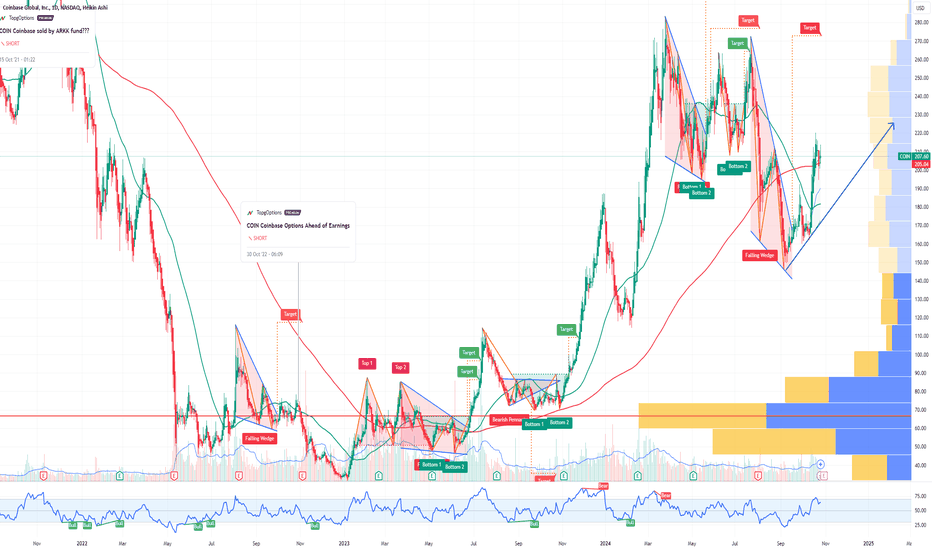

COIN Coinbase Global Options Ahead of EarningsAnalyzing the options chain and the chart patterns of COIN Coinbase Global prior to the earnings report this week,

I would consider purchasing the 200usd strike price in the money Calls with

an expiration date of 2024-11-15,

for a premium of approximately $21.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Buy-sell-indicators

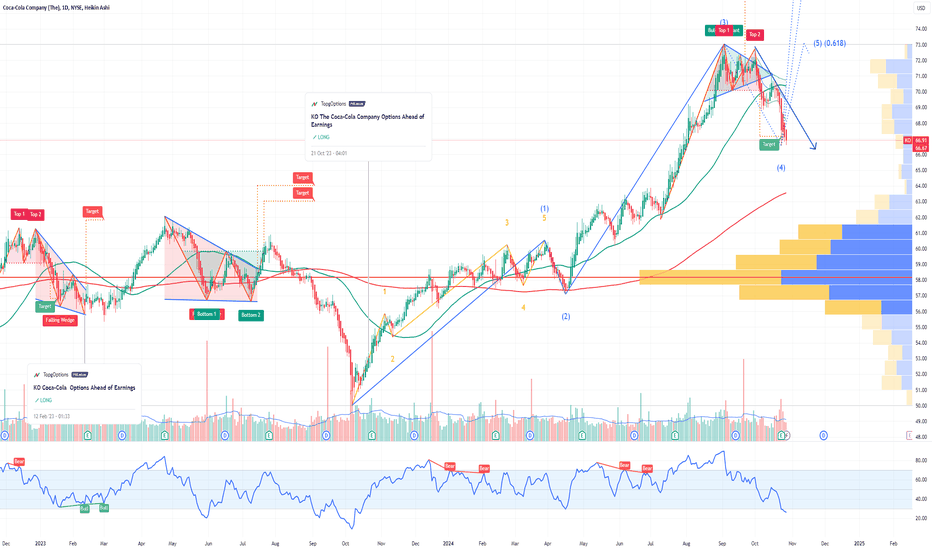

KO Coca-Cola and the E. coli outbreak linked to McDonald’sIf you haven`t bought the dip on KO:

Now you need to know that Coca-Cola (KO) could see a decline due to the E. coli outbreak linked to McDonald’s, as the two brands have a longstanding partnership, with Coca-Cola products being served widely in McDonald's restaurants.

Negative publicity impacting McDonald's could indirectly affect Coca-Cola by reducing in-store traffic, which may lower beverage sales.

Additionally, Coca-Cola's association with fast food means that consumer sentiment shifting towards healthier options could further impact sales.

If the outbreak spurs changes in public dining behavior, Coca-Cola may face a temporary decline in demand across other food service venues, potentially impacting its stock performance.

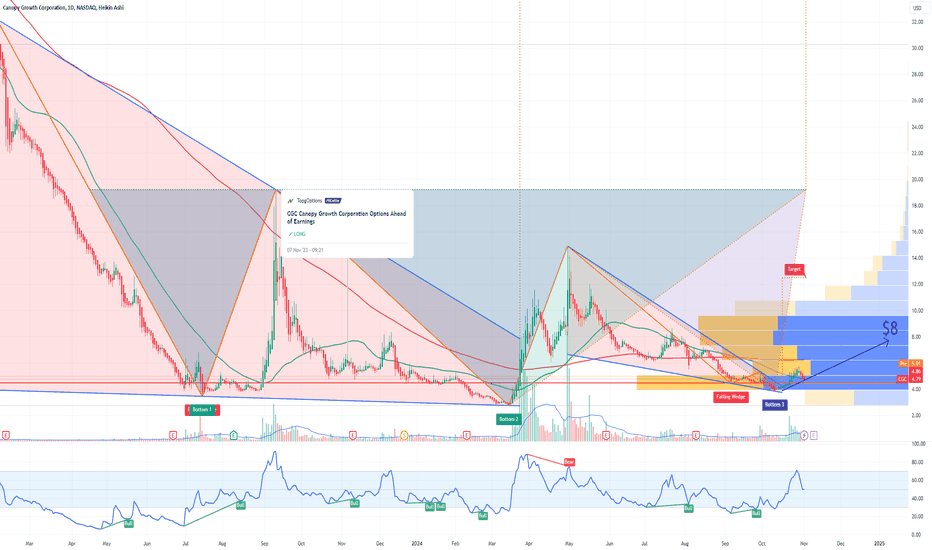

CGC Canopy Growth Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CGC Canopy Growth Corporation prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $0.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

