C98

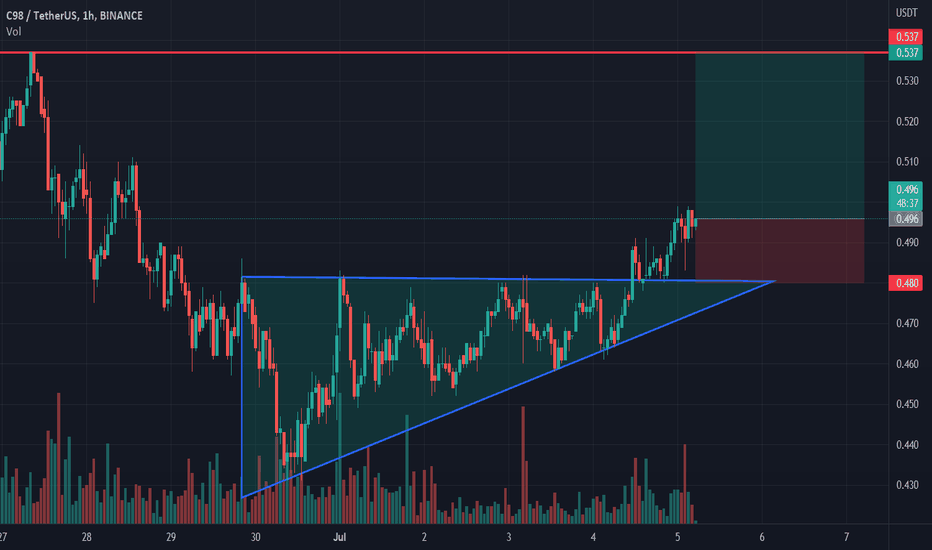

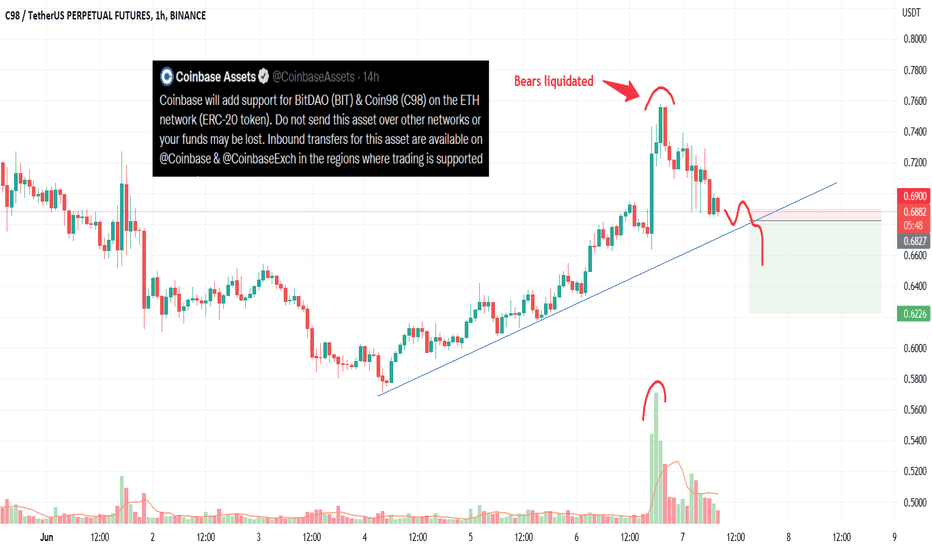

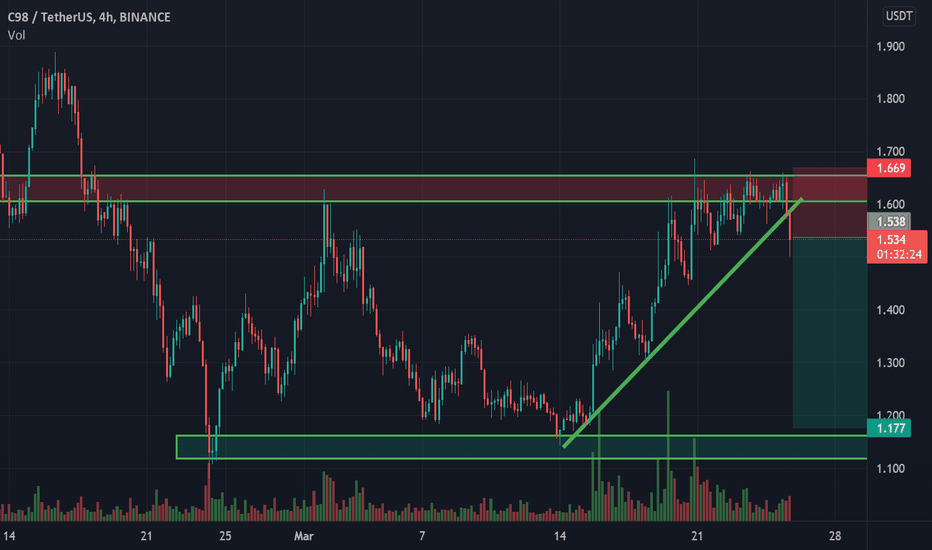

C98 - Listed on Coinbase but that was a trap for bulls🐮Reasons to take short

⭐️ BTC bearish

⭐️ Trendline is clear

⭐️ Volume at top

⭐️ Trapped a lot of bulls with listing

⭐️ 5th touch

⭐️ Under VWAP

Will enter when price squeezes to the trendline on 5m timeframe, the base will form and the strip will get faster.

If you don't understand the previous sentence, just use swing stop-loss 3-5%

Fix profit by parts:

1% - 1/3

2% - 1/3, stoploss to breakeven

What's left, hold to the maximum

