Carvana

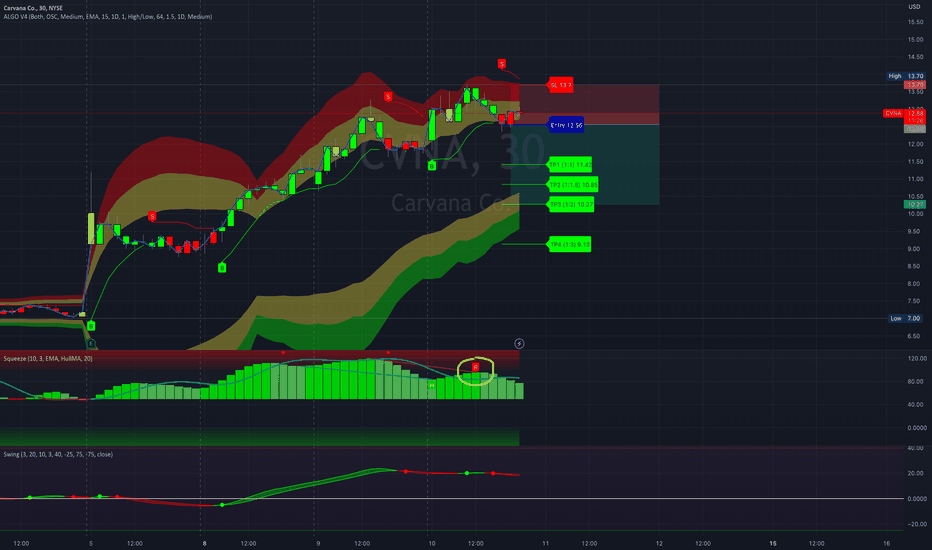

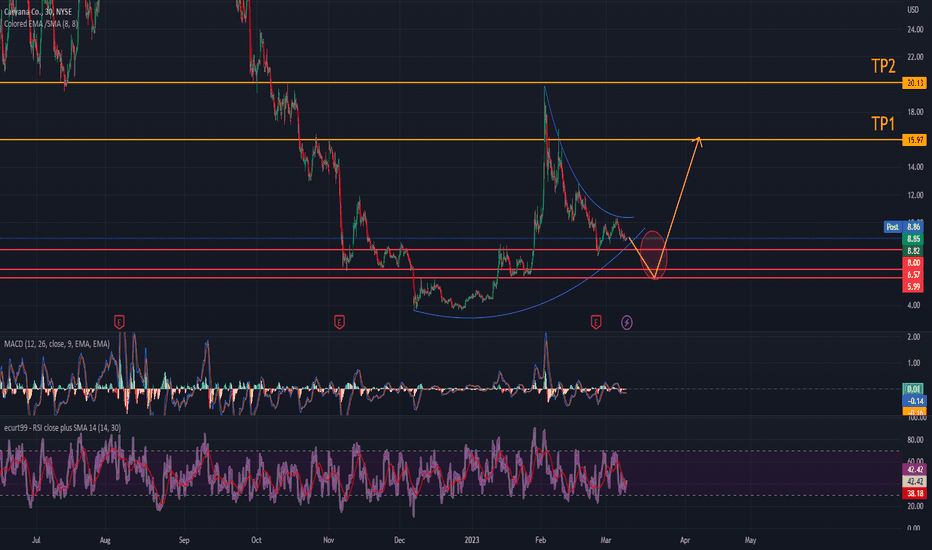

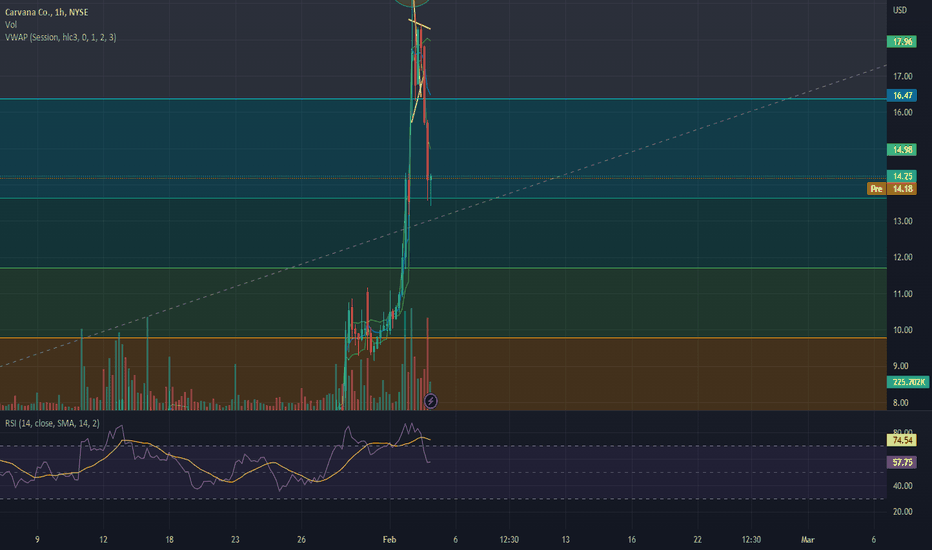

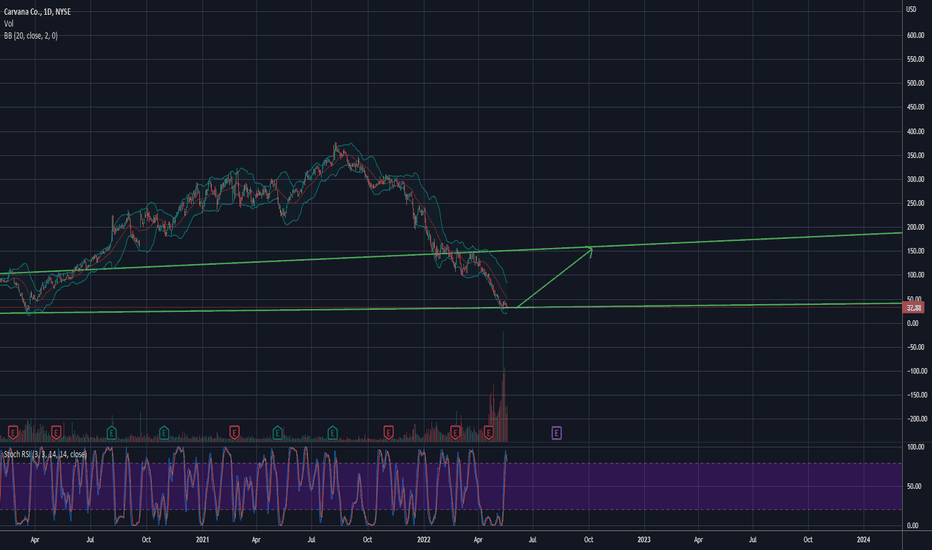

$CVNA-Regular Divergence Indicates Potential Bearish OpportunityCarvana ( NYSE:CVNA ), the innovative online used car retailer, has recently shown signs of a regular bearish divergence on its chart, indicating a potential reversal in its current trend. With an identified entry, stop loss, and take profit points, we could be looking at a shorting opportunity here.

Technical Indicators:

The regular bearish divergence, circled in yellow on the chart, suggests a weakening in the current uptrend. This pattern is often a sign of a potential upcoming bearish phase, making it an opportunity for short sellers.

Trade Setup:

Here's a potential trading setup based on the current technical indicators:

- Entry Price: 12.56

- Stop Loss: 13.70

- Take Profit 1: 10.77

- Take Profit 2: 9.13

This setup offers a good risk to reward ratio. The stop loss is set above the recent swing high, limiting potential losses if the price unexpectedly rises. The two take profit points allow for managing the trade more efficiently, taking some profit at the first target and letting the rest run if the price continues to move favorably.

Options Play:

For those interested in options, a Put option expiring on May 19th with a strike price of $10 could be a potential play. This would gain value if NYSE:CVNA stock price decreases, aligning with the bearish divergence.

NYSE:CVNA current technical setup suggests a potential bearish opportunity. However, as always, it's essential to manage risk effectively and ensure the trade aligns with your overall trading strategy.

