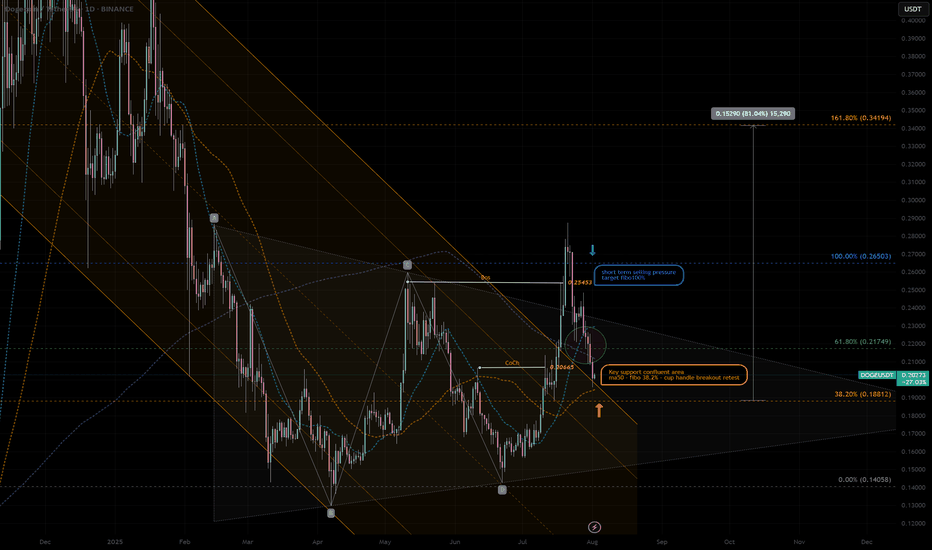

DOGEUSDT|Pullback Confluent Support -cup&handle next ext. +80%DOGE - retraced at the confluent support zone, high potential pullback buy position:

- SMA50 Dynamic support—often attracts mean-reversion buys.

- cup & handle support retest Price retested prior breakout zone—flips resistance to support.

- key 38% Fib “sweet spot” pullback level after corrective moves.

- Previous Change of Character marks shift from bearish to bullish structure—support confluence.

Potential Entry & Risk Management

Entry Zone

- Aggressive: immediate handle breakout support

- Conservative: Wait for liquidity pattern and re-bounce confirmation candle above SMA50

Stop-Loss

-Below Cup Handle low -10% larger position prior swing high RR:2.5/1

-Suggested SL: previous low -0.17 USDT - 5% below entry

Initial Targets

-Key resistance 61.8% Fib retracement — 0.217 USD

-100% Prior swing high — 0.26 USD

-162% Next extended target - 0.35 USD

Trade Rationale

-Mean-reversion into SMA50 and Fib 38.2% zone aligns multiple buyers.

-Pattern support: Cup & handle retest confirms breakout strength.

-Structure flip: CoCh zone indicates bullish regime shift.

Watch-Outs

-Rejection below 0.188 USD erodes support cluster—invalidates setup.

-Rising volume on bounce is crucial—low-volume lifts often fail.

-Beware broader market sell-offs impacting altcoins.

Next Steps:

-Monitor 4-hour candlestick close inside entry zone.

-Check volume spike on reversal candle.

-Adjust risk dynamically if price gravitates toward upper channel resistance.

Always trade with affordable risk and respect your stop..

Chartpatterntrading

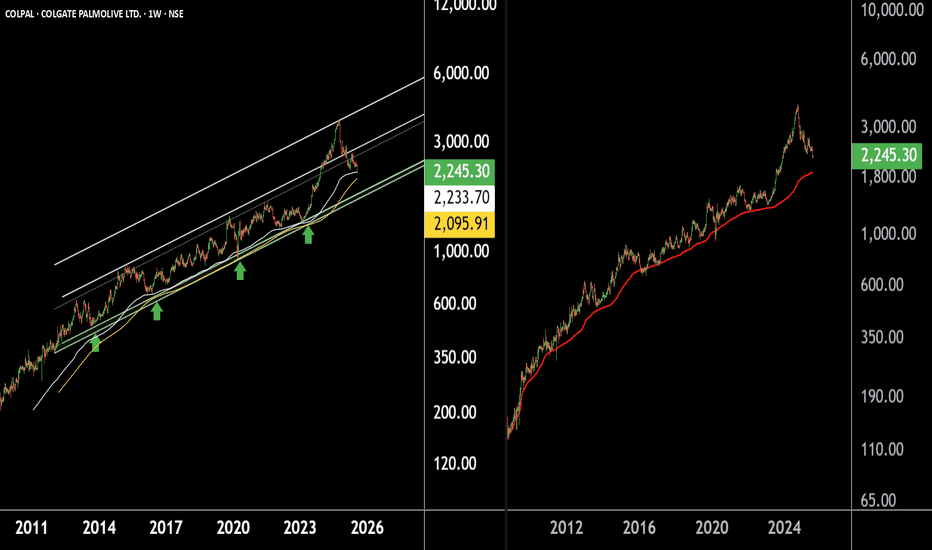

Colgate Palmolive – A Safe Haven Stock for Long-Term InvestorsThere are two chart of Colpal.

COLPAL is moving in well defined parallel channel with support near at 1750-1850.

COLPAL is taking support on Ema with near at 2050-2150.

COLPAL is taking support near its AVWAP zone, which lies between ₹1800–₹1900.

If this level is sustain then we may see higher prices in COLPAL.

Thank You !!

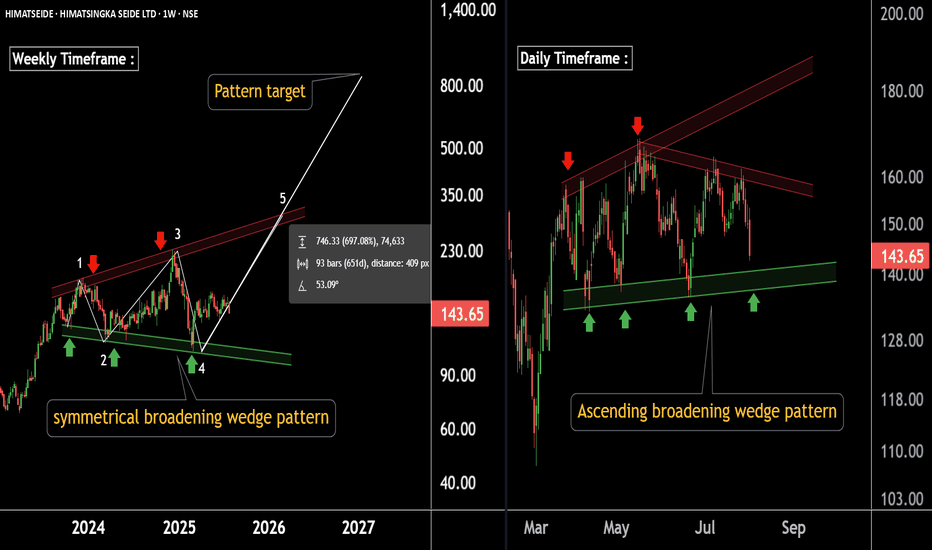

Massive Base Formation on Charts – Potential Multibagger LoadingThere are two Chart of HIMATSINGKA SEIDE.

Himatsingka Seide is forming a symmetrical broadening wedge pattern on the weekly timeframe, with a strong support zone near ₹100.

On the daily timeframe, Himatsingka Seide is forming an ascending broadening wedge pattern, with a crucial support level near ₹135.

If this level is Sustain then we may see higher prices in Himatsingka Seide.

Thank You !!

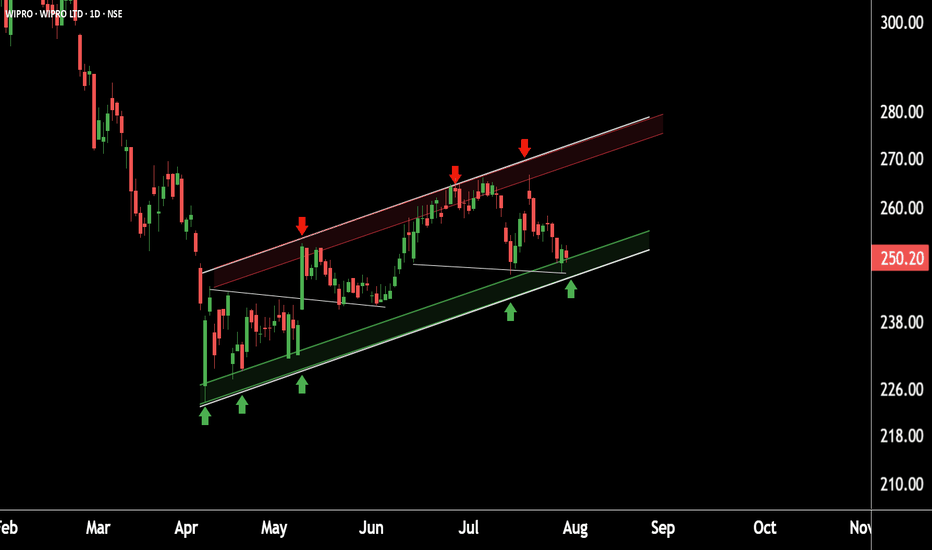

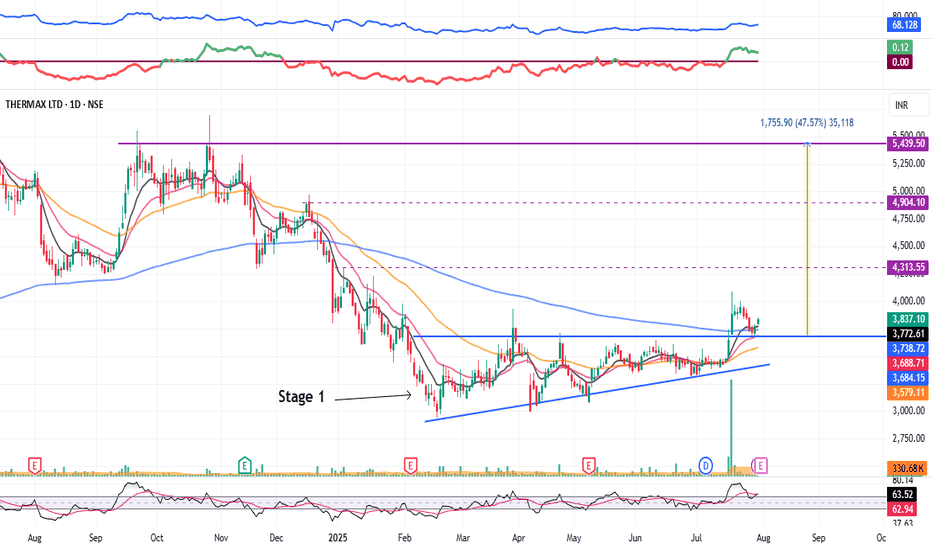

Thermax : Stage 1 Breakout (1-3 Months)#Thermax #stage1nreakout #ascendingtrianglepattern #patternbreakout #trendingstock #swingTrading

Thermax : Swing Trading

>> Stage 1 Breakout + Retest done

>> Ascending Triangle @ bottom of Downtrend

>> Trending setup in stock

>> Good strength & Recent Volume Buildup

>> Low Risk High Reward Trade

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, comment & Follow for more Analysis

Disc : Charts Shared are for Learning Purpose & not a Trade recommendation. Pls consult a SEBI Registered Advisor before taking position in it

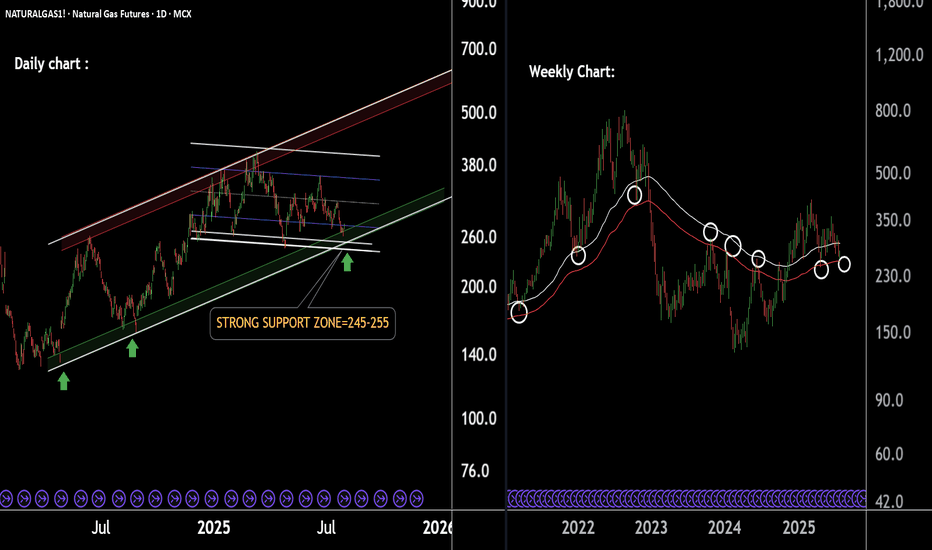

Natural Gas Cooling Near Support Zone – Bounce Ahead!Natural Gas Technical Overview (2-Chart Analysis):

Chart 1 – Parallel Channel Formation:

Natural Gas is moving within a well-defined parallel channel.

The lower support boundary of this channel is observed near 250, indicating a potential bounce zone.

Chart 2 – EMA-Based Support Structure:

Price is currently sustaining above key EMAs, reflecting short-term strength.

The last EMA support lies around 252, acting as an additional support confluence.

If this level is sustain then we may see higher prices in Natural gas futures.

Thank you !!

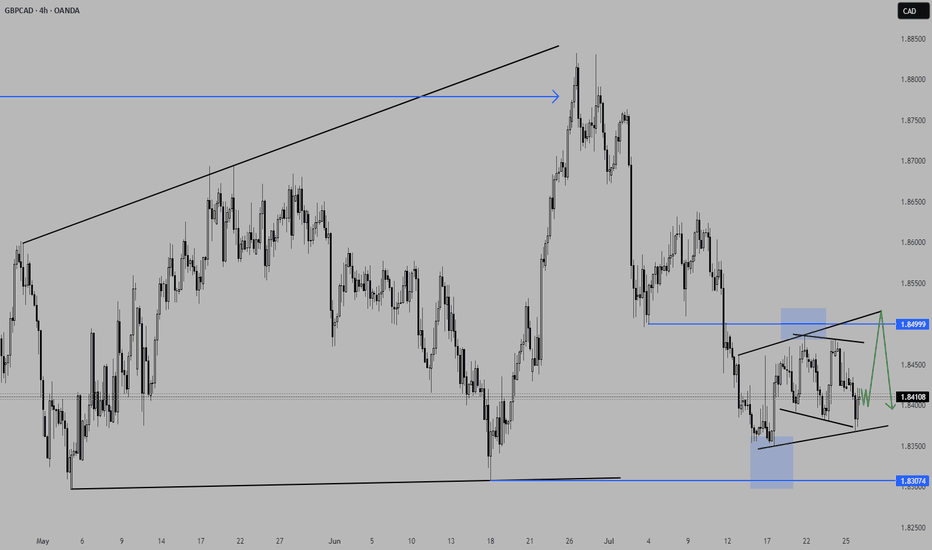

GBPCAD a short-term long trade into a HTF short area.GBPCAD presents a potential LTF long trade into a HTF short area. I am overall still bearish biased, but considering we have gaps to the top of the structure we might get an opportunity for a short-term counter long trade to finish the consolidation before we see the next bigger move to the downside.

📈 Simplified Trading Rules:

> Follow a Valid Sequence

> Wait for Continuation

> Confirm Entry (valid candlestick pattern)

> Know When to Exit (SL placement)

Remember, technical analysis is subjective; develop your own approach. I use this format primarily to hold myself accountable and to share my personal market views.

⚠ Ensure you have your own risk management in place and always stick to your trading plan.

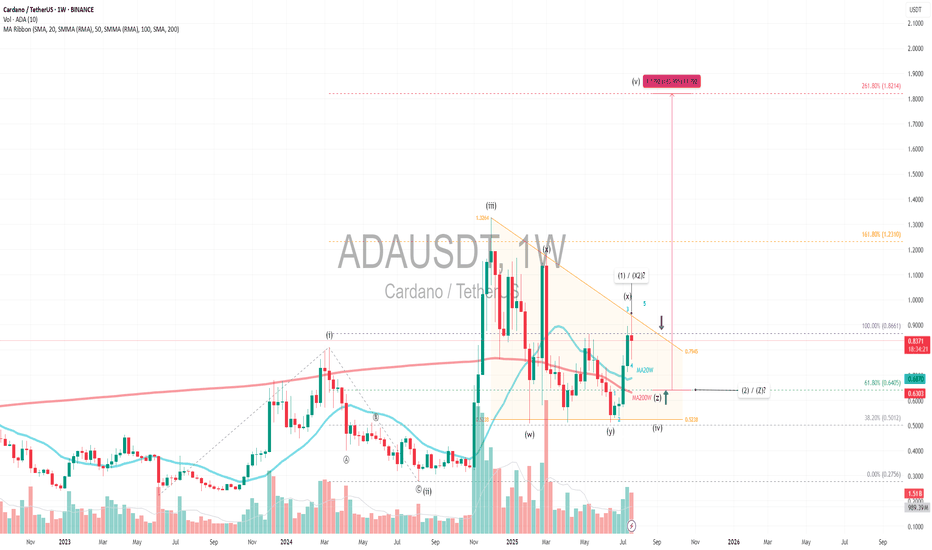

ADAUSDT|Triangle Setup WXYX2Z (1-2) +180% - Revisit $1.82 TargetPrimary Pattern: A contracting triangle within a larger corrective structure, likely wave 4.

Wave Count: A diagonal 5-wave impulse (i–v), followed by a WXY (X2) Z complex correction, suggesting wave 4 is still unfolding, possibly nearing completion.

Current Price: $0.83 with volume and SMA ribbon golden crosses showing bullish signal and near completion of accumulation phase.

Fibonacci Extension:

Targeting diagonal wave 5 at 261.8% extension from the base of wave 1 aligns with the projected target of $1.82, which matches the height of the triangle target. This also coincides with a +180% move from the possible upcoming wave Z or wave 2 —technically ambitious, but plausible if wave 5 kicks off with momentum.

Wave 4 Triangle Context:

The WXY(X2)Z structure implies a complex sideways correction which is typical of wave 4 behavior 1.6x - 2x wave 2 time extension

Key Support:

Entry: If X or 1 is nearing completion, and triangle support holds at key support MA20W Fibonacci 61.8%, the breakout into wave 5 could be explosive—especially with diagonal structure suggesting a leading diagonal pattern.

SL: Triangle Support is the last liquidity / smart money entry

Always trade with affordable risk and respect your stoploss!

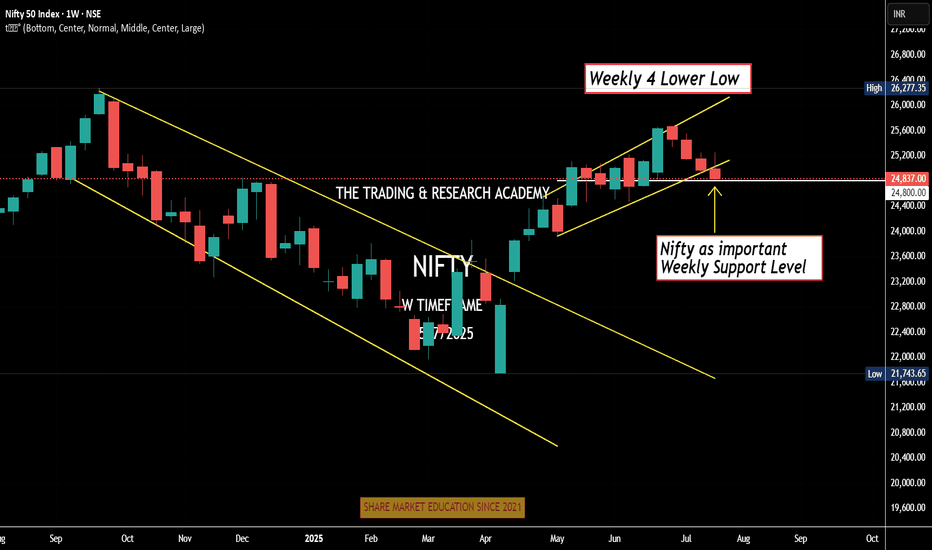

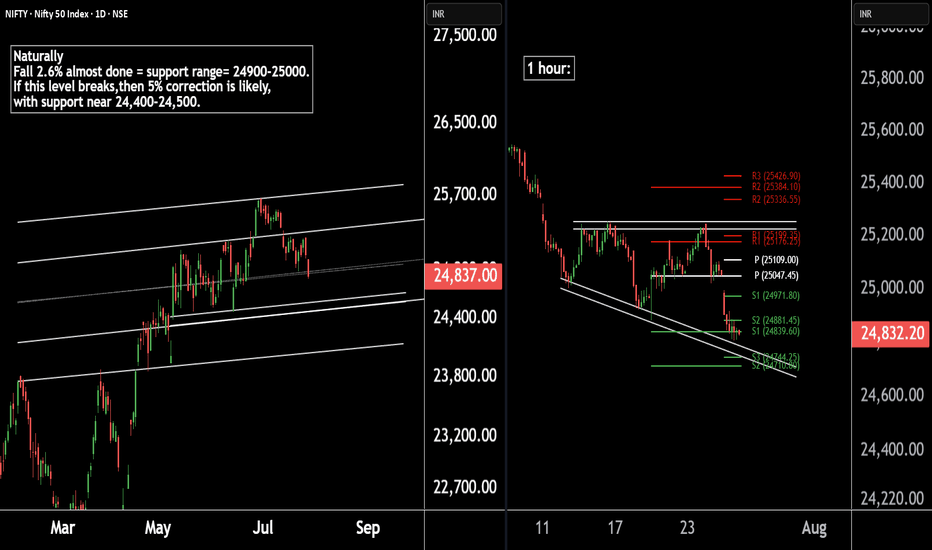

Nifty 50 Update | Technical Levels MappedThere are two chart of Nifty50.

Nifty 50 is trading within a well-defined parallel channel. As part of its natural corrective phase, a potential decline of around 5% cannot be ruled out, with key support anticipated near the 24,400–24,500 zone.

Nifty is forming a broadening wedge pattern on the 1-hour timeframe, with crucial support around 24,740. Additionally, both the weekly and monthly pivot supports are aligned in the 24,740–24,710 zone, reinforcing the significance of this level.

If this level sustain then we may see higher prices in Nifty50.

Thank You !!

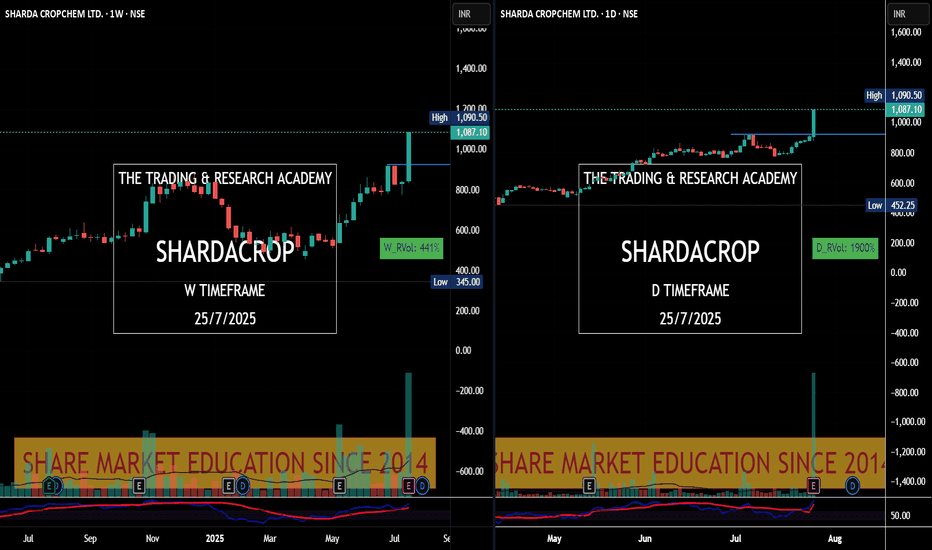

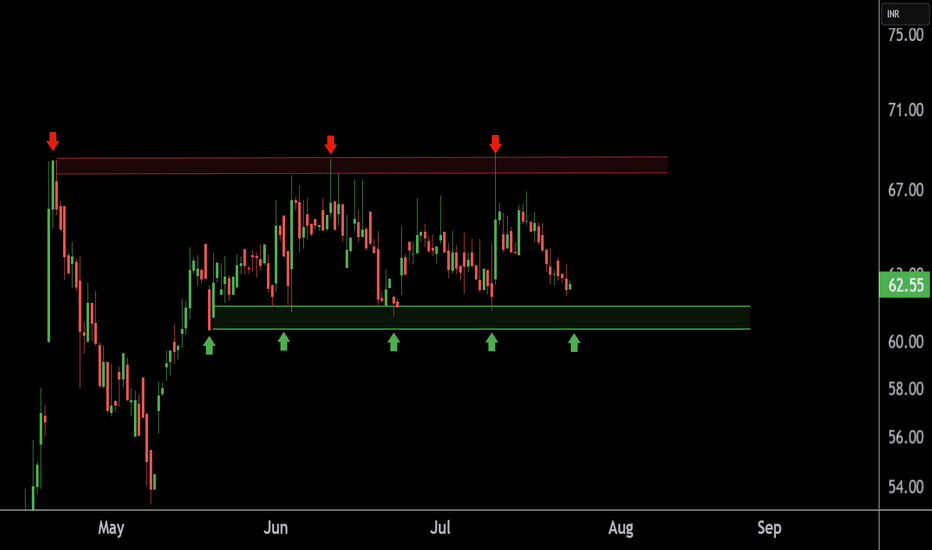

Charts Speak #Sharada Cropchem

Sharada Cropchem

Charts always lead the News! This is yet another example where price was leading & News came later.

Stock was under accumulation since June with higher qty. In fact since May 25, it was getting bought in average 2-3M qty weekly. What a planned buying..

28th May, 4 June, 18th July were nice buying alarms for us. Today it was just a final nail in the coffin.

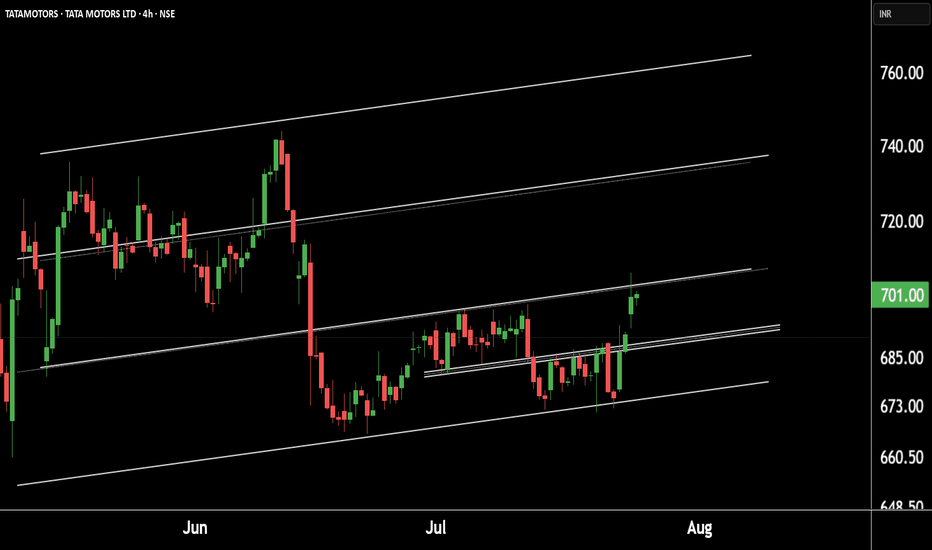

Tata Motors Gearing Up for a Fresh Rally! Technical Breakout !!This is the 4 hour chart of tata motor.

Tatamotor is moving in well defined parallel channel and bounced from it's supportt level near at 680, now ready for the breakout level at 705 .

If this level is sustain after the breakout then , we will see higher price in Tata motor.

Thank you !!

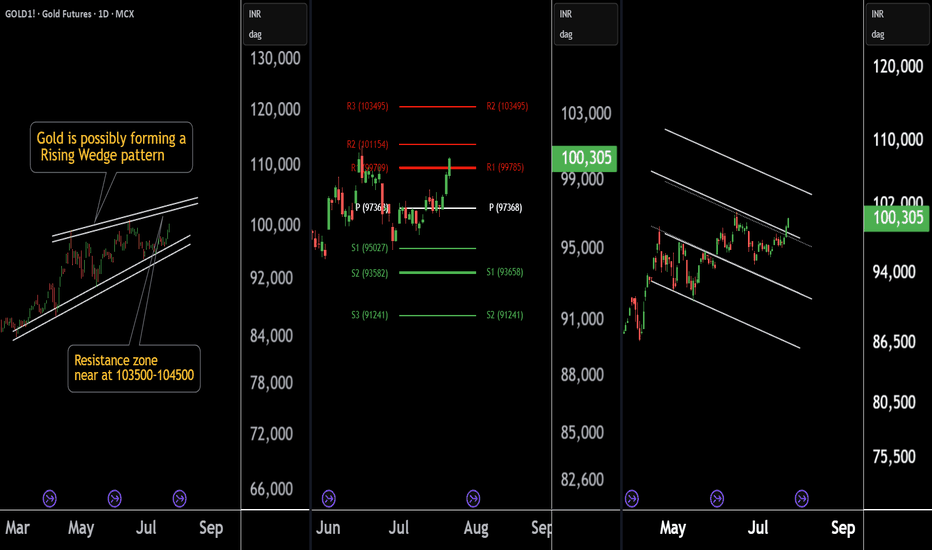

Gold at a Crossroad: Long or Short? Key Levels in FocusThere are three chart of Gold .

Gold1! is forming a Rising Wedge pattern, with resistance positioned between 103500-104000 levels.

Gold1! is facing Pivot Point resistance around the 103500 level, indicating potential supply pressure.

Gold1! is approaching the parallel channel resistance, and the upside move is nearly complete in percentage terms, with resistance around 103800-104000.

if this level sustain then we may see first of all higher prices then again fall in gold1!

Thank You !!

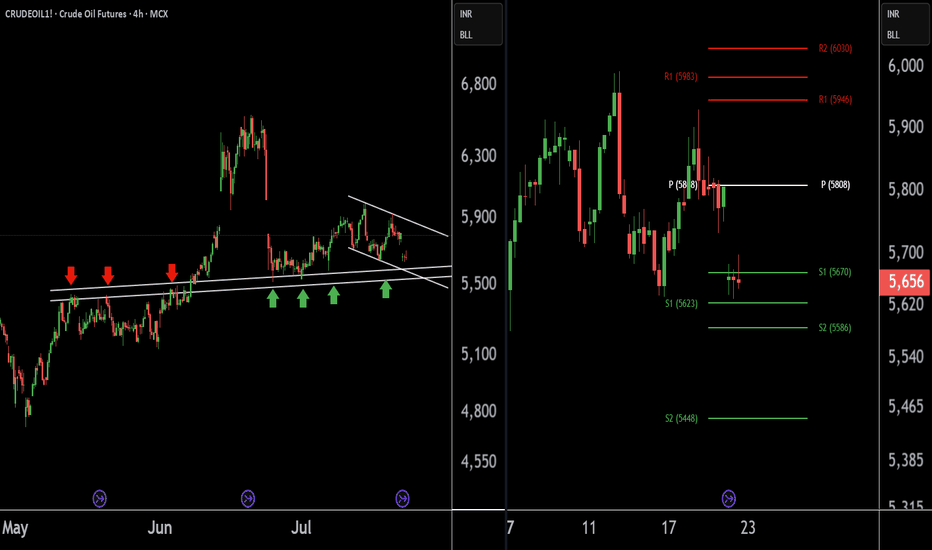

Crude Oil Buying Alert: Strategic Entry Point IdentifiedThere are two charts of Crude Oil on the 4-hour timeframe.

In the first chart, Crude Oil is sustaining near its lower point (LOP), with a support range of 5540-5580.

A-VWAP is also providing support to Crude Oil around the 5580 level.

The Pivot Point is also supporting Crude Oil around the 5580-5620 level.

If this level is sustain then we may see higher prices in Crude Oil.

Thank you !!

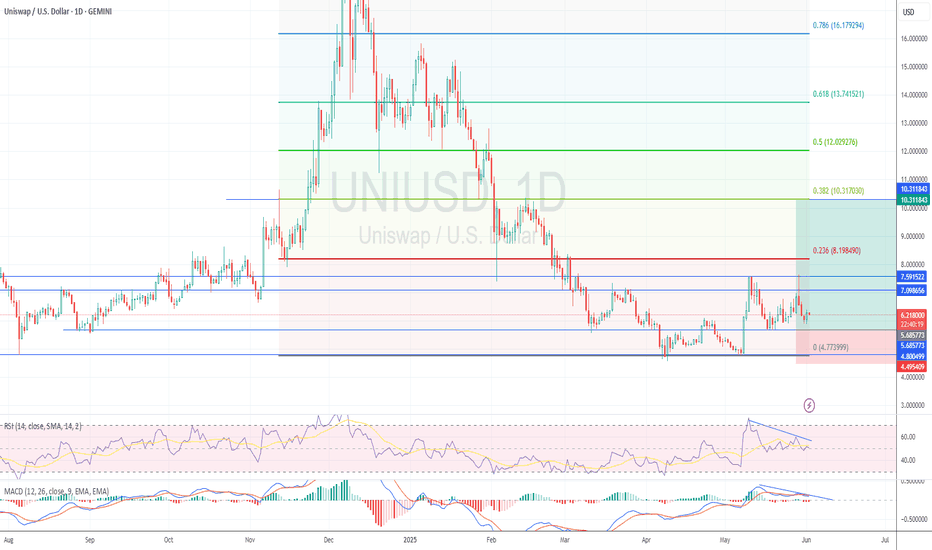

$UNI - $10 from here?Hi guys! 👋🏻

🔔I'll be trying this setup for Uniswap

🔔 We have bounced from the strong support at $4.80, which we retested in April 25 and May 7 forming a pattern impersonating a double bottom

🔔 With the current chart pattern and levels, I'll be expecting a jump with a target on $10.

🔔 Might drop to $5.70 before another move upwards.

✊🏻 Good luck with your trades! ✊🏻

If you like the idea hit the 👍🏻 button, follow me for more ideas.

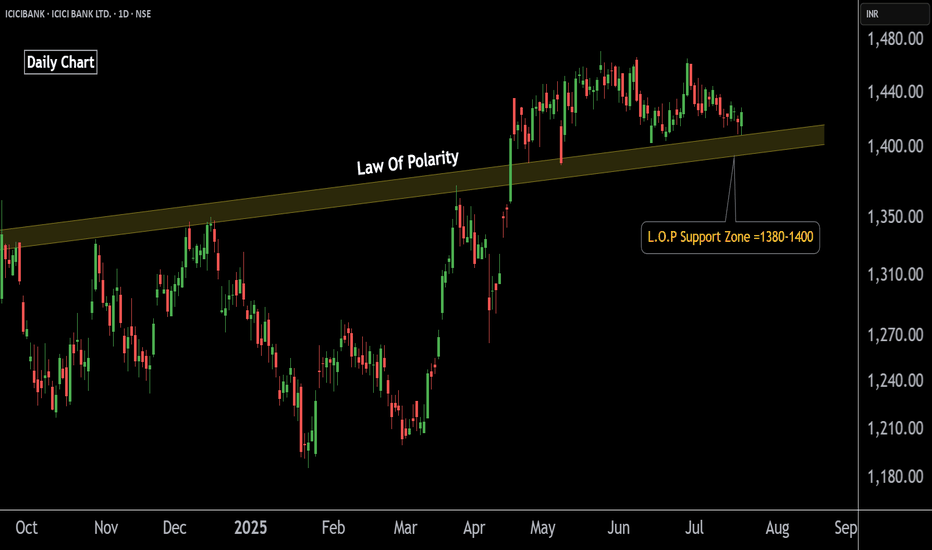

Exide Industries Ready for the Next Bull Run !! Powering Up !!there are two chart of Exide Industries.

In a first chart: EXIDEIND is moving in a well defined parallel channel and currently trading near at support 365-375 range

In the second chart,EXIDEIND is respecting support at both the monthly pivot and the supertrend indicator, with the support zone positioned between ₹365-₹370.

EXIDEIND is currently sustaining below both the monthly and weekly pivot levels at ₹290. As long as the stock does not break above this pivot zone, the momentum is expected to remain weak.

If this level is suatin then ,we may see higher prices in EXIDEIND.

Thank you !!