What do you think of this idea? What is your opinion? Share it in the comments📄🖌

If you like the idea, please give it a like. This is the best "Thank you!" for the author 😊

P.S. Always do your own analysis before a trade. Put a stop loss. Fix profit in parts. Withdraw profits in fiat and reward yourself and your loved ones

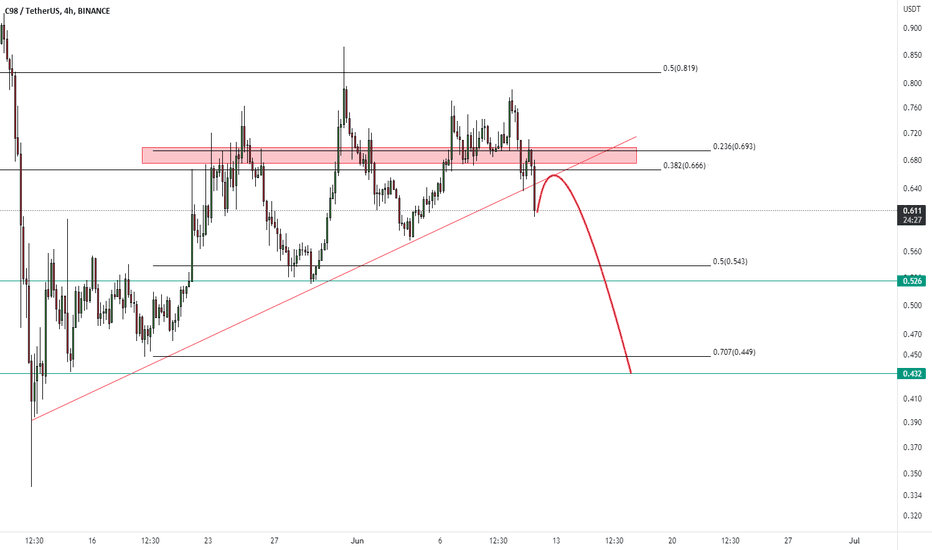

C98 a nice ride?Fundamentals:

+/- DEFI Agregator

+/- DEX

+Cross Chain

Opinion:

Just another copy of 1inch with extra Defi/Yield features and CrossChain. Unlikely to pump outside token-economics shifting events.

This is not intended or made to constitute any financial advice.

