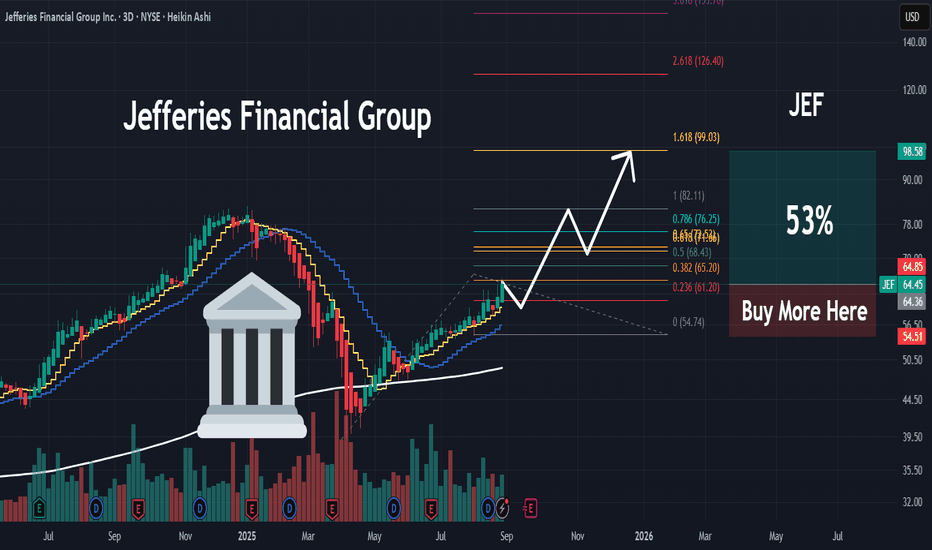

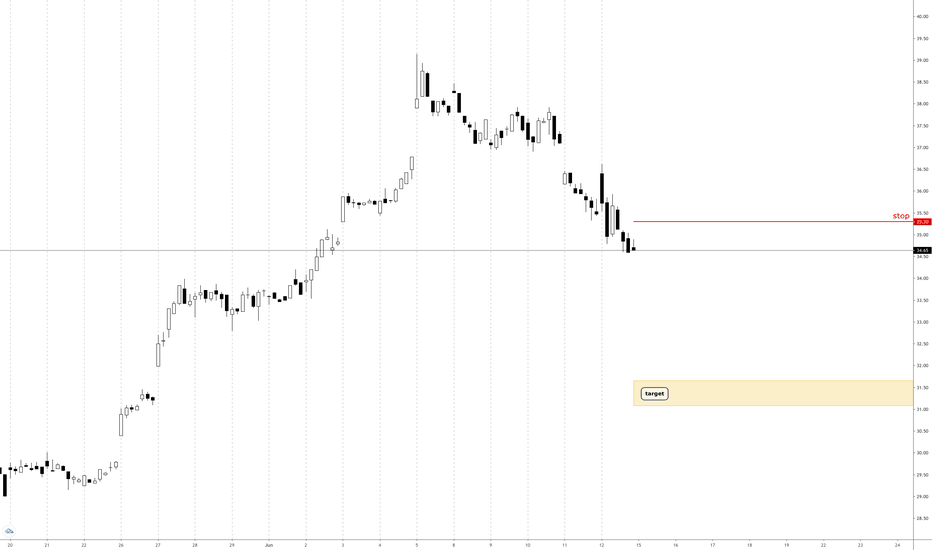

JEF | Strong Move Incoming | Capital MarketsJefferies Financial Group, Inc. is a holding company, which engages in the provision of financial services. It operates through Investment Banking and Capital Markets, and Asset Management. The Investment Banking and Capital Markets segment involves the provision of underwriting and financial advisory services in the Americas, Europe and the Middle East, and Asia-Pacific. The Asset Management segment includes investing seed and additional strategic capital. The company was founded in 1968 and is headquartered in New York, NY.

