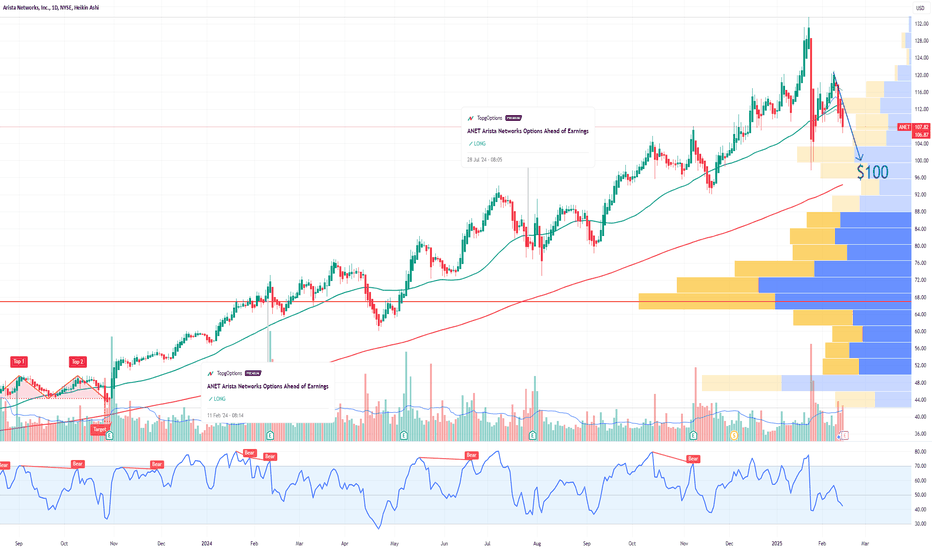

ANET Arista Networks Options Ahead of EarningsIf you haven`t bought ANET before the rally:

Now analyzing the options chain and the chart patterns of ANET Arista Networks prior to the earnings report this week,

I would consider purchasing the 100usd strike price Puts with

an expiration date of 2025-2-21,

for a premium of approximately $2.92.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Buy-sell-indicators

BMBL Bumble Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BMBL Bumble prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

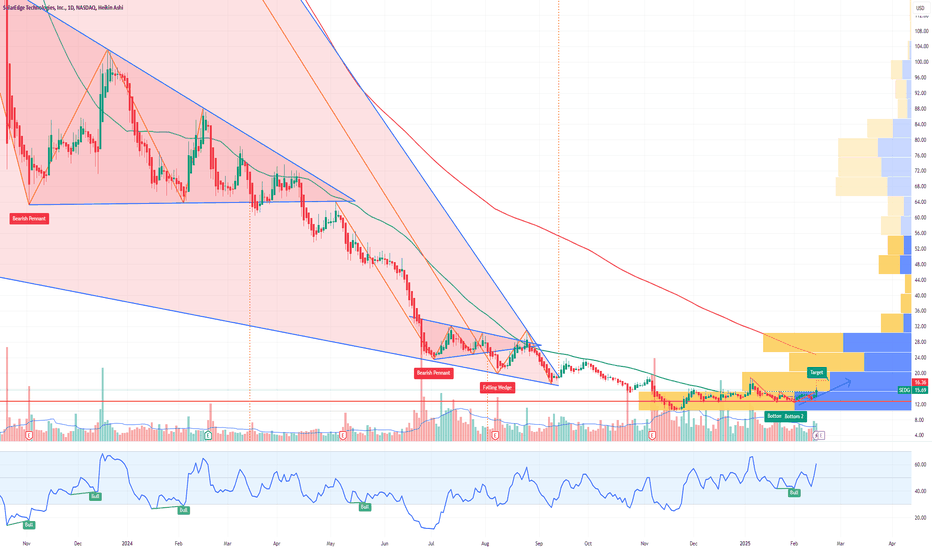

SEDG SolarEdge Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2025-2-28,

for a premium of approximately $1.76.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

