Early Week Pullback Ahead of Key Economic ReleasesGold Outlook – 14 July | Early Week Pullback Ahead of Key Economic Releases

🌍 Market Sentiment & Macro Overview

Gold has started the week with a sharp retracement after filling prior liquidity gaps (FVG) from the past two weeks.

This early weakness signals a risk-off tone as traders adopt a cautious stance ahead of a heavy macroeconomic calendar and geopolitical trade discussions.

This week’s high-impact events include:

📌 US CPI (Inflation Data)

📌 US PPI (Producer Prices)

📌 Unemployment Claims

📌 Retail Sales Figures

These data points will likely set the tone for price action through the second half of the week, with potential for sharp moves in gold.

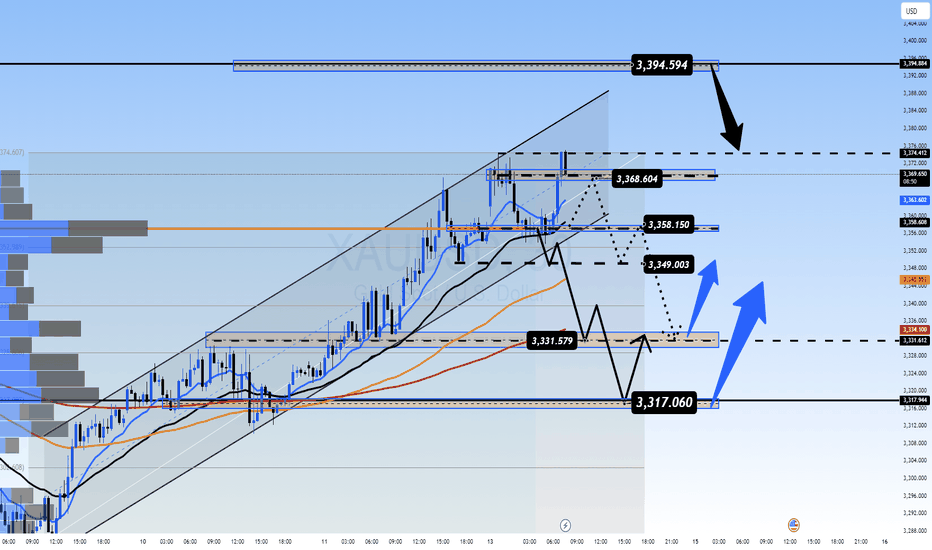

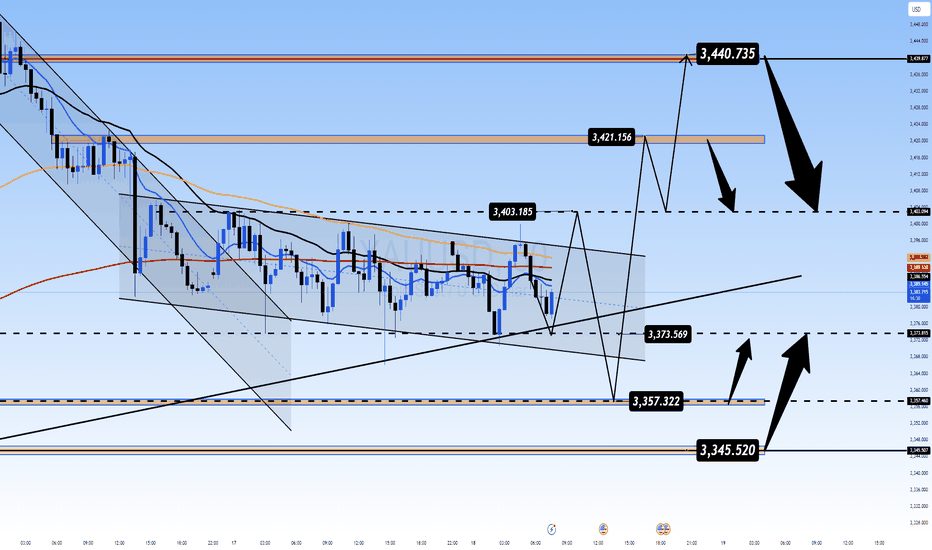

📉 Technical Snapshot – M30 Chart Structure

Price swept minor liquidity above recent highs

Pulled back by more than $15 from the short-term top

Currently trading below the intraday VPOC (~3358), suggesting short-term bearish momentum

If the selling pressure holds, we may see a move toward:

⚠️ 333x zone — initial liquidity pool

❗ 332x zone — deeper liquidity grab before any bullish reversal

🧭 Trading Plan – Key Zones and Setup

📥 Buy Setup: 3331 – 3329 (Zone of Interest)

Stop Loss: 3325

Target Levels:

TP1: 3335

TP2: 3340

TP3: 3344

TP4: 3350

TP5: 3360 – 3370

✅ A highly reactive zone — ideal for intraday long setups if price sweeps into this area and shows bullish confirmation (e.g., volume spike or rejection wick).

📤 Sell Setup: 3393 – 3395 (Resistance Re-Test)

Stop Loss: 3399

Target Levels:

TP1: 3390

TP2: 3386

TP3: 3382

TP4: 3378

TP5: 3374 – 3370 – 3360

📉 Potential scalp zone if price retests resistance with signs of exhaustion. Monitor closely for bearish structure confirmation.

📊 Key Support & Resistance Levels

Resistance Zones:

3358

3368

3374

3394

Support Zones:

3349

3340

3331

3318

These zones remain relevant for both momentum trades and reversion setups.

⚠️ Strategy Considerations

At the time of writing, gold is trading indecisively around the M30 VPOC. No clear breakout has occurred yet.

⏳ Wait for volume confirmation during the London session

🚫 Avoid impulsive entries based on emotions or FOMO

✅ Stick to your risk parameters and let price come to your level

🧠 Summary & Bias

Gold is experiencing an early-week technical correction after recent strength.

The market is in "wait-and-see" mode, with macro drivers likely to dictate direction from mid-week onwards.

📍 Watch the 3331–3329 zone closely — it remains the most attractive level for long setups.

📍 The 3393–3395 zone is a key area to fade strength if price struggles at resistance.

Patience and precision are key this week. Let the market reveal its intention, and trade accordingly.

Cfdtrading

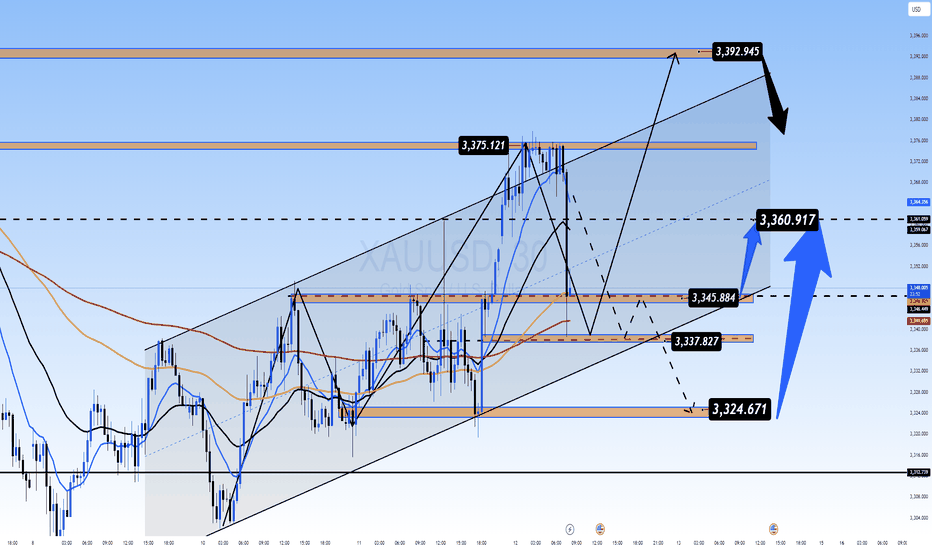

Gold Ready to Explode Ahead of NFP and Trump’s “Super Bill”?Gold Ready to Explode Ahead of NFP and Trump’s “Super Bill”? | Global Macro Focus

🌍 MACRO UPDATE – What the World is Watching:

Gold continues its bullish trajectory as the USD weakens sharply following last night’s disappointing ADP jobs report (-33K vs expected +99K). This soft labour data has fueled further speculation that the Fed could begin rate cuts as early as September, with a 90% probability now being priced in.

In the political arena, Donald Trump’s recent statement that House Republicans are aligned to push forward a so-called “Super Bill” has triggered fresh uncertainty around US fiscal policy. This could elevate safe-haven demand for gold, especially if it leads to increased tensions over debt ceilings or government spending.

With the US Non-Farm Payrolls (NFP) due later today and the UK and US markets heading into a long weekend, traders should brace for heightened volatility and liquidity gaps.

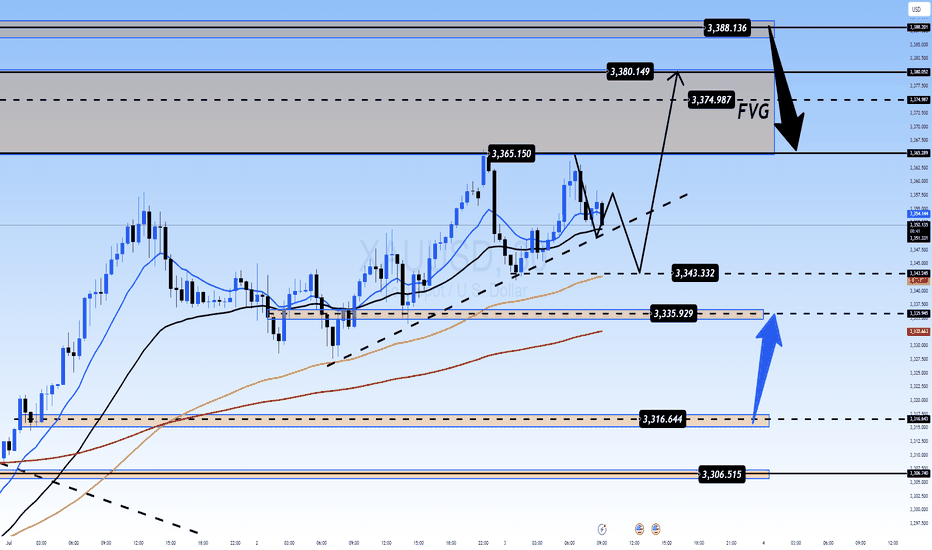

📈 TECHNICAL OUTLOOK – What the Charts Are Saying:

Overall Trend: Bullish structure remains intact as gold breaks and holds above 3365.

EMA Setup: Price trades above EMA 13/34/89/200 – signaling strong upside momentum.

Fair Value Gap (FVG): 3374 – 3388 area remains an unfilled FVG zone; possible magnet for short-term price action.

Key Resistance Levels: 3365, 3374, 3380, 3388, 3393

Key Support Levels: 3343, 3335, 3325, 3316, 3304

Trendline & Structure: The ascending trendline from 3316 remains unbroken, providing a potential bounce point if price corrects.

🎯 TRADE SETUPS – Strategic Zones to Watch:

🔵 Buy (Short-Term Scalp):

Entry: 3335 – 3333

SL: 3329

TP: 3340 → 3350 → 3360 → 3370

🟢 Buy Zone (Swing Perspective):

Entry: 3316 – 3314

SL: 3310

TP: 3320 → 3336 → 3350 → 3360

🔴 Sell Scalp (Reversal Zone)

Entry: 3374 – 3376

SL: 3380

TP: 3370 → 3360 → 3350

⚠️ Sell Zone (High-Risk Rejection):

Entry: 3388 – 3390

SL: 3394

TP: 3380 → 3370 → 3360

🔎 NOTE FOR GLOBAL TRADERS:

With UK markets partially closed and US session shortened ahead of the Independence Day holiday, liquidity may be thin and volatility could spike unexpectedly. Always place stop-loss and avoid emotional entries near key resistance.