Capitalmarkets

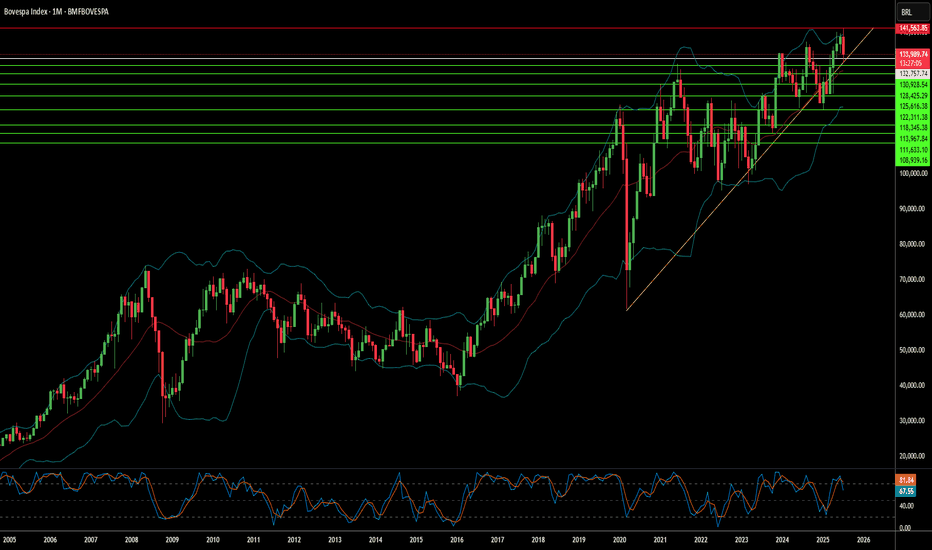

Has Geopolitics Clouded Brazil's Market Horizon?The Bovespa Index, Brazil's benchmark stock market index, faces significant headwinds from an unexpected source: escalating geopolitical tensions with the United States. Recent decisions by the US administration to impose a steep 50% tariff on most Brazilian imports, citing the ongoing prosecution of former President Jair Bolsonaro, have introduced considerable uncertainty. This move, framed by the US as a response to perceived "human rights abuses" and an undermining of the rule of law in Brazil's judiciary, marks a departure from conventional trade disputes, intertwining economic policy with internal political affairs. Brazilian President Luiz Inácio Lula da Silva has firmly rejected this interference, asserting Brazil's sovereignty and its willingness to negotiate trade, but not judicial independence.

The economic repercussions of these tariffs are multifaceted. While key sectors like civil aircraft, energy, orange juice, and refined copper have secured exemptions, critical exports such as beef and coffee face the full 50% duty. Brazilian meatpackers anticipate losses exceeding $1 billion, and coffee exporters foresee significant impacts. Goldman Sachs estimates an effective tariff rate of around 30.8% on total Brazilian shipments to the US. Beyond direct trade, the dispute dampens investor confidence, particularly given the US's existing trade surplus with Brazil. The threat of Brazilian retaliation looms, potentially exacerbating economic instability and further impacting the Bovespa.

The dispute extends into the technological and high-tech realms, adding another layer of complexity. US sanctions against Brazilian Supreme Court Justice Alexandre de Moraes, who oversees Bolsonaro's trial, directly link to his judicial orders against social media companies like X and Rumble for alleged disinformation. This raises concerns about digital policy and free speech, with some analysts arguing that regulating major US tech companies constitutes a trade issue given their economic significance. Furthermore, while the aerospace industry (Embraer) received an exemption, the broader impact on high-tech sectors and intellectual property concerns, previously highlighted by the USTR regarding Brazilian patent protection, contribute to a cautious investment environment. These intertwined geopolitical, economic, and technological factors collectively contribute to a volatile outlook for the Bovespa Index.

