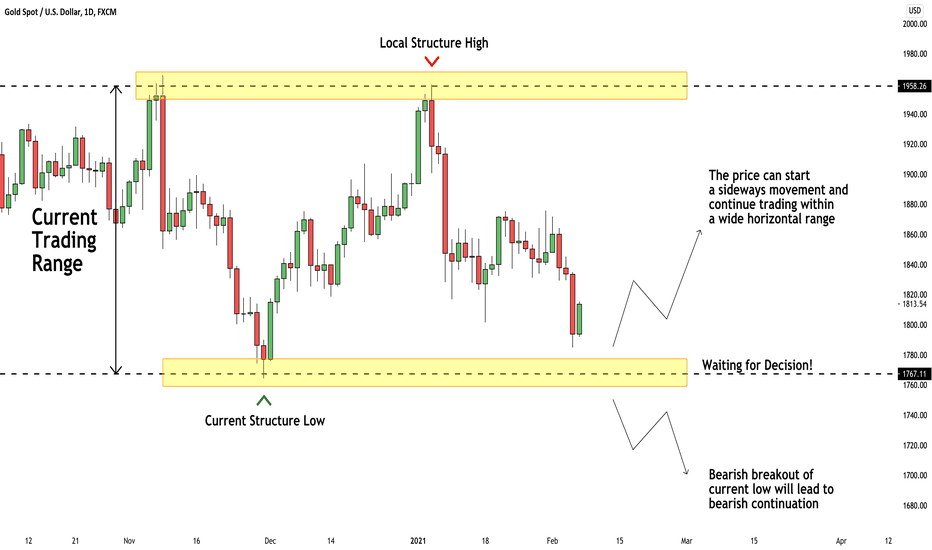

GOLD (XAUUSD) What to Expect Next Week?

Gold is currently trading within a wide horizontal trading range on a daily.

1765 is its low and 1965 is its high.

On Friday the price almost reached the support of the range.

Depending on the reaction of the market to that here are two potential scenarios:

1 - The price may respect the support and continue trading within the underlined boundaries

2 - The price may drop the support. Daily candle close below will signify a highly probable bearish continuation.

Make your trading decisions accordingly or wait for a reaction first, and only then follow the market.

What do you think will happen?

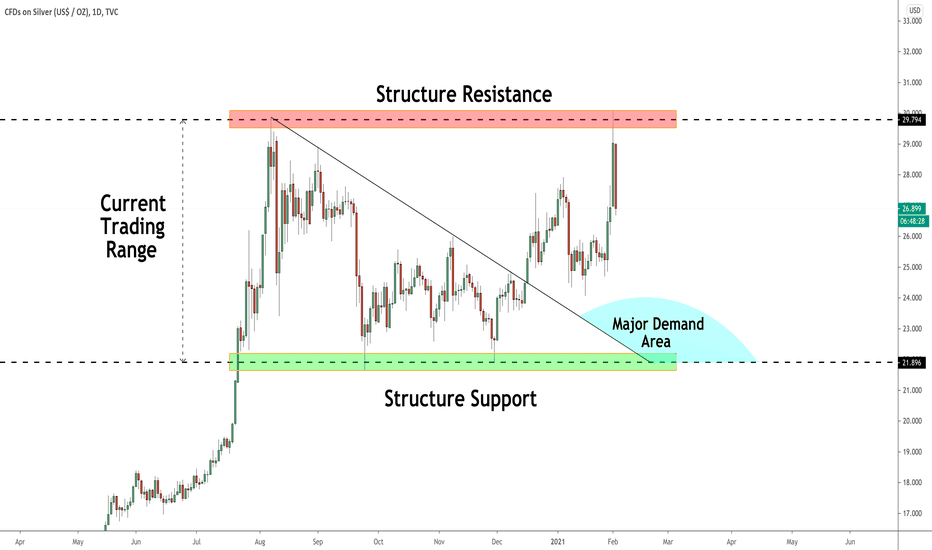

CFD

SILVER (XAGUSD) Technical Outlook

hey traders,

a lot of questions about silver.

on a daily we are currently trading in a wide horizontal trading range.

30.0 is its resistance and 21.7 is its support.

yesterday we tested the resistance of the range and then we saw an immediate strong bearish reaction from that.

the last 4 trading days are quite impulsive and for now, the best option for us is to let the market calm down.

the safest zone from where I would consider buying opportunities is based on a confluence between a major falling trend line

and range's support.

