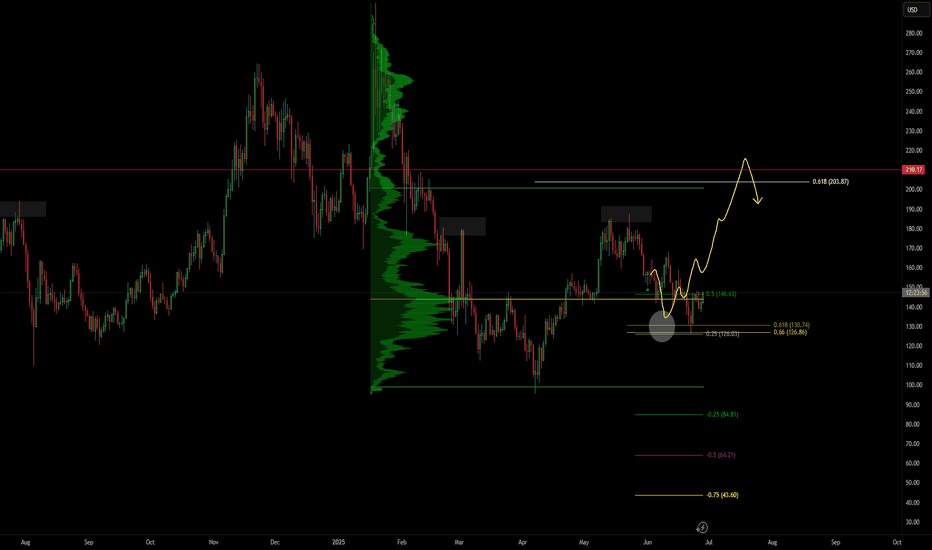

Bitcoin CME Closing Price: The Key to Next Week’s TrendIn this video I cover the CME closing price and go through a plan which includes a gap to the upside and a short squeeze before gravitating to the downside for lower targets .

I also give a bias for higher prices if the VAH is claimed .

This idea is modelled on the daily time frame and can play out over the course of the following week or more .

I also look at the Eth/Btc pair and the Btc dominance chart and marry whats happening on those charts with this idea .

When looking at BTC I use order flow software to further support my bias and the confluences I present in the chart.

If you have any questions then leave them below .