*Note: This analysis is for informational purposes only. Always do your own research and consult with a professional advisor before making investment decisions.*

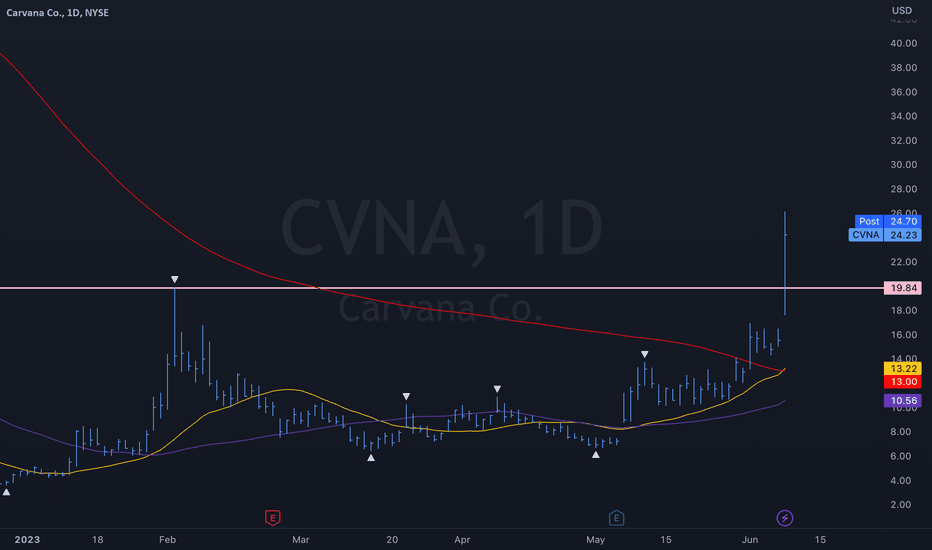

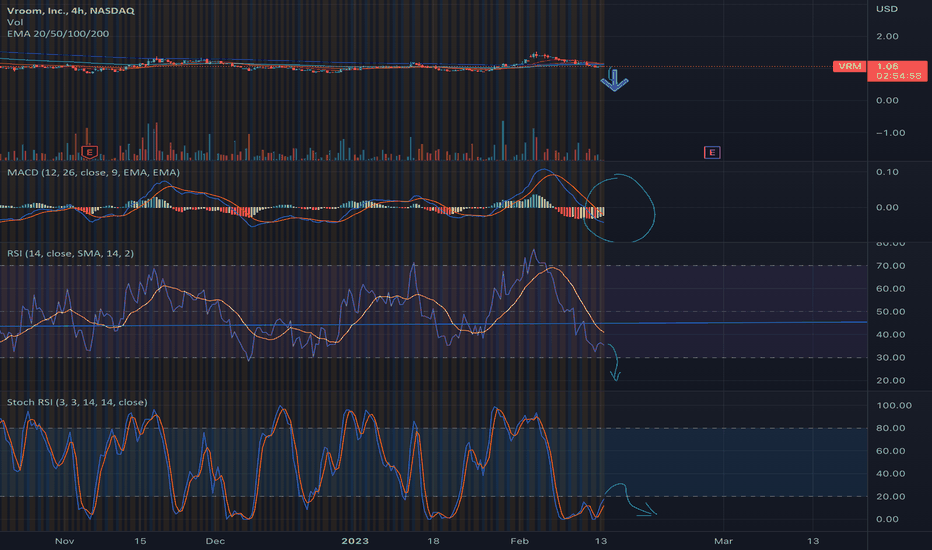

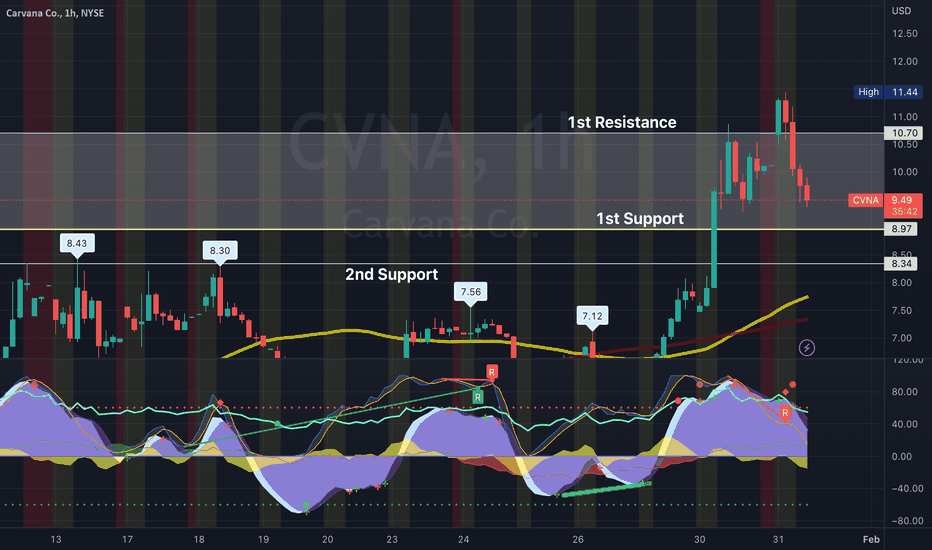

