Bitcoin (BTC/USD) Daily Chart Analysis For July 1, 2022Technical Analysis and Outlook:

Bitcoin is trading at under $20,000 as it is waiting for oxygen therapy - with the possibility of making advancements to Mean Res $21,575 and a low probability additional rally to Mean Res of $22,670; currently sitting at our of Key Sup $18,900. The coin is facing take down to the #2 Outer Coin Dip $15,500 mark.

Macroeconomic Analysis And Trading Ideas

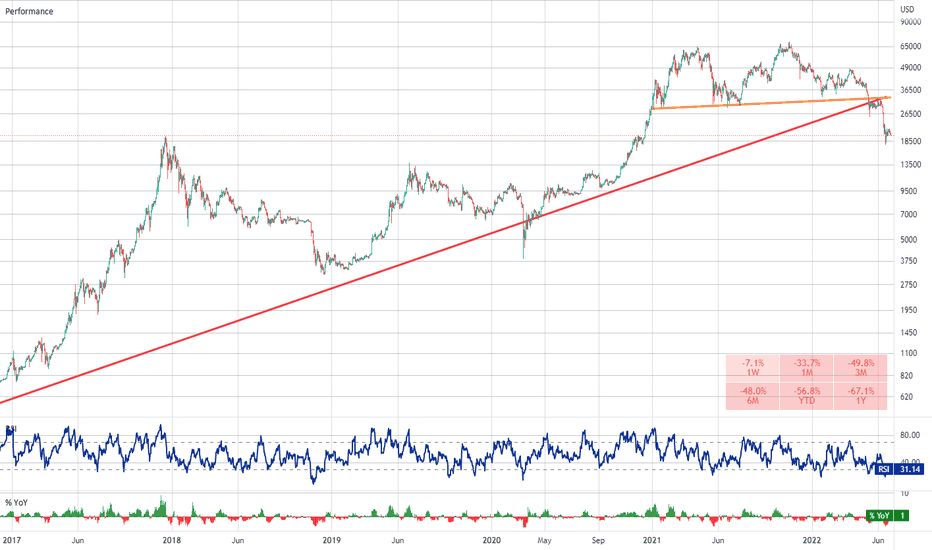

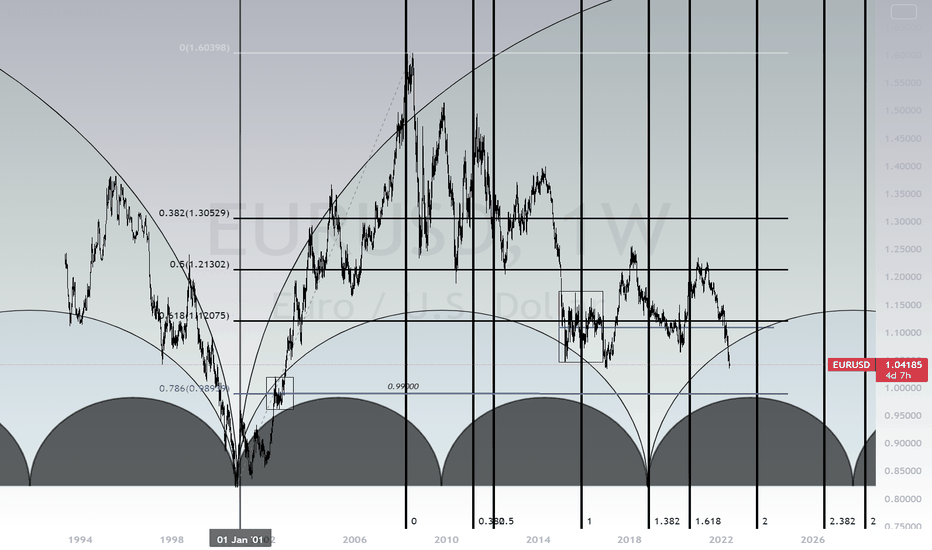

Bitcoin or BUTT-Coin :) SELLIf the red trendline is any good (with 30 years of being in the financial markets doing economieetrics / fundamentals and asset allocation), then we are in for major shockS / disappointments in teh financial markets in the coming quarters.

BUTT Coin is the posterboy of what is wrong with teh current financial system / CENTRAL bANBKETS / GEN X / GEN Z / MILLENIALS / Value of Money / etc.

