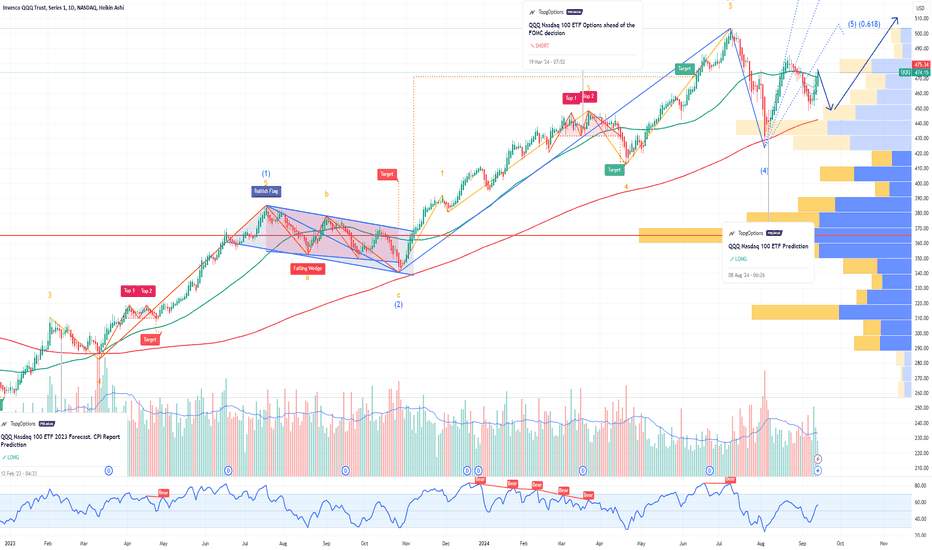

QQQ Short-Term Selloff After the Fed's Rate Cut DecisionIf you haven`t bought the recent dip in QQQ:

Then you need to know that as we approach the Federal Reserve's rate cut decision this week, there is growing speculation that the central bank may implement a larger-than-expected 50 basis point cut, instead of the anticipated 25. While rate cuts are typically viewed as bullish for markets, this unexpected move could trigger a short-term selloff, particularly in tech-heavy indices like the QQQ.

Why? The market tends to operate on a "buy the rumor, sell the news" mentality. Investors have already priced in expectations of a modest 25 bps cut, so if the Fed delivers a more aggressive 50 bps cut, it may signal heightened concern over economic conditions, causing traders to pull back. Such a scenario could spook the market, leading to a temporary selloff in major indices like the Nasdaq 100 (QQQ).

In light of this, it may be worth considering a bearish strategy for the short term. Specifically, the $475 strike price puts expiring on September 20 could be a prudent option, as they stand to gain value in the event of a selloff following the Fed decision. The short-term market reaction could make these puts a strategic play for traders anticipating a dip.

While the reaction to the Fed decision could be sharp in the short term, it’s unlikely to be long-lasting. Market participants will soon digest the news, and I expect a recovery by the end of the month. In fact, by November 5th—U.S. election day—we could see new all-time highs in both the S&P 500 (SPX) and the Nasdaq 100 (NDX).

Fed Chair Jerome Powell has been keen on maintaining market stability, which could give the Democrats a slight edge in the upcoming elections. After all, former President Donald Trump has stated he wouldn’t reappoint Powell if re-elected, possibly adding a political dimension to the Fed’s moves.

In conclusion, while the QQQ might face near-term turbulence due to the Fed’s potentially larger-than-expected rate cut, the broader market is likely to recover soon, with tech stocks regaining their upward momentum as the election approaches. The $475 strike price puts expiring on September 20 could serve as a timely hedge during this brief period of volatility.

Buy-sell-indicators

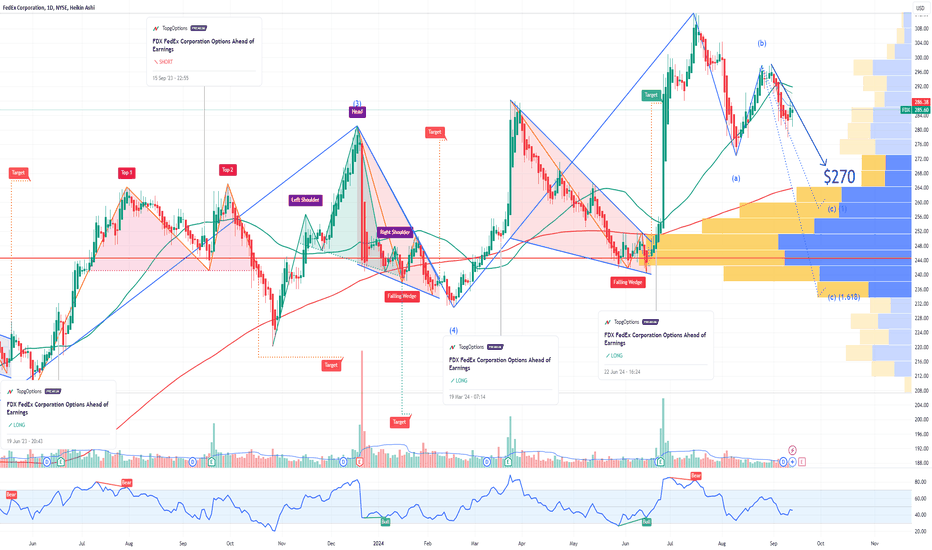

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX before the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 270usd strike price Puts with

an expiration date of 2024-9-20,

for a premium of approximately $4.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TON Toncoin Potential Sell-OffIf you haven`t bought TON before the breakout:

Now you need to know that on August 24, 2024, the arrest of Telegram founder Pavel Durov by French authorities sent shockwaves through both the platform and its cryptocurrency, Toncoin (TON).

