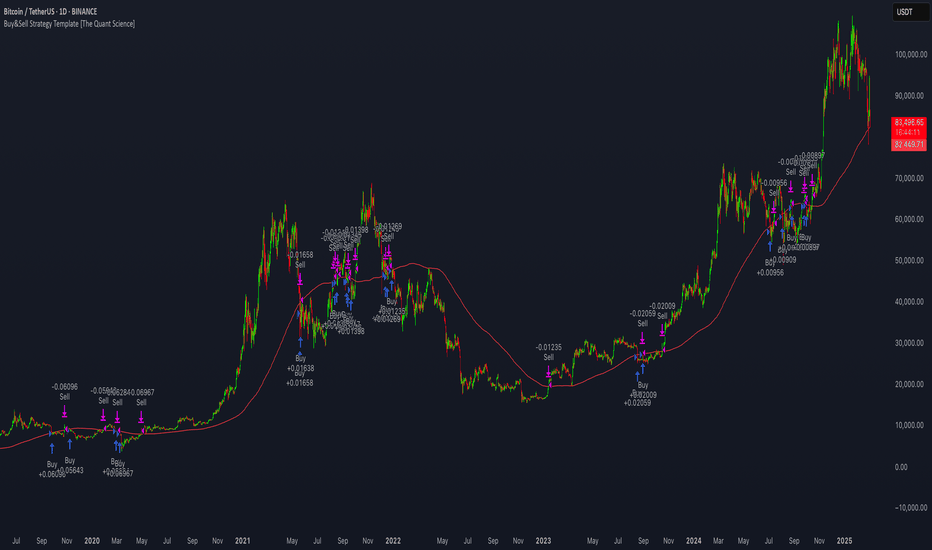

Buyandsell

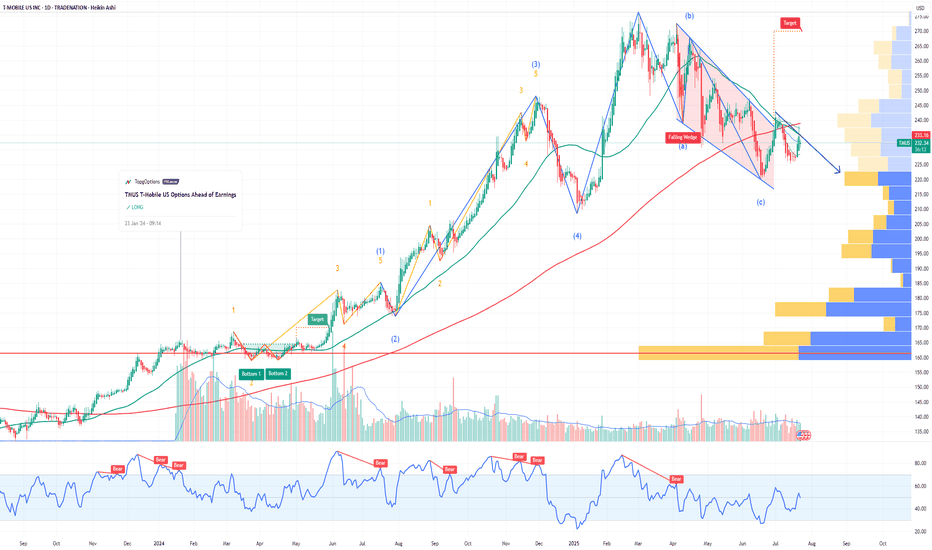

TMUS T-Mobile US Options Ahead of EarningsIf you haven`t bought TMUS before the rally:

Now analyzing the options chain and the chart patterns of TMUS T-Mobile US prior to the earnings report this week,

I would consider purchasing the 227.5usd strike price Puts with

an expiration date of 2025-7-25,

for a premium of approximately $3.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

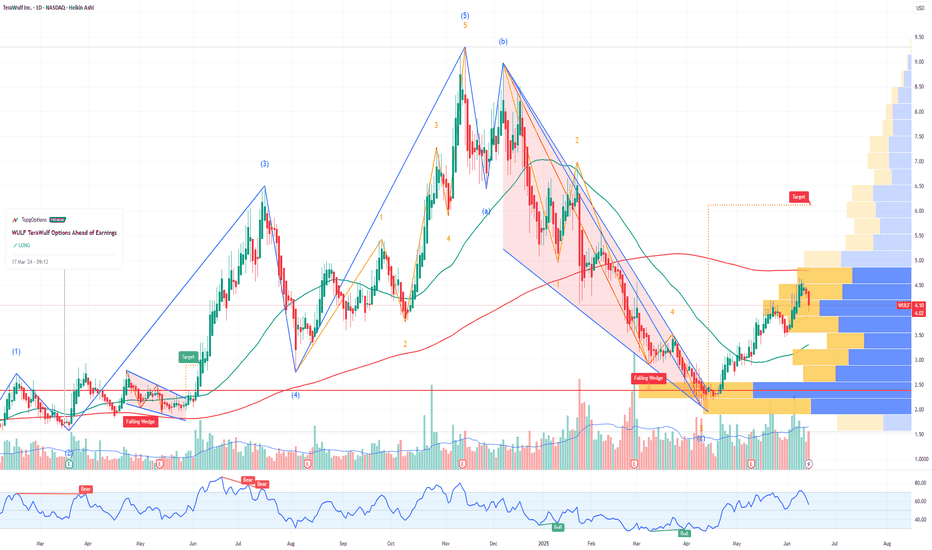

WULF TeraWulf Leader in Clean Crypto Mining & HPC InfrastructureIf you haven`t bought WULF before the rally:

Now TeraWulf WULF is emerging as a compelling growth story in the digital infrastructure and cryptocurrency mining sectors, distinguished by its commitment to zero-carbon energy and expanding high-performance computing (HPC) hosting capabilities. Despite near-term financial challenges, the company’s rapid capacity growth, strong cash position, and strategic initiatives position it well for substantial upside in 2025 and beyond.

