Gold holds its bullish momentum - Strategy 1000 pips ? Hello everyone, what do you think about gold prices?

Yesterday, gold ended the session near the key psychological level of 3,400 USD. Overall, the metal remains in a short-term uptrend.

Some immediate supporting factors include:

-Concerns about the US economy – The Fed may soon have to cut interest rates, weakening the USD and making gold more attractive.

-Geopolitical uncertainty – Trade tensions between the US and India over Russian oil imports are prompting investors to turn to gold.

-Financial market volatility – Global equities show signs of a pullback after a strong rally, driving defensive capital flows into gold to reduce portfolio risk.

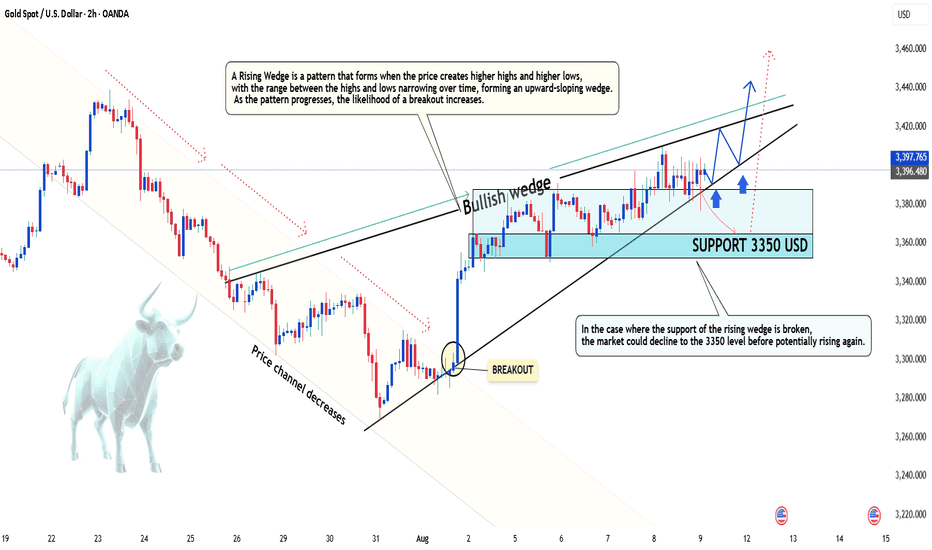

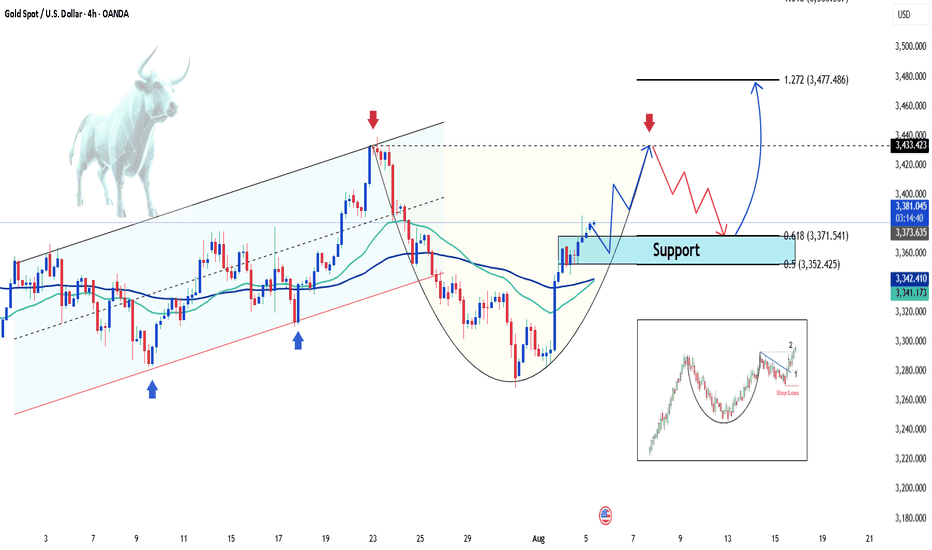

From a technical perspective: XAUUSD is maintaining a steady upward trend after breaking out of its previous down channel and forming a Rising Wedge pattern. On the chart, prices are consistently creating higher highs and higher lows, with the range narrowing over time — a sign that the market is consolidating before a potential breakout.

Currently, the lower boundary of the wedge is acting as support. If prices hold above this level, the primary scenario remains a move higher toward the 3,433 to 3,450 USD resistance zone. Conversely, if the wedge’s support is broken, the price could retrace to 3,350 USD before the uptrend resumes.

And you — what’s your view on XAUUSD’s next move? Share your thoughts in the comments!

Buy-signal

EURUSD : Buy to Win ? Hello everyone, what’s your view on FX:EURUSD trend?

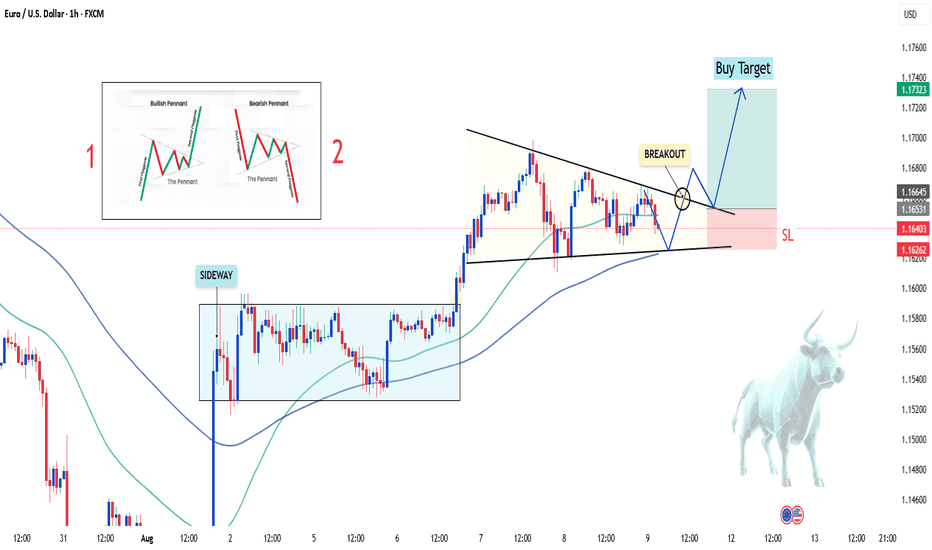

EURUSD is currently forming its first Bullish Pennant pattern after a strong upward move, suggesting a high probability that the market will continue to push higher.

On the H1 chart, after a period of sideways movement, the price has broken out and entered a narrowing consolidation zone – a hallmark of the pennant pattern. The short-term EMA remains above the long-term EMA, supporting the bullish bias.

Preferred scenario: If the price breaks clearly above the upper boundary of the pattern, the buying target will be in the 1.17xx zone.

This pattern often appears in the middle of a trend, so if the breakout is successful, the rally could extend with stronger buying momentum.

Good luck!

Kevinn_Nguyen!

Gold rises on continued central bank buyingHello everyone, great to see you again!

Gold prices have continued their upward momentum since last night, reaching as high as 3,403 USD, up 33 USD from the session’s low. At the time of writing, gold is undergoing a slight pullback but remains elevated around 3,385 USD.