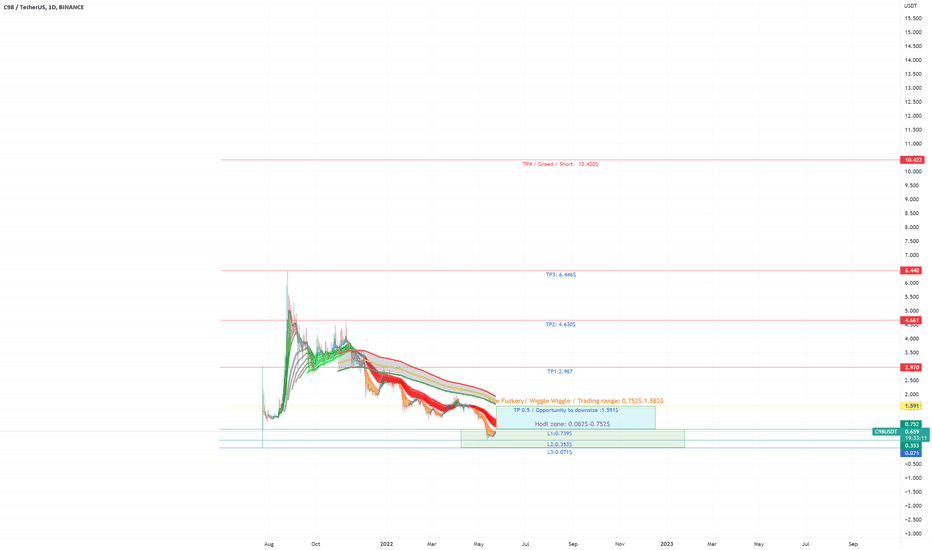

Notes on how I personally use of my charts/NFA:

Each level L1-L3 and TP1-TP3 has a deployment percentage. The idea is to flag these levels so I can buy 11% at L1 , 28% at L2 and if L3 deploy 61% of assigned dry powder. The same in reverse goes for TP. TP1: 61%, TP2:28% and TP3:11%. If chart pivots between TP's, in-between or in Between Sell levels these percentages are still respected. I like to use the trading range to accumulate by using this tactic.

Just my personal way of using this. This is not intended or made to constitute any financial advice.

This is not intended or made to constitute any financial advice.

FED Macro Situation Consideration:

All TP's are drawn within the context of a return to FED Neutral policy. I do not expect these levels to be reached before tightening is over.

NOT INVESTMENT ADVICE

I am not a financial advisor .

The Content in this TradingView Idea is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within this idea constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this idea post is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the idea/post constitutes professional and/or financial advice, nor does any information on the idea/post constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the idea/post before making any decisions based on such information.

