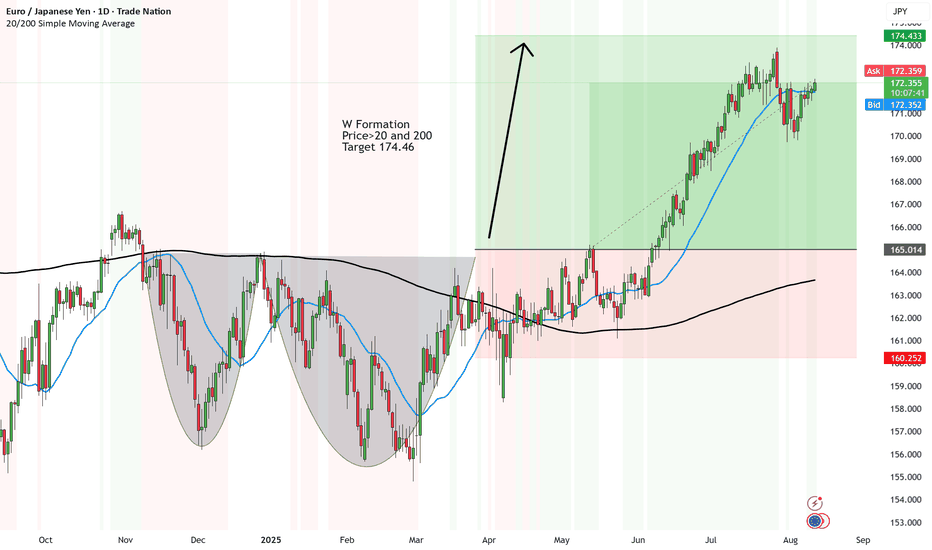

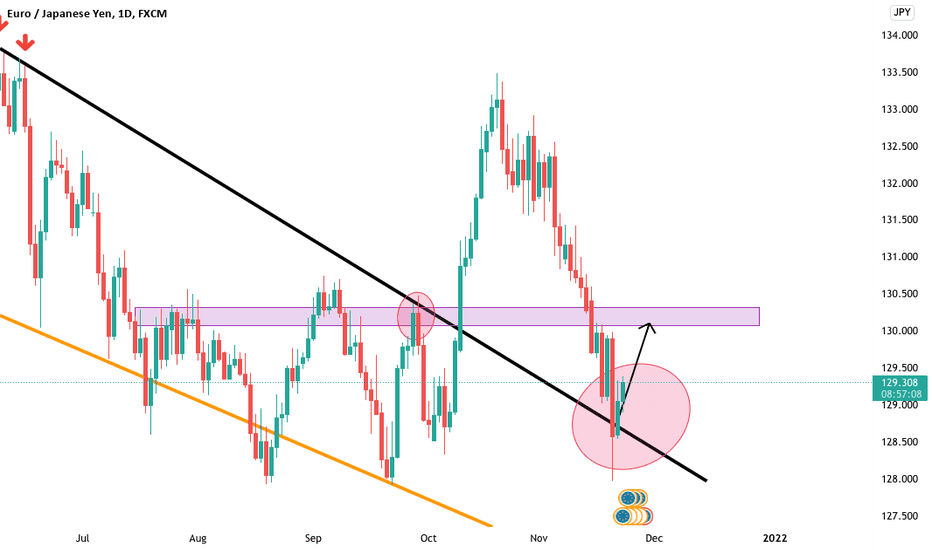

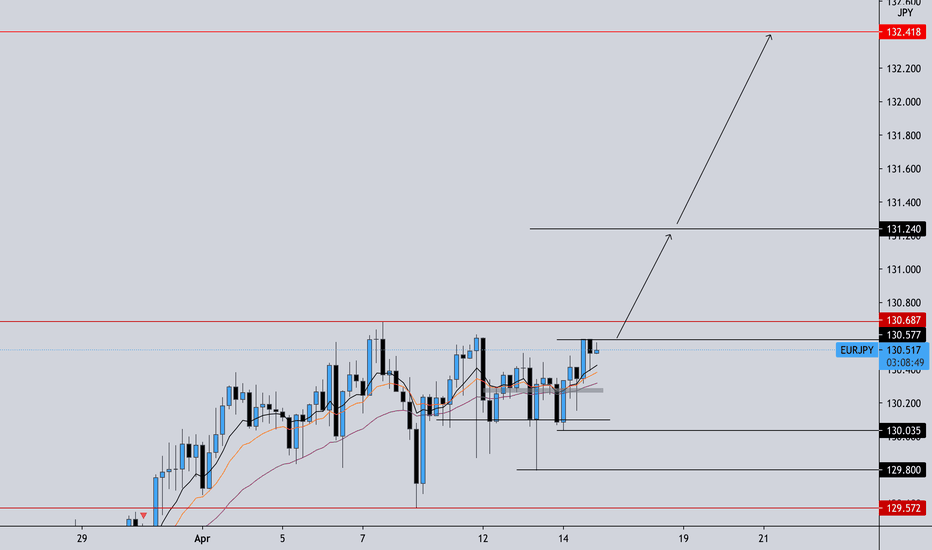

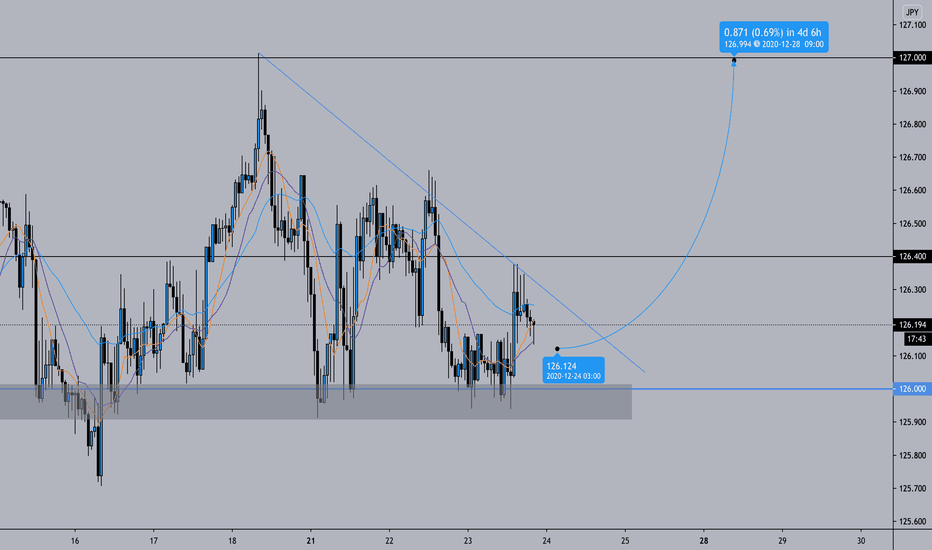

