Market Surprise? June Rate Cut Might Be Delayed Market Surprise? June Rate Cut Might Be Delayed

After today’s BOJ and RBA interest rate decisions, eyes will turn to the Fed’s decision on Wednesday.

Although the US central bank is expected to keep rates unchanged, it could change its outlook due to the upside surprise in the latest CPI and PPI reports.

For now, the first cut is still seen happening in June, but there is a possibility that this gets pushed back a month or two again. Maybe the market would be the only one surprised by this possibility.

But what USD pair could be interesting this week?

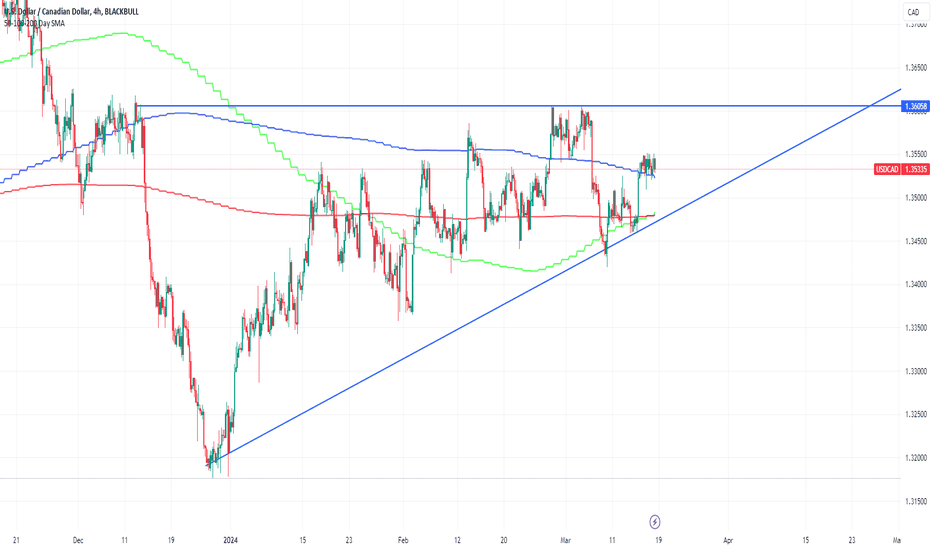

The Canadian Dollar is facing pressure in anticipation of the February inflation figures set to release on Tuesday. Analysts expect the annual headline inflation to have risen to 3.1% from January's 2.9%. This could postpone the Bank of Canada's intentions to lower interest rates, potentially leading to a clash with the Federal Reserve's monetary policy plans.

Depending on where market sentiment lay after we get the US and Canada data, the 100-day SMA could continue to support bulls. If sentiment turns, we have the 50- and 200-day SMA, which sits just above the ascending triangle trend, as a target for another support.

CAD

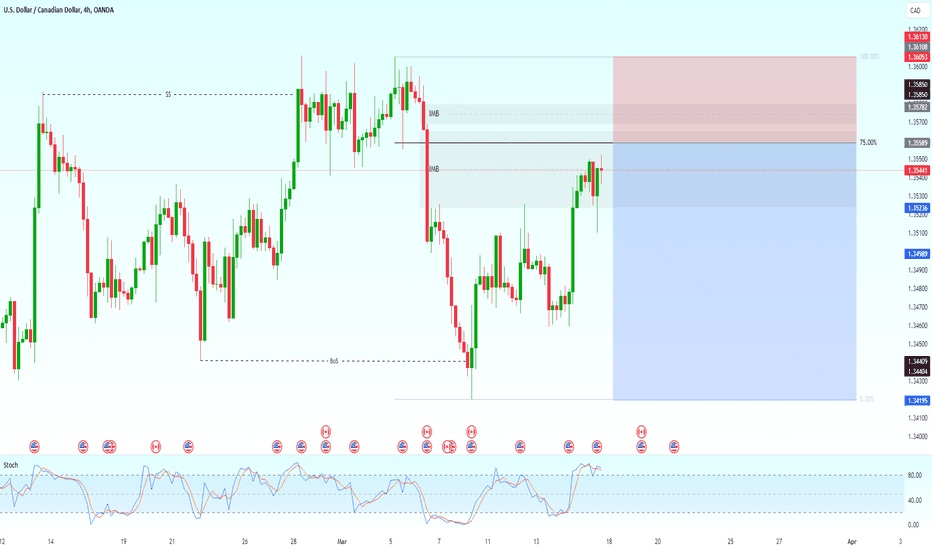

USD CADMy analysis on USD CAD, I use limit orders so I don't need to be in front of the chart all day.

