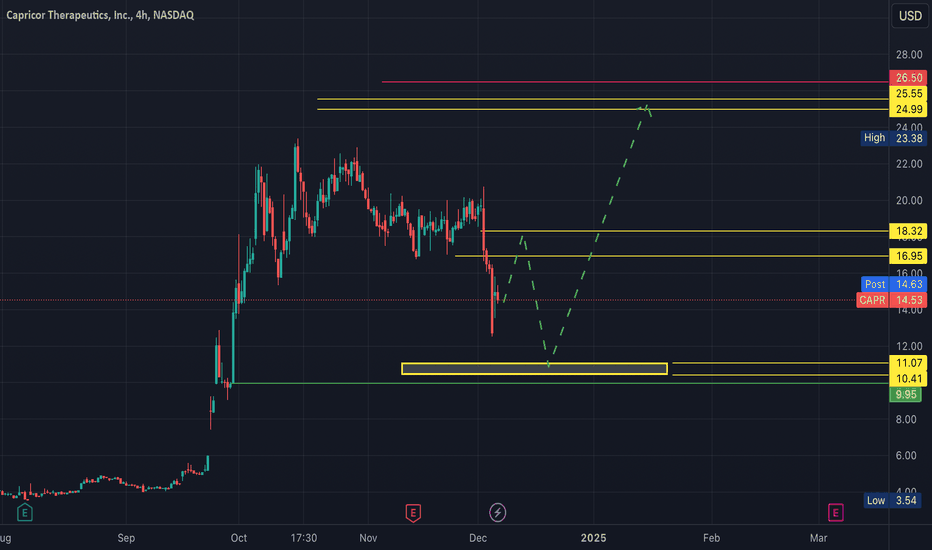

CAPR projected to see additional volatility NEAR TERM. Recent short attack will likely be a two-part process.

Expecting strong buy wave to 17-18.5 zone near term before renewed aggressive selling down to next liquidity target zone at 10.4-11 level.

There exists a small gap at 9.95-10.05 which may be targeted by shorts. Unsure if it gets filled during market hrs or during extended session.

Planning to go long again from 10.4-11 via limit buy orders sometime this month. Expecting us to get the buy opportunity before 12/20 date before the next swing target to 25.00

once we see a break above 26.5, it'll confirm for me the greater buy sequence will continue on weekly timeframe for advancement to 75-80$ analyst target level. Until then, we may remain rangebound between 15-25$ levels.

Personally expecting price to reach 100$ sometime by late 2025.