💬 Do you believe gold can break and close above the FVG zone (3388) before the weekend volatility hits full throttle? Let’s discuss.

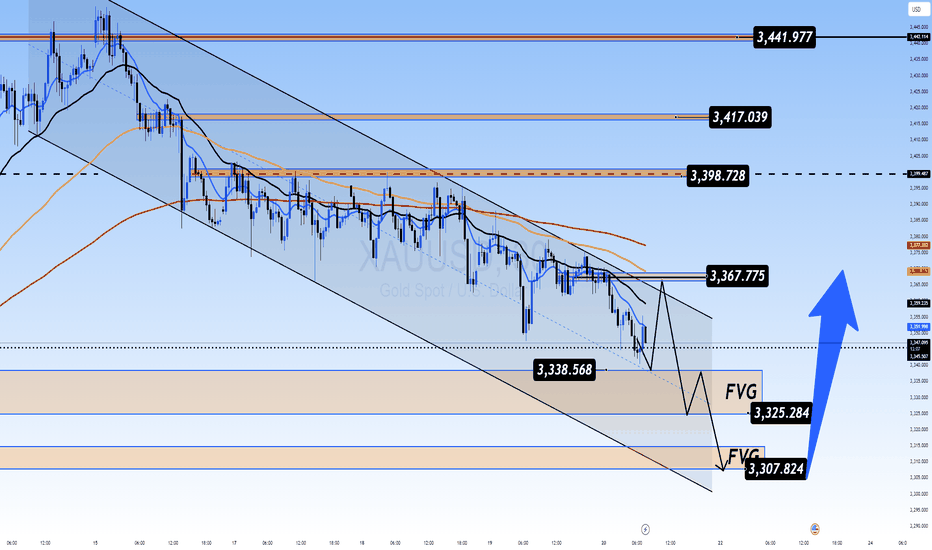

XAUUSD D1 Forecast: Gold at Pivotal 325x Support What's Next for the Yellow Metal?

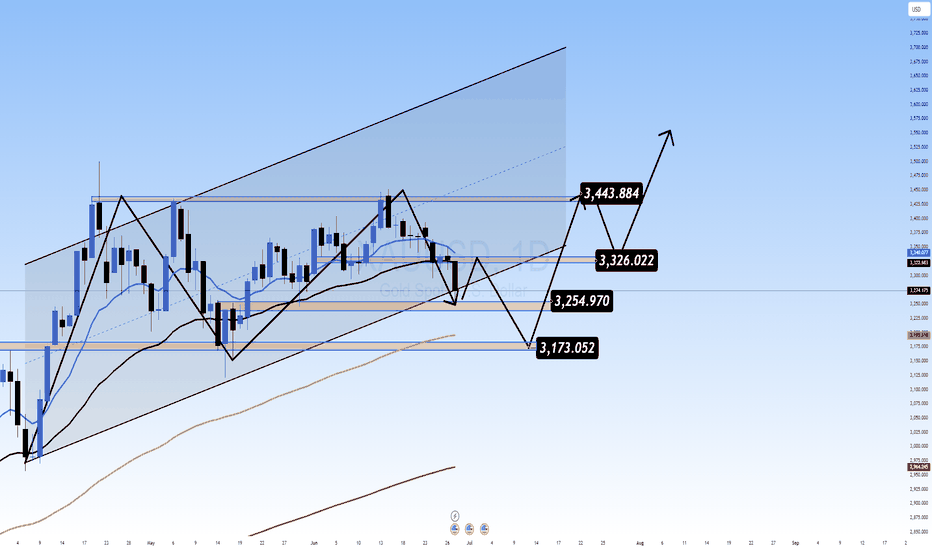

Today, we're zooming out to examine the broader picture for Gold (XAUUSD) on the Daily (D1) timeframe. Our latest analysis indicates that Gold has encountered a very strong, critical support level around the 325x region. This is a pivotal point that could significantly influence Gold's medium to long-term direction!

🌍 Macroeconomic Landscape: The Underlying Forces Influencing Gold

While we've observed a degree of USD weakness stemming from speculations around the Federal Reserve (such as the rumours regarding Jerome Powell's replacement) and expectations of interest rate cuts, these factors haven't fully countered Gold's recent decline on the daily chart. Furthermore, the sustained ceasefire between Israel and Iran continues to temper Gold's appeal as a safe-haven asset.

Nevertheless, the current price action at the robust 325x support level presents a significant technical signal. The impact of forthcoming US macroeconomic data (particularly the PCE Price Index on Friday) and speeches from FOMC members will be crucial in confirming or negating our projected movements for Gold. Should positive news for Gold align with this support holding, it could act as a potent catalyst.

📊 XAUUSD D1 Technical Analysis: Projecting Gold's Next Move

Given that Gold has reached strong support at 325x, we can anticipate the following scenarios:

Bounce from 325x (Potential Upside Phase):

If the 325x area (which reinforces the 3264.400 support from image_e9d325.png) holds firm, we expect a strong reaction and an upward move for Gold.

The initial target for this bounce would be the 332x region, aligning with resistance levels 3313.737 - 3330.483 from our previous analysis. On a broader timeframe (as illustrated in image_83845c.png), this corresponds to the resistance zone around 3326.022. This 332x area might represent a continuation pattern, suggesting it could be a corrective rally before the resumption of the larger trend.

Resumption of Downtrend (After Reaching 332x):

Once Gold reaches and tests the 332x zone (3313.737 - 3330.483 / 3326.022) and exhibits bearish confirmation signals (e.g., a strong bearish engulfing candle, a pin bar, or a clear top formation), we anticipate a resumption of the downward movement.

The next major target for this decline would be the 317x area, which correlates well with the strong support at 3173.052 on the larger timeframe (as depicted in image_83845c.png).

🎯 XAUUSD D1 Trading Plan: Your Long-Term Strategy Ahead!

Considering the current D1 analysis, here's our actionable plan:

1. BUY PHASE (Bounce from Support):

Entry: Observe price reaction in the 325x - 326x zone (specifically 3264.400). Only consider buying if there are clear bullish confirmations (e.g., a confirmed bullish pattern on the daily or 4-hour candle, a strong bounce from the zone with significant volume).

SL (Stop Loss): Position just below the 325x support zone (e.g., 3245-3240, depending on confirmation).

TP (Take Profit): 3280 - 3284 - 3290 - 3295 - 3300 - 3305 - 3310 - 3313.737 - 3320 - 3326.022 (key 332x zone). This will be our primary target for the potential bounce.

2. SELL PHASE (Downtrend Resumption):

Entry: Once the price reaches and tests the 332x zone (3313.737 - 3330.483 / 3326.022) and shows bearish confirmation signals (e.g., a strong bearish engulfing, pin bar, or clear top formation).

SL (Stop Loss): Position slightly above the 332x zone (e.g., 3335-3340).

TP (Take Profit): 3326 - 3320 - 3316 - 3310 - 3305 - 3300 - 3295 - 3290 - 3280 - 3200 - 3173.052 (final 317x target).

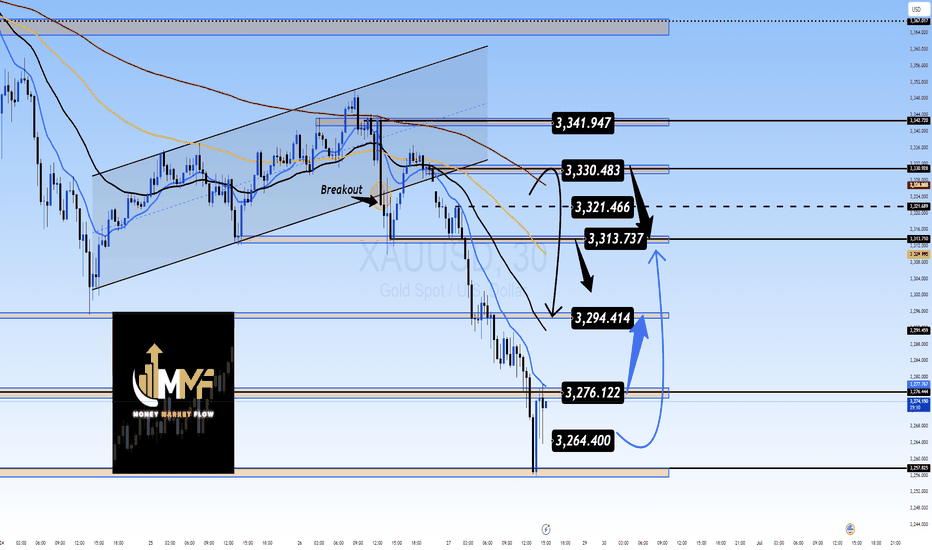

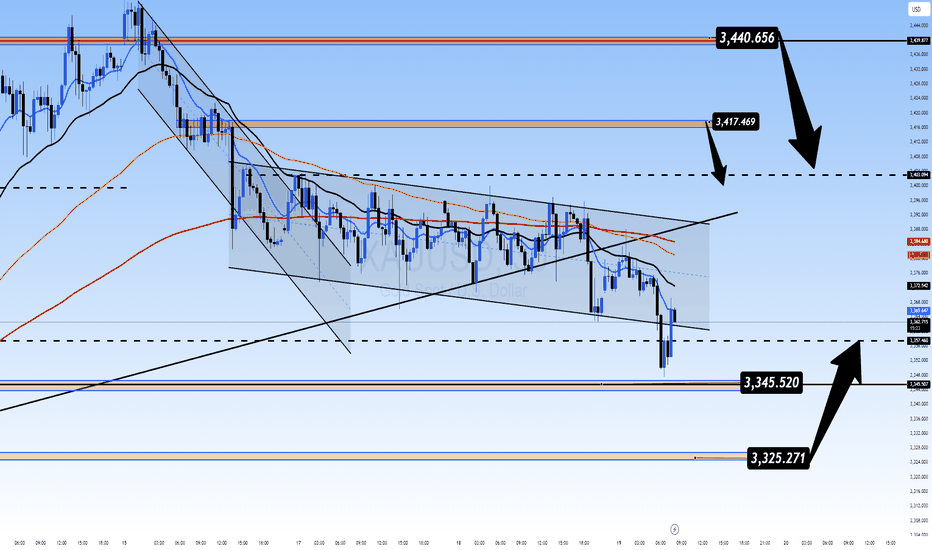

XAUUSD Daily Update: Gold Enters "Strong Bearish MomentumXAUUSD Daily Update: Gold Enters "Strong Bearish Momentum" – Where Are the Opportunities?

Hello TradingView Community!

Hot news from the Gold (XAUUSD) market today! We've just closely analyzed the Daily Chart and spotted a crucial signal: Gold's downward momentum is extremely strong and clear! This indicates that the short-term trend may have shifted, or selling pressure is currently overwhelming other supporting factors.

🌍 Current Macroeconomic Context (A Multi-faceted View):

Previously, we discussed how a weaker USD might support Gold. Indeed, concerns about the Fed's independence (due to rumors of Powell's replacement) and expectations of Fed rate cuts have pushed the USD lower, typically a positive for Gold.