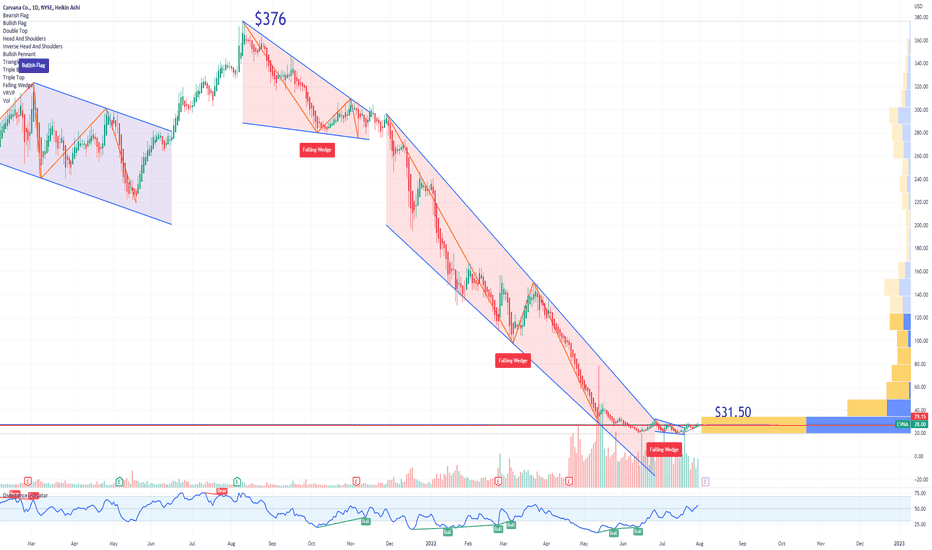

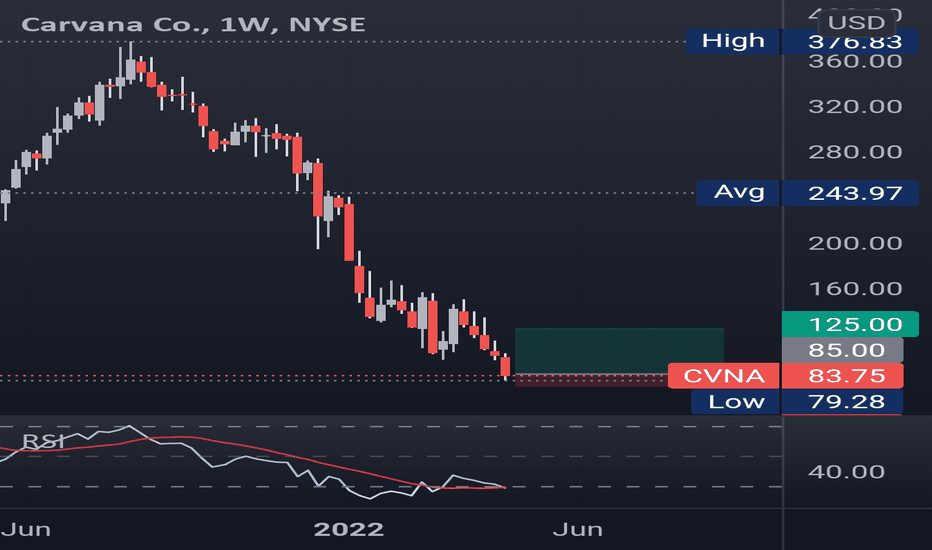

Carvana in a DUMP trendCarvana stock looks very bad. It has created already new lows. We expect this trend to continue as Carvana doesn't look good also when it comes to its fundamentals. Carvana shares tank as bankruptcy concerns grow.