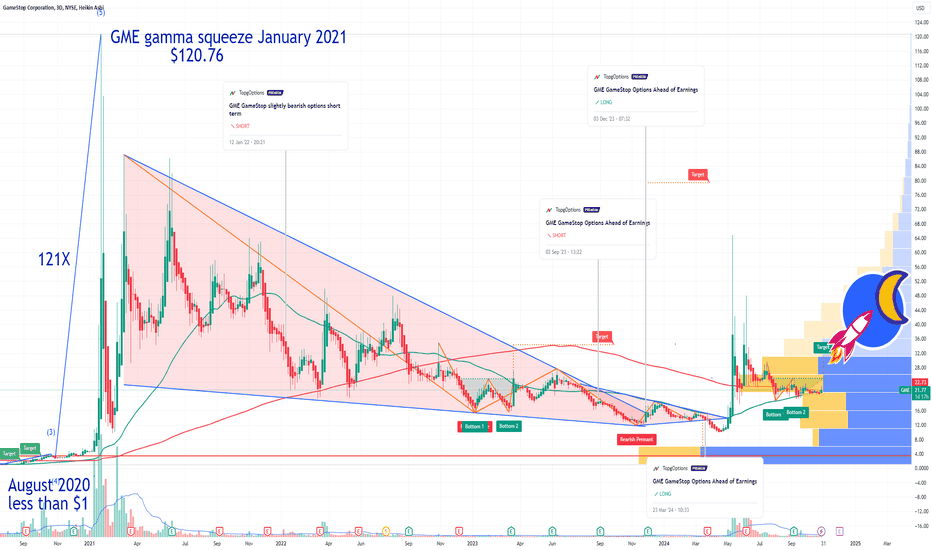

GME GameStop - Short Squeeze in the Making!If you haven`t bought GME before the previous breakout:

Now you need to know that GameStop (GME) is creating a buzz in the options market, especially as it gears up for an exciting week ahead!

After experiencing an astronomical increase of over 121X in less than four months in the past, GME has captured the attention of traders and investors alike.

This dramatic surge in price has raised speculation about the potential for another gamma squeeze, reminiscent of the impressive rallies seen in the past.

With calls at the $125 strike price set to expire on January 17, 2025, there's palpable optimism in the air!

The notable volume of these calls suggests that investors are positioning themselves for a significant move.

Traders are eager to capitalize on the momentum that GME has built, especially with historical patterns indicating that such surges often lead to increased volatility and price spikes.

The options chain for this Friday looks extremely bullish, with an uptick in activity signaling strong demand for GME calls.

The convergence of high open interest and the upcoming expiration date has the potential to ignite a new wave of buying pressure, further fueling the chances of a gamma squeeze.

As more traders enter the market, the cascading effects of rising call prices could push the underlying stock higher, benefiting those who are well-positioned in the options market!