To consider this a good entry there are certain criteria to follow:

1. Clean BoS with IMB.

2. * Look for areas where liquidity has been purged.

3. * Stochastic: in uptrend 0-15, in downtrend 85-100.

( * ) = Not optional but increases our probability.

I use Fibonacci to get these extreme points and my preferred one is 75% retracement, with a risk-reward of 1:3.

Set and forget.

Trade carefully,

This is not financial advice, DYOR.

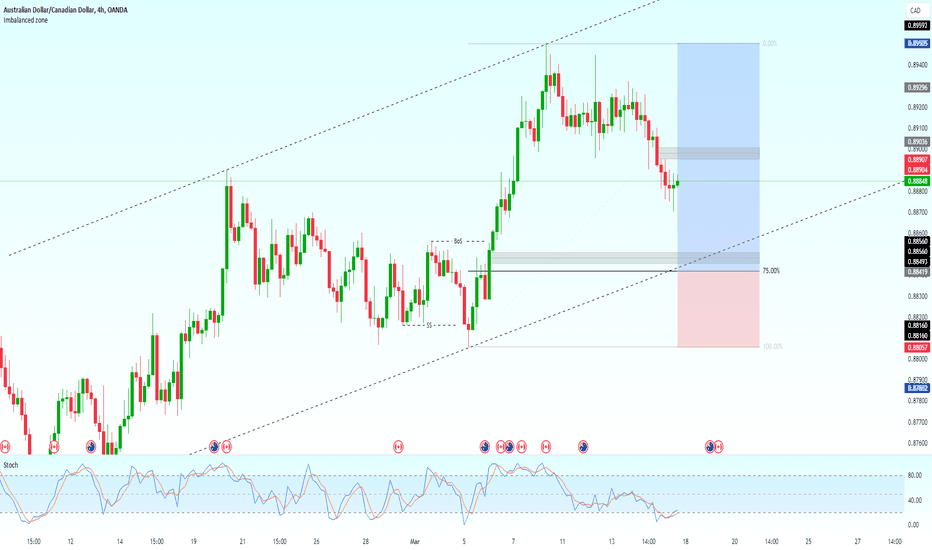

AUD CADMy analysis on AUD CAD, I use limit orders so I don't need to be in front of the chart all day.

To consider this a good entry there are certain criteria to follow:

1. Clean BoS with IMB.

2. * Look for areas where liquidity has been purged.

3. * Stochastic: in uptrend 0-15, in downtrend 85-100.

( * ) = Not optional but increases our probability.

I use Fibonacci to get these extreme points and my preferred one is 75% retracement, with a risk-reward of 1:3.

Trade carefully

This is not financial advice, DYOR.