Durov's arrest, reportedly tied to illegal activities on Telegram, has been widely seen as an attack on free speech, which has paradoxically boosted interest in both Telegram and Toncoin.

This spotlight on Durov and his platforms presents both challenges and opportunities.

While the surge in activity signals increased attention, the future is uncertain.

The ongoing investigation and heightened regulatory scrutiny are likely to impact TON's market performance.

Investors and users are closely watching for further legal actions, as they could have significant consequences for Telegram and Toncoin.

With the regulatory landscape in flux, TON remains a risky investment until the legal situation stabilizes.

My price target for TON is $2.15.

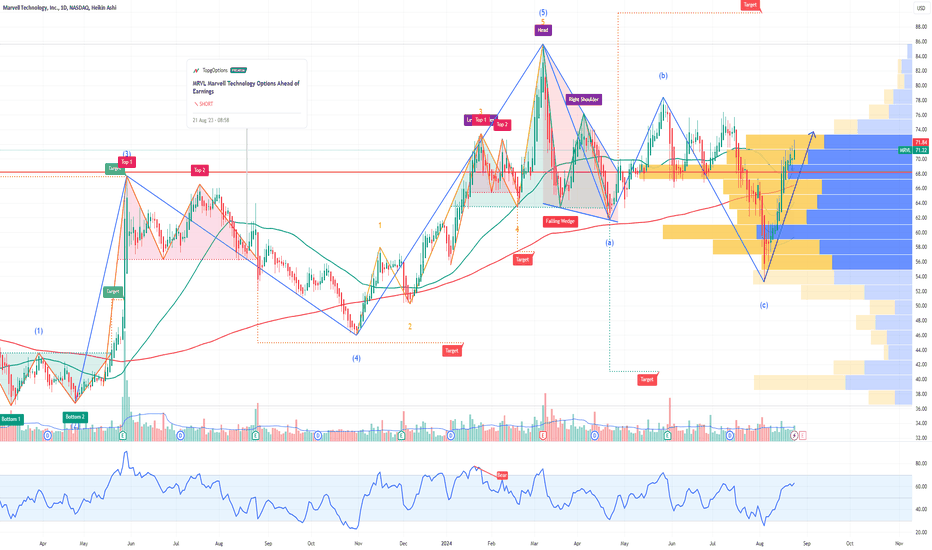

MRVL Marvell Technology Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MRVL Marvell Technology prior to the earnings report this week,

I would consider purchasing the 70usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $9.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

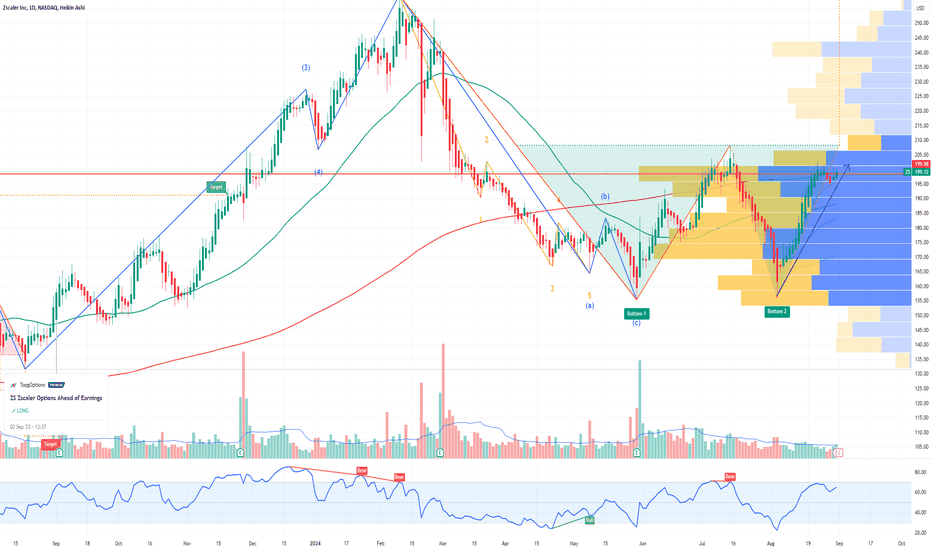

ZS Zscaler Options Ahead of EarningsIf you haven`t bought the dip on ZS:

Now analyzing the options chain and the chart patterns of ZS Zscaler prior to the earnings report this week,

I would consider purchasing the 200usd strike price Calls with

an expiration date of 2024-9-20,

for a premium of approximately $11.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

