Chart Patterns

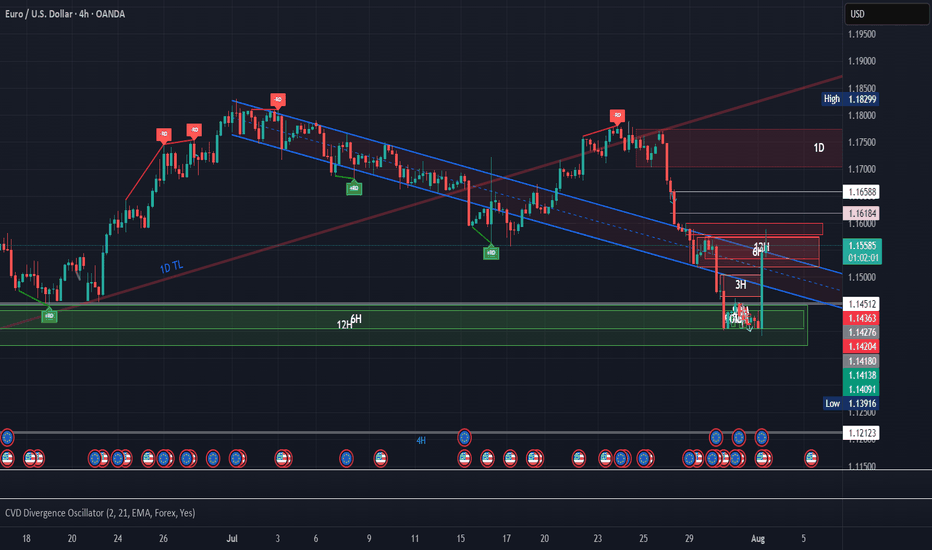

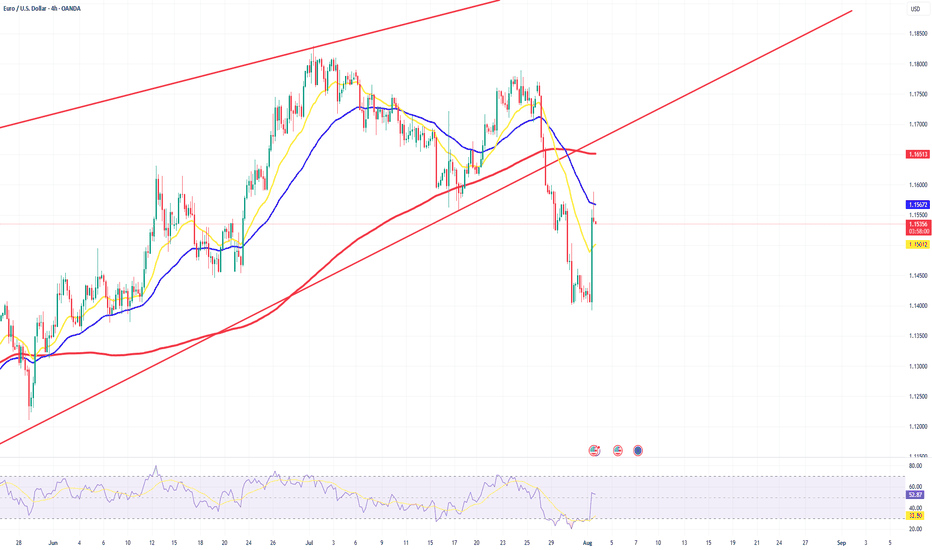

EURUSD short to 1.121Hello Traders,

Factoring in the fundamentals such as US EUR trade deal, $600 billion of investment into US, $350 billion investment from South Korea.

4hr chart, trading under 1 day up trendline.

Was strong sell signal from 1.177 last Thursday.

200ema starting to turn downwards

Still close to upper regression channel that began July 1st, believe it is still in play.

6 hr and 12 hr block still support, strong rejection at 4h bearish block. not expecting much else today since it's Friday. Still targeting 1.121 in August

Originally entered trade at 1.172 area, added 3 times on the way down, originally targeting 1.143 but with the ever evolving trade deal news that I believe to be bullish for the USD I moved target to 1.121.

Goodluck to you all.

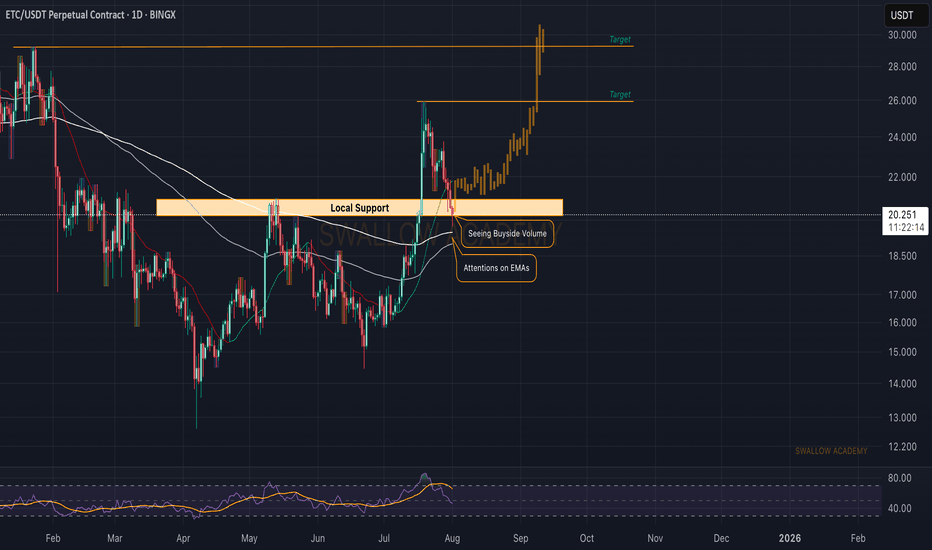

Ethereum (ETH): Might Be Good Zone to Bounce From ETC caught our attention with a local retest of the support zone, which, after a breakout, was a natural movement for the coin!

Now that we have been having that retest, we are looking closely for any signs of recovery, which would give us an opportunity to long from here.

While we see a smaller recovery happening, we need that proper MBS to take place above the support zone, so keep your eyes on it.

As long as we are above the EMAs, this is the game plan we are going to look for!

Swallow Academy

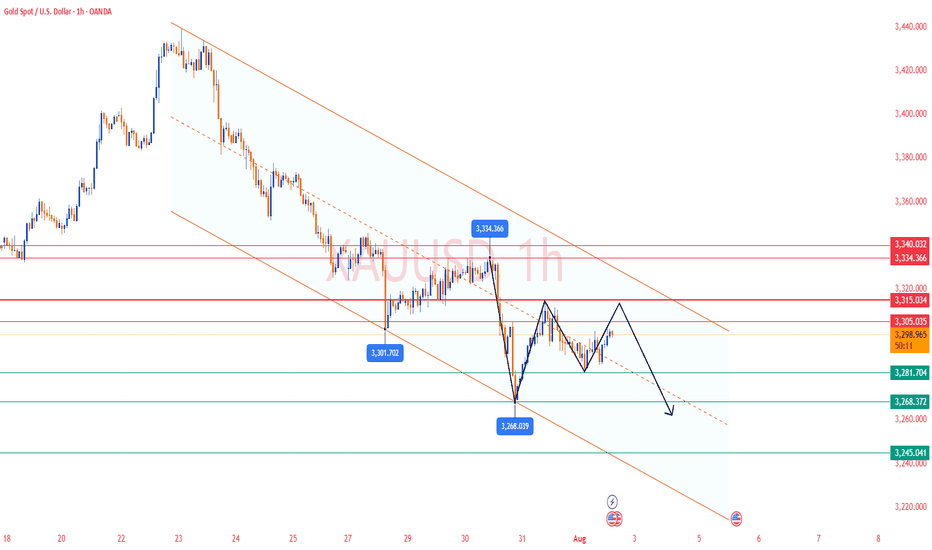

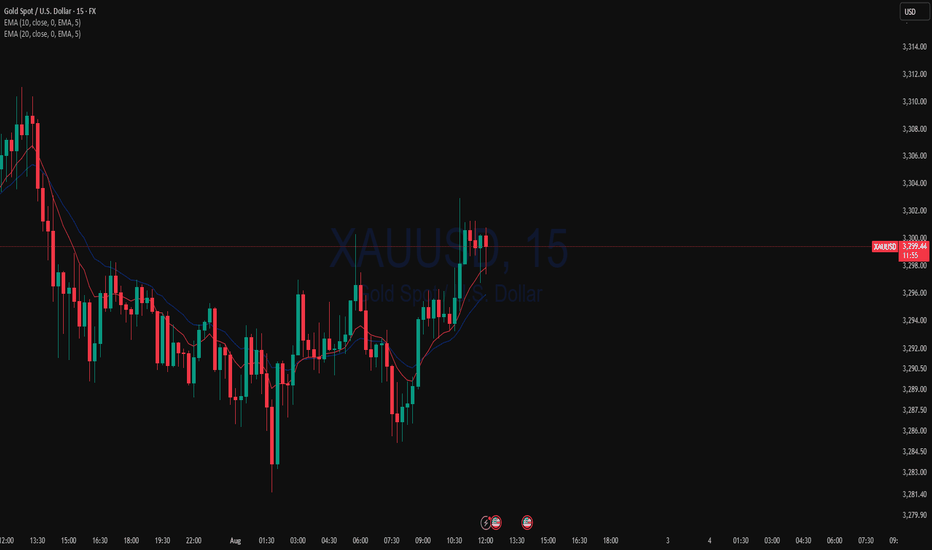

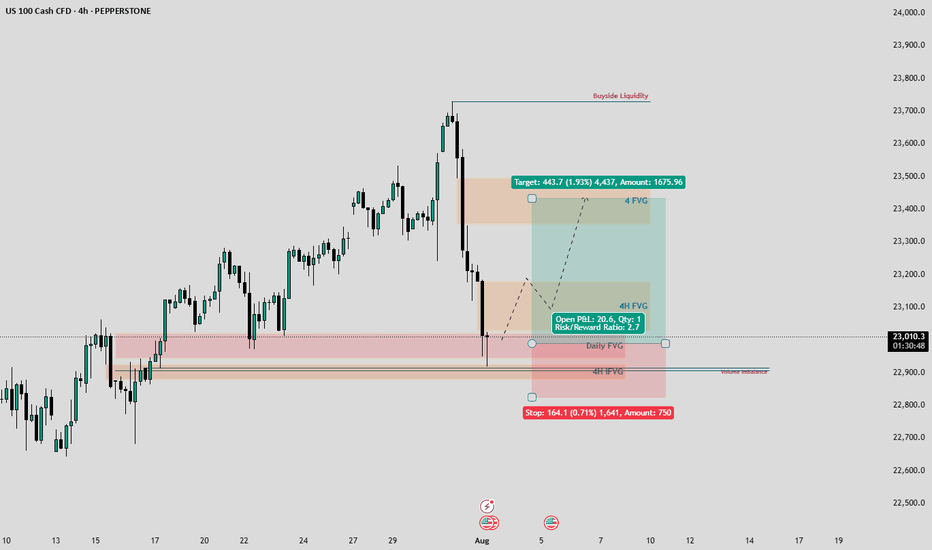

Gold Analysis and Trading Strategy | August 1✅ Fundamental Analysis

🔹 Trump Signs New Tariff Executive Order

On July 31, President Trump signed an executive order imposing a new round of tariffs on countries including Canada and India, while Mexico was granted a 90-day grace period. This move has once again heightened global trade uncertainty, fueling risk-off sentiment and providing support to gold.

🔹 Dollar Strength Limits Gold's Upside

Despite the increase in risk aversion, the U.S. Dollar Index has risen sharply, exerting downside pressure on gold. As a result, the price of gold remains capped, with a tug-of-war between bulls and bears dominating market dynamics.

🔹 Key U.S. Economic Data in Focus

The U.S. Non-Farm Payrolls (NFP) report is the major event on the calendar today. It is expected to be a decisive driver for short-term gold direction:

If the data is bullish for gold (e.g., weak job growth or slower wage increases), gold may retest the 3340 level.

If the data is bearish for gold (e.g., strong job gains or higher wages), gold may break below 3260, continuing its downward trend.

Ahead of the data release, gold is likely to remain in a consolidation range, with market participants generally adopting a cautious stance.

✅ Technical Analysis

🔸 Daily Chart Structure:

Gold printed a gravestone doji yesterday, characterized by a long upper shadow, indicating strong selling pressure at higher levels. The overall trend remains weak. After four consecutive daily declines followed by a minor rebound, another strong bearish candle has emerged, signaling a continuation of the downtrend.

🔸 Hourly Chart Structure:

On the 1-hour timeframe, gold remains below all major moving averages, which are aligned in a bearish formation. Despite multiple rebound attempts, each high has been lower than the last, reflecting diminishing bullish strength. The second U.S. session high was capped around 3310. If today's rebound fails to break above that level, the bearish trend remains dominant.

🔴 Resistance Levels: 3305 / 3315 / 3340

🟢 Support Levels: 3275 / 3260 / 3245

✅ Trading Strategy Reference:

🔻 Short Position Strategy:

🔰Consider entering short positions in batches if gold rebounds to the 3305-3310 area. Target: 3285-3270;If support breaks, the move may extend to 3250.

🔺 Long Position Strategy:

🔰Consider entering long positions in batches if gold pulls back to the 3245-3250 area. Target: 3265-3275;If resistance breaks, the move may extend to 3285.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions. If you have any questions or need one-on-one guidance, feel free to contact me🤝

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

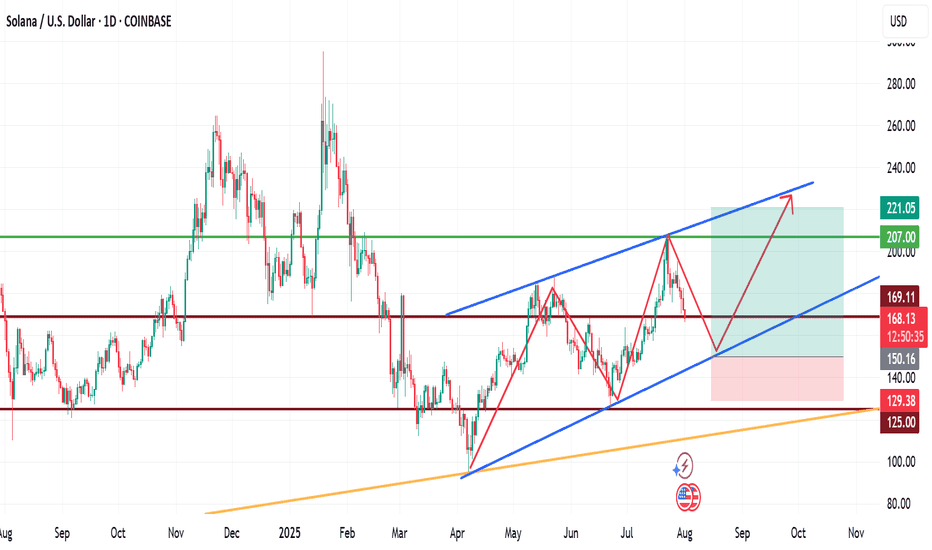

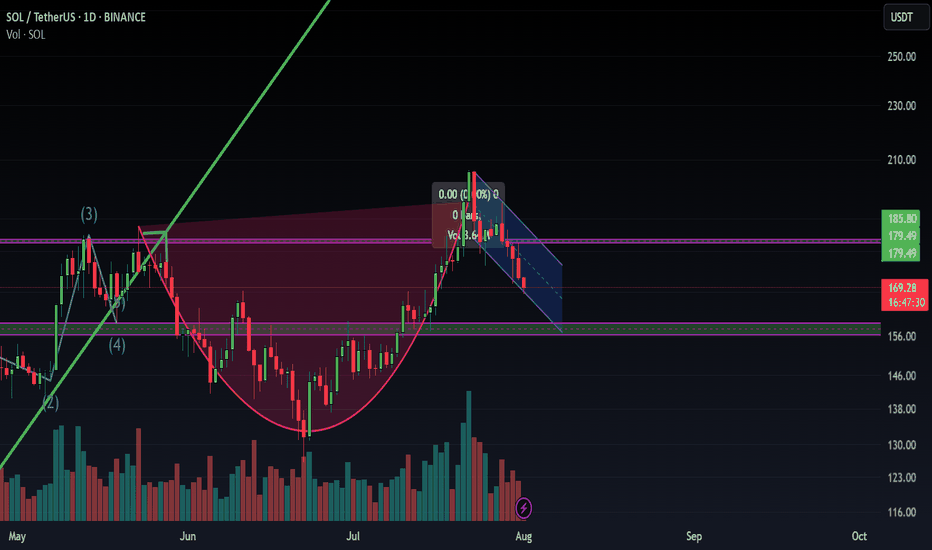

My View for SOLANA next moveMy View for SOLANA next move.

Technically, SOL has been trading within a channel for a while now, with the formation of HHs and HLs.

If fundamentals play out positively long to mid-term, we are likely to see SOLNA fall to $150 zone before another upward leg forms. This leg may rally to as high as $220.

Trade with care.

If you found this helpful, please connect with me.

Like, comment and share

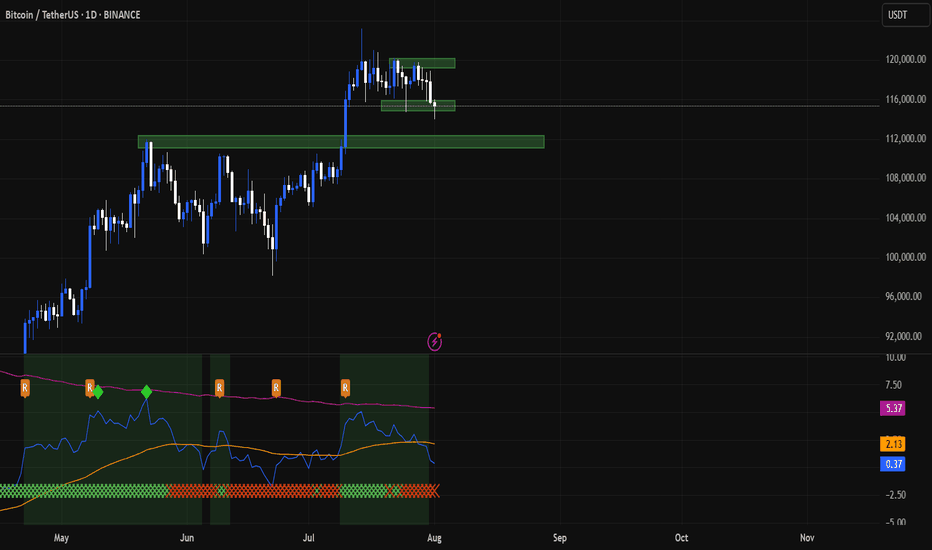

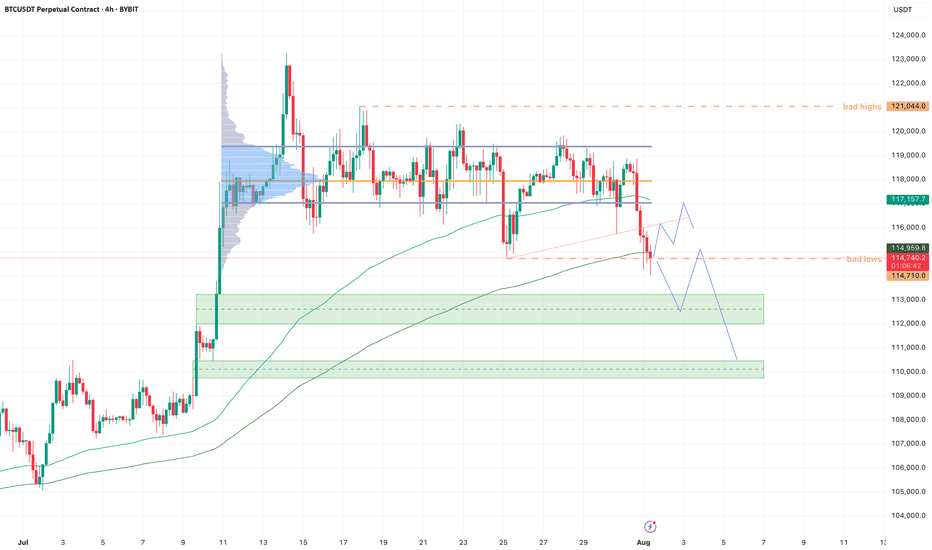

BTC - Cleaned up the lows!Bearish momentum is starting to stall here at the lows.

New month, and we started it by cleaning up the previous month's bad lows.

If we can hold here I'm looking for a trendline retest and VAL retest soon. Maybe we get one more sweep of the low, giving us a three drive pattern.

Reclaim VAL then it's back to VAH, maybe take out all the bad highs.

If we start bleeding into the lower demand zone (green box), I will start paying attention for a potential bearish retest into 110k, which we be our last area of imbalance to fill.

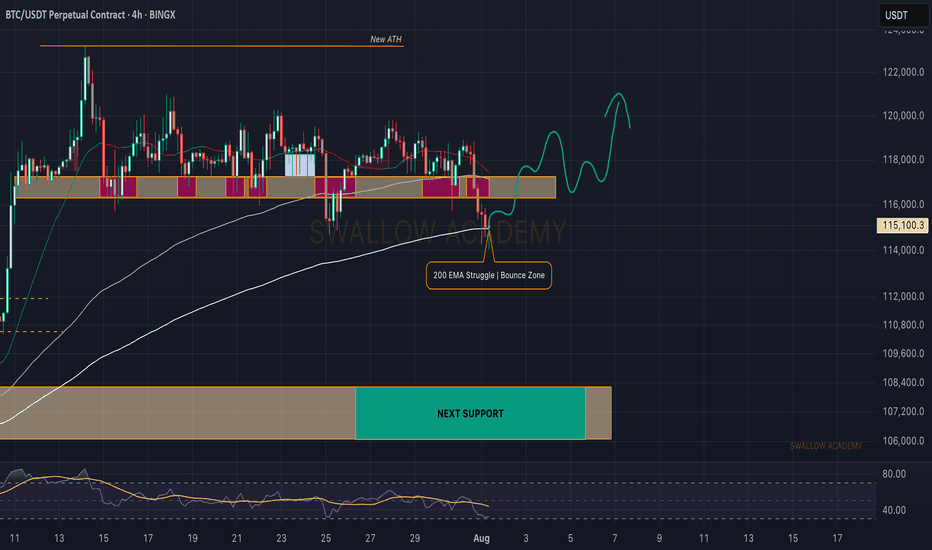

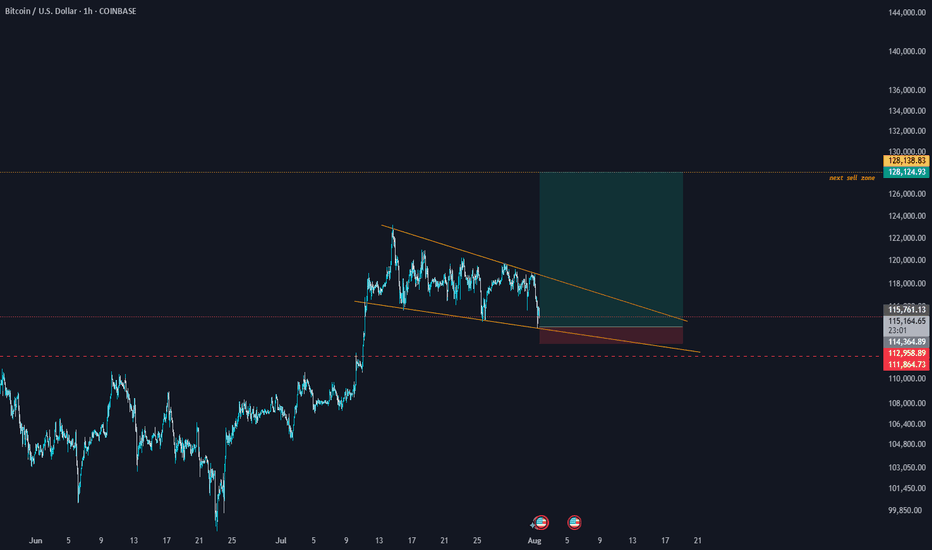

Bitcoin (BTC): 200EMA is Key Are Currently | Red Monthly OpeningBTC had a really sharp start to the month, and we are back near $115K, which was a key zone for us last time (due to huge orders sitting there).

Now, we see a similar struggle like last time but not quite the same, as the 200EMA has aligned with the $115K area. We are now looking for any signs of MSB, as we think we might get a recovery from here.

Now if we do not recover right now (by the end of today), we are going to see a really deep downside movement during the weekend most likely!

Swallow Academy

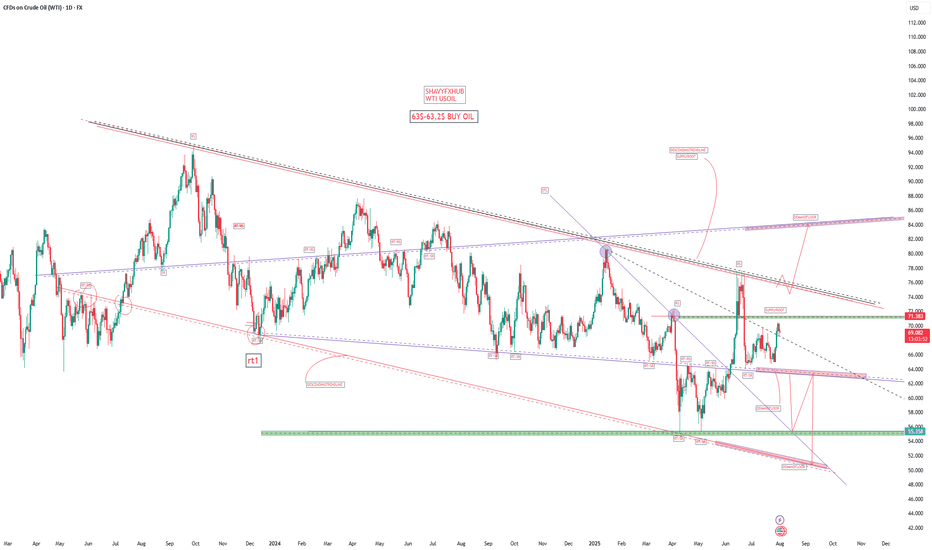

USOIL WTIWest Texas Intermediate (WTI) oil is a major benchmark for crude oil pricing, known for its high quality—being both light and sweet due to its low sulfur content and low density. WTI is sourced primarily from inland Texas and is the underlying commodity for oil futures traded on the New York Mercantile Exchange (NYMEX). The main physical delivery point is Cushing, Oklahoma, a critical U.S. oil storage and trading hub.

Current Price (as of August 1, 2025)

WTI crude oil is trading around $69.15–$69.36 per barrel.

Recently, WTI prices have seen volatility due to global economic factors, including U.S. tariffs, OPEC+ production, and shifts in oil demand. Despite a small decline on the day, oil prices have posted their strongest weekly performance since June, rising over 6% for the week.

Market and Outlook

Recent price movement reflects concerns about global trade tensions, new tariffs, and their impact on economic growth and energy demand. At the same time, supply risks remain due to geopolitical factors such as potential sanctions on Russian oil and U.S.-China trade developments.

Analyst forecasts for the remainder of 2025 suggest continued volatility, with WTI potentially ranging between $56 and $73 per barrel, influenced by demand, OPEC+ decisions, and geopolitical events.

Quick Facts Table

Feature Detail

Type Light, sweet crude

Benchmark NYMEX (U.S.), major global reference

Main Delivery Point Cushing, Oklahoma

Latest Price (Aug 1, 2025) $69.15–$69.36 per barrel

Typical Drivers U.S. tariffs, OPEC+ decisions, trade policy, supply risks, global demand

WTI oil plays a central role in global energy markets, serving as a benchmark for North American and international oil pricing. Its price reflects both supply fundamentals and broader macroeconomic and geopolitical developments.

#OIL #WTI

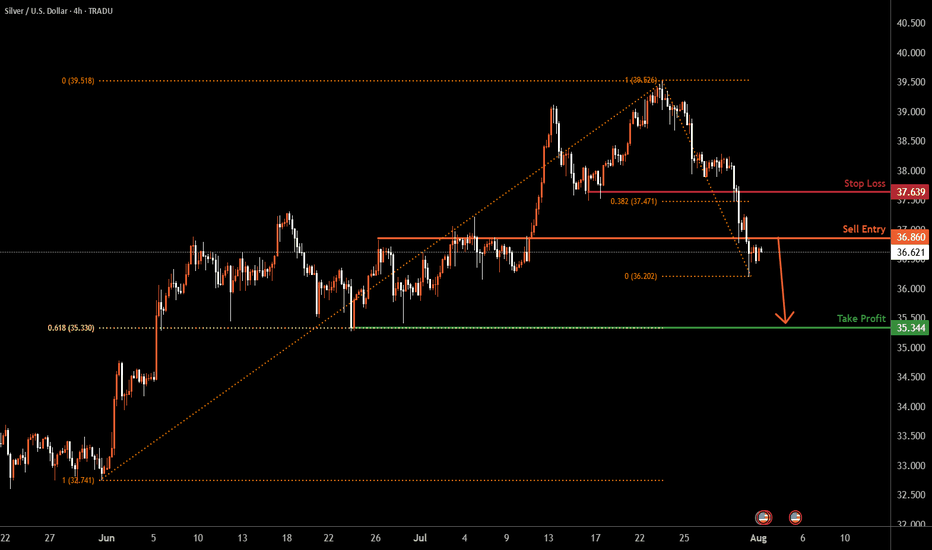

Silver H4 | Potential bearish dropBased on the H4 chart analysis, we could see the price reverse from the sell entry at 3.86, and could drop from this level to the downside.

Stop loss is at 37.63, which is a pullback resistance that is slightly above the 38.2% Fibonacci retracement.

Take profit is at 35.34, which is a swing low support that lines up with th e 61.8% Fibonacci retraecment.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

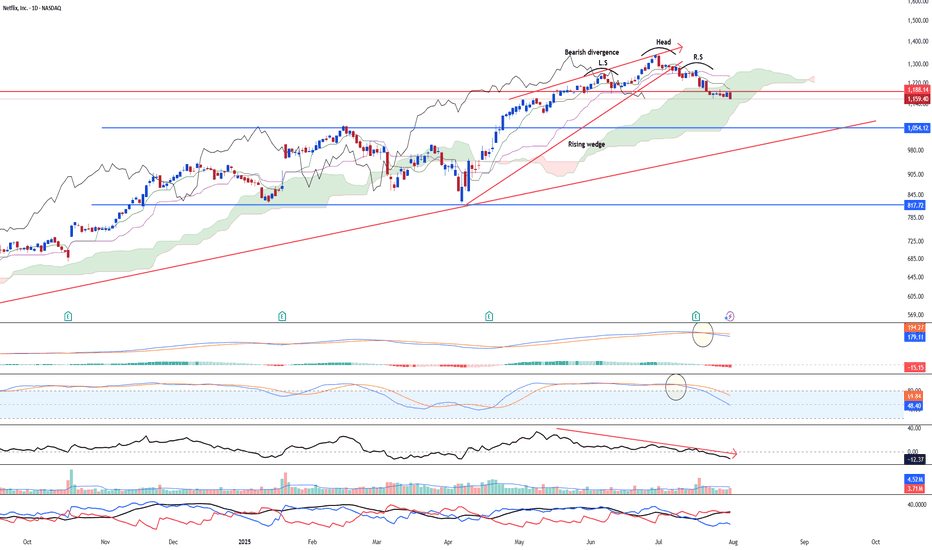

Turning the side for NetflixNetflix NASDAQ:NFLX may go through some serious correction soon after the stock rallied a lot till the high of 1337. Furthermore, the stock has confirmed the head and shoulder reversal with the latest bearish candle rejecting the neckline resistance @ 1188.14. Furthermore, the bearish divergence has been on since 19 May 2025.

Long-term MACD has performed a bearish crossover at the top and histogram is negative.

Stochastic Oscillator has confirmed the overbought signal.

23-period ROC turns negative and forms a bearish divergence. Directional movement index saw increased bearish trend strength signal.

Target is at 1054 in the near-term

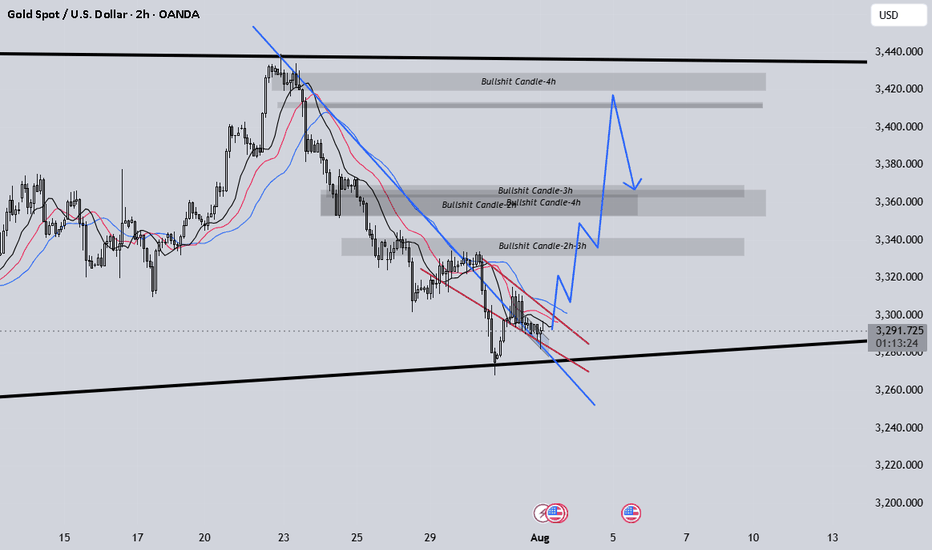

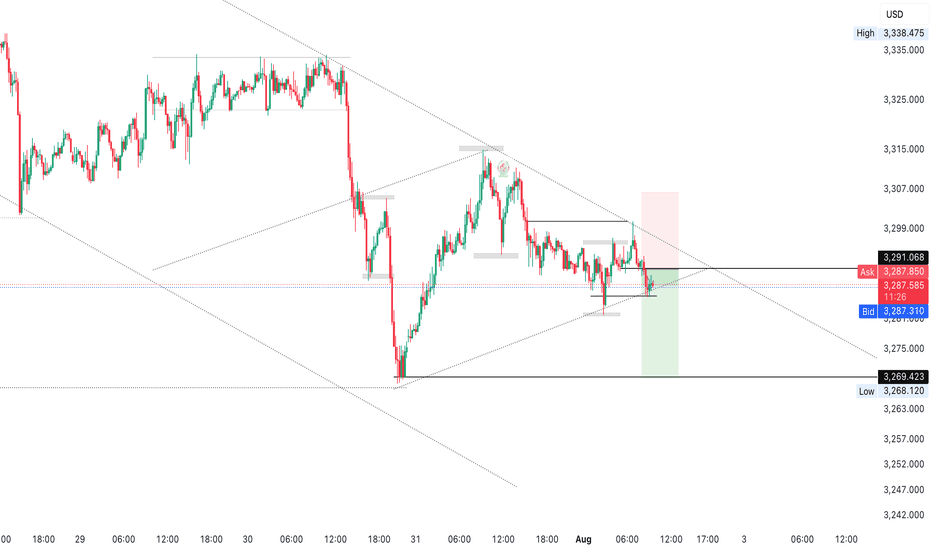

Gold Market Holds Bearish Structure Below 3291Gold market continues to hold firm within the bearish channel, with 3291 acting as a supply zone, maintaining pressure down toward 3269. As long as this zone remains unbroken, bearish momentum stays in play.

🔍 Key Insight:

3291 = active supply resistance

3269 = short-term target if sentiment holds

follow for more insights , comment and boost idea

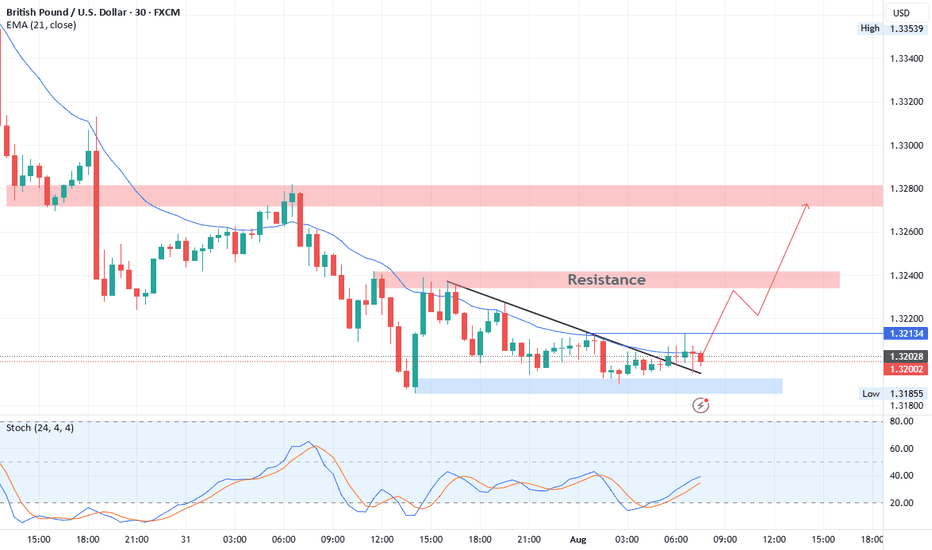

GBPUSD Technical BreakdownTrendline Breakout:

Price has decisively broken above a short-term descending trendline, signaling a potential shift in intraday momentum from bearish to bullish.

Support Zone (1.3185 – 1.3195):

This demand area has provided a strong base, with multiple successful rejections confirming buyer interest.

Resistance Levels:

Near-term resistance: 1.3213 (minor breakout level – watch for retest)

Key upside targets: 1.3240 followed by the major supply zone at 1.3275 – 1.3290

📈 Trade Outlook:

Bias: Bullish above 1.3213

Entry Idea: Look for bullish confirmation on a retest of 1.3213 as support

Targets:

TP1: 1.3240

TP2: 1.3275 – 1.3290

Invalidation: A sustained move below 1.3185 would invalidate the setup and reopen downside risk.

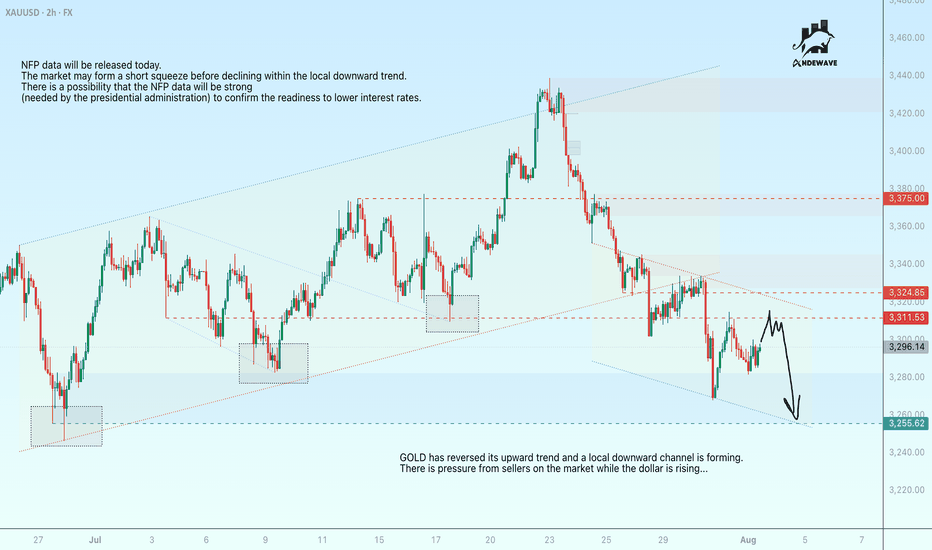

GOLD may be subject to manipulation ahead of the NFPGOLD has reversed its upward trend and a local downward channel is forming. There is pressure from sellers on the market while the dollar is rising...

NFP data will be released today. The market may form a short squeeze before declining within the local downward trend.

There is a possibility that NFP data will be strong (needed by the presidential administration) to confirm the readiness to lower interest rates.

Scenario: ahead lies a strong resistance zone at 3311.5 - 3324.85. The formation of a false breakout could intensify bearish pressure, leading to a decline in prices to 3255

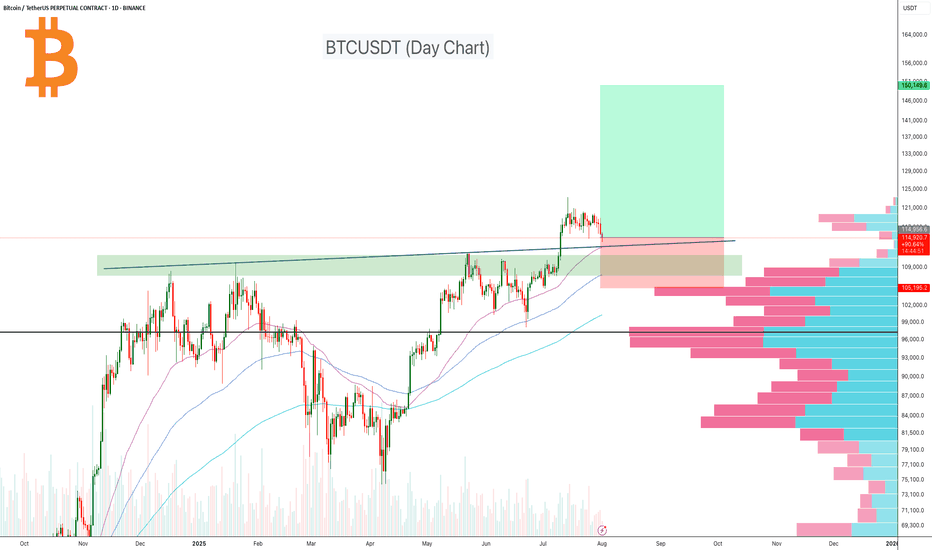

BTC Next Move Toward $150K?Bitcoin recently broke out above a long-standing resistance zone ($110K–$115K), supported by a clean move through the volume profile high node. After testing local highs, BTC is now pulling back to retest the breakout area, a critical level that could act as new support.

Key Points:

Breakout Retest: Price has pulled back into the breakout zone around $114K, aligning with strong previous resistance that may now flip to support.

Volume Profile: A strong high-volume node is visible below ($105K–$110K), which reinforces this area as a major demand zone.

EMA Confluence: The 50-day and 100-day EMAs are trending upward and aligning near the retest area, providing additional support.

If this level holds, BTC could resume its bullish leg toward the $150K level.

Cheers

Hexa