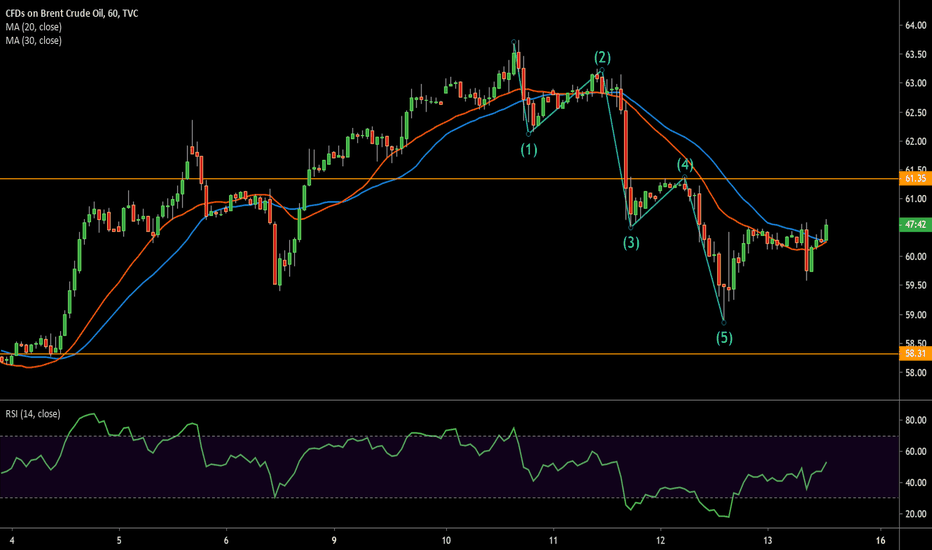

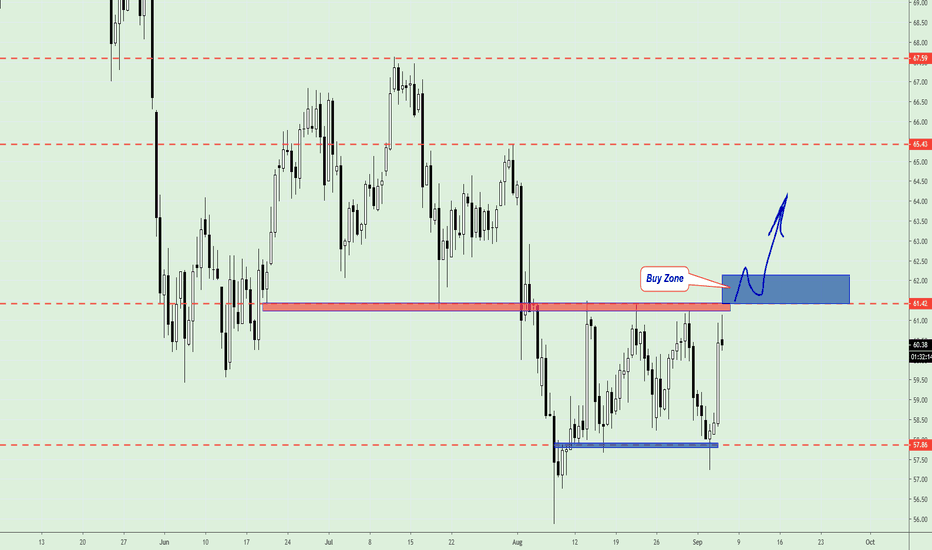

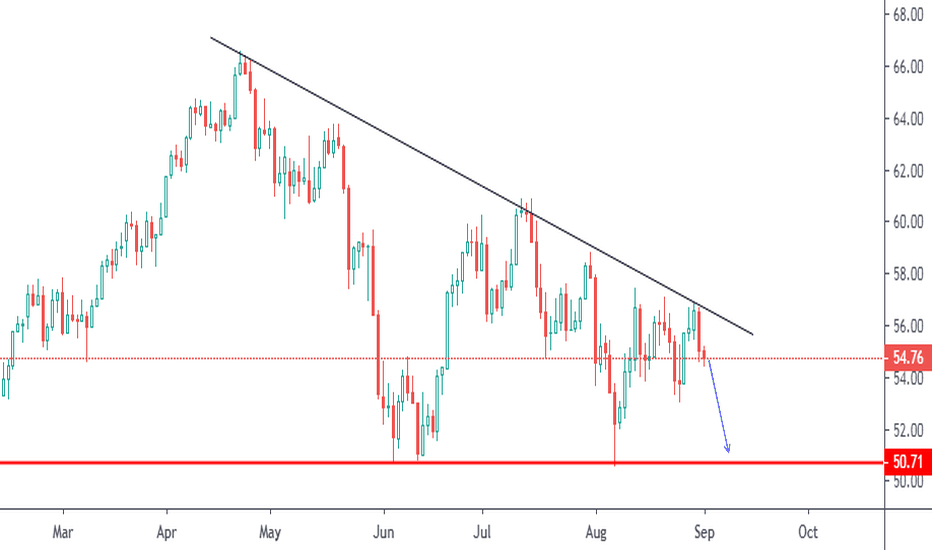

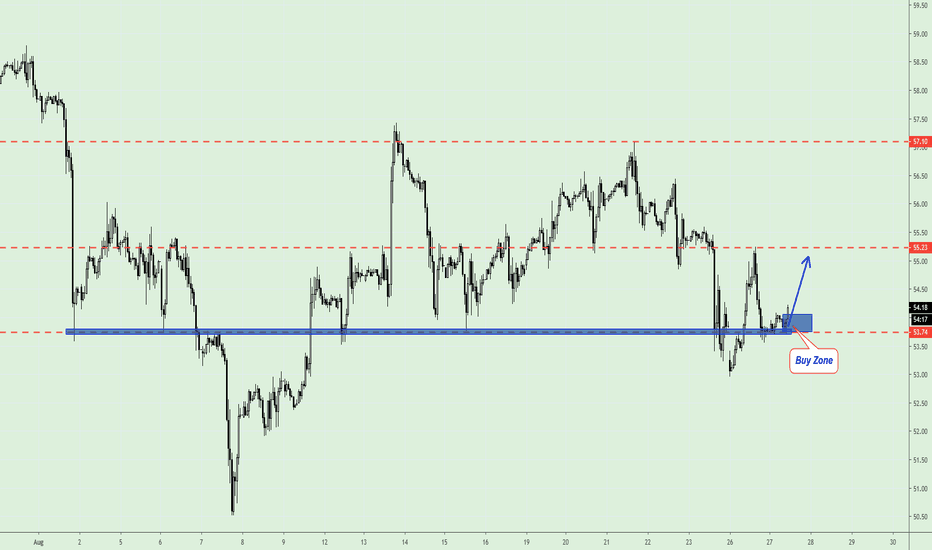

US OIL comes to powerful Key Level!!!It was powerful move down from Key Level 58.79 at 31Jul.

This level was confirmed at 10 Sep.

It'sa huge possibility that the price will have some reaction here.

Before to trade my ideas make your own analyse.

Write your comments and questions here!

No need to write them in PM.

Thanks for your support!

CFD

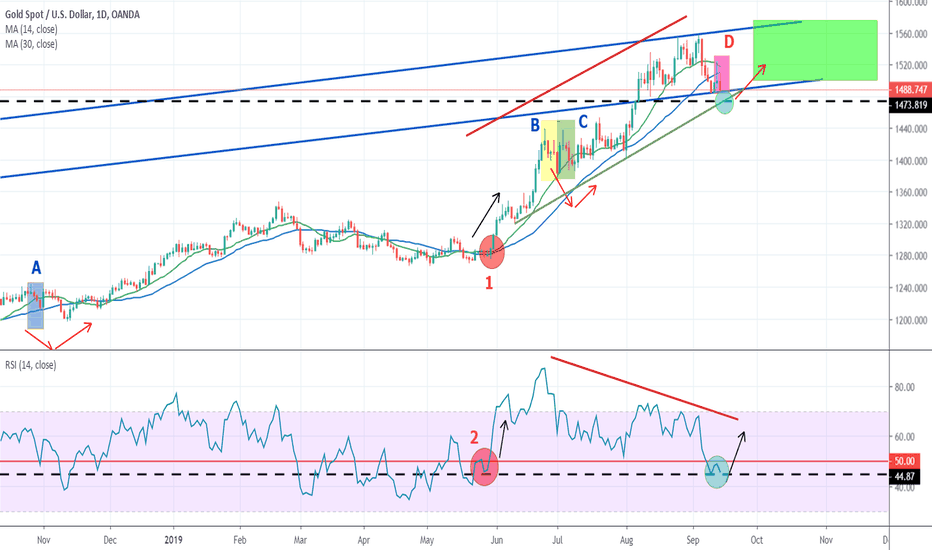

GOLD / XAUUSD - BullishReading is must:

Interesting, there is a bearish divergence according to the daily chart. seems gold will go down? Answer is up to you but let me show you something.

Look at the letters of A, B, C & D with color boxes. if you closely see the candles in each box shows you a shooting star candle with a bearish candle which is direct you to a certain period or pips bearish movement. but each and every time its bounce back to bullish movement.

if you see the RSI and you can see that RED circles with black color arrows shows you the direction. look at the number 2 circle shows you a pattern it was came from black line and then towards to RSI 50 red line then again back to black line and bounced back. that same pattern is creating from the blue circle. it means it will come down for certain period or pips down and will bounce back and create a new bullish momentum. you can see the number 1 area in red circle which is created a new bullish momentum.

TP areas in Green

Note: Trade at your own risk and hope this will works. fingers crossed. Hope this will works better if oil will goes high

Open for discussion and suggestions are most welcome.

