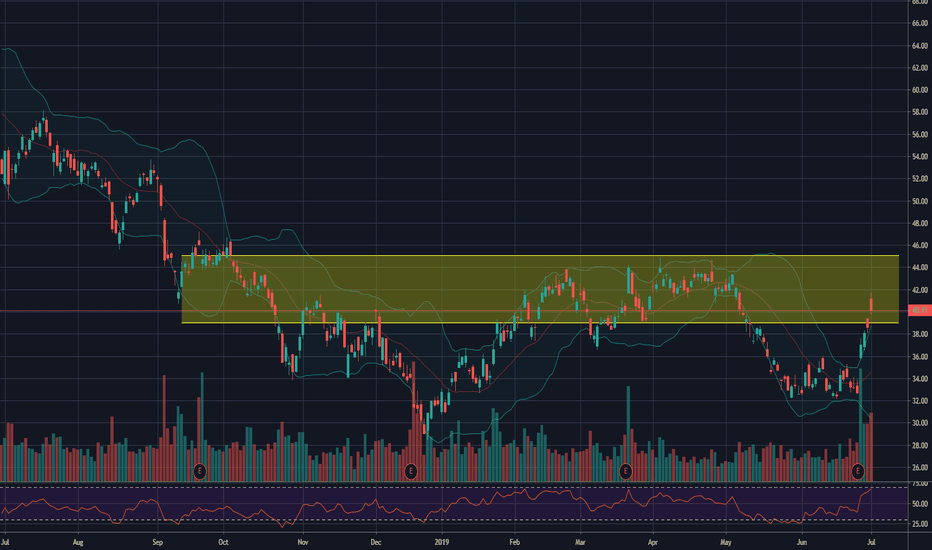

$MU Calendar Spread Opportunity$MU just had earnings and traded way up again today. Right now I'm looking at this "congestion zone" that the stock had back in February - March of this year. I think that if $MU keeps going that it might stall out here in this zone, and that might be a good opportunity to buy a Calendar spread on $MU - a trade that takes advantage of increasing IV. I have had success buying calendars on $MU in the past.