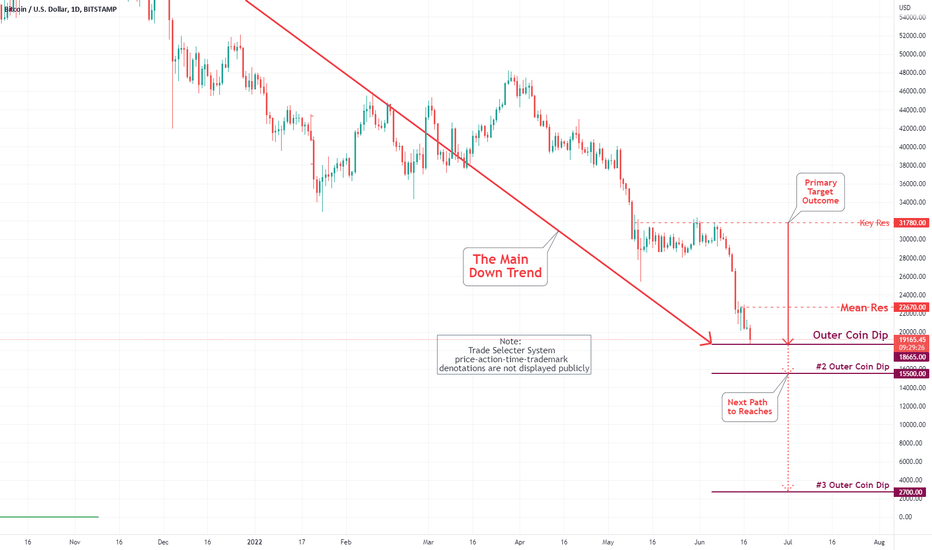

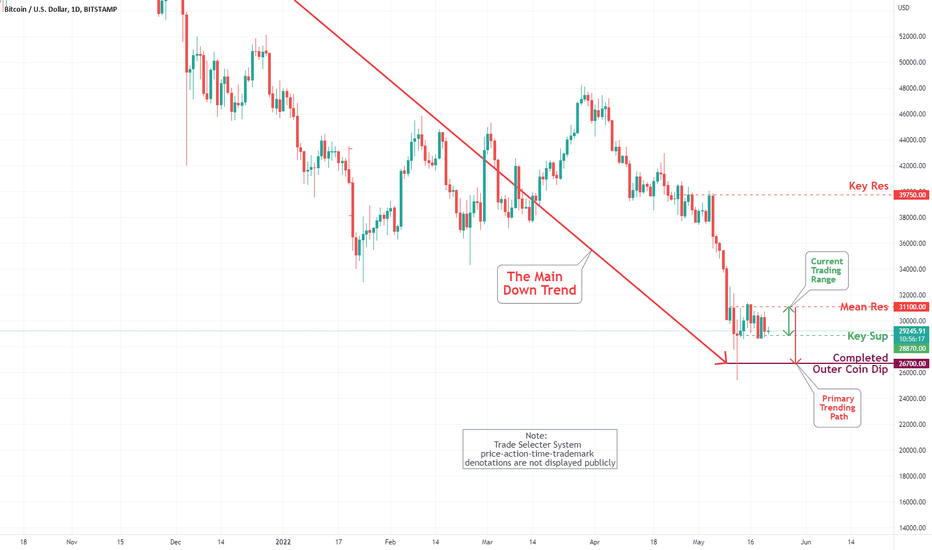

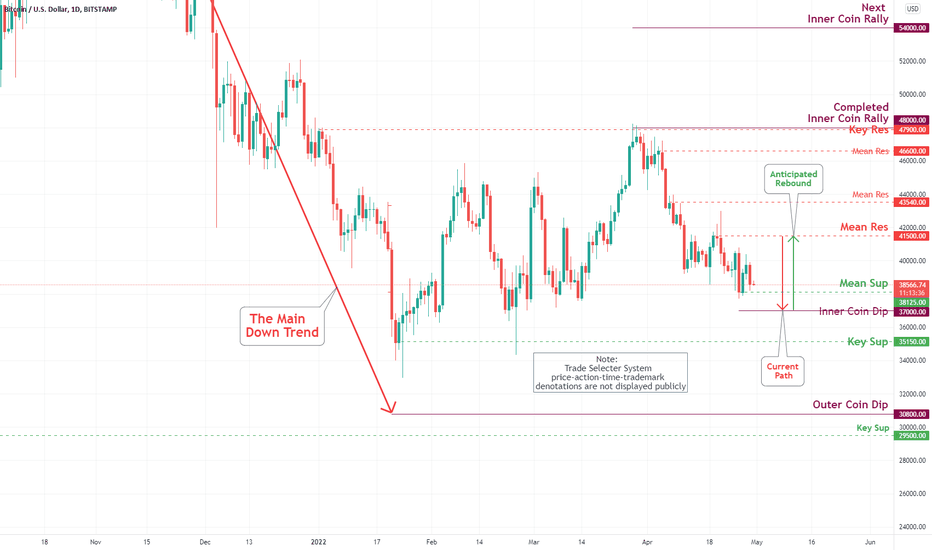

Bitcoin (BTC/USD) Daily Chart Analysis For June 24, 2022Technical Analysis and Outlook:

Since the June 18th completion of our Outer Coin Dip of $18,665, the Bitcoin is advancing slowly to our Mean Res of $22,670; however, if all fails, the coin will take us to the retest of Key Sup $18,900 and #2 Outer Coin Dip $15,500 mark.

