Chart Patterns

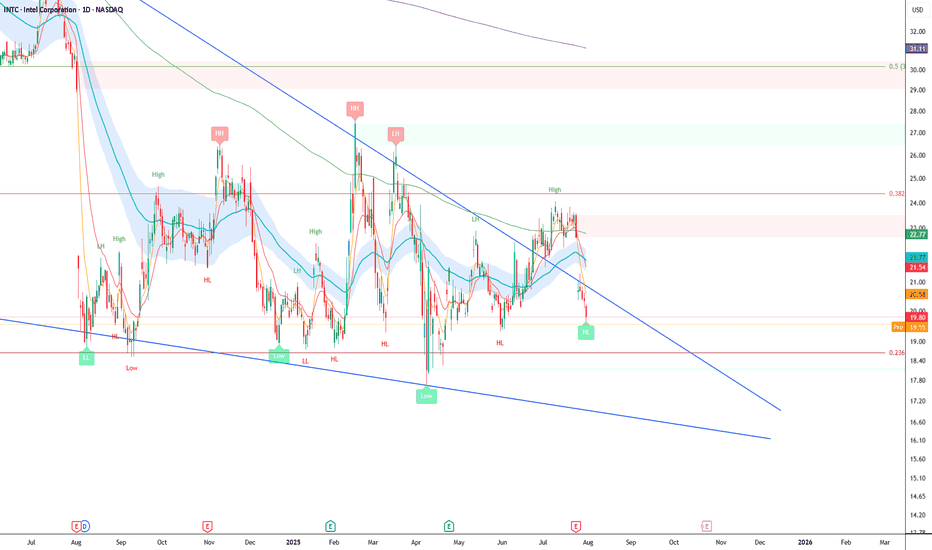

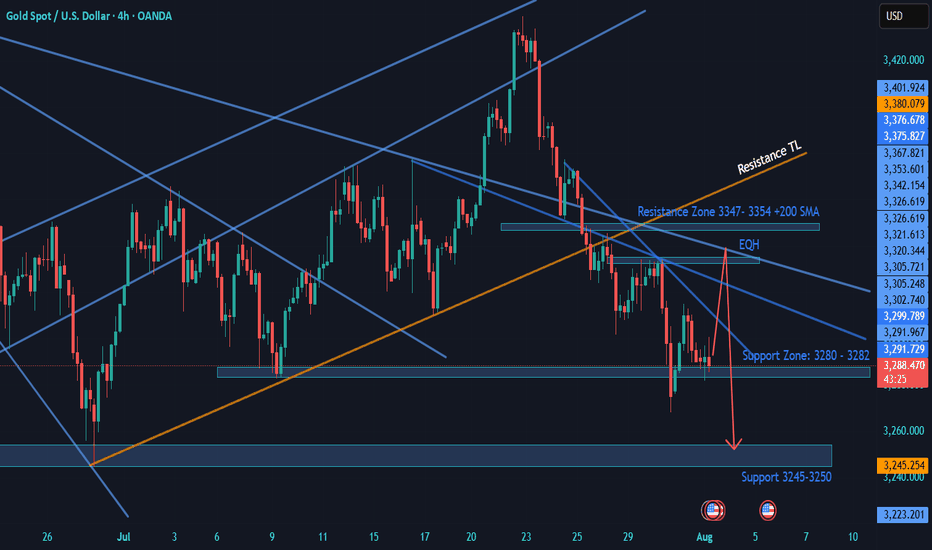

Gold on NFP : Bearish OutlookGold is moving on fundamentals. Technical also validates the fundamental changes in market.

This week’s Fundamental developments:

• FED kept interest rates un changed: Bearish for Gold

• Trade/tariff war seems to settle Down: Bearish for Gold.

• US GDP Results Positive: Bearish for Gold

• Inflation: Results High inflation in US: Bearish for Gold.

Now today on Friday we have US Nonfarm payroll announcement. If the NFP also comes positive. It will add more fuel in dollar buying and DXY bullish chart will add more bullish candles.

Technicals:

Price structure is bearish with Head and shoulders structure at top.

