CAT

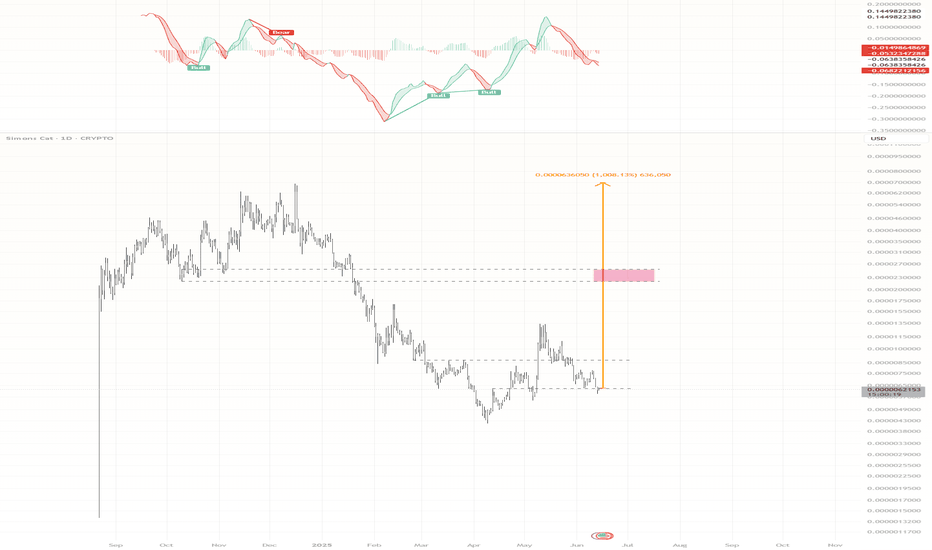

The only cat on binanceWhy NYSE:CAT Could Shine in Autumn 2025 Bullrun

Meme Coin Momentum: Bullruns often favor meme coins due to retail investor enthusiasm. NYSE:CAT ’s strong brand and cute cat theme could capture attention, especially if marketed effectively on platforms like X or TikTok.

Gaming and NFT Hype: The integration of NYSE:CAT in mobile games and NFTs taps into growing sectors. If new games or NFT drops launch in Autumn 2025, it could drive demand.

Low Market Cap: With a sub-$300M market cap, NYSE:CAT has significant growth potential compared to larger meme coins, making it attractive for speculative investors.

Community Strength: The Simon’s Cat brand gives NYSE:CAT a loyal, non-crypto-native audience, which could translate into broader adoption during a market upswing.

