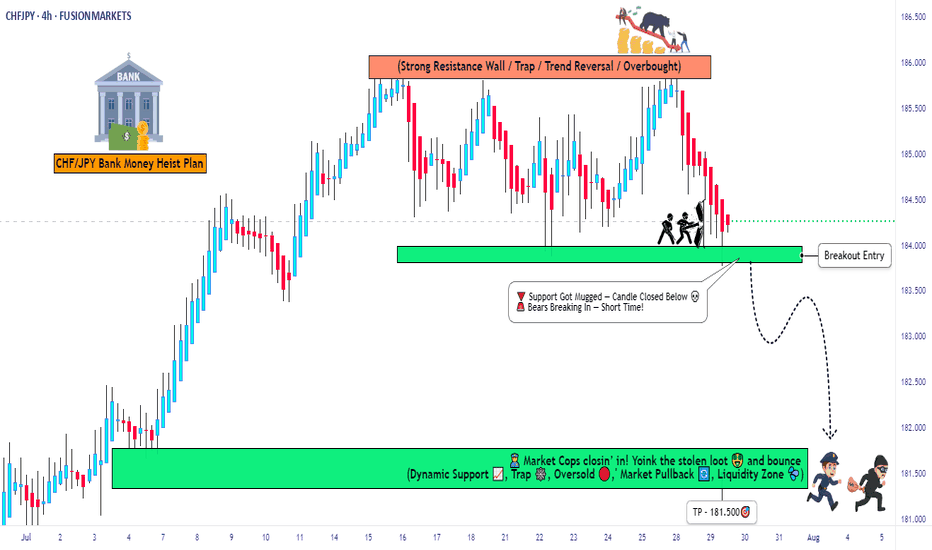

CHFJPY Day/Swing Trade Setup – Bearish Move Loading...💸"Operation Swiss Shadow: The CHF/JPY Forex Heist Blueprint" 💸

(Thief Trading Style: Master Plan Edition)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Robbers & Market Ninjas 🤑💰✈️,

This ain't your average trade idea — this is a Thief Trading certified forex heist targeting the CHF/JPY aka "Swiss vs Japanese". Based on my unique blend of 🔥technical traps + fundamental pressure points🔥, we've built the perfect blueprint to rob this pair at its weakest moment.

💣 Our target? The overhyped bullish zone — oversold, consolidating, and ripe for reversal. This is where institutional bulls camp, and we’re about to hit ‘em where it hurts.

🎯 Trade Setup Breakdown (Bearish Bias)

🎯 Entry Point:

The heist begins at 183.800 — wait for a neutral level breakout and prepare your sell orders.

💥 Recommended play:

Place Sell Stop just below the breakout confirmation.

For pros: use Sell Limit orders above MA or at pullback zones (15m/30m chart) near recent swing highs/lows — layer in using DCA style to catch premium entries.

🔔 Pro Tip:

Set alerts at the breakout zone. Don’t sleep on the move — timing is key in every robbery.

🛑 Stop Loss Strategy

"Yo listen! This ain't no demo drill!"

SL = 185.500 (4H swing high wick)

Place SL ONLY after breakout confirms — no pre-breakout SLs, no pre-heist drama.

Adjust SL based on risk %, lot size, and number of entries you're stacking.

If you’re reckless, go wild. But don’t say I didn’t warn you. You’re dancing with the FX devil here.

📉 Target Exit Zone

TP = 181.500

But real thieves know: If the heat gets heavy, vanish early. Escape before the target if price action warns you.

Survive > Greed. Always.

🔍 Macro Market Intel for Our Heist Plan

CHF/JPY is in a Bearish narrative, aligned with:

🧠 Fundamental Shifts

🏦 Macro Trends (Swiss deflation concerns + Japanese carry trade dynamics)

📉 Commitment of Traders (COT) Data

🌦️ Seasonal & Intermarket Correlation

🧭 Sentiment, Risk Flows & Future Pricing Models

🗞️ Before you break in, read the news, study the reports, watch the market smoke signals.

🚨 Trading Alert (News Protocol):

📢 Important: News releases = wild volatility. Stay smart:

No new trades during high-impact releases

Use trailing SLs to protect bagged profits

Adjust sizing to dodge unnecessary exposure

💖💥 Support the Robbery Plan 💥💖

Smash that 🚀BOOST button if you're vibing with the Thief Trading Style.

Every click helps build the strongest robbery crew in the FX game. This ain't luck — it's strategy, timing, and execution. 💪📈🎯

I'll be back soon with another market heist plan — stay sharp, stay paid. 🐱👤💼📊

Chfjpyshort

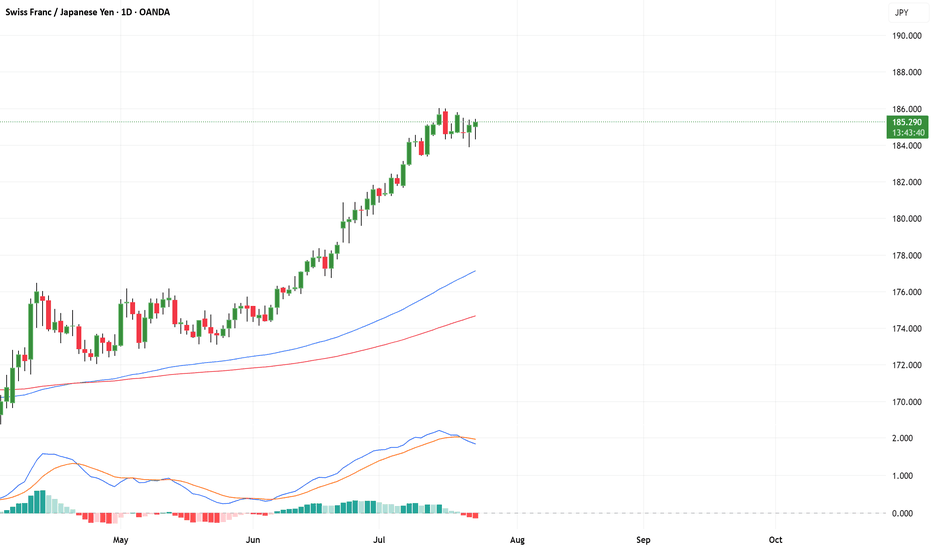

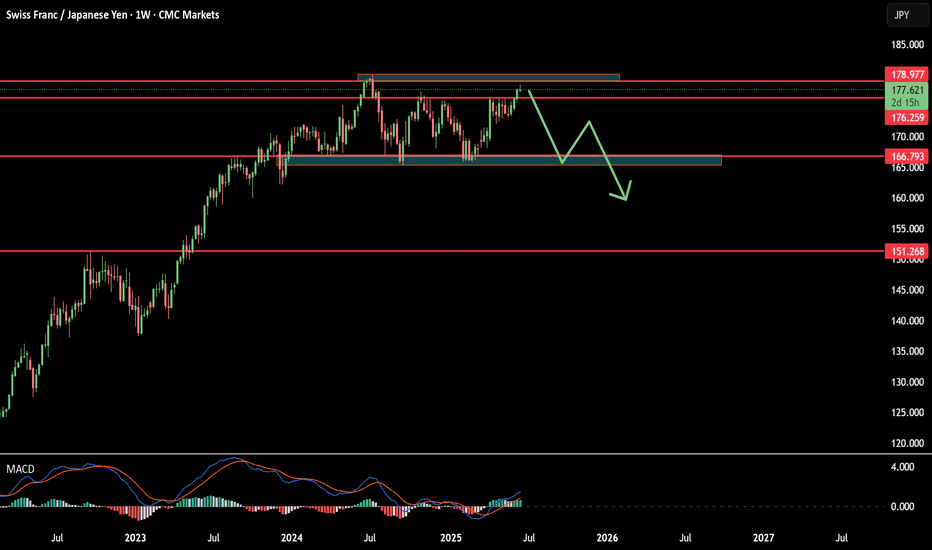

CHFJPY Looks Toppy… Is a 500 Pip Crash Coming?CHFJPY Has Exploded Past 180 — But Is the Top Already In?

After blowing clean through the key 180 resistance level, CHFJPY has continued surging into July — a month historically known for thin liquidity as traders hit holiday mode. These low-volume environments often lead to exaggerated price moves, much like we see in late December.

From a structural standpoint, this pair looks seriously overextended and ripe for a sharp pullback — with potential downside targets around 180 and 178 over the coming weeks.

If I were a bull, I’d want to see a clear break and weekly/monthly close above 186 before considering further upside.

As it stands, I’m gradually building into a short position, eyeing that 180 handle as my first key level.

Let me know your thoughts in the comments — agree, disagree, or seeing something I’m not?

*This is my personal analysis shared for educational purposes only. Always do your own research — never blindly follow anyone’s trades.*

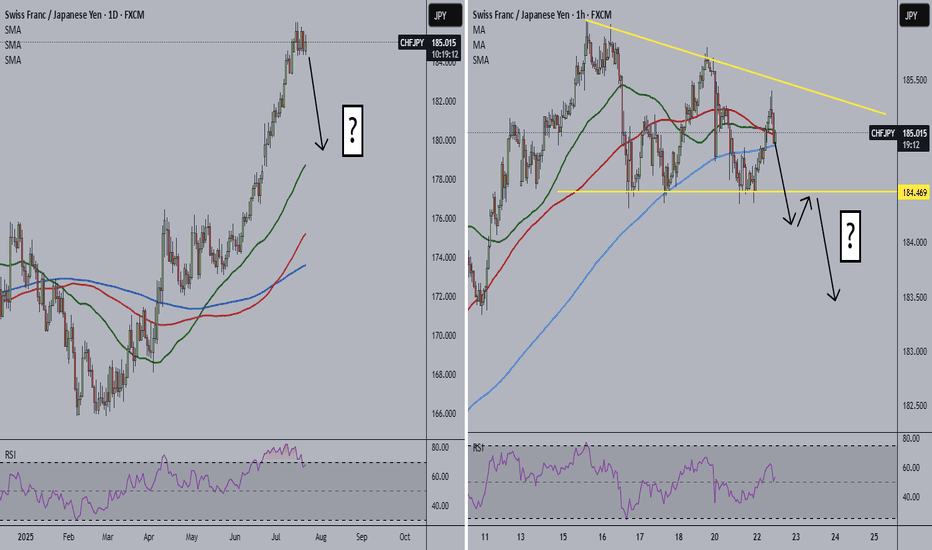

CHFJPY Alert!

🚨 CHFJPY Alert 🚨

Don't catch a falling knife... 🔪 However, price always returns to moving averages, and CHFJPY could be starting its descent.

Personally, I think price may form one last bullish move up and then come crashing down. However, the 1-hour is forming a descending triangle. A break below the triangle could be the start of the daily retracement.

Thoughts?

CMCMARKETS:CHFJPY

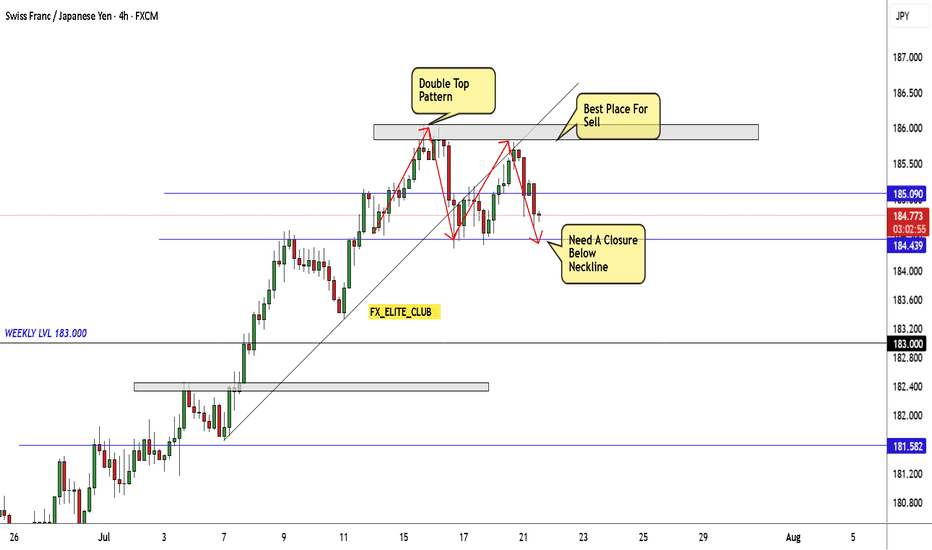

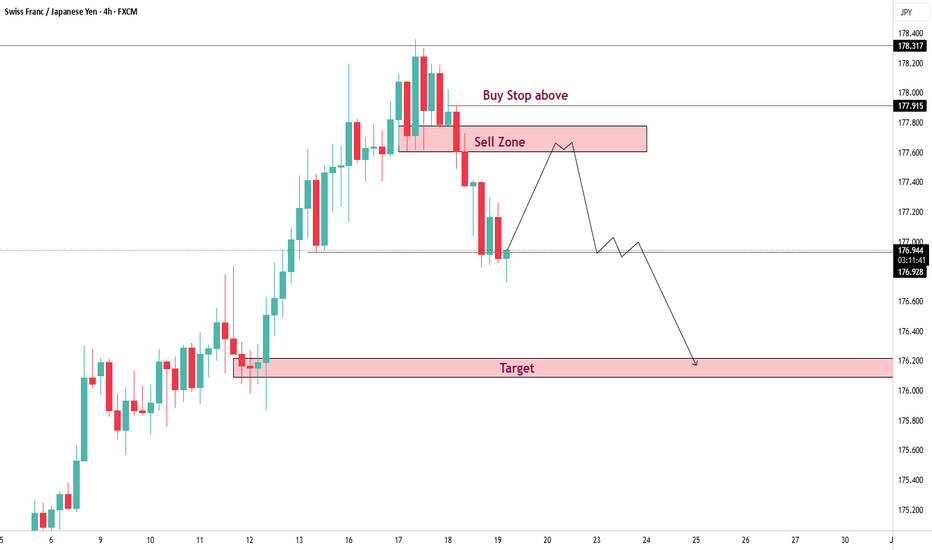

CHF/JPY Creating Double Top Reversal Pattern , Ready To Sell ?Here is my opinion on CHF/JPY 4H Chart , if we take a look we will see that the price moved tp upside very hard without any correction and now finally we have a reversal pattern but still not confirmed , so we have 2 places to sell this pair , first one is highest one around 185.800 To 186.000 and the second one if the price confirmed the pattern and closed below the neckline then we can enter a sell trade and targeting the nearest support . if we have not a closure below the neckline to confirm the pattern then this setup not valid .

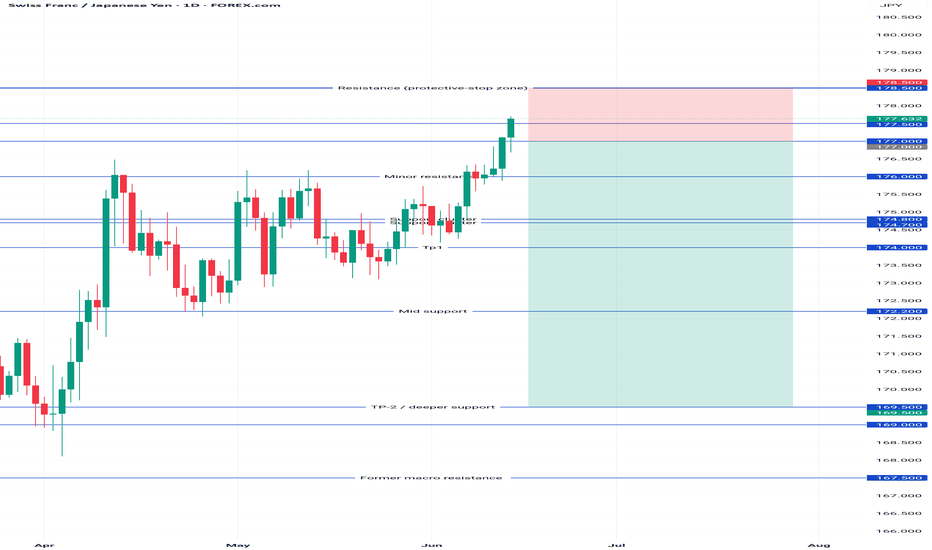

CHFJPY July Setup: Bearish Reversal Brewing from RSI ExtremesCHFJPY is setting up for a clean bearish reversal heading into July.

📌 Here's the breakdown using Vinnie’s Trading Cheat Code System:

✅ RSI OB Zone triggered – momentum stretched

✅ Trendline exhaustion forming near key resistance (~178.00)

✅ Waiting on Confirm Sell or MACD cross to validate entry

✅ First targets at 174.00 and 170.60 (prior demand zones)

The pair is showing signs of topping after a strong JPY selloff and CHF strength surge. If risk-off flows hit, CHFJPY could unwind fast.

Watching for lower timeframe triggers to scale in. Will update once confirmation hits.

🧠 Powered by:

Cheat Code Confirm Alerts

CC Trend Indicator

RSI OB/OS

MACD Momentum Roll

Drop a comment if you’re watching this too — let’s track it together.

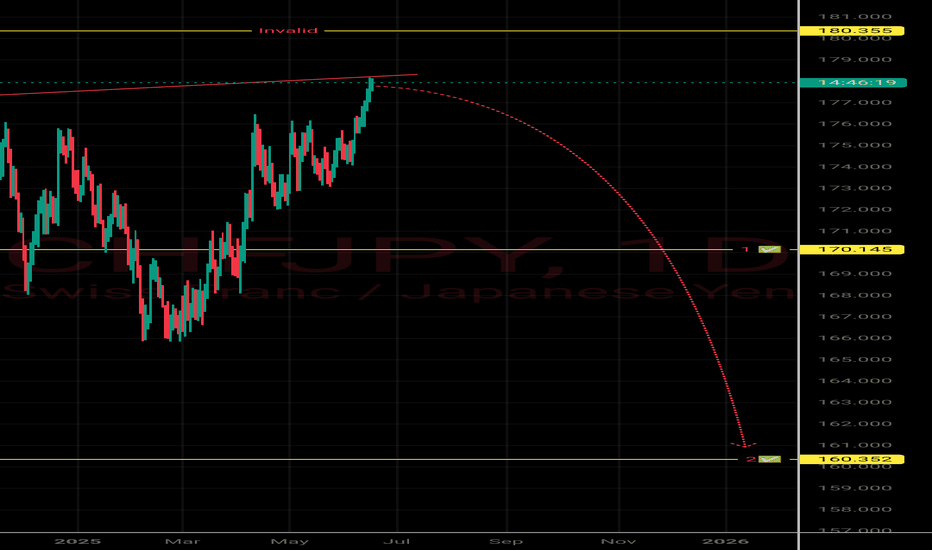

CHFJPY Daily Analysis – Potential Rounded Top Reversal🧠 Key Insights:

Price is approaching strong resistance near 180.355, aligning with historical highs.

A rounded top formation is visible, signaling potential bearish reversal.

A break above 180.355 would invalidate the bearish setup (marked “Invalid” on chart).

---

🔻 Bearish Scenario:

If rejection occurs at resistance:

✅ TP1: 170.145

↪ Horizontal support; prior consolidation zone.

✅ TP2: 160.352

↪ Major demand area; long-term support.

Entry can be considered on confirmation signals (e.g. bearish engulfing, divergence, or rejection wicks).

---

❌ Invalidation:

A daily candle close above 180.355 invalidates this setup and may signal continued bullish momentum.

---

✅ Summary:

CHFJPY is at a key resistance zone and showing signs of a possible top. If bearish confirmation forms, targets lie at 170.145 and 160.352. Use proper risk management and wait for confirmation before entering.

---

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with a licensed financial advisor before making any trading decisions.

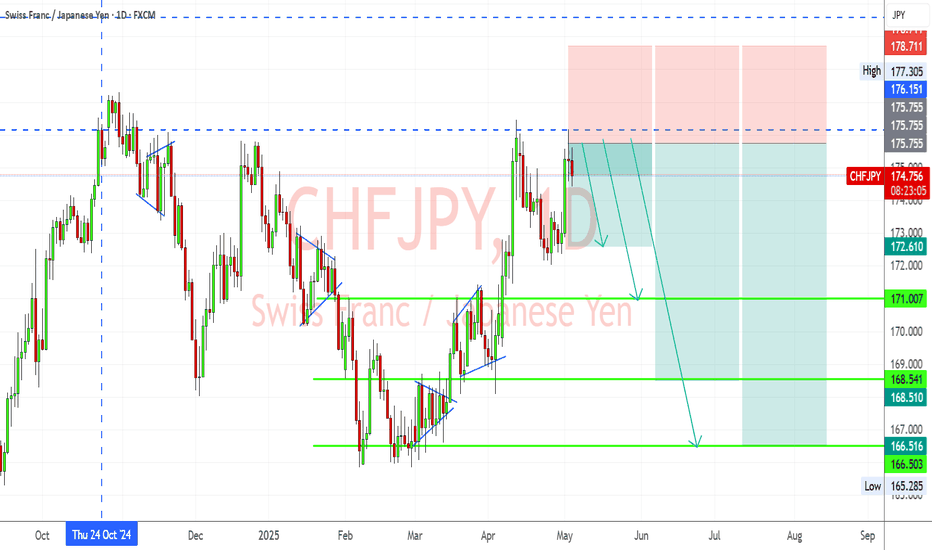

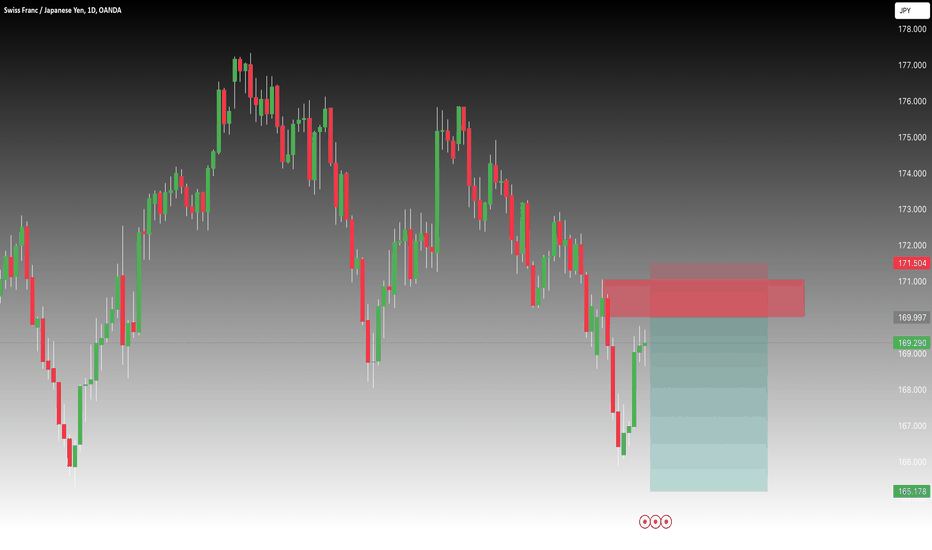

CHFJPY Analysis – Bearish Rejection at ResistanceCHFJPY pair is showing signs of exhaustion near a strong resistance zone just under 176.00. With price action printing multiple rejections and forming lower highs, the setup favors a bearish bias heading into mid-Q2 2025. With Japanese yen sentiment strengthening despite market doubts and Swiss inflation data showing stagnation, the technical picture is aligning with macro fundamentals for a potential drop.

📊 Technical Outlook (Daily Chart)

Key Resistance Rejected:

Price failed to sustain above 175.75–176.15 area, a strong historical resistance.

Multiple rejection wicks highlight bearish pressure at this level.

Bearish Structure:

Rising wedge and flag breakdowns have preceded the current move.

The chart shows a projected bearish leg forming, with three potential targets marked by green support zones.

Support Levels to Watch:

172.61 – Minor structure and neckline support.

171.00 – Key horizontal zone; likely the first major test.

168.50–166.50 – Final bearish targets based on previous structure and price consolidation.

Bearish Trade Plan (as indicated):

Entry zone: ~174.80–175.50 (after a confirmed lower high or breakdown).

Stop: Above 176.15 (structure invalidation).

TP1: 172.60

TP2: 171.00

TP3: 168.50

Final TP: 166.50

🌐 Fundamental Drivers

Swiss Inflation (April 2025):

Swiss CPI was flat MoM and YoY (0.0%), reflecting weak price momentum

Core inflation remained modest (+0.1%), reducing pressure on SNB to tighten policy.

JPY Sentiment & Positioning:

COT data shows record net-long JPY positions, suggesting strong speculative interest

Analysts warn of overbought sentiment, but dovish BoJ policy continues to suppress JPY bears for now.

Macro Context:

Risk-off sentiment or yield curve steepening could favor the yen further.

CHF may weaken if Swiss data continues to underwhelm.

✅ Summary

CHFJPY has rejected strong resistance, and both technical and macro indicators suggest a pullback is likely. A break below 172.60 could open the door to deeper declines toward 168.50–166.50 in the coming weeks.

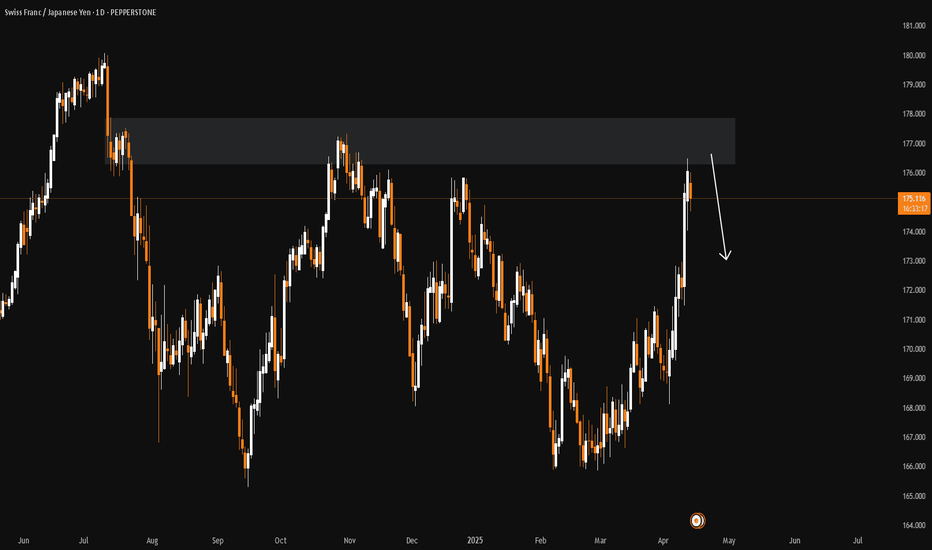

CHFJPY Rejection from Multi-Year ResistanceCHFJPY recently rejected strongly from the 176.15 resistance zone, a level that has historically acted as a ceiling since mid-2023. After a parabolic rise into this resistance, we’re now seeing early signs of a bearish reversal pattern, indicating sellers may be regaining control.

Key Technical Levels:

Current Price: 173.19

Resistance Zone: 176.15 – 177.07 (multi-year highs)

Bearish Targets:

🎯 TP1: 171.00 – psychological and structural support

🎯 TP2: 168.50 – previous demand zone

🎯 TP3: 166.50 – strong horizontal support area

Invalidation: Daily close above 176.15 would nullify the bearish setup.

📉 Bearish Confluence Factors:

✅ Price rejection from historical resistance

✅ Formation of lower highs on the lower timeframe

✅ Overbought conditions following a strong rally

✅ Potential double-top or head & shoulders formation developing

📌 Strategy Outlook:

Bias: Bearish below 176.15

Entry Trigger: Break below recent minor swing low (~172.80)

SL: Above 176.15

Targets: 171.00, 168.50, and 166.50

🧠 Fundamental Angle (Contextual Support):

CHF strength may be peaking amid fading safe-haven flows

JPY might strengthen if global risk sentiment worsens or yields decline

Possible SNB caution on an overly strong franc could weigh on CHF

BoJ policy stance still favors volatility in yen pairs, but CHFJPY is heavily extended and due for correction

📌 Conclusion:

CHFJPY appears to be in the early stages of a technical pullback after reaching key resistance. If momentum builds below 172.80, expect bearish continuation toward 168.50 and possibly 166.50 in the coming weeks.

CHFJPY Discretionary Analysis: Bouncing from the zoneHello traders.

CHFJPY is getting ready for the bounce. Start looking for a setup, if you are not already in.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making decisions based on what you see, what you feel, and what you've learned through experience. Unlike systematic strategies that rely on fixed rules or algorithms, discretionary traders use their judgment to read the market in real time. It's a skill that can't be rushed, because it's built on screen time, pattern recognition, and the ability to stay calm under pressure.

There's no shortcut here. You need to see enough market conditions, wins, and losses to build that intuition—the kind that tells you when to pull the trigger or sit on your hands. Charts might look the same, but context changes everything, and that's something only experience can teach you.

At the end of the day, discretionary trading is an art, refined over time, sharpened through mistakes, and driven by instinct. It's not for everyone, but for those who've put in the work, it can be a powerful way to trade.

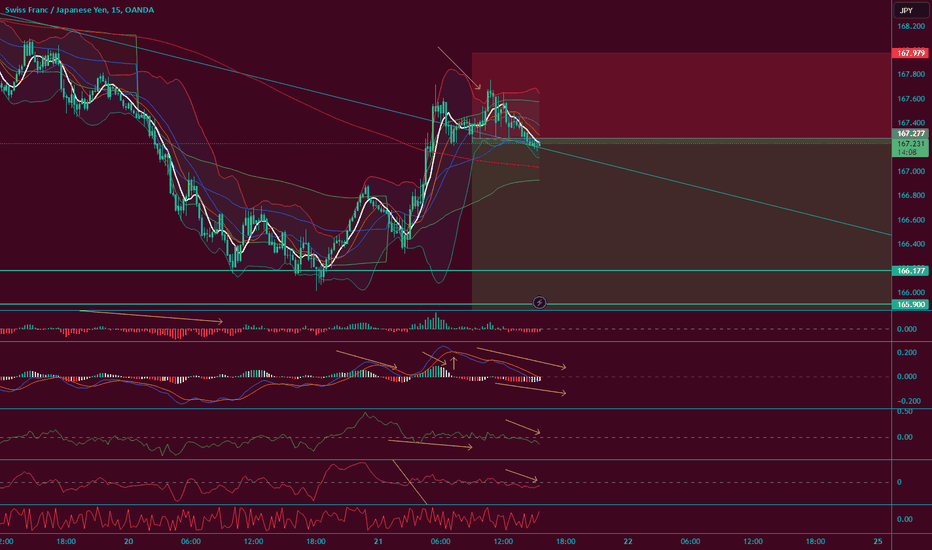

CHF/JPY Triangle Pattern (27.3.25)The CHF/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 169.06

2nd Support – 168.46

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

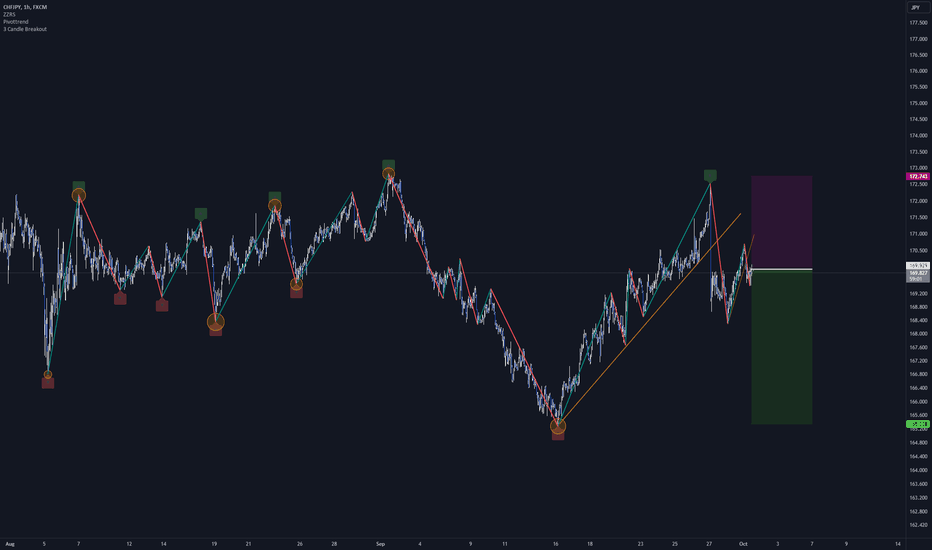

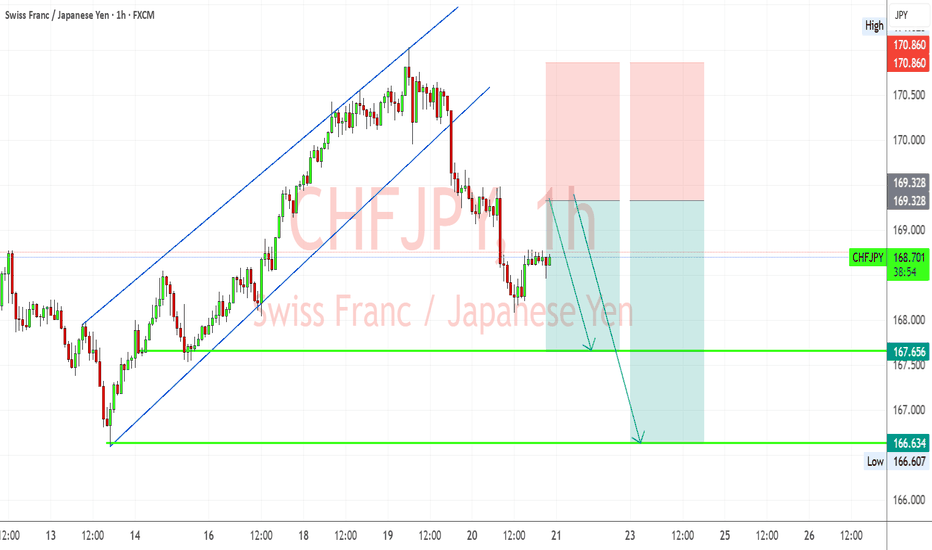

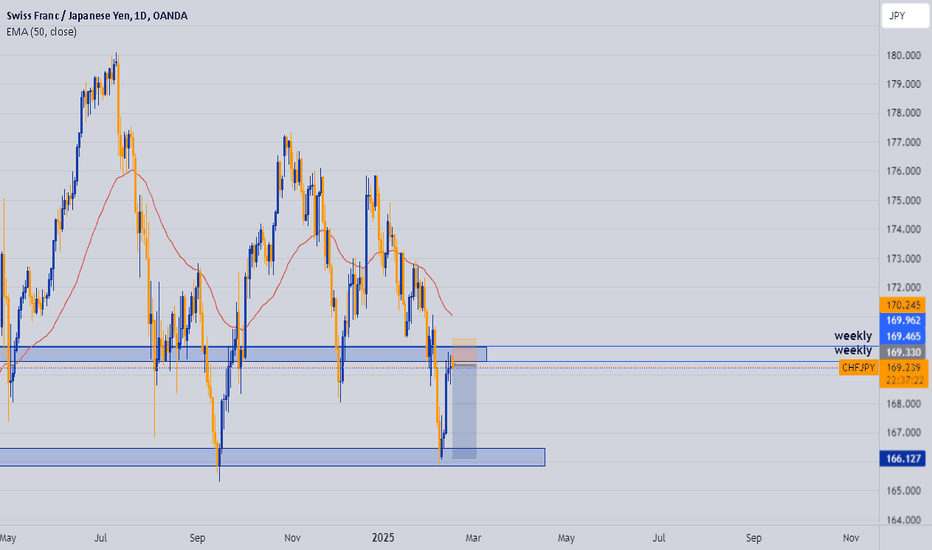

CHFJPY: Trend Channel Collapse Signals Bearish ShiftTrend Channel Breakdown: The chart clearly shows a previously established upward trend channel that has been decisively broken to the downside. This indicates a potential shift in momentum from bullish to bearish.

Key Levels:

The 169.328 level has been breached, suggesting it may now act as resistance.

Potential support levels are identified at 167.656 and the low of 166.607.

Bearish Momentum: The sharp downward movement following the trendline break suggests strong bearish momentum.

Timeframe: The 1-hour timeframe focuses on short-term price action.

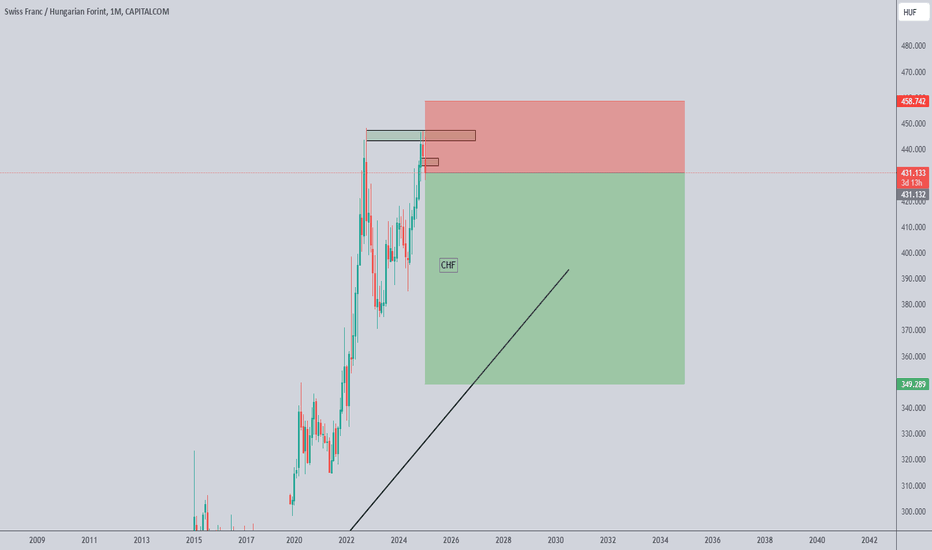

SELL CHFDouble Top Formation 📉 | CHF Poised to Weaken Across All Pairs 💱

The Swiss Franc (CHF) is showing a classic double top pattern, signaling a potential bearish trend. The structure is solid, aligning with technical analysis principles, and suggests a decline in CHF value against major currencies. 🌍

💡 Key Highlights:

Double top formation: Indicates strong resistance and potential reversal.

Big positive swap: Holding positions yields positive returns, making this setup even more attractive.

Bearish sentiment: CHF expected to weaken, offering opportunities for traders across all currency pairs.

📊 Watch for confirmations to validate the setup before entry! Perfect time for strategic planning. 🚀

MY CHFJPY Short Idea 21/2/2025CHFJPY is short due to many reasons but the main theme here is Japan is combating inflation (or hypothetically trying to increase their inflation) which strengthens the bond and the YEN. Meanwhile the SNB is cutting rates with their easing policies hence weakening the FRANC strength. CHFJPY is an extremely bearish FX pair and probably most likely pair to fall in %percentage for the year of 2025. I expect a 1.5-2.5% drop in the next few days or weeks.

My entry was a little late hence why I have a tight SL which could get triggered but I will take any short opportunity on this pair.

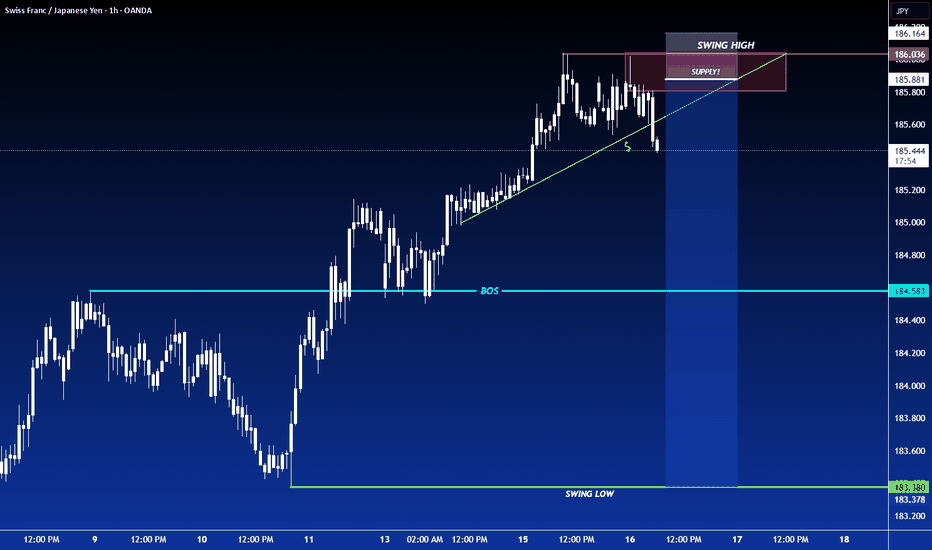

CHFJPY - Short after BOS !!Hello traders!

‼️ This is my perspective on CHFJPY.

Technical analysis: Here we are in a bearish market structure from daily timeframe perspective, so I look for a short. Price filled the imbalance and rejected from bearish OB. On H4 price formed regular divergence for sell, so after BOS I will open the trade.

Like, comment and subscribe to be in touch with my content!

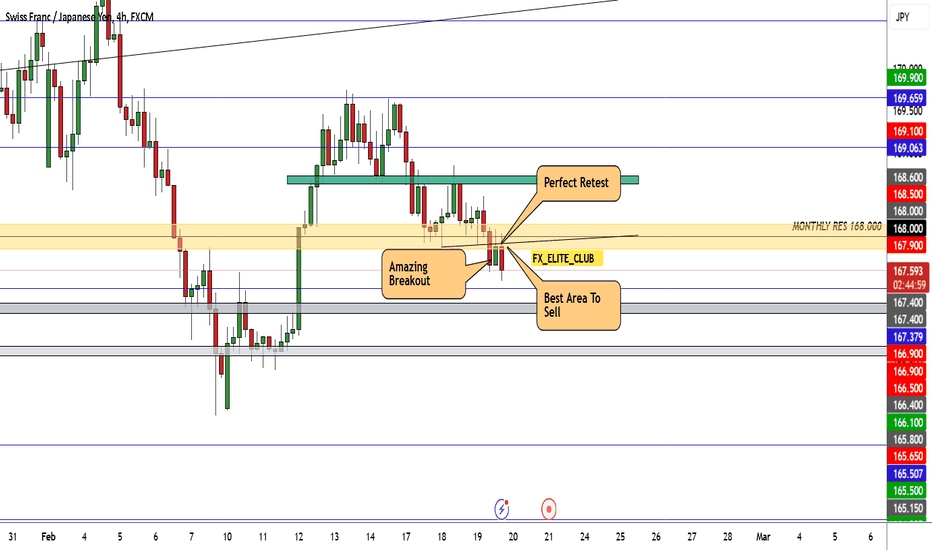

CHF/JPY Ready To Go Down , Are You Ready To Get 250 Pips ?Here is my chf/jpy chart and i think it will continue to downside for the next few days , so i`m looking to sell this pair if the price go up a little and retest the area that show in he chart for one more time , and i`m targeting 250 Pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

CHFJPY - Potential short idea !!Hello traders!

‼️ This is my perspective on CHFJPY.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. I expect price to continue the retracement to fill the imbalance and then to reject from bearish OB + institutional big figure 171.000.

Like, comment and subscribe to be in touch with my content!