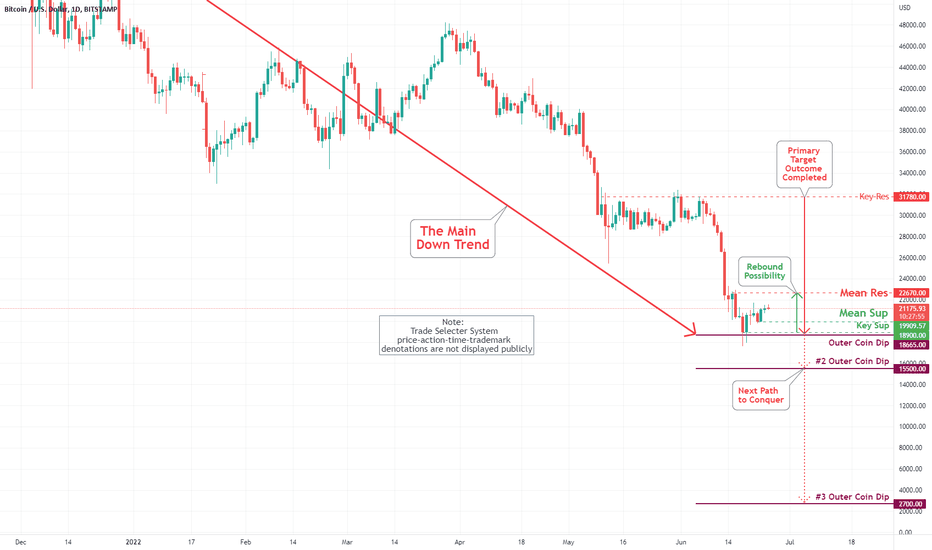

Bitcoin (BTC/USD) Daily Chart Analysis For June 17, 2022Technical Analysis and Outlook:

This week was marked by sharp declines and panic in the Bitcoin market. Bitcoin's trending price action hit our Outer Coin Dip at $18,665. With this primary path completed, upon verification (In progress), expect the rebound to Mean Res $22,670; however, if all fails, the coin will take us to the #2 Outer Coin Dip $15,500 mark.