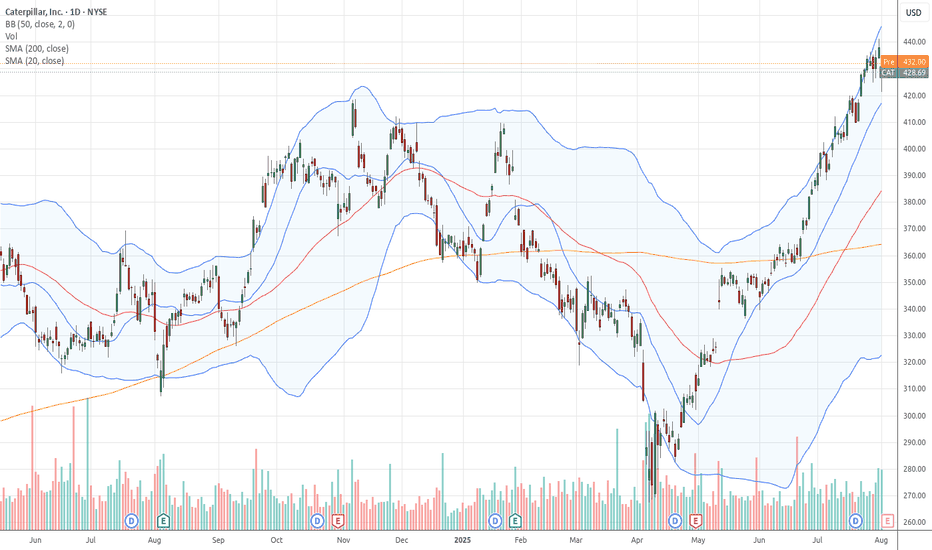

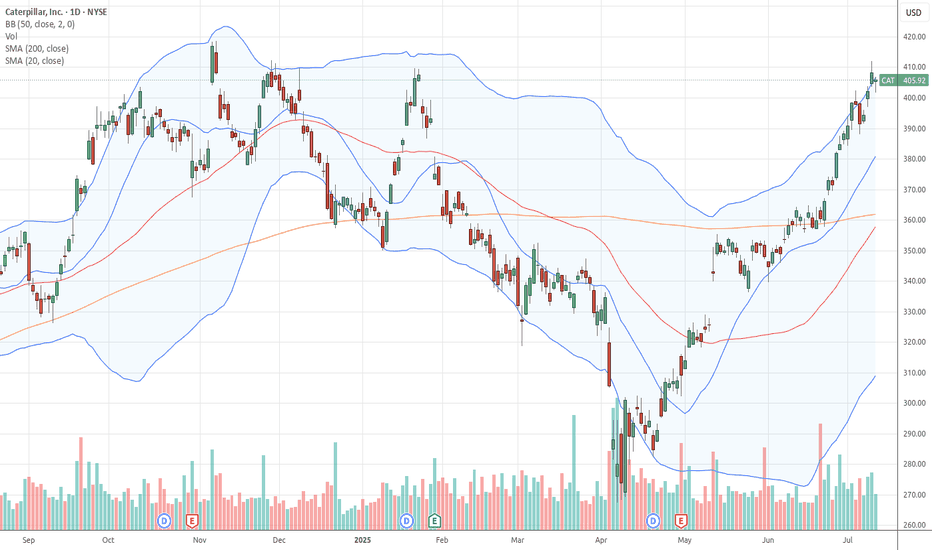

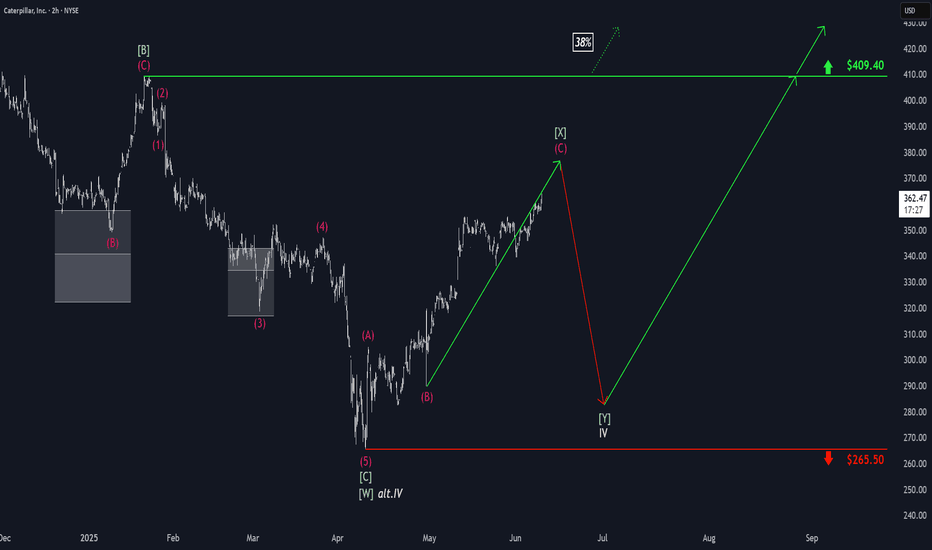

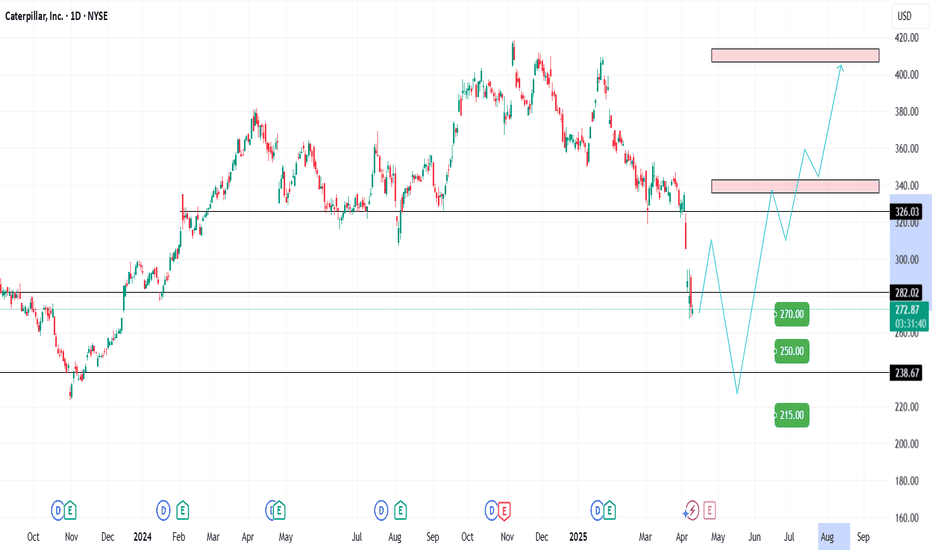

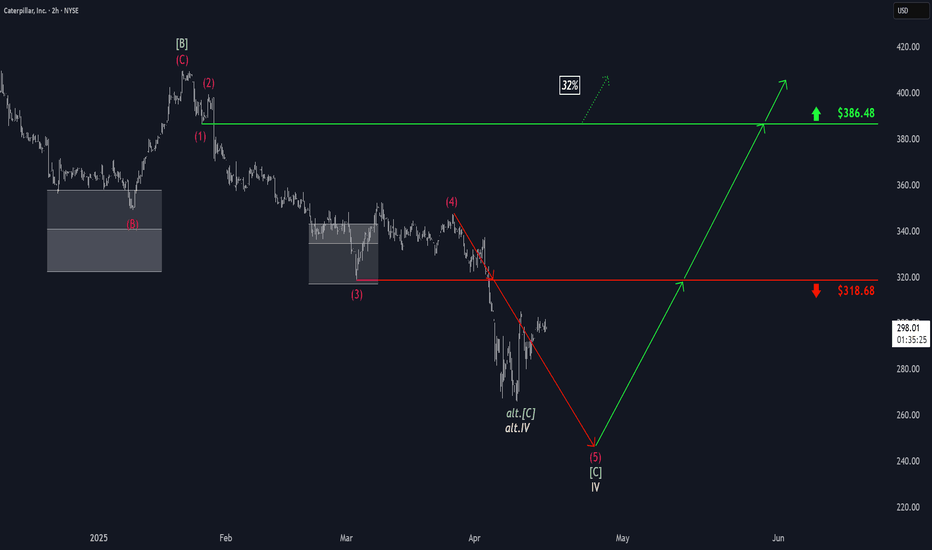

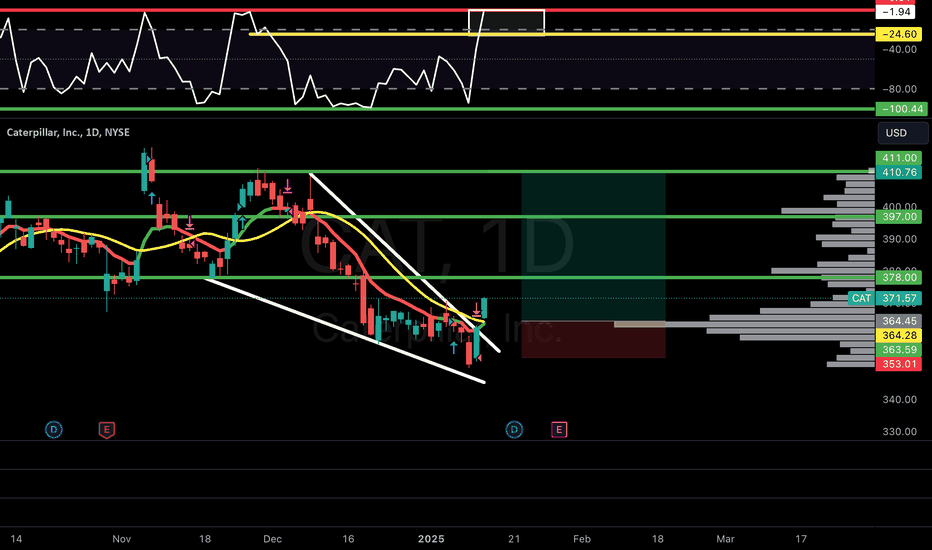

Caterpillar: Countertrend ActionCaterpillar’s green wave has further room to run. However, this rise represents only an internal countertrend – the broader correction in beige wave IV is still ongoing. Under our primary scenario, we expect the price to form another low before launching into a sustained advance, which should ultimately push above resistance at $409.40. Meanwhile, our alternative scenario—carrying a 38% probability—suggests that beige wave alt.IV has already bottomed. If that’s the case, the correction is complete, and a direct breakout above $409.40 could follow.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

MEGAPHONE ALERT! BTC 1H Outlook🧩 Megaphone Formation (Broadening Wedge)

Volatility expanding inside a widening range

Price now testing the Fib cluster (0.66–0.618) between 105,568–105,987

RSI at 66.3, nearing overbought — pressure is building

Volume surging above 20-period MA → breakout imminent

🎯 Key Confluences:

Upper Bollinger Band: 105,950

Mid BB (Basis): 105,110

Lower BB: 104,342

55 SMA: 104,500

SL Zone (Invalidation): Above 106,500 (upper wick resistance)

🔻 Bearish Breakdown Scenario:

Loss of 105,100 and breakdown from lower wedge line

RSI drops < 45 + volume spike → hedge confirmation

Targets: 104,000 → 102,500

🔺 Bullish Breakout Scenario:

Close above 106,000–106,500 with volume

Targets: 107,800 → 108,900

Manage with trailing stops — things will be quick!

⚠️ Summary:

Megaphone = Volatility Bomb

Stay nimble. If BTC fails at this Fib zone, the breakdown will be fast and decisive. If it breaks out, bulls might squeeze higher but need volume to sustain it.

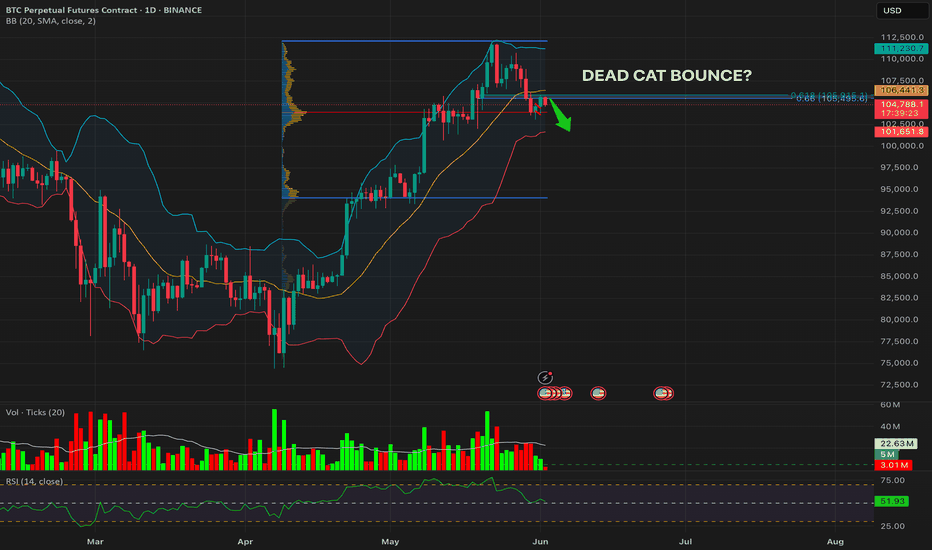

DEAD CAT BOUNCE? | BTC/USDT Daily + 4H Breakdown📉 Daily Chart – Rejection from Mid-BB & Fib Cluster

BTC bounced into the 0.618–0.66 retracement zone (105,495–106,443)

Price failed to close above the mid-Bollinger Band (106,443)

Volume declining on the bounce → lack of buying conviction

RSI barely holding above 50 (52.05) → weak momentum

Price is now rejecting from the underside of broken support → classic S/R flip

Possible Dead Cat Bounce forming below structure

🕵️♂️ 4H Chart – Short Hedge Retest Opportunity

Breakdown confirmed below 104,472 HL

RSI still below 45 on the 4H → bearish momentum intact

Retest of breakdown zone with weak volume

Price capped by mid-BB + 55 SMA (105,400–106,000 region)

Structure confirms a potential LPSY (Last Point of Supply) in Wyckoff markdown

🎯 Trade Plan (RTP-Compliant Short Hedge)

Entry: ~104,800 (confirmed breakdown zone)

SL: Just above 106,443 (Fib + BB basis + 55 SMA)

TP1: 103,300 (Lower BB)

TP2: 101,500 (Lower channel bound)

TP3: Trailing 1.0% below 101,400

⚠️ Summary

BTC's bounce lacks volume, RSI strength, and structural reclaim. Unless bulls close above 106,443 with force, this setup favors a continuation lower.