Join us with (Telegram) - @theturningpoint

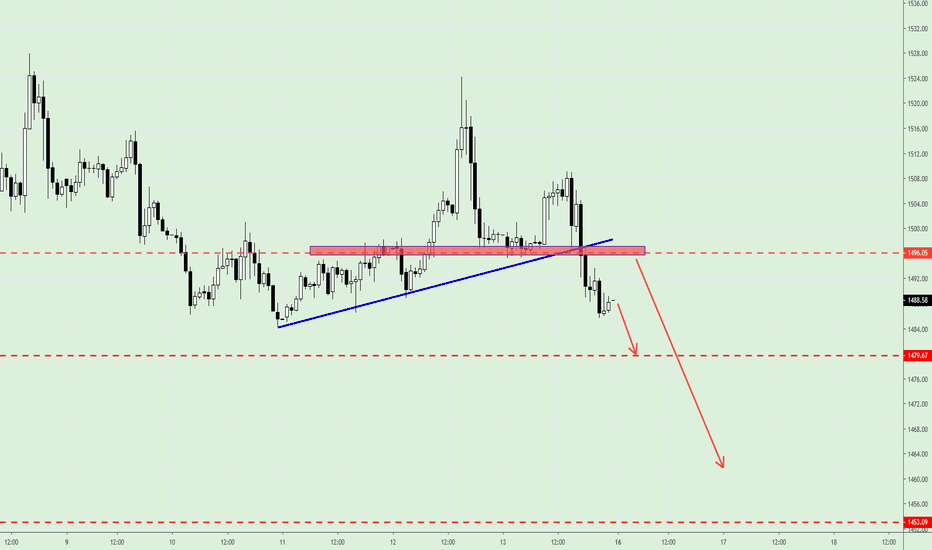

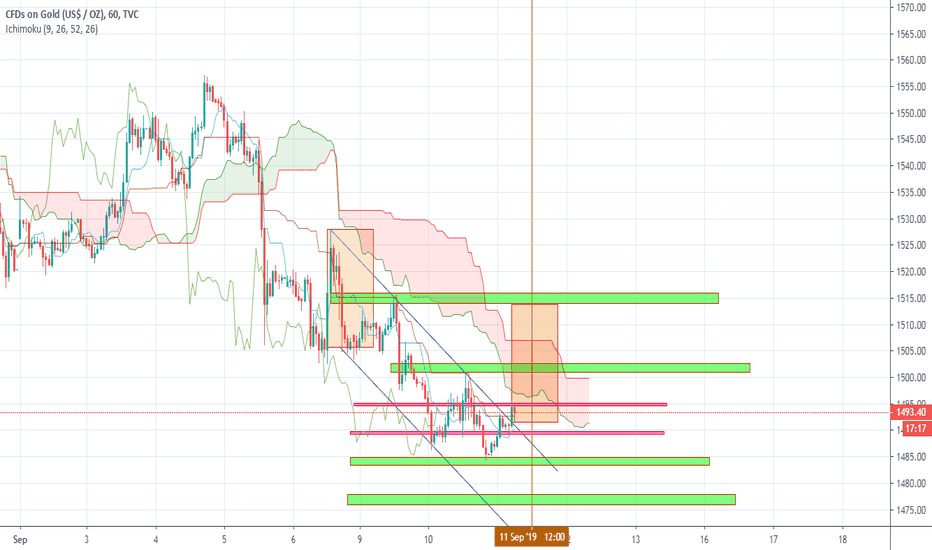

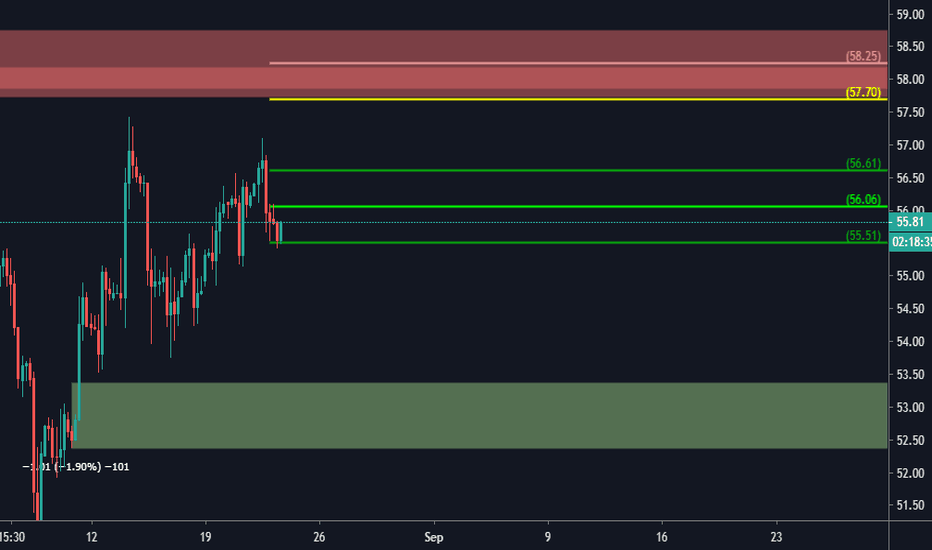

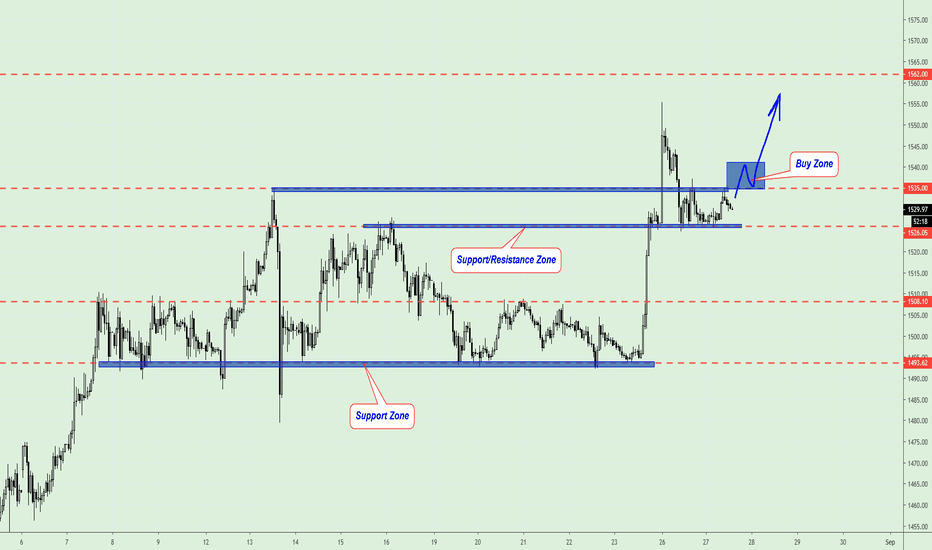

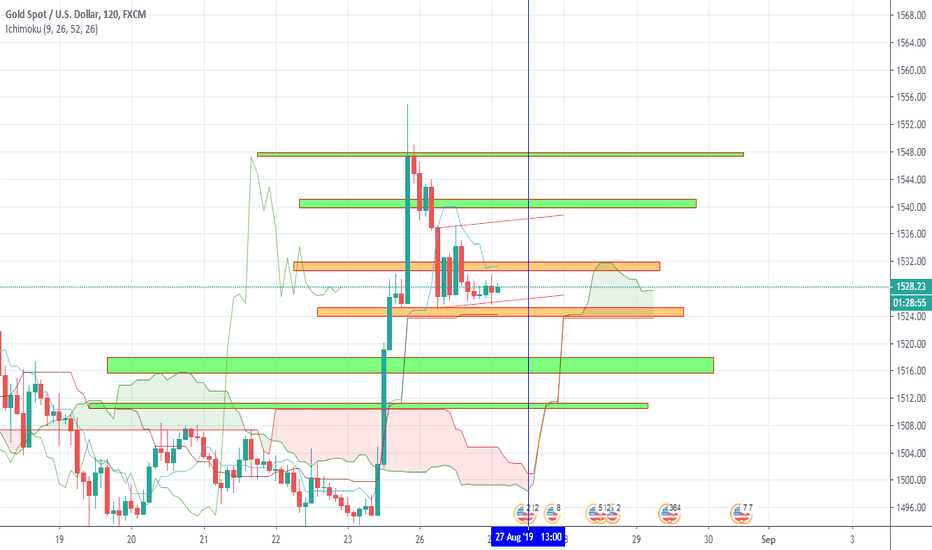

GOLD, Possiple move donw!The price is under Resistance Zone now.

It's huge possibility to continue move down.

BUT!!! If the news about attack in Saudi Arabia on oil Factory can influence on Gold and Oil.

So if you will see a GAP after the market will open - don't open any trades, it will be better for you.

Before to trade my ideas make your own analyse.

Write your comments and questions here!

No need to write them in PM.

Thanks for your support!

