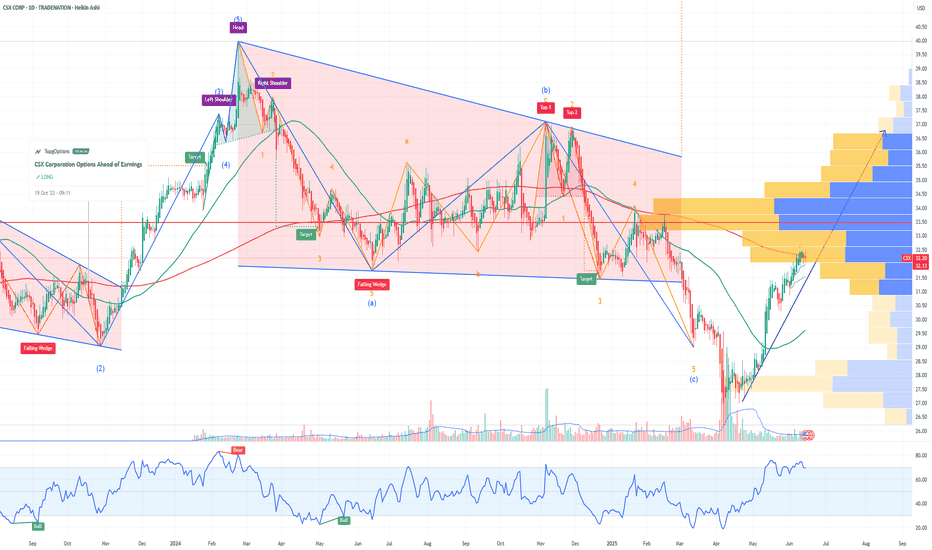

Why CSX Corporation CSX Could Reach $37.50 by the End of 2025If you haven`t bought CSX ahead of the previous earnings:

Now CSX Corporation CSX, a leading North American rail freight operator, is positioned for a meaningful upside in 2025, with a realistic price target of $37.50. This target is supported not only by strong fundamentals and industry tailwinds but also by recent options market activity showing significant call option interest at the $37 strike price, indicating growing investor conviction around this level.

1. Strong Options Market Signals at $37.50

Recent options data reveals a notable concentration of call open interest and volume at the $37 strike price in the CSX options chain, especially for near- and mid-term expirations.

This elevated activity suggests that institutional and retail investors are positioning for a rally toward $37–$38, reflecting confidence that the stock will surpass $35 and approach $37.50 by year-end.

The options market’s pricing and demand at this level provide a real-time, market-driven validation of the $37.50 target, adding weight to the fundamental bullish case.

2. Analyst Price Targets and Upward Revisions Support $37.50+

Several analysts have price targets ranging from $35 up to $38–$39, with recent upward revisions reflecting improving operational metrics and resilient demand.

Bank of America and Goldman Sachs, among others, have raised targets closer to or above $35, and the options market activity suggests investors expect further upside beyond these levels.

3. Operational Improvements and Network Optimization

CSX continues to address past network challenges, improving service reliability and operational efficiency, which are expected to drive volume growth in key sectors such as agriculture, minerals, and intermodal freight.

These improvements are critical for margin expansion and revenue growth, underpinning the stock’s appreciation potential.

4. Favorable Macroeconomic and Industry Tailwinds

The resilient U.S. economy and ongoing federal infrastructure investments support sustained freight demand.

Rail’s environmental advantages and cost efficiency over trucking position CSX to capture increased market share as companies seek sustainable logistics solutions.

5. Financial Strength and Shareholder Returns

CSX boasts strong free cash flow generation, enabling consistent dividend growth and share repurchases.

The company’s valuation remains attractive relative to peers, with a P/E around 15.5 and a dividend yield near 1.4%, making it appealing for both growth and income investors.

6. Technical Support and Market Sentiment

The stock has held solid support near $30–$31 and is trading near $34.60 as of mid-June 2025, showing resilience amid market volatility.