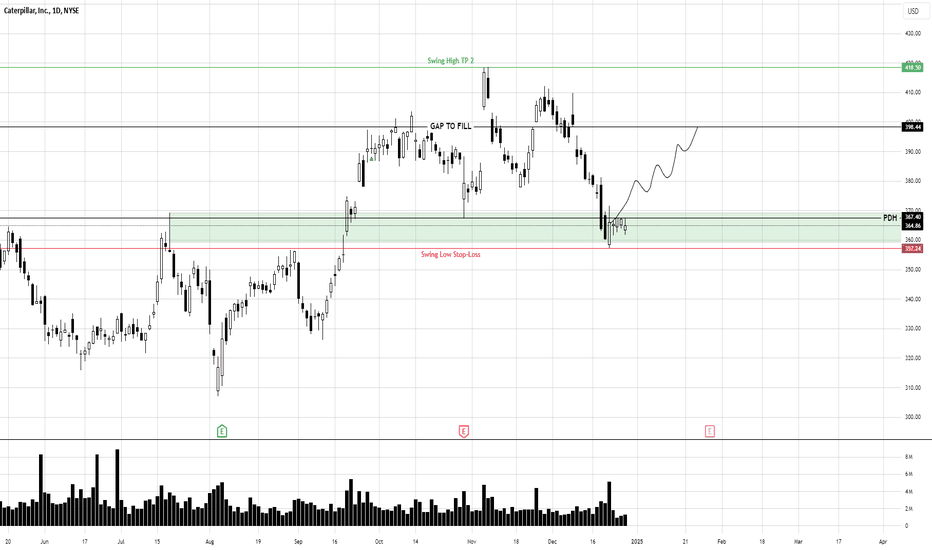

CAT TRADE IDEA – HEAVY EQUIPMENT, HEAVY POTENTIAL 📈🏗️🐾Sector: Industrials – Construction & Machinery

When the giants sleep, we prepare. And when they wake, we ride the momentum.

Caterpillar has been consolidating, and the recent pullback opens the door for a high-conviction setup. I'm looking to build my position in 3 strategic zones — scaling in with patience, letting the market give me the setup on my terms.

🟢 Entry Plan (Scaling In):

⚙️270 – First nibble as it approaches key structural support

⚙️250 – Historical support level and psychological round number

⚙️215 – Panic zone entry — if it hits here, it's a gift 🧨

🎯 Profit Targets:

320 – Swing back to resistance; first trim zone

370 – Momentum continuation with strong industrial tailwinds

400 – Full send 🚀 Long-term target if infrastructure demand and global growth trends align

🛡️ Risk Strategy:

Staggered entries allow for cost basis control

Adjust position sizing based on entry zone reached

💡 Why CAT?

Caterpillar’s fundamentals remain strong with global infrastructure spending on the rise, and the stock is approaching historical discount levels. This setup is about anticipating the bounce, not chasing it. Plan the trade, trade the plan.

📢 DISCLAIMER:

This is not financial advice. I'm sharing my personal trade plan for educational purposes only. Always do your own research and consult a licensed financial advisor before making any investment decisions. Trading involves real risk — respect it.

