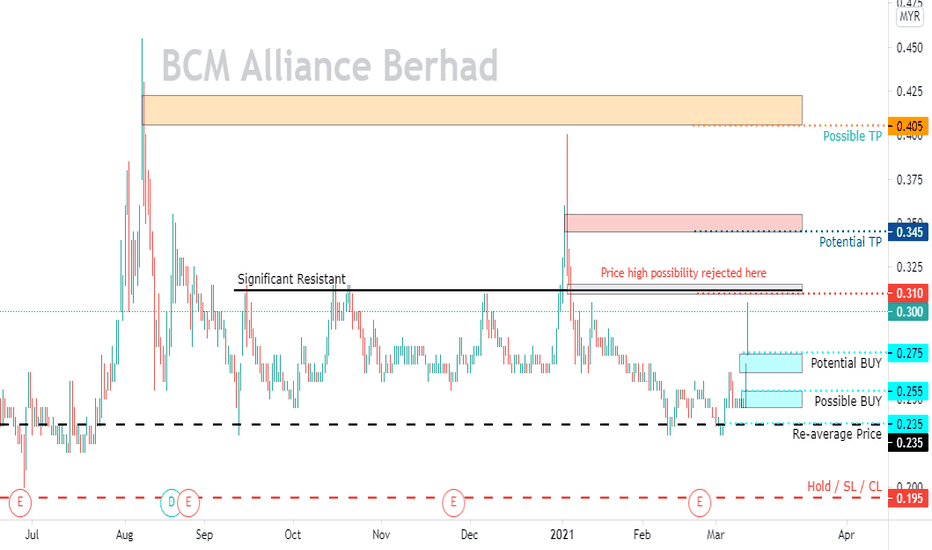

Bursa BCM Alliance BerhadThe rally price might get reject at RM 0.310 before continuing uptrend. If this happened, there is an opportunity to entry at the buy zone.

Disclaimer: If you choose to follow this trading idea you do so at your own risk after giving thorough and reasonable thought and consideration to your actions. All trading is high risk and one of the most difficult activities you will ever consider. Don’t trade with money you can’t afford to lose.