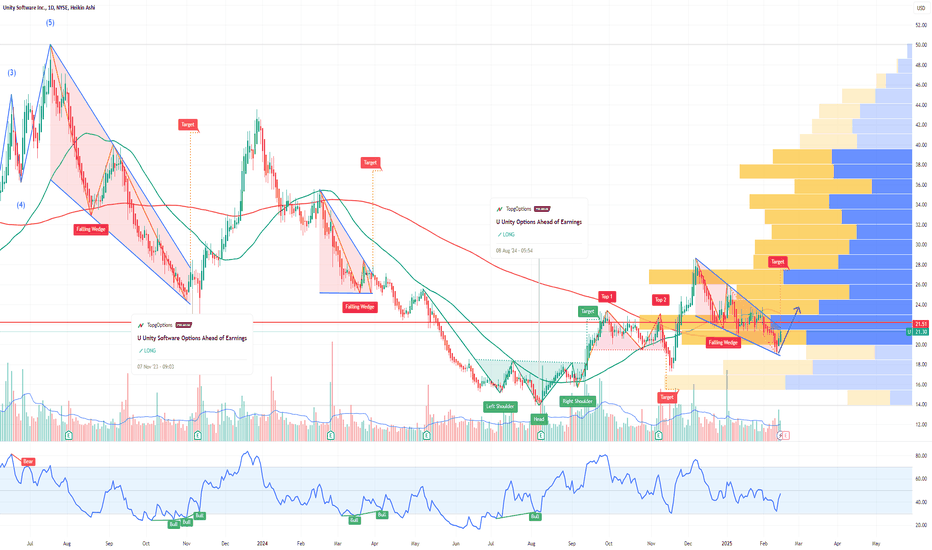

U Unity Software Options Ahead of EarningsIf you haven`t bought U before the previuos earnings:

Now analyzing the options chain and the chart patterns of U Unity Software prior to the earnings report this week,

I would consider purchasing the 21usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $1.73.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

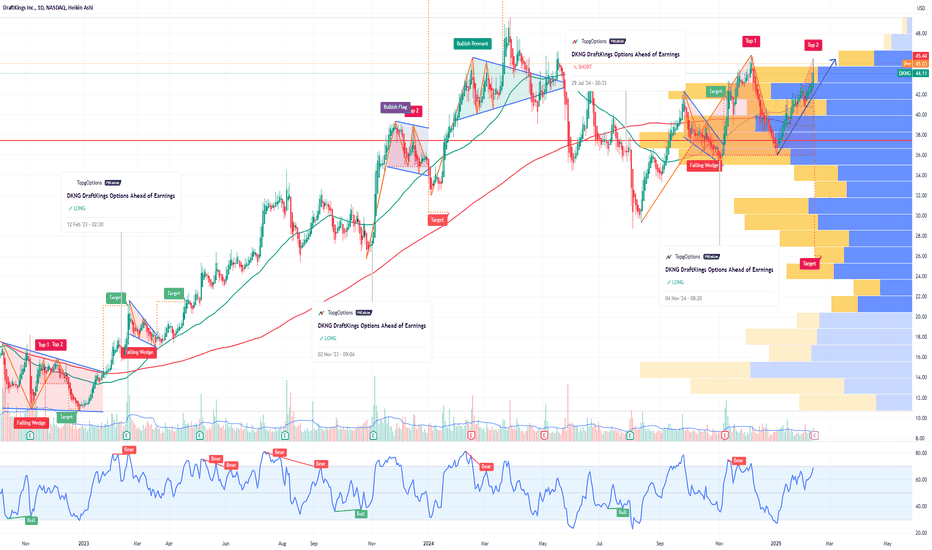

DKNG DraftKings Options Ahead of EarningsIf you haven`t bought DKNG before the previuos earnings:

Now analyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 45usd strike price Calls with

an expiration date of 2025-2-14,

for a premium of approximately $2.24.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

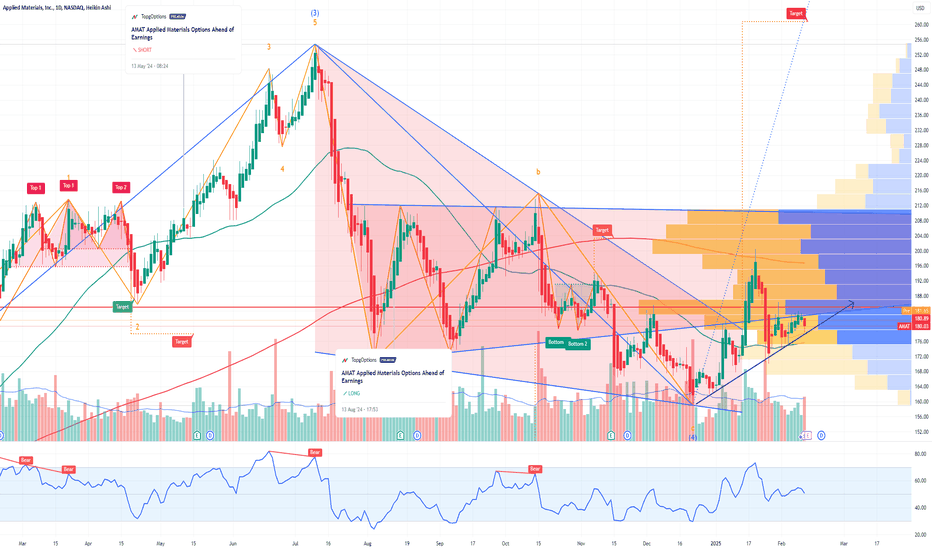

AMAT Applied Materials Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AMAT Applied Materials prior to the earnings report this week,