We are having bearish death cross on Daily chart. Last day daily candle present rejection of 3300 level. Lower chart show multiple rejections near 3300 level.

In such a case I see price testing 3250 & When price breaks it 3200 on horizon.

As of current 100 DMA is defending the Bulls at 3270.

Chart says the rest. Good Luck !

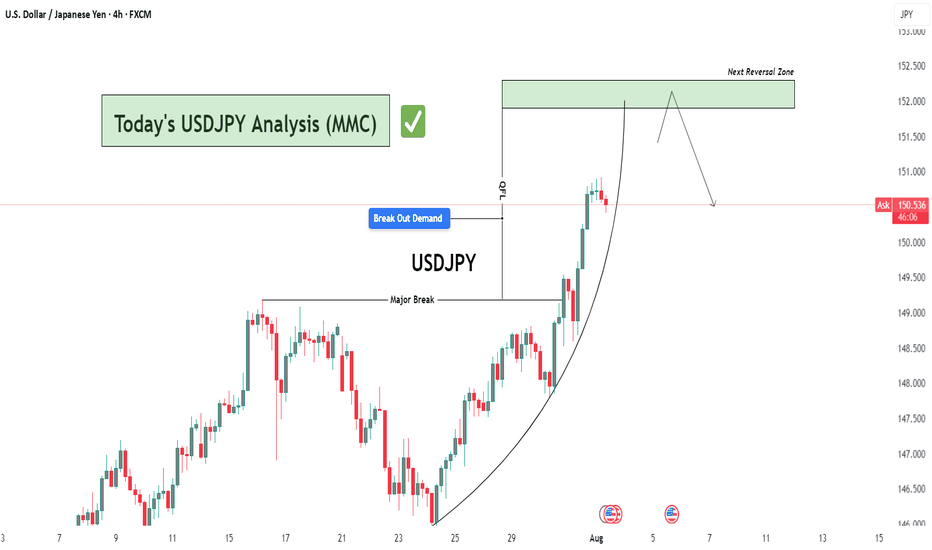

USDJPY Analysis : Key Reversal Zone After Parabolic Rally🧠 Market Psychology & Structure

The USDJPY 4-hour chart reveals a classic parabolic curve pattern signifying an acceleration phase in bullish momentum. This phase typically occurs during the final stages of a bullish move, where price action becomes increasingly steep due to aggressive buyer participation.

The rounded curve drawn on the chart reflects momentum compression—where pullbacks become shallower, and higher highs are formed rapidly. However, this pattern often ends in a blow-off top or a sharp correction, especially when approaching key supply zones.

🧩 Key Technical Highlights

Major Break Zone: The previous resistance around 148.80–149.00 (now flipped to support) was clearly broken with strong bullish candles, confirming trend continuation.

Break Out Demand : Price retested the breakout zone (around 149.80–150.00) before launching higher, validating this level as a new demand zone.

Current Price Action: The pair is currently hovering around 150.50 after a powerful rally, showing early signs of exhaustion with smaller bullish candles and slight upper wicks.

🔍 Target Area – Next Reversal Zone (151.80–152.30)

The green highlighted zone marks a strong supply area / reversal zone, identified from:

Previous price rejections in historical data.

Overbought conditions due to vertical rally.

Completion of the parabolic structure (climax zone).

We can expect price to reach this zone in the coming sessions, where it may:

Face strong selling pressure.

Trigger short positions from institutional sellers.

Lead to distribution or reversal back toward the demand area near 150.00.

🔄 Forecast & Trade Plan

Scenario 1 (High Probability): Price taps into 151.80–152.30, forms bearish engulfing or rejection wick, then pulls back to 150.00 or lower.

Scenario 2 (Invalidation): Strong breakout above 152.30 with momentum—bullish continuation towards 153.00+ possible.

🧠 Trader’s Mindset (MMC Insight)

This chart suggests a matured bullish trend nearing exhaustion. As smart traders, we anticipate rather than react. Wait for the price to reach the supply zone, then observe for confirmation (bearish structure, divergence, candlestick pattern) before shorting.