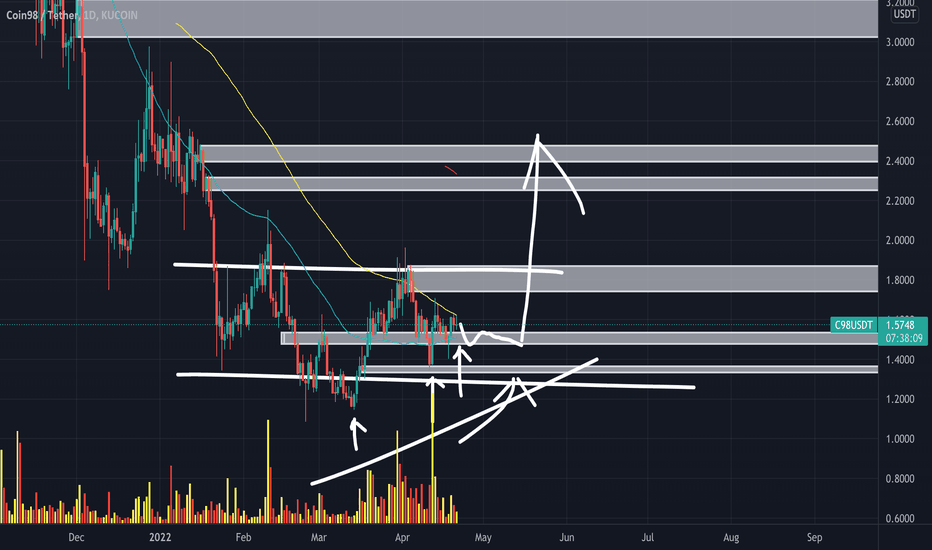

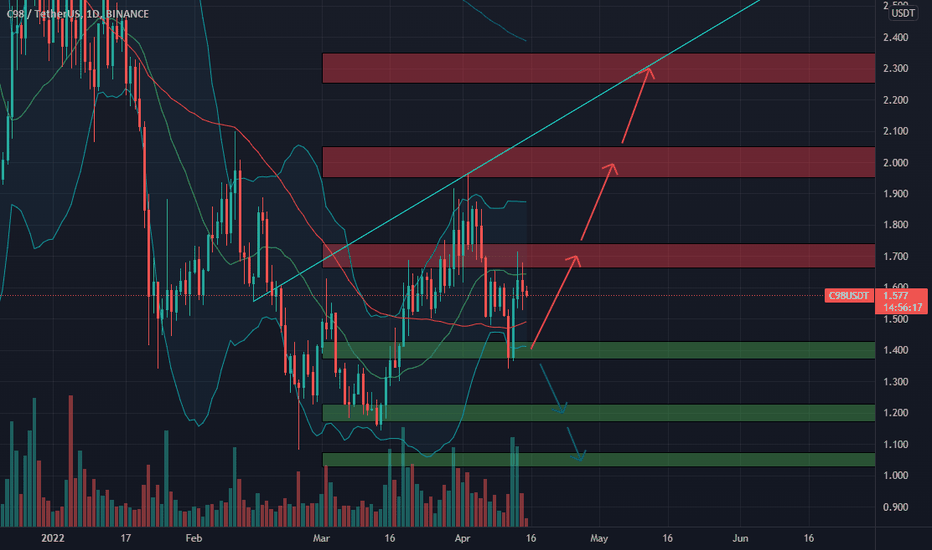

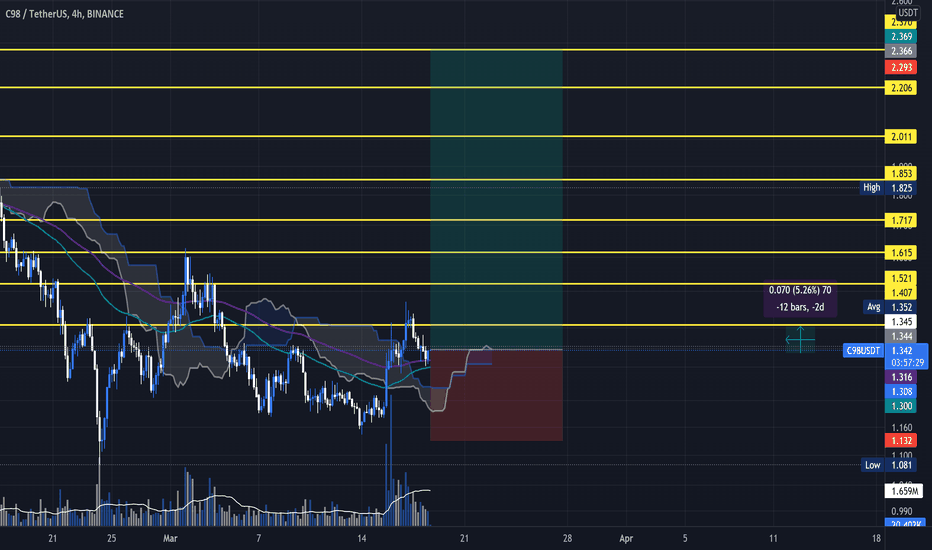

🆓Coin98 (C98) Apr-15 #C98 $C98

C98 has just had a very strong buying force when it approached the $1.4 zone, but it is being rejected at the $1.7 zone, so in the near future it may correct to the $1.4 zone to retest this zone. After that, it is likely to rally strongly back to the $1.7 zone to conquer this zone and rally strongly to the $2 and 2.3 zone.