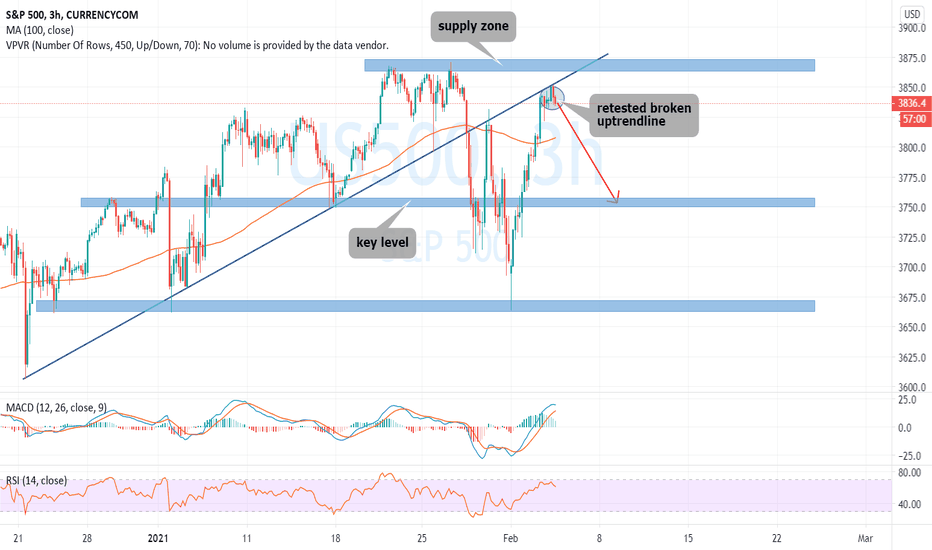

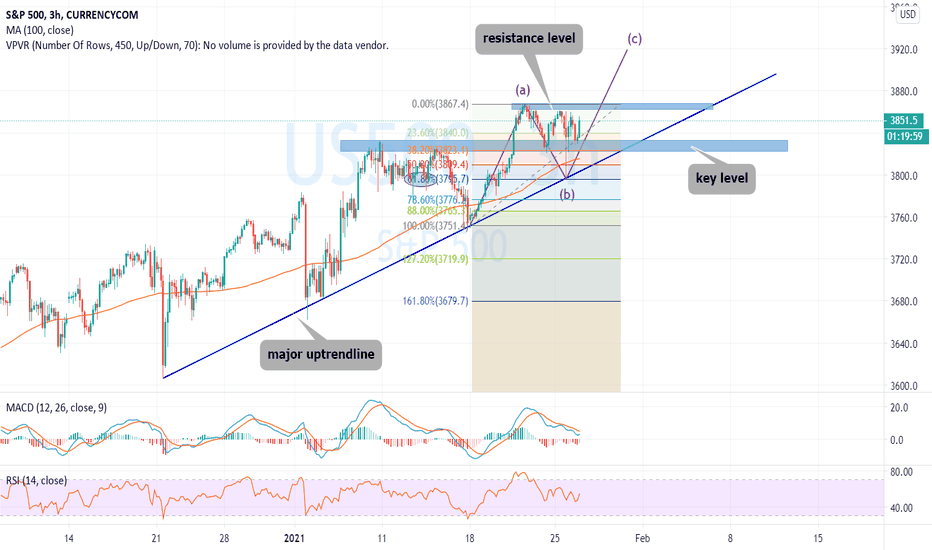

S&P 500 ANALYSISS&P 500 retested broken uptrendline

MACD shows weakness in bullish momentum

RSI rebounded from overbought region

It's expected for coming correction to target key level at 3750

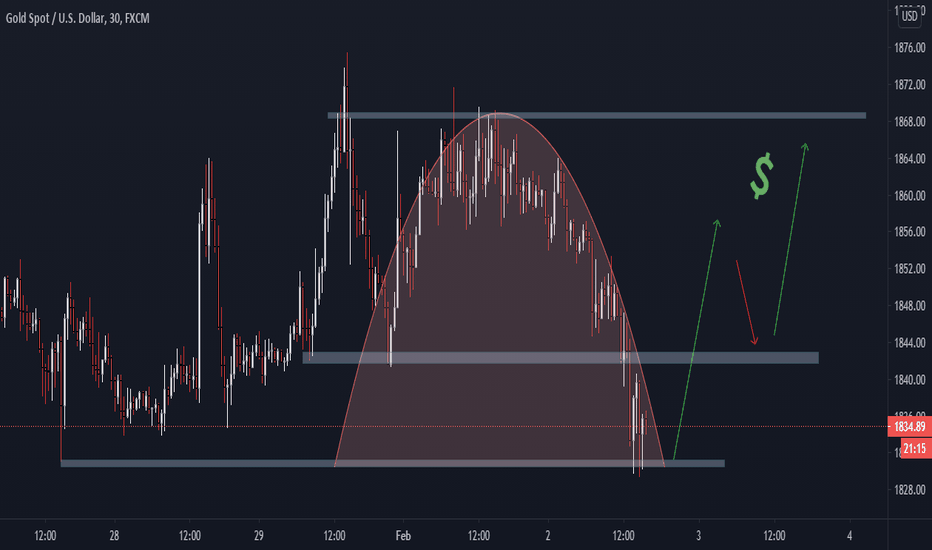

GOLD buy! Good Luck traders Hello Traders, here is the full analysis for this pair.

