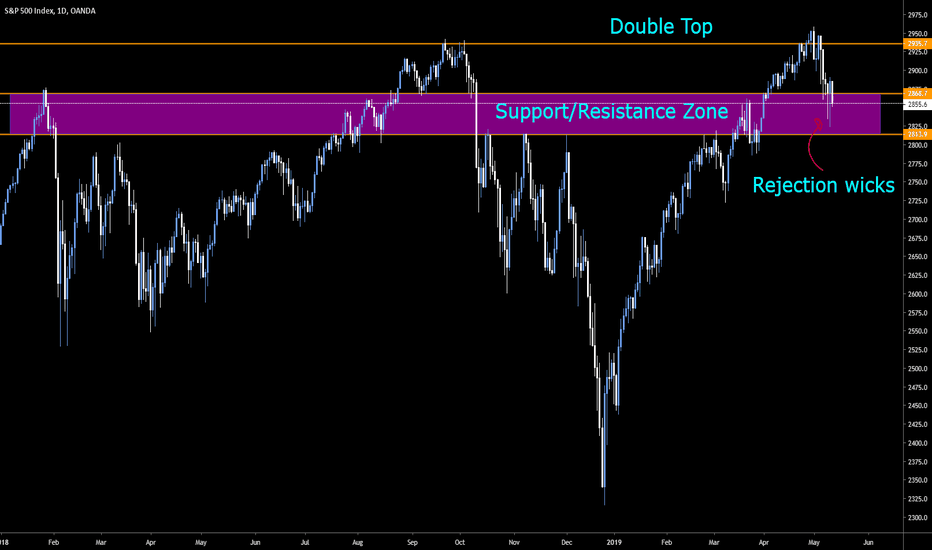

S&P 500 Pulling Back after Tariffs | $USD $SPX500After Trump announced more tariffs on China we can see that the S&P 500 has propped down quite strongly, hitting a solid support at 2860. We can also see that the drop was caused buy a very solid multiple to rejection.

Is this pullback a setup to Blow past our double top or will it continue to consolidate in it's current zones?