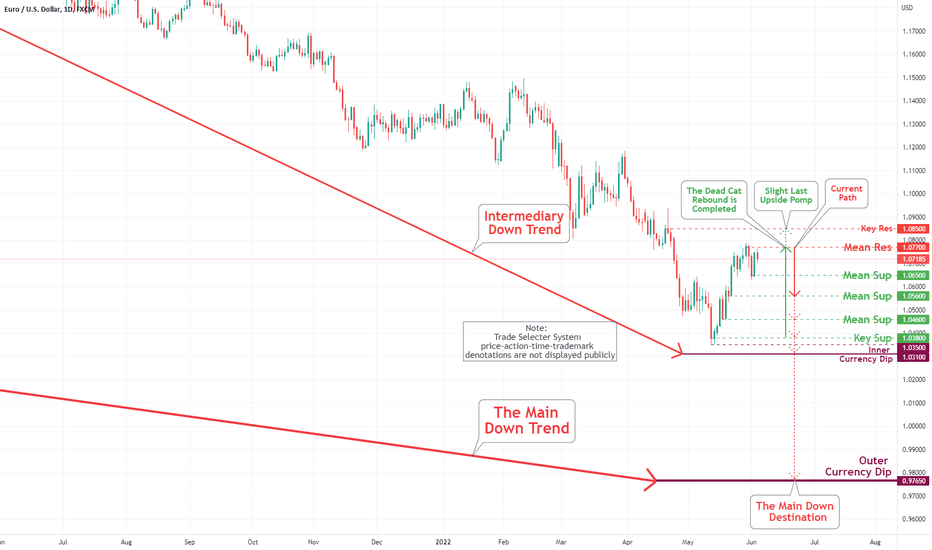

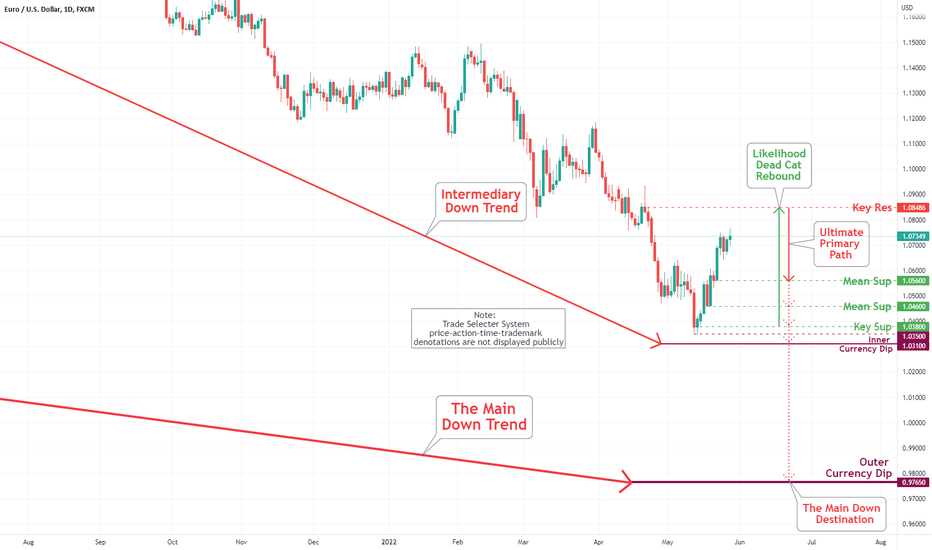

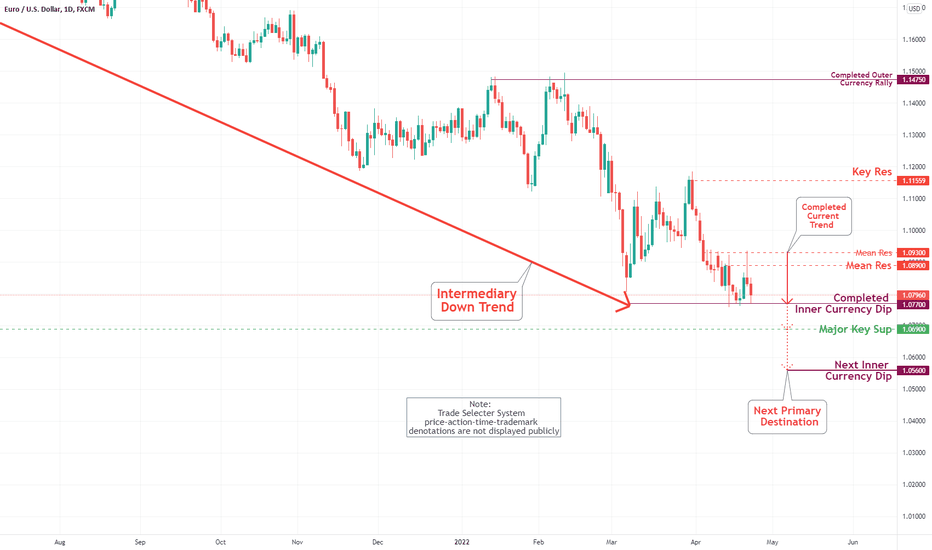

EUR/USD Daily Chart Analysis For June 3, 2022Technical Analysis and Outlook:

The Euro has created a new Mean Res 1.077 and Mean Sup 1.065.

The next strong resistance is in the 1.085mark. On the downside, the Mean Sup 1.056, Mean Sup 1.046, and Key Sup 1.038 are the primary targets - The ultimate Inner Currency Dip is marked at 1.031.

EUR/USD Daily Chart Analysis For May 27, 2022Technical Analysis and Outlook:

The Euro gained quite a bit over the trading week, breaking over our Key Res 1.062 price level. The next strong resistance is in the 1.08 area. On the downside, the Mean Sup 1.056, Mean Sup 1.045, and Key Sup 1.038 are the primary targets - The ultimate Inner Currency Dip is marked at 1.031.