The primary driver behind today’s rally is news that the People’s Bank of China (PBoC) continued accumulating gold in July, marking the ninth consecutive month of purchases.

Specifically, PBoC’s gold reserves increased by 60,000 ounces, bringing total holdings to 73.96 million ounces. Since November last year, China has purchased roughly 36 tonnes of gold in a move to diversify reserves and reduce reliance on the US dollar.

This trend of central bank gold buying, particularly by China, has been one of the key factors pushing gold prices up by 30% year-to-date, even though the pace has slowed as prices remain high.

With continued buying from central banks, gold is expected to maintain its upward trajectory, although a stronger US dollar could pose some headwinds.

EUR/USD Holds Steady Ahead of US DataHello everyone, what are your thoughts on FX:EURUSD ?

Today, the pair is trading in a narrow range around 1.1650 on Friday. While the US dollar is struggling to regain strength, a slight pullback in EUR/GBP following the Bank of England’s policy announcement has limited the upside for EUR/USD. The market now awaits upcoming US economic data.

From a technical perspective, EUR/USD remains anchored above newly established support levels. If these levels hold, this pullback could be an excellent accumulation phase before a breakout move.

What do you think? How will EUR/USD move by the end of the session and in the coming days?

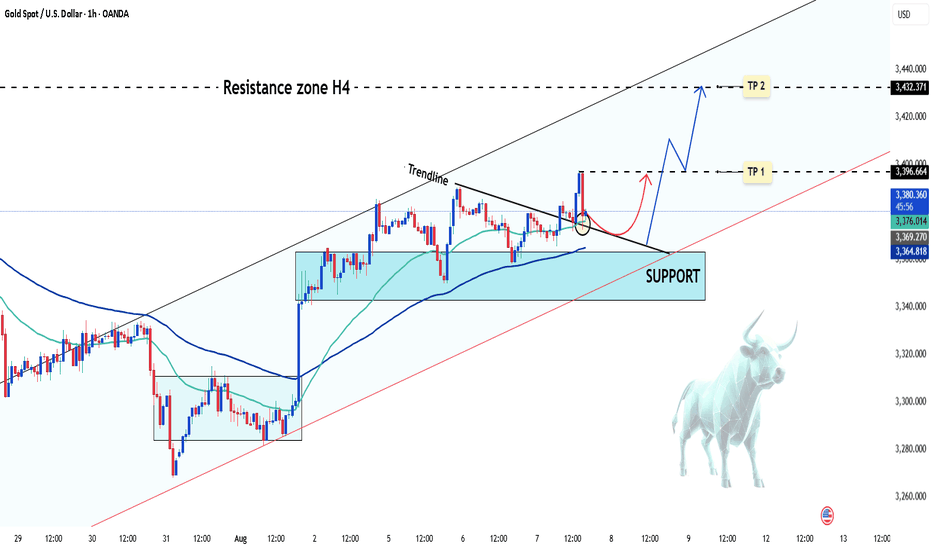

XAU/USD Short-Term Buy Opportunity ? XAU/USD has recently formed a bullish pattern, currently trading around 3,380 USD and showing an increase of more than 10 USD for the day.

From a technical analysis perspective, the price is following an upward trendline and showing signs of momentum accumulation. The area around 3,350 USD provides strong support, which could establish a solid base for further upward movement.

Key Levels:

Resistance (Target 1): 3,396 USD

Resistance (Target 2): 3,432 USD

To consider a short-term buy, it’s important to monitor price action around the support levels and wait for confirmation t

Good luck!

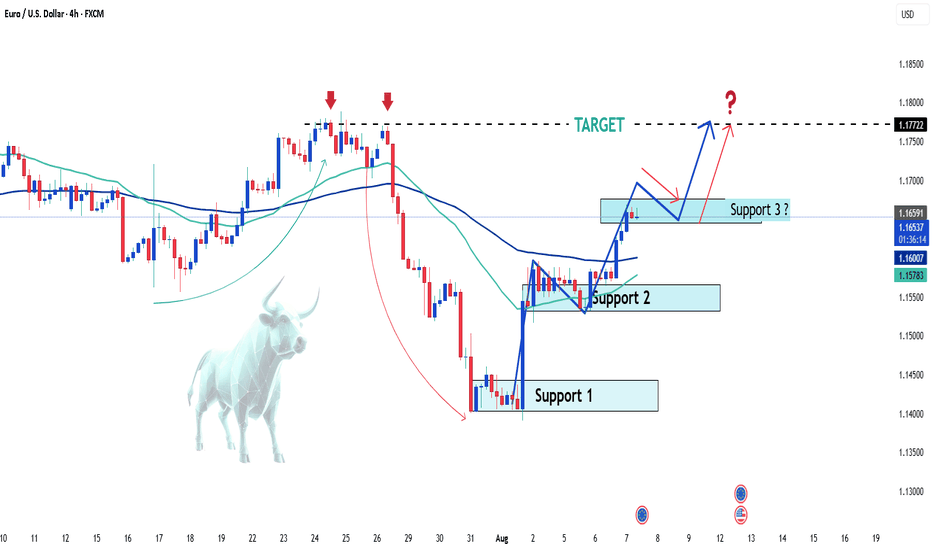

EURUSD Short-Term Bullish Momentum - Buy ? Hello everyone, what do you think about EURUSD?

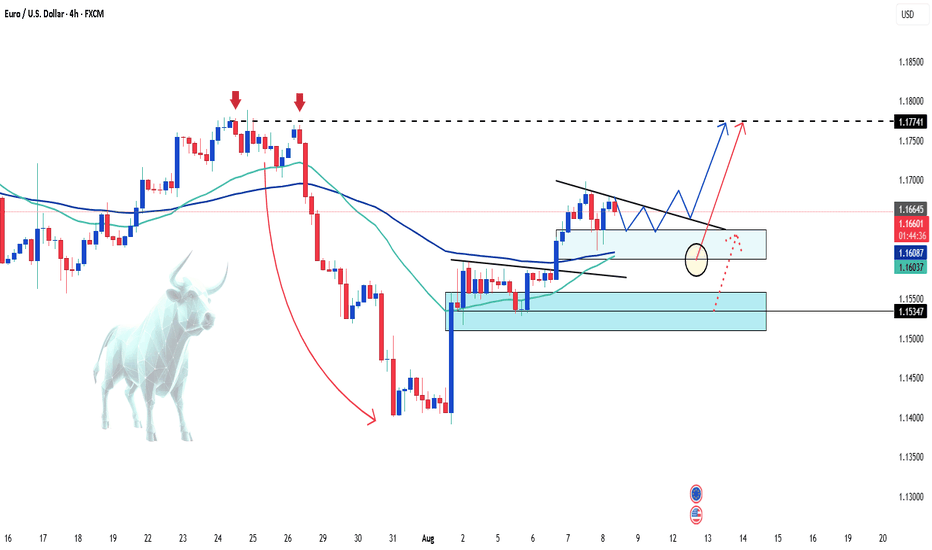

Yesterday, we discussed the sideways movement of this pair, and now, it seems that EUR/USD is showing a short-term bullish trend. The price is currently moving around 1.165, as marked on the chart.

In the short term, the market appears ready for further upward movement. With support at multiple levels (Support 1 and Support 2), and the possibility of forming a Support 3 to reach the target of 1.177, the overall outlook remains optimistic.

