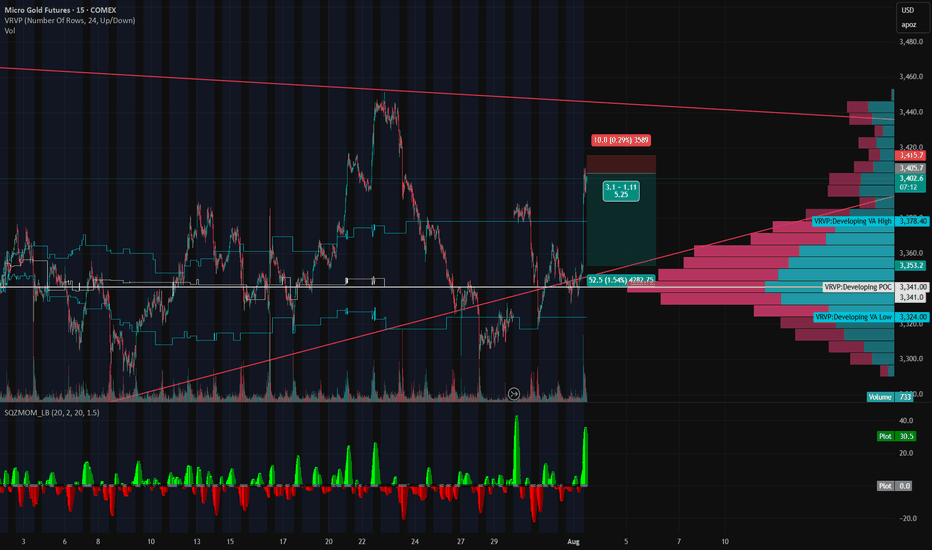

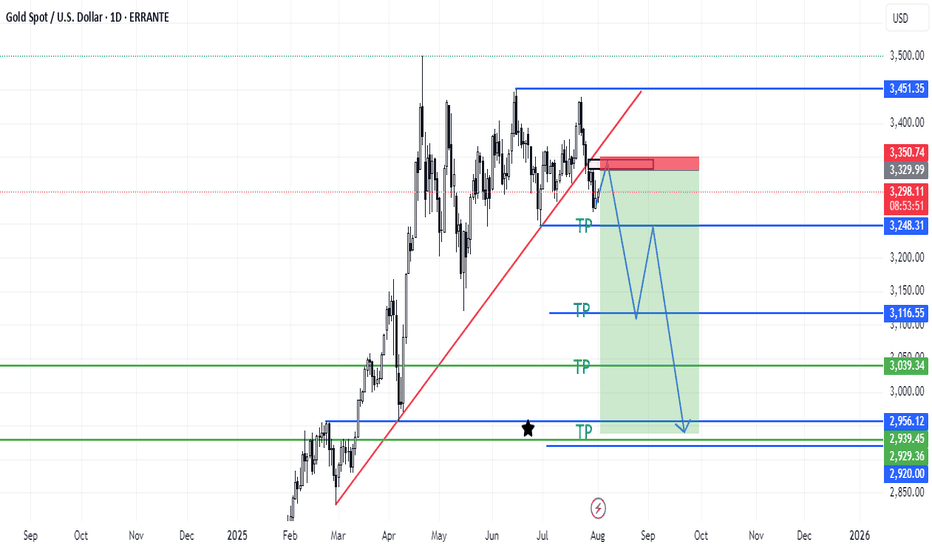

Gold’s on a Roller Coaster — and We’re Riding It Down🎢 Gold’s on a Roller Coaster — and We’re Riding It Down 🎢

Gold just snapped up like it saw Trump tweet “TARIFFS ARE BACK” — but the move smells like a knee-jerk algo pump, not real conviction. We just rejected right into a thin-volume imbalance zone and tagged the underside of a long-standing trendline.

📉 Short Setup Locked In:

💥 Entry: 3405

🛑 Stop: 3415

🎯 Target: 3353

💰 R:R ≈ 5:1

🔍 Why I'm In This Trade:

That rip? Total headline panic, not structural strength.

Low volume shelf above, with a massive POC magnet below at 3353.

We tapped the Developing VAH (3414) and got rejected — classic trap setup.

SQZMOM showing the energy is already fizzling. Green flash, no follow-through.

🧠 The Narrative:

Gold’s trying to price in volatility from every angle — Trump talk, tariffs, macro chaos — but under the hood, this pop looks unsustainable. If this is just a liquidity grab, we could see a flush back into the meat of value fast.

Grab your helmets — this roller coaster might just be heading downhill 🎢📉

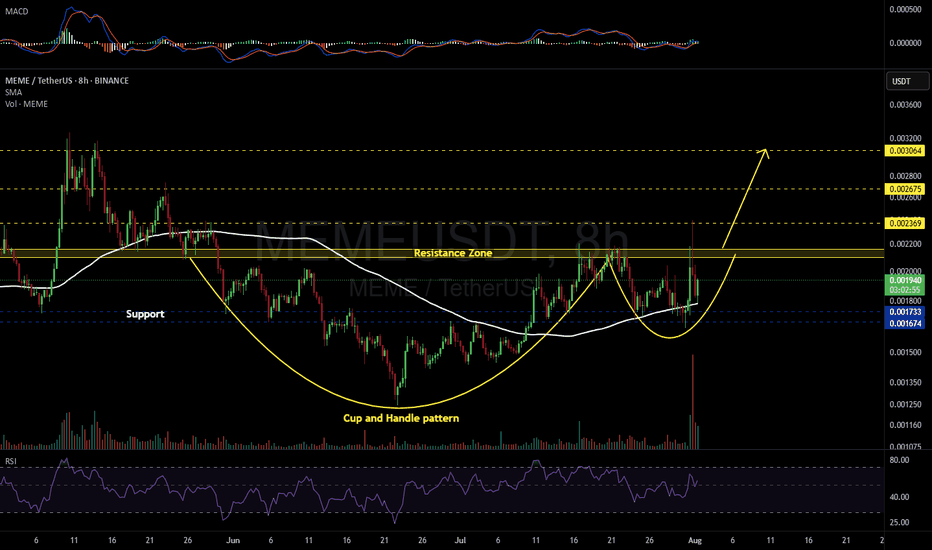

Chart Patterns

MEMEUSDT 8H#MEME has formed a Cup and Handle pattern on the 8H timeframe. It has bounced nicely off the SMA100, and volume is showing signs of strong accumulation.