1. Rapid Expansion of Mining Capacity and Hashrate Growth

TeraWulf energized Miner Building 5, increasing its total mining capacity to 245 MW and boosting its Bitcoin mining hashrate to 12.2 exahashes per second (EH/s), a 52.5% increase year-over-year.

This significant growth in self-mining capacity enhances revenue potential and operational scale, positioning TeraWulf among the more efficient and sizable clean-energy miners.

The company’s vertically integrated model, powered primarily by zero-carbon energy, aligns with increasing regulatory and investor demand for sustainable crypto mining.

2. Strategic Buildout of High-Performance Computing (HPC) Infrastructure

TeraWulf commenced the buildout of dedicated HPC data halls and remains on track to deliver 72.5 MW of gross HPC hosting infrastructure to Core42 in 2025.

The company is actively pursuing additional HPC customers, targeting 200–250 MW of operational HPC capacity by the end of 2026, which diversifies revenue streams beyond crypto mining.

HPC infrastructure is a high-growth segment driven by demand for AI, big data, and cloud computing, offering TeraWulf exposure to secular technology trends.

3. Strong Financial Position and Capital Allocation

As of March 31, 2025, TeraWulf held approximately $219.6 million in cash and bitcoin holdings, providing liquidity to fund expansion and weather market volatility.

The company has repurchased $33 million of common stock in 2025, signaling management’s confidence in the business and commitment to shareholder value.

While total outstanding debt is around $500 million, TeraWulf maintains a strong current ratio (~5.4), indicating solid short-term liquidity.

4. Industry-Leading Sustainability Profile

TeraWulf’s focus on zero-carbon energy for its mining operations differentiates it in an industry increasingly scrutinized for environmental impact.

This green positioning not only appeals to ESG-conscious investors but may also provide access to incentives, partnerships, and preferential contracts as governments and enterprises emphasize sustainability.

5. Revenue Growth Outlook and Market Opportunity

Despite a temporary revenue dip to $34.4 million in Q1 2025, the company is projected to deliver a 53% increase in revenue for the full year 2025, significantly outpacing industry averages.

The combination of expanding mining capacity and HPC hosting services positions TeraWulf to capitalize on the growing demand for digital infrastructure powered by clean energy.

6. Navigating Financial Challenges with Growth Focus

TeraWulf reported a GAAP net loss of $0.16 per share in Q1 2025, reflecting ongoing investments in capacity and infrastructure.

Operational cash flow remains positive and improving, with management focused on scaling efficiently and improving margins over time.

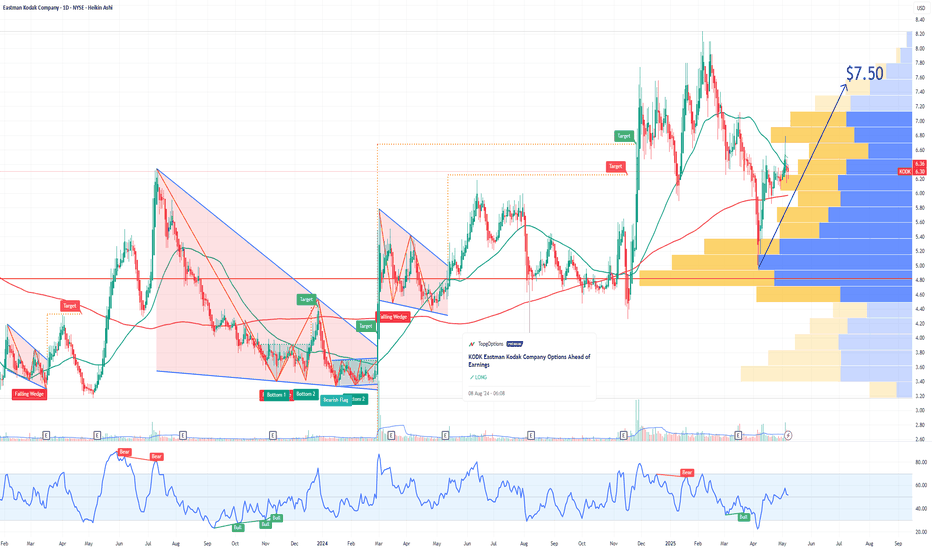

KODK Eastman Kodak Company Options Ahead of EarningsIf you haven`t bought KODK before the previous earnings:

Now analyzing the options chain and the chart patterns of KODK Eastman Kodak prior to the earnings report this week,

I would consider purchasing the 7.5usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $0.92.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

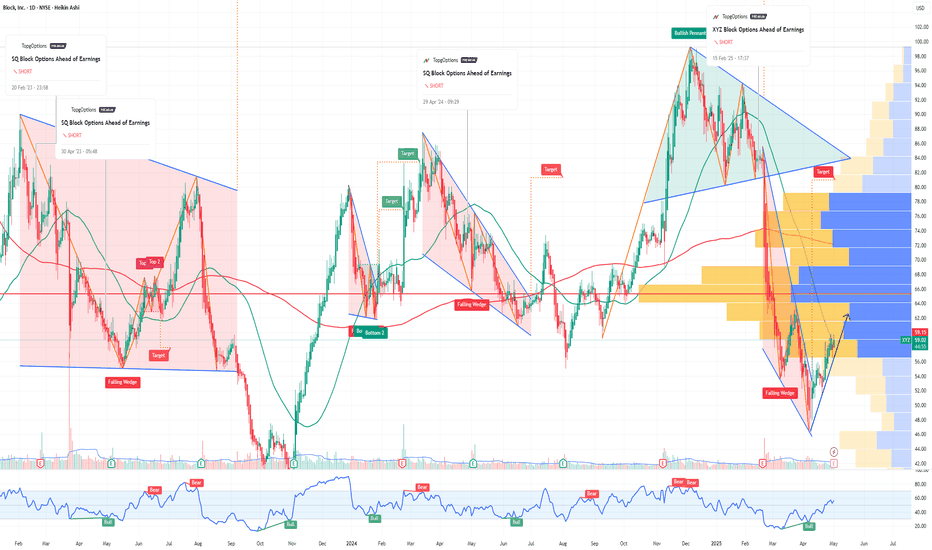

XYZ Block Options Ahead of EarningsIf you haven`t sold XYZ before the previous earnings:

Now analyzing the options chain and the chart patterns of XYZ Block prior to the earnings report this week,

I would consider purchasing the 58usd strike price Calls with

an expiration date of 2025-5-2,

for a premium of approximately $3.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

How to develop a simple Buy&Sell strategy using Pine ScriptIn this article, will explain how to develop a simple backtesting for a Buy&Sell trading strategy using Pine Script language and simple moving average (SMA).