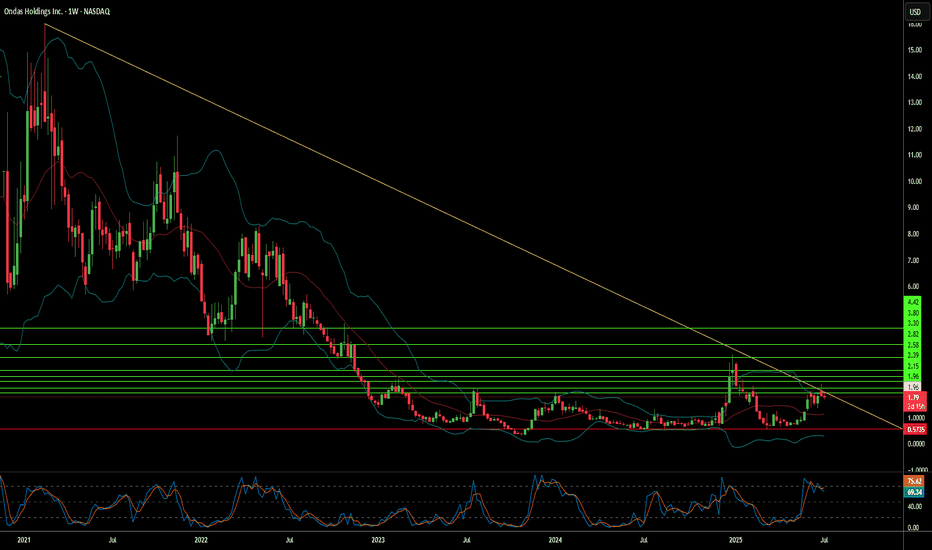

Can Ondas Holdings Redefine Defense Tech Investment?Ondas Holdings (NASDAQ: ONDS) is carving a distinct path in the evolving defense technology landscape, strategically positioning itself amid escalating global tensions and the modernization of warfare. The company’s rise stems from a synergistic approach, combining innovative autonomous drone and private wireless network solutions with shrewd financial maneuvers. A pivotal partnership with Klear, a financial technology firm, provides Ondas and its growing ecosystem with non-dilutive working capital. This off-balance-sheet financing mechanism is crucial, enabling rapid expansion and strategic acquisitions within the capital-intensive defense, homeland security, and critical infrastructure sectors without shareholder dilution.

Furthermore, Ondas's American Robotics subsidiary, a leader in FAA Type Certified autonomous drones, recently cemented a strategic manufacturing and supply chain partnership with Detroit Manufacturing Systems (DMS). This collaboration leverages U.S.-based production to enhance scalability, efficiency, and resilience in delivering American Robotics' advanced drone platforms. This domestic manufacturing focus aligns seamlessly with initiatives like the "Unleashing American Drone Dominance" executive order, which aims to bolster the U.S. drone industry, fostering innovation while safeguarding national security against foreign competition.

The company's offerings directly address the paradigm shift in modern warfare. Ondas's private industrial wireless networks (FullMAX) provide critical secure communication for C4ISR and battlefield operations, while its autonomous drone solutions (like the Optimus System and Iron Drone Raider for counter-UAS) are integral to evolving surveillance, reconnaissance, and combat strategies. As geopolitical instabilities intensify, driving unprecedented demand for advanced defense capabilities, Ondas’s integrated operational and financial platform is primed for significant growth, attracting considerable investor interest with its innovative approach to capital deployment and technological advancement.