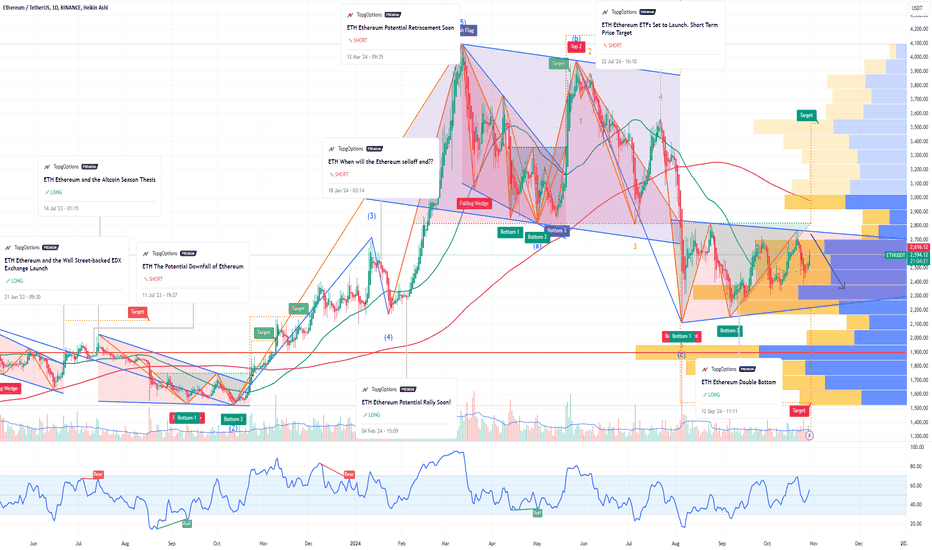

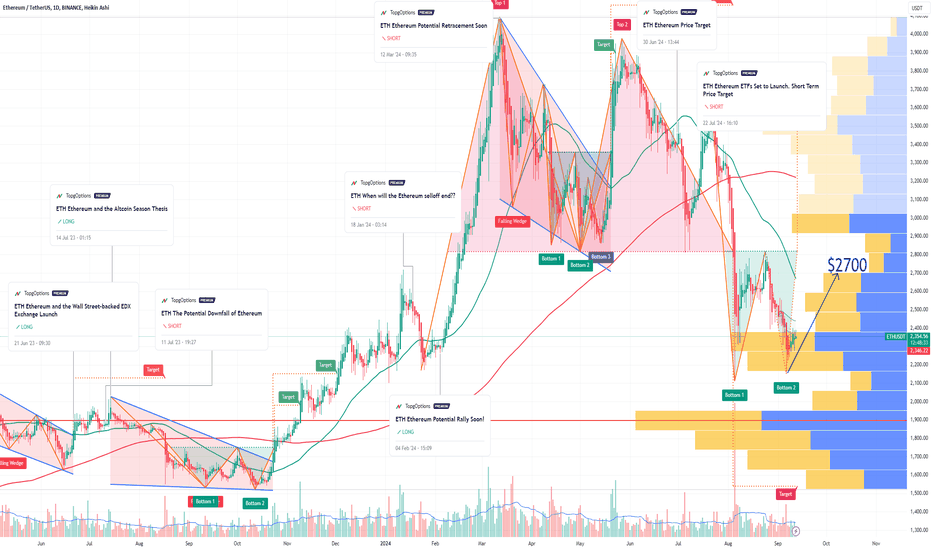

ETH Ethereum Potential retracement soonIf you haven`t bought the recent Double Bottom on ETH:

Now Ethereum might be facing bearish pressure following the U.S. Department of Justice's (DOJ) launch of a criminal investigation into Tether, the issuer of the widely used stablecoin USDT.

According to reports from the Wall Street Journal, this investigation is led by the U.S. attorney’s office in Manhattan and focuses on potential violations of sanctions and anti-money laundering regulations.

As Tether’s USDT is a crucial component of the cryptocurrency ecosystem, widely utilized for trading and liquidity on various platforms, any negative developments regarding its regulatory compliance could have significant ramifications for Ethereum. Tether's stability and its ability to maintain its peg to the U.S. dollar are vital for many trading pairs involving Ethereum. If the investigation reveals serious issues, it could lead to a loss of confidence in USDT, prompting traders to seek safer alternatives or even pull out of the market altogether.

The ripple effects of Tether’s troubles may extend to Ethereum and other cryptocurrencies that depend on stablecoins for liquidity. A decline in USDT’s credibility could trigger panic selling, as traders rush to liquidate their positions in Ethereum and other assets, leading to increased volatility and downward pressure on prices. This scenario could particularly impact Ethereum, given its integral role in decentralized finance (DeFi), where USDT is frequently used for collateral and trading.

The scrutiny surrounding Tether may prompt regulators to cast a wider net over the cryptocurrency market, leading to increased oversight of other stablecoins and projects operating on the Ethereum network. This heightened regulatory environment could deter new investments and innovations within the Ethereum ecosystem, hindering its growth potential.

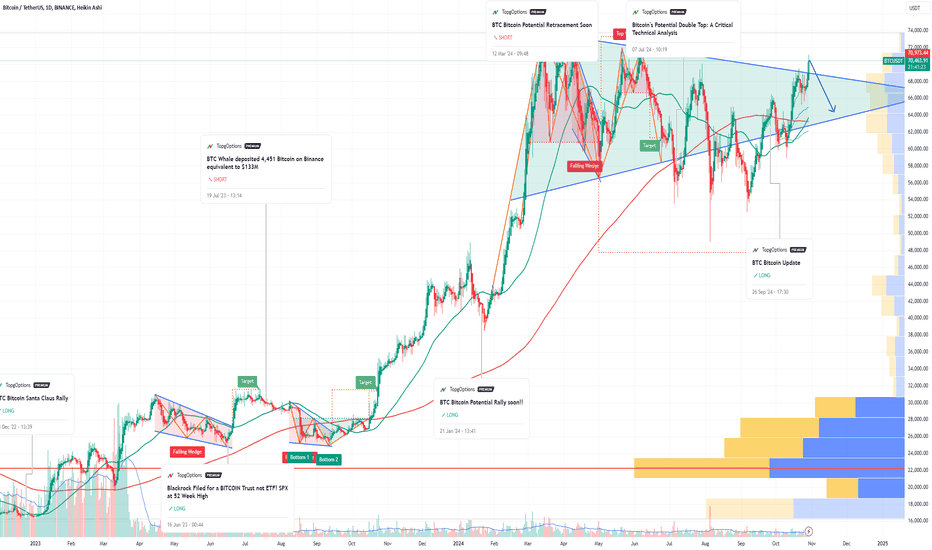

Bitcoin Faces Bearish Pressure Amid Tether InvestigationIf you didn’t purchase BTC before the last rally:

Now Bitcoin's recent performance may be overshadowed by growing concerns surrounding the stability of the cryptocurrency market, particularly in light of the U.S. Department of Justice (DOJ) launching a criminal investigation into Tether, the issuer of the popular stablecoin USDT.

According to reports from the Wall Street Journal, this investigation, spearheaded by the U.S. attorney’s office in Manhattan, is examining potential violations of sanctions and anti-money laundering regulations.

Tether has been a crucial component of the cryptocurrency ecosystem, as its dollar-pegged stablecoin is widely used for trading and liquidity across numerous exchanges. Any negative developments in the investigation could undermine confidence in USDT, leading to broader implications for Bitcoin and other cryptocurrencies that rely on stablecoins for stability and transaction efficiency.

Investors may become increasingly wary, fearing that regulatory actions could restrict Tether's operations or even jeopardize its ability to maintain its peg to the U.S. dollar. A loss of faith in USDT could trigger panic selling, as traders might rush to liquidate their positions in Bitcoin and other assets, leading to increased volatility and downward pressure on prices.