Calendarspread

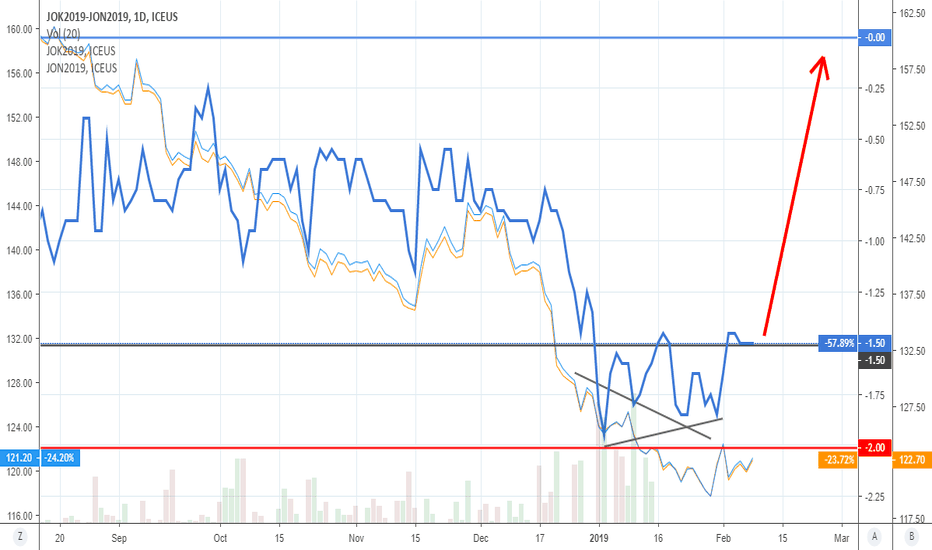

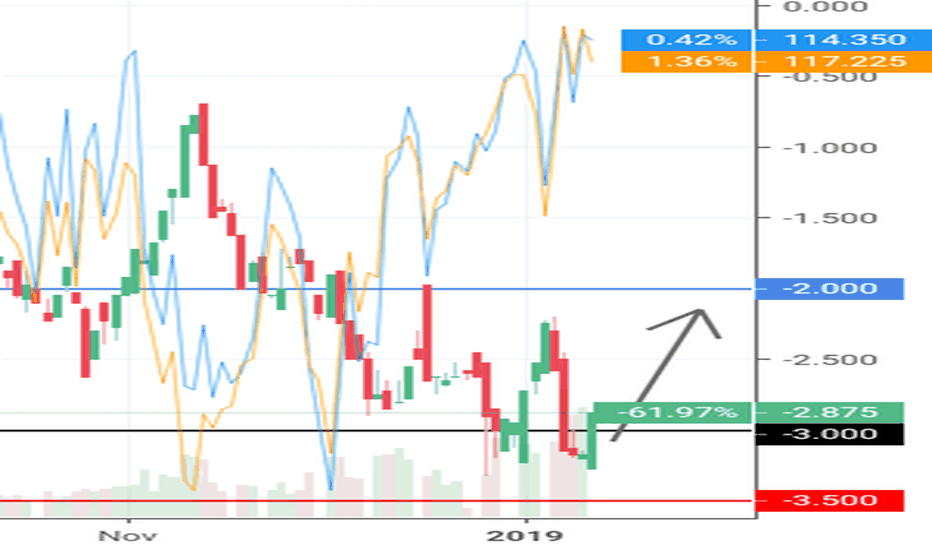

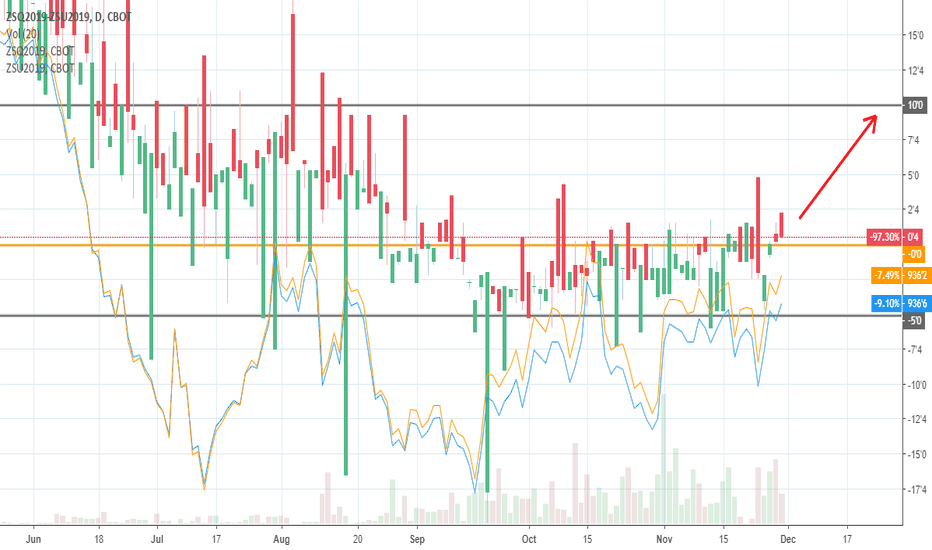

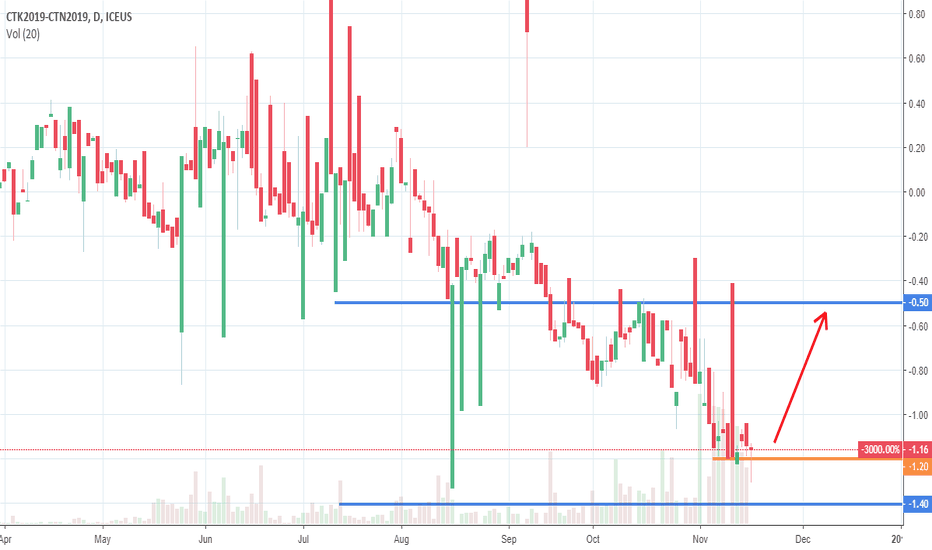

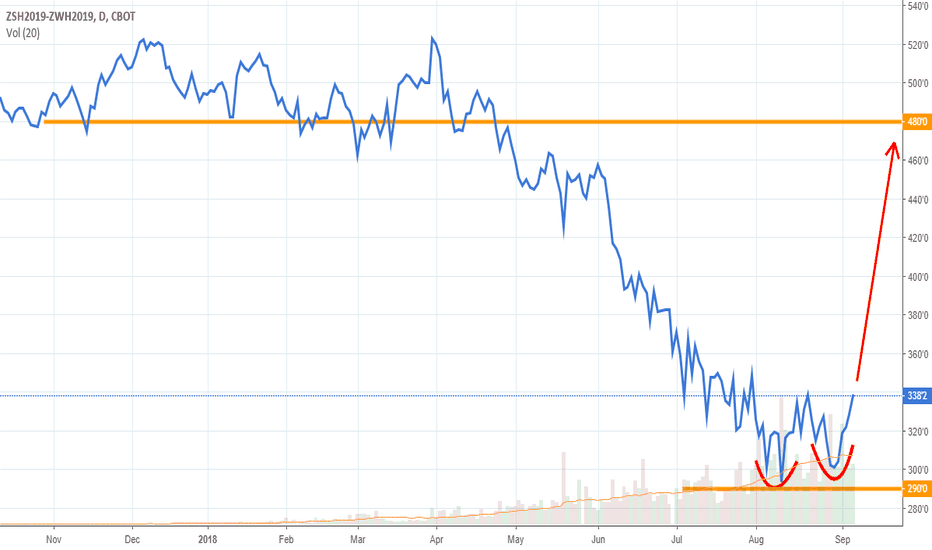

#OJ_F $OJ_F #OrangeJuice – BULL SPREADA bull spread OJK19-OJN19 is quite low and it offers interesting RRR. COT analysis confirms an oversold state of a market.

Entry -1,5

SL -2,0 ($75/contract)

PT 0,0 ($225/contract)