I would consider purchasing the 180usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $6.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

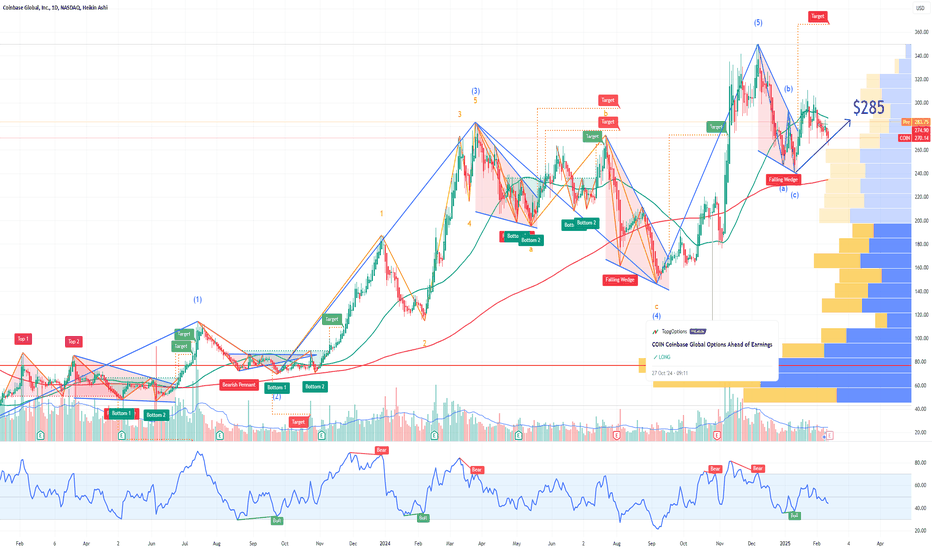

COIN Coinbase Global Options Ahead of EarningsIf you haven`t bought COIN before the previous earnings:

Now analyzing the options chain and the chart patterns of COIN Coinbase Global prior to the earnings report this week,

I would consider purchasing the 285usd strike price Calls with

an expiration date of 2025-2-14,

for a premium of approximately $7.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

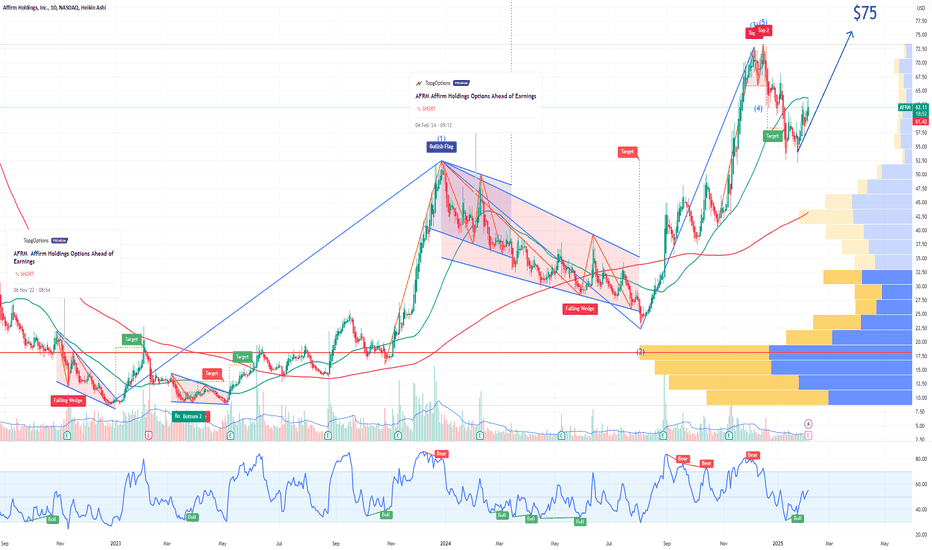

AFRM Affirm Holdings Options Ahead of EarningsIf you haven`t sold AFRM before the previous earnings:

Now analyzing the options chain and the chart patterns of AFRM Affirm Holdings prior to the earnings report this week,

I would consider purchasing the 75usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $3.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AMZN Amazon Options Ahead of EarningsIf you haven`t bought AMZN before the previos earnings:

Now analyzing the options chain and the chart patterns of AMZN Amazon prior to the earnings report this week,

I would consider purchasing the 240usd strike price Calls with

an expiration date of 2025-2-7,

for a premium of approximately $6.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