The scrutiny surrounding Tether could prompt regulators to examine other stablecoins and cryptocurrency projects more closely, adding to the uncertainty and potential for further regulatory crackdowns. This environment of increased regulatory oversight could deter new investors from entering the market and may lead existing investors to reassess their positions.

TXN Texas Instruments Incorporated Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TXN Texas Instruments Incorporated prior to the earnings report this week,

I would consider purchasing the 200usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $6.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

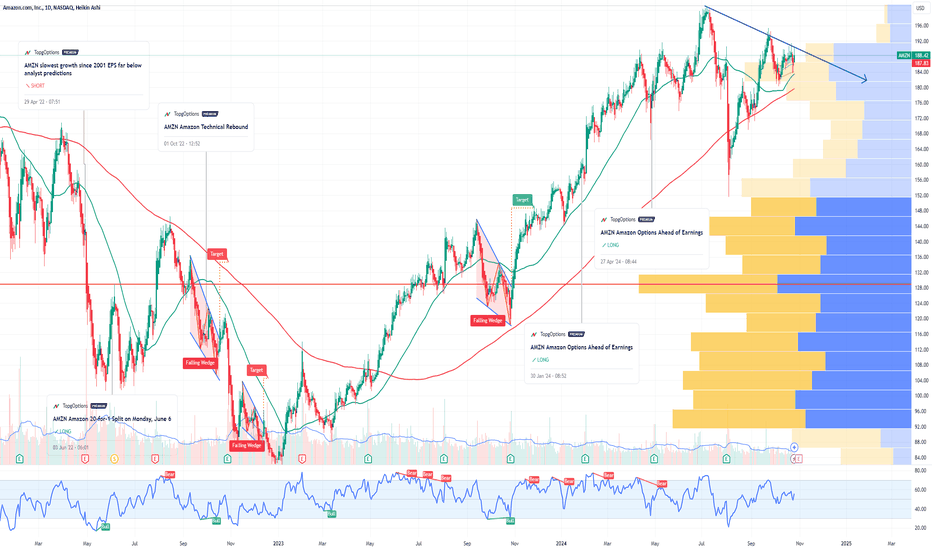

AMZN Amazon Options Ahead of EarningsIf you haven`t bought AMAZN before the previous earnings:

Now analyzing the options chain and the chart patterns of AMZN Amazon prior to the earnings report this week,

I would consider purchasing the 190usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $11.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

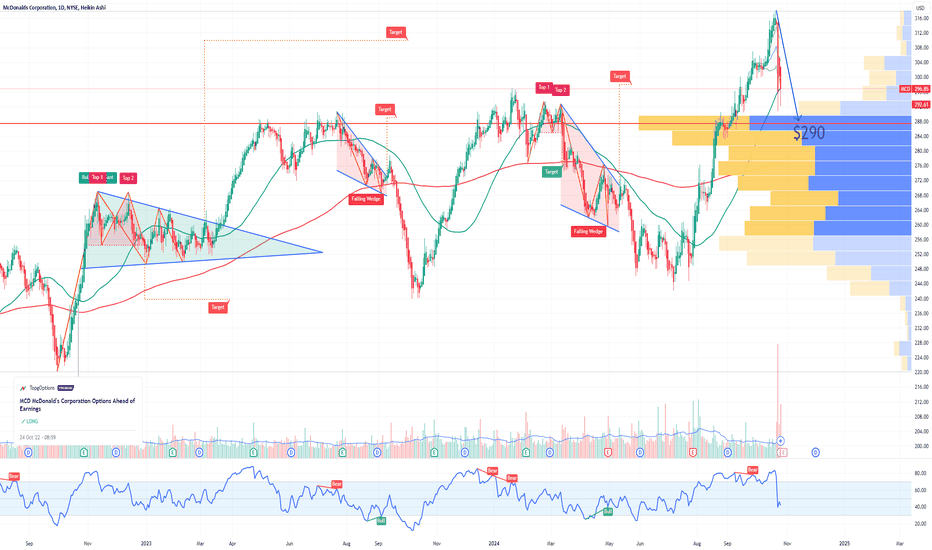

MCD McDonald's Corporation Options Ahead of EarningsIf you haven`t bought MCD before the previous earnings:

Now analyzing the options chain and the chart patterns of MCD McDonald's Corporation prior to the earnings report this week,

I would consider purchasing the 290usd strike price Puts with

an expiration date of 2024-11-15,

for a premium of approximately $5.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

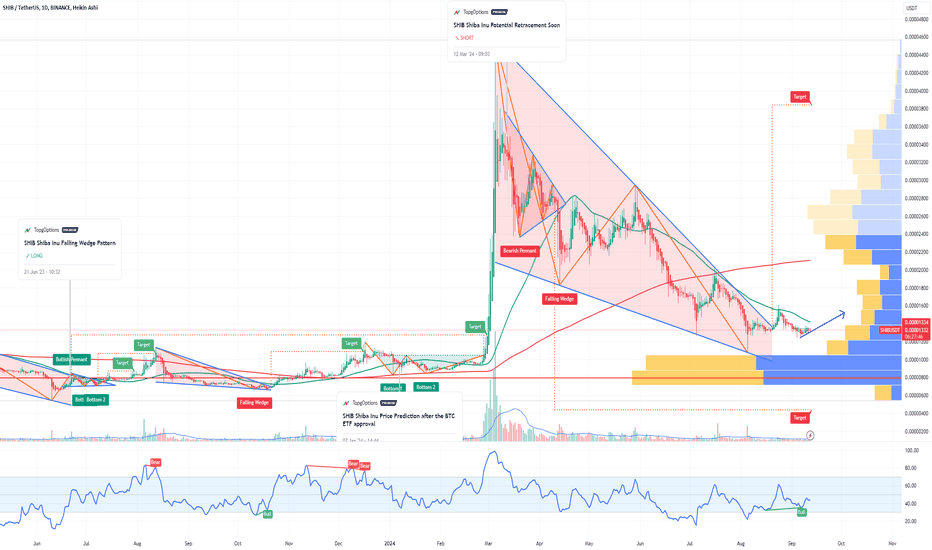

SHIB Shiba Inu Potential breakoutIf you haven`t bought SHIB before the previous rally:

nor sold the top:

Analyzing Shiba Inu’s chart, it appears to be entering a phase of accumulation following the conclusion of a falling wedge pattern, which is often a bullish signal.