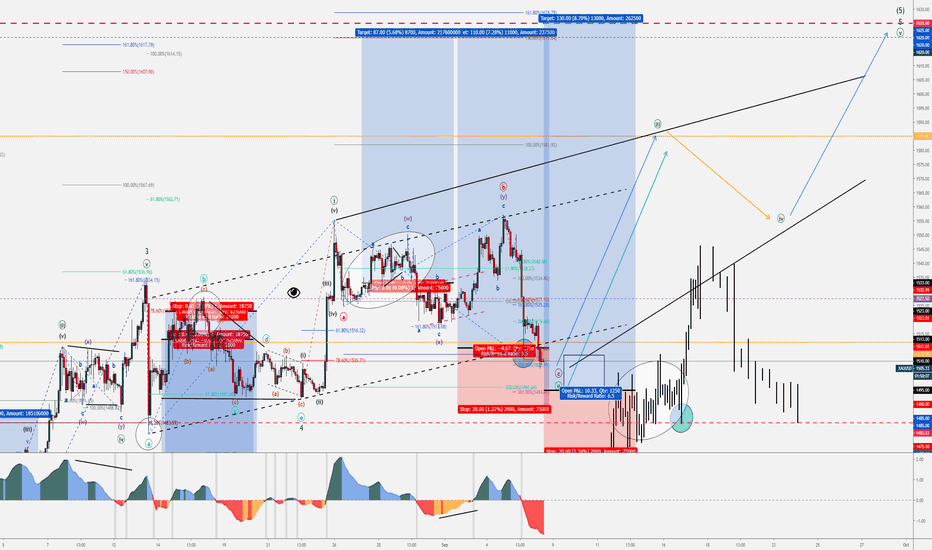

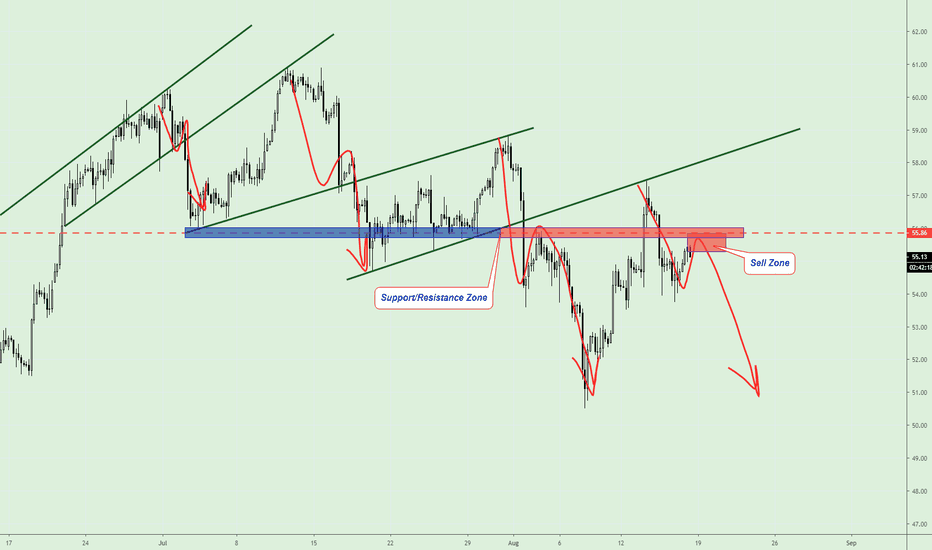

Brent Crude - End of the 5th wave?Brent Crude (1H) - potential bullish reversal

The oil price has been stabilising following 3 impulse moves to the downside. The correction might have come to an end ahead of a stronger 4H support near 58.30. The price is ranging around the moving averages, which means selling pressures have waned and the market might be getting ready for a U-turn. 61.30 will act as the immediate target.