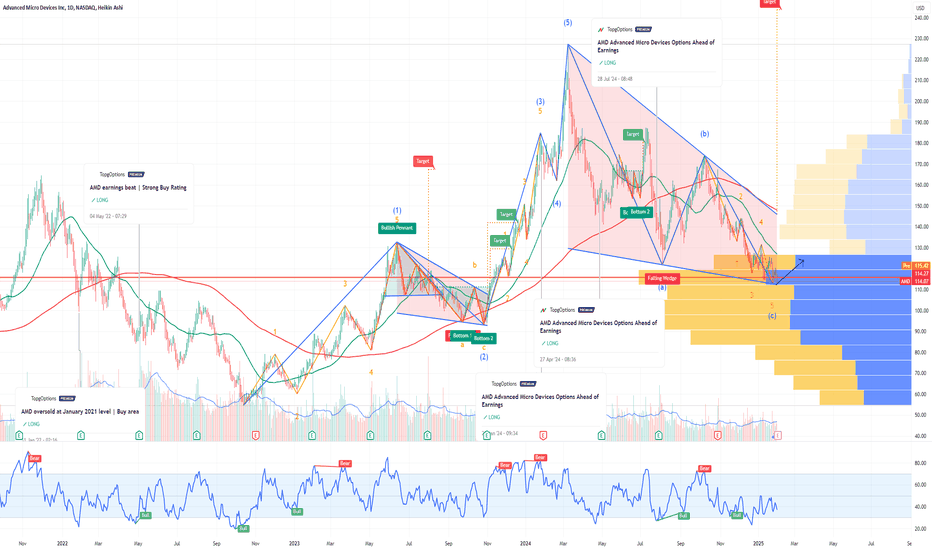

AMD Advanced Micro Devices Options Ahead of EarningsIf you haven`t bought AMD before the previous earnings:

Now analyzing the options chain and the chart patterns of AMD Advanced Micro Devices prior to the earnings report this week,

I would consider purchasing the 113usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $7.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

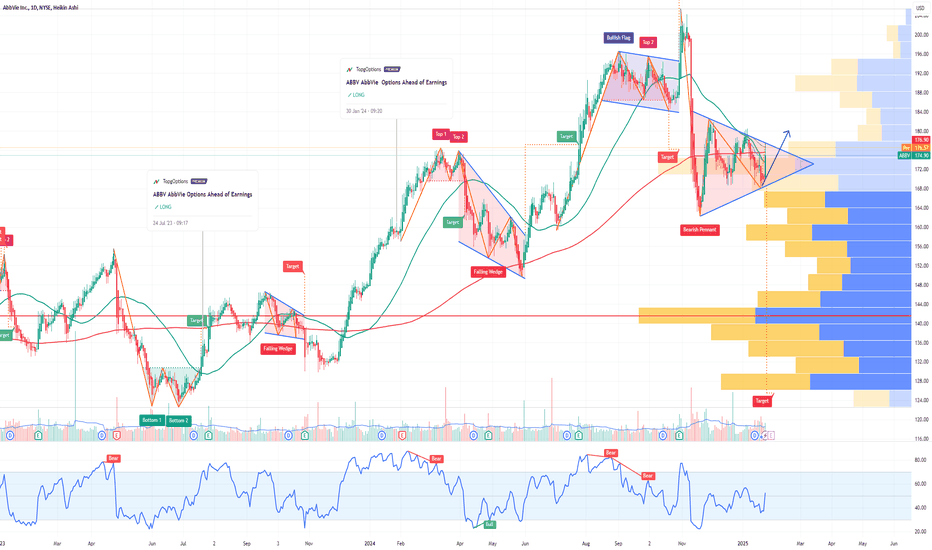

ABBV AbbVie Options Ahead of EarningsIf you haven`t bought ABBV before the previous earnings:

Now analyzing the options chain and the chart patterns of ABBV AbbVie prior to the earnings report this week,

I would consider purchasing the 175usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $6.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

