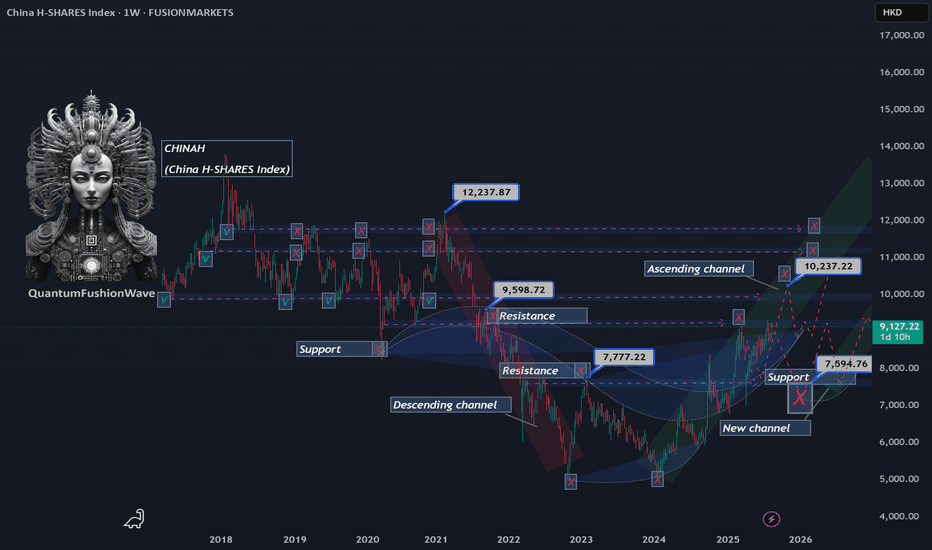

ChinaH Index at a Crossroad: Testing 9,500 ResistanceThe ChinaH Index is currently trading around $9,135, continuing its bullish momentum without the deeper retracement toward the $7,500 support many anticipated. Price action is now approaching a major resistance zone at $9,500—a level that acted as resistance in 2021 and as support through 2017, 2018, and 2019.

Bullish scenario: If the index breaks $9,500 decisively, we could see an acceleration toward $10,200–$10,900 with little to no interim pullback.

Bearish scenario: A rejection at $9,500 may signal the formation of a new channel, with a support base developing in the $8,600–$8,800 area before any renewed upside attempt.

The next few sessions will be critical in determining whether this breakout extends into a sharp rally—or if a healthy consolidation phase comes first.

Chinahongkong

ChinaH Index: New Era of Economic Power and Market DominanceIn the current global economic shift, China is emerging as the leading force across multiple sectors, including economy, corporations, artificial intelligence, quantum technologies, and international alliances. With the U.S. facing economic struggles, including growing national debt, loss of investor confidence, and strained alliances, China is solidifying its position as the world's dominant economic power.

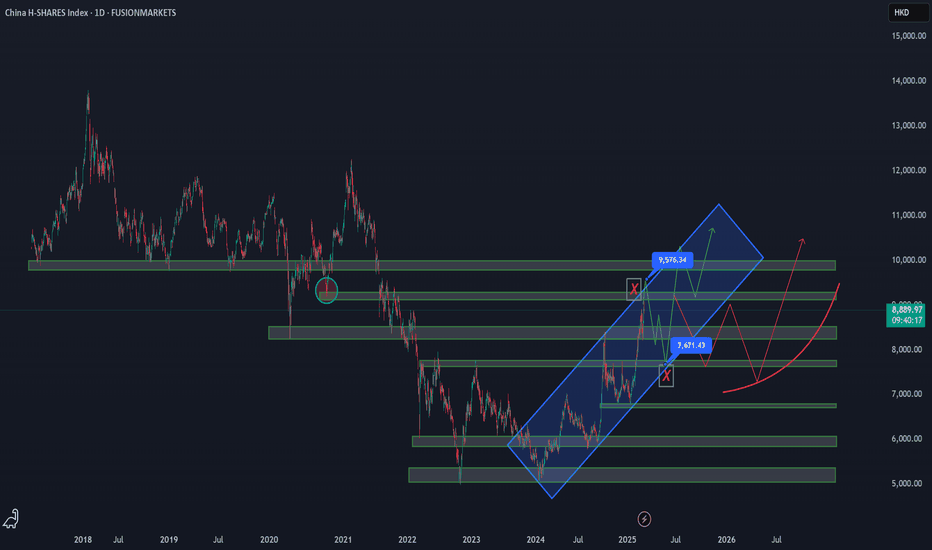

At $8,900, the ChinaH Index is in a strong bullish channel, following an impressive 34% rally from $6,700 on January 11 to its current level. Moving forward, there are two key scenarios that could play out:

Scenario 1: Healthy Pullback Before Resuming Growth

After reaching $9,000, the index could experience a natural correction to $7,600, allowing for a stronger consolidation phase.

This level would provide a solid base for the next bullish breakout, targeting $10,000 by mid-2025.

Scenario 2: Market Overextension and Historical Price Repetition

If the bullish momentum overextends, we could see a push toward $9,400–$9,800, representing a 44% rise, similar to past price movements.

The $9,700 level is a historically significant support zone from 2017–2020, making it a critical battleground for further gains.

A successful break above this level could send the index soaring toward $10,000 by July 2025, further reinforcing China’s dominance in the new global order.

Key Levels to Watch

$8,000 Support → A strong base in the new world economy. If it holds, further upside is likely.

$9,700 Resistance → A critical level from 2017–2020, which, if broken, confirms a long-term bullish shift.

$10,000 Target → A key psychological and technical milestone expected by mid-2025.

Conclusion: The ChinaH Index Reflects China’s Growing Global Influence

With shifting global economic dynamics favoring China, the ChinaH Index is positioned for long-term growth. If $8,000 holds, a breakout beyond $9,700 could confirm China’s continued financial dominance, leading to a potential target of $10,000 by July 2025. The next few months will be crucial in determining whether the market corrects before resuming its bullish trajectory or pushes straight toward new highs.