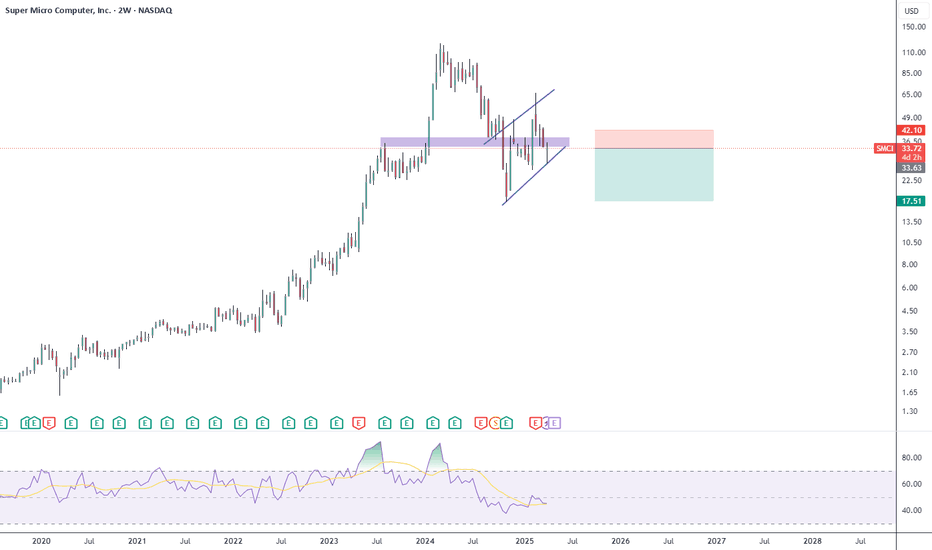

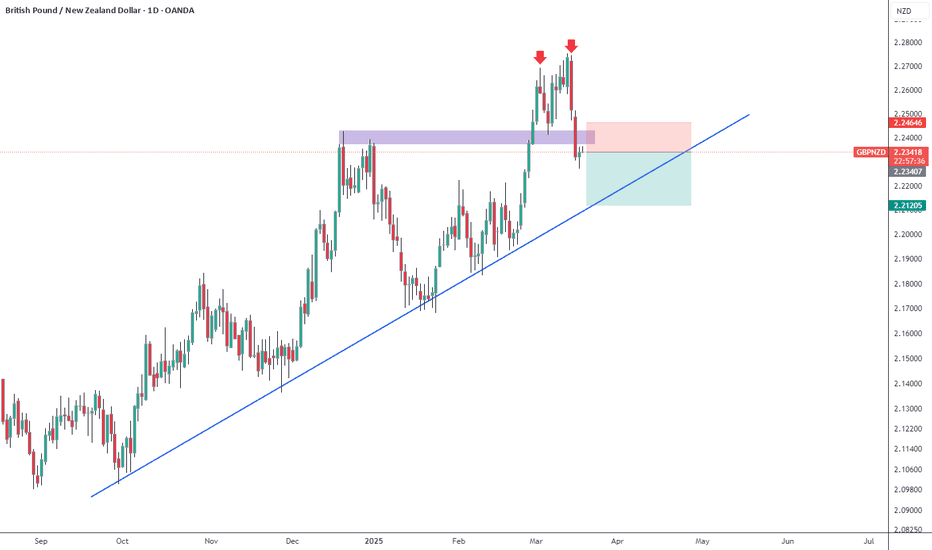

I'm shorting thisTwo weekly timeframe for a better understanding. Looks like a large bearish flag forming. Price just bounce off the bottom of the flag. But I think is a dead cat bounce. Is hitting a resistance level 35-36. Doesn't look too sting to break it up. SL triggers if a weekly candle breaks up the resistance and closes above it.

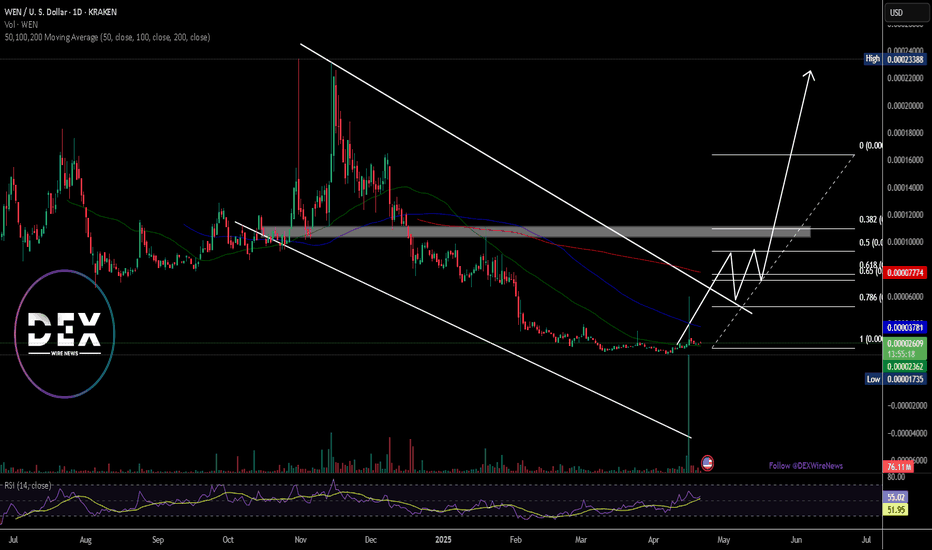

$WEN Set for 500% Surge Amidst Breaking Out of 38.2% Fib LevelThe price of the cat-themed memecoin ( NASDAQ:WEN ) is to go parabolic should the asset break pass the 38.2% Fibonacci retracement level.

NASDAQ:WEN coin, a memecoin built and integrated in the Solana ecosystem has since surge 4000% in Month of March, 2024 but the asset sharply experience a pullback losing about 96% of market value.

NASDAQ:WEN is gearing up for a bullish reversal move, should this cat-themed memecoin break out of the 38.2% Fib level, the 500% surge might be feasible, given the growing interest of the Solana blockchain.

The RSI at 56 is also hinting on a bullish campaign as it is neither oversold nor overbought. Other factors that posits to this rally is the Market cap. With a market cap of $19.7 Million, this asset is prime for a comeback to reclaim $144 million market cap with an anticipated listing from Binance, this asset could be the next big thing on the Solana ecosystem. This memecoin is already listed on 30+ CEXs and DEXes.

Notably, NASDAQ:WEN 's 24 hour trading volume has since increase by 32% to $3.5 Million hinting on a growing interest on the meme coin. With the recent ATH of $300 million in market cap, compared to the present market cap of $19.7 million and a growing community of 155k on X, this memecoin might just be the ticking bomb you are neglecting.

What is Wen?

Wen is a Solana-based memecoin that originated from a poem.

Each WEN token represents a small piece of the poem “A Love Letter to the Wen Sisters.” Written by Meow, the pseudonymous creator of the Jupiter decentralized exchange (DEX), the poem was the first NFT to be minted using the WNS standard and then split into tradable tokens. The WEN memecoin was developed by the Jupiter team before airdropping Jupiter’s native token, JUP, to DEX users.

Caterpillar: Progress!Caterpillar has successfully fallen below the $318.68 level, marking an important step in our primary scenario. There is a 32% probability that we have already seen the low of wave alt.IV in beige, which would allow the price to move directly above the resistance at $386.48 from here. However, due to the price structure, we assume that the regular wave IV in beige still requires a new low before the next rise is scheduled. Once this important bottom of wave IV is found, there is ample potential on the upside.