Strategy description

The strategy illustrated works on price movements around the 200-period simple moving average (SMA). Open long positions when the price crossing-down and moves below the average. Close position when the price crossing-up and moves above the average. A single trade is opened at a time, using 5% of the total capital.

Behind the code

Now let's try to break down the logic behind the strategy to provide a method for properly organizing the source code. In this specific example, we can identify three main actions:

1) Data extrapolation

2) Researching condition and data filtering

3) Trading execution

1. GENERAL PARAMETERS OF THE STRATEGY

First define the general parameters of the script.

Let's define the name.

"Buy&Sell Strategy Template "

Select whether to show the output on the chart or within a dashboard. In this example will show the output on the chart.

overlay = true

Specify that a percentage of the equity will be used for each trade.

default_qty_type = strategy.percent_of_equity

Specify percentage quantity to be used for each trade. Will be 5%.

default_qty_value = 5

Choose the backtesting currency.

currency = currency.EUR

Choose the capital portfolio amount.

initial_capital = 10000

Let's define percentage commissions.

commission_type = strategy.commission.percent

Let's set the commission at 0.07%.

commission_value = 0.07

Let's define a slippage of 3.

slippage = 3

Calculate data only when the price is closed, for more accurate output.

process_orders_on_close = true

2. DATA EXTRAPOLATION

In this second step we extrapolate data from the historical series. Call the calculation of the simple moving average using close price and 200 period bars.

sma = ta.sma(close, 200)

3. DEFINITION OF TRADING CONDITIONS

Now define the trading conditions.

entry_condition = ta.crossunder(close, sma)

The close condition involves a bullish crossing of the closing price with the average.

exit_condition = ta.crossover(close, sma)

4. TRADING EXECUTION

At this step, our script will execute trades using the conditions described above.

if (entry_condition==true and strategy.opentrades==0)

strategy.entry(id = "Buy", direction = strategy.long, limit = close)

if (exit_condition==true)

strategy.exit(id = "Sell", from_entry = "Buy", limit = close)

5. DESIGN

In this last step will draw the SMA indicator, representing it with a red line.

plot(sma, title = "SMA", color = color.red)

Complete code below.

//@version=6

strategy(

"Buy&Sell Strategy Template ",

overlay = true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 5,

currency = currency.EUR,

initial_capital = 10000,

commission_type = strategy.commission.percent,

commission_value = 0.07,

slippage = 3,

process_orders_on_close = true

)

sma = ta.sma(close, 200)

entry_condition = ta.crossunder(close, sma)

exit_condition = ta.crossover(close, sma)

if (entry_condition==true and strategy.opentrades==0)

strategy.entry(id = "Buy", direction = strategy.long, limit = close)

if (exit_condition==true)

strategy.exit(id = "Sell", from_entry = "Buy", limit = close)

plot(sma, title = "SMA", color = color.red)

The completed script will display the moving average with open and close trading signals.

IMPORTANT! Remember, this strategy was created for educational purposes only. Not use it in real trading.

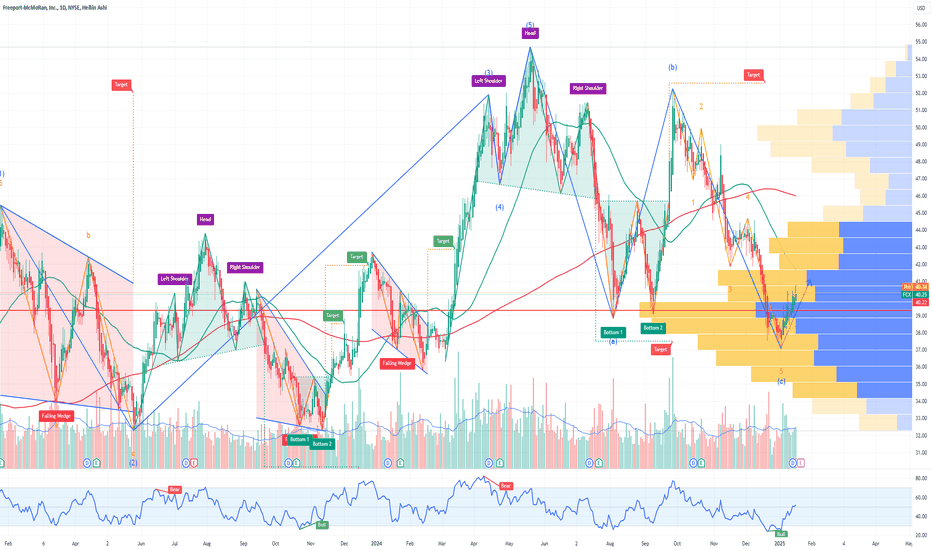

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $1.94.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