Expecting a small bounce towards the resistance, next heavy rejection and the downtrend continuation .

Play a small bounce or short it at the resistance.

Good luck

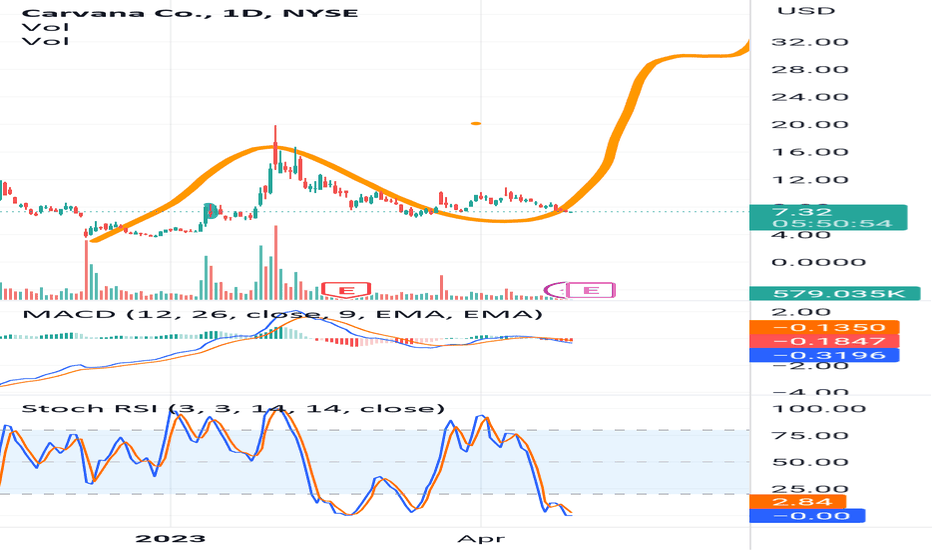

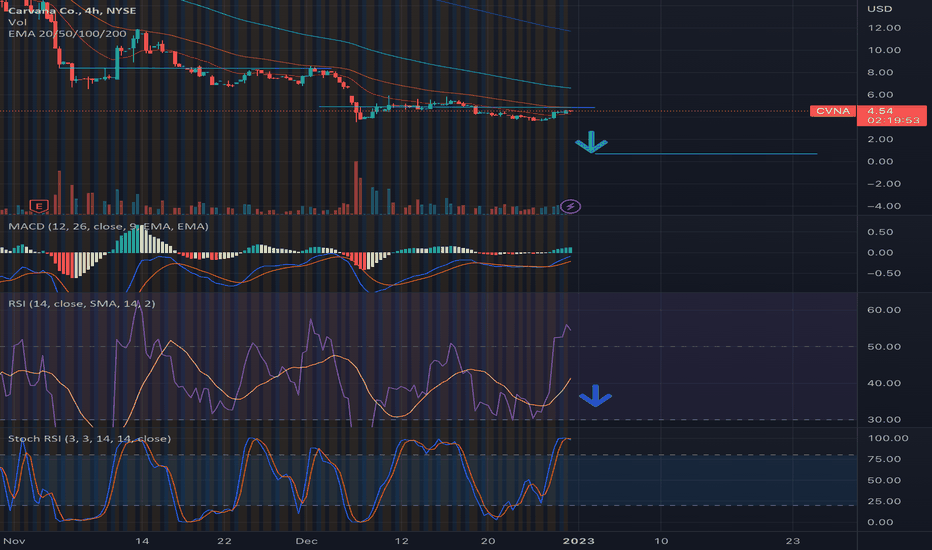

CARVANA to 0 will be a big indicator! (Bottom)ENG:

- Carvana is a used car dealership that operates like a unicorn. (they don't make money, they operate on loses).

- Sadly, Carvana is NOT a tech company that can generate additional revenues in any other way other than: SELLING CARS.

- Used car sales for the past 2 years went crazy towards the upside, and are now crashing fast.

- Most car loans generated in these last 18 to 24 months are underwater by quite an insane margin.

- The Car Repo Business has acquired long term properties, to not drop all inventory into the market at once, and kinda stabilizing prices.