Given this setup, I anticipate a potential upward movement in SHIB over the next two weeks as buying pressure builds.

The price action suggests growing momentum, and I’m targeting the next key resistance level at $0.00001500.

This zone could act as a pivotal point for the next leg higher if the bullish sentiment continues to strengthen.

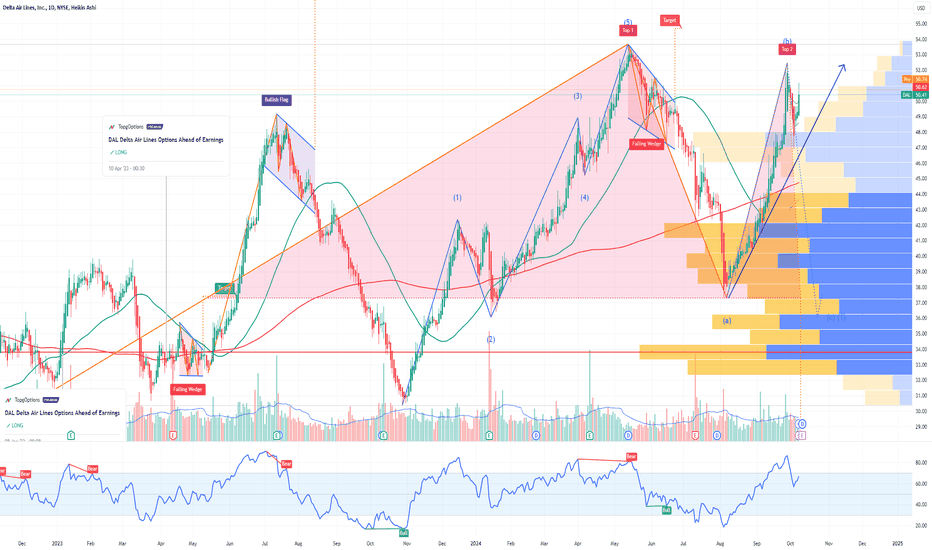

DAL Delta Air Lines Options Ahead of EarningsIf you haven`t bought the dip on DAL:

Now analyzing the options chain and the chart patterns of DAL Delta Air Lines prior to the earnings report this week,

I would consider purchasing the 50usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $3.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

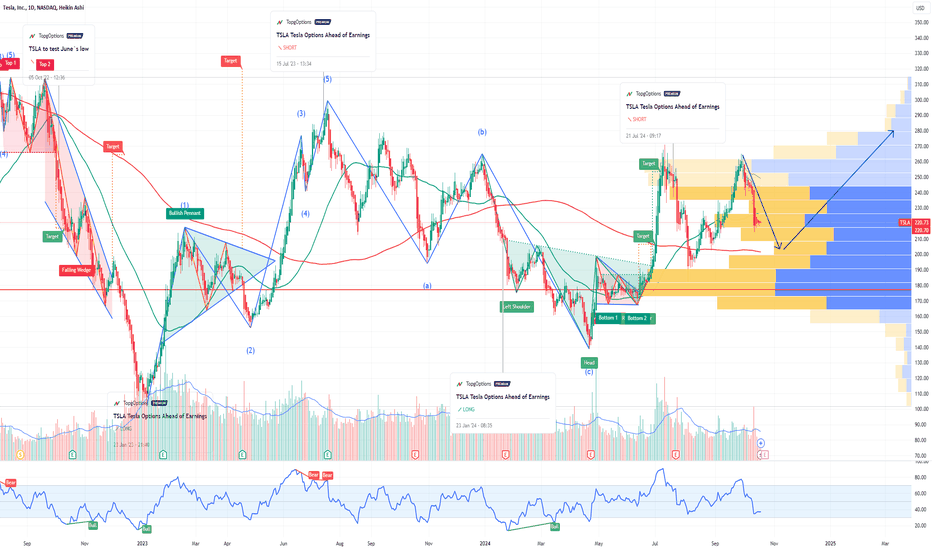

TSLA Tesla Options Ahead of EarningsIf you haven`t bought the dip on TSLA:

Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week,

I would consider purchasing the 210usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $32.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Overall, I’m bullish on TSLA in the long run, so this might just be a short-term play.