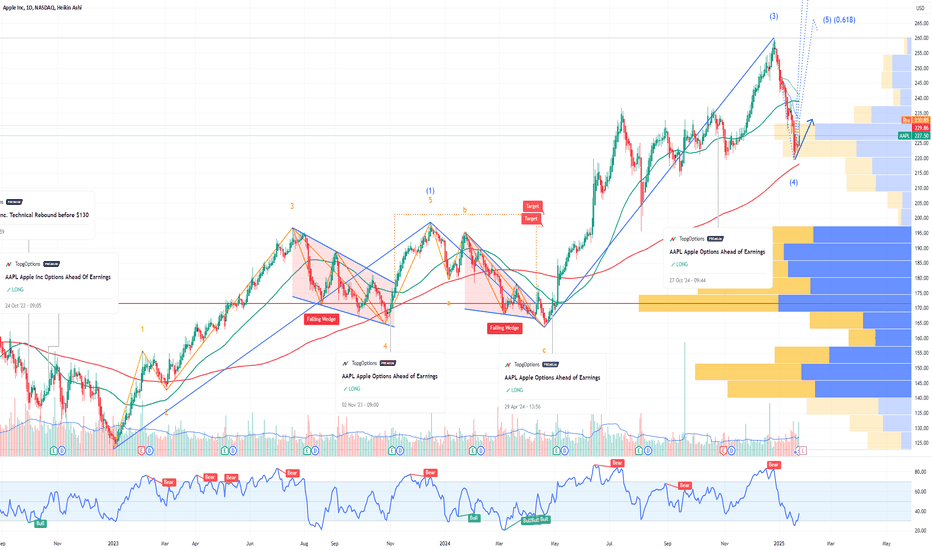

AAPL Apple Options Ahead of EarningsIf you haven`t bought AAPL before the recent rally:

Now analyzing the options chain and the chart patterns of AAPL Apple prior to the earnings report this week,

I would consider purchasing the 225usd strike price Calls with

an expiration date of 2025-1-31,

for a premium of approximately $8.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

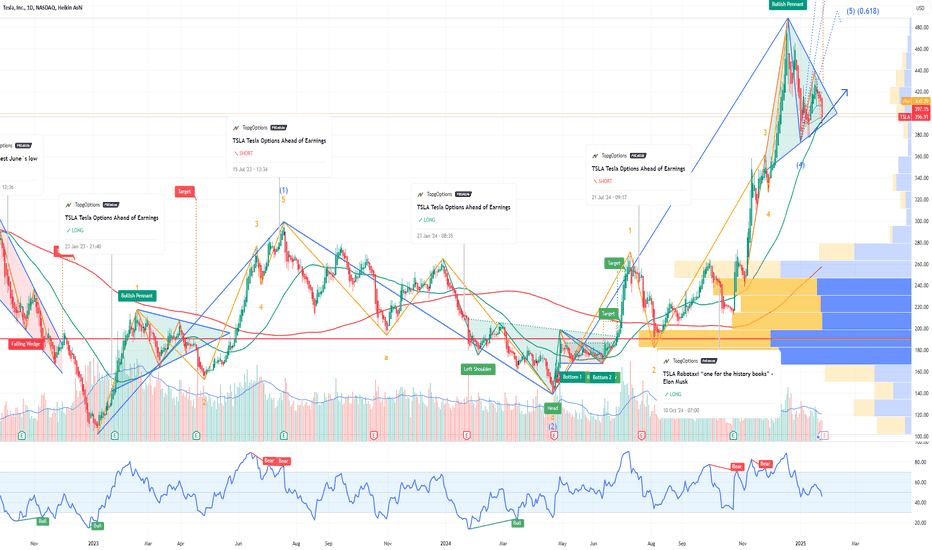

TSLA Tesla Options Ahead of EarningsIf you haven`t bought TSLA before the previous earnings:

Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week,

I would consider purchasing the 400usd strike price Calls with

an expiration date of 2025-1-31,

for a premium of approximately $16.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

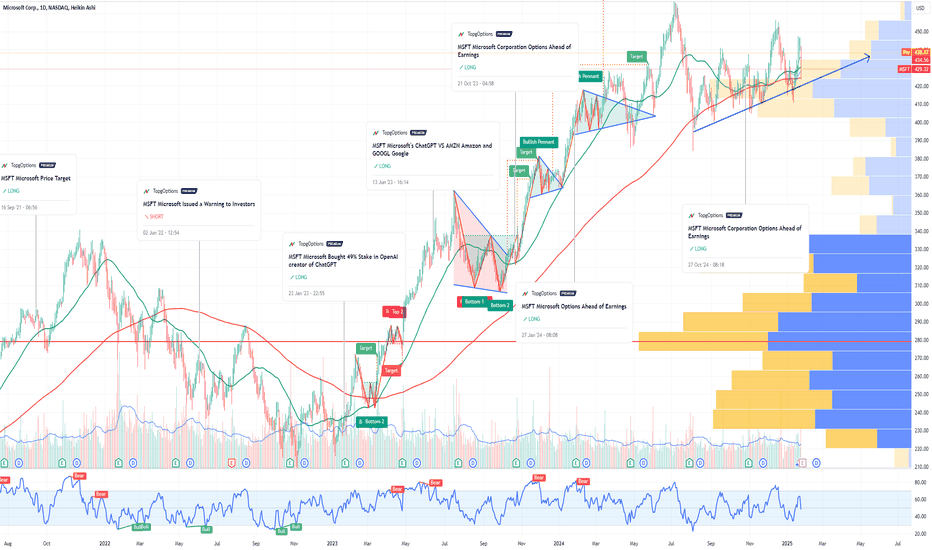

MSFT Microsoft Corporation Options Ahead of EarningsIf you haven`t bought MSFT when they reported 49% stake in OpenAI:

Now analyzing the options chain and the chart patterns of MSFT Microsoft Corporation prior to the earnings report this week,

I would consider purchasing the 430usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $15.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

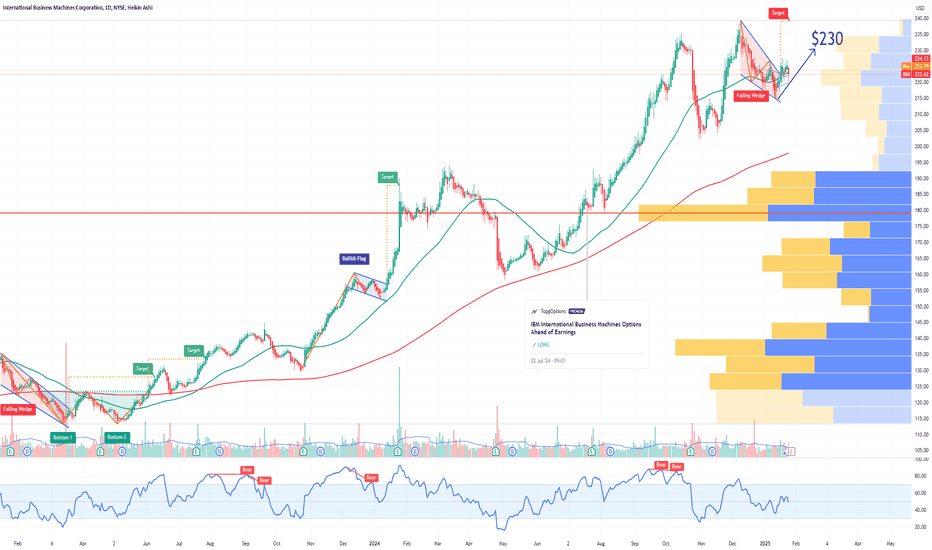

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the previous earnings:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 230usd strike price Calls with

an expiration date of 2025-1-31,

for a premium of approximately $5.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

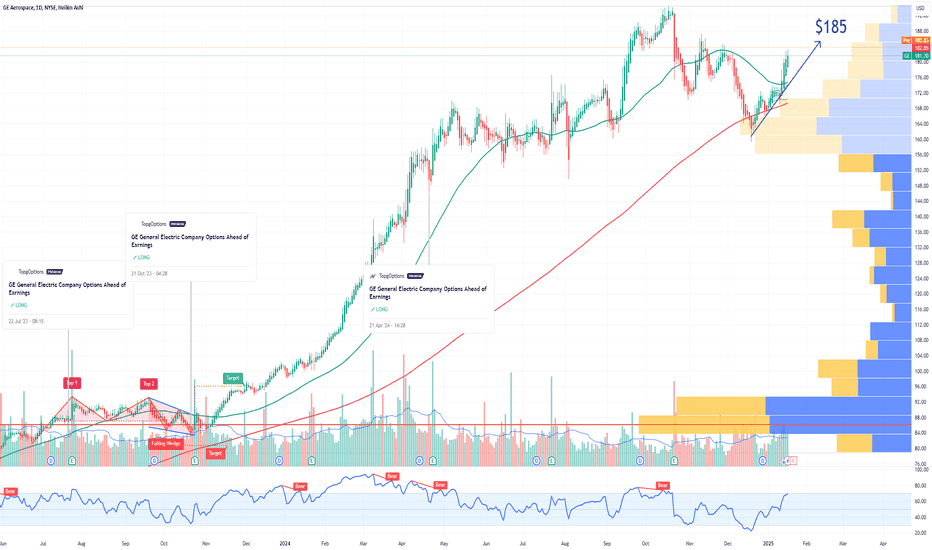

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the breakout:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 185usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $8.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