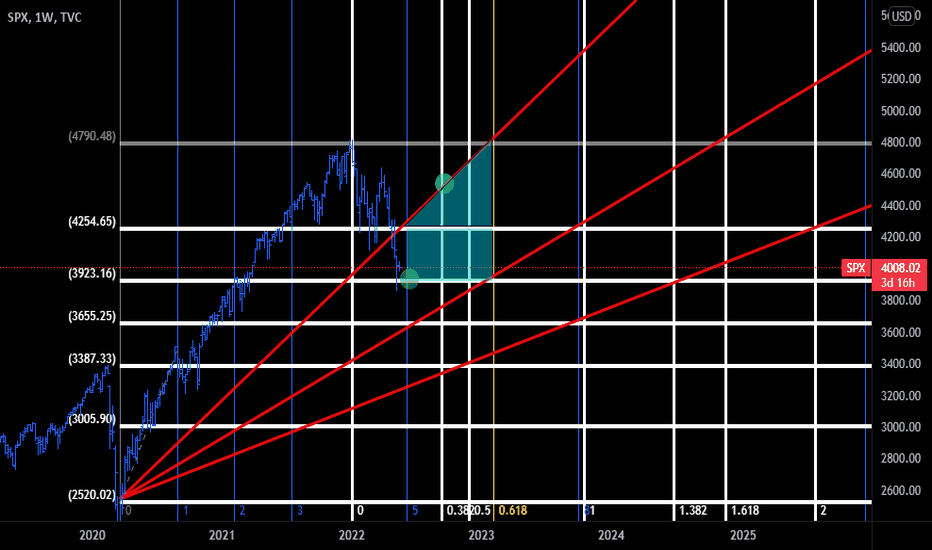

SPX Forecast 22'-23' (Fibonacci Analysis)Notes:

Expecting financial markets to rally amid FOMC summer hikes.

Entering "Complacency" (June 06, 2022 - Feb 2023) in market cycle.

Entering "Anxiety" (Nov. 2022 - Oct. 2023) in market cycle.

Hedge Idea

(Long):

Entry Price: $3,923.00

Entry Date: June 06, 2022

Price Target: $4,500.00

Date Target: Nov. 2022

(Short):

Entry Price: $4,500.00

Entry Date: Feb. 06, 2023

Price Target: $3,600.00

Date Target: Oct. 2023

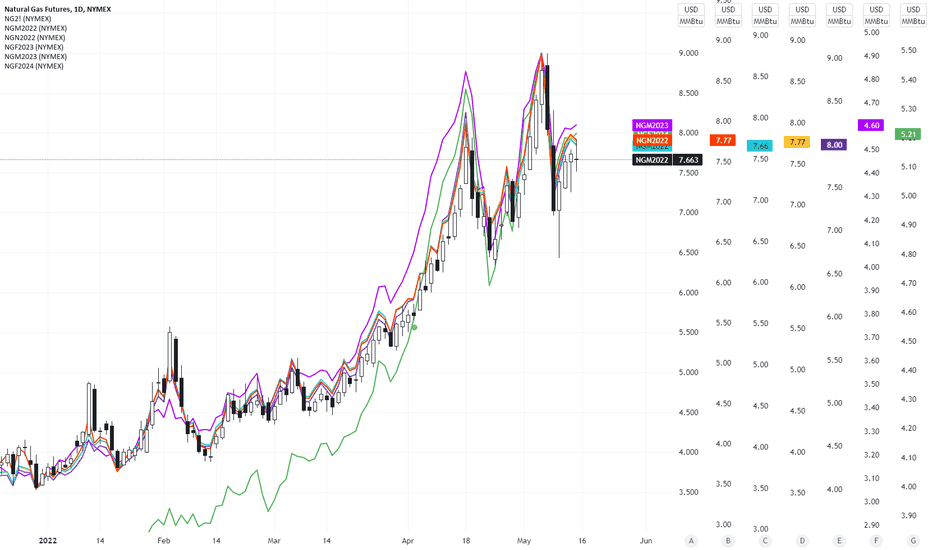

Henry Hub Natural Gas futures showing slowing momentumHenry Hub Natural Gas futures showing slowing momentum across the futures curve up to Jan 2024 ($NGF2024).

Recent geopolitical risks i.e. The Russian invasion of Ukraine, have pushed the prices of both spot and futures of commodities higher.

Natural Gas futures across the curve are tracking each other with a tighter spread till Jun 2023 implying that the market participants expect the prices to remain elevated for a longer time. However in the short-term, the price action shows an exhaustion by bulls forming a ranging pattern with a possibility of a reversal.

Central banks around the developed world highlighted in their Monetary Policy Statements this May that they expect energy prices to remain elevated for the next 18 months. I'll definitely be watching out for the impact of the policy tightening regime - which we are in now - to the demand side of the economy, and it's second-order effects on gas prices.