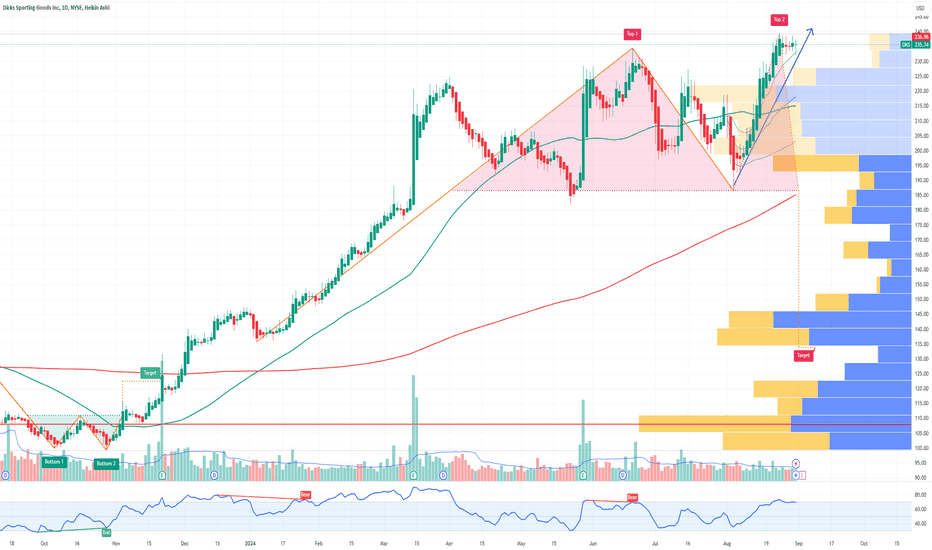

DKS DICK'S Sporting Goods Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DKS DICK'S Sporting Goods prior to the earnings report this week,

I would consider purchasing the 240usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $24.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

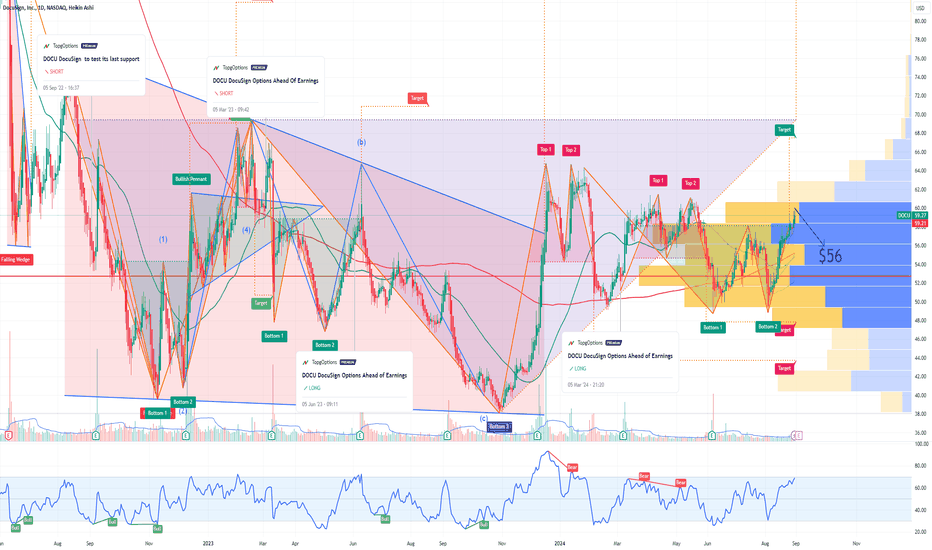

DOCU DocuSign Options Ahead of EarningsIf you haven`t bought DOCU before the previous earnings:

Now analyzing the options chain and the chart patterns of DOCU DocuSign prior to the earnings report this week,

I would consider purchasing the 59usd strike price Puts with

an expiration date of 2024-9-6,

for a premium of approximately $2.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

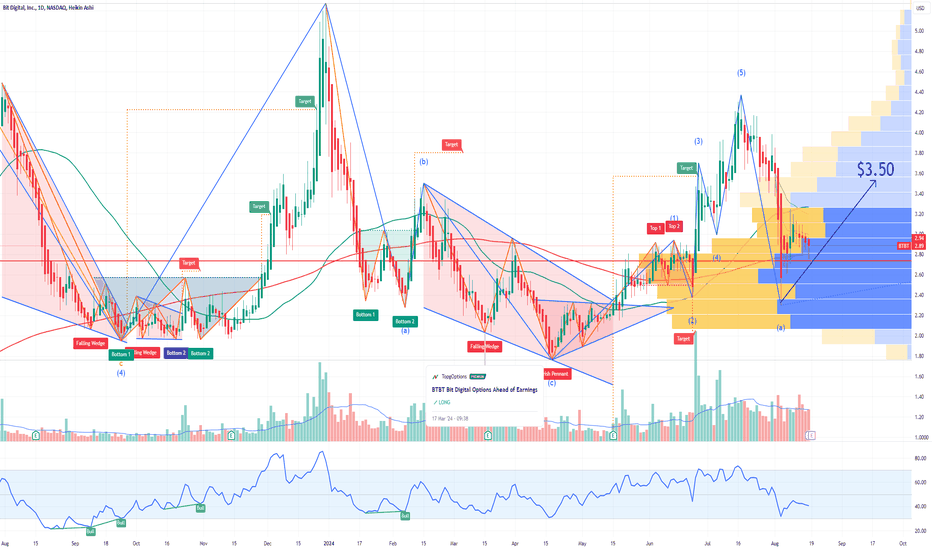

BTBT Bit Digital Options Ahead of EarningsIf you haven`t bought BTBT before the previous earnings:

Now analyzing the options chain and the chart patterns of BTBT Bit Digital prior to the earnings report this week,

I would consider purchasing the 3.50usd strike price Calls with

an expiration date of 2024-9-20,

for a premium of approximately $0.27.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CHWY Chewy Options Ahead of EarningsIf you haven`t sold CHWY before the selloff:

Now analyzing the options chain and the chart patterns of CHWY Chewy prior to the earnings report this week,

I would consider purchasing the 28.50usd strike price Calls with

an expiration date of 2024-8-30,

for a premium of approximately $1.21.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

S SentinelOne Options Ahead of EarningsIf you haven`t bought S before the previous earnings:

Now analyzing the options chain and the chart patterns of S SentinelOne prior to the earnings report this week,

I would consider purchasing the 27usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $2.07.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

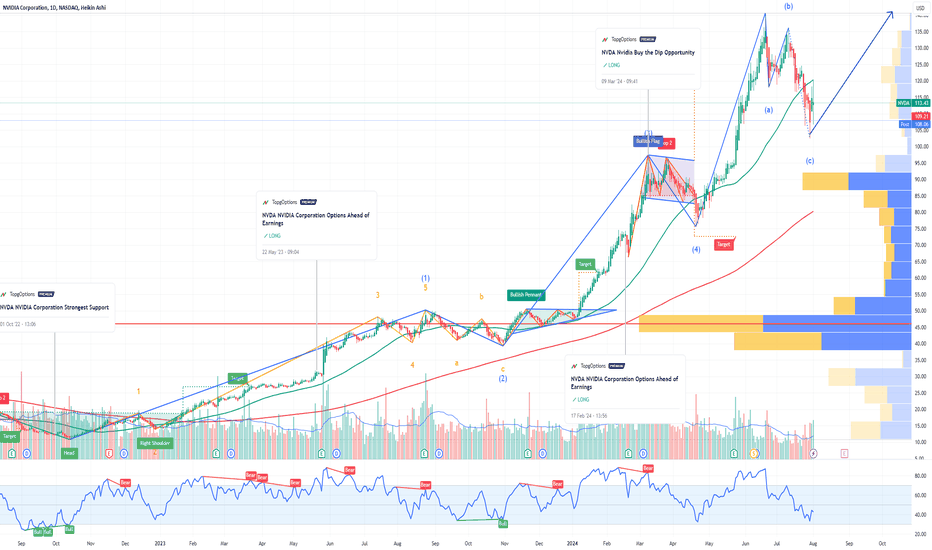

NVDA Nvidia Buy the Dip OpportunityIf you haven`t bought NVDA before the breakout:

It's important to note that the leading company in Artificial Intelligence is currently trading at a Forward P/E ratio of 29.48. This valuation suggests it might be relatively inexpensive for investors considering a long-term position. Given the company's strong market position and growth potential in the AI sector, this could be an opportune time to enter, especially if you believe in the sustained growth and innovation of the industry. The Forward P/E ratio is a key indicator of expected future earnings and, at this level, it indicates that Nvidia is reasonably priced in comparison to its future earning potential.

My price target for the end of the year is $140-145.

Sleeping Giant Awakes: Gold's Path to $2,800If you haven`t bought Gold before the previous breakout:

Now I am optimistic that GOLD is on the cusp of reaching a new all-time high, with a target of $2,800 by year's end, driven by a significant breakout.

The bullish sentiment is clearly reflected in the options chain for major gold miners!

Provided that gold maintains its position above the crucial support level of $2,428, the bullish trajectory remains intact. We foresee gold not only surpassing its historical high of $2,483 in the near future but also advancing to $2,800.

After lying dormant for many years, this sleeping giant appears ready to awaken and exhibit remarkable growth.

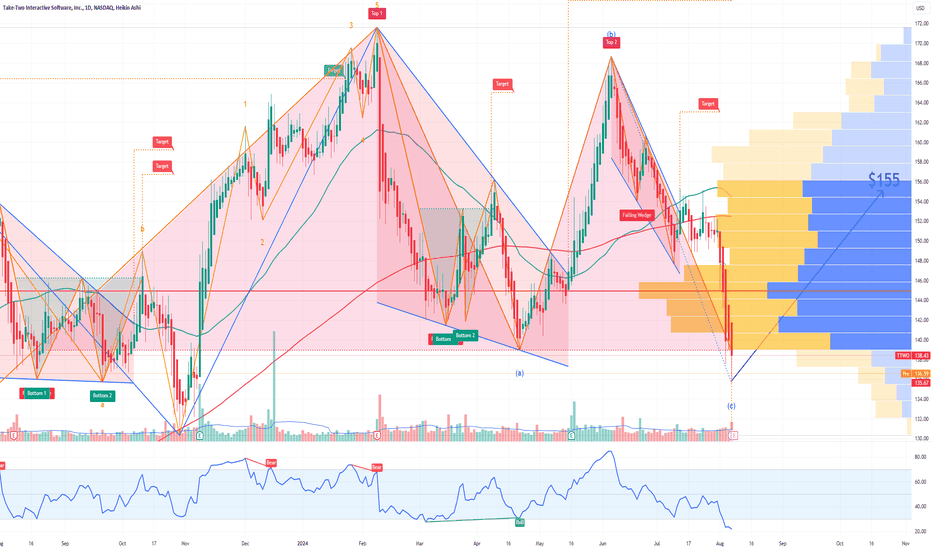

TTWO Take-Two Interactive Software Take-Two Interactive SoftwareAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 155usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $6.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