📈RED PLAN

♻️Condition : If 1-Day closes ABOVE 1.4$ zone

🔴Buy : 1.4

🔴Sell : 1.7 - 2 - 2.3

📉BLUE PLAN

♻️Condition : If 1-Day closes BELOW 1.4$ zone

🔵Sell : 1.4

🔵Buy : 1.2 - 1.05

❓Details

📈Red Arrow : Main Direction as RED PLAN

📉Blue Arrow : Back-Up Direction as BLUE PLAN

🟩Green zone : Support zone as BUY section

🟥Red zone : Resistance zone as SELL section

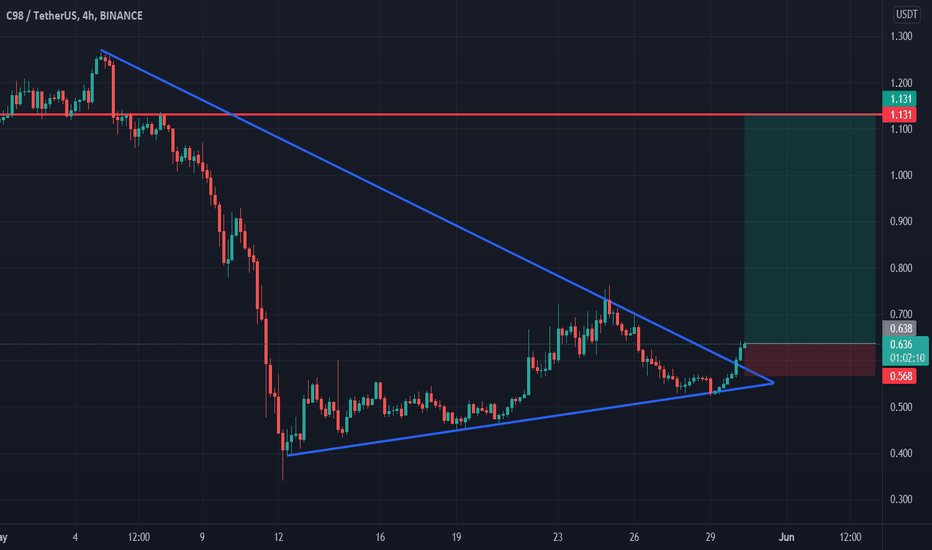

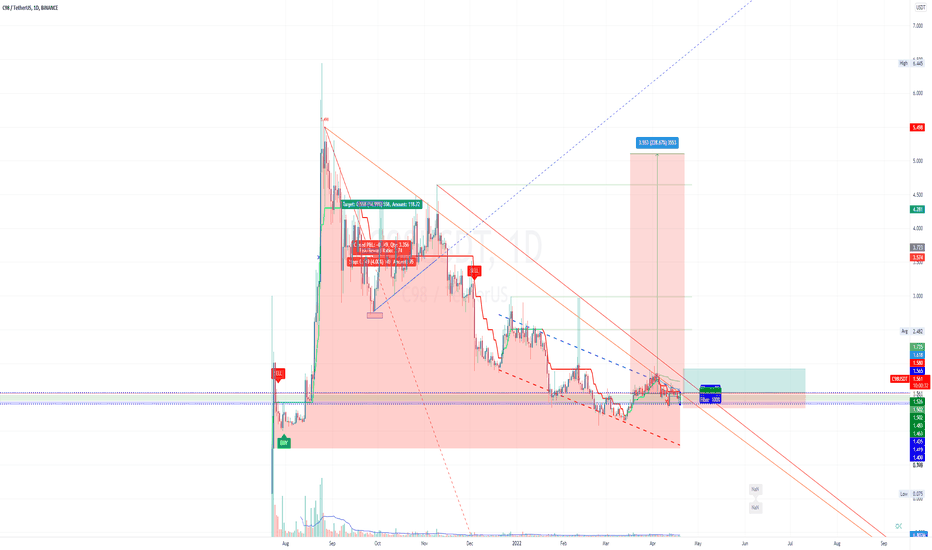

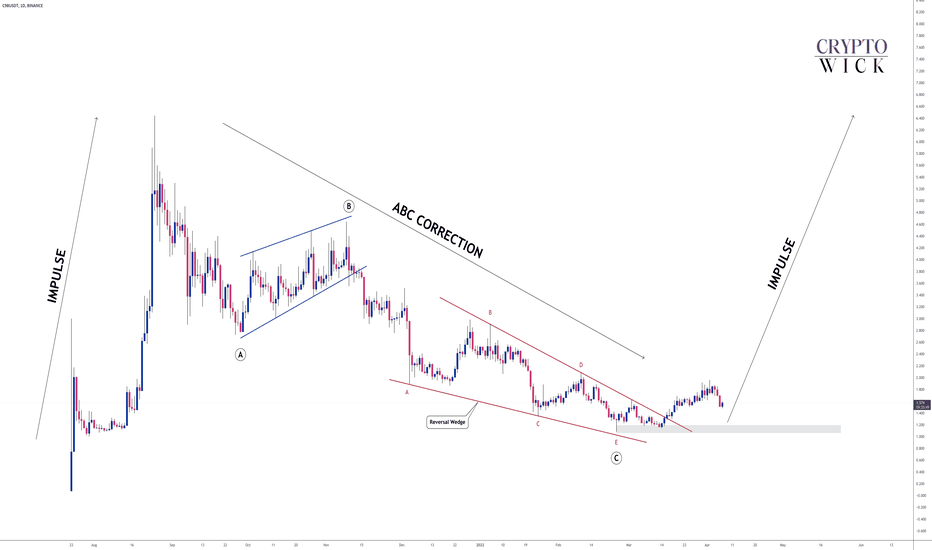

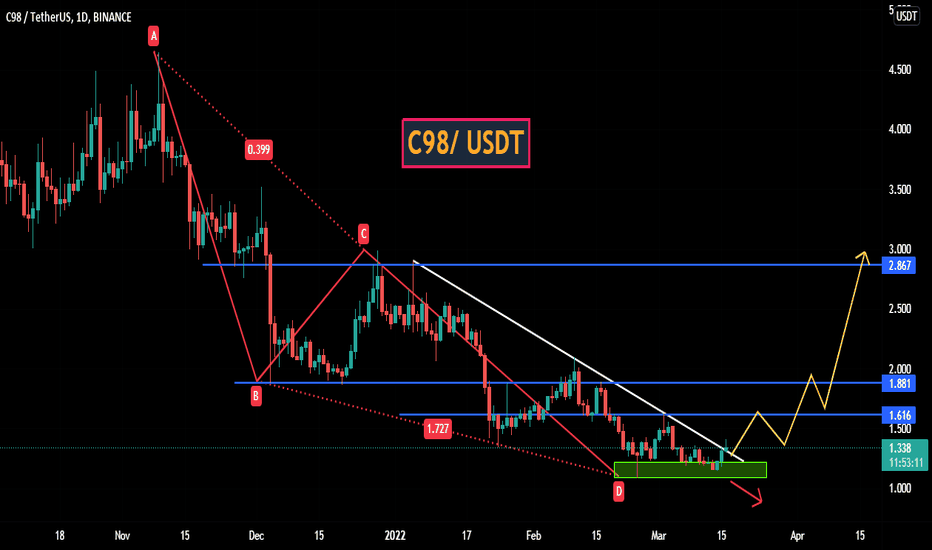