Watch strong price action at the current levels for BUY. GOOD LUCK! Great BUY opportunity in GOLD ..

I still did my best and this is the most likely count for me at the moment ..

Support the idea with like and follow my profile TO SEE MORE!

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

GOLD buy! Good Luck traders Hello Traders, here is the full analysis for this pair.

Watch strong price action at the current levels for BUY. GOOD LUCK! Great BUY opportunity in GOLD ..

I still did my best and this is the most likely count for me at the moment ..

Support the idea with like and follow my profile TO SEE MORE!

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

OIL_BRENT trading plan!Hi friends!

Since the beginning of the year, oil has been trading in a channel under a strong resistance level of 56.15

On the breakout of this level, when all the conditions of my trading system are met, I plan to buy.

target 1: 57.7$

target 2: 59$

✔ Do not forget to trade using your own trading system and with stops!

✔ If you like what I do, put 👍 and subscribe! 🙌👀

✔ This is the best gratitude for my work! 💕

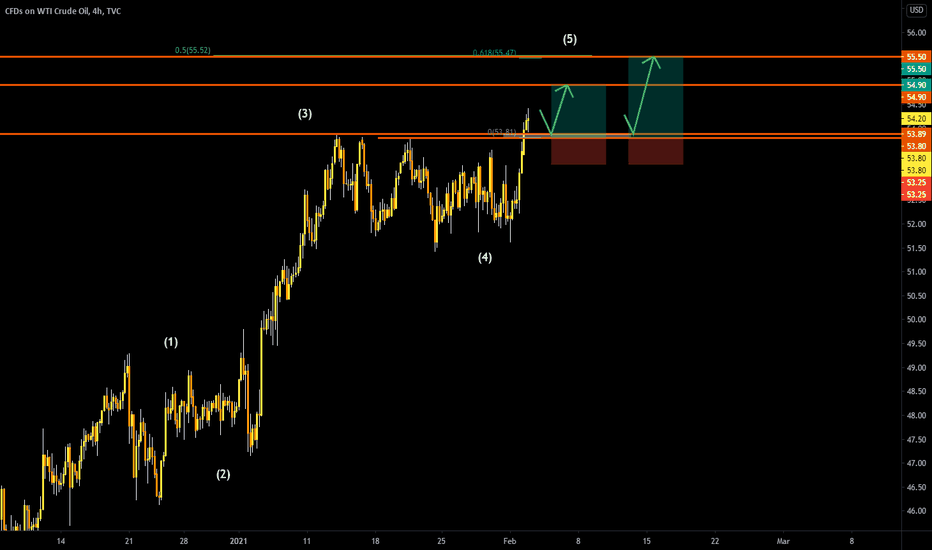

Could We See the USOIL Around the 54.90 or 55.90 Level ? 🚀🚀🚀Although the pandemic is still spreading around and most of the economies are shut down the USOIL is still rallying without any fundamental explanation.

Technically, if we look at the graph, the black gold is respecting the Elliott Wave Structure by accomplishing the first four waves. Currently, We are in the fifth wave, where we expect the price to rally again towards the two next targets 54.90 & 55.90 levels.

💡 Trade Idea

📈 Buy Limit USOIL @ 53.80

🎯 Target Profit 1 54.90

🎯 Target Profit 2 55.90

🛑 Stop Loss 53.25

❌ Do not risk more than 1 % of your account on each trade

🙂 Good Luck !