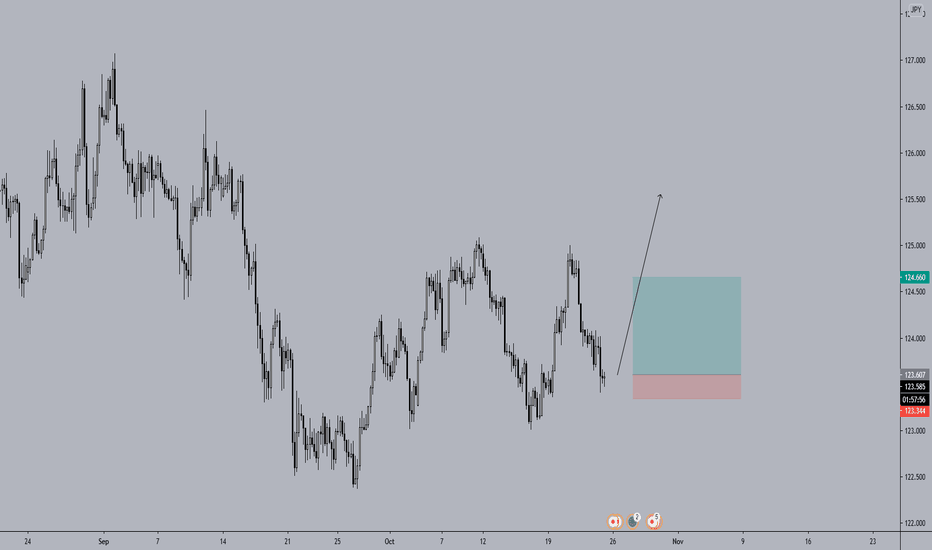

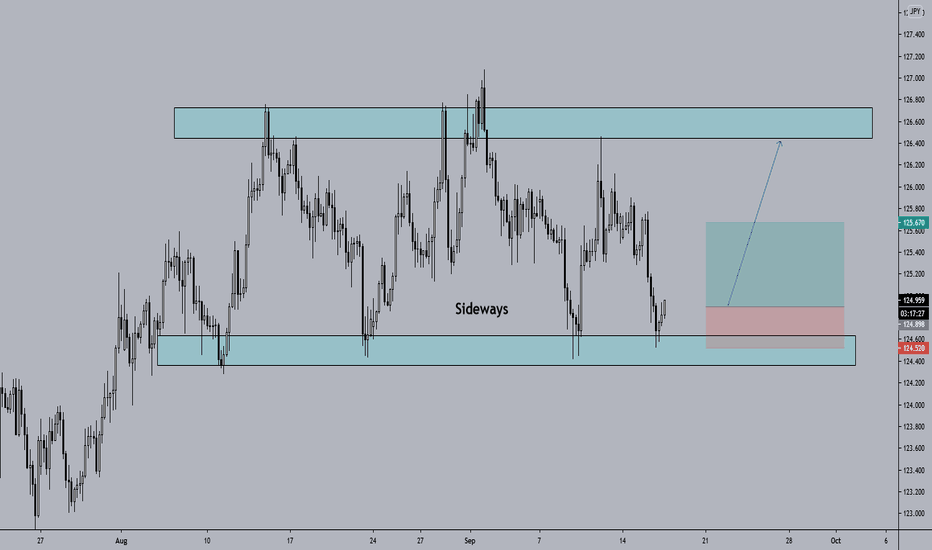

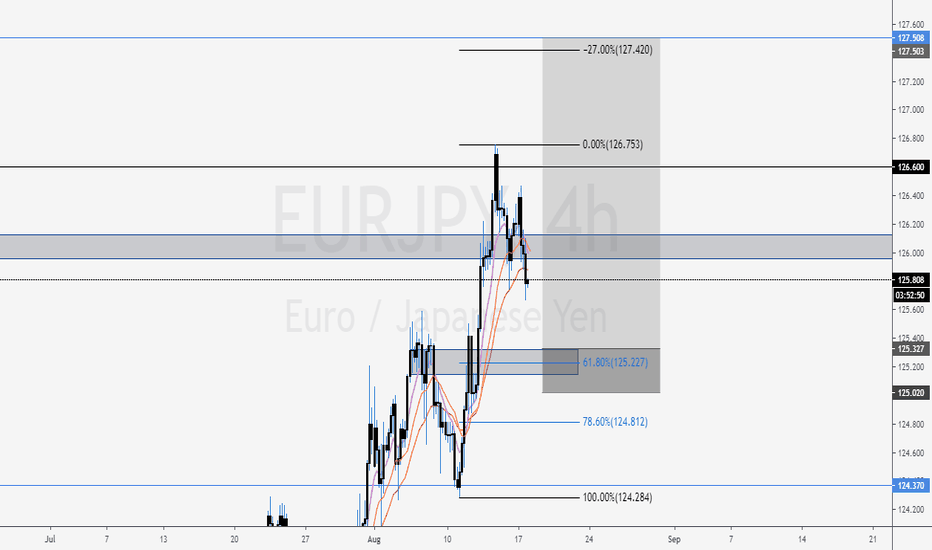

EUR/JPY - target almost reached at 174.46 - But is it worth it?W Formation formed tick.

Price>20 and 200 - Tick

Target 174.46

Stop loss - not hit - TICK

All easy and said and done.

BUt the analysis was done in April. It is August.