- High interest rates make it impossible for average people to buy new or old cars at the moment and for the next year or so based on what the Fed says.

THESIS: Carvana shouldn't exist. They took advantage of being funded like a technology company, when their business model never evolved further than any other conventional car sales company.

Carvana is ONE OF MANY companies that shouldn't exists in this market. Until we see these companies go bust and what the consequences to the investment firms that poured money into them are, we can't call it a bottom.

-----------

- Carvana es una concesionaria de autos usados que opera como un unicornio. (no ganan dinero, operan con pérdidas).

- Lamentablemente, Carvana NO es una empresa de tecnología que pueda generar ingresos adicionales de otra forma que no sea: VENDER AUTOS.

- Las ventas de autos usados durante los últimos 2 años se volvieron locas hacia arriba y ahora se están desplomando rápidamente.

- La mayoría de los préstamos para automóviles generados en estos últimos 18 a 24 meses están bajo el agua por un margen bastante gordo.

- El negocio de reposesion de autos, ha adquirido propiedades a largo plazo, para no dejar caer todo el inventario en el mercado a la vez y asi estabilizar un poco los precios.

- Las altas tasas de interés hacen que sea imposible para la gente promedio comprar autos nuevos o viejos en este momento y durante el próximo año, según lo que dice la Reserva Federal.

TESIS: Carvana no debería existir. Aprovecharon que se financiaban como una empresa de tecnología, cuando su modelo de negocio nunca evolucionó más que cualquier otra empresa de venta de automóviles convencional.

Carvana es UNA DE LAS MUCHAS empresas que no deberían existir en este mercado. Hasta que veamos que estas empresas quiebran y cuáles son las consecuencias para las empresas de inversión que invirtieron dinero en ellas, no podemos llamarlo fondo.