Please press “Like” if you appreciate the trading idea 👍

“Follow” for more trading ideas in the future 👀

“Comment” below to share your thoughts with us and other traders 👥

-------------------------------------------------------------------------------------

Risk Disclaimer: All trading ideas published by “collegeofpips” are for educational purposes only. These posts can help you to enhance your trading skills, but please do your own research before opening any trading position. ⚠️

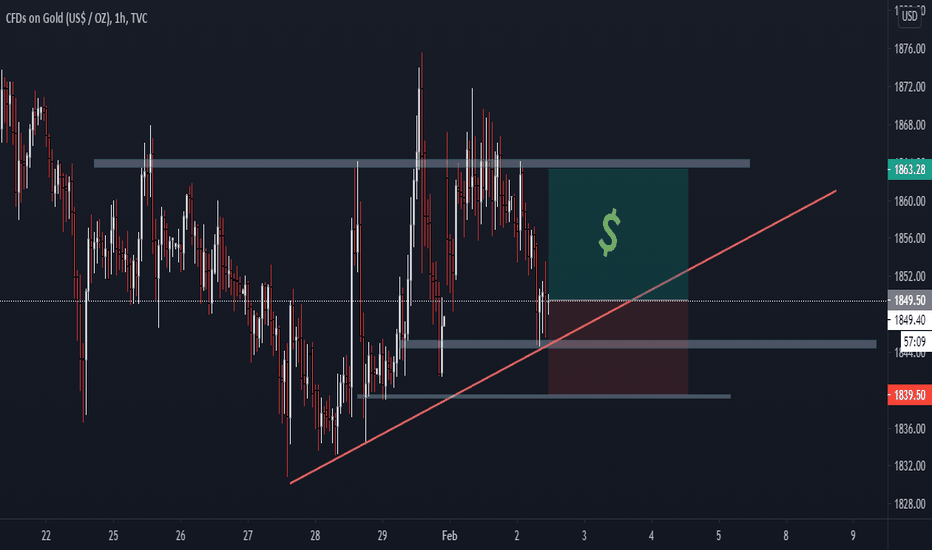

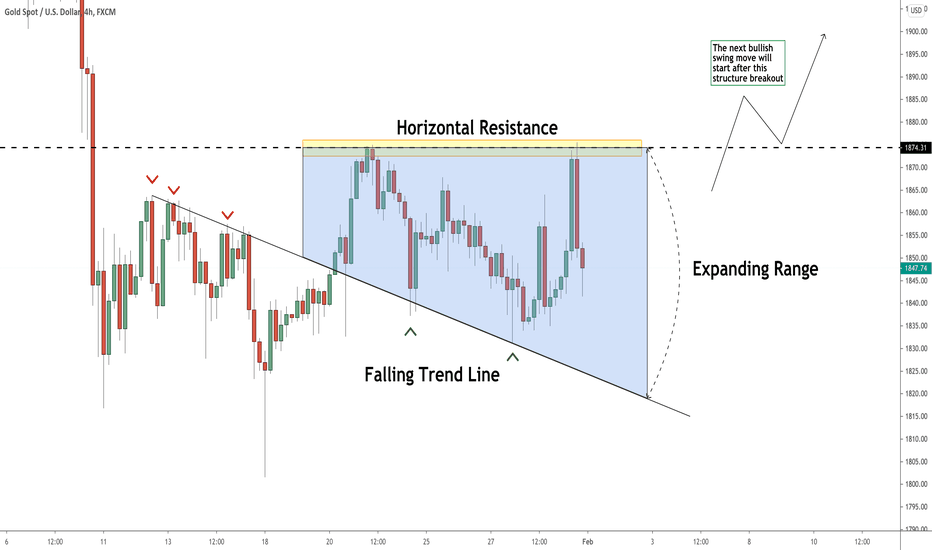

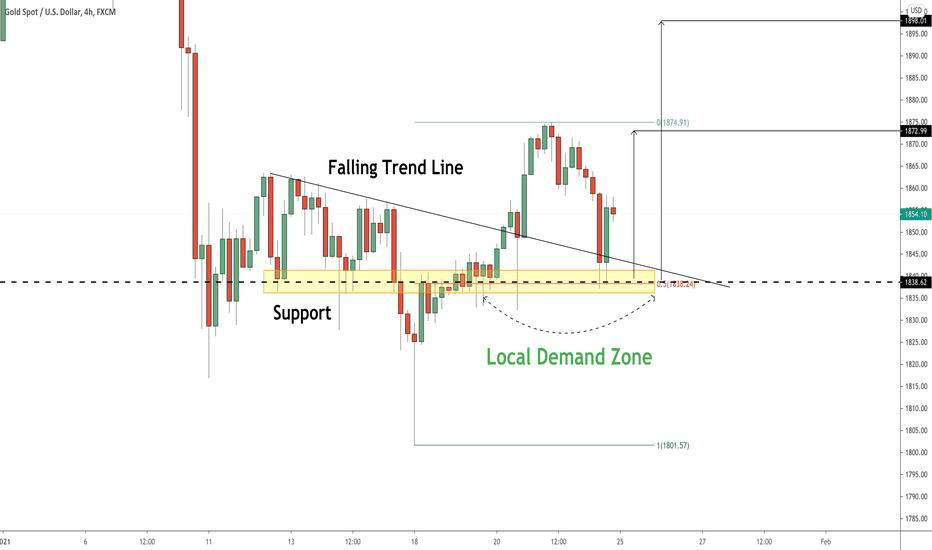

GOLD (XAUUSD): When Will the Next Bullish Move Start?

hey traders,

Though gold was quite impulsive and bullish on Thursday and Friday,

analyzing 4H structure we can notice that the price is currently stuck within an expanding range with equal highs and lower lows.