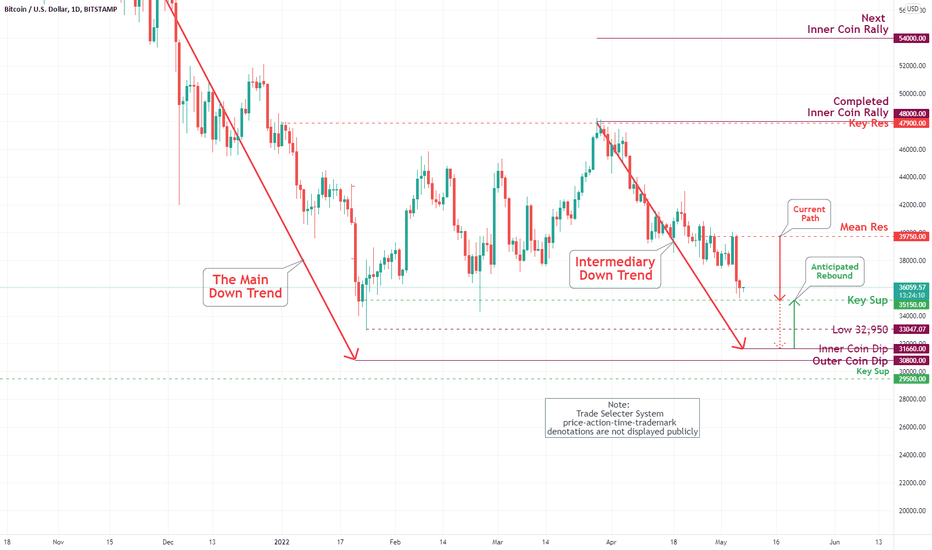

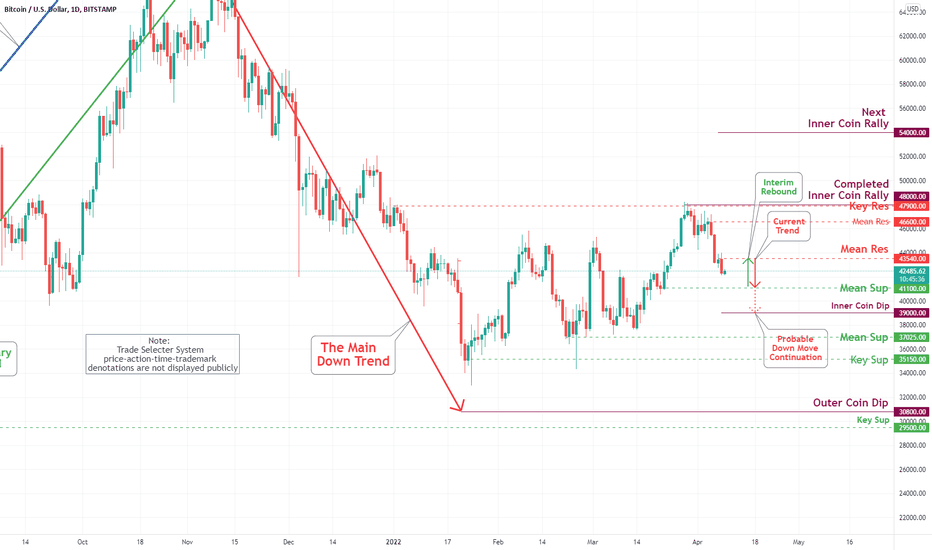

Bitcoin (BTC/USD) Daily Chart Analysis For May 6, 2022Technical Analysis and Outlook:

Bitcoin is looking very bearish at this point. The current path is flagged to Inner Coin Dip $31,660 and Outer Coin Dip $30,800. A possible significant rebound is anticipated upon completion of Inner Coin Dip $31,660, while Key Sup $35,150 might offer transient upside movement.

EUR/USD Daily Chart Analysis For April 22, 2022After retesting Mean Res 1.089 first time followed through to Mean Res 1.093 was again retested. The stoppage occurred at a solid bottom marked Inner Currency Dip 1.077. A drop to Major Key Sup 1.069 and Next Inner Currency Dip 1.056 is inevitable - to some extent, bullish moves are possible within the current downtrend.