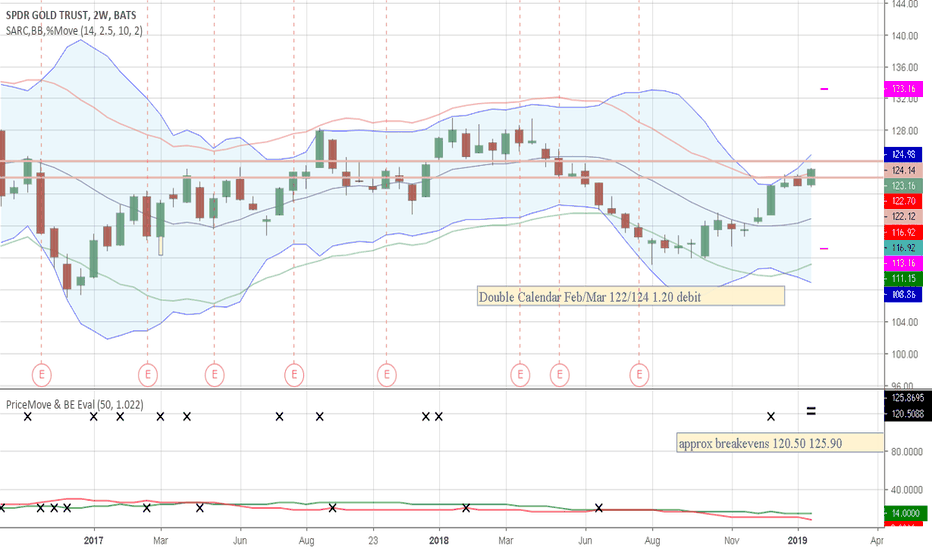

Opening Double Calendar Feb/Mar 122 Puts 124 Callstradingview.sweetlogin.com

for a debit of 1.20/contract.

At open, Theta 1.8 and Delta -1.65.

Chart 2 weeks per candle.

Bottom panel shows % move adjusted to approx. breakeven prices and the historic occurence % of those moves. Xs (top=up, bottom=down) plot for

each occurence and the red green lines show percentage for the selected number in the PriceMove indicator settings (published).