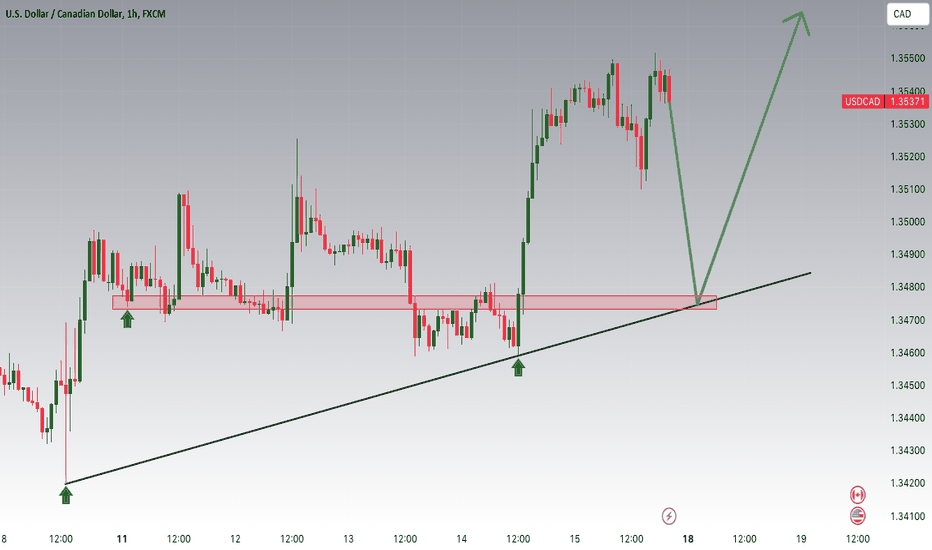

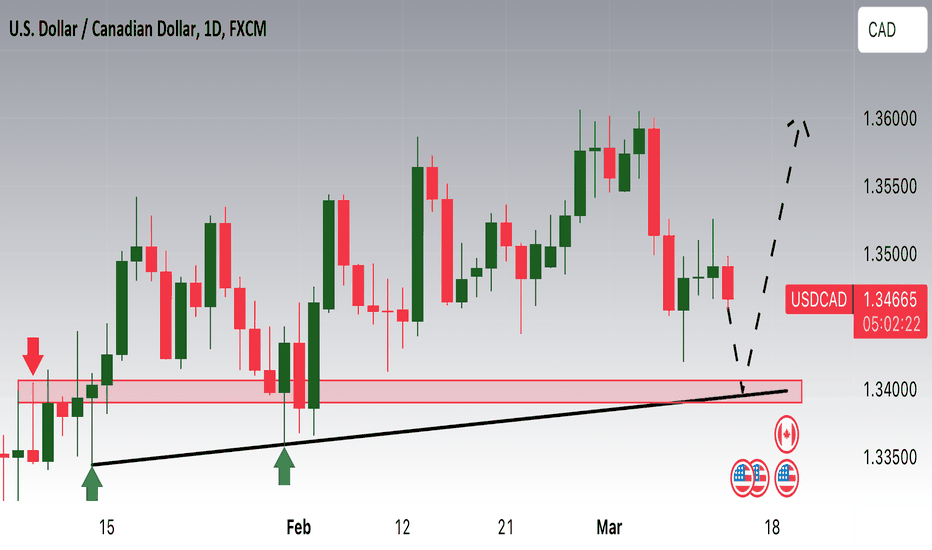

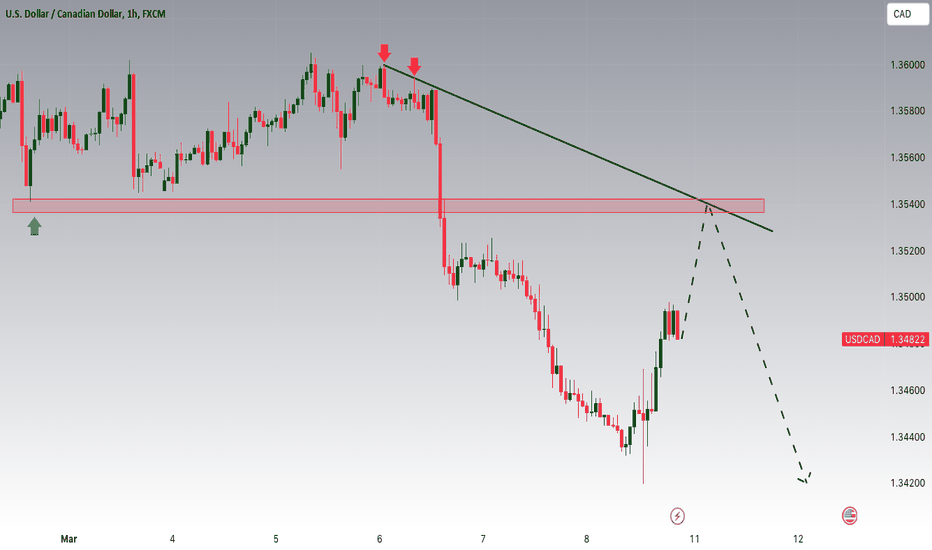

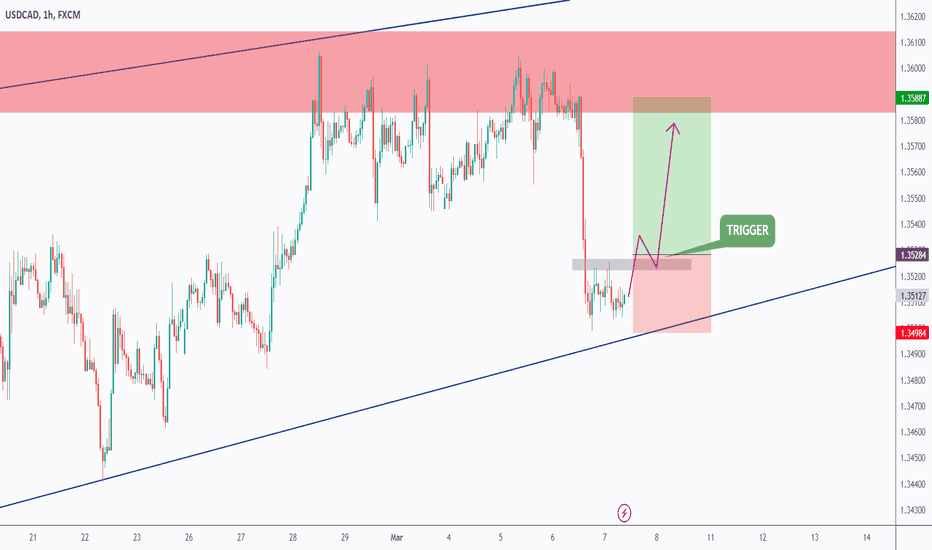

USDCAD is approaching a significant levelHey Traders. in today's trading session we are monitoring USDCAD for a buying opportunity around 1.34700 zone, USDCAD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.34700 support and resistance area.

Trade safe, Joe.

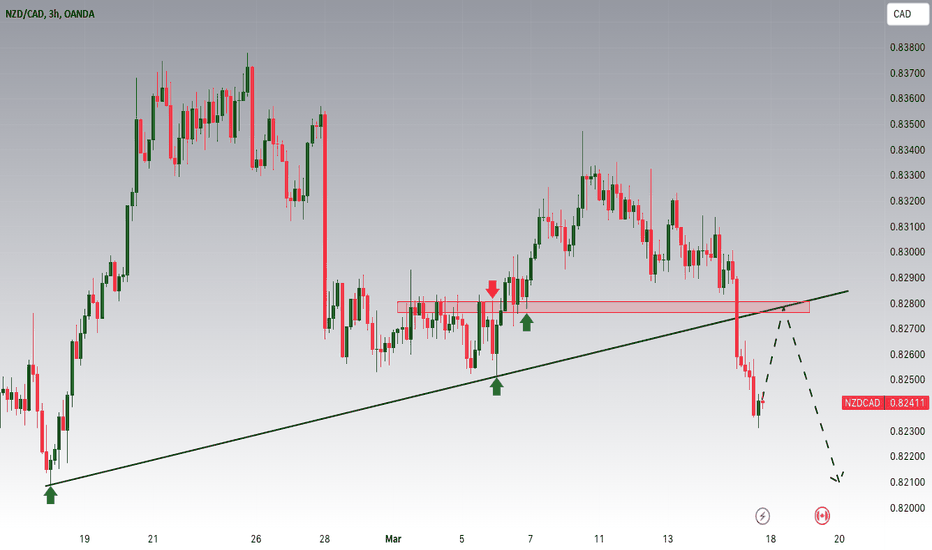

NZDCAD Bearish stocks and potential downsidesHey Traders, in the coming week we are monitoring NZDCAD for a selling opportunity around 0.82800 zone, NZDCAD is trading in a uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 0.82800 support and resistance area.

We would also consider the current bearish bias on stock market and indices, due to the correlation when stocks are bearish the NZDCAD is under pressure

Trade safe, Joe.