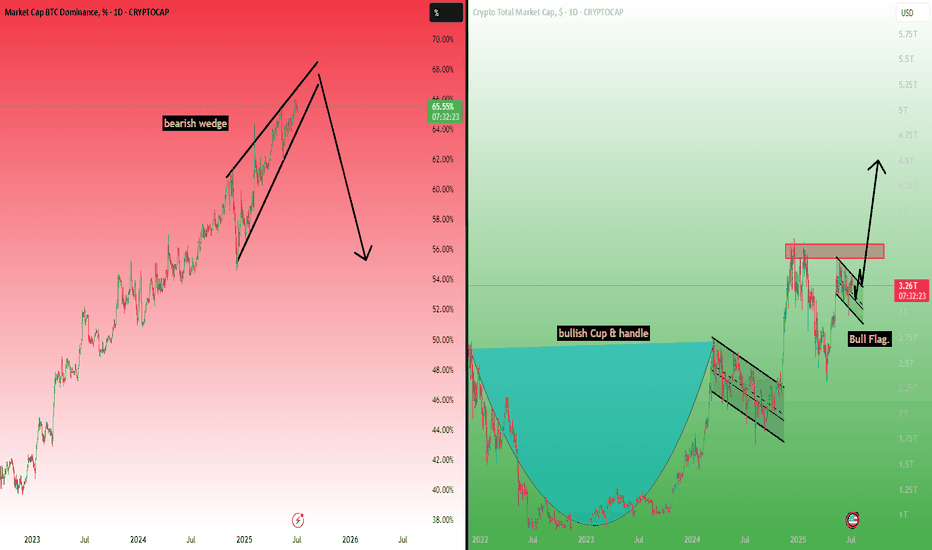

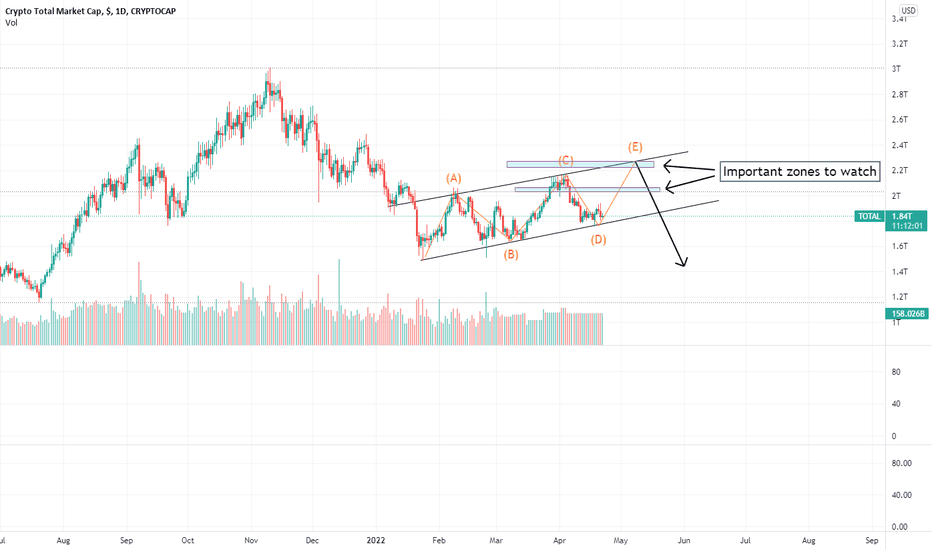

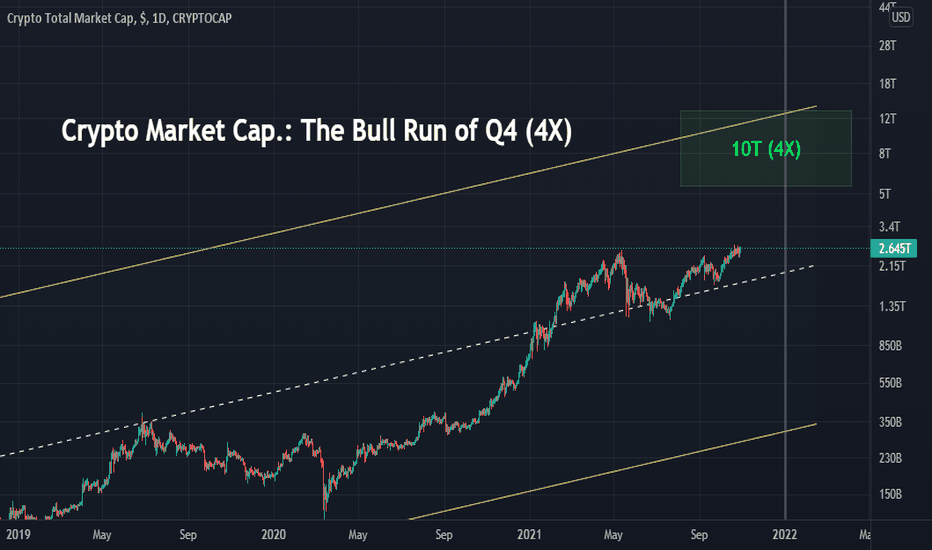

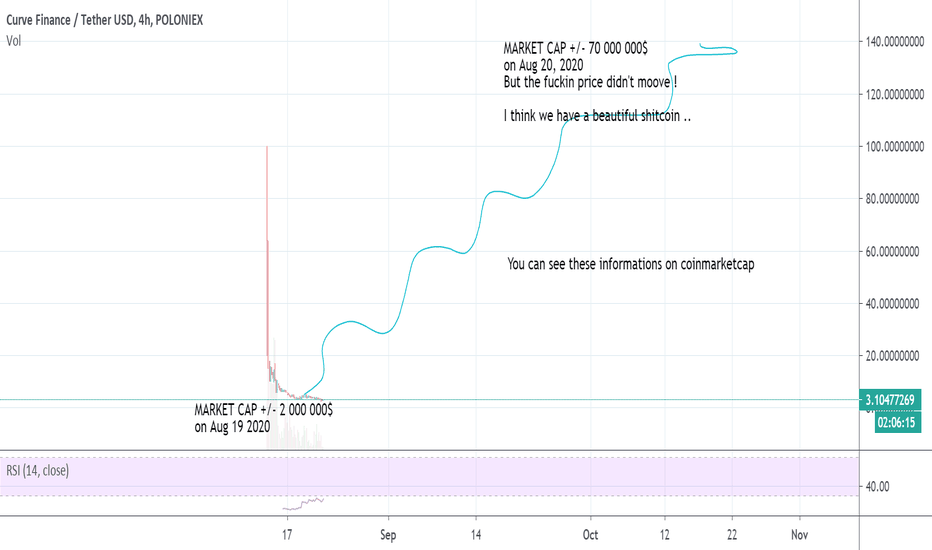

BEARISH DOM + BULLISH CAP = ALT SEASONsimple TA analysis with simple arithmetic operation :

decline of bitcoin Dominance with the rise of market capitale = the season of altcoins and price explosions.