Cfds

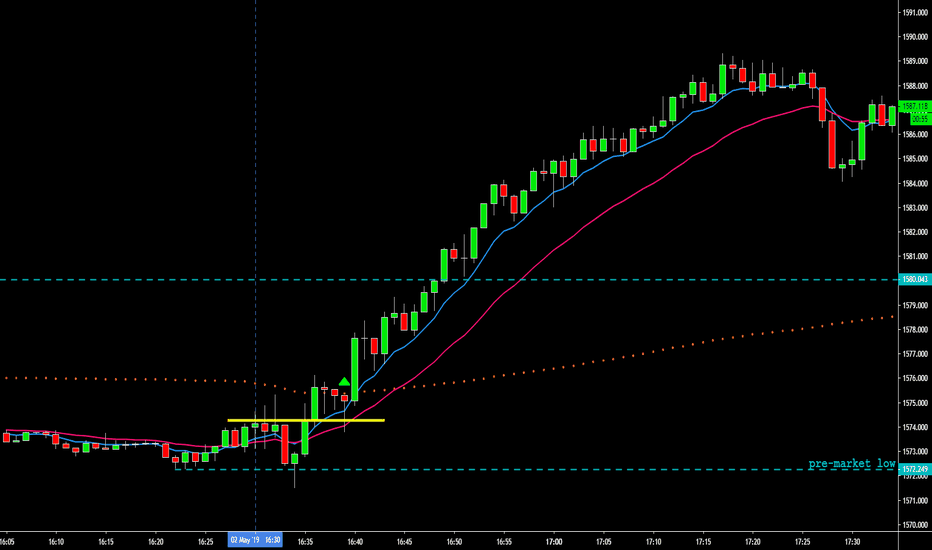

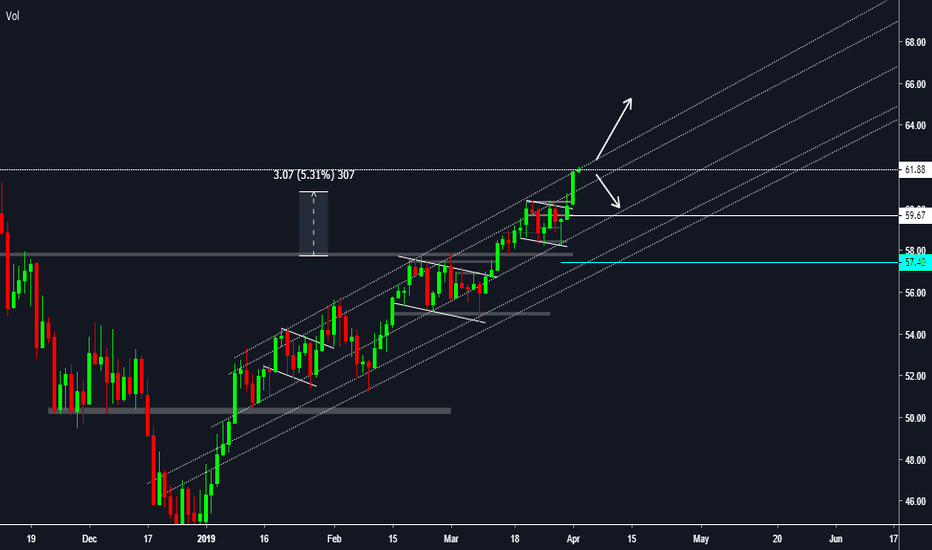

Day Trading $US2000 - +3.50 -> Hot momentum!If only every single trading day was like this one.

15 minutes in and I was able to call it a day. A very nice follow through right as I entered the trade, the market never looked in the opposite direction.

The thing I have to improve on is when I'm scaling out to maybe leave the last portion run a little more instead of setting a "hard target".

Hope you enjoy the video!

**NOTE THAT THESE TRADES HAS ALREADY BEEN TAKEN, IT IS NOT A RECOMMENDATION TO TRADE

UK100 - SLOW MOMENTUM DAY -> -0.20% Hey everyone,

Today was probably a day that I shouldn't have taken any trades. Seeing as how it's Labour Day across many countries in Europe it seem like it translated onto the FTSE100 as well even though it wasn't a holiday in the UK. Nevertheless, the thesis for the proved to be right was just caught in a choppy market/

Hope you enjoy the video! :)