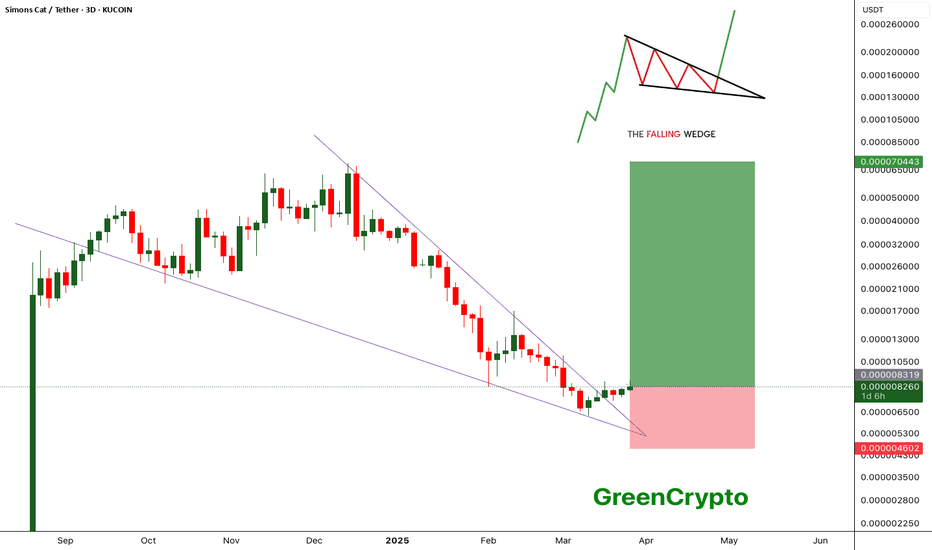

CAT - Falling Wedge PatternKUCOIN:CATUSDT (3D CHART) Technical Analysis Update

CAT is currently trading at $0.000008225 and showing overall bullish sentiment

Price has broken out from the falling wedge pattern and we are seeing beginning of the bullish trend. Expecting this trend to continue until the price hits the resistance zone.

Entry level: $0.000008225

Stop Loss Level: $0.000004602

TakeProfit 1: $0.000011536

TakeProfit 2: $0.000011536

TakeProfit 3: $0.000034238

TakeProfit 4: $0.000065098

Max Leverage: 2x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

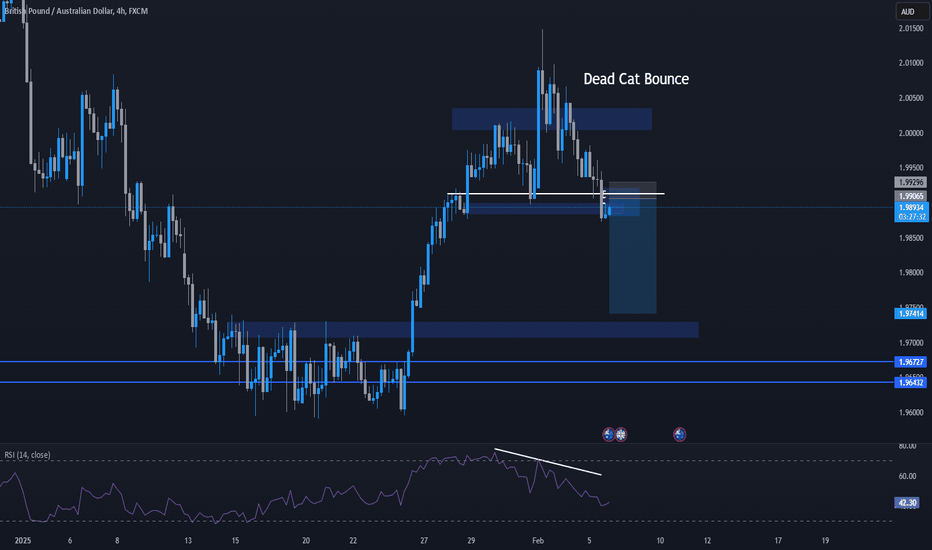

GBPAUD - Bearish Reversal Pattern + SetupHello traders,

GBPAUD has been in an uptrend since last week. But now it is showing bearishness with the break of the demand zone.

Add to this the RSI divergence which makes this trade a higher probability setup.

My entry, sl and tp are as marked on the chart.

CAT: Will be a beneficiary of disastersNYSE:CAT - SWING TRADE:

Sadly after the flooding in NC, the fires in CA, and hurricanes a lot needs rebuilt. Leading to CAT to profit from the destruction. Also, pullback and recession proof for the most part. Safe swing that could turn into a long play.

-Falling Wedge breakout

-Green H5 Indicator about to cross through smoothing line

-Volume shelf launch

-Wr% running into red barrier, will wait for that to peel off and stay in until H5 indicator or WCB breaks after it creates support.

3 SOLID PROFIT TARGETS!

Not financial advice

A classic break-n-retest on CAT!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