However, the market isn't driven by just one factor. The sustained ceasefire between Israel and Iran is reducing Gold's safe-haven demand. It appears that, at present, factors like decreased safe-haven demand and potentially strong technical breakdowns are prevailing, creating significant selling pressure on the daily timeframe. We also need to emphasize that the market remains very cautious about confirming a bottom for Gold, and we are still awaiting crucial US economic data (especially PCE on Friday) and FOMC speeches.

➡️ In summary: While a weaker USD theoretically supports Gold, the price action on the daily chart clearly shows bears are dominating. We must respect this signal and adjust our strategy accordingly.

📊 XAUUSD Technical Analysis (Focus on Daily Chart - Strong Bearish Momentum!):

Based on the strong bearish signal from the Daily timeframe and key price levels from the chart (image_e9d325.png):

Primary Trend on Daily: Clearly strong bearish momentum. Large, consecutive bearish candles breaking previous support zones indicate overwhelming selling pressure.

Resistance Zones (Potential SELL Opportunities - where price might retrace before falling further):

3313.737 - 3315: This is the nearest and most important resistance area. If the price retraces here, it could present an opportunity to sell.

3321.466 - 3330.483: A stronger resistance zone, if price retraces deeper.

3341.947: Extremely strong resistance, unlikely to be reached in this context unless there's a major trend-reversing news event.

Support Zones (BUY Opportunities - extremely cautious, only for Scalp or clear reversal signals):

3294.414: Immediate support, but could be easily broken if bearish momentum persists.

3276.122: The next support area if the price continues to fall.

3264.400: This is a very strong support and a potential downside target if bearish momentum holds. Consider BUYs here only if price hits this level and shows clear reversal patterns on smaller timeframes.

🎯 Updated XAUUSD Trading Plan (Prioritizing SELLs):

Given the strong bearish momentum on the Daily chart, we will prioritize active SELL entries and approach BUY scalps with extreme caution, only at very strong support levels or with clear reversal confirmations.

1. ACTIVE SELL TRADES (Priority):

SELL ZONE 1 (Selling at near resistance):

Entry: 3313 - 3315 (If price retraces to this area and shows bearish rejection candle patterns on H1/H4)

SL: 3320 (Just above the nearest resistance)

TP: 3310 - 3305 - 3300 - 3295 - 3290 - 3280 - 3276.122 (Next target according to the chart) - 3264.400 (Final target if strong bearish momentum continues)

SELL ZONE 2 (Selling at stronger resistance - if deeper retracement):

Entry: 3331 - 3333 (If price retraces deeper and shows reversal signals)

SL: 3337

TP: 3326 - 3320 - 3316 - 3310 - 3305 - 3300 - 3294.414

2. CAUTIOUS BUY TRADES (Only for Scalp/Clear Reversal Signals):

BUY ZONE (BUY SCALP AT STRONG SUPPORT):

Entry: 3266 - 3264 (Only buy if price hits this zone and shows clear reversal signals on M15/M30, such as reversal candle patterns, RSI divergence, etc.)

SL: 3260 (Very tight, acknowledging higher risk)

TP: 3270 - 3276.122 - 3280 - 3284 - 3290 (Aim for short TPs, no expectation of prolonged uptrend in strong bearish conditions)

INTERMEDIATE BUY SCALP:

Entry: 3284 - 3282 (If price has broken down through here and retraces, wait for confirmation)

SL: 3278

TP: 3288 - 3292 - 3296 - 3300 (Short-term targets only)

⚠️ Crucial Factors to Monitor Closely Today:

Price Action at Resistance/Support Levels: How price reacts at these key marks will dictate the next move.

US Macro Data (especially PCE on Friday): Any surprising news can rapidly reverse the current trend.

FOMC Speeches: Can induce significant volatility in USD and Gold.

Geopolitical Situation: Although currently optimistic, any unexpected developments could reignite safe-haven demand.

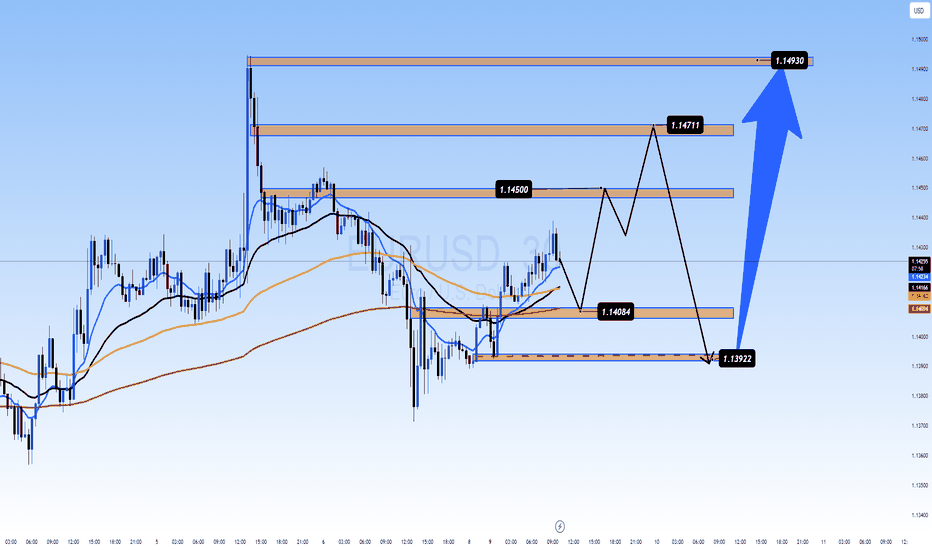

Can it Reach New Highs as USD Weakens?EUR/USD: Euro's Resilience Holds Strong – Can it Reach New Highs as USD Weakens?

🌍 Macro Landscape: EUR/USD Rides Risk-On Sentiment and Fed Cut Hopes

The Euro (EUR) is showing significant strength, maintaining its position near a three-year high against the US Dollar (USD). This resilience is largely fueled by a moderately positive risk appetite in the market.

Simultaneously, the US Dollar is facing considerable downward pressure. This weakness stems from recent weaker-than-expected economic data from the United States and increasing market expectations for the Federal Reserve (Fed) to implement interest rate cuts. If US economic indicators continue to soften, it could solidify the case for earlier Fed rate cuts, further undermining the USD and potentially boosting EUR/USD.

🏦 Central Bank Policy: Diverging Paths for ECB and Fed

Federal Reserve (Fed): The market is increasingly pricing in the likelihood of Fed interest rate cuts. Weaker US data strengthens this narrative, as the Fed might be compelled to ease monetary policy to support economic growth. This dovish outlook for the Fed is a key driver of USD weakness.

European Central Bank (ECB): While the provided information focuses on the EUR's strength due to broader market sentiment and USD weakness, the ECB's more measured approach to monetary policy compared to the Fed's potential easing can create a favorable interest rate differential for the Euro, attracting capital flows.

This divergence in central bank policy expectations—with the Fed leaning towards cuts and the ECB maintaining a more cautious stance—creates a tailwind for the EUR/USD pair.

🌐 Capital Flows: Money Favors Euro Amidst USD Softness

Global capital flow models suggest that funds are increasingly moving towards assets perceived as offering better relative value or stability. As US yields become less attractive due to anticipated Fed rate cuts, capital may flow out of USD-denominated assets.

This outflow from the USD naturally benefits currencies like the Euro, especially given its current positive momentum driven by a moderate risk-on environment. The re-pricing of Fed policy risk directly influences these capital movements, contributing to the upward trajectory of EUR/USD.

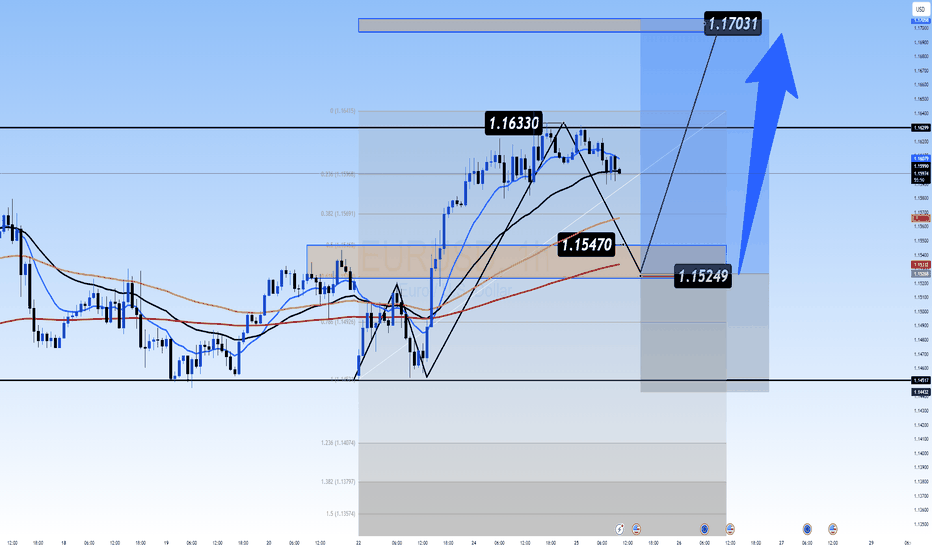

📊 Technical Structure (H4 Chart Analysis): EUR/USD Eyes Key Resistance Levels

Based on the provided EUR/USD H4 chart:

Uptrend intact: The pair continues to exhibit a positive trend, characterized by higher lows and higher highs within an ascending channel.

Key Resistance Levels:

Initial Resistance: 1.16330. This level aligns with recent highs and the top of the minor channel. A break above this suggests further bullish momentum.

Major Resistance Zone: 1.17031. This is indicated as a significant resistance area, potentially a long-term target or a reversal point. A break here would confirm strong bullish conviction.

Key Support Levels:

Immediate Support: 1.15470. This level has acted as a support point, aligning with the EMA 200 and a Fibonacci retracement level, indicating a potential bounce area.

Strong Support Zone: 1.15249. This zone represents a robust demand area, aligning with previous price action and serving as a crucial level for bulls to defend.

Moving Averages (EMA 13-34-89-200): The price is trading above the short-term and long-term EMAs, suggesting strong bullish momentum. The EMAs are fanning out and showing a bullish alignment, reinforcing the uptrend.

Projected Price Action: The chart suggests that the price might retrace towards the 1.15470 or 1.15249 support zones before resuming its upward trajectory towards the 1.16330 and potentially 1.17031 resistance levels.

🎯 Trade Strategy Recommendations:

Scenario 1 – BUY the Dip:

Entry: Look for bullish confirmation around 1.15470 - 1.15249.

Stop-Loss: Below 1.15100 (or a level below the 1.15249 support for risk management).

Take-Profit:

TP1: 1.15600

TP2: 1.15800

TP3: 1.16000

TP4: 1.16200

TP5: 1.16330 (Targeting the immediate resistance)

TP6: 1.16500

TP7: 1.16800

TP8: 1.17031 (Targeting the major resistance)

Scenario 2 – SELL the Rally (Counter-trend/Reversal):

Entry: Look for bearish confirmation around 1.16330 - 1.16400 or higher near 1.17031.

Stop-Loss: Above 1.16500 (or above 1.17100 if selling at higher resistance).

Take-Profit:

TP1: 1.16200

TP2: 1.16000

TP3: 1.15800

TP4: 1.15600

TP5: 1.15470 (Targeting the immediate support)

TP6: 1.15249 (Targeting the strong support zone)

⚠️ Key Events to Watch:

Upcoming US Economic Data: Any further weak data could solidify Fed rate cut expectations and weigh on the USD.