the year 2025 will be profitable, enjoy the summer

CRYPTOCAP:BTC.D CRYPTOCAP:TOTAL BINANCE:BTCUSDT INDEX:BTCUSD BITFINEX:BTCUSD COINBASE:BTCUSD

Was the Price of Avoiding a Bailout Worth More Than Just Money?In the wake of the 2008 financial crisis, Barclays faced a pivotal decision that would echo through the halls of financial history for more than a decade. The bank's recent £40 million settlement with the Financial Conduct Authority (FCA) brings to light a fascinating intersection of survival strategies, regulatory compliance, and the true cost of maintaining independence during a financial storm.

The saga revolves around Barclays' £11.8 billion capital raise in 2008, which successfully helped the bank avoid a government bailout – a feat that distinguished it from many of its peers. However, the intricate web of arrangements with Qatari investors, including alleged preferential fee structures and undisclosed payments totaling £322 million, raises profound questions about the delicate balance between institutional survival and market transparency. The case became a landmark in British financial history, marking the first time a major bank's CEO faced a jury over financial crisis-related events.

What makes this case particularly compelling is its broader implications for corporate governance and regulatory oversight. Despite the FCA's findings of "reckless" conduct and lack of integrity, Barclays has emerged as what the regulator acknowledges is "a very different organization today." This transformation, coupled with the complete acquittal of all individuals involved, including former CEO John Varley and three other executives, presents a complex narrative about institutional evolution and the challenges of judging crisis-era decisions through a post-crisis lens. The resolution not only closes a chapter in Barclays' history but also serves as a powerful reminder that in the world of high finance, the line between innovative survival strategies and regulatory compliance can often become precariously thin.

"UnoMinda" at the cusp of breakout! "UnoMinda" is a great counter to go Long on with high probability and great risk - reward ratio! The stock is about to breakout from a Cup Pattern. The price is at the cusp of breakout which is giving more confidence to enter the trade on Long Side.

#SniperTrade #Momentum #Options #CapitalMarkets #harshal95 #StockMarket

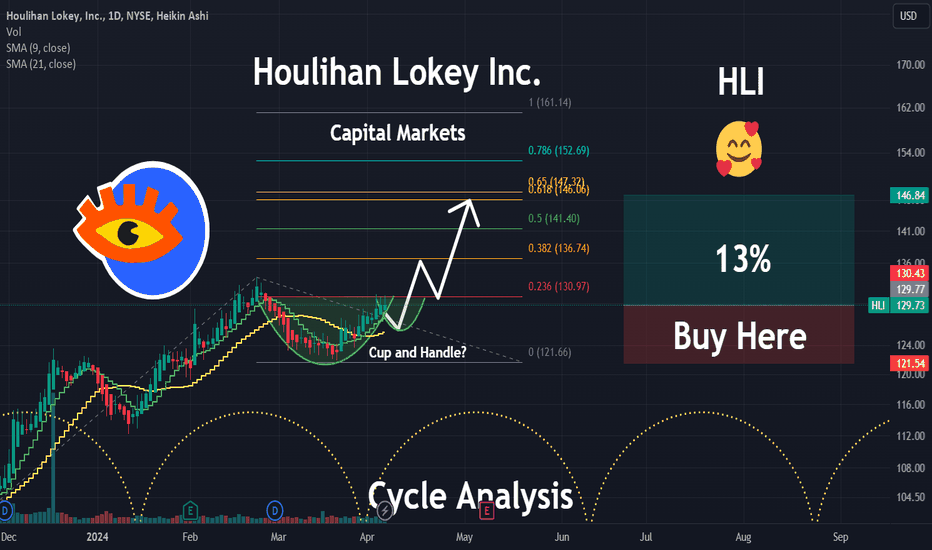

HLI | A Low Key High Flyer | LONGHoulihan Lokey, Inc. engages in the provision of investment banking services. It operates through the following segments: Corporate Finance, Financial Restructuring, and Financial and Valuation Advisory. The Corporate Finance segment provides general financial advisory services in addition to advice on mergers and acquisitions and capital markets offering. The Financial Restructuring segment provides advice to debtors, creditors, and parties-in-interest in connection with recapitalization or deleveraging transactions. The Financial Valuation and Advisory Services segment provides valuation of various assets including companies, illiquid debt and equity securities and intellectual property. The company was founded in 1972 and is headquartered in Los Angeles, CA.

