Carvana Leading Auto Retail – Outpacing LAD & AN-Financial Performance & Momentum:

Carvana reported a record-breaking adjusted EBITDA of $488M in Q1 2025, up $253M YoY, with an EBITDA margin of 11.5% (+3.8pp YoY). The company's strong operational efficiency positions it as a leader in the auto retail industry, nearly doubling the margins of competitors like Lithia Motors (LAD) and AutoNation (AN).

- Competitive Positioning & Growth Outlook:

Carvana’s EBITDA quality is superior due to lower non-cash expenses, enhancing long-term sustainability. The company expects sequential EBITDA growth in Q2 and targets 13.5% EBITDA margins within 5-10 years.

-Peer Comparison:

- Lithia Motors (LAD): EBITDA margin at 4.4% (up from 4% YoY), facing tariff-related headwinds that could impact pricing and demand.

- AutoNation (AN): SG&A as a percentage of gross profit rose to 67.5% in Q1, expected to stay between 66-67% in FY 2025, pressuring margins further.

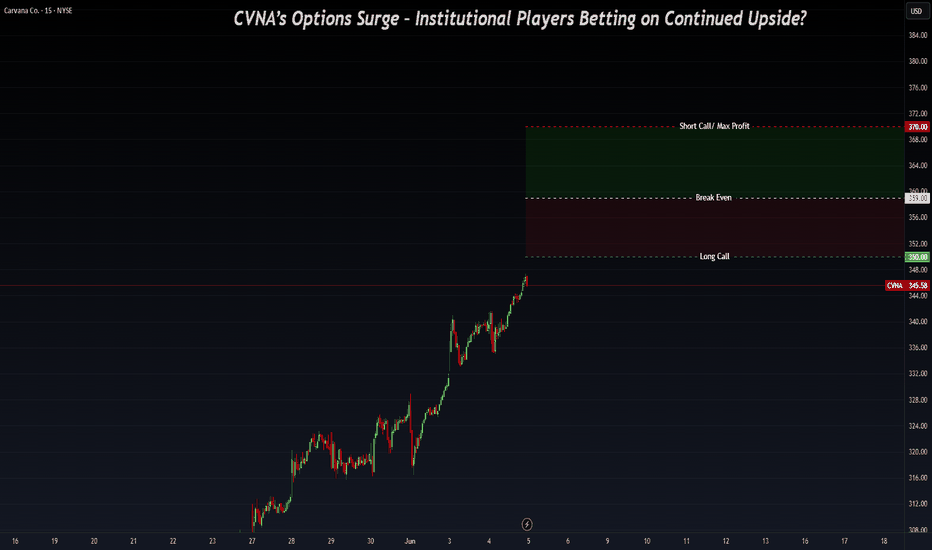

-Options Flow & Institutional Activity - Key Levels: $350/$370

Recent institutional flow activity indicates strong positioning around $350/$370 strikes, potentially signaling a vertical spread in play rather than outright selling:

1️⃣ Momentum Confirmation:

- CVNA has strong upside momentum following its Q1 results, reinforcing a bullish outlook for near-term price action.

- Institutional traders may be accumulating bullish vertical spreads rather than unwinding positions.

Vertical Spread Setup ($350/$370 Strikes)

- Long Call ($350 Strike) → Signals expectations for further upside.

- Short Call ($370 Strike) → Caps max profit while reducing cost.

- Breakeven Price: $359 → CVNA must close above $359 for profitability.

Profit & Risk Zones

- Above $370: Maximum profit achieved.

- Between $359-$370: Partial profit zone (spread remains in play).

- Below $359: Spread loses value, making recovery dependent on extended upside momentum.

Carvanatradeidea

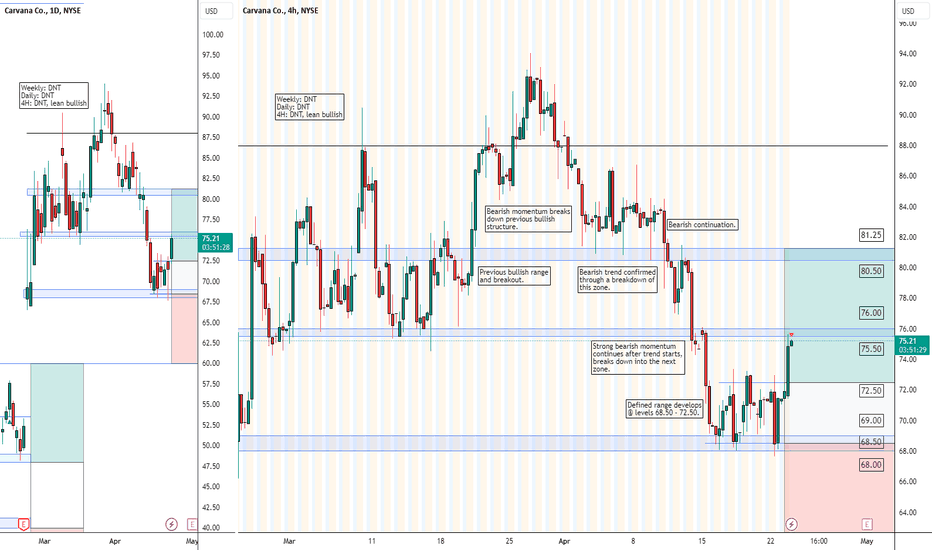

CARVANA $CVNA | RANGE BREAKOUT BEFORE EARNINGS - Apr. 23rd,CARVANA NYSE:CVNA | RANGE BREAKOUT BEFORE EARNINGS - Apr. 23rd, 2024

BUY/LONG ZONE (GREEN): $72.50 - $81.25

DO NOT TRADE/DNT ZONE (WHITE): $68.50 - $72.50

SELL/SHORT ZONE (RED): $60.00 - $68.50

Weekly: DNT

Daily: DNT

4H: DNT, lean bullish

This was requested at the end of last week but I didn't get around to it. I drew up this NYSE:CVNA chart analysis yesterday as I was entering a new trade, but wanted to wait until today to post it. I did not adjust the zones and kept them as they were yesterday, even though today price has already broken into the bullish zone, there is still room to enter new trades to the upside, or if bears want to take on some extra risk they could enter extremely early here if they expect a pullback. Earnings release next Wednesday, May 1st, 2024, and I'm looking to take advantage of possible volatility. NYSE:CVNA has broken down structure on the weekly timeframe, developed bearish structure on the daily (which is now broken as of today), and had a defined range on the 4H (which was also broken as of today).

Previous NYSE:CVNA trade idea is linked below!

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, NYSE:CVNA , carvana, carvanastock, cvnastock, cvna, carvanaearnings, earningsreport, earningsrelease, carvanaearningsreport, carvanatradeidea, carvanapricerange, rangebreakout, rangebreakdown, carvanarange, rangetrading, chartpatterntrading, chartpatterns,