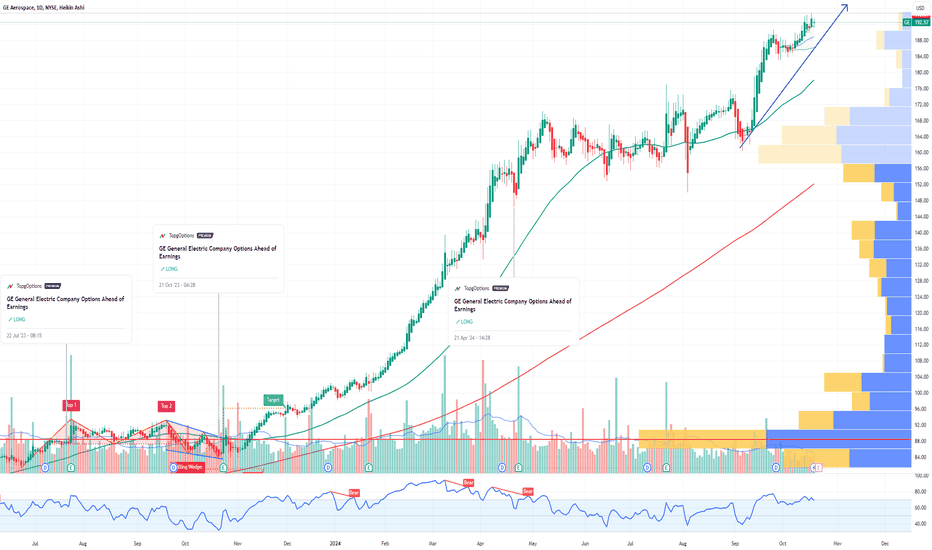

GE Aerospace Options Ahead of EarningsIf you haven`t bought the dip on GE:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 195usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $8.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

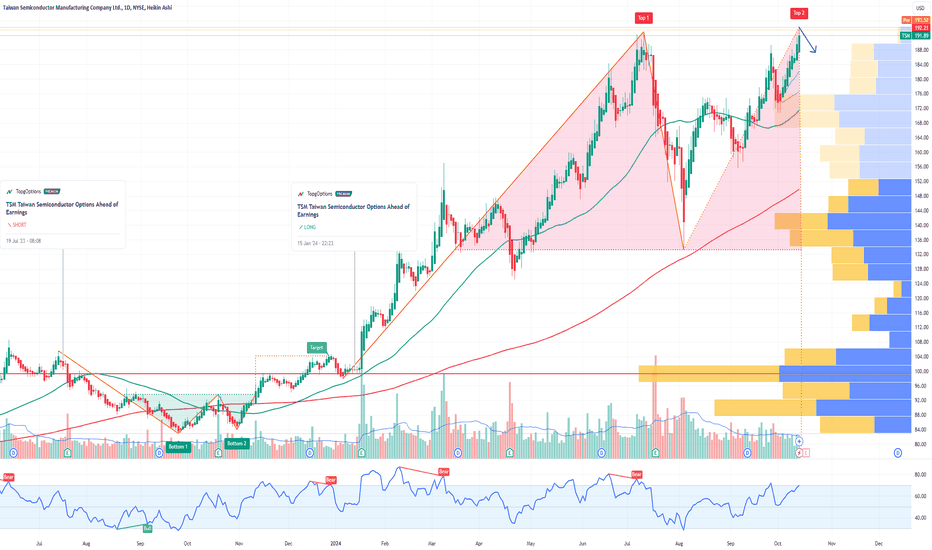

TSM Taiwan Semiconductor Options Ahead of EarningsIf you haven`t bought TSM before the major breakout:

Now analyzing the options chain and the chart patterns of TSM Taiwan Semiconductor Manufacturing Company prior to the earnings report this week,

I would consider purchasing the 190usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $13.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

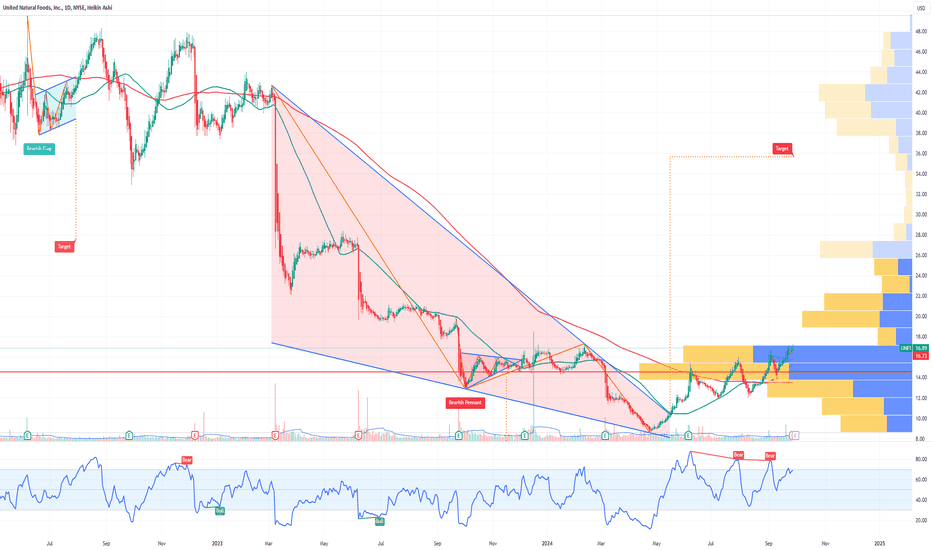

UNFI United Natural Foods Options Ahead of EarningsAnalyzing the options chain and the chart patterns of UNFI United Natural Foods prior to the earnings report this week,

I would consider purchasing the 17usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $1.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LW Lamb Weston Holdings Options Ahead of EarningsIf you haven`t sold LW before the previous earnings:

Now analyzing the options chain and the chart patterns of LW Lamb Weston Holdings prior to the earnings report this week,

I would consider purchasing the 65usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $5.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

WFC Wells Fargo & Company Options Ahead of EarningsIf you haven`t bought the dip on WFC:

Now analyzing the options chain and the chart patterns of WFC Wells Fargo & Company prior to the earnings report this week,

I would consider purchasing the 51usd strike price Puts with

an expiration date of 2024-11-1,

for a premium of approximately $0.24.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