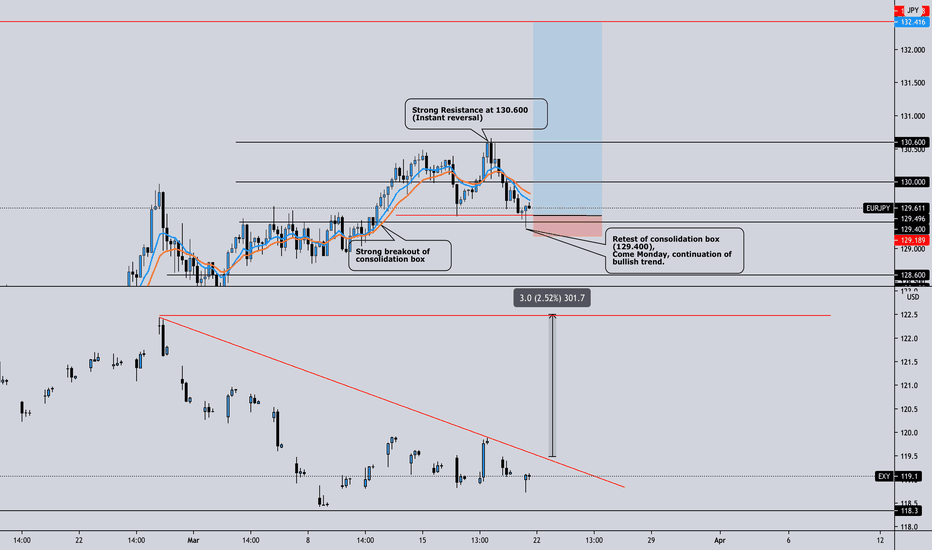

We take on daily interest charges.

Opportunity costs.

So are these LONG term trades good in the long run? Maybe with LARGE portfolios then it's all relative and the costs are the price to pay.

But for smaller portfolios that most people have - it's not worth it.

Prioritise with your trading risk management and profile. And if need be, implement a TIME STOP LOSS to avoid long winded holding trades that turn into unnecessary marriages.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