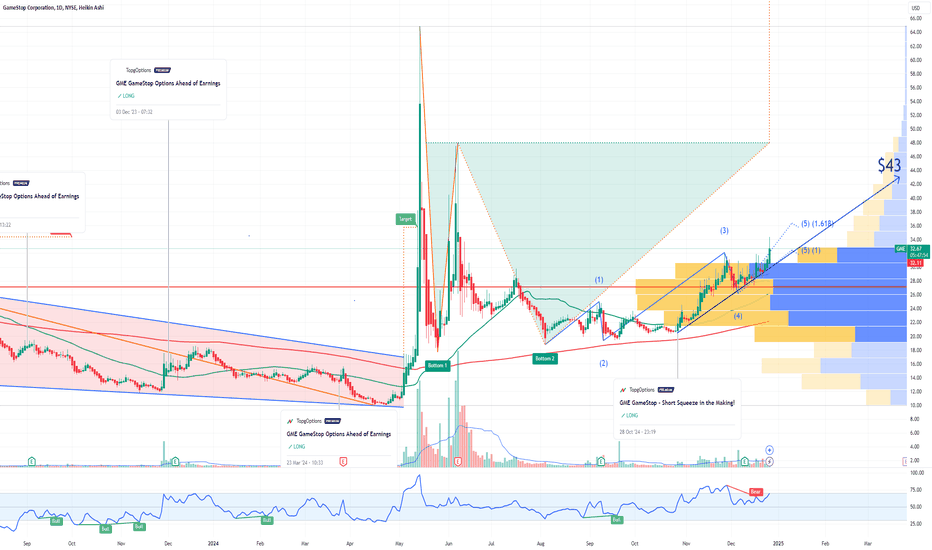

GME GameStop Among My Top 10 Picks for 2025 | Price TargetIf you haven`t bought GME before the previous breakout:

My price target for GME in 2025 is $43, driven by the following fundamental factors:

Transformation into a Digital Retailer:

GameStop is actively transitioning from a traditional brick-and-mortar retailer to a digital-first company. This strategic pivot includes enhancing its e-commerce platform and investing in digital gaming, which are essential for capturing the growing online gaming market. As consumers increasingly shift towards digital purchases, GameStop's ability to adapt and innovate positions it to benefit from this trend, potentially driving significant revenue growth in the coming years.

Financial Recovery and Profitability Focus:

After a challenging period, GameStop is on a path toward profitability. Analysts predict that the company will earn approximately $0.08 per share in the fiscal year ending January 2025, reflecting a positive trend in its financial performance. The company's focus on reducing excess costs and improving operational efficiencies will further enhance its bottom line. As profitability improves, investor confidence is likely to increase, supporting higher stock valuations.

Strong Market Sentiment and Stock Performance:

GameStop has demonstrated remarkable stock performance over the past year, with a return of over 110%, significantly outperforming major indices 1. This momentum has created positive market sentiment around GME, which could attract more investors looking for growth opportunities. The current trading price around $26.84 suggests that there is room for appreciation as the company continues to execute its strategic initiatives.

Strategic Partnerships and Collaborations:

GameStop's collaborations with various technology partners are opening new avenues for growth. These partnerships are aimed at enhancing customer experience and expanding product offerings, particularly in the pre-owned game category where GameStop has unique refurbishment capabilities. By leveraging these strengths, GameStop can cater to niche segments of the gaming market, further solidifying its competitive position.

S SentinelOne Options Ahead of EarningsIf you haven`t bought S before the previous breakout:

Now analyzing the options chain and the chart patterns of S SentinelOne prior to the earnings report this week,

I would consider purchasing the 30usd strike price Calls with

an expiration date of 2024-12-6,

for a premium of approximately $0.87.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

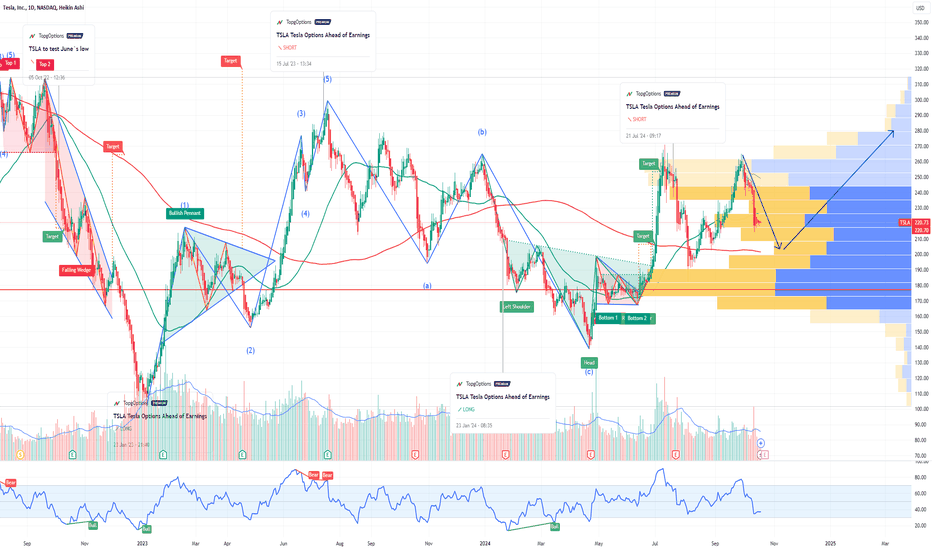

TSLA Tesla Options Ahead of EarningsIf you haven`t bought the dip on TSLA:

Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week,

I would consider purchasing the 210usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $32.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Overall, I’m bullish on TSLA in the long run, so this might just be a short-term play.