ECB Official Statements: Comments from ECB members on inflation or monetary policy could impact EUR's strength.

Global Risk Sentiment: A continued moderate risk-on environment will generally support the EUR against the USD.

Trade smart and stay informed! Wishing everyone a successful trading day!

XAUUSD – Are the Bulls Back? Key Reversal Zone in PlayXAUUSD – Are the Bulls Back? Key Reversal Zone in Play

Gold has been consolidating in a tight range for several sessions, but both macro and technical indicators are pointing to a potential breakout. With volatility expected to rise, traders should keep a close eye on these high-probability zones.

🌍 Macro Overview – Is the Tide Turning for Gold?

📉 The Fed remains hawkish, but market sentiment has shifted, with over 65% probability priced in for a rate cut in September. This adds pressure on the dollar and offers upside potential for gold.

💸 10-year US Treasury yields are stabilizing, reducing the opportunity cost of holding gold and reigniting interest from risk-averse investors.

⚠️ Ongoing geopolitical risks in the Middle East and Eastern Europe continue to fuel demand for safe-haven assets.

🏦 Central banks, especially in China and India, are steadily increasing their gold reserves — a bullish long-term signal for the market.

📊 Technical Outlook – Watch the Fair Value Gap (FVG)

The 3325–3327 support zone aligns with an unfilled FVG on H1-H4 charts, providing a key area for bullish momentum to resume.

Sustained price action above this level may open a path toward 3360 and beyond.

Conversely, if price reaches the 3398–3400 resistance area and shows signs of exhaustion, it could trigger a short-term pullback.

✅ Trade Setup

🟢 BUY ZONE: 3327 – 3325

SL: 3320

TP Targets: 3330 → 3335 → 3340 → 3345 → 3350 → 3355 → 3360 →

🔴 SELL ZONE: 3398 – 3400

SL: 3405

TP Targets: 3395 → 3390 → 3386 → 3380 → 3375 → 3370 → 3360

⚠️ Final Thoughts

The gold market is approaching a decision point... With the PCE and US GDP data due this week, traders should expect a potential volatility spike.

Risk management remains key — wait for confirmation at key levels, stick to your plan, and don’t let emotions override discipline. This week could offer strong directional moves for gold, but only for those prepared.

Gold on the Edge: Will US Debt Fears Spark a Breakout?XAUUSD – Gold on the Edge: Will US Debt Fears Spark a Breakout?

After weeks of muted movement, gold is coiling within a bearish channel — but a fresh warning from Goldman Sachs may be the trigger that changes everything. With concerns mounting over America’s fiscal future, gold could be preparing for a decisive shift.

🌐 Macro View – Goldman Sachs Sounds the Alarm

🔺 Goldman Sachs recently issued a critical warning:

US national debt is expected to exceed WWII levels, with interest payments topping $1 trillion by 2025, outpacing spending on defense and healthcare.

If urgent fiscal reforms aren’t implemented, the US could face a tightening cycle that slows GDP growth without reducing the debt-to-GDP ratio.

The root causes? Excessive spending, rising interest rates, and deep political gridlock.

📌 For global investors, this type of uncertainty is often bullish for gold — especially as a hedge against both inflation and US dollar instability.

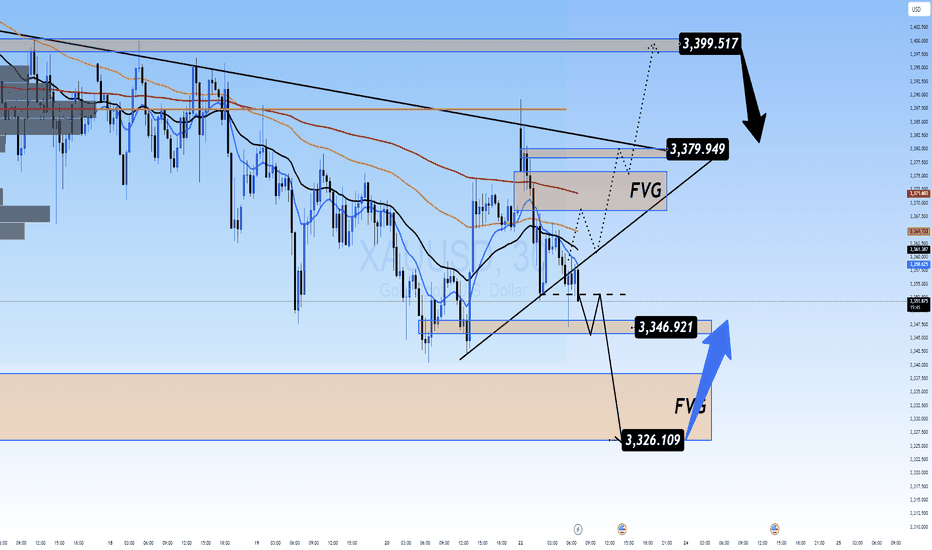

📉 Technical Outlook (Updated – M30 to H1)

Gold is still trading inside a well-defined descending channel, with sellers firmly in control.

Price is currently hovering around the pivot zone at 3,338.42, with a possible short-term bounce toward 3,368.04, the upper edge of the channel.

EMA ribbons (13–200) are sharply aligned to the downside, signaling strong bearish momentum.

If the price fails to break above 3,368, the next key support zones lie at 3,325.78, and potentially 3,309.25, where unfilled fair value gaps (FVG) await.

✅ Trade Plan

🟢 BUY ZONE: 3310 – 3308

Stop-Loss: 3303

Targets: 3314 → 3318 → 3322 → 3326 → 3330 → 3340 → 3350 → 3360 →

🟢 BUY SCALP: 3325 – 3323

Stop-Loss: 3318

Targets: 3330 → 3334 → 3338 → 3342 → 3346 → 3350 → 3360 → 3370 →

🔴 SELL ZONE: 3418 – 3420

Stop-Loss: 3424

Targets: 3414 → 3410 → 3405 → 3400 → 3396 → 3390 → 3385 → 3380

🔻 SELL SCALP: 3396 – 3398

Stop-Loss: 3403

Targets: 3392 → 3388 → 3384 → 3380 → 3375 → 3370

💬 Closing Thoughts – A Volatile End to the Week?

With US markets returning from a bank holiday and macro pressure rising, volatility could spike to close the week.

✅ Stick to disciplined SL/TP levels. Avoid premature entries and let price confirm direction.

Gold remains technically bearish — but the global debt narrative could turn this market on its head.

Prepare. Observe. Strike only when the structure aligns.

Gold Breaks the Range: Trend Reversal or Just a Fakeout?XAUUSD – Gold Breaks the Range: Trend Reversal or Just a Fakeout?

After several days of sideways action, gold has finally broken out of its consolidation channel — but not upward. The price action signals uncertainty, while underlying global risks suggest a larger move may be brewing. With US markets closed for a bank holiday, low liquidity could lead to sharp, unexpected spikes — traders, stay alert.

🌍 Macro & Fundamental Outlook

📌 As widely expected, the Federal Reserve held rates steady, but Fed Chair Powell maintained a hawkish tone, warning that inflation risks remain due to ongoing geopolitical instability and rising commodity costs.

🔥 The gold market now hinges on two major geopolitical scenarios in the Middle East:

If the US intervenes diplomatically to ease tensions between Iran and Israel, gold may continue to correct further — possibly into the 3,325 – 3,300 range or lower.

However, if reports are accurate that Trump is coordinating with Israel for potential strikes on Iran, gold could spike aggressively as safe-haven demand surges toward 3,417 – 3,440.

📊 Technical Breakdown (M30 – H1)

Price has broken below the range-bound structure, suggesting a potential momentum shift to the downside.

The EMA cluster (13–34–89–200) is sloping downward, confirming bearish short-term pressure.

The 3,345 level has acted as support, but if it gives way, 3,325 becomes a critical liquidity zone where buyers may step in.

✅ Trading Plan

🟢 BUY ZONE 1: 3,325 – 3,328

Entry: Only after a clear bullish reversal (pin bar / bullish engulfing candle)

SL: Below 3,320

TP: 3,345 → 3,360 → 3,373 → 3,384

🟢 BUY ZONE 2: 3,345 – 3,348

Entry: On price retest and bullish confirmation

SL: Below 3,340

TP: 3,360 → 3,373 → 3,384 → 3,403

🔴 SELL ZONE: 3,417 – 3,440

Entry: If price rallies into resistance with no supporting fundamentals

SL: Above 3,445

TP: 3,403 → 3,384 → 3,360 → 3,345

💬 Final Thoughts

Gold is at a pivotal point. While today’s break could indicate a new leg down, we’ve seen countless false breakouts during low liquidity sessions. Only trade on confirmation — not emotion. Watch for geopolitical headlines and let price action guide your risk-adjusted decisions.

Stay patient. Stay sharp. Let the market prove itself before you do.

Smart Money Zones Revealed (XAUUSD) Is Gold Just Breathing or Breaking? Smart Money Zones Revealed (XAUUSD)

🔍 Macro & Sentiment Overview

Gold faced a sharp correction after a strong Asian session rally, which caught many traders off guard...

While the US Dollar gained 0.7% due to safe-haven flows and Fed anticipation, gold's dip seems more like a liquidity sweep than a structural reversal...

🌍 Rising geopolitical tensions — especially Iran–Israel and Trump’s comments about Tehran — keep the fear premium alive…

🛢️ Meanwhile, oil prices are surging, and institutional funds might be rotating capital between commodities and equities...

📝 All eyes are now on the Fed’s rate decision and the US retail sales report — a potential "horror print" that could shock rate expectations and trigger high volatility across markets.

📉 Technical Breakdown (M30 Perspective)

Price pulled back sharply after an overextended bullish move from Asian FOMO…

EMAs (13, 34, 89, 200) show early signs of potential crossover — signaling caution for buyers…

Liquidity gaps (FVG zones) below current price indicate a magnet for institutional fills…

🎯 Trade Setup

🔵 BUY ZONE: 3345 – 3343

Stop-Loss: 3339

Take Profits:

3350 → 3354 → 3358 → 3362 → 3366 → 3370 → 3380 → 3400 → ???

🧠 Look for confirmation through price action and rejection candles during London/NY sessions before entering.

🔴 SELL ZONE: 3442 – 3444

Stop-Loss: 3448

Take Profits:

3438 → 3434 → 3430 → 3425 → 3420 → 3410 → 3400

⚠️ Only short upon clean rejection and strong bearish confirmation patterns — avoid blind entries in this volatile phase.

🧠 Final Thoughts

Gold is moving within a smart money playbook — triggering stop hunts and liquidity grabs. With macro uncertainty ahead, patience and precision matter more than ever.

Let price come to your zones. Don’t chase. Let volatility serve you — not shake you.

📌 Follow this idea for live updates during the Fed press conference and NY session.