Key support: 59.60/58.90

Key resistance: 61.30/63.00

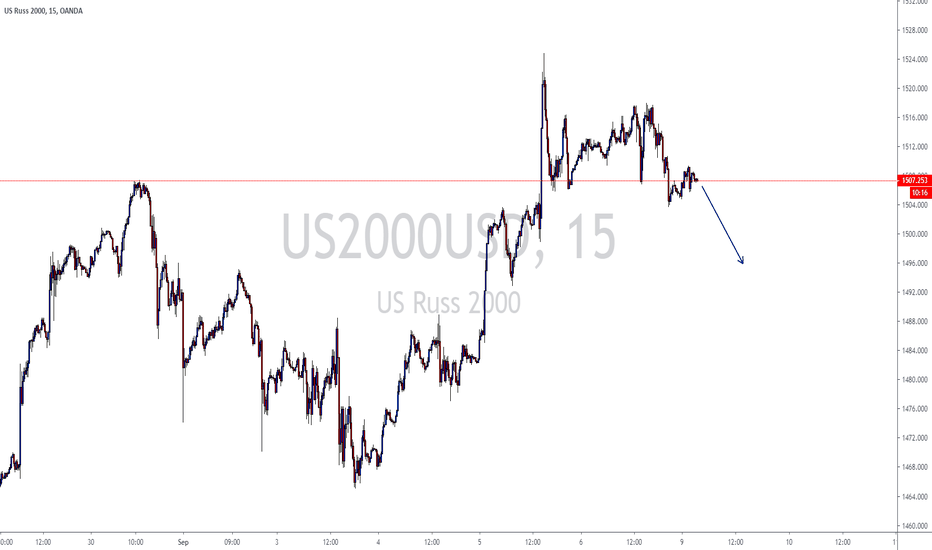

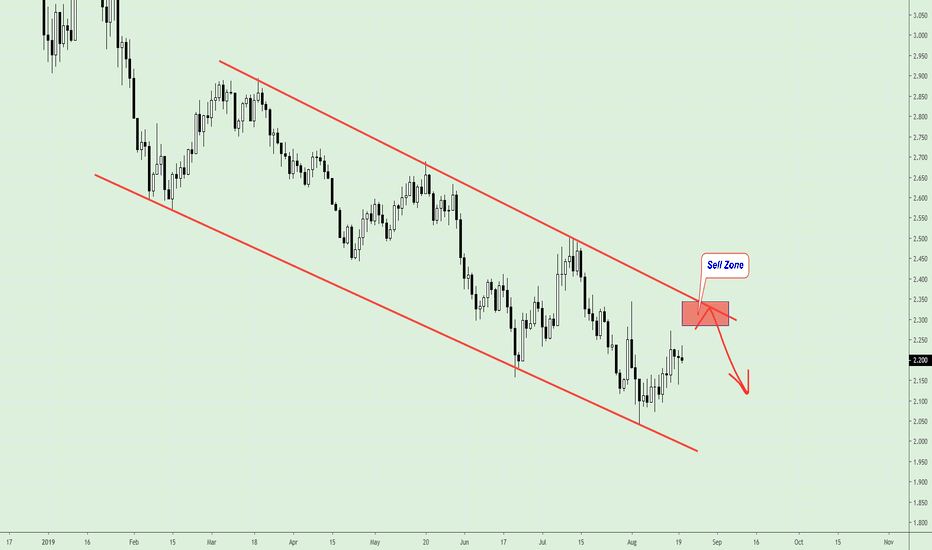

Expecting a Bearish Impulse (STA)All these predictions are made by Quantitative Analysis Algorithms following short term trends. These Quantitative Analysis Algorithms will calculate maximum correction relative to previous impulses.

Relative to previous bearish impulse we are now in a bullish correction. So algorithm expecting a short term bearish impulse.

Join Our Telegram Channel :-

t.me

Youtube :-

www.youtube.com

Instagram :-

www.instagram.com

Twitter :-

twitter.com

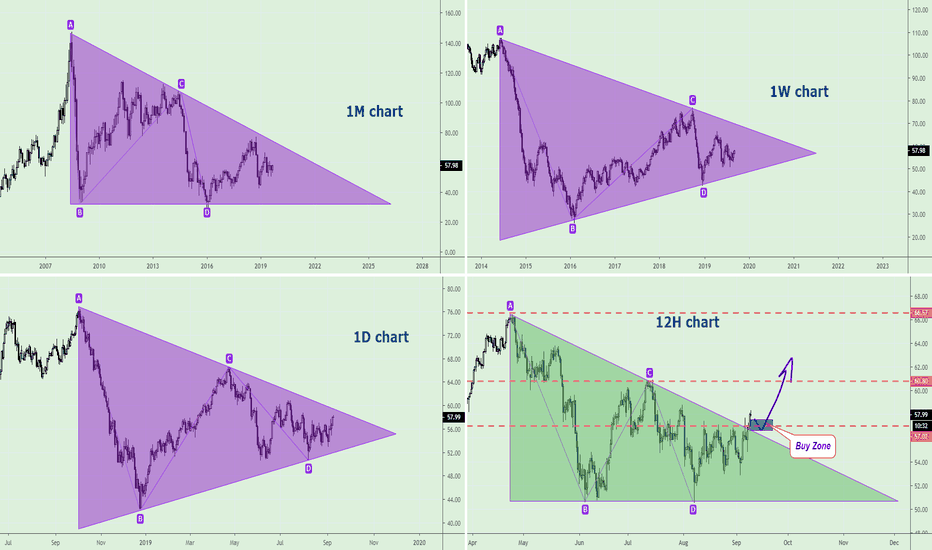

USOIL exit from the Triangle...As you see on different timeframe charts are similar triangles.

Only the last 12H chart shows to us an exit from the Triangle.

Basides that we have an accumulation below 57.00.

The best place for Buy entry is after pullback to 57.00.

Write your comments and questions here in comments!

No need to write them in PM.

Thanks for your support!