Keep an eye on how the market reacts at these important levels! Don’t forget to like if you agree with my view!

Good luck!

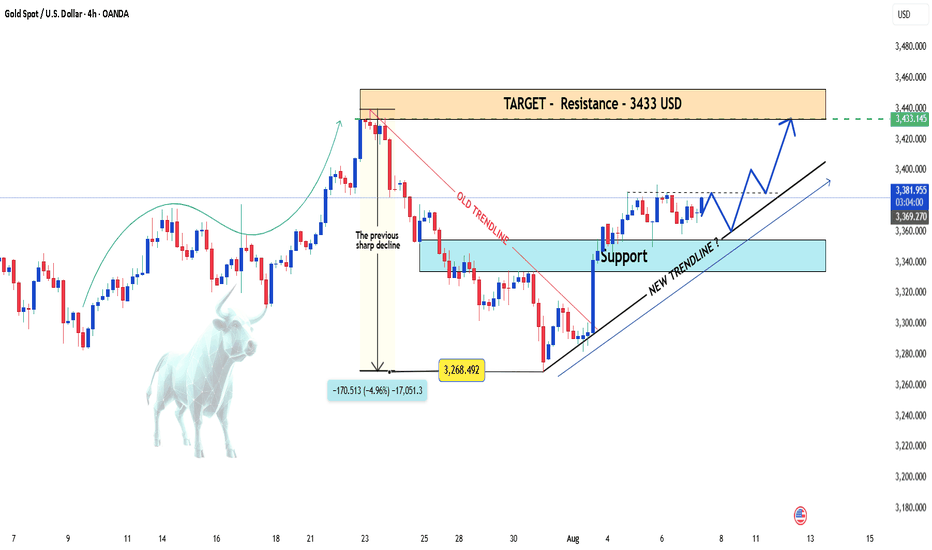

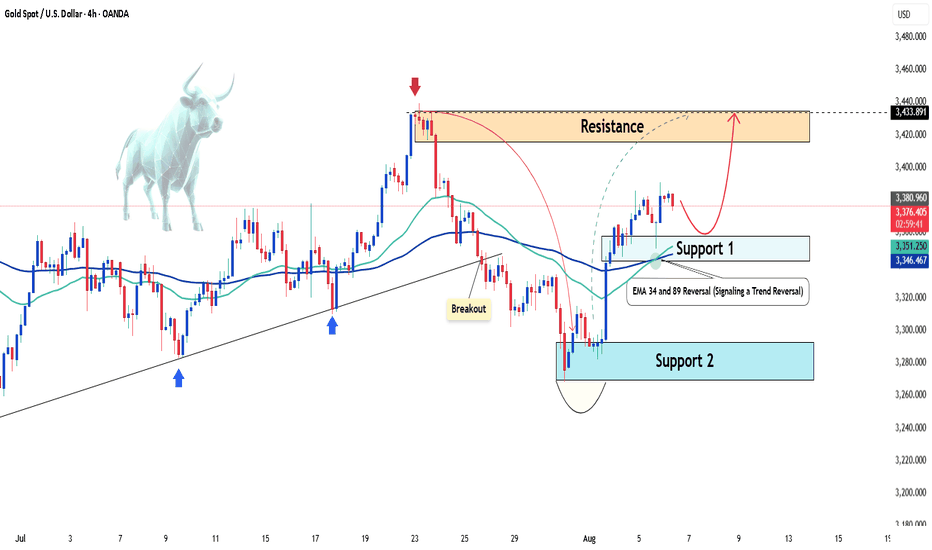

Gold Continues Strong Bullish Move Hello everyone, wishing you a great trading day!

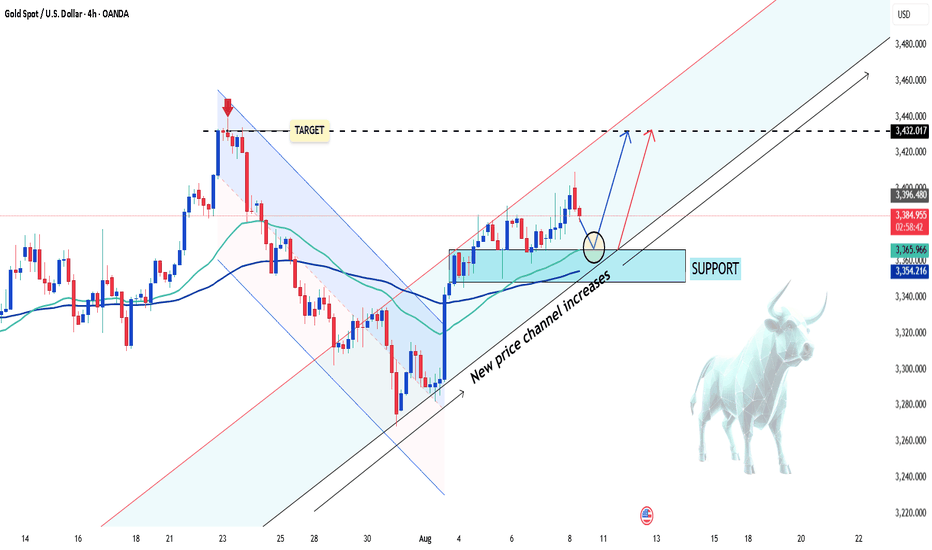

After a sharp decline from the recent highs, OANDA:XAUUSD quickly regained its strength and established a clear upward trend. The H4 chart shows the potential formation of a new upward trendline, with support positioned around the 3,350 USD zone.

This recent recovery is not just a technical bounce – it's supported by strong fundamental factors: weakening US bond yields, rising expectations that the Fed will cut interest rates in September, and a market sentiment that’s leaning towards safe-haven assets.

Currently, gold is trading around 3,380 USD and seems to be consolidating the momentum to approach the next resistance level at 3,433 USD. If the price holds above the new trendline and doesn’t break the marked support, the continuation of the upward trend is highly likely.

Personal view: The bullish trend remains intact – just a breakout confirmation and the 3,433 USD target will be within reach.

What do you think? Will gold continue its breakout this week? Leave your thoughts in the comments below!

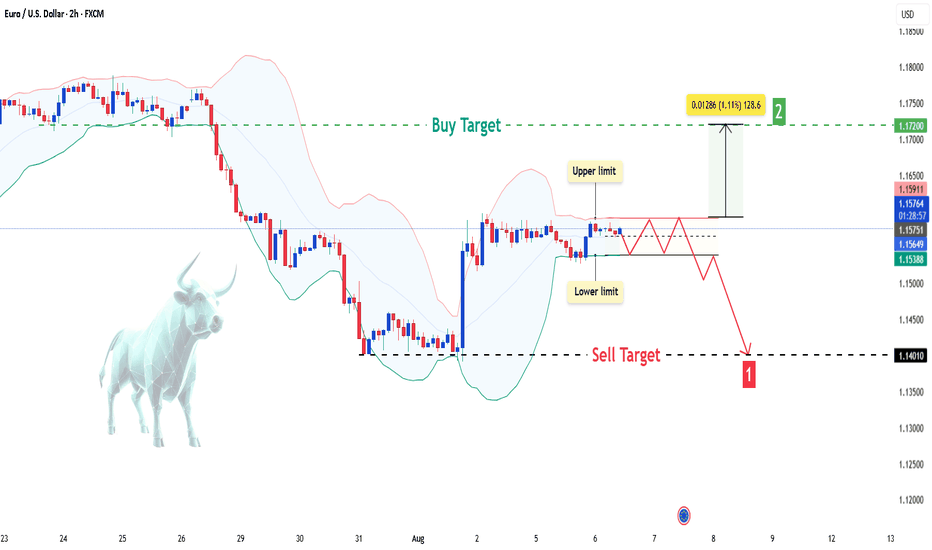

EURUSD – Which Way Will It Break?Hello everyone, what are your thoughts on the EURUSD trend?