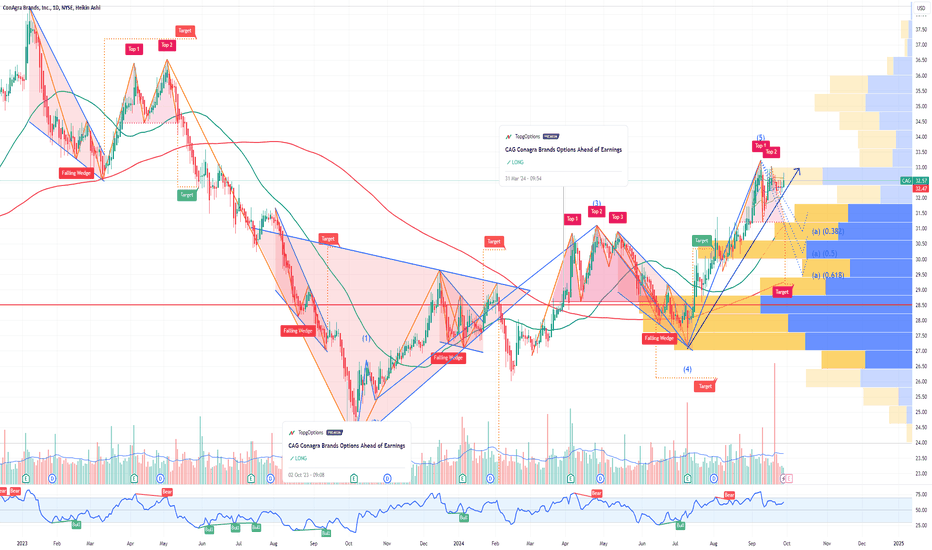

CAG Conagra Brands Options Ahead of EarningsIf you haven`t bought the dip on CAG:

Now analyzing the options chain and the chart patterns of CAG Conagra Brands prior to the earnings report this week,

I would consider purchasing the 32usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $1.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

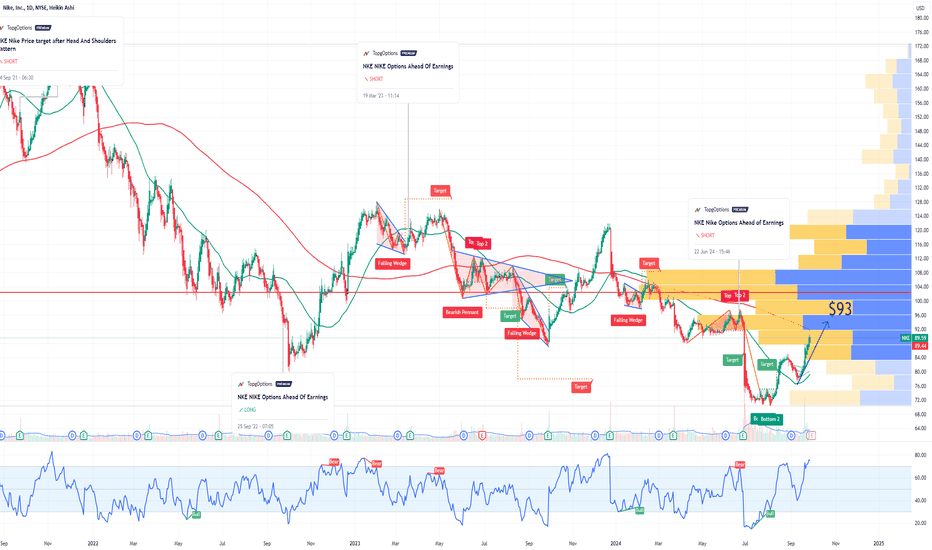

NKE NIKE Options Ahead of EarningsIf you haven`t sold NKE before the previous earnings:

Now analyzing the options chain and the chart patterns of NKE NIKE prior to the earnings report this week,

I would consider purchasing the 93usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $1.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

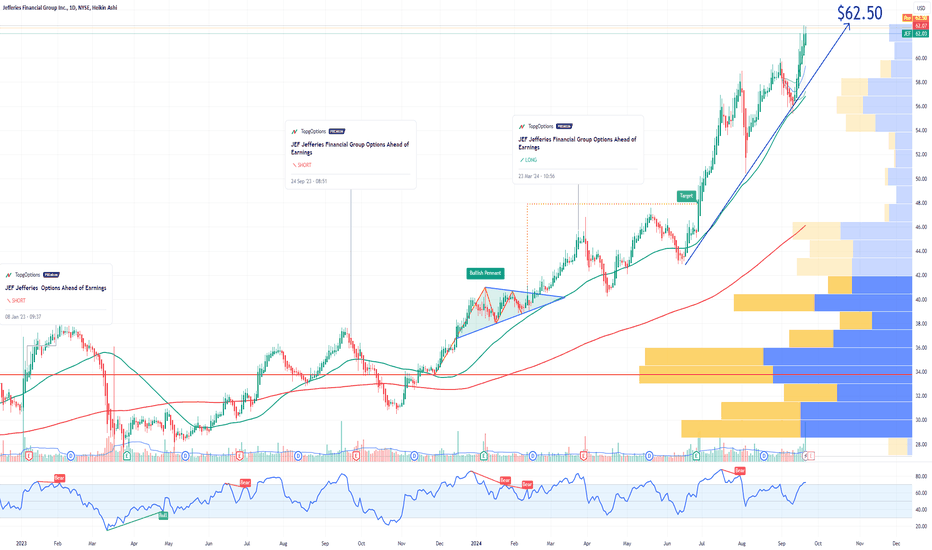

JEF Jefferies Financial Group Options Ahead of EarningsIf you haven`t bought JEF before the previous earnings:

Now analyzing the options chain and the chart patterns of JEF Jefferies Financial prior to the earnings report this week,

I would consider purchasing the 62.50usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $2.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

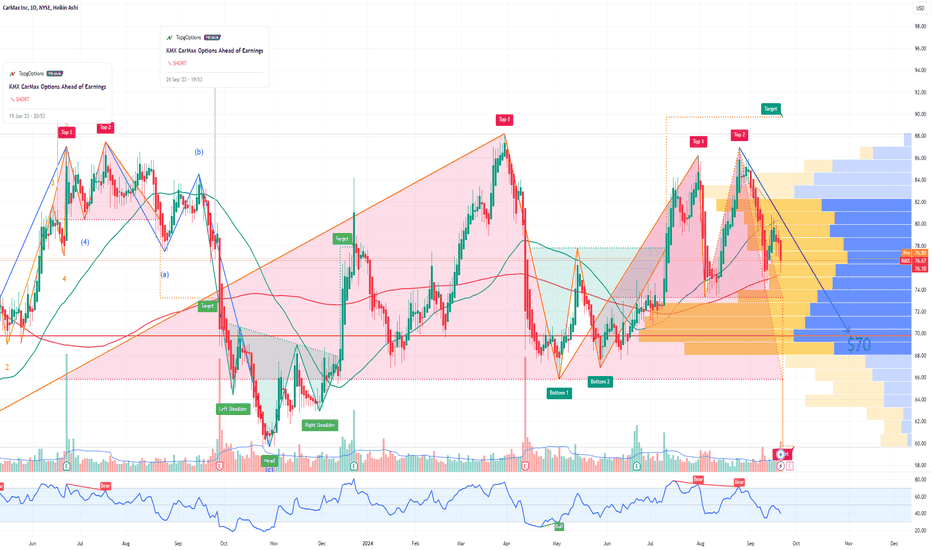

KMX CarMax Options Ahead of EarningsIf you haven`t sold KMX before the previous earnings:

Now analyzing the options chain and the chart patterns of KMX CarMax prior to the earnings report this week,

I would consider purchasing the 70usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $4.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

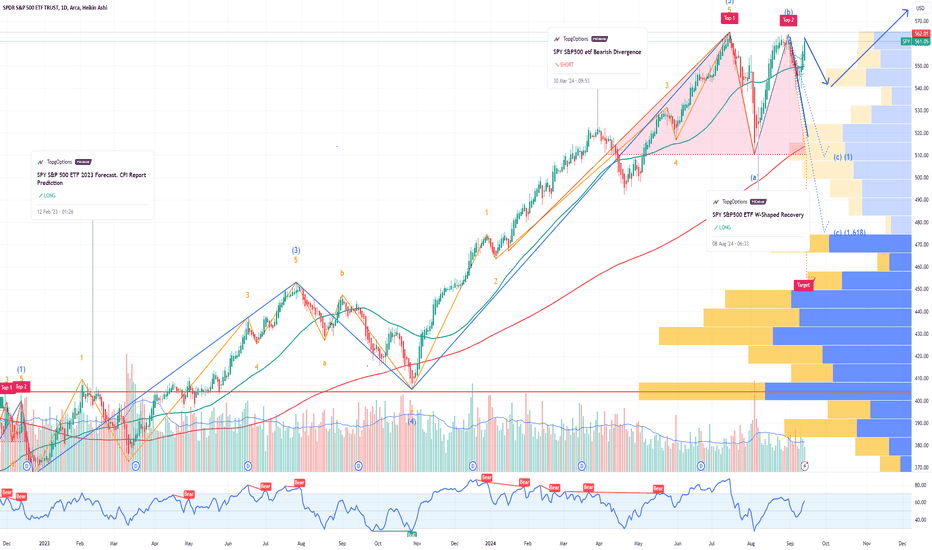

SPY: Short-Term Selloff Anticipated After Fed Rate Cut DecisionIf you haven`t bought the recent dip on SPY:

Now you need to know that as the Federal Reserve approaches its rate cut decision this week, speculation is high that we may see a larger-than-expected cut of 50 basis points rather than the anticipated 25. This could trigger a short-term selloff in equities, including the SPY (S&P 500 ETF), despite the initial market reaction.

The market often exhibits a “buy the rumor, sell the news” behavior, and this situation could be no different. With expectations set for a 25 basis point cut, a surprise 50 basis point reduction might lead to concerns about the underlying economic conditions. This could prompt a selloff in major indices, including SPY, as traders and investors react to the Fed’s unexpected move.

In the immediate aftermath of the Fed decision, SPY might see a brief uptick as market participants adjust their positions and optimism prevails. However, this short-term rally could be quickly overshadowed by a broader correction. As the market digests the implications of the Fed's actions and potential economic concerns come to light, SPY is likely to experience a pullback.

For those looking to capitalize on this potential downturn, the $550 strike price puts expiring on October 18, 2024, could be a prudent choice. These puts offer a strategic way to hedge against or profit from the anticipated short-term decline in SPY. Given the expected correction following the Fed's rate cut, this option could provide significant value as SPY faces downward pressure.

While SPY may experience an initial rise in response to the Fed’s decision, the broader market sentiment is likely to shift towards risk aversion, leading to a correction in the weeks following the announcement. By October 18, the broader market and SPY could be reflecting these adjustments, making the $550 puts a timely investment.

In summary, while SPY might see some early gains next week, a correction is expected to follow as the market reacts to the Fed’s decision. The $550 strike price puts expiring on October 18, 2024, could offer a valuable opportunity for those anticipating this short-term volatility.