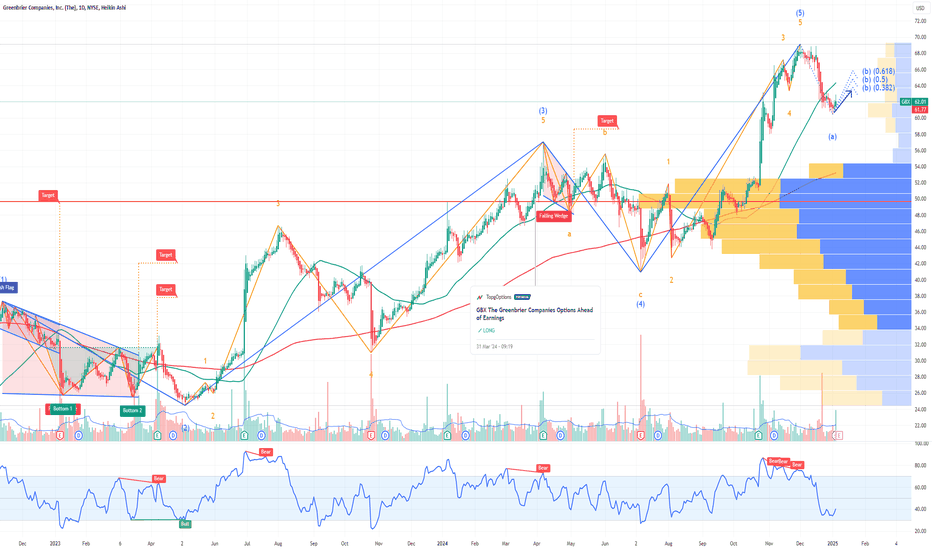

GBX The Greenbrier Companies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GBX The Greenbrier Companies prior to the earnings report this week,

I would consider purchasing the 65usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $3.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

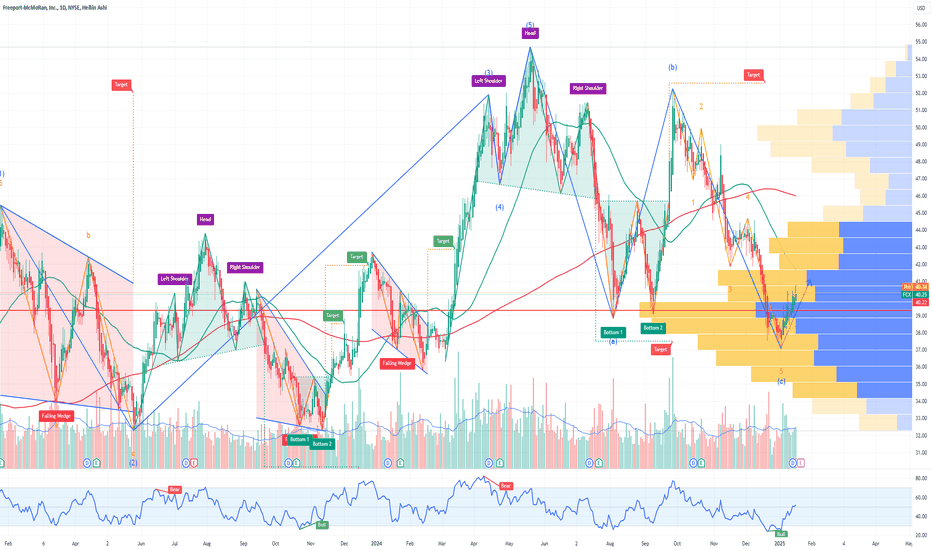

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $1.94.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

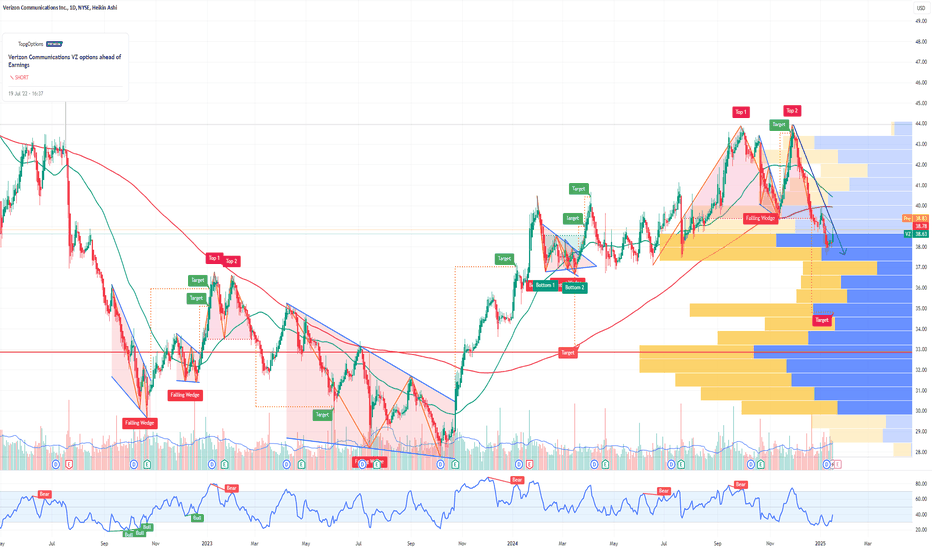

VZ Verizon Communications Options Ahead of EarningsIf you didn’t exit VZ before the selloff:

Now analyzing the options chain and the chart patterns of VZ Verizon Communications prior to the earnings report this week,

I would consider purchasing the 38.50usd strike price Puts with

an expiration date of 2025-1-31,

for a premium of approximately $0.68.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

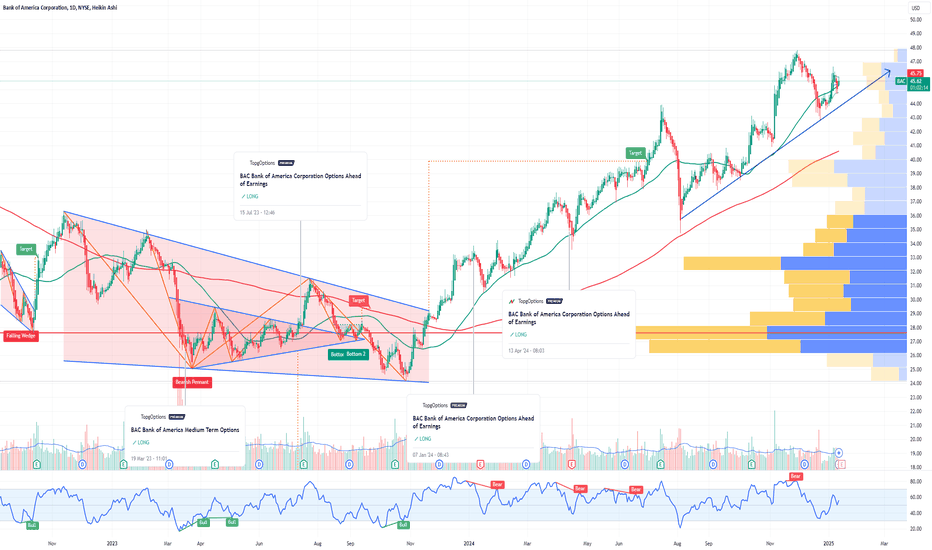

BAC Bank of America Corporation Options Ahead of EarningsIf you haven`t bought BAC before the recent rally:

Now analyzing the options chain and the chart patterns of BAC Bank of America Corporation prior to the earnings report this week,

I would consider purchasing the 47usd strike price Calls with

an expiration date of 2025-2-7,

for a premium of approximately $0.89.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SLB Schlumberger Limited Options Ahead of EarningsIf you haven`t sold the Double Top on SLB:

Now analyzing the options chain and the chart patterns of SLB Schlumberger prior to the earnings report this week,

I would consider purchasing the 40usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $3.17.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

WFC Wells Fargo & Company Options Ahead of EarningsIf you haven`t bought WFC before the breakout:

Now analyzing the options chain and the chart patterns of WFC Wells Fargo & Company prior to the earnings report this week,

I would consider purchasing the 70usd strike price Puts with

an expiration date of 2025-3-21,

for a premium of approximately $2.82.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

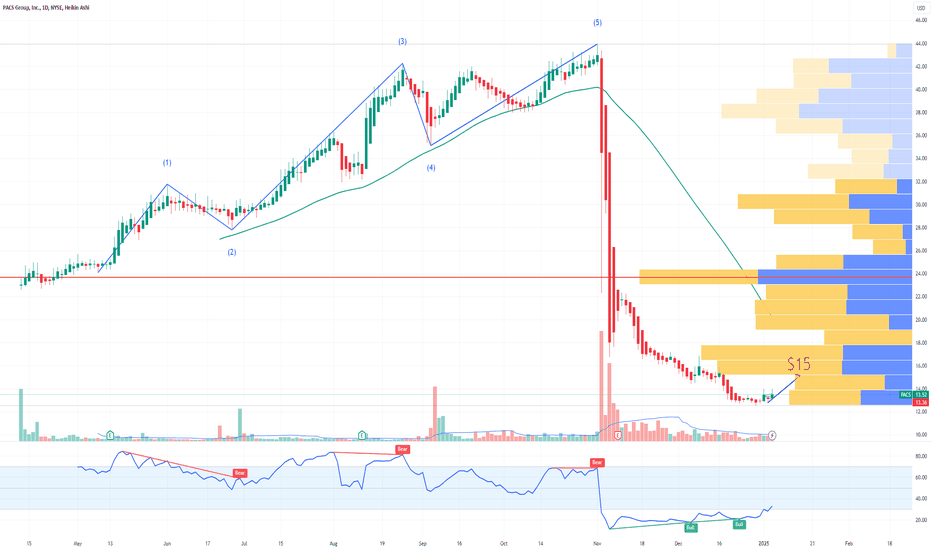

PACS Group Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PACS Group prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.27.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.