C98 - Massive PotentialHigher timeframe shows that we've had a massive impulse followed by a correction. Naturally the next move should be (and most likely will be) an impulse.

The ABC correction completed with a nice descending wedge and now we are in bullish territory.

Trade Idea:

- Watch for bullish price action on lower timeframe

- Not anticipating price to break the bottom so stops would be safe below that level

- Targets: 4.4, 6.2, actively manage the rest

Goodluck!

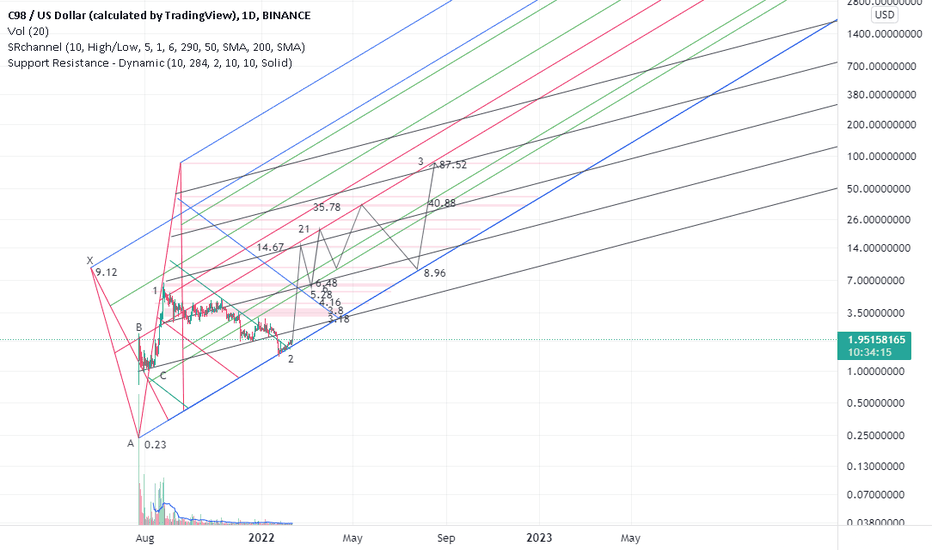

C98 is starting the 3rd wave?C98 is starting the 3rd wave or still needs to consolidate by wxyxz triple combination in the 2nd wave?

crab harmonic pattern:

X=$9.12

A=$0.234

AB=0.61 XA

BC=0.38 AB

0.78 BC=$1.87

0.88 BC=$2.03

1.6 BC=$3.8

0.78 XA=$4.16

2 BC=$5.28

0.88 XA=$6

2.24 BC=$6.48

2.6 BC=$8.96

1.13 XA=$14.67

3.6 BC=$21

1.27 XA=$24.67

4.23 BC=$35.78

1.41 XA=$40.88

1.6 XA=$87.52

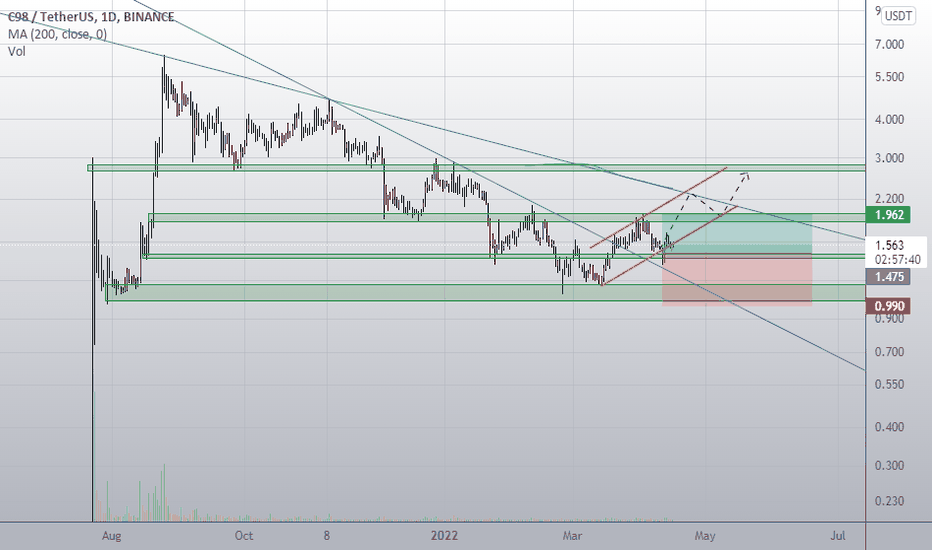

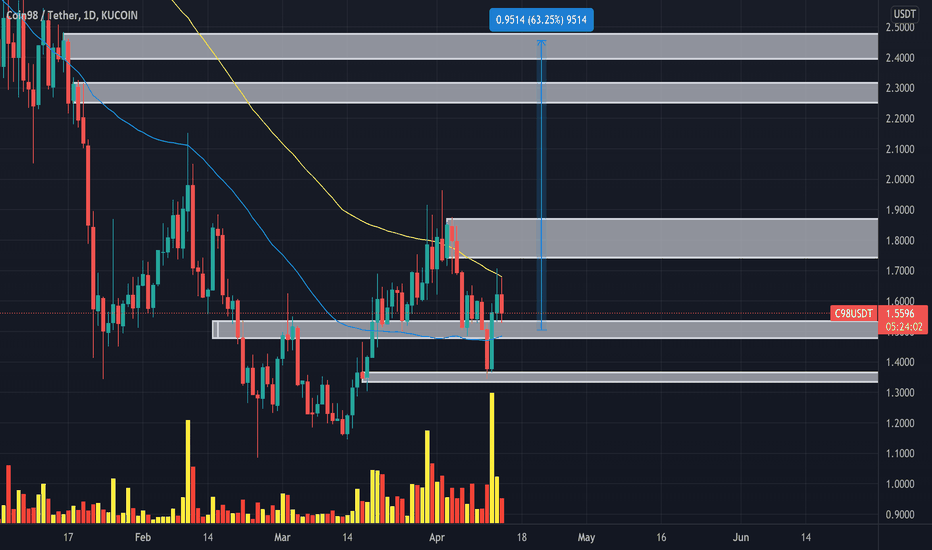

🆓Coin98 (C98) Mar-13 #C98 $C98

C98 is retesting the bottom of $1.2 and $1.1. The buying force can completely appear at this zone to help C98 increase strongly to the $1.6 and $2 areas in the near future. However, the buying power of C98 is quite weak, so it still has the ability to continue to lose the $1.1 area to fall sharply to the $0.8 area. But buying it at 1.1-1.2$ zone is a good idea for long-term