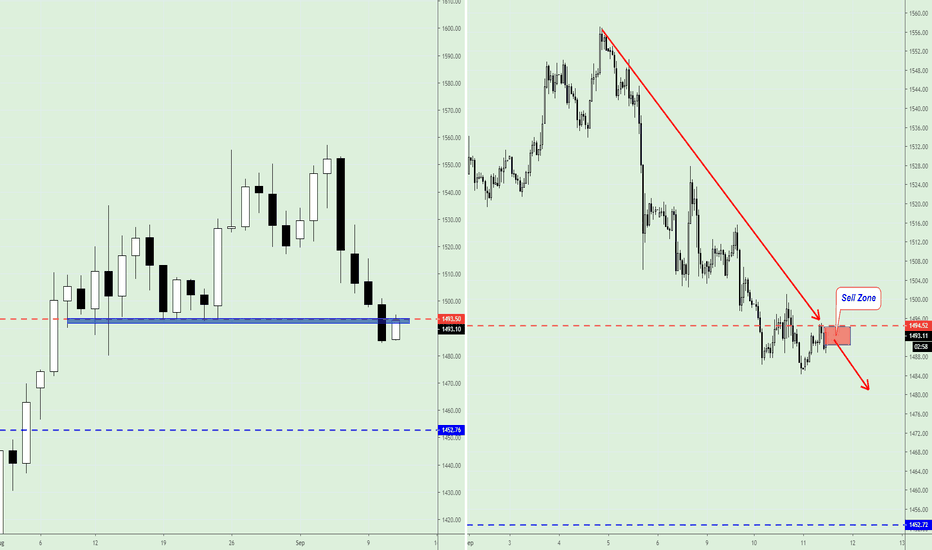

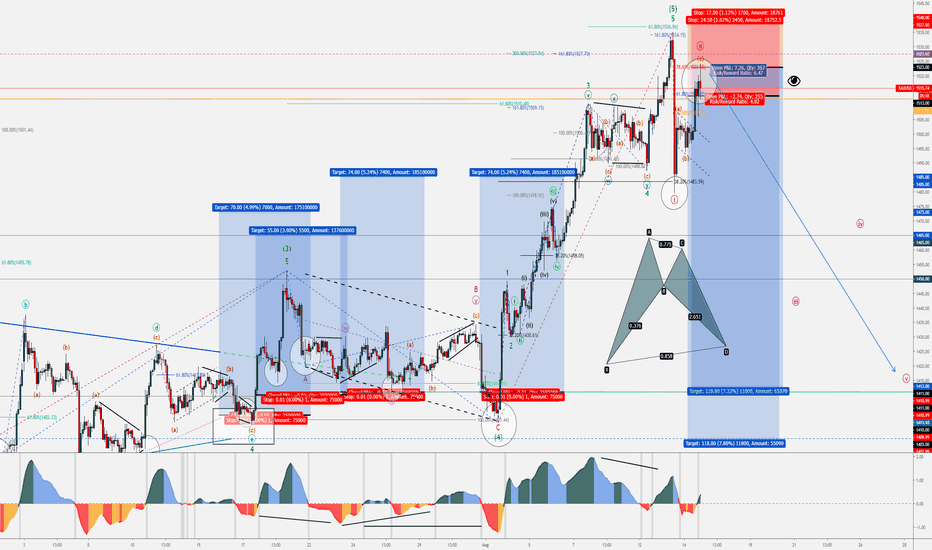

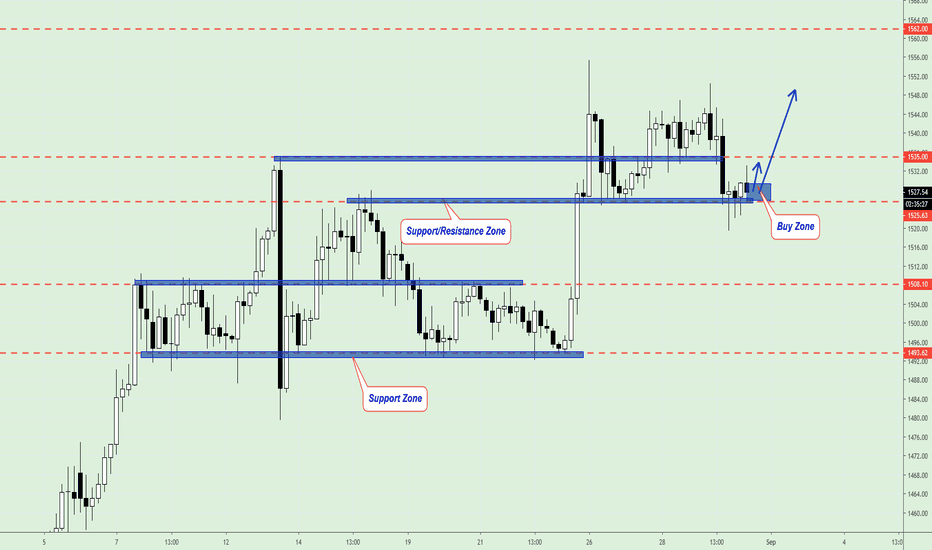

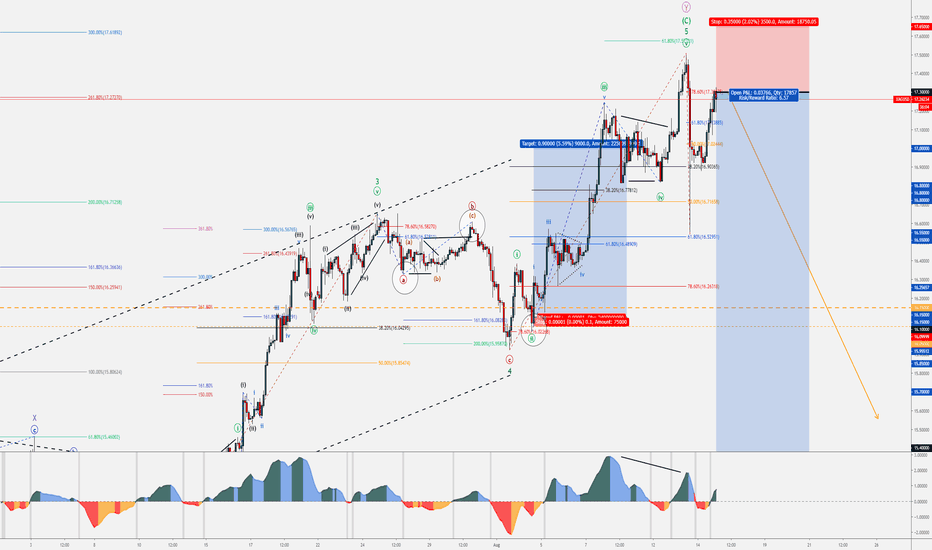

XAUUSD - SHORT - Sell Orders - Bearish ReversalI've been able to ride the entire bullish rally.

Now I want to short XAUUSD. Let me tell you why!

A complete 5-wave sequence in an impulse has completed.

The Fractal which I posted before has completed as well.

At the breaking point, I noticed the change and was able to continue the bullish impulse.

(check my updates)

I've even been able to extend my bullish views on the consolidation and continuation patterns, while a lot out there were turning bearish too early.

A bearish sequence should commence.

Aug 13th fall has shown consistency, retracing 38.2% of the entire above-mentioned rally.

This is a retracement typical for a wave A or a wave 1.

What am I expecting after the successful rally?

This:

Technicals in favor of a bearish swing:

- Five-swing sequence complete

- Bearish Divergence

- 78.6% Fibonacci Retracement