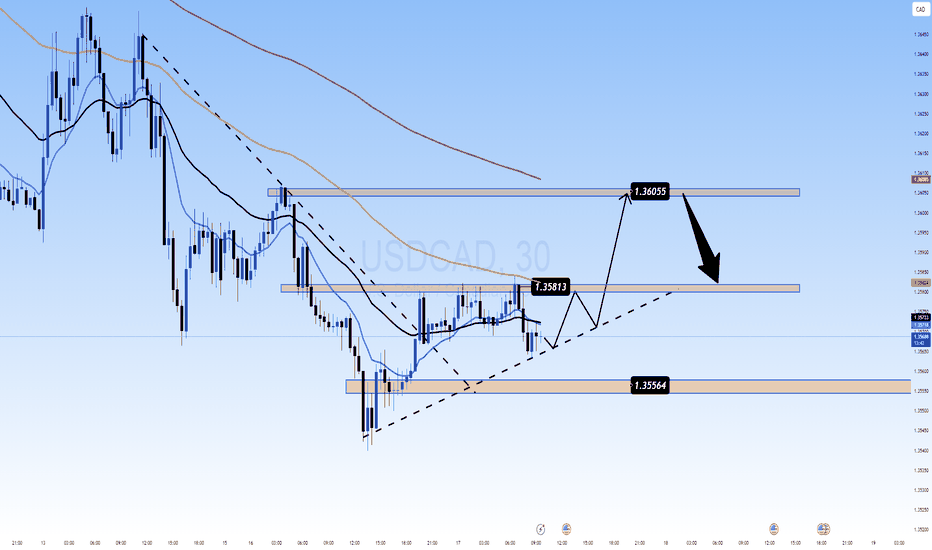

Oil Rises, Canadian Yields Surge: Can USD/CAD Rebound?USDCAD 17/06 – Oil Rises, Canadian Yields Surge: Can USD/CAD Rebound?

After a significant drop to the 1.355x area, USD/CAD is showing early signs of recovery. However, the pair remains influenced by strong macro headwinds—particularly oil prices and Canadian monetary policy signals.

🌐 Macro & Sentiment Overview

WTI crude oil is rising due to ongoing tensions between Israel and Iran, which increase the risk of global supply disruptions. This supports the Canadian Dollar (CAD) as a commodity-linked currency.

Canada’s 10-year bond yields have reached their highest levels in 5 months (~3.4%), reinforcing expectations that the BoC may remain hawkish in the near term.

USD weakens slightly as traders await more clarity from the Federal Reserve about the next rate cut timeline, potentially in Q3.

📊 Technical Analysis (M30 Chart)

Price is printing higher lows above the key trendline.

EMAs 13–34–89 are tightening → sign of sideways pressure before breakout.

Short-term bullish channel still intact.

Key resistance zones: 1.3581 and 1.3605.

🎯 Trade Setup Scenarios

📈 Long Scenario

Entry: 1.3556 – 1.3560 (trendline bounce)

Stop Loss: 1.3535

Take Profits: 1.3581 → 1.3605

✅ Wait for M30/H1 confirmation like bullish engulfing or price-action breakout.

📉 Short Scenario

Entry: 1.3605 (if price rejects resistance)

Stop Loss: 1.3630

Take Profits: 1.3581 → 1.3556

⚠️ Trigger only on bearish rejection with strong candle and volume at resistance.

📌 Strategic Outlook

USD/CAD is caught in a tug-of-war: stronger Canadian fundamentals (oil + yields) vs. cautious USD movement post-FOMC. If oil prices and Canadian yields continue to climb, CAD may remain in favor. However, short-term technical rebounds toward 1.3600 remain valid if price structure holds.

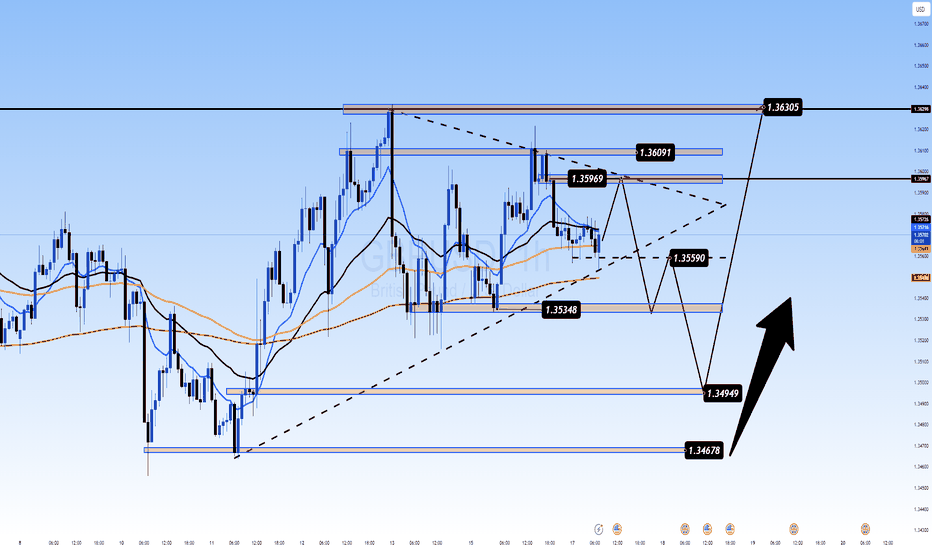

The Calm Before the Storm: All Eyes on UK CPI & Central BanksGBPUSD 17/06 – The Calm Before the Storm: All Eyes on UK CPI & Central Banks

The GBPUSD pair is coiling in a tight range near the mid-1.3500s as traders brace for two high-impact events: UK CPI data on Wednesday and interest rate decisions from both the Fed and BoE this week. Price remains supported above the 200 EMA and is compressing within a symmetrical triangle – typically a precursor to a major breakout.

📊 Macro & Fundamental Outlook

🔹 Federal Reserve (FOMC): Expected to hold rates steady, but growing anticipation of a dovish tilt toward September is weighing slightly on the USD.

🔹 Bank of England (BoE): Markets are pricing in deeper rate cuts following recent UK GDP weakness, pressuring the GBP in the short term.

🔹 Geopolitical Risks: Rising Middle East tensions are fuelling demand for USD as a safe haven, reinforcing its strength ahead of data events.

📝 Bottom Line: The CPI release could be the first trigger to shift GBPUSD’s current consolidation. A hot inflation print might push GBP higher; a miss could fuel further downside.

🔧 Technical Analysis (H1 Chart)

Price is ranging between 1.3535 (support) and 1.3609 (resistance)

EMAs 13/34 crossing below EMA 89 → signal of potential bearish continuation

Uptrend line from 1.3467 is still intact and acting as dynamic support

Break below 1.3559 may lead to a move toward 1.3495 and 1.3467

A confirmed breakout above 1.3609 opens the door to 1.3630+

🎯 Trade Scenarios

Scenario 1 – Buy from Trendline Support

Buy Zone: 1.3495 – 1.3467

Stop Loss: 1.3440

Targets: 1.3535 → 1.3559 → 1.3596 → 1.3630

🟢 Best setup if price prints a bullish engulfing or hammer candle on key support + UK CPI surprise.

Scenario 2 – Sell on Resistance Rejection

Sell Zone: 1.3609 – 1.3630

Stop Loss: 1.3660

Targets: 1.3590 → 1.3559 → 1.3535 → 1.3495

🔴 Only valid with strong rejection signals + softer UK data or hawkish Fed tone.

💡 Market Sentiment

Retail traders are trapped in a waiting zone – expecting a breakout

Institutions may push price into one direction pre-data to collect liquidity

Risk appetite is fragile, and traders are cautious ahead of back-to-back central bank announcements

📌 Final Thoughts

GBPUSD is preparing for volatility. Instead of chasing moves, let the market come to your key zones and react with discipline. The 1.3467–1.3495 support area could be crucial for the next directional move.

Stay patient. Wait for confirmation. Respect your risk.

Weak Pullback, Bears in Control | Will the $100K Zone Hold? BTCUSD – Weak Pullback, Bears in Control | Will the $100K Zone Hold?

🌍 Macro & Fundamental Outlook

Bitcoin continues to face downside pressure after failing to hold above the key $108K resistance. Several macro factors are influencing sentiment:

📉 US bond yields are rising again, as markets expect the Fed to delay rate cuts. This adds pressure on risk assets like BTC.

🪙 Bitcoin Spot ETF inflows remain positive, but are currently not strong enough to counter short-term selling pressure.

💵 The DXY (US Dollar Index) is recovering, as investors flee to USD amid geopolitical volatility in the Middle East.

📊 Institutional liquidity is thinning across exchanges, adding to intraday volatility.

📉 Technical Analysis – H1 Chart

🔹 Trend Structure:

BTC is now firmly in a short-term downtrend, trading below the descending trendline and all key moving averages (EMA 34, 89, 200).

Rejection from every pullback suggests that sellers are still in control.

🔹 Key Price Zones:

Bearish FVG Resistance: 106,096 – 107,004

First Support Zone: 102,821

Major Support Zone: 101,539 → 100,419

A clean break below 100K could open the door to 98,000 and below

🔹 Momentum:

RSI is neutral, hovering around the mid-40s without strong divergence signals.

Selling volume is increasing but not yet explosive — indicating the market may be awaiting a macro catalyst.

🧠 Market Sentiment

Traders are currently in “wait-and-see” mode, eyeing the next round of macroeconomic data and potential Fed commentary.

Short-term profit-taking is dominant after last week’s sharp rally.

Overall sentiment: Bearish short-term – Neutral mid-term – Bullish long-term

🎯 Trade Setup Ideas

🔻 SELL if price retests FVG and gets rejected

Entry: 106,000 – 107,000

Stop-Loss: 107,500

Targets: 102,821 → 101,539 → 100,419

🔹 BUY if price reacts strongly from 100,419 – 101,500

Entry: 100,500 – 100,800

Stop-Loss: 99,800

Targets: 102,800 → 104,400 → 106,000

Preference is given to selling the rally in the short term. Buying should only be considered on confirmed reversal signals at key support.

✅ Conclusion

BTCUSD is currently in a corrective phase, with bears maintaining control. The key level to watch is the $100,419 support zone, which may determine whether Bitcoin maintains its medium-term bullish structure or breaks further. Discipline and confirmation are crucial in this volatile environment.

📌 Strategy Focus: Look to sell rallies toward resistance; buy only on confirmed bounce from strong support zones.

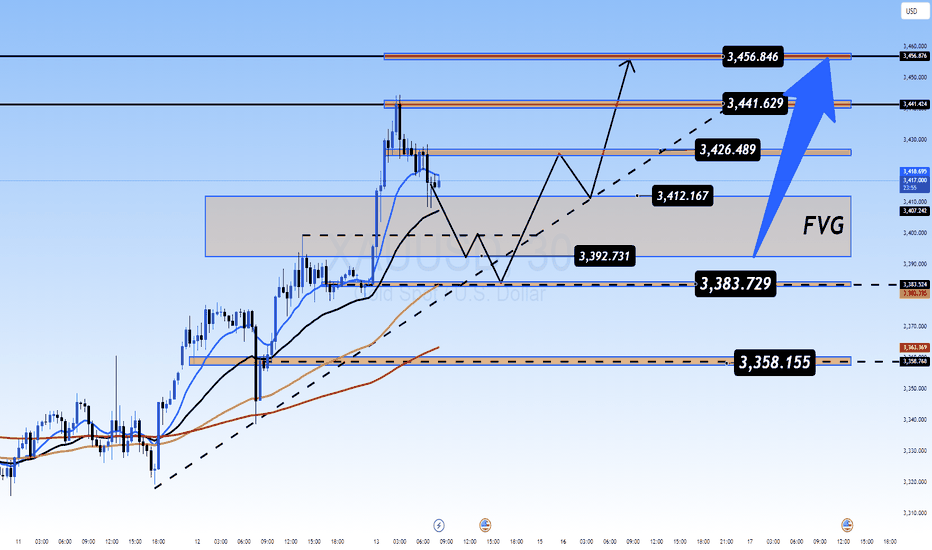

Gold Surges on Middle East Conflict: What's the Next Move?XAUUSD – Gold Surges on Middle East Conflict: What's the Next Move?