Broker statements

www.mql5.com

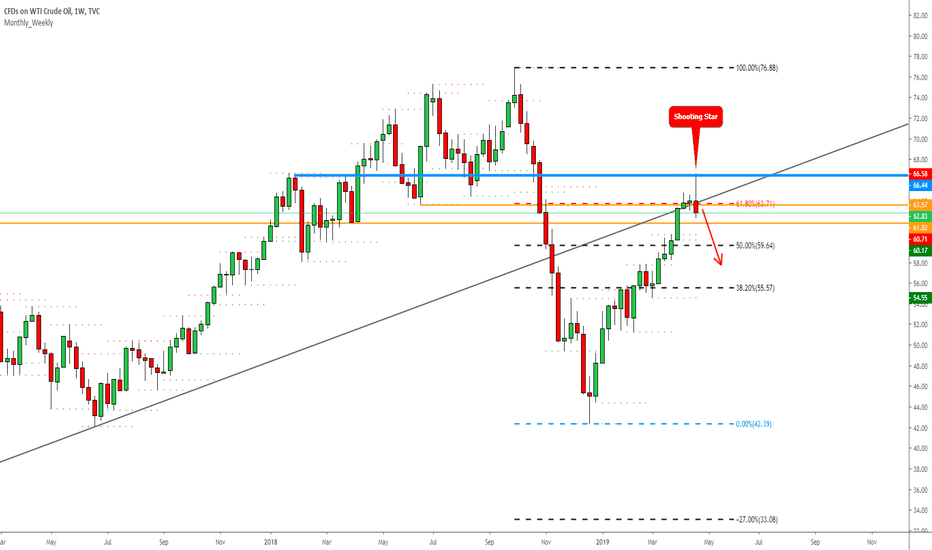

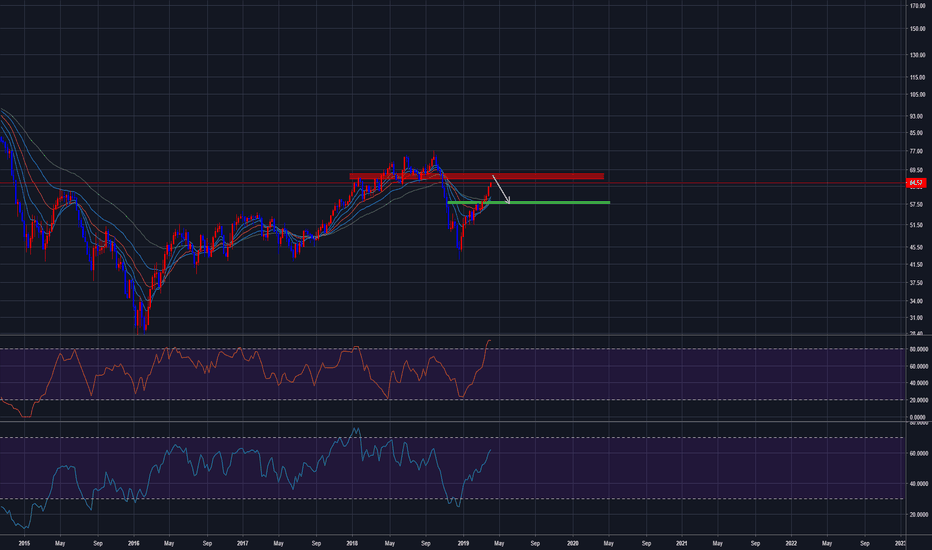

USOIL - Finally, Really Strong Reversal Signs!!Last week, we got a really strong rejection from the higher levels which ended up with a bearish candlestick pattern!

The rejection came (trade criteria):

1. From the Fibonacci golden ratio of 62%

2. From the previously worked resistance level (blue line)

3. From the previously worked support levels which now becomes resistance (orange lines)

4. From the ABC Equal waves, drawn from the bottom

5. From the trendline which is pulled from 2016 low, second touch 2017 low, it made a breakthrough at 2018 and now, this is a classical retest situation. The 2018 breakthrough has occurred with a strong and powerful candle so this could be a sign that this trendline works as a strong resistance!

6. From the Monthly EMA100 & soon also 200 EMA

7. Rejection area consists of 6 monthly high or low levels!

8. Possibly, we have a first stronger lower low during on the rally from the bottom:

9(!!). AND this rejection ended up with Shooting Star (sloppy bearish Engulfing, so, 2in1 ;P) candlestick pattern on the Weekly timeframe.

Setup is like a textbook example, let's see, what the market want's to offer us!

Feel free to support my idea post by hitting the "LIKE" button, it is my only fee from You!

Have a nice weekend,

Cheers!

*This information is not a recommendation to buy or sell, it is used for educational purposes only!

Discipline management is one of the hardest things to master. Discipline management is one of the hardest things to master . At the same time, it is the most important element

of successful trading.

It is up to every trader to establish a pre-market routine and build strong trading habits.

You should strive to attain discipline if you ever hope to achieve any level of trading success.

Trading discipline is practised 100 percent of the time, in every trade, each and every day.

If you want to trade the market,and you still find it difficult because your strategey doesn't work or you don't

know what to do, iam here, and i can help you.i have a trading method that helped thousands of traders

become profitable,it is easy, simple, and very profitable, and it will work certainly for you. if you are interested Just Send me A private Massege