- Bearish Harmonic

- Corrective three-swing sequence in an ABC

-------------------------

XAUUSD - SHORT - Sell Orders

(my orders, shared with my members)

Trade 1: Entry @ 1513.00 with SL @ 1537.5

Trade 2: Entry @ 1523.00 with SL @ 1540.00

TP @ 1465.00 / 1440.00 / 1410.00 / 1395.00 / 1380.00

-------------------------

As always,

Many pips ahead!

*More details about me in my signature.

P.S. Please support me with a like if you think I deserve it, thanks.

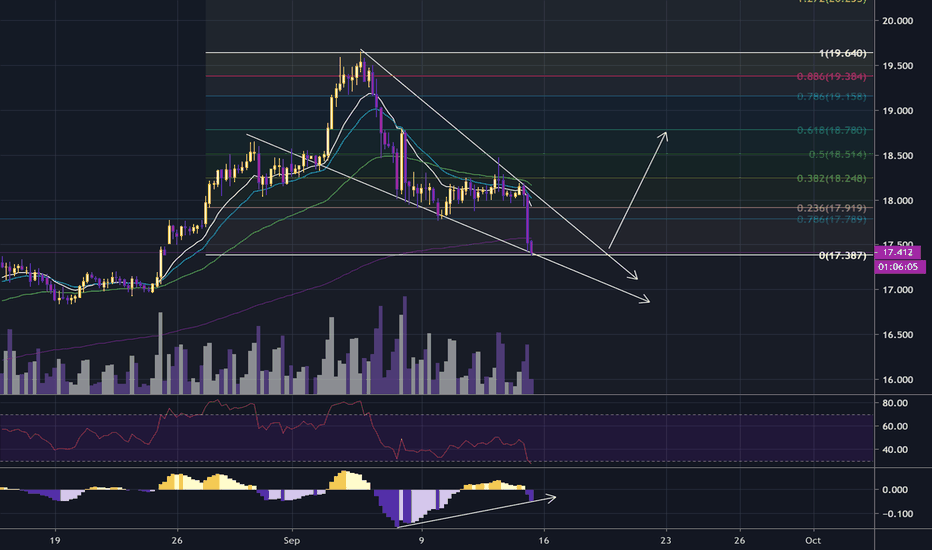

XAGUSD - SELL (Short) Trading Signal - IntradayI caught the bullish rally, even continued it after.

Bottom call:

Continuation:

Now I'm turning bearish on XAGUSD.

-----------------------------

XAGUSD - SELL (Short) Trading Signal - Intraday

Entry @ Market Price (approx. 17.30)

SL @ 17.65

TP @ 16.80 / 16.50 / 16.15 / 15.80 / 15.50 / 15.25 / 15.00

-----------------------------

As always,

Many pips ahead!

*More details about me in my signature.

P.S. Please support me with a like if you think I deserve it, thanks.