EURUSD is currently experiencing a Bollinger Bands squeeze, signaling a potential breakout in either direction. The price is trading near the lower limit, hovering around 1.157 , with two potential scenarios unfolding:

Bullish scenario: The price could break upward toward 1.172, testing the upper resistance zone.

Bearish scenario: If the price falls below the lower limit, it could head towards the sell target at 1.140.

💬 For me, I’m leaning toward FOMO (Fear of Missing Out) and following the sell trend with a target of 1.140. What about you? Let me know your thoughts in the comments below!

Gold Set to Reach Historic HighsHello everyone, great to see you again!

Gold has been on a strong upward trajectory, breaking previous bearish structures and showing solid growth momentum. Market sentiment is heavily supported by the weakening of global currencies, particularly the US dollar, and expectations surrounding the potential interest rate cuts by the Federal Reserve.

Looking at the technical picture, we are approaching the historic peak of $3,433. The gold market is showing significant strength, confirmed by EMA 34 and EMA 89, as well as new support zones, signaling a trend reversal and confirming the bullish outlook.

The next few trading sessions could play a critical role in confirming whether the precious metal can break the all-time highs.

What do you think? Is gold about to make history? Let me know in the comments below!

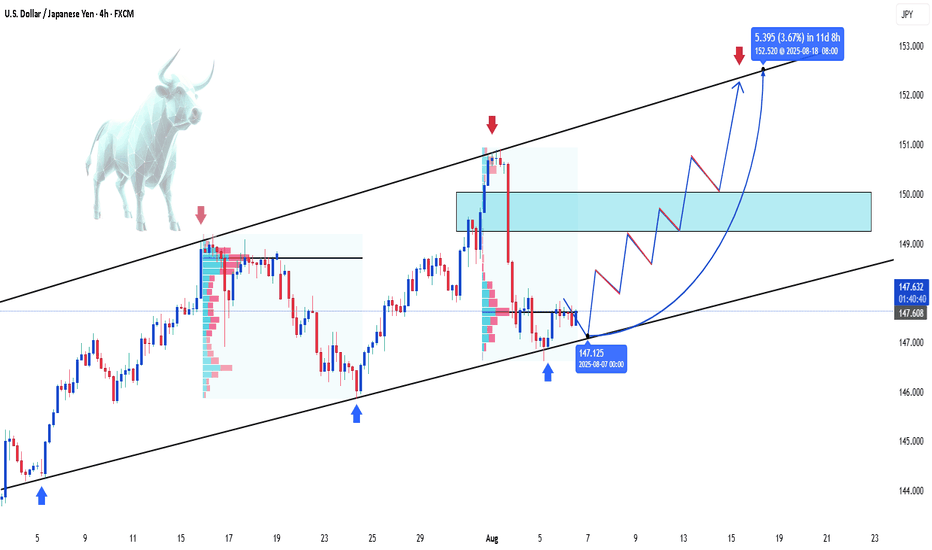

USDJPY Bullish Momentum Continues ? Hello traders, what do you think about USDJPY?

As of now, USDJPY is showing a slight upward movement after the recent correction. The price is trading around 147.59, not changing much since the beginning of the session.

The Japanese yen remains under pressure due to Japan’s slow recovery and ongoing economic challenges, giving USD an edge to capitalize on recent gains.

From a technical standpoint, USDJPY is moving in an ascending wedge pattern. After testing the trendline support near 147, the pair could be headed toward the psychological target of 150, or even higher towards the upper trendline boundary in the coming days.

Keep an eye on the price action near key resistance levels as the market continues to evaluate global economic factors, especially the upcoming US jobs data and Fed policy outlook.

What’s your take on USDJPY? Do you expect this pair to rise further? Let me know in the comments below!

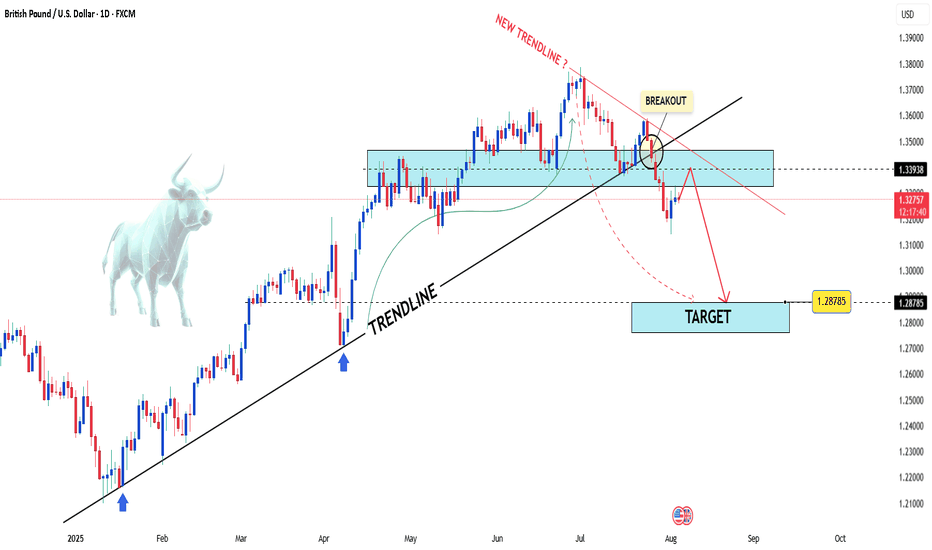

GBPUSD – Trendline Broken, More Downside Ahead?Hello traders! What’s your take on GBPUSD?

The GBP/USD pair has broken below its long-term ascending trendline and is now trading beneath a key resistance zone. After a failed breakout at the newly formed trendline, price quickly reversed and dropped sharply.

This resistance zone previously acted as a strong support level but has now been flipped to resistance. If price fails to reclaim this area during the next pullback, the bearish outlook will be further confirmed.

💬 Do you think GBPUSD will bounce from the 1.32 region, or will it continue falling toward the lower targets? Share your thoughts below!