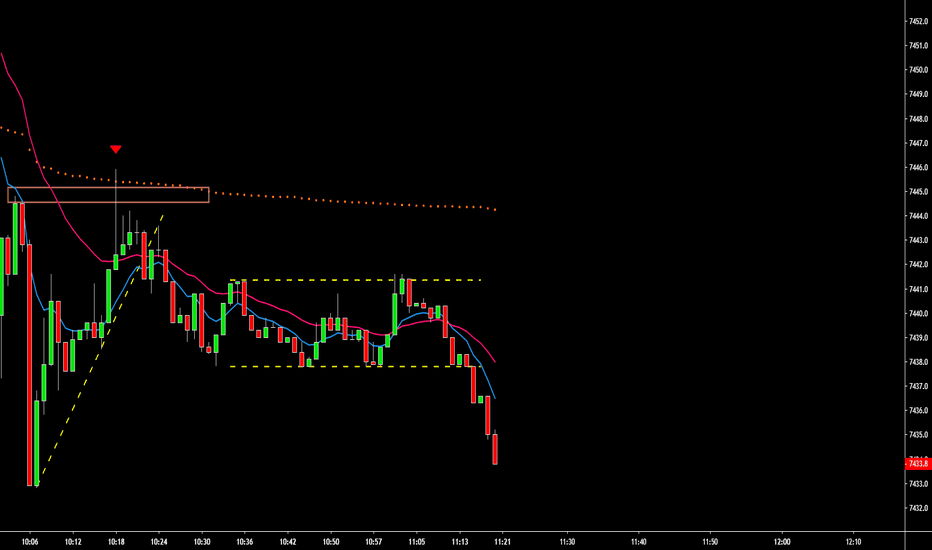

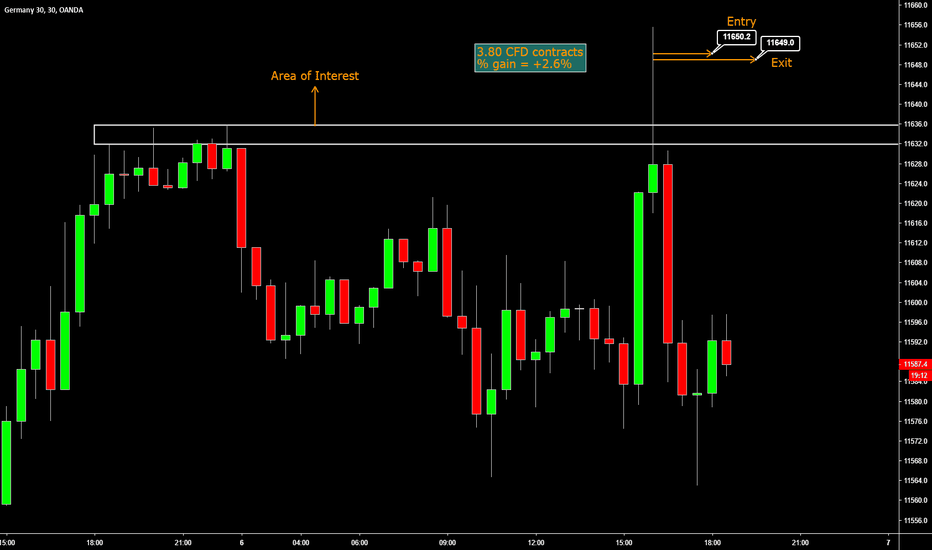

SHORT €DAX30 - SCALP TRADE - +2.6% - DETAILS BELOWHey everyone,

I managed to take a quick short scalp trade on the €DAX30 for a 2.6% gain

I will be posting both the screenshot from my broker's platform as well as the 5m chart below so that you can clearly see the levels laid out. (cannot post an idea below the 15m TF and my trade was taken on the 5m)

Details:

Entry @ 11650.20

Exit @ 11649.00

**NOTE THAT THIS TRADE HAS ALREADY BEEN TAKEN, IT IS NOT A RECOMMENDATION TO TRADE

www.mql5.com

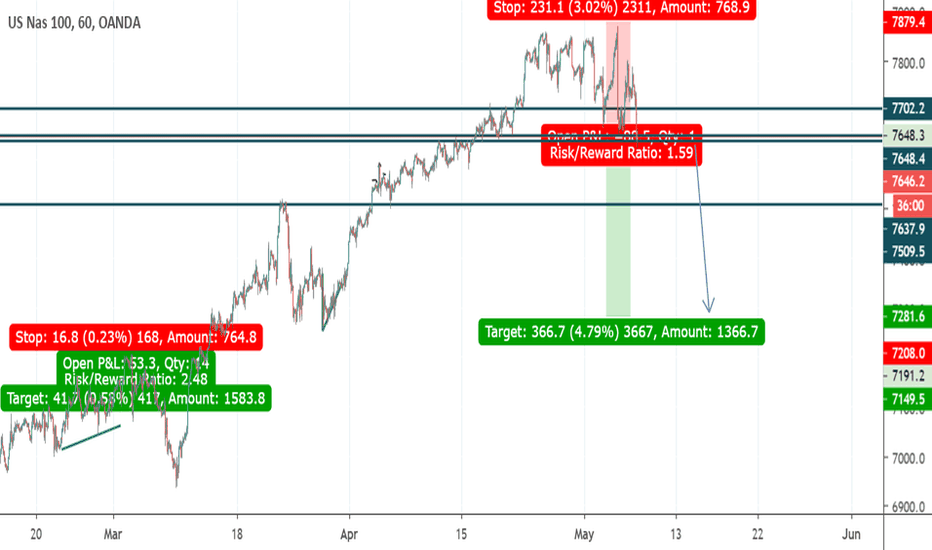

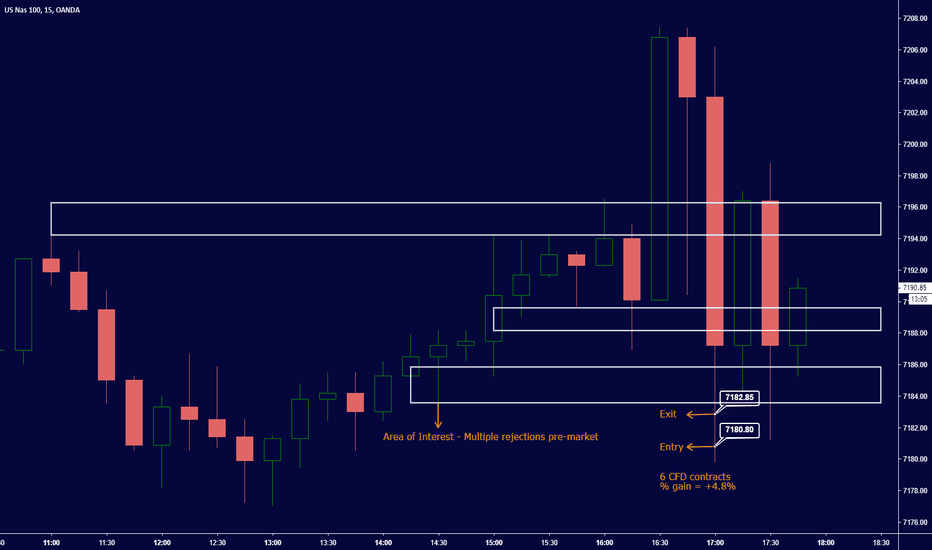

$NQ100 - SCALP TRADE - +4.8% - DETAILS BELOWHey everyone,

I managed to take a quick a quick long scalp trade on the $NQ100 for a 4.6% gain

I will be posting both the screenshot from my broker's platform as well as the 5m chart below so that you can clearly see the levels laid out. (cannot post an idea below the 15m TF and my trade was taken on the 5m)

Details:

Entry @ 7182.85

Exit @ 7180.80

**NOTE THAT THIS TRADE HAS ALREADY BEEN TAKEN, IT IS NOT A RECOMMENDATION TO TRADE

Trade from broker platform -> www.mql5.com

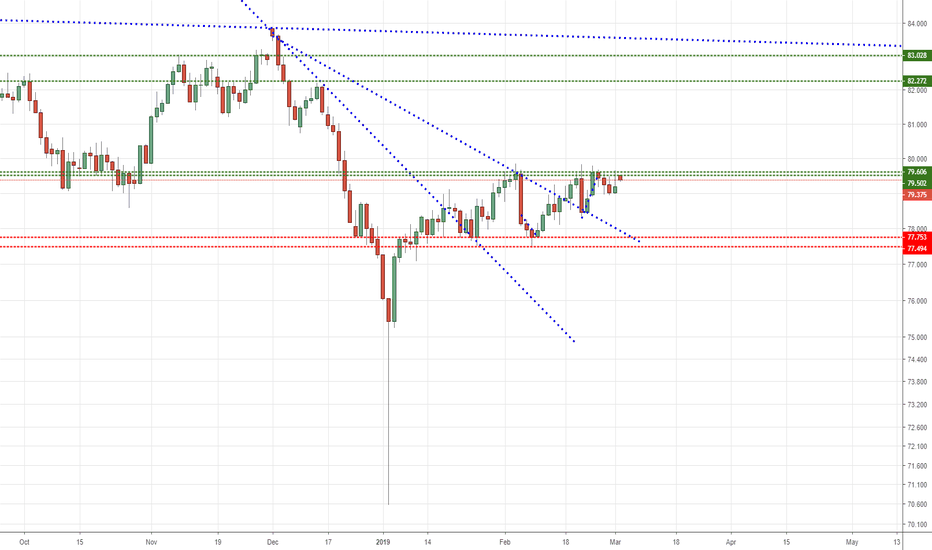

AUDJPY - NeutralAUDJPY currency pair appears to be locked in an indecisive range between 79.606 & 77.753 cluster zones. Our outlook is neutral at the moment but might provide opportunities for range traders. Current price action warrants further observation in candle behavior as a daily close that completely engulfs previous day's candle (reverse hanging man) or a daily close near its terminus, might open up opportunities to the bottom of the range at 77.753 cluster zone.