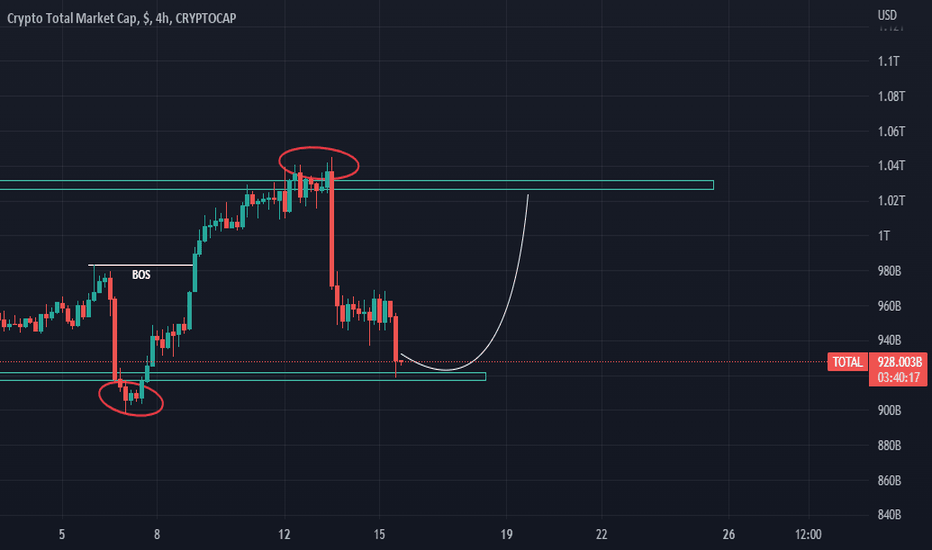

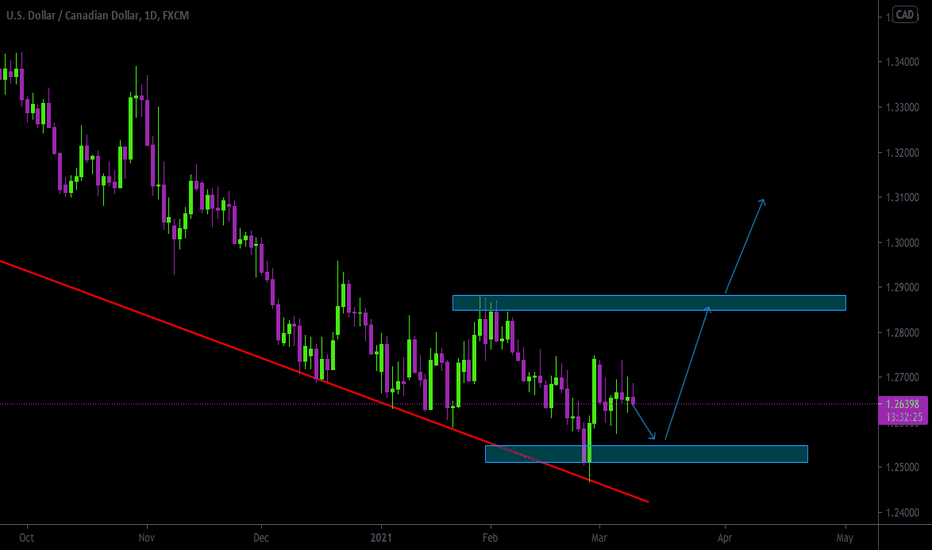

TOTAL CRYPTO CAP#TOTAL MARKET CAP ANALYSIS

Heavily rejected after taking stops above the horizontal resistance. Currently, it is holding above the order block that has been formed after BOS(break of structure).

A bounce can be expected from here and in case of breakdown of order block, it'll fill the marked imbalance area also there is a possibility of creating a three-tap setup there.