📌 Consider entering this coin only after a solid breakout above the resistance zone.

If the breakout occurs, the potential targets are:

🎯 $0.002369

🎯 $0.002675

🎯 $0.003064

⚠️ As always, use a tight stop-loss and apply proper risk management.

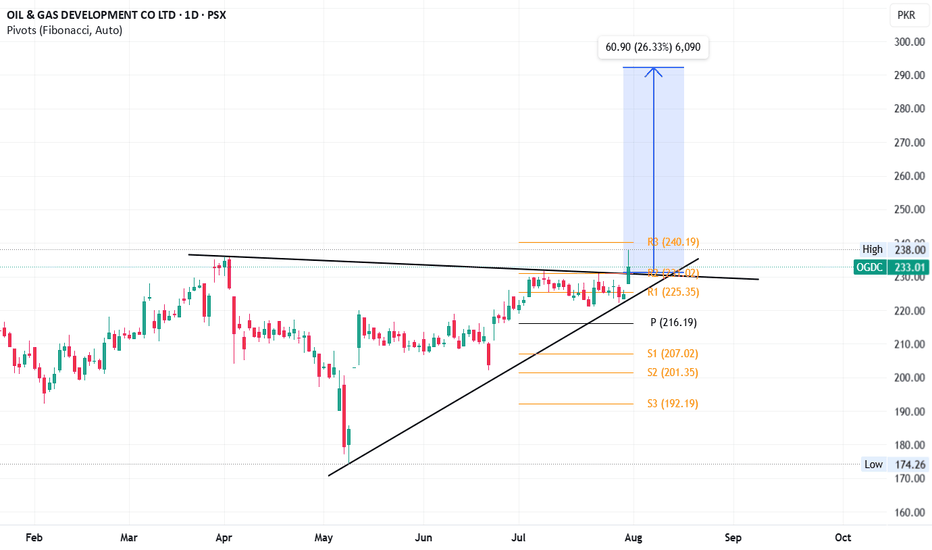

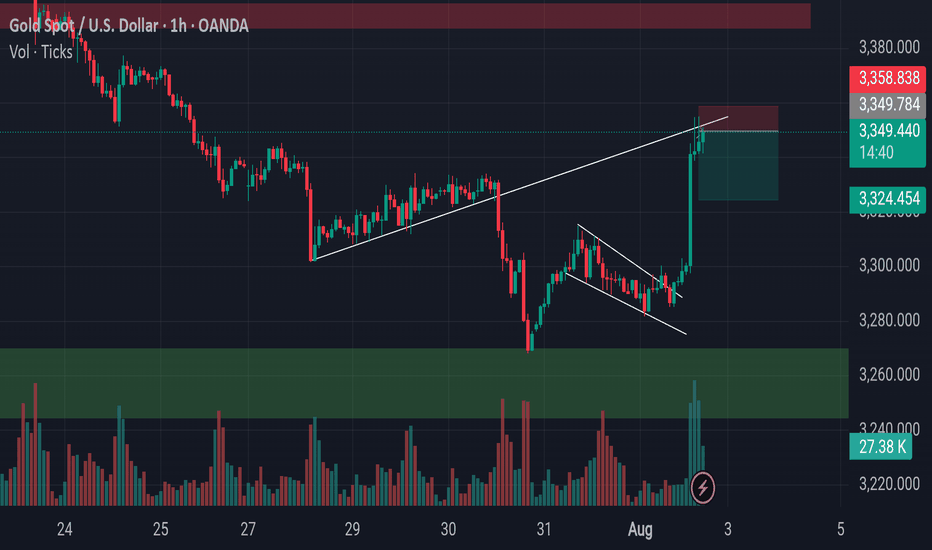

Gold Approaches Key Reversal Zone After Liquidity Sweep.Gold has recently broken out of a parallel channel during the New York session, followed by a strong upward move triggered by the NFP (Non-Farm Payroll) news event. Currently, the market is trading near a key trendline resistance zone. In this area, the price has also swept the liquidity residing above recent highs, indicating that potential buy-side liquidity has been taken out.

This level now becomes critical for observation. If the market forms a Market Structure Shift (MSS) or provides any valid bearish confirmation — such as a strong rejection candle, bearish engulfing, or a break of lower timeframe support — then there is a high probability that a downward move may follow from this zone.

As always, conduct your own research (DYOR) and wait for price action to confirm the bias before executing any trades. Acting on confirmation rather than assumptions protects both capital and strategy.