Avoid chasing longs at these highs—risk-to-reward is no longer favorable. Patience will offer a much cleaner entry if the reversal unfolds as expected.

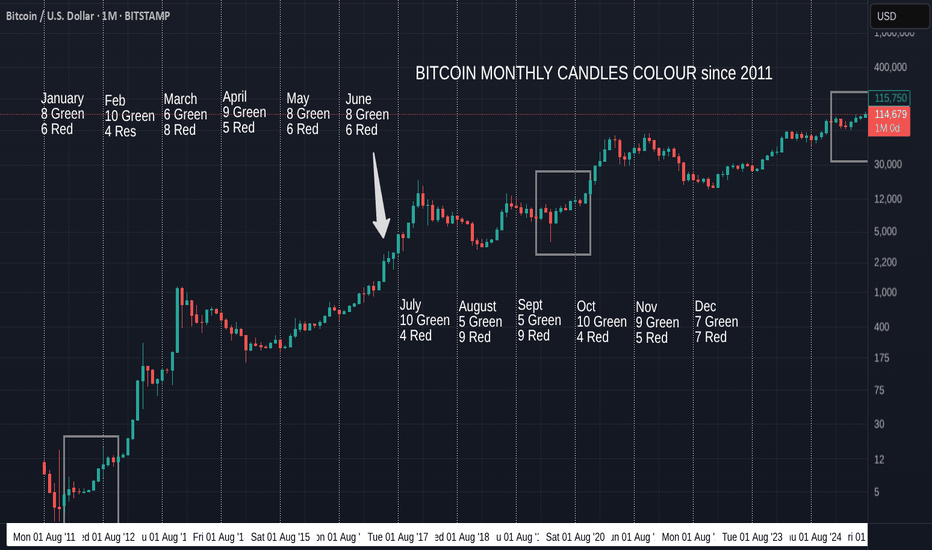

Bitcoin Monthly Candle Colour patterns and Colours since 2011

We got the expected GREEN July and so, amazingly, we continue to repeat the pattern from January to July 2012. ( Left Box )

It is almost the same pattern as 2020, apart from the Red May candle in that Year. (Right box)

The Large Arrow points towards another occasion where we had a series of consecutive Green candles from March to July, though these candles sizes are nothing like the ones we are currently experiencing.

The Boxes show us The only 2 occasions where we have had a Green December, Red January, Red February, Green March, Green April.

Then we had a Green May 2012 and a Red May 2020

Then both repeated a Green June, Green July.

The thing to note here is how all these are en-route to Cycle Highs.

So, August count currently is 5 Green to 9 Red, so the Odds are, while looking at BTC History, that we will get a RED August

HOWEVER, if we continue this run of following previous patterns, we will see a GREEN August.

In fact, 3 of those 5 Green August closes were in these 3 patterns mentioned.

Every single one of the 5 Green previous August followed a Green July, the last time was in 2021.

As mentioned in last months report, the size of the candles currently in this pattern are more like those in 2020 than the other 2 patterns talked about here.

With this in mind, we may expect a smaller Green candle close for August , Followed by a small Red candle in September. This did also happen in 2017 ( Arrow).

This August has opened Red but so far this year, many month opens were red and then changed.

So, My expectation id for a small Green August as markets cool off over the holidays and we wait for the start of Q4 in October.

