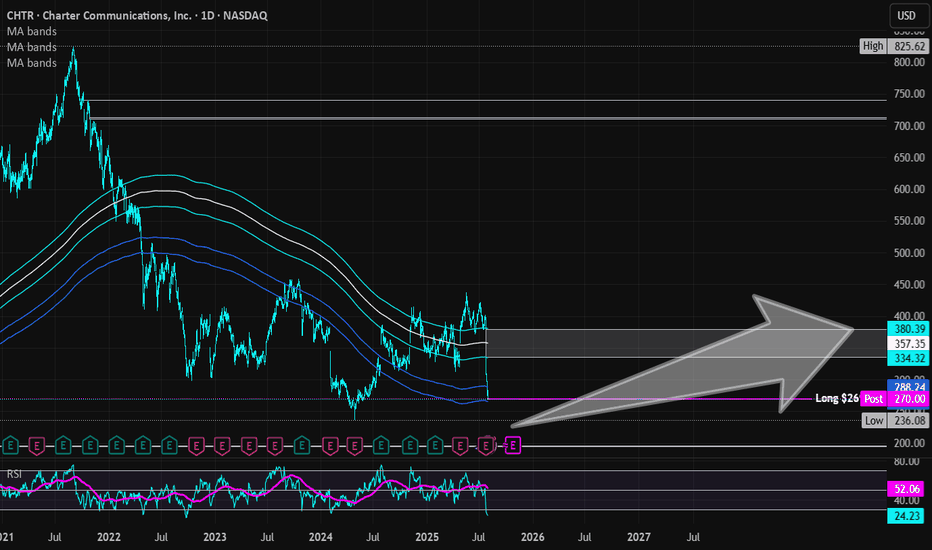

Charter Communications (Revised) | CHTR | Long at $269.50 **This is a revised analysis from December 26, 2024: . My stop was triggered in that original trade after the recent price drop (some gains were taken at 13%, as noted).**

Charter Communications NASDAQ:CHTR stock recently dropped due to a disappointing Q2 2025 earnings report, with earnings per share of $9.18 missing estimates of $9.58 and a larger-than-expected loss of 111,000 residential internet customers. Despite the recent subscriber losses and increased competition, the following factors suggest long-term growth potential:

Network Expansion: Launch of 2x1 Gbps service in eight markets in 2025, boosting competitiveness.

Rural Growth: Rural revenue projected to reach 10–15% of total revenue by 2025.

Cox Acquisition: $34.5B merger expected to close by mid-2026, yielding $500M in annual cost savings by 2028 and enhancing market share.

Mobile and AI Strategies: Strong mobile growth and AI-driven customer service tools to improve retention and efficiency.

Lower Interest Rates: Reduced bowering costs to help with profit margins.

Charter's President/CEO recently grabbed $2.5 million in shares under $300. From a technical analysis perspective, there is an open price gap near $195 that could be of concern in the near-term. I foresee that being closed if the whole market flips or more bad news for the company arises. But, with a P/E of 7x and the industry average being near 13x, I believe NASDAQ:CHTR is a good value at the moment.

Thus, at $269.50, NASDAQ:CHTR is in a personal buy zone with a note of "risk" of a drop near $195 (a second personal entry point if it hits that level before targets are reached).

Targets into 2028:

$330.00 (+22.4%)

$375.00 (+39.1%)