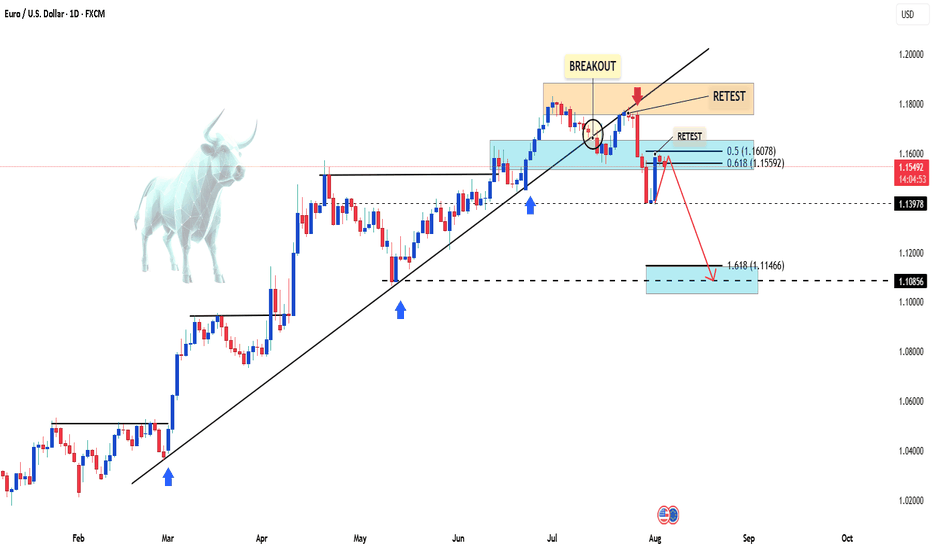

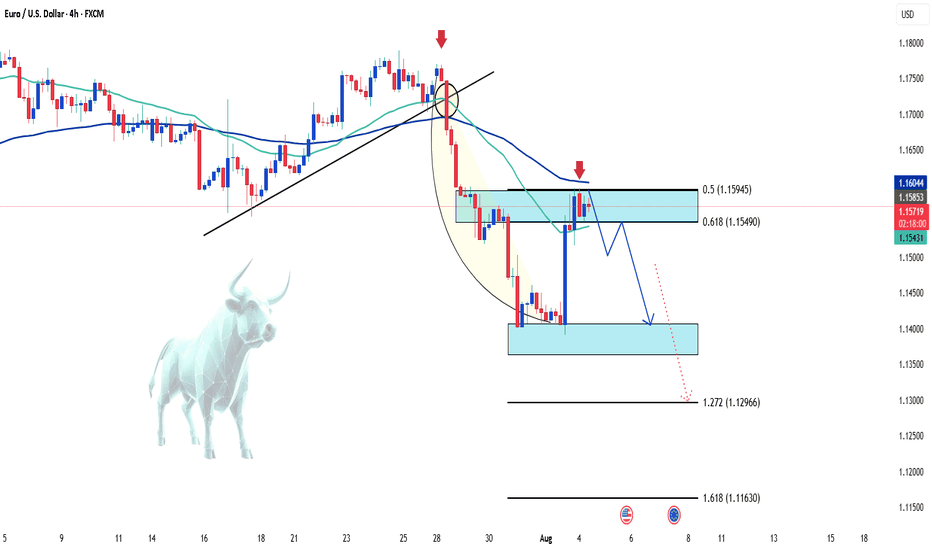

EURUSD Faces Renewed Selling PressureHello, what are your thoughts on EURUSD?

After failing to break above the 1.1600 level, the EUR/USD pair is now facing strong selling pressure again, currently testing the mid-1.1500s on Monday. Meanwhile, the US Dollar has seen a modest rebound across the board as investors digest Friday’s sharp drop following weaker-than-expected US jobs data.

From a technical standpoint, this setup may lead EURUSD to even lower levels. The recent movement aligns well with our previous outlook and follows the Dow Theory principles.

I'm expecting the price to continue its correction—what about you?

Gold Surges on Weak NFP Hello everyone, what’s your take on XAUUSD?

Gold prices soared at the end of the last session and are now trading around $3,380. This sharp rise followed a weaker-than-expected U.S. Non-Farm Payrolls (NFP) report, which shifted market sentiment toward expectations that the Fed may delay interest rate cuts. As a result, the U.S. dollar weakened and demand for gold as a safe haven surged.

Technically, gold appears to be forming a cup and handle pattern, with the first resistance target at $3,400, followed by $3,435.

What do you think? Could this rally continue? Let us know in the comments!

EURUSD – Bearish pullback in play ? EURUSD has broken the ascending trendline and dropped below the EMA confluence, confirming a bearish structure. The current rebound is testing the 0.5–0.618 Fibonacci zone, but weak buying pressure and rejection candles suggest it’s likely just a technical pullback.

If momentum holds, the pair may resume its downtrend toward 1.1400 and potentially 1.1296. The bears remain in control unless strong fundamentals shift the balance.

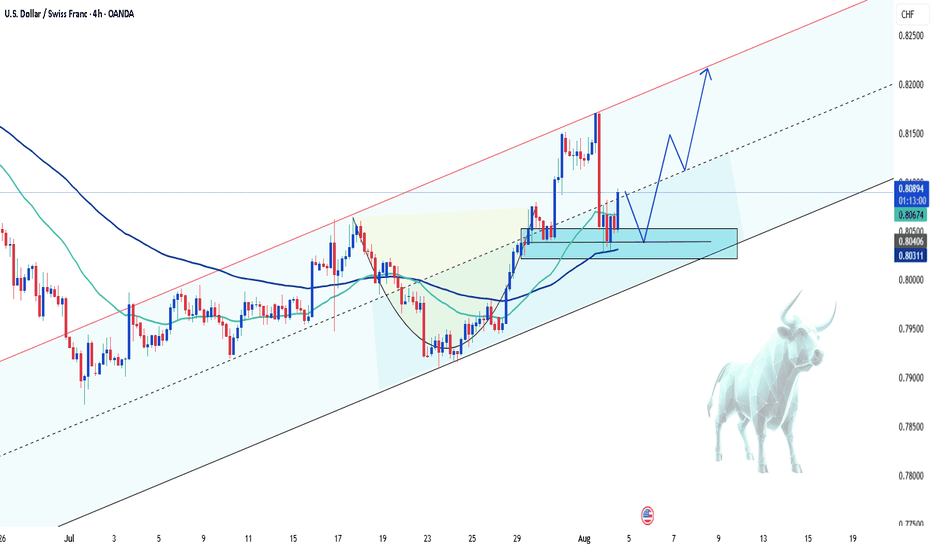

USDCHF – Bullish comeback in progress?Hey everyone! What’s your take on the current trend of USDCHF?

While the pair experienced a recent dip, take a step back and look at the bigger picture — doesn’t it still seem to be moving within an ascending channel?

Right now, USDCHF is hovering around 0.8092 and starting to bounce back. The recovery appears to be supported by a newly formed support zone and the confluence of the EMA 34 and 89. The pair seems to be eyeing the recent high, with potential to climb further toward the upper boundary of the channel.

My current bias? Bullish.

What about you — do you see the same opportunity?

Drop a comment and hit like if you’re on the same page!

Latest Gold Price Update TodayHey everyone! Let’s take a closer look at what’s happening with gold today.

Over the past week, the global gold market experienced dramatic swings. Prices tumbled following cautious remarks from Federal Reserve Chair Jerome Powell, only to rebound sharply after disappointing U.S. employment data.

On Wednesday, the Fed held interest rates steady, and Powell stated, “We haven’t made any decisions for September.” Though brief, that statement hinted that a rate cut isn’t guaranteed — dashing investor hopes and sending gold to its lowest level in four weeks.

But by Friday, the narrative flipped. A weaker-than-expected jobs report triggered a powerful rally. Within just two minutes of the data release, gold surged by $30, closing the week at $3,361 — a gain of over 2% in a single day.