🌍 Geopolitical Shock Fuels Market Volatility

The gold market responded sharply after Israel launched a series of targeted airstrikes on Iran’s nuclear facilities, including the Natanz uranium site. These actions triggered global concern:

Gold jumped to $3,430/oz, hitting a new weekly high

WTI crude surged by over 8%

US equity indices dipped significantly

The US remains officially neutral but confirmed it will defend its troops if provoked

Investors are now moving rapidly into safe-haven assets, especially gold.

📊 Technical Breakdown (H1/M30)

Trend Structure: Bullish momentum continues following the breakout above $3,392

Key Support Zone: $3,412–$3,426, with price holding above this region

Fair Value Gap (FVG): Identified between $3,405–$3,412, could act as re-entry zone

EMA Alignment: Price is above the 13, 34, 89, and 200 EMAs — signalling strength across short and long-term moving averages

Psychological Resistance: Eyes now on the $3,454–$3,456 zone for potential selling pressure

🧠 Market Sentiment & Risk Behaviour

Risk-off mood dominates: Capital is rotating into gold, CHF, and JPY

Traders are reacting to news headlines over economic data

Institutional flows are entering strongly on dips, building positions in defensive assets

🎯 Trade Setup for 13th June

✅ Buy Zone: 3384 – 3382

Stop-Loss: 3378

Targets: 3388 – 3392 – 3396 – 3400 – 3405 – 3410

❌ Sell Zone: 3454 – 3456

Stop-Loss: 3460

Targets: 3450 – 3446 – 3442 – 3438 – 3434 – 3430

📌 Tactical Summary

Gold remains a go-to asset amid geopolitical uncertainty. While the technicals support further upside, caution is warranted near resistance. Any easing in military headlines could trigger a fast retracement.

🔍 Pro tip: Avoid chasing. Let price confirm near key levels before entering. Manage risk diligently in high-volatility environments.

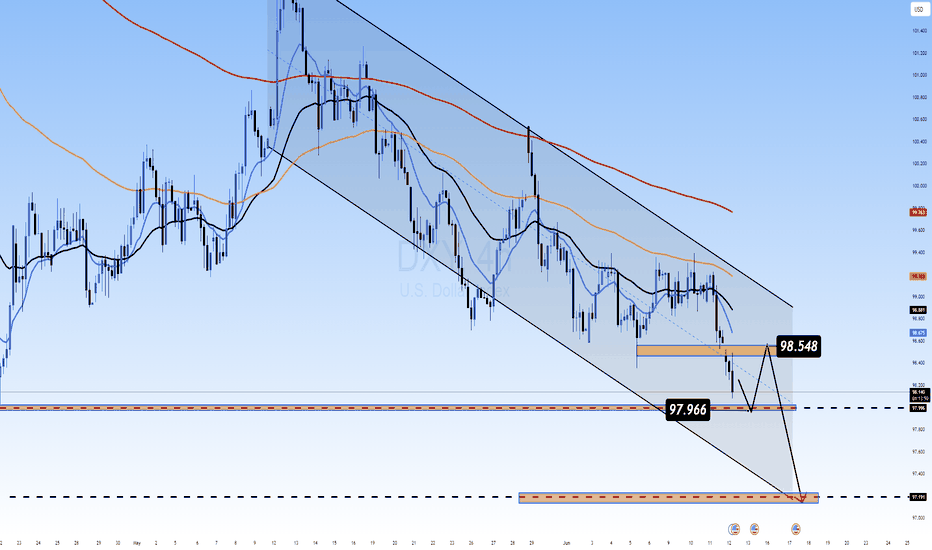

DXY H4 – Dollar Weakens Ahead of PPI Release DXY H4 – Dollar Weakens Ahead of PPI Release | Is the Market Pricing in a Fed Pivot?

🌐 Macro & Fundamental Context

As we head into the New York session on June 12, the market’s attention shifts to one critical data point: the US PPI (Producer Price Index). Following the softer-than-expected CPI reading of 2.4% YoY (vs. 2.5% forecast), the Dollar Index (DXY) dropped sharply—signaling fading inflation pressure and reigniting rate cut expectations.

✅ Bearish Fundamentals Building for the USD:

CPI miss fuels Fed rate cut bets (currently ~65% chance for September per FedWatch Tool).

US Treasury yields are easing, reflecting the market’s pricing of a less aggressive Fed.

Risk assets rallying as capital flows rotate away from USD into gold, equities, and long-duration bonds.

If today’s PPI also comes in below forecast, it could confirm a deeper correction in DXY. Conversely, a surprise PPI upside might trigger a short-term pullback.

📉 Technical Analysis – H4 Timeframe

🔹 Overall Trend:

DXY is locked within a clearly defined descending channel, with a consistent Lower High – Lower Low structure holding since late May.

🔹 Key Technical Zones:

Short-term resistance: 98.548 – likely to act as a ceiling unless PPI surprises to the upside.

Immediate support: 97.966 – a break below opens the door toward the key support zone at 97.191, which aligns with previous FVG imbalance and multi-timeframe demand.

🔹 EMA Structure:

Price remains below all major EMAs (13 – 34 – 89 – 200), confirming persistent bearish pressure.

EMA13 is currently acting as dynamic resistance on H4, pressing down on price.

🧠 Market Sentiment & Flow Insight

Investors are rotating out of USD as inflation fears fade and Fed easing expectations increase.

Risk-on sentiment is returning, benefiting gold and stocks while weighing on DXY.

However, a hot PPI print could spook the market briefly, leading to a corrective bounce in the Dollar before the trend resumes.

🔍 Scenarios to Watch:

PPI comes in lower than expected:

DXY may retest 98.548 resistance and reject lower.

Next targets: 97.966 → 97.191

PPI surprises to the upside:

Technical bounce toward 98.5–98.8 possible.

But trend remains bearish unless price reclaims 99.2+ zone.

✅ Conclusion

DXY remains under pressure from both macro and technical angles. The PPI report will be the next catalyst that determines whether this is a short-term dip or the continuation of a broader USD downtrend.

🎯 Tactical view: Favour short positions on DXY if price bounces into resistance and PPI supports the disinflation narrative. Target: 97.1 and below.

Gold Extends Gains Post-CPI | All Eyes on PPI for the Next Move XAUUSD – Gold Extends Gains Post-CPI | All Eyes on PPI for the Next Move

🌍 Macro Pulse: CPI Sparks Momentum, But Will PPI Sustain It?

Gold surged following softer-than-expected US inflation data on Tuesday, with the CPI rising just 0.1% MoM and 2.4% YoY—both below forecasts. This triggered a broad sell-off in the USD, a pullback in Treasury yields, and a renewed appetite for non-yielding safe havens like gold.

Markets are now increasingly pricing in a rate cut by the Fed in September, adding further fuel to the rally. However, Wednesday’s US PPI data could either reinforce this bullish sentiment or reverse it sharply.

📉 Technical Landscape – H1 & H4 View

🔹 Trend Bias

The bullish structure remains intact, with price carving out higher highs and higher lows since the 3312 level. The recent breakout above 3370 confirms bullish momentum.

🔹 Price Channels

Gold continues to track within a defined ascending channel. A potential retest of the lower trendline near 3345–3350 could provide a dip-buying opportunity.

🔹 EMA Structure

The price trades comfortably above the 13, 34, 89, and 200 EMAs.

Short-term EMA crossovers are supportive of continued upside.

🔹 Critical Resistance Ahead: 3392 – 3395

A key technical zone combining Fibonacci extension levels and recent rejection wicks. A decisive break or rejection here will set the tone for the next 48 hours.

🧠 Market Psychology & PPI Scenarios

The market is currently optimistic, but still cautious. The PPI report due later today will likely serve as the next directional trigger:

If PPI prints below estimates → reinforces disinflation narrative → potential breakout above 3,400 with upside targets towards 3,420+.

If PPI comes in hot → raises concerns about sticky input costs → possible short-term reversal or consolidation.

Expect volatility to spike during the New York session.

🎯 Today’s Tactical Trade Setups – 12 June

🟢 Buy Zone: 3324 – 3322

Stop Loss: 3318

Take Profit Targets: 3330 – 3334 – 3338 – 3342 – 3346 – 3350

🟢 Buy Scalp Zone: 3337 – 3335

SL: 3330

TPs: 3341 – 3345 – 3350 – 3354 – 3360 – 3370 – 3380

🔴 Sell Zone: 3392 – 3394

Stop Loss: 3398

Take Profit Targets: 3388 – 3384 – 3380 – 3375 – 3370 – 3360 – 3350

✅ Final Take

Gold bulls are in control, but the PPI data will likely dictate whether momentum continues or stalls. With key resistance just ahead and macro risk on the table, this is not the time to trade blindly.

🧭 Strategy Tip: Let price confirm the reaction to PPI. Don’t pre-position into volatility. Play the breakout or the fade—but wait for clarity.

Oil's Volatility Meets Fed's Patience: A Path to 1.3643?USDCAD – Oil's Volatility Meets Fed's Patience: A Path to 1.3643?

🌍 Macro Landscape: Diverging Monetary Paths & Oil's Influence

The USDCAD pair is currently navigating a complex environment shaped by diverging central bank policies and the significant influence of crude oil prices. While the Federal Reserve is signaling a "higher-for-longer" interest rate stance due to sticky inflation, the Bank of Canada (BoC) is in a more nuanced position, balancing inflation control with economic growth. This divergence creates a fundamental tailwind for the USD.

However, Canada's economy is heavily tied to commodity prices, especially crude oil. Recent volatility in oil markets can exert significant pressure on the Canadian dollar. If oil prices remain subdued or face downward pressure, it could exacerbate the CAD's weakness against the USD, amplifying the impact of policy divergence.

🏦 Central Bank Policy Divergence: Fed's Firmness vs. BoC's Caution

Federal Reserve: FOMC members continue to signal patience on rate cuts. Recent inflation data (PCE, CPI) shows persistent price pressure, particularly in the services sector, reinforcing the Fed's hawkish bias. This suggests the USD may retain its strength as higher rates attract capital.

Bank of Canada: The BoC, while having taken aggressive steps previously, might be more cautious in its future rate decisions. Any dovish undertones or hints at pausing rate hikes could weaken the CAD. Conversely, a resurgence in inflation or stronger economic data could prompt the BoC to maintain a firm stance.

This policy divergence, coupled with external factors like commodity prices, creates a fertile ground for significant moves in USDCAD.

🌐 Capital Flows: Safe-Haven Dynamics and Commodity Impact

Global capital flow models indicate a shift towards the US dollar as a preferred safe haven amidst geopolitical tensions and global economic uncertainties. While Gold remains a traditional hedge, the USD's yield advantage makes it an attractive destination for institutional capital.

For CAD, its sensitivity to commodity prices means that capital flows are heavily influenced by the outlook for global growth and energy demand. A softening global economic outlook could lead to reduced demand for commodities, weighing on the CAD, and potentially driving inflows into USD-based assets.

📊 Technical Structure: Channel Breakdown & Bearish Momentum Towards 1.3643

On the H1 chart (as observed from the provided image):

Price Channel: USDCAD has been trading within a clear ascending channel. However, the price recently broke below the lower boundary of this channel, suggesting a potential shift in momentum from bullish to bearish.