It is a classic variation of a sideways consolidating market.

Being bullish biased, we must admit that the next major swing move will start only after a bullish breakout of the resistance of the range.

Only then a strong bullish continuation will be expected.

For now, follow the boundaries of the range and consider them for intraday trading opportunities.

Good luck!

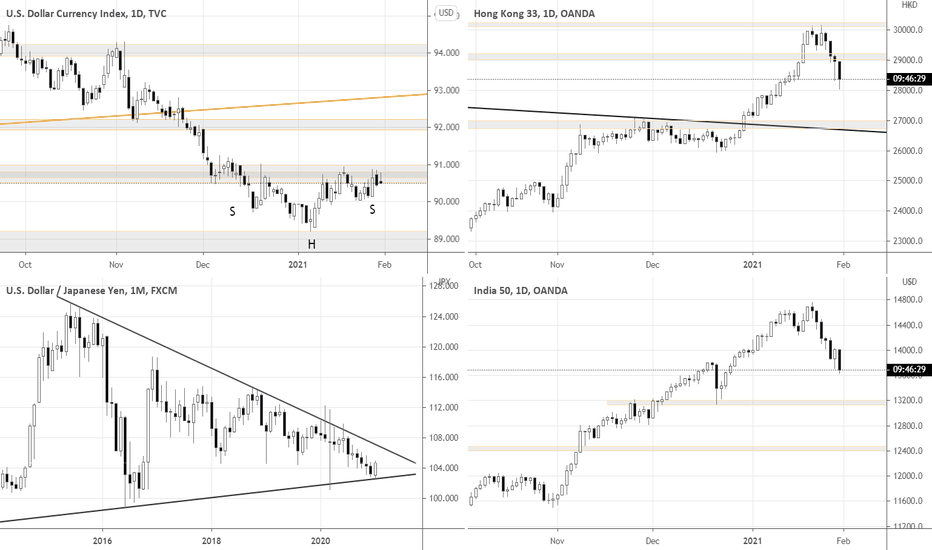

Weekly Market recap 17: rut into safe-havens?Overview: What's happening?

The risk assets have been confirming their short-term weakness and the need to correct and digest recent gains. We can see that most of the stock indices are in negative territory these days. The big technical picture of DXY also suggests possible upward momentum. We can expect the increased volatility in the Forex market in the upcoming months as USDJPY is approaching the long-term triangle's inflexion point.

What patterns are driving Forex?

DXY has formed H&S pattern on Daily timeframe, which is another evidence of a possible reversal, especially that it's formed around the long-term support. If DXY breaks 91.00, I want to be long on USD against some relatively weak currency.

USDJPY tells us the story of the approaching volatility storm in the Forex market. The pair formed a long-term symmetrical triangle. If the triangle breaks out in either direction, it will have a powerful impact on the market as both USD and JPY are safe-haven currencies.

No-brainer: short the weakest!

At this point, it's good to look for short-sell setups in indices. The logic is simple - consider the indices that got hit the hardest by the correction and historically have been underperforming relative to other indices. HK33HKD and IN50USD are good examples of such relatively weak indices. What's left is to wait for specific setups in these instruments according to your strategy. HK33HKD behaves interestingly - recently I mentioned it's been relatively strong for a short time due to capital inflows from Mainland investors. Now the underlying relative weakness came back and shrugged off recent sentiments of the Hong Kong market.

Summing up

There may be nice short-sell setups in indices these days. Watch out for the breakouts of the key levels in DXY and USDJPY and proceeding volatility.