📈RED PLAN

♻️Condition : If 1-Day closes ABOVE 1.1$ zone

🔴Buy : 1.2 - 1.1

🔴Sell : 1.4 - 1.6 - 2

📉BLUE PLAN

♻️Condition : If 1-Day closes BELOW 1.1$ zone

🔵Sell : 1.1

🔵Buy : 0.8

❓Details

🚫Stoploss for Long : 10%

🚫Stoploss for Short : 5%

📈Red Arrow : Main Direction as RED PLAN

📉Blue Arrow : Back-Up Direction as BLUE PLAN

🟩Green zone : Support zone as BUY section

🟥Red zone : Resistance zone as SELL section

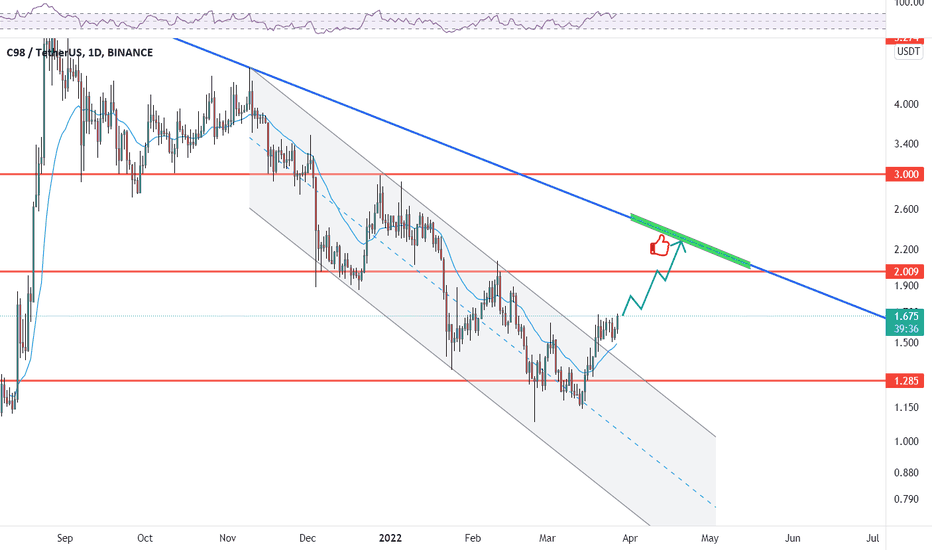

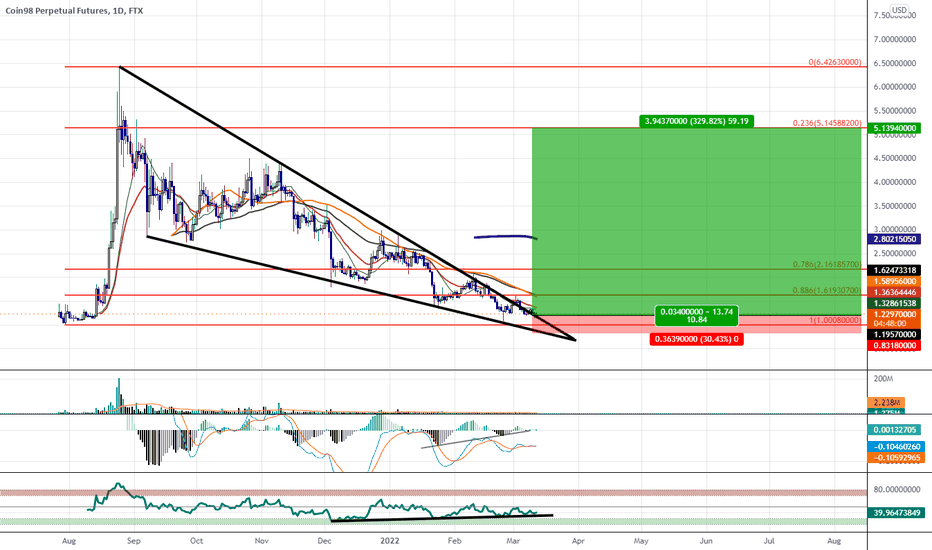

Coin98: Falling Wedge Breakout with 330% Measured MoveI've attempted before to catch a Preemptive Breakout for this coin but failed that however this time it's actually Broken Out and is showing yet another level of Bullish Divergence on the MACD and RSI so i will be attempting a second time with the same Bullish Target.