However on the upside, a daily close above 79.606 cluster resistance zone should provide a healthy target focus on 82.272 over several weeks of bullish strength.

Happy Trading!!

www.trading-equity.com

www.facebook.com

AUDUSD LongThe AUDUSD is tracing out what appears to be the finishing stages of a downward move. Downward momentum appears to be finishing and our bias is largely bullish for the pair. However current downward move could still stretch to as low as 0.70191/0.70137 cluster zone. At this zone we expect to see strong buy orders enter the market if not before.

However, the bullish case shall be completely enforced if downward sloping blue dotted trend line as shown is penetrated at daily close. On daily close above downward trending blue dotted line, next target will open up in the 0.76690/0.76031 resistance zone.

Happy Trading!!

www.trading-equity.com

www.facebook.com

AUDCAD LongAUDCAD has assumed a bullish shape. Currently we anticipate consolidating into long positions just above the blue trend line shown with target in the 0.96388 region. However, any price move or price close on a daily basis below 0.9352 zone invalidates the bullish outlook

Happy Trading!

www.trading-equity.com

www.facebook.com

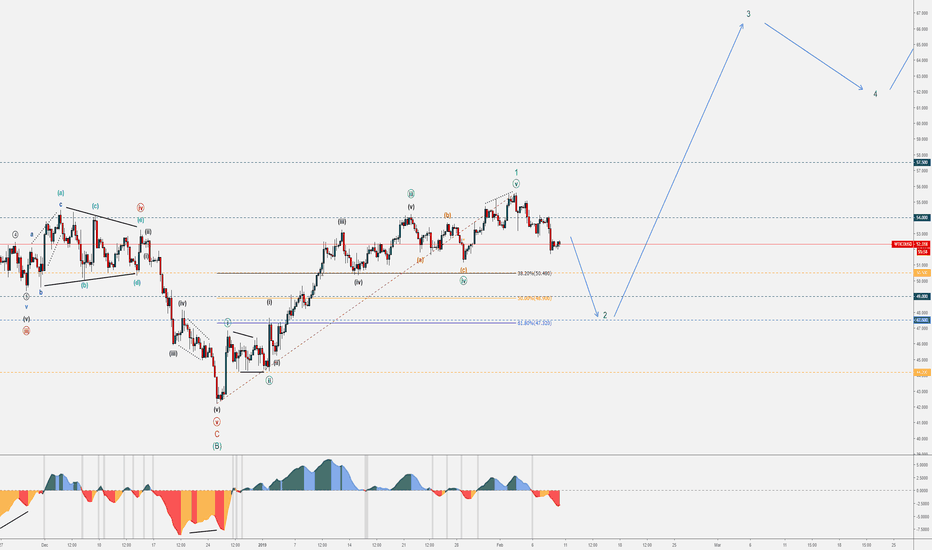

USOIL (WTI) - Bearish Minor 2 - February Wave Counts - Part 4USOIL (WTI) labeled in a corrective sequence in Minor 2 (green), which appears to unfold as a sharp correction.

A bearish impulse would be expected before WTI could bounce back.

If you like my work, please support me with a like.

More details in my signature.

Many pips ahead!