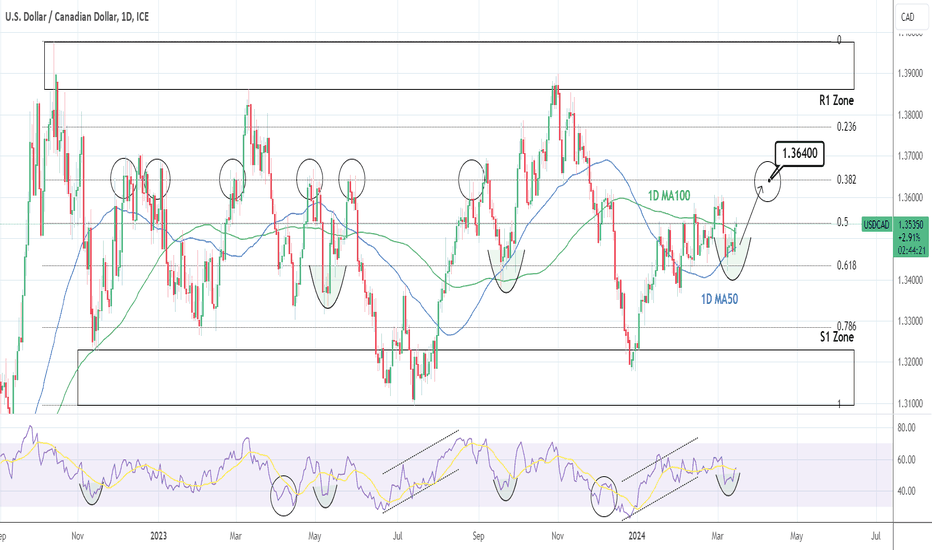

USDCAD: Short term buyUSDCAD is almost neutral on its 1D technical outlook (RSI = 55.021, MACD = 0.001, ADX = 15.874) as the price has been mostly ranging within the 0.5 - 0.618 Fibonacci zone for the past two months. The 1D MA50 held and the push crossed over the 1D MA100 again, so on the short term we expect a HH on the 0.382 Fibonacci (TP = 1.36400). After that test, the price action since October 2022 (which is sideways) shows that most likely a pullback under the 0.618 Fib is to be expected.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

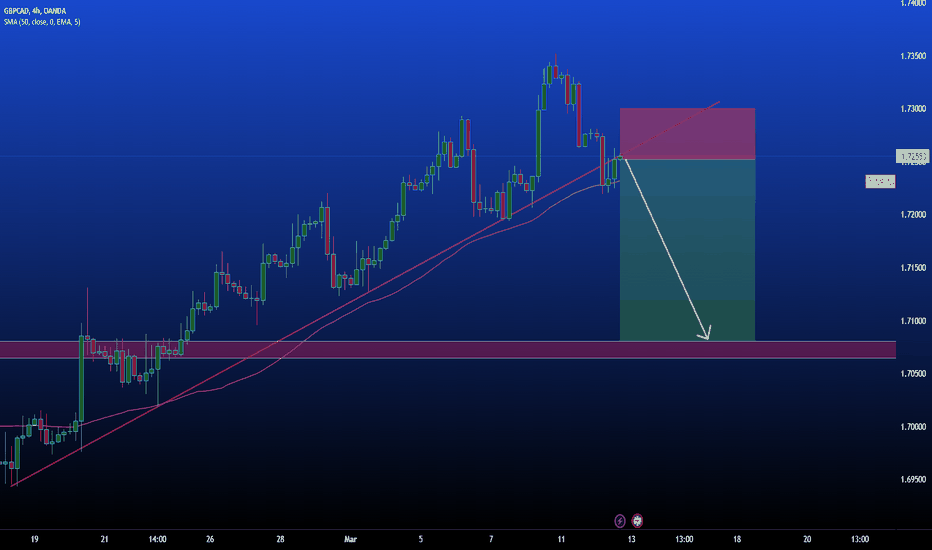

GBPCAD: Strong start for GBP fading out?GBP has been the strongest performing currency so far this year - I keep asking myself why??

Country in a recession

Stagnant economy

Limp Central Bank

With today's unemployment reading I'm expecting this to be the start of bearish involvement in sterling, I'm starting with this pair.