Positive sentiment from institutional investors and steady trading volumes reinforce the potential for a breakout toward $37.50.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Buy-sellsignal

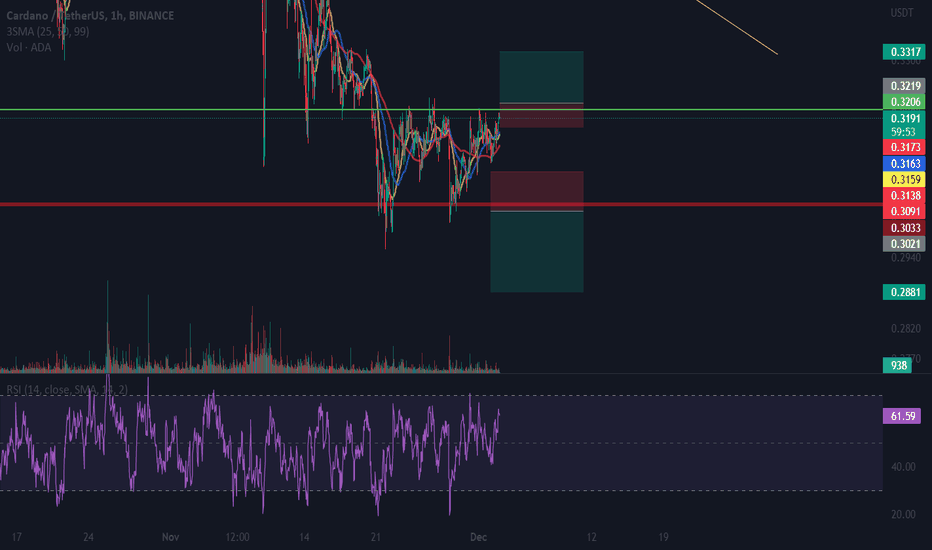

ALPHA/USDT / BINANCE / TECHNICAL ANALYSIStomorrow is the event of alpha usdt

so i will share our analysis with u

buy/sell

buy alpha at 0.75

sell target = 0.98 almost 30% profit

our only 1 request with u are u satisfy with my idea soo don't forgot to like

becoz i am much happy after gaining likes :)