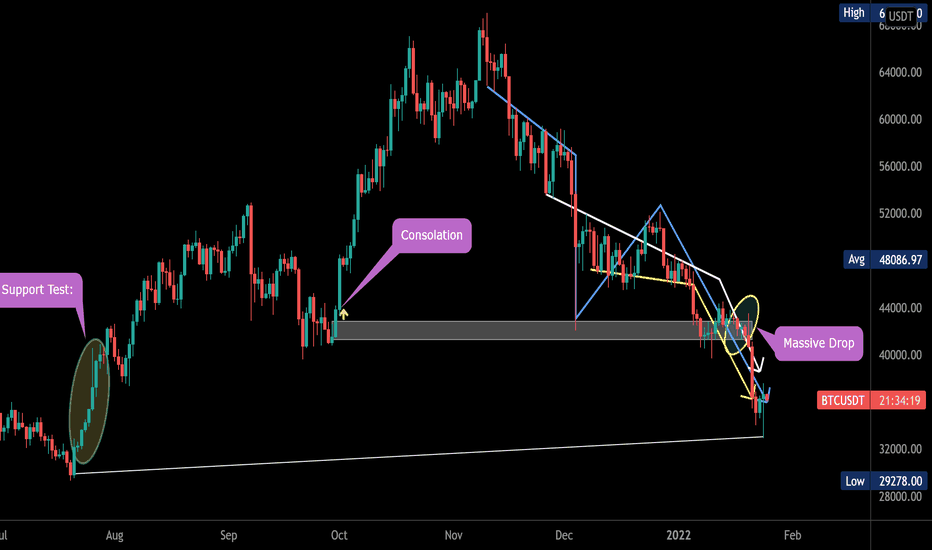

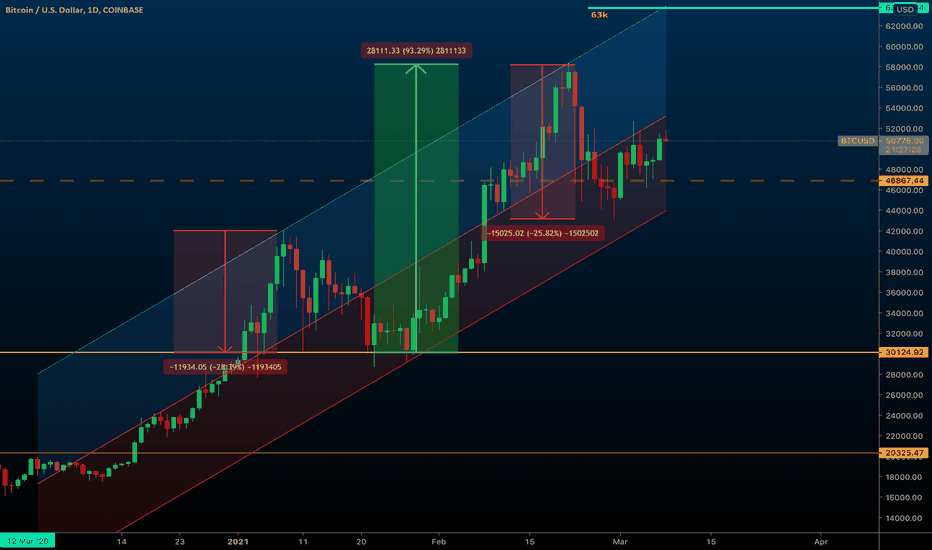

BTC/USD DROP PATTERNBitcoin got unloaded hard as of late and it's the initial opportunity to test 100W EMA since April 2020 !

As we find in outline this 100W EMA (dynamic help) is vital … each time cost shut week after week beneath it monstrous accident occurs later

So presently every one of the eyes on moving normal + 30k Strong help

Bulls should show strength here or the agony will proceed might be up to 20k

Requests Note that Price can likewise remain longer time playing in this reach for a few additional prior weeks next decisional development