Moving Averages: The price has moved below the EMA 13 – 34 – 89. This bearish alignment (EMA "fan-out formation" in reverse) confirms a short-term bearish momentum is building. The 200 EMA (red line) is currently acting as a key resistance level, near the prior support turned resistance.

Key Resistance (Sell Zone): The region around 1.36989 (aligning with previous support and possibly a Fibonacci retracement level) is now acting as a crucial resistance. Any retest of this zone, especially with bearish candlestick patterns, could offer selling opportunities. The 200 EMA reinforces this zone as a strong overhead barrier.

Key Support (Target Zone): The price is projected towards 1.36431. This level aligns with a strong prior support and also coincides with the Fibonacci Extension 1.382 level from a previous swing, making it a high-probability target for bearish moves. A bounce from 1.36734 (a mid-channel support or Fibonacci level) could offer a temporary reprieve, but the overall technical structure points to the lower target.

🎯 Trade Strategy Recommendations

Scenario 1 – Sell the Pullback (Preferred):

Entry: 1.3685 – 1.3695 (retest of broken channel line/resistance near 1.36989, possibly confluence with 200 EMA).

Stop-Loss: 1.3720 (above recent swing high/channel top).

Take-Profit: 1.3673 (initial target) → 1.3643 (main target) → 1.3620.

Scenario 2 – Breakout Momentum Sell (if price consolidates below 1.3673):

Entry: 1.3670 (break below 1.36734 with strong bearish momentum).

Stop-Loss: 1.3690.

Take-Profit: 1.3643 → 1.3620.

⚠️ Key Events to Watch:

US PCE Price Index (upcoming data): If hotter-than-expected, this would reinforce the Fed’s hawkish tone and lift USD.

Canadian CPI (upcoming data): Cooler-than-expected inflation could prompt a more dovish stance from the BoC, weakening CAD.

Crude Oil Inventory/News: Any significant news or data regarding global oil supply/demand can directly impact CAD.

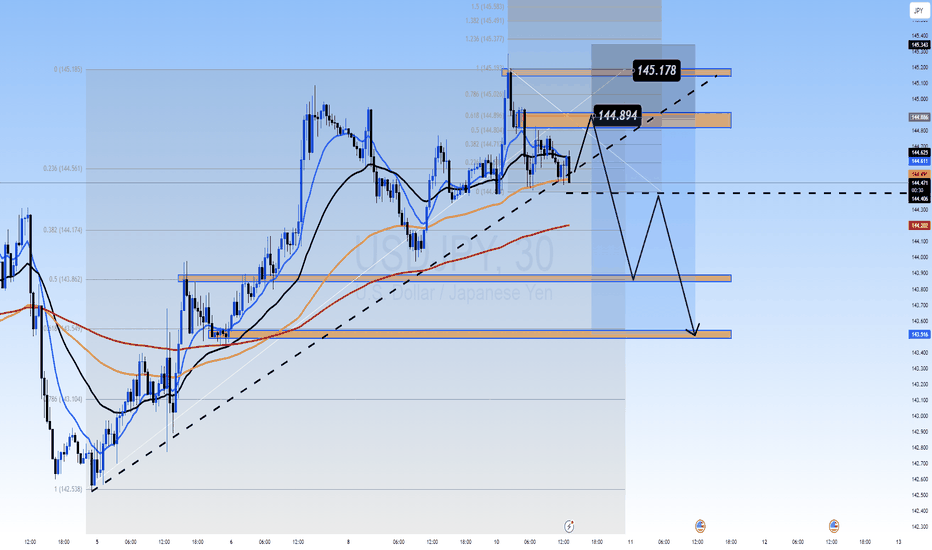

Storm Ahead? Key Level Breakout or Dangerous Reversal!USD/JPY: Storm Ahead? Key Level Breakout or Dangerous Reversal!

Overview:

The USD/JPY pair stands at a crucial crossroads, with technical signals indicating the potential for significant volatility in the near term. Will the Yen regain its footing, or will pressure from the USD continue to push the pair to new highs? This analysis delves into technical, fundamental, and macroeconomic factors to outline potential scenarios and identify key trading zones.

Detailed Technical Analysis:

Primary Trend: The USD/JPY chart clearly shows a short-term uptrend, supported by an ascending trendline (dashed line on the chart) and upward-sloping moving averages (MA). Trend analysis is considered the most important area of technical analysis, and is key to determining the general direction of a security. However, the price is approaching strong resistance zones, suggesting potential selling pressure. Technical analysis is a trading tool used to evaluate stocks and attempt to predict their future movements by analyzing statistical data obtained from trading activity.

Key Price Levels:

Crucial Resistance Zone (SELL Zone): Around 144.894 - 145.178. This is a significant Fibonacci Extension zone (1.13 and 1.236), where the price has reacted in the past and could attract strong selling pressure. If the price breaks and holds above this zone, the uptrend will be confirmed.

Crucial Support Zone (BUY Zone): Around 143.600 - 143.750. This support zone is formed by previous lows and the ascending trendline. If the price corrects to this zone and shows reversal signals, it could be a good buying opportunity. The next support zone is around 142.800. The goal of technical analysis is to determine the buy and sell points of a stock.

Technical Indicators: The MAs (blue, orange, red) maintain a relatively consistent distance and are sloping upwards, supporting the uptrend. However, the convergence of MAs near resistance zones could signal a weakening of upward momentum.

Price Patterns: Currently, the price is forming a pattern similar to a bull flag or an ascending triangle, suggesting a potential continuation of the uptrend if it breaks upwards. Conversely, if the price fails to overcome resistance and breaks the uptrend line, a bearish reversal pattern could form. Wave analysis is a technique based on the observation that markets move in specific patterns called waves.

Relevant Fundamental and Economic Factors:

Macroeconomic Analysis (Japan): The Bank of Japan (BOJ) continues to maintain ultra-loose monetary policy, with negative interest rates and yield curve control. This exerts continuous downward pressure on the Yen. Any signal of change from the BOJ regarding policy will have a significant impact on USD/JPY.

Macroeconomic Analysis (United States): The U.S. Federal Reserve (FED) is still in an aggressive monetary tightening cycle to combat inflation. Inflation reports (CPI, PPI), employment data (NFP), and statements from FED officials will be key drivers for the USD. If U.S. inflation remains high, the FED may continue to raise interest rates, pushing USD/JPY higher. Fundamental analysis focuses on evaluating economic, political, and social factors affecting the value of a currency pair.

Upcoming Economic Events: Closely monitor inflation reports from both the U.S. and Japan, GDP data, unemployment rates, and policy meetings of the BOJ and FED. These events will act as catalysts for sharp movements.

Conclusion and Trading Recommendations:

USD/JPY is in an uptrend but approaching crucial resistance zones.

BUY

Entry: When the price breaks and closes above 145.178, confirming the uptrend continuation. Or when the price corrects to the 143.600 - 143.750 zone and shows bullish reversal candles (e.g., bullish engulfing, hammer).

Take Profit: Higher Fibonacci levels (e.g., 1.382 at 145.491 or 1.5 at 145.918).

Stop Loss: Below the nearest support zone, e.g., below 143.500 if buying at support, or below 144.800 if buying after a resistance breakout.

SELL Scenario:

Entry: When the price approaches the 144.894 - 145.178 zone and strong bearish reversal signals appear (e.g., Gravestone Doji, bearish engulfing, double top pattern).

Take Profit: Lower support levels, e.g., 143.700, 142.800.

Stop Loss: Above the resistance zone, e.g., above 145.300.

Risk Disclaimer: Financial markets always involve high risks. Always manage your capital carefully and never trade with money you cannot afford to lose. This analysis is for informational purposes only and not investment advice.

09/06/2025: WILL WE SEE A BREAKOUT ABOVE 1.3550?GBP/USD PLAN – 09/06/2025: WILL WE SEE A BREAKOUT ABOVE 1.3550?

🌍 Macroeconomic & Fundamental Context:

UK Economic Outlook (BoE): The Bank of England (BoE) is under pressure due to inflation and has to make decisions regarding interest rate policy. Diverging opinions on whether to raise or lower rates are creating uncertainty in the market.

US Economic Outlook (Fed): The Federal Reserve's monetary policy continues to be a major influence on the USD, especially as the Fed maintains its rate hikes to control inflation.

US-UK Trade Relations: Trade negotiations between the US and the UK will remain an important factor this week, and any new developments could impact GBP/USD.

📉 Technical Analysis – GBP/USD:

On the H4 and H1 timeframes, GBP/USD is consolidating within a corrective structure, and price has broken several key Fibonacci levels. The EMA indicators (13, 34, 89) are showing strong momentum.

Key Resistance Levels:

1.3550 – This is a major resistance level. If broken, GBP/USD could continue its rally towards 1.3612.

Key Support Levels:

1.3520 – A short-term support level. If this breaks, price may retrace back to 1.3470.

🎯 Trading Scenarios for Today:

🟢 BUY ZONE:

Buy Zone: 1.3520 – 1.3500

SL: 1.3480

TP: 1.3550 → 1.3570 → 1.3600 → 1.3620 → 1.3650

If price retraces to 1.3520 – 1.3500, this would be an ideal buying opportunity with a target at 1.3550. Look for confirmation from technical indicators and the current trend.

🔴 SELL ZONE:

Sell Zone: 1.3550 – 1.3570

SL: 1.3590

TP: 1.3520 → 1.3500 → 1.3470 → 1.3450 → 1.3420

If price reaches the resistance zone of 1.3550 – 1.3570, consider selling with targets at the support levels below.

🟡 Scalping:

Buy Scalping: 1.3520 → 1.3500

Sell Scalping: 1.3570 → 1.3600

Look for short-term opportunities when price moves within the range.

⚠️ Important Notes:

Pay close attention to short-term fluctuations and any major economic data releases from the BoE and Fed.

Risk management is key during volatile periods.

📌 Conclusion:

GBP/USD is in a short-term corrective phase, but a breakout above 1.3550 could trigger a strong rally. Traders should monitor support and resistance levels carefully and ensure risk management is in place.

WILL EUR CONTINUE TO RALLY AHEAD OF THE IMPORTANT NFP DATA?EUR/USD – WILL EUR CONTINUE TO RALLY AHEAD OF THE IMPORTANT NFP DATA?

📈 EUR/USD IS AT A CRITICAL POINT AHEAD OF KEY ECONOMIC DATA

Amid the ongoing pressure on the US Dollar and macroeconomic factors supporting the Euro, EUR/USD might continue its short-term bullish trend. However, key data such as US CPI and central bank meetings could determine the direction for this currency pair moving forward.

🌍 Macroeconomic Overview & Market Sentiment

USD & DXY: The US Dollar continues to weaken due to signals from the Federal Reserve (Fed) that they are not in a hurry to cut interest rates. DXY has fallen below the 99 level, with macroeconomic factors showing a continued bearish trend for the USD.

Eurozone: The ECB (European Central Bank) is maintaining a slightly tight monetary policy. However, the Eurozone economy is showing signs of recovery, with positive data from the region.

US Economy: Forecasts for the US labor market data could impact the USD and lead to volatility in the EUR/USD pair. All attention is on the reports from the US this week.

📊 Technical Analysis (H1 – H4 – D1)

EMA 13/34/89/200: The EMA indicators on the H1 and H4 timeframes support the current bullish trend for EUR/USD in the short term. In particular, the EMA 13 and EMA 34 are crossing above the EMA 200, signaling a strong upward trend.