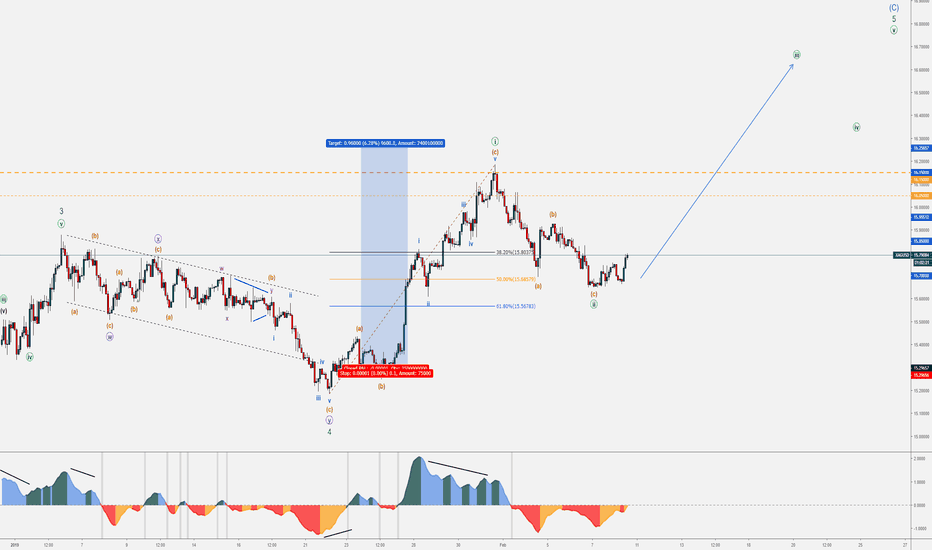

XAGUSD - Bullish Minot 5 - February Wave Counts - Part 3SILVER (XAGUSD) labeled in a bullish impulsive sequence in Intermediate (C) (blue), with Minor 1 and 2 (green) complete.

Bullish Minor 3 (green) should now commence and should be powerful.

If you like my work, please support me with a like.

More details in my signature.

Many pips ahead!