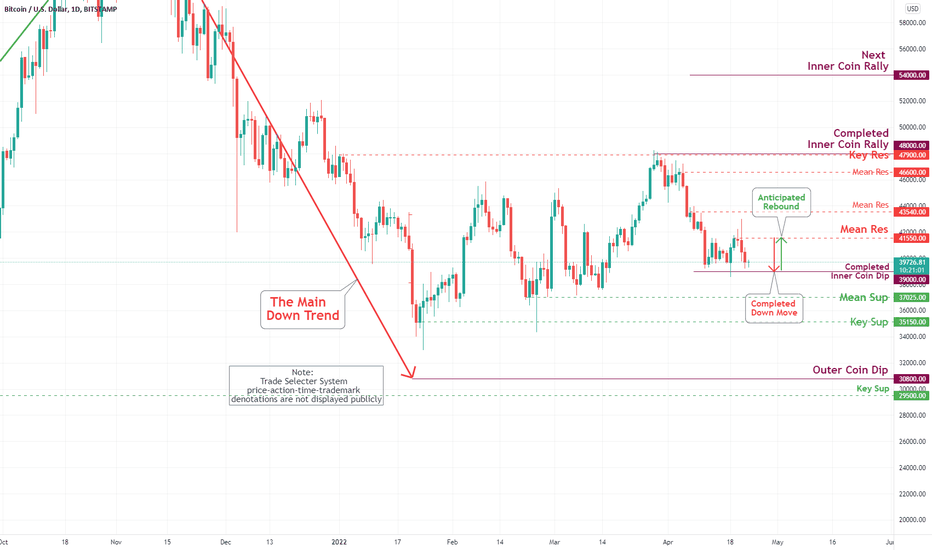

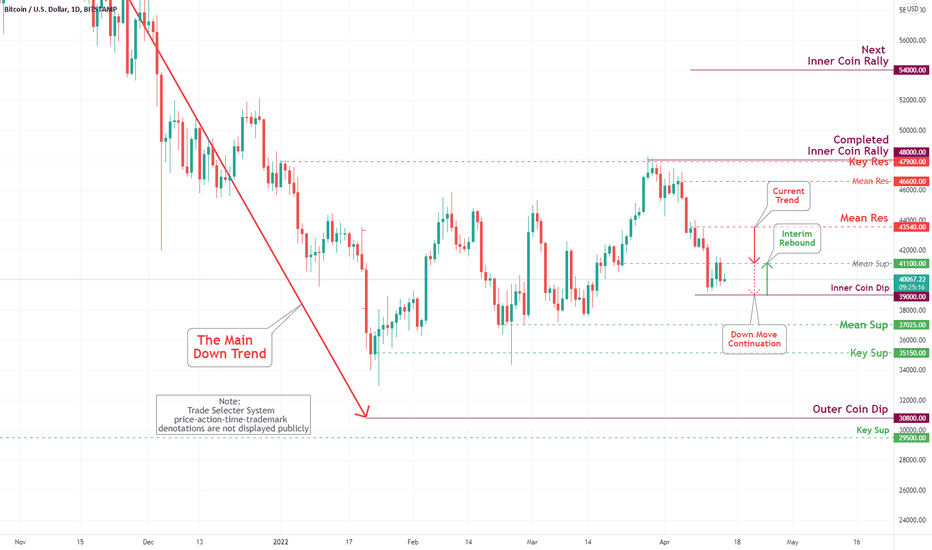

Bitcoin (BTC/USD) Daily Chart Analysis For April 15, 2022Technical Analysis and Outlook:

The bitcoin price experienced its most significant daily drop since February earlier this week and dipped below $40,000 on Monday, posting a low of $39,218; however, failing to fulfill our Inner Coin Dip 39,000 - the completion is anticipated. Bullish activities are possible within this movement.

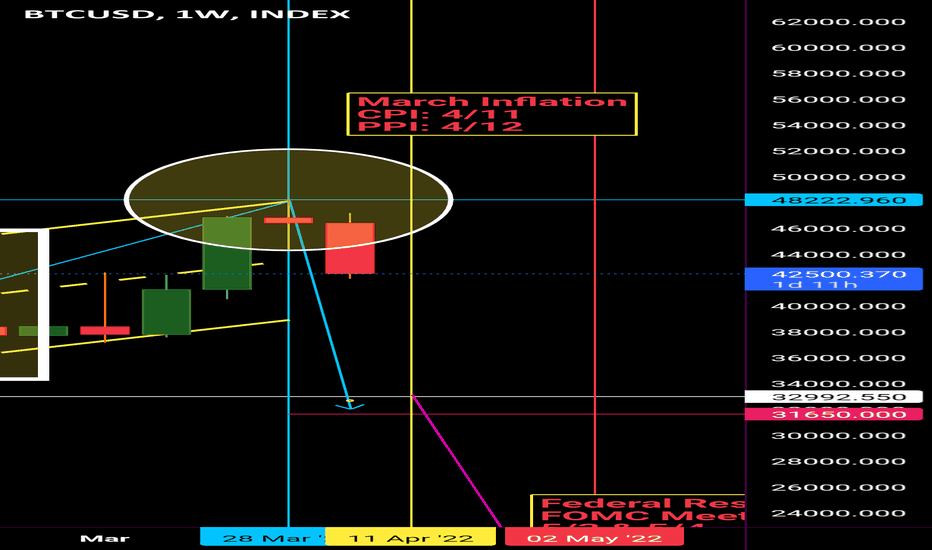

Bitcoin Bear Market ScenarioFollowing macroeconomic environment, with inflation reporting this week followed by upcoming central bank FOMC meeting in early may (rate hikes & balance sheet reductions)... the following high-level SR zones are key levels to watch.