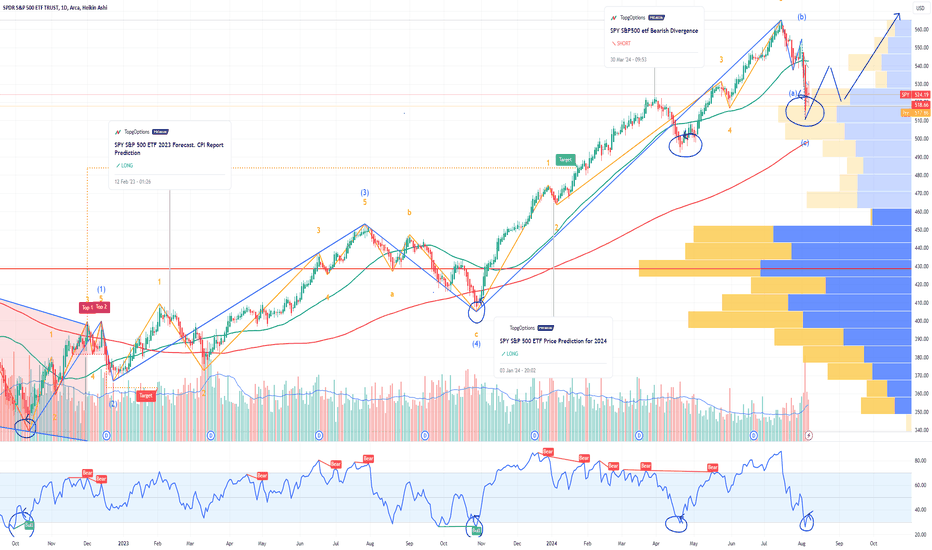

SPY S&P500 ETF W-Shaped RecoveryIf you haven`t bought the previous correction:

Now historically, the SPY S&P500 ETF has demonstrated a consistent pattern where a Relative Strength Index (RSI) at or below 30 triggers buying activity.

This technical indicator, typically viewed as signaling an oversold condition, has reliably attracted investors looking to capitalize on perceived undervaluation.

As a result, these dips have been quickly bought up, suggesting a strong market tendency to rebound from such low RSI levels.

I expect the recovery to be V-shaped or W-shaped, ending the year higher.

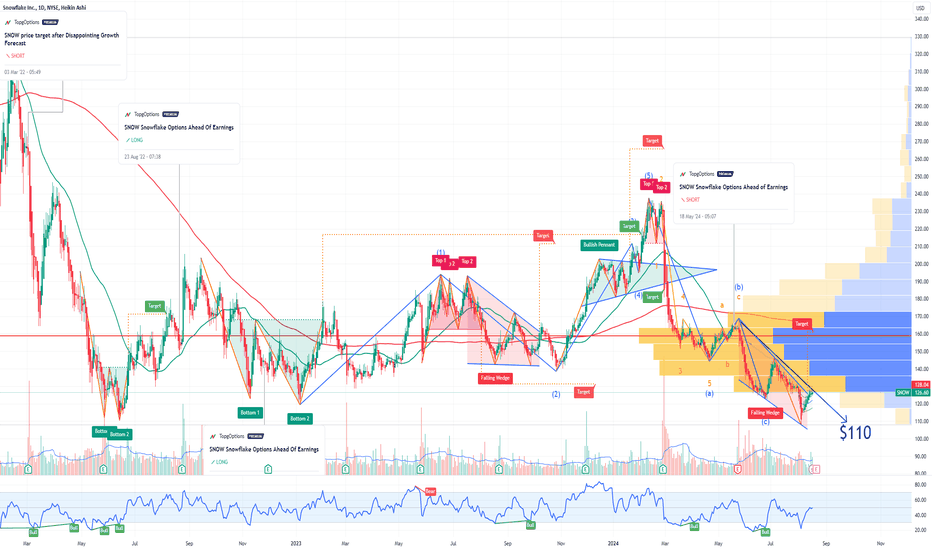

SNOW Snowflake Options Ahead of EarningsIf you haven`t sold SNOW before the previous earnings:

Now analyzing the options chain and the chart patterns of SNOW Snowflake prior to the earnings report this week,

I would consider purchasing the 110usd strike price Puts with

an expiration date of 2024-9-20,

for a premium of approximately $2.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