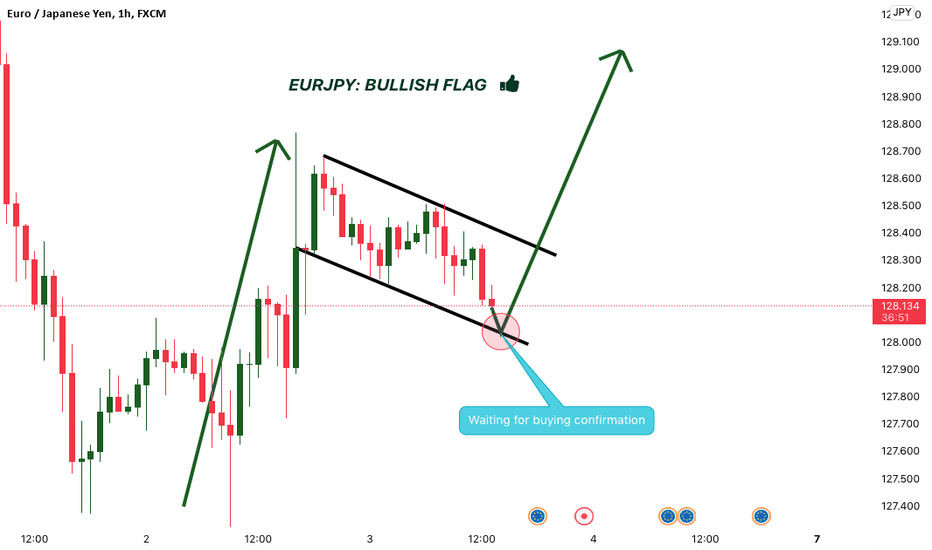

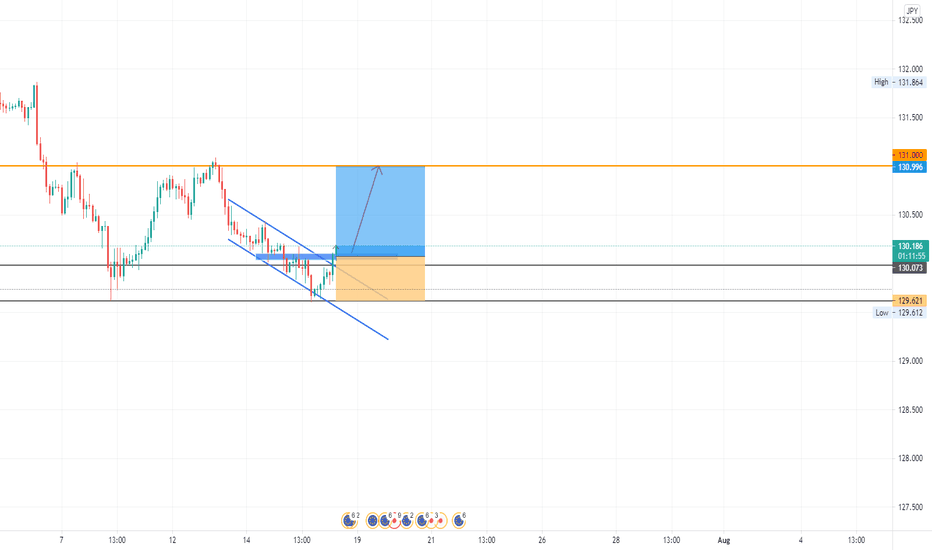

Buyeurjpy

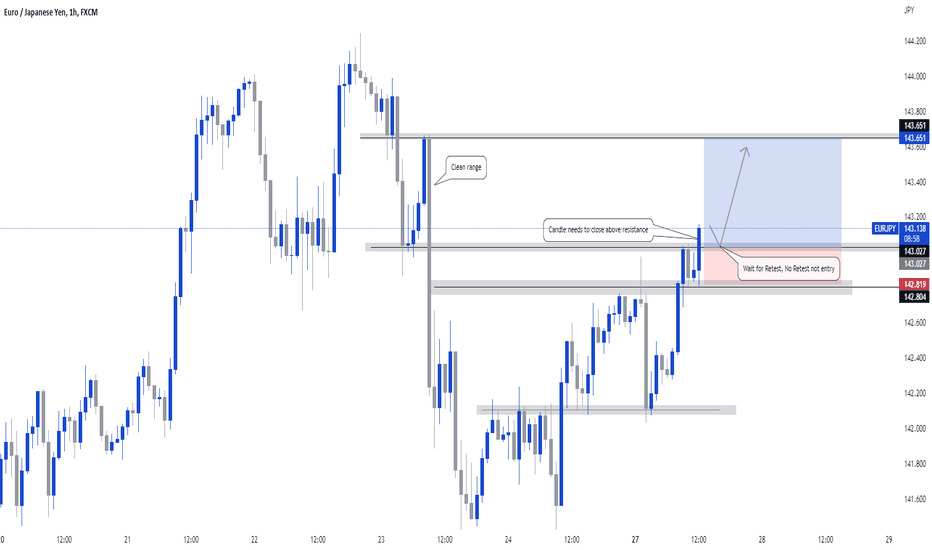

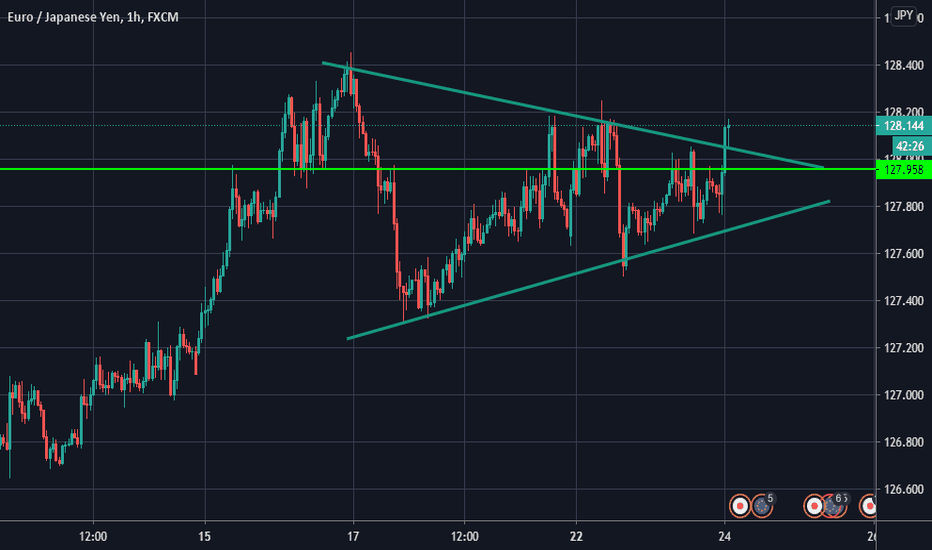

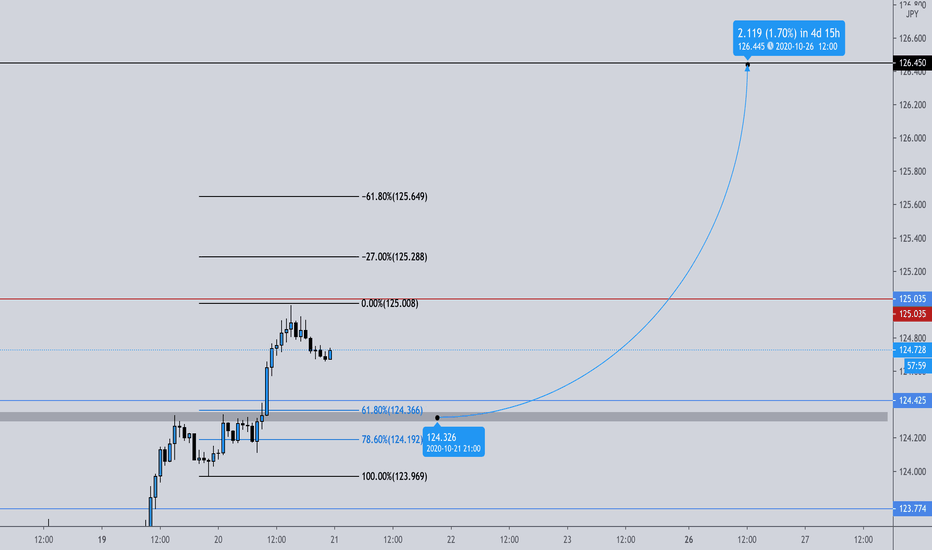

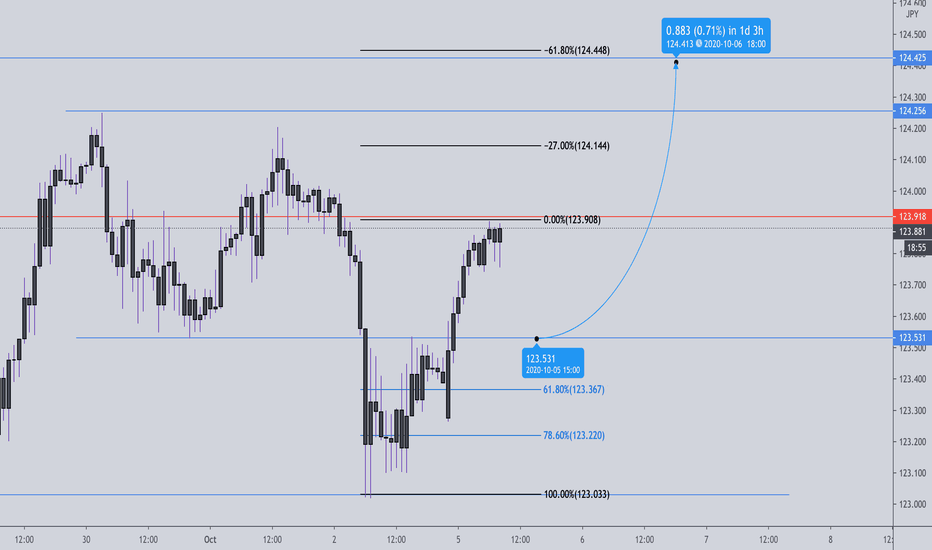

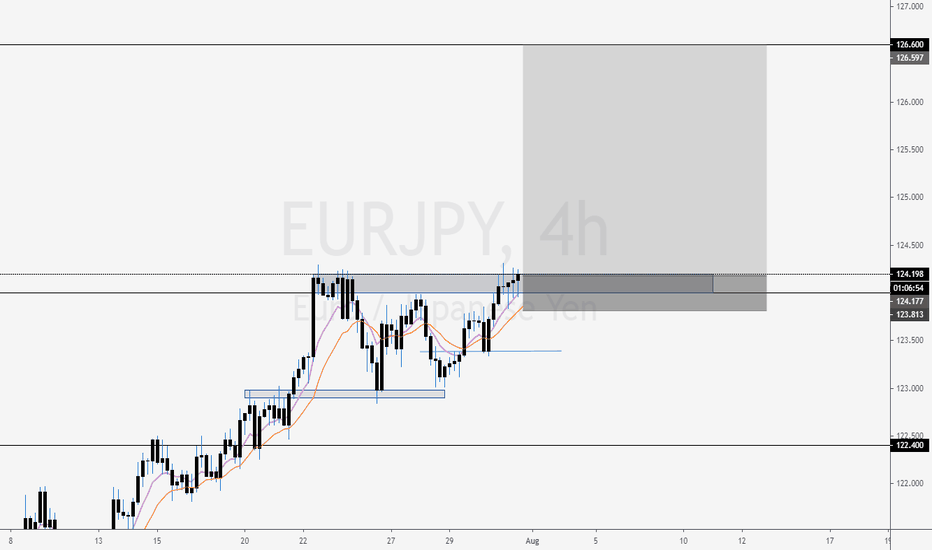

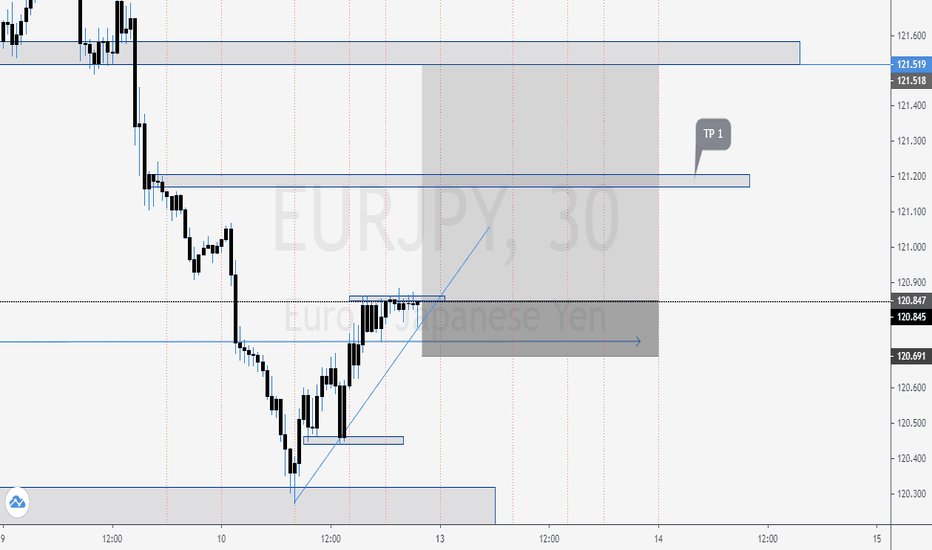

Simple buy coming up on EURJPYHi Traders,

New week, New opportunities, today I see a simple play on EUR/JPY, Price is bullish based on the higher timeframes such as the weekly and daily so it makes sense to try finding those buying opportunities on the lower timeframes.

What we have is price currently looking very convincing in the continuation of the HTF momentum, Price has managed to break above 143.0 which was previously a point of resistance. In order for me to be interested in the Buy, I would like to see price close above this current level.

Once we have gotten the close I would like to see price 1st retest this level before taking a buy into 143.600 which should be a smooth and easy trade because of the clean range on the left-hand side.

Please be sure to wait for the candle close.

Renaldo Philander.