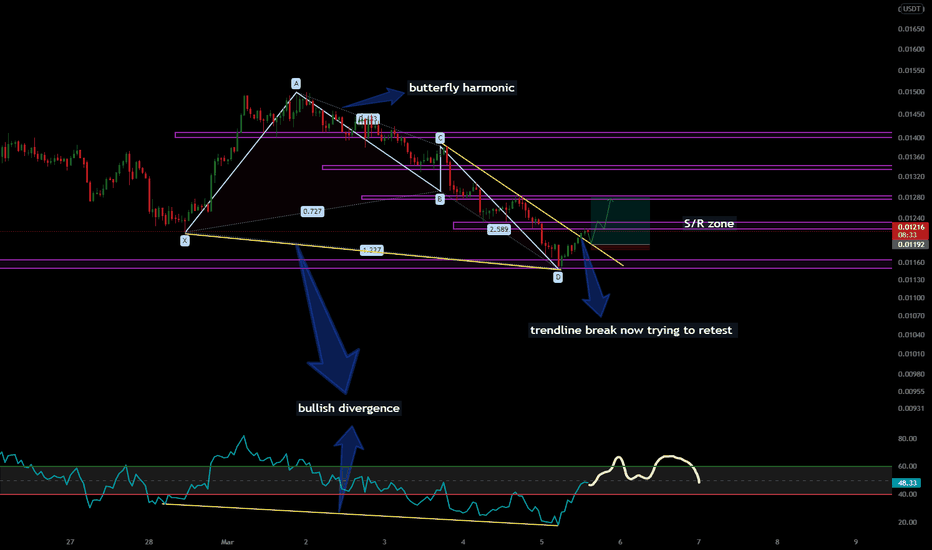

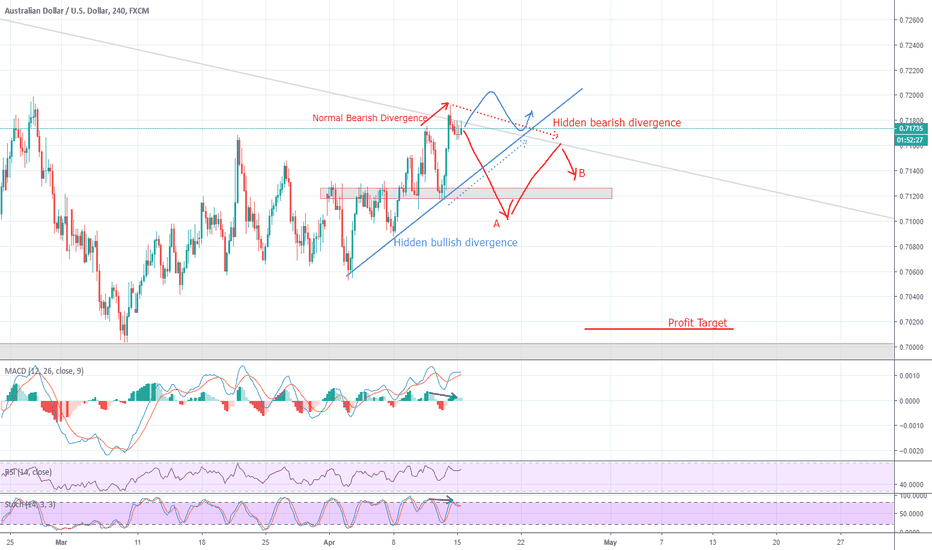

AUD/USD scenariosAUDUSD has finally reached the daily descending trendline and formed a normal bearish divergence on the H4 timeframe. If the price bounces from the trendline and falls under the last low on H4, a short position may be opened in an aggresive manner or, if your trading style is on the conservative side, a short position may be opened after the prices finishes a corrective movement and forms a hidden bearish divergence. In case the price climb higher, long positions may be opened after the price makes a corrective movement regressing back to the ascending trendline on the H4 timeframe while forming a hidden bullish divergence in regards to the last low.