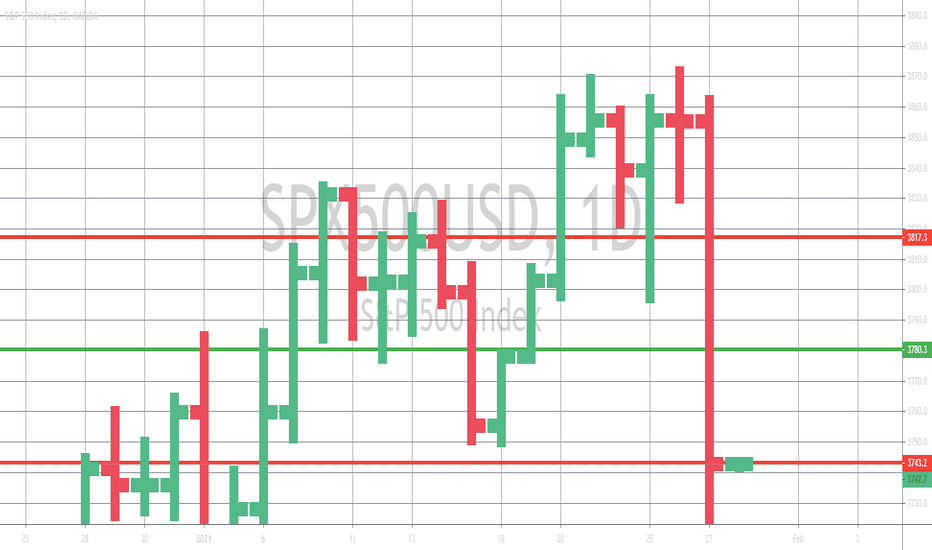

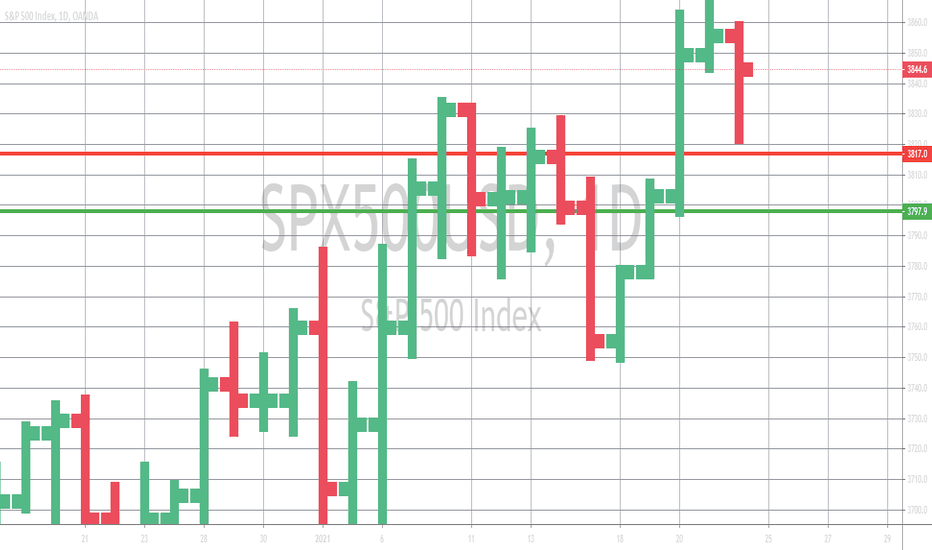

Stopped out of Long. Initiated ShortClearly stopped out of the long position, order was filled at 3816.84. (top red line)

Approximately 10% loss on the trade. So unfortunately we have erased some of the previos gains from earlier this year.

Based on our model, the short term trend has shifted to negative. As such, a short position has been initiated at close. (bottom red line)

Stop is set at 3780.28. (Green Line)

Message if you have any questions. More resources on the way supporting info on the model.

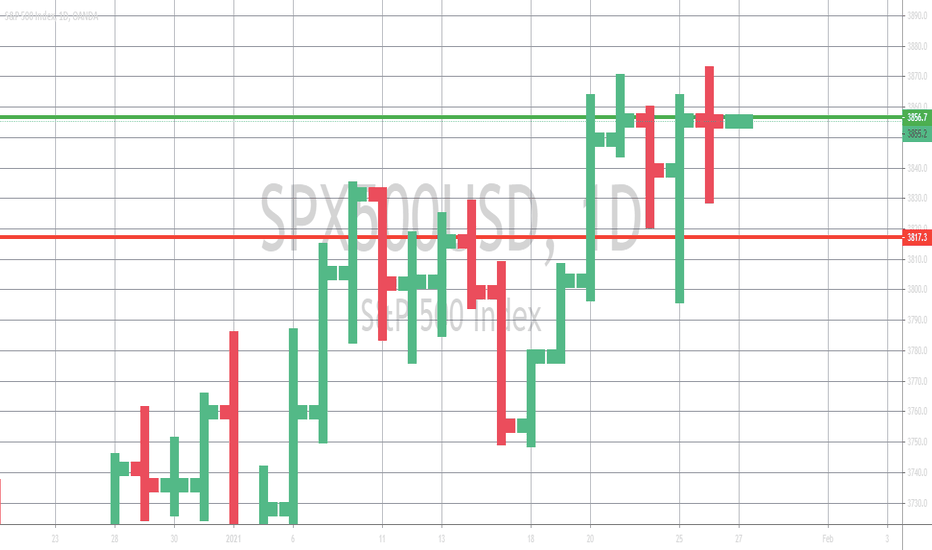

S&P 500 ANALYSISS&P 500 rebounded from major uptrendline corresponding to 61.8 % Fibonacci level at 3795.7