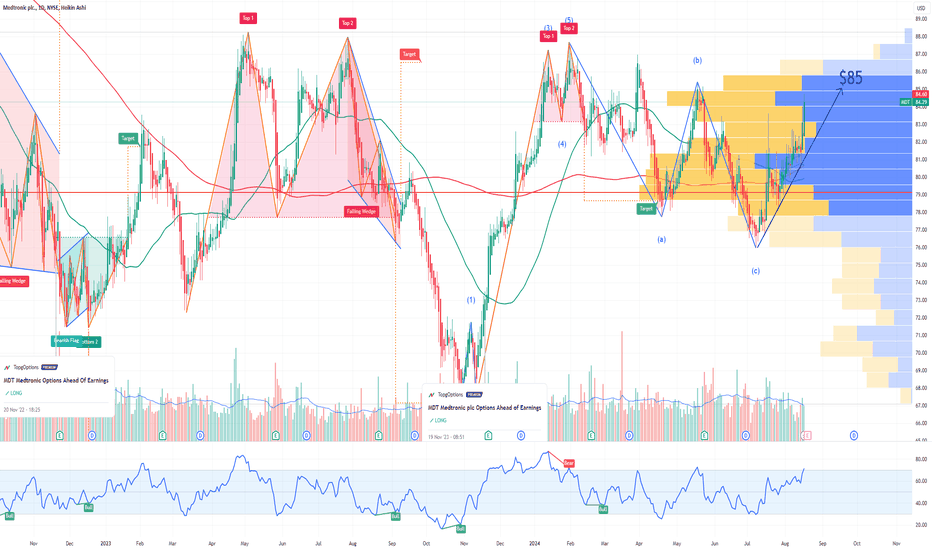

MDT Medtronic plc Options Ahead of EarningsIf you haven`t bought the dip on MDT:

Now analyzing the options chain and the chart patterns of MDT Medtronic plc prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2024-8-23,

for a premium of approximately $1.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

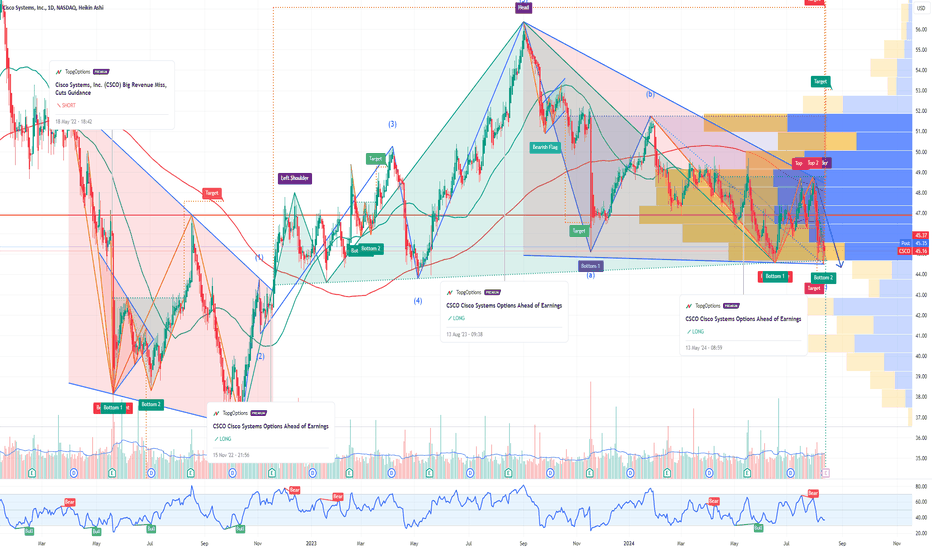

CSCO Cisco Systems Options Ahead of EarningsIf you haven`t bought the dip on CSCO:

Now analyzing the options chain and the chart patterns of CSCO Cisco Systems prior to the earnings report this week,

I would consider purchasing the 45usd strike price Puts with

an expiration date of 2024-8-16,

for a premium of approximately $1.41.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

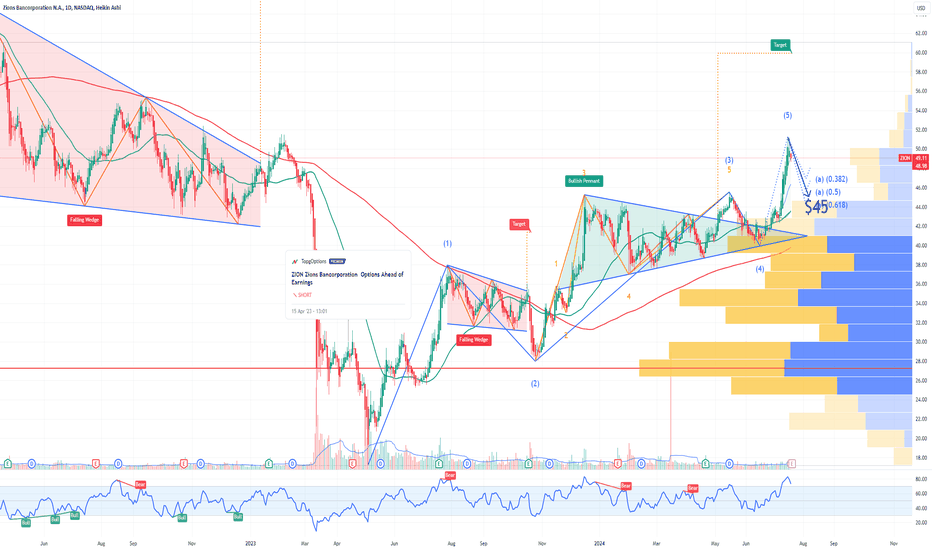

ZION Zions Bancorporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ZION Zions Bancorporation prior to the earnings report this week,

I would consider purchasing the 45usd strike price Puts with

an expiration date of 2024-8-16,

for a premium of approximately $0.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DKNG DraftKings Options Ahead of EarningsIf you haven`t bought DKNG before the previous earnings:

Now analyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 36usd strike price Puts with

an expiration date of 2024-8-2,

for a premium of approximately $1.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