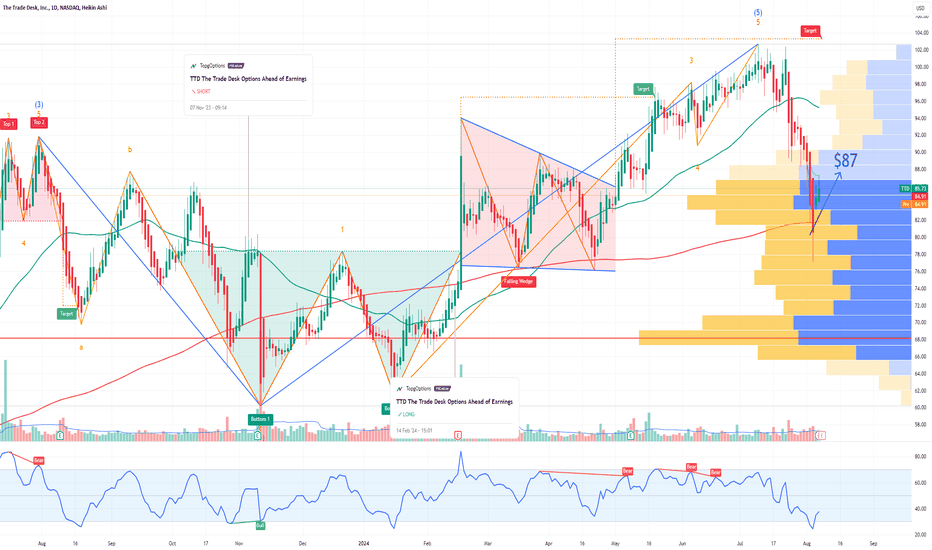

TTD The Trade Desk Options Ahead of EarningsIf you haven`t bought the dip on TTD:

Now analyzing the options chain and the chart patterns of TTD The Trade Desk prior to the earnings report this week,

I would consider purchasing the 87usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $4.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

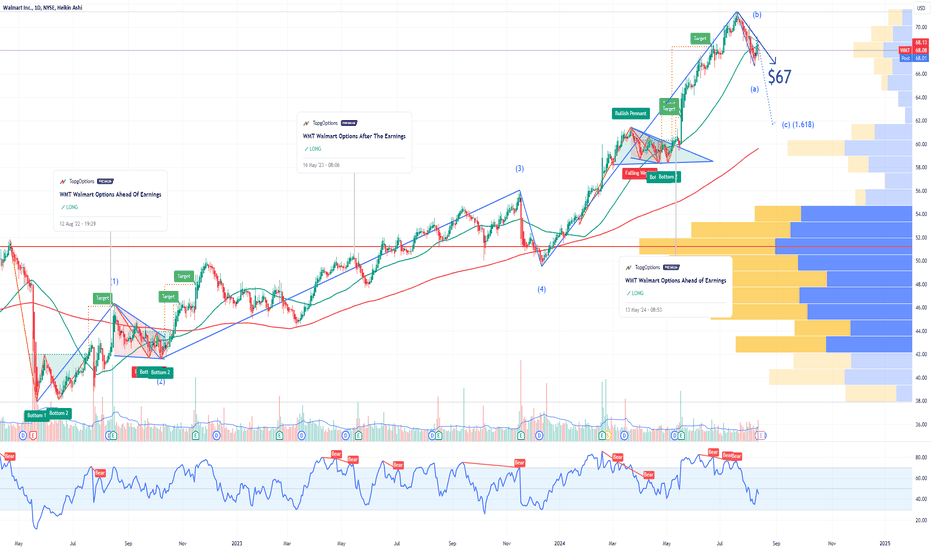

WMT Walmart Options Ahead of EarningsIf you haven`t bought WMT before the previous earnings:

Now analyzing the options chain and the chart patterns of WMT Walmart prior to the earnings report this week,

I would consider purchasing the 67usd strike price Puts with

an expiration date of 2024-8-16,

for a premium of approximately $1.46.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

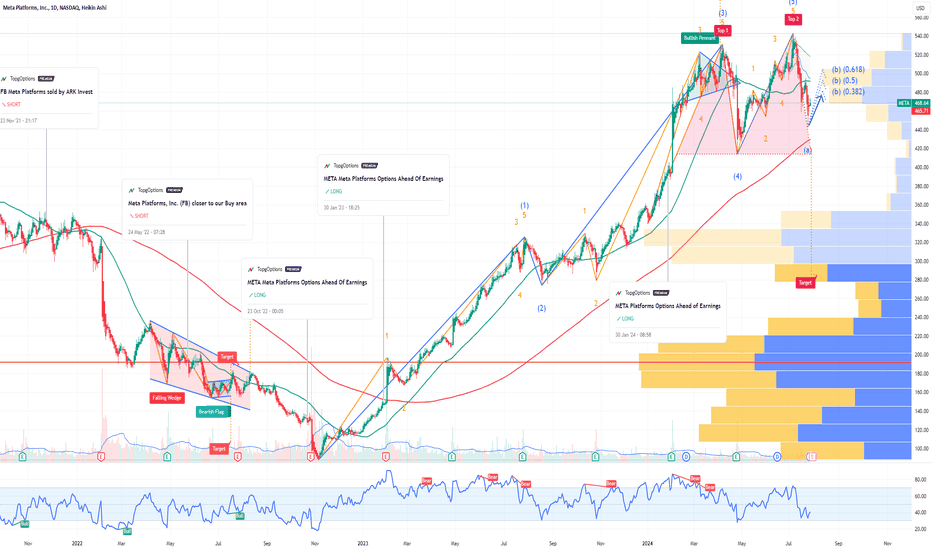

META Platforms Options Ahead of EarningsIf you haven`t bought META before the previous earnings:

Now analyzing the options chain and the chart patterns of META Platforms prior to the earnings report this week,

I would consider purchasing the 465usd strike price Calls with

an expiration date of 2024-8-2,

for a premium of approximately $22.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