Price is based above key level at 3828

Above SMA 100

We r waiting price to exceed resistance level at 3867.4 to open long trade

It's expected to target level 3920

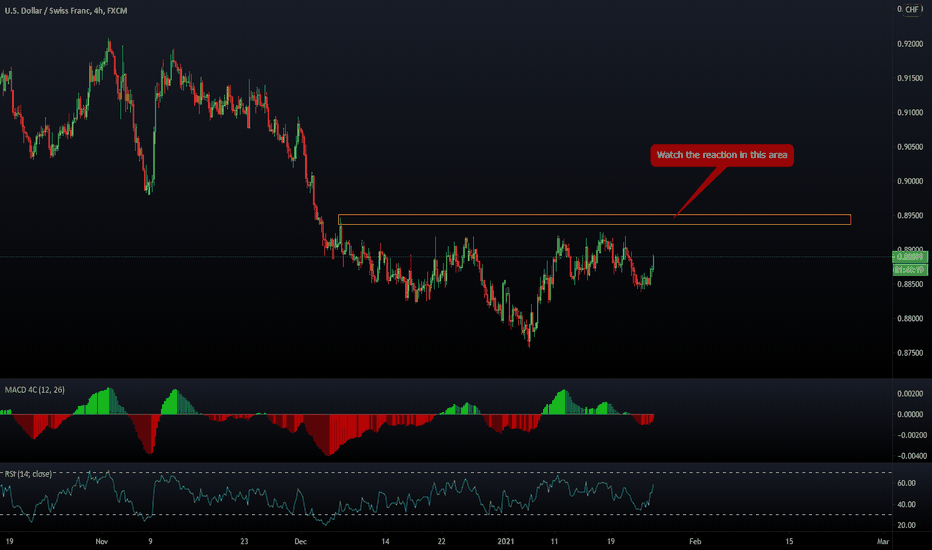

USDCHF - Week 4Trade with care.

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. We do not recommend making hurried trading decisions. You should always understand the risk that trading implies and that PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

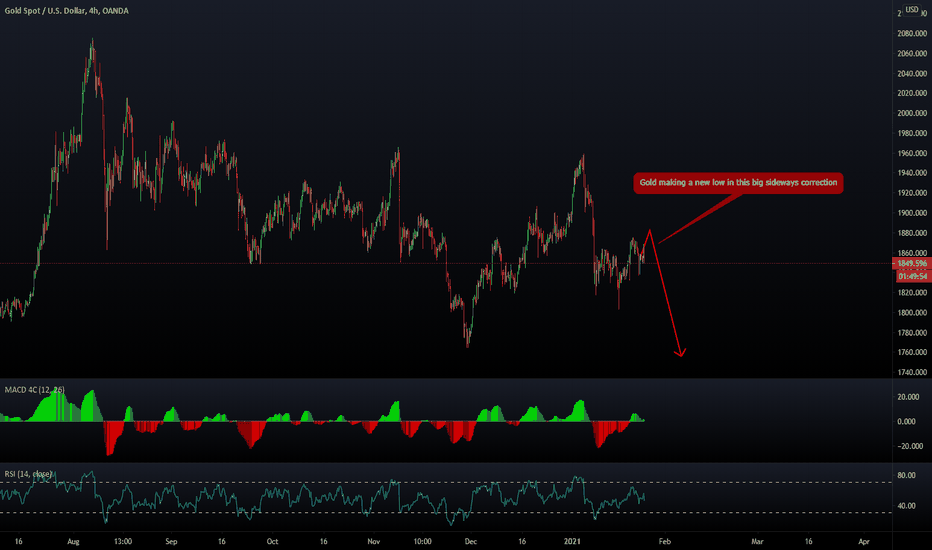

XAUUSD (GOLD) - Week 4Trade with care.