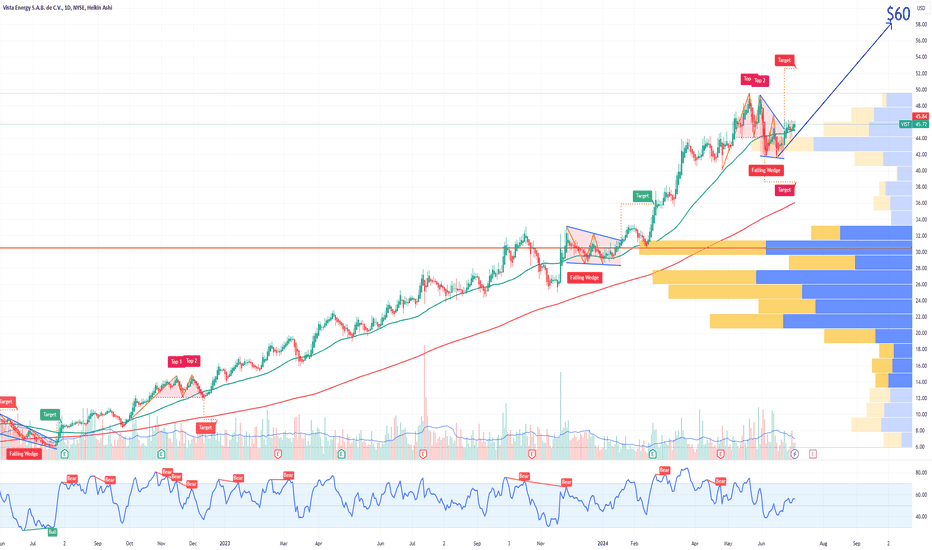

VIST Vista Energy Options Ahead of EarningsAnalyzing the options chain and the chart patterns of VIST Vista Energy prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $1.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

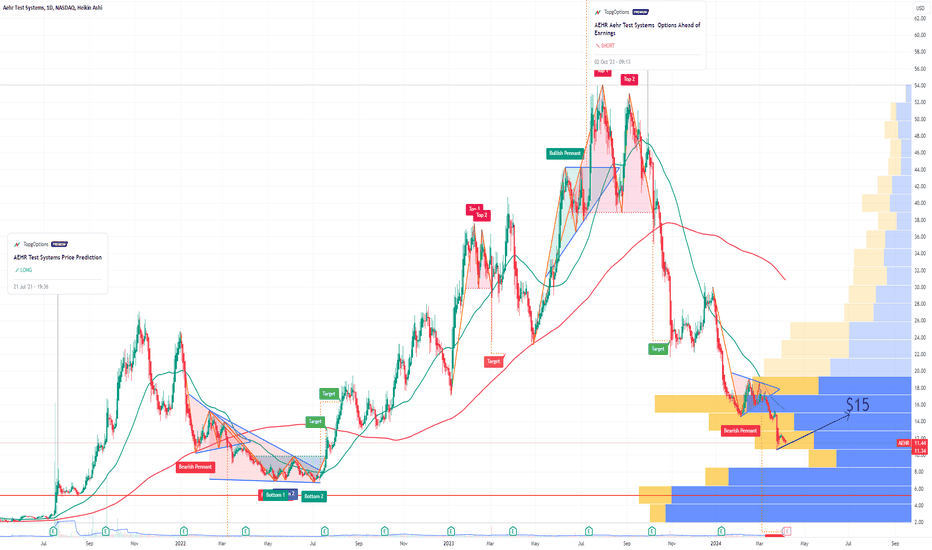

AEHR Test Systems Options Ahead of EarningsIf you haven`t bought AEHR before the rally:

nor sold the Double Top:

Then analyzing the options chain and the chart patterns of AEHR Test Systems prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2024-7-19,

for a premium of approximately $0.98.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

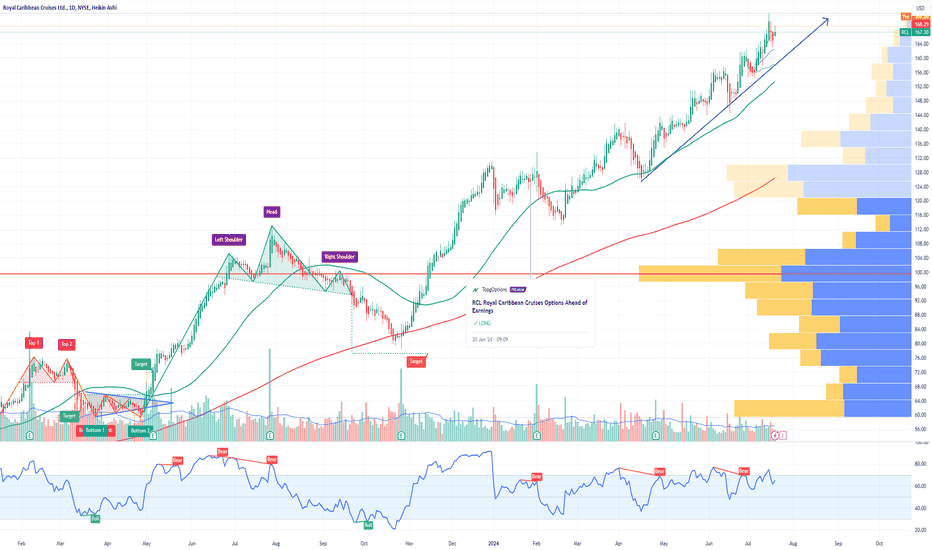

RCL Royal Caribbean Cruises Options Ahead of EarningsIf you haven`t bought RCL before the previous earnings:

Now analyzing the options chain and the chart patterns of RCL Royal Caribbean Cruises prior to the earnings report this week,

I would consider purchasing the 165usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $13.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