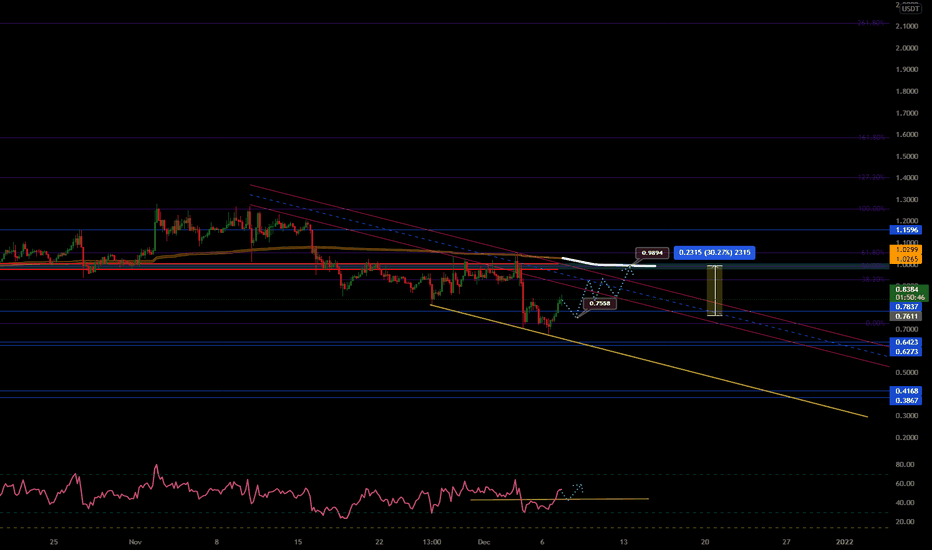

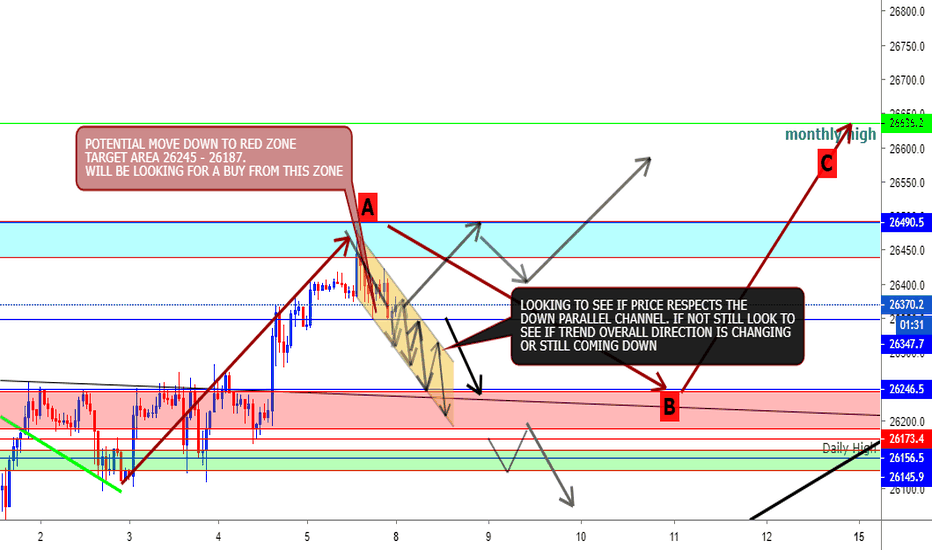

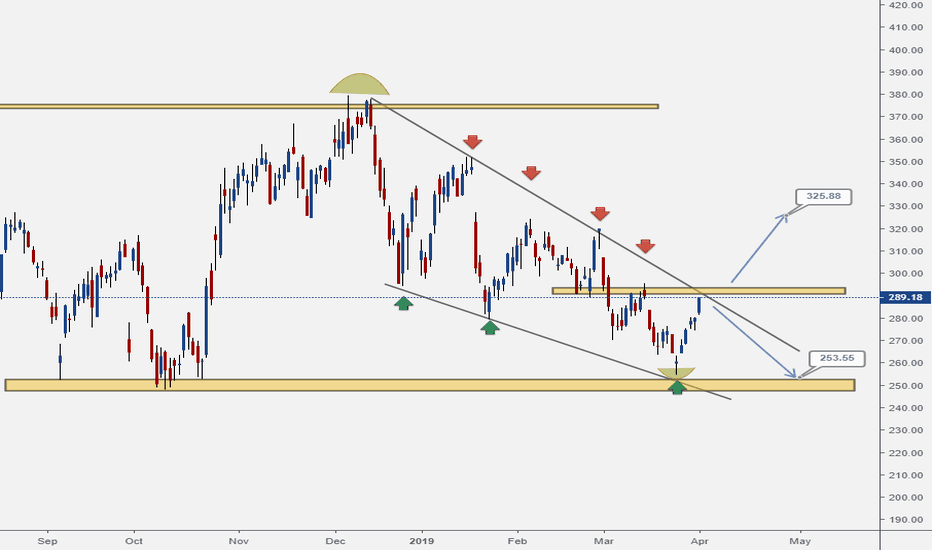

US30 ANALYSISUS30 is always an interesting chart for me to analyse.

we have a ABC directional trend in the red arrows showing us that we could see price reaching a monthly high.

my main focus right now is seeing if price respects the down diagonal parallel channel, if this is the case then we can enter short term buys & Sells from a intraday perspective.

with the sentiment showing around 70% sells right now from the market i am expecting the market movers to continue driving the price higher ultimately to flush everybody out.

therefore i am expecting the Red zonal box to be reached/ touched by the market before seeing a big bullish rally up to the monthly high.

as most of you may know the US30 moves very quickly but also sometimes slowly so lets wait and see what happens throughout the week.

Follow our Youtube Channel and please like, subscribe and share!

Social media platforms

Youtube: Learnitempire

Instagram: Vellly

Instagram : Learnitempire

if you connect to our social medias via this trading view post kindly put #Tradingview in our comment section so that we can send you some more set ups directly to you!

Remember

Every day is money day

EVRI looks quite long orientatedEveri Holdings Inc. looks pretty good after a down trend and now chances to go higher in accordance with earnings. Nevertheless in the light of technical analysis the chances for down trend are quite high.

So, as traders, we need to be ready to both scenarios and there are our usual two plans:

Plan A : we need to wait until todays markets close to make the final decision, if it's appropriate for long, we'll buy ASAP.

Plan B : in the case the price shows weakness before or after we open positions, we need to be ready tern positions to short.

For more ideas visit: mercuriusam.wordpress.com