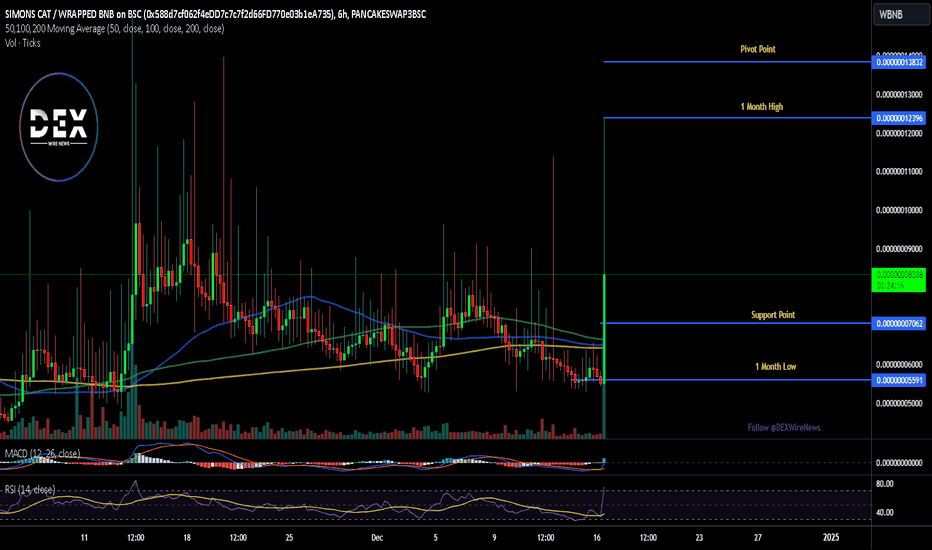

Simon’s Cat ($CAT) Surged 123% On Binance HODLer Airdrop AlertSimon's Cat ( NYSE:CAT ) token has captured the crypto spotlight with a remarkable 123% surge in value, driven by Binance’s announcement of its inclusion in the HODLer Airdrop program. As the airdrop unfolds, NYSE:CAT has solidified its position as a top contender in the meme coin category, reflecting a mix of robust fundamentals and promising technical indicators.

Binance’s Impact on NYSE:CAT ’s Market Performance

Binance’s HODLer Airdrop initiative is a game-changer for $CAT. The program, which rewards BNB holders with airdrops, has brought significant attention to Simon’s Cat and Pudgy Penguins (PENGU). With NYSE:CAT ’s listing set for December 17, 2024, trading will open against USDT, BNB, FDUSD, and TRY pairs, marking a major milestone for the token. This announcement catalyzed the surge, pushing NYSE:CAT to trade 45% higher within hours of the news.

Key figures:

- Current Market Cap: $416,233,834

- Circulating Supply Upon Listing: 7.89 trillion NYSE:CAT tokens (88% of the maximum supply)

- HODLer Airdrop Rewards: 1.14 trillion NYSE:CAT tokens (12.7% of max supply)

- Daily Trading Volume: $289,201,537 (+452.80% in 24 hours)

The Unique Appeal of Simon’s Cat

Simon's Cat Token is the officially endorsed memecoin of the globally beloved Simon’s Cat brand. Originating from the British animated series created by Simon Tofield, the brand boasts over 1.6 billion views on YouTube and widespread recognition across social media platforms. This strong IP backing gives NYSE:CAT a unique edge in the competitive memecoin space.

Key Features of the Project:

- Web3 Integration: Establishing the Simon’s Cat brand in the blockchain ecosystem.

- Community-Driven: Initiatives aimed at feeding and rescuing cats worldwide.

- Massive Exposure: Leveraging a globally recognized brand to attract a diverse audience.

Technical Analysis

From a technical standpoint, NYSE:CAT is showcasing a bullish trajectory:

- RSI: At 75, indicating an overbought zone but signaling strong market momentum.

- Support Levels: Immediate support lies at the 78.2% Fibonacci retracement level, presenting a potential buy zone during price corrections.

- Price Action: NYSE:CAT recently hit an all-time high of $0.00006562, just 5.78% below its current price. This suggests that the token may reclaim and surpass its ATH soon, particularly with increased market activity.

Despite the RSI being in the overbought territory, the token’s recent 45% gain reflects sustained buying interest. If selling pressure arises, a retracement to the support zone could create another rally opportunity.

Simon's Cat on Binance: A New Era for NYSE:CAT

Binance’s listing is expected to drive further adoption and liquidity for $CAT. However, the rapid increase in circulating supply due to the airdrop could lead to price fluctuations. Traders should approach cautiously and watch for key support levels to maximize gains.

What Lies Ahead for Simon’s Cat?

With its strong brand backing, innovative approach to Web3, and Binance’s support, Simon’s Cat is well-positioned to capture further market attention. The project’s focus on community engagement and real-world initiatives adds to its long-term appeal.

For those looking to enter the memecoin market, NYSE:CAT ’s unique fundamentals and current technical outlook make it a token worth watching. As the Binance listing date approaches, increased trading activity could pave the way for further price rallies, making NYSE:CAT a standout performer in the crypto space.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrency.