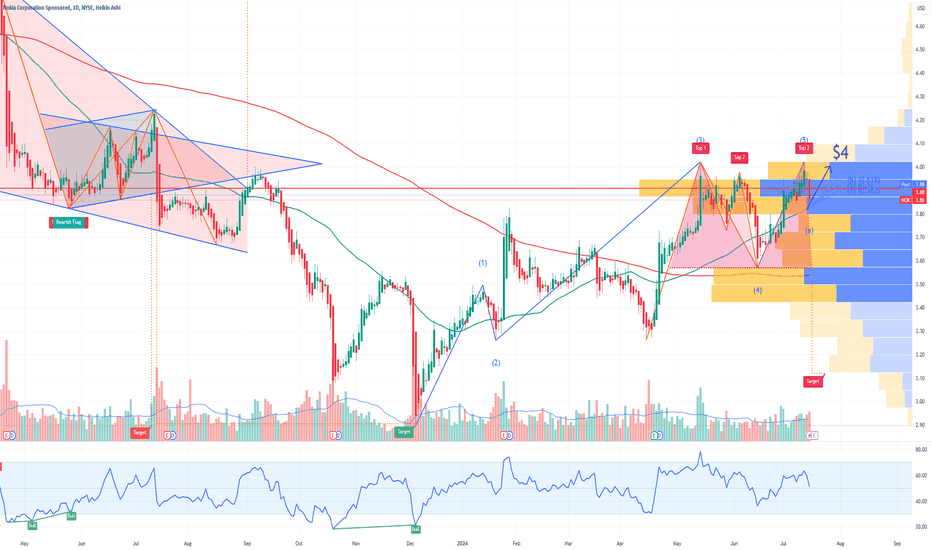

NOK Nokia Options Ahead of EarningsAnalyzing the options chain and the chart patterns of NOK Nokia prior to the earnings report this week,

I would consider purchasing the 4usd strike price Calls with

an expiration date of 2024-7-19,

for a premium of approximately $0.09.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

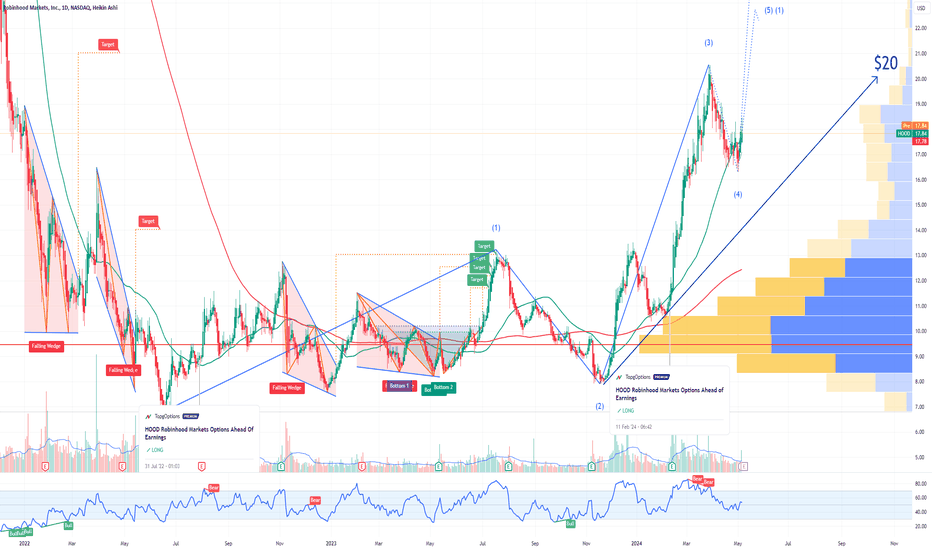

HOOD Robinhood Markets Options Ahead of EarningsIf you haven`t bought HOOD before the previous earnings:

Then analyzing the options chain and the chart patterns of HOOD Robinhood Markets prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2024-9-20,

for a premium of approximately $2.22.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

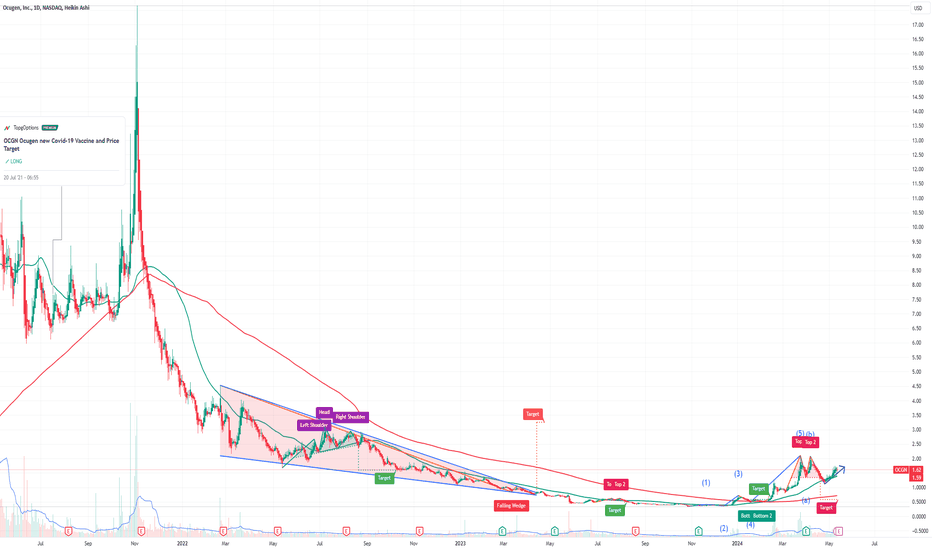

OCGN Ocugen Options Ahead of EarningsIf you haven`t bought OCGN when they released their Covid vaccine:

Then analyzing the options chain and the chart patterns of OCGN Ocugen prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Calls with

an expiration date of 2024-5-17,

for a premium of approximately $0.22.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