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. We do not recommend making hurried trading decisions. You should always understand the risk that trading implies and that PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

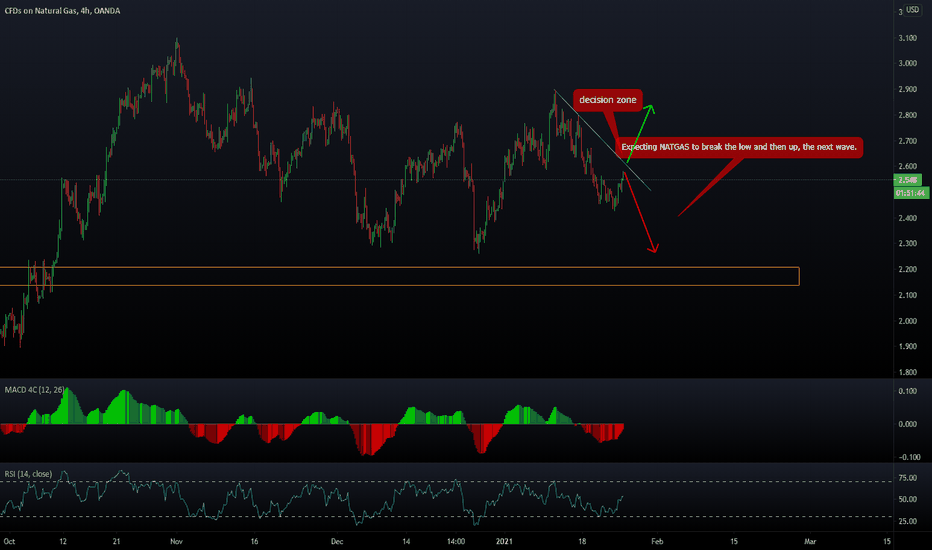

NATGASUSD - Week 4Trade with care.

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. We do not recommend making hurried trading decisions. You should always understand the risk that trading implies and that PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

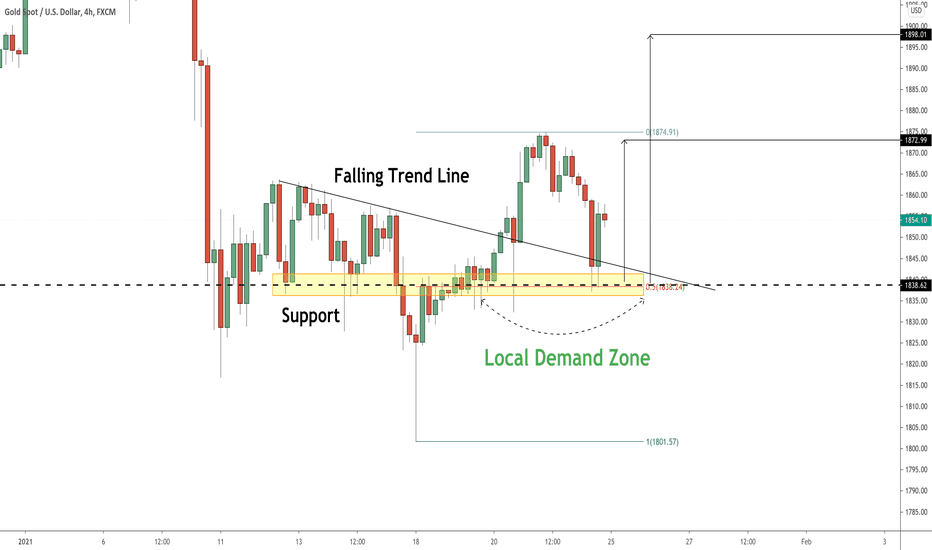

GOLD (XAUUSD) Price Action & Outlook for Next Week

For a quite long period of time, I remain bullish biased on gold.

Wednesday's bullish move and bullish violation of a falling trend line on 4H was a quite important bullish clue to consider.

After some stagnation and consolidation, the price has dropped retesting the broken trend line.

A positive bullish reaction, especially on hourly, makes me think that next week bullish continuation will follow.

The price may retest a current local 4H high and then go even higher.

Good luck and have a great weekend!

GOLD (XAUUSD) Price Action & Outlook for Next Week

For a quite long period of time, I remain bullish biased on gold .

Wednesday's bullish move and bullish violation of a falling trend line on 4H was a quite important bullish clue to consider.

After some stagnation and consolidation, the price has dropped retesting the broken trend line .

A positive bullish reaction, especially on hourly, makes me think that next week bullish continuation will follow.

The price may retest a current local 4H high and then go even higher.

Good luck and have a great weekend!

Moivng stop up to 3817. Great trade so farQuick update on our SPY CFD swing trading strategy. Entry price was 3797.92 and we have a great profit of 10.83% based on current price. Moving the stop up to 3817. This came very close to getting hit earlier today, but the price has improved since then. Follow for more updates on our proprietary S&P500 Swing Trading System. So far we are up over 20% year to date. We have full details and update videos coming to YouTube shortly. Will be sure to post the links when everything is up.