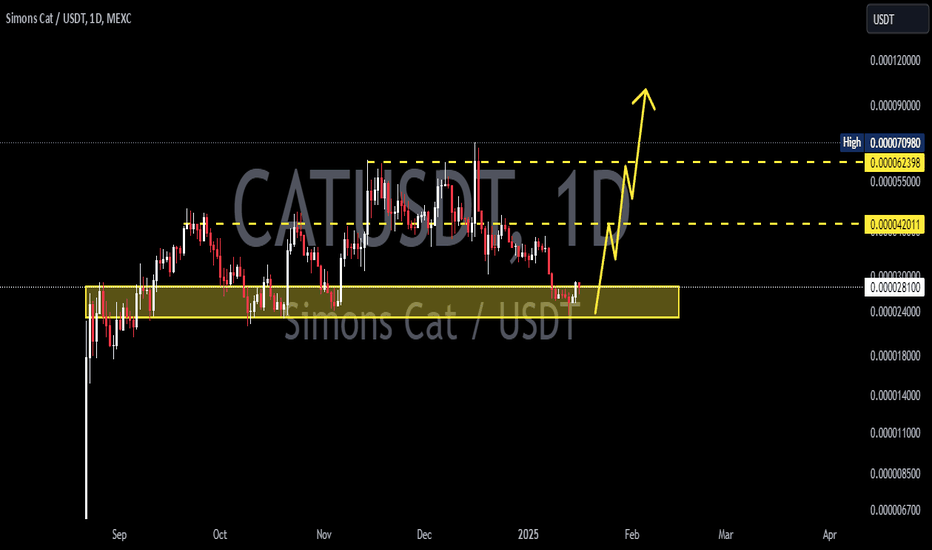

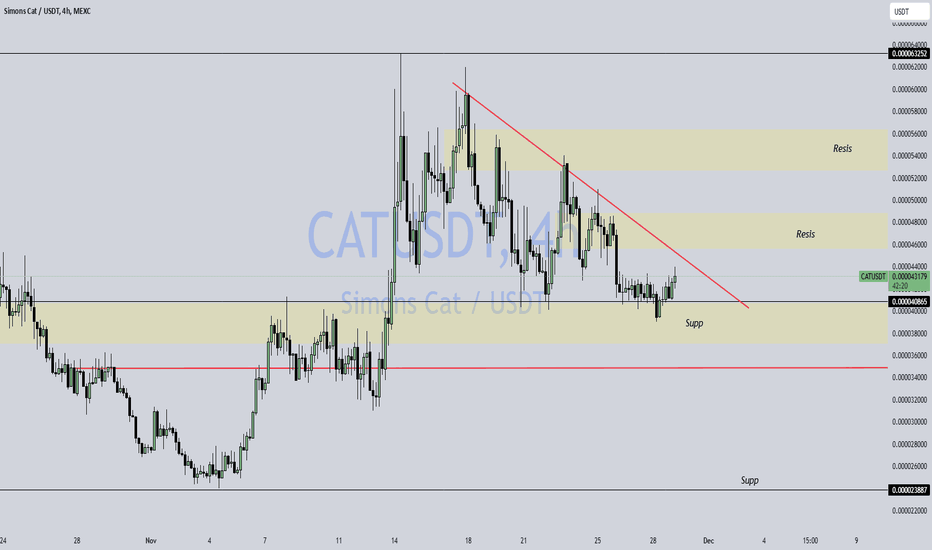

Cat/UsdtMEXC:CATUSDT

🚨 **CAT Price Analysis** 🚨

- **Current Price**: 0.000431

- **Resistance Levels**:

- **First Resistance**: 0.000480

- **Second Resistance**: 0.0005600

- **Support Levels**:

- **First Support**: 0.000408

- **Second Support**: 0.00003123

- **Third Support**: 0.0002345

🔑 **Key Points**:

- **Resistance**: If CAT breaks above the **0.000431** level, the next resistance areas to watch are at **0.000480** and **0.0005600**. A successful break and hold could indicate further upward movement.

- **Support**: If CAT fails to hold at **0.000431**, it could test the support levels at **0.000408**, **0.00003123**, or even **0.0002345**, where it may find a rebound.

💡 **What to Watch**:

- **Price Breaks Above Resistance**: A break above **0.000431** could lead to tests of the next resistance levels at **0.000480** and **0.0005600**.

- **Price Falls Below Support**: If the price falls below **0.000431** and tests support, keep an eye on the **0.000408**, **0.00003123**, and **0.0002345** levels for potential reversals.

⚠️ **Not Financial Advice**: Please do your own research and trade carefully.

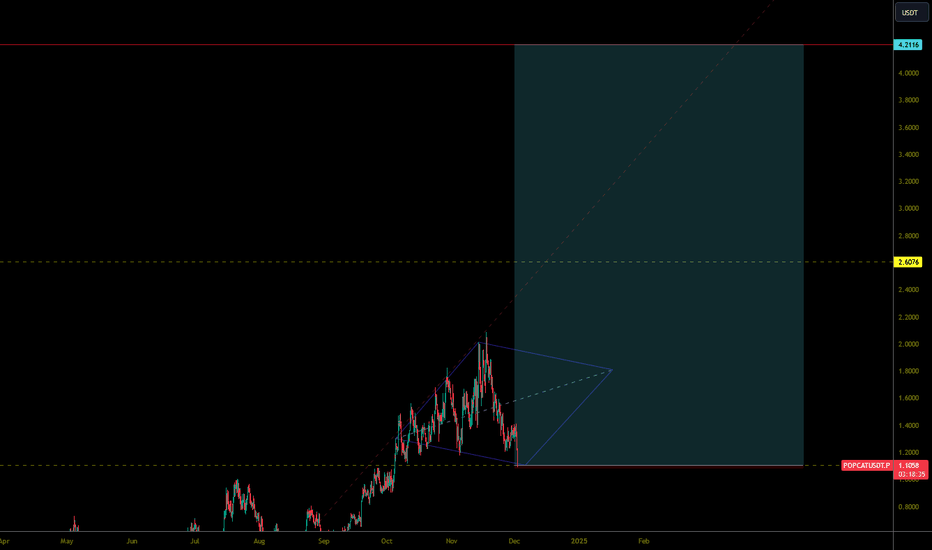

Time to buy $CAT?Simons Cat did a 2X after the Binance Futures and OKX listing. Great result.

NYSE:CAT couldn't break the ATH, for now... After the pump NYSE:CAT drops 30% which could happen after such pump. Simons Cat has reached the support level and we can also see on the 4HR timeframe a Bullish Divergence.

Is the bottom in?

KUCOIN:CATUSDT MEXC:CATUSDT OKX:CATUSDT GATEIO:CATUSDT POLONIEX:CATUSDT HTX:CATUSDT BYBIT:CATUSDT COINEX:CATUSDT OKX:CATUSDT.P PANCAKESWAP:CATUSDT_4A39EB