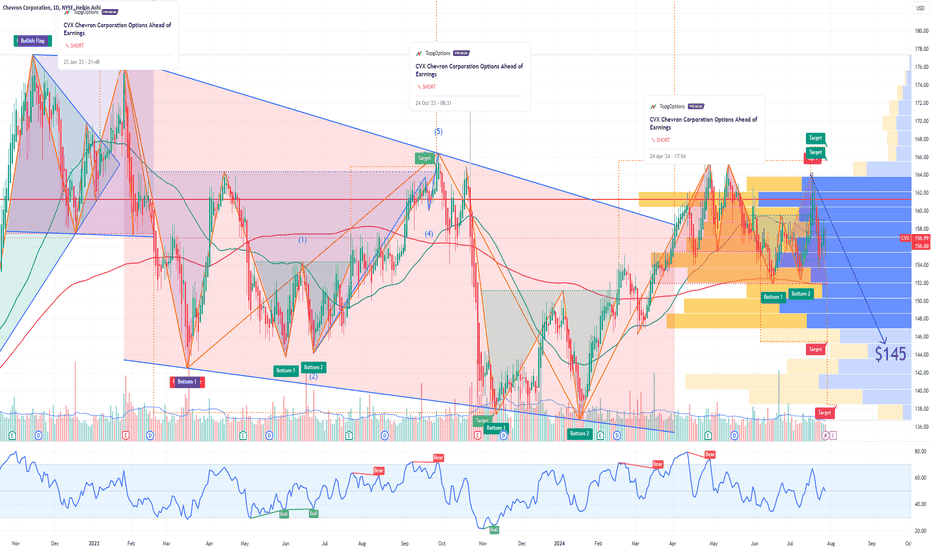

CVX Chevron Corporation Options Ahead of EarningsIf you haven`t sold CVX before the previous earnings:

Now analyzing the options chain and the chart patterns of CVX Chevron Corporation prior to the earnings report this week,

I would consider purchasing the 145usd strike price Puts with

an expiration date of 2024-12-20,

for a premium of approximately $4.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

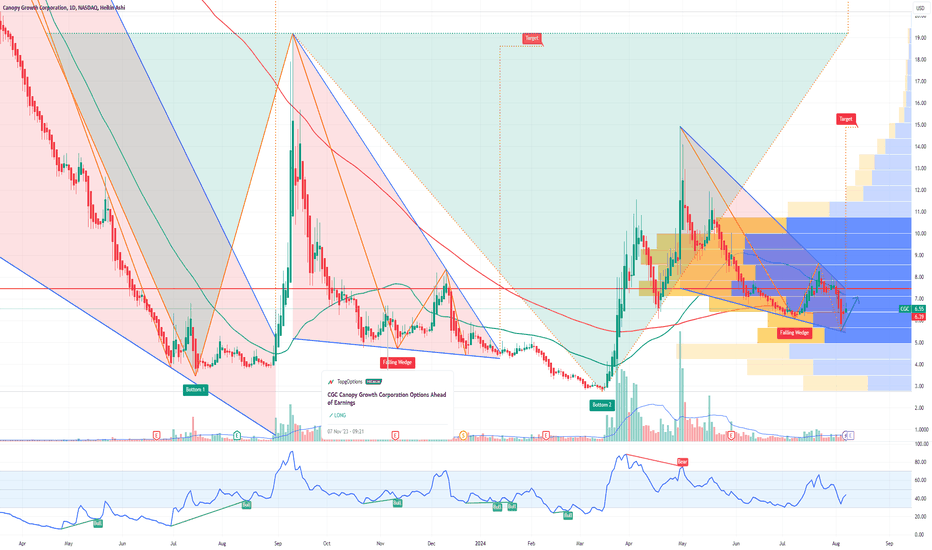

CGC Canopy Growth Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CGC Canopy Growth Corporation prior to the earnings report this week,

I would consider purchasing the 6usd strike price Calls with

an expiration date of 2024-8-9,

for a premium of approximately $0.48.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

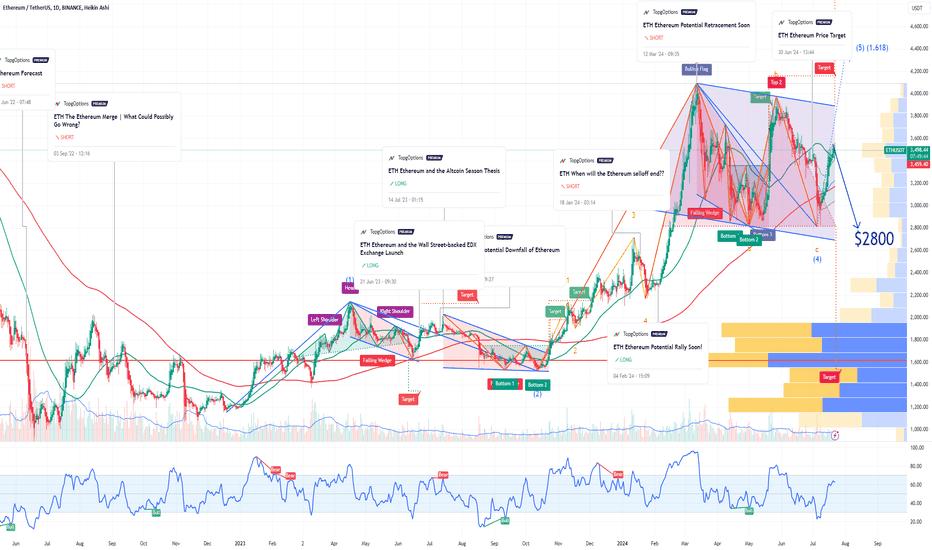

ETH Ethereum ETFs Set to Launch. Short Term Price TargetIf you haven`t sold the top on ETH:

Then you need to know that the Chicago Board Options Exchange (CBOE) has announced that five spot Ethereum exchange-traded funds (ETFs) are slated to begin trading on July 23, pending regulatory approval.