Chtrlong

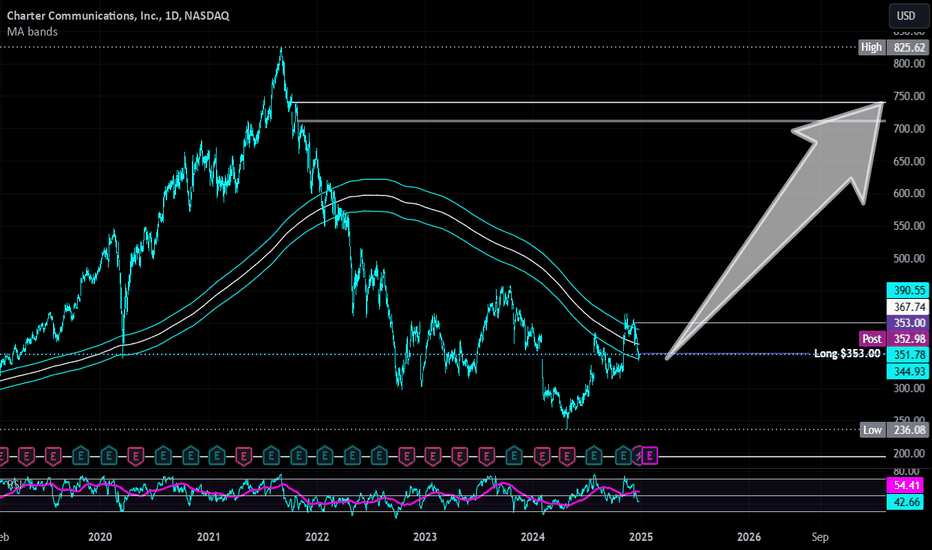

Charter Communications | CHTR | Long at $353.00Charter Communications NASDAQ:CHTR has hit the bottom of my historical simple moving average band. It may consolidate for a while around the current price or dip in the near-term (potentially in the $270's), but dropping interest rates will be extremely beneficial for telecommunication companies in the long-term. There are two open price gaps on the daily chart ($700's) that will inevitably close - just a matter of when. With a 90M float and 12% short interest, it's a stock that could get interesting if upward momentum takes over. Earnings and cash flow growth are anticipated through 2027, so at $353.00, NASDAQ:CHTR is in a personal buy zone.

Target #1 = $400.00

Target #2 = $500.00

Target #3 = $600.00

Target #4 = $700.00

Target #5 = $740.00

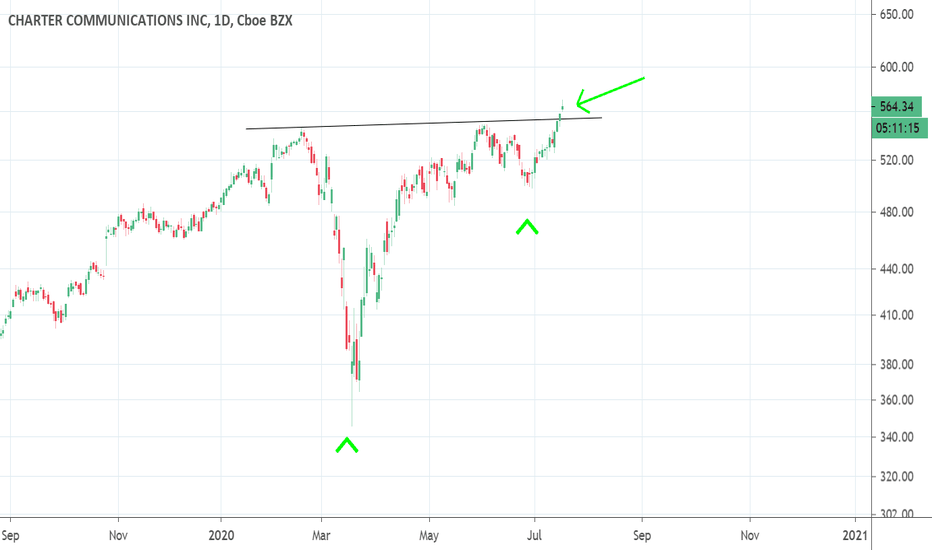

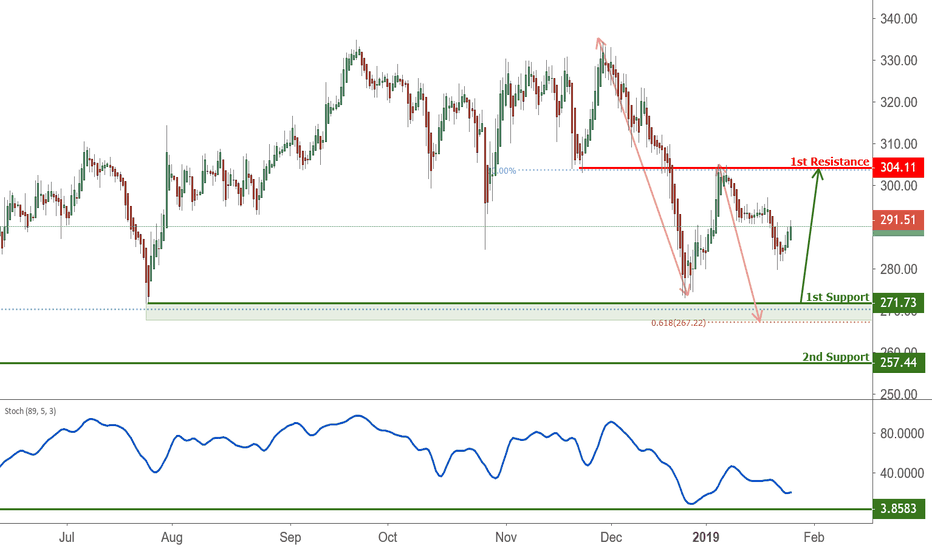

CHTR approaching support, potential bounce! CHTR is approaching our first support at 271.73 (horizontal swing low support, 61.8% Fibonacci extension, 76.4% Fibonacci retracement) where a strong bounce might occur above this level pushing price up to our major resistance at 304.11 (horizontal overlap resistance, 50% Fiboancci retracement).

Stochastic (89,5,3) is also approaching support where we might see a corresponding bounce in price.