Think oil has dropped a lot and could be ready to bounce up which is good for CAD.

Seem to have broken the ascending trendline and retesting it now, failure to break back in will signify a change in direction.

My first target is 1.708, around the MA50 (daily) and clear support.

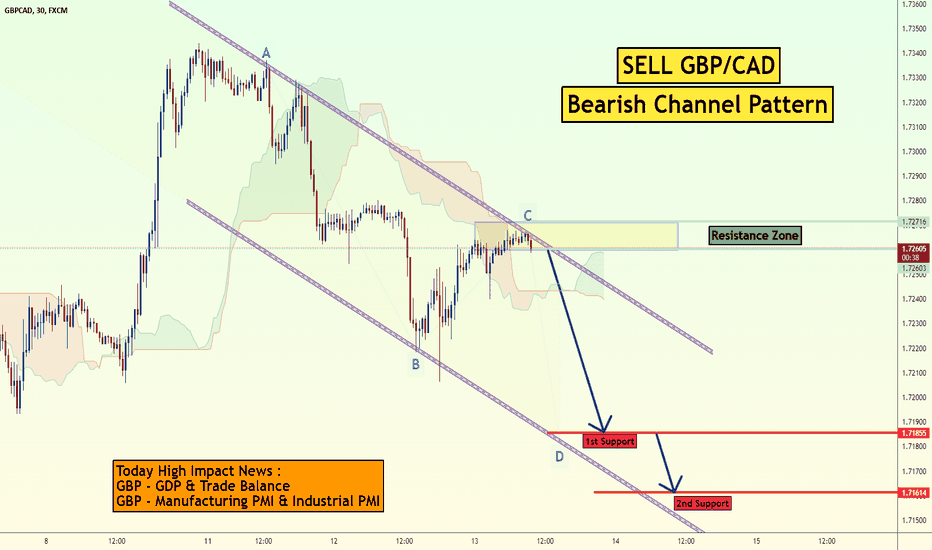

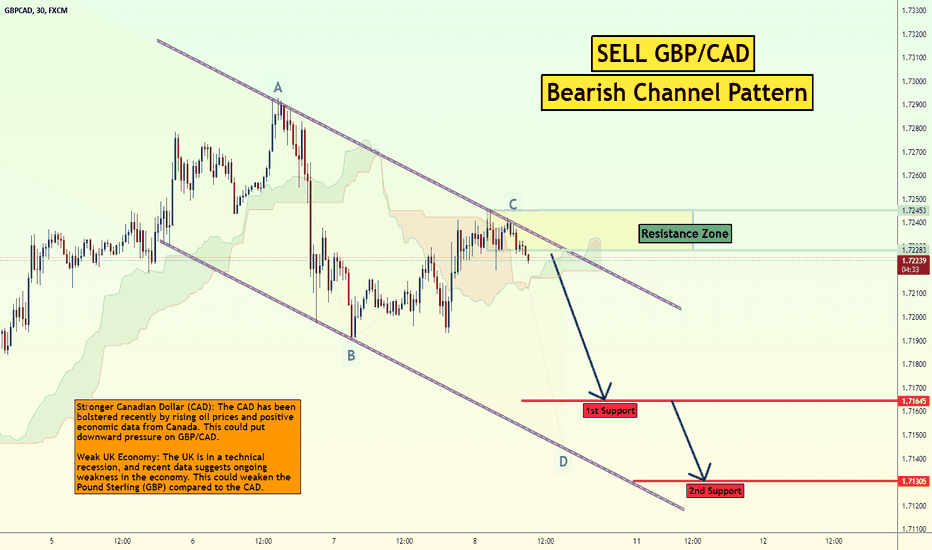

Sell GBPCAD Bearish ChannelThe GBP/CAD pair on the M30 timeframe presents a potential selling opportunity due to the presence of a well-defined bearish channel pattern. This suggests ongoing selling pressure and a higher likelihood of further declines in the coming minutes or hours.

Key Points:

Sell Entry: Consider entering a short position around the current price of 1.7262, positioned close to the channel resistance. This offers an entry point near a potential reversal zone.