Support my work with a boost and Safe trading

Bybitfutures

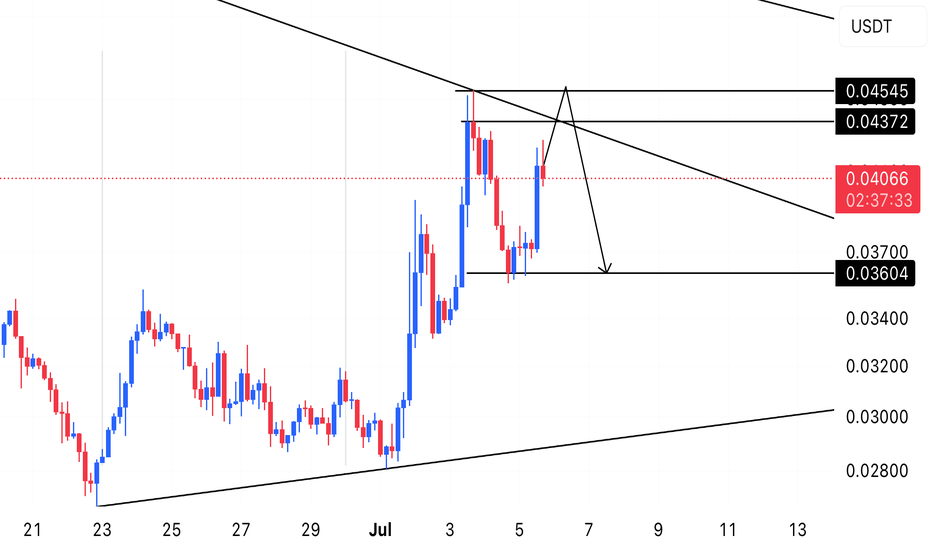

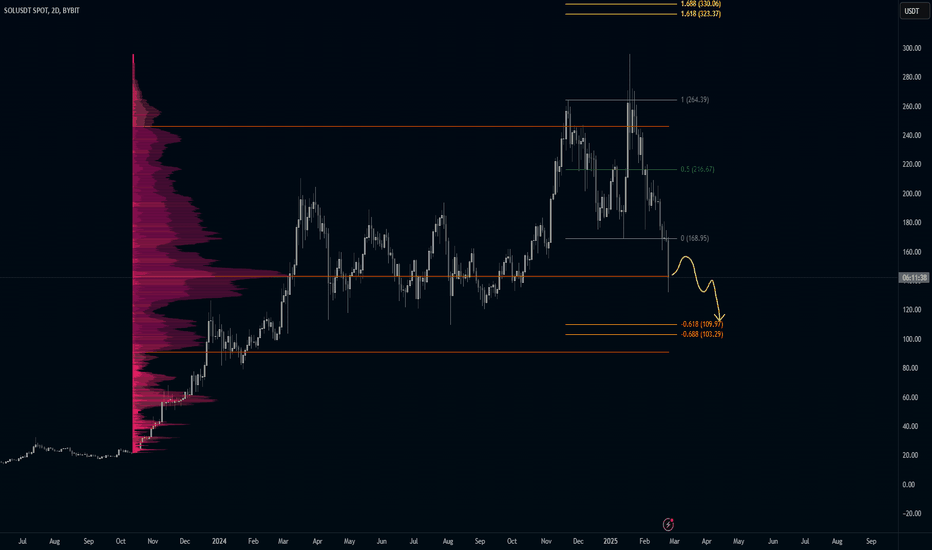

Solana coin Long setupIn this video I go through the current price action and talk about how the 126$ target level was recently reached for a clean long entry and on the daily timeframe we printed a higher low .

I expand on my thoughts for a continuation to the upside and to retest some higher levels of resistance 180$s and time will tell if we print a higher high at the 180$s before retesting the $200 zone .

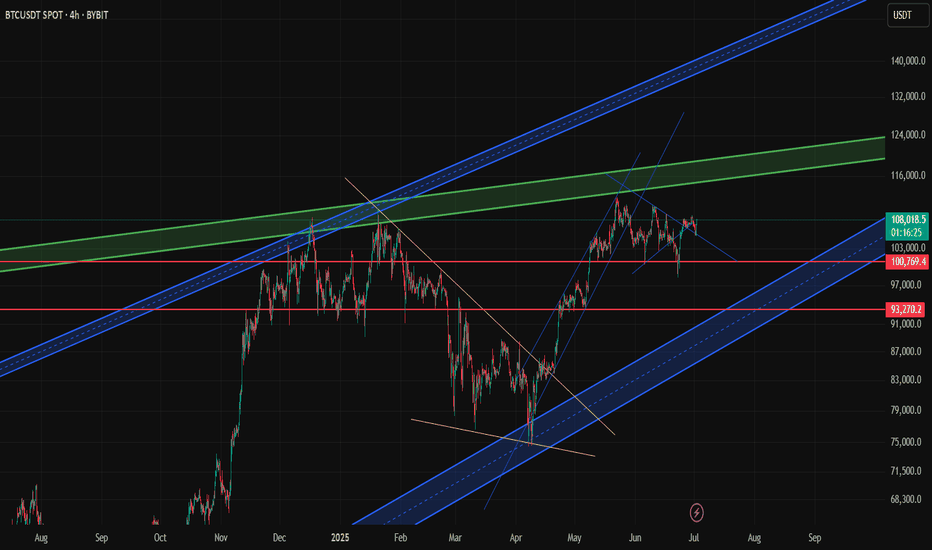

How I Use Bybit Referral Code BY500 for BTC Scalping –Live TradeBTC/USDT – 4H Scalping Setup with Real Price Action Zones & Channel Analysis (Bybit Referral code BY500 Chart) Over the past few weeks, Bitcoin has been moving within a clear ascending channel with multiple pullbacks creating scalp-worthy entries on the 4H timeframe. In this analysis, I’m sharing my current BTC/USDT scalping strategy built around support/resistance, channel breakouts, and confluence zones—all visualized on the chart above.

Current BTC Setup:

BTC is currently trading near $107,800, having bounced from the $100,769 red support line

A potential retest of the descending wedge is underway

The price remains above a critical long-term support zone marked in blue channels, suggesting a bullish mid-term outlook

Why I Use This Strategy

My scalping technique is based on identifying high-probability zones within channel ranges, especially in confluence with long-term trendlines. This strategy is particularly effective when using exchanges with low fees and fast execution.

I personally trade this setup using a platform that offers deep liquidity and competitive trading fees (hint: chart is from that platform). Lower fees = better ROI per scalp, especially in volatile conditions.

Scalping Tools Used:

Channels: To identify swing zones and trend continuation

Volume zones: (Not shown here, but used on execution layer)

Multi-timeframe confluence

Support/Resistance flips

Pro Tip:

If you're an active scalper, always watch for:

Wick rejections at trendlines

Volume surge near breakout

Failing rallies as signs of retracement

usE bYBIT referral Code - BY500

These are all visible in this BTC structure.