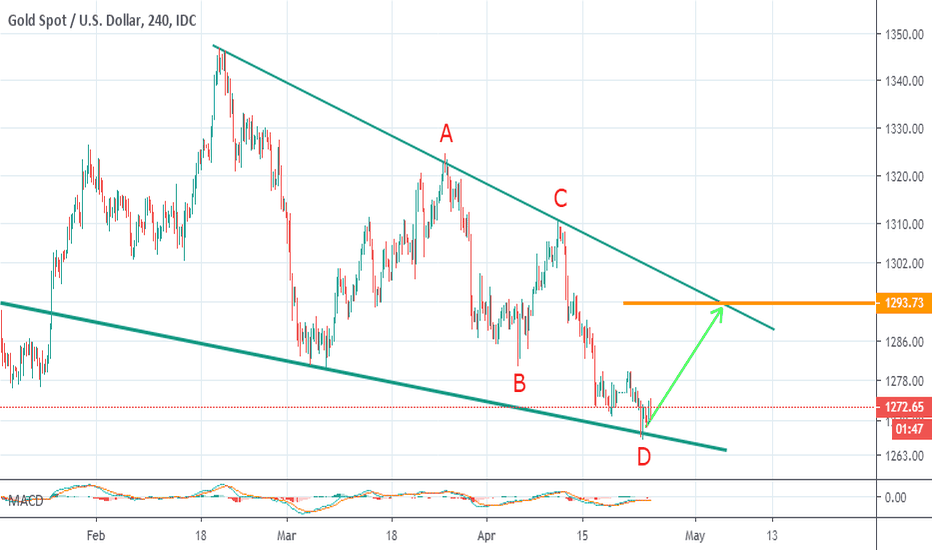

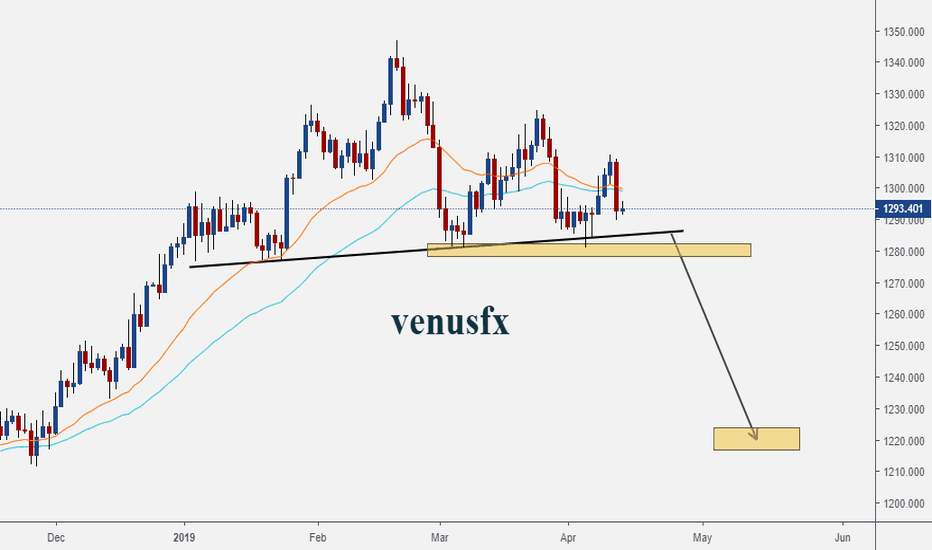

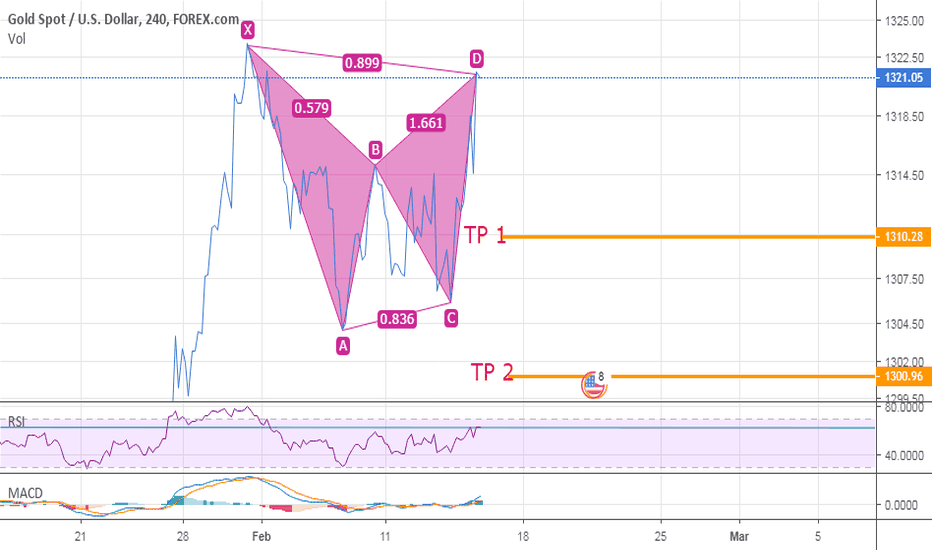

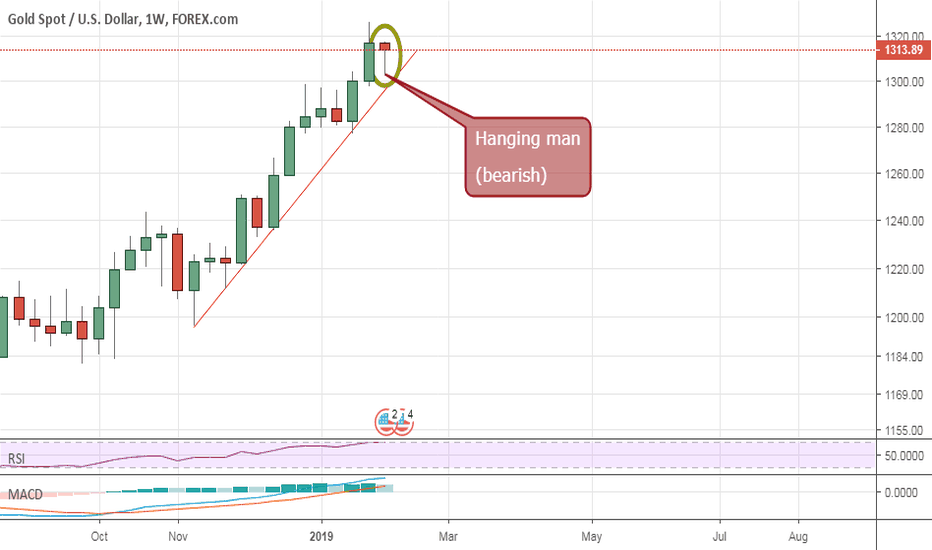

XAUUSD - Bullish Minot 5 - February Wave Counts - Part 2GOLD (XAUUSD) labeled in a bullish impulse, at the end of Minute IV (green), and about to start bullish Minute V (green) so it can complete a larger degree sequence.

If you like my work, please support me with a like.

More details in my signature.

Many pips ahead!