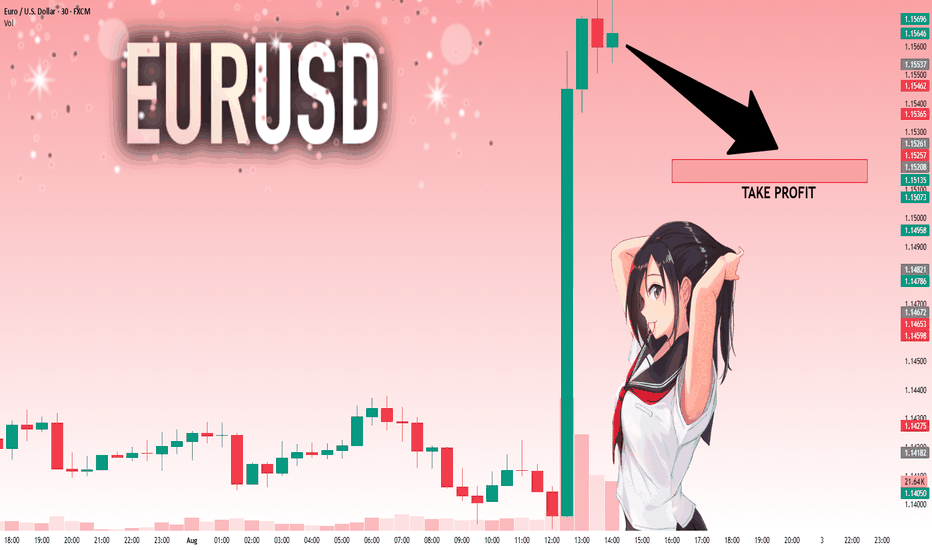

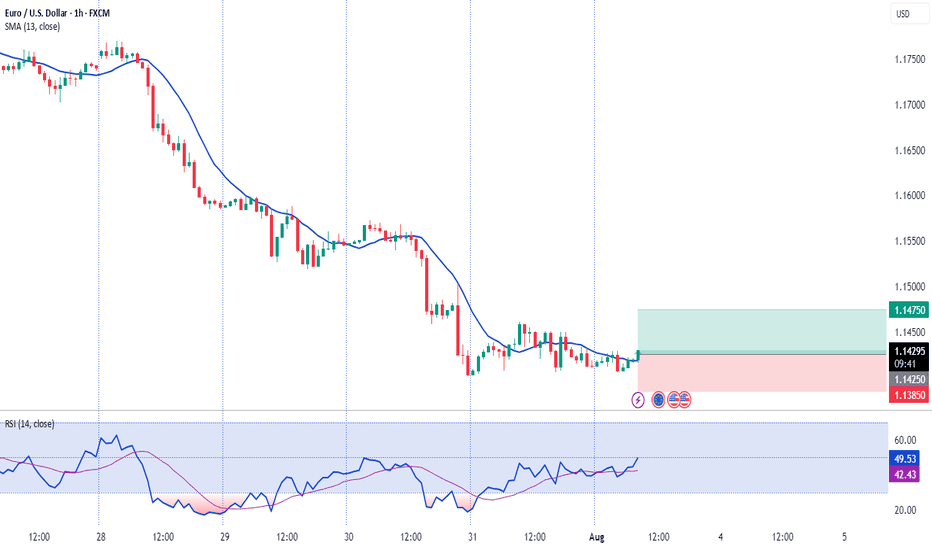

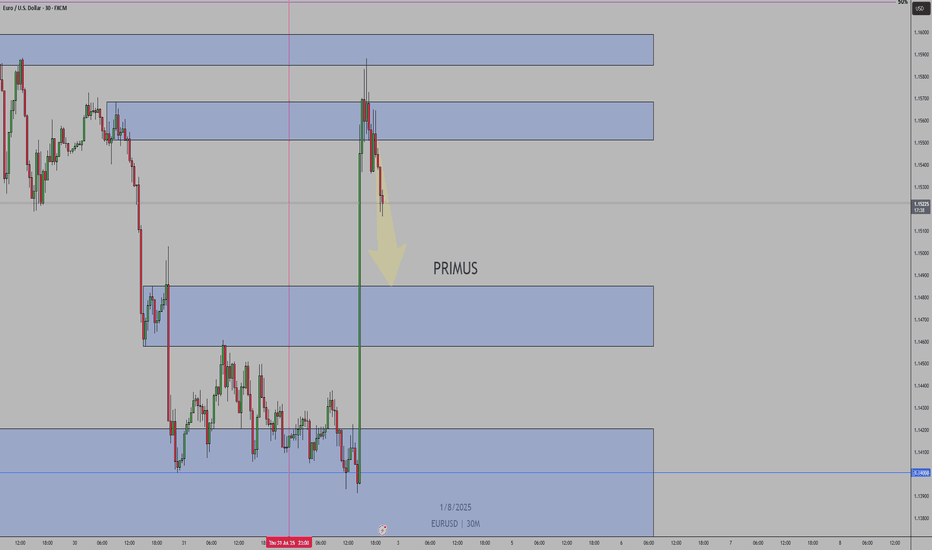

EURUSD: Move Down Expected! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.15337 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1.15208.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

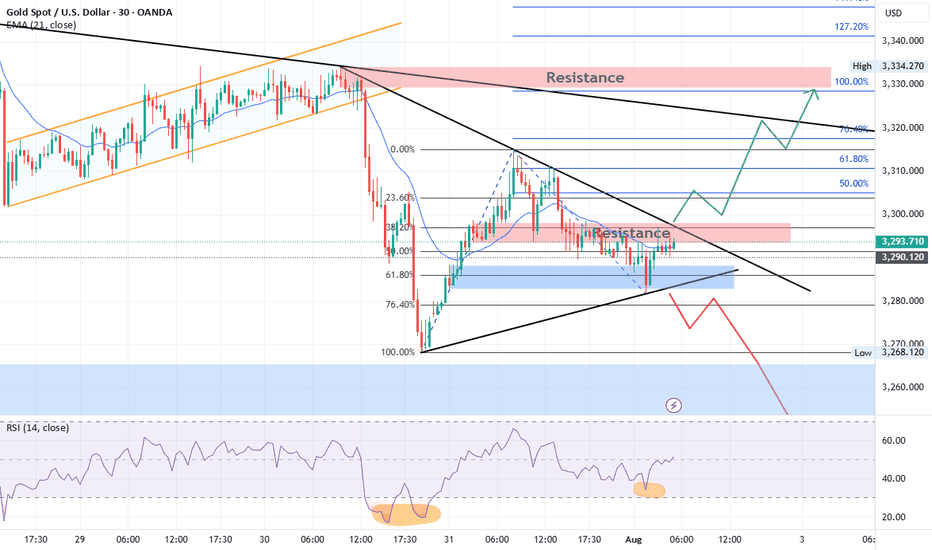

Gold Technical Outlook

Gold is currently consolidating inside a triangle pattern. After a recent bullish rally, price retraced between the 61.8% – 76.4% Fibonacci levels, finding support and bouncing upward. At present, gold is facing resistance at both the falling trendline and the 3298–3300 zone.

Bullish Scenario:

A breakout above the resistance trendline and the 3298–3300 zone could trigger a strong bullish move toward 3311, 3322, and 3333. A sustained break above 3333 would confirm a short-term bullish trend, opening the way for higher targets at 3360 and 3400.

Bearish Scenario:

If price faces rejection from the 3300 resistance and the falling trendline, gold is expected to move lower, retesting 3270. A decisive break below 3270 may extend the decline toward 3250. If 3250 is broken, gold could enter strong bearish momentum, potentially shifting the long-term trend to the downside with targets at 3000 and 2850.

OANDA:XAUUSD Gold Technical Outlook

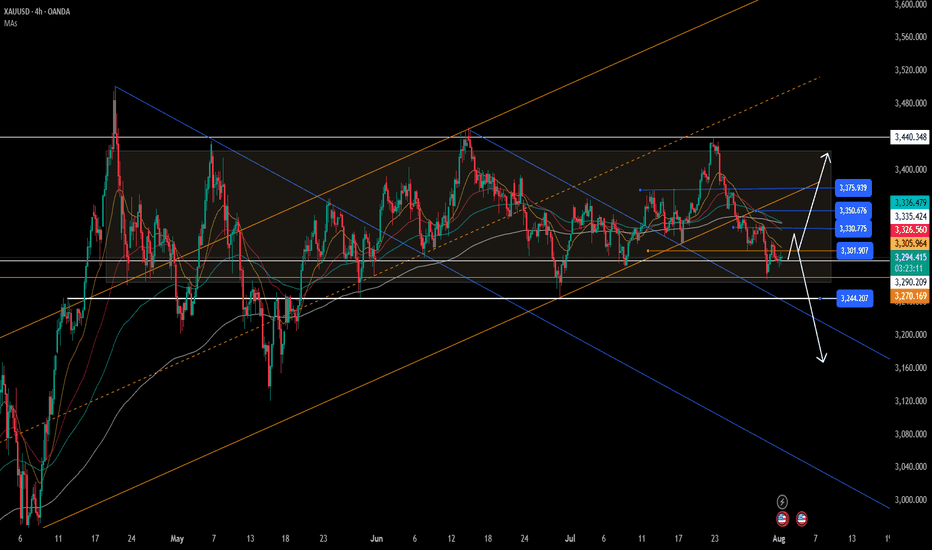

Gold continues to go long in the 3280-3300 range.Gold continues to go long in the 3280-3300 range.

Today, we remain firmly bullish on a bottom in the 3280-3300 range.

On August 1st, the Federal Reserve, while keeping interest rates unchanged, acknowledged slowing economic growth, triggering a repricing of expectations for a rate cut.

This led to a rebound in gold prices, but of course, this was just a pretext for the price increase.

Recently, gold prices experienced a four-day decline (July 23-28), falling from $3431 to $3268, as progress in trade negotiations and a rebound in the US dollar dampened safe-haven demand.

Non-farm Payrolls

Here are the key takeaways:

Today's US July non-farm payrolls data (expected to increase by 110,000, compared to 147,000 previously) will determine expectations for a September rate cut by the Federal Reserve.

A weak reading (e.g., below 100,000) could push gold prices back towards $3,400;

A strong reading (above 150,000) would remain bearish for gold. Gold prices continue to decline, and we are long in the 3280-3300 range.

Today, we remain firmly bullish on gold bottoming in the 3280-3300 range.

On August 1st, the Federal Reserve, while keeping interest rates unchanged, acknowledged slowing economic growth, triggering a repricing of rate cut expectations in the market.

This led to a rebound in gold prices, but of course, this was just a pretext for the price increase.

Recently, gold prices experienced a four-day decline (July 23-28), falling from $3431 to $3268, as progress in trade negotiations and a rebound in the US dollar dampened safe-haven demand.

Non-farm Payroll Data

Here are the key takeaways:

Today's US July non-farm payroll data (expected to increase by 110,000, compared to 147,000 previously) will determine expectations for a September rate cut by the Federal Reserve. A weak reading (e.g., below $100,000) could push gold back to $3,400.

A strong reading (above $150,000) would continue to be bearish for gold.

Technical Analysis and Trading Recommendations

Key Levels:

Support:

$3,270 (100-day moving average)

$3,248 (June low);

Resistance:

$3,300 psychological level

$3,340 (21-day/50-day moving average crossover).

Trading Strategy:

Short-term:

1: If the price holds above $3,300, initiate a long position with a target of $3,330-3,350.

2: If the price falls below $3,270, a drop to $3,248 is possible.

3: Focus on the key watershed at $3,300

4: Key Point:

As long as the gold price is above $3,300, I believe it's a good time to buy the dip. Following the upward trend in gold prices is a very wise choice.

As shown in Figure 4h:

The potential for gold prices to rebound is becoming increasingly clear.

The lower edge of the wide fluctuation range is slowly stabilizing.

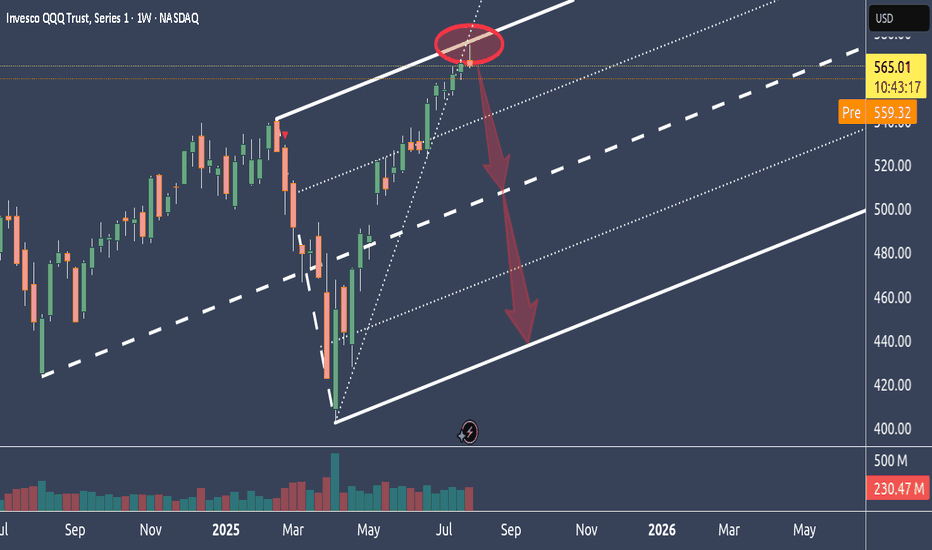

Why NQ is probably tanking big timeIn this weekly chart, we see QQQ, which represents the Nasdaq.

As we can see, it had a hell of a run up.

Too far too fast IMO, and it reached the stretch level at the Upper Medianline Parallel.

The natural move is now to let go, take a breath and trade down to center again, which is the Centerline.

After all the most major and most important earnings results are over, and Funds have pumped up their gains through manipulative Options plays, it's time to reap what they have planted and book the gains.

It's all in line with, all moves are at the point, and everything is showing in a simple chart.

Unless price is opening and closing outside of the U-MLH, it's time to load the Boat and sail to the South.

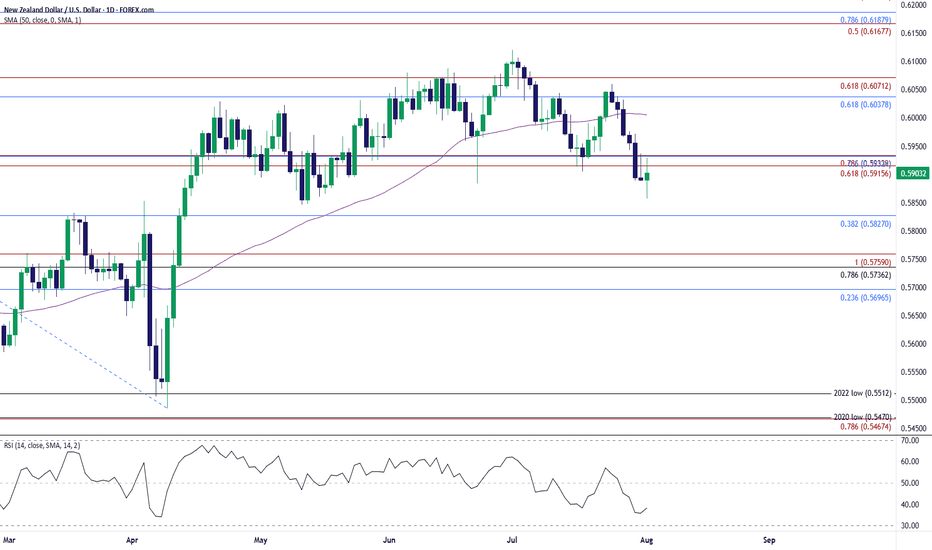

NZD/USD Holds Above May LowNZD/USD halts the decline from earlier this week to hold above the May low (0.5847), with a move/close above the 0.5920 (61.8% Fibonacci extension) to 0.5930 (78.6% Fibonacci extension) region bringing the 0.6040 (61.8% Fibonacci retracement) to 0.6070 (61.8% Fibonacci extension) zone on the radar.

Next area of interest comes in around the July high (0.6120), but the rebound in NZD/USD may turn out to be temporary if it struggles to trade back above the 0.5920 (61.8% Fibonacci extension) to 0.5930 (78.6% Fibonacci extension) region.

A breach of the May low (0.5847) opens up 0.5830 (38.2% Fibonacci retracement), with the next area of interest coming in around 0.5740 (78.6% Fibonacci retracement) to 0.5760 (100% Fibonacci extension).

--- Written by David Song, Senior Strategist at FOREX.com

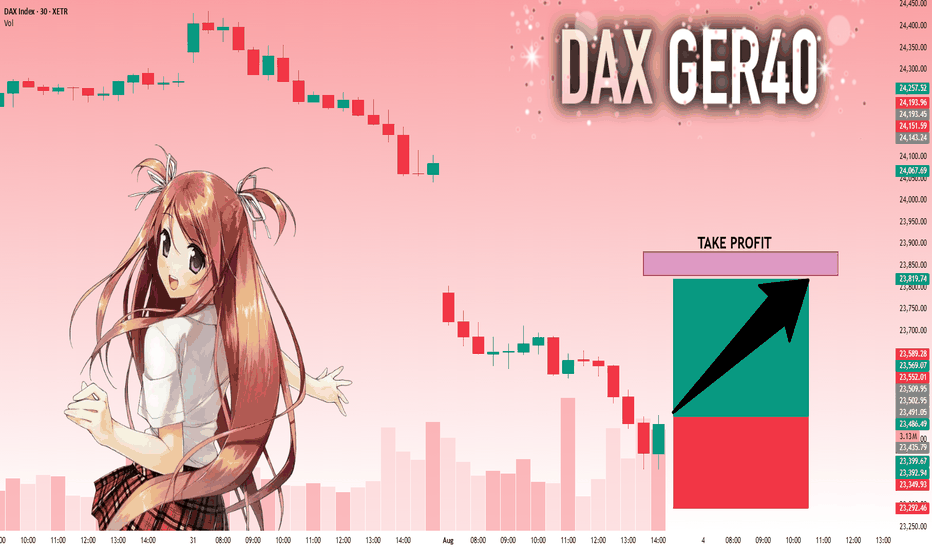

DAX: Next Move Is Up! Long!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 23,502.95 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

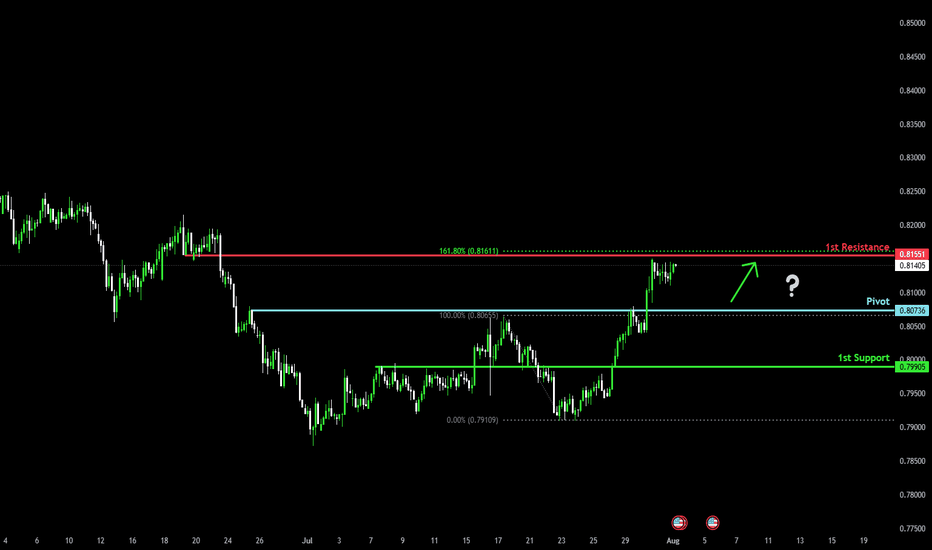

Bullish bounce off pullback support?The Swissie (USD/CHF) is falling towards the pivot, which acts as a pullback support and could bounce to the 1st resistance, which lines up with the 161.8% Fibonacci extension.

Pivot: 0.8073

1st Support: 0.7990

1st Resistance: 0.8155

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

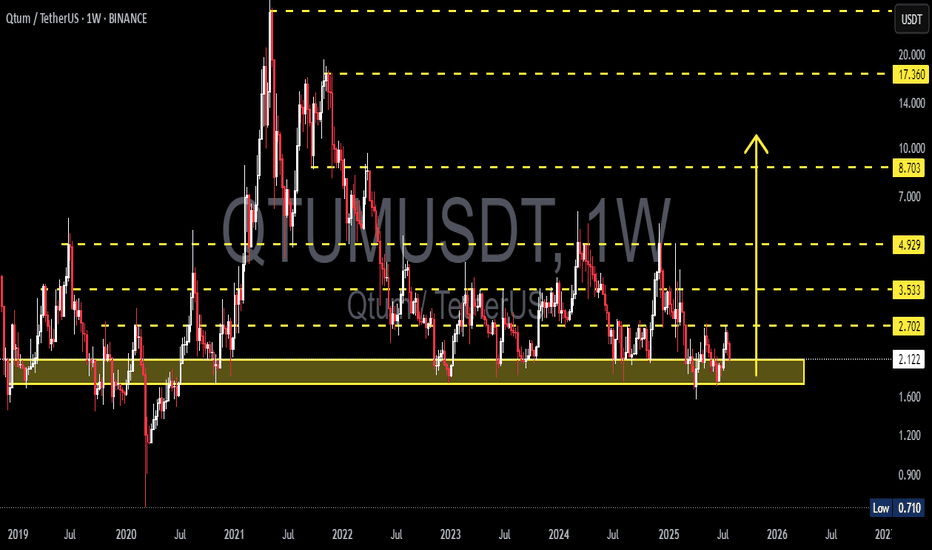

QTUM/USDT – Make or Break? Testing the Edge of Accumulation?🧠 Overview:

After going through a volatile multi-year cycle, QTUM is now back at one of the most critical historical support zones. This demand area has acted as a strong reversal point multiple times since 2020 and is once again being tested as price consolidates near the bottom of its macro range.

---

📉 Price Structure & Key Levels:

📍 Major Support Zone (1.70 – 2.10 USDT):

A proven accumulation zone based on multiple long wicks and price rejections in the past.

This is where smart money tends to accumulate during market uncertainty.

📍 Layered Resistance Levels (Bullish Targets):

2.70 USDT → Initial breakout validation

3.53 USDT → Mid-range resistance

4.93 USDT → Key structural level

8.70 USDT → Mid-term breakout target

17.36 USDT → Peak from previous macro cycle

---

🧩 Current Pattern: "Sideways Accumulation Range"

QTUM is clearly in a range-bound accumulation phase, with tight price action within a key support area. Historically, such patterns often precede large impulsive moves, especially when accompanied by volume surges and breakouts from structure.

> ⚠️ Important Note: Sideways movement at historical support, combined with increasing accumulation volume, often leads to a breakout into the markup phase.

---

📈 Bullish Scenario: Potential Upside Momentum

Trigger: A confirmed breakout and weekly candle close above 2.70 USDT.

Additional Confirmation: Strong bullish candle with increased volume.

Targets:

3.53 USDT (local resistance)

4.93 USDT (mid-range structural level)

8.70 USDT (swing target)

17.36 USDT (macro cycle high)

🎯 High reward-to-risk potential if entries are made near support with a stop-loss under 1.70 USDT.

---

📉 Bearish Scenario: Breakdown Risk

Trigger: Weekly candle closes below 1.70 USDT.

Implication: Breakdown from long-term demand zone.

Downside Targets:

1.20 USDT → Minor horizontal support

0.71 USDT → Historical all-time low

Warning Sign: High volume breakdown = likely sign of institutional selloff or panic exit.

---

📊 Strategic Summary:

> QTUM is at a pivotal crossroads.

The 1.70 – 2.10 USDT range is a decisive area.

A bullish breakout could spark a major recovery rally,

while a breakdown may lead to a deeper capitulation.

This is a “calm before the storm” situation. Traders should monitor closely as the next few weekly candles could define the trend for the rest of 2025.

#QTUMUSDT #QTUM #CryptoAnalysis #AltcoinSetup #TechnicalAnalysis #AccumulationPhase #SupportAndResistance #BreakoutPlay #CryptoBreakout

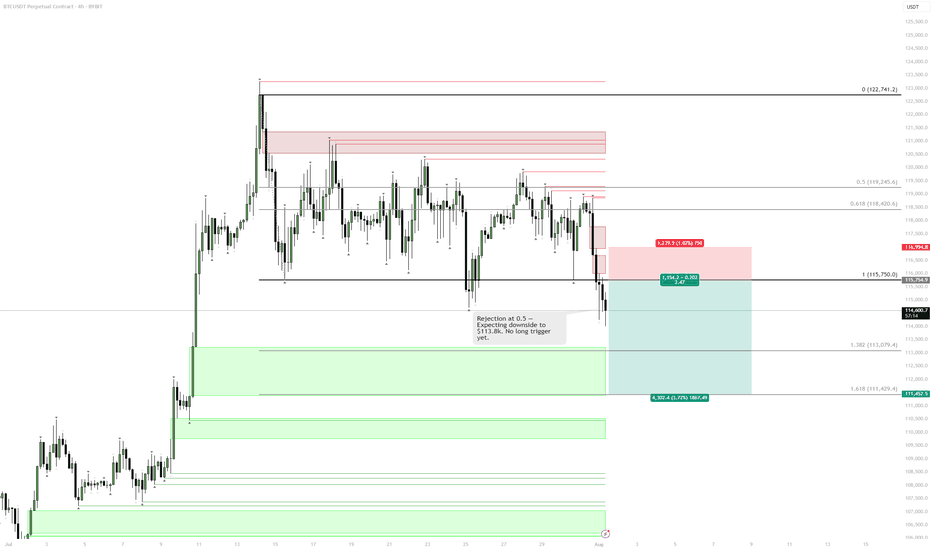

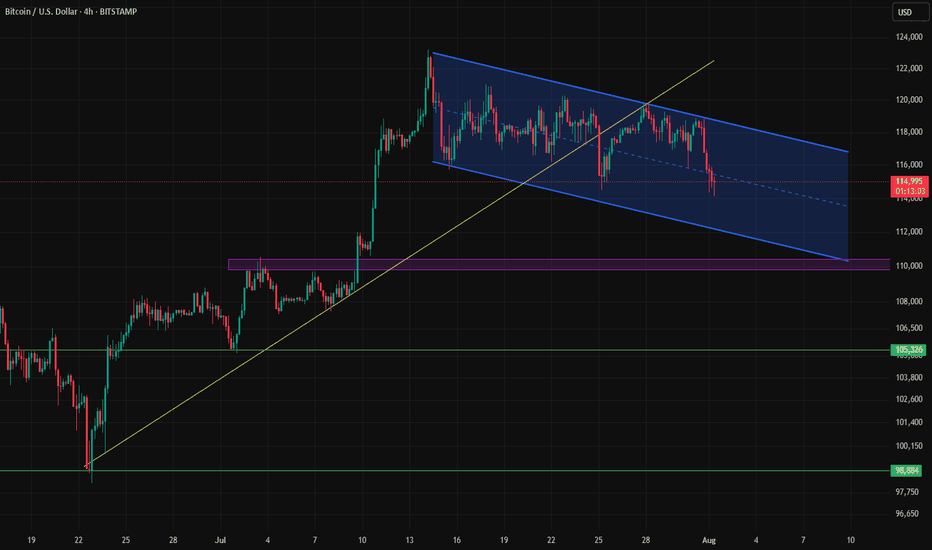

BTC | Short Bias — Targeting $113kPrice rejected perfectly off the 0.5 retracement and is now filling the previous imbalance.

Yesterday's daily close was decisively bearish, confirming downside momentum.

There’s a lack of convincing reversal signals at current levels.

Plan:

Main expectation is continued downside toward the $113k support.

Not interested in longs until price stabilizes at or below that level.

Bitcoin at $110,000?After reaching its last ATH, Bitcoin practically went into a coma. Now, with the strengthening of the dollar, it's undergoing a correction — and if that correction deepens, there's a possibility it could drop to \$110,000. We'll have to see whether it finds support around the \$112,000 level or not.

#BTC Potential Trading Opportunities📊#BTC Potential Trading Opportunities🔥

🧠We've been trading sideways for quite some time, and selling pressure has largely been exhausted, so we need to find support to enter a long trade.

➡️From a structural perspective, there's a chance for a bullish head-and-shoulders pattern to form. If this pattern holds, we could see a move above $120,000 or even higher.

Potential support is likely between $116,300 and $117,000.

Short-term resistance is around $120,000.

⚠️Note: A break below L1 would destabilize the structure and significantly reduce bullish expectations.

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

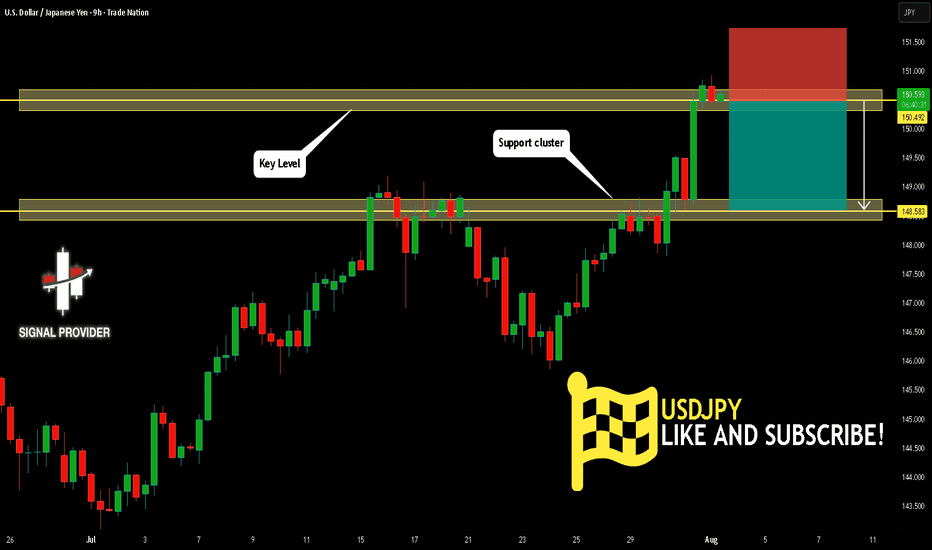

USDJPY Is Very Bearish! Sell!

Here is our detailed technical review for USDJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 150.492.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 148.583 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

I maintain my #3,277.80 and #3,252.80 TargetsI didn't engaged any re-Sell orders throughout yesterday's session and re-Sold Gold on #3,295.80 ahead of Asian session, with plan to keep orders over-night. However due NFP, Gold might be stationary / ranging until the news as I closed both of my orders on #3,291.80 / each #9.000 Eur Profit and my #3,300.80 pending Sell limit has been triggered over-night which is now running in Profits with Stop on breakeven. I do expect #3,277.80 and #3,252.80 Targets to be met within #1 - #3 sessions and if there aren't NFP numbers, I would keep all three orders / set of Selling orders maintaining my first #3,277.80 Target. Due the news, Gold might fluctuate within Neutral Rectangle until the news.

Technical analysis: My earlier Selling configuration / Technical expectations was confirmed on Hourly 4 chart under prolonged weakness and Price-action respecting the trend-line guarding the downtrend (very Bearish formation) as Hourly 1 chart is already an aggressive Descending Channel (width opened on Williams) that should reach it’s next local Low’s (currently Trading slightly below Double Bottom) and Oversold state near my take Profit of #3,252.80 benchmark. If the bands are widened Traders may witness #3,277.80 test, also if gets invalidated and #3,270.80 gives away, #3,252.80 mark extension test is inevitable. In any case I will update my Targets or levels of Profit taking if I decide to exit earlier than #3,252.80 benchmark to be in accordance with the Daily chart’s period / I already ride Selling wave since #,3,300's and my Profit will be already good to ignore.

My position: DX is soaring, Gold is under Bearish Technical developments and #3,252.80 benchmark is my final Target of current Selling leg. Only factor which can reverse this Intra-day but not postpone is NFP. I expect downside Jobs surprise which may reverse DX from local High's however hot upside surprise will make Gold test #3,252.80 Intra-day. NFP or not I do believe Gold is Bearish. Trade accordingly.

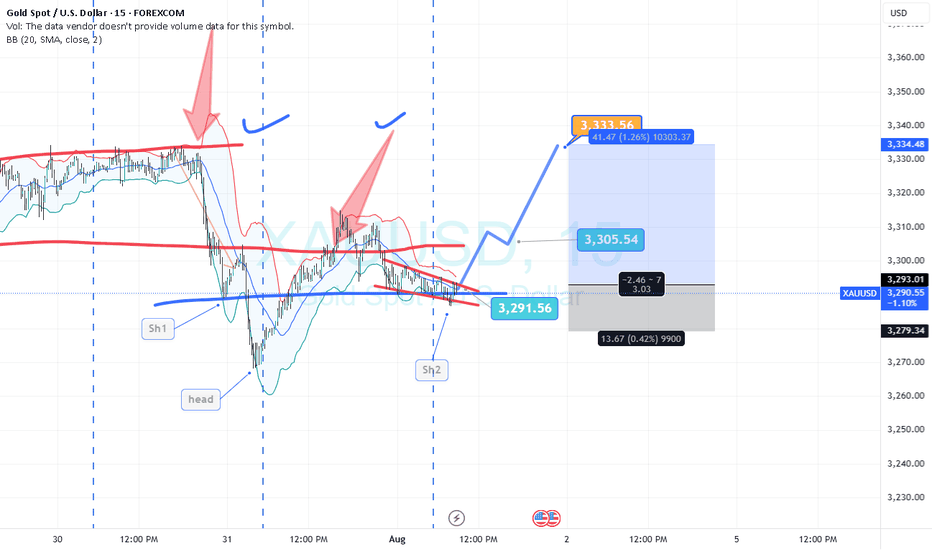

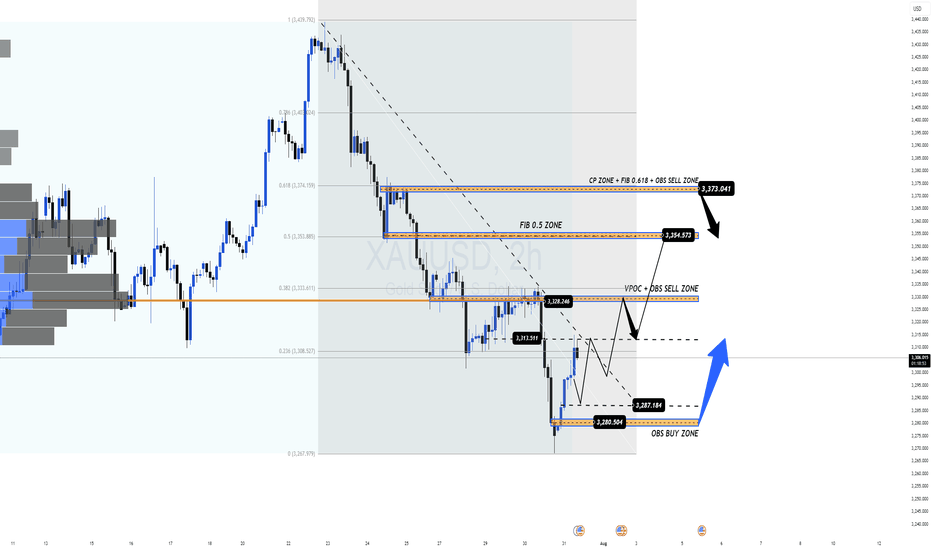

Bounce From Final Liquidity or Start of a Bullish Move? Bounce From Final Liquidity or Start of a Bullish Move?

After the FOMC event, gold completed a sweep of the final liquidity zone at 3269–3271 and rebounded strongly, in line with the broader bullish trend. The price has now recovered sharply and is gradually returning to the liquidity zones left behind after yesterday’s sharp drop.

📍 At the moment, gold is reacting around 3295, which aligns with a CP (Compression Point) Zone on the M30 chart. We're seeing a slight pullback here, and another retracement could occur before a strong upward continuation — potentially breaking out of the descending trendline that’s formed over recent days.

📊 Trading Plan & Key Levels

✅ BUY ZONE – Trend Continuation Setup

Entry: 3286–3284

Stop Loss: 3278

Take Profits:

3290 → 3294 → 3298 → 3304 → 3308 → 3312 → 3316 → 3320 → 3330 → …

💡 This is a prime area to look for re-entries into the dominant bullish move. Price action left a clean liquidity zone below after the aggressive upside reaction — ideal for riding the next wave.

❌ SELL ZONE – Only Valid Below VPOC

Entry: 3328–3330 (Volume Point of Control)

Stop Loss: 3335

Take Profits:

3324 → 3320 → 3315 → 3310 → 3305 → 3300

🔻 This is a high-probability short only if price stays below 3330. If gold closes above this VPOC region, the structure shifts to bullish and we should look for sells higher up — around 335x–337x zones.

📅 Monthly Candle Close – Watch for Indecision

As it’s the last trading day of the month, note that the past two monthly candles have printed doji-like wicks, signalling indecision and liquidity grabs. The market is still waiting for a clearer signal from the Fed on the first potential rate cut of the year.

🚫 Avoid emotional trading. This is a highly reactive environment, so careful risk management is key.

🧭 Final Thoughts

Gold continues to respect market structure and liquidity theory. The first major test lies at the 3313 resistance level — if broken, it opens the door to stronger bullish momentum toward the broader VPOC zone.

⏳ Be patient and only act when price confirms your bias.