These moves highlight just how sensitive gold is to Fed signals. A slight shift in tone or a single data point can spark major volatility.

From a technical perspective, falling U.S. Treasury yields have allowed XAU/USD to regain bullish momentum, as the market reassesses Fed rate expectations after the weak NFP print. If gold successfully breaks out of its current channel after a short-term pullback, the next target could be $3,400 — or even higher.

Do you agree with this outlook? Share your thoughts in the comments.

Good luck and happy trading!

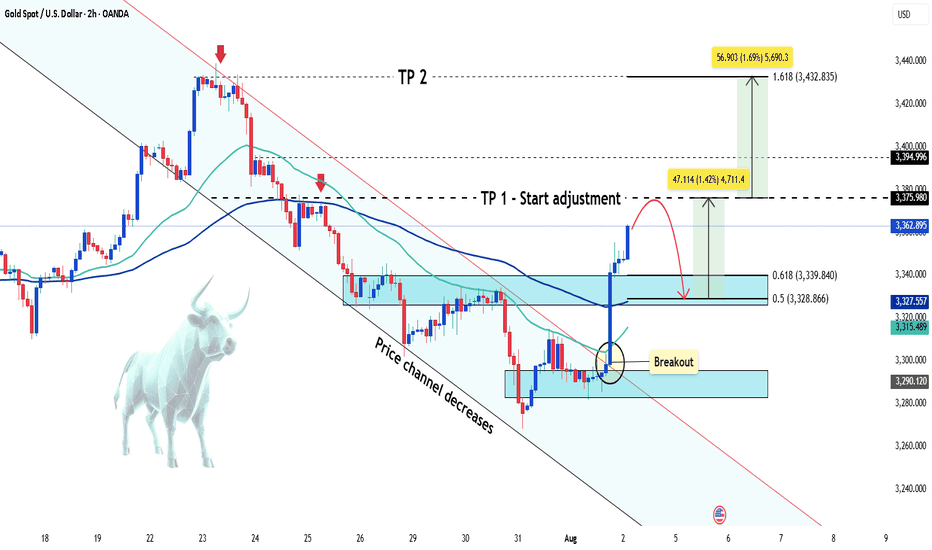

Gold suddenly increased sharply Hey everyone, let’s dive into what’s happening with XAUUSD!

Gold is experiencing a remarkable rally this weekend, skyrocketing from the $3,285 zone to around $3,362 — gaining over 700 pips. This sharp move comes amid weakening U.S. labor market data, which has fueled speculation that the Federal Reserve may begin cutting interest rates as early as September.

According to the U.S. Bureau of Labor Statistics (August 1st), non-farm payrolls rose by just 73,000 jobs in July — well below economists’ expectations of 106,000. The disappointing figures have shaken confidence in the U.S. economy and placed pressure on the U.S. dollar, as markets increasingly anticipate a dovish shift from the Fed.

For gold, this weak jobs report reinforces its role as a safe-haven asset, driving strong demand as investors seek protection from economic uncertainty. At the same time, lingering fears around global trade tensions and new tariffs imposed by President Donald Trump continue to support the flight to safety.

From a technical perspective, gold has broken out of its descending price channel and is moving fast. According to Dow Theory, a short-term correction may occur soon, but if price holds above key support levels, the rally could extend toward the $3,432 region — the 1.618 Fibonacci extension zone.

This move might mark the beginning of a new bullish phase after weeks of consolidation.

What do you think — is gold just getting started?

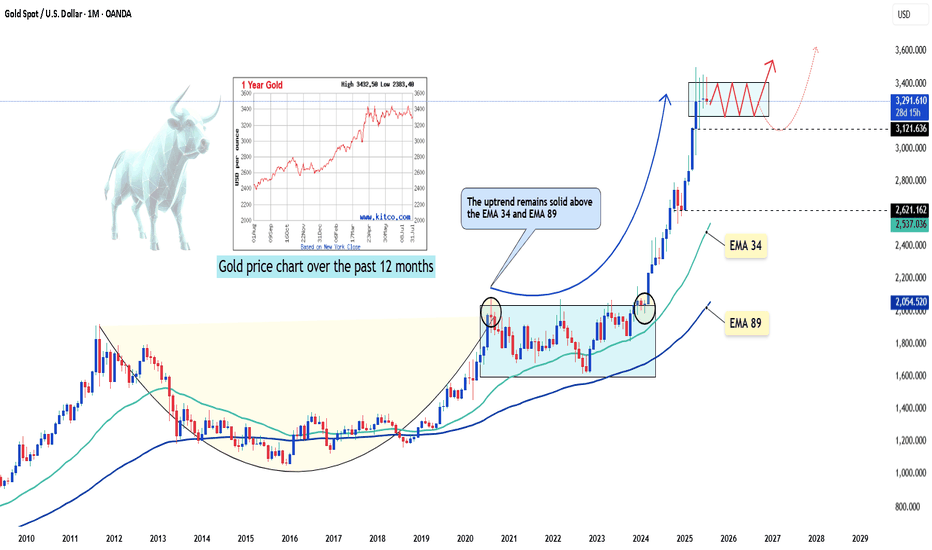

XAUUSD – the calm before the next breakout?Hello traders, what’s your take on the current trend in OANDA:XAUUSD ?

Looking back over the past 12 months, gold has delivered a truly impressive performance. From around $2,380 in August 2024, the precious metal surged to an all-time high of $3,432 by April this year — a gain of more than $1,000 in less than a year. But what’s more telling than the rise itself is how the market behaved afterward: instead of crashing, gold has maintained a high consolidation range, suggesting the uptrend is still very much alive.

This powerful rally didn’t happen in isolation. In a world marked by uncertainty, gold has once again asserted its role as a safe-haven asset. Inflation remains persistent across major economies, geopolitical tensions continue to stretch from Eastern Europe to the Middle East and Asia, and de-dollarization efforts by countries like China and Russia are reshaping global capital flows. None of these events alone could shake the markets, but together, they have laid the groundwork for gold’s sustained relevance.

From a technical standpoint, the long-term bullish structure remains intact. Following its peak at $3,432, gold has entered a modest correction phase — one that may well be a healthy consolidation before the next directional move.

Interestingly, while many investors remain cautious, the chart paints a different story: a market that isn’t afraid, but simply catching its breath. The real question is no longer “Can gold hold above $3,400?” but rather “Is the market gearing up for a fresh breakout — or a deeper correction?”

We may not be able to predict the future, but we can observe how price reacts at key levels. And sometimes, it’s in these seemingly quiet phases that the biggest turning points begin to form.

What do you think — is gold preparing for another leg up?

