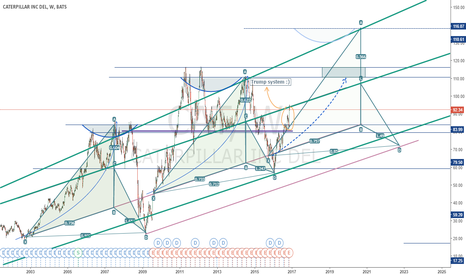

CAT

CAT @ daily @ best dow share (+42%) 2016, still pretty bullish ?Take care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Buying/Selling or even only watching is always your own responsibility ...

DOW JONES Index incl. all 30 Shares (2016 Yearly Performance) @ drive.google.com

Best regards

Aaron

CAT kills a Bear - What happend...Initiated this BCS bevor price broke back in the fork again (hint hint hint ;-) )

This is me, being impatient (proof: I'm human).

Because this is a risk defined trade, I leave it on with "hopium" that price come back again, below my strike of 90 (...LOL...good one Dude...).

Meanwhile I sell some puts to reduce some of my loss.

Next...

P!

Cat /(Carterpillar) , + UPOne of the areas directly benefited by Trump's choice is the Construction sector, // product of its promises of Re-construction and renovation.

Of USA preferentially to the structures in decay and creation of new, this is reflected in the rise of the companies related to the construction and also with the same materials used in the contribution ///

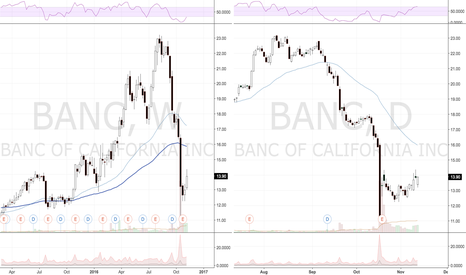

BANC morning star reversal on weekly?BANC has come under alot of criticism for their operations being a little too good to be true and eerily resembling another financial operator with links to the firm that turned out to be fraud (identified by some short activists). BANC responded that it's false and tried to use a firm that is a customer of the bank to help clear the air. We will see in the next several weeks if the daily charts are setup up a strong reversal (bullish) or if it's a dead cat bounce and flagging (bearish).

CAT about to get scratchedI'm bearish on the sector in general as well as the company after some interesting research from Hedgeye. I think the recent rally was a gift from the market gods, and am simply looking to fire my shots.

RSI momentum is negative while the share price failed to break above 50% fib retracement level. Possible 50 day ma acting as over head resistance as well.

I'm buying a 12month put now and will add to it if stock breaks below 81.00.

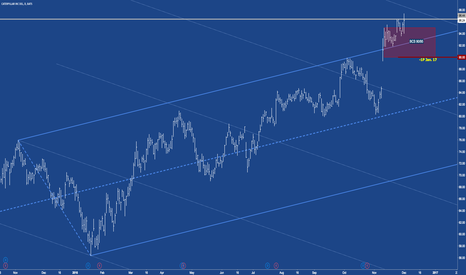

XMR SHORT - Time to turn the corner!Monero has recently seen a few tumultuous weeks of trading and looks to finally be on the back side of this event. Looks to be consolidating some and trying to find a floor. All indicators are lining up towards a nice short position in the 4h chart.

The price has resisted crossing the downward trend since the ATH a few days ago, and finally rolled over. There has been strong resistance at fib levels all the way down to here at 235, 220, 200, and 180.

I think that it will stabilize around 150 , where it had a consolidation period on the way up. Ultimate candle stick lows should be somewhere around 120-130 , maybe even lower. Great chance to catch the bottom and flip for a long on the dead cat bounce.

The market has not looked this decided in a while, I am excited to see how things turn out!

Currently holding a short position with entry at 178. Will keep this updated as the market moves.

Caterpillar technicals point to downside riskCAT reached new annual highs last week but failed to break above an important technical level at $83.90 (50% Fib level in chart). A negative divergence has taken shape in the daily RSI as prices retreat from a trend line resistance tested on 17 August. So long as prices remain below $85.30 (current projected trend line level), we may see CAT correct down towards $80.90 by next week. $77.40/$78.00 is also a possible target if such a correction takes place next month.