Continuously adjust with the market changes

Furthermore Enjoy your time

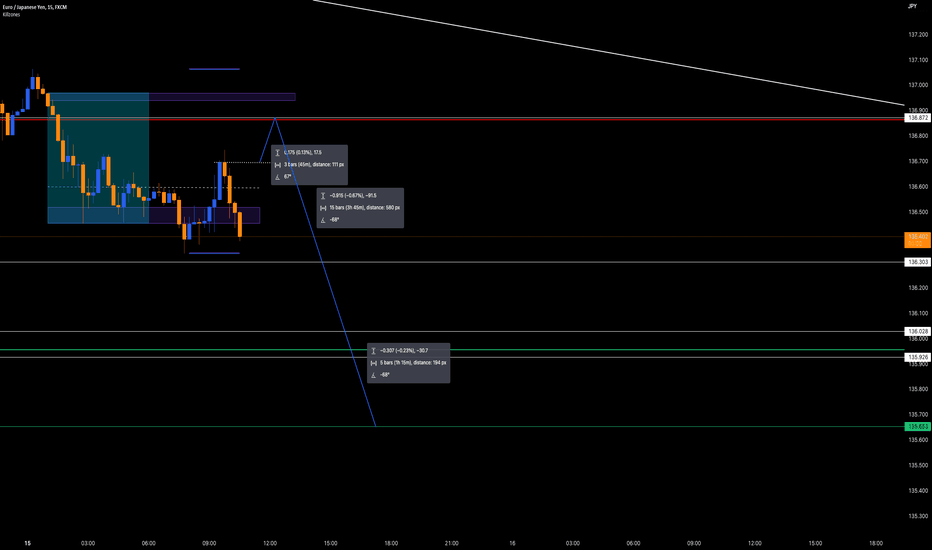

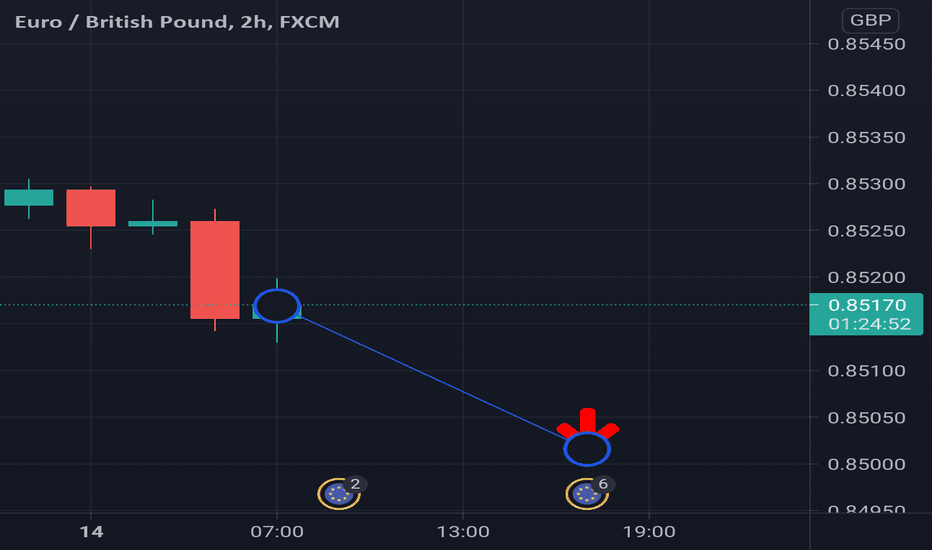

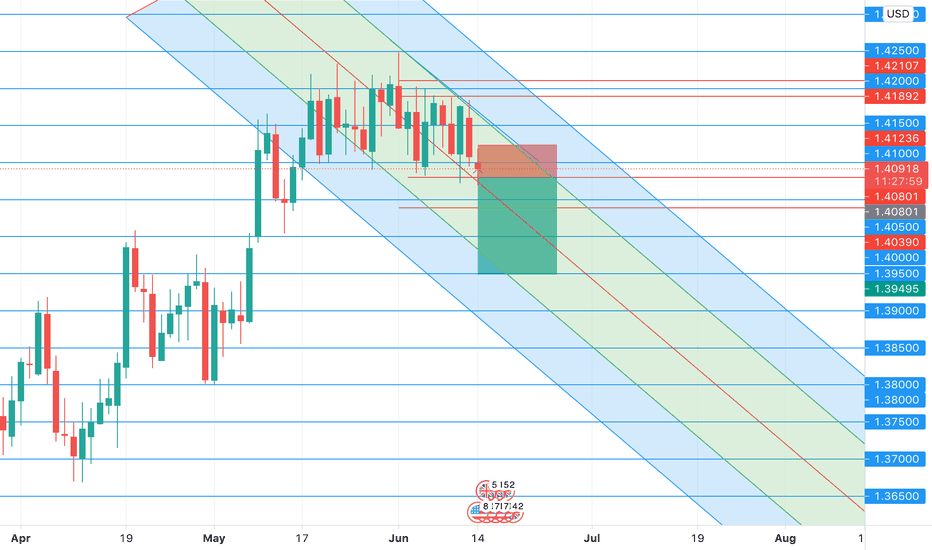

Eurgbp downtrend

The tool goes down in price. It is hard enough for him to do it on low volatility .

Perhaps such a consolidation approach will give a strong movement in the future.

The target - which I'm interested in, is the ambassador of the price rollback from the level - support 0.8473

———————

❗️15 / 17 last EURGBP ideas come TRUE

✅EURGBP №1 ✅EURGBP №10

✅EURGBP №2 ❌EURGBP №11

✅EURGBP №3 ✅EURGBP №12

✅EURGBP №4 ✅EURGBP №13

❌EURGBP №5 ✅EURGBP №14

✅EURGBP №6 ✅EURGBP №15

✅EURGBP №7 ✅EURGBP №16

✅EURGBP №8 ✅EURGBP №17

✅EURGBP №9

——