However, the launch of these Ethereum ETFs could lead to a price decline similar to what was observed with Bitcoin.

After the launch of the spot Bitcoin ETFs in January 2024, Bitcoin experienced a notable drop in its price. Initially, Bitcoin was trading above $48,000 but then plummeted to as low as $38,700 on January 23, 2024.

This represents a nearly 20% decline from its high. The initial drop of 5% was observed shortly after the ETFs went live, attributed to profit-taking behavior and market dynamics.

For Ethereum, a similar scenario could unfold. The influx of capital and the heightened attention could initially drive up prices. However, once the ETFs start trading, profit-taking behavior might set in, potentially causing Ethereum's price to fall by 5% to 20%.

Investors should be prepared for potential volatility surrounding the launch date.

My Price Target is $2800.

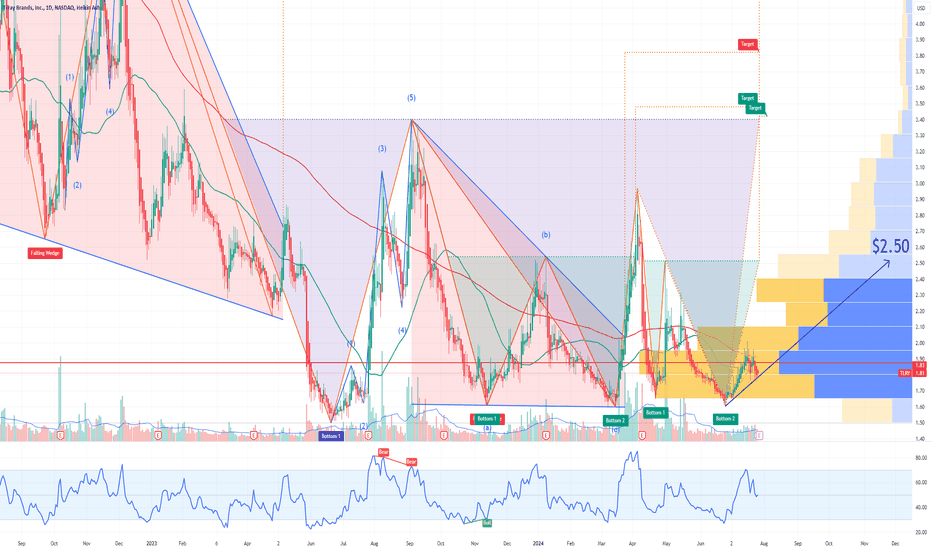

TLRY Tilray Brands Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 2.50usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.29.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

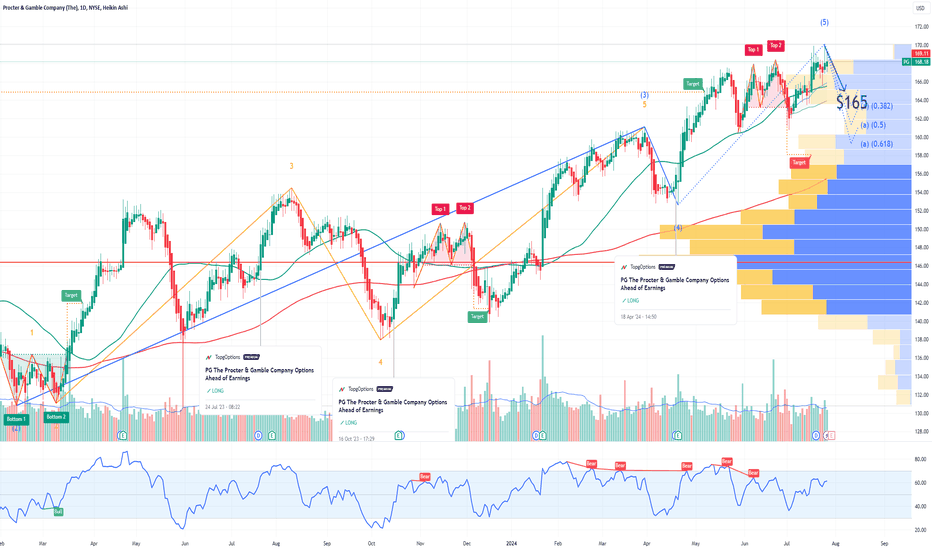

PG The Procter & Gamble Company Options Ahead of EarningsIf you haven`t bought PG before the previous earnings:

Now analyzing the options chain and the chart patterns of PG The Procter & Gamble Company prior to the earnings report this week,

I would consider purchasing the 165usd strike price Puts with

an expiration date of 2024-9-20,

for a premium of approximately $2.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.