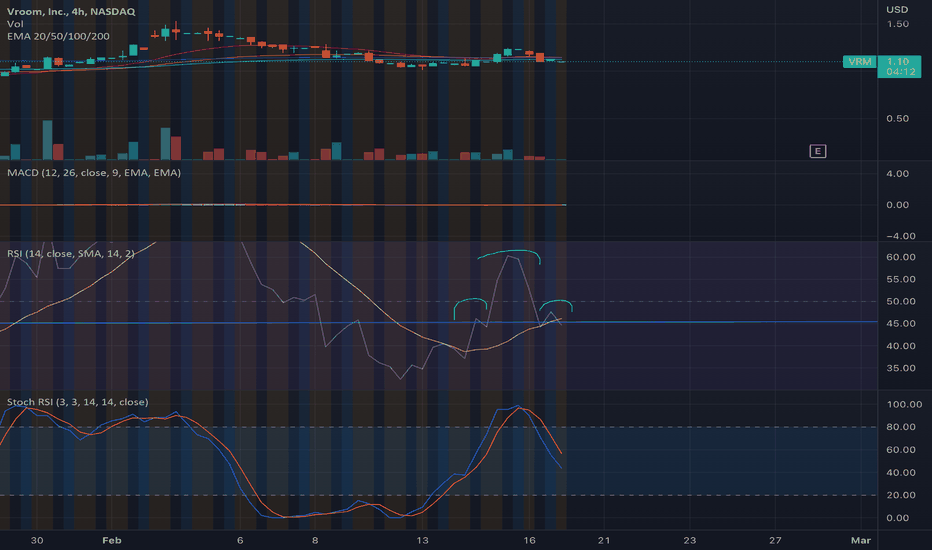

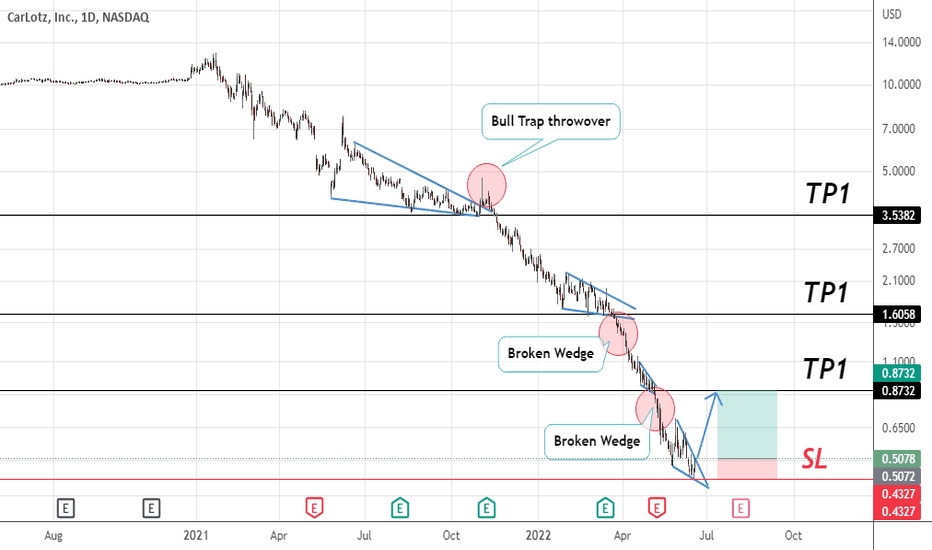

Carlotz 72% Move Possible bullish wedge break, confluence with bullish divergence. Smart money flow index changing positive as of 6/17. TP1- $0.87 TP2 - $1.60 TP3 - $3.53 SL - $0.43