Using the guidelines of monthly move of less than $10 (Plus / Minus 10 shown in fuchsia ahead of last candle)

and (per TW platform analysis) ratio of > .5 (max profit)/debit at expiration

This looked okay, we will see. My mentor on these looks only nearer monthly expriation times so 20-30 dte on short leg and long 50-60 dte.

Placed an immediate 25% ($30) closing order and will watch closely as goal of 25-50% of debit.

Will shoot for higher % up to 50 when can watch it.

If price reaches a breakeven I add a calendar ATM if 10 dte remaining and if not, I take off the position.

Categories tricky for the way I trade but overall price movement and limits will fit into support and resistance.

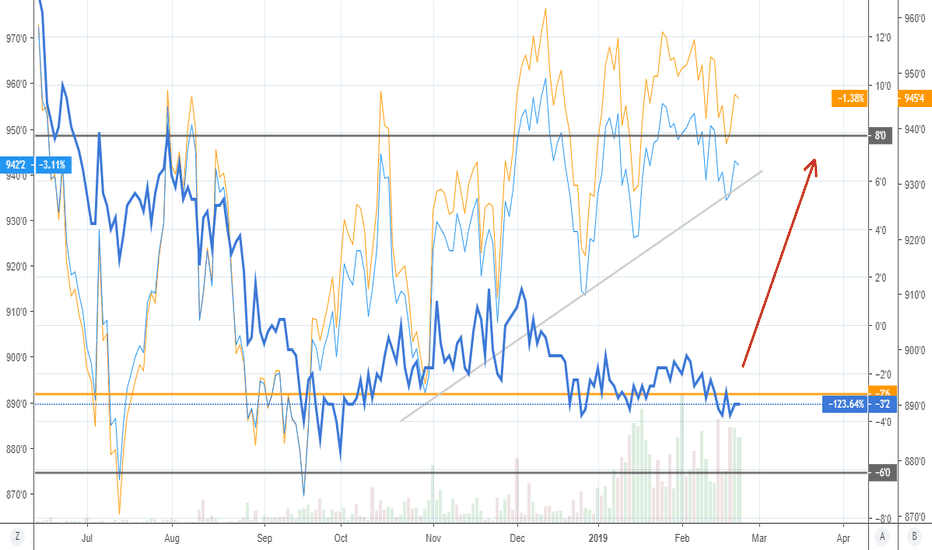

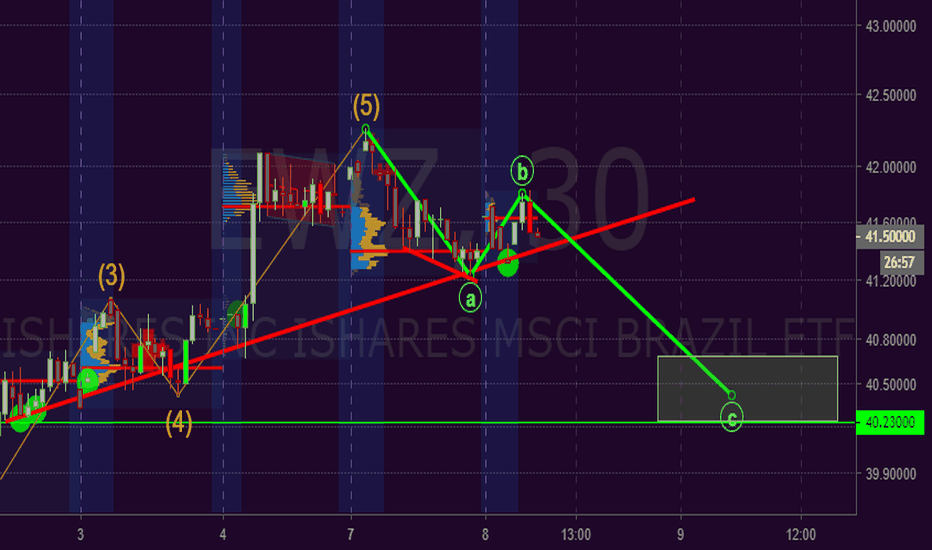

Looking for EWZ to retrace as it should. Patience on re-entry.Trading EWZ with options.

Calenders and Verticals in specific.

looking for a retrace so im open ended on the position to the down side.

Im long term Bullish.

Short term Bearish.

Also note, if retracement actually matures, it will leave a bearish formation producing resistance levels.

The market will have to fight back a little harder to bring back the current high levels.