NZD/USD Dead Cat Bounce 30min and Bullish Cypher on the 240minThere is a Dead Cat Bounce on the 30 min happening right now. Price retraced to the .50 fib, you can use which ever level you like, I like the .50 and .618 fibs. I am currently short (.71391) because of the big bearish pin bar and the shooting star candles. I have my stop just above the current swing high at .7160 and my target at .6985. There is also a Bullish Cypher Pattern on the 240 min. It completes at .6808, I will have my stop below the level at .6765 and targets at .6995 and .7110. Good luck trading out there.

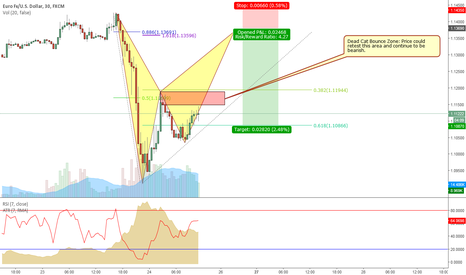

EUR/USD Bearish Bat 30 min or Dead Cat Bounce retestThere is potential Bearish Bat on the 30 min. There is also a 1.618 fib ext correlation in the same zone. I would look to get short around 1.1369 with my stop above the swing high at 1.1435 and a target at 1.1087. The target is a .618 fib retrace from the entry price. This is of course, if price breaks and closes above the .50 fib zone. Also, this .50 fib zone could be a potential retest in the Dead Cat Bounce area. Good luck trading out there.

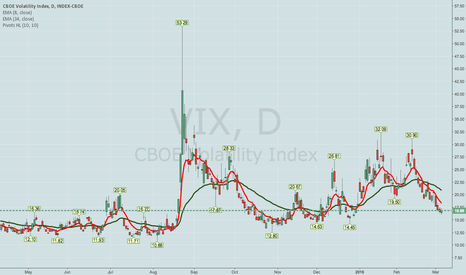

THE WEEK AHEAD -- "LESS THAN SEXY" FOR PREMIUM SELLINGWith the VIX finishing the week out at 16.66, next week is setting itself up to be a less than sexy week for premium selling, particularly in broader market instruments like SPY, IWM, QQQ, and DIA.

Moving to other sectors, the Brazil ETF, EWZ continues to be hot premium selling wise, with an implied volatility rank of 72. A couple of issues in the oil and gas space follow closely behind in the 70+ club (UNG (implied vol rank 72); RIG (71)); with several gold plays remaining in the 60s (GDXJ, GDX, GG).

From there, volatility in individual underlyings and/or ETF's slips off somewhat dramatically, with only a few in the 50-60 range (X at 57; ORCL, 57 (one of this season's last earnings plays); CAT, 55 (earnings afterglo vol); and GLD, 52; with the remainder of most highly liquid, options playable issues slipping below 50 thereafter.

Given the fact that I'm in a gold play, in EWZ, and have exposure to oil, I don't see myself putting on a heckuvalot of new trades next week. That's not all bad; these little volatility lulls make for a good time to do housekeeping on the various messes I created during the last volatility wave, clean up the earnings plays that didn't work out this past season, and/or dry out powder for the next volatility spike or whatever comes next ... .

Naturally, should VIX spike to plus 25, I'll be right back in it with some new plays to take advantage of that. In the meantime, a cleaning of my trading "garage"/"basement"/"backyard" is overdue.

It ain't sexy, but it's gotta be done some time.

WHAT I'M LOOKING AT THIS WEEK FOR EARNINGS -- AAPL, FB, BA, AMZNThis is a "kid in a candy store" week, with a good selection of earnings plays to choose from:

AAPL: Tuesday, after market close

BA: Wednesday, before market open

FB: Wednesday, after market close

BABA: Thursday, before market open

CAT: Thursday, before market open

AMZN: Thursday, after market close

MSFT: Thursday, after market close

I'll post setups on Tuesday once I have open market options pricing to look at. Pricing in off hours is notoriously suspect ... .