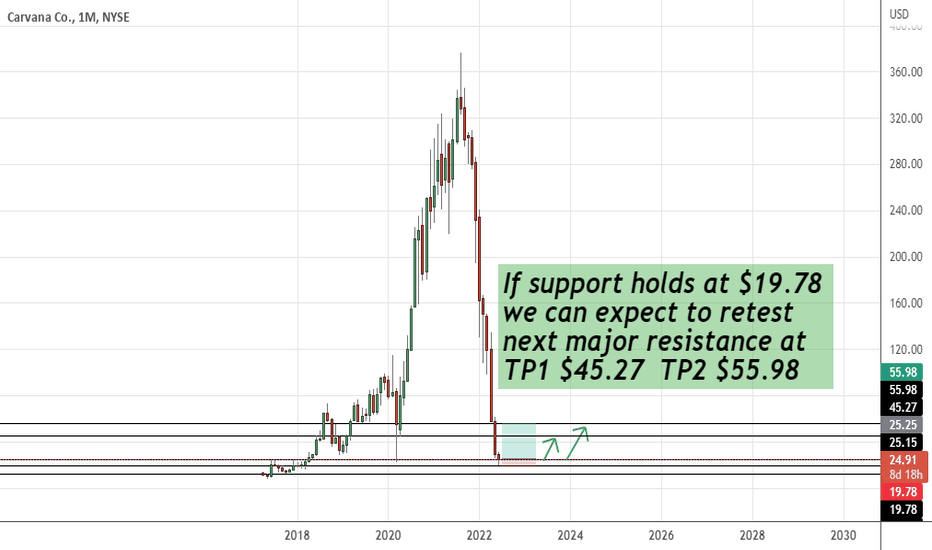

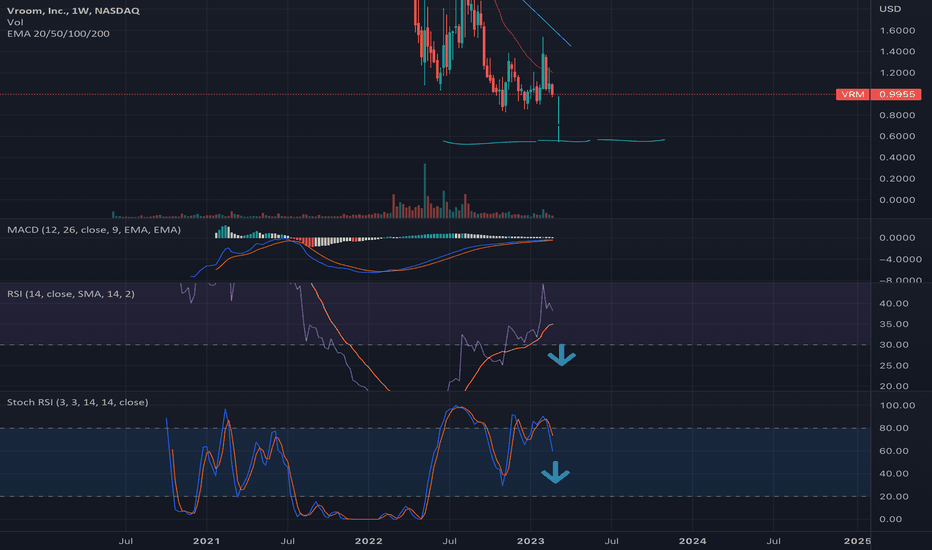

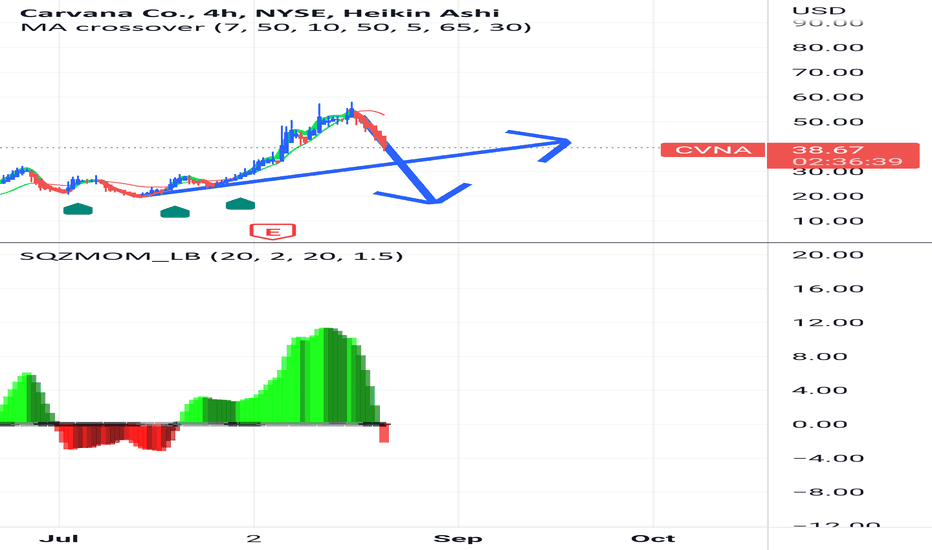

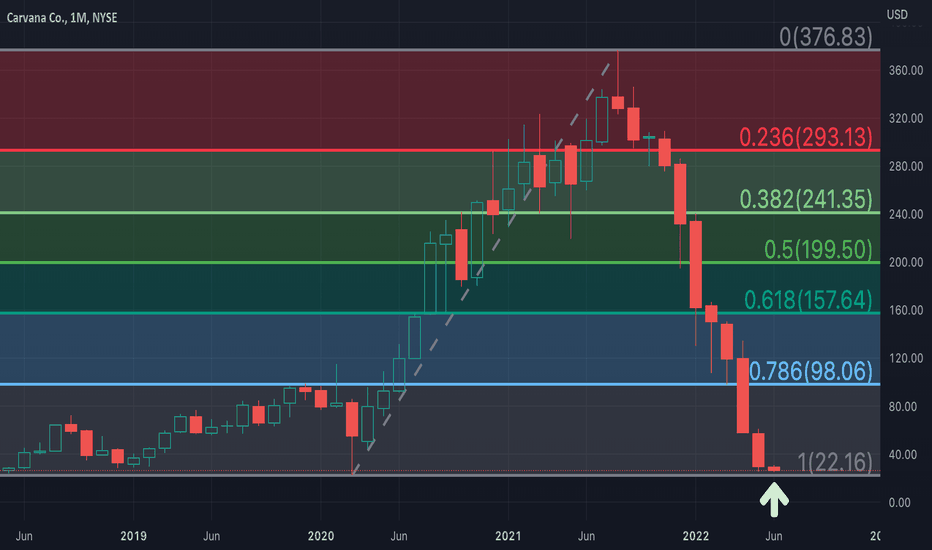

Buying Opportunity: Carvana (CVNA)This analysis is fairly straightforward. Carvana (CVNA) is nearly fully retraced. Momentum downward is slowing, multiple indicators are showing a bottoming pattern, and open interest in calls is increasing. Although the price can still fall another 10-20% to the low, it's likely that a bottom is near. This is an obvious choice for long-term investors who want to enter at the bottom to go long. Be aware that this is a monthly chart and reversals can take time. Conservative investors may wish to wait until a bullish monthly or weekly candle forms before entering to go long.

Not financial advice.