GL luck all

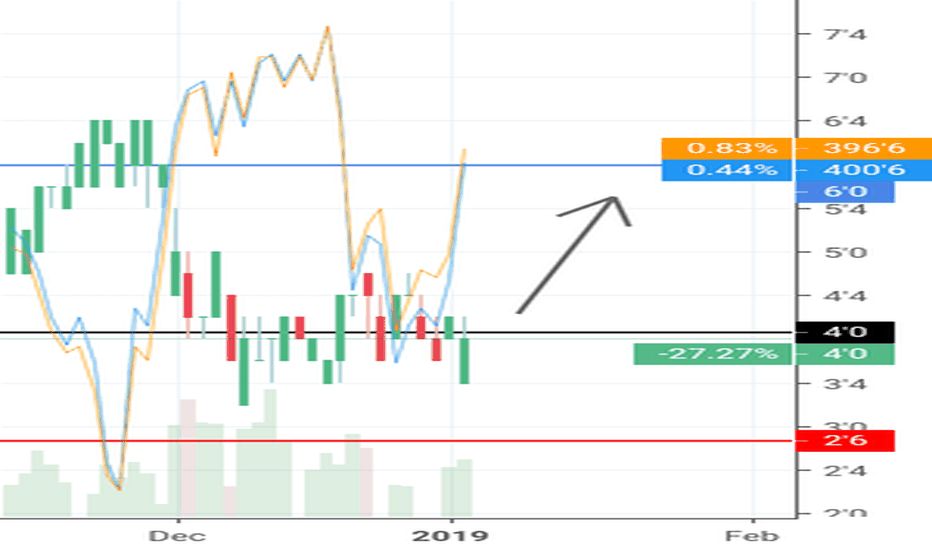

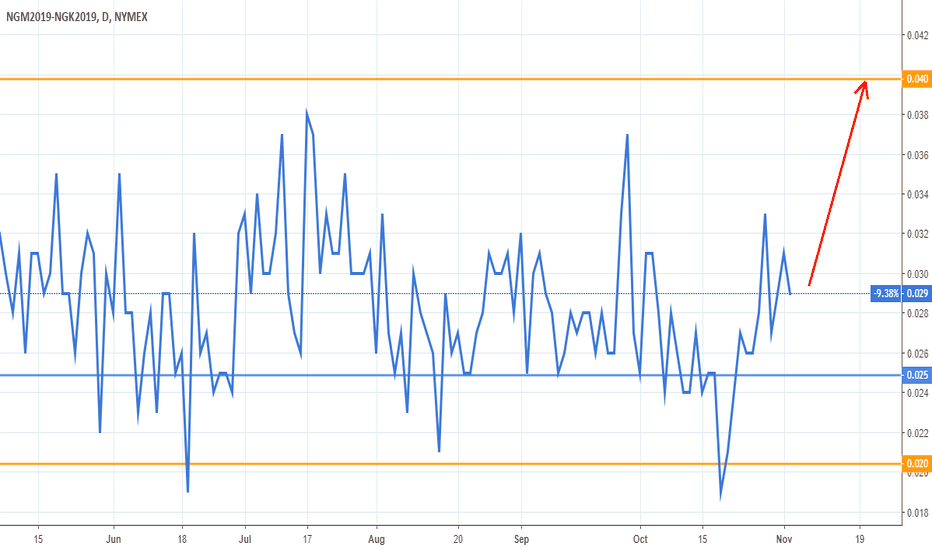

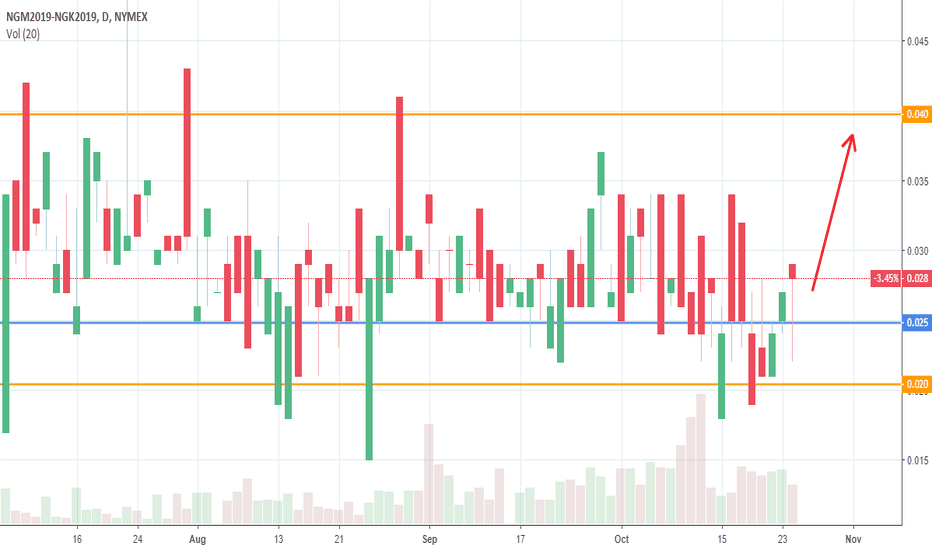

#NG_F $NG_F #NaturalGas - Bear spreadCOT analysis in Natural Gas confirms an extreme overbought state of a market. That is why I built this bear spread, which is quite cheap yet. There is very nice potential in this trade. I already opened a position at 0,025 with PT 0,040 ($150/contract) and SL 0,020 ($50/contract). The price could do some corrections before it will go up.

#OJ_F $OJ_F #OrangeJuice - Bull spreadOrange Juice price is a bit oversold and a bullish correction could come very soon. I built a bull spread OJF19-OJH19 and I wait for an entry about -1,50 with SL -2,50 ($150/contract) and PT 2,00 ($525/contract).

