CAVA Earnings Options Play (Aug 12, 2025⚠️ CAVA Earnings Options Play (Aug 12, 2025)**

**Bias:** 🐻 Moderate Bearish (65% Confidence) — Mixed fundamentals + bearish technicals

📊 **Fundamentals:**

* Revenue growth strong (+28.1% TTM) but EPS expected to plunge -58.3%

* Margins tight; cost pressures looming

* Forward P/E sky-high at 168.7 — pricey expectations

* Sector exposed to consumer spending risks

📈 **Technicals:**

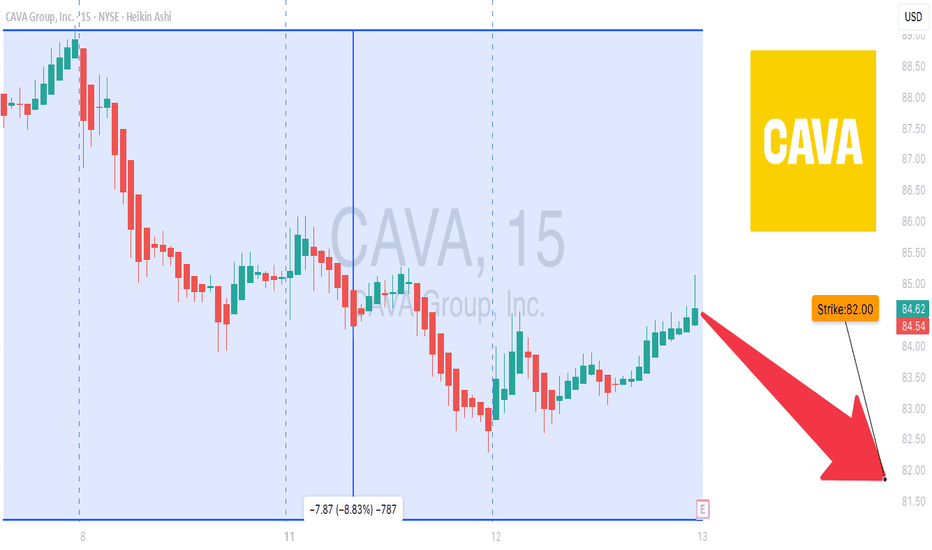

* Trading below 50 & 200 DMA → bearish momentum

* RSI near oversold at 40.08 — possible short-term bounce but downtrend intact

* Key support: \$82.00 — breach signals more downside

💡 **Options Flow:**

* Heavy open interest on \$80 puts and \$85 calls — mixed sentiment but bearish tilt

* IV Rank 60% with expected move \~ \$5.00 → priced for volatility

---

### 💣 Trade Setup:

* **Instrument:** CAVA

* **Trade:** Buy PUT

* **Strike:** \$82.00

* **Entry Price:** \$4.05 (bid side, conservative)

* **Expiry:** Aug 15, 2025

* **Profit Target:** \$12.15 (+200%)

* **Stop Loss:** \$2.025 (50% premium decay)

* **Size:** 2 contracts

* **Entry Timing:** Pre-earnings close

* **Earnings Date:** Aug 14, AMC

⚠️ **Risk:** Close position within 2 hours post-earnings if no target hit

---

**TL;DR:**

Price action and fundamentals suggest downside risk post-earnings. Buying puts at \$82 strike targets a big move down, but manage your risk tightly around earnings volatility.

\#CAVA #EarningsPlay #OptionsTrading #PutOptions #BearishSetup #VolatilityTrading #OptionsFlow #StockMarket #TechnicalAnalysis #EarningsSeason