Drop your thoughts in the comments below! 👇

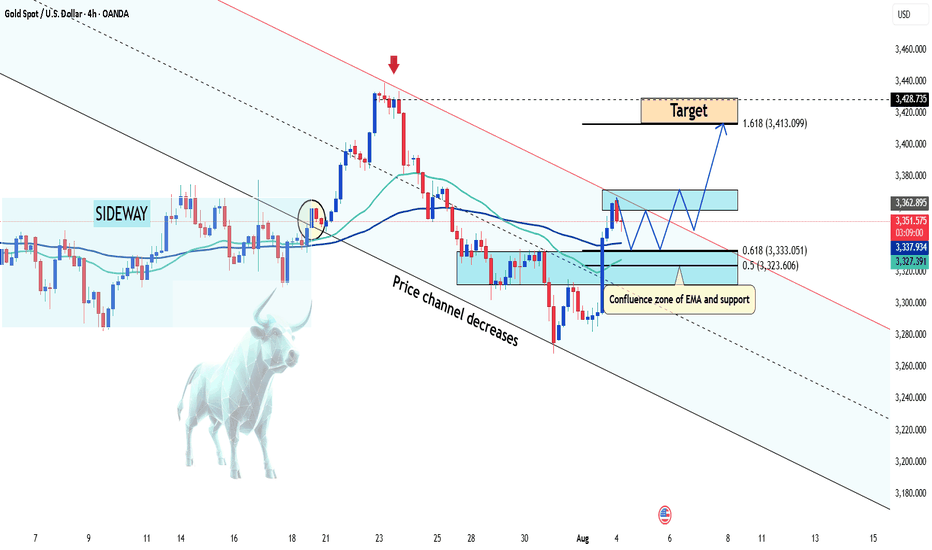

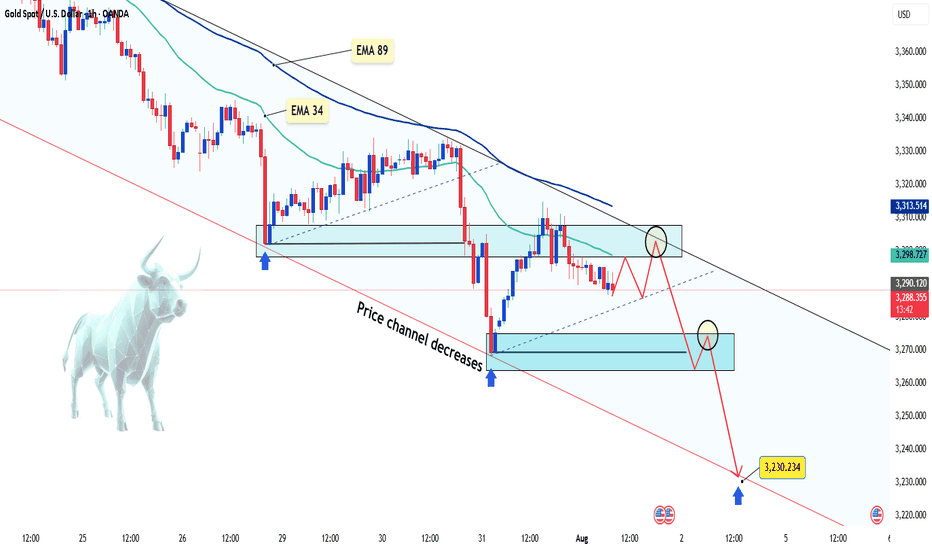

Gold keeps falling – is there more to come?Hello everyone, great to see you again!

Today, gold remains under pressure following a series of strong U.S. economic data releases, which have reinforced expectations that the Federal Reserve will keep interest rates elevated for longer. As a result, the U.S. dollar has strengthened, Treasury yields have climbed, and gold has lost its footing.

On the H1 chart, XAUUSD is clearly trading within a descending price channel. Both the EMA 34 and EMA 89 are acting as dynamic resistance zones. Recent attempts to rally have consistently failed at these levels, mirroring the bearish setup seen before July 29.

Currently, price is retesting a minor resistance area. If this retest fails, the next downside targets lie near 3,270 – and potentially down to 3,230 USD, which aligns with the lower boundary of the price channel.

From my perspective, the bearish momentum is likely to continue.

What about you? How do you think gold will close the day?

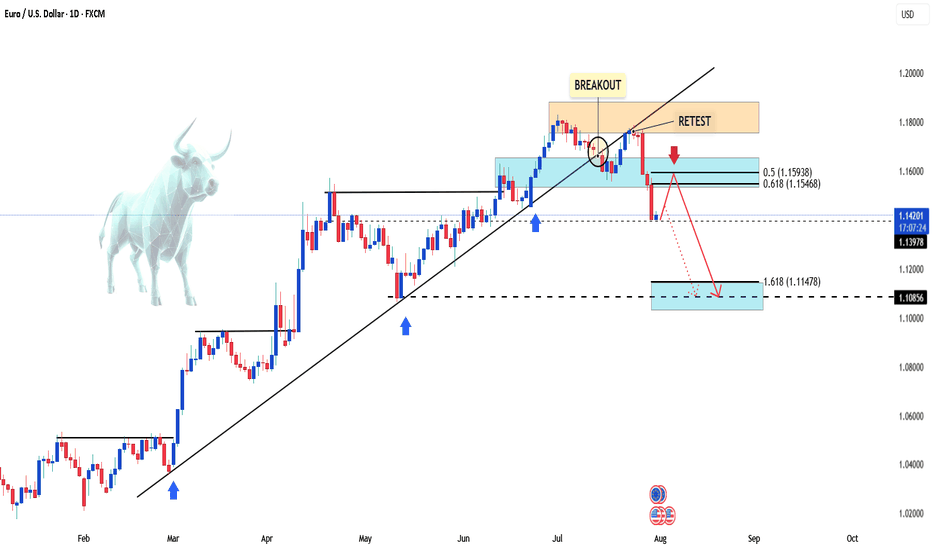

EURUSD – Retest Failed, Bearish Pressure RemainsHello, what’s your take on FX:EURUSD ?

After breaking the trendline, EURUSD attempted a retest but failed. The price is now hovering around 1.142, with selling pressure still evident.

This setup targets the 1.618 Fibonacci extension zone around 1.114. In the short term, a correction based on Dow Theory may unfold — the marked area could offer a perfect selling opportunity.

💡 Priority: SELL on RETEST – strict risk management with clear TP and SL.

Now it’s your turn — what’s your view? Share it in the comments below.

Good luck!

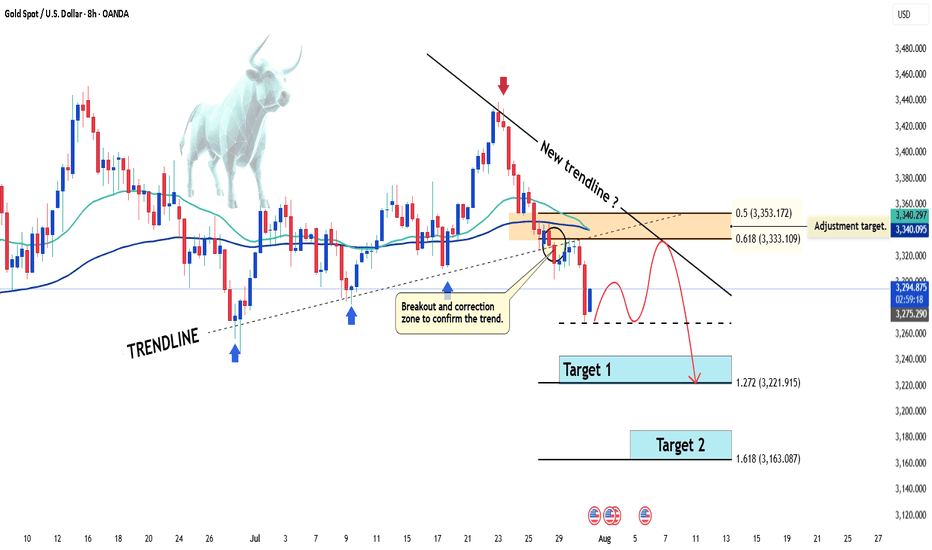

Gold price continues sharp declineHello everyone! Do you think gold will rise or fall? Let’s dive into the latest movements of this precious metal.