We will have to wait and see as ever

Stay safe

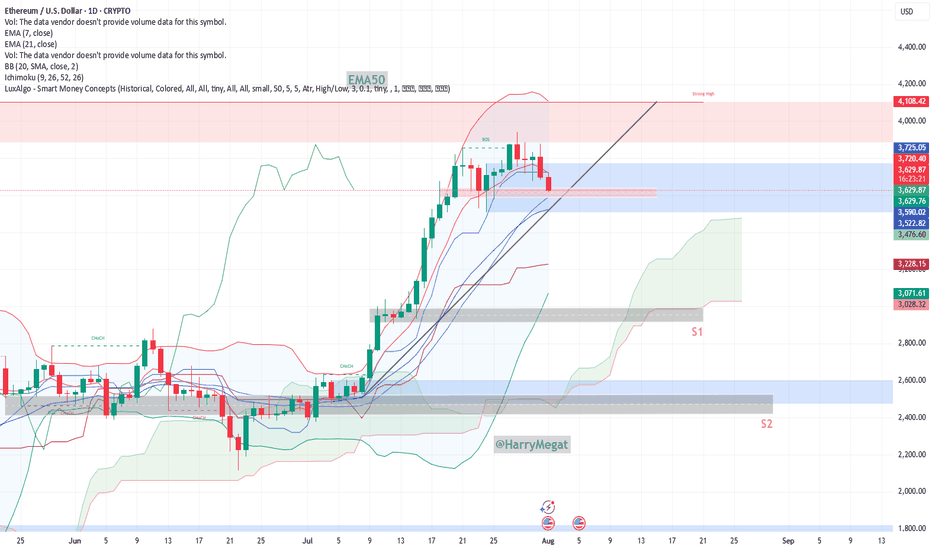

Ethereum (ETH/USD) Technical InsightsEthereum (ETH/USD) Technical Insights

**Chart Overview**

* **Current Price**: \~\$3,631

* **EMA 7 (Red Line)**: \$3,720.80

* **EMA 21 (Blue Line)**: \$3,522.96

* **Key Support Zone (Pink area)**: \~\$3,600–\$3,650

* **Support 1 (S1)**: \~\$2,950

* **Support 2 (S2)**: \~\$2,500

* **Uptrend Line**: Still intact, but under pressure

**Technical Insights**

* **Price Breakdown**: ETH has dropped below the **EMA 7**, and is now testing a **critical horizontal support zone** around **\$3,600–\$3,650**.

* **Trendline**: Still holds, but ETH is **hovering just above it**, signaling a potential bounce or breakdown.

* **EMA 21** near \$3,522 is the next short-term support if \$3,600 fails.

* **Momentum**: Recent candles show **strong selling**, indicating weakness, but no full breakdown yet.

**Bullish Scenario**

*Conditions**:

* Price **holds above** \$3,600–\$3,620 zone and the **trendline**

* **Bounce** with bullish daily candle from current zone or above \$3,650

**Buy Setup**:

* **Entry**: \$3,620–\$3,650 on confirmation

* **Stop-loss**: Below \$3,520 (just under EMA 21)

* **Targets**:

* TP1: \$3,720 (reclaim EMA 7)

* TP2: \$3,850–\$3,940

* TP3: \$4,100+

**Bearish Scenario**

**Conditions**:

* Price **breaks below** \$3,600 and **the trendline**

* EMA 21 is lost with strong bearish candle

**Sell Setup**:

* **Entry**: Below \$3,580 on breakdown

* **Stop-loss**: Above \$3,650

* **Targets**:

* TP1: \$3,520 (EMA 21)

* TP2: \$2,950 (S1)

* TP3: \$2,500 (S2)

**Bias: Neutral with Bearish Lean**

* **Decision Zone**: ETH is at a key inflection point

* Wait for **confirmation**: bounce or breakdown before entering

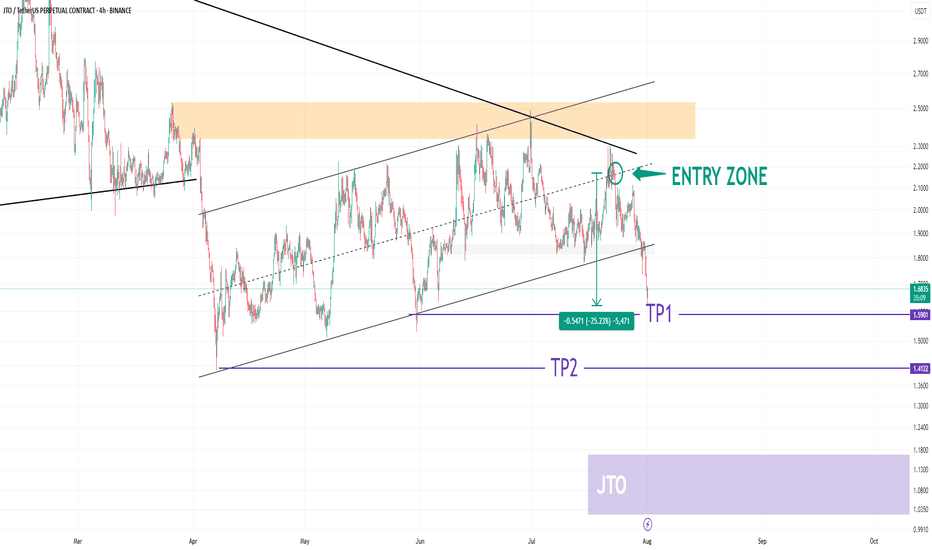

JTO USDT UpdateHELLO 😍

JTO Update

💁♂️ -25% 🔥

I shared this analysis when it was in the entry section. It would be nice to have an update of this analysis.

The JTO cryptocurrency has corrected 25% since the entry zone.

We saw a very good analysis together. What do you think? 😊💖

You can save some profit from the position in this area. 🐱

Please don't forget to like, share, and boost so that I can analyze it for you with more enthusiasm. Thank you. 💖😍

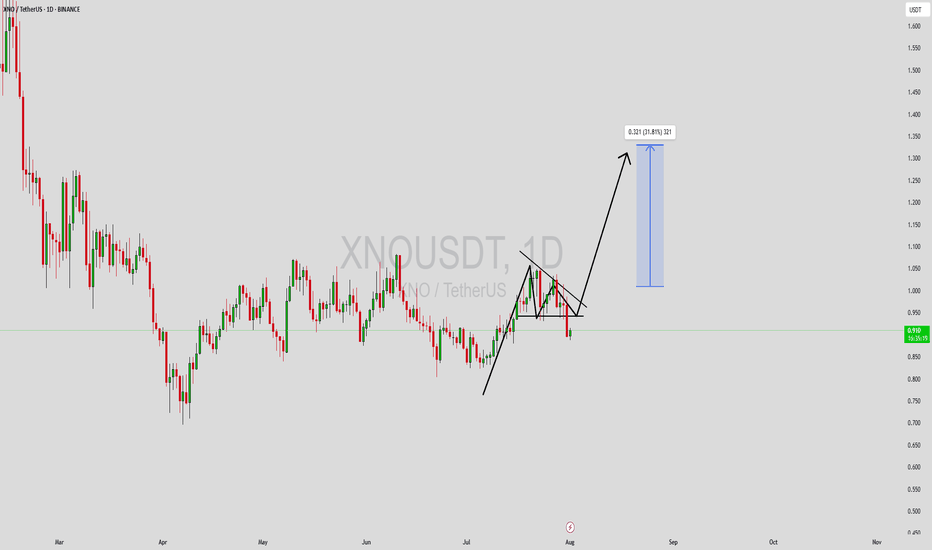

XNOUSDT Forming Bullish PennantXNOUSDT is currently displaying a bullish pennant pattern on the charts, which typically signals a continuation of the prior upward trend after a brief consolidation. This formation is marked by converging trendlines and reduced volatility, often setting the stage for a sharp breakout to the upside. With bullish momentum already in place, traders are closely monitoring this setup for confirmation of the next leg up.

The trading volume remains supportive, maintaining a steady flow that could power a breakout beyond the pennant resistance line. A breakout with a strong volume spike would indicate renewed buying pressure, which could push prices up by 20% to 30% or more. This makes XNO an attractive short-term opportunity for technical traders looking to capitalize on momentum-driven setups.

Investor interest around XNO has been gaining traction, especially as smaller altcoins with solid patterns begin to outperform during market recoveries. The bullish pennant adds to the credibility of this setup, especially in combination with favorable sentiment and increased watchlist mentions across trading communities.

Given the structure and volume dynamics in play, XNOUSDT is positioned for a potential bullish surge if key resistance levels are breached. This pattern, combined with current market conditions, could offer a favorable risk-reward ratio for traders watching for breakout confirmation.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!