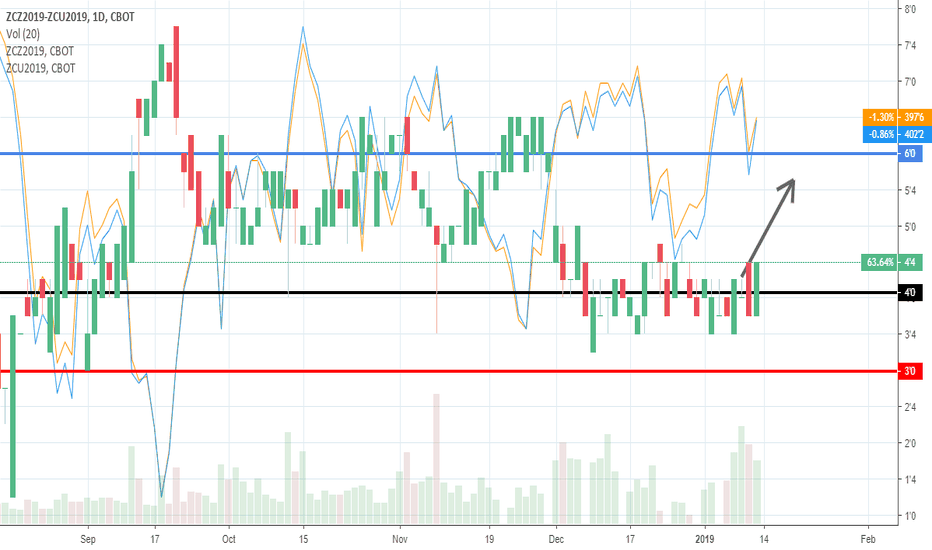

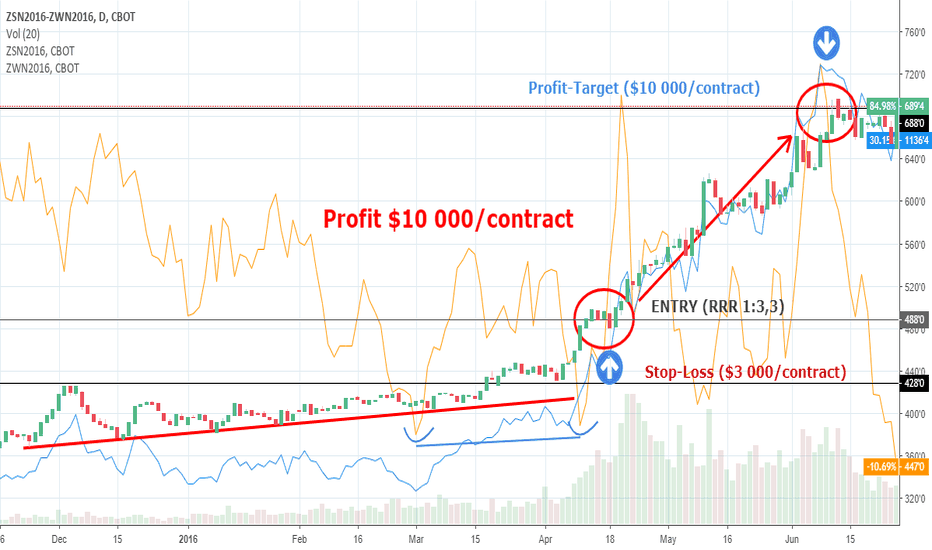

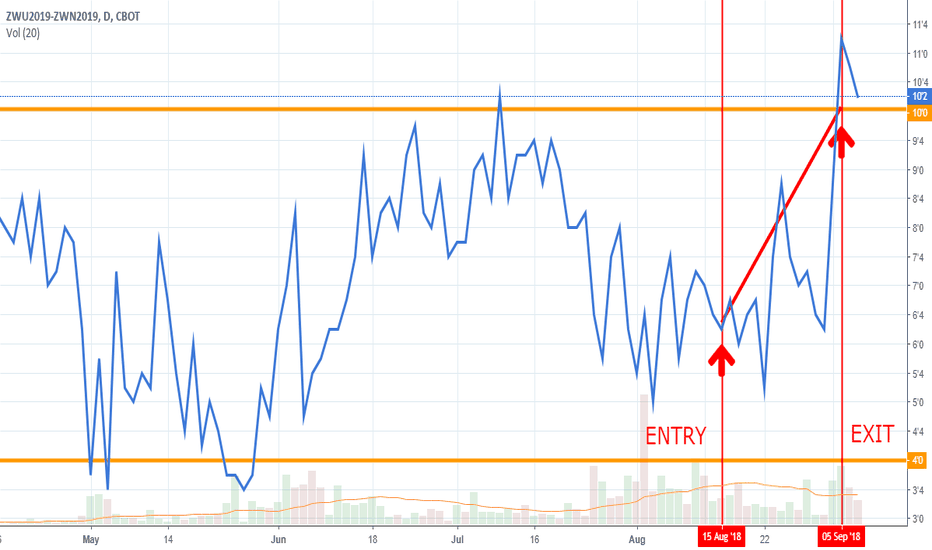

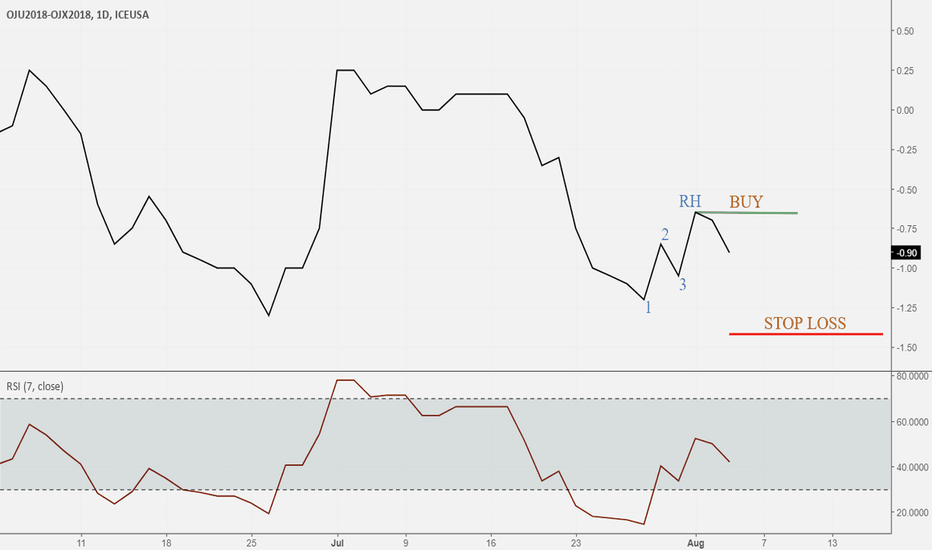

Spread trading on ORANGE JUICEAn interesting Spread proposed by SeasonAlgo on ORANGE JUICE, to be exact: BUY OJU18 (delivery September) and SELL OJX18 (delivery November). The bullish seasonal window started on August 1 and will end on September 2. Win: 14/15 (93%).

Graphically, the chart has formed a 1-2-3 low of Ross and, after, a Ross Hook. Buying the spread if the price will rise above the RH. Stop loss below the point 1 of the formation.

The only problem: FND/LTD September 4 (very close).