Wave Structure: EUR/USD is currently in a corrective wave after testing the strong resistance level at 1.1450. A recovery signal is emerging around the support level at 1.1380, which could present a buying opportunity in the short term.

Fibonacci Expansion: The Fibonacci extension levels at 1.1470 and 1.1490 could be the next targets if EUR/USD breaks through the 1.1400 resistance zone.

⚡ Key Levels to Watch

Resistance: 1.1450, 1.1470, 1.1490, 1.1500

Support: 1.1380, 1.1350, 1.1320, 1.1300

🧭 Trading Scenario

🔵 BUY ZONE: 1.1380 – 1.1365

SL: 1.1340

TP: 1.1420 → 1.1450 → 1.1470 → 1.1490

🔻 SELL ZONE: 1.1450 – 1.1460

SL: 1.1475

TP: 1.1420 → 1.1400 → 1.1370 → 1.1350

✅ Summary

EUR/USD is currently in a short-term bullish trend and could continue to rise if the support at 1.1365 holds. However, key economic data from the US, especially CPI and central bank meetings from the Fed and ECB, could impact the next direction for this pair. Traders should keep an eye on important support and resistance levels to identify safe trading opportunities.

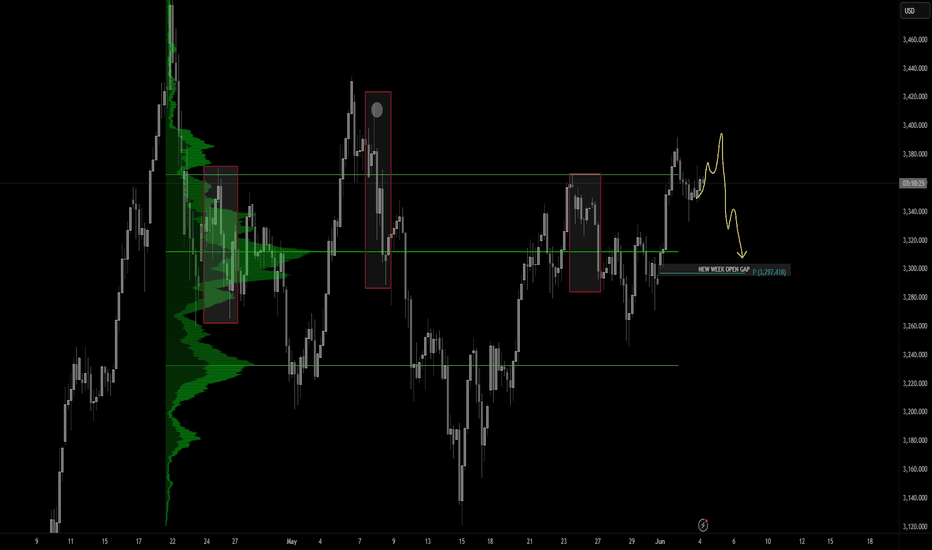

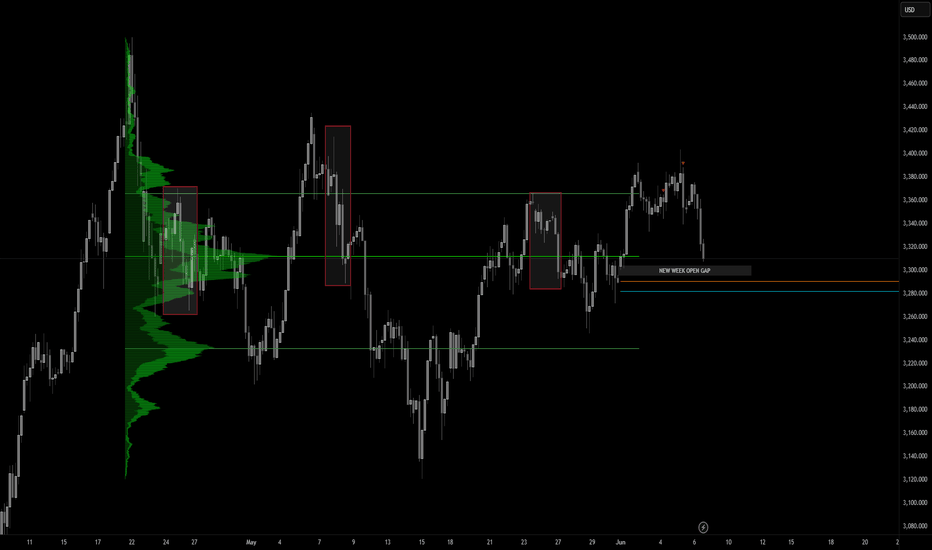

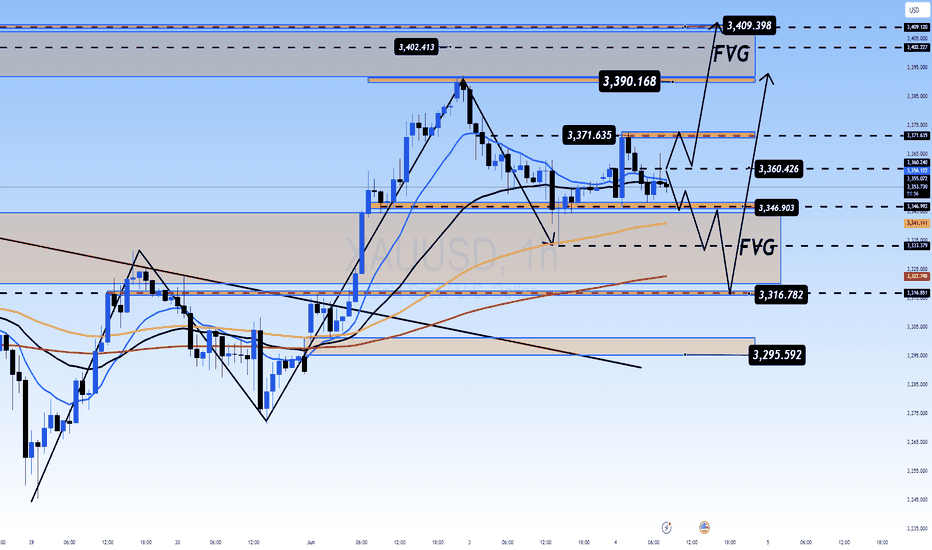

Gold liquidity run short setup In this video I map out the range using the fixed range tool and talk about the possibility of a liquidity run on the weekly high before dropping back inside the range .

Engineering liquidity at the range value area high and thus heightening the expectation for more upside continuation , take the liquidity at $3392 and pull back below the vah *Value area high and head down to fill the new week open gap and the new monthly pivots $3297 and the poc * point of control and remain rangebound.

We all know that nothing is set in stone and this is just an idea out of many but its something to consider .

Set alerts and wait for reaction and lower time frame for confirmation

Thanks for your support

PMI Divergence & ECB Rate Decision Looms:0.84 Key Level in PlayEURGBP 04/06 – PMI Divergence & ECB Rate Decision Looms: 0.84 Key Level in Play

EUR/GBP is hovering around the 0.8420 mark after mixed PMI releases from the Eurozone and Germany. Traders are cautiously awaiting the ECB’s interest rate decision this Thursday, while the Bank of England signals potential easing — but remains non-committal on timing.

🌍 MACRO OUTLOOK

Eurozone & German PMI:

Eurozone Composite PMI eased to 50.2, still above forecasts (49.5) but reflecting slowing momentum.

German Composite dropped to 48.5; Services fell further to 47.1 — signaling contraction risk in Europe’s largest economy.

ECB Dovish Expectations:

Core inflation fell to 1.9% YoY in May — below the 2% ECB target for the first time in eight months.

Markets are fully pricing in a 25bps rate cut this week.

BoE Shifts Cautiously Dovish:

Governor Andrew Bailey acknowledged that monetary easing is likely, but warned of "uncertainty ahead."

The MPC is split — some fear sticky inflation; others warn that rates staying too high too long may damage growth.

Market Sentiment:

EUR remains pressured by ECB dovish expectations.

GBP is also under pressure from weak UK macro indicators and global trade tensions.

📉 TECHNICAL OUTLOOK (H1 Chart)

Price is consolidating near the EMA200 (0.8409) — a crucial dynamic support.

A tight sideways range has formed; 0.8408 is a key horizontal level to watch for breakout/breakdown confirmation.

Break below 0.8408 could send price toward Fibo 1.618 at 0.8383 or psychological support at 0.8373.

If bulls defend 0.8408, we may see a bounce toward 0.8429 → 0.8449 resistance zone.

🔑 KEY TRADE ZONES

🟢 BUY ZONE: 0.8380 – 0.8373

SL: 0.8358

TP: 0.8400 → 0.8415 → 0.8429 → 0.8435

🔴 SELL ZONE: 0.8448 – 0.8450

SL: 0.8460

TP: 0.8435 → 0.8420 → 0.8408 → 0.8388

⚠️ TRADE STRATEGY

Watch the 0.8408 area closely. If price holds → short-term BUY scalp opportunities.

If it breaks strongly → consider SELL toward lower Fibo/structure levels at 0.838x.

Be cautious around ECB release — avoid trading during the spike. Wait for structure confirmation post-news.

📌 CONCLUSION

"EUR/GBP is entering a critical zone near 0.8400. With ECB and BoE both leaning dovish, expect increased volatility. Hold or break at this key level will likely define the next directional leg. Stay patient and let the market show its hand."

Gold Awaits Breakout: Will the 3345–3370 Range Explode? XAUUSD 04/06 – Gold Awaits Breakout: Will the 3345–3370 Range Explode?

Gold is currently consolidating within a critical range between 3345–3370, following a wave 4 correction. After a sharp retracement to the 335x area, traders are closely watching for the next move — either a continuation of the correction or a breakout toward new highs.

🌍 MACRO CONTEXT

Trump–Xi Call Incoming: A high-level diplomatic call is expected in the coming days. Market participants are anticipating potential shifts in global trade sentiment.

US 10-Year Yields remain elevated, keeping pressure on gold in the short term. However, geopolitical risks and macro uncertainty still support demand for safe-haven assets.

The US Dollar Index (DXY) is showing signs of weakness after recent strength, which may give gold room for recovery.

📉 TECHNICAL ANALYSIS – H1 / H4 Timeframe

Gold is in a wave 4 structure within a 5-wave Elliott pattern. A break above 3370 could signal the beginning of wave 5, targeting 3400.

A breakdown below 3345 would imply deeper correction toward the 332x liquidity zone, completing wave 4 before a bullish continuation.

EMAs 13 and 34 remain above EMA200 on H1, indicating the broader uptrend is still intact.

🔑 STRATEGIC PRICE LEVELS

🟢 BUY ZONE: 3317 – 3315

Stop Loss: 3310

Take Profit: 3322 → 3326 → 3330 → 3334 → 3338 → 3345 → 3350 → 3360

🔴 SELL ZONE: 3372 – 3374

Stop Loss: 3378

Take Profit: 3368 → 3364 → 3360 → 3356 → 3350 → 3345

⚠️ STRATEGY RECOMMENDATION

Respect the 3345–3370 range until a breakout is confirmed.

Avoid chasing trades in the middle of the range. Wait for strong rejections or clear breakout confirmations.

Be cautious with unexpected news from the Trump–Xi call, which may trigger sudden market volatility.

📌 FINAL THOUGHT

“Gold is at a turning point. Break above 3370 and we may see wave 5 unfold toward 3400. But a breakdown below 3345 could drag price lower before the next bullish leg begins. Focus on the key zones — volatility is just getting started.”