Target Levels: Initial bearish targets lie at the previous support levels within the channel, now acting as potential resistance zones: 1.7185 and 1.7162. Further downside targets could be determined using other technical analysis methods like Fibonacci retracements or extensions.

Stop-Loss: To manage risk, place a stop-loss order above the broken resistance line of the channel, ideally around 1.7285. This helps limit potential losses if the price unexpectedly reverses and breaks back upwards.

Thank you

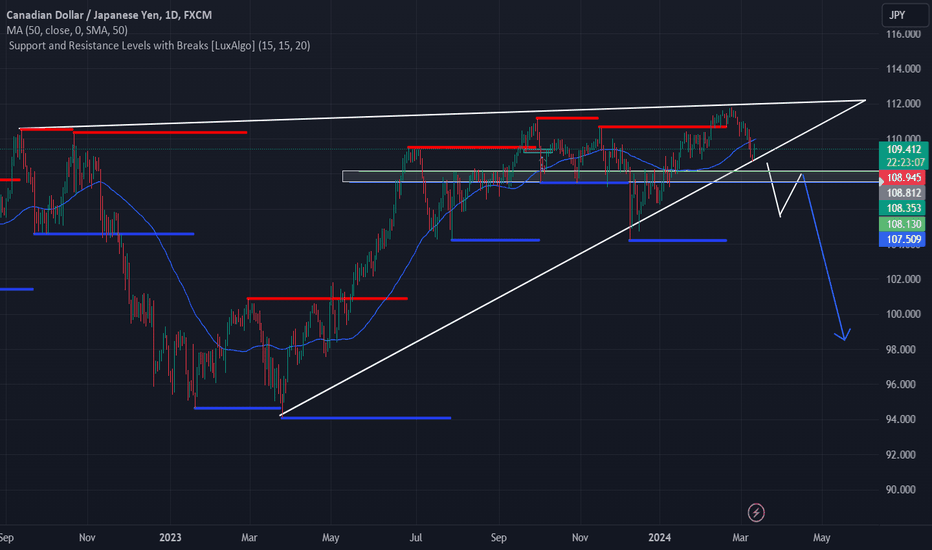

CADJPY AnalysisHello, traders I have been analyzing the CADJPY market trend for a while now and if you look closely it has created a rising wedge pattern on a Daily time frame for my understanding, this pattern signals a bearish move. So now I will wait for the price to break the trend line and that zone I highlighted and come back to it and act as resistance then I can look for long bearish trades. So what do you think about this one?

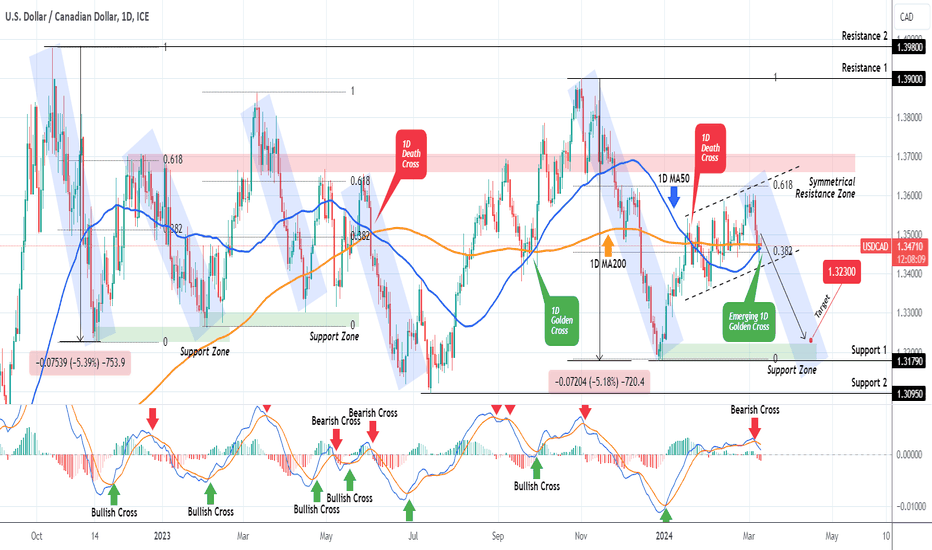

USDCAD Short-term sell signal to the December Low.The USDCAD pair gave us a strong buy signal last time we traded it (February 09, see chart below) but was rejected right under the 0.618 Fibonacci retracement level:

A similar rejection happened on December 07 2022 and April 25 2023 which resulted into a sell-off to the lower Support Zone. Even though the medium-term pattern is a (dashed) Channel Up, the recent Bearish Cross formation can initiate a sell-off to the lower Support Zone similar to those we mentioned before. The confirmation would be a 1D candle closing below the 1D MA50 (blue trend-line) and the Higher Lows trend-line of the Channel Up.