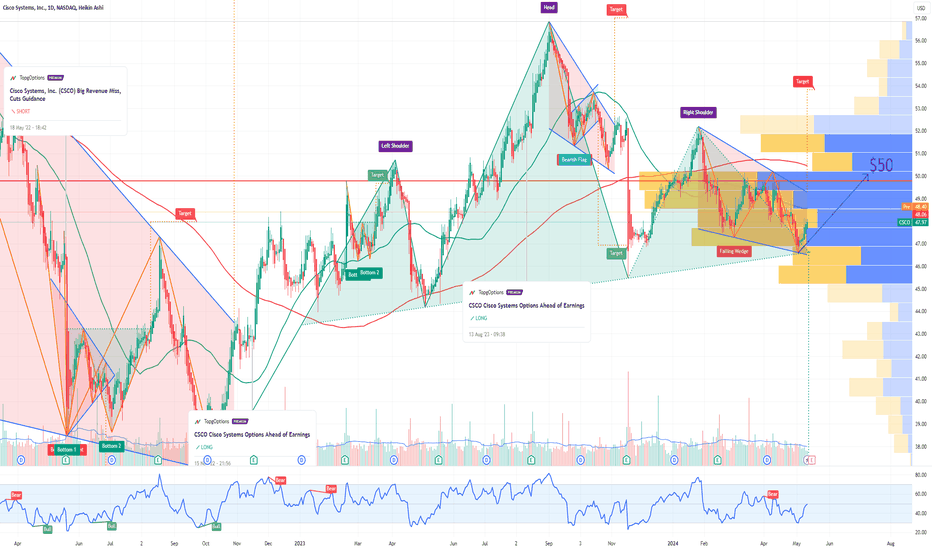

CSCO Cisco Systems Options Ahead of EarningsIf you haven`t bought the dip on CSCO:

Then analyzing the options chain and the chart patterns of CSCO Cisco Systems prior to the earnings report this week,

I would consider purchasing the 50usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $1.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

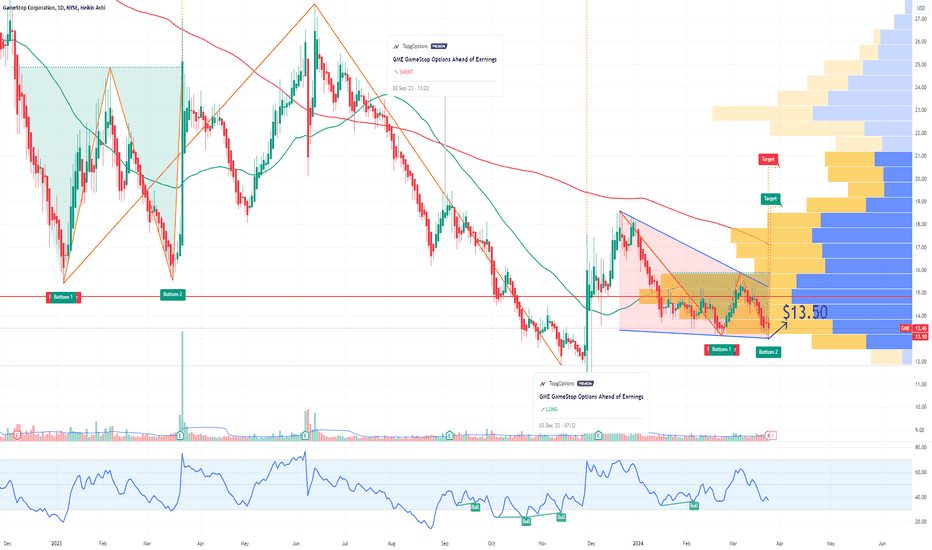

GME GameStop Options Ahead of EarningsIf you haven`t sold GME before the previous earnings:

Then analyzing the options chain and the chart patterns of GME GameStop prior to the earnings report this week,

I would consider purchasing the 13.50usd strike price Calls with

an expiration date of 2024-3-28,

for a premium of approximately $1.41.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

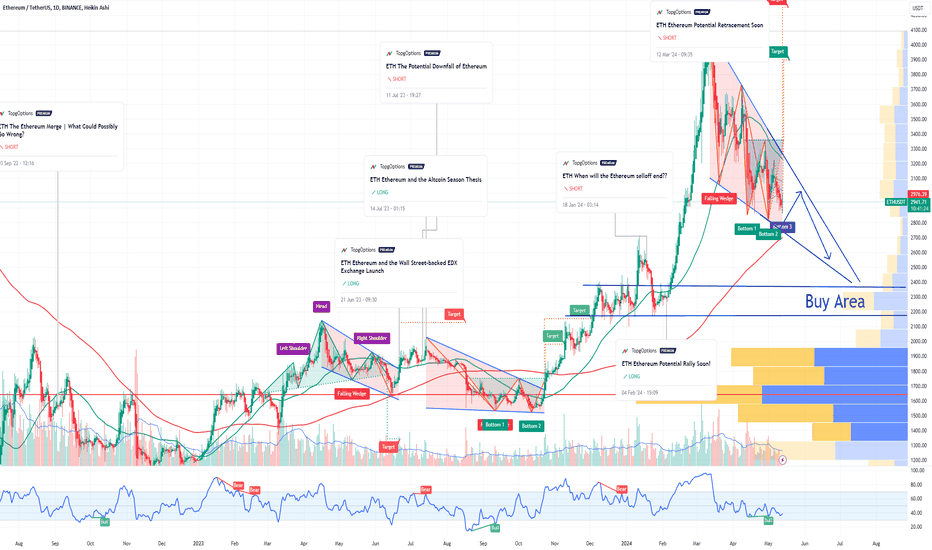

ETH Ethereum falling wedge pattern If you haven`t sold ETH at the top:

As the cryptocurrency market navigates through choppy waters, Ethereum, the second-largest cryptocurrency by market capitalization, finds itself ensnared within a bearish formation known as a falling wedge pattern. This technical setup, coupled with broader market uncertainties, casts a shadow over Ethereum’s short-term prospects, with a looming price target of $2400 becoming increasingly probable.

A falling wedge pattern typically signals a continuation of a prevailing downtrend, suggesting that Ethereum’s recent struggles may persist in the near term. Characterized by a series of lower highs and lower lows, this pattern reflects a gradual erosion of bullish momentum, often culminating in a breakdown below the wedge’s lower boundary.