Assuming broader markets are going to experience a significant correction as the Fed loses ability to leverage QE & stimulus in propping up markets without hyperinflation risk, BTC as a risk-on asset will face significant headwinds.

Without a changing economic environment, the markets will continue to realize bearish sentiment with more speculative assets (tech stonks & "digital asset technologies") realizing the most severe of pullbacks.

FOMC in early May will attempt to reign inflation in, while June's FOMC meeting will include a more nuanced summary of economic projections given assessment of Q1 results as well as Q2 winding down.

Bitcoin Evening StarsBitcoin weekly has had two evening star candles in short period of time as the markets grapple with sharply rising prices, declining sales, and a massive labor shortage.

Markets are beginning to price in rate hikes, but have yet to entertain the implications of rampant, widespread inflation or the reality of an aging population with low and continuing lower birthrates.

As central banks look to regime change via rate hikes and divesting bloated balance sheets, the economy is in for a significant slow down and the markets will realize major retracement.

Bond yields, durable goods sales, home sales, inflationary measures... all point to a full market reversal.

BTC price action will continue lower as bearish sentiment settles in and speculative risk-on behaviors curtail.

Bitcoin (BTC/USD) Daily Chart Analysis For April 8, 2022Technical Analysis and Outlook:

After embarking on a Key Res at $47,900 retest this month, Bitcoin has punctured coin sentiment by sliding into a direction to Mean Sup $41,100. After follow-thru to Inner Coin Dip, $39,000 is a high probability. Interim rebound to Mean Res $43,540 is also in play.

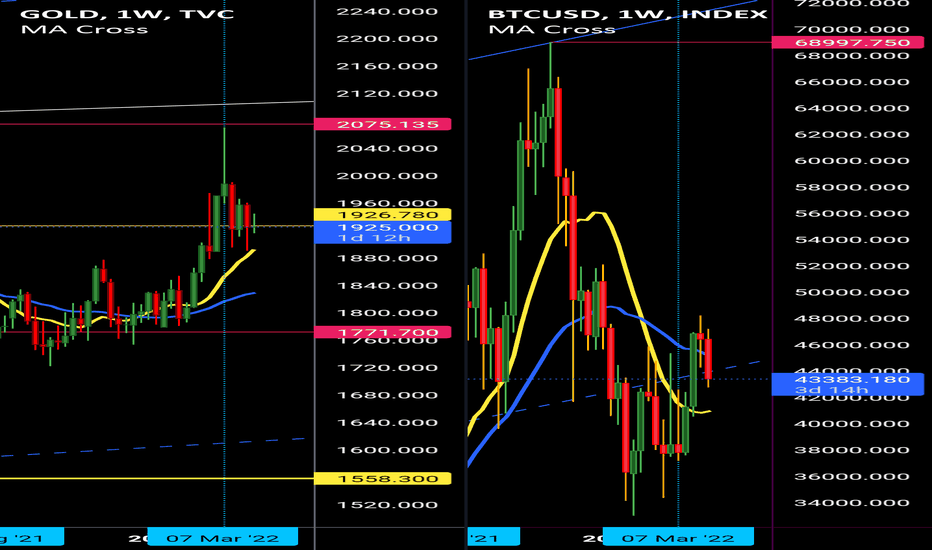

Risk: On or Off? Gold & BitcoinBitcoin has been touted as "digital gold" and even as an "inflation hedge."

When you compare BTC to Gold with long-term channels, the Bitcoin chart does look to mirror Gold at approx 15.6:1 timeframes... at least until recently.

Bitcoin's creation coincides with the biggest regime change since the USD was disassociated w/ Gold in the early 1970's, its entire existence has been under a dovish monetary environment that encourages risk-on behavior w/ unfettered government intervention into the markets w/ Quantitative Easing.

This loose policy has kept markets propped up since the housing market bubble burst. Unfortunately, the March 2020 pandemic response with global economies being halted resulted in unfettered stimulus and bloated Central Bank balance sheets resulting in the appearance of rampant, widespread, persistent inflation.

Central Banks are now at a crossroads, continue QE and a dovish policy regime that will exacerbate inflationary price pressures or reverse course.

Course reversal as bond yields increase is achieved by raising rate while central banks reduce $9 Trillion in assets.

This regime results in risk-off behaviors, apparently causing Gold:Bitcoin chart correlation to disassociate.

Given current market response, expect Gold to realize positive PA while Bitcoin is challenged by sell pressure while monetary policies tighten.