As a result our short-term target is 1.32300 (just above the Support Zone). A closing above the Symmetrical Resistance Zone, invalidates that.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Sell GBP/CAD Bearish ChannelThe GBP/CAD pair on the M30 timeframe presents a potential selling opportunity due to the presence of a well-defined bearish channel pattern. This pattern suggests ongoing selling pressure and a higher likelihood of further declines in the coming minutes or hours.

Key Points:

Sell Entry: Consider entering a short position around the current price of 1.7225, positioned close to the channel resistance. This offers an entry point near a potential reversal zone.

Target Levels: Initial bearish targets lie at the previous support levels within the channel, now acting as potential resistance zones: 1.7164 and 1.7130.

Stop-Loss: To manage risk, place a stop-loss order above the broken resistance line of the channel, ideally around 1.7252. This helps limit potential losses if the trend unexpectedly reverses and the price breaks back upwards.

Thank you

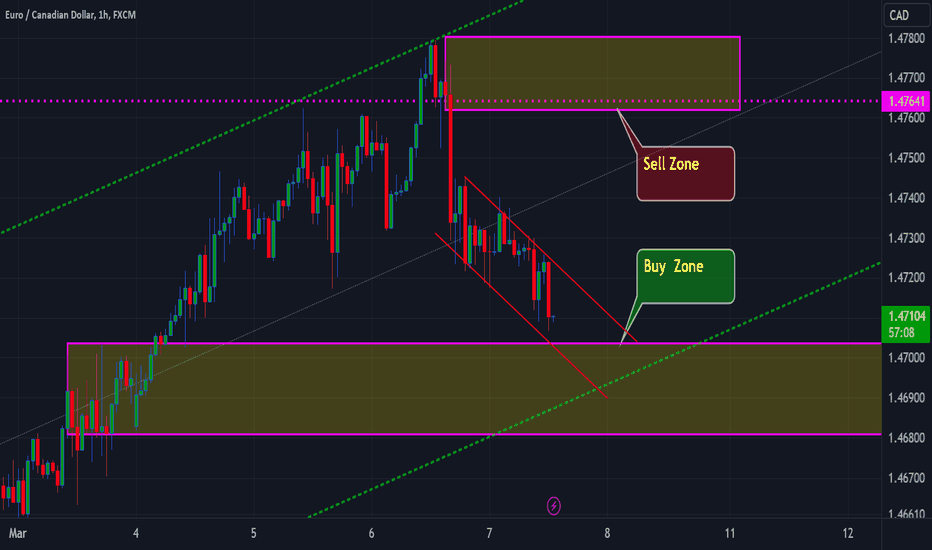

EUR/CAD Analysis: Daily Zones and Cautions

Traders,

Let's assess EUR/CAD's daily zones and accompanying considerations:

Wait for LTF Confirmations: Exercise patience and await confirmations from lower time frames before making trading decisions.

Monthly RSI: Suggests a range zone, indicating potential stability.

Weekly RSI: Indicates a potential bearish move, urging caution regarding long trades.

Daily RSI: Signals more bearish days ahead, reinforcing the need for caution.

Daily Chart: Presents a bullish channel, providing a potential avenue for upward movement.

1-Hour Chart: Identifies a buy zone around a broken level and a sell zone near the supply zone.

Be mindful of these dynamics and ensure thorough analysis before entering trades.

Best regards,

USDCAD - Top-Down Analysis 📹 UpdateHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #USDCAD.

USDCAD is hovering around the lower bound of the wedge pattern. So we will be looking for trend-following buy setups on lower timeframes.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich