CHILE Stock Market Technical and Fundamental PerspectivesChile’s stock market is primarily represented by several key indices, each with distinct characteristics and coverage:

IGPA (Índice General de Precios de Acciones) BCS:SPCLXIGPA

The IGPA is the broadest and most representative index, covering the majority of stocks traded on the Santiago Stock Exchange. It is a capitalization-weighted index, revised annually, and includes companies across all major sectors of the Chilean economy. As of May 2025, the IGPA reached a historic high of over 42,000 points, reflecting robust market performance.

IPSA (Índice de Precios Selectivo de Acciones) BCS:SP_IPSA

The IPSA is a more focused index, comprising the 40 most heavily traded stocks on the Santiago Stock Exchange. It is revised quarterly and serves as the benchmark for large-cap Chilean equities.

S&P/CLX INTER Index 10 BCS:SPCLXIN10

This index tracks the 10 main Chilean stocks that also have American Depositary Receipts (ADRs) listed abroad, providing a bridge between local and international investors.

STOXX® Chile Total Market Index

This index aims to cover approximately 95% of Chile’s free-float market capitalization, with top components including major companies such as Falabella, Banco de Chile, LATAM Airlines Group, Cencosud, Banco Santander Chile, Empresas Copec, and Sociedad Química y Minera de Chile (SQM).

Key Components

The leading companies in Chile’s indices span various sectors:

Financials: Banco de Chile, Banco Santander Chile, Banco de Crédito e Inversiones

Retail: Falabella, Cencosud

Utilities/Energy: Enel Américas, Empresas Copec

Mining/Chemicals: Sociedad Química y Minera de Chile (SQM)

Forestry/Paper: Empresas CMPC

Airlines: LATAM Airlines Group

Long-Term Technical Perspective and Recent Trends

The Chilean stock market, as reflected by the IGPA and IPSA, has experienced a strong rally in 2025, with the major indices gaining over 25% year-to-date

The MSCI Chile index currently presents a mixed technical picture. While long-term moving averages (200-day) signal a "buy," shorter-term indicators (5-100 day) are on "sell," and several oscillators (RSI, Stochastic, MACD) indicate oversold conditions or continued selling pressure.

This suggests that, despite the recent rally, some short-term consolidation or correction could occur, but the long-term trend remains constructive.

Fundamental breakdown

The Santiago Stock Exchange’s market capitalization stands at approximately $187 billion, with a price-to-earnings (P/E) ratio of 12.08, which is below both the emerging markets average (14.3) and the global average (22.12).

This relatively low valuation, even after a significant rally, suggests Chilean equities remain attractive on a fundamental basis.

The Chilean economy is projected to grow by 2.3% in 2025. Inflation has moderated to 4.5%, and the central bank’s benchmark interest rate is stable at 5%.

The banking sector is particularly robust, with Banco de Chile reporting a 14.2% year-over-year increase in net income for Q1 2025.

The mining sector, especially lithium, is poised for growth following major investments and Chile’s strategic push to regain global leadership in lithium production.

The combination of strong fundamentals, sectoral diversity, and attractive valuations positions Chile’s stock market for steady long-term growth, though short-term volatility is possible as global and local conditions evolve.

Conclusion

Chile’s stock market demonstrates strong long-term potential, underpinned by solid economic fundamentals, sectoral strengths, and attractive valuations, though investors should remain mindful of cyclical corrections and global market influences.

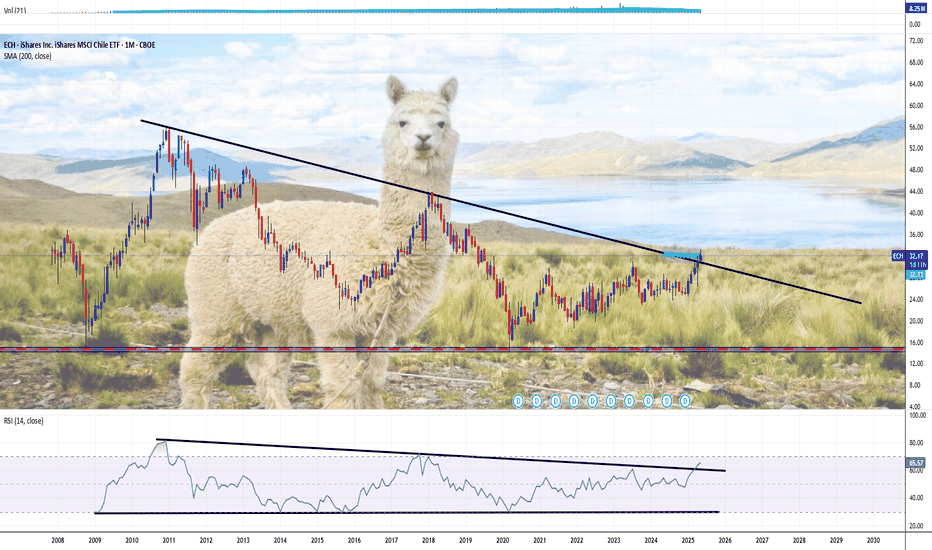

Thу main technical chart for CBOE:ECH - iShares MSCI Chile ETF (total return) points on massive 200-months SMA breakthrough, attempts to break long term 'descending top/ flat bottom' technical figure.

--

Best wishes,

@PandorraResearch Team 😎

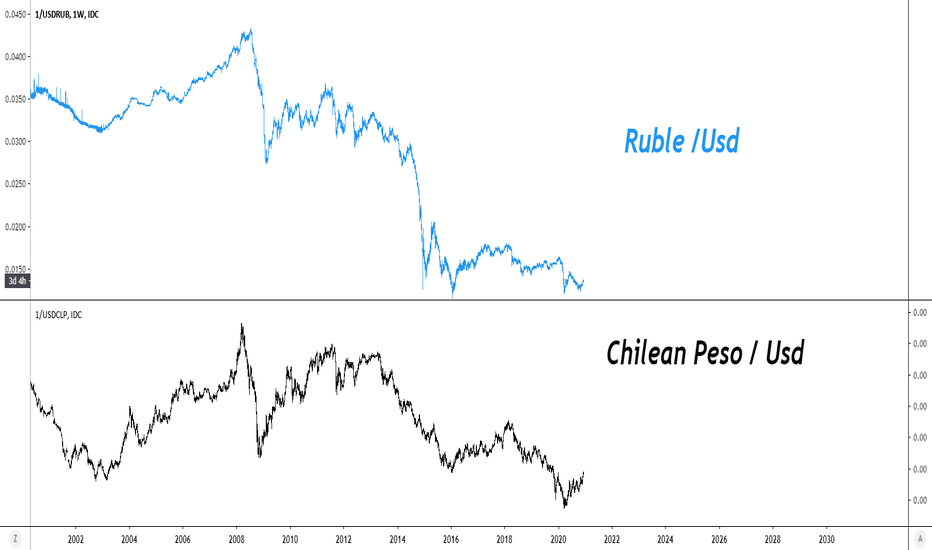

Chileanpeso

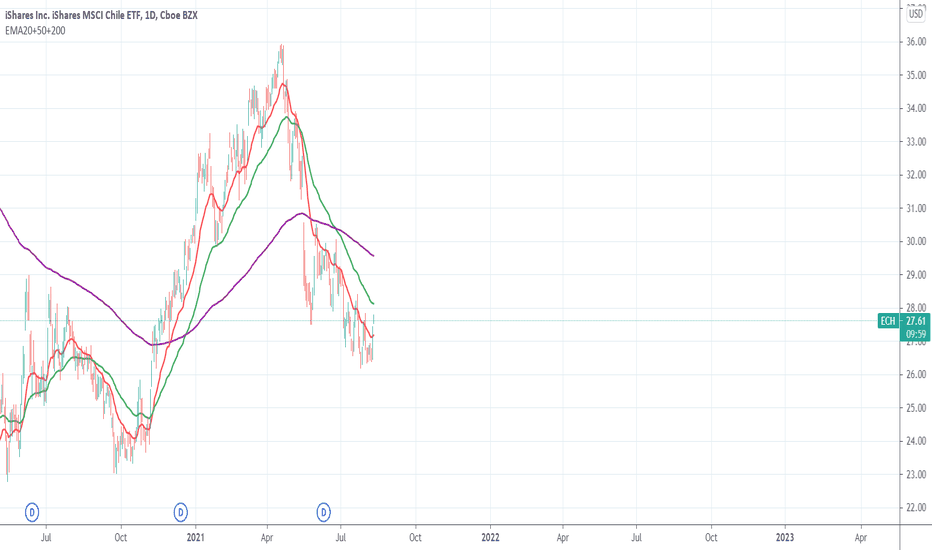

I'm buying weakness in Chilean stocksAfter the IPCC's recent report showing that the North Atlantic Current may be on its last legs, I decided that I needed to diversify away from the US and Europe a bit. (If the North Atlantic Current fails, it would cause massive, disruptive climate change for Europe and North America.) So I committed to look for opportunities in some country ETFs.

The one I've been buying is $ECH, the iShares Chile ETF. Chile stocks are beaten down because of currency weakness amid heavy pandemic spending, but honestly their debt-to-GDP ratio is still one of the world's best at just 27%. (Contrast the US at 107% and Japan at 238%.)

Chile has had a highly effective vaccine rollout, with the world's sixth highest vaccination rate. (With 67.2% of Chileans fully vaccinated, they lag behind a few much smaller countries, like Malta and Iceland.)

Thanks to pandemic UBI and a high vaccination rate, Fitch yesterday raised its 2021 real GDP growth forecast for Chile from 6.1% to 8.3%, making Chile one of the world's fastest growing economies this year, trailing just behind China's 8.4%. But whereas China ETFs trade at 14x cash flow and yield 1.1%, $ECH trades at less than 5x cash flow with a distribution yield of 2.34%.

There is, undoubtedly, some political risk when buying a Latin American ETF. Latin America is notorious for its political instability, and Chile is no exception. Chile currently ranks 19th in the world for economic freedom, and its current leader is a Harvard-trained economist and business engineer. But he's also wildly unpopular due to excessive use of force against protesters the last couple years. The country is currently in the process of drafting a new national constitution, and many of the constitutional delegates lean left. It remains to be seen what shape the future government of Chile might take.

Despite the uncertainty, the immediate future for Chile looks relatively bright. At this valuation and with this GDP growth rate, I've bought a modest stake and plan to hold for the forseeable future.

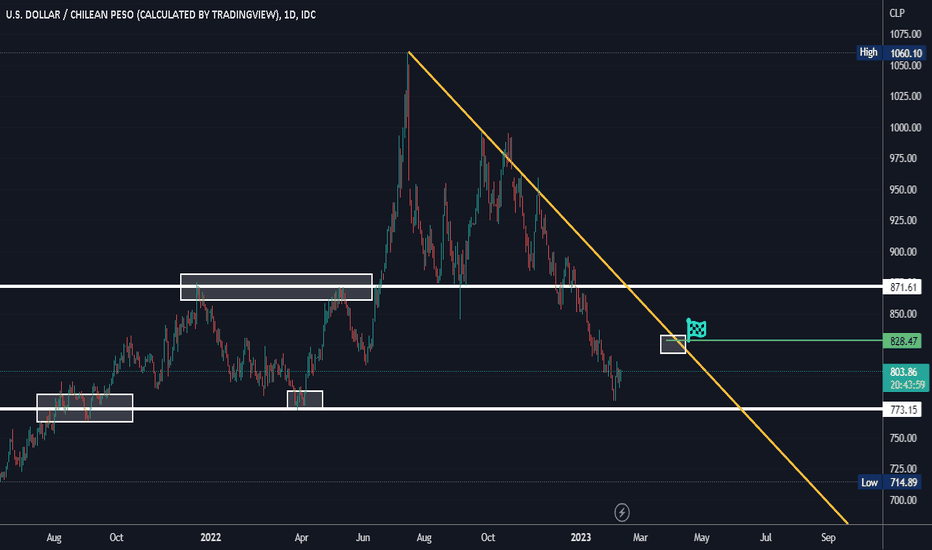

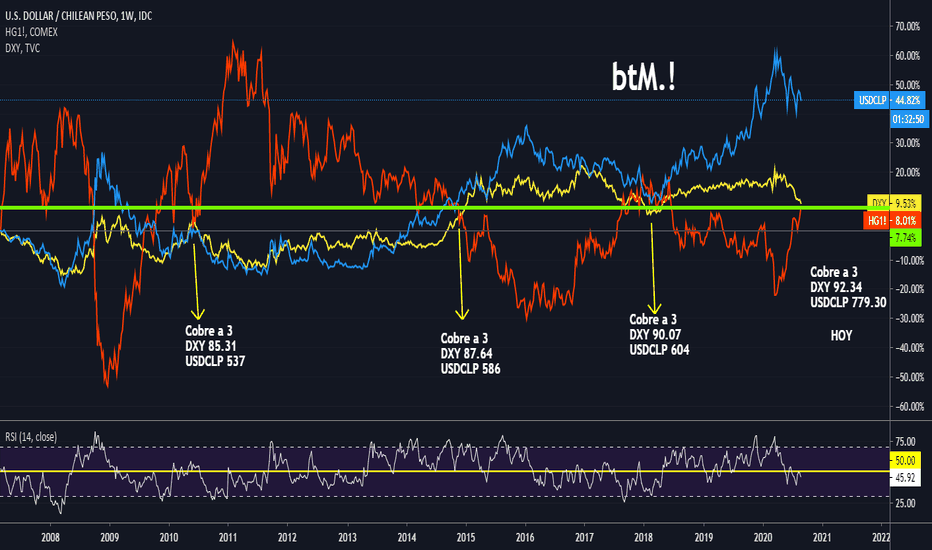

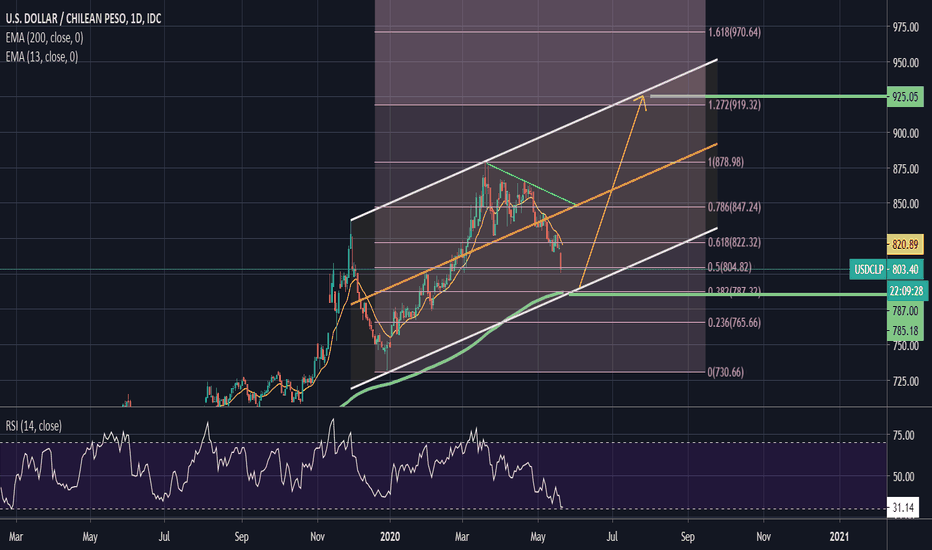

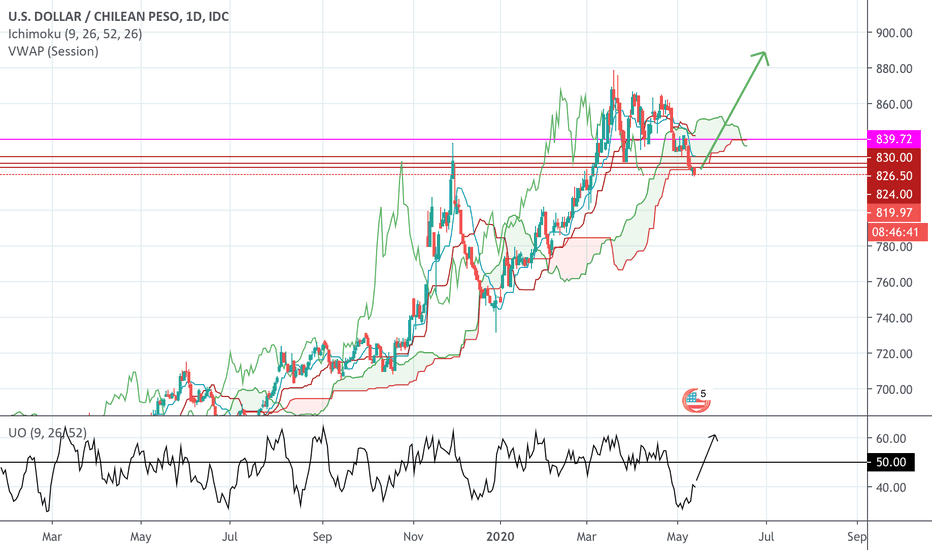

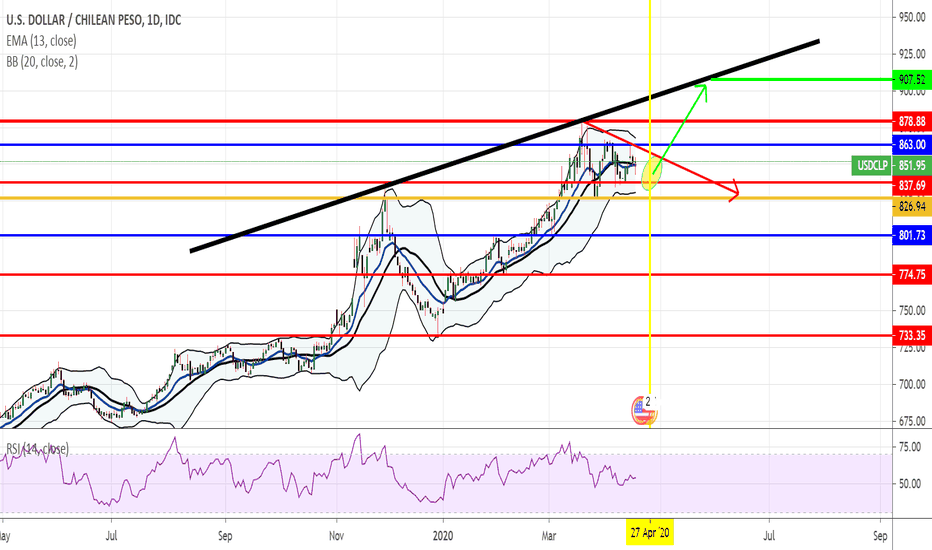

Puntos de Equilibrio del Yankee ChilenoEl punto de equilibrio está en 839.72, los alcistas deben cruzar ese punto. Los más agresivos pueden poner sus ordenes en los puntos de equilibrio de menor escalas de tiempo. Los bajistas deben mantenerse debajo del Kumo y del equilibrio diario en rosado. Por como siento la economía en Chile, creo que este país se irá a la chu’, así que voy al alza, espero que nuestro Banco Central recapacite, compre oro y se deje de inyectar más dólares a la economía, solo se devalúa nuestra propia moneda en favor de dolarucho.

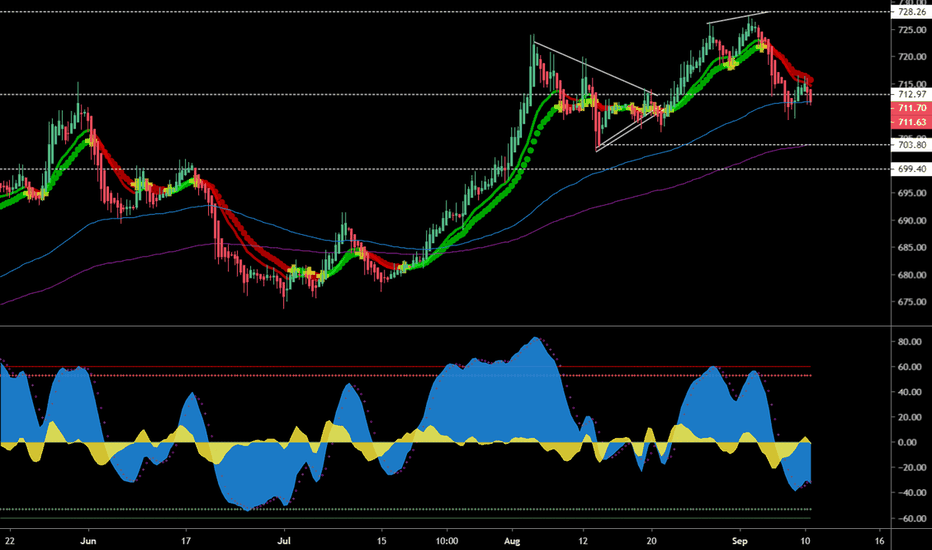

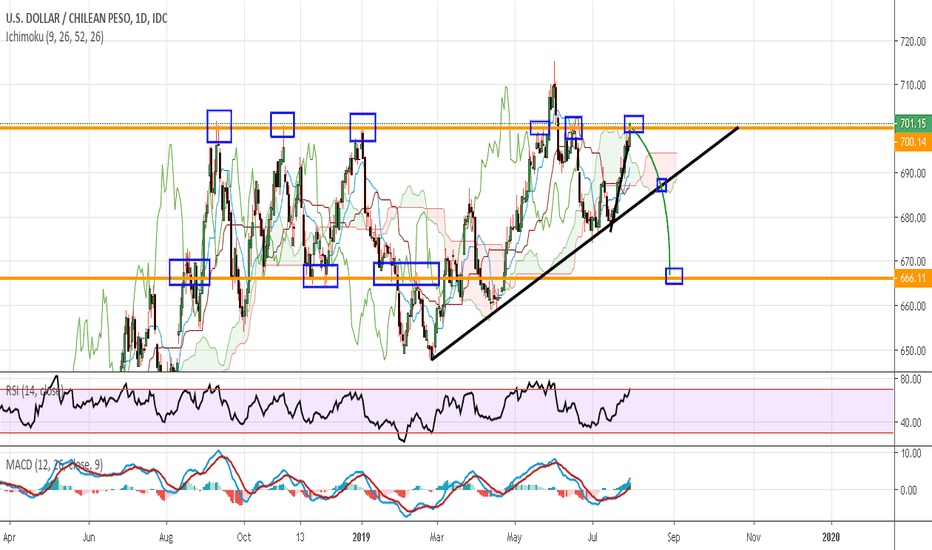

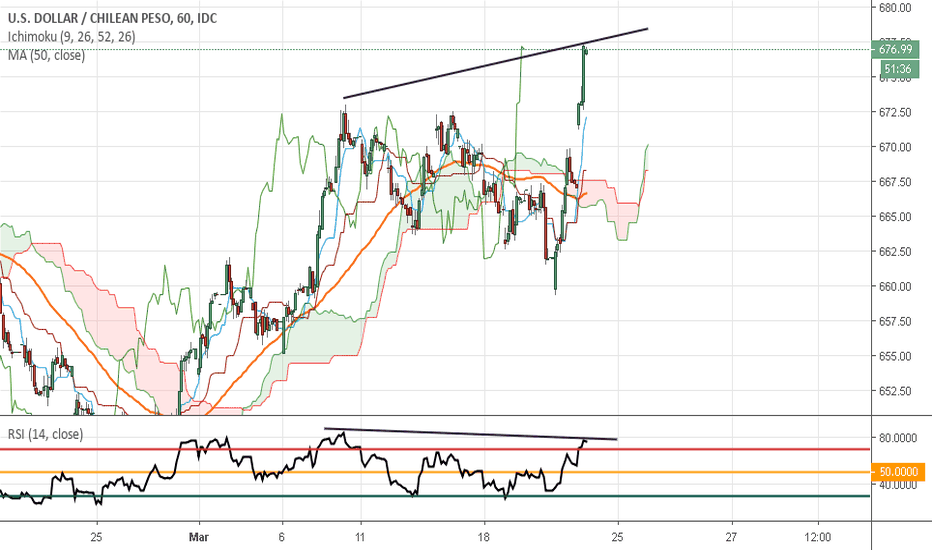

Dollar Chilean Peso - 0.5pts Interest Rate So the divergence wins ! but we cannot sing victory yet... MA of Middle-Term acting as a support, we need to brake the $700 CLP to celebrate ! (MA of Long-term)

Y la Divergencia tomo efecto, pero aun es anticipado para cantar victoria, Grafico 4H, MM de MP actuando de soporte . Necesitamos vencer esos $700 (MM de LP)

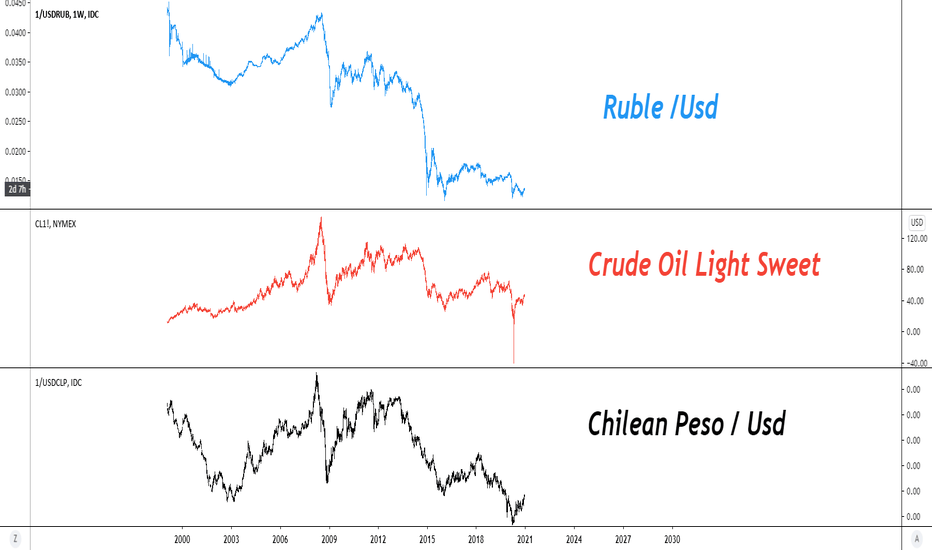

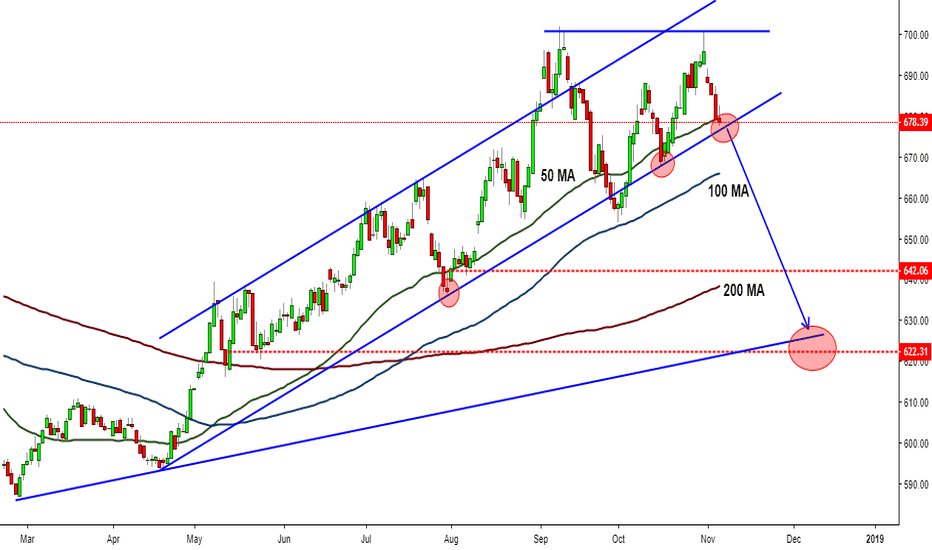

USDCLP Buying Chilean Peso no matter what you hear about EM?Emerging Markets are weak in general, but this is one of those economies that are quite apart of the rest. A very stable country that would benefit from foreign assets stepping out from risk economies like the U.S and Europe.

Unfortunately, it's quite difficult to find a broker offering this pair.

Learn how to beat the market as Professional Trader with an ex-insider!

Be part of an elite trading group. Last course of the year on November 13th, 2018.

Have a Nice Trading Week!

Cream Live Trading, Best Regards!