Just as we anticipated in yesterday’s strategy , gold has extended its downward move, with the bears firmly in control. The precious metal is currently trading around 3,290 USD, clearly signaling a short-term downtrend after breaking the ascending trendline that started in early July. Although there was a slight bounce, price remains capped below the key resistance zone of 3,333 – 3,350 USD, which coincides with the confluence of the 0.618 – 0.5 Fibonacci retracement and the EMA 34/89 — adding even more downside pressure.

The main reason behind this recent drop lies in the easing of trade tensions following the US-EU tariff agreement, which has significantly weakened gold’s safe-haven appeal. At the same time, the FOMC meeting yesterday failed to provide any bullish catalyst for gold. Even though the Fed is expected to keep rates unchanged, a single hawkish remark from Chair Powell was enough to intensify short-term selling pressure.

From a technical perspective, gold attempted to retest the broken trendline but failed, confirming the bearish structure. A new wave of correction could emerge soon, but the overall outlook remains tilted toward further downside.

My personal view:

Target 1 is at the 1.272 Fibonacci extension.

Target 2 lies at the 1.618 Fibonacci level — which could be the next destination.

And you — what do you think about this trendline break? Let’s discuss in the comments!

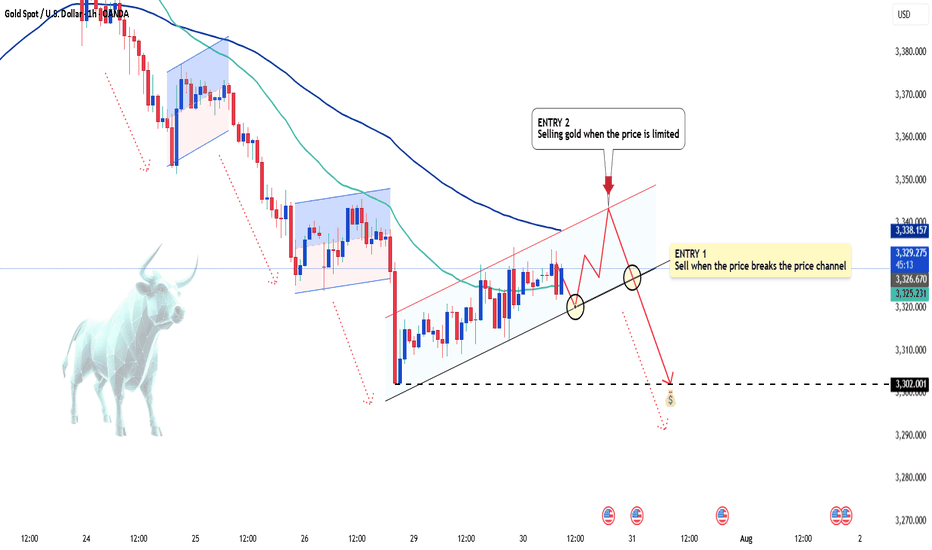

Gold's Strong Moves: Will the Bears Take Over?Hello everyone, Kevinn here!

Today, gold continues to experience significant fluctuations in the new week, with XAU/USD currently hovering around 3,325 USD. Amid the strong rise of the USD, the gold market has seen a sharp adjustment. However, the medium-term trend still seems to favor the bears.

The main reason for the turbulence in gold prices is the strengthening of the U.S. dollar, following strong economic news from the U.S. that points to a clear recovery. The stronger USD has made gold more expensive for international investors. Additionally, the market is awaiting further moves from the Fed regarding interest rate policies, which is limiting the flow of capital into gold.

Looking at the technical chart, we can see that although gold has shown a slight uptick, bearish pressures are still lurking. Indicators and patterns suggest that gold may break its rising price channel, with a high likelihood of further declines. The next support level could be around 3,310 USD, and if broken, gold may continue to fall toward 3,300 USD or lower.

Based on the signals from the chart, ENTRY 1 strategy would be to sell when the price breaks the upward channel. Additionally, if the price pulls back to the upper limit zone, ENTRY 2 could present another potential selling point.

For today's strategy, I expect gold to decrease. What do you think? Share your thoughts in the comments!

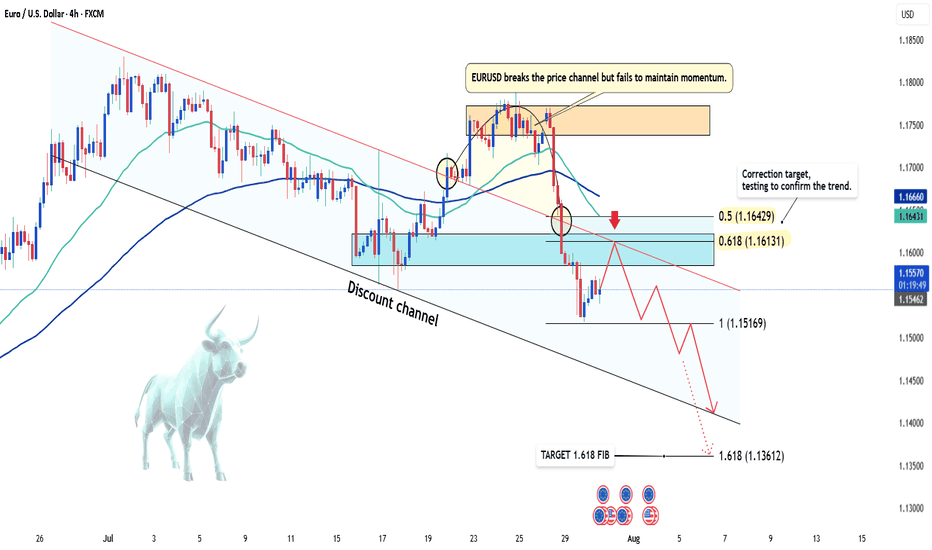

EUR/USD Latest Update TodayHello everyone, what do you think about FX:EURUSD ?

EUR/USD previously broke the downward price channel, but failed to maintain the momentum, leading to a strong correction phase. Currently, the price is trading around 1.156 and testing key Fibonacci levels, with the 0.5 - 0.618 levels marked as potential reversal zones, as highlighted in the analysis.

With the current market sentiment, the strong recovery of the USD has been the main factor driving the EUR/USD movement in recent days. Positive economic data from the US has strengthened the US dollar, decreasing the appeal of gold and safe-haven assets like the EUR. Furthermore, expectations surrounding Fed policy decisions continue to add pressure on EUR/USD, with investors bracing for the possibility of the Fed maintaining high interest rates for a longer period.

For traders, it's clear that the bearish trend is in favor, as indicated by the EMA reversal. The Fibonacci levels 0.5 (1.164) and 0.618 (1.161) will be crucial zones, where reaction signals could open opportunities for SELL positions. The next target will be at Fib 1 and Fib 1.618.

That's my perspective and share